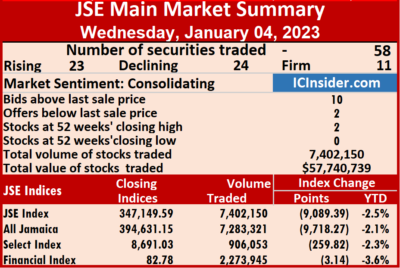

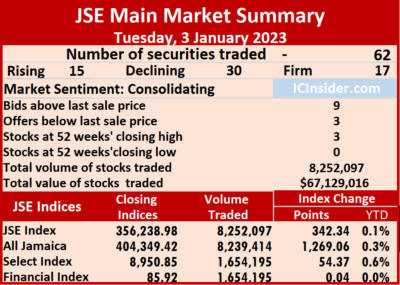

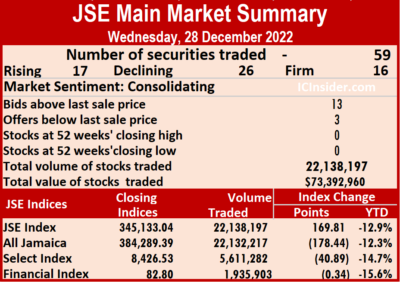

Stock rising and falling was almost evenly matched at the close of market activity on the Main Market of the Jamaica Stock Exchange on Wednesday, following a 10 percent slide in the volume of stocks traded with a 14 percent lower value than on Tuesday and a significant fall in the market index, with 58 securities trading compared to 62 on Tuesday, with 23 rising, 24 declining and 11 ending unchanged.

The All Jamaican Composite Index lost 9,718.27 points to settle at 394,631.15, the JSE Main Index fell 9,089.39 points to settle at 347,149.59 and the JSE Financial Index lost 3.14 points to settle at 82.78.

The All Jamaican Composite Index lost 9,718.27 points to settle at 394,631.15, the JSE Main Index fell 9,089.39 points to settle at 347,149.59 and the JSE Financial Index lost 3.14 points to settle at 82.78.

A total of 7,402,150 shares were exchanged for $57,740,739 versus 8,252,097 units at $67,129,016 on Tuesday. Trading averages 127,623 units at $995,530 versus 133,098 shares at $1,082,726 on Tuesday and month to date, an average of 130,452 units at $1,040,581. December closed with an average of 604,110 units at $4,072,598.

Sagicor Select Financial Fund led trading with 2.53 million shares for 34.2 percent of total volume followed by Wigton Windfarm with 1.31 million units for 17.7 percent of the day’s trade and Transjamaican Highway with 948,703 units for 12.8 percent market share.

