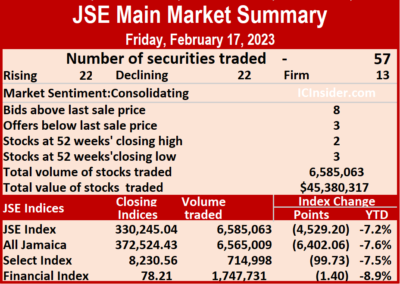

The Jamaica Stock Exchange Main Market ended trading with a significant decline on Friday following a marginal decline in the volume of stocks traded and a 36 percent fall in the value of stocks changing hands compared to Thursday, and ended with trading in 57 securities compared to 58 on Thursday, leading to rising and declining stock accounting for 22 stocks each and 13 ending unchanged.

Trading ended with two stocks in the preference segment hitting new 52 weeks’ highs and three ordinary shares hitting 52 weeks’ lows.

Trading ended with two stocks in the preference segment hitting new 52 weeks’ highs and three ordinary shares hitting 52 weeks’ lows.

A total of 6,585,063 shares were traded for $45,380,317, down from 6,869,971 units at $71,142,724 on Thursday.

Trading averaged 115,527 shares at $796,146, down from 118,448 units at $1,226,599 on Thursday and for the month to date, an average of 168,975 units at $1,941,407 versus 173,529 units at $2,038,988 on the previous day. January closed with an average of 205,236 units at $1,805,558.

Wigton Windfarm led trading with 2.42 million shares for 36.8 percent of total volume, followed by Transjamaican Highway with 2.06 million units for 31.3 percent of the day’s trade and Pulse Investments with 308,500 units for 4.7 percent market share.

The All Jamaican Composite Index plunged 6,402.06 points to end at 372,524.43, some 6 percent lower than at the start of the year, the JSE Main Index dropped 4,529.20 points to 330,245.04, to be down 5.9 percent for the year to date and the JSE Financial Index dipped 1.40 points to close at 78.21 with a loss of 7.3 percent year to date.

The All Jamaican Composite Index plunged 6,402.06 points to end at 372,524.43, some 6 percent lower than at the start of the year, the JSE Main Index dropped 4,529.20 points to 330,245.04, to be down 5.9 percent for the year to date and the JSE Financial Index dipped 1.40 points to close at 78.21 with a loss of 7.3 percent year to date.

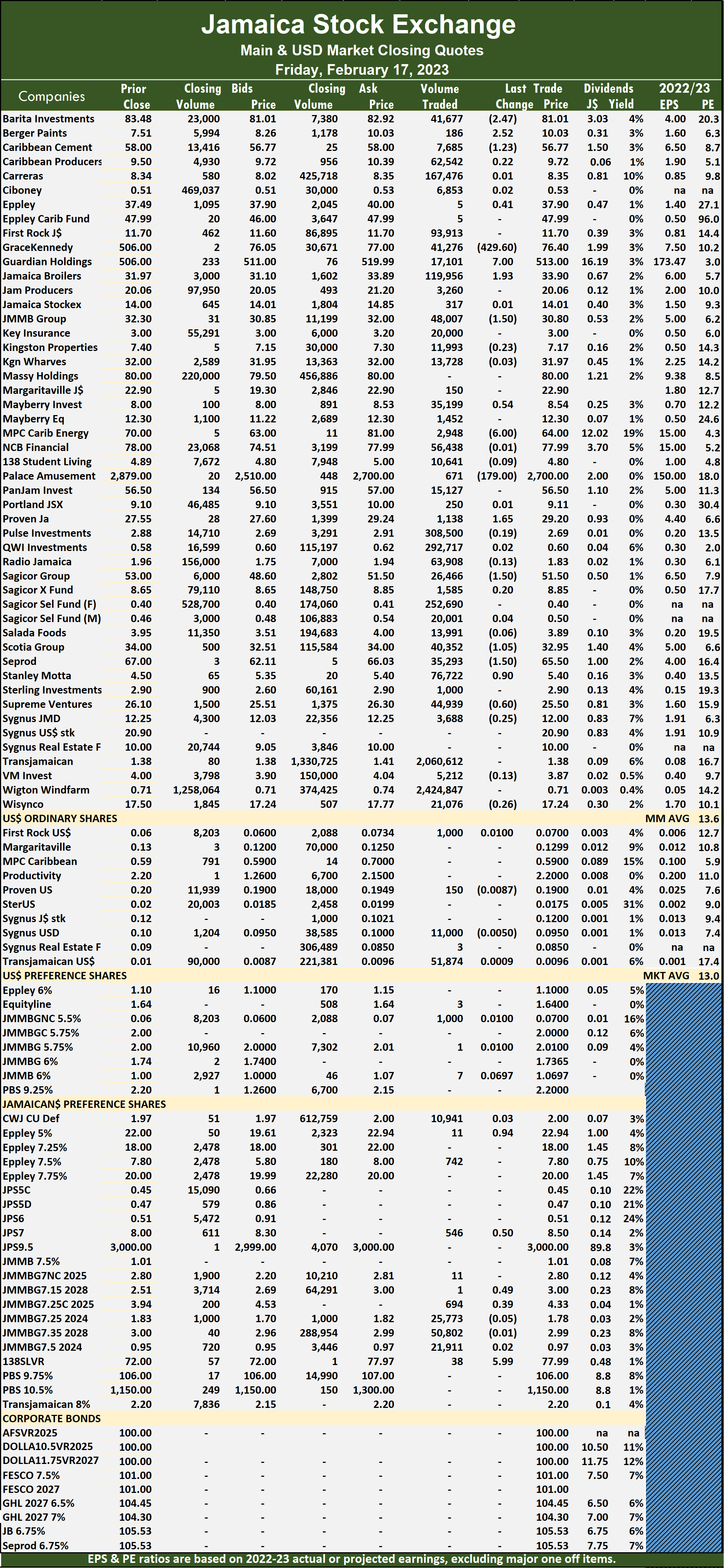

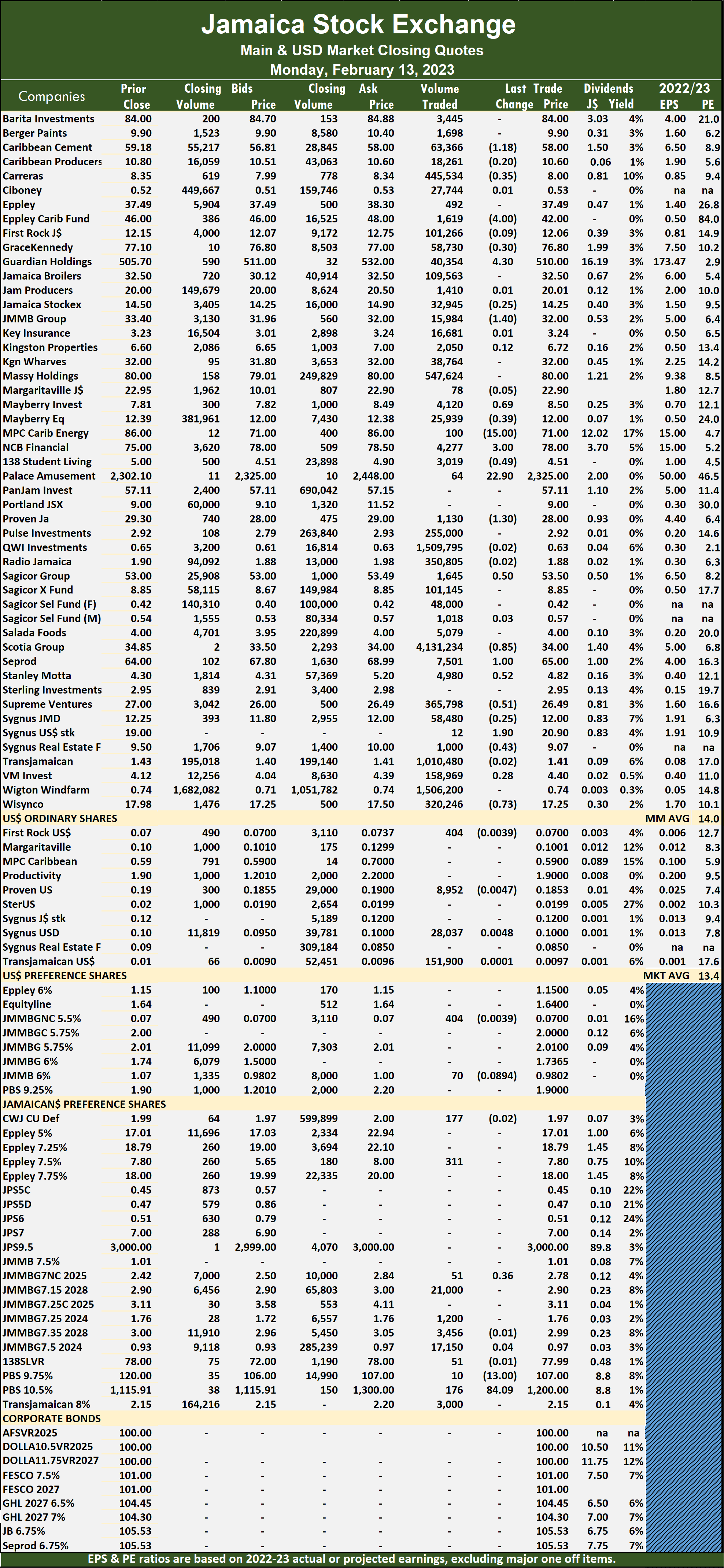

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows eight stocks ending with bids higher than their last selling prices and three with lower offers.

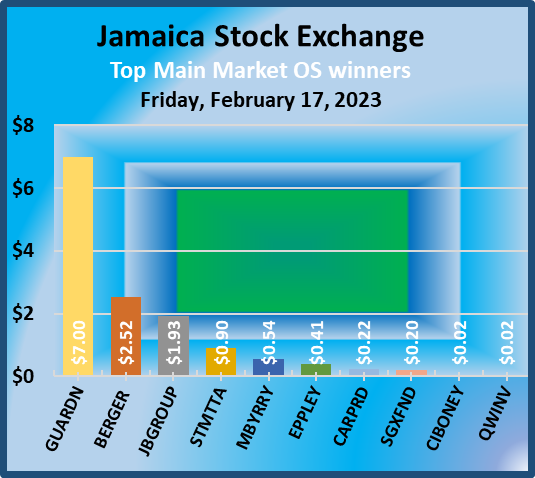

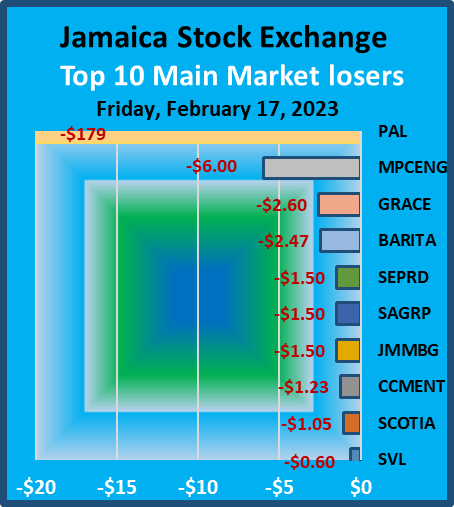

At the close, Barita Investments declined $2.47, ending at a 52 weeks’ low of $81.01, exchanging 41,677 shares, Berger Paints advanced $2.52 to $10.03 after a transfer of 186 stocks,  Caribbean Cement fell $1.23 to end at $56.77 with the swapping of 7,685 stock units. Eppley popped 41 cents to $37.90 after trading five units, GraceKennedy shed $2.60 in closing at $76.40 with 41,276 stocks changing hands, Guardian Holdings rallied $7 in closing at $513 in switching ownership of 17,101 shares. Jamaica Broilers rose $1.93 to $33.90 with investors transferring 119,956 stock units, JMMB Group lost $1.50 to $30.80 after 48,007 units passed through the market, Mayberry Investments gained 54 cents in ending at $8.54 after an exchange of 35,199 shares. MPC Caribbean Clean Energy declined $6 to close at a 52 weeks’ low of $64 with the swapping of 2,948 stock units, Palace Amusement dropped $179 in closing at $2,700 in an exchange of 671 units, Proven Investments rose $1.65 to end at $29.20 in trading 1,138 stocks. Sagicor Group dipped $1.50 to $51.50 with 26,466 units changing hands, Salada Foods lost 6 cents to end at a 52 weeks’ low of $3.89 after trading 13,991 shares, Scotia Group shed $1.05 to close at $32.95 as investors exchanged 40,352 stock units, Seprod fell $1.50 in ending at $65.50 after trading 35,293 shares. Stanley Motta gained 90 cents to end at $5.40 with 76,722 stocks clearing the market and Supreme Ventures lost 60 cents in ending at $25.50 after an exchange of 44,939 units.

