Trading ended on Wednesday with an equal number of stocks rising and falling leaving the Jamaica Stock Exchange Main Market Index virtually flat after an exchange of 49 percent fewer shares than on Tuesday with a 31 percent fall in the value.

At the close, the All Jamaican Composite Index shed 8.73 points to settle at 419,396.65, the Main Index slipped 12.43 points to 382,636.75 and the JSE Financial Index lost 0.37 points to settle at 97.93.

At the close, the All Jamaican Composite Index shed 8.73 points to settle at 419,396.65, the Main Index slipped 12.43 points to 382,636.75 and the JSE Financial Index lost 0.37 points to settle at 97.93.

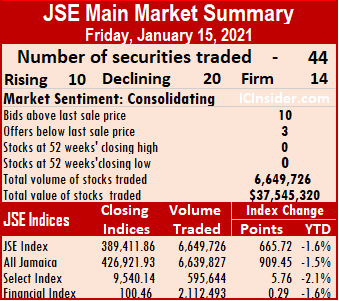

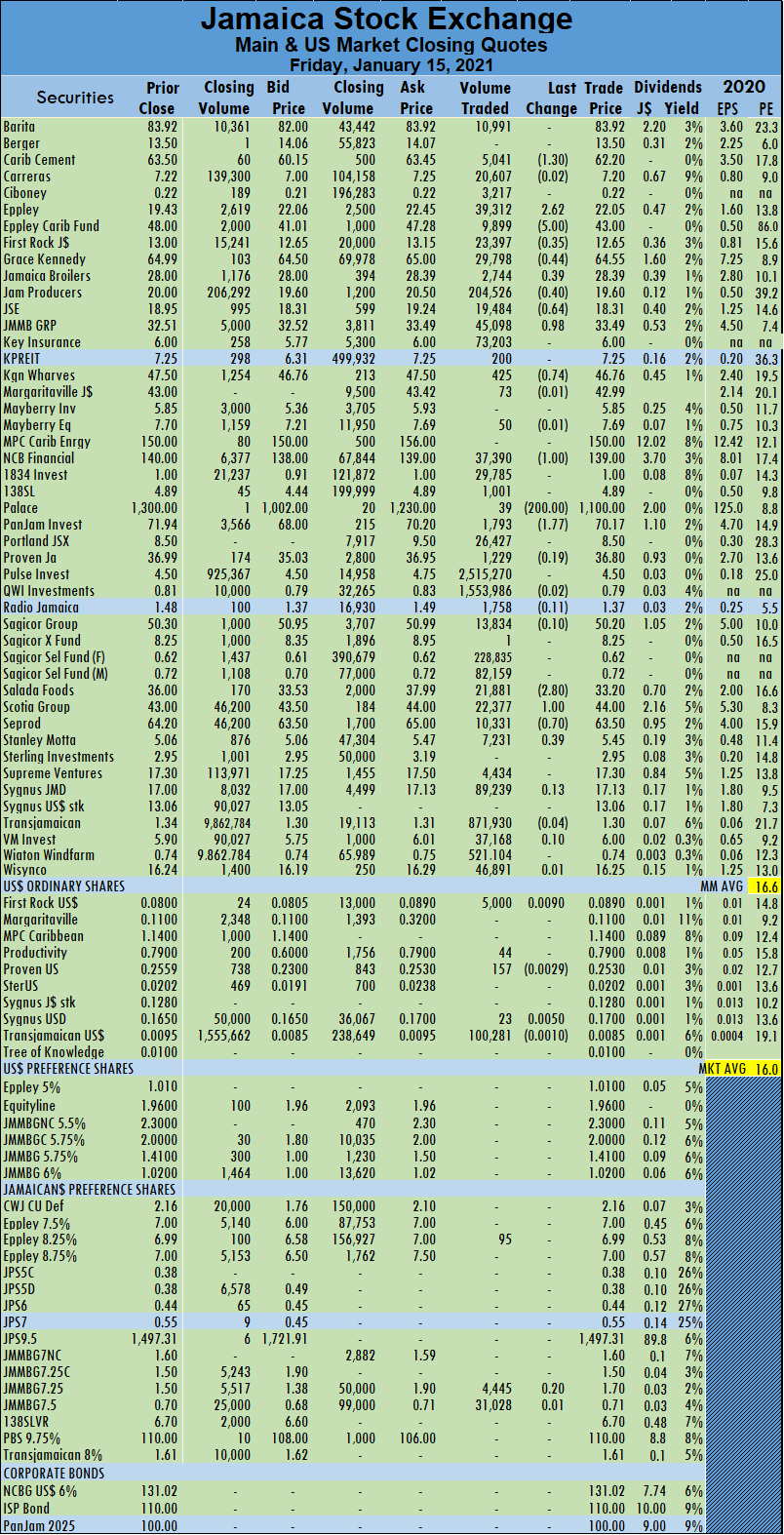

The number of securities trading remained elevated with 44 changing hands, down from 46 on Tuesday as the market closed with 12 stocks rising, 12 declining and 20 closing unchanged. The PE Ratio closed with an average of 16.6 based on ICInsider.com’s forecast of 2020-21 earnings.

