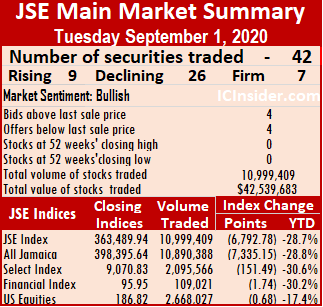

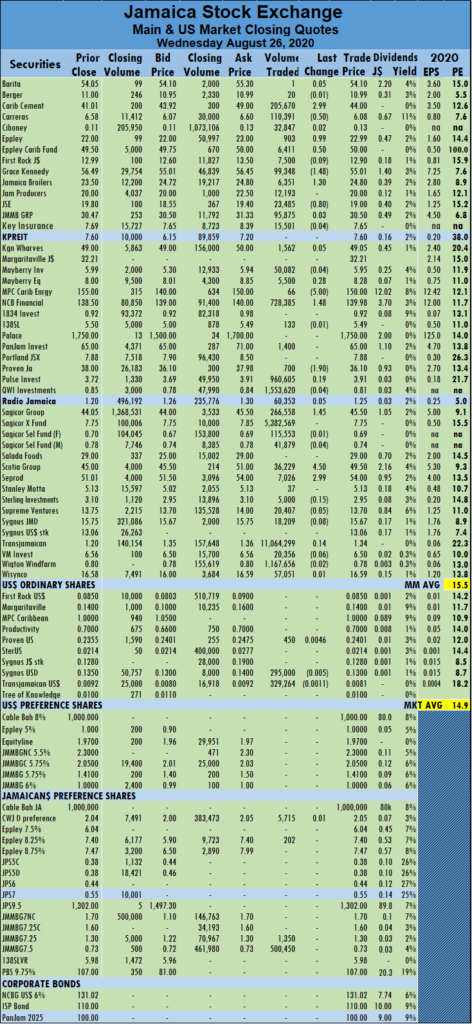

The Jamaica Stock Exchange Main Market suffered a sharp fall at the close of trading on Tuesday with just a few stocks rising compared that that fell on a day there were 54 percent fewer shares changing hands than on Monday.

At the close, the All Jamaican Composite Index dropped 7,335.15 points to 398,395.64, the Main Index declined by 6,792.78 points to 363,489.94 and the JSE Financial Index shed 1.74 points to close at 95.95.

At the close, the All Jamaican Composite Index dropped 7,335.15 points to 398,395.64, the Main Index declined by 6,792.78 points to 363,489.94 and the JSE Financial Index shed 1.74 points to close at 95.95.

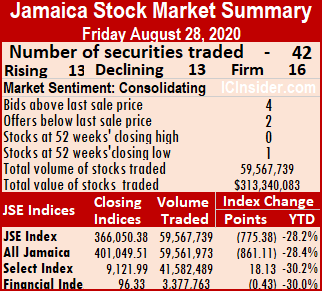

Trading ended with 42 securities changing hands compared to 38 on Monday, with the prices of nine stocks rising, 26 declining and seven remaining unchanged. The average PE Ratio of the market ended at 15 based on IC Insider.com forecast of 2020-21 earnings.

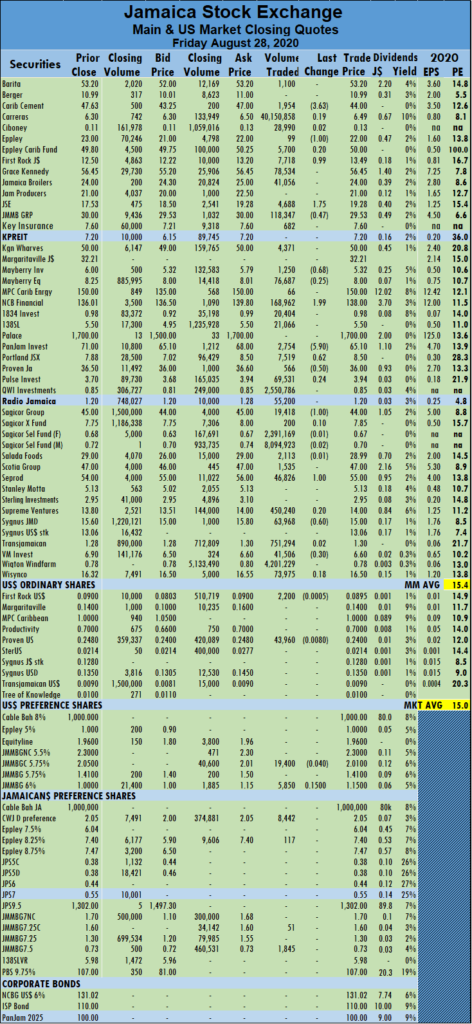

The market closed with an exchange of 10,999,409 shares for $42,539,683 compared to 24,003,466 units at $161,278,819 on Monday. Wigton Windfarm led trading with 5.77 million shares for 52.4 percent of total volume, followed by Transjamaican Highway with 1.62 million units for 14.8 percent of the day’s trade and Carreras with 1.01 million units for 9.2 percent market share.

