With trading resuming on the Main Market of the Jamaica Stock Exchange on Friday after the two days break for the Christmas holidays, investors pushed the market down on higher volume but lower value than on Tuesday.

With trading resuming on the Main Market of the Jamaica Stock Exchange on Friday after the two days break for the Christmas holidays, investors pushed the market down on higher volume but lower value than on Tuesday.

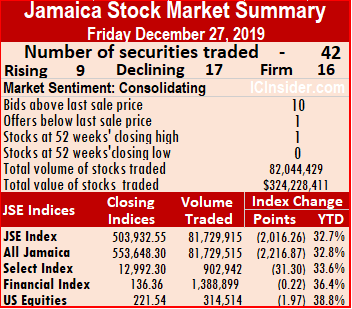

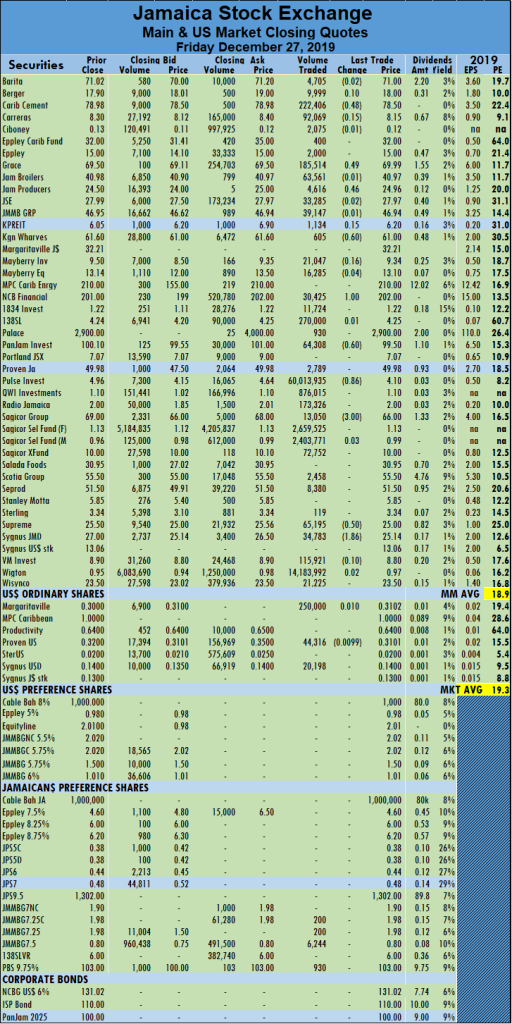

At the close of trading, the JSE All Jamaican Composite Index dropped 2,216.87 points to 553,648.38, the JSE Market Index sank 2,016.26 points to close at 503,932.55 and the JSE Financial Index declined by 0.22 points to 136.36.

The market closed, with 42 securities changing hands in the Main and US dollar markets, with 17 advancing, 10 declining and the prices of 15 stocks closed unchanged. JSE Main Market activity ended, with 39 securities accounting for 81,729,915 units amounting to $324,228,411 in contrast to 35,380,225 valued at $722,803,611 from 39 securities changing hands on Tuesday.

Pulse Investments dominated trading, with 60 million shares and 73 percent of volume traded followed by Wigton Windfarm with 14.2 million units for 17 percent of the day’s trade, and Sagicor Select Funds – Financial with 2.7 million shares for 3 percent market share.

The market closed, with an average of 2,095,639 units valued at $8,313,549 for each security traded, in contrast to 907,185 units valued at $18,533,426 on Tuesday. The average volume and value for the month to date amounts to 596,352 units for $9,410,939 and previously, an average of 509,598 units for $9,478,232 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 10 stocks ending, with bids higher than their last selling prices and one closed, with a lower offer. The PE ratio of the market ended at 19.3, with the Main Market ending at 18.9 times the current year’s earnings.

In the premier market, Caribbean Cement lost 48 cents to end at $78.50 in transferring of 222,406 stock units; Grace Kennedy gained 49 cents to close at $69.99, after exchanging 185,514 shares, Jamaica Producers rose 46 cents to end at $24.96, with 4,616 shares changing hands. Kingston Wharves fell 60 cents to $61 with 605 stock units trading. NCB Financial climbed $1 to close at $202 in the transferring of 30,245 stock units,  PanJam Investment fell 60 cents to $99.50, with 64,308 shares crossing the exchange. Pulse Investments dropped 86 cents to end the day at $4.10, with a whopping 60,013,935 shares changing hands. Sagicor Group dropped $3 to close at $66 with an exchange of 13,050 shares, Supreme Ventures lost 50 cents to end at $25, after exchanging 65,195 shares and Sygnus Credit Investments lost $1.86 to end at $25.14 with 34,783 stock units trading.

PanJam Investment fell 60 cents to $99.50, with 64,308 shares crossing the exchange. Pulse Investments dropped 86 cents to end the day at $4.10, with a whopping 60,013,935 shares changing hands. Sagicor Group dropped $3 to close at $66 with an exchange of 13,050 shares, Supreme Ventures lost 50 cents to end at $25, after exchanging 65,195 shares and Sygnus Credit Investments lost $1.86 to end at $25.14 with 34,783 stock units trading.

Trading in the US dollar market closed with 314,514 amounting to $94,537, with the market index declining 1.97 points to close at 221.54. Margaritaville rose 1 cent in trading 250,000 shares to end at 52 weeks’ high of 31.02 US cents, Proven Investments slipped 1 cent in trading 44,316 shares to close at 31.01 US cents and Sygnus Credit Investments exchanged 20,198 stock units and held firm at 14 US cents.

Sharp fall for JSE Main Market

Big jump in JSE Main Market trading

Trading on the Main Market of the Jamaica Stock Exchange resulted in moderate gains in the two primary market indices on Tuesday as advancing stocks subdued decliners with a surge of cash passing through the market.

Trading on the Main Market of the Jamaica Stock Exchange resulted in moderate gains in the two primary market indices on Tuesday as advancing stocks subdued decliners with a surge of cash passing through the market.