The market closed with 5,962,706 shares traded for $43,631,865 compared to 11,593,159 units at $63,685,850 on Tuesday. Transjamaican Highway led trading with 41 percent of total volume for 2.45 million shares followed by Sagicor Select Financial Fund with 22.7 percent for 1.35 million units and Wigton Windfarm with 9 percent market share, with 533,829 units changing hands.

Transjamaican Highway led trading with 41 percent of total volume for 2.45 million shares followed by Sagicor Select Financial Fund with 22.7 percent for 1.35 million units and Wigton Windfarm with 9 percent market share, with 533,829 units changing hands.

Trading for the day averaged 135,516 units at $991,633 down from an average of 252,025 shares at $1,384,475 on Tuesday. The month to date averaged 317,481 units at $1,213,011 for each security, in contrast to 328,085 units at $1,225,912 on the prior trading day. Trading in December averaged 455,206 units at $7,774,631.

Investor’s Choice bid-offer indicator reading has 11 stocks ending with bids higher than their last selling prices and five with lower offers.

At the close of the market, Caribbean Cement climbed $4.99 to $64.99 in trading 19,142 shares, Jamaica Stock Exchange shed 50 cents to end at $18.50, after exchanging 18,130 units, JMMB Group fell $1.49 to end at $31.51, with a transfer of 178,666 shares. Mayberry Investments rose 43 cents to $5.83, with the swapping of 1,100 units. Pan Jam Investment advanced by $2 to $68, with 4,690 stocks changing hands, Scotia Group declined $1.50 to end at $42.50 trading 28,644 shares. Supreme Ventures rose 34 cents to close at $17.25 and finishing with an exchange of 31,430 stock units and Sygnus Credit Investments ended 30 cents higher at $16.40, after crossing the market with 10,730 stocks.

Pan Jam Investment advanced by $2 to $68, with 4,690 stocks changing hands, Scotia Group declined $1.50 to end at $42.50 trading 28,644 shares. Supreme Ventures rose 34 cents to close at $17.25 and finishing with an exchange of 31,430 stock units and Sygnus Credit Investments ended 30 cents higher at $16.40, after crossing the market with 10,730 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

At the close, the All Jamaican Composite Index advanced by 793.87 points to 419,405.38 and the Main Index rose 732.08 points to 382,649.18, and the JSE Financial Index gained 0.60 points to settle at 98.30.

At the close, the All Jamaican Composite Index advanced by 793.87 points to 419,405.38 and the Main Index rose 732.08 points to 382,649.18, and the JSE Financial Index gained 0.60 points to settle at 98.30. Trading averaged 252,025 units at $1,384,475 for each security, compared to an average of 683,391 shares at $1,732,445 on Monday. The month to date averaged 328,085 units at $1,225,912, in contrast to 333,020 units at $1,215,624 on Monday. Trading in December averaged 455,206 units at $7,774,631.

Trading averaged 252,025 units at $1,384,475 for each security, compared to an average of 683,391 shares at $1,732,445 on Monday. The month to date averaged 328,085 units at $1,225,912, in contrast to 333,020 units at $1,215,624 on Monday. Trading in December averaged 455,206 units at $7,774,631. Sagicor Group rose 85 cents to $47.50, with 156,219 units crossing the market, Sagicor Real Estate Fund gained 70 cents to close at $8.95 trading 500 stocks, Salada Foods fell $3 to $33, with 966 stock units changing hands. Scotia Group fell 50 cents to $44 after the transferring of 20,375 units and Sygnus Credit Investments closed at $16.10, with a loss of $1.80 136,520 stock units changing hands.