Caribbean Cement fell $1.23 to end at $56.77 with the swapping of 7,685 stock units. Eppley popped 41 cents to $37.90 after trading five units, GraceKennedy shed $2.60 in closing at $76.40 with 41,276 stocks changing hands, Guardian Holdings rallied $7 in closing at $513 in switching ownership of 17,101 shares. Jamaica Broilers rose $1.93 to $33.90 with investors transferring 119,956 stock units, JMMB Group lost $1.50 to $30.80 after 48,007 units passed through the market, Mayberry Investments gained 54 cents in ending at $8.54 after an exchange of 35,199 shares. MPC Caribbean Clean Energy declined $6 to close at a 52 weeks’ low of $64 with the swapping of 2,948 stock units, Palace Amusement dropped $179 in closing at $2,700 in an exchange of 671 units, Proven Investments rose $1.65 to end at $29.20 in trading 1,138 stocks. Sagicor Group dipped $1.50 to $51.50 with 26,466 units changing hands, Salada Foods lost 6 cents to end at a 52 weeks’ low of $3.89 after trading 13,991 shares, Scotia Group shed $1.05 to close at $32.95 as investors exchanged 40,352 stock units, Seprod fell $1.50 in ending at $65.50 after trading 35,293 shares. Stanley Motta gained 90 cents to end at $5.40 with 76,722 stocks clearing the market and Supreme Ventures lost 60 cents in ending at $25.50 after an exchange of 44,939 units.

In the preference segment, Eppley 5% preference share popped 94 cents to close at $22.94 after crossing the exchange with 11 shares. Jamaica Public Service 7% gained 50 cents to settle at a 52 weeks’ high of $8.50 in exchanging 546 stocks, JMMBG7.25C – 2025 climbed 39 cents to close at a 52 weeks’ high of $4.33 after an exchange of 694 shares, JMMB Group 7.15% – 2028 popped 49 cents in closing at $3 in switching ownership of one stock unit and 138 Student Living preference share rallied $5.99 to $77.99 with the swapping of 38 stock units.

In the preference segment, Eppley 5% preference share popped 94 cents to close at $22.94 after crossing the exchange with 11 shares. Jamaica Public Service 7% gained 50 cents to settle at a 52 weeks’ high of $8.50 in exchanging 546 stocks, JMMBG7.25C – 2025 climbed 39 cents to close at a 52 weeks’ high of $4.33 after an exchange of 694 shares, JMMB Group 7.15% – 2028 popped 49 cents in closing at $3 in switching ownership of one stock unit and 138 Student Living preference share rallied $5.99 to $77.99 with the swapping of 38 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big drop for JSE Main market

JSE Main Market rises on moderate trading

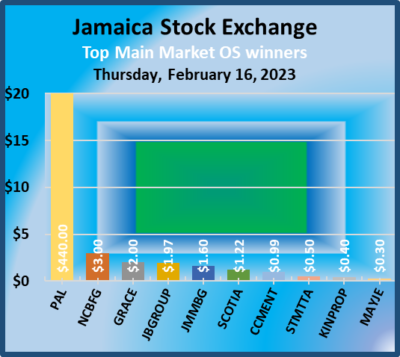

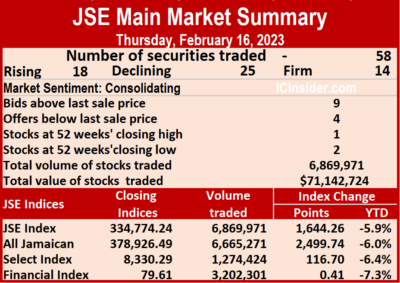

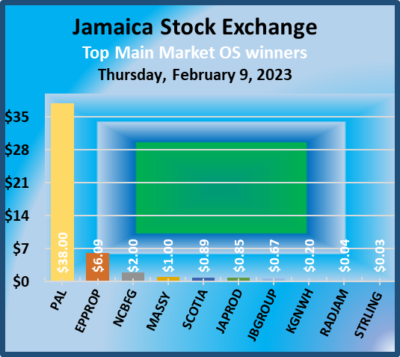

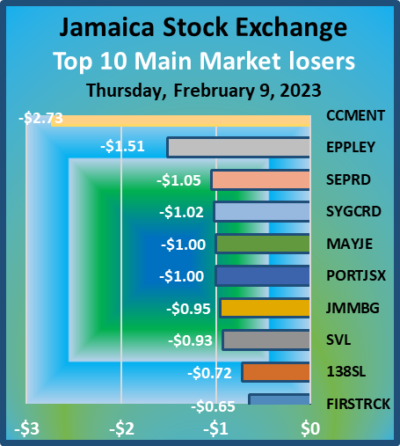

Trading dipped on the Jamaica Stock Exchange Main Market on Thursday, but the major market indices rose at the close even as declining stocks outnumbered those rising by a decent margin following a 49 percent decline in the volume of stocks traded, with a 22 percent lower value than on Wednesday, after 58 securities were exchanged compared to 59 on Wednesday, with 18 rising, 26 declining and 14 ending unchanged.

A total of 6,869,971 shares were traded for $71,142,724 compared to 13,423,503 units at $91,730,395 on Wednesday.

A total of 6,869,971 shares were traded for $71,142,724 compared to 13,423,503 units at $91,730,395 on Wednesday.

Trading averaged 118,448 shares at $1,226,599, versus 227,517 shares at $1,554,752 on Wednesday and trading month to date, averaged 173,529 stock units at $2,038,988, compared with 178,757 units at $2,116,105 on the previous day. January closed with an average of 205,236 units at $1,805,558.

Wigton Windfarm led trading with 1.35 million shares for 19.6 percent of total volume followed by Sagicor Select Financial Fund with 1.14 million units for 16.5 percent of the day’s trade and Transjamaican Highway with 967,468 units for 14.1 percent market share.

The All Jamaican Composite Index climbed 2,499.74 points to 378,926.49, the JSE Main Index advanced 1,644.26 points to end at 334,774.24 and the JSE Financial Index gained 0.41 points to end at 79.61.

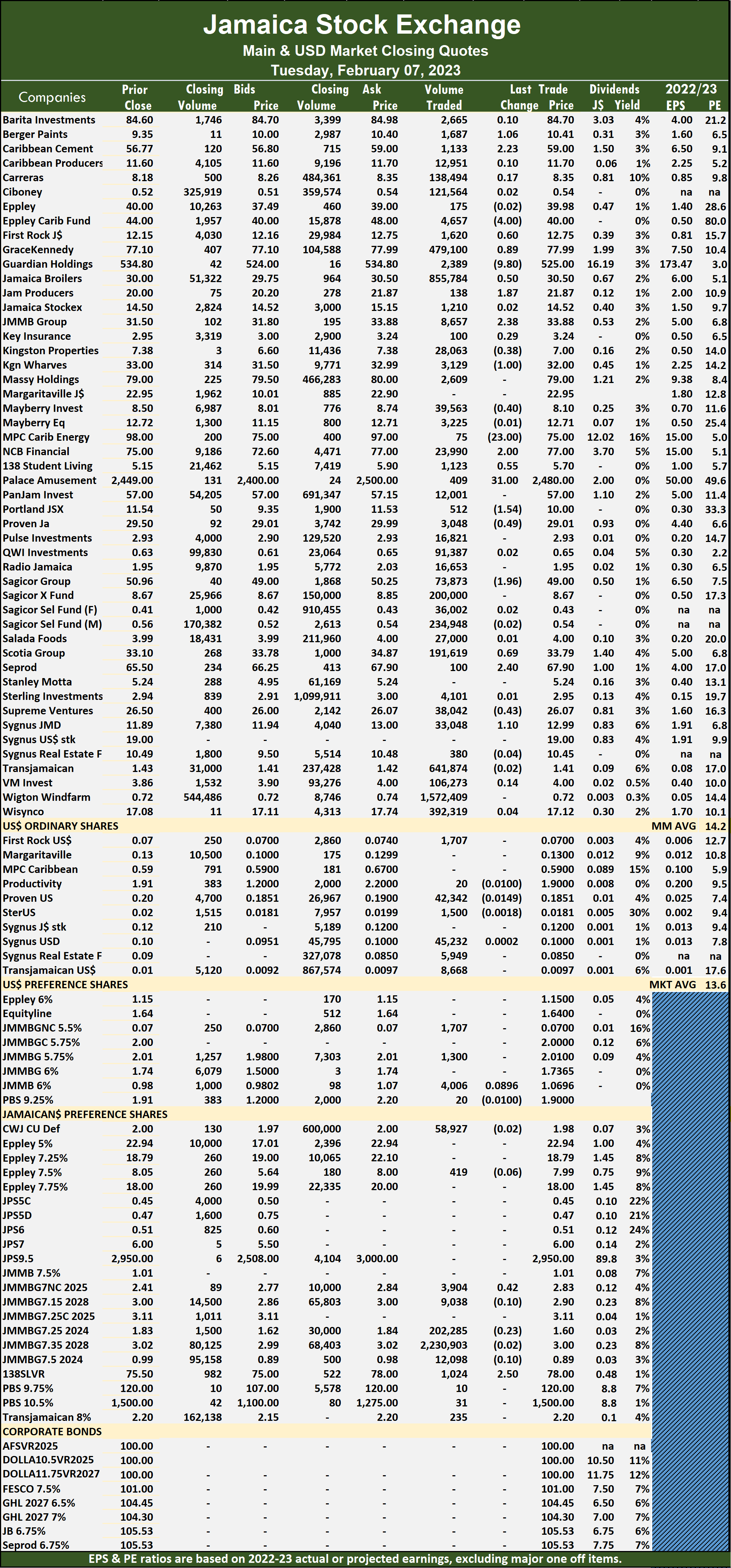

The PE Ratio, a formula used to ascertain appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula used to ascertain appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and four with lower offers.

