Scotia Group generated a huge 74 percent jump in net profit to $12.8 billion for the nine months to July 2023 over $7.3 billion in 2022. Profits for the quarter rose a much more subdued 40 percent to $5.16 billion and is up strongly from $3.68 billion in 2022 as well as form profit $4.2 billion in this year’s April quarter.

Scotia Group generated a huge 74 percent jump in net profit to $12.8 billion for the nine months to July 2023 over $7.3 billion in 2022. Profits for the quarter rose a much more subdued 40 percent to $5.16 billion and is up strongly from $3.68 billion in 2022 as well as form profit $4.2 billion in this year’s April quarter.

Earnings per share for the July quarter was a strong $1.66, up from $1.18 in July 2022 and $4.11 for the nine months to July this year and puts the group on track to generate income close to $6 per share for the fiscal year end in October 2023. ICinsider.com is forecasting $5.50 in earnings for the current fiscal year.

Loans grew by $40.5 billion or a solid 18.5 percent compared to July 2022, with loans net of allowances for credit losses increasing to $259.6 billion. “Our core loan book continues to perform well with mortgages increasing year over year by 29 percent, consumer loans by 10 percent and commercial loans by 20 percent,” the group informed investors in their commentary on the results.

Audrey Tugwell Henry Scotia Group’s CEO

Total revenues excluding expected credit losses for the nine months to July, grew by $10 billion to $41.5 billion reflecting an increase of 31.5 percent over the comparative prior year period. “This was primarily driven by an increase in net interest income of $7.1 billion stemming from the strong growth in our loan portfolio, higher insurance revenue as well as higher fee and commission income earned given the significant increase in transaction volumes” the directors informed shareholders in their commentary on the financial performance.

The directors hiked the dividend to 40 cents per stock unit, payable on October 19, to stockholders up from 35 cents per stock unit last paid.