Trading ended with an average of 261,891 units changing hands at $1,012,850 for each security, in comparison to an average of 631,670 shares at $4,244,179 on Monday.  Trading in August averaged 497,441 units at $3,201,918.

Trading in August averaged 497,441 units at $3,201,918.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows four stocks ending with bids higher than their last selling prices and four with lower offers.

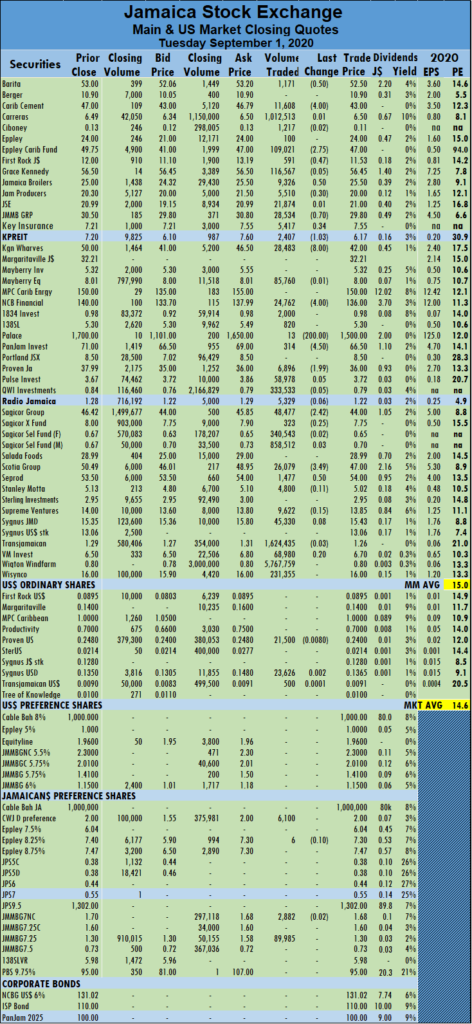

At the close of the market, Barita Investments lost 50 cents, trading 1,171 shares in closing at $52.50, Caribbean Cement dropped $4 to $43, in exchanging 11,608 stock units, Eppley Caribbean Property Fund fell $2.75 to $47, with 109,021 shares clearing the market. First Rock Capital ended 47 cents lower at $11.53, in transferring 591 units, Jamaica Broilers Group gained 50 cents to settle at $25.50 after exchanging 9,326 stock units, Jamaica Producers Group lost 30 cents to end at $20 as investors swapped 5,510 stock units. JMMB Group closed at $29.80, after falling 70 cents with 28,534 stock units passing through the market,  Key Insurance gained 34 cents, to close at $7.55 with an exchange of 5,417 stock units, Kingston Properties fell by $1.03 to $6.17, with 2,407 units changing hands. Kingston Wharves dropped $8 after trading 28,483 stock units to close at $42, NCB Financial Group declined by $4 to $136, after exchanging 24,762 stocks, Palace Amusement fell $200 to end at $1,500, with a transfer of 13 units. PanJam Investment fell $4.50 to $66.50 while trading 314 shares, Proven Investments shed $1.99 to close at $36 with an exchange of 6,896 stock units, Sagicor Group finished at $44, after losing $2.42 and the transferring of 48,477 shares. Scotia Group declined by $3.49 to settle at $47 in trading 26,079 stock units and Seprod gained 50 cents to end at $54, with 1,477 units changing hands.

Key Insurance gained 34 cents, to close at $7.55 with an exchange of 5,417 stock units, Kingston Properties fell by $1.03 to $6.17, with 2,407 units changing hands. Kingston Wharves dropped $8 after trading 28,483 stock units to close at $42, NCB Financial Group declined by $4 to $136, after exchanging 24,762 stocks, Palace Amusement fell $200 to end at $1,500, with a transfer of 13 units. PanJam Investment fell $4.50 to $66.50 while trading 314 shares, Proven Investments shed $1.99 to close at $36 with an exchange of 6,896 stock units, Sagicor Group finished at $44, after losing $2.42 and the transferring of 48,477 shares. Scotia Group declined by $3.49 to settle at $47 in trading 26,079 stock units and Seprod gained 50 cents to end at $54, with 1,477 units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