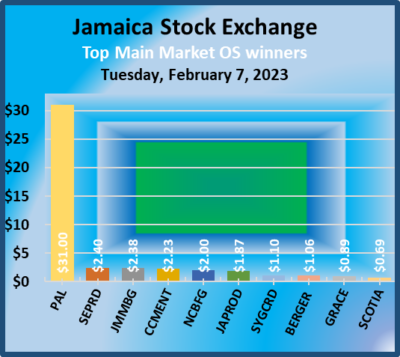

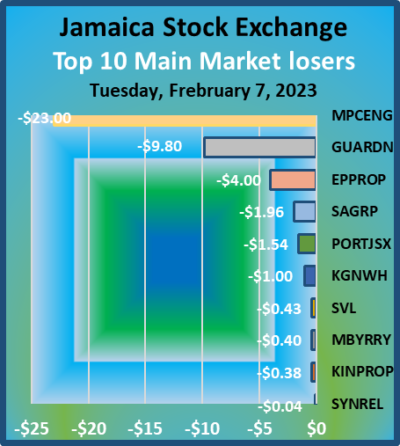

At the close, Barita Investments fell 52 cents to close at a 52 weeks’ low of $83.48 after an exchange of 85,628 shares, Caribbean Cement gained 99 cents in closing at $58 as investors traded 33,528 units, Caribbean Producers shed $1 to end at a 52 weeks’ low of $9.50 with 194,040 stocks changing hands. GraceKennedy climbed $2 to $79 after a transfer of 187,063 stock units, Guardian Holdings declined $4 to finish at $506 with the swapping of 40 stock units, Jamaica Broilers rallied $1.97 to close at $31.97 after 9,706 units passed through the market. Jamaica Producers shed $1.79 in ending at $20.06 after trading 6,075 shares,  JMMB Group advanced $1.60 to $32.30 in switching ownership of 8,541 stocks, Kingston Properties rose 40 cents to $7.40 in exchanging 135,083 units. MPC Caribbean Clean Energy fell $1 to end at $70 with an exchange of 200 shares, NCB Financial advanced $3 to $78 in trading 16,948 stocks, Palace Amusement popped $440 to $2,879 with a transfer of 492 stock units. PanJam Investment fell 60 cents to close at $56.50 with an exchange of 1,120 stocks, Proven Investments lost 45 cents to end at $27.55 as investors swapped 6,091 stock units, Scotia Group rallied $1.22 in closing at $34 with 25,491 shares changing hands. Stanley Motta popped 50 cents to end at $4.50 after 61,156 units crossed the exchange, Supreme Ventures lost 40 cents in closing at $26.10 with investors transferring 14,531 units and Wisynco Group dipped 40 cents to $17.50 trading 353,875 shares.

JMMB Group advanced $1.60 to $32.30 in switching ownership of 8,541 stocks, Kingston Properties rose 40 cents to $7.40 in exchanging 135,083 units. MPC Caribbean Clean Energy fell $1 to end at $70 with an exchange of 200 shares, NCB Financial advanced $3 to $78 in trading 16,948 stocks, Palace Amusement popped $440 to $2,879 with a transfer of 492 stock units. PanJam Investment fell 60 cents to close at $56.50 with an exchange of 1,120 stocks, Proven Investments lost 45 cents to end at $27.55 as investors swapped 6,091 stock units, Scotia Group rallied $1.22 in closing at $34 with 25,491 shares changing hands. Stanley Motta popped 50 cents to end at $4.50 after 61,156 units crossed the exchange, Supreme Ventures lost 40 cents in closing at $26.10 with investors transferring 14,531 units and Wisynco Group dipped 40 cents to $17.50 trading 353,875 shares.

In the preference segment, Productive Business 10.50% preference share dropped $50 to close at $1,150 with the swapping of 1 stock unit, Eppley 7.25% preference share fell 79 cents to end at $18 after exchanging 3,664 stocks, Jamaica Public Service 7% gained $1 to close at a 52 weeks’ high of $8 after 42 stock units crossed the market.  JMMB Group 7.15% – 2028 lost 49 cents in closing at $2.51 in switching ownership of 20,011 units, 138 Student Living preference share dropped $6 to settle at $72 after a transfer of 53 stocks and Productive Business Solutions 9.75% preference share dipped $1 to close at $106 with 18 shares changing hands.

JMMB Group 7.15% – 2028 lost 49 cents in closing at $2.51 in switching ownership of 20,011 units, 138 Student Living preference share dropped $6 to settle at $72 after a transfer of 53 stocks and Productive Business Solutions 9.75% preference share dipped $1 to close at $106 with 18 shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading jumps on JSE Main Market

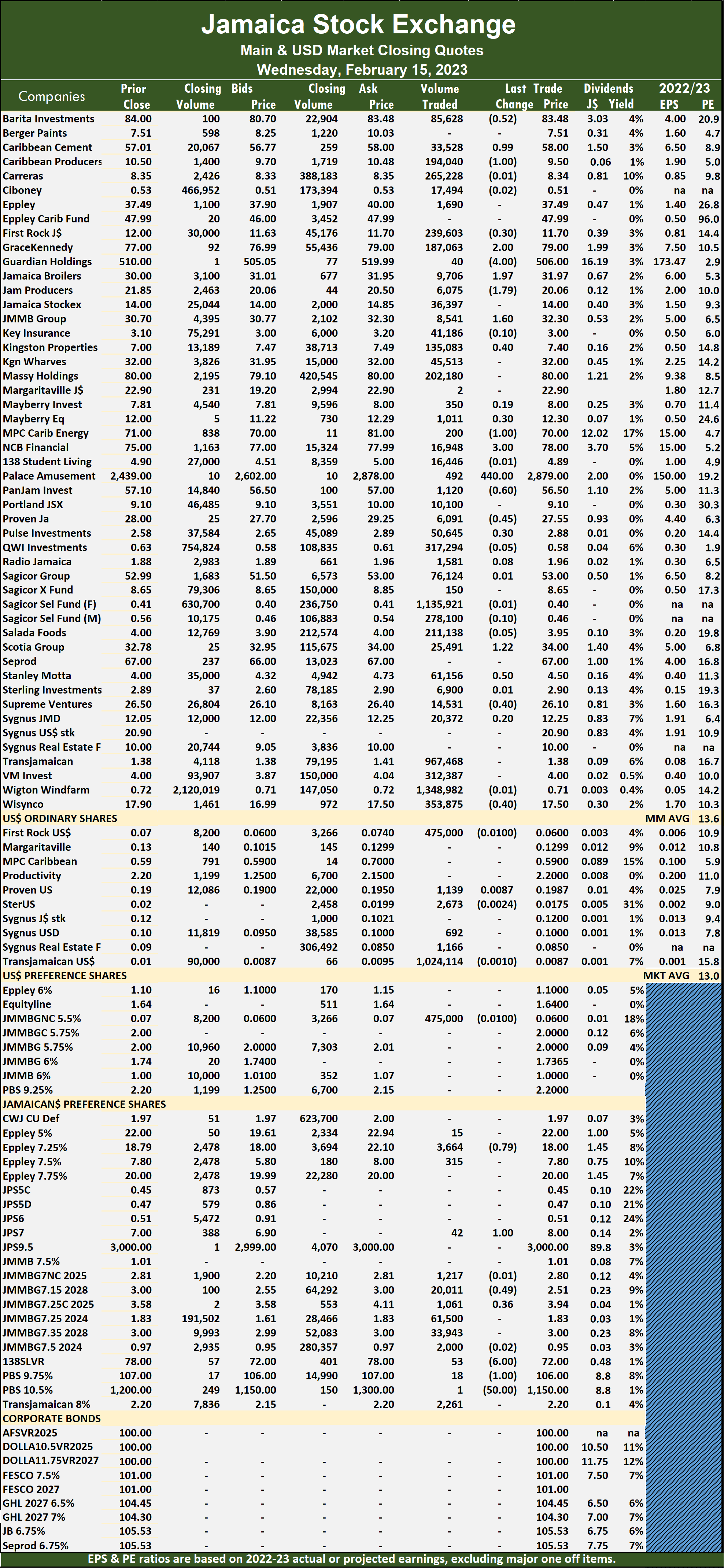

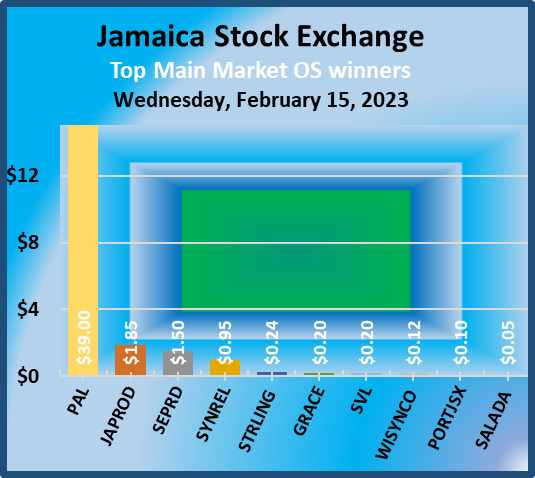

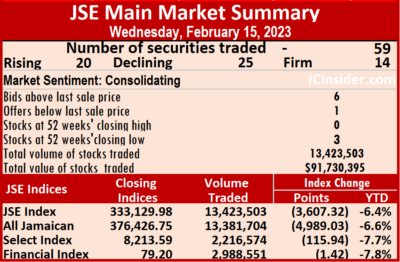

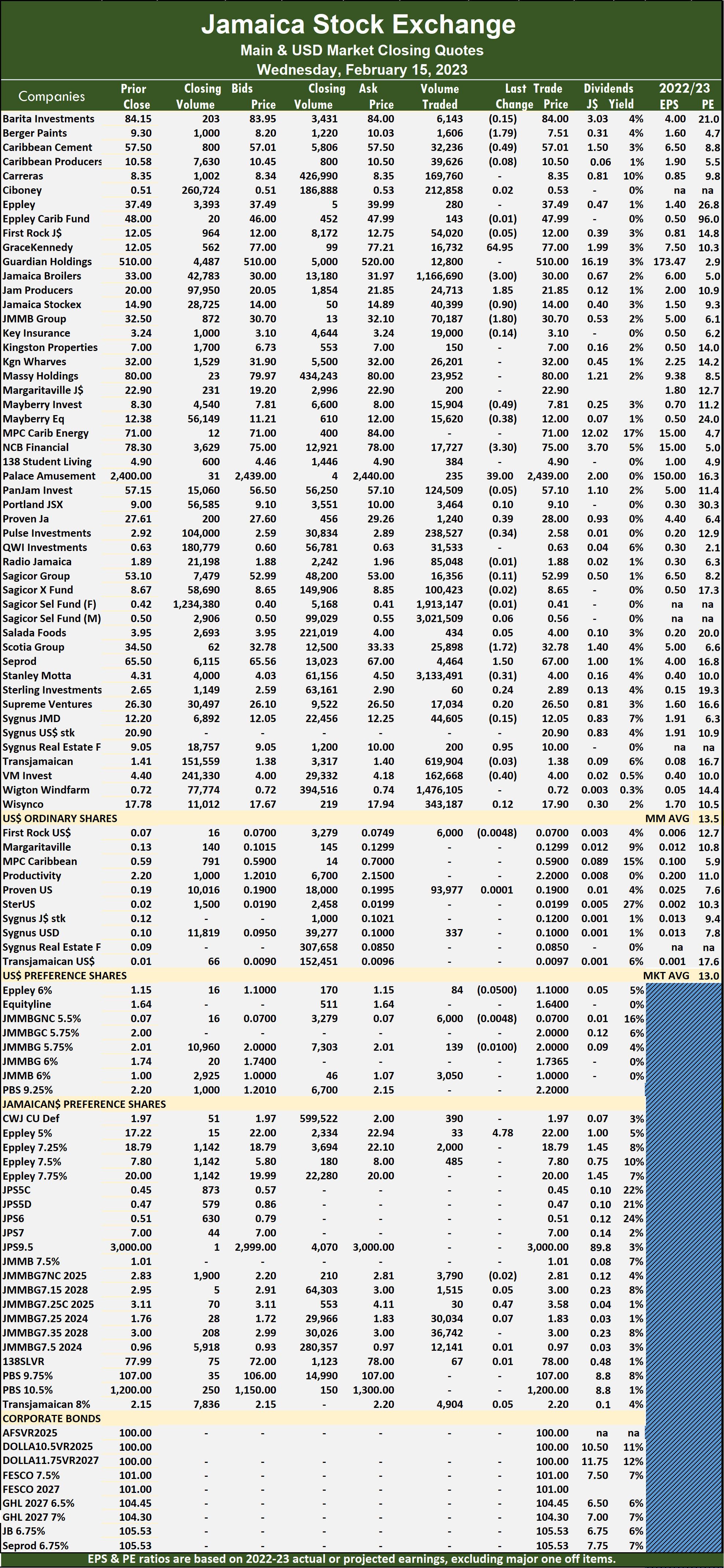

The Jamaica Stock Exchange Main Market closed on Wednesday with a 151 percent rise in the volume of stocks traded, valued 207 percent more than on Tuesday, following trading in 59 securities compared to 53 on Tuesday, and leading to prices of 20 rising, 25 declining and 14 ending unchanged.

A total of 13,423,503 shares were exchanged for $91,730,395 versus 5,344,520 units at $29,834,911 on Tuesday.

A total of 13,423,503 shares were exchanged for $91,730,395 versus 5,344,520 units at $29,834,911 on Tuesday.

Trading averaged 227,517 units at $1,554,752 up from 100,840 shares at $562,923 on Tuesday and month to date, an average of 178,757 units at $2,116,105 compared with 173,546 units at $2,176,105 on the previous day. January closed with an average of 205,236 units at $1,805,558.

Stanley Motta led trading with 3.13 million shares for 23.3 percent of total volume followed by Sagicor Select Manufacturing & Distribution Fund with 3.02 million units for 22.5 percent of the day’s trade, Sagicor Select Financial Fund with 1.91 million units for 14.3 percent market share, Wigton Windfarm with 1.48 million units for 11 percent and Jamaica Broilers with 1.17 million units for 8.7 percent market share.

The All Jamaican Composite Index dived 4,989.03 points to 376,426.75, the JSE Main Index fell 3,607.32 points to 333,129.98 and the JSE Financial Index shed 1.42 points to end at 79.20.

The All Jamaican Composite Index dived 4,989.03 points to 376,426.75, the JSE Main Index fell 3,607.32 points to 333,129.98 and the JSE Financial Index shed 1.42 points to end at 79.20.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows six stocks ending with bids higher than their last selling prices and one stock with a lower offer.

At the close, Berger Paints fell $1.79 in closing at a 52 weeks’ low of $7.51 with 1,606 shares clearing the market, Caribbean Cement dipped 49 cents to t $57.01 with investors transferring 32,236 stock units, Jamaica Broilers declined $3 to $30 after trading 1,166,690 stocks but only after trading at an intraday high of $34.  Jamaica Producers rose $1.85 to end at $21.85 after exchanging 24,713 units, Jamaica Stock Exchange shed 90 cents in ending at $14 with a transfer of 40,399 stocks, JMMB Group fell $1.80 to close at a 52 weeks’ low of $30.70 in switching ownership of 70,187 units. Mayberry Investments lost 49 cents to end at $7.81 with 15,904 stock units changing hands, NCB Financial declined $3.30 to finish at $75 as investors exchanged 17,727 shares, Palace Amusement advanced $39 in closing at $2,439 with the swapping of 235 stock units. Scotia Group fell $1.72 to $32.78 exchanging 25,898 shares, Seprod gained $1.50 to settle at $67 in trading 4,464 stocks, Sygnus Real Estate Finance rallied 95 cents to close at $10 in an exchange of 200 units and Victoria Mutual Investments lost 40 cents to end at $4 in switching ownership of 162,668 units.

Jamaica Producers rose $1.85 to end at $21.85 after exchanging 24,713 units, Jamaica Stock Exchange shed 90 cents in ending at $14 with a transfer of 40,399 stocks, JMMB Group fell $1.80 to close at a 52 weeks’ low of $30.70 in switching ownership of 70,187 units. Mayberry Investments lost 49 cents to end at $7.81 with 15,904 stock units changing hands, NCB Financial declined $3.30 to finish at $75 as investors exchanged 17,727 shares, Palace Amusement advanced $39 in closing at $2,439 with the swapping of 235 stock units. Scotia Group fell $1.72 to $32.78 exchanging 25,898 shares, Seprod gained $1.50 to settle at $67 in trading 4,464 stocks, Sygnus Real Estate Finance rallied 95 cents to close at $10 in an exchange of 200 units and Victoria Mutual Investments lost 40 cents to end at $4 in switching ownership of 162,668 units.

In the preference segment, Eppley 5% preference share popped $4.78 ending at $22 with 33 stock units crossing the market and JMMB Group 7.25% preference share rose 47 cents in closing at $3.58 with an exchange of 30 shares.

In the preference segment, Eppley 5% preference share popped $4.78 ending at $22 with 33 stock units crossing the market and JMMB Group 7.25% preference share rose 47 cents in closing at $3.58 with an exchange of 30 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market stocks gains

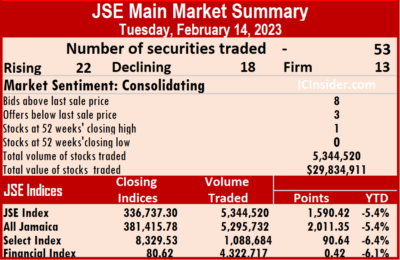

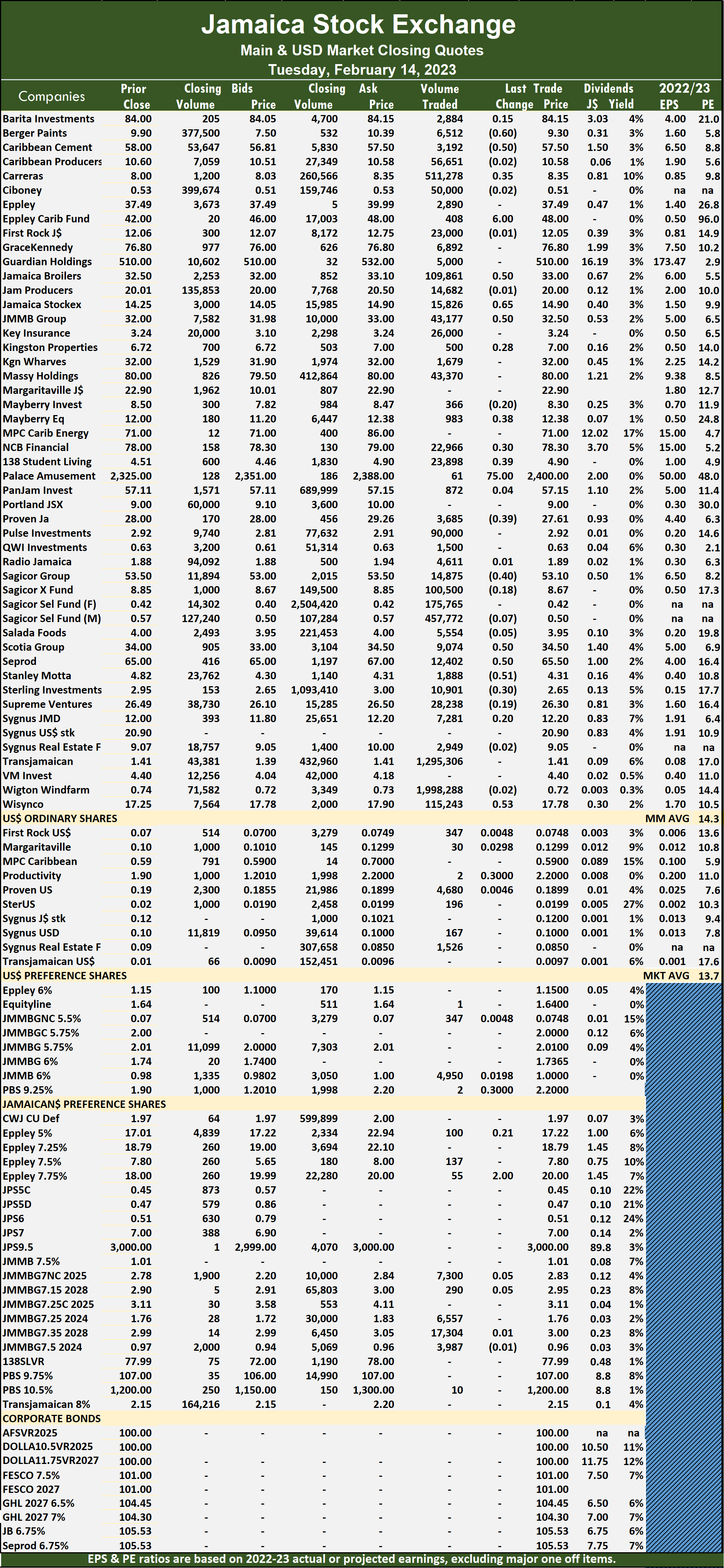

Trading activity on the Jamaica Stock Exchange Main Market ended on Tuesday with a 53 percent fall in the volume of stocks traded with the value ending 88 percent lower than on Monday following trading in 53 securities compared to 57 on Monday, with 22 rising, 18 declining and 13 ending unchanged.

A total of 5,344,520 shares were exchanged for a mere $29,834,911 compared with 11,450,226 units at $243,197,157 on Monday.

A total of 5,344,520 shares were exchanged for a mere $29,834,911 compared with 11,450,226 units at $243,197,157 on Monday.

Trading averaged 100,840 units at $562,923 versus 200,881 shares at $4,266,617 on Monday and month to date, an average of 173,546 units at $2,176,105 compared to 181,268 units at $2,347,445 on the previous day. Trading in January closed with an average of 205,236 units at $1,805,558.

Wigton Windfarm led trading with 2.0 million shares for 37.4 percent of total volume followed by Transjamaican Highway with 1.30 million units for 24.2 percent of the day’s trade and Carreras with 511,278 units for 9.6 percent market share.

The All Jamaican Composite Index advanced 2,011.35 points to 381,415.78, the JSE Main Index rose 1,590.42 points to end at 336,737.30 and the JSE Financial Index gained 0.42 points to close at 80.62.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows eight stocks ending with bids higher than their last selling prices and three with lower offers.

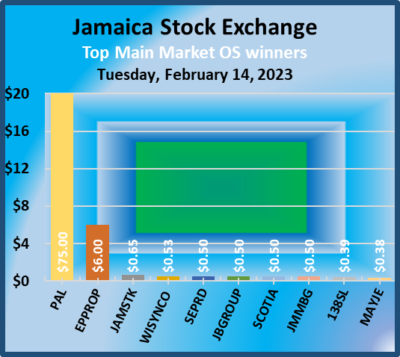

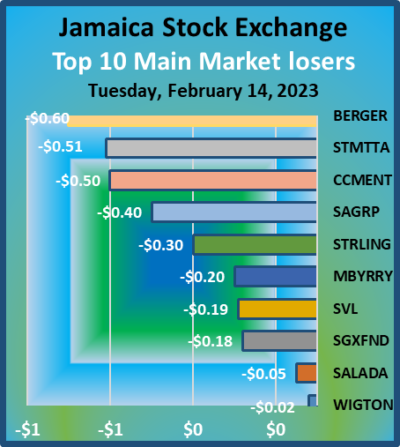

At the close, Berger Paints fell 60 cents to close at $9.30 trading 6,512 shares, Caribbean Cement shed 50 cents to end at $57.50 with a transfer of 3,192 units, Eppley Caribbean Property Fund rallied $6 in closing at $48 after 408 stock units passed through the market. Jamaica Broilers rose 50 cents to close at a 52 weeks’ high of $33 with an exchange of 109,861 stocks, Jamaica Stock Exchange popped 65 cents to finish at $14.90 after trading 15,826 units,  JMMB Group rallied 50 cents to $32.50 with 43,177 shares crossing the exchange. Palace Amusement climbed $75 to $2,400 in transferring 61 stock units, Sagicor Group lost 40 cents to settle at $53.10 after 14,875 stocks changed hands, Scotia Group advanced 50 cents to $34.50 with the swapping of 9,074 shares. Seprod gained 50 cents to close at $65.50 after investors traded 12,402 stocks, Stanley Motta dipped 51 cents to end at $4.31 closed with 1,888 stock units changing hands and Wisynco Group gained 53 cents in closing at $17.78 in switching ownership of 115,243 units.

JMMB Group rallied 50 cents to $32.50 with 43,177 shares crossing the exchange. Palace Amusement climbed $75 to $2,400 in transferring 61 stock units, Sagicor Group lost 40 cents to settle at $53.10 after 14,875 stocks changed hands, Scotia Group advanced 50 cents to $34.50 with the swapping of 9,074 shares. Seprod gained 50 cents to close at $65.50 after investors traded 12,402 stocks, Stanley Motta dipped 51 cents to end at $4.31 closed with 1,888 stock units changing hands and Wisynco Group gained 53 cents in closing at $17.78 in switching ownership of 115,243 units.

In the preference segment, Eppley 7.75% preference share advanced $2 to close at $20 as investors exchanged 55 shares.

In the preference segment, Eppley 7.75% preference share advanced $2 to close at $20 as investors exchanged 55 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market trading rises but prices fall

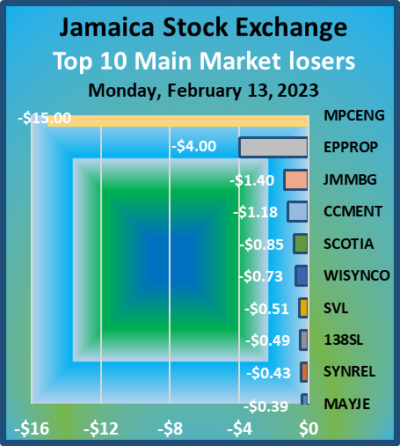

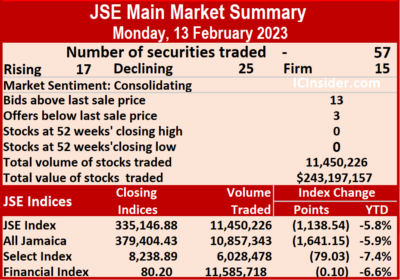

Trading jumped sharply on the Jamaica Stock Exchange Main Market on Monday with a marginal decline in the volume traded with a 164 percent surge in value over Friday, resulting in trading in 57 securities compared to 53on Friday, with 17 rising, 25 declining and 15 ending unchanged.

A total of 11,450,226 shares were traded for $243,197,157 versus 11,840,614 units at $92,145,603 on Friday.

A total of 11,450,226 shares were traded for $243,197,157 versus 11,840,614 units at $92,145,603 on Friday.

Trading averaged 200,881 units at $4,266,617 versus 223,408 shares at $1,738,596 on Friday and month to date, an average of 181,268 units at $2,347,445 compared to 178,739 units at $2,099,950 on the previous day. Trading in January averaged 205,236 units at $1,805,558.

Scotia Group led trading with 4.13 million shares for 36.1 percent of total volume followed by QWI Investments with 1.51 million units for 13.2 percent of the day’s trade, Wigton Windfarm with 1.51 million units for 13.2 percent and Transjamaican Highway with 1.01 million units for 8.8 percent market share.

The All Jamaican Composite Index dropped 1,641.15 points to 379,404.43, the JSE Main Index fell 1,138.54 points to 335,146.88 and the JSE Financial Index shed 0.10 points to close at 80.20.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows 13 stocks ending with bids higher than their last selling prices and three with lower offers.

At the close, Caribbean Cement dropped $1.18 to $58 with a transfer of 63,366 shares, Eppley Caribbean Property Fund declined $4 in closing at $42 as investors traded 1,619 stock units, Guardian Holdings advanced $4.30 in ending at $510 with 40,354 stocks crossing the market. JMMB Group shed $1.40 to close at $32 trading 15,984 units, Mayberry Investments popped 69 cents to end at $8.50 after exchanging 4,120 stocks, MPC Caribbean Clean Energy dropped $15 to finish at $71 with 100 units changing hands.  NCB Financial rose $3 to close at $78 after a transfer of 4,277 shares, 138 Student Living lost 49 cents to settle at $4.51 after 3,019 stock units passed through the market, Palace Amusement climbed $22.90 to $2,325 in switching ownership of 64 units. Proven Investments fell $1.30 in closing at $28 after trading 1,130 stock units, Sagicor Group gained 50 cents to end at $53.50 with investors transferring 1,645 stocks, Scotia Group dipped 85 cents in closing at $34 with an exchange of 4,131,234 shares. Seprod rose $1 to end at $65 with the swapping of 7,501 stock units, Stanley Motta rallied 52 cents to close at $4.82 after an exchange of 4,980 units, Supreme Ventures shed 51 cents in ending at $26.49 in transferring 365,798 stocks. Sygnus Credit Investments USD share gained $1.90 to finish at $20.90 after clearing the market with 12 shares, Sygnus Real Estate Finance lost 43 cents in closing at $9.07 as investors traded 1,000 shares,

NCB Financial rose $3 to close at $78 after a transfer of 4,277 shares, 138 Student Living lost 49 cents to settle at $4.51 after 3,019 stock units passed through the market, Palace Amusement climbed $22.90 to $2,325 in switching ownership of 64 units. Proven Investments fell $1.30 in closing at $28 after trading 1,130 stock units, Sagicor Group gained 50 cents to end at $53.50 with investors transferring 1,645 stocks, Scotia Group dipped 85 cents in closing at $34 with an exchange of 4,131,234 shares. Seprod rose $1 to end at $65 with the swapping of 7,501 stock units, Stanley Motta rallied 52 cents to close at $4.82 after an exchange of 4,980 units, Supreme Ventures shed 51 cents in ending at $26.49 in transferring 365,798 stocks. Sygnus Credit Investments USD share gained $1.90 to finish at $20.90 after clearing the market with 12 shares, Sygnus Real Estate Finance lost 43 cents in closing at $9.07 as investors traded 1,000 shares,  Wisynco Group fell 73 cents to $17.25 with the swapping of 320,246 units.

Wisynco Group fell 73 cents to $17.25 with the swapping of 320,246 units.

In the preference segment, Productive Business 10.50% preference share climbed $84.09 to close at $1,200 after exchanging 176 stocks and Productive Business Solutions 9.75% preference share dropped $13 to end at $107 with a transfer of 10 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

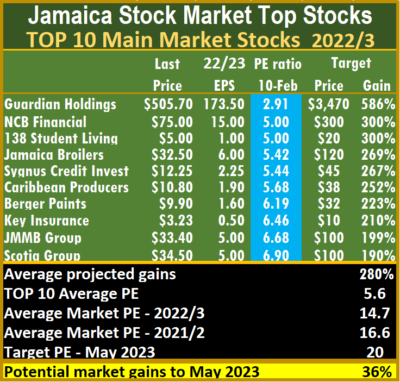

Four new ICTOP10 stocks

ICTOP10 has four new additions this week. The changes followed release of new company results that saw upward and downward movements in earnings per share, while the price of one stock rose to exit the list.

At the end of the week, Paramount Trading jumped 17 percent to $2.58 after the supply of stocks in the market fell sharply during the week as the stock hit a 52 weeks’ intraday high of $2.95 before pulling back by the end of the week and Honey Bun rose 4 percent to $7.35. Lasco Manufacturing fell 8 percent to close at $4.33, General Accident slipped 6 percent to $4.70, Lasco Distributors lost 5 percent to end at $2.60 and Iron Rock Insurance fell 4 percent to $2.39.

At the end of the week, Paramount Trading jumped 17 percent to $2.58 after the supply of stocks in the market fell sharply during the week as the stock hit a 52 weeks’ intraday high of $2.95 before pulling back by the end of the week and Honey Bun rose 4 percent to $7.35. Lasco Manufacturing fell 8 percent to close at $4.33, General Accident slipped 6 percent to $4.70, Lasco Distributors lost 5 percent to end at $2.60 and Iron Rock Insurance fell 4 percent to $2.39.

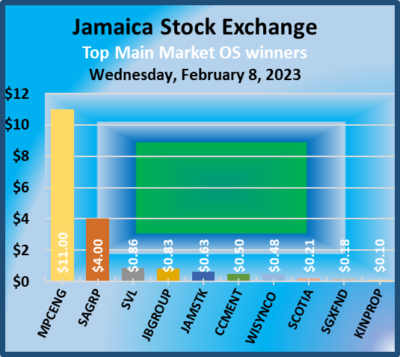

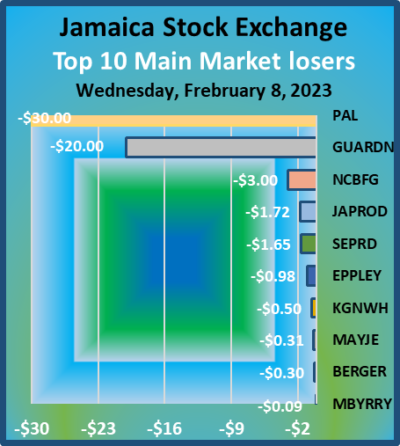

Stocks rising in the Main Market TOP10 were hard to come by as losers outgunned winners. Jamaica Broilers jumped 8 percent to close at 52 weeks’ high of $32.50, but 138 Student Living dropped 10 percent to $5.00, as investors reacted negatively to a board decision to raise added capital by issuing more shares to the public. Radio Jamaica fell 7 percent to $1.90 after reporting poor results to December, while Caribbean Producers and Sygnus Investments fell 6 percent to $10.80 and $12.25, respectively, followed by a 5 percent decline for Guardian Holdings to close at $505.70.

Tropical Battery returns to ICTOP10 after a one week absence, Main Event posted better than expected full year results and moved into the TOP10 with projected earnings of $1.45 for the 2023 fiscal year and One on One Education moved into the TOP10, while Lasco Manufacturing moved out followed by Lasco Financial and Paramount Trading. In the Main Market, Radio Jamaica slipped out of the TOP10 and Scotia Group reentered after a brief respite.

Tropical Battery returns to ICTOP10 after a one week absence, Main Event posted better than expected full year results and moved into the TOP10 with projected earnings of $1.45 for the 2023 fiscal year and One on One Education moved into the TOP10, while Lasco Manufacturing moved out followed by Lasco Financial and Paramount Trading. In the Main Market, Radio Jamaica slipped out of the TOP10 and Scotia Group reentered after a brief respite.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.6, well below the market average of 14.7, while the Junior Market Top 10 PE sits at 6.6 compared with the market at 12.3, important indicators of the level of the undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 207 percent and the Main Market TOP10, an average of 280 percent, to May this year. The primary concern for the Main Market achieving such gains by May is that the list is dominated by financial companies that are out of favour and may need to see the summer months before the total interest of investor start to show.

The Junior Market has 15 stocks representing 31 percent of the market, with PEs from 15 to 30, averaging 20 compared with the above average of the market. The top half of the market has an average PE of 18. The above average shows the extent of potential gains for the TOP 10 stocks.

The situation in the Main Market is similar, with the 18 highest valued stocks priced at a PE of 15 to 90, with an average of 27 and 22 excluding the highest valued stocks and 27 for the top half excluding the highest valued stocks.

The situation in the Main Market is similar, with the 18 highest valued stocks priced at a PE of 15 to 90, with an average of 27 and 22 excluding the highest valued stocks and 27 for the top half excluding the highest valued stocks.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Trading drops on JSE Main Market

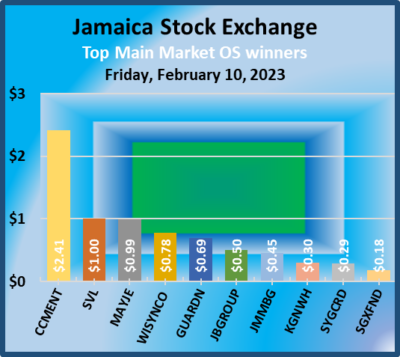

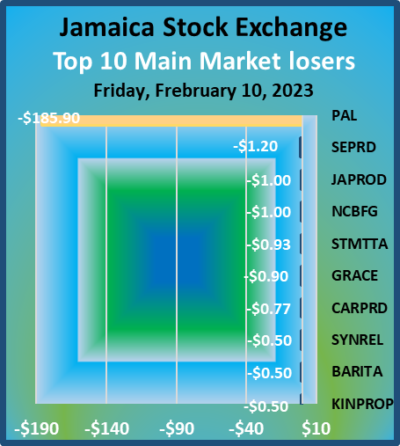

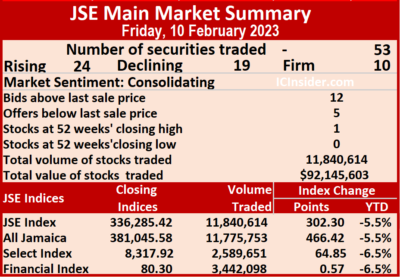

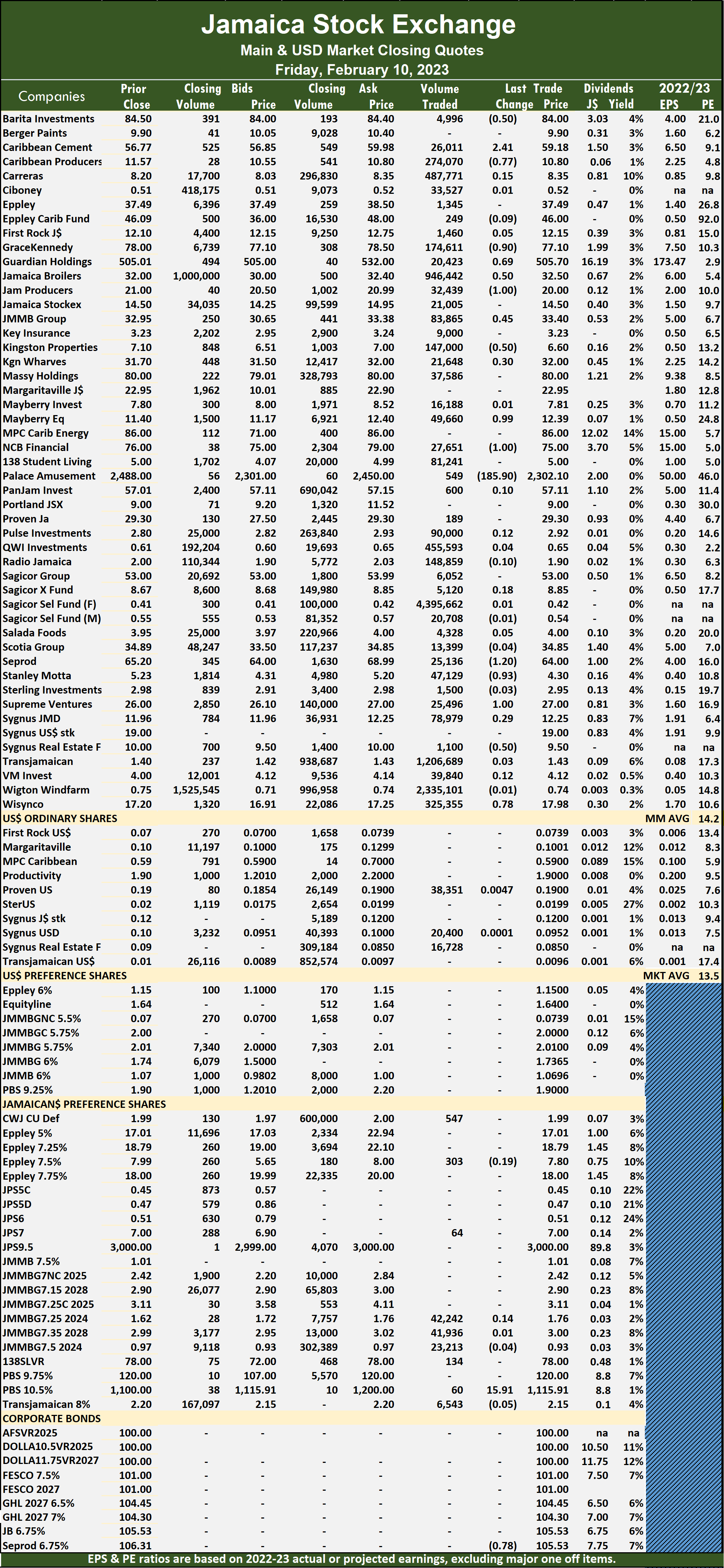

Trading dropped on the Jamaica Stock Exchange Main Market on Friday with a 30 percent drop in the volume of stocks traded at a 77 percent lower value than on Thursday, after trading in 53 securities up from 51 on Thursday, resulting in prices of stocks 24 rising, 19 declining and 10 ending unchanged.

A total of 11,840,614 shares were traded for $92,145,603 compared to 16,899,213 units at $398,378,363 on Thursday.

A total of 11,840,614 shares were traded for $92,145,603 compared to 16,899,213 units at $398,378,363 on Thursday.

Trading averaged 223,408 shares at $1,738,596 compared to 331,357 shares at $7,811,340 on Thursday and month to date, an average of 178,739 stock units at $2,099,950 compared with 172,653 stocks at $2,149,183 on the previous day. January closed with an average of 205,236 units at $1,805,558.

Sagicor Select Financial Fund led trading with 4.40 million shares for 37.1 percent of total volume followed by Wigton Windfarm with 2.34 million units for 19.7 percent of the day’s trade and Transjamaican Highway with 1.21 million units for 10.2 percent market share.

The All Jamaican Composite Index advanced 466.42 points to 381,045.58, the JSE Main Index rose 302.30 points to close at 336,285.42 and the JSE Financial Index rallied 0.57 points to settle at 80.30.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded price and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded price and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows 12 stocks ending with bids higher than their last selling prices and five with lower offers.

At the close, Barita Investments lost 50 cents in closing at $84 in trading 4,996 shares, Caribbean Cement advanced $2.41 to $59.18 with a transfer of 26,011 units, Caribbean Producers dipped 77 cents to $10.80 with 274,070 stock units changing hands after trading at an intraday 52 weeks’ low of $10.19 following the release of half year results showing reduced profit in the December quarter compared with that of 2021. GraceKennedy shed 90 cents to end at $77.10 after an exchange of 174,611 stocks, Guardian Holdings rallied 69 cents to close at $505.70 with the swapping of 20,423 shares,  Jamaica Broilers gained 50 cents in closing at a 52 weeks’ high of $32.50 after 946,442 stocks passed through the market. Jamaica Producers fell $1 in ending at $20 after trading 32,439 stock units, JMMB Group popped 45 cents to close at $33.40 with investors transferring 83,865 units, Kingston Properties shed 50 cents to finish at $6.60 in an exchange of 147,000 units. Mayberry Jamaican Equities rose 99 cents to end at $12.39 in switching ownership of 49,660 stocks, NCB Financial declined $1 in closing at $75 with the swapping of 27,651 stock units, Palace Amusement dropped $185.90 to close at $2,302.10 while trading 549 shares. Seprod dipped $1.20 to end at $64 with an exchange of 25,136 units, Stanley Motta fell 93 cents to settle at $4.30 with 47,129 shares changing hands, Supreme Ventures rose $1 to $27 in an exchange of 25,496 stock units.

Jamaica Broilers gained 50 cents in closing at a 52 weeks’ high of $32.50 after 946,442 stocks passed through the market. Jamaica Producers fell $1 in ending at $20 after trading 32,439 stock units, JMMB Group popped 45 cents to close at $33.40 with investors transferring 83,865 units, Kingston Properties shed 50 cents to finish at $6.60 in an exchange of 147,000 units. Mayberry Jamaican Equities rose 99 cents to end at $12.39 in switching ownership of 49,660 stocks, NCB Financial declined $1 in closing at $75 with the swapping of 27,651 stock units, Palace Amusement dropped $185.90 to close at $2,302.10 while trading 549 shares. Seprod dipped $1.20 to end at $64 with an exchange of 25,136 units, Stanley Motta fell 93 cents to settle at $4.30 with 47,129 shares changing hands, Supreme Ventures rose $1 to $27 in an exchange of 25,496 stock units.  Sygnus Real Estate Finance shed 50 cents to end at $9.50 after 1,100 stocks cleared the market and Wisynco Group popped 78 cents in closing at $17.98 in a transfer of 325,355 units.

Sygnus Real Estate Finance shed 50 cents to end at $9.50 after 1,100 stocks cleared the market and Wisynco Group popped 78 cents in closing at $17.98 in a transfer of 325,355 units.

In the preference segment, Productive Business 10.50% preference share advanced $15.91 to end at $1,115.91 trading 60 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading picks for JSE Main Market

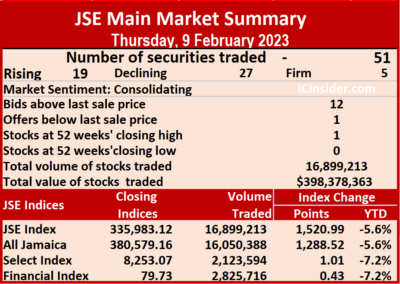

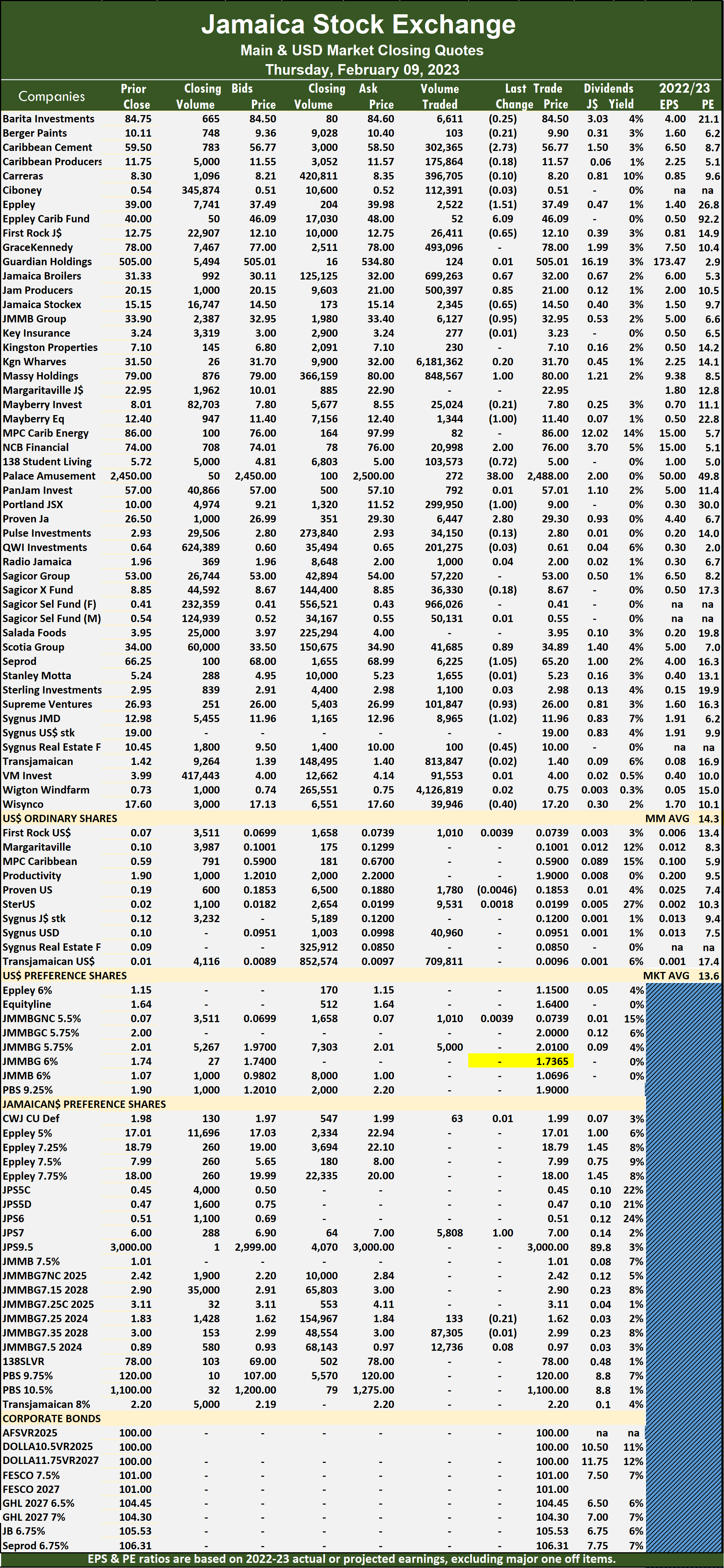

Trading jumped sharply on the Jamaica Stock Exchange Main Market on Thursday with the volume of stocks traded jumping 78 percent with the value surging 323 percent above Wednesday’s level, after an exchange of 51 securities compared to 52 on the previous day, with 19 rising, 27 declining and five ending unchanged.

A total of 16,899,213 shares were exchanged for $398,378,363 versus 9,512,250 units at $94,127,743 on Wednesday.

A total of 16,899,213 shares were exchanged for $398,378,363 versus 9,512,250 units at $94,127,743 on Wednesday.

Trading averaged 331,357 units at $7,811,340 compared with 182,928 shares at $1,810,149 on Wednesday and month to date, an average of 172,653 units at $2,149,183 compared with 148,706 units at $1,294,834 on the previous day. January closed with an average of 205,236 units at $1,805,558.

Kingston Wharves led trading with 6.18 million shares for 36.6 percent of total volume followed by Wigton Windfarm with 4.13 million units for 24.4 percent of the day’s trade and Sagicor Select Financial Fund with 966,026 units for 5.7 percent market share.

The All Jamaican Composite Index advanced 1,288.52 points to 380,579.16, the JSE Main Index rose 1,520.99 points to 335,983.12 and the JSE Financial Index gained 0.43 points to end at 79.73.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.3 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.3 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows 12 stocks ending with bids higher than their last selling prices and one stock with a lower offer.

At the close, Caribbean Cement declined $2.73 in closing at $56.77 with an exchange of 302,365 shares, Eppley fell $1.51 to end at $37.49 after 2,522 stock units were traded, Eppley Caribbean Property Fund advanced $6.09 to finish at $46.09 with 52 stocks crossing the market. First Rock Real Estate shed 65 cents to settle at $12.10 in transferring 26,411 units, Jamaica Broilers rose 67 cents to close at $32 with 699,263 stocks clearing the market, Jamaica Producers popped 85 cents to close at $21 with the swapping of 500,397 stock units.  Jamaica Stock Exchange shed 65 cents to end at $14.50 in exchanging 2,345 units, JMMB Group fell 95 cents to $32.95 in switching ownership of 6,127 shares, Massy Holdings gained $1 to close at $80 as investors traded 848,567 shares. Mayberry Jamaican Equities lost $1 in ending at $11.40 with the swapping of 1,344 stock units, NCB Financial popped $2 to finish at $76 in an exchange of 20,998 units, 138 Student Living lost 72 cents to end at $5 in switching ownership of 103,573 stocks. Palace Amusement climbed $38 in closing at $2,488 after 272 shares passed through the market, Portland JSX shed $1 after ending at $9 as investors traded 299,950 stock units, Proven Investments advanced $2.80 to $29.30 in trading 6,447 stocks. Scotia Group rose 89 cents to $34.89 with an exchange of 41,685 units, Seprod fell $1.05 to end at $65.20 with investors transferring 6,225 shares, Supreme Ventures declined 93 cents in closing at $26 with the swapping of 101,847 units. Sygnus Credit Investments dipped $1.02 to t $11.96 after an exchange of 8,965 stocks,

Jamaica Stock Exchange shed 65 cents to end at $14.50 in exchanging 2,345 units, JMMB Group fell 95 cents to $32.95 in switching ownership of 6,127 shares, Massy Holdings gained $1 to close at $80 as investors traded 848,567 shares. Mayberry Jamaican Equities lost $1 in ending at $11.40 with the swapping of 1,344 stock units, NCB Financial popped $2 to finish at $76 in an exchange of 20,998 units, 138 Student Living lost 72 cents to end at $5 in switching ownership of 103,573 stocks. Palace Amusement climbed $38 in closing at $2,488 after 272 shares passed through the market, Portland JSX shed $1 after ending at $9 as investors traded 299,950 stock units, Proven Investments advanced $2.80 to $29.30 in trading 6,447 stocks. Scotia Group rose 89 cents to $34.89 with an exchange of 41,685 units, Seprod fell $1.05 to end at $65.20 with investors transferring 6,225 shares, Supreme Ventures declined 93 cents in closing at $26 with the swapping of 101,847 units. Sygnus Credit Investments dipped $1.02 to t $11.96 after an exchange of 8,965 stocks,  Sygnus Real Estate Finance shed 45 cents in ending at $10 with a transfer of 100 stock units and Wisynco Group dipped 40 cents to close at $17.20 as investors switched ownership of 39,946 stock units.

Sygnus Real Estate Finance shed 45 cents in ending at $10 with a transfer of 100 stock units and Wisynco Group dipped 40 cents to close at $17.20 as investors switched ownership of 39,946 stock units.

In the preference segment, Jamaica Public Service 7% advanced $1 in closing at a 52 weeks’ high of $7 after a transfer of 5,808 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

