The slippage of the Jamaican dollar continued on Tuesday against all its main trading currencies as purchases of all currencies by dealers amounted to US$42,569,572 equivalent, compared with US$47,599,698, on Monday and selling of the equivalent of US$42,408,749 versus sale of US$45,306,652, previously.

The slippage of the Jamaican dollar continued on Tuesday against all its main trading currencies as purchases of all currencies by dealers amounted to US$42,569,572 equivalent, compared with US$47,599,698, on Monday and selling of the equivalent of US$42,408,749 versus sale of US$45,306,652, previously.

In US dollar trading, dealers bought US$39,083,575 compared to US$40,204,355 on Monday. The buying rate for the US dollar was up 22 cents to $115.03 and US$39,865,854 was sold versus US$38,650,336 on Monday, the selling rate rose 9 cents to end at $115.52. The Canadian dollar buying rate fell $1.45 to $93.24 with dealers buying C$1,080,630 and selling C$627,164, at an average rate that declined by 75 cents to $95.18. The rate for buying the British  Pound climbed $1.93 to $173.01 for the purchase of £1,150,674, while £570,089 was sold, at an average rate that climbed $1.31 to $176.21. At the end of trading it took J$125.63 to purchase the Euro, 26 cents more than on Monday, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$123.08 for a rise of 25 cents from Monday’s rate. Other currencies bought, amounted to the equivalent of US$879,276, while the equivalent of US$1,156,585, was sold.

Pound climbed $1.93 to $173.01 for the purchase of £1,150,674, while £570,089 was sold, at an average rate that climbed $1.31 to $176.21. At the end of trading it took J$125.63 to purchase the Euro, 26 cents more than on Monday, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$123.08 for a rise of 25 cents from Monday’s rate. Other currencies bought, amounted to the equivalent of US$879,276, while the equivalent of US$1,156,585, was sold.

Highs & Lows| The highest buying rate for the US dollar, rose 13 cents to $115.85. The lowest buying rate remained unchanged at $93.94. The highest selling rate rose 33 cents to $120.70 and the lowest selling rate jumped $19.03 to $112.80.  The highest buying rate for the Canadian dollar climbed 50 cents to $96.20. The lowest buying rate was up 42 cents to $74.87, the highest selling rate gained $1.16 to $98.31 and the lowest selling rate rose 30 cents to $90.30. The highest buying rate for the British Pound, rose 95 cents to $177.20, the lowest buying rate fell 12 cents to $139.32, the highest selling rate climbed 51 cents to $180.27 with the lowest selling rate falling 15 cents to $167.85.

The highest buying rate for the Canadian dollar climbed 50 cents to $96.20. The lowest buying rate was up 42 cents to $74.87, the highest selling rate gained $1.16 to $98.31 and the lowest selling rate rose 30 cents to $90.30. The highest buying rate for the British Pound, rose 95 cents to $177.20, the lowest buying rate fell 12 cents to $139.32, the highest selling rate climbed 51 cents to $180.27 with the lowest selling rate falling 15 cents to $167.85.

J$ falls most against the Pound

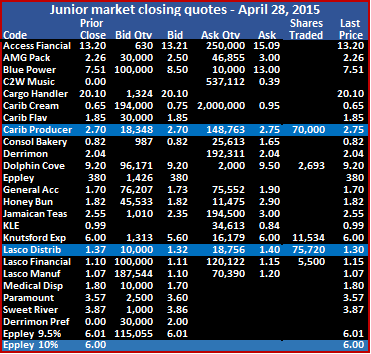

Juniors down but pregnant to go

At the close of the market, there were 8 stocks with bids higher than their last selling prices and just 1 with a lower offer. The junior market ended with 4 securities closing with no bids to buy and 9 securities that had no stocks being offered for sale.