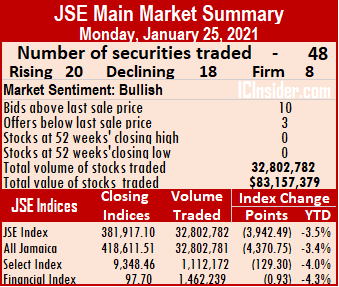

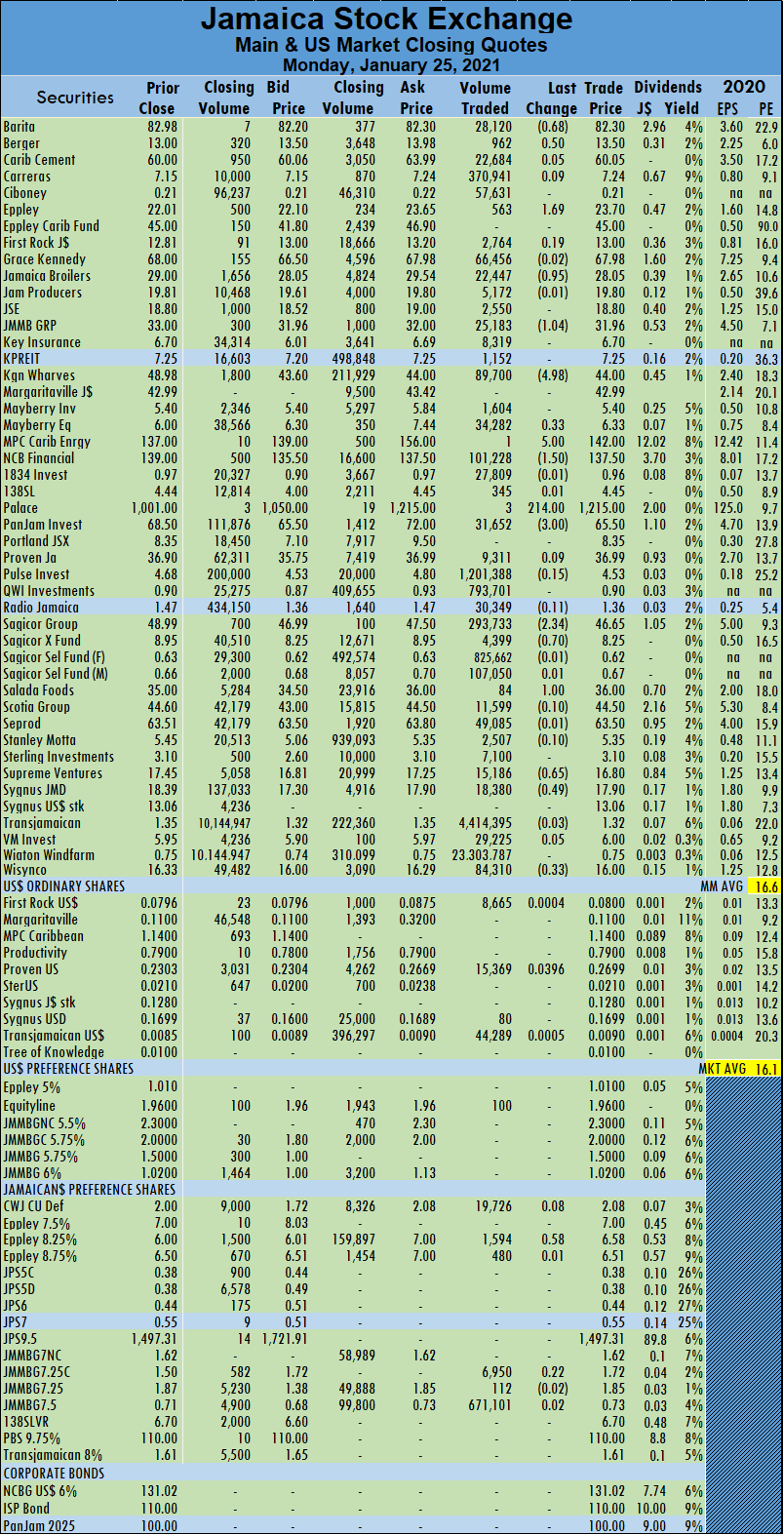

Sagicor Group rose 85 cents to $47.50, with 156,219 units crossing the market, Sagicor Real Estate Fund gained 70 cents to close at $8.95 trading 500 stocks, Salada Foods fell $3 to $33, with 966 stock units changing hands. Scotia Group fell 50 cents to $44 after the transferring of 20,375 units and Sygnus Credit Investments closed at $16.10, with a loss of $1.80 136,520 stock units changing hands. At the close, the All Jamaican Composite Index dropped 4,370.75 points to 418,611.51, the Main Index fell by 3,942.49 points to 381,917.10 and the JSE Financial Index lost 0.93 points to settle at 97.70.