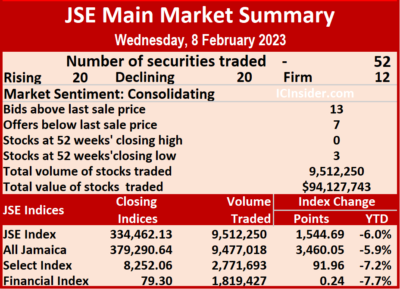

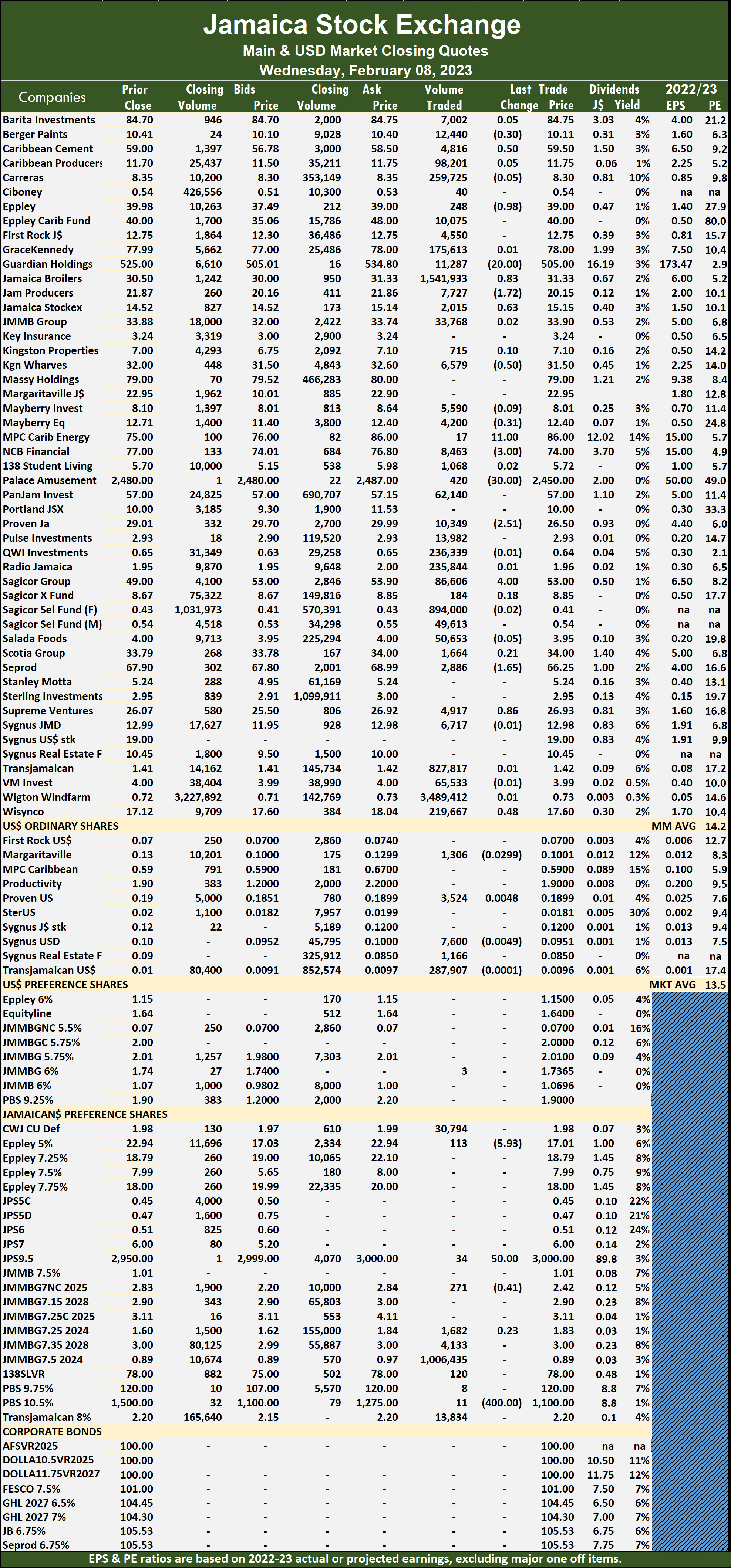

JSE Main Market falls

Trading ended on the Jamaica Stock Exchange Main Market on Wednesday with a 20 percent rise in the volume of stocks traded as the value dipped 7 percent below that on Tuesday, resulting from 52 securities trading, down from 57 on Tuesday with prices of 20 rising, 20 declining and 12 ending unchanged.

A total of 9,512,250 shares were exchanged for $94,127,743 versus 7,945,794 units at $100,709,129 on Tuesday.

A total of 9,512,250 shares were exchanged for $94,127,743 versus 7,945,794 units at $100,709,129 on Tuesday.

Trading averaged 182,928 units at $1,810,149 compared with 139,400 shares at $1,766,827 on Tuesday and month to date an average of 148,706 units at $1,294,834 compared to 142,484 units at $1,201,140 on the previous day. January closed with an average of 205,236 units at $1,805,558.

Wigton Windfarm led trading with 3.49 million shares for 36.7 percent of total volume followed by Jamaica Broilers with 1.54 million units for 16.2 percent of the day’s trade and JMMB Group 7.5% with 1.01 million units for 10.6 percent market share.

The All Jamaican Composite Index rallied 3,460.05 points to 379,290.64, the JSE Main Index advanced 1,544.69 points to 334,462.13 and the JSE Financial Index popped 0.24 points to end at 79.30.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows 13 stocks ending with bids higher than their last selling prices and 7 with lower offers.

At the close, Caribbean Cement popped 50 cents to close at $59.50 after 4,816 shares passed through the market, Eppley fell 98 cents to $39 in an exchange of 248 stocks, Guardian Holdings dropped $20 to $505 with a transfer of 11,287 units. Jamaica Broilers gained 83 cents to close at $31.33 with the swapping of 1,541,933 stock units, Jamaica Producers dipped $1.72 to $20.15 after trading 7,727 units, Jamaica Stock Exchange rose 63 cents to close at $15.15 in switching ownership of 2,015 shares. Kingston Wharves shed 50 cents to finish at $31.50 with an exchange of 6,579 stock units, MPC Caribbean Clean Energy rose $11 to $86 with 17 stocks changing hands,  NCB Financial declined $3 to a 52 weeks’ low of $74 with 8,463 stock units clearing the market. Palace Amusement dropped $30 to close at $2,450 in trading 420 stocks, Proven Investments declined $2.51 to close at $26.50 with the swapping of 10,349 units, Sagicor Group rallied $4 to $53 with investors transferring 86,606 shares. Seprod fell $1.65 to end at $66.25 with a transfer of 2,886 units, Supreme Ventures rose 86 cents in closing at $26.93 after exchanging 4,917 stock units and Wisynco Group gained 48 cents in ending at $17.60 after a transfer of 219,667 shares.

NCB Financial declined $3 to a 52 weeks’ low of $74 with 8,463 stock units clearing the market. Palace Amusement dropped $30 to close at $2,450 in trading 420 stocks, Proven Investments declined $2.51 to close at $26.50 with the swapping of 10,349 units, Sagicor Group rallied $4 to $53 with investors transferring 86,606 shares. Seprod fell $1.65 to end at $66.25 with a transfer of 2,886 units, Supreme Ventures rose 86 cents in closing at $26.93 after exchanging 4,917 stock units and Wisynco Group gained 48 cents in ending at $17.60 after a transfer of 219,667 shares.

In the preference segment, Productive Business 10.50% preference share dived $400 in closing at $1,100 with the swapping of 11 stocks,  Eppley 5% preference share declined $5.93 in ending at $17.01 and trading 113 shares, Jamaica Public Service 9.5% climbed $50 to settle at $3,000 as investors exchanged 34 units and JMMB Group 7% preference share shed 41 cents to close at $2.42 in an exchange of 271 stocks.

Eppley 5% preference share declined $5.93 in ending at $17.01 and trading 113 shares, Jamaica Public Service 9.5% climbed $50 to settle at $3,000 as investors exchanged 34 units and JMMB Group 7% preference share shed 41 cents to close at $2.42 in an exchange of 271 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbs on JSE Main Market

Investors pumped 211 percent more money into the Jamaica Stock Exchange Main Market on Tuesday and purchased16 percent fewer shares than on Monday and sending more stocks closing higher than those falling with57securities trading, as was the case on Monday, and ended with prices of 27 rising, 21 declining and nine ending unchanged.

A total of 7,945,794 shares were exchanged for $100,709,129 compared to 9,434,901 units at $32,400,825 on Monday.

A total of 7,945,794 shares were exchanged for $100,709,129 compared to 9,434,901 units at $32,400,825 on Monday.

Trading averaged 139,400 units at $1,766,827 versus 165,525 shares at $568,436 on Monday and month to date, an average of 142,484 units at $1,201,140 compared with 143,252 units at $1,060,336 on the previous day. January closed with an average of 205,236 units at $1,805,558.

JMMB Group 7.35% – 2028, led trading with 2.23 million shares for 28.1 percent of total volume, followed by Wigton Windfarm with 1.57 million units for 19.8 percent of the day’s trade and Jamaica Broilers with 855,784 units for 10.8 percent market share.

The All Jamaican Composite Index declined 2,558.42 points to 375,830.59, the JSE Main Index fell 2,316.43 points to 332,917.44 and the JSE Financial Index shed 0.64 points to close at 79.06.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows seven stocks ending with bids higher than their last selling prices and four with lower offers.

At the close, Berger Paints rose $1.06 to $10.41 in an exchange of 1,687 shares, Caribbean Cement advanced $2.23 to $59 in trading 1,133 stocks, Eppley Caribbean Property Fund fell $4 in closing at $40 after 4,657 units crossed the market. First Rock Real Estate gained 60 cents in ending at $12.75 in transferring 1,620 stock units, GraceKennedy rose 89 cents to end at $77.99 in switching ownership of 479,100 stocks, Guardian Holdings declined $9.80 to close at $525 with an exchange of 2,389 units. Jamaica Broilers popped 50 cents to finish at $30.50 in switching ownership of 855,784 stock units, Jamaica Producers rallied $1.87 to close at $21.87 after a transfer of 138 shares, JMMB Group advanced $2.38 in ending at $33.88 with 8,657 stock units changing hands. Kingston Wharves dipped $1 in closing at $32 after 3,129 shares passed through the market, Mayberry Investments lost 40 cents to end at $8.10 after exchanging 39,563 stocks, MPC Caribbean Clean Energy dropped $23 to end at $75 with a transfer of 75 units. NCB Financial rallied $2 in closing at $77 as investors exchanged 23,990 shares after the price hit a new one year low of $72, 138 Student Living gained 55 cents to settle at $5.70 with the swapping of 1,123 stocks, Palace Amusement popped $31 to close at $2,480 with 409 stock units changing hands. Portland JSX shed $1.54 to settle at $10 with 512 units clearing the market, Proven Investments lost 49 cents in ending at $29.01 with investors transferring 3,048 units, Sagicor Group fell $1.96 to end at $49, trading 73,873 shares. Scotia Group rose 69 cents to close at $33.79 in exchanging 191,619 stocks, Seprod advanced $2.40 to $67.90 after trading 100 stock units, Supreme Ventures lost 43 cents to close at $26.07 in switching ownership of 38,042 shares and Sygnus Credit Investments rose $1.10 to $12.99 with the swapping of 33,048 stock units.

Kingston Wharves dipped $1 in closing at $32 after 3,129 shares passed through the market, Mayberry Investments lost 40 cents to end at $8.10 after exchanging 39,563 stocks, MPC Caribbean Clean Energy dropped $23 to end at $75 with a transfer of 75 units. NCB Financial rallied $2 in closing at $77 as investors exchanged 23,990 shares after the price hit a new one year low of $72, 138 Student Living gained 55 cents to settle at $5.70 with the swapping of 1,123 stocks, Palace Amusement popped $31 to close at $2,480 with 409 stock units changing hands. Portland JSX shed $1.54 to settle at $10 with 512 units clearing the market, Proven Investments lost 49 cents in ending at $29.01 with investors transferring 3,048 units, Sagicor Group fell $1.96 to end at $49, trading 73,873 shares. Scotia Group rose 69 cents to close at $33.79 in exchanging 191,619 stocks, Seprod advanced $2.40 to $67.90 after trading 100 stock units, Supreme Ventures lost 43 cents to close at $26.07 in switching ownership of 38,042 shares and Sygnus Credit Investments rose $1.10 to $12.99 with the swapping of 33,048 stock units.

In the preference segment, JMMB Group 7% preference share gained 42 cents in closing at $2.83 with a transfer of 3,904 stocks and 138 Student Living preference share advanced $2.50 to close at a record high of $78 in trading 1,024 units.

In the preference segment, JMMB Group 7% preference share gained 42 cents in closing at $2.83 with a transfer of 3,904 stocks and 138 Student Living preference share advanced $2.50 to close at a record high of $78 in trading 1,024 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 36

- 37

- 38

- 39

- 40

- …

- 164

- Next Page »