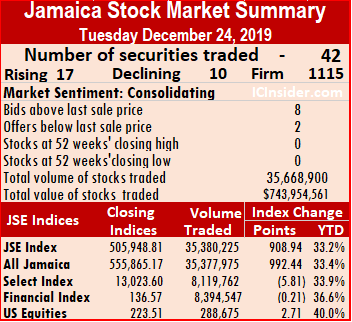

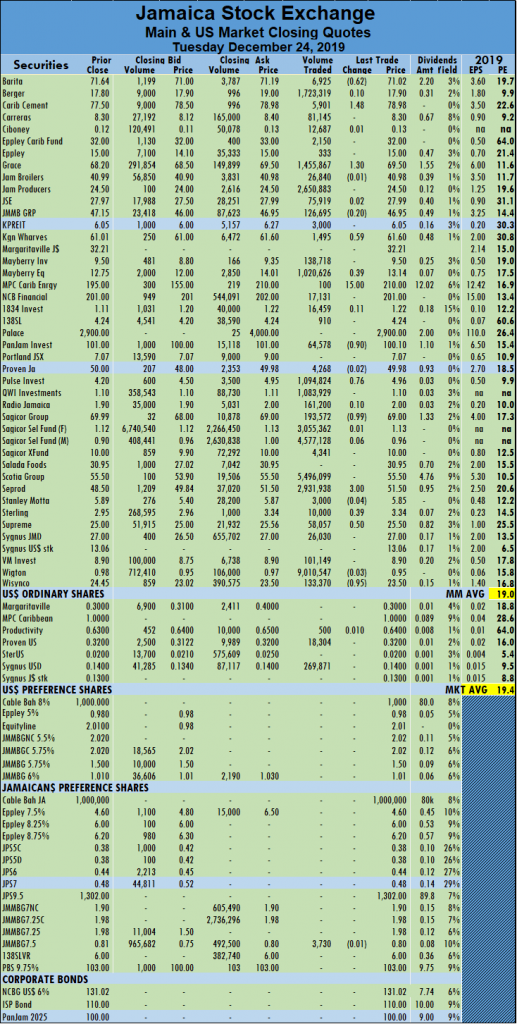

The market closed, with 42 securities changing hands in the Main and US dollar markets, with 17 advancing, 10 declining and the prices of 15 stocks closed unchanged. JSE Main Market activity ended, with 39 securities accounting for 35,380,225 units valued at $722,803,611, in contrast to 15,783,620 units for a consideration of $75,868,402 on Monday, from 39 securities changing hands.

At the close of trading, the JSE All Jamaican Composite Index rose 992.44 points to 555,865.17, the JSE Market Index climbed 908.94 points to close at 505,948.81 and the JSE Financial Index fell 0.21 points to 136.57.

Wigton Windfarm dominated trading, with 9 million shares and 25.5 percent of volumes traded followed by Scotia Group with 5.4 million units for 15 percent of the day’s trade and Sagicor Select Manufacturing and Distribution fund rounding out the top three with 4.6 million shares for 13 percent market share.

The market closed, with an average of 907,185 units valued at an average of $18,533,426 for each security traded, in contrast to 404,708 units valued at an average of $1,945,344 on Tuesday. The average volume and value for the month to date amounts to 509,598 units for $9,478,232 and previously, an average of 485,179 units for $8,886,686 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8 stocks ending, with bids higher than their last selling prices and two closed, with lower offers. The PE ratio of the market ended at 19.4, with the Main Market ending at 19 times the current year’s earnings.

In the premier market, Barita Investments lost 62 cents to settle at $71.02, with 6,925 shares changing hands, Caribbean Cement jumped $1.48 to $78.98 in transferring of 5,901 stock units, Grace Kennedy gained $1.30 to end at $69.50, after exchanging 1,455,867 shares, Kingston Wharves gained 59 cents to end at $61.60 with 1,495 stock units trading. Mayberry Jamaican Equities gained 39 cents to end at $13.14, with 1,020,626 stock units trading, MPC Caribbean jumped $15 to close at $210 to end at $210 with an exchange of 100 stock units, PanJam Investment fell 90 cents to end at $100.10, with 64,578 shares crossing the exchange. Proven Investments dropped $4 to land at $50 while trading 4,696 stock units, Sagicor Group lost 99 cents to $69 with 193,572 shares changing hands. Seprod jumped $3 in exchanging 2,931,938 shares to close at $51.50, Sterling Investments added 39 cents to close at $3.34 with an exchange of 10,000 stock units, Supreme Ventures added 560cents to end at $2550., while trading 58,057 shares and Wisynco Group lost 95 cents to $23.50, with 133,370 shares changing hands.

Proven Investments dropped $4 to land at $50 while trading 4,696 stock units, Sagicor Group lost 99 cents to $69 with 193,572 shares changing hands. Seprod jumped $3 in exchanging 2,931,938 shares to close at $51.50, Sterling Investments added 39 cents to close at $3.34 with an exchange of 10,000 stock units, Supreme Ventures added 560cents to end at $2550., while trading 58,057 shares and Wisynco Group lost 95 cents to $23.50, with 133,370 shares changing hands.

Trading in the US dollar market closed with 288,675 units amounting to $43,882, with the market index adding 2.71 points to close at 223.51. Productive Business Solutions traded 500 shares to close 1 cent higher at 64 US cents, Proven Investments had 18,304 shares changing hands to end at 32 US cents and Sygnus Credit Investments traded 261,871 stock units to close at 14 US cents.

Moderate gains for JSE Main Market

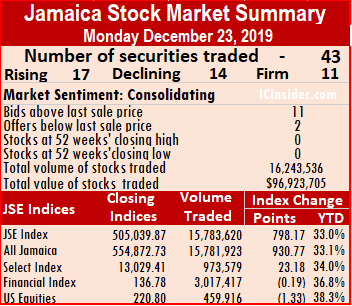

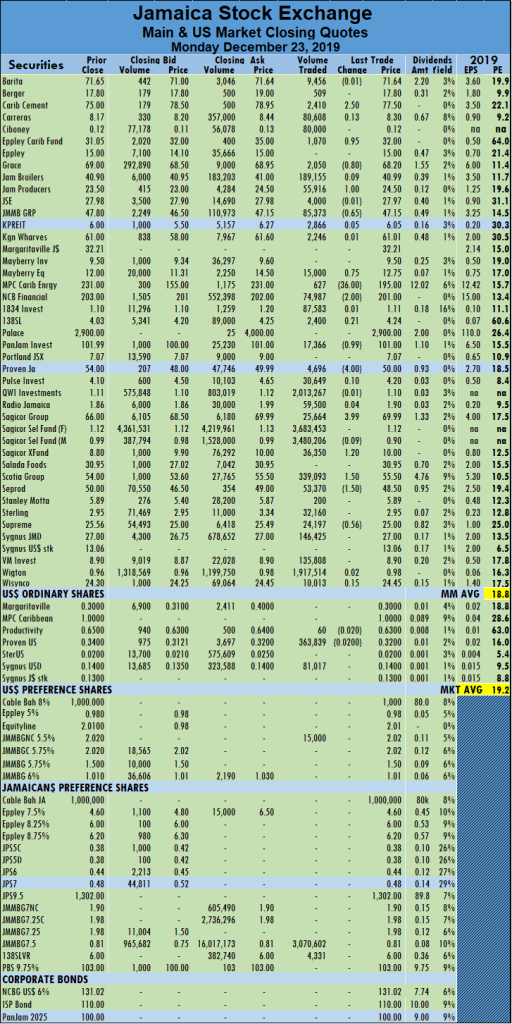

Trading on the Main Market of the Jamaica Stock Exchange resulted in moderate gains for the two primary market indices on Monday as rising stocks edged out decliners after trading declined again following a sharp drop on Friday.

Trading on the Main Market of the Jamaica Stock Exchange resulted in moderate gains for the two primary market indices on Monday as rising stocks edged out decliners after trading declined again following a sharp drop on Friday.

At the close of trading, the JSE All Jamaican Composite Index gained 930.77 points to 554,872.73, the JSE Market Index added 798.17 points to close at 505,039.87 and the JSE Financial Index dropped 1.19 points to 136.78.

The market closed, with 43 securities changing hands in the Main and US dollar markets, with 18 advancing, 16 declining and the prices of 9 stocks closed unchanged. JSE Main Market activity ended, with 39 securities accounting for 15,783,620 units for a consideration of $75,868,401.70, in contrast to 37,939,404 units with a consideration of $92,284,016, on Friday, from 41 securities changing hands.

Sagicor Select – Financial fund was the market leader with 3.7 million shares and 3 percent of the volume traded, closely followed by Sagicor Select – Manufacturing and Distribution fund with 3.5million shares and 22 percent of the day’s trade. JMMB Group rounded out the top three with 3.1 million units and 19 percent of the market share.

The market closed, with an average of 404,708 units valued at an average of $1,945,344 for each security traded, in contrast to 925,351 units at $2,250,830 on Monday. The average volume and value for the month to date amounts to 485,179 units for $8,886,686 and previously, an average of 490,445 units for $9,371,834 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 11 stocks ending, with bids higher than their last selling prices and two closed, with lower offers. The PE ratio of the market ended at 19.2, with the Main Market ending at 18.8 times the current year’s earnings.

In the JSE Main Market, Caribbean Cement jumped $2.50 to end at $77.50 with a transfer of 2,410 stock units, Eppley Caribbean Property Fund traded 1,070 units and rose 95 cents to close at $32, Grace Kennedy lost 80 cents to end at $68.20, after exchanging 2,050 shares. Jamaica Producers gained $1 to end at $24.50 with 55,9161 stock units trading, JMMB Group fell 65 cents to settle at $47.15, with 85,373 shares changing hands, units. Mayberry Jamaican Equities gained 75 cents to end at $12.75, with 15,000 stock units trading, MPC Caribbean dived $36 to end at $195 with an exchange of 627 stock units, NCB Financial Group declined by $2 to close at $201, in swapping 74,987 shares.  PanJam Investment fell 99 cents to end at $101, with 17,366 shares crossing the exchange, Proven Investments dropped $4 to land at $50 while trading 4,696 stock units, Sagicor Group jumped $3.99 to $69.99 with 25,664 shares changing hands. Sagicor Real Estate Fund gained $1.20 to $10 with 36,350 shares, Scotia Group gained $1.50 to end at $55.50, in transferring 339,093 shares, Seprod lost $1.50 in trading 53,370 units to close at $48.50 and Supreme Ventures shed 56 cents to end at $25 while trading 24,197 stock units.

PanJam Investment fell 99 cents to end at $101, with 17,366 shares crossing the exchange, Proven Investments dropped $4 to land at $50 while trading 4,696 stock units, Sagicor Group jumped $3.99 to $69.99 with 25,664 shares changing hands. Sagicor Real Estate Fund gained $1.20 to $10 with 36,350 shares, Scotia Group gained $1.50 to end at $55.50, in transferring 339,093 shares, Seprod lost $1.50 in trading 53,370 units to close at $48.50 and Supreme Ventures shed 56 cents to end at $25 while trading 24,197 stock units.

Trading in the US dollar market closed with 459,916 units amounting to $158,311, with the market index losing 1.33 points to close at 220.80. Productive Business Solution traded 60 shares to end at 63 US cents, a decline of 2 cents, Proven Investments lost 2 cents after exchanging 363,839 shares to close at 32 US cents, Sygnus Credit Investments exchanged 81,017 stock units, to close at 14 US cents and JMMB Group 5.5% preference share traded 15,000 units at US$2.02.

Sygnus US$ stock hits IC TOP 10

The JSE Main Market TOP 10 had just stock leaving with Sygnus Credit Investments Jamaican dollar listing replaced by the US dollar listed stock, with the price of the latter at 14 US cents or just under J$19 equivalent.

The JSE Main Market TOP 10 had just stock leaving with Sygnus Credit Investments Jamaican dollar listing replaced by the US dollar listed stock, with the price of the latter at 14 US cents or just under J$19 equivalent.

The Sygnus Jamaican quoted stock climbed to a record high of $30 on Friday, but ended at a record closing high of $27 at the end of trading and moved down to 12th spot in the overall market ranking.

The recently listed Lumber Depot closed trading at $1.91 on Friday and moved out of the TOP Junior Market listing. Also, leaving the TOP 10 was Honey Bun, with the price rising to $8.39 with a limited supply of the stock.

Coming into the Junior Market listing, are Lasco Distributors and Paramount Trading as investors beat down their prices.

The targeted PE ratio is now 25, with several stocks trading at that level or around 22 currently. The average projected gains for the IC TOP 10 stocks are 179 percent for Junior Market and 154 percent for JSE Main market Top 10 shares.

The top three Junior Market stocks currently are the Main Event with projected gains of 243 percent, followed by Medical Disposables with a potential increase of 238 percent and Jamaican Teas with 220 percent likely capital growth.

Radio Jamaica still holds on to the lead for Main Market stocks, with an expected increase of 236 percent, followed by Pulse Investments in the number two spot with projected growth of 205 percent and Sygnus US dollar-denominated stock with likely gains of 186 percent, is next.

Radio Jamaica still holds on to the lead for Main Market stocks, with an expected increase of 236 percent, followed by Pulse Investments in the number two spot with projected growth of 205 percent and Sygnus US dollar-denominated stock with likely gains of 186 percent, is next.

The JSE Main Market closed the week, with an overall PE of 20.6 and the Junior Market at 14.3, based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks averages 9.1 with the Main Market PE at 10.1.

The TOP 10 stocks now trade at a discount of 36 percent of the average for Junior Market stocks and the Main Market stocks trade at a discount of 51 percent to the overall market.

IC TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with the PE ratio for each company’s current fiscal year, are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Forecasted values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have an interest in securities included in the commentary.

JSE Main Market pulls back – Friday

Proven Investments closed at a 52 weeks’ high of J$54.

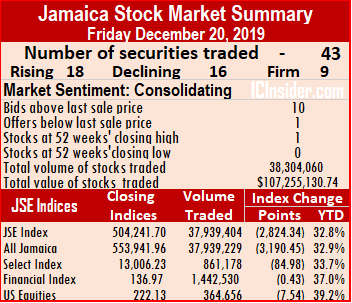

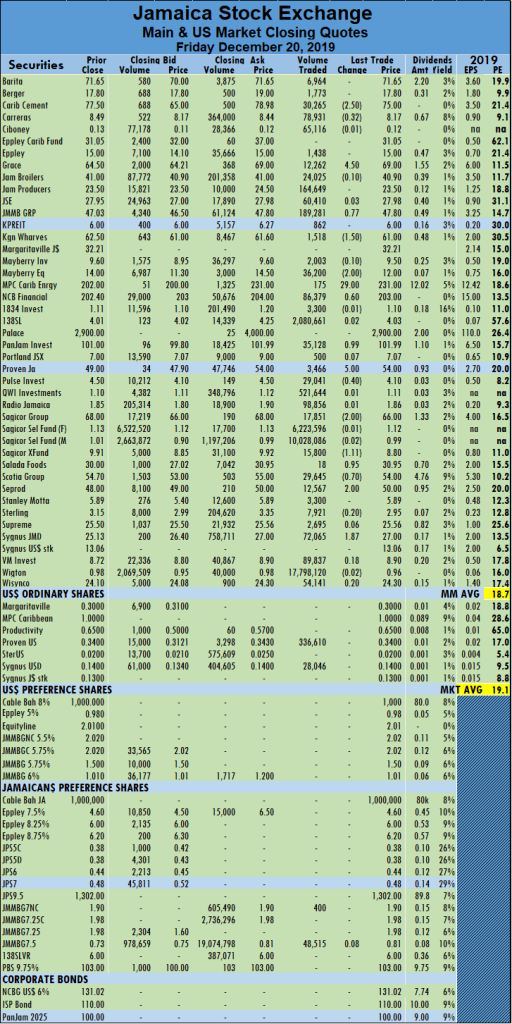

Trading on the Main Market of the Jamaica Stock Exchange resulted in declines in the two primary market indices on Friday as rising stocks edged out decliners after volume of shares traded rose sharply at just over half of the value that exchanged on Thursday.

At the close of trading, the JSE All Jamaican Composite Index dropped 3,190.45 points to end at 553,941.96, the JSE Market Index lost 2,824.34 points to close at 504,241.70 and the JSE Financial Index declined by 0.43 points to finish at 136.97.

The market closed, with 43 securities changing hands in the Main and US dollar markets, with 18 advancing, 16 declining and the prices of 9 stocks closed unchanged. JSE Main Market activity ended, with 39 securities accounting for 37,939,404 units with a consideration of $92,284,016, in contrast to 22,307,168 units amounting to $166,924,750, on Thursday, from 38 securities changing hands.

Wigton Windfarm returned to dominate trading, with 17.8 million shares and 50 percent of volumes traded followed by Sagicor Select – Manufacturing and Distribution fund with 10 million units for 26.4 percent of the day’s trade and Sagicor Select – Financial Fund with 6.2 million shares for 16.4 percent market share.

The market closed, with an average of 925,351 units at $2,250,830 for each security traded, in contrast to 587,031 units at $4,392,757 on Thursday. The average volume and value for the month to date amounts to 490,445 units for $9,371,834 and previously, an average of 458,316 units for $9,936,556 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 10 stocks ending, with bids higher than their last selling prices and one closed, with a lower offer. The PE ratio of the market ended at 19.1, with the Main Market ending at 18.7 times the current year’s earnings.

In the premier market, Caribbean Cement declined by $2.50 to end at $75 with a transfer of 30,265 stock units, Carreras lost 22 cents to end at $8.17, in trading 78,931 stock units. Grace Kennedy climbed $4.50 to end at $69, trading 12,262 shares, JMMB Group gained 77 cents to settle at $47.80 with 189,281 shares changing hands, Kingston Wharves dropped $1.50 to settle at $61, in trading 1,518 units. Mayberry Jamaican Equities fell by $2 to end at $12, with 36,200 stock units trading, MPC Caribbean jumped $29 to end at $231 with an exchange of 175 stock units, NCB Financial Group advanced by 60 cents to close at $203, in swapping 86,379 shares. PanJam Investment rose 99 cents to end at $101.99, with 35,128 shares crossing the exchange, Proven Investments jumped $5 to land at a record high of $54 while trading 3,466 stock units, Pulse Investments had 29,041 changing hands and lost 40 cents to close at $4.10.  Sagicor Group dropped $2 to $66 with 17,851 shares changing hands, Salada Foods traded just 18 shares after rising 95 cents to end at $30.95, Scotia Group lost 70 cents to end at $54, in transferring 29,645 shares. Seprod recovered the $2 lost on Thursday in trading 12,567 stock units to close at $50, Sygnus Credit Investments put on $1.87 to close at $27, with 72,065 units crossing the market and Wisynco Group rose 20 cents to $24.30, with 54,141 shares changing hands.

Sagicor Group dropped $2 to $66 with 17,851 shares changing hands, Salada Foods traded just 18 shares after rising 95 cents to end at $30.95, Scotia Group lost 70 cents to end at $54, in transferring 29,645 shares. Seprod recovered the $2 lost on Thursday in trading 12,567 stock units to close at $50, Sygnus Credit Investments put on $1.87 to close at $27, with 72,065 units crossing the market and Wisynco Group rose 20 cents to $24.30, with 54,141 shares changing hands.

Trading in the US dollar market closed, with 364,656 units amounting to $111,725 units, with the market index falling 7.54 points to close at 222.13. Proven Investments traded 336,610 shares to close at 34 US cents and Sygnus Credit Investments exchanged 28,046 stock units to close at 14 US cents.

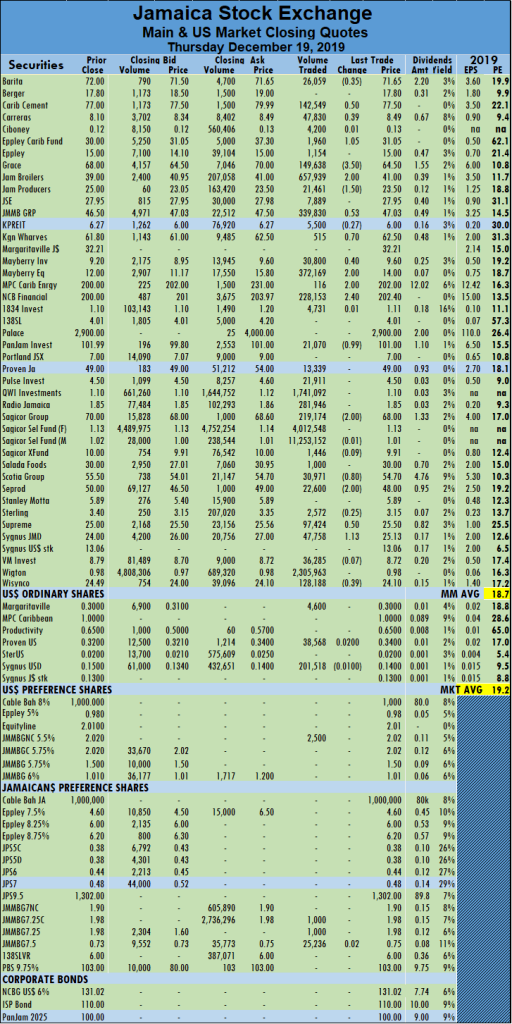

Big jump in JSE Main Market – Thursday

Trading on the Main Market of the Jamaica Stock Exchange resulted in a surge in the two primary market indices on Thursday as rising stocks edged out decliners following a rise in volume and values of shares changing hands.

Trading on the Main Market of the Jamaica Stock Exchange resulted in a surge in the two primary market indices on Thursday as rising stocks edged out decliners following a rise in volume and values of shares changing hands.

At the close, JSE All Jamaican Composite Index surged 4,382.42 points to 557,132.41, the JSE Market Index jumped 4,008.03 points to close at 507,066.04 and the JSE Financial Index rose 1.15 points higher to 137.40.

The market closed, with 42 securities changing hands in the Main and US dollar markets, with 14 advancing, 13 declining and the prices of 13 stocks closed unchanged. JSE Main Market activity ended, with 38 securities accounting for 22,307,168 units amounting to $166,924,750 in contrast to 9,385,975 units valued $145,118,400, on Wednesday, from 38 securities.

Sagicor Select – Manufacturing and Distribution fund dominated trading, with 11.3 million shares and 50.5 percent of volumes traded followed by Sagicor Select – Financial Fund with 4 million units for 18 percent of the day’s trade and Wigton Windfarm with 2.3 million shares for 10 percent market share.

The market closed, with an average of 587,031 units at $4,392,757 for each security traded, in contrast to 246,999 units valued at an average of $3,818,905 on Wednesday. The average volume and value for the month to date amounts to 458,316 units for $9,936,556 and previously, an average of 448,856 units for $10,376,356 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 10 stocks ending, with bids higher than their last selling prices and one closed, with a lower offer. The PE ratio of the market ended at 19.2, with the Main Market ending at 18.7 times the current year’s earnings.

In the premier market, Barita Investments lost 35 cents to settle at $71.65, with 26,059 shares changing hands, Caribbean Cement gained 50 cents to end at $77.50 with a transfer of 142,549 stock units, Carreras gained 39 cents to end at $8.49, in trading 47,830 stock units. Eppley Caribbean Property gained $1.05 to end at $31.05, after exchanging 1,960 shares, Grace Kennedy lost $3.50 to end at $64.50, trading 149,638 shares, Jamaica Broilers rose by $2 to settle at $41, with 657,939 shares changing hands. Jamaica Producers fell $1.50 to end at $24.96 with 21,461 stock units trading, JMMB Group gained 53 cents to settle at $47.03 with 339,830 shares changing hands, Kingston Wharves gained 70 cents to settle at $62.50, in trading 515 units. Mayberry Investments added 40 cents to end at $9.60, trading 30,800 shares, Mayberry Jamaican Equities rose $2 to end at $14, with 372,169 stock units trading,  MPC Caribbean gained $2 to end at $202 with an exchange of 116 stock units, NCB Financial Group advanced by $2.40 to close at $202.40, in swapping 228,153 shares. PanJam Investment lost 99 cents to end at $101, with 21,070 shares crossing the exchange. Sagicor Group dropped $2 to settle at $68 with 219,174 shares changing hands, Scotia Group lost 80 cents to settle at $54.70, in transferring 30,971 shares. Seprod dipped $2 trading 22,600 stock units to close at $48, Supreme Ventures gained 50 cents to end at $25.50, while exchanging 97,424 shares, Sygnus Credit Investments put on $1.13 to close at $25.13, with 47,758 units crossing the market and Wisynco Group fell 39 cents to $24.10, with 128,188 shares changing hands.

MPC Caribbean gained $2 to end at $202 with an exchange of 116 stock units, NCB Financial Group advanced by $2.40 to close at $202.40, in swapping 228,153 shares. PanJam Investment lost 99 cents to end at $101, with 21,070 shares crossing the exchange. Sagicor Group dropped $2 to settle at $68 with 219,174 shares changing hands, Scotia Group lost 80 cents to settle at $54.70, in transferring 30,971 shares. Seprod dipped $2 trading 22,600 stock units to close at $48, Supreme Ventures gained 50 cents to end at $25.50, while exchanging 97,424 shares, Sygnus Credit Investments put on $1.13 to close at $25.13, with 47,758 units crossing the market and Wisynco Group fell 39 cents to $24.10, with 128,188 shares changing hands.

Trading in the US dollar market closed, with 247,186 units amounting to $48,362, with the market index adding 3.39 points to close at 229.67. Margaritaville traded 4,600 shares to end at 30 US cents, Proven Investments gained 2 cents with 38,568 shares crossing the exchange to close at 34 US cents and Sygnus Credit Investments exchanged 201,518 stock units after slipping by one cent to close at 14 US cents. JMMB Group 5.5% preference share, traded 2,500 units at US$2.02.

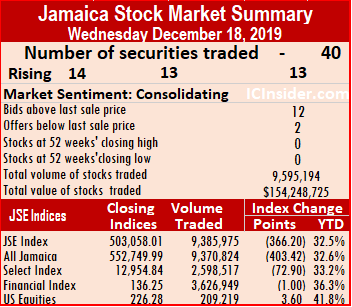

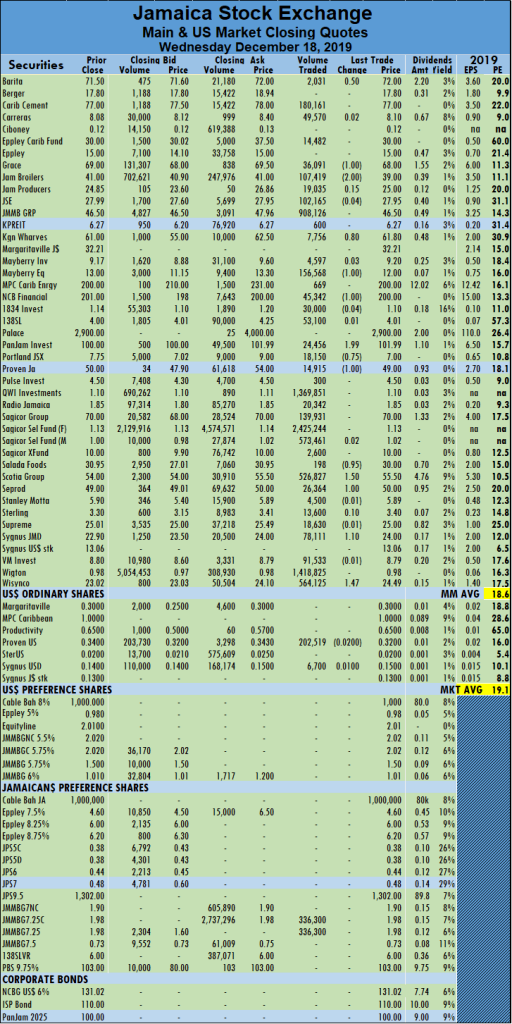

More declines for JSE Main Market – Wednesday

The Jamaica Stock Exchange suffered more declines in the market indices on Wednesday with an almost equal number of rising and declining stocks and a fall in volume and a modest rise in values of stocks crossing the market.

The Jamaica Stock Exchange suffered more declines in the market indices on Wednesday with an almost equal number of rising and declining stocks and a fall in volume and a modest rise in values of stocks crossing the market.

At the close, JSE All Jamaican Composite Index fell 403.42 points to close at 552,749.99, the JSE Market Index declined by 366.20 points to close at 503,058 and the JSE Financial Index slipped 1.00 points higher to 136.25.

The market closed, with 40 securities changing hands in the Main and US dollar markets, with 14 advancing, 13 declining and the prices of 13 stocks closed unchanged. JSE Main Market activity ended, with 38 securities accounting for 9,385,975 units amounting to $145,118,400 in contrast to 15,225,126 units valued $142,466,453, on Tuesday, from 37 securities.

Sagicor Select Funds – Financial stocks dominated trading, with 2.4 million shares and 26 percent of volumes traded followed by Wigton Windfarm, with 1.4 million units for 15 percent of the day’s trade and QWI Investments, with 1.37 million shares for 15 percent market share.

The market closed, with an average of 246,999 units valued at an average of $3,818,905 for each security traded, in contrast to 411,490 units for $3,850,445 on Tuesday.  The average volume and value for the month to date amounts to 448,856 units for $10,376,356 and previously, an average of 464,870 units for $10,941,397 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

The average volume and value for the month to date amounts to 448,856 units for $10,376,356 and previously, an average of 464,870 units for $10,941,397 for each security changing hands. The market closed out November, with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 13 stocks ending, with bids higher than their last selling prices and one closed, with a lower offer. The PE ratio of the market ended at 19.1, with the Main Market ending at 18.6 times the current year’s earnings.

In the premier market, Barita Investments rose 50 cents to close at $72, with 2,031 shares changing hands, Grace Kennedy lost $1 to end at $68, after trading 36,091 stock units, Jamaica Broilers fell $2 to settle at $39, with 107,419 shares changing hands. Kingston Wharves gained 80 cents to end at $61.80 trading 7,756 units, Mayberry Jamaican Equities dropped $1 to end at $12, with 156,568 stock units trading,  NCB Financial Group lost $1 to close at $200, in swapping shares, 45,342 shares. PanJam Investment gained $1.99 to end at $101.99, with 24,456 shares crossing the exchange. Portland JSX lost 75 cents to settle at $7, with 18,180 shares changing hands. Proven Investments lost $1 in trading 14,915 to close at a $49, Salada Foods slipped 95 cents to end at $30, trading 198 shares, Scotia Group rose $1.50 to settle at $55.50, in transferring 526,827 shares. Seprod added $1 in trading 26,364 units to close at $50, Sygnus Credit Investments put on $1.10 to close at $24, with 78,111 units crossing the market and Wisynco Group climbed $1.47 to $24.49, with 564,12 5 shares changing hands.

NCB Financial Group lost $1 to close at $200, in swapping shares, 45,342 shares. PanJam Investment gained $1.99 to end at $101.99, with 24,456 shares crossing the exchange. Portland JSX lost 75 cents to settle at $7, with 18,180 shares changing hands. Proven Investments lost $1 in trading 14,915 to close at a $49, Salada Foods slipped 95 cents to end at $30, trading 198 shares, Scotia Group rose $1.50 to settle at $55.50, in transferring 526,827 shares. Seprod added $1 in trading 26,364 units to close at $50, Sygnus Credit Investments put on $1.10 to close at $24, with 78,111 units crossing the market and Wisynco Group climbed $1.47 to $24.49, with 564,12 5 shares changing hands.

Trading in the US dollar market closed, with 209,219 units valued at US$67,632, with the market index adding 3.60 points to close at 226.28. Proven Investments dipped 2 cents in trading 202,519 shares to close at 32 US cents and Sygnus Credit Investments in exchanging 6,700 shares gained a cent to close at 15 US cents.

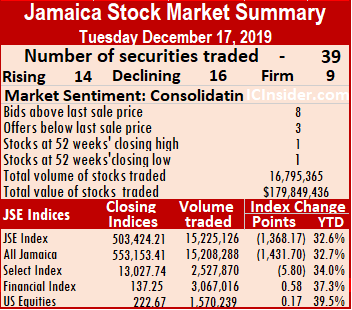

JSE Main Market falls – Tuesday

Trading on the Jamaica Stock Exchange on Tuesday led to an almost equal number of securities rising and declining, but with a substantial fall in volume and values of stocks crossing the market and declines in the two Main Market indices.

Trading on the Jamaica Stock Exchange on Tuesday led to an almost equal number of securities rising and declining, but with a substantial fall in volume and values of stocks crossing the market and declines in the two Main Market indices.

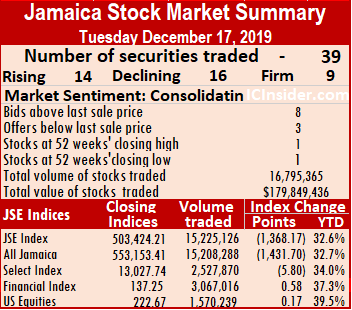

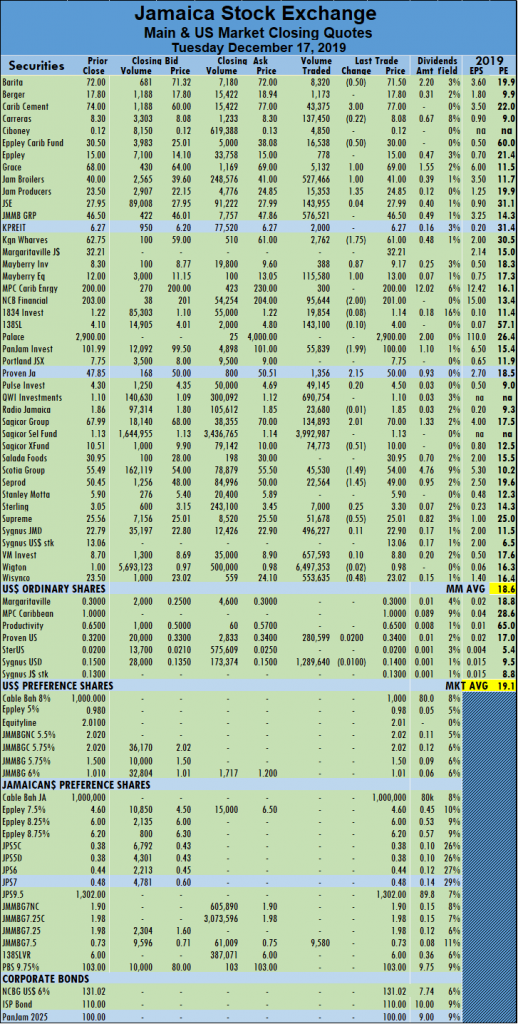

At the close, JSE All Jamaican Composite Index dropped 1,431.70 points to close at 553,153.41, the JSE Market Index declined by 1,368.17 points to 503,424.21 and the JSE Financial Index inched 0.58 points higher to 137.25.

The market closed with 39 securities changing hands in the main and US dollar markets with 14 advancing, 16 declining and the prices of 9 stocks closed unchanged. JSE Main Market activity ended with 37 securities accounting for 15,225,126 units valued $142,466,453, in contrast to 23,258,908 units at $2,096,079,296 on Monday, from 39 securities.

Wigton Windfarm dominated trading with 6.5 million shares accounting for 43 percent of volume traded, followed by Sagicor Select Funds – Financial stocks with 4 million units for 26 percent of the day’s trade and QWI Investments with 690,754 shares for 4.5 percent market share.

The market closed with an average of 411,490 units for $3,850,445 for each security traded, in contrast to 596,382 units, for an average of $53,745,623 on Monday. The average volume and value for the month to date amounts to 464,870 units for $10,941,397 and previously, an average of 469,338 units for $11,590,816 for each security changing hands. The market closed out November with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows eight stocks ending with bids higher than their last selling prices and three closed with lower offers. The PE ratio of the market ended at 19.1, with the Main Market ending at 18.6 times the current year’s earnings.

In the premier market, Barita Investments lost 50 cents to settle at $71.50 with 8,320 shares changing hands, Caribbean Cement jumped $3 to end at $77, with 43,375 units crossing the exchange, Eppley Caribbean Fund dropped 50 cents to settle at a 52 weeks’ low of $30 with 16,538 shares changing hands. Grace Kennedy gained $1 to end at $69, trading 5,132 shares, Jamaica Broilers climbed $1 to settle at $41 with 527,466 shares changing hands, Jamaica Producers exchanged 15,353 stock units and gained $1.35 to end at $24.85 with. Kingston Wharves lost $1.75 to settle at $61, in exchanging 2,762 units, Mayberry Investments climbed 87 cents to settle at $9.17 with 388 shares changing hands, Mayberry Jamaican Equities gained $1 to end at $13 with 115,580 stock units trading, NCB Financial Group lost $2 to close at $201, in swapping shares, 95,644 shares, PanJam Investment fell $1.99 to end at $100, with 55,839 shares crossing the exchange.  Proven Investments jumped $2.15 in trading 1,326 to close at a 52 weeks’ high of $50, Sagicor Group gained $2.01 to end at $70, trading 134,893 shares, Sagicor Real Estate Fund exchanged 74,773 after declining 51 cents to end at $10. Scotia Group dropped $1.49 to settle at $54, in transferring 45,530 shares, Seprod shed $1.45 in trading 22,564 stock units to close at $49. Supreme Ventures lost 55 cents to close at $25.01, with 119,205 units crossing the market and Wisynco Group fell 48 cents to $23.02, with 553,635 shares changing hands.

Proven Investments jumped $2.15 in trading 1,326 to close at a 52 weeks’ high of $50, Sagicor Group gained $2.01 to end at $70, trading 134,893 shares, Sagicor Real Estate Fund exchanged 74,773 after declining 51 cents to end at $10. Scotia Group dropped $1.49 to settle at $54, in transferring 45,530 shares, Seprod shed $1.45 in trading 22,564 stock units to close at $49. Supreme Ventures lost 55 cents to close at $25.01, with 119,205 units crossing the market and Wisynco Group fell 48 cents to $23.02, with 553,635 shares changing hands.

Trading in the US dollar market closed with 223,174 units valued at US$135,657 with the market index adding 5.09 points to close at 222.51. Proven Investments gained 2 cents in trading 280,559 shares to close at 34 US cents and Sygnus Credit Investments in exchanging 1,289,640 shares fell by a cent at 14 US cents.

Surge in trading on JSE Main Market

Rising stocks outnumbered declining ones by a substantial margin leading the Main Market indices of the Jamaica Stock Exchange to gains on Monday as the value of stocks trading surged nearly three times Friday’s level.

Rising stocks outnumbered declining ones by a substantial margin leading the Main Market indices of the Jamaica Stock Exchange to gains on Monday as the value of stocks trading surged nearly three times Friday’s level.

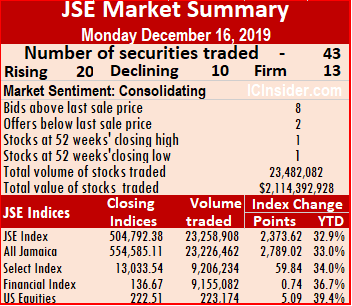

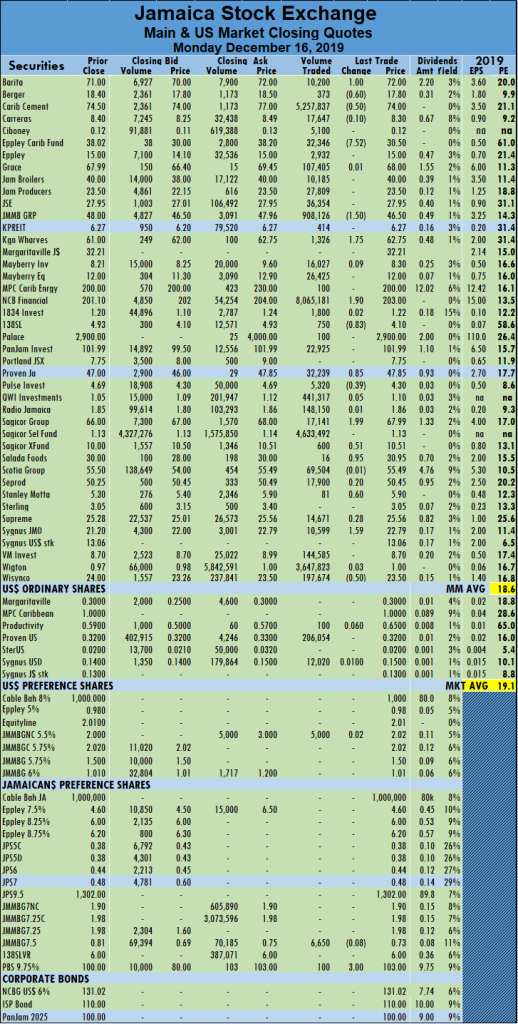

At the close, JSE All Jamaican Composite Index jumped by 2,789.02 points to close at 554,585.11, the JSE Market Index climbed 2,373.62 points to close at 505,948.81 and the JSE Financial Index inched 0.74 points higher to 136.67.

The market closed with 43 securities changing hands in the main and US dollar markets with the prices of 20 rising, 10 declining and the 12, closing unchanged. JSE Main Market activity ended with 39 securities accounting for 23,258,908 units at $2,096,079,296, in contrast to 59,610,460 units for $774,571,962 on Friday, from 37 securities.

NCB Financial dominated trading with 8 million shares and 35 percent of volumes traded followed by Caribbean Cement with 5.3 million units for 23 percent of the day’s trade and with Sagicor Select Funds financial sector with 4.6 million shares for 20 percent market share.

The market closed with an average of 596,382 units for $53,745,623 for each security traded, in contrast to 1,528,704 units valued at an average of $21,515,888 on Friday.  The average volume and value for the month to date amounts to 469,338 units for $11,590,816 and previously, an average of 457,043 units for $7,086,604 for each security changing hands. The market closed out November with an average of 653,621 units valued at $8,699,916 for each security traded.

The average volume and value for the month to date amounts to 469,338 units for $11,590,816 and previously, an average of 457,043 units for $7,086,604 for each security changing hands. The market closed out November with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows eight stocks ending with bids higher than their last selling prices and two closed with lower offers. The PE ratio of the market ended at 19, with the Main Market ending at 18.6 times the current year’s earnings.

In the premier market, Barita Investments climbed $1 to settle at $72 with 10,200 shares changing hands, Berger Paints traded 373 shares and gained 60 cents to end at $17.80, Caribbean Cement lost 50 cents to end at $74, with 5,257,837 units crossing the exchange. Eppley Caribbean Fund dropped $7.52 to settle at a 52 weeks’ low of $30.50 with 32,346 shares changing hands, JMMB Group dived $8 to end at $40, trading 10,185 stock units. Kingston Wharves gained $1.75 to settle at $62.75, in trading 1,326 units, NCB Financial Group gained $1.90 to close at $203, in swapping 8,065,181 shares, 138 Student Living fell 83 cents to end at $4.10, with 750 shares crossing the exchange. Proven Investments traded 32,239 and rose 85 cents to close at $47.85, Pulse Investments fell 39 cents to $4.30, with 5,320 units changing hands, Sagicor Group gained $1.99 to end at $67.99, trading 17,141 shares, Sagicor Real Estate Fund exchanged 600 after rising 51 cents to end at $10.51. Salada Foods climbed 95 cents to settle at $30.95 with 16 shares changing hands, Scotia Group dropped $2 to settle at $55.50, in transferring 62,328 shares, Seprod shed 20 cents in trading 17,900 stock units to close at $50.45, Stanley Motta gained 60 cents to end at $5.90, trading 81 shares. Supreme Ventures rose 28 cents to close at $25.56 with 14,671 units crossing the market, Sygnus Credit Investments climbed $1.59 to $22.79 while exchanging 10,599 shares and Wisynco Group fell 50 cents to $23.50 with 197,674 shares changing hands. In the preference sector, Productive Business Solution 9.75% traded 100 units and rose $3 to close at $103.

Salada Foods climbed 95 cents to settle at $30.95 with 16 shares changing hands, Scotia Group dropped $2 to settle at $55.50, in transferring 62,328 shares, Seprod shed 20 cents in trading 17,900 stock units to close at $50.45, Stanley Motta gained 60 cents to end at $5.90, trading 81 shares. Supreme Ventures rose 28 cents to close at $25.56 with 14,671 units crossing the market, Sygnus Credit Investments climbed $1.59 to $22.79 while exchanging 10,599 shares and Wisynco Group fell 50 cents to $23.50 with 197,674 shares changing hands. In the preference sector, Productive Business Solution 9.75% traded 100 units and rose $3 to close at $103.

Trading in the US dollar market closed with 223,174 units valued at US$135,657 with the market index adding 5.09 points to close at 222.51. Productive Business Solution traded 100 units and rose 6 cents to a 52 weeks’ high of 65 US cents. Proven Investments transferred 206,054 shares to close at 32 US cents, Sygnus Credit Investments gained 1 cent in exchanging 12,020 shares at 15 US cents and JMMB Group 5.5% preference share closed trading of 5,000 units and gained 2 cents to end at $2.02.

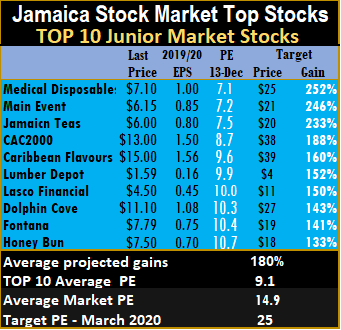

Lumber Depot set to leave IC TOP 10

Newly listed Lumber Depot traded for the first time after listing on Friday to close at $1.59, up 32.5 percent from the IPO issue price of $1.20. The stock remains in the TOP Junior Market listing at 6th position from third, last week, but may not be in it much longer.

Newly listed Lumber Depot traded for the first time after listing on Friday to close at $1.59, up 32.5 percent from the IPO issue price of $1.20. The stock remains in the TOP Junior Market listing at 6th position from third, last week, but may not be in it much longer.

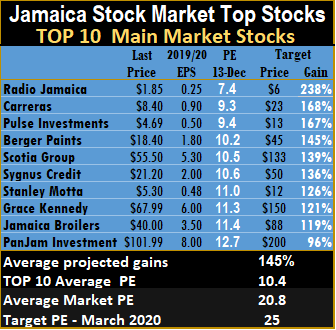

Honey Bun that jumped ship at the end of the prior week, returns to sit at 10th spot with the fall of tTech while the JSE Main Market welcomed back Stanley Motta to the TOP 10 at the expense of NCB Financial.

IC Insider.com has upgraded the target PE ratios to 25 with several stocks trading at that around 22 currently. The average projected gains for the IC TOP 10 stocks are 187 percent for Junior Market stocks and 145 percent for JSE Main market Top 10 companies.

The top three Junior Market stocks are Medical Disposables with projected gains of 252 percent, followed by Main Event with a potential appreciation of 246 percent and Jamaican Teas with 233 percent.

Radio Jamaica holds the lead of Main Market stocks with projected gains of 238 percent, followed by Carreras in the number two spot with projected growth of 168 percent and Pulse Investments with likely increases of 167 percent is next.

The JSE Main Market closed the week, with an overall PE of 20.8 and the Junior Market at 14.9, based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks averages 9.1 with the Main Market PE at 10.4.

The TOP 10 stocks now trade at a discount of 39 percent of the average for Junior Market stocks and Main Market stocks trade at a discount of 50 percent to the overall market.

IC TOP 10 stocks are likely to deliver the best returns to March next year.  Projected earnings, along with the PE ratio for each company’s current fiscal year, are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Future values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Projected earnings, along with the PE ratio for each company’s current fiscal year, are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Future values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have an interest in the securities commented on.

- « Previous Page

- 1

- …

- 138

- 139

- 140

- 141

- 142

- …

- 268

- Next Page »