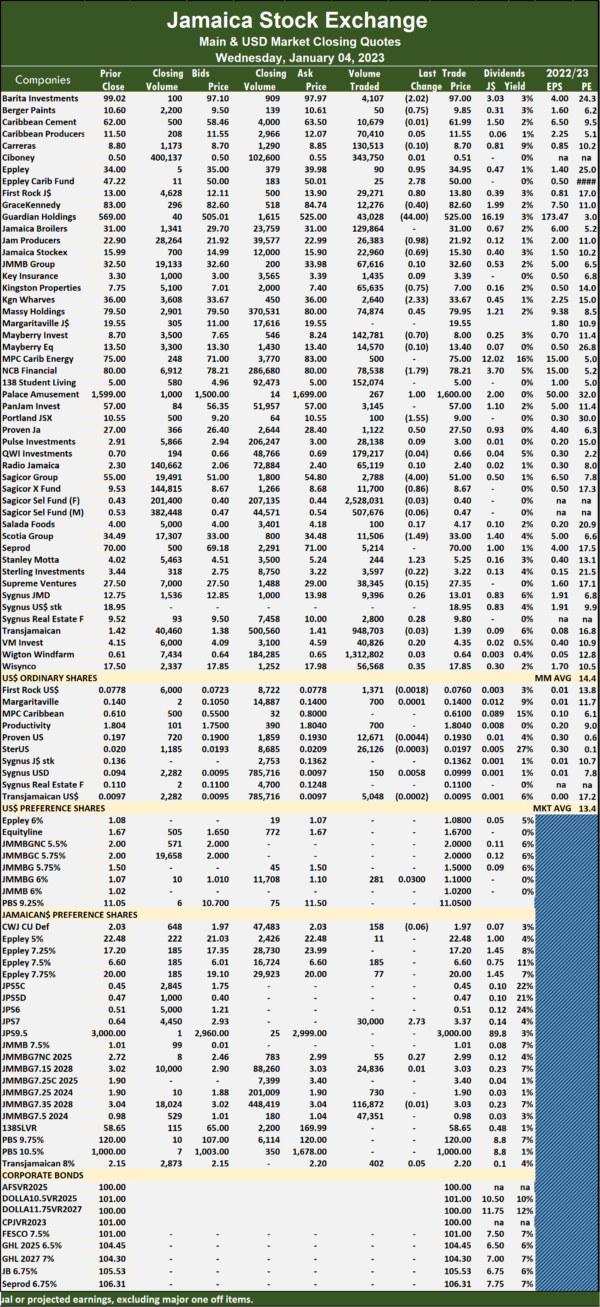

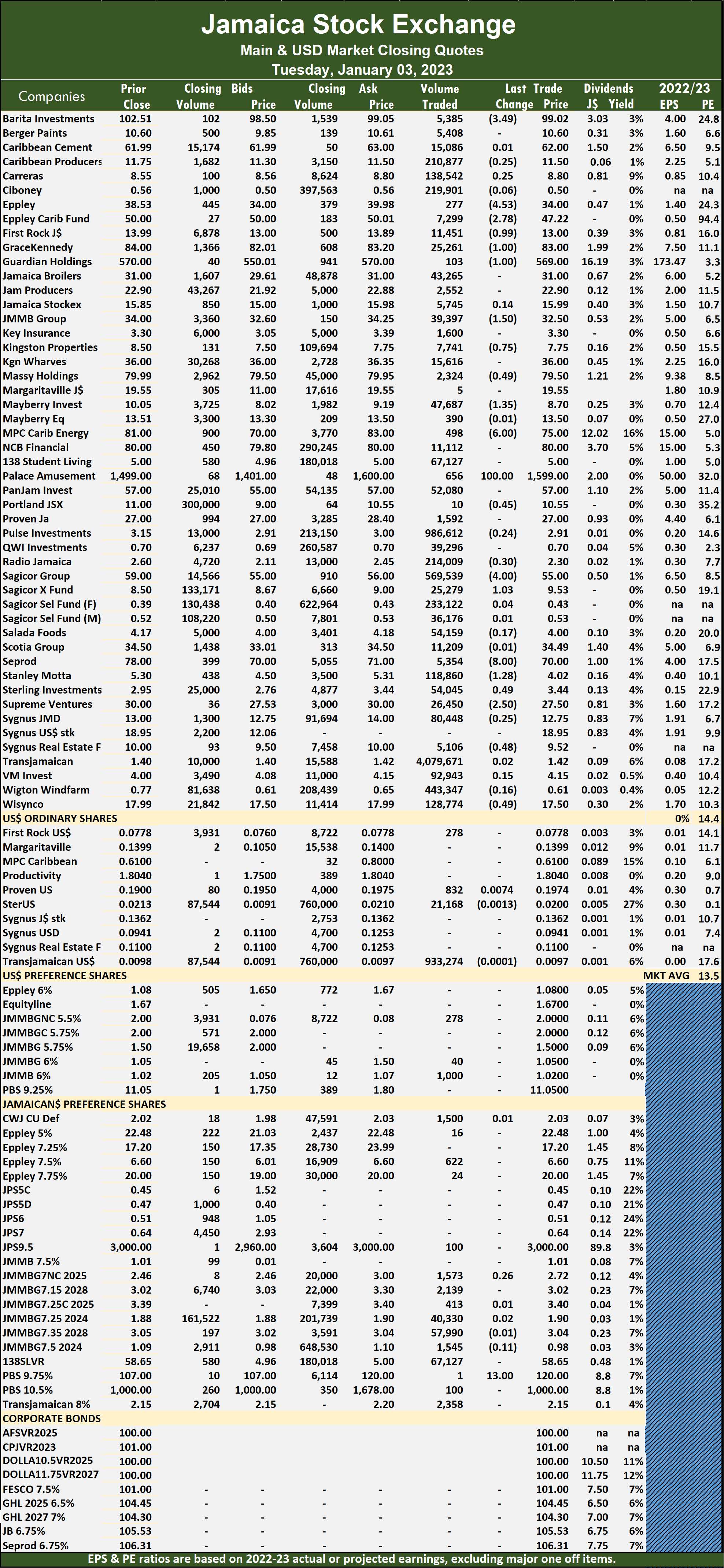

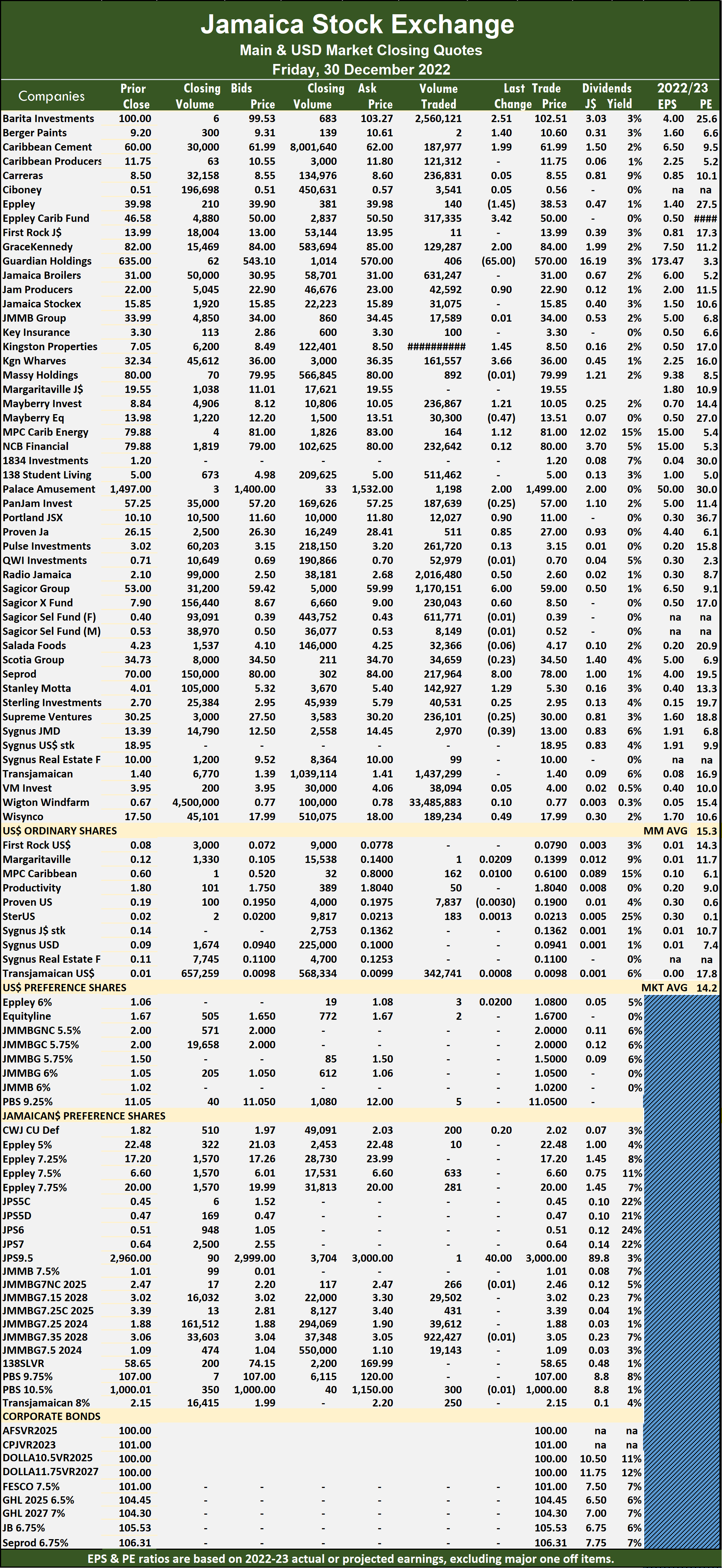

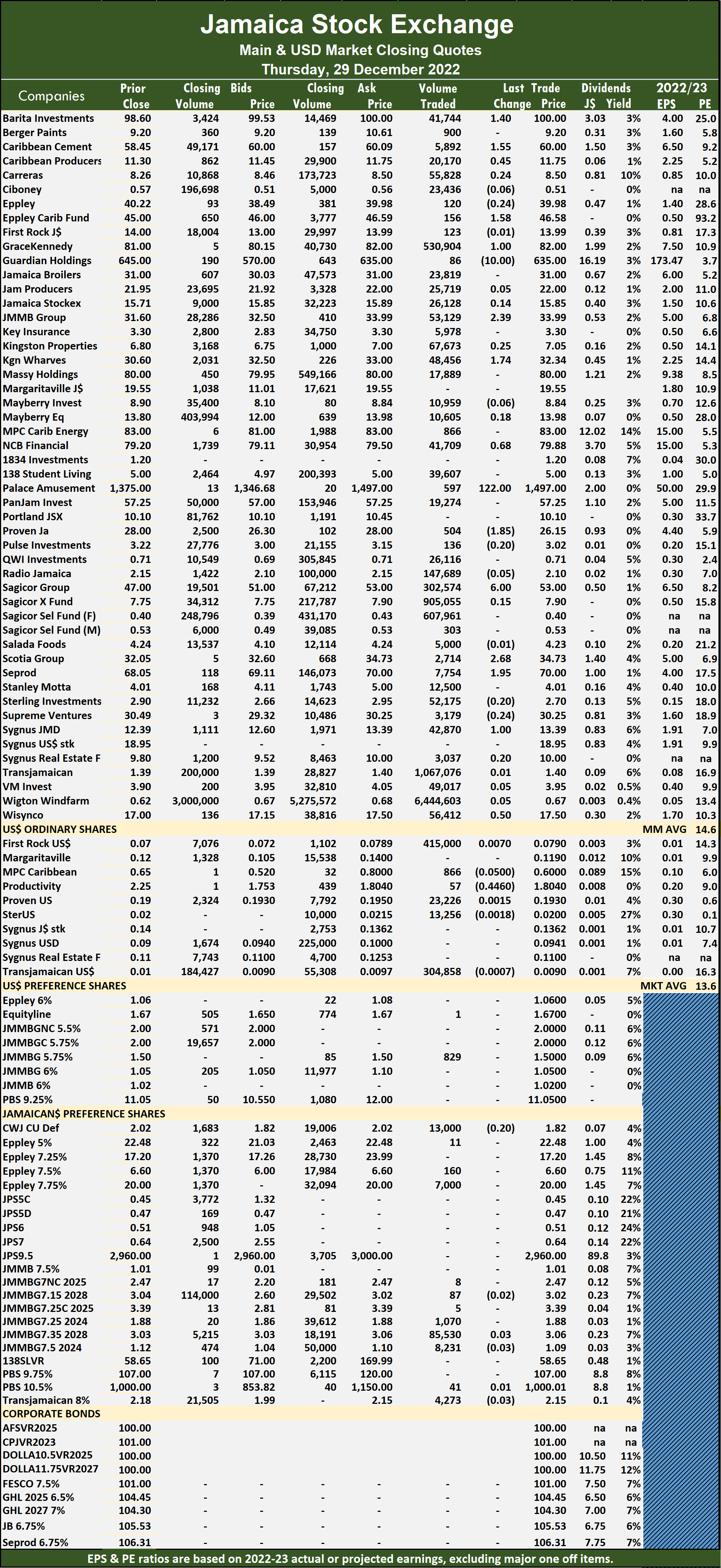

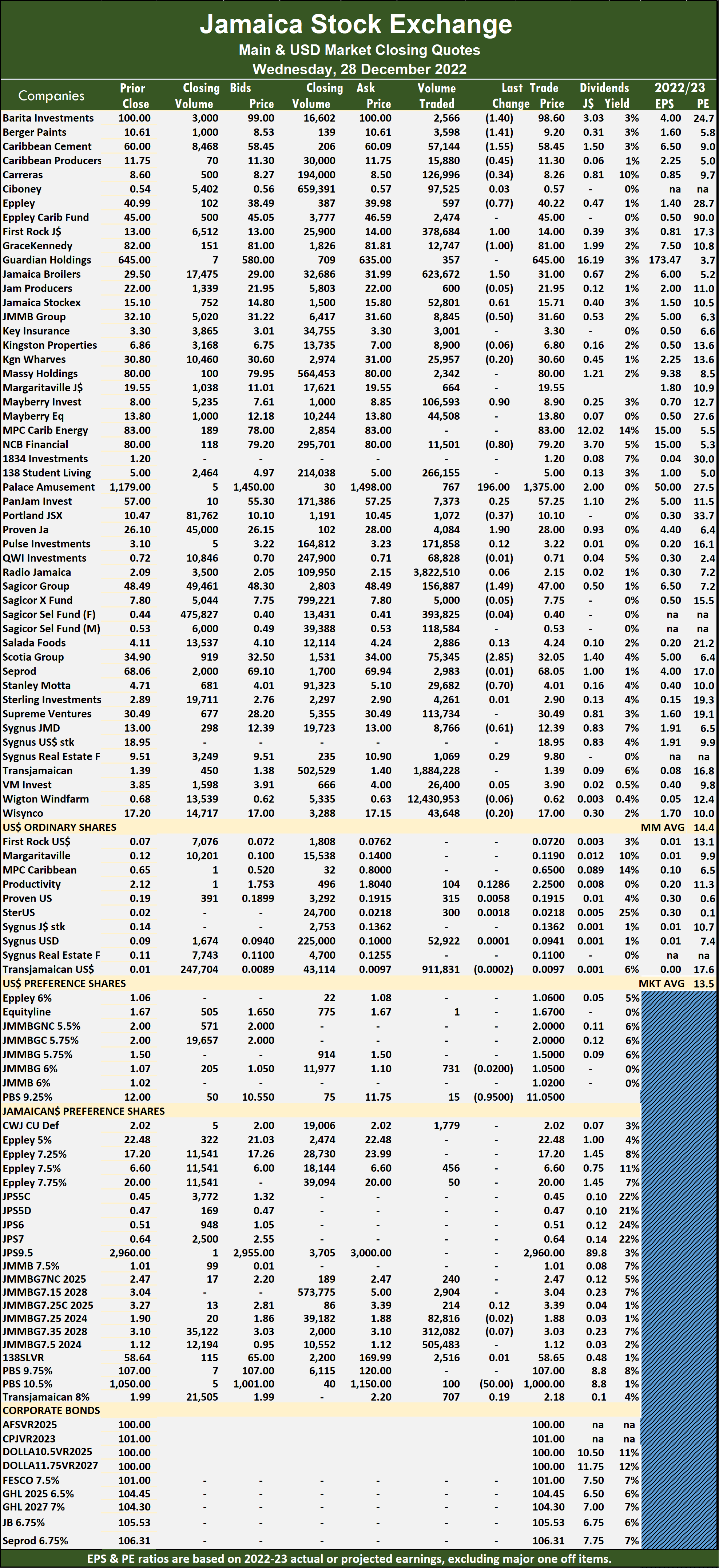

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and two with lower offers.

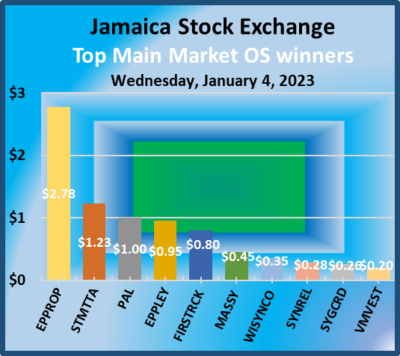

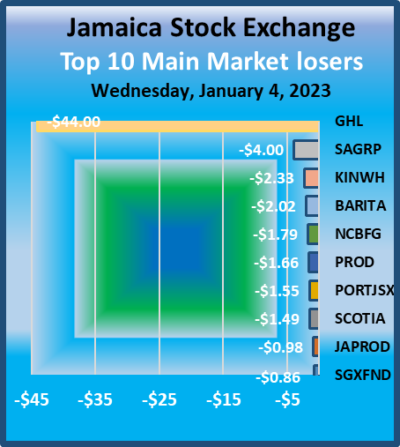

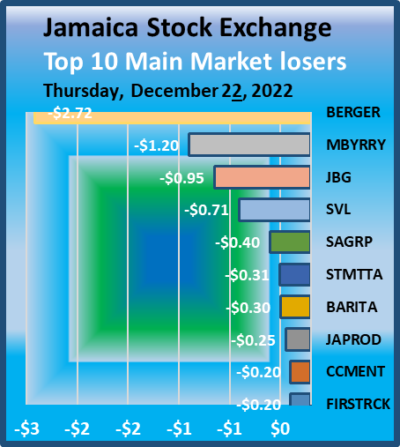

At the close, Barita Investments shed $2.02 in closing at $97 with an exchange of 4,107 shares, Berger Paints lost 75 cents to end at $9.85 in trading 50 stock units, Eppley rose 95 cents to $34.95, with 90 stocks crossing the market. Eppley Caribbean Property Fund advanced $2.78 to close at $50 while exchanging 25 units, First Rock Real Estate rallied 80 cents in ending at $13.80 in an exchange of 29,271 shares, GraceKennedy dipped 40 cents to $82.60 with a transfer of 12,276 stock units. Guardian Holdings fell $44 to $525 and finished with 43,028 stocks changing hands, Jamaica  Stock Exchange declined 69 cents to end at $15.30 after exchanging 22,960 units, Kingston Properties dropped 75 cents to close at $7, with 65,635 stock units clearing the market. Kingston Wharves dropped $2.33 in closing at $33.67, with 2,640 shares changing hands, Massy Holdings climbed 45 cents to $79.95 as 74,874 units were traded, Mayberry Investments fell 70 cents to end at $8 closing with 142,781 stocks passing through the market. NCB Financial lost $1.79 in closing at $78.21, with 78,538 units crossing the market, Palace Amusement popped $1 to close at a 52 weeks’ high of $1600 as 267 stock units passed through the