Trading picked up on the Jamaica Stock Exchange US dollar market on Wednesday, with a 2,798 percent surge in the volume of stocks changing hands valued 184 percent more than on Tuesday and resulting in trading in eight securities, compared to 10 on Tuesday with four rising, three declining and one ending unchanged.

A total of 757,348 shares were traded and valued at US$10,500 compared to 26,137 units at US$3,700 on Tuesday.

A total of 757,348 shares were traded and valued at US$10,500 compared to 26,137 units at US$3,700 on Tuesday.

Trading averaged 94,669 shares at US$1,312, up from 2,614 stock units at US$370 on Tuesday, with a month to date average of 32,970 shares at US$1,296 compared with 15,341 units at US$1,291 on the previous day. May ended with an average of 43,350 units for US$2,759.

The US Denominated Equities Index dipped 11.81 points to close at 229.59.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.9. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and two with lower offers.

At the close, First Rock Real Estate USD share ended at 5 US cents after a transfer of 46,900 shares, Margaritaville declined 0.01 of a cent to close at 11.47 US cents in an exchange of 34 stock units, Productive Business Solutions popped 4 cents in closing at US$1.90 as investors exchanged 3 stocks, Proven Investments rose 0.49 of one cent to 16.99 US cents, with 2,380 units crossing the market, Sterling Investments dropped 0.03 of a cent to 1.65 US cents with shareholders swapping one stock unit, Sygnus Credit Investments dipped 0.03 of a cent to end at 11 US cents after an exchange of 4,554 stocks and Transjamaican Highway gained 0.09 of one cent in closing at 1.34 US cents after investors exchanged 703,466 units.

Proven Investments rose 0.49 of one cent to 16.99 US cents, with 2,380 units crossing the market, Sterling Investments dropped 0.03 of a cent to 1.65 US cents with shareholders swapping one stock unit, Sygnus Credit Investments dipped 0.03 of a cent to end at 11 US cents after an exchange of 4,554 stocks and Transjamaican Highway gained 0.09 of one cent in closing at 1.34 US cents after investors exchanged 703,466 units.

In the preference segment, Productive Business 9.25% preference share advanced US$1 and ended at US$13.50 with investors transferring 10 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading picks up on JSE USD Market

Slim trading in JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with an 82 percent fall in the volume of stocks changing hands after a minute decline in value compared with trading on Monday, resulting in 10 securities traded, compared to eight on Monday with three rising, two declining and five ending unchanged.

Overall, 26,137 shares were traded for US$3,700 compared to 144,256 units at US$3,922 on Monday.

Overall, 26,137 shares were traded for US$3,700 compared to 144,256 units at US$3,922 on Monday.

Trading averaged 2,614 shares at US$370 down from 18,032 units at US$490 on Monday, with the month to date averaging 15,341 shares at US$1,303 compared with 22,412 units at US$1,821 on the previous day. May ended with an average of 43,350 units for US$2,759.

The US Denominated Equities Index popped 7.14 points to 241.46.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.9. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and three with lower offers.

In trading, First Rock Real Estate USD share ended at 5 US cents after 15,226 shares were traded, Productive Business Solutions popped 1 cent in closing at US$1.86 while exchanging 10 stocks, Proven Investments dipped 0.5 of a cent to close at 16.5 US cents with investors trading 300 units,  Investors exchanged 9,594 shares of Sterling Investments at 1.68 US cents. Sygnus Credit Investments popped 1.03 cents to 11.03 US cents in swapping 330 stocks, Sygnus Real Estate Finance USD share closed at 11 US cents with an exchange of 107 units and Transjamaican Highway rallied 0.05 of a cent to close at 1.25 US cents in an exchange of 364 stock units.

Investors exchanged 9,594 shares of Sterling Investments at 1.68 US cents. Sygnus Credit Investments popped 1.03 cents to 11.03 US cents in swapping 330 stocks, Sygnus Real Estate Finance USD share closed at 11 US cents with an exchange of 107 units and Transjamaican Highway rallied 0.05 of a cent to close at 1.25 US cents in an exchange of 364 stock units.

