Investors’ attention turned to the Junior Market in both 2020 and 2021 as that market provided better values for stocks and therefore greater opportunities to make higher profits. Projected earnings of the listed companies suggest that the situation is unlikely to change in 2022.

Investors’ attention turned to the Junior Market in both 2020 and 2021 as that market provided better values for stocks and therefore greater opportunities to make higher profits. Projected earnings of the listed companies suggest that the situation is unlikely to change in 2022.

The Main Market of the Jamaica Stock Exchange eked out a modest gain of 1.1 percent in the All Jamaica Composite index at the end of 2021, the index was 21.7 percent lower than the end of 2019.

The PE for the Main market is 14 times 2022 earnings compared to 16 based on 2021 earnings, that does not suggest a big uptick for the market with just a 14 percent increase expected in 2022 over 2021 that would push the index to 499,694 points, still well below the 559,853.26 points the market closed out 2019 at.

There are several stocks in the market, data suggest could more than double in 2022 and investor would be wise to not only pay attention but pick up some of these undervalued stocks in preparation for long term growth as the Jamaican economy rebounds and move into a new stage of long term positive growth that a number of these companies will benefit from.

Banks could be amongst the big performer as they shed the need for continued heavy provisioning of loans as well as grow their book of loans to deliver more income to profits. Added the increase in interest rates will help improve their net interest income.

Banks could be amongst the big performer as they shed the need for continued heavy provisioning of loans as well as grow their book of loans to deliver more income to profits. Added the increase in interest rates will help improve their net interest income.

ICInsider.com data indicates that there are 8 stocks that can double in the Main Market in 2022 into early 2023. 2021 finished with several stocks trading at or above 20 times earnings in the Main Market if that level of valuation continues into 2022 and is more widespread, then the gain in the market could exceed the above potential gains. In the final analysis, the market index is just a simple measure as to how the overall market is doing. It comes down to individual stocks that can do well and that is the case for ICInsider.com TOP15 stocks.

3 new ICTOP10 listings as Spur Tree exists

The Junior Market ICTOP10 stocks have three new listings in a week that saw Spur Tree Spices trading for the first time on Friday with the price climbing to $1.32 for a rise of 32 percent since the Initial Public offer at the end of 2021, there are no new Main Market listings.

Other stocks that were in the spotlight this past week were ones that lasted off to record new all-time highs and include AMG Packaging, Caribbean Assurance Brokers, Caribbean Producers and Dolphin Cove a TOP10 contender up to the week ending December 2, also hit a 52 weeks’ high of $23.50 this past week to be up more than 100% since it came into the top flight in August last year at $9.86.

Other stocks that were in the spotlight this past week were ones that lasted off to record new all-time highs and include AMG Packaging, Caribbean Assurance Brokers, Caribbean Producers and Dolphin Cove a TOP10 contender up to the week ending December 2, also hit a 52 weeks’ high of $23.50 this past week to be up more than 100% since it came into the top flight in August last year at $9.86.

With the rise in the price of Spur Tree Spices, the stock is one of four to move out of the TOP10, followed by Medical Disposables that 16 percent for the week and Caribbean Cream that reported terrible third quarter results with a loss being made in the period as revenues climbed 14 percent in the quarter. Coming into the TOP10 are Lumber Depot, Fontana and General Accident.

Junior Market, AMG Packaging rose a strong 45 percent, ahead of the first quarter results to November that showed profit after tax jumping a big 146 percent over 2020. Investors can expect more gains to come this coming week as the stock traded up $3.90 last week. Caribbean Assurance Brokers climbed to a new 52 weeks’ high during the week and closed $3.12 up 26 percent, Access Financial Services continues to seesaw and recovered 17 percent to $20 this past week and Elite Diagnostic gained 8 percent to $3.18.

Junior Market, AMG Packaging rose a strong 45 percent, ahead of the first quarter results to November that showed profit after tax jumping a big 146 percent over 2020. Investors can expect more gains to come this coming week as the stock traded up $3.90 last week. Caribbean Assurance Brokers climbed to a new 52 weeks’ high during the week and closed $3.12 up 26 percent, Access Financial Services continues to seesaw and recovered 17 percent to $20 this past week and Elite Diagnostic gained 8 percent to $3.18.

The sharp price movements in the Junior Market reduced the potential gains markedly, with the average gains projected for the TOP 10 Junior Market stocks now 122 percent versus 148 percent last week.

The top three stocks are Access Financial Services followed by Lasco Distributors and Caribbean Assurance Brokers can gain between 124 and 160 percent, sharply down from 182 and 204 percent, previously.

The top three stocks are Access Financial Services followed by Lasco Distributors and Caribbean Assurance Brokers can gain between 124 and 160 percent, sharply down from 182 and 204 percent, previously.

Major Main Market TOP10 moving stocks are Caribbean Producers up 7 percent, to $15.99 and Radio Jamaica rallying 7 percent to $3.45 as increased buying interest came in for the stock.

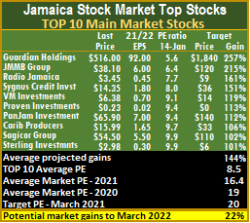

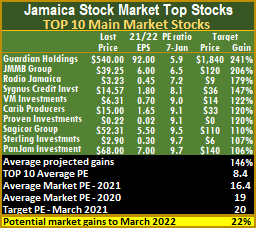

The potential gains for Main Market stocks moved from 146 percent to this weeks’ 144 percent this week, with top three Main Market stocks being Guardian Holdings followed by JMMB Group and Radio Jamaica all projected to gain between 161 and 257 percent up from 199 and 258 percent last week.

The Junior Market closed the week, with an average PE of 14.7 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings.  The TOP 10 stocks trade at a PE of a mere 9.1, with a 38 percent discount to that market’s average.

The TOP 10 stocks trade at a PE of a mere 9.1, with a 38 percent discount to that market’s average.

The Junior Market can gain 36 percent to March this year, based on an average PE of 20 and 16 percent based on an average PE of 17. Eleven stocks representing 26 percent of all Junior Market stocks with positive earnings are trading at or above this level averaging 25.