market, Portland JSX declined $1.55 to close at $9 as investors exchanged 100 stocks. Proven Investments gained 50 cents to end at $27.50 after exchanging 1,122 shares, Sagicor Group dipped $4 in closing at $51 in switching ownership of 2,788 stocks, Sagicor Real Estate Fund shed 86 cents to end at $8.67 as 11,700 stock units crossing the exchange.

Stock Exchange declined 69 cents to end at $15.30 after exchanging 22,960 units, Kingston Properties dropped 75 cents to close at $7, with 65,635 stock units clearing the market. Kingston Wharves dropped $2.33 in closing at $33.67, with 2,640 shares changing hands, Massy Holdings climbed 45 cents to $79.95 as 74,874 units were traded, Mayberry Investments fell 70 cents to end at $8 closing with 142,781 stocks passing through the market. NCB Financial lost $1.79 in closing at $78.21, with 78,538 units crossing the market, Palace Amusement popped $1 to close at a 52 weeks’ high of $1600 as 267 stock units passed through the market, Portland JSX declined $1.55 to close at $9 as investors exchanged 100 stocks. Proven Investments gained 50 cents to end at $27.50 after exchanging 1,122 shares, Sagicor Group dipped $4 in closing at $51 in switching ownership of 2,788 stocks, Sagicor Real Estate Fund shed 86 cents to end at $8.67 as 11,700 stock units crossing the exchange.  Scotia Group dipped $1.49 to close at $33 in exchanging 11,506 shares and Stanley Motta increased $1.23 after ending at $5.25 with a transfer of 244 units.

Scotia Group dipped $1.49 to close at $33 in exchanging 11,506 shares and Stanley Motta increased $1.23 after ending at $5.25 with a transfer of 244 units.