In the preference segment, Productive Business 9.25% preference share shed 65 cents in closing at US$12.50 after 200 shares were traded, Eppley 6% preference share ended at US$1.40 after a transfer of 1 share and JMMB Group 5.75% ended at US$1.90 in an exchange of 5 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading slips on the JSE USD market

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with the volume of stocks changing hands rising 29 percent but with an 85 percent drop in value compared with that on Friday and resulted in eight securities trading, compared to seven on Friday with three rising, one declining and four ending unchanged.

A total of 144,256 shares were traded for US$3,922 compared with 112,013 units at US$25,887 on Friday.

A total of 144,256 shares were traded for US$3,922 compared with 112,013 units at US$25,887 on Friday.

Trading averaged 18,032 shares at US$490 compared with 16,002 units at US$3,698 on Friday, with a month to date average of 22,412 shares at US$1,821 compared to 25,916 units at US$2,885 on the previous day. May ended with an average of 43,350 units for US$2,759.

The US Denominated Equities Index slipped 3.84 points to end at 234.33.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.8. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share remained at 5 US cents as 3,324 shares passed through the market,  Productive Business Solutions climbed 0.50 of one cent to US$1.85 in an exchange of 49 stocks, Proven Investments advanced 0.9 of a cent and ended at 17 US cents in exchanging 9,000 stocks, Sygnus Credit Investments ended at 10 US cents in switching ownership of 1,749 units and Transjamaican Highway dipped 0.2 of a cent in closing at 1.2 US cents with 130,011 shares crossing the market.

Productive Business Solutions climbed 0.50 of one cent to US$1.85 in an exchange of 49 stocks, Proven Investments advanced 0.9 of a cent and ended at 17 US cents in exchanging 9,000 stocks, Sygnus Credit Investments ended at 10 US cents in switching ownership of 1,749 units and Transjamaican Highway dipped 0.2 of a cent in closing at 1.2 US cents with 130,011 shares crossing the market.

In the preference segment, Productive Business 9.25% preference share rallied 65 cents to end at US$13.15, with 15 stock units crossing the market, Eppley 6% preference share remained at US$1.40, with 4 units changing hands and JMMB Group 5.75% ended at US$1.90 in an exchange of 104 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Kremi tops ICTOP10 Lasco Manufacturing in

Iron Rock Insurance ended the past week up 14 percent to $2.25 and Lasco Distributors climbed 11 percent to $2.77 after both jumped 34 percent and 21 percent, respectively, earlier in the week, with two new stocks entering the Junior Market ICTOP10. At the same time, the Main Market TOP10 delivered moderate up and down movements.

The Lasco Distributors price movement follows release of full year results with earnings of 38.5 cents per share, with ICInsider.com projecting earnings of 55 cents for the fiscal year ending March 2024, leaving much room for solid upside price movement in the months ahead.

The Lasco Distributors price movement follows release of full year results with earnings of 38.5 cents per share, with ICInsider.com projecting earnings of 55 cents for the fiscal year ending March 2024, leaving much room for solid upside price movement in the months ahead.

Lasco Manufacturing (LasM) and Caribbean Cream (Kremi) released improved full year results over those for 2022. Importantly, ICInsider.com forecast for the 2024 fiscal year is 70 cents per share for LasM and 90 cents for Kremi, with both entering the TOP10 this week, with one at the top and one at the bottom. Iron Rock Insurance and Edufocal fell from the Junior Market TOP10 to make way for the two stocks.

The stock rising in the ICTOP10 Junior Market, apart from those mentioned in the opening paragraph, is Consolidated Bakeries, with an increase of 4 percent to $2.27. At the same time, Caribbean Assurance Brokers, iCreate and One on One dipped 4 percent to $2.40, $1.26 and $1.10 respectively.

The price of Main Market listed Caribbean Producers, popped 5 percent in closing at $10.06, Key Insurance fell 11 percent to $2.80 and 138 Student Living lost 8 percent in value to close at $5.15.

The price of Main Market listed Caribbean Producers, popped 5 percent in closing at $10.06, Key Insurance fell 11 percent to $2.80 and 138 Student Living lost 8 percent in value to close at $5.15.