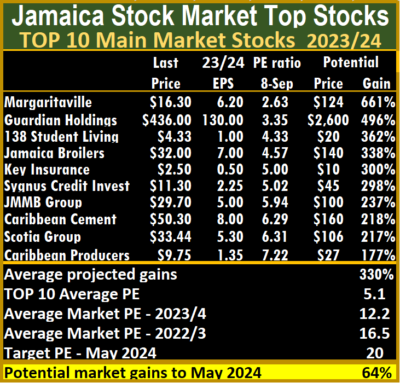

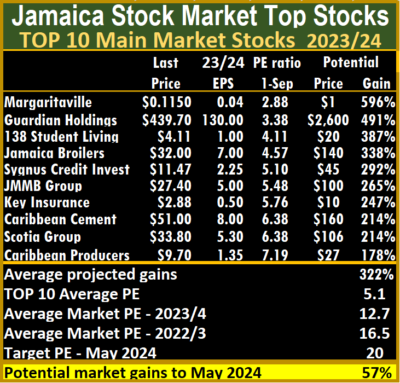

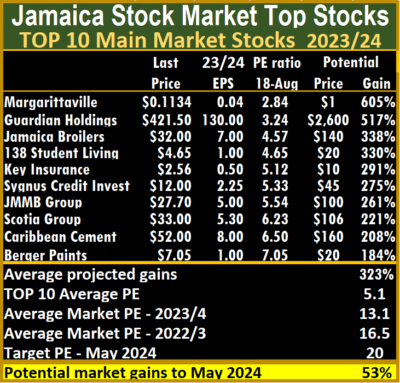

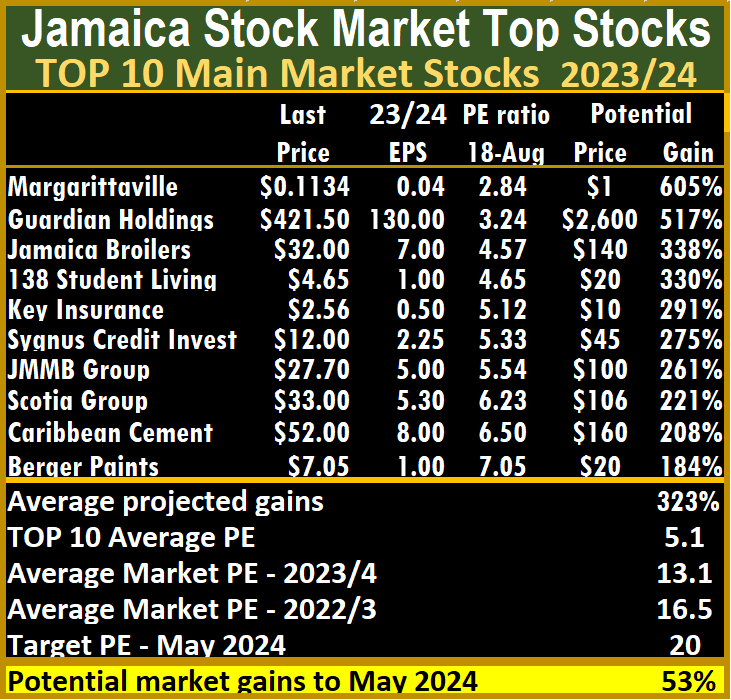

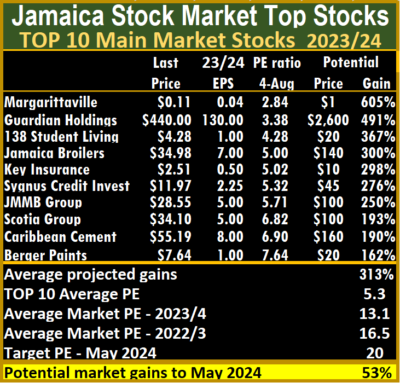

ICInsider.com is accordingly placing an ICBuyRated seal of approval on the stock, which is one of ICInsider.com TOP10 Buy Rated list of stocks. Investors have hardly noticed this performance with the share price falling from $33.44 in the morning session to $33 mid morning with trading in just over 54,000 shares with the stock trading at 5.5 times earnings currently, compared with an average of 12.2 for the overall Main Market, with a huge upside potential for growth for the next 12 months or so.

Elite Diagnostics had a bad fiscal year to June, with a loss of $1.7 million in the June quarter and a profit of only $2.8 million for the year, down from $49 million in 2022. With finance cost jumping to $47 million from $27 million the previous year while depreciation climbed by $41 million to $148 million. ICInsider.com expect revenues to keep on climbing at a above average rate and for cost to increase at a slower pace and deliver an attractive profit which is projected at 40 cents for the year. Recent history suggests that forecasts can be derailed by unforeseen developments, but the stock is worth while looking at as a medium term investment that is undervalued relative to potential.

Elite Diagnostics had a bad fiscal year to June, with a loss of $1.7 million in the June quarter and a profit of only $2.8 million for the year, down from $49 million in 2022. With finance cost jumping to $47 million from $27 million the previous year while depreciation climbed by $41 million to $148 million. ICInsider.com expect revenues to keep on climbing at a above average rate and for cost to increase at a slower pace and deliver an attractive profit which is projected at 40 cents for the year. Recent history suggests that forecasts can be derailed by unforeseen developments, but the stock is worth while looking at as a medium term investment that is undervalued relative to potential. The Junior Market ICTOP10 closed the week with General Accident rising 10 percent to $4.94, followed by Caribbean Assurance Brokers, up 6 percent to $2.83 as Iron Rock Insurance dropped 9 percent to $2.10 and Everything Fresh dipped 5 percent to $1.30.

The Junior Market ICTOP10 closed the week with General Accident rising 10 percent to $4.94, followed by Caribbean Assurance Brokers, up 6 percent to $2.83 as Iron Rock Insurance dropped 9 percent to $2.10 and Everything Fresh dipped 5 percent to $1.30. The markets are not in a bullish state but there continue to be cases of slow upward movements in some prices as investors respond to some recent attractive results leading them to quietly nibble away at a number of stocks, gradually reducing the supply of a number of them that are attractively priced. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors and Lasco Manufacturing, Main Event and Transjamaican Highway.

The markets are not in a bullish state but there continue to be cases of slow upward movements in some prices as investors respond to some recent attractive results leading them to quietly nibble away at a number of stocks, gradually reducing the supply of a number of them that are attractively priced. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors and Lasco Manufacturing, Main Event and Transjamaican Highway.

Note that Margaritaville is listed on both the Main Market and the USD Market, with similar values.

Note that Margaritaville is listed on both the Main Market and the USD Market, with similar values. The markets are not in a bullish state, but there continue to be cases of slow upward movements in some prices as investors respond to some recent attractive results, leading them to quietly nibble away at a number of stocks, gradually reducing the supply of a number of them that are attractively priced. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors and Lasco Manufacturing, Main Event and Transjamaican Highway.

The markets are not in a bullish state, but there continue to be cases of slow upward movements in some prices as investors respond to some recent attractive results, leading them to quietly nibble away at a number of stocks, gradually reducing the supply of a number of them that are attractively priced. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors and Lasco Manufacturing, Main Event and Transjamaican Highway.

Addition to fixed assets absorbed $2.4 billion during the year and includes work in progress of $1.4 billion. In 2022, addition to fixed assets was $637 million as the group increased investments in plant and machinery to expand its operation, which William Mahfood advises is targeted to expand factory and warehouse space by 60 percent to meet growing demand locally and overseas for its products.

Addition to fixed assets absorbed $2.4 billion during the year and includes work in progress of $1.4 billion. In 2022, addition to fixed assets was $637 million as the group increased investments in plant and machinery to expand its operation, which William Mahfood advises is targeted to expand factory and warehouse space by 60 percent to meet growing demand locally and overseas for its products.