Bids are building for some of the junior market stocks, included in this list are Caribbean Cream with 194,000 units at 75 cents and below 6,535,715 units between 70 and 71 cents, Blue Power with 100,000 units at $8.50, Dolphin Cove 96,171 shares at $9.20, General Accident 76,207 units at $1.73.

and Lasco Manufacturing 187,544 shares at $1.10Stocks trading in the junior market are, Caribbean Producers had 70,000 shares trading at $2.75, with a gain of 5 cents. Dolphin Cove closed at $9.20, with 2,693 shares changing hands, Knutsford express traded 11,534 shares and closed unchanged at $6, Lasco Distributors had 75,720 shares trading at $1.30 for a loss of 7 cents and Lasco Financial Services with 5,500 units traded at the close at $1.15 after gaining 5 cents.

and Lasco Manufacturing 187,544 shares at $1.10Stocks trading in the junior market are, Caribbean Producers had 70,000 shares trading at $2.75, with a gain of 5 cents. Dolphin Cove closed at $9.20, with 2,693 shares changing hands, Knutsford express traded 11,534 shares and closed unchanged at $6, Lasco Distributors had 75,720 shares trading at $1.30 for a loss of 7 cents and Lasco Financial Services with 5,500 units traded at the close at $1.15 after gaining 5 cents.

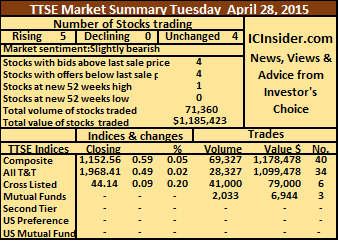

5 stocks gained on TTSE

Trading on the Trinidad Stock Exchange remains moderate but ended with 9 securities changing hands of which 5 advanced, none declined and 4 traded firm, with a total of 71,360 units, valued at $1,185,423.

Trading on the Trinidad Stock Exchange remains moderate but ended with 9 securities changing hands of which 5 advanced, none declined and 4 traded firm, with a total of 71,360 units, valued at $1,185,423.

At the close of the market, the Composite Index advanced by 0.59 points to 1,152.56, the All T&T Index rose 0.49 points to close at 1,968.41 and the Cross Listed Index increased by 0.09 points to close at 44.14.

Gains| Stocks increasing in price at the close are, Clico Investment Fund traded 7,480 shares valued at $168,674 with the price rising 1 cent to $22.56. First Citizens Bank traded just 33 shares to close at $35.69, up 1 cent. JMMB Group with 30,000 shares changing hands, closed 1 cent higher at 47 cents, Point Lisa traded 1,100 units to close 9 cents higher at $3.69, but the bid closed at $3.75 to buy 155,625 shares and Unilever had 140 units trading at $66.09 to gain 1 cent, for a new 52 weeks’ high.

Declines| No stocks declined at the end of trading on Tuesday.

Declines| No stocks declined at the end of trading on Tuesday.

Firm Trades| Stocks closing with prices unchanged at the end of trading are, National Enterprises contributing just 10 shares at $17.30 while Praetorian Property Mutual Fund traded just 2,000 shares at $3.10, Sagicor Financial Corporation traded 11,000 shares at $5.90 and Scotiabank traded 4,500 shares valued at $280,485 to close at $62.33.

National Commercial Bank did not traded but closed with a bid of $1.50, the same price as the last sale to buy 24,859 units at $1.50.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 4 stocks with the bid higher than their last selling prices and 4 stocks with offers that were lower.