In the preference segment, Jamaica Public Service 7% advanced $2.73 to close at a 52 weeks’ high of $3.37 with the swapping of 30,000 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Another week of ICTOP10 changes

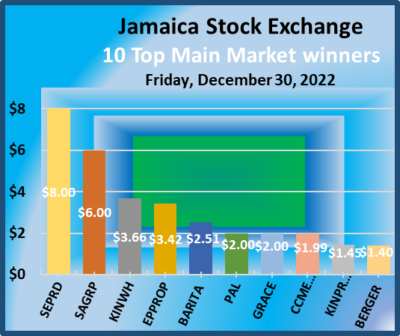

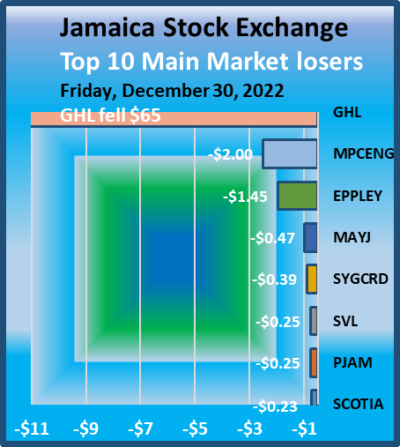

The Jamaica Stock Exchange Main Market recorded two weeks of solid gains to close out a disappointing 2022, with the Main Market declining after a promising start, with the market adding 17,123 points in the last two weeks while the All Jamaica added 22,797 points and the Junior Market put on 93 points in the same period, resulting in movements in and out of the TOP10 in both markets.

Junior Market action resulted in Caribbean Cream popping 19 percent to $4, followed by Caribbean Assurance with a 9 percent rise to $2.16, Tropical Battery chipped in with a 7 percent increase to $2.30 and Paramount Trading rose 5 percent to $1.99. General Accident was the biggest loser with a fall of 12 percent to $4.41, Lasco Distributors slipped 8 percent to $2.50 and Lasco Manufacturing declined 6 percent to $3.95.

Junior Market action resulted in Caribbean Cream popping 19 percent to $4, followed by Caribbean Assurance with a 9 percent rise to $2.16, Tropical Battery chipped in with a 7 percent increase to $2.30 and Paramount Trading rose 5 percent to $1.99. General Accident was the biggest loser with a fall of 12 percent to $4.41, Lasco Distributors slipped 8 percent to $2.50 and Lasco Manufacturing declined 6 percent to $3.95.

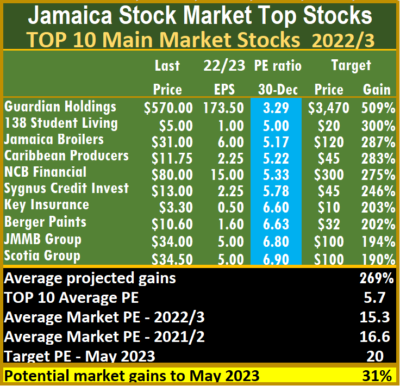

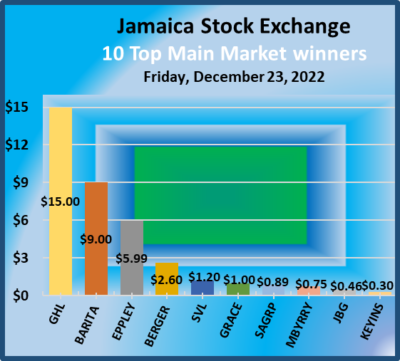

In the Main Market, Radio Jamaica rose 24 percent to $2.60, followed by JMMB Group up 6 percent to $34 and Jamaica Broilers up 5 percent to $31. The only losing stock in the Main Market is Guardian Holdings dropping 12 percent to $570.

In the Main Market, with the rise in the price of Radio Jamaica, Scotia Group reclaimed its TOP10 spot once more as RJR slipped out after reentering the TOP10 in the previous week, The Junior Market’s Tropical Battery dropped out of the TOP10 and replaced by Knutsford Express.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.6, well below the market average of 15.3, while the Junior Market Top 10 PE sits at 6.2 versus the market at 12.9, important indicators of the level of the undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 228 percent and the Main Market TOP10, an average now of 269 percent, to May 2023.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.6, well below the market average of 15.3, while the Junior Market Top 10 PE sits at 6.2 versus the market at 12.9, important indicators of the level of the undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 228 percent and the Main Market TOP10, an average now of 269 percent, to May 2023.

The Junior Market has 15 stocks representing 32 percent of the market, with PEs from 15 to 35, averaging 21 compared with the above average of the market. The top half of the market has an average PE of 18 and shows the extent of potential gains that lie ahead for the TOP 10 stocks. The situation in the Main Market is similar, with the 20 highest valued stocks priced at a PE of 15 to 110, with an average of 33.5 and 24 excluding the highest valued ones and 22 for the top half excluding the highest valued stock.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Four changes to ICTOP10

The Jamaica Stock Exchange Main Market closed the past week some 6,000 points higher than the previous week while the Junior Market ended slightly higher, resulting in four Junior Market TOP10 stocks declining between one and 5 percent as five gained between one and 31 percent while the Main Market TOP10 had six rising and three declining.

The Junior Market Iron Rock Insurance popped 31 percent to $2.35, General Accident gained 13 percent to $5, followed by Dolphin Cove with an 11 percent rise to $14.78 and a 5 percent increase for Caribbean Cream to $3.35. Medical Disposables fell 5 percent to $4.90 and Lasco Distributors slipped 4 percent to $2.71.

The Junior Market Iron Rock Insurance popped 31 percent to $2.35, General Accident gained 13 percent to $5, followed by Dolphin Cove with an 11 percent rise to $14.78 and a 5 percent increase for Caribbean Cream to $3.35. Medical Disposables fell 5 percent to $4.90 and Lasco Distributors slipped 4 percent to $2.71.

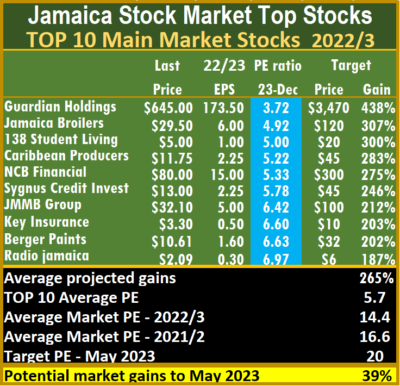

In the Main Market, Guardian Holdings jumped 12 percent to $645, Scotia Group rose 9 percent to $34.90, followed by Berger Paints with a 6 percent rise to $10.61 and JMMB Group up 4 percent to $32.10. Stocks declining are 138 Student Living, that fell 12 percent to $5 and Jamaica Broilers, down 8 percent to $29.50.

After reentering the TOP10 in the previous week, the Main Market’s Scotia Group swapped places with Radio Jamaica returning to the TOP flight of stocks. The Junior Market’s CAC2000, Dolphin Cove and Medical Disposables dropped out, following lower earnings projections and were replaced by Caribbean Brokers with its price down to $1.98, Lasco Manufacturing and Tropical Battery.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.6, well below the market average of 14.4, while the Junior Market Top 10 PE sits at 6.1 versus the market at 12.6, important indicators of the level of the undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 232 percent and the Main Market TOP10 by an average of 265 percent to May 2023.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.6, well below the market average of 14.4, while the Junior Market Top 10 PE sits at 6.1 versus the market at 12.6, important indicators of the level of the undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 232 percent and the Main Market TOP10 by an average of 265 percent to May 2023.

The Junior Market has 14 stocks around 30 percent of the market, with PEs from 15 to 33, averaging 20 compared with the above average of the market. The top half of the market has an average PE of 17 and shows the extent of potential gains that lie ahead for the TOP 10 stocks. The situation in the Main Market is similar, with the 17 highest valued stocks priced at a PE of 15 to 105, with an average of 32 and 24 excluding the highest valued ones and 21 for the top half excluding the highest valued stock.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

A total of 8,252,097 shares were exchanged for $67,129,016 versus 182,913,713 units with a value of $1,549,169,032 on Friday.