Caribbean Cream the leading mover in the Junior Market ICTOP10, climbed 10 percent to $4.15, followed by Edufocal rising 4 percent to $1.45. Iron Rock Insurance was the worst performer, falling 12 percent to $2.10 and was followed by general Accident, down 10 percent to $4.43, while Caribbean Assurance Brokers slipped just 4 percent to $2.87.

Caribbean Cream the leading mover in the Junior Market ICTOP10, climbed 10 percent to $4.15, followed by Edufocal rising 4 percent to $1.45. Iron Rock Insurance was the worst performer, falling 12 percent to $2.10 and was followed by general Accident, down 10 percent to $4.43, while Caribbean Assurance Brokers slipped just 4 percent to $2.87. The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks. The 2023 full year results reflect a greater level of rebound from the declines suffered following the fallout in the economy as a result of the advent of covid-19 and, in particular, the fallout in the global market with higher input costs that flowed from supply disruptions as well as tourism sector that were still recovering during the 2023 fiscal year that ended in March.

The 2023 full year results reflect a greater level of rebound from the declines suffered following the fallout in the economy as a result of the advent of covid-19 and, in particular, the fallout in the global market with higher input costs that flowed from supply disruptions as well as tourism sector that were still recovering during the 2023 fiscal year that ended in March.

Investors may want to note the latest report on the court judgement on the Mystic Mountain sale as there were indications that Dolphin Cove was an interested buyer and they may well be amongst the preferred bidders. If they succeed, expect the stock that currently has limited offers posted on the JSE platform to jump.

Investors may want to note the latest report on the court judgement on the Mystic Mountain sale as there were indications that Dolphin Cove was an interested buyer and they may well be amongst the preferred bidders. If they succeed, expect the stock that currently has limited offers posted on the JSE platform to jump. Dolphin Cove reported a 5 percent increase in revenues to US$4.4 million in the June 2023 quarter over the June 2022 quarter and a 37 percent jump for the half year to US$9.2 million from US$6.76 million, with profit of US$1.153 million for the second quarter, up 10.5 percent over the $1.04 million in the June 2022 quarter and US$2.72 million for the half year, up 48 percent to US$1.84 million in the half year to June 2022.

Dolphin Cove reported a 5 percent increase in revenues to US$4.4 million in the June 2023 quarter over the June 2022 quarter and a 37 percent jump for the half year to US$9.2 million from US$6.76 million, with profit of US$1.153 million for the second quarter, up 10.5 percent over the $1.04 million in the June 2022 quarter and US$2.72 million for the half year, up 48 percent to US$1.84 million in the half year to June 2022. The markets are not bullish, but there continue to be cases of slow upward movements in some prices as investors respond to some recent attractive results leading them to quietly nibble away at many stocks, gradually reducing the supply of a number of them that are attractively priced. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors and Lasco Manufacturing, Main Event and Transjamaican Highway.

The markets are not bullish, but there continue to be cases of slow upward movements in some prices as investors respond to some recent attractive results leading them to quietly nibble away at many stocks, gradually reducing the supply of a number of them that are attractively priced. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors and Lasco Manufacturing, Main Event and Transjamaican Highway. Everything Fresh reported a 14.4 percent increase in revenues to $827 million for the June quarter and a 32 percent jump for the half year to $1.67 billion and a profit of $43 million for the second quarter compared with $30 million in 2022 for the June quarter, and $78 million r the half year versus $38 million in 2022.

Everything Fresh reported a 14.4 percent increase in revenues to $827 million for the June quarter and a 32 percent jump for the half year to $1.67 billion and a profit of $43 million for the second quarter compared with $30 million in 2022 for the June quarter, and $78 million r the half year versus $38 million in 2022. The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the level of likely gains for ICTOP10 stocks.

The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the level of likely gains for ICTOP10 stocks. Lasco released first quarter results, in late July, with a rise in pretax profit jumping a robust 57 percent to $602 million and post-tax climbing a solid 38 percent to $448 million from a 17 percent rise in revenues to $7.3 billion from $6.3 billion.

Lasco released first quarter results, in late July, with a rise in pretax profit jumping a robust 57 percent to $602 million and post-tax climbing a solid 38 percent to $448 million from a 17 percent rise in revenues to $7.3 billion from $6.3 billion.

The 14 most highly valued Main Market stocks representing 30 percent of the Main Market are priced at a PE of 15 to 108, with an average of 30 and 20 excluding the highest PE ratios, with a PE of 23 for the top half and 18 excluding the stocks with the highest PEs.

The 14 most highly valued Main Market stocks representing 30 percent of the Main Market are priced at a PE of 15 to 108, with an average of 30 and 20 excluding the highest PE ratios, with a PE of 23 for the top half and 18 excluding the stocks with the highest PEs. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.