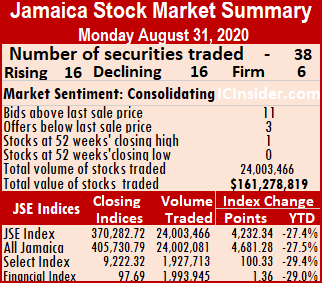

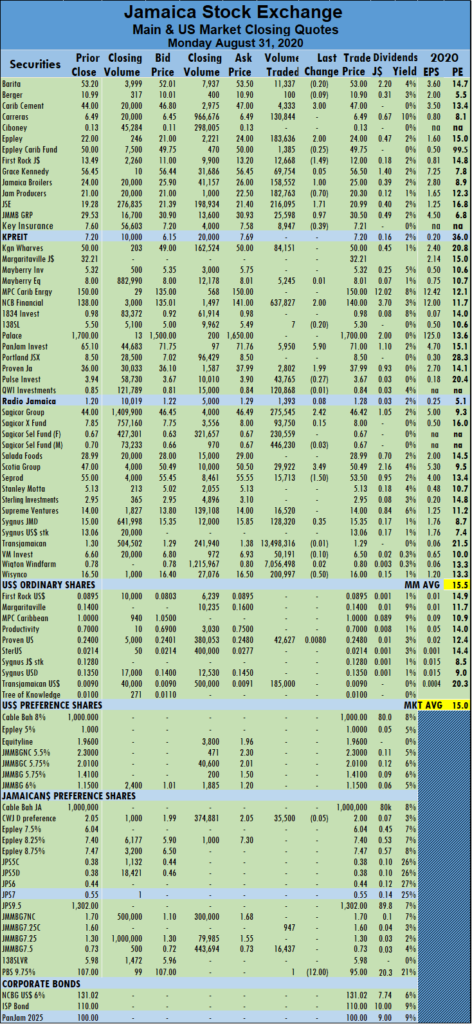

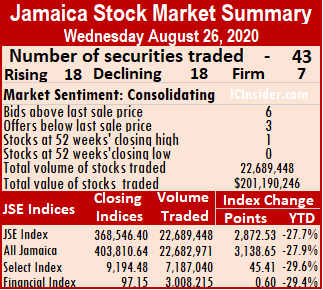

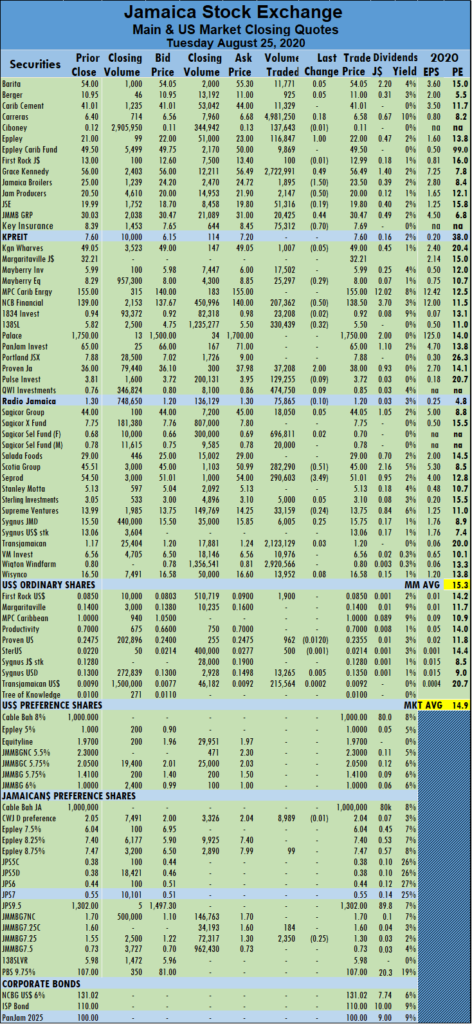

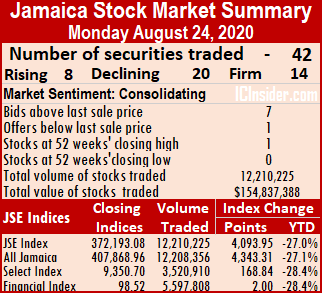

At the close, the All Jamaican Composite Index climbed 4,681.28 points to 405,730.79, the Main Index bounced 4,232.34 points to end at 370,282.72 and the JSE Financial Index gained 1.36 points to close at 97.69.

At the close, the All Jamaican Composite Index climbed 4,681.28 points to 405,730.79, the Main Index bounced 4,232.34 points to end at 370,282.72 and the JSE Financial Index gained 1.36 points to close at 97.69. The average trade for the month to date ended at 497,441 units at $3,201,934 for each security, in contrast to 491,213 units at $3,153,576. Trading for the month to date is well ahead of July, which closed with an average of 392,128 shares for $2,444,356.