A total of 8,252,097 shares were exchanged for $67,129,016 versus 182,913,713 units with a value of $1,549,169,032 on Friday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

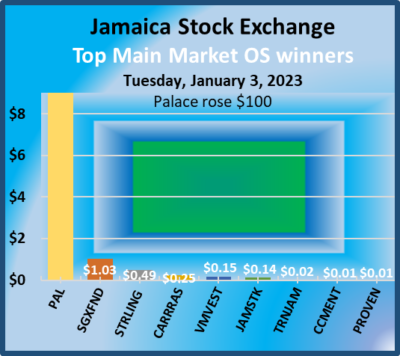

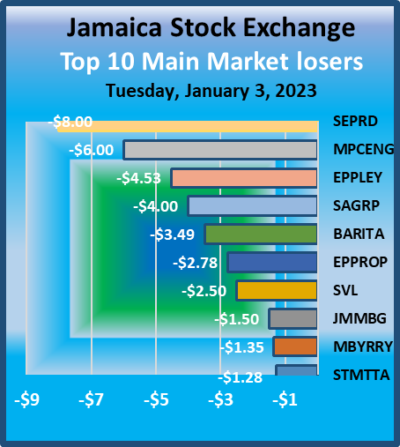

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023. Jamaica Producers fell 98 cents to end at $21.92 while exchanging 2,552 stock units, JMMB Group ost $1.50 to close at $32.50 in trading 39,397 stocks, Kingston Properties dipped 75 cents to $7.75 in trading 7,741 stock units. Massy Holdings declined 49 cents to $79.50 with 2,324 shares crossing the market, Mayberry Investments shed $1.35 in closing at $8.70, with 47,687 units changing hands, MPC Caribbean Clean Energy dropped $6 to end at $75 after an exchange of 498 stocks. Palace Amusement rose $100 to close at a 52 weeks’ high of $1599 as investors exchanged 656 units, Portland JSX declined 45 cents in ending at $10.55 after an exchange of 10 stocks, Sagicor Group dropped $4 to end at $55 with 569,539 shares crossing the market. Sagicor Real Estate Fund rallied $1.03 in closing at 52 weeks’ high of $9.53 with investors transferring 25,279 stock units, Seprod shed $8 to close at $70 with 5,354 shares clearing the market, Stanley Motta dipped $1.28 to end at $4.02 in switching ownership of 118,860 stocks. Sterling Investments gained 49 cents in ending at $3.44 after 54,045 stock units changed hands, Supreme Ventures fell $2.50 to $27.50 with the swapping of 26,450 units,

Jamaica Producers fell 98 cents to end at $21.92 while exchanging 2,552 stock units, JMMB Group ost $1.50 to close at $32.50 in trading 39,397 stocks, Kingston Properties dipped 75 cents to $7.75 in trading 7,741 stock units. Massy Holdings declined 49 cents to $79.50 with 2,324 shares crossing the market, Mayberry Investments shed $1.35 in closing at $8.70, with 47,687 units changing hands, MPC Caribbean Clean Energy dropped $6 to end at $75 after an exchange of 498 stocks. Palace Amusement rose $100 to close at a 52 weeks’ high of $1599 as investors exchanged 656 units, Portland JSX declined 45 cents in ending at $10.55 after an exchange of 10 stocks, Sagicor Group dropped $4 to end at $55 with 569,539 shares crossing the market. Sagicor Real Estate Fund rallied $1.03 in closing at 52 weeks’ high of $9.53 with investors transferring 25,279 stock units, Seprod shed $8 to close at $70 with 5,354 shares clearing the market, Stanley Motta dipped $1.28 to end at $4.02 in switching ownership of 118,860 stocks. Sterling Investments gained 49 cents in ending at $3.44 after 54,045 stock units changed hands, Supreme Ventures fell $2.50 to $27.50 with the swapping of 26,450 units,  Sygnus Real Estate Finance fell 48 cents ending at $9.52 trading 5,106 stock units and Wisynco Group declined 49 cents to $17.50 with a transfer of 128,774 units.

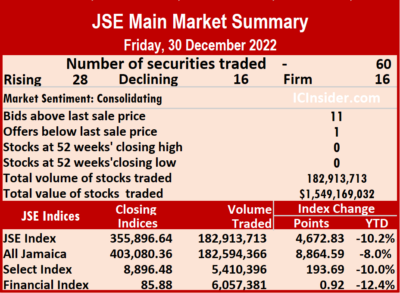

Sygnus Real Estate Finance fell 48 cents ending at $9.52 trading 5,106 stock units and Wisynco Group declined 49 cents to $17.50 with a transfer of 128,774 units. At the close, 60 securities traded compared to 58 on Thursday, with 28 rising, 16 declining and 16 ending unchanged and resulting in an exchange of 182,913,713 shares valued at $1,549,169,032 versus 10,927,858 units at $93,761,610 on Thursday, with Kingston Properties chipping in with 136 million shares carrying a value of $1.05 billion.

At the close, 60 securities traded compared to 58 on Thursday, with 28 rising, 16 declining and 16 ending unchanged and resulting in an exchange of 182,913,713 shares valued at $1,549,169,032 versus 10,927,858 units at $93,761,610 on Thursday, with Kingston Properties chipping in with 136 million shares carrying a value of $1.05 billion. Trading averaged 3,048,562 shares at $25,819,484, up from 188,411 units at $1,615,711 on Thursday and month to date, an average of 604,110 units at $4,071,008, compared with 467,038 stocks at $2,851,468 on the previous day. November closed with an average of 202,406 units at $1,736,493.

Trading averaged 3,048,562 shares at $25,819,484, up from 188,411 units at $1,615,711 on Thursday and month to date, an average of 604,110 units at $4,071,008, compared with 467,038 stocks at $2,851,468 on the previous day. November closed with an average of 202,406 units at $1,736,493. At the close, Barita Investments rose $2.51 to close at $102.51 with the swapping of 2,560,121 shares, Berger Paints gained $1.40 in closing at $10.60 after exchanging two stock units, Caribbean Cement gained $1.99 to $61.99 while exchanging 187,977 units. Eppley declined $1.45 to end at $38.53, with 140 stocks crossing the market, Eppley Caribbean Property Fund climbed $3.42 to $50, with a transfer of 317,335 stocks, GraceKennedy rallied $2 in closing at $84 with an exchange of 129,287 stock units. Guardian Holdings shed $65 to end at $570, with 406 shares crossing the exchange, Jamaica Producers popped 90 cents to $22.90 in an exchange of 42,592 units, Kingston Properties advanced $1.45 in ending at $8.50, with 136,036,412 shares clearing the market. Kingston Wharves climbed $3.66 to close at $3, with 161,557 units changing hands, Mayberry Investments popped $1.21 to close at $10.05 with investors exchanging 236,867 stocks, Mayberry Jamaican Equities dipped 47 cents in closing at $13.51 as 30,300 stock units passed through the market. MPC Caribbean Clean Energy lost $2 to end at $81 after trading 164 units, Palace Amusement advanced $2 to $1499 in trading 1,198 stock units, Portland JSX rallied 90 cents to $11 as investors exchanged 12,027 stocks. Proven Investments rose 85 cents to $27 and closed with 511 shares changing hands, Radio Jamaica gained 50 cents in ending at $2.60 in an exchange of 2,016,480 units, Sagicor Group increased $6 in closing at $59 after a transfer of 1,170,151 stock units.

At the close, Barita Investments rose $2.51 to close at $102.51 with the swapping of 2,560,121 shares, Berger Paints gained $1.40 in closing at $10.60 after exchanging two stock units, Caribbean Cement gained $1.99 to $61.99 while exchanging 187,977 units. Eppley declined $1.45 to end at $38.53, with 140 stocks crossing the market, Eppley Caribbean Property Fund climbed $3.42 to $50, with a transfer of 317,335 stocks, GraceKennedy rallied $2 in closing at $84 with an exchange of 129,287 stock units. Guardian Holdings shed $65 to end at $570, with 406 shares crossing the exchange, Jamaica Producers popped 90 cents to $22.90 in an exchange of 42,592 units, Kingston Properties advanced $1.45 in ending at $8.50, with 136,036,412 shares clearing the market. Kingston Wharves climbed $3.66 to close at $3, with 161,557 units changing hands, Mayberry Investments popped $1.21 to close at $10.05 with investors exchanging 236,867 stocks, Mayberry Jamaican Equities dipped 47 cents in closing at $13.51 as 30,300 stock units passed through the market. MPC Caribbean Clean Energy lost $2 to end at $81 after trading 164 units, Palace Amusement advanced $2 to $1499 in trading 1,198 stock units, Portland JSX rallied 90 cents to $11 as investors exchanged 12,027 stocks. Proven Investments rose 85 cents to $27 and closed with 511 shares changing hands, Radio Jamaica gained 50 cents in ending at $2.60 in an exchange of 2,016,480 units, Sagicor Group increased $6 in closing at $59 after a transfer of 1,170,151 stock units.  Sagicor Real Estate Fund rose 60 cents to end at $8.50, with 230,043 stocks crossing the market, Seprod advanced $8 to close at $78 with a transfer of 217,964 shares, Stanley Motta gained $1.29 in ending at $5.30 after trading 142,927 shares and Wisynco Group rose 49 cents to close at $17.99 in switching ownership of 189,234 stock units.