At the close, the All Jamaican Composite Index dropped 4,370.75 points to 418,611.51, the Main Index fell by 3,942.49 points to 381,917.10 and the JSE Financial Index lost 0.93 points to settle at 97.70. Trading in December averaged 455,206 units at $7,774,631.

Trading in December averaged 455,206 units at $7,774,631. Sagicor Real Estate Fund shed 70 cents to settle at $8.25 trading 4,399 stock units, Salada Foods rose $1 to close at $36, in an exchange of 84 shares, Supreme Ventures shed 65 cents to $16.80, with 15,186 stocks crossing the market. Sygnus Credit Investments slipped 49 cents to $17.90 after transferring 18,380 stock units and Wisynco Group lost 33 cents in closing at $16 trading 84,310 shares.

Sagicor Real Estate Fund shed 70 cents to settle at $8.25 trading 4,399 stock units, Salada Foods rose $1 to close at $36, in an exchange of 84 shares, Supreme Ventures shed 65 cents to $16.80, with 15,186 stocks crossing the market. Sygnus Credit Investments slipped 49 cents to $17.90 after transferring 18,380 stock units and Wisynco Group lost 33 cents in closing at $16 trading 84,310 shares.

Sagicor Real Estate Fund advanced by 70 cents to close at $8.95, in clearing the market with 193 units, Salada Foods rose 99 cents to $35 while exchanging 300 stock units and Scotia Group finished 60 cents higher at $44.60, with 75,000 shares changing hands.