The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.5 representing a 48 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

ICTOP10 scaling new highs

Main Market TOP10 stock, Sagicor Group price fell to $52.31 to return to the TOP10 after closing the previous week at $58 and replaced by Scotia Group that slipped from $36 to $35.50 as both the Main and Junior Markets displayed some bullish signs in the past week, with Caribbean Producers hitting a record high of $15 and gained 436 percent in just over a year.

Sagicor Group back in ICTOP10.

Other big news for the week was the continued rise of ICTOP10 Main Market stock, Caribbean Producers that closed the week with a gain of 15 percent at a record high of $15 and is now in the sixth spot with the potential to gain another 120 percent in months. Radio Jamaica rose 7 percent for the week to $3.23 and Guardian Holdings rose 5 percent.

Junior Market AMG Packaging rose 6 percent but could climb higher with the first quarter results to November, due this coming week and the company is also expected to announce a dividend. Lasco Financial put on 7 percent to land at $3.20, Elite Dynastic gained 4 percent to $2.95, Caribbean Assurance Brokers climbed as high as $2.75 during the week but closed down at $2.48 for a 3 percent gain, and Access Financial Services fell 10 percent to $17.08 and Lasco Distributors lost 6 percent to $3.20.

Elsewhere, investors in the Spur Tree Spices Initial Public offer will receive just over 11.76 percent of the shares they applied for in the heavily oversubscribed issue that is sure to drive the stock price with a big bang in the first week of trading which should be ahead of the end of January.

Elsewhere, investors in the Spur Tree Spices Initial Public offer will receive just over 11.76 percent of the shares they applied for in the heavily oversubscribed issue that is sure to drive the stock price with a big bang in the first week of trading which should be ahead of the end of January.

The top three Main Market stocks, this week are Guardian Holdings followed by JMMB Group and Radio Jamaica all projected to gain between 199 and 258 percent up from 183 and 261 percent last week.

The Junior Market’s top three stocks for the week are Access Financial Services followed by AMG Packaging and Caribbean Assurance Brokers. All three can gain between 182 and 204 percent versus 174 and 218 percent, previously.

The average gains projected for the TOP 10 Junior Market stocks is 148 percent and Main Market stocks moved from 152 percent to this weeks’ 146 percent.

The average gains projected for the TOP 10 Junior Market stocks is 148 percent and Main Market stocks moved from 152 percent to this weeks’ 146 percent.

The Junior Market closed the week, with an average PE of 14.8 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of just 8.2, with a 45 percent discount to that market’s average.

The Junior Market can gain 35 percent to March this year, based on an average PE of 20 and 15 percent based on an average PE of 17. Ten stocks representing 26 percent of all Junior Market stocks with positive earnings are trading at or above this level and averaging 25.

The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.4 representing a 49 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.4 representing a 49 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market.  ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

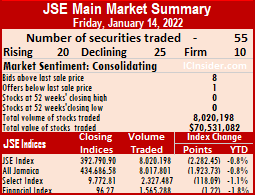

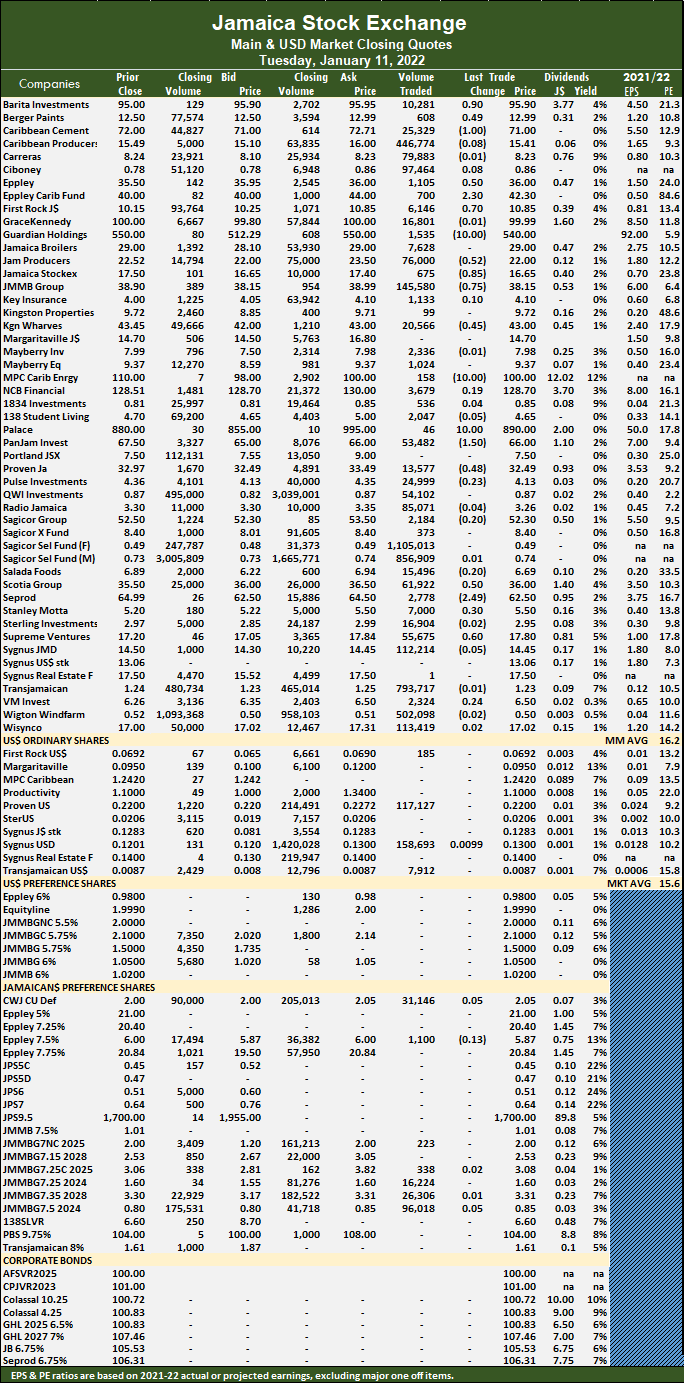

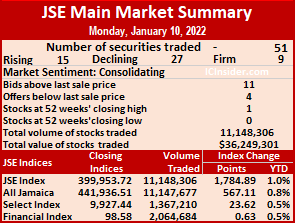

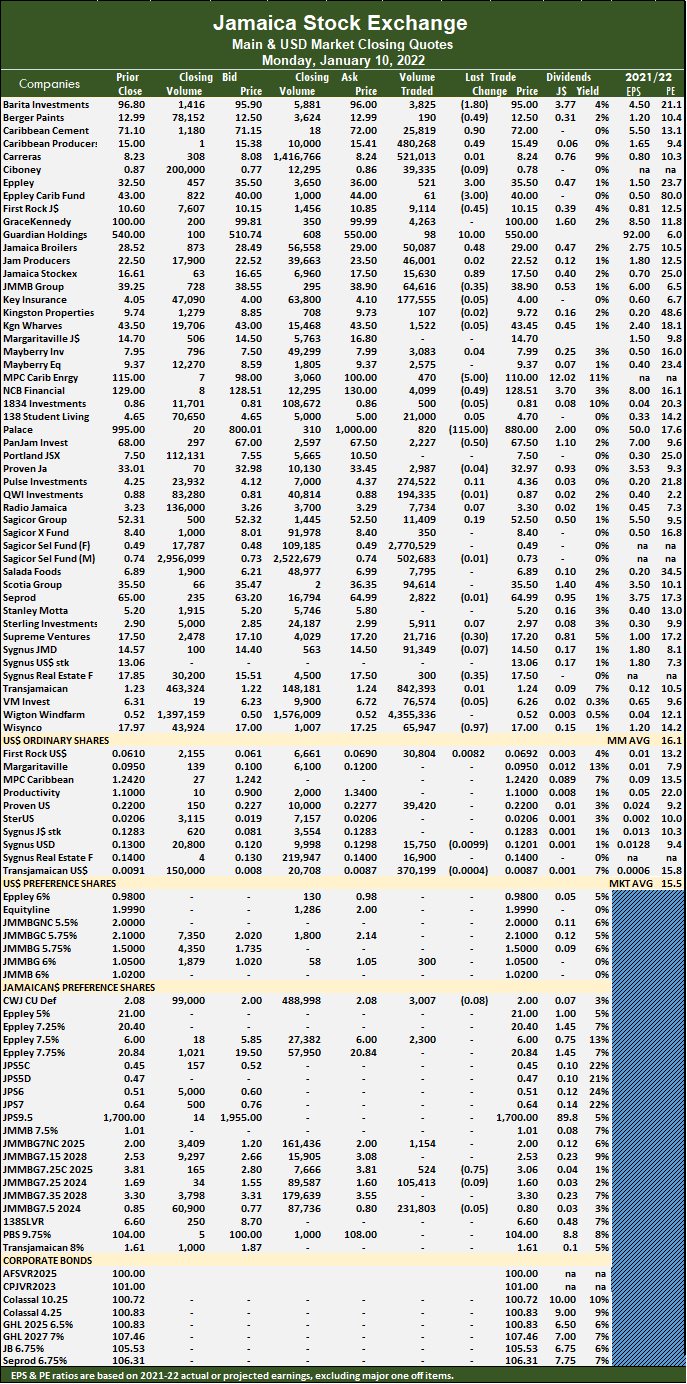

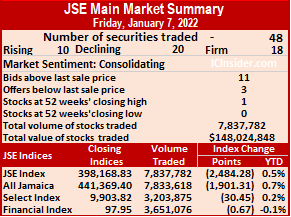

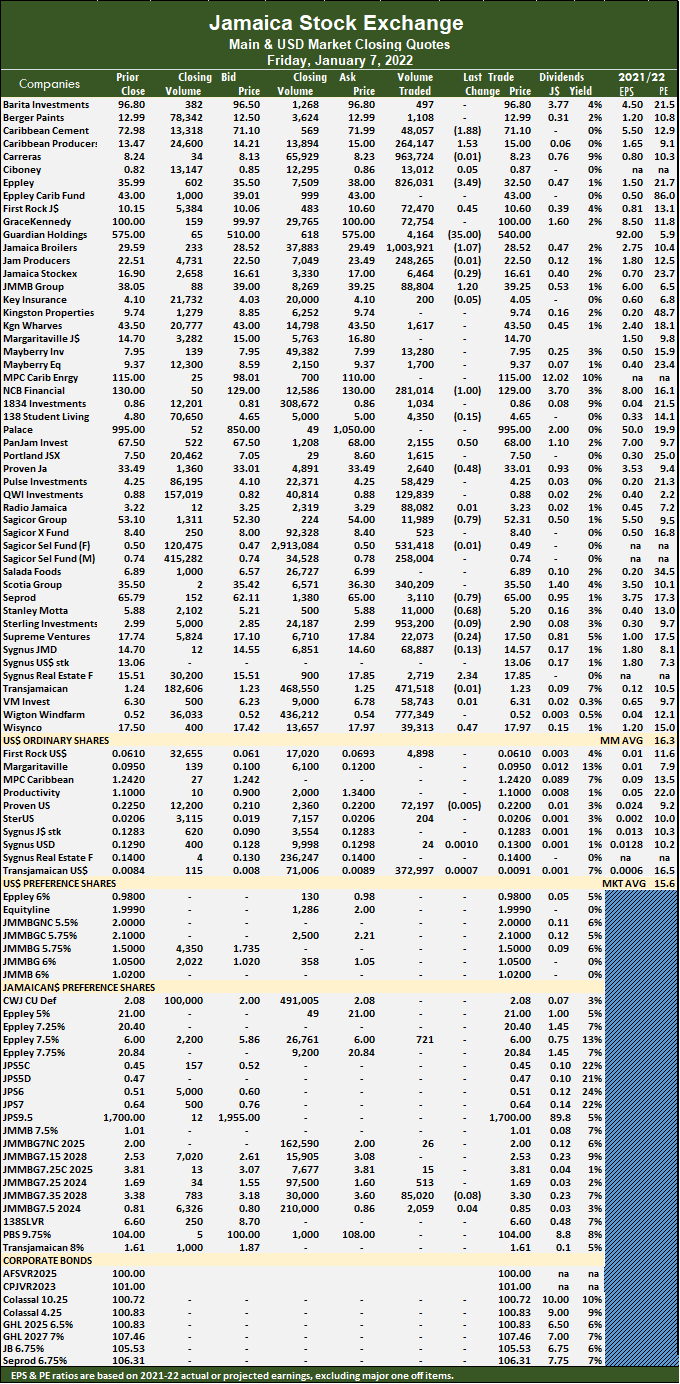

The All Jamaican Composite Index dropped 1,923.73 points to 434,686.58, the JSE Main Index plunged 2,282.45 points to 392,790.90 and the JSE Financial Index fell 1.22 points to end at 96.27.

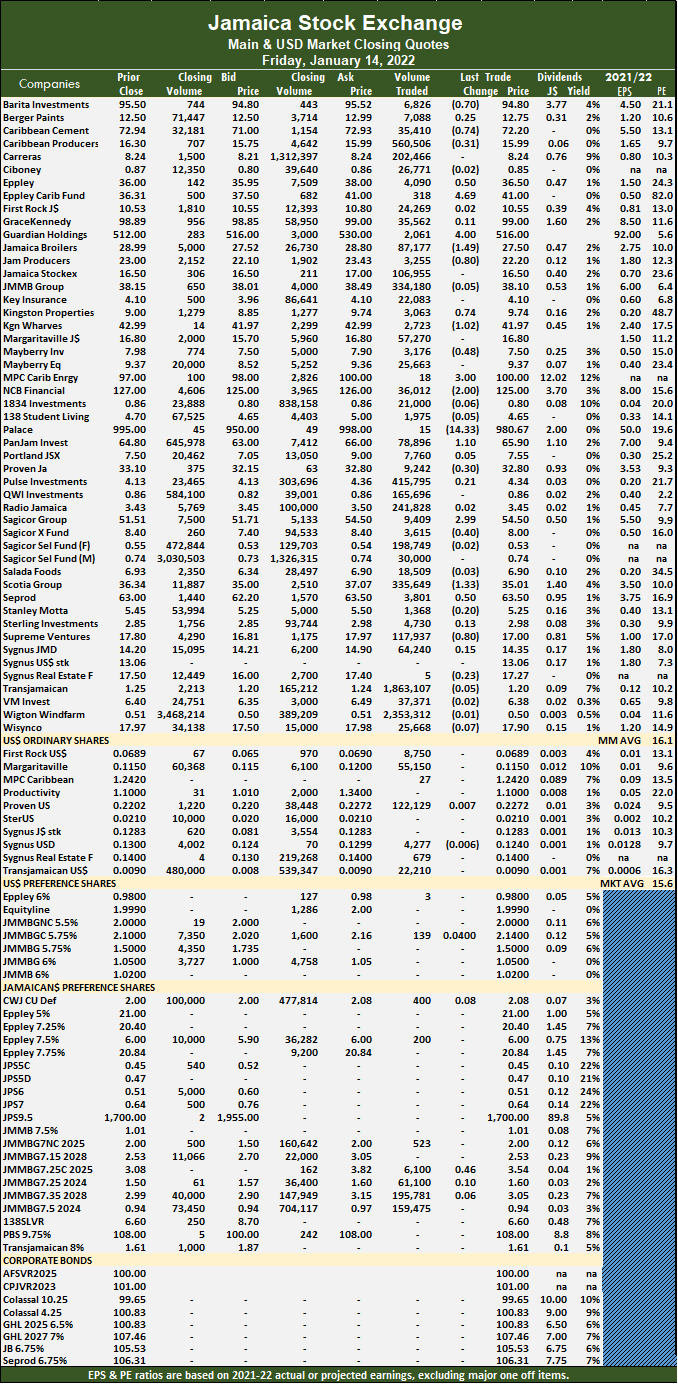

The All Jamaican Composite Index dropped 1,923.73 points to 434,686.58, the JSE Main Index plunged 2,282.45 points to 392,790.90 and the JSE Financial Index fell 1.22 points to end at 96.27. At the close, Barita Investments lost 70 cents to close at $94.80 with an exchange of 6,826 shares, Caribbean Cement shed 74 cents in ending at $72.20 with the swapping of 35,410 units, Caribbean Producers lost 31 cents to close at $15.99 with 560,506 stocks crossing the exchange. Eppley rallied 50 cents to $36.50 in trading 4,090 stock units, Eppley Caribbean Property Fund advanced $4.69 to $41 with 318 units clearing the market, Guardian Holdings rose $4 to end at $516 in an exchange of 2,061 shares. Jamaica Broilers fell $1.49 to close at $27.50 with the swapping of 87,177 stock units, Jamaica Producers shed 80 cents in closing at $22.20 after trading 3,255 stocks, Kingston Properties gained 74 cents ending at $9.74 in switching ownership of 3,063 units. Kingston Wharves fell $1.02 to $41.97 with 2,723 stock units changing hands, Mayberry Investments lost 48 cents to finish at $7.50 after 3,176 stocks crossed the market, MPC Caribbean Clean Energy advanced $3 to close at $100 in switching ownership of 18 shares. NCB Financial declined $2 in closing at $125 with a transfer of 36,012 stocks, Palace Amusement dropped $14.33 to $980.67 with 15 units changing hands, PanJam Investment popped $1.10 to close at $65.90 in transferring 78,896 stock units.