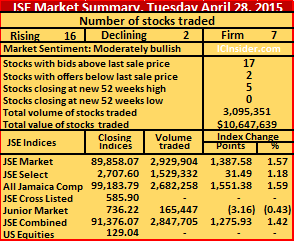

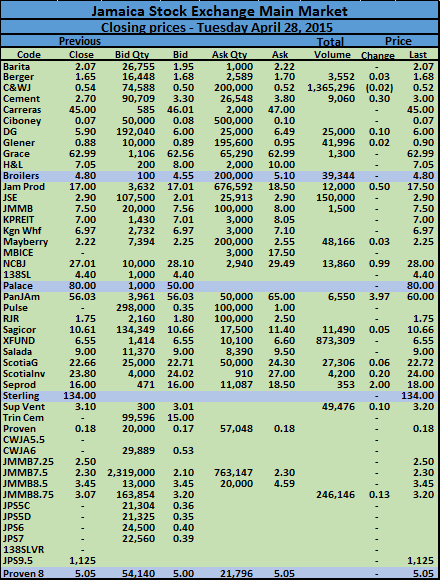

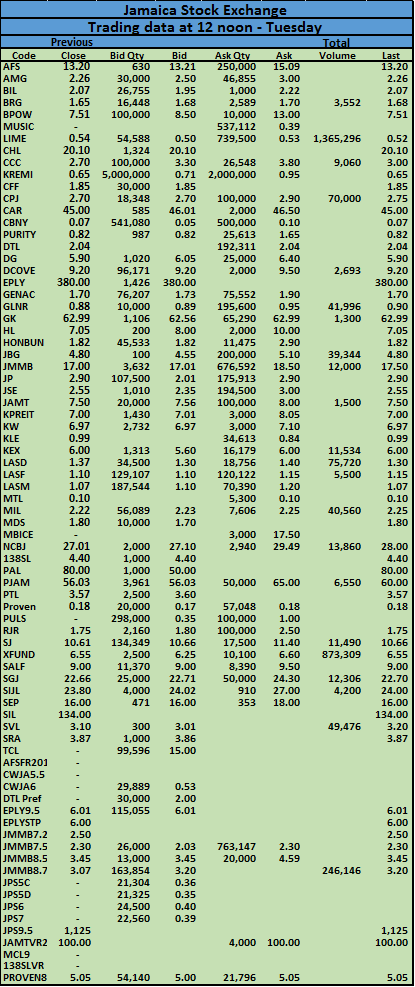

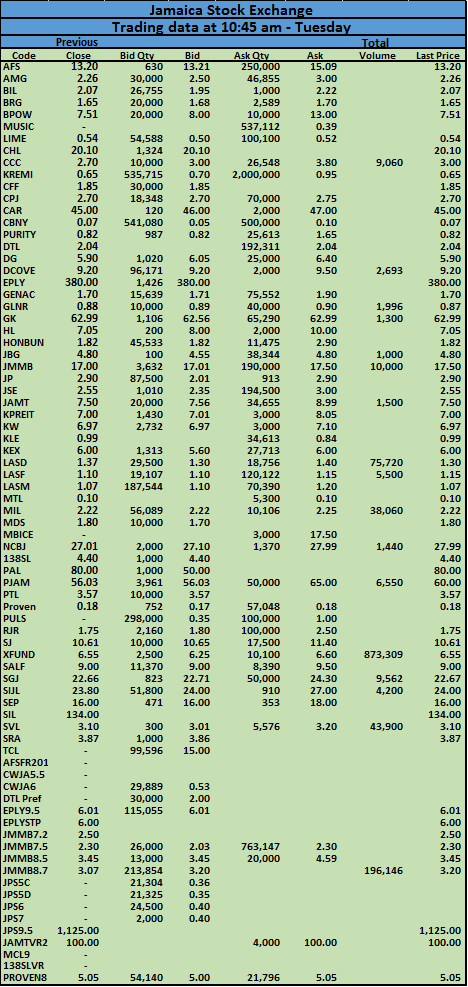

Market holding poised to gain more

Jamaica Stock Exchange activity saw 22 securities trading up to midday on Tuesday leading to  the all Jamaica composite Index being up 1,146.53 points to 98,778.94 and the JSE market Index gained 1,025.48 points to 89,495.97.There were 5 securities trading in the junior market. In the main market Caribbean Cement traded 9,060 units at $3, up by 30 cents and now have a bid for 100,000 units at $3.30, Carreras’ bid is at $46.01 but for only 585 units, the stock last traded on Tuesday at $45. Desnoes & Geddes bid is at $6.05 for a small volume versus $5.90 at the last sale on Tuesday, JMMB Group has a bid at $7.56 versus the last sale of $7.50.

