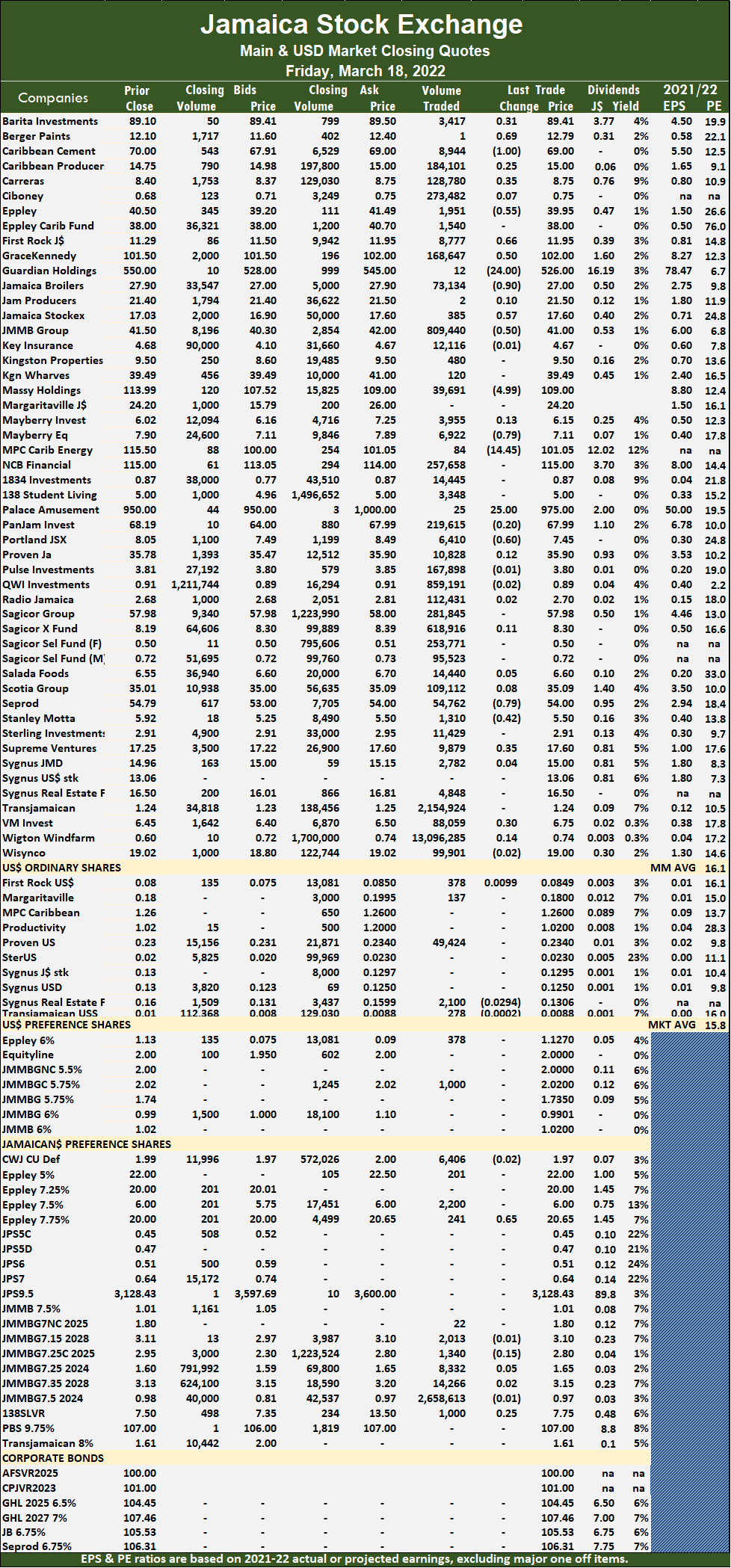

Trading on the Jamaica Stock Exchange Main Market jumped sharply on Friday, with an exchange of 103 percent more shares valued 74 percent more than on Thursday, leading to rising stocks exceeding those declining and sending the main indices higher at the close.

The All Jamaican Composite Index popped 1,319.00 points to settle at 429,258.81, the JSE Main Index rallied 1,620.15 points to close at 384,350.94 and the JSE Financial Index climbed 0.18 points to settle at 92.36.

The All Jamaican Composite Index popped 1,319.00 points to settle at 429,258.81, the JSE Main Index rallied 1,620.15 points to close at 384,350.94 and the JSE Financial Index climbed 0.18 points to settle at 92.36.

Trading ended with 59 securities compared to 54 on Thursday, with 24 rising, 20 declining and 15 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 16.1. The PE ratio for the JSE Main and USD Market closing quotes is based on ICInsider.com earnings forecasts for companies with financial years ending to August 2022.

Overall, 22,970,250 shares were exchanged for $151,749,632 versus 11,327,830 units at $87,135,931 on Thursday. Wigton Windfarm led trading with 13.10 million shares for 57 percent of total volume, followed by JMMB Group 7.5% with 2.66 million units for 11.6 percent of the day’s trade and Transjamaican Highway with 2.15 million units for 9.4 percent market share.

Trading averages 389,326 units at $2,572,028, compared to 209,775 shares at $1,613,628 on Thursday and month to date, an average of 407,288 units at $6,223,499, compared to 408,901 units at $6,551,408 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Barita Investments popped 31 cents in closing at $89.41, with 3,417 shares crossing the market, Berger Paints climbed 69 cents to $12.79 in exchanging just one unit, Caribbean Cement dropped $1 to $69, with 8,944 stock units crossing the exchange. Carreras gained 35 cents to end at $8.75, trading 128,780 units, Eppley fell 55 cents to close at $39.95 with an exchange of 1,951 shares, First Rock Capital increased 66 cents in closing at $11.95 in an exchange of 8,777 units. GraceKennedy rallied 50 cents to close at $102 with the swapping of 168,647 stocks, Guardian Holdings declined $24 to $526 after trading 12 stock units, Jamaica Broilers shed 90 cents to end at $27 in trading 73,134 stocks. Jamaica Stock Exchange rose 57 cents to $17.60 after exchanging 385 shares, JMMB Group lost 50 cents to close at $41 after trading 809,440 stock units, Massy Holdings shed $4.99 to close at $109 while exchanging 39,691 units. Mayberry Jamaican Equities lost 79 cents in closing at $7.11 and finishing trading of 6,922 shares, MPC Caribbean Clean Energy declined $14.45 to end at $101.05 in switching ownership of 84 stock units, Palace Amusement advanced $25 to $975 after 25 stocks crossed the market.

At the close, Barita Investments popped 31 cents in closing at $89.41, with 3,417 shares crossing the market, Berger Paints climbed 69 cents to $12.79 in exchanging just one unit, Caribbean Cement dropped $1 to $69, with 8,944 stock units crossing the exchange. Carreras gained 35 cents to end at $8.75, trading 128,780 units, Eppley fell 55 cents to close at $39.95 with an exchange of 1,951 shares, First Rock Capital increased 66 cents in closing at $11.95 in an exchange of 8,777 units. GraceKennedy rallied 50 cents to close at $102 with the swapping of 168,647 stocks, Guardian Holdings declined $24 to $526 after trading 12 stock units, Jamaica Broilers shed 90 cents to end at $27 in trading 73,134 stocks. Jamaica Stock Exchange rose 57 cents to $17.60 after exchanging 385 shares, JMMB Group lost 50 cents to close at $41 after trading 809,440 stock units, Massy Holdings shed $4.99 to close at $109 while exchanging 39,691 units. Mayberry Jamaican Equities lost 79 cents in closing at $7.11 and finishing trading of 6,922 shares, MPC Caribbean Clean Energy declined $14.45 to end at $101.05 in switching ownership of 84 stock units, Palace Amusement advanced $25 to $975 after 25 stocks crossed the market.  Seprod fell 79 cents to $54, with 54,762 units clearing the market, Stanley Motta dropped 42 cents in closing at $5.50, with 1,310 stock units changing hands, Supreme Ventures increased 35 cents in ending at $17.60 after exchanging 9,879 units and Victoria Mutual Investments rallied 30 cents to end at $6.75, with 88,059 stocks changing hands.

Seprod fell 79 cents to $54, with 54,762 units clearing the market, Stanley Motta dropped 42 cents in closing at $5.50, with 1,310 stock units changing hands, Supreme Ventures increased 35 cents in ending at $17.60 after exchanging 9,879 units and Victoria Mutual Investments rallied 30 cents to end at $6.75, with 88,059 stocks changing hands.

In the preference segment, Eppley 7.75% preference share gained 65 cents to close at $20.65 after trading 241 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading picks up for JSE Main Market

NCB in sharp fall below $100 on Thursday

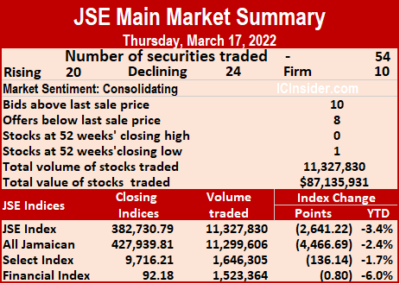

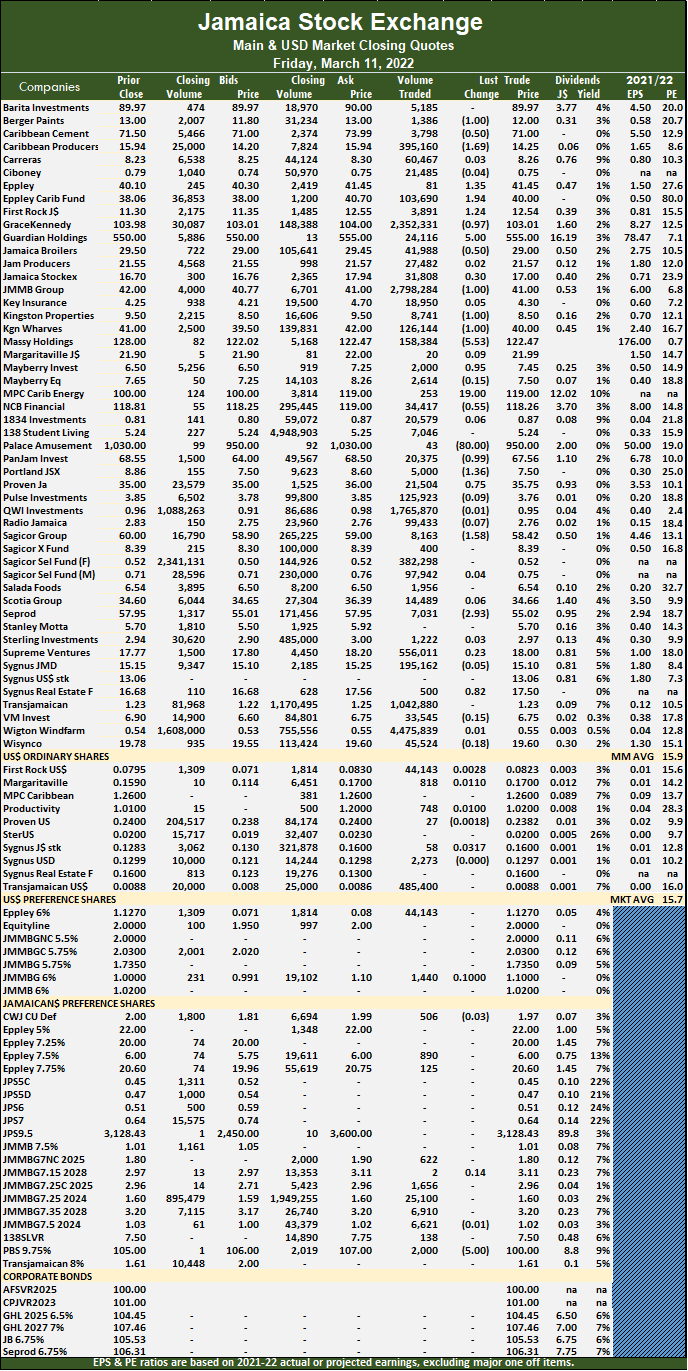

NCB Financial traded to an intraday low for the day of $91.01 as demand for the stock melted away made worse by the stock hitting 52 weeks’ lows in the Trinidad and Tobago market, but it closed at $115, with few bids that are weak. Elsewhere market activity ended, with the volume of shares trading declining moderately but the value dropped 44 percent lower than on Wednesday on the Jamaica Stock Exchange Main Market as declining stocks exceeded those rising leaving the market falling at the close on Thursday.

NCB Financial hits a new low on Thursday.

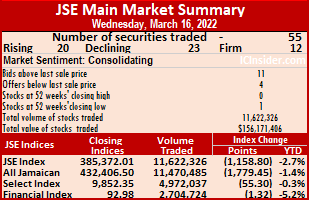

The All Jamaican Composite Index fell 4,466.69 points to settle at 427,939.81, JSE Main Index declined 2,641.22 points to close at 382,730.79 and the JSE Financial Index fell 0.80 points to settle at 92.18.

Trading ended with 54 securities compared to 55 on Wednesday, as 20 rose, 24 fell and 10 ended unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 16. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 11,327,830 shares traded at $87,135,931 versus 11,622,326 units at $156,171,406 on Wednesday. Wigton Windfarm led trading with 6.08 million shares accounting for 53.6 percent of total volume followed by Transjamaican Highway, 1.30 million units for 11.5 percent of the day’s trade and Sagicor Select Financial Fund, 1.03 million units with 9.1 percent market share.

Trading averages 209,775 units at $1,613,628, compared to 211,315 shares at $2,839,480 on Wednesday and month to date, an average of 408,901 units at $6,551,408, compared to 426,733 units at $6,993,598 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and eight with lower offers.

At the close, Barita Investments shed 87 cents to close at $89.10 with an exchange of 33,219 shares, Berger Paints fell 30 cents to close at $12.10 trading 102 stock units, Eppley rallied 60 cents in closing at $40.50, with 199 stocks changing hands. GraceKennedy dropped $1 to end at $101.50, with 366,663 units crossing the market, Guardian Holdings rose $27 in ending at $550 with the swapping of 1,820 units, Jamaica Stock Exchange lost 96 cents to end at $17.03 after 4,495 stock units were traded. JMMB Group popped $1.50 to close at $41.50, with 258,062 stocks crossing the market, Kingston Properties increased $1 in ending at $9.50 while exchanging 35 shares, Kingston Wharves declined $1.51 in closing at $39.49, with 2,495 units clearing the market. Margaritaville advanced $2.20 to $24.20 with 5,300 stock units changing hands, Massy Holdings gained $6.19 in ending at $113.99 after exchanging 26,384 stocks, Mayberry Investments shed 49 cents to close at $6.02 after trading 906 shares.

At the close, Barita Investments shed 87 cents to close at $89.10 with an exchange of 33,219 shares, Berger Paints fell 30 cents to close at $12.10 trading 102 stock units, Eppley rallied 60 cents in closing at $40.50, with 199 stocks changing hands. GraceKennedy dropped $1 to end at $101.50, with 366,663 units crossing the market, Guardian Holdings rose $27 in ending at $550 with the swapping of 1,820 units, Jamaica Stock Exchange lost 96 cents to end at $17.03 after 4,495 stock units were traded. JMMB Group popped $1.50 to close at $41.50, with 258,062 stocks crossing the market, Kingston Properties increased $1 in ending at $9.50 while exchanging 35 shares, Kingston Wharves declined $1.51 in closing at $39.49, with 2,495 units clearing the market. Margaritaville advanced $2.20 to $24.20 with 5,300 stock units changing hands, Massy Holdings gained $6.19 in ending at $113.99 after exchanging 26,384 stocks, Mayberry Investments shed 49 cents to close at $6.02 after trading 906 shares.  Mayberry Jamaican Equities climbed 84 cents to end at $7.90 in switching ownership of 2,535 shares, MPC Caribbean Clean Energy popped $10.50 in closing at $115.50 in an exchange of 20 stock units, Sagicor Real Estate Fund rose $1.96 to $8.19 in exchanging 36,732 stocks. Supreme Ventures dropped 35 cents in closing at $17.25, with 6,098 units crossing the exchange and Sygnus Real Estate Finance fell 43 cents to end at $16.50 in trading 3,603 shares.

Mayberry Jamaican Equities climbed 84 cents to end at $7.90 in switching ownership of 2,535 shares, MPC Caribbean Clean Energy popped $10.50 in closing at $115.50 in an exchange of 20 stock units, Sagicor Real Estate Fund rose $1.96 to $8.19 in exchanging 36,732 stocks. Supreme Ventures dropped 35 cents in closing at $17.25, with 6,098 units crossing the exchange and Sygnus Real Estate Finance fell 43 cents to end at $16.50 in trading 3,603 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

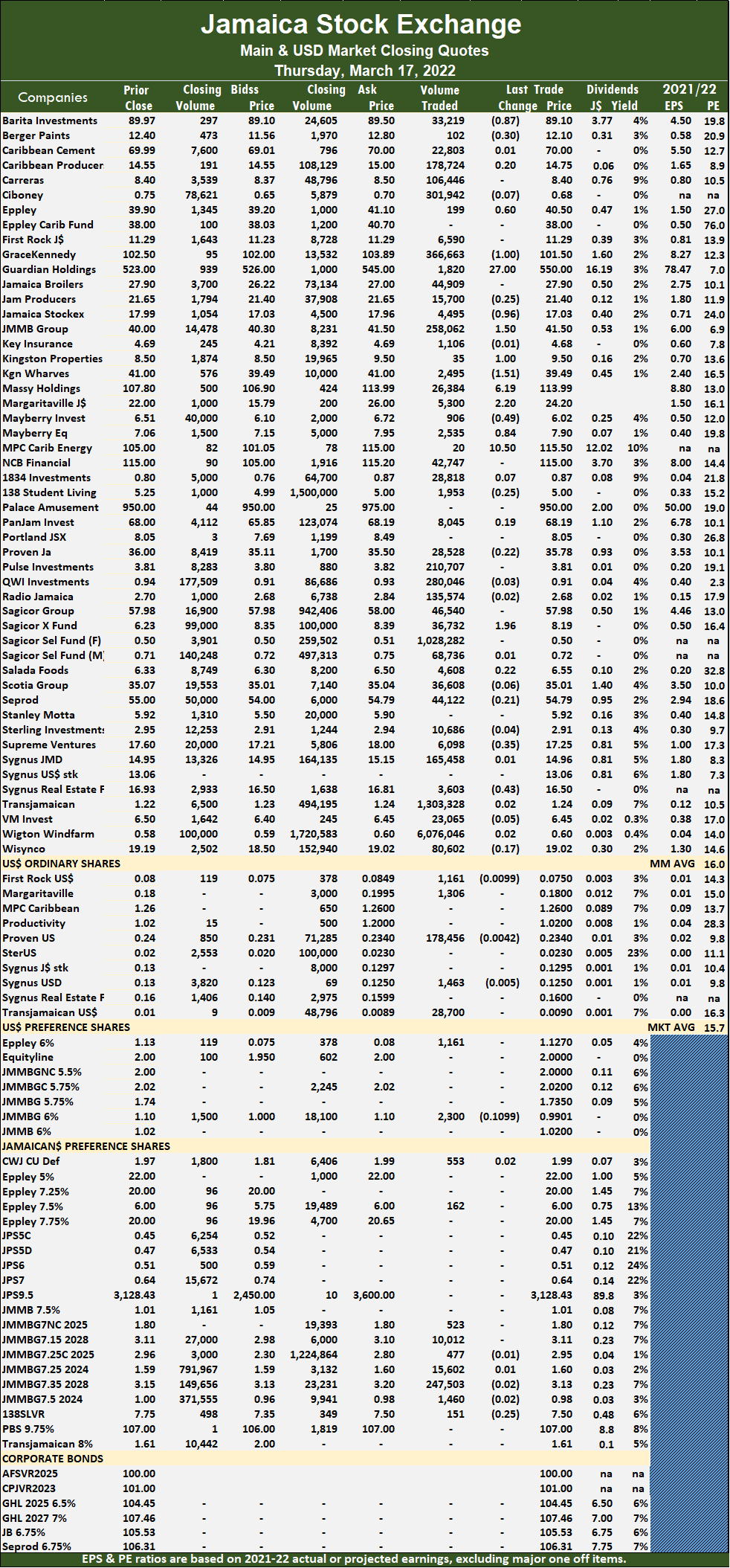

JSE Majors fall on Wednesday

Market activity ended on Wednesday, with the volume of shares trading declining after trading with the value 20 percent lower than on Tuesday on the Jamaica Stock Exchange Main Market as falling stocks exceeded those rising leading to a fall in the market indices, with, the All Jamaican Composite Index falling 1,779.45 points to 432,406.50 and the JSE Main Index losing 1,158.80 points to end at 385,372.01.

The JSE Financial Index shed 1.32 points to settle at 92.98. Trading ended with 55 securities compared to 49 on Tuesday, with 20 rising, 23 declining and 12 ending unchanged.

The JSE Financial Index shed 1.32 points to settle at 92.98. Trading ended with 55 securities compared to 49 on Tuesday, with 20 rising, 23 declining and 12 ending unchanged.

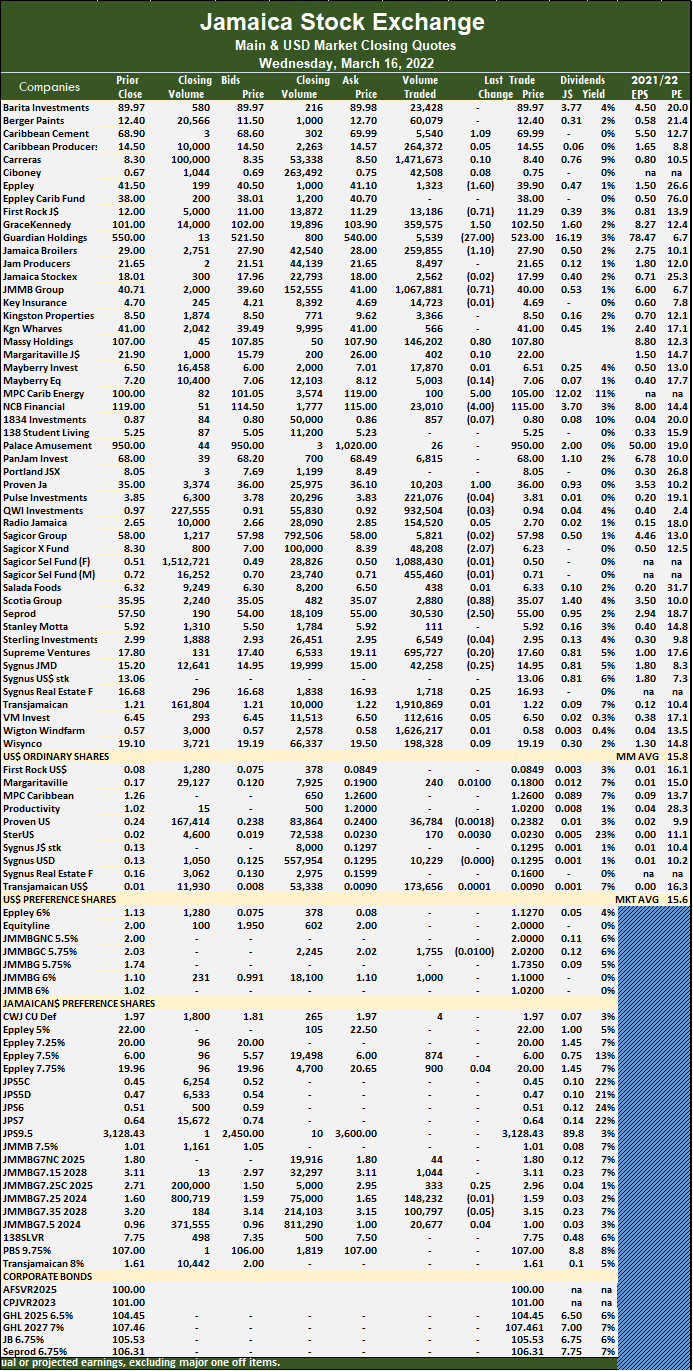

The PE Ratio, a formula for computing appropriate stock values, averages 15.8. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 11,622,326 shares were traded for $156,171,406, down from 12,554,479 units at $195,108,057 on Tuesday. Transjamaican Highway led trading with 1.91 million shares for 16.4 percent of total volume followed by Wigton Windfarm 1.63 million units with 14 percent of the day’s trade, Carreras chipped in with 1.47 million units for 12.7 percent market share, followed by Sagicor Select Financial Fund with 1.09 million units for 9.4 percent of traded stocks and JMMB Group with 1.07 million units for 9.2 percent market share.

Trading averages 211,315 units at $2,839,480, compared to 256,214 shares at $3,981,797 on Tuesday and month to date, an average of 426,733 units at $6,993,598, down from 448,354 units at $7,410,526 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Caribbean Cement climbed $1.09 to close at $69.99 after exchanging 5,540 shares, Eppley lost $1.60 to end at $39.90 and closed with 1,323 stock units changing hands, First Rock Capital shed 71 cents to $11.29 after exchanging 13,186 units. GraceKennedy gained $1.50 after ending at $102.50 in an exchange of 359,575 stocks, Guardian Holdings dipped $27 in closing at $523, with 5,539 stocks changing hands, Jamaica Broilers fell $1.10 to $27.90 trading 259,855 units. JMMB Group declined 71 cents in closing at $40, with 1,067,881 stock units crossing the exchange, Massy Holdings rose 80 cents to $107.80 with 146,202 shares clearing the market, MPC Caribbean Clean Energy rallied $5 to end at $105 after 100 units crossed through the market. NCB Financial dropped $4 to close at a 52 weeks’ low of $115 while exchanging 23,010 shares after hitting an intraday 52 weeks’ low of $108.11, Proven Investments increased $1 in ending at $36 with the swapping of 10,203 stock units,

At the close, Caribbean Cement climbed $1.09 to close at $69.99 after exchanging 5,540 shares, Eppley lost $1.60 to end at $39.90 and closed with 1,323 stock units changing hands, First Rock Capital shed 71 cents to $11.29 after exchanging 13,186 units. GraceKennedy gained $1.50 after ending at $102.50 in an exchange of 359,575 stocks, Guardian Holdings dipped $27 in closing at $523, with 5,539 stocks changing hands, Jamaica Broilers fell $1.10 to $27.90 trading 259,855 units. JMMB Group declined 71 cents in closing at $40, with 1,067,881 stock units crossing the exchange, Massy Holdings rose 80 cents to $107.80 with 146,202 shares clearing the market, MPC Caribbean Clean Energy rallied $5 to end at $105 after 100 units crossed through the market. NCB Financial dropped $4 to close at a 52 weeks’ low of $115 while exchanging 23,010 shares after hitting an intraday 52 weeks’ low of $108.11, Proven Investments increased $1 in ending at $36 with the swapping of 10,203 stock units, Sagicor Real Estate Fund lost $2.07 to $6.23 in trading 48,208 stocks. Scotia Group fell 88 cents to end at $35.07 in exchanging 2,880 shares and Seprod declined $2.50 in closing at $55 in switching ownership of 30,530 stock units.

Sagicor Real Estate Fund lost $2.07 to $6.23 in trading 48,208 stocks. Scotia Group fell 88 cents to end at $35.07 in exchanging 2,880 shares and Seprod declined $2.50 in closing at $55 in switching ownership of 30,530 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

More decline for JSE Main Market

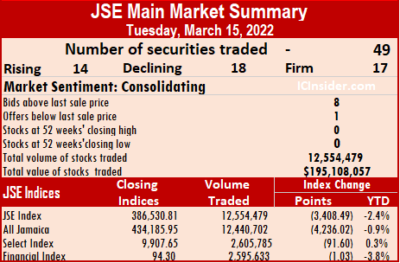

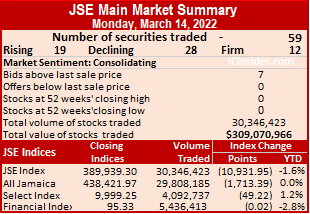

Market activity ended on Tuesday on the Jamaica Stock Exchange Main Market with the volume of shares trading sliding 59 percent as 37 percent less funds entered the market compared to Monday and resulted in rising stocks pressured from those declining.

The All Jamaican Composite Index fell 4,236.02 points to 434,185.95, JSE Main Index dropped 3,408.49 points to close at 386,530.80 and the JSE Financial Index slipped 1.03 points to 94.30.

The All Jamaican Composite Index fell 4,236.02 points to 434,185.95, JSE Main Index dropped 3,408.49 points to close at 386,530.80 and the JSE Financial Index slipped 1.03 points to 94.30.

A total of 49 securities traded down from 59 on Monday, with 14 rising, 18 declining and 17 ending unchanged.

The PE Ratio, the most used formula to compute appropriate stock values, averages 16.1. The PE for JSE Main and USD Market incorporates earnings forecast done by ICInsider.com for companies with financial years ending to August 2022.

A total of 12,554,479 shares traded for $195,108,057 versus 30,346,423 units at $309,070,966 on Monday. Wigton Windfarm led trading with 3.15 million shares for 25.1 percent of total volume, followed by Sagicor Select Financial Fund with 2.24 million units for 17.9 percent of the day’s trade and QWI Investments with 1.19 million units for 9.5 percent market share.

Trading averages 256,214 units at $3,981,797, compared to 514,346 shares at $5,238,491 on Monday and month to date, an average of 448,354 units at $7,410,526, down from 467,221 units at $7,747,214 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

Trading averages 256,214 units at $3,981,797, compared to 514,346 shares at $5,238,491 on Monday and month to date, an average of 448,354 units at $7,410,526, down from 467,221 units at $7,747,214 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and one with lower offers.

At the close, Caribbean Cement shed $1.10 to close at $68.90 trading 7,575 shares, Eppley rose $1.20 to $41.50 after 1,358 stock units crossed the market, Jamaica Stock Exchange gained $1.01 in ending at $18.01, with 215,905, with stocks changing hands. Key Insurance popped 42 cents to $4.70, with 8,532 units clearing the market, Kingston Properties dropped $1 to $8.50 in switching ownership of 11,259 shares, Kingston Wharves popped $1.50 to $41 after exchanging 200 stocks. Massy Holdings jumped $8 in closing at $107, finishing at 108,561 stock units, Mayberry Investments lost 75 cents to close at $6.50 after exchanging 537 units, MPC Caribbean Clean Energy dropped $19 to end at $100 with an exchange of 92 shares.  NCB Financial rallied $2.25 to $119 while exchanging 34,372 stock units, PanJam Investment declined 50 cents to end at $68 in exchanging 45,596 units, Proven Investments fell $1.10 in closing at $35 after 14,131 stocks changed hands. Sagicor Group lost $3 after ending at $58 in an exchange of 605,621 stocks, Seprod climbed $2.10 to close at $57.50, with 7,462 units crossing the market, Victoria Mutual Investments fell 30 cents to $6.45, with 10,788 shares crossing the exchange and Wisynco Group shed 42 cents to close at $19.10 with the swapping of 93,865 stock units.

NCB Financial rallied $2.25 to $119 while exchanging 34,372 stock units, PanJam Investment declined 50 cents to end at $68 in exchanging 45,596 units, Proven Investments fell $1.10 in closing at $35 after 14,131 stocks changed hands. Sagicor Group lost $3 after ending at $58 in an exchange of 605,621 stocks, Seprod climbed $2.10 to close at $57.50, with 7,462 units crossing the market, Victoria Mutual Investments fell 30 cents to $6.45, with 10,788 shares crossing the exchange and Wisynco Group shed 42 cents to close at $19.10 with the swapping of 93,865 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Massy takes out JSE Main Index

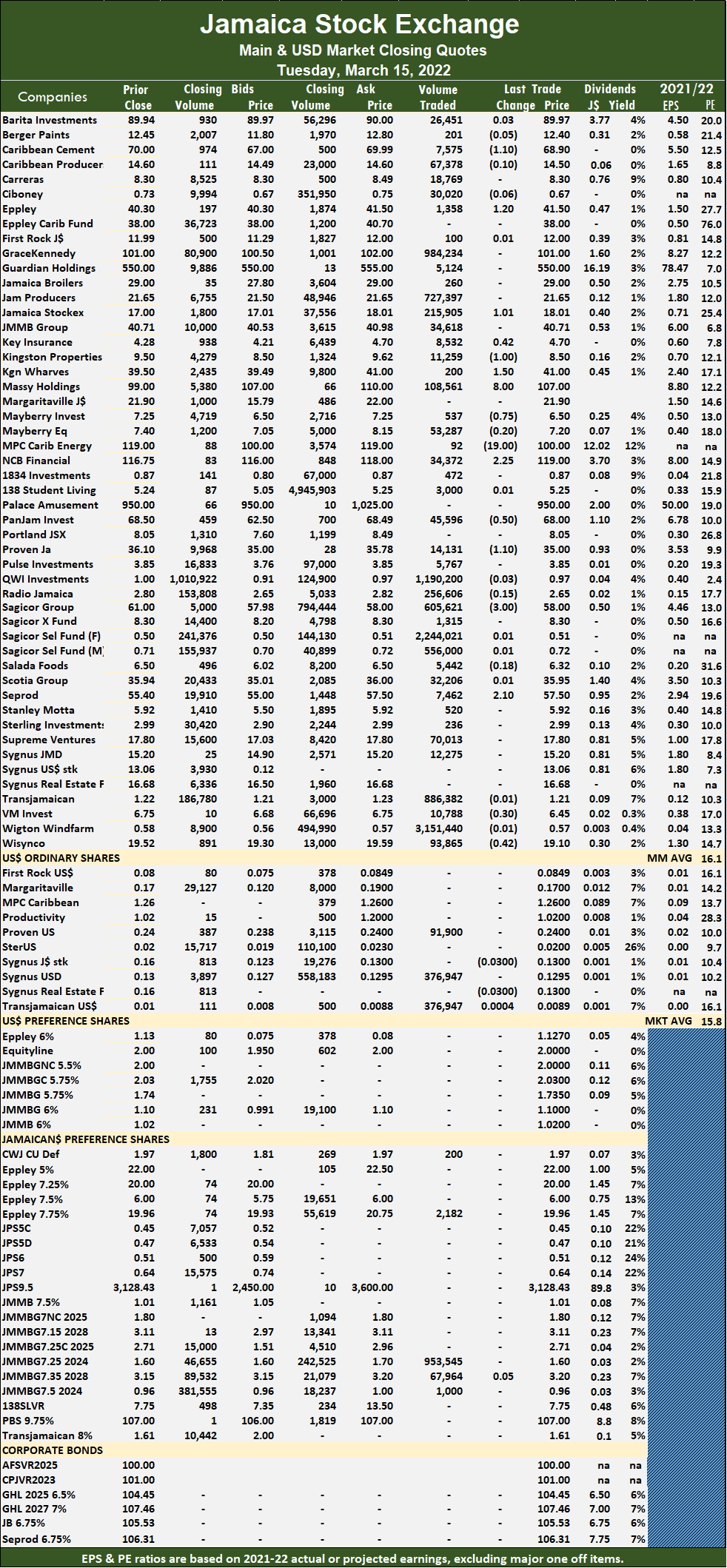

Massy lost ground in market activity on Monday with the price diving $23.47 and taking a big bite out of JSE Main Index as the volume of shares trading surged 100 percent and with the value falling 30 percent compared to Friday as rising stocks were outgunned by those declining at the close of the Jamaica Stock Exchange Main Market.

The All Jamaican Composite Index declined 1,713.39 points to settle at 438,421.97, JSE Main Index plunged 10,931.95 points to end at 389,939.30 and the JSE Financial Index shed 0.02 points to close at 95.33.

The All Jamaican Composite Index declined 1,713.39 points to settle at 438,421.97, JSE Main Index plunged 10,931.95 points to end at 389,939.30 and the JSE Financial Index shed 0.02 points to close at 95.33.

Trading ended with 59 securities similar to Friday, with 19 rising, 28 declining and 12 ending unchanged.

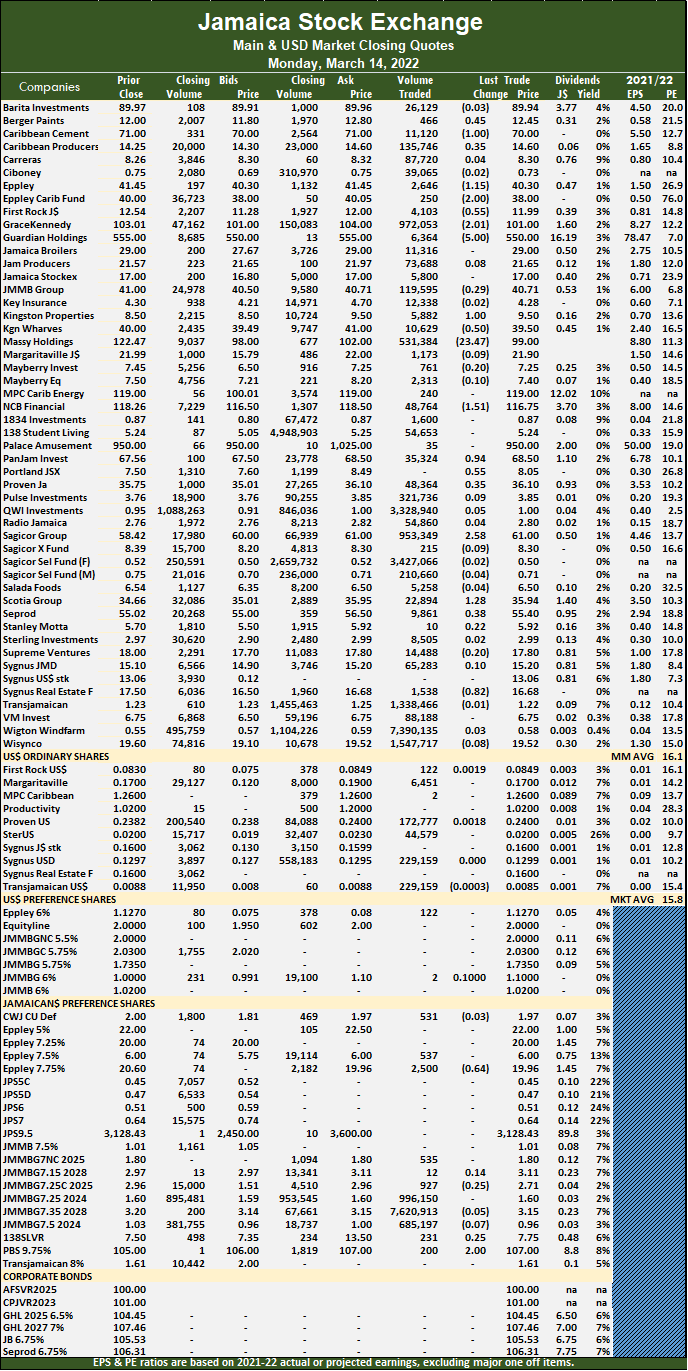

The PE Ratio, the most used formula to compute appropriate stock values, averages 16.2 and those for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years, ending up to August 2022.

Overall, 30,346,423 shares were exchanged for $309,070,966 versus 15,195,980 units at $440,781,941 on Friday. JMMB Group 7.35% – 2028 led trading with 25.1 percent of total volume for 7.62 million shares followed by Wigton Windfarm, 24.4 percent for 7.39 million units, Sagicor Select Financial Fund contributed 11.3 percent with 3.43 million units, QWI Investments held 11 percent after an exchange of 3.33 million units, Wisynco Group followed with 5.1 percent after transferring 1.55 million units and Transjamaican Highway controlled 4.4 percent with an exchange of 1.34 million units.

Trading for the day averages 514,346 units at $5,238,491, compared to 257,559 shares at $7,470,880 on Friday and month to date, an average of 467,221 units at $7,747,214, compared to 460,902 units at $8,083,611 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and none with lower offers.

At the close of the market, Berger Paints gained 45 cents to finish at $12.45 in trading just 466 shares, Caribbean Cement fell $1 in closing at $70 with an exchange of 11,120 units, Caribbean Producers rose 35 cents to $14.60 after transferring 135,746 stocks. Eppley fell $1.15 to $40.30 with the swapping of 2,646 stock units, Eppley Caribbean Property Fund declined $2 to $38, with 250 units clearing the market, First Rock Capital lost 55 cents after ending at $11.99 in an exchange of 4,103 shares. GraceKennedy shed $2.01 to end at $101 with the swapping of 972,053 stock units, Guardian Holdings declined $5 to $550 with 6,364 stocks changing hands, Kingston Properties advanced $1 in closing at $9.50 in switching ownership of 5,882 shares. Kingston Wharves lost 50 cents to close at $39.50 with 10,629 stocks crossing the market, Massy Holdings dropped $23.47 in closing at $99 in exchanging 531,384 stock units, NCB Financial shed $1.51 to end at $116.75 with a transfer of 48,764 units. PanJam Investment popped 94 cents to close at $68.50 in exchanging 35,324 shares, Proven Investments rallied 35 cents to end at $36.10 in trading 48,364 stocks, Sagicor Group advanced $2.58 to $61 with the swapping of 953,349 stock units.

At the close of the market, Berger Paints gained 45 cents to finish at $12.45 in trading just 466 shares, Caribbean Cement fell $1 in closing at $70 with an exchange of 11,120 units, Caribbean Producers rose 35 cents to $14.60 after transferring 135,746 stocks. Eppley fell $1.15 to $40.30 with the swapping of 2,646 stock units, Eppley Caribbean Property Fund declined $2 to $38, with 250 units clearing the market, First Rock Capital lost 55 cents after ending at $11.99 in an exchange of 4,103 shares. GraceKennedy shed $2.01 to end at $101 with the swapping of 972,053 stock units, Guardian Holdings declined $5 to $550 with 6,364 stocks changing hands, Kingston Properties advanced $1 in closing at $9.50 in switching ownership of 5,882 shares. Kingston Wharves lost 50 cents to close at $39.50 with 10,629 stocks crossing the market, Massy Holdings dropped $23.47 in closing at $99 in exchanging 531,384 stock units, NCB Financial shed $1.51 to end at $116.75 with a transfer of 48,764 units. PanJam Investment popped 94 cents to close at $68.50 in exchanging 35,324 shares, Proven Investments rallied 35 cents to end at $36.10 in trading 48,364 stocks, Sagicor Group advanced $2.58 to $61 with the swapping of 953,349 stock units.  Scotia Group rose $1.28 after ending at $35.94 in switching ownership of 22,894 shares, Seprod rallied 38 cents to $55.40 with 9,861 units crossing the market and Sygnus Real Estate Finance lost 82 cents in closing at $16.68 with 1,538 stock units changing hands.

Scotia Group rose $1.28 after ending at $35.94 in switching ownership of 22,894 shares, Seprod rallied 38 cents to $55.40 with 9,861 units crossing the market and Sygnus Real Estate Finance lost 82 cents in closing at $16.68 with 1,538 stock units changing hands.

In the preference segment, Eppley 7.75% preference share shed 64 cents to close at $19.96 with an exchange of 2,500 stocks and Productive Business Solutions 9.75% preference share advanced $7 to end at $107 after 200 shares crossed the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Cargo Handlers exits ICTOP10 with 33% gain

Cargo Handlers returned to ICTOP10 listing last week and was another winner with gains of 33 percent, sufficient to move it out of the top flight Junior Market stocks. The stock joins a long list of high performance ICTOP10 stocks, including the 32 percent gain in Tropical Battery stock in the previous week.

Caribbean Assurance Brokers come back in the Junior Market list, while Sterling Investments makes it back to the Main Market listing at the expense of TransJamacian Highway after just one week, but investors should keep an eye for this one.

Caribbean Assurance Brokers come back in the Junior Market list, while Sterling Investments makes it back to the Main Market listing at the expense of TransJamacian Highway after just one week, but investors should keep an eye for this one.

In a week when the Junior Market dropped 297 points in three days that pushed the index down to 3,871 points, it bounced on the last two days to close over 4,031, still 137 points from the record of 4,168.16, at the end of the previous week. Meanwhile, the Main Market continues to consolidate around support at 440,000 points measured by the All Jamaica Composite Index.

Recent IPOs JFP limited and EducFocal are set to list on Monday and Tuesday coming following the oversubscribed initial public offers.

During the past week, the Junior Market TOP10 listed Access Financial, Lasco Financial and Iron Rock Insurance gained 6 percent each while Medical Disposables fell 9 percent and Tropical Battery slipped 5 percent. In the Main Market, the primary movers are Guardian Holdings with a 4 percent gain, while JMMB Group fell 7 percent and Proven Investments declined by 5 percent.

During the past week, the Junior Market TOP10 listed Access Financial, Lasco Financial and Iron Rock Insurance gained 6 percent each while Medical Disposables fell 9 percent and Tropical Battery slipped 5 percent. In the Main Market, the primary movers are Guardian Holdings with a 4 percent gain, while JMMB Group fell 7 percent and Proven Investments declined by 5 percent.

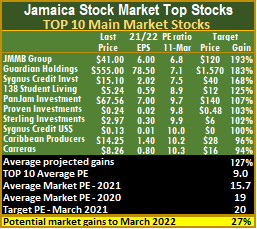

The potential gains for the TOP 10 Junior Market stocks remained for a second week at 105 percent, much lower than the Main Market at 127 percent, an indication that the Main Market is undervalued. The top three stocks in the Junior Market are Medical Disposables followed by Elite Diagnostic and Lasco Distributors to gain between 122 and 133 percent, compared to 121 and 126 percent, previously.

The potential gains for Main Market stocks moved from 124 percent last week to this weeks’ 127 percent, with the top three being JMMB Group followed by Guardian Holdings and Sygnus Credit Investments all projected to gain between 168 and 193 percent versus 161 and 193 percent last week.

The potential gains for Main Market stocks moved from 124 percent last week to this weeks’ 127 percent, with the top three being JMMB Group followed by Guardian Holdings and Sygnus Credit Investments all projected to gain between 168 and 193 percent versus 161 and 193 percent last week.

The average PE for Junior Market has surpassed the average of 17 times 2020 earnings achieved at the end of March last year in moving to 19 based on ICInsider.com’s 2021-22 earnings and is ahead of the JSE Main and USD Markets at 15.7 well off from 19 in 2021. The TOP 10 stocks trade at a PE of a mere 9, with a 48 percent discount to that market’s average.

All the stocks in the Junior Market can gain just 5 percent to the end of March this year, based on an average PE of 20. About a third of Junior Market stocks with positive earnings are trading at or above this level, averaging around 23.

The average PE for the JSE Main Market is 21 percent less than the PE of 19 at the end of March and 24 percent below the target of 20 to the end of March this year. The Main Market TOP 10 average PE is 9 representing a 43 percent discount to the market, well below the potential of 20. Around 15 stocks or a thirty percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times current year’s earnings. The depressed PE of the main market may be indicating that bigger investors are reluctant to be aggressive in buying into the market currently with inflation, rising interest rates and war populating the headlines.

The average PE for the JSE Main Market is 21 percent less than the PE of 19 at the end of March and 24 percent below the target of 20 to the end of March this year. The Main Market TOP 10 average PE is 9 representing a 43 percent discount to the market, well below the potential of 20. Around 15 stocks or a thirty percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times current year’s earnings. The depressed PE of the main market may be indicating that bigger investors are reluctant to be aggressive in buying into the market currently with inflation, rising interest rates and war populating the headlines.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Increased trading on Main Market

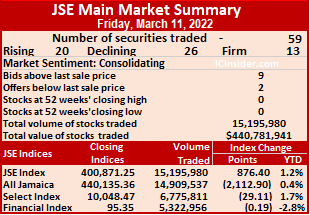

Market activity ended on Friday with the volume of shares trading rising moderately above Thursday level with 239 percent higher value at the close of the Jamaica Stock Exchange Main Market as declining were more than rising ones.

The All Jamaican Composite Index declined 2,112.90 points to 440,135.36, the JSE Main Index rose 876.40 points to 400,871.25 and the JSE Financial Index fell 0.19 points to end at 95.35.

The All Jamaican Composite Index declined 2,112.90 points to 440,135.36, the JSE Main Index rose 876.40 points to 400,871.25 and the JSE Financial Index fell 0.19 points to end at 95.35.

A total of 59 securities traded, up from 56 on Thursday ending with 20 rising, 26 declining and 13 unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 15.90. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 15,195,980 shares were exchanged for $440,781,941 versus 14,510,096 units at $130,102,912 on Thursday. Wigton Windfarm led trading with 29.5 percent of total volume for an exchange of 4.48 million shares followed by JMMB Group with 18.4 percent for 2.80 million units, GraceKennedy controlled 15.5 percent with 2.35 million units, QWI Investments held 11.6 percent after trading 1.77 million units and Transjamaican Highway had 6.9 percent with 1.04 million units changing hands.

Trading averaged 257,559 units at $7,470,880, compared to 259,109 shares at $2,323,266 on Thursday and month to date, an average of 460,902 units at $8,083,611, compared to 492,391 units at $8,178,496 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Berger Paints fell $1 to $12 with 1,386 shares crossing the market, Caribbean Cement lost 50 cents to close at $71 in an exchange of 3,798 stocks, Caribbean Producers declined $1.69 after ending at $14.25 with 395,160 stock units clearing the market. Eppley rose $1.35 in closing at $41.45 with a transfer of 81 units, Eppley Caribbean Property Fund advanced $1.94 to $40 in exchanging 103,690 shares, First Rock Capital rallied $1.24 in closing at $12.54 in switching ownership of 3,891 stocks.GraceKennedy shed 97 cents to end at $103.01 with the swapping of 2,352,331 shares, Guardian Holdings advanced $5 to $555 in trading 24,116 stock units, Jamaica Broilers lost 50 cents to settle at $29 with a transfer of 41,988 units. Jamaica Stock Exchange popped 30 cents to end at $17 while 31,808 stock stocks changed hands, JMMB Group fell $1 to $41 trading 2,798,284 stock units, Kingston Properties shed $1 to end at $8.50 in exchanging 8,741 shares. Kingston Wharves fell $1 to $40 after 126,144 units crossed the exchange, Massy Holdings declined $5.53 to close at $122.47 after transferring 158,384 stocks, Mayberry Investments gained 95 cents in closing at $7.45 with the swapping of 2,000 stock units. MPC Caribbean Clean Energy climbed $19 to end at $119 after trading 253 units, NCB Financial shed 55 cents to close at $118.26 in exchanging 34,417 shares, Palace Amusement dropped $80 to $950 in switching ownership of 43 stock units.

At the close, Berger Paints fell $1 to $12 with 1,386 shares crossing the market, Caribbean Cement lost 50 cents to close at $71 in an exchange of 3,798 stocks, Caribbean Producers declined $1.69 after ending at $14.25 with 395,160 stock units clearing the market. Eppley rose $1.35 in closing at $41.45 with a transfer of 81 units, Eppley Caribbean Property Fund advanced $1.94 to $40 in exchanging 103,690 shares, First Rock Capital rallied $1.24 in closing at $12.54 in switching ownership of 3,891 stocks.GraceKennedy shed 97 cents to end at $103.01 with the swapping of 2,352,331 shares, Guardian Holdings advanced $5 to $555 in trading 24,116 stock units, Jamaica Broilers lost 50 cents to settle at $29 with a transfer of 41,988 units. Jamaica Stock Exchange popped 30 cents to end at $17 while 31,808 stock stocks changed hands, JMMB Group fell $1 to $41 trading 2,798,284 stock units, Kingston Properties shed $1 to end at $8.50 in exchanging 8,741 shares. Kingston Wharves fell $1 to $40 after 126,144 units crossed the exchange, Massy Holdings declined $5.53 to close at $122.47 after transferring 158,384 stocks, Mayberry Investments gained 95 cents in closing at $7.45 with the swapping of 2,000 stock units. MPC Caribbean Clean Energy climbed $19 to end at $119 after trading 253 units, NCB Financial shed 55 cents to close at $118.26 in exchanging 34,417 shares, Palace Amusement dropped $80 to $950 in switching ownership of 43 stock units.  PanJam Investment shed 99 cents to end at $67.56 with 20,375 stocks crossing the exchange, Portland JSX fell $1.36 to $7.50 after the swapping of 5,000 shares, Proven Investments popped 75 cents in closing at $35.75 with a transfer of 21,504 stocks. Sagicor Group fell $1.58 to end at $58.42 with 8,163 stock units changing hands, Seprod declined $2.93 to $55.02 with the swapping of 7,031 units and Sygnus Real Estate Finance rose 82 cents to $17.50 in an exchange of 500 shares.

PanJam Investment shed 99 cents to end at $67.56 with 20,375 stocks crossing the exchange, Portland JSX fell $1.36 to $7.50 after the swapping of 5,000 shares, Proven Investments popped 75 cents in closing at $35.75 with a transfer of 21,504 stocks. Sagicor Group fell $1.58 to end at $58.42 with 8,163 stock units changing hands, Seprod declined $2.93 to $55.02 with the swapping of 7,031 units and Sygnus Real Estate Finance rose 82 cents to $17.50 in an exchange of 500 shares.

In the preference segment, Productive Business Solutions 9.75% preference share declined $5 to close at $100 after exchanging 2,000 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

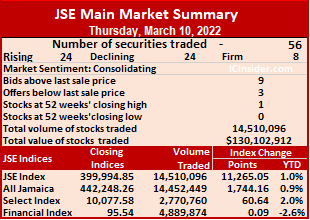

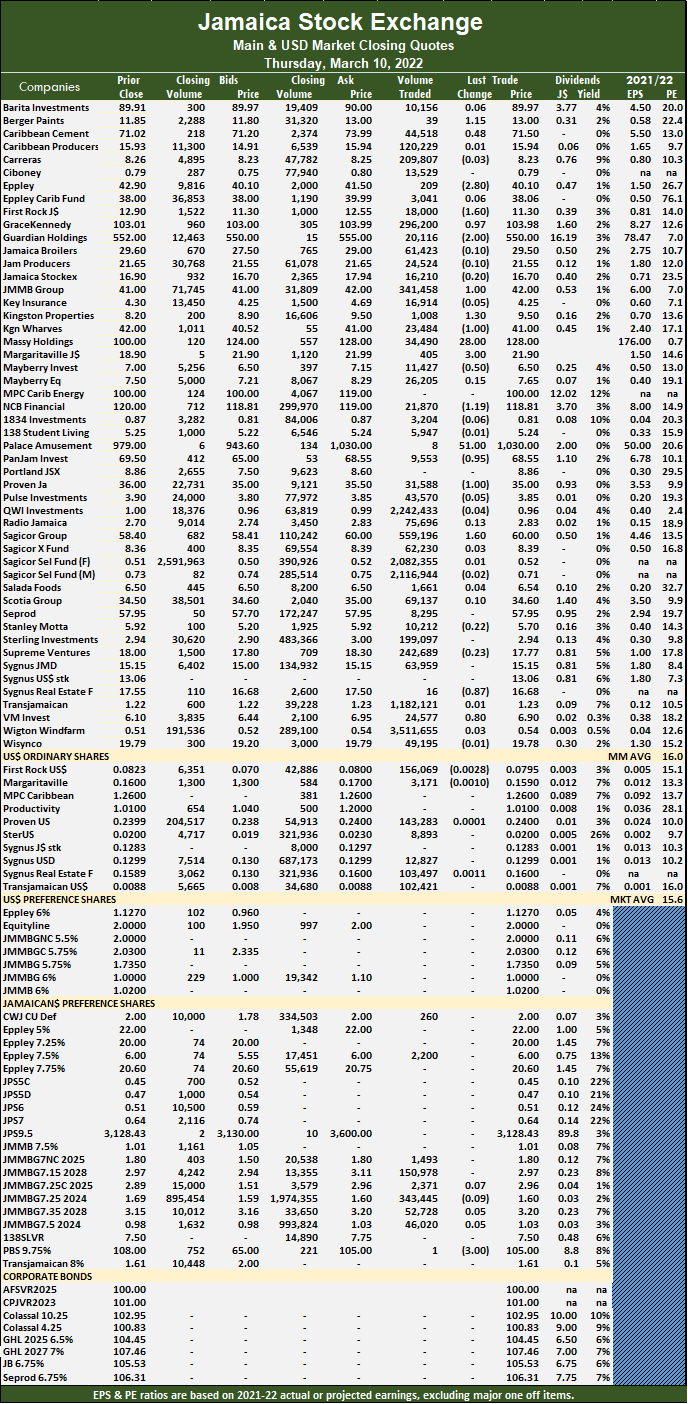

Massy pushes Main Market Index 11,265 points

Massy Holdings jumped 28 percent after the stock was split into 20 units on Thursday, sending the Main Market Index flying more than 11,000 points as trading ended with the volume of shares exchanged declining 15 percent and the value falling 71 percent below Wednesday’s levels at the close of the Jamaica Stock Exchange Main Market as rising and declining stocks were equal in numbers.

The All Jamaican Composite Index gained 1,744.16 points to 442,248.26, the JSE Main Index surged 11,265.05 to 399,994.85 and the JSE Financial Index popped 0.09 points to settle at 95.54.

The All Jamaican Composite Index gained 1,744.16 points to 442,248.26, the JSE Main Index surged 11,265.05 to 399,994.85 and the JSE Financial Index popped 0.09 points to settle at 95.54.

Trading ended with 56 securities versus 55 on Wednesday with 24 rising, 24 declining and eight ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 16. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 14,510,096 shares were exchanged for $130,102,912 versus 16,997,775 units at $448,161,608 on Wednesday. Wigton Windfarm led trading with 24.2 percent of total volume for an exchange of 3.51 million shares, followed by QWI Investments, 15.5 percent with 2.24 million units, Sagicor Select Manufacturing & Distribution Fund accounted for 14.6 percent with 2.12 million units, Sagicor Select Financial Fund traded 2.08 million units for 14.4 percent market share and Transjamaican Highway, 8.1 percent in transferring 1.18 million units.

Trading averages 259,109 units at $2,323,266, compared to 309,050 shares at $8,148,393 on Wednesday and month to date, an average of 492,391 units at $8,178,496, compared to 532,587 units at $9,187,397 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Berger Paints rallied $1.15 in closing at $13 with an exchange of just 39 shares, Caribbean Cement popped 48 cents to close at $71.50 in trading 44,518 units, Eppley fell $2.80 to end at $40.10 in switching ownership of 209 stocks. First Rock Capital shed $1.60 to end at $11.30 with 18,000 stock units changing hands, GraceKennedy rose 97 cents to $103.98 after 296,200 shares crossed the market, Guardian Holdings fell $2 to end at $550 in transferring 20,116 stocks. JMMB Group rose $1 to $42 in switching ownership of 341,458 units, Kingston Properties advanced $1.30 in closing at $9.50 after exchanging 1,008 shares, Kingston Wharves fell $1 to $41 in trading 23,484 units. Margaritaville added $3 to close at $21.90 with 405 stocks crossing the market, Massy Holdings rose $28 to a 52 weeks’ high of $128, with the swapping of 34,490 shares, after a 20 to one stock split took effect on the Jamaica Stock Exchange on Thursday. Mayberry Investments lost 50 cents to finish at $6.50 with an exchange of 11,427 stock units. NCB Financial fell $1.19 to end at $118.81 in swapping 21,870 stocks, Palace Amusement climbed $51 to $1,030 in exchanging 8 shares, PanJam Investment lost 95 cents in ending at $68.55 with 9,553 stock units changing hands.

At the close, Berger Paints rallied $1.15 in closing at $13 with an exchange of just 39 shares, Caribbean Cement popped 48 cents to close at $71.50 in trading 44,518 units, Eppley fell $2.80 to end at $40.10 in switching ownership of 209 stocks. First Rock Capital shed $1.60 to end at $11.30 with 18,000 stock units changing hands, GraceKennedy rose 97 cents to $103.98 after 296,200 shares crossed the market, Guardian Holdings fell $2 to end at $550 in transferring 20,116 stocks. JMMB Group rose $1 to $42 in switching ownership of 341,458 units, Kingston Properties advanced $1.30 in closing at $9.50 after exchanging 1,008 shares, Kingston Wharves fell $1 to $41 in trading 23,484 units. Margaritaville added $3 to close at $21.90 with 405 stocks crossing the market, Massy Holdings rose $28 to a 52 weeks’ high of $128, with the swapping of 34,490 shares, after a 20 to one stock split took effect on the Jamaica Stock Exchange on Thursday. Mayberry Investments lost 50 cents to finish at $6.50 with an exchange of 11,427 stock units. NCB Financial fell $1.19 to end at $118.81 in swapping 21,870 stocks, Palace Amusement climbed $51 to $1,030 in exchanging 8 shares, PanJam Investment lost 95 cents in ending at $68.55 with 9,553 stock units changing hands. Proven Investments shed $1 in closing at $35 in transferring 31,588 units, Sagicor Group advanced $1.60 to end at $60 with 559,196 shares clearing the market, Sygnus Real Estate Finance shed 87 cents in ending at $16.68 in switching ownership of 16 units and Victoria Mutual Investments rose 80 cents to close at $6.90 in an exchange of 24,577 stocks.

Proven Investments shed $1 in closing at $35 in transferring 31,588 units, Sagicor Group advanced $1.60 to end at $60 with 559,196 shares clearing the market, Sygnus Real Estate Finance shed 87 cents in ending at $16.68 in switching ownership of 16 units and Victoria Mutual Investments rose 80 cents to close at $6.90 in an exchange of 24,577 stocks.

In the preference segment, Productive Business Solutions 9.75% preference share declined $3 to $105 after trading a mere one stock unit.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

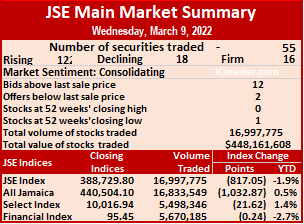

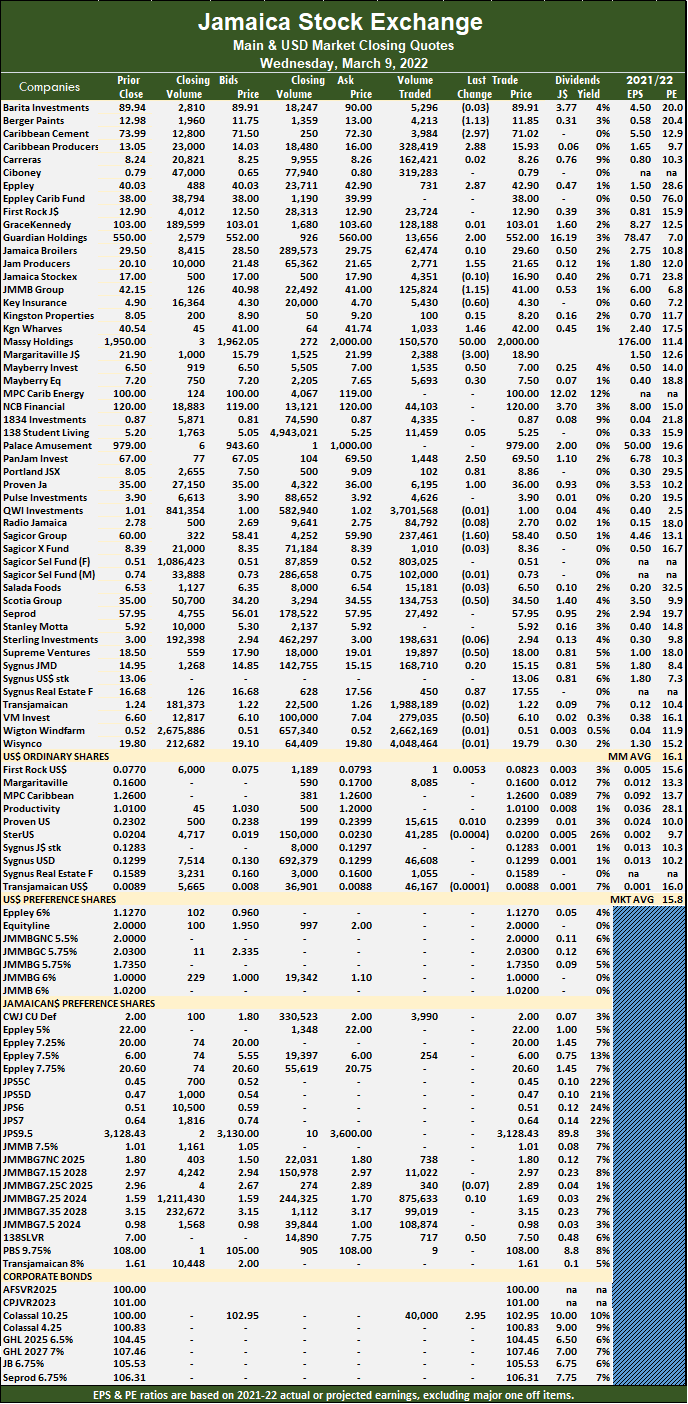

JSE Main Market slips on Wednesday

Market activity ended on Wednesday with the volume of shares trading remaining fairly stable but with an 80 percent higher value than on Tuesday on the Jamaica Stock Exchange Main Market as the number of rising and declining stocks were almost equal.

The All Jamaican Composite Index shed 1,032.87 points to 440,504.10, the JSE Main Index fell 817.05 points to 388,729.80 and the JSE Financial Index slipped 0.24 points to end at 95.45.

The All Jamaican Composite Index shed 1,032.87 points to 440,504.10, the JSE Main Index fell 817.05 points to 388,729.80 and the JSE Financial Index slipped 0.24 points to end at 95.45.

Trading ended with 55 securities similar to Tuesday, with 20 rising, 21 declining and 14 ending unchanged.

The PE Ratio, a formula used in computing appropriate stock values, averages 16.1. The PE ratio for the JSE Main and USD Market closing quotes uses ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 16,997,775 shares were exchanged for $448,161,608 versus 17,322,599 units at $249,225,504 on Tuesday. Wisynco Group led trading with 23.8 percent of total volume in exchanging 4.05 million shares followed by QWI Investments with 21.8 percent after trading 3.7 million units, Wigton Windfarm, 15.7 percent after trading 2.66 million units and Transjamaican Highway, 11.7 percent with a transfer of 1.99 million units.

Trading on Wednesday averaged 309,050 units at $8,148,393 compared to 314,956 shares at $4,531,373 on Tuesday and month to date an average of 532,587 units at $9,187,397, compared to 578,123 units at $9,399,046 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

Trading on Wednesday averaged 309,050 units at $8,148,393 compared to 314,956 shares at $4,531,373 on Tuesday and month to date an average of 532,587 units at $9,187,397, compared to 578,123 units at $9,399,046 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

The Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and one with lower offers.

At the close, Berger Paints shed $1.13 to close at $11.85 in switching ownership of 4,213 shares, Caribbean Cement declined $2.97 to $71.02 with 3,984 stock units changing hands, Caribbean Producers advanced $2.88 to $15.93 in trading 328,419 units. Eppley popped $2.87 to $42.90 with 731 stocks clearing the market, Guardian Holdings advanced $2 to $552 in exchanging 13,656 shares, Jamaica Producers rose $1.55 in closing at $21.65 with the swapping of 2,771 stocks. JMMB Group fell $1.15 to end at $41 in trading 125,824 units, Key Insurance lost 60 cents after ending at $4.30 with 5,430 stock units crossing the market, Kingston Wharves rallied $1.46 to $42 with 1,033 shares changing hands. Margaritaville declined $3 to close at $18.90 in switching ownership of 2,388 units, Massy Holdings climbed $50 to close at $2,000 after exchanging 150,570 stock units, with the price adjusting for the 20 to one split effective at the commencement of trading on Thursday. Mayberry Investments gained 50 cents to finish at $7 with a transfer of 1,535 stocks, Mayberry Jamaican Equities popped 30 cents to end at $7.50 in trading 5,693 shares, PanJam Investment advanced $2.50 in closing at $69.50 with 1,448 stocks crossing the market, Portland JSX rose 81 cents to $8.86 with the swapping of 102 units.  Proven Investments rallied $1 to $36, with 6,195 stock units changing hands, Sagicor Group fell $1.60 to end at $58.40 with an exchange of 237,461 stock units, Scotia Group lost 50 cents at $34.50 after swapping 134,753 stocks. Supreme Ventures lost 50 cents in closing at $18 after switching ownership of 19,897 shares, Sygnus Real Estate Finance rose 87 cents to close at $17.55 with a transfer of 450 units and Victoria Mutual Investments shed 50 cents to settle at $6.10 in an exchange of 279,035 stock units.

Proven Investments rallied $1 to $36, with 6,195 stock units changing hands, Sagicor Group fell $1.60 to end at $58.40 with an exchange of 237,461 stock units, Scotia Group lost 50 cents at $34.50 after swapping 134,753 stocks. Supreme Ventures lost 50 cents in closing at $18 after switching ownership of 19,897 shares, Sygnus Real Estate Finance rose 87 cents to close at $17.55 with a transfer of 450 units and Victoria Mutual Investments shed 50 cents to settle at $6.10 in an exchange of 279,035 stock units.

In the preference segment, 138 Student Living preference shares gained 50 cents ending at $7.50 in trading 717 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market rallies

Market activity ended on Tuesday on the Jamaica Stock Exchange Main Market with the volume of shares declining 34 percent and the value 52 percent lower than on Monday and leading to rising stocks exceeding those declining.

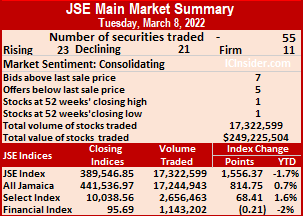

The All Jamaican Composite Index advanced 814.75 points to settle at 441,536.97, the Main Index climbed 1,556.37 points to 389,546.85 and the JSE Financial Index popped 1.02 points to close at 95.69.

The All Jamaican Composite Index advanced 814.75 points to settle at 441,536.97, the Main Index climbed 1,556.37 points to 389,546.85 and the JSE Financial Index popped 1.02 points to close at 95.69.

A total of 55 securities were traded compared to 54 on Monday, with 23 rising, 21 declining and 11 ending unchanged.

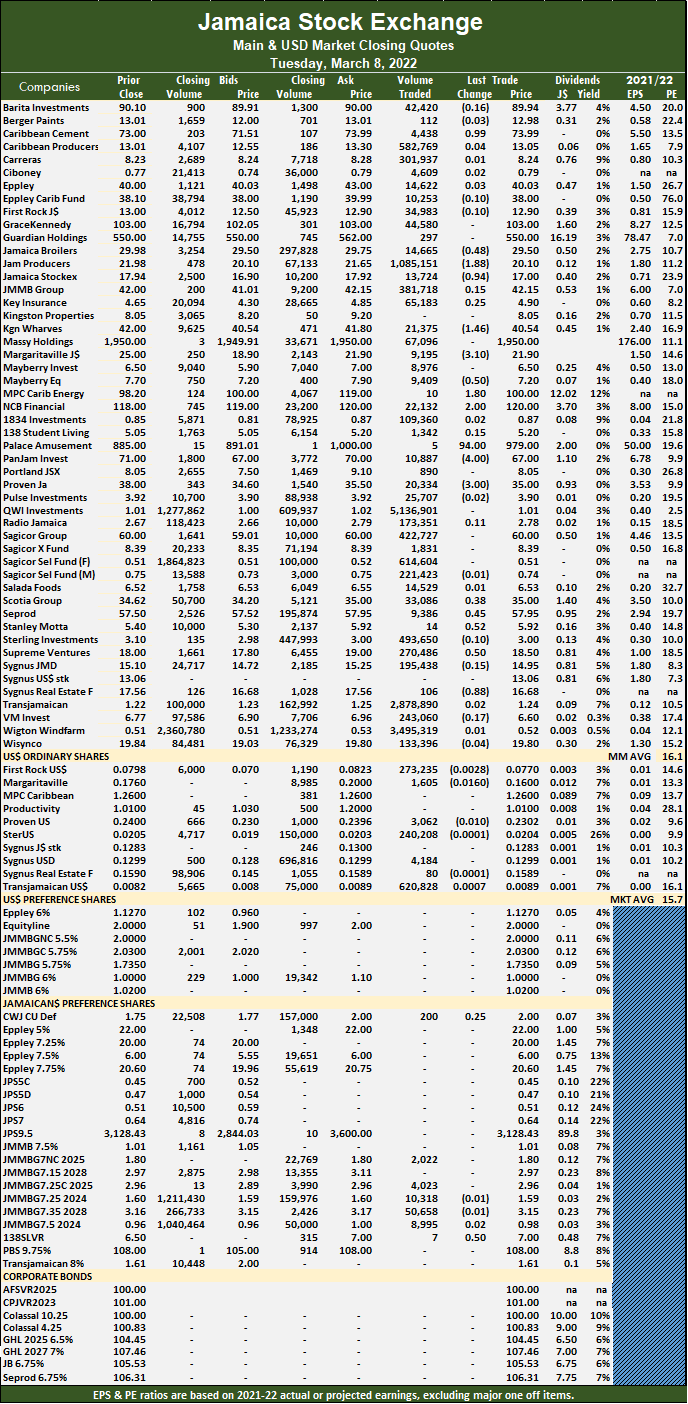

The PE Ratio a formula for computing appropriate stock values, averages 16.1. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years, ending up to August 2022.

A total of 17,322,599 shares were traded for $249,225,504, down from 26,282,472 units at $523,039,414 on Monday.

QWI Investments led trading with 29.7 percent of total volume after transferring 5.14 million shares followed by Wigton Windfarm, 20.2 percent with 3.5 million units, Transjamaican Highway accounted for 16.6 percent with 2.88 million units and Jamaica Producers exchanged 1.09 million units for 6.3 percent market share.  Trading averages 314,956 units at $4,531,373, down from 486,712 shares at $9,685,915 on Monday and month to date, an average of 578,123 units at $9,399,046, compared to 645,444 units at $10,644,265 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

Trading averages 314,956 units at $4,531,373, down from 486,712 shares at $9,685,915 on Monday and month to date, an average of 578,123 units at $9,399,046, compared to 645,444 units at $10,644,265 on the previous trading day. February closed with an average of 392,520 units at $3,199,976.

The Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and one with a lower offer.

At the close, Caribbean Cement gained 99 cents to end at $73.99 with 4,438 shares crossing the market, Jamaica Broilers lost 48 cents to end at $29.50 after exchanging 14,665 stocks, Jamaica Producers declined $1.88 to $20.10 with a transfer of 1,085,151 units. Jamaica Stock Exchange shed 94 cents in closing at $17 in trading 13,724 stock units, Kingston Wharves fell $1.46 to close at $40.54 after 21,375 units crossed the market, Margaritaville declined $3.10 to close at $21.90 in switching ownership of 9,195 shares. Mayberry Jamaican Equities lost 50 cents to end at $7.20 in an exchange of 9,409 stock units, MPC Caribbean Clean Energy advanced $1.80 to $100 in transferring 10 stocks, NCB Financial rallied $2 in closing at $120 with the swapping of 22,132 units.  Palace Amusement popped $94 to $979 in switching ownership of 5 stock units, PanJam Investment dropped $4 at $67 with 10,887 shares clearing the market, Proven Investments declined $3 to $35 in trading 20,334 stocks. Scotia Group gained 38 cents to close at $35 with the swapping of 33,086 shares, Seprod rose 45 cents in closing at $57.95, finishing with 9,386 units changing hands, Stanley Motta rose 52 cents to end at $5.92 with a transfer of 14 stock units. Supreme Ventures gained 50 cents to close at $18.50 with the swapping of 270,486 stocks, Sygnus Real Estate Finance fell 88 cents to end at $16.68 with an exchange of 106 stock units.

Palace Amusement popped $94 to $979 in switching ownership of 5 stock units, PanJam Investment dropped $4 at $67 with 10,887 shares clearing the market, Proven Investments declined $3 to $35 in trading 20,334 stocks. Scotia Group gained 38 cents to close at $35 with the swapping of 33,086 shares, Seprod rose 45 cents in closing at $57.95, finishing with 9,386 units changing hands, Stanley Motta rose 52 cents to end at $5.92 with a transfer of 14 stock units. Supreme Ventures gained 50 cents to close at $18.50 with the swapping of 270,486 stocks, Sygnus Real Estate Finance fell 88 cents to end at $16.68 with an exchange of 106 stock units.

In the preference segment, 138 Student Living preference shares popped 50 cents in closing at $7 after trading 7 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 53

- 54

- 55

- 56

- 57

- …

- 183

- Next Page »