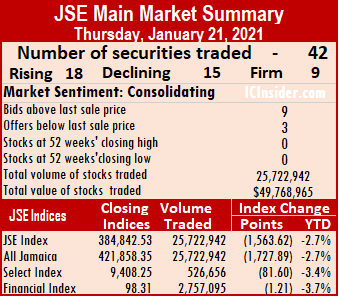

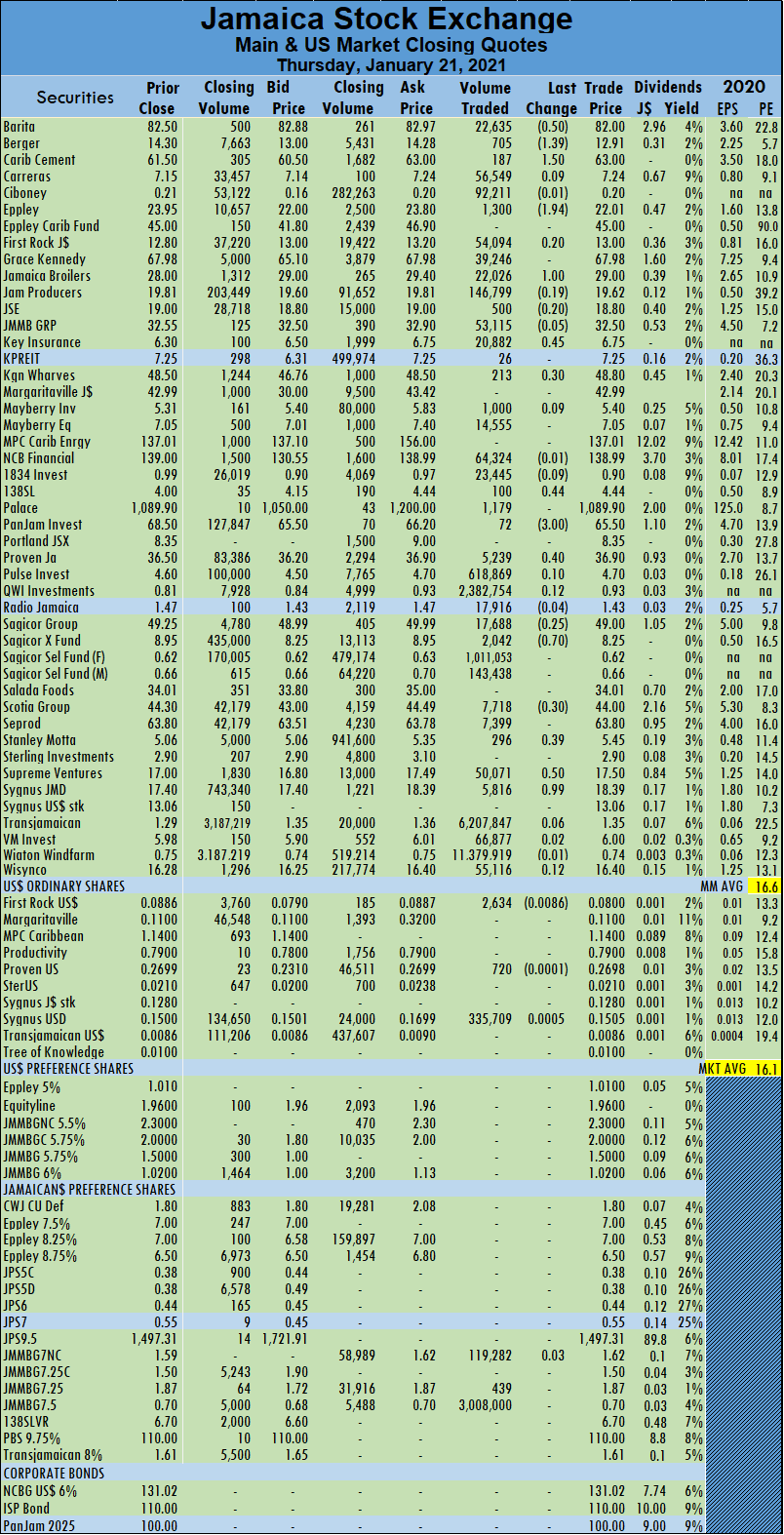

Sagicor Real Estate Fund advanced by 70 cents to close at $8.95, in clearing the market with 193 units, Salada Foods rose 99 cents to $35 while exchanging 300 stock units and Scotia Group finished 60 cents higher at $44.60, with 75,000 shares changing hands. At the close, the market is down 2.7 percent for the year so far (39 percent annualized) as the All Jamaican Composite Index dropped 1,727.89 points to 421,858.35, the Main Index fell by 1,536.26 points to 384,842.53 and the JSE Financial Index lost 1.21 points to settle at 98.31.

At the close, the market is down 2.7 percent for the year so far (39 percent annualized) as the All Jamaican Composite Index dropped 1,727.89 points to 421,858.35, the Main Index fell by 1,536.26 points to 384,842.53 and the JSE Financial Index lost 1.21 points to settle at 98.31. Trading averaged 612,451 units at $1,184,975, versus 235,221 shares at $2,649,800 on Wednesday. Trading month to date averaged 310,349 units at $1,157,230, in contrast to 288,359 units at $1,155,210 on Wednesday. Trading in December averaged 455,206 units at $7,774,631.

Trading averaged 612,451 units at $1,184,975, versus 235,221 shares at $2,649,800 on Wednesday. Trading month to date averaged 310,349 units at $1,157,230, in contrast to 288,359 units at $1,155,210 on Wednesday. Trading in December averaged 455,206 units at $7,774,631. Proven Investments finished 40 cents higher at $36.90, in an exchange of 5,239 stock units, Sagicor Real Estate Fund shed 70 cents in closing at $8.25, in clearing the market with 2,042 shares, Scotia Group slipped 30 cents to $44 while exchanging 7,718 stocks. Stanley Motta gained 39 cents to settle at $5.45, in trading 296 stock units, Supreme Ventures rose 50 cents to close at $17.50, with the swapping of 50,071 shares and Sygnus Credit Investments advanced by 99 cents to $18.39, with 5,816 units changing hands.