the all Jamaica composite Index being up 1,146.53 points to 98,778.94 and the JSE market Index gained 1,025.48 points to 89,495.97.There were 5 securities trading in the junior market. In the main market Caribbean Cement traded 9,060 units at $3, up by 30 cents and now have a bid for 100,000 units at $3.30, Carreras’ bid is at $46.01 but for only 585 units, the stock last traded on Tuesday at $45. Desnoes & Geddes bid is at $6.05 for a small volume versus $5.90 at the last sale on Tuesday, JMMB Group has a bid at $7.56 versus the last sale of $7.50.

Market up so far & heading higher

Jamaica Stock Exchange activity was off to a slow start on Tuesday but trading picked and is continuing on its bullish stance of recent days, with the all Jamaica composite Index being up 1,181.01 points to 98,813.42and the JSE market Index gained 1,056.32 points to 89,526.81.Only 3 securities have traded in the junior market so far with Lasco Distributors being the lead trade in this market with 75,720 shares at $1.30 down by 7 cents.

being up 1,181.01 points to 98,813.42and the JSE market Index gained 1,056.32 points to 89,526.81.Only 3 securities have traded in the junior market so far with Lasco Distributors being the lead trade in this market with 75,720 shares at $1.30 down by 7 cents.

In the main market Caribbean Cement traded 9,060 units at $3, up by 30 cents, Jamaica Producers gained 50 cents with 10,000 units changing hands at $17.50, National Commercial Bank traded 1,440 shares at $27.99, Pan Jamaican Investment climbed $3.97 to $60 with 6,550 shares, Sagicor Real Estate X Fund had a large trade of 873,309 units at $6.55, Supreme Ventures posted 43,900 shares at 3.10 and Jamaica Money Market Brokers Ltd 8.75% preference share traded 196,146 units at $3.20 after gaining 13 cents.

No end to J$ devaluation yet

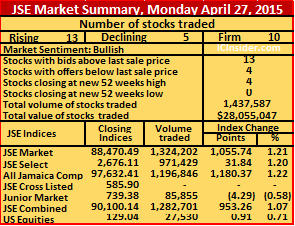

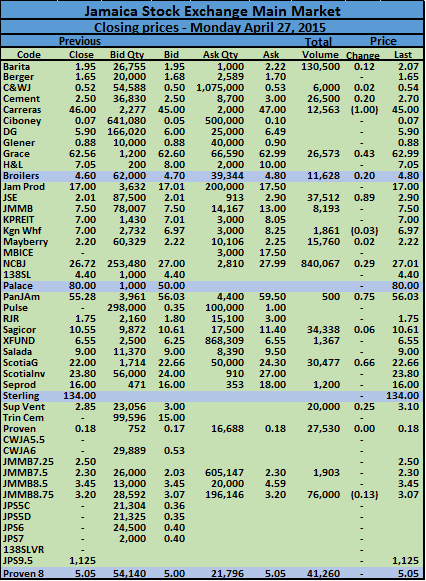

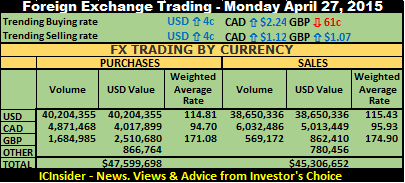

The slippage of the Jamaican dollar continued on Monday against all its main trading currencies. Purchases of all currencies by dealers on Monday amounted to US$47,599,698 equivalent, compared with US$28,651,795, on Friday and selling of the equivalent of US$45,306,652 versus sale of US$28,357,266, previously.