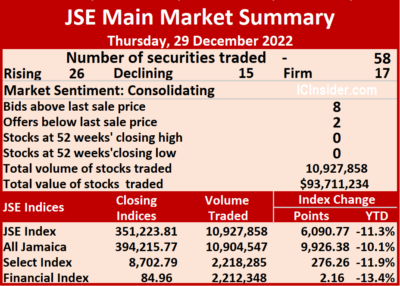

Sagicor Real Estate Fund rose 60 cents to end at $8.50, with 230,043 stocks crossing the market, Seprod advanced $8 to close at $78 with a transfer of 217,964 shares, Stanley Motta gained $1.29 in ending at $5.30 after trading 142,927 shares and Wisynco Group rose 49 cents to close at $17.99 in switching ownership of 189,234 stock units. A total of 10,927,858 shares were exchanged for $93,711,234 versus 22,138,197 units at $73,392,960 on Wednesday.

A total of 10,927,858 shares were exchanged for $93,711,234 versus 22,138,197 units at $73,392,960 on Wednesday. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

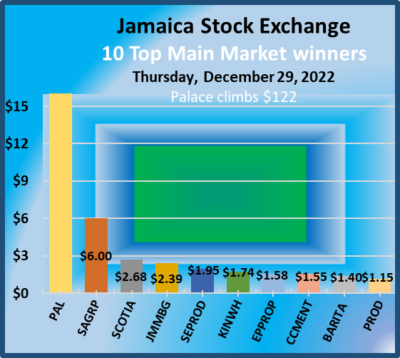

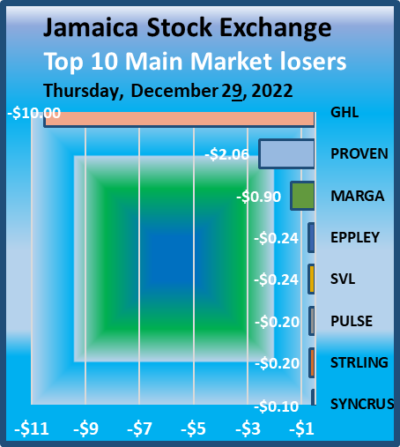

The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023. Guardian Holdings lost $10 at $635, with 86 stock units changing hands. JMMB Group rallied $2.39 to end at $33.99 trading 53,129 stocks, Kingston Wharves increased $1.74 in closing at $32.34 after trading of 48,456 shares, NCB Financial advanced 68 cents to close at $79.88 with 41,709 shares clearing the market. Palace Amusement climbed $122 to $1497 in switching ownership of 597 stocks, Proven Investments declined $1.85 to $26.15, with 504 stock units crossing the market, Sagicor Group rose $6 to $53 with the swapping of 302,574 units. Scotia Group increased $2.68 in closing at $34.73, with 2,714 stocks crossing the market, Seprod rallied $1.95 to end at $70 after an exchange of 7,754 stock units, Sygnus Credit Investments gained $1 to close at $13.39 as investors exchanged 42,870 shares and

Guardian Holdings lost $10 at $635, with 86 stock units changing hands. JMMB Group rallied $2.39 to end at $33.99 trading 53,129 stocks, Kingston Wharves increased $1.74 in closing at $32.34 after trading of 48,456 shares, NCB Financial advanced 68 cents to close at $79.88 with 41,709 shares clearing the market. Palace Amusement climbed $122 to $1497 in switching ownership of 597 stocks, Proven Investments declined $1.85 to $26.15, with 504 stock units crossing the market, Sagicor Group rose $6 to $53 with the swapping of 302,574 units. Scotia Group increased $2.68 in closing at $34.73, with 2,714 stocks crossing the market, Seprod rallied $1.95 to end at $70 after an exchange of 7,754 stock units, Sygnus Credit Investments gained $1 to close at $13.39 as investors exchanged 42,870 shares and  Wisynco Group popped 50 cents to end at $17.50 with investors transferring 56,412 units.

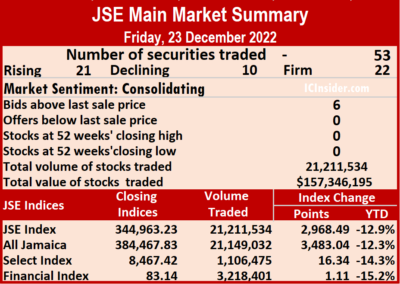

Wisynco Group popped 50 cents to end at $17.50 with investors transferring 56,412 units. A total of 22,138,197 shares were traded for $73,392,960 compared with 21,211,534 units at $157,346,195 last Friday.

A total of 22,138,197 shares were traded for $73,392,960 compared with 21,211,534 units at $157,346,195 last Friday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

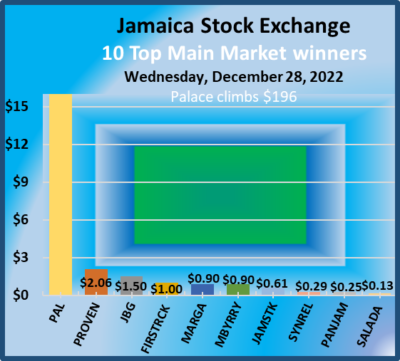

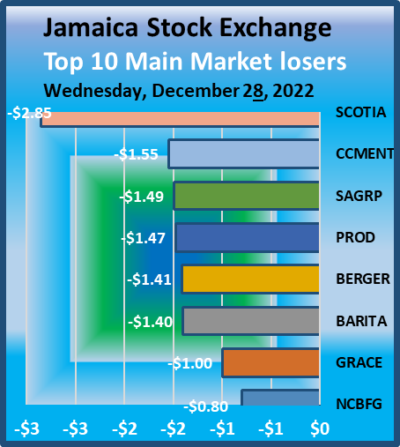

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023. GraceKennedy shed $1 in ending at $81 after 12,747 stock units were traded, Jamaica Broilers gained $1.50 in closing at $31 with an exchange of 623,672 stocks, Jamaica Stock Exchange popped 61 cents to close at $15.71 in trading 52,801 stocks. JMMB Group declined 50 cents to $31.60 after exchanging 8,845 stock units, Mayberry Investments advanced 90 cents in closing at $8.90, with 106,593 units crossing the market, NCB Financial dipped 80 cents to $79.20 while trading 11,501 shares. Palace Amusement rallied $196 to end at $1,375 after 767 stocks changed hands, Proven Investments increased $1.90 to $28 as 4,084 units were exchanged, Sagicor Group fell $1.49 to close at $47 as 156,887 shares passed through the market. Scotia Group dropped $2.85 to $32.05 after exchanging 75,345 stock units,

GraceKennedy shed $1 in ending at $81 after 12,747 stock units were traded, Jamaica Broilers gained $1.50 in closing at $31 with an exchange of 623,672 stocks, Jamaica Stock Exchange popped 61 cents to close at $15.71 in trading 52,801 stocks. JMMB Group declined 50 cents to $31.60 after exchanging 8,845 stock units, Mayberry Investments advanced 90 cents in closing at $8.90, with 106,593 units crossing the market, NCB Financial dipped 80 cents to $79.20 while trading 11,501 shares. Palace Amusement rallied $196 to end at $1,375 after 767 stocks changed hands, Proven Investments increased $1.90 to $28 as 4,084 units were exchanged, Sagicor Group fell $1.49 to close at $47 as 156,887 shares passed through the market. Scotia Group dropped $2.85 to $32.05 after exchanging 75,345 stock units,  Stanley Motta lost 70 cents to close at $4.01, with 29,682 shares changing hands and Sygnus Credit Investments shed 61 cents in closing at $12.39 with investors transferring 8,766 units.