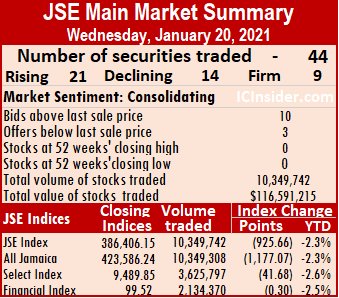

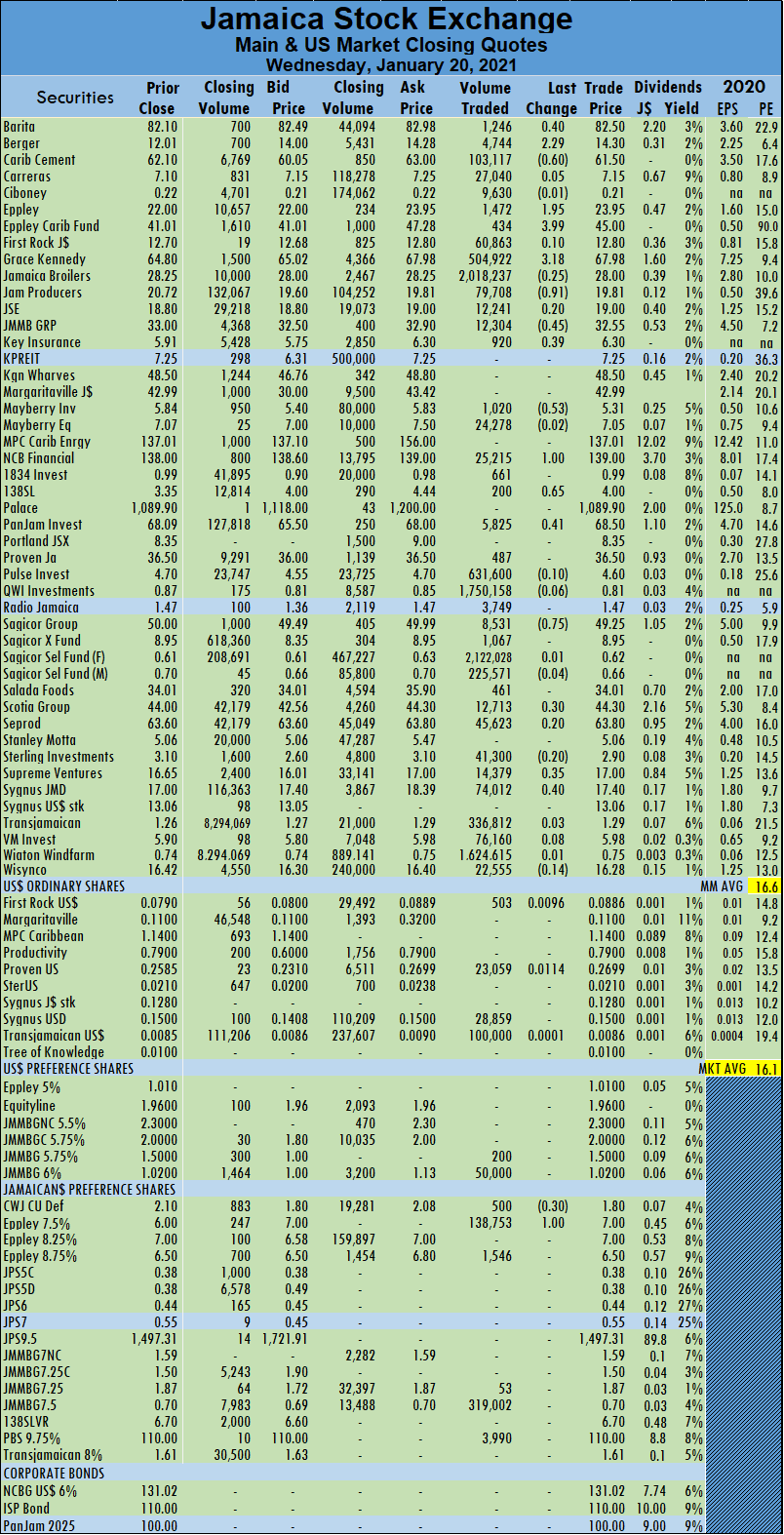

Proven Investments finished 40 cents higher at $36.90, in an exchange of 5,239 stock units, Sagicor Real Estate Fund shed 70 cents in closing at $8.25, in clearing the market with 2,042 shares, Scotia Group slipped 30 cents to $44 while exchanging 7,718 stocks. Stanley Motta gained 39 cents to settle at $5.45, in trading 296 stock units, Supreme Ventures rose 50 cents to close at $17.50, with the swapping of 50,071 shares and Sygnus Credit Investments advanced by 99 cents to $18.39, with 5,816 units changing hands. The All Jamaican Composite Index fell by 1,177.07 points to 423,586.24, the Main Index declined 925.66 points to 386,406.15 and the JSE Financial Index lost 0.30 points to close at 99.52.

The All Jamaican Composite Index fell by 1,177.07 points to 423,586.24, the Main Index declined 925.66 points to 386,406.15 and the JSE Financial Index lost 0.30 points to close at 99.52. Trading for the day averaged 235,221 units at $2,649,800, compared to 130,214 shares at $830,150 on Tuesday. Trading month to date averaged 288,359 units at $1,155,210, in contrast to 292,746 units at $1,031,829 on Tuesday. Trading in December averaged 455,206 units at $7,774,631.

Trading for the day averaged 235,221 units at $2,649,800, compared to 130,214 shares at $830,150 on Tuesday. Trading month to date averaged 288,359 units at $1,155,210, in contrast to 292,746 units at $1,031,829 on Tuesday. Trading in December averaged 455,206 units at $7,774,631. NCB Financial rose $1 in ending at $139, with the swapping of 25,215 shares, 138 Student Living rose 65 cents to $4, in exchange of 200 units, Pan Jam Investment gained 41 cents to settle at $68.50, after clearing the market with 5,825 units, Sagicor Group lost 75 cents to end at $49.25, with an exchange of 8,531 units. Scotia Group closed at $44.30, with gains of 30 cents after exchanging 12,713 shares, Supreme Ventures rose 35 cents to $17 trading 14,379 stocks, Sygnus Credit Investments finished 40 cents higher at $17.40, with the swapping of 74,012 stock units.