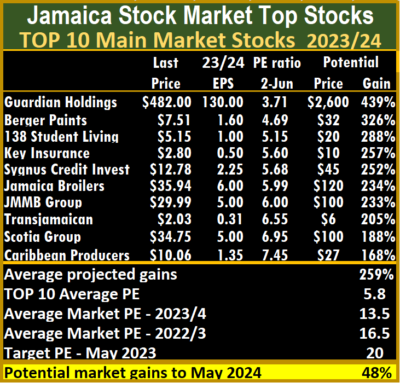

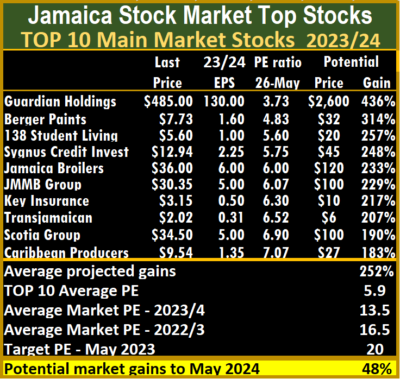

At the end of the week, the average PE for the JSE Main Market TOP10 is 5.9, well below the market average of 13.5. The Main Market TOP10 is projected to have an average of 259 percent, to May 2024, based on 2023 forecasted earnings.

The 15 most highly valued Main Market stocks are priced at a PE of 15 to 110, with an average of 28 and 19 excluding the highest PE stocks and 18 for the top half excluding the stocks with the highest valuation.

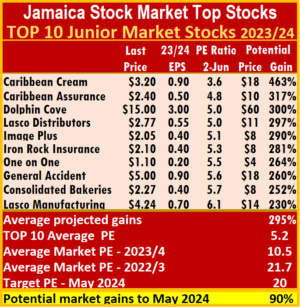

The Junior Market Top 10 PE sits at 5.3 compared with the market at 10.5. There are 10 stocks representing 21 percent of the market, with PEs from 15 to 24, averaging 19 are well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently. Junior Market is projected to rise by 295 percent to May 2024.

Lasco’s ICool drinks.

The differences between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the level of likely gains for ICTOP10 stocks.

In the market generally, Investors continue to nibble away at a number of stocks and, in the process, gradually reduce the supply of several stocks that are attractively priced as the market moves toward the summer months, the start of the stock market year.

A look behind the supply chain shows an ever decreasing number of stocks on offer. The list includes Caribbean Assurance Brokers with strong buying interest between $1.88 and $2.40, but limited selling above $2.50, Caribbean Cement, Caribbean Producers (CPJ), Fontana, Dolphin Cove, Honey Bun, Main Event,  Massey Holdings, Seprod, Transjamaican and Wisynco have started to look positive. Supplies of some stocks are being quietly sucked out of the market, setting the stage for a sustained rally sometime down the road. ICTOP10 focuses on likely yearly winners. Accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

Massey Holdings, Seprod, Transjamaican and Wisynco have started to look positive. Supplies of some stocks are being quietly sucked out of the market, setting the stage for a sustained rally sometime down the road. ICTOP10 focuses on likely yearly winners. Accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

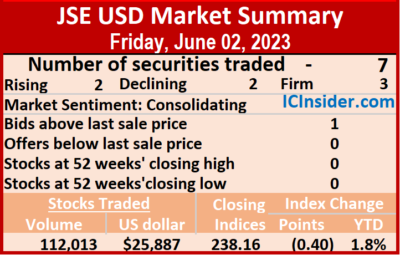

Increased funding for the JSEUSD market

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks changing hands declining 24 percent but with the value surging 878 percent over Thursday, resulting in trading in seven securities, compared to three on Thursday with two rising, two declining and three ending unchanged.

A total of 112,013 shares were traded for US$25,887 compared with 147,149 units at US$2,647 on Thursday.

A total of 112,013 shares were traded for US$25,887 compared with 147,149 units at US$2,647 on Thursday.

Trading averaged 16,002 units at US$3,698 compared t0 49,050 shares at US$882on Thursday, with a month to date average of 25,916 shares at US$2,853 compared to May with an average of 43,350 units for US$2,759.