Stanley Motta lost 70 cents to close at $4.01, with 29,682 shares changing hands and Sygnus Credit Investments shed 61 cents in closing at $12.39 with investors transferring 8,766 units. A total of 21,211,534 shares were traded for $157,346,195 compared to 7,586,543 units at $112,182,540 on Thursday.

A total of 21,211,534 shares were traded for $157,346,195 compared to 7,586,543 units at $112,182,540 on Thursday. The All Jamaican Composite Index rose 3,483.04 points to settle at 384,467.83, the JSE Main Index popped 2,968.49 points to settle at 344,963.23 and the JSE Financial Index rose 1.11 points to settle at 83.14.

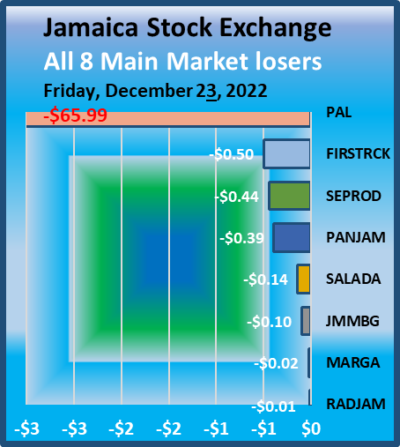

The All Jamaican Composite Index rose 3,483.04 points to settle at 384,467.83, the JSE Main Index popped 2,968.49 points to settle at 344,963.23 and the JSE Financial Index rose 1.11 points to settle at 83.14. GraceKennedy climbed $1 to $82 and closed with an exchange of 8,337 stocks, Guardian Holdings climbed $15 to $645 as investors exchanged 640 units. Jamaica Broilers advanced 46 cents to $29.50 while exchanging 74,794 stock units, Mayberry Investments rose 75 cents to $8 with an exchange of 22,100 shares, Palace Amusement dropped $65.99 in closing at $1179 after exchanging 113 units. Proven Investments shed $2.30 in ending at $26.10 21,006 stock units passed through the market, Sagicor Group advanced 89 cents to end at $48.49 after trading 48,096 stocks, Seprod dipped 44 cents in ending at $68.06 with a transfer of 1,008 shares and Supreme Ventures increased $1.20 to close at $30.49 with 117,285 stock units clearing the market.

GraceKennedy climbed $1 to $82 and closed with an exchange of 8,337 stocks, Guardian Holdings climbed $15 to $645 as investors exchanged 640 units. Jamaica Broilers advanced 46 cents to $29.50 while exchanging 74,794 stock units, Mayberry Investments rose 75 cents to $8 with an exchange of 22,100 shares, Palace Amusement dropped $65.99 in closing at $1179 after exchanging 113 units. Proven Investments shed $2.30 in ending at $26.10 21,006 stock units passed through the market, Sagicor Group advanced 89 cents to end at $48.49 after trading 48,096 stocks, Seprod dipped 44 cents in ending at $68.06 with a transfer of 1,008 shares and Supreme Ventures increased $1.20 to close at $30.49 with 117,285 stock units clearing the market. In the preference segment, Eppley 5% preference share popped $1.45 to $22.48, with 2,213 shares crossing the market.

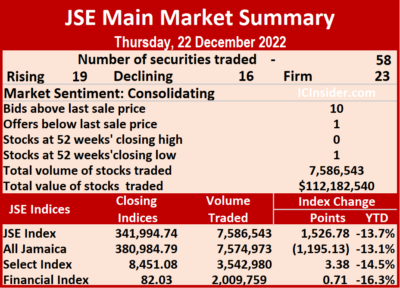

In the preference segment, Eppley 5% preference share popped $1.45 to $22.48, with 2,213 shares crossing the market. A total of 7,586,543 shares were traded for $112,182,540 versus 68,370,391 units at $766,972,565 on Wednesday.

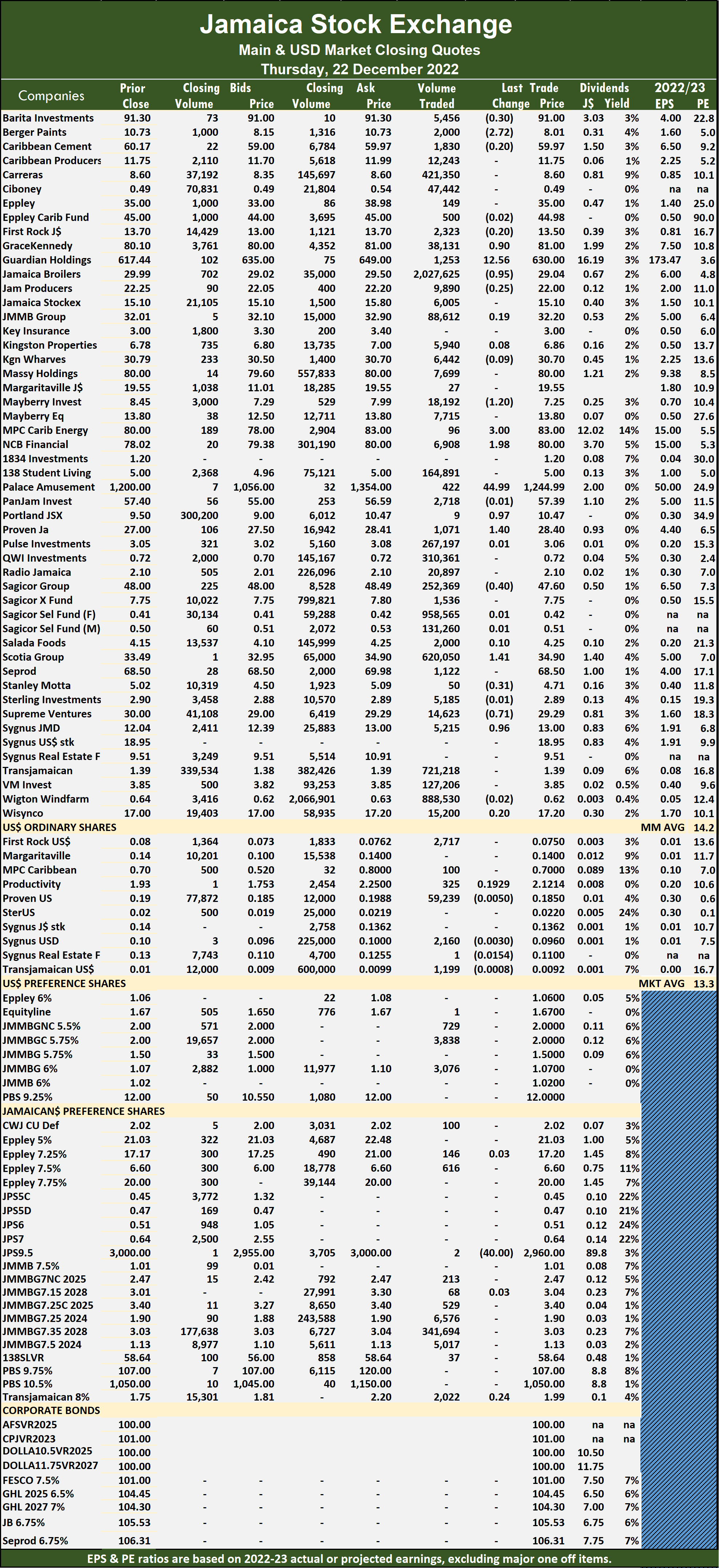

A total of 7,586,543 shares were traded for $112,182,540 versus 68,370,391 units at $766,972,565 on Wednesday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

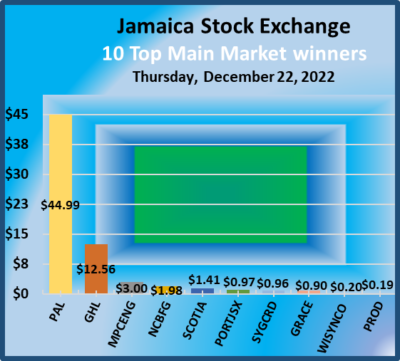

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023. NCB Financial advanced $1.98 to end at $80 with an exchange of 6,908 units, Palace Amusement popped $44.99 to close at $1244.99 with investors transferring 422 stock units, Portland JSX climbed 97 cents in ending at $10.47, with nine shares clearing the market. Proven Investments gained $1.40 to $28.40, with 1,071 units crossing the exchange, Sagicor Group declined 40 cents in closing at $47.60 after trading 252,369 stocks, Scotia Group popped $1.41 to $34.90 after a transfer of 620,050 stock units. Supreme Ventures shed 71 cents in ending at $29.29 with 14,623 units crossing the market and Sygnus Credit Investments gained 96 cents to close at $13 as 5,215 stocks passed through the market.