At the close, Barita Investments lost 70 cents to close at $94.80 with an exchange of 6,826 shares, Caribbean Cement shed 74 cents in ending at $72.20 with the swapping of 35,410 units, Caribbean Producers lost 31 cents to close at $15.99 with 560,506 stocks crossing the exchange. Eppley rallied 50 cents to $36.50 in trading 4,090 stock units, Eppley Caribbean Property Fund advanced $4.69 to $41 with 318 units clearing the market, Guardian Holdings rose $4 to end at $516 in an exchange of 2,061 shares. Jamaica Broilers fell $1.49 to close at $27.50 with the swapping of 87,177 stock units, Jamaica Producers shed 80 cents in closing at $22.20 after trading 3,255 stocks, Kingston Properties gained 74 cents ending at $9.74 in switching ownership of 3,063 units. Kingston Wharves fell $1.02 to $41.97 with 2,723 stock units changing hands, Mayberry Investments lost 48 cents to finish at $7.50 after 3,176 stocks crossed the market, MPC Caribbean Clean Energy advanced $3 to close at $100 in switching ownership of 18 shares. NCB Financial declined $2 in closing at $125 with a transfer of 36,012 stocks, Palace Amusement dropped $14.33 to $980.67 with 15 units changing hands, PanJam Investment popped $1.10 to close at $65.90 in transferring 78,896 stock units.  Proven Investments lost 30 cents after ending at $32.80 with an exchange of 9,242 shares, Sagicor Group rose $2.99 to end at $54.50 after trading 9,409 stocks, Sagicor Real Estate Fund shed 40 cents to close at $8 with 3,615 stock units changing hands. Scotia Group fell $1.33 to finish at $35.01 with an exchange of 335,649 shares, Seprod popped 50 cents to $63.50 in switching ownership of 3,801 units and Supreme Ventures shed 80 cents to $17 in an exchange of 117,937 units.

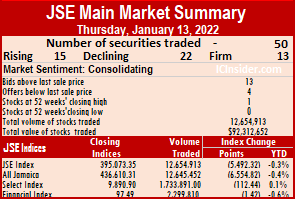

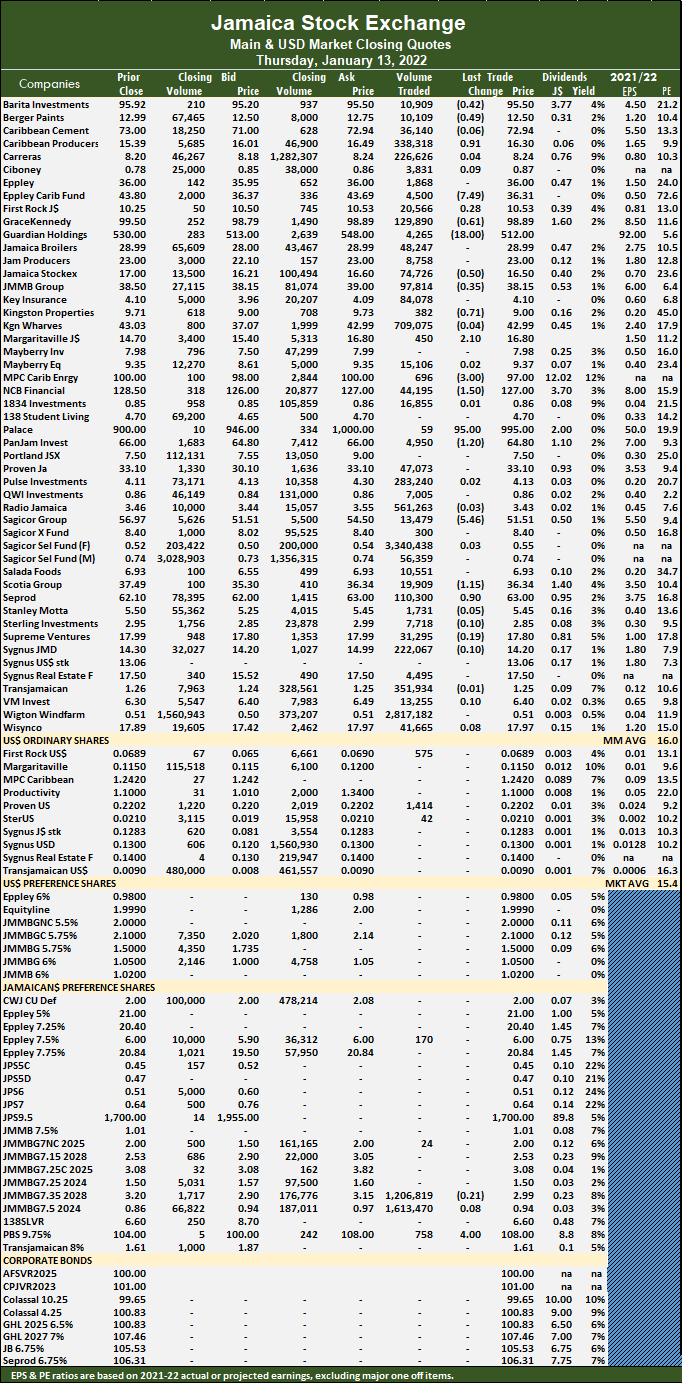

Proven Investments lost 30 cents after ending at $32.80 with an exchange of 9,242 shares, Sagicor Group rose $2.99 to end at $54.50 after trading 9,409 stocks, Sagicor Real Estate Fund shed 40 cents to close at $8 with 3,615 stock units changing hands. Scotia Group fell $1.33 to finish at $35.01 with an exchange of 335,649 shares, Seprod popped 50 cents to $63.50 in switching ownership of 3,801 units and Supreme Ventures shed 80 cents to $17 in an exchange of 117,937 units. At the close, Barita Investments lost 42 cents to end at $95.50 in exchanging 10,909 shares, Berger Paints shed 49 cents in closing at $12.50 with a transfer of 10,109 stock units, Caribbean Producers popped 91 cents to close at a 52 weeks’ high of $16.30 in trading 338,318 units. Eppley Caribbean Property Fund declined $7.49 to close at $36.31 in switching ownership of 4,500 stocks, GraceKennedy fell 61 cents to $98.89 after 129,890 units crossed the market, Guardian Holdings dropped $18 to end at $512 with the swapping of 4,265 shares. Jamaica Stock Exchange shed 50 cents to finish at $16.50 with 74,726 stock units changing hands, JMMB Group lost 35 cents to close at $38.15 with an exchange of 97,814 stocks, Kingston Properties fell 71 cents to $9 in switching ownership of 382 stock units. Margaritaville rose $2.10 to $16.80 in trading 450 stocks, MPC Caribbean Clean Energy declined $3 to a 52 weeks’ low of $97 with the swapping of 696 shares, NCB Financial shed $1.50 to end at $127 with 44,195 units crossing the market. Palace Amusement climbed $95 to close at $995 in exchanging 59 stock units, PanJam Investment fell $1.20 to $64.80 after 4,950 stocks cleared the market, Sagicor Group declined $5.46 in closing at $51.51 and switching ownership of 13,479 shares.

At the close, Barita Investments lost 42 cents to end at $95.50 in exchanging 10,909 shares, Berger Paints shed 49 cents in closing at $12.50 with a transfer of 10,109 stock units, Caribbean Producers popped 91 cents to close at a 52 weeks’ high of $16.30 in trading 338,318 units. Eppley Caribbean Property Fund declined $7.49 to close at $36.31 in switching ownership of 4,500 stocks, GraceKennedy fell 61 cents to $98.89 after 129,890 units crossed the market, Guardian Holdings dropped $18 to end at $512 with the swapping of 4,265 shares. Jamaica Stock Exchange shed 50 cents to finish at $16.50 with 74,726 stock units changing hands, JMMB Group lost 35 cents to close at $38.15 with an exchange of 97,814 stocks, Kingston Properties fell 71 cents to $9 in switching ownership of 382 stock units. Margaritaville rose $2.10 to $16.80 in trading 450 stocks, MPC Caribbean Clean Energy declined $3 to a 52 weeks’ low of $97 with the swapping of 696 shares, NCB Financial shed $1.50 to end at $127 with 44,195 units crossing the market. Palace Amusement climbed $95 to close at $995 in exchanging 59 stock units, PanJam Investment fell $1.20 to $64.80 after 4,950 stocks cleared the market, Sagicor Group declined $5.46 in closing at $51.51 and switching ownership of 13,479 shares. Scotia Group fell $1.15 to $36.34 after exchanging 19,909 units and Seprod gained 90 cents to settle at $63 in an exchange of 110,300 units.

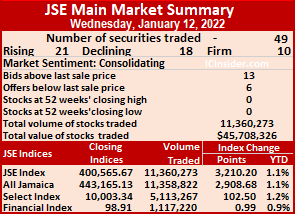

Scotia Group fell $1.15 to $36.34 after exchanging 19,909 units and Seprod gained 90 cents to settle at $63 in an exchange of 110,300 units. The All Jamaican Composite Index advanced 2,908.68 points to 443,165.13, the JSE Main Index rallied 3,210.20 points to end at 400,565.67 and the JSE Financial Index popped 0.99 points to settle at 98.91.

The All Jamaican Composite Index advanced 2,908.68 points to 443,165.13, the JSE Main Index rallied 3,210.20 points to end at 400,565.67 and the JSE Financial Index popped 0.99 points to settle at 98.91. The average trade for the day was 231,842 units at $932,823 compared to 94,316 shares at $686,412 on Tuesday and month to date, an average of 154,766 units at $1,113,600, against 144,586 units at $1,137,476 on Tuesday. December closed with an average of 479,143 units at $6,686,322.

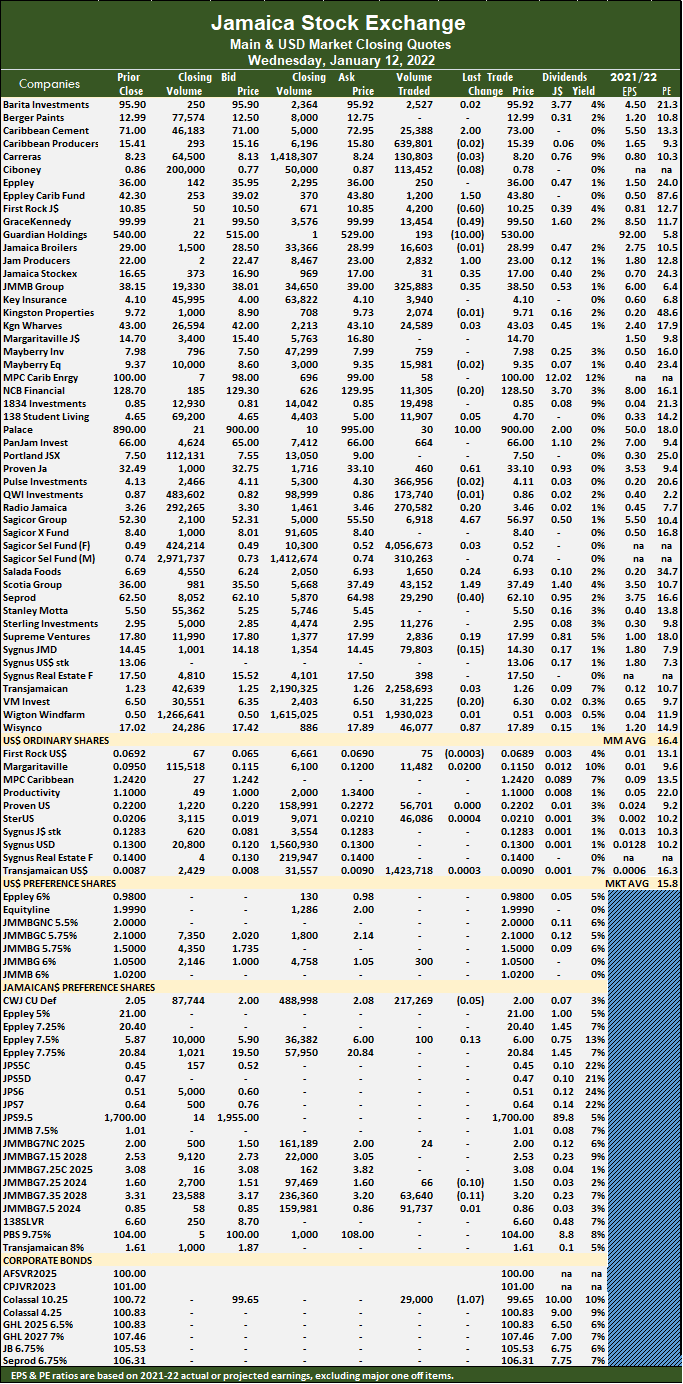

The average trade for the day was 231,842 units at $932,823 compared to 94,316 shares at $686,412 on Tuesday and month to date, an average of 154,766 units at $1,113,600, against 144,586 units at $1,137,476 on Tuesday. December closed with an average of 479,143 units at $6,686,322. Proven Investments rallied 61 cents to end at $33.10 after 460 shares crossed the market, Sagicor Group climbed $4.67 in closing at $56.97 with 6,918 stock units clearing the market, Scotia Group advanced $1.49 to end at $37.49 with investors switching ownership of 43,152 stocks. Seprod fell 40 cents to end at $62.10 in transferring 29,290 shares and Wisynco Group rallied 87 cents to $17.89 in trading 46,077 stock units.

Proven Investments rallied 61 cents to end at $33.10 after 460 shares crossed the market, Sagicor Group climbed $4.67 in closing at $56.97 with 6,918 stock units clearing the market, Scotia Group advanced $1.49 to end at $37.49 with investors switching ownership of 43,152 stocks. Seprod fell 40 cents to end at $62.10 in transferring 29,290 shares and Wisynco Group rallied 87 cents to $17.89 in trading 46,077 stock units. Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and one with a lower offer.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and one with a lower offer. Palace Amusement advanced $10 to end at $890 in transferring 46 stocks, PanJam Investment shed $1.50 after ending at $66 with 53,482 units crossing the market, Proven Investments dipped 48 cents in closing at $32.49 with 13,577 shares changing hands. Scotia Group gained 50 cents to finish at $36 in switching ownership of 61,922 stock units, Seprod shed $2.49 to end at $62.50 in an exchange of 2,778 shares, Stanley Motta popped 30 cents in closing at $5.50 after trading 7,000 stock units and Supreme Ventures rose 60 cents to end at $17.80 in an exchange of 55,675 stocks.

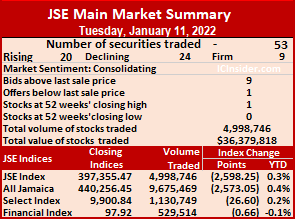

Palace Amusement advanced $10 to end at $890 in transferring 46 stocks, PanJam Investment shed $1.50 after ending at $66 with 53,482 units crossing the market, Proven Investments dipped 48 cents in closing at $32.49 with 13,577 shares changing hands. Scotia Group gained 50 cents to finish at $36 in switching ownership of 61,922 stock units, Seprod shed $2.49 to end at $62.50 in an exchange of 2,778 shares, Stanley Motta popped 30 cents in closing at $5.50 after trading 7,000 stock units and Supreme Ventures rose 60 cents to end at $17.80 in an exchange of 55,675 stocks. The All Jamaican Composite Index rose 567.11 points and closed at 441,936.51, the JSE Main Index advanced 1,784.89 points to 399,953.72 and the JSE Financial Index rose 0.63 points to settle at 98.58.

The All Jamaican Composite Index rose 567.11 points and closed at 441,936.51, the JSE Main Index advanced 1,784.89 points to 399,953.72 and the JSE Financial Index rose 0.63 points to settle at 98.58. Trading averages 218,594 units at $710,771 versus 163,287 shares at $3,083,851 on Friday and month to date, an average of 152,965 units at $1,212,654 compared to 140,429 units at $1,308,519 on Friday. December closed with an average of 479,143 units at $6,686,322.

Trading averages 218,594 units at $710,771 versus 163,287 shares at $3,083,851 on Friday and month to date, an average of 152,965 units at $1,212,654 compared to 140,429 units at $1,308,519 on Friday. December closed with an average of 479,143 units at $6,686,322. Jamaica Stock Exchange rose 89 cents to $17.50 in trading 15,630 stock units, JMMB Group shed 35 cents to end at $38.90 after exchanging 64,616 units, MPC Caribbean Clean Energy shed $5 to close at $110 with the swapping of 470 stocks. NCB Financial lost 49 cents to end at $128.51 in switching ownership of 4,099 units, Palace Amusement dropped $115 to close at $880 in transferring 820 shares, PanJam Investment fell 50 cents to $67.50 with 2,227 stock units crossing the market. Supreme Ventures lost 30 cents in closing at $17.20 after an exchange of 21,716 stocks, Sygnus Real Estate Finance fell 35 cents to end at $17.50 with 300 stocks clearing the market and Wisynco Group shed 97 cents after ending at $17 with the swapping of 65,947 shares.

Jamaica Stock Exchange rose 89 cents to $17.50 in trading 15,630 stock units, JMMB Group shed 35 cents to end at $38.90 after exchanging 64,616 units, MPC Caribbean Clean Energy shed $5 to close at $110 with the swapping of 470 stocks. NCB Financial lost 49 cents to end at $128.51 in switching ownership of 4,099 units, Palace Amusement dropped $115 to close at $880 in transferring 820 shares, PanJam Investment fell 50 cents to $67.50 with 2,227 stock units crossing the market. Supreme Ventures lost 30 cents in closing at $17.20 after an exchange of 21,716 stocks, Sygnus Real Estate Finance fell 35 cents to end at $17.50 with 300 stocks clearing the market and Wisynco Group shed 97 cents after ending at $17 with the swapping of 65,947 shares. Trading averages 163,287 units at $3,083,851 versus 118,286 shares at $667,562 on Thursday and month to date, an average of 140,429 units at $1,308,519, compared to 135,419 units at $919,405 on the prior day. December averaged 479,143 units at $6,686,322.

