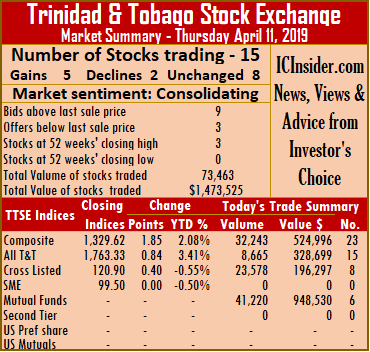

First Citizens is one of a number of Trinidad stocks closing at 52 weeks’ high in 2019 on TTSE.

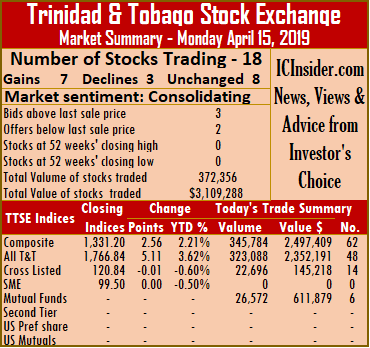

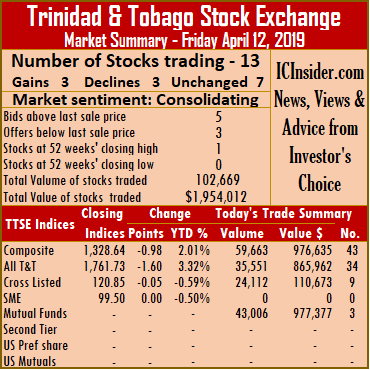

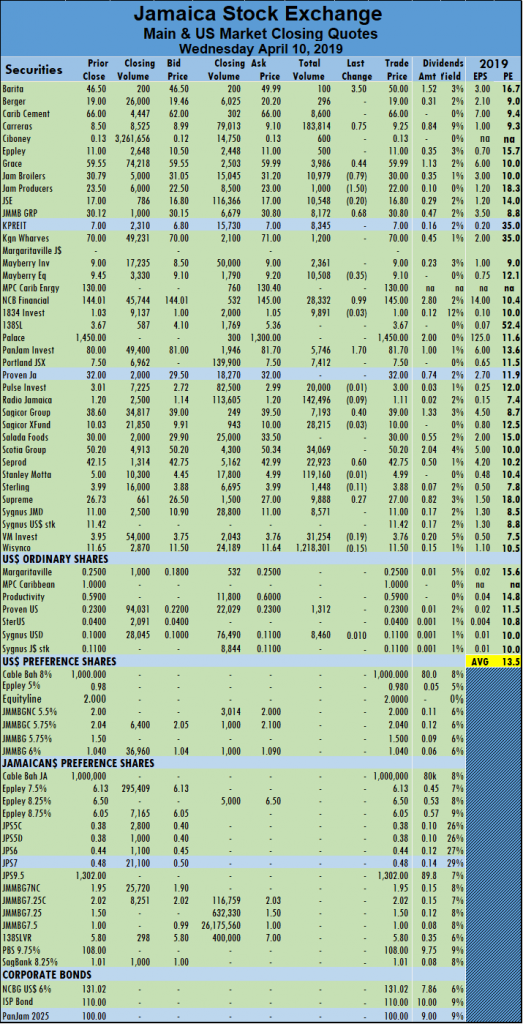

Trading on the Trinidad & Tobago Stock Exchange, continues to show signs of new life in 2019, with the market ending on Monday with 18 securities changing hands, against 13 on Friday.

The market closed with 7 stocks rising, 3 declining and 8 remaining unchanged, leading to positive gains in the main market indices and rise of 3.6 percent for the year to date for Trinidad stocks compared to a 1.8 percent fall at the same time in 2018. For the year to date, a number of stocks recorded new 52 weeks’ highs and that trend seems set to continue.

At the market’s close, Composite Index rose 2.56 points to 1,331.20. The All T&T Index declined gained 5.11 points to 1,766.84, while the Cross Listed Index inched down by 0.01 points higher to close at 120.84. At the close, investors exchanged 372,356 shares at $3,109,288, compared to 102,669 shares at $1,954,012 on Friday.

