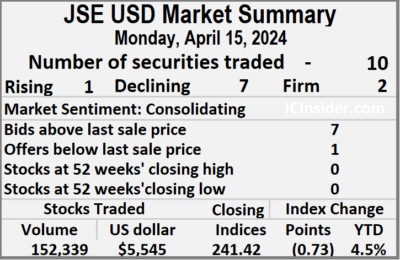

Trading jumped sharply on Monday over the miniscule amounts traded on Friday on the Jamaica Stock Exchange US dollar market, with the volume of stocks exchanged rising 1,470 percent after 223 percent more US dollars entered the market than on Friday, resulting in trading in 10 securities, compared to six on Friday with prices of one rising, seven declining and two ending unchanged.

The market closed with an exchange of 152,339 shares for US$5,545 compared to 9,705 units at US$1,717 on Friday.

The market closed with an exchange of 152,339 shares for US$5,545 compared to 9,705 units at US$1,717 on Friday.

Trading averaged 15,234 units at US$554 up from 1,618 shares at US$286 on Friday, with a month to date average of 32,963 shares at US$2,123 compared with 35,733 units at US$2,368 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index sank 0.73 points to conclude trading at 241.42.

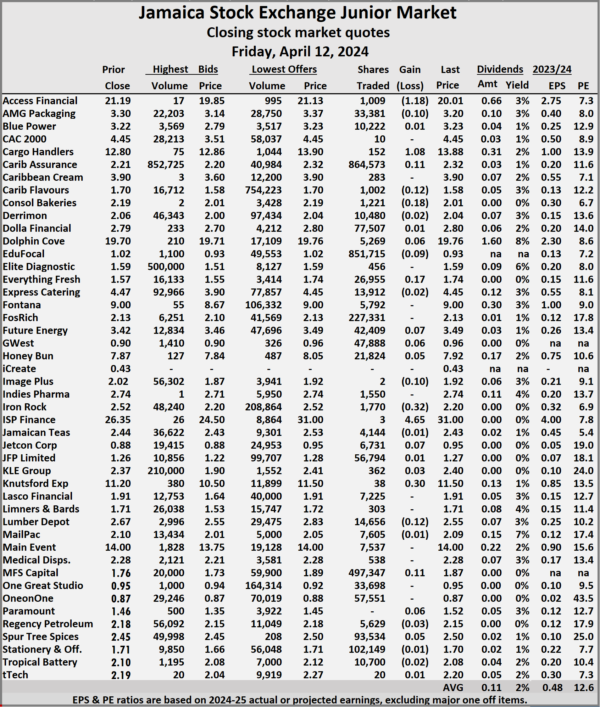

The PE Ratio, a measure used in computing appropriate stock values, averages 9.2. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, AS Bryden rose 0.47 of a cent to end at 22.49 US cents after an exchange of 2,250 shares, First Rock Real Estate USD share declined 0.08 of a cent in closing at 4.02 US cents after 1,946 stocks passed through the market,  MPC Caribbean Clean Energy fell 1 cent to 61 US cents with an exchange of 16 shares. Productive Business Solutions remained at US$1.59, with one stock unit crossing the market, Proven Investments dipped 0.18 of a cent to end at 13.73 US cents in swapping 3,455 shares, Sterling Investments lost 0.09 of a cent to close at 1.51 US cents with 301 stocks clearing the market. Sygnus Credit Investments slipped 0.27 of one cent to 7.6 US cents with investors swapping 7,851 units, Sygnus Real Estate Finance USD share ended at 9 US cents after a transfer of 540 stock units and Transjamaican Highway slipped 0.02 cent in closing at 2.2 US cents, with 135,904 shares changing hands.

MPC Caribbean Clean Energy fell 1 cent to 61 US cents with an exchange of 16 shares. Productive Business Solutions remained at US$1.59, with one stock unit crossing the market, Proven Investments dipped 0.18 of a cent to end at 13.73 US cents in swapping 3,455 shares, Sterling Investments lost 0.09 of a cent to close at 1.51 US cents with 301 stocks clearing the market. Sygnus Credit Investments slipped 0.27 of one cent to 7.6 US cents with investors swapping 7,851 units, Sygnus Real Estate Finance USD share ended at 9 US cents after a transfer of 540 stock units and Transjamaican Highway slipped 0.02 cent in closing at 2.2 US cents, with 135,904 shares changing hands.

In the preference segment, Sygnus Credit Investments E8.5% skidded 10 cents to finish at US$10.70 in an exchange of 75 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbs on JSE USD Market

Muted trading on JSE USD market

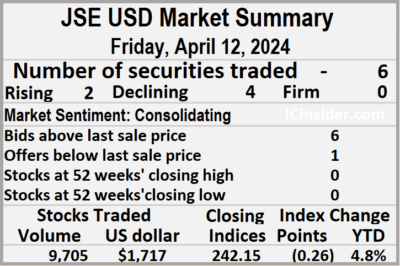

Stocks hardly traded on the Jamaica Stock Exchange US dollar market ended on Friday, with a 97 percent plunge in the volume exchanged following a 90 percent fall in value compared with Thursday and resulted in trading in six securities, down from seven on Thursday with prices of two rising, four declining.

The market closed with an exchange of 9,705 shares for US$1,717 down sharply on 326,941 units at US$17,135 on Thursday.

The market closed with an exchange of 9,705 shares for US$1,717 down sharply on 326,941 units at US$17,135 on Thursday.

Trading averaged 1,618 units at US$286 versus 46,706 shares at US$2,448 on Thursday, with a month to date average of 35,733 shares at US$2,368 compared with 39,263 units at US$2,583 on the previous day and March with an average of 49,394 units for US$3,593.

The US Denominated Equities Index dipped 0.26 points to finish at 242.15.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share dipped 0.8 of one cent to end at 4.1 US cents with a transfer of 3,000 stocks,  Proven Investments lost 0.09 of a cent in closing at 13.91 US cents, with 286 units crossing the market, Sygnus Credit Investments shed 0.09 of a cent to end at 7.87 US cents with trading of 426 shares and Transjamaican Highway declined 0.03 cent to finish at 2.22 US cents with 4,872 stock units clearing the market.

Proven Investments lost 0.09 of a cent in closing at 13.91 US cents, with 286 units crossing the market, Sygnus Credit Investments shed 0.09 of a cent to end at 7.87 US cents with trading of 426 shares and Transjamaican Highway declined 0.03 cent to finish at 2.22 US cents with 4,872 stock units clearing the market.

In the preference segment, JMMB Group US8.5% preference share advanced 0.85 of one cent and ended at US$1.1985 with traders dealing in 1,113 shares and Sygnus Credit Investments E8.5% rose 30 cents to close at US$10.80, with 8 units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbs on the JSE USD market

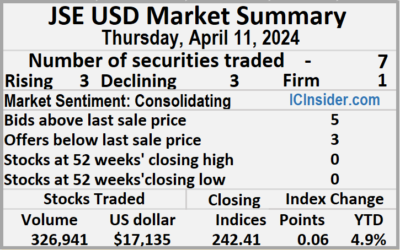

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks changing hands rising 40 percent after 167 percent more US dollars were exchanged than on Wednesday, resulting in trading in seven securities, compared to four on Wednesday with prices of three rising, three declining and one ending unchanged.

The market closed with an exchange of 326,941 shares for US$17,135 compared to 233,494 units at US$6,425 on Wednesday.

The market closed with an exchange of 326,941 shares for US$17,135 compared to 233,494 units at US$6,425 on Wednesday.

Trading averaged 46,706 units at US$2,448 versus 58,374 shares at US$1,606 on Wednesday, with a month to date average of 39,263 shares at US$2,583 compared with 38,241 units at US$2,602 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index popped 0.06 points to close at 242.41.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.5. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, First Rock Real Estate USD share rallied 0.83 of one cent to close at 4.9 US cents in switching ownership of 1,000 stock units,  Proven Investments skidded 0.76 of one cent to 14 US cents as investors exchanged 3,588 shares, Sterling Investments ended at 1.6 US cents with trading taking place in 14,440 units. Sygnus Credit Investments popped 0.86 of one cent in closing at 7.96 US cents crossing the market 100 stocks and Transjamaican Highway increased 0.02 cent to finish at 2.25 US cents in an exchange of 303,149 shares.

Proven Investments skidded 0.76 of one cent to 14 US cents as investors exchanged 3,588 shares, Sterling Investments ended at 1.6 US cents with trading taking place in 14,440 units. Sygnus Credit Investments popped 0.86 of one cent in closing at 7.96 US cents crossing the market 100 stocks and Transjamaican Highway increased 0.02 cent to finish at 2.25 US cents in an exchange of 303,149 shares.

In the preference segment, JMMB Group 5.75% fell 2 cents and ended at US$2.10 after closing with an exchange of 4,650 units and Sygnus Credit Investments E8.5% declined 30 cents to US$10.50 after an exchange of 14 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

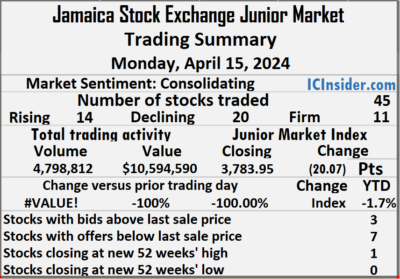

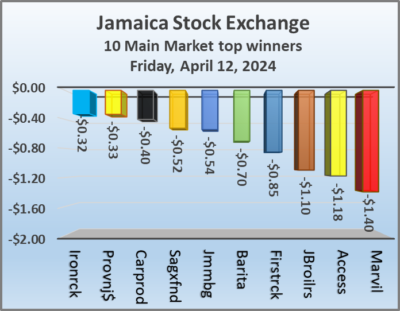

The market closed trading of 4,798,812 shares for $10,594,590 compared with 3,153,277 units at $5,829,829 on Friday.

The market closed trading of 4,798,812 shares for $10,594,590 compared with 3,153,277 units at $5,829,829 on Friday. Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and seven with lower offers.

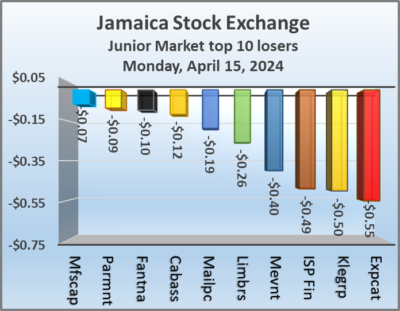

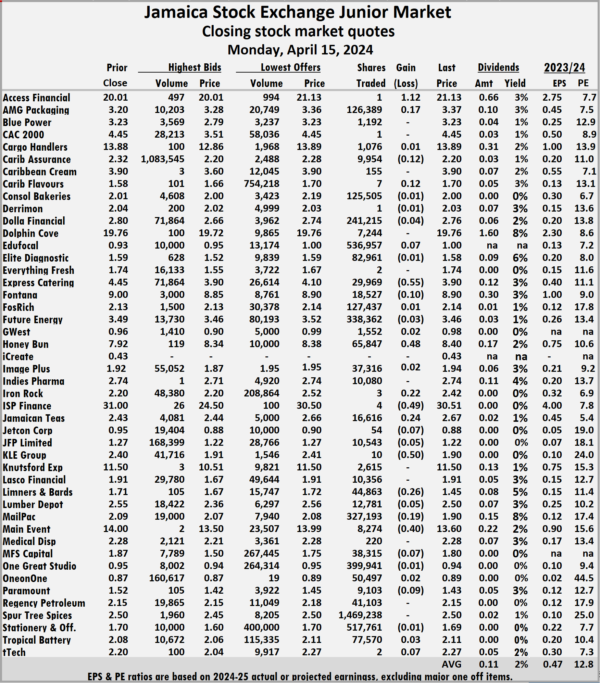

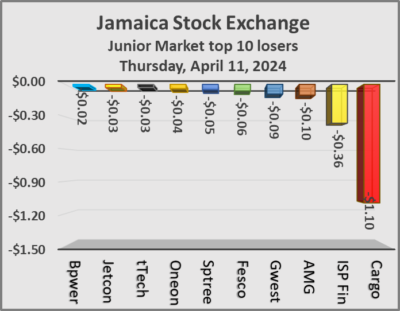

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and seven with lower offers. ISP Finance dropped 49 cents to close at $30.51 with investors swapping 4 stocks, Jamaican Teas advanced 24 cents to end at $2.67 with a transfer of 16,616 units, Jetcon Corporation lost 7 cents in closing at 88 cents, with 54 stock units crossing the market. KLE Group skidded 50 cents to $1.90 with investors transferring 10 shares, Limners and Bards sank 26 cents to close at $1.45 with 44,863 units clearing the market, Mailpac Group declined 19 cents in closing at $1.90 after trading 327,193 stocks. Main Event slipped 40 cents and ended at $13.60, with 8,274 stock units crossing the market, MFS Capital Partners sank 7 cents to finish at $1.80 with an exchange of 38,315 shares and tTech rose 7 cents to end at $2.27 in trading 2 units.

ISP Finance dropped 49 cents to close at $30.51 with investors swapping 4 stocks, Jamaican Teas advanced 24 cents to end at $2.67 with a transfer of 16,616 units, Jetcon Corporation lost 7 cents in closing at 88 cents, with 54 stock units crossing the market. KLE Group skidded 50 cents to $1.90 with investors transferring 10 shares, Limners and Bards sank 26 cents to close at $1.45 with 44,863 units clearing the market, Mailpac Group declined 19 cents in closing at $1.90 after trading 327,193 stocks. Main Event slipped 40 cents and ended at $13.60, with 8,274 stock units crossing the market, MFS Capital Partners sank 7 cents to finish at $1.80 with an exchange of 38,315 shares and tTech rose 7 cents to end at $2.27 in trading 2 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

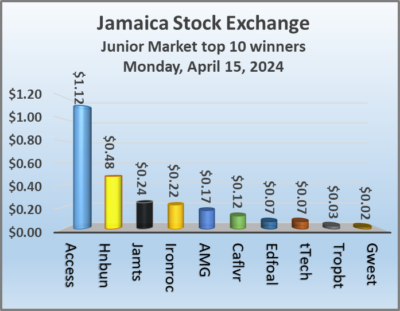

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the end of trading, the JSE Combined Market Index gained 104.84 points to close at 339,850.42, the All Jamaican Composite Index skidded 64.70 points to 366,436.25, but the JSE Main Index gained 255.28 points to end at 327,010.52. The Junior Market Index skidded 20.07 points to conclude trading at 3,783.95 and the JSE USD Market Index sank 0.73 points to 241.42.

At the end of trading, the JSE Combined Market Index gained 104.84 points to close at 339,850.42, the All Jamaican Composite Index skidded 64.70 points to 366,436.25, but the JSE Main Index gained 255.28 points to end at 327,010.52. The Junior Market Index skidded 20.07 points to conclude trading at 3,783.95 and the JSE USD Market Index sank 0.73 points to 241.42. In the preference segment, Jamaica Public Service 7% slipped $1.01 and ended at $46.99, 138 Student Living preference share lost $3 to end at $210, Productive Business Solutions 9.75% preference share popped $23.37 in closing at $118.45 and Sygnus Credit Investments C10.5% dipped $6 to close at $104.

In the preference segment, Jamaica Public Service 7% slipped $1.01 and ended at $46.99, 138 Student Living preference share lost $3 to end at $210, Productive Business Solutions 9.75% preference share popped $23.37 in closing at $118.45 and Sygnus Credit Investments C10.5% dipped $6 to close at $104. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. Trading closed with an exchange of 10,926,398 shares for $160,297,742 compared to 16,091,472 units at just $32,718,333 on Thursday.

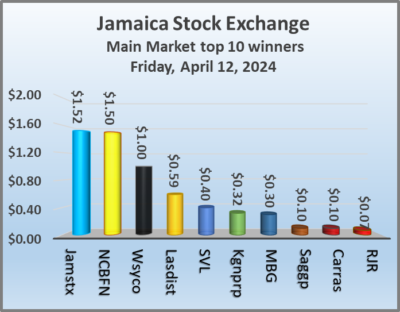

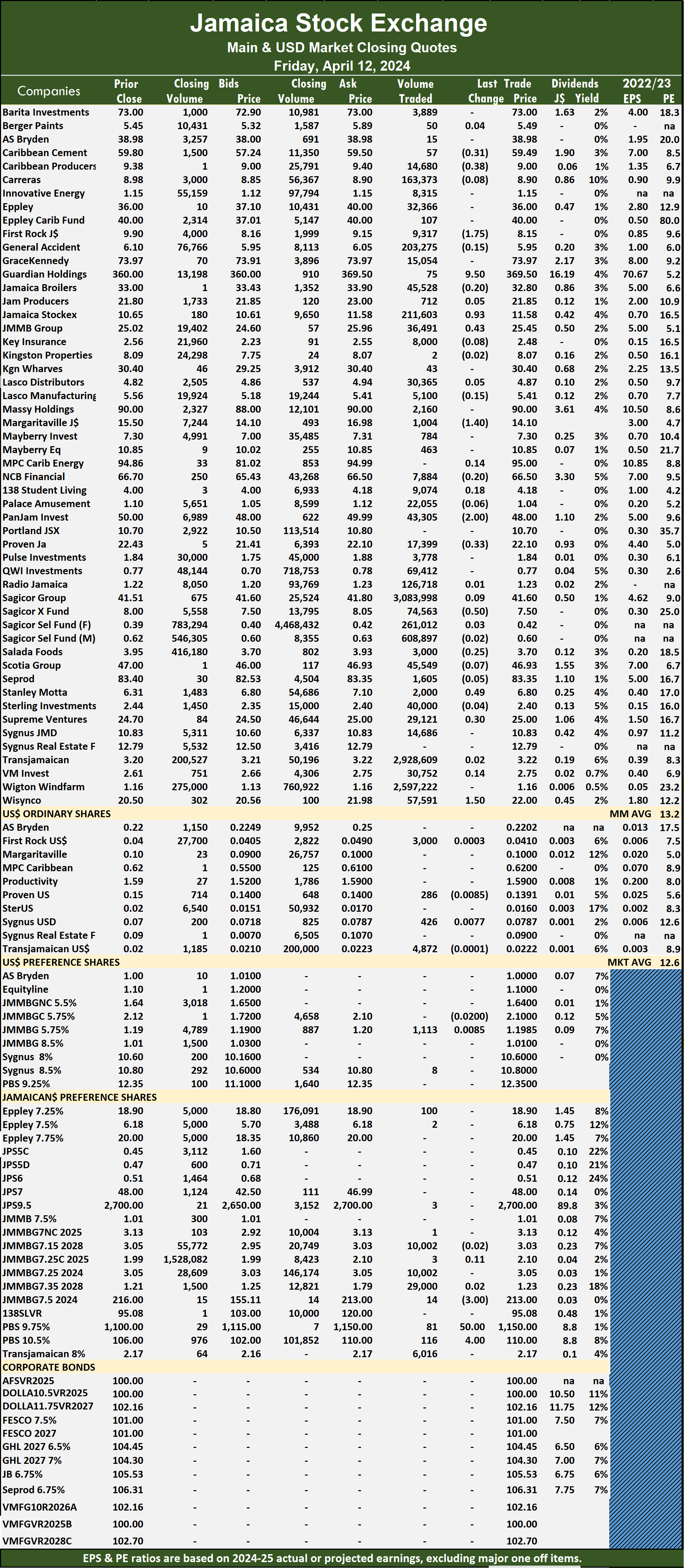

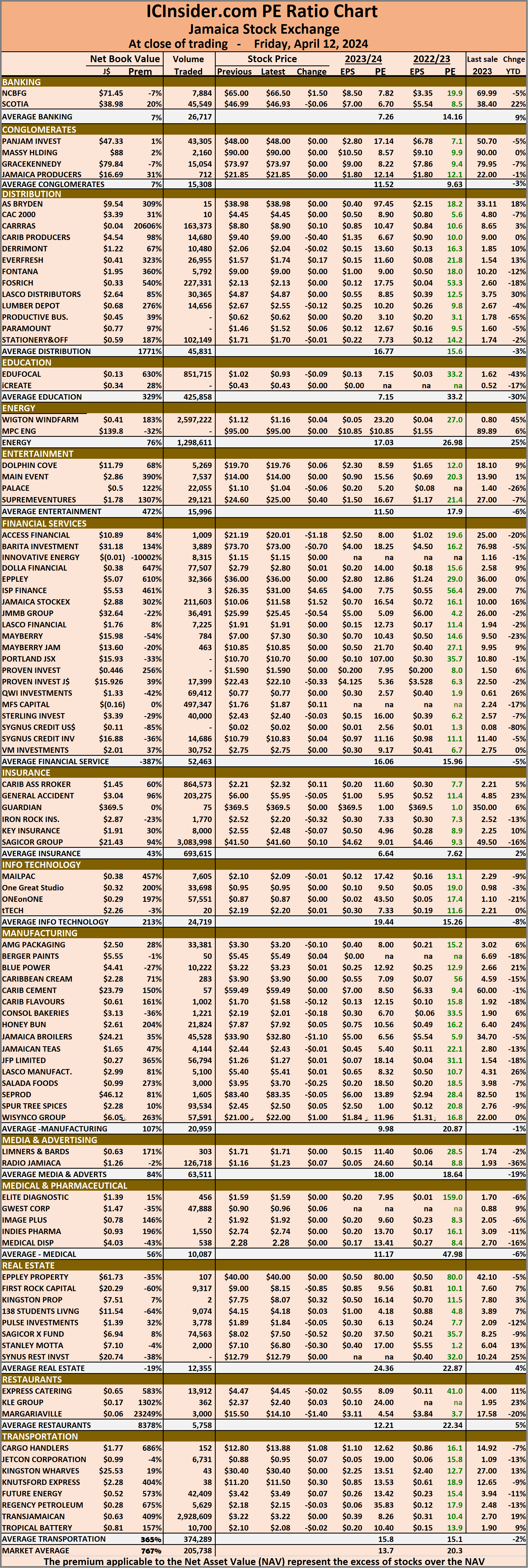

Trading closed with an exchange of 10,926,398 shares for $160,297,742 compared to 16,091,472 units at just $32,718,333 on Thursday. The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Mayberry Group popped 30 cents to end at $7.30 as investors traded 784 shares. NCB Financial climbed $1.50 to $66.50 in switching ownership of 7,884 units, Proven Investments declined by 33 cents to $22.10, with 17,399 stock units crossing the market, Sagicor Real Estate Fund skidded 52 cents to finish at $7.50 in an exchange of 74,563 stock units. Stanley Motta slipped 30 cents to end at $6.80 with investors dealing in 2,000 shares, Supreme Ventures rose 40 cents to finish at $25 with a transfer of 29,121 stocks and Wisynco Group climbed $1 and ended at $22, with 57,591 units changing hands.

Mayberry Group popped 30 cents to end at $7.30 as investors traded 784 shares. NCB Financial climbed $1.50 to $66.50 in switching ownership of 7,884 units, Proven Investments declined by 33 cents to $22.10, with 17,399 stock units crossing the market, Sagicor Real Estate Fund skidded 52 cents to finish at $7.50 in an exchange of 74,563 stock units. Stanley Motta slipped 30 cents to end at $6.80 with investors dealing in 2,000 shares, Supreme Ventures rose 40 cents to finish at $25 with a transfer of 29,121 stocks and Wisynco Group climbed $1 and ended at $22, with 57,591 units changing hands. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

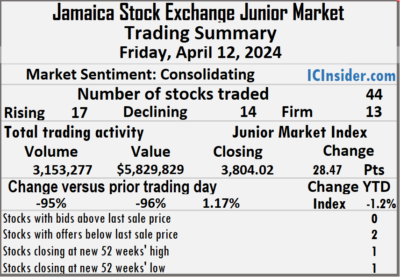

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading on Friday, the JSE Combined Market Index shed 1,284.91 points to end at 339,745.60, the All Jamaican Composite Index skidded 1,102.99 points to close at 366,500.95, the JSE Main Index fell 1,547.35 points to 326,755.24. The Junior Market Index popped 28.47 points to end trading at 3,804.02 and the JSE USD Market Index slipped 0.26 points to settle at 242.15.

At the close of trading on Friday, the JSE Combined Market Index shed 1,284.91 points to end at 339,745.60, the All Jamaican Composite Index skidded 1,102.99 points to close at 366,500.95, the JSE Main Index fell 1,547.35 points to 326,755.24. The Junior Market Index popped 28.47 points to end trading at 3,804.02 and the JSE USD Market Index slipped 0.26 points to settle at 242.15. In the preference segment, 138 Student Living preference share fell $3 to end at $213 and Sygnus Credit Investments C10.5% gained $4 in closing at $110.

In the preference segment, 138 Student Living preference share fell $3 to end at $213 and Sygnus Credit Investments C10.5% gained $4 in closing at $110. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. At the close of trading, the Junior Market Index climbed 28.47 points to wrap-up trading at 3,804.02.

At the close of trading, the Junior Market Index climbed 28.47 points to wrap-up trading at 3,804.02. Investor’s Choice bid-offer indicator shows no stock ending with a bid higher than the last selling price and two with lower offers.

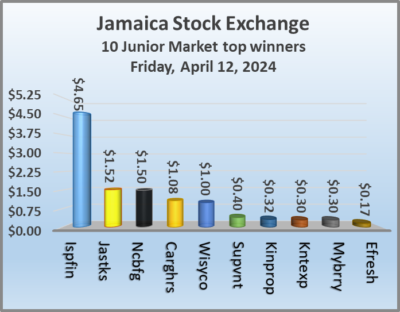

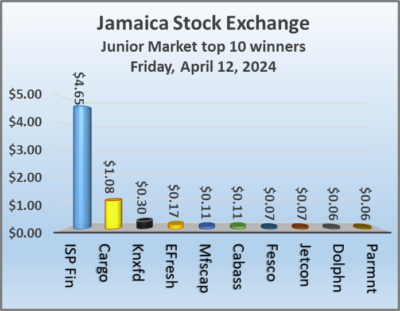

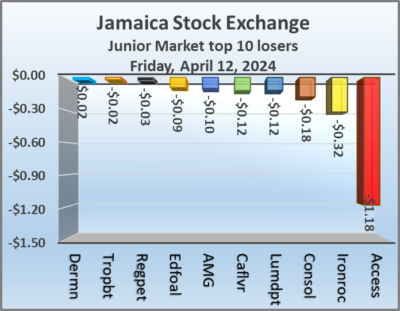

Investor’s Choice bