Market activity on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks traded declining 17 percent, with the value rising 58 percent above Monday’s moderate levels as declining stocks exceeded those rising and resulted in a decline in the primary market indices.

A total of 6,129,079 shares were exchanged for $50,321,427 versus 7,396,135 units at $31,788,226 on Monday. Trading averaged 111,438 units at $914,935, compared to 125,358 shares at $538,783 on Monday, with the month to date, averaging 160,435 units at $1,135,635, compared to 165,265 units at $1,157,389 on the previous trading day. July averaged173,643 units at $1,683,017.

A total of 6,129,079 shares were exchanged for $50,321,427 versus 7,396,135 units at $31,788,226 on Monday. Trading averaged 111,438 units at $914,935, compared to 125,358 shares at $538,783 on Monday, with the month to date, averaging 160,435 units at $1,135,635, compared to 165,265 units at $1,157,389 on the previous trading day. July averaged173,643 units at $1,683,017.

Wigton Windfarm led trading with 2.15 million shares for 35 percent of total volume, followed by Transjamaican Highway with 1.26 million units for 20.5 percent of the day’s trade and Carreras with 295,502 units for 4.8 percent market share.

Trading ended with 55 securities compared to 59 on Monday, with 16 rising, 27 declining and 12 ending unchanged. The All Jamaican Composite Index dived by 1,679.50 points to 417,768.56, the Main Index fell 808.61 points to 366,715.99 and the JSE Financial Index dipped 0.53 points to settle at 87.91.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to August 2023.

Investor’s Choice bid-offer indicator shows 14 stocks ended with bids higher than their last selling prices and eight with lower offers.

At the close, Caribbean Cement declined 80 cents to close at $59, with 13,474 shares crossing the exchange, GraceKennedy rallied $2.50 to $98 after exchanging 84,925 units, Guardian Holdings advanced $16.10 in ending at $521.10, with 60 stock units changing hands. JMMB Group shed 50 cents in closing at $42, with 144,349 stocks crossing the market, Margaritaville gained $5.74 to close at a 52 weeks’ high of $29.94 after exchanging 100 stock units, Massy Holdings fell $2 to end at $87 and closed with 781 shares changing hands. Mayberry Investments lost $2.44 to close at $7.51, with 98,300 stocks clearing the market, NCB Financial increased $1 in closing at $95 after exchanging 101,809 units, Palace Amusement dropped $66.62 after ending at $753.37 in trading 196 shares. PanJam Investment fell 95 cents to $60.05 in an exchange of 814 stocks, Portland JSX shed $1.65 in ending at $9.35 while exchanging 245 units, Scotia Group declined $1.45 to close at $35.05 after transferring 5,742 stock units and Wisynco traded 54,729 shares and gained 30 cents in closing at $17.70.

At the close, Caribbean Cement declined 80 cents to close at $59, with 13,474 shares crossing the exchange, GraceKennedy rallied $2.50 to $98 after exchanging 84,925 units, Guardian Holdings advanced $16.10 in ending at $521.10, with 60 stock units changing hands. JMMB Group shed 50 cents in closing at $42, with 144,349 stocks crossing the market, Margaritaville gained $5.74 to close at a 52 weeks’ high of $29.94 after exchanging 100 stock units, Massy Holdings fell $2 to end at $87 and closed with 781 shares changing hands. Mayberry Investments lost $2.44 to close at $7.51, with 98,300 stocks clearing the market, NCB Financial increased $1 in closing at $95 after exchanging 101,809 units, Palace Amusement dropped $66.62 after ending at $753.37 in trading 196 shares. PanJam Investment fell 95 cents to $60.05 in an exchange of 814 stocks, Portland JSX shed $1.65 in ending at $9.35 while exchanging 245 units, Scotia Group declined $1.45 to close at $35.05 after transferring 5,742 stock units and Wisynco traded 54,729 shares and gained 30 cents in closing at $17.70.

In the preference segment, 138 Student Living preference share rose 78 cents to end at $50.10 after trading 21 stock units and Productive Business Solutions 9.75% preference share dropped $38.80 in closing at $126.20 with an exchange of 373 shares.

In the preference segment, 138 Student Living preference share rose 78 cents to end at $50.10 after trading 21 stock units and Productive Business Solutions 9.75% preference share dropped $38.80 in closing at $126.20 with an exchange of 373 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market falls

Modest gains for JSE Main Market

Stocks closed mixed on the Jamaica Stock Exchange Main Market on Monday, resulting in market indices rising moderately, with the volume of stocks traded remaining subdued with 49 percent more volume passing through the market compared to Friday, with the value of stocks traded dropping a sharp 51 percent.

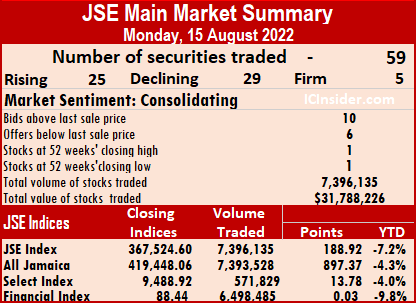

Overall, 7,396,135 shares were exchanged for $31,788,226 versus 4,959,941 units at $65,424,573 on Friday. Trading averaged 125,358 units at $538,783 compared to 88,570 shares at $1,168,2961 on Friday and month to date, an average of 165,265 units at $1,157,389, compared to 169,983 units at $1,230,531 on the previous trading day. July averaged 173,643 units at $1,683,017.

Overall, 7,396,135 shares were exchanged for $31,788,226 versus 4,959,941 units at $65,424,573 on Friday. Trading averaged 125,358 units at $538,783 compared to 88,570 shares at $1,168,2961 on Friday and month to date, an average of 165,265 units at $1,157,389, compared to 169,983 units at $1,230,531 on the previous trading day. July averaged 173,643 units at $1,683,017.

Wigton Windfarm led trading with 3.4 million units for 46 percent of total volume, followed by Transjamaican Highway with 1.16 million shares for 15.6 percent of the day’s trade and Sagicor Select Financial Fund with 610,087 units for 8.2 percent of market share.

Trading ended with 59 securities compared to 56 on Tuesday, with 25 rising, 29 declining and five ending unchanged. At the close, the All Jamaican Composite Index rose 897.37 points to 419,448.06, the JSE Main Index gained 188.92 points to close at 367,524.60, and the JSE Financial Index inched 0.03 points higher to 88.44.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and six stocks with lower offers.

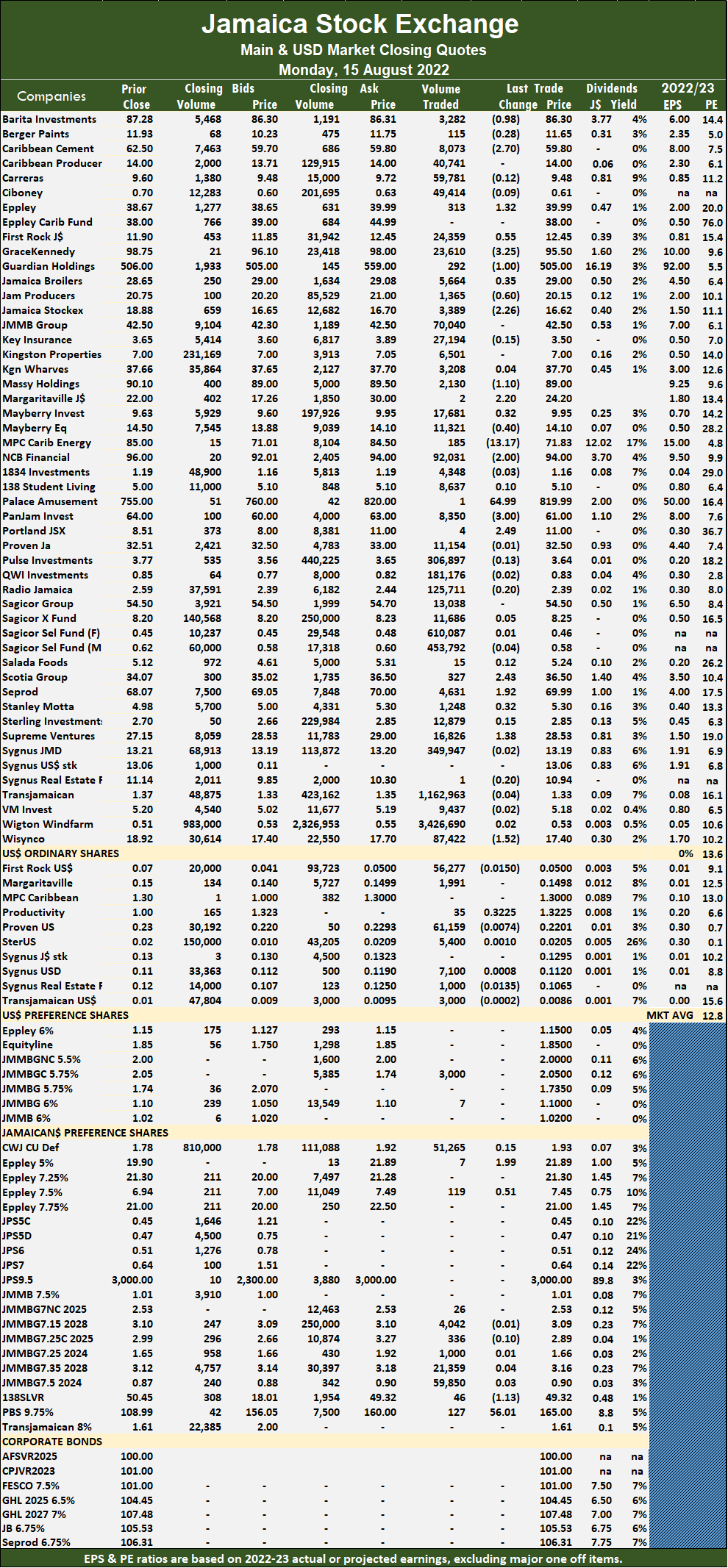

At the close, Barita Investments fell 98 cents to $86.30 after exchanging 3,282 shares, Caribbean Cement dropped $2.70 to close at $59.80 after an exchange of 8,073 shares, Eppley jumped $1.32 in closing at $39.39, with 313 stocks crossing the market. First Rock traded 24,359 shares after rising 55 cents to $12.45. GraceKennedy dropped $3.25 to end at $95.50, with 23,610 units changing hands, Guardian Holdings fell $1 to close at $505 after trading 292 stock units, Jamaica Broilers rose 35 cents to $29 after exchanging 5,664 stocks. Jamaica Producers fell 60 cents in closing at $20.15, with an exchange of 1,365 shares, Jamaica Stock Exchange fell $2.26 to $16.70 after an exchange of 3,389 shares, Massy Holdings shed $1.10 in ending at $89, with 2,130 units crossing the exchange, Margaritaville climbed $2.20 to $24.20, with just two stocks changing hands. Mayberry Jamaican Equities fell 40 cents to close at $14.10 after trading 11,321 stock units. MPC Carib Energy fell $13.17 to close at a 52 weeks’ low of $71.83 after trading 185 shares, NCB Financial lost $2 to end at $94 with an exchange of 92,031 shares, PanJam Investment shed $3 in closing at $61 in an exchange of 8,350 units.

At the close, Barita Investments fell 98 cents to $86.30 after exchanging 3,282 shares, Caribbean Cement dropped $2.70 to close at $59.80 after an exchange of 8,073 shares, Eppley jumped $1.32 in closing at $39.39, with 313 stocks crossing the market. First Rock traded 24,359 shares after rising 55 cents to $12.45. GraceKennedy dropped $3.25 to end at $95.50, with 23,610 units changing hands, Guardian Holdings fell $1 to close at $505 after trading 292 stock units, Jamaica Broilers rose 35 cents to $29 after exchanging 5,664 stocks. Jamaica Producers fell 60 cents in closing at $20.15, with an exchange of 1,365 shares, Jamaica Stock Exchange fell $2.26 to $16.70 after an exchange of 3,389 shares, Massy Holdings shed $1.10 in ending at $89, with 2,130 units crossing the exchange, Margaritaville climbed $2.20 to $24.20, with just two stocks changing hands. Mayberry Jamaican Equities fell 40 cents to close at $14.10 after trading 11,321 stock units. MPC Carib Energy fell $13.17 to close at a 52 weeks’ low of $71.83 after trading 185 shares, NCB Financial lost $2 to end at $94 with an exchange of 92,031 shares, PanJam Investment shed $3 in closing at $61 in an exchange of 8,350 units.  Portland JSX jumped $2.49 to $11 in switching ownership of a mere four stocks, Scotia Group popped $2.43 to end at $36.50 with the swapping of 327 stock units, Seprod rose $1.92 to $69.99, with 4,631 stocks crossing the market, Supreme Ventures climbed $1.38 to close at $28.53 in exchanging 16,826 shares and Wisynco dropped $1.52 in closing at $10.21, in trading 87,422 stocks.

Portland JSX jumped $2.49 to $11 in switching ownership of a mere four stocks, Scotia Group popped $2.43 to end at $36.50 with the swapping of 327 stock units, Seprod rose $1.92 to $69.99, with 4,631 stocks crossing the market, Supreme Ventures climbed $1.38 to close at $28.53 in exchanging 16,826 shares and Wisynco dropped $1.52 in closing at $10.21, in trading 87,422 stocks.

In the preference segment, Eppley 5% traded seven shares and rose $1.99 to $21.89, Eppley 7.5% rose 51 cents to $7.45 after an exchange of 119 shares, 138 Student Living preference shares fell $1.13 to end at $49.32 in an exchange of 46 units. Productive Business Solutions preference share surged $56.01 to a 52 weeks’ high of $165 with the swapping of 127 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

More changes to ICTOP10

While some investors were selling shares to buy into the latest IPO to hit the market, recent investors in the Junior Market listed Dolla Financial gave the market a shot in the arm following a disclosure that the company had corresponded with Access Financial to explore merger talks.

Investors reacted the first chance they had and drove the prices of both stocks higher on Friday.

Investors reacted the first chance they had and drove the prices of both stocks higher on Friday.

The Ipo of OneonOne IPO opened on Friday morning and closed at the end of the day, as was to be expected, after attracting some 15,000 applications. The shares are likely to be listed before the end of August, with a name change to follow. ICInsider.com expects the stock will move into the $2 range sometime after listing.

The disclosure of the Dolla interest sent the TOP 10 listed Access up $5.79 or 25 percent to close at $25 on Friday, with the stock falling from the TOP10. Other big Junior Market TOP10 movers this past week are Caribbean Assurance Brokers, up 12 percent lower at $2.80, Paramount Trading with a rise of 9 percent, CAC 2000, up 6 percent to $7.65, while General Accident dropped 9 percent to a very attractive price of $5.

The Main Market ended the week with 138 Student Living jumping 23 percent to $5 and is likely to rise further, with the company posting solid results after the market closed, with earnings of 21 cents for the June quarter and 58 cents per share for the nine months to June. Berger Paints rose 8 percent to $11.93, VM Investments popped 4 percent to $5.20 and Guardian Holdings reversed most of the previous week’s gain by dropping a sharp 22 percent from $650 to $506.

The Main Market ended the week with 138 Student Living jumping 23 percent to $5 and is likely to rise further, with the company posting solid results after the market closed, with earnings of 21 cents for the June quarter and 58 cents per share for the nine months to June. Berger Paints rose 8 percent to $11.93, VM Investments popped 4 percent to $5.20 and Guardian Holdings reversed most of the previous week’s gain by dropping a sharp 22 percent from $650 to $506.

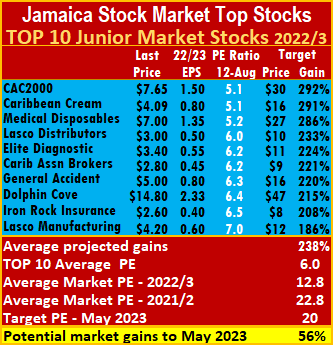

The new entrants to the ICTOP listing are Iron Rock Insurance and Lasco Manufacturing, replacing Access Financial and Paramount Trading. There were no changes in the Main market.

The average PE for the JSE Main Market TOP 10 is 6.2, well below the market average of 13.9, while the Junior Market Top 10 PE sits at 5.9 versus the market at 12.8. The Junior Market is projected to rise 240 percent and the Main Market TOP10 an average of 235 percent each to May 2023.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

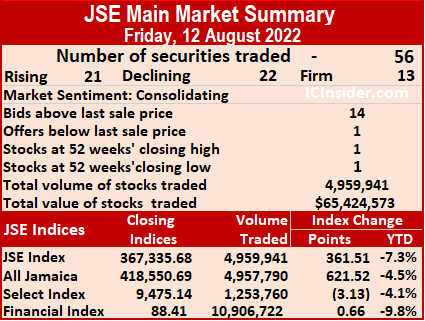

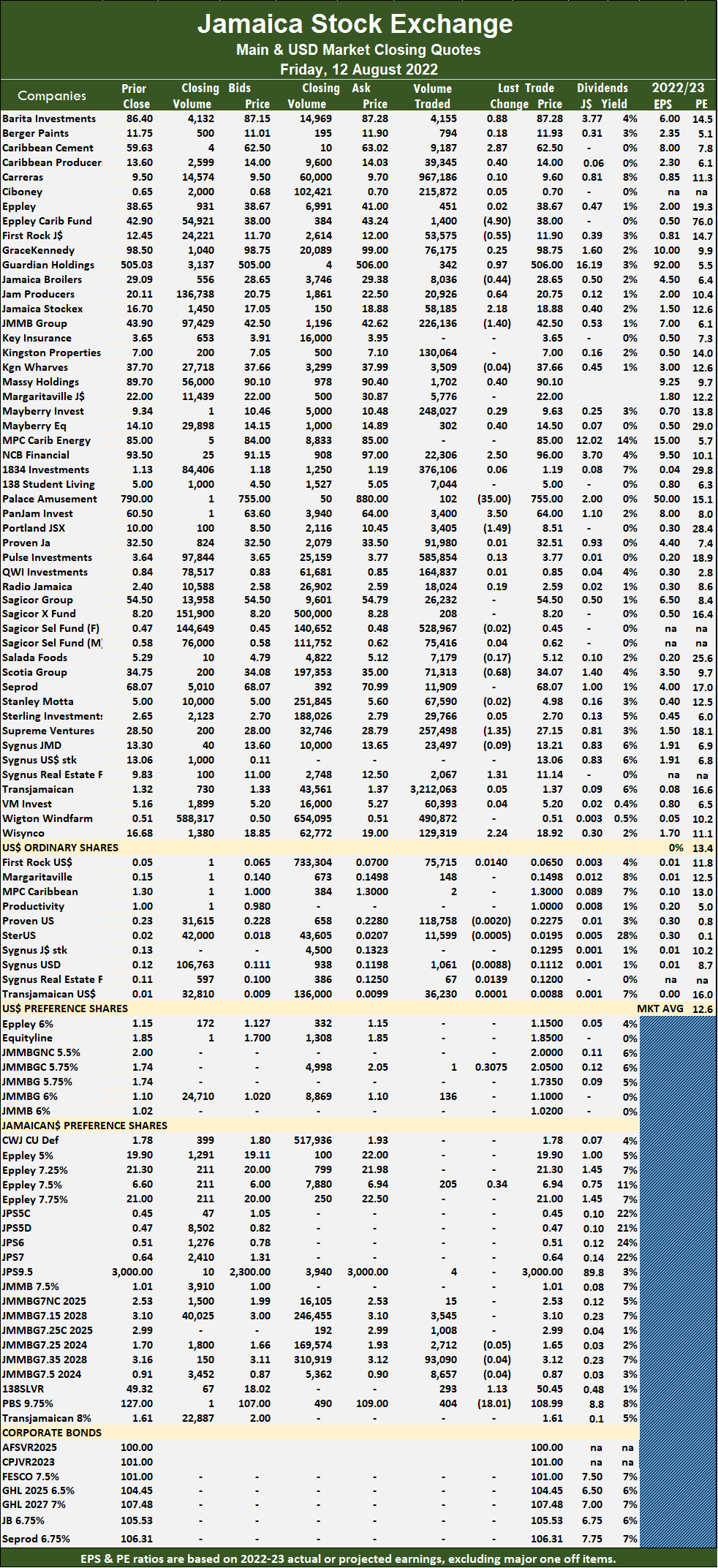

Trading rises to close out the week

Market activity on the Jamaica Stock Exchange Main Market ended on Friday, with the volume of stocks traded rising 43 percent with 156 percent greater value than on Thursday as 56 securities were exchanged, up from 53 on Thursday, with 21 rising, 22 declining and 13 ending unchanged.

Overall, 4,959,941 shares were exchanged for $65,424,573 versus 3,472,392 units at $25,553,670 on Thursday. Trading averages 88,570 units at $1,168,296, compared to 65,517 shares at $482,145 on Thursday and month to date, an average of 169,983 units at $1,230,531, compared to 180,275 units at $1,238,398 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

Overall, 4,959,941 shares were exchanged for $65,424,573 versus 3,472,392 units at $25,553,670 on Thursday. Trading averages 88,570 units at $1,168,296, compared to 65,517 shares at $482,145 on Thursday and month to date, an average of 169,983 units at $1,230,531, compared to 180,275 units at $1,238,398 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

Sagicor Select Financial Fund led trading with 1.34 million shares for 27 percent of total volume, followed by Wigton Windfarm with 564,932 units for 11.4 percent of the day’s trade and Transjamaican Highway with 524,843 units for 10.6 percent market share.

All Jamaican Composite Index gained 621.52 points to end at 418,550.69, the JSE Main Index rose 361.51 points to 367,335.68 and the JSE Financial Index advanced 0.66 points to 88.41.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Investor’s Choice bid-offer indicator shows 14 stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Caribbean Producers popped 42 cents to $14.02 after trading 20,482 stocks. Eppley increased $1.28 to close at $39.93, with 75 stock units changing hands. Eppley Caribbean Property Fund fell $4.50 to end at $38.40 with the swapping of 300 stocks, First Rock Real Estate lost 40 cents in ending at $12.05 after trading 5,075 shares, Guardian Holdings surged $64.96 to $569.99 after exchanging 352 stocks.Massy Holdings lost $2.70 in closing at $87, with 1,178 stock units crossing the exchange. Mayberry Investments climbed 65 cents to close at $9.99 in exchanging 99 stocks, Mayberry Jamaican Equities shed 22 cents in closing at $13.88 in trading 104,177 units, MPC Caribbean Clean Energy lost 50 cents in ending at $84.50 while exchanging 321 stock units. NCB Financial rose $1.50 to end at $95 in trading 236,805 shares, Palace Amusement dropped $30 to $760 with an exchange of 10 stocks, PanJam Investment shed 50 cents to end at $60 in switching ownership of 5,628 stock units, Seprod climbed $3.37 in closing at $71.44 in an exchange of 97,364 units and Stanley Motta popped 50 cents to $5.50 after trading 1,600 stocks.

At the close, Caribbean Producers popped 42 cents to $14.02 after trading 20,482 stocks. Eppley increased $1.28 to close at $39.93, with 75 stock units changing hands. Eppley Caribbean Property Fund fell $4.50 to end at $38.40 with the swapping of 300 stocks, First Rock Real Estate lost 40 cents in ending at $12.05 after trading 5,075 shares, Guardian Holdings surged $64.96 to $569.99 after exchanging 352 stocks.Massy Holdings lost $2.70 in closing at $87, with 1,178 stock units crossing the exchange. Mayberry Investments climbed 65 cents to close at $9.99 in exchanging 99 stocks, Mayberry Jamaican Equities shed 22 cents in closing at $13.88 in trading 104,177 units, MPC Caribbean Clean Energy lost 50 cents in ending at $84.50 while exchanging 321 stock units. NCB Financial rose $1.50 to end at $95 in trading 236,805 shares, Palace Amusement dropped $30 to $760 with an exchange of 10 stocks, PanJam Investment shed 50 cents to end at $60 in switching ownership of 5,628 stock units, Seprod climbed $3.37 in closing at $71.44 in an exchange of 97,364 units and Stanley Motta popped 50 cents to $5.50 after trading 1,600 stocks.

In the preference segment, Eppley 7.50% preference share increased 87 cents to $7.47, with 201 shares crossing the market. Eppley 7.75% preference share declined $1 to end at $20 with one stock changing hands, JMMB Group 7.25% preference share rallied 28 cents to close at $3.27 in exchanging 90 stock units and Productive Business Solutions 9.75% preference share gained $29.05 to close at a 52 weeks’ high of $156.05, with 105 shares crossing the exchange.

In the preference segment, Eppley 7.50% preference share increased 87 cents to $7.47, with 201 shares crossing the market. Eppley 7.75% preference share declined $1 to end at $20 with one stock changing hands, JMMB Group 7.25% preference share rallied 28 cents to close at $3.27 in exchanging 90 stock units and Productive Business Solutions 9.75% preference share gained $29.05 to close at a 52 weeks’ high of $156.05, with 105 shares crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

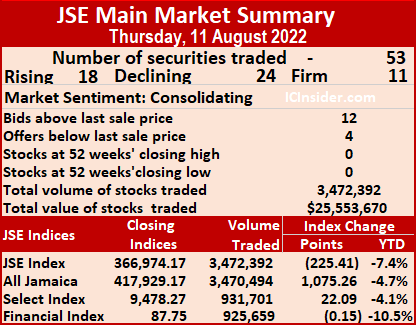

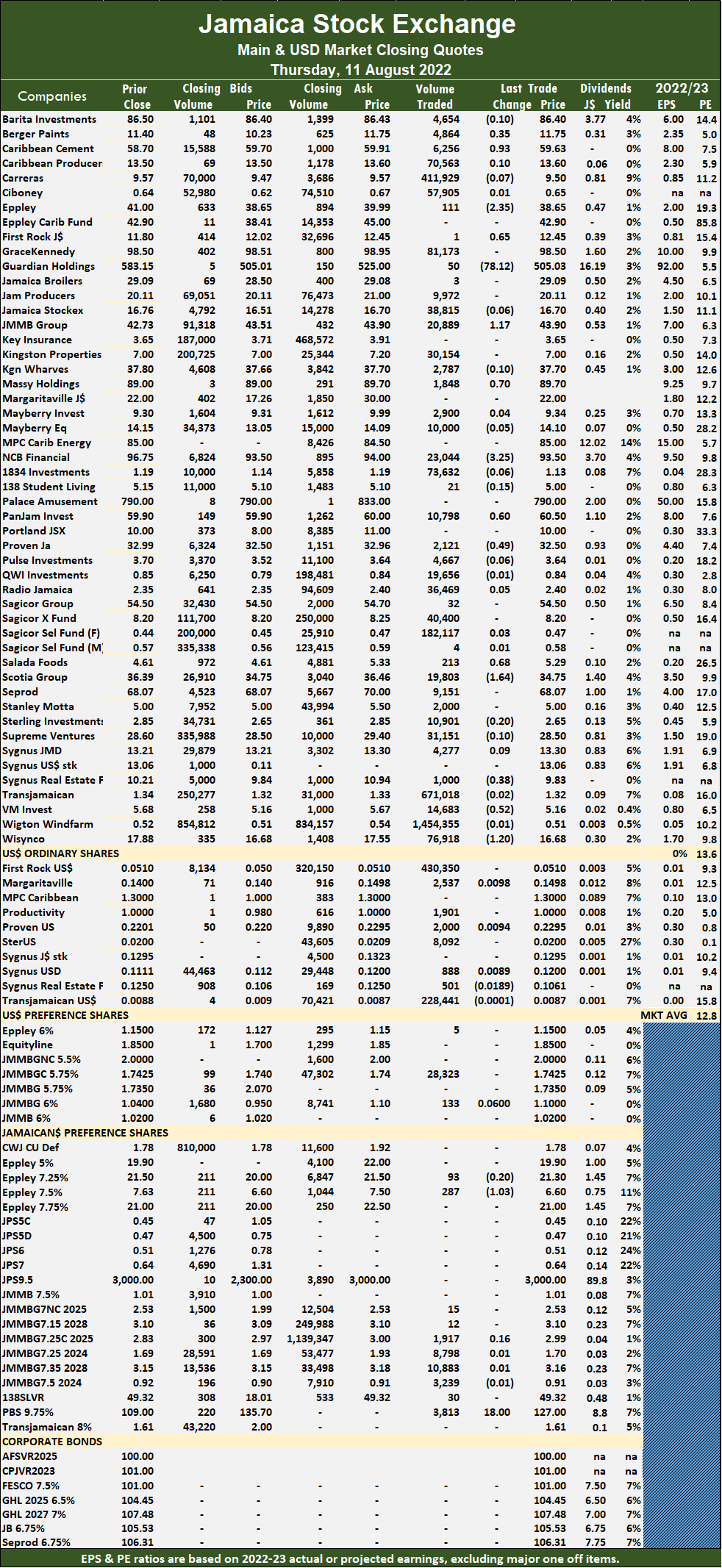

Trading plunged lower on Thursday

Market activity on the Jamaica Stock Exchange Main Market ended on Thursday, with the volume of stocks traded declining 46 percent with a 55 percent lower value than on Wednesday as 53 securities traded compared to 57 on Wednesday, with prices of 18 rising, 24 declining and 11 ending unchanged.

Only 3,472,392 shares valued $25,553,670 were traded on Thursday versus 6,419,042 units at $56,245,124 on Wednesday. Trading averaged 65,517 units at $482,145 down from 112,615 shares at $986,757 Wednesday and month to date, an average of 180,275 units at $1,238,398, compared to 195,870 units at $1,341,170 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

Only 3,472,392 shares valued $25,553,670 were traded on Thursday versus 6,419,042 units at $56,245,124 on Wednesday. Trading averaged 65,517 units at $482,145 down from 112,615 shares at $986,757 Wednesday and month to date, an average of 180,275 units at $1,238,398, compared to 195,870 units at $1,341,170 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

Wigton Windfarm led trading with 1.45 million shares for 41.9 percent of total volume, Transjamaican Highway followed with 671,018 units for 19.3 percent of the day’s trade and Carreras ended with 411,929 units for 11.9 percent of market share.

The All Jamaican Composite Index rose 1,075.26 points to 417,929.17, the Main Index shed 225.41 points to 366,974.17 and the JSE Financial Index slipped 0.15 points to settle at 87.75.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.6 for the Main Market. The SE Main and USD Market PE ratios are computed based on ICInsider.com’s earnings forecast for companies with financial years ending up to the close of August 2023.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Caribbean Cement climbed 93 cents to $59.63 after the price hit an intraday 52 weeks’ low of $55.12 in trading 6,256 shares, Eppley fell $2.35 in closing at $38.65 while exchanging 111 stock units, First Rock Real Estate rallied 65 cents to end at $12.45 in trading one share. Guardian Holdings declined $78.12 to close at $505.03 in trading 50 units, JMMB Group increased $1.17 to $43.90, with 20,889 shares crossing the exchange, Massy Holdings gained 70 cents to end at $89.70 in an exchange of 1,848 stocks. NCB Financial dropped $3.25 to end at $93.50 in trading 23,044 stock units, PanJam Investment advanced 60 cents to close at $60.50, with 10,798 units changing hands, Proven Investments shed 49 cents in closing at $32.50 with 2,121 units clearing the market. Salada Foods rose 68 cents to $5.29 after exchanging 213 stocks, Scotia Group lost $1.64 to close at $34.75, with 19,803 stock units crossing the market, Victoria Mutual Investments dropped 52 cents in closing at $5.16 after trading 14,683 shares and Wisynco Group lost $1.20 to end at $16.68 as investors transferred 76,918 stock units.

At the close, Caribbean Cement climbed 93 cents to $59.63 after the price hit an intraday 52 weeks’ low of $55.12 in trading 6,256 shares, Eppley fell $2.35 in closing at $38.65 while exchanging 111 stock units, First Rock Real Estate rallied 65 cents to end at $12.45 in trading one share. Guardian Holdings declined $78.12 to close at $505.03 in trading 50 units, JMMB Group increased $1.17 to $43.90, with 20,889 shares crossing the exchange, Massy Holdings gained 70 cents to end at $89.70 in an exchange of 1,848 stocks. NCB Financial dropped $3.25 to end at $93.50 in trading 23,044 stock units, PanJam Investment advanced 60 cents to close at $60.50, with 10,798 units changing hands, Proven Investments shed 49 cents in closing at $32.50 with 2,121 units clearing the market. Salada Foods rose 68 cents to $5.29 after exchanging 213 stocks, Scotia Group lost $1.64 to close at $34.75, with 19,803 stock units crossing the market, Victoria Mutual Investments dropped 52 cents in closing at $5.16 after trading 14,683 shares and Wisynco Group lost $1.20 to end at $16.68 as investors transferred 76,918 stock units.

In the preference segment, Eppley 7.50% preference share fell $1.03 to end at $6.60 in switching ownership of 287 stocks and Productive Business Solutions 9.75% preference share popped $18, ending at a record closing high of $127, with 3,813 shares changing hands.

In the preference segment, Eppley 7.50% preference share fell $1.03 to end at $6.60 in switching ownership of 287 stocks and Productive Business Solutions 9.75% preference share popped $18, ending at a record closing high of $127, with 3,813 shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market stocks push market down

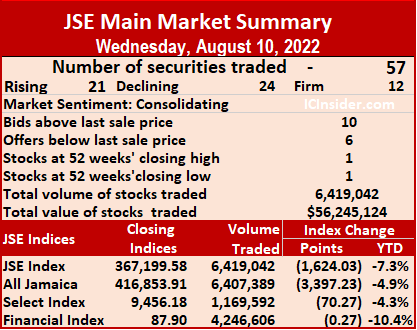

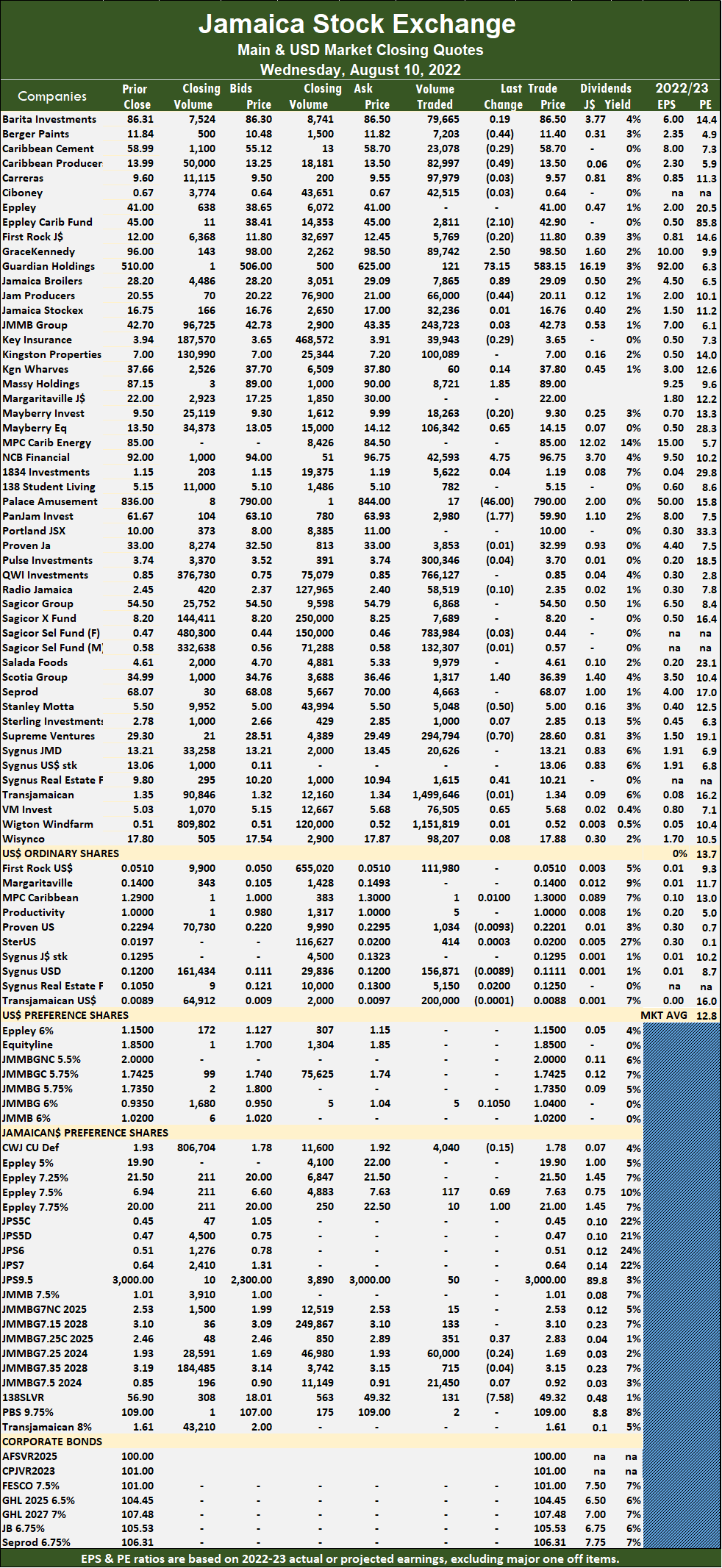

Stocks dropped on the Jamaica Stock Exchange Main Market on Wednesday and resulted in market indices plunging at the close of the market with the volume of stocks traded remaining subdued with 30 percent less volume passing through the market compared to Tuesday as funds entering the market remained steady.

Trading ended with 57 securities compared to 55 on Tuesday, with 21 rising, 24 declining and 12 ending unchanged. At the close, the All Jamaican Composite Index shed 3,397.23 points to 416,853.91, the JSE Main Index dropped 1,624.03 points to close at 367,199.58 and the JSE Financial Index dipped 0.27 points to settle at 87.90.

Trading ended with 57 securities compared to 55 on Tuesday, with 21 rising, 24 declining and 12 ending unchanged. At the close, the All Jamaican Composite Index shed 3,397.23 points to 416,853.91, the JSE Main Index dropped 1,624.03 points to close at 367,199.58 and the JSE Financial Index dipped 0.27 points to settle at 87.90.

Overall, 6,419,042 shares were exchanged for $56,245,124 compared to 9,160,573 units at $56,371,792 on Tuesday. Trading averages 112,615 units at $986,757, compared to 166,556 shares at $1,024,942 on Tuesday and month to date, an average of 195,870 units at $1,341,170, compared to 210,121 units at $1,401,836 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

Transjamaican Highway led trading with 1.50 million shares for 23.4 percent of total volume followed by Wigton Windfarm with 1.15 million units for 17.9 percent of the day’s trade and Sagicor Select Financial Fund with 783,984 units for 12.2 percent market share.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.7 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.7 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and six stocks with lower offers.

At the close, Berger Paints lost 44 cents ending at $11.40 after exchanging 7,203 shares, Caribbean Cement slipped 29 cents to close at a 52 weeks’ low of 58.70 after an exchange of 23,078 shares, Caribbean Producers dropped 49 cents to end at $13.50 while trading 82,997 stock units, Eppley Caribbean Property Fund declined $2.10 in closing at $42.90, with 2,811 stocks crossing the market. GraceKennedy gained $2.50 to end at $98.50, with 89,742 units changing hands, Guardian Holdings climbed $73.15 to close at $583.15 after trading 121 stock units, Jamaica Broilers rose 89 cents to $29.09 after exchanging 7,865 stocks. Jamaica Producers fell 44 cents in closing at $20.11, with an exchange of 66,000 shares, Massy Holdings increased $1.85 in ending at $89, with 8,721 units crossing the exchange, Mayberry Jamaican Equities rallied 65 cents to close at $14.15 in trading 106,342 stock units. NCB Financial advanced $4.75 to end at $96.75 with an exchange of 42,593 shares, Palace Amusement shed $46 after ending at $790 in switching ownership of 17 stocks, PanJam Investment shed $1.77 in closing at $59.90 in an exchange of 2,980 units.  Scotia Group popped $1.40 to end at $36.39 with the swapping of 1,317 stock units, Stanley Motta dropped 50 cents to $5, with 5,048 stocks crossing the market, Supreme Ventures declined 70 cents to close at $28.60 in exchanging 294,794 shares. Sygnus Real Estate Finance popped 41 cents in closing at $10.21, with 1,615 units clearing the market and Victoria Mutual Investments advanced 65 cents to close at $5.68 in trading 76,505 stocks.

Scotia Group popped $1.40 to end at $36.39 with the swapping of 1,317 stock units, Stanley Motta dropped 50 cents to $5, with 5,048 stocks crossing the market, Supreme Ventures declined 70 cents to close at $28.60 in exchanging 294,794 shares. Sygnus Real Estate Finance popped 41 cents in closing at $10.21, with 1,615 units clearing the market and Victoria Mutual Investments advanced 65 cents to close at $5.68 in trading 76,505 stocks.

In the preference segment, Eppley 7.50% preference share rose 69 cents to end at $7.63 in an exchange of 117 units. Eppley 7.75% preference share climbed $1 to a 52 weeks’ high of $21 with the swapping of 10 stock units and 138 Student Living preference share fell $7.58 to $49.32 with an exchange of 131 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

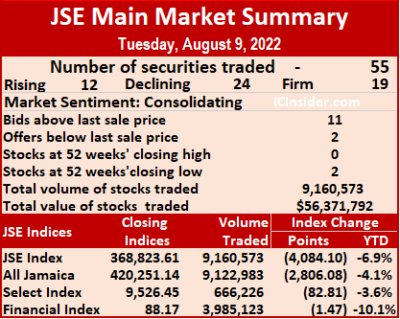

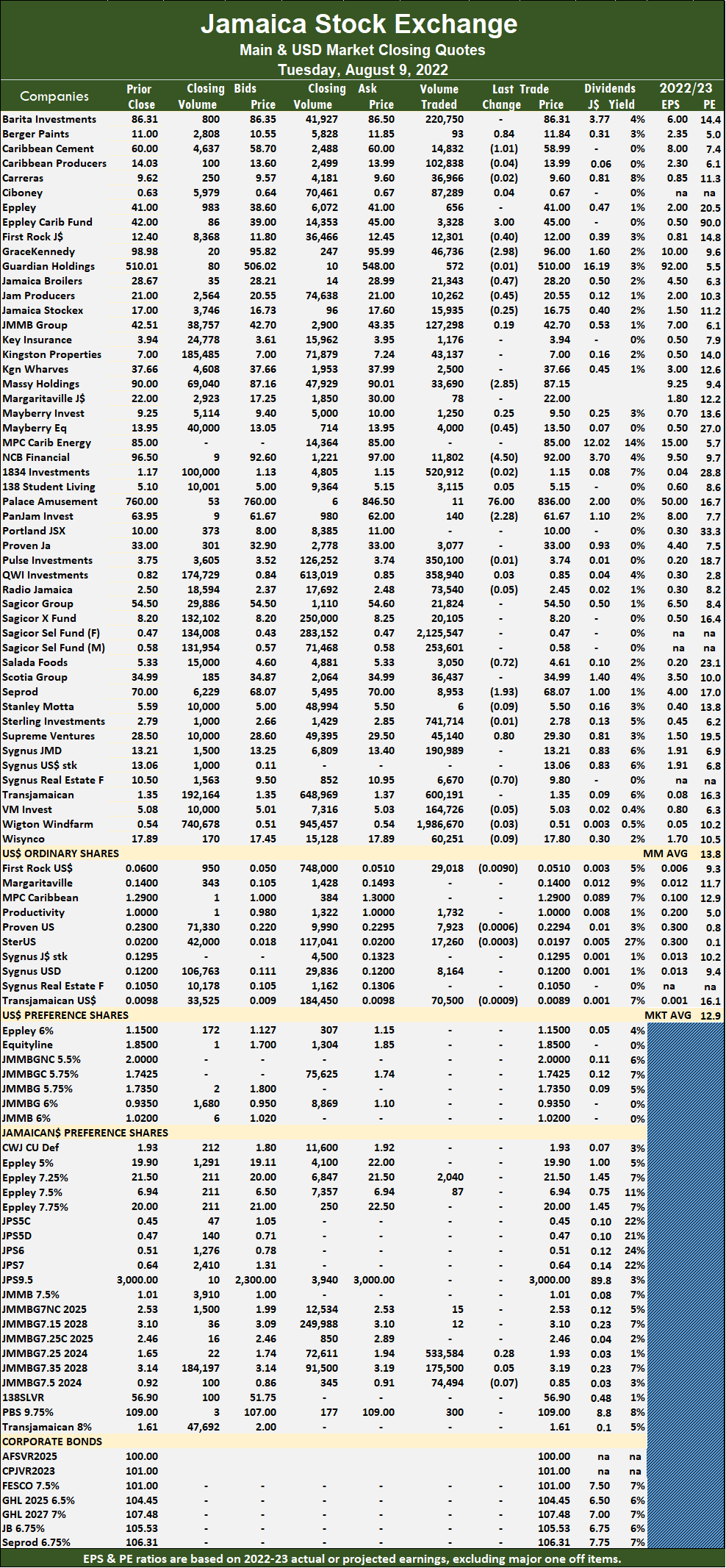

Another day of decline for JSE Main Market

Jamaica Stock Exchange Main Market activity ended with the volume of stocks traded declining 15 percent, with the value slipping marginally lower compared to trading on Monday as the market declined further in overall value versus Monday.

At the close, 9,160,573 shares were exchanged for $56,371,792, compared to 10,753,625 units at $57,897,672 on Monday. Trading averaged 166,556 units at $1,024,942, compared to 182,265 units at $981,316 on Monday and month to date, an average of 324,185 units at $1,476,401, compared to 324,185 units at $1,476,401 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

At the close, 9,160,573 shares were exchanged for $56,371,792, compared to 10,753,625 units at $57,897,672 on Monday. Trading averaged 166,556 units at $1,024,942, compared to 182,265 units at $981,316 on Monday and month to date, an average of 324,185 units at $1,476,401, compared to 324,185 units at $1,476,401 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

Wigton Windfarm led trading with 2.13 million units for 23.2 percent of total volume followed by Sagicor Select Financial Fund with 2.1 million units for 21.7 percent market share and Sterling Investments traded 741,714 shares with 8.1 percent market share.

Trading ended with 55 securities compared to 59 on Monday, with 12 rising, 24 declining and 19ending unchanged. At the close, the All Jamaican Composite Index dropped 2,806.08 points to 420,251.14, the JSE Main Index plunged 4,084.10 points to close at 368,823.61 and the JSE Financial Index dipped 1.47 points to 88.17.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.8 for the Main Market.  The JSE Main and USD Market PEs are computed using ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

The JSE Main and USD Market PEs are computed using ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

The Investor’s Choice bid-offer indicator shows 11 stocks closing with bids closing above their last selling prices and two closing with lower offers.

At the close, Berger Paints climbed 84 cents to $11.84 in switching ownership of 93 shares, Caribbean Cement fell $1.01, in ending at $58.99 after trading 14,832 stocks, Eppley Carib Fund exchanged 3,328 shares and gained $3 to end at $45, First Rock gained 40 cents trading 12,301 shares in closing at $12, GraceKennedy dropped $2.98 in closing at $96 with 46736 stock units crossing the exchange, Jamaica Broilers fell 45 cents to $28.20 after trading 22,343 shares. Jamaica Producers traded 10,262 shares and fell 45 cents in closing at $20.55, Massy Holdings shed $2.85 in closing at a 52 weeks’ low of $87.15, with 33,690 units changing hands, NCB Financial decreased $4.50 in ending at $92 while exchanging 11,802 shares, Mayberry Jamaican Equities lost 45 cents to close at $13.50 with 4,000 shares changing hands, Palace Amusement rallied $76 to close at $836 in exchanging 11 units.  PanJam Investment traded 140 units and fell $2.28 to $61.67, Salada Foods fell 72 cents to $4.61 after exchanging 3,050 stock units, Seprod traded 8,953 shares and lost $1.93 and closed at $68.07, Supreme Ventures rose 80 in closing at $29.30 in trading 45,140 stocks and Sygnus Real Estate Finance fell 70 cents in ending at a 52 weeks’ low of $9.80, with 6,670 units clearing the market.

PanJam Investment traded 140 units and fell $2.28 to $61.67, Salada Foods fell 72 cents to $4.61 after exchanging 3,050 stock units, Seprod traded 8,953 shares and lost $1.93 and closed at $68.07, Supreme Ventures rose 80 in closing at $29.30 in trading 45,140 stocks and Sygnus Real Estate Finance fell 70 cents in ending at a 52 weeks’ low of $9.80, with 6,670 units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Stocks mostly fall on JSE Main Market