At the close, investors exchanged 372,356 shares at $3,109,288, compared to 102,669 shares at $1,954,012 on Friday.

IC bid-offer Indicator|The Investor’s Choice bid-offer ended at 5 stocks with bids higher than their last selling prices and 2 with lower offers.

At the close of the market, stocks ending with gains| Clico Investments gained 3 cents and settled at $23.03, with 26,572 stock units changing hands, First Citizens added 2 cents to close at $36.55, after exchanging 1,712 shares, National Enterprises increased 45 cents and settled at $7.25, with 2,000 stock units changing hands. National Flour rose 5 cents and closed at $1.68, in trading 180,293 units, One Caribbean Media closed with a gain of 15 cents and completed trading at $10.30, after exchanging 119,300 shares. Point Lisas gained 10 cents and settled at $3.55, with 1,000 stock units changing hands and Republic Financial Holdings finished trading 563 shares with a rise of 8 cents in closing at $120.

Stocks closing with losses| Angostura Holdings fell 20 cents and settled at $15.80, with 1,105 stock units changing hands, Massy Holdings closed with a loss of 11 cents and completed trading at $53.09, after exchanging 9,550 shares and Sagicor Financial shed 1 cent and completed trading at  $8.79, after exchanging 13,754 shares.

$8.79, after exchanging 13,754 shares.

Stocks closing firm| Agostini’s completed trading at $23.33, after exchanging 560 shares, Grace Kennedy settled at $3.35, with 300 stock units changing hands, Guardian Holdings concluded trading with 137 units at $18.50, JMMB Group completed trading at $1.75, after exchanging 7,385 shares. NCB Financial Group ended at $8.25, after exchanging 1,257 shares, Trinidad & Tobago NGL exchanged 3,765 units, at $29.40, Trinidad Cement ended at $2.60, after exchanging 2,303 shares and Unilever Caribbean traded 800 shares at $26.30.

Prices of securities trading for the day are those at which the last trade took place.

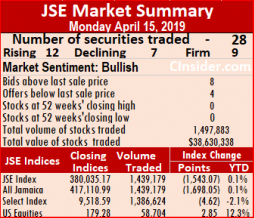

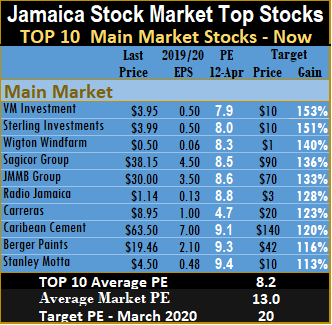

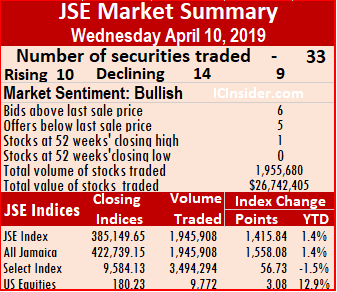

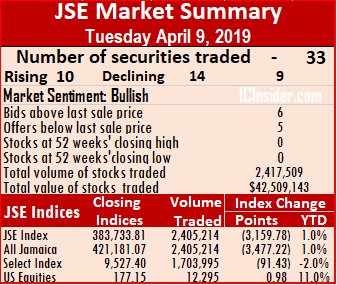

Trading on the main market of the Jamaica Stock Exchange ended Monday as the JSE All Jamaican Composite Index sank 1,698.05 points to 417,110.99 and the JSE Index dropping 1,543.07 points to close at 380,035.17, with a positive advance decline ratio.

Trading on the main market of the Jamaica Stock Exchange ended Monday as the JSE All Jamaican Composite Index sank 1,698.05 points to 417,110.99 and the JSE Index dropping 1,543.07 points to close at 380,035.17, with a positive advance decline ratio.  volume, followed by Sagicor Group with 254,940 units with 18 percent of the day’s trades and Carreras with a mere 152,725 units for 11 percent of volume traded.

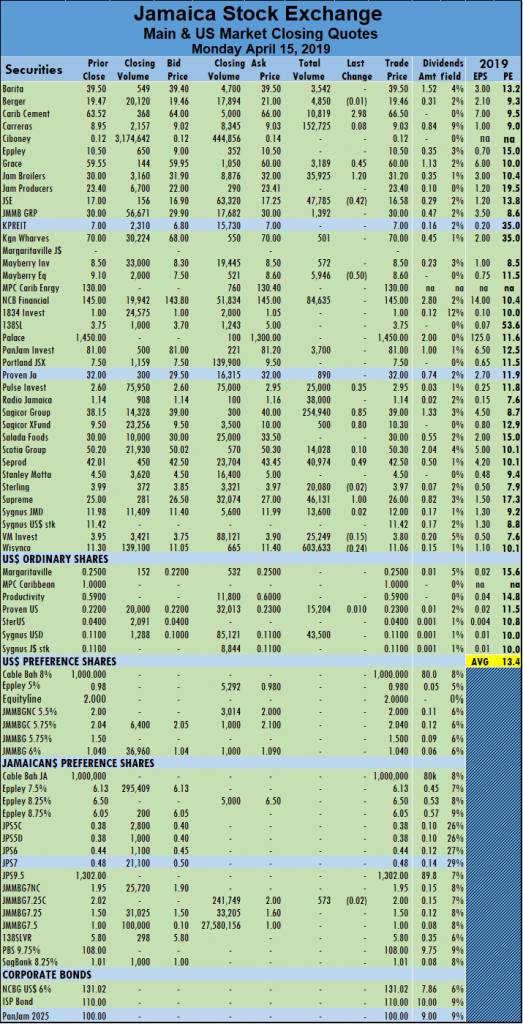

volume, followed by Sagicor Group with 254,940 units with 18 percent of the day’s trades and Carreras with a mere 152,725 units for 11 percent of volume traded. Jamaica Stock Exchange fell 42 cents to close at $16.58, after trading 47,785 shares, Mayberry Jamaican Equities lost 50 cents trading 5,946 shares at $8.6, Pulse Investments rose 35 cents and finished at $2.95, with 25,000 shares crossing the exchange, Sagicor Group rose 85 cents in trading 254,940 shares to close at $39. Sagicor Real Estate Fund exchanged just 500 shares to close at $10.30, after gaining 80 cents, Supreme Ventures rose $1 and finished at $26, with 46,131 units changing hands and Wisynco Group fell 24 cents trading 603,633 units to close at $11.06.

Jamaica Stock Exchange fell 42 cents to close at $16.58, after trading 47,785 shares, Mayberry Jamaican Equities lost 50 cents trading 5,946 shares at $8.6, Pulse Investments rose 35 cents and finished at $2.95, with 25,000 shares crossing the exchange, Sagicor Group rose 85 cents in trading 254,940 shares to close at $39. Sagicor Real Estate Fund exchanged just 500 shares to close at $10.30, after gaining 80 cents, Supreme Ventures rose $1 and finished at $26, with 46,131 units changing hands and Wisynco Group fell 24 cents trading 603,633 units to close at $11.06.

negative impact on stock prices as investors gather funds to invest in what is proving to be a very popular issue. Reports reaching this publication is that a number of brokerage houses saw heavy traffic of applicants to purchase

negative impact on stock prices as investors gather funds to invest in what is proving to be a very popular issue. Reports reaching this publication is that a number of brokerage houses saw heavy traffic of applicants to purchase  close of the previous week and Jamaican Teas closed at $4.05, up from the bid price of $3.50 to move out of the top tier of stocks.

close of the previous week and Jamaican Teas closed at $4.05, up from the bid price of $3.50 to move out of the top tier of stocks.

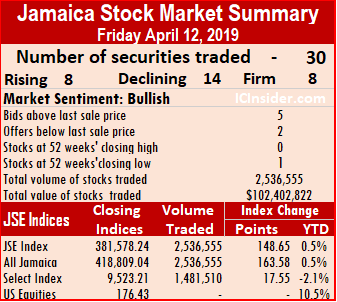

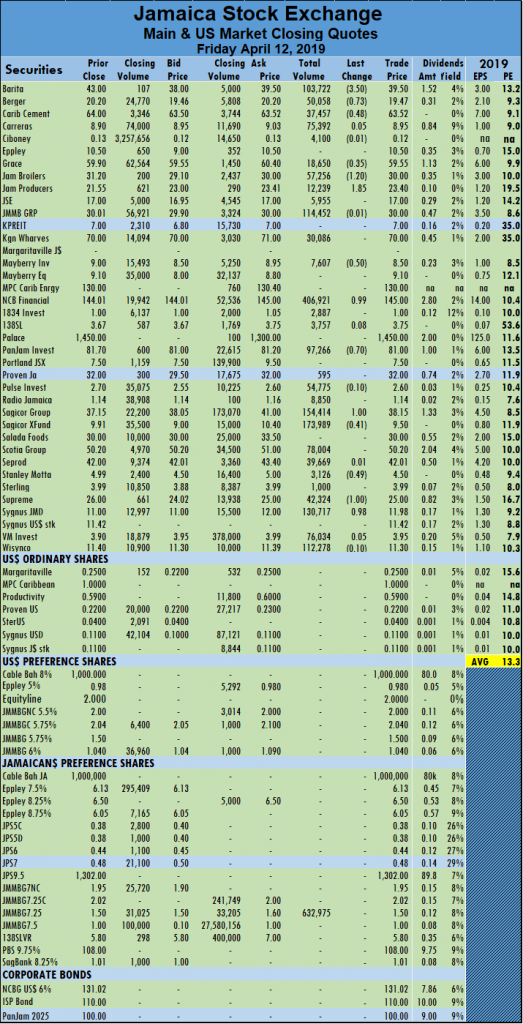

Trading on the main market of the Jamaica Stock Exchange ended Friday with JSE All Jamaican Composite Index added just 163.58 points to end at 418,809.04 and the JSE Index advanced 148.65 points to 381,578.24, with a decline advance ratio of 7 to 4.

Trading on the main market of the Jamaica Stock Exchange ended Friday with JSE All Jamaican Composite Index added just 163.58 points to end at 418,809.04 and the JSE Index advanced 148.65 points to 381,578.24, with a decline advance ratio of 7 to 4.

Jamaica Broilers dropped $1.20 to close at $30, with 57,256 shares changing hands, Jamaica Producers climbed $1.85 to close at $23.40, trading 12,239 shares, Mayberry Investments lost 50 cents trading 7,607 shares at $8.50, NCB Financial took back the 99 cents it lost on Thursday to settle at $145, trading 406,921 units. PanJam Investments lost 70 cents and finished at $81, with 97,266 shares crossing the exchange,

Jamaica Broilers dropped $1.20 to close at $30, with 57,256 shares changing hands, Jamaica Producers climbed $1.85 to close at $23.40, trading 12,239 shares, Mayberry Investments lost 50 cents trading 7,607 shares at $8.50, NCB Financial took back the 99 cents it lost on Thursday to settle at $145, trading 406,921 units. PanJam Investments lost 70 cents and finished at $81, with 97,266 shares crossing the exchange,  Trading ended with 13 securities changing hands, against 15 on Thursday on the Trinidad & Tobago Stock Exchange, on Friday, leading to 3 stocks rising, 3 declining and 7 remaining unchanged.

Trading ended with 13 securities changing hands, against 15 on Thursday on the Trinidad & Tobago Stock Exchange, on Friday, leading to 3 stocks rising, 3 declining and 7 remaining unchanged. exchanging 660 shares and JMMB Group closed with a loss of 1 cent at $1.75, after trading 14,244 shares.

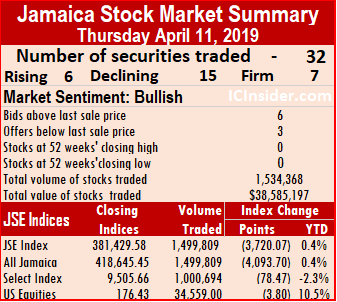

exchanging 660 shares and JMMB Group closed with a loss of 1 cent at $1.75, after trading 14,244 shares. Trading on the main market of the Jamaica Stock Exchange ended Thursday with JSE All Jamaican Composite Index dropping 4,093.70 points to 418,645.45 and the JSE Index diving by 3,720.07 points to 381,429.58 following a decline advance ratio of 5 to 2.