The slippage of the Jamaican dollar continued on Monday against all its main trading currencies. Purchases of all currencies by dealers on Monday amounted to US$47,599,698 equivalent, compared with US$28,651,795, on Friday and selling of the equivalent of US$45,306,652 versus sale of US$28,357,266, previously.

In US dollar trading, dealers bought US$40,204,355 compared to US$25,241,737 on Friday. The buying rate for the US dollar was up 4 cents to $114.81 and US$38,650,336 was sold versus US$26,240,617 on Friday, the selling rate rose 4 cents to end at $115.43. The Canadian dollar buying rate gained $2.24 to $94.70 with dealers buying C$4,871,468 and selling C$6,032,486, at an average rate that rose $1.12 to $95.93.  The rate for buying the British Pound fell 61 cents to $171.08 for the purchase of £1,684,985, while £569,172 was sold, at an average rate that climbed $1.07 to $174.90. At the end of trading it took J$125.37 to purchase the Euro, 83 cents more than on Friday, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$122.83 for a rise of 73 cents from Friday’s rate. Other currencies bought, amounted to the equivalent of US$866,764, while the equivalent of US$780,456, was sold.

The rate for buying the British Pound fell 61 cents to $171.08 for the purchase of £1,684,985, while £569,172 was sold, at an average rate that climbed $1.07 to $174.90. At the end of trading it took J$125.37 to purchase the Euro, 83 cents more than on Friday, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$122.83 for a rise of 73 cents from Friday’s rate. Other currencies bought, amounted to the equivalent of US$866,764, while the equivalent of US$780,456, was sold.

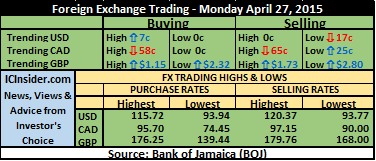

Highs & Lows| The highest buying rate for the US dollar, rose 7 cents to $115.72. The lowest buying and the highest selling rates remained unchanged at $93.94 and $120.37 respectively. The lowest selling rate fell 17 cents to $93.77.  The Canadian dollar fell 58 cents to $95.70. The lowest buying rate was unchanged at $74.45, the highest selling rate declined 65 cents to $97.15 and the lowest selling rate gained 25 cents to $90. The highest buying rate for the British Pound, rose $1.15 to $176.25, the lowest buying rate increased $2.32 to $139.44, the highest selling rate climbed $1.73 to $179.76 with the lowest selling rate climbing $2.80 to $168.

The Canadian dollar fell 58 cents to $95.70. The lowest buying rate was unchanged at $74.45, the highest selling rate declined 65 cents to $97.15 and the lowest selling rate gained 25 cents to $90. The highest buying rate for the British Pound, rose $1.15 to $176.25, the lowest buying rate increased $2.32 to $139.44, the highest selling rate climbed $1.73 to $179.76 with the lowest selling rate climbing $2.80 to $168.

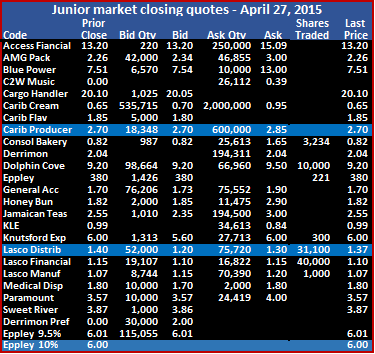

Juniors still not partying

Activity on the Junior Market closed with 7 securities trading and ending with only 85,855 units changing hands, valued at $268,199. The JSE Junior Market Index declined 4.29 points to close at 739.38. At the close 2 stocks fell and none record a price increase, as investors shun the juniors in favour of the main market stocks.

Activity on the Junior Market closed with 7 securities trading and ending with only 85,855 units changing hands, valued at $268,199. The JSE Junior Market Index declined 4.29 points to close at 739.38. At the close 2 stocks fell and none record a price increase, as investors shun the juniors in favour of the main market stocks.

At the close of the market, there were 6 stocks with bids higher than their last selling prices and 2 with offers that were lower. The junior market ended with 4 securities closing with no bids to buy and 7 securities that had no stocks being offered for sale.

Stocks trading in the junior market are, Consolidated Bakeries traded 3,234 shares at 82 cents, Dolphin Cove had 10,000 shares trading at $2.70, Eppley traded just 221 units unchanged at $380, Knutsford Express closed unchanged at $6 with just 300 shares changing hands. Lasco Distributors traded 31,100 shares to close at $1.37 after losing 3 cents, Lasco Financial Services had 40,000 units trading at $1.10 with a fall of 5 cents and Lasco Manufacturing with only 1,000 shares ended at $1.07, but had a bid at $1.15 at the close.

Stocks trading in the junior market are, Consolidated Bakeries traded 3,234 shares at 82 cents, Dolphin Cove had 10,000 shares trading at $2.70, Eppley traded just 221 units unchanged at $380, Knutsford Express closed unchanged at $6 with just 300 shares changing hands. Lasco Distributors traded 31,100 shares to close at $1.37 after losing 3 cents, Lasco Financial Services had 40,000 units trading at $1.10 with a fall of 5 cents and Lasco Manufacturing with only 1,000 shares ended at $1.07, but had a bid at $1.15 at the close.

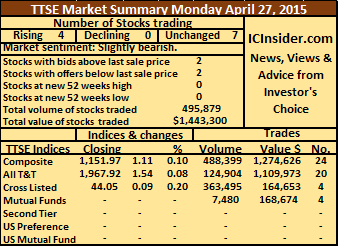

No decline Monday on TTSE

Trading on the Trinidad Stock Exchange remains moderate, but ended with 11 securities changing hands, of which 4 advanced, none declined and 6 traded firm, with a total of 495,879 units, valued at $1,443,300.

Trading on the Trinidad Stock Exchange remains moderate, but ended with 11 securities changing hands, of which 4 advanced, none declined and 6 traded firm, with a total of 495,879 units, valued at $1,443,300.

At the close of the market, the Composite Index advanced by 1.11 points to 1,151.97, the All T&T Index rose 1.54 points to close at 1,967.92 and the Cross Listed Index increased by 0.09 points to close at 44.05.

Gains| Stocks increasing in price at the close are, JMMB Group with 363,145 shares changing hands for a value of $163,428 to close 3 cents higher at 43 cents, Massy Holdings trading 931 shares to close at $63.37 with a gain of 26 cents. Scotiabank traded 3,367 shares valued at $213,198 to close with a gain of 3 cents and end at $62.33 and Trinidad Cement with 84,445 shares trading for $224,679 to end with a 16 cents gain to $2.77.

Declines| No stocks declined at the end of trading on Monday.

Firm Trades|Stocks closing with prices unchanged at the end of trading are, Ansa Merchant Bank with 1,000 shares at $38.95, Clico Investment Fund traded 7,480 shares valued at $168,674 with the price remaining at $22.55.  First Citizens Bank traded 2,373 shares to close $35.61, Grace Kennedy traded 350 units to close at $3.50, Guardian Holdings added 9,358 shares valued at $131,479.90 to close at $14.05. National Enterprises contributed 17,430 shares with a value of $301,539 and ended at $17.30, while Prestige Holdings with 6,000 shares traded at $10.

First Citizens Bank traded 2,373 shares to close $35.61, Grace Kennedy traded 350 units to close at $3.50, Guardian Holdings added 9,358 shares valued at $131,479.90 to close at $14.05. National Enterprises contributed 17,430 shares with a value of $301,539 and ended at $17.30, while Prestige Holdings with 6,000 shares traded at $10.

IC bid-offer Indicator|At the end of trading the Investor’s Choice bid-offer indicator had 2 stocks with the bid higher than their last selling prices and 2 stocks with offers that were lower.