Trading averages 163,287 units at $3,083,851 versus 118,286 shares at $667,562 on Thursday and month to date, an average of 140,429 units at $1,308,519, compared to 135,419 units at $919,405 on the prior day. December averaged 479,143 units at $6,686,322. PanJam Investment rose 50 cents to $68 in exchanging 2,155 stock units, Proven Investments shed 48 cents in closing at $33.01 in an exchange of 2,640 shares, Sagicor Group fell 79 cents to end at $52.31, with 11,989 units crossing the market. Seprod lost 79 cents to $65 in trading 3,110 shares, Stanley Motta dropped 68 cents to $5.20 in switching ownership of 11,000 stock units, Sygnus Real Estate Finance climbed $2.34 to close at $17.85 while exchanging 2,719 stocks and Wisynco Group increased 47 cents to end at $17.97 with an exchange of 39,313 units.

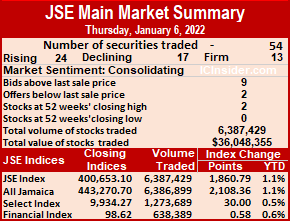

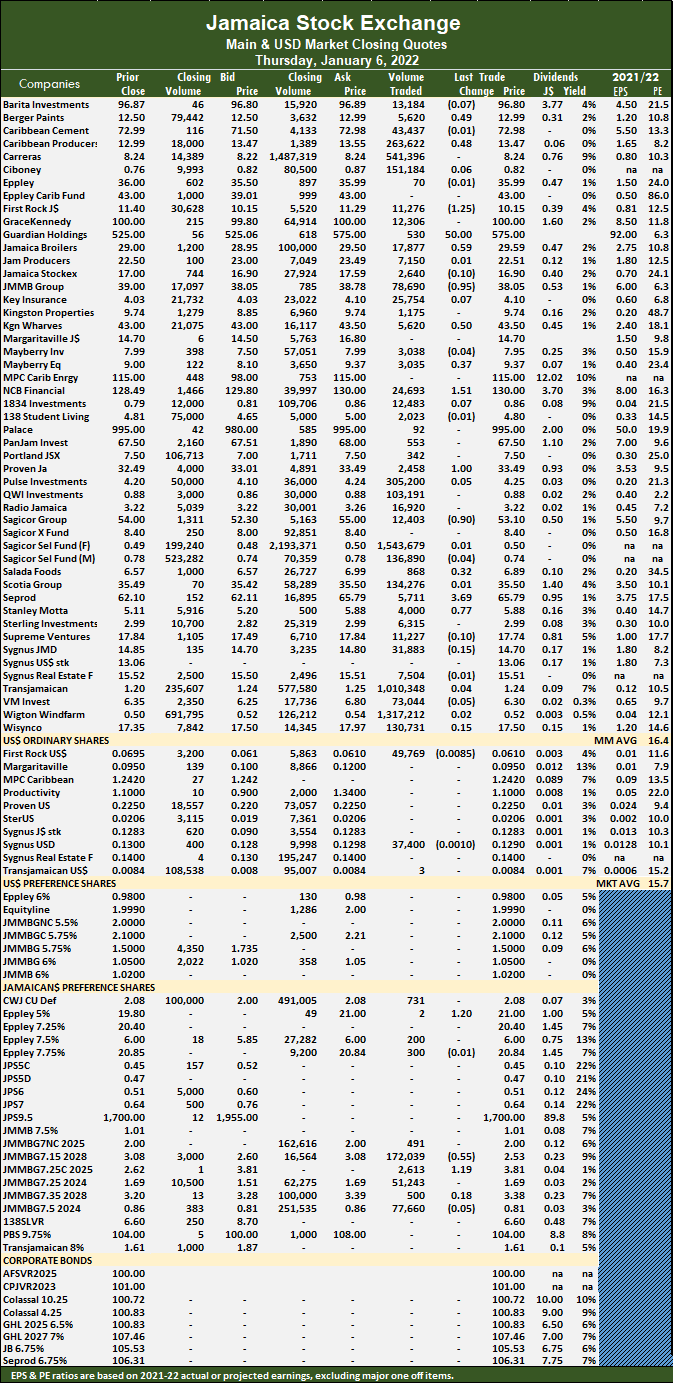

PanJam Investment rose 50 cents to $68 in exchanging 2,155 stock units, Proven Investments shed 48 cents in closing at $33.01 in an exchange of 2,640 shares, Sagicor Group fell 79 cents to end at $52.31, with 11,989 units crossing the market. Seprod lost 79 cents to $65 in trading 3,110 shares, Stanley Motta dropped 68 cents to $5.20 in switching ownership of 11,000 stock units, Sygnus Real Estate Finance climbed $2.34 to close at $17.85 while exchanging 2,719 stocks and Wisynco Group increased 47 cents to end at $17.97 with an exchange of 39,313 units. The All Jamaican Composite Index climbed 2,108.36 points to 443,270.70, the JSE Main Index popped 1,860.79 points to close at 400,653.10 398,792.32 and the JSE Financial Index gained 0.58 points to end at 98.62. Similar to Wednesday’s trading, 54 securities traded, with 24 rising, 17 declining and 13 ending unchanged.

The All Jamaican Composite Index climbed 2,108.36 points to 443,270.70, the JSE Main Index popped 1,860.79 points to close at 400,653.10 398,792.32 and the JSE Financial Index gained 0.58 points to end at 98.62. Similar to Wednesday’s trading, 54 securities traded, with 24 rising, 17 declining and 13 ending unchanged. Trading averages 118,286 units at $667,562, up from 100,923 shares at $497,100 on Wednesday and month to date, an average of 135,419 units at $919,405, compared to 141,026 units at $1,001,827 on the prior day. December closed with an average of 479,143 units at $6,686,322.

Trading averages 118,286 units at $667,562, up from 100,923 shares at $497,100 on Wednesday and month to date, an average of 135,419 units at $919,405, compared to 141,026 units at $1,001,827 on the prior day. December closed with an average of 479,143 units at $6,686,322. Seprod advanced $3.69 in closing at $65.79 after 5,711 stock units crossed the exchange and Stanley Motta spiked 77 cents to end at $5.88, with 4,000 shares clearing the market.

Seprod advanced $3.69 in closing at $65.79 after 5,711 stock units crossed the exchange and Stanley Motta spiked 77 cents to end at $5.88, with 4,000 shares clearing the market.