The US Denominated Equities Index lost 0.40 points to settle at 238.16.

The PE Ratio, a measure used to compute stock values, averages 8.8. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and none with a lower offer.

At the close, Productive Business Solutions dipped 5.5 cents to US$1.845, with 5 shares crossing the exchange,  Proven Investments rose 0.1 of a cent to finish trading at 16.1 US cents after 29,361 stock units were traded, Sterling Investments ended at 1.68 US cents after 13,500 stocks changed hands, Sygnus Credit Investments fell 1.03 cents to end at 10 US cents with 2,208 units being traded and Transjamaican Highway climbed 0.2 of a cents to close at 1.4 US cents while exchanging 65,367 shares.

Proven Investments rose 0.1 of a cent to finish trading at 16.1 US cents after 29,361 stock units were traded, Sterling Investments ended at 1.68 US cents after 13,500 stocks changed hands, Sygnus Credit Investments fell 1.03 cents to end at 10 US cents with 2,208 units being traded and Transjamaican Highway climbed 0.2 of a cents to close at 1.4 US cents while exchanging 65,367 shares.

In the preference segment, Productive Business 9.25% preference share ended at US$12.50 with shareholders swapping 1,570 stock units and JMMB Group 5.75% ended at US$1.90 with an exchange of 2 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Fall back for JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday with an 83 percent fall in the volume of stocks changing hands at a 97 percent lower value than on Wednesday, resulting from trading in just three securities, compared to seven on Wednesday with one rising, one declining and one ending unchanged.

A total of 147,149 shares were exchanged for US$2,647 compared with 842,727 units at US$97,351 on Wednesday.

A total of 147,149 shares were exchanged for US$2,647 compared with 842,727 units at US$97,351 on Wednesday.

Trading averaged 49,050 units at US$882 compared to 120,390 shares at US$13,907 on Wednesday. May ended with an average of 43,350 units for US$2,759.

The US Denominated Equities Index shed 4.12 points to settle at 238.57.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.8. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

The Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and none with a lower offer.

The Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and none with a lower offer.

At the close, Sygnus Credit Investments rose 0.02 of a cent to 11.03 US cents after trading ended with 2,236 shares changing hands and Transjamaican Highway dipped 0.25 of a cent in closing at 1.2 US cents with a transfer of 144,438 stocks.

In the preference segment, JMMB Group 6% remained at US$1.20 after ending with 475 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading dives on JSE USD Market

A 98 percent fall in stocks trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with the market climbing above the close on Monday and resulted in the trading of six securities, down from eight on Monday and ended with prices of three rising, none declining and three ending unchanged.

Overall, 15,452 shares were traded for US$986 compared to 959,588 units at US$46,217 on Monday.

Overall, 15,452 shares were traded for US$986 compared to 959,588 units at US$46,217 on Monday.

Trading averaged 2,575 shares at US$164 versus 119,949 units at US$5,777 on Monday, with a month to date average of 39,779 shares at US$2,243 compared with 41,318 units at US$2,329 on the previous day. April ended with an average of 394,241 units for US$22,357.

The US Denominated Equities Index popped 12.60 points to conclude trading at 212.29.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.5. The PE ratio is calculated based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close,  First Rock Real Estate USD share popped 0.5 of a cent after closing at 5 US cents, with shareholders swapping 560 shares, Proven Investments ended at 16.9 US cents after a transfer of 2,325 stock units, Sterling Investments remained at 1.68 US cents, with 5,741 stocks crossing the market and Transjamaican Highway rose 0.29 of a cent to end at 1.29 US cents after closing with an exchange of 6,616 units.

First Rock Real Estate USD share popped 0.5 of a cent after closing at 5 US cents, with shareholders swapping 560 shares, Proven Investments ended at 16.9 US cents after a transfer of 2,325 stock units, Sterling Investments remained at 1.68 US cents, with 5,741 stocks crossing the market and Transjamaican Highway rose 0.29 of a cent to end at 1.29 US cents after closing with an exchange of 6,616 units.