NCB Financial rose $1 in ending at $139, with the swapping of 25,215 shares, 138 Student Living rose 65 cents to $4, in exchange of 200 units, Pan Jam Investment gained 41 cents to settle at $68.50, after clearing the market with 5,825 units, Sagicor Group lost 75 cents to end at $49.25, with an exchange of 8,531 units. Scotia Group closed at $44.30, with gains of 30 cents after exchanging 12,713 shares, Supreme Ventures rose 35 cents to $17 trading 14,379 stocks, Sygnus Credit Investments finished 40 cents higher at $17.40, with the swapping of 74,012 stock units. Investor’s Choice bid-offer indicator shows seven stocks ending with bids higher than their last selling prices and three with lower offers.

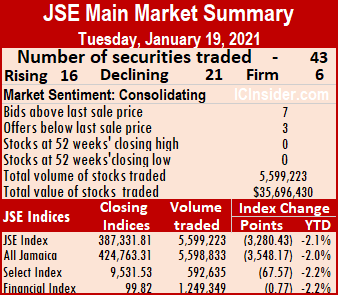

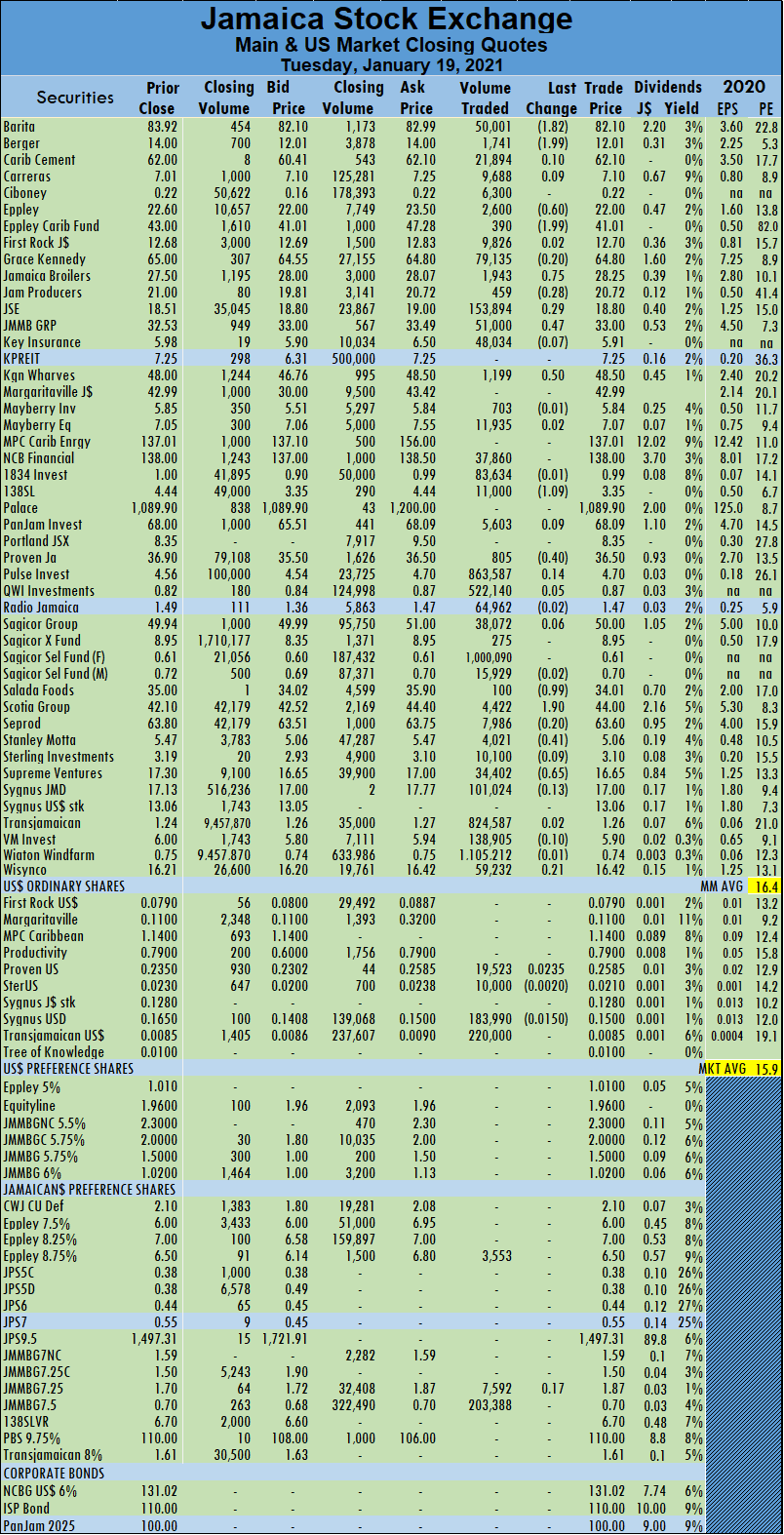

Investor’s Choice bid-offer indicator shows seven stocks ending with bids higher than their last selling prices and three with lower offers. Salada Foods settled at $34.01, with a loss of 99 cents after exchanging 100 shares, Scotia Group climbed $1.90 to $44, in swapping 4,422 units, Stanley Motta slipped 41 cents to $5.06, in crossing the market with 4,021 stock units and Supreme Ventures shed 65 cents to close at $16.65, after 34,402 shares cleared the market.

Salada Foods settled at $34.01, with a loss of 99 cents after exchanging 100 shares, Scotia Group climbed $1.90 to $44, in swapping 4,422 units, Stanley Motta slipped 41 cents to $5.06, in crossing the market with 4,021 stock units and Supreme Ventures shed 65 cents to close at $16.65, after 34,402 shares cleared the market. Trading month to date averaged 307,009 units at $1,049,528 for each security, in contrast to 326,985 units at $1,105,486 on Friday. Trading in December averaged 455,206 units at $7,774,631.

Trading month to date averaged 307,009 units at $1,049,528 for each security, in contrast to 326,985 units at $1,105,486 on Friday. Trading in December averaged 455,206 units at $7,774,631. Pan Jam Investment closed at $68, after losing $2.17 and trading 4,017 shares, Sagicor Real Estate Fund rose 70 cents to $8.95, in a transfer of 250 stocks, Salada Foods advanced to $35, with gains of $1.80 in switching ownership of 44,051 stock units. Scotia Group fell $1.90 to $42.10, exchanging 8,179 shares and Seprod gained 30 cents, ending at $63.80 after 10,198 stocks crossed the exchange.

Pan Jam Investment closed at $68, after losing $2.17 and trading 4,017 shares, Sagicor Real Estate Fund rose 70 cents to $8.95, in a transfer of 250 stocks, Salada Foods advanced to $35, with gains of $1.80 in switching ownership of 44,051 stock units. Scotia Group fell $1.90 to $42.10, exchanging 8,179 shares and Seprod gained 30 cents, ending at $63.80 after 10,198 stocks crossed the exchange. Trading for the day averaged 151,130 units at $853,303, compared to 301,312 shares at $1,395,993 on Thursday. Trading month to date averaged 326,985 units at $1,105,486, in contrast to 346,427 units at $1,133,366 on Thursday. Trading in December averaged 455,206 units at $7,774,631.

Trading for the day averaged 151,130 units at $853,303, compared to 301,312 shares at $1,395,993 on Thursday. Trading month to date averaged 326,985 units at $1,105,486, in contrast to 346,427 units at $1,133,366 on Thursday. Trading in December averaged 455,206 units at $7,774,631. Kingston Wharves shed 74 cents to end at $46.76, in switching ownership of 425 units, NCB Financial fell $1 to $139, with 37,390 stock units crossing the market, Palace Amusement dropped $200 in closing at $1,100, with an exchange of 39 units. PanJam Investment fell $1.77 to $70.17, in transferring 1,793 units, Salada Foods ended at $33.20, with a loss of $2.80 trading 21,881 stocks, Scotia Group rose $1 to $44, after exchanging 22,377 shares, Seprod shed 70 cents in closing at $63.50, in an exchange of 10,331 stocks and Stanley Motta settled at $5.45, with gains of 39 cents while exchanging 7,231 stock units.

Kingston Wharves shed 74 cents to end at $46.76, in switching ownership of 425 units, NCB Financial fell $1 to $139, with 37,390 stock units crossing the market, Palace Amusement dropped $200 in closing at $1,100, with an exchange of 39 units. PanJam Investment fell $1.77 to $70.17, in transferring 1,793 units, Salada Foods ended at $33.20, with a loss of $2.80 trading 21,881 stocks, Scotia Group rose $1 to $44, after exchanging 22,377 shares, Seprod shed 70 cents in closing at $63.50, in an exchange of 10,331 stocks and Stanley Motta settled at $5.45, with gains of 39 cents while exchanging 7,231 stock units.