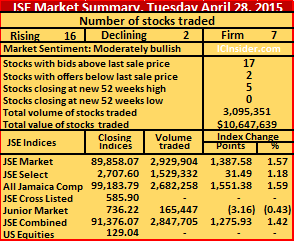

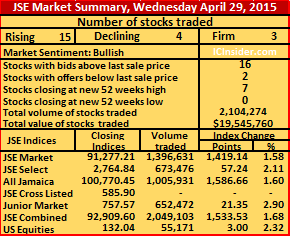

Trading resulted in the prices of 15 stocks rising, 4 declining as 22 securities changed hands, ending in 2,104,274 units trading, valued at $19,545,760, in all market segments.

Main Market| The JSE Market Index gained 1,419.14 points to 91,277.21, the JSE All Jamaican Composite Index rose 1,586.66 points to close at 100,770.45 and the JSE Combined Index gained 1,533.53 points to close at 92,909.60. The market is at its highest since January 5, 2012 when it closed then at 101,108.42 on the all Jamaican Composite index.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 16 stocks with bids higher than their last selling prices and 2 with offers that were lower.

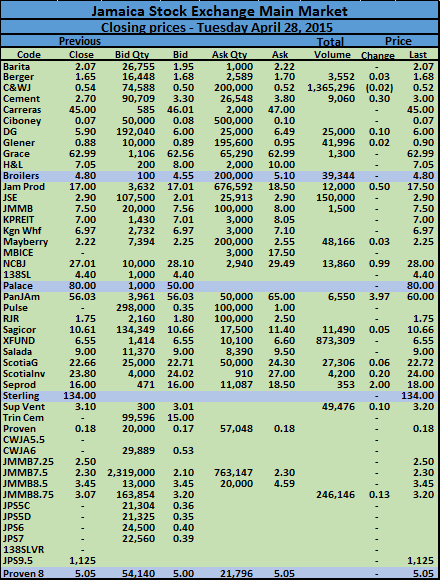

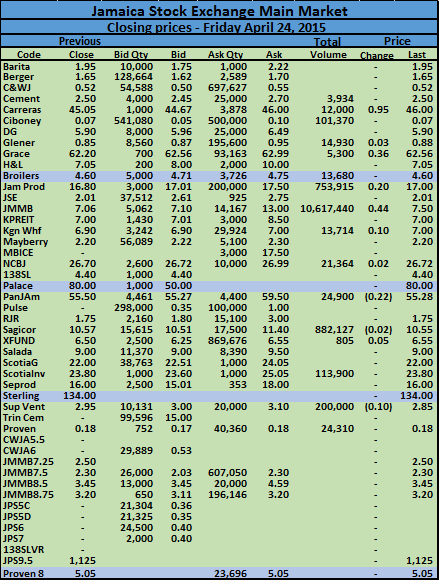

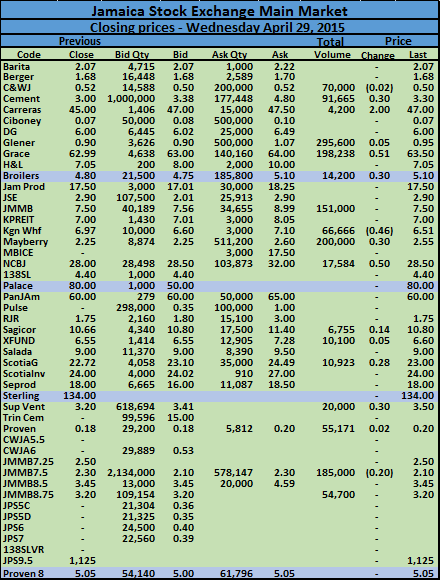

Wednesday session closed with, Caribbean Cement gained 30 cents in trading 91,665 units at $3.30, Carreras having 4,200 units changing hands to end with a gain of $2, at a new 52 weeks’ high of $47, Gleaner closed with 295,600 shares being active to end at 95 cents, up by 5 cents. Grace Kennedy put on 51 cents with 198,238 shares traded, at $63.50, Jamaica Broilers traded 14,200 units at a new 52 weeks’ high of $5.10,for a 30 cents increase, JMMB Group traded 151,000 units at $7.50, Kingston Wharves

traded 66,666 shares at $6.51,as the price fell 46 cents. Mayberry Investments traded 200,000 units at a new 52 weeks’ high of $2.55, after putting on 30 cents on the price.

National Commercial Bank had 17,584 units changing hands for 50 cents higher to end at a new 52 weeks’ high of $28.50. Sagicor Group traded 6,755 shares at a new 52 weeks’ high of $10.80, after gaining 14 cents, Scotia Group exchanged 10,923 shares for a new 52 weeks’ high of $23, with an increase of 28 cents, Supreme Ventures gained 30 cents in trading 20,000 units, at a new 52 weeks’ high of $3.50. Proven Investments traded 55,171 ordinary shares at 20 US cents, for a 2 cents increase, Jamaica Money Market Brokers 7.50% preference share, traded 185,000 units at $2.10 and Jamaica Money Market Brokers 8.75% preference share traded 54,700 units at $3.20.

National Commercial Bank had 17,584 units changing hands for 50 cents higher to end at a new 52 weeks’ high of $28.50. Sagicor Group traded 6,755 shares at a new 52 weeks’ high of $10.80, after gaining 14 cents, Scotia Group exchanged 10,923 shares for a new 52 weeks’ high of $23, with an increase of 28 cents, Supreme Ventures gained 30 cents in trading 20,000 units, at a new 52 weeks’ high of $3.50. Proven Investments traded 55,171 ordinary shares at 20 US cents, for a 2 cents increase, Jamaica Money Market Brokers 7.50% preference share, traded 185,000 units at $2.10 and Jamaica Money Market Brokers 8.75% preference share traded 54,700 units at $3.20.