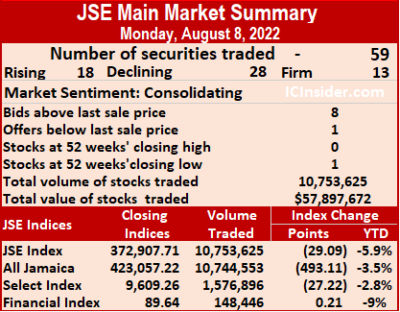

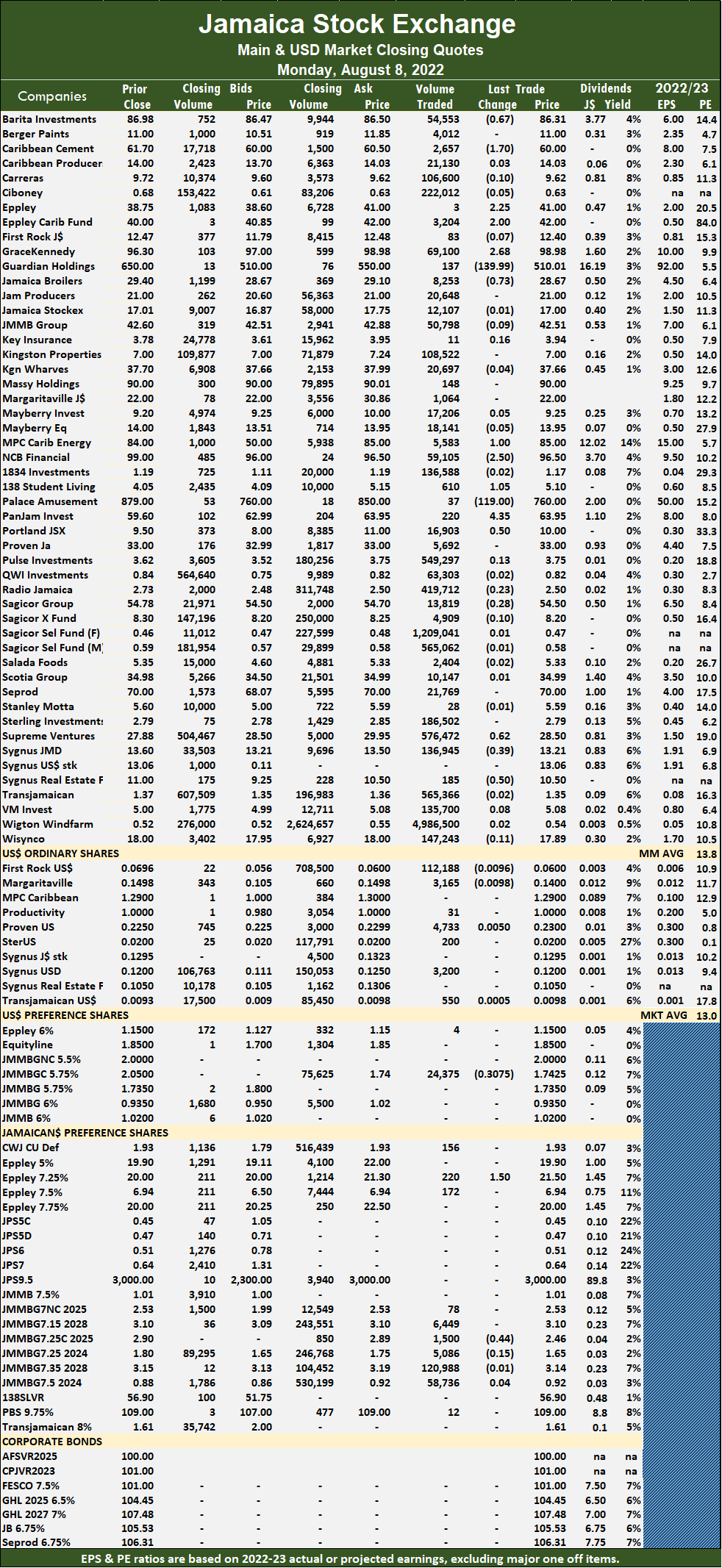

Jamaica Stock Exchange Main Market activity ended on Monday, with the volume of stocks traded declining 43 percent and the value falling 64 percent compared to trading on Friday as the market slipped in overall value.

At the close, 10,753,625 shares were exchanged for $57,897,672, down from 18,706,267 units at $161,301,374 on Friday. Trading averaged 182,265 units at $981,316, compared to 366,790 shares at $3,162,772 on Friday and month to date, an average of 324,185 units at $1,476,401, compared to 228,567 units at $1,609,780 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

At the close, 10,753,625 shares were exchanged for $57,897,672, down from 18,706,267 units at $161,301,374 on Friday. Trading averaged 182,265 units at $981,316, compared to 366,790 shares at $3,162,772 on Friday and month to date, an average of 324,185 units at $1,476,401, compared to 228,567 units at $1,609,780 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

At the close, the All Jamaican Composite Index fell 493.11 points to 423,057.22, the JSE Main Index slipped just 29.08 points to close at 372,907.71 and the JSE Financial Index as rose 0.21 points to 89.64.

Trading ended with 59 securities compared to 51 on Friday, with 18 rising, 28 declining and 13 ending unchanged.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.9 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Wigton Windfarm led trading with 4.99 million units for 46.4 percent of total volume followed by Sagicor Select Financial Fund with 1.2 million units for 11.2 percent market share and Supreme Ventures with 576,472 shares for 5.4 percent of the total.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and one closing with a lower offer.

At the close, Barita Investments fell 67 cents to $86.31 after switching ownership of 54,553 shares, Caribbean Cement dropped $1.70 to $60 after trading 2,657 stocks, Eppley popped $2.25 to end at $41 in an exchange of three units. Eppley Carib Fund exchanged 3,204 shares and gained $2 to end at $42, GraceKennedy popped $2.68 in closing at $98.98 with 69,100 stock units crossing the exchange, Guardian Holdings gave back $139.99 of what was gained on Friday to close at $510.01 with 137 stocks crossing the market, Jamaica Broilers fell 73 cents to $28.67 after trading 8,253 shares. MPC Caribbean Clean Energy added $1 in closing at $85, with 5,583 units changing hands, NCB Financial decreased $2.50 in ending at $96.50 while exchanging 59,105 shares, 138 Student Living gained $1.05 to close at $5.10 with 610 shares changing hands, Palace Amusement rallied $119 to close at $760 in exchange of 37 units.

At the close, Barita Investments fell 67 cents to $86.31 after switching ownership of 54,553 shares, Caribbean Cement dropped $1.70 to $60 after trading 2,657 stocks, Eppley popped $2.25 to end at $41 in an exchange of three units. Eppley Carib Fund exchanged 3,204 shares and gained $2 to end at $42, GraceKennedy popped $2.68 in closing at $98.98 with 69,100 stock units crossing the exchange, Guardian Holdings gave back $139.99 of what was gained on Friday to close at $510.01 with 137 stocks crossing the market, Jamaica Broilers fell 73 cents to $28.67 after trading 8,253 shares. MPC Caribbean Clean Energy added $1 in closing at $85, with 5,583 units changing hands, NCB Financial decreased $2.50 in ending at $96.50 while exchanging 59,105 shares, 138 Student Living gained $1.05 to close at $5.10 with 610 shares changing hands, Palace Amusement rallied $119 to close at $760 in exchange of 37 units.  PanJam traded 220 units and fell $4.35 at $63.95, Portland JSX rose 50 cents to $10 after exchanging 16,903 stock units, Supreme Ventures rose 62 in closing at $28.50 in trading 576,472 stocks, Sygnus Credit Investments shed 39 cents to close at $13.21 in exchanging 136,945 shares and Sygnus Real Estate Finance fell 50 cents in ending at a 52 weeks’ low of $10.50, with 185 units clearing the market.

PanJam traded 220 units and fell $4.35 at $63.95, Portland JSX rose 50 cents to $10 after exchanging 16,903 stock units, Supreme Ventures rose 62 in closing at $28.50 in trading 576,472 stocks, Sygnus Credit Investments shed 39 cents to close at $13.21 in exchanging 136,945 shares and Sygnus Real Estate Finance fell 50 cents in ending at a 52 weeks’ low of $10.50, with 185 units clearing the market.

In the Preference segment, Eppley 7.25% jumped $1.50 to $21.50 after trading 220 shares and JMMBG7.25C due 2025 fell 44 cent to $2.46, with 1,500 units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

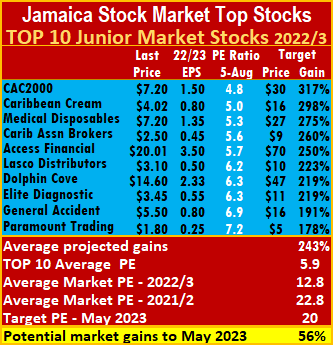

Three changes to ICTOP10

The past week ended with new entrants to the ICTOP listing, with Dolphin Cove and Paramount Trading reentering the Junior Market list while 138 Student Living enters the TOP10 Main market list.

Jetcon Corporation and Lasco Financial are out of the Junior Market TOP10, and Caribbean Cement left the Main Market list.

Jetcon Corporation and Lasco Financial are out of the Junior Market TOP10, and Caribbean Cement left the Main Market list.

The Junior Market suffered some declines, no doubt connected to investors focusing on the latest IPO – OneonOne Educational Services to hit the market, as they seek funds to go into the issue, continuing a feature visible in the market for most popular IPOS. The Main Market moves were less pronounced, with just one significant fall.

In the Junior Market, Elite Diagnostic gained 7 percent to $3.45 and General Accident was up 8 percent to $5.50. Access Financial and CAC 2000 dipped 13 percent to $20.01 and $7.20, respectively and Caribbean Cream and Jetcon Corporation slipped 6 percent to $4.02 and $1.20, respectively. Caribbean Assurance Brokers ended 4 percent lower at $2.50 but has limited stocks offered, with most offers over $2.70.

The Main Market ended the week with Guardian Holdings jumping a sharp 29 percent to $650 on limited volume. There are now less than 1,000 shares offered for sale. At the close, there was an offer of 76 shares at $594 and the highest bid was $505 to buy 2012 shares. Profit for the June Quarter was TT$256 million, up 220 percent from $80 million in 2021, with six months moving up by 70 percent from $256 million to TT$436 million. The EPS comes out at TT$1.88 or J$43. The other big move was by Productive Business Solutions, falling 12 percent to US$1.

The Main Market ended the week with Guardian Holdings jumping a sharp 29 percent to $650 on limited volume. There are now less than 1,000 shares offered for sale. At the close, there was an offer of 76 shares at $594 and the highest bid was $505 to buy 2012 shares. Profit for the June Quarter was TT$256 million, up 220 percent from $80 million in 2021, with six months moving up by 70 percent from $256 million to TT$436 million. The EPS comes out at TT$1.88 or J$43. The other big move was by Productive Business Solutions, falling 12 percent to US$1.

The average PE for the JSE Main Market TOP 10 is 6.2, well below the market average of 13.9, while the Junior Market Top 10 PE sits at 5.9 versus the market at 12.8. The Junior Market is projected to rise by 243 percent and the Main Market TOP10 is projected to gain an average of 239 percent each to May 2023.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always.  ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

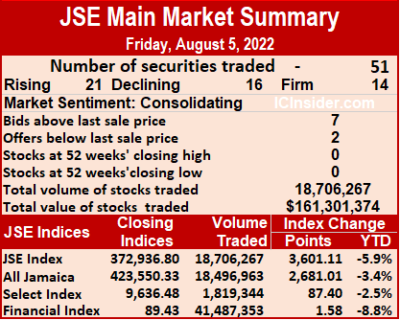

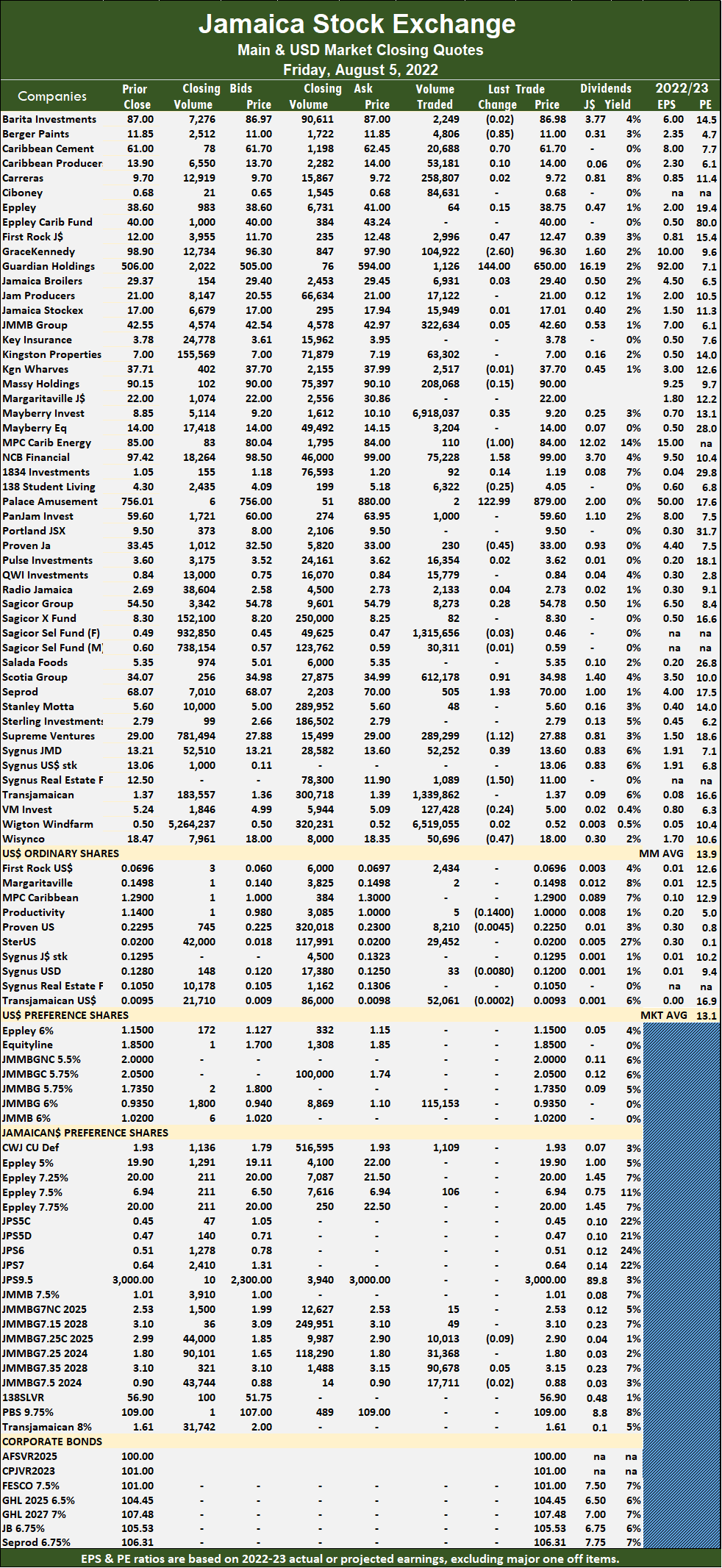

Guardian Holdings jumps $144 on Friday

Guardian Holdings jumped 28.5 percent on limited volume after jumping $144 on the Jamaica Stock Exchange Main Market on Friday, with the supply of the stock available for sale virtually dried up after several months of selling pressure. The overall Main Market volume of stocks traded rose 12 percent, with a value 250 percent greater than on Thursday, leading the market to climb as rising stocks exceeded those declining.

.

The All Jamaican Composite Index rallied 3,224.68 points to 423,550.33, the JSE Main Index jumped 3,601.11 to 372,936.80 and the JSE Financial Index popped 1.98 points to close at 89.43.

Trading ended with 51 securities compared to 58 on Thursday, with 21 rising, 16 declining and 14 ending unchanged.

At the close, 18,706,267 shares were exchanged for $161,301,374 versus 16,728,941 units at $46,042,543 on Thursday. Trading averaged 366,790 units at $3,162,772, compared to 288,430 shares at $793,837 on Thursday and month to date, an average of 228,567 units at $1,609,780, compared to 186,606 units at $1,138,336 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

Mayberry Investments led trading with 6.92 million shares for 37 percent of total volume, followed by Wigton Windfarm with 6.52 million units for 34.8 percent of the day’s trade, Transjamaican Highway with 1.34 million units for 7.2 percent market share and Sagicor Select Financial Fund with 1.32 million units for 7 percent market share.

Mayberry Investments led trading with 6.92 million shares for 37 percent of total volume, followed by Wigton Windfarm with 6.52 million units for 34.8 percent of the day’s trade, Transjamaican Highway with 1.34 million units for 7.2 percent market share and Sagicor Select Financial Fund with 1.32 million units for 7 percent market share.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.9 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to August 2023.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and two stocks with lower offers.

At the close, Berger Paints fell 85 cents to $11 in switching ownership of 4,806 shares, Caribbean Cement rose 70 cents in ending at $61.70 and trading 20,688 stocks, First Rock Real Estate popped 47 cents to end at $12.47 in an exchange of 2,996 units.GraceKennedy dropped $2.60 in closing at $96.30, with 104,922 stock units crossing the exchange, Guardian Holdings gained $144 to close at $650 with an exchange of 1,126 stocks, but the offer for the stock was at $590 at the close, Mayberry Investments climbed 35 cents to $9.20 and closed with 6,918,037 stock units changing hands. MPC Caribbean Clean Energy shed $1 in closing at $84 after trading 110 units, NCB Financial increased $1.58 to $99 while exchanging 75,228 shares, Palace Amusement rallied $122.99 to close at $879 after exchanging two units.  Proven Investments declined 45 cents to end at $33 after trading 230 stock units, Scotia Group advanced 91 cents to $34.98, with 612,178 stocks crossing the market, and Seprod popped $1.93 to end at $70 with the swapping of 505 shares. Supreme Ventures lost $1.12 in closing at $27.88 after trading 289,299 stocks, Sygnus Credit Investments gained 39 cents to close at $13.60 in exchanging 52,252 shares, Sygnus Real Estate Finance fell $1.50 in ending at $11 with 1,089 units clearing the market and Wisynco Group shed 47 cents in ending at $18 with an exchange of 50,696 stock units.

Proven Investments declined 45 cents to end at $33 after trading 230 stock units, Scotia Group advanced 91 cents to $34.98, with 612,178 stocks crossing the market, and Seprod popped $1.93 to end at $70 with the swapping of 505 shares. Supreme Ventures lost $1.12 in closing at $27.88 after trading 289,299 stocks, Sygnus Credit Investments gained 39 cents to close at $13.60 in exchanging 52,252 shares, Sygnus Real Estate Finance fell $1.50 in ending at $11 with 1,089 units clearing the market and Wisynco Group shed 47 cents in ending at $18 with an exchange of 50,696 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 60

- 61

- 62

- 63

- 64

- …

- 268

- Next Page »