Trading on the main market of the Jamaica Stock Exchange ended Thursday with JSE All Jamaican Composite Index dropping 4,093.70 points to 418,645.45 and the JSE Index diving by 3,720.07 points to 381,429.58 following a decline advance ratio of 5 to 2.  Victoria Mutual Investments with a mere 138,470 units or 9 percent of volume traded.

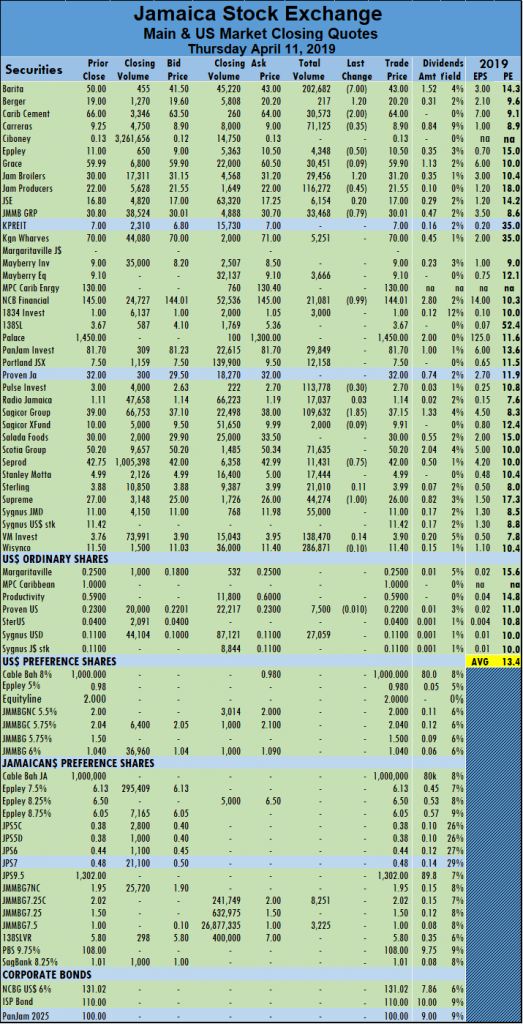

Victoria Mutual Investments with a mere 138,470 units or 9 percent of volume traded. hands, Jamaica Producers lost 45 cents to close at $21.55, trading 116,272 shares. JMMB Group fell 79 cents to end at $30.01, with an exchange of 33,468 shares, NCB Financial gave back the 99 cents it gained on Wednesday to settle at $144.01, trading 21,081 units, Pulse Investments lost 30 cents and finished at $2.70, with 113,778 shares crossing the exchange. Sagicor Group fell $1.85 in trading 109,632 shares at $37.15, Seprod lost 75 cents to close at $42, with 11,431 shares traded and Supreme Ventures lost $1 and finished at $26, with 44,274 units changing hands.

hands, Jamaica Producers lost 45 cents to close at $21.55, trading 116,272 shares. JMMB Group fell 79 cents to end at $30.01, with an exchange of 33,468 shares, NCB Financial gave back the 99 cents it gained on Wednesday to settle at $144.01, trading 21,081 units, Pulse Investments lost 30 cents and finished at $2.70, with 113,778 shares crossing the exchange. Sagicor Group fell $1.85 in trading 109,632 shares at $37.15, Seprod lost 75 cents to close at $42, with 11,431 shares traded and Supreme Ventures lost $1 and finished at $26, with 44,274 units changing hands.

valued at $3,510,251 on Tuesday. The average volume and value for the month to date amounts to 182,335 shares at $2,500,108 for each security, compared to 198,040 shares at $2,749,721 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

valued at $3,510,251 on Tuesday. The average volume and value for the month to date amounts to 182,335 shares at $2,500,108 for each security, compared to 198,040 shares at $2,749,721 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded. $1.50 to close at $22, trading 1,000 shares. JMMB Group added 68 cents to end at $30.80, with an exchange of 8,172 shares, NCB Financial rose 99 cents to settle at $145, trading 28,332 units, Mayberry Jamaican Equities lost 35 cents in trading 10,508 shares, at $9.10. PanJam Investment jumped $1.70 trading 5,746 to close at $81.70, Sagicor Group gained 40 cents in trading 7,193 shares at $39, Seprod rose 60 cents to close at $42.75, with 22,923 shares traded and Supreme Ventures rose 27 cents and finished at $27, with 9,888 units changing hands.

$1.50 to close at $22, trading 1,000 shares. JMMB Group added 68 cents to end at $30.80, with an exchange of 8,172 shares, NCB Financial rose 99 cents to settle at $145, trading 28,332 units, Mayberry Jamaican Equities lost 35 cents in trading 10,508 shares, at $9.10. PanJam Investment jumped $1.70 trading 5,746 to close at $81.70, Sagicor Group gained 40 cents in trading 7,193 shares at $39, Seprod rose 60 cents to close at $42.75, with 22,923 shares traded and Supreme Ventures rose 27 cents and finished at $27, with 9,888 units changing hands. $6.80, with 100 stock units changing hands, Sagicor Financial closed with a loss of 30 cents at $8.50, after exchanging 130,100 shares and Trinidad & Tobago NGL shed 9 cents and completed trading with 17,443 units at $29.40.

$6.80, with 100 stock units changing hands, Sagicor Financial closed with a loss of 30 cents at $8.50, after exchanging 130,100 shares and Trinidad & Tobago NGL shed 9 cents and completed trading with 17,443 units at $29.40.

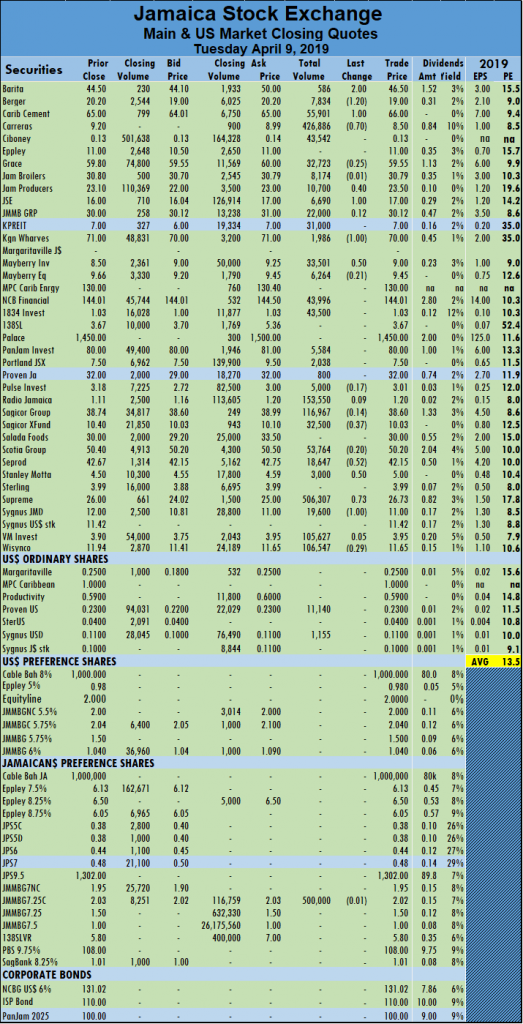

shares, Kingston Wharves gave up $1 to settle at $70, trading 1,986 units, Mayberry Investments gained 50 cents in trading 33,501 shares, at $9. Sagicor Real Estate Fund lost 37 cents in trading 32,500 shares at $10.03, Seprod lost 52 cents to close at $42.15, with 18,647 shares traded, Stanley Motta gained 50 cents and ended at $5, in trading 3,000 shares and Supreme Ventures rose 73 cents and finished at $26.73, with 506,307 units changing hands.

shares, Kingston Wharves gave up $1 to settle at $70, trading 1,986 units, Mayberry Investments gained 50 cents in trading 33,501 shares, at $9. Sagicor Real Estate Fund lost 37 cents in trading 32,500 shares at $10.03, Seprod lost 52 cents to close at $42.15, with 18,647 shares traded, Stanley Motta gained 50 cents and ended at $5, in trading 3,000 shares and Supreme Ventures rose 73 cents and finished at $26.73, with 506,307 units changing hands.