NCB Financial advanced $1.98 to end at $80 with an exchange of 6,908 units, Palace Amusement popped $44.99 to close at $1244.99 with investors transferring 422 stock units, Portland JSX climbed 97 cents in ending at $10.47, with nine shares clearing the market. Proven Investments gained $1.40 to $28.40, with 1,071 units crossing the exchange, Sagicor Group declined 40 cents in closing at $47.60 after trading 252,369 stocks, Scotia Group popped $1.41 to $34.90 after a transfer of 620,050 stock units. Supreme Ventures shed 71 cents in ending at $29.29 with 14,623 units crossing the market and Sygnus Credit Investments gained 96 cents to close at $13 as 5,215 stocks passed through the market. In the preference segment, Jamaica Public Service 9.5% dipped $40 to end at $2960 in switching ownership of two shares.

In the preference segment, Jamaica Public Service 9.5% dipped $40 to end at $2960 in switching ownership of two shares. A total of 68,370,391 shares were traded for $766,972,599 up from 8,931,395 units at $95,827,826 on Tuesday.

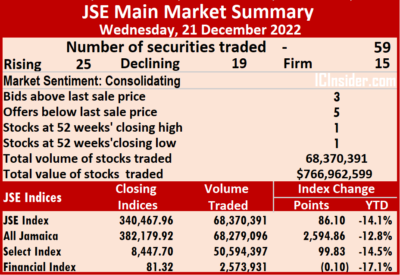

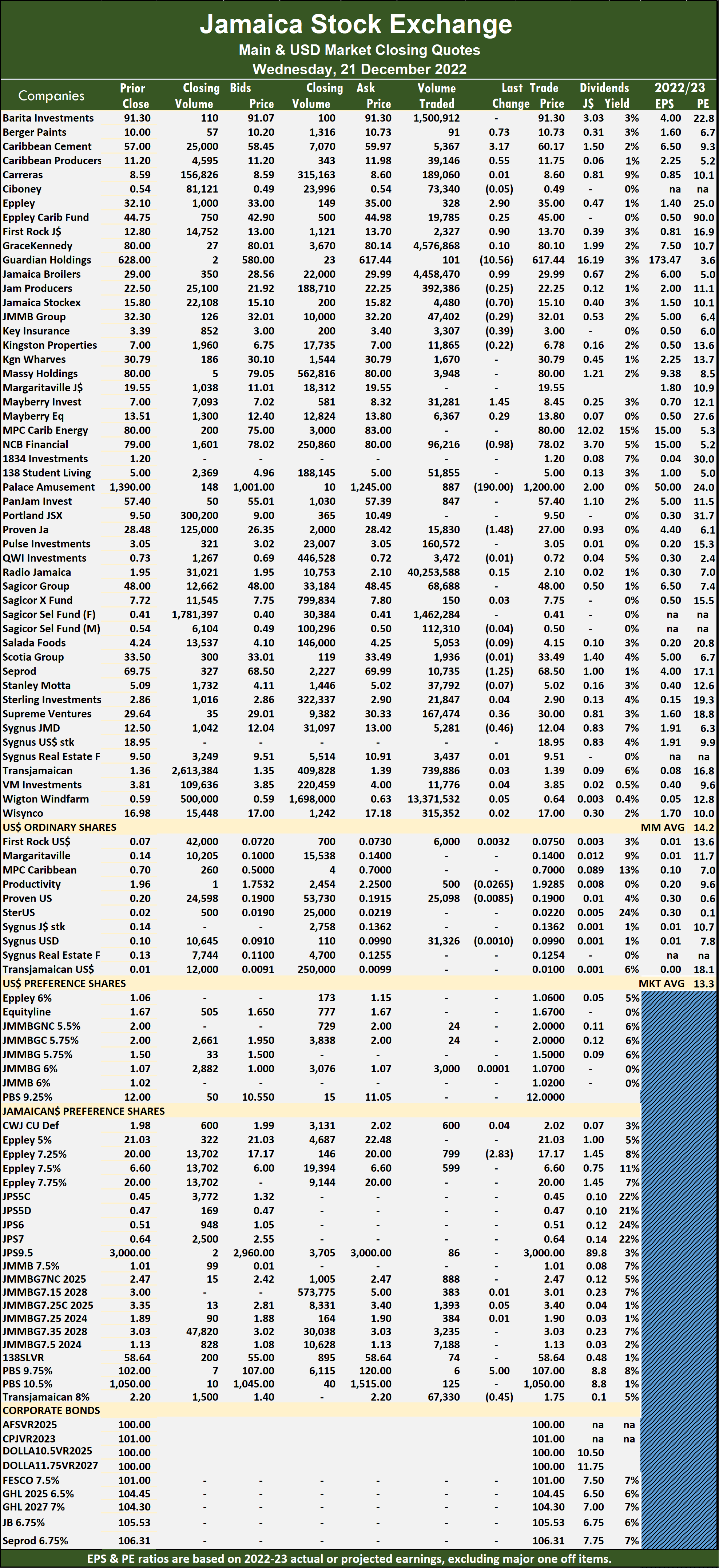

A total of 68,370,391 shares were traded for $766,972,599 up from 8,931,395 units at $95,827,826 on Tuesday. The All Jamaican Composite Index gained 2,594.86 points to 382,179.92, the JSE Main Index rose 86.10 points to 340,467.96 and the JSE Financial Index slipped 0.10 points to settle at 81.32.

The All Jamaican Composite Index gained 2,594.86 points to 382,179.92, the JSE Main Index rose 86.10 points to 340,467.96 and the JSE Financial Index slipped 0.10 points to settle at 81.32. Guardian Holdings lost $10.56 after ending at $617.44, with 101 shares crossing the exchange. Jamaica Broilers rose 99 cents to end at $29.99 in exchanging 4,458,470 stock units, Jamaica Stock Exchange dipped 70 cents in closing at $15.10 as 4,480 stocks passed through the market, Mayberry Investments rallied $1.45 to close at $8.45 in an exchange of 31,281 stock units. NCB Financial shed 98 cents to a 52 weeks’ low of $78.02 as investors exchanged 96,216 shares, Palace Amusement dropped $190 to end at $1200 after an exchange of 887 units, Proven Investments declined $1.48 to close at $27 with investors transferring 15,830 stocks. Seprod fell $1.25 in closing at $68.50, with 10,735 stock units crossing the market and Sygnus Credit Investments dipped 46 cents in ending at $12.04 after a transfer of 5,281 shares.

Guardian Holdings lost $10.56 after ending at $617.44, with 101 shares crossing the exchange. Jamaica Broilers rose 99 cents to end at $29.99 in exchanging 4,458,470 stock units, Jamaica Stock Exchange dipped 70 cents in closing at $15.10 as 4,480 stocks passed through the market, Mayberry Investments rallied $1.45 to close at $8.45 in an exchange of 31,281 stock units. NCB Financial shed 98 cents to a 52 weeks’ low of $78.02 as investors exchanged 96,216 shares, Palace Amusement dropped $190 to end at $1200 after an exchange of 887 units, Proven Investments declined $1.48 to close at $27 with investors transferring 15,830 stocks. Seprod fell $1.25 in closing at $68.50, with 10,735 stock units crossing the market and Sygnus Credit Investments dipped 46 cents in ending at $12.04 after a transfer of 5,281 shares. In the preference segment, Eppley 7.25% preference share shed $2.83 in ending at $17.17 after an exchange of 799 stocks, Productive Business Solutions 9.75% preference share gained $5 in closing at $107 after trading just six stocks and Transjamaican Highway 8% fell 45 cents to $1.75 with an exchange of 67,330 units.

In the preference segment, Eppley 7.25% preference share shed $2.83 in ending at $17.17 after an exchange of 799 stocks, Productive Business Solutions 9.75% preference share gained $5 in closing at $107 after trading just six stocks and Transjamaican Highway 8% fell 45 cents to $1.75 with an exchange of 67,330 units.