In the preference segment, JMMB Group 5.75% ended at US$1.90 with 204 shares changing hands and JMMB Group 6% increased 13 cents to US$1.20 as investors exchanged just 6 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Increased trading hits JSEUSD Market

The Jamaica Stock Exchange US dollar Market had another chunk of the index chopped off on Monday, with the volume of stocks changing hands surging 354 percent and valued 172 percent more than on Friday, resulting in the trading of eight securities, compared to seven on Friday with two rising, three declining and three ending unchanged.

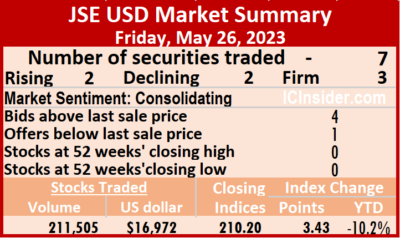

Investors traded 959,588 shares for US$46,217 compared with 211,505 units at US$16,972 on Friday.

Investors traded 959,588 shares for US$46,217 compared with 211,505 units at US$16,972 on Friday.

Trading averaged 119,949 shares at US$5,777 versus 30,215 units at US$2,425 on Friday, with a month to date average of 41,318 shares at US$2,329 compared to 36,727 units at US$2,127 on the previous trading day. April ended with an average of 394,241 units for US$22,357.

The US Denominated Equities Index lost 10.51 points to end at 199.69.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.2. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share fell 0.5 of a cent and ended at 4.5 US cents as 11,871 shares passed through the market, Margaritaville ended at 9.01 US cents while exchanging 570 units,  Proven Investments rose 0.9 of a cent to 16.9 US cents, with 233,554 stock units clearing the market, but only after trading at a 52 weeks’ intraday low of 13.6 cents. Sterling Investments ended at 1.68 US cents after trading 4,057 stocks, Sygnus Credit Investments popped 0.86 of one cent to 11.01 US cents, with 100 shares crossing the exchange, Sygnus Real Estate Finance USD share lost 0.1 of a cent in closing at 11 US cents after an exchange of 100 units and Transjamaican Highway dipped 0.3 cents to 1 US cent in trading 708,836 stocks.

Proven Investments rose 0.9 of a cent to 16.9 US cents, with 233,554 stock units clearing the market, but only after trading at a 52 weeks’ intraday low of 13.6 cents. Sterling Investments ended at 1.68 US cents after trading 4,057 stocks, Sygnus Credit Investments popped 0.86 of one cent to 11.01 US cents, with 100 shares crossing the exchange, Sygnus Real Estate Finance USD share lost 0.1 of a cent in closing at 11 US cents after an exchange of 100 units and Transjamaican Highway dipped 0.3 cents to 1 US cent in trading 708,836 stocks.

In the preference segment, JMMB Group 6% ended at US$1.07 and with 500 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Insurance companies head ICTOP10

The JSE Main Market gained more than 7,000 points in the past week, but the Junior Market just closed a few points north of the prior week’s close, resulting in sizable changes in both markets’ ICTOP10 as insurance companies head TOP10.

Elsewhere the only other news of note was the passing of the Chairman and majority owner of the Lasco companies, the addition of two new directors at ISP Finance and the Bank of Jamaica issue of $35 billion in 28 days CDS with investors offering to buy just $35.24 billion, BOJ took up less than the amount offered with $34.45 billion being sterilized the amount offered and moved the total amount of CDs outstanding to a record $111.45 billion up from $109 billion the week before. The average interest rate climbed back above 8 to 8.24 percent.

Elsewhere the only other news of note was the passing of the Chairman and majority owner of the Lasco companies, the addition of two new directors at ISP Finance and the Bank of Jamaica issue of $35 billion in 28 days CDS with investors offering to buy just $35.24 billion, BOJ took up less than the amount offered with $34.45 billion being sterilized the amount offered and moved the total amount of CDs outstanding to a record $111.45 billion up from $109 billion the week before. The average interest rate climbed back above 8 to 8.24 percent.

Investors are nibbling at stocks that seem to be the market signal being sent, with gains in some of the ICTOP10 listings. Notable amongst them are Caribbean Assurance Brokers with solid buying interest between $1.88 and $2.09 but limited selling above $2.50, Caribbean Producers (CPJ), Dolphin Cove Massey Holdings, Transjamaican, and Wisynco have started to look positive. Supplies of some stocks are being quietly sucked out of the market and setting the stage for a sustained rally sometime down the road. Investors should look to July as an important month that could trigger a change in mood as investors anticipate second quarter results.