The average trade for the month to date ended at 497,441 units at $3,201,934 for each security, in contrast to 491,213 units at $3,153,576. Trading for the month to date is well ahead of July, which closed with an average of 392,128 shares for $2,444,356. Key Insurance lost 39 cents to settle at $7.21, with 8,947 units changing hands, NCB Financial Group carved out a gain of $2 to close at $140 with investors swapping 637,827 shares. PanJam Investment advanced $5.90 to $71, after exchanging 5,950 stock units, Proven Investments rose $1.99 to settle at $37.99, in 2,802 units changing hands. Sagicor Group finished $2.42 higher at $46.42, with an exchange of 275,545 shares, Scotia Group climbed $3.49 to $50.49, in exchanging 29,922 stock units, Seprod shed $1.50 to close at $53.50, having traded 15,713 stock units. Sygnus Credit Investments rose 35 cents to close at $15.35 with 128,320 shares passing through the market and Wisynco Group lost 50 cents to close at $16 and 200,997 shares changing hands.

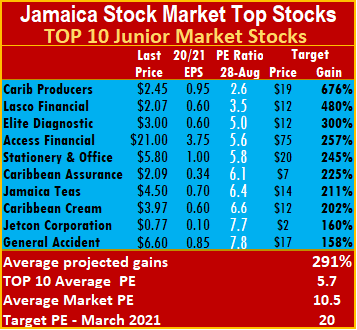

Key Insurance lost 39 cents to settle at $7.21, with 8,947 units changing hands, NCB Financial Group carved out a gain of $2 to close at $140 with investors swapping 637,827 shares. PanJam Investment advanced $5.90 to $71, after exchanging 5,950 stock units, Proven Investments rose $1.99 to settle at $37.99, in 2,802 units changing hands. Sagicor Group finished $2.42 higher at $46.42, with an exchange of 275,545 shares, Scotia Group climbed $3.49 to $50.49, in exchanging 29,922 stock units, Seprod shed $1.50 to close at $53.50, having traded 15,713 stock units. Sygnus Credit Investments rose 35 cents to close at $15.35 with 128,320 shares passing through the market and Wisynco Group lost 50 cents to close at $16 and 200,997 shares changing hands. During the past week, companies continued the release of midyear results, with little impact on the market. Jamaica Broilers released decent first-quarter results to the end of July, with a slight improvement in after-tax profit, with operating profit rising 25 percent on lower revenues. Wisynco Group full-year audited financials showed modest gains in profit while Blue Power profits jumped 41 percent. Of the three, only Jamaica Broilers is in the TOP 10. At the close of the week, Medical Disposables dropped out of the Junior Market listing and replaced by Jetcon Corporation. NCB Financial returns to TOP 10 and now sits at the bottom of the list, having replaced Eppley.

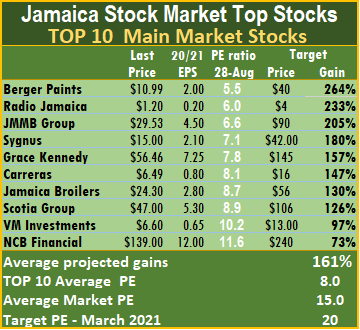

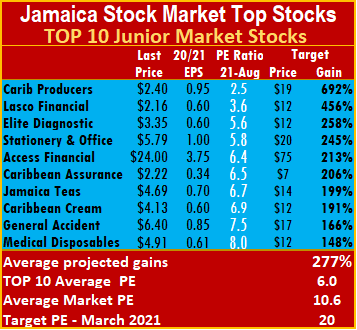

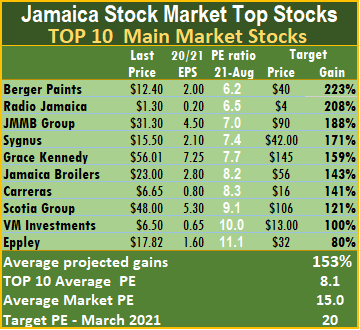

During the past week, companies continued the release of midyear results, with little impact on the market. Jamaica Broilers released decent first-quarter results to the end of July, with a slight improvement in after-tax profit, with operating profit rising 25 percent on lower revenues. Wisynco Group full-year audited financials showed modest gains in profit while Blue Power profits jumped 41 percent. Of the three, only Jamaica Broilers is in the TOP 10. At the close of the week, Medical Disposables dropped out of the Junior Market listing and replaced by Jetcon Corporation. NCB Financial returns to TOP 10 and now sits at the bottom of the list, having replaced Eppley.

Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic, the focus on all three is on the 2021 fiscal year results, projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 205 to 264 percent, are Berger Paints followed by Radio Jamaica and JMMB Group, all three suffered declines during the week.

Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic, the focus on all three is on the 2021 fiscal year results, projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 205 to 264 percent, are Berger Paints followed by Radio Jamaica and JMMB Group, all three suffered declines during the week.

The average projected gain for the Junior Market IC TOP 10 stocks is 291 percent, and 161 percent for the JSE Main Market, based on 2020-21 earnings, an indication of potentially greater gains in the Junior Market than in the Main Market.

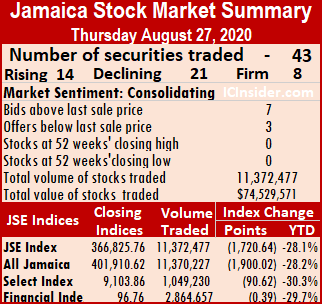

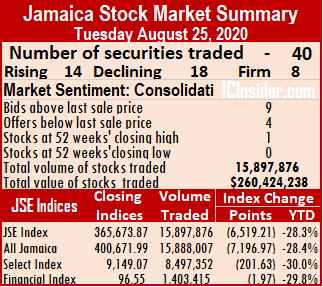

The average projected gain for the Junior Market IC TOP 10 stocks is 291 percent, and 161 percent for the JSE Main Market, based on 2020-21 earnings, an indication of potentially greater gains in the Junior Market than in the Main Market. At the close, the All Jamaican Composite Index declined by 861.11 points to 401,049.51, the Main Index shed 775.38 points to settle at 366,050.38 and the JSE Financial Index lost 0.43 points to close at 96.33.

At the close, the All Jamaican Composite Index declined by 861.11 points to 401,049.51, the Main Index shed 775.38 points to settle at 366,050.38 and the JSE Financial Index lost 0.43 points to close at 96.33. QWI Investments traded 2.55 million units accounting for 4.3 percent of Main Market volume and Sagicor Select Financial Fund ended trading, with 2.39 million shares and 4 percent of the volume.

QWI Investments traded 2.55 million units accounting for 4.3 percent of Main Market volume and Sagicor Select Financial Fund ended trading, with 2.39 million shares and 4 percent of the volume. Jamaica Stock Exchange climbed $1.75 to settle at $19.28, after exchanging 4,688 stock units, JMMB Group shed 47 cents and closed at $29.53 with a transfer of 118,347 shares, Mayberry Investments ended 68 cents lower at $5.32, after exchanging 1,250 units. NCB Financial Group rose $1.99 to settle at $138, with 168,962 shares changing hands, PanJam Investment dropped $5.90, in closing at $65.10 as investors swapped 2,754 units, Portland JSX rose 62 cents to finish at $8.50, with investors switching ownership of 7,519 stock units. Proven Investments ended at $36, after losing 50 cents, with an exchange of 566 units, Sagicor Group fell $1 to $44, in trading 19,418 shares, Seprod carved out a gain of $1 to end at $55, with an exchange of 46,826 stock units. Sygnus Credit Investments lost 60 cents to close at $15, with investors trading 63,968 units and Victoria Mutual Investments closed 30 cents lower to end at $6.60, with 41,506 shares changing hands.

Jamaica Stock Exchange climbed $1.75 to settle at $19.28, after exchanging 4,688 stock units, JMMB Group shed 47 cents and closed at $29.53 with a transfer of 118,347 shares, Mayberry Investments ended 68 cents lower at $5.32, after exchanging 1,250 units. NCB Financial Group rose $1.99 to settle at $138, with 168,962 shares changing hands, PanJam Investment dropped $5.90, in closing at $65.10 as investors swapped 2,754 units, Portland JSX rose 62 cents to finish at $8.50, with investors switching ownership of 7,519 stock units. Proven Investments ended at $36, after losing 50 cents, with an exchange of 566 units, Sagicor Group fell $1 to $44, in trading 19,418 shares, Seprod carved out a gain of $1 to end at $55, with an exchange of 46,826 stock units. Sygnus Credit Investments lost 60 cents to close at $15, with investors trading 63,968 units and Victoria Mutual Investments closed 30 cents lower to end at $6.60, with 41,506 shares changing hands. Trading month to date is well ahead of July with an average of 392,128 shares for $2,444,356.

Trading month to date is well ahead of July with an average of 392,128 shares for $2,444,356. JMMB Group carved out a loss 50 cents to close at $30, with 44,422 stocks crossing the market, Kingston Properties shed 40 cents in closing at $7.20 with an exchange of 169 stock units. Kingston Wharves rose 95 cents to close at $50 in exchanging 572,067 stocks, NCB Financial Group dropped $3.97 to end at $136.01 after trading 158,851 shares, Palace Amusement dropped by $50 in closing at $1700 crossing the market one stocks. PanJam Investment gained $6 to end at $71 in trading 1,520 stocks, Proven Investments advanced 40 cents to $36.50 with investors swapping 20,001 stock units, Sagicor Group shed 50 cents to close at $45 after exchanging 18,139 units. Scotia Group dropped by $2.50 in ending at $47, with an exchange of 112,320 shares and Victoria Mutual Investments gained 40 cents and closed $6.90, with investors switching ownership of 117,840 units.

JMMB Group carved out a loss 50 cents to close at $30, with 44,422 stocks crossing the market, Kingston Properties shed 40 cents in closing at $7.20 with an exchange of 169 stock units. Kingston Wharves rose 95 cents to close at $50 in exchanging 572,067 stocks, NCB Financial Group dropped $3.97 to end at $136.01 after trading 158,851 shares, Palace Amusement dropped by $50 in closing at $1700 crossing the market one stocks. PanJam Investment gained $6 to end at $71 in trading 1,520 stocks, Proven Investments advanced 40 cents to $36.50 with investors swapping 20,001 stock units, Sagicor Group shed 50 cents to close at $45 after exchanging 18,139 units. Scotia Group dropped by $2.50 in ending at $47, with an exchange of 112,320 shares and Victoria Mutual Investments gained 40 cents and closed $6.90, with investors switching ownership of 117,840 units.

Transjamaican Highway led trading with 11.06 million shares for 48.8 percent of total volume followed by Sagicor Real Estate Fund with 5.38 million units for 23.7 percent of the day’s trade, QWI Investments with 1.55 million units for 6.8 percent market share and Wigton Windfarm ended with 1.17 million shares changing hands for 5 percent of total shares changing hands.

Transjamaican Highway led trading with 11.06 million shares for 48.8 percent of total volume followed by Sagicor Real Estate Fund with 5.38 million units for 23.7 percent of the day’s trade, QWI Investments with 1.55 million units for 6.8 percent market share and Wigton Windfarm ended with 1.17 million shares changing hands for 5 percent of total shares changing hands. Eppley Caribbean Property Fund gained 50 cents to end at $50 after 6,411 units passed through the market, Grace Kennedy carved out a loss $1.48 to settle at $55.01, with 99,348 stocks passing through the market, Jamaica Broilers Group gained $1.30 to end at $24.80 in exchanging 6,351 stock units. Jamaica Stock Exchange lost 80 cents to settle at $19 after 23,485 stocks crossed the exchange, MPC Caribbean Clean Energy shed $5 to close at $150 in an exchange of 66 shares, NCB Financial Group gained $1.48 in closing at $139.98, trading 728,385 stocks. Proven Investments dropped by $1.90 in closing at $36.10, with 700 stock units changing hands, Sagicor Group gained $1.45 to close at $45.50, after 266,558 stocks passed through the market, Scotia Group jumped $4.50 to close at $49.50 with an exchange of 36,229 stock units and Seprod advanced by $2.99 in closing at $54 and exchanging 7,026 shares.

Eppley Caribbean Property Fund gained 50 cents to end at $50 after 6,411 units passed through the market, Grace Kennedy carved out a loss $1.48 to settle at $55.01, with 99,348 stocks passing through the market, Jamaica Broilers Group gained $1.30 to end at $24.80 in exchanging 6,351 stock units. Jamaica Stock Exchange lost 80 cents to settle at $19 after 23,485 stocks crossed the exchange, MPC Caribbean Clean Energy shed $5 to close at $150 in an exchange of 66 shares, NCB Financial Group gained $1.48 in closing at $139.98, trading 728,385 stocks. Proven Investments dropped by $1.90 in closing at $36.10, with 700 stock units changing hands, Sagicor Group gained $1.45 to close at $45.50, after 266,558 stocks passed through the market, Scotia Group jumped $4.50 to close at $49.50 with an exchange of 36,229 stock units and Seprod advanced by $2.99 in closing at $54 and exchanging 7,026 shares. Transjamaican Highway was the only other stock to exceed a million shares and ended with 2.12 million units changing hands.

Transjamaican Highway was the only other stock to exceed a million shares and ended with 2.12 million units changing hands. Jamaica Producers Group lost 50 cents to close at $20 with investors swapping 2,147 shares, JMMB Group climbed 44 cents to $30.47 while exchanging 20,425 stock units. Key Insurance shed 70 cents to close at $7.69 and finished trading 75,312 stocks, NCB Financial Group carved out a loss 50 cents in closing at $138.50 while 207,362 stock units changed hands, 138 Student Living carved out a loss 32 cents to close at $5.50 after exchanging 330,439 shares. Proven Investments rose $2 to end at $38 in trading 37,208 stocks. Scotia Group lost 51 cents to end at $45, with 282,290 stock units passing through the market and Seprod declined $3.49 to settle at $51.01 in exchanging 290,603 shares.

Jamaica Producers Group lost 50 cents to close at $20 with investors swapping 2,147 shares, JMMB Group climbed 44 cents to $30.47 while exchanging 20,425 stock units. Key Insurance shed 70 cents to close at $7.69 and finished trading 75,312 stocks, NCB Financial Group carved out a loss 50 cents in closing at $138.50 while 207,362 stock units changed hands, 138 Student Living carved out a loss 32 cents to close at $5.50 after exchanging 330,439 shares. Proven Investments rose $2 to end at $38 in trading 37,208 stocks. Scotia Group lost 51 cents to end at $45, with 282,290 stock units passing through the market and Seprod declined $3.49 to settle at $51.01 in exchanging 290,603 shares. Sagicor Select Financial Fund with 1.3 million units or 10.8 percent of overall trade and QWI Investments with 1.2 million stock units for 10 percent of stocks trading.

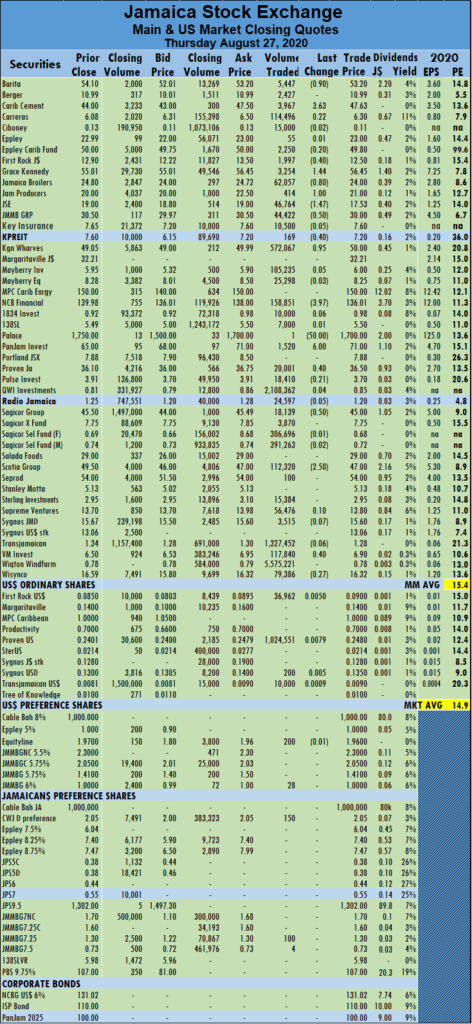

Sagicor Select Financial Fund with 1.3 million units or 10.8 percent of overall trade and QWI Investments with 1.2 million stock units for 10 percent of stocks trading. Eppley jumped $3.18 to settle at 52 weeks’ high of $21 with an exchange of 40,535 units. Jamaica Broilers Group carved out a gain of $2 to close at $25 while trading 2,197 stocks, Jamaica Producers Group fell $2.48 to end at $20.50 with investors swapping 193,306 units, JMMB Group dropped by $1.27, in ending at $30.03 after 24,388 stocks passed through the market. Mayberry Jamaican Equities lost 46 cents in closing at $8.29, with 153 units changing hands, MPC Caribbean Clean Energy gained $2.99 to end at $155, after an exchange of 1,587 units, PanJam Investment declined $3 to end at $65 and cleared the market with 11,980 stock units. Proven Investments climbed $1.90 to $36 after trading 23,024 shares, Scotia Group carved out a loss $2.49 to end at $45.51 with investors switching ownership of 245,287 stock units and Wisynco Group fell 40 cents to close at $16.50 while exchanging 17,470 stocks.

Eppley jumped $3.18 to settle at 52 weeks’ high of $21 with an exchange of 40,535 units. Jamaica Broilers Group carved out a gain of $2 to close at $25 while trading 2,197 stocks, Jamaica Producers Group fell $2.48 to end at $20.50 with investors swapping 193,306 units, JMMB Group dropped by $1.27, in ending at $30.03 after 24,388 stocks passed through the market. Mayberry Jamaican Equities lost 46 cents in closing at $8.29, with 153 units changing hands, MPC Caribbean Clean Energy gained $2.99 to end at $155, after an exchange of 1,587 units, PanJam Investment declined $3 to end at $65 and cleared the market with 11,980 stock units. Proven Investments climbed $1.90 to $36 after trading 23,024 shares, Scotia Group carved out a loss $2.49 to end at $45.51 with investors switching ownership of 245,287 stock units and Wisynco Group fell 40 cents to close at $16.50 while exchanging 17,470 stocks. The fall elevating it back into the Junior Market TOP 10, with Lasco Distributors dropping out, while there was no change to the main market list.

The fall elevating it back into the Junior Market TOP 10, with Lasco Distributors dropping out, while there was no change to the main market list.

The targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, an indication of the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10.6, based on IC Insider.com’s projected 2020-21 earnings.

The targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, an indication of the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10.6, based on IC Insider.com’s projected 2020-21 earnings.  The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere six at just 56 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.1 or 54 percent of the PE of the overall market.

The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere six at just 56 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.1 or 54 percent of the PE of the overall market. IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on possible gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on possible gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information. Trading for the day ended with an average of 229,432 units changing hands for the day at $1,207,987 for each security, in comparison to an average of 441,246 shares at $1,282,200 on Thursday. The average trade for the month to date ended at 460,700 units at $2,591,884, in contrast to 479,152 units at $2,702,302. Trading month to date compares adversely to July with an average of 392,128 shares for $2,444,356.

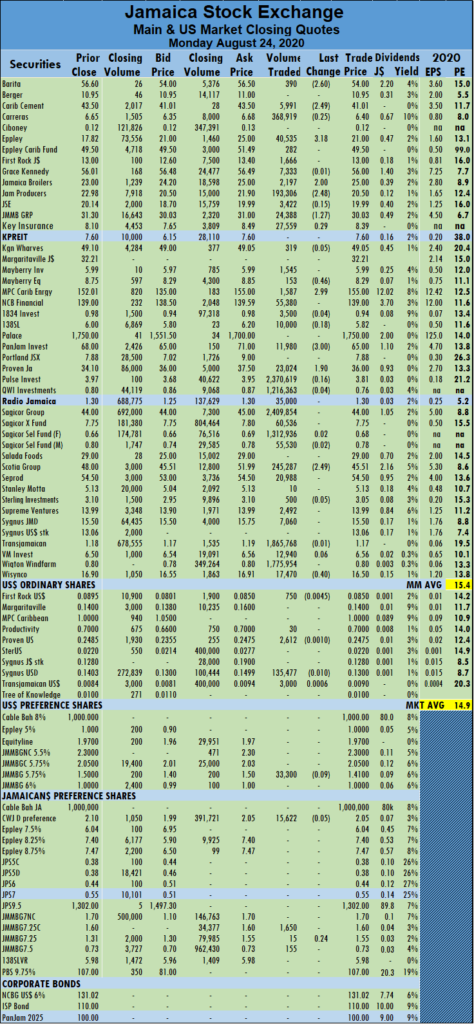

Trading for the day ended with an average of 229,432 units changing hands for the day at $1,207,987 for each security, in comparison to an average of 441,246 shares at $1,282,200 on Thursday. The average trade for the month to date ended at 460,700 units at $2,591,884, in contrast to 479,152 units at $2,702,302. Trading month to date compares adversely to July with an average of 392,128 shares for $2,444,356. Jamaica Stock Exchange fell 35 cents to settle at $20.14 with 3,815 stock units traded, JMMB Group advanced 60 cents to close at $31.30 with investors switching ownership of 38,865 units, Kingston Properties finished 40 cents higher at $7.60 with 250 stock units changing hands. Kingston Wharves declined by 90 cents to end at $49.10 with an exchange of 3,134 units, NCB Financial Group increased by $1 to close at $139, with 30,821 stocks traded, PanJam Investment climbed $3.50 to end at $68 with investors transferring 932 stock units. Proven Investments carved out a loss of $1.75 to finish at $34.10 with 40,514 stock units changing hands, Scotia Group climbed $1.75 to settle at $48 in the exchange of 27,903 stock units, Seprod dropped 50 cents to end at $54.50 with 5,874 stock units traded and Wisynco Group carved out a loss of 50 cents to close at $16.90 with 48,649 stock units crossing the exchange.

Jamaica Stock Exchange fell 35 cents to settle at $20.14 with 3,815 stock units traded, JMMB Group advanced 60 cents to close at $31.30 with investors switching ownership of 38,865 units, Kingston Properties finished 40 cents higher at $7.60 with 250 stock units changing hands. Kingston Wharves declined by 90 cents to end at $49.10 with an exchange of 3,134 units, NCB Financial Group increased by $1 to close at $139, with 30,821 stocks traded, PanJam Investment climbed $3.50 to end at $68 with investors transferring 932 stock units. Proven Investments carved out a loss of $1.75 to finish at $34.10 with 40,514 stock units changing hands, Scotia Group climbed $1.75 to settle at $48 in the exchange of 27,903 stock units, Seprod dropped 50 cents to end at $54.50 with 5,874 stock units traded and Wisynco Group carved out a loss of 50 cents to close at $16.90 with 48,649 stock units crossing the exchange.