Action in the markets this past week resulted in four ICTOP10 Junior Market stocks recording significant losses of 6 to 26 percent, with only 2 with 4 percent gains. Everything Fresh dropped out of the TOP10 and iCreate returns after a brief absence. Main Market stocks were mixed, with one noted loss and two gains of note.

Action in the markets this past week resulted in four ICTOP10 Junior Market stocks recording significant losses of 6 to 26 percent, with only 2 with 4 percent gains. Everything Fresh dropped out of the TOP10 and iCreate returns after a brief absence. Main Market stocks were mixed, with one noted loss and two gains of note.

Stocks rising in the ICTOP10 Junior Market are Everything Fresh and One on One, which increased 4 percent to $$1.72 and $1.15, respectively. Iron Rock Insurance dropped 26 percent to $1.85, Consolidated Bakeries shed 10 percent to $2.19, while Dolphin Cove and Lasco Distributors lost 6 percent to end at $15.50 and $2.50, respectively.

The price of Main Market listed Transjamaican rose 6 percent to close at $2.02, Caribbean Producers popped 5 percent in closing at $9.54 and Key Insurance fell 14 percent to $3.15.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.9, well below the market average of 13.5. The Main Market TOP10 is projected to have an average of 252 per cent, by May 2024, based on 2023 forecasted earnings.

The 15 most highly valued Main Market stocks are priced at a PE of 15 to 93, with an average of 29 and 19 excluding the highest PE stocks and 19 for the top half excluding the stocks with the highest valuation.

The Junior Market Top 10 PE sits at 5.8 compared with the market at 10.9. There are 11 stocks representing 23 percent of the market, with PEs from 15 to 25, averaging 19, which is well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently. Junior  Market is projected to rise by 265 percent to May 2024.

Market is projected to rise by 265 percent to May 2024.

The differences between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

JSE USD market inched higher on Friday

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks changing hands rising 48 percent but valued 45 percent less than on Thursday, resulting in a rise in the market index, following trading in seven securities, compared to six on Thursday with two rising, two declining and three ending unchanged.

A total of 211,505 shares were traded for US$16,972 compared to 142,507 units at US$31,099 on Thursday.

A total of 211,505 shares were traded for US$16,972 compared to 142,507 units at US$31,099 on Thursday.

Trading averaged 30,215 units at US$2,425 compared with 23,751 shares at US$5,183 on Thursday, with a month to date average of 36,727 shares at US$2,127 compared with 37,077 units at US$2,111 on the previous day. April ended with an average of 394,241 units for US$22,357.

The US Denominated Equities Index rose 3.83 points to close at 210.66.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.3. The PE ratio is computed based on the last traded price of each stock divided by projected earnings, forecasted by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share added 0.6 of a cent to end at 5 US cents with  1,133 shares being traded, Margaritaville dipped 0.34 of a cent to 9.01 US cents after trading 1,430 stocks, Proven Investments ended at 16 US cents, with 95,323 stock units crossing the market. Sterling Investments ended at 1.68 US cents with an exchange of one unit, Sygnus Credit Investments dipped 0.88 of one cent to close at 10.15 US cents in exchanging 51 shares and Transjamaican Highway gained 0.1 of a cent to close at 1.3 US cents in switching ownership of 113,517 stock units.

1,133 shares being traded, Margaritaville dipped 0.34 of a cent to 9.01 US cents after trading 1,430 stocks, Proven Investments ended at 16 US cents, with 95,323 stock units crossing the market. Sterling Investments ended at 1.68 US cents with an exchange of one unit, Sygnus Credit Investments dipped 0.88 of one cent to close at 10.15 US cents in exchanging 51 shares and Transjamaican Highway gained 0.1 of a cent to close at 1.3 US cents in switching ownership of 113,517 stock units.

In the preference segment, Eppley 6% preference share remained at US$1.40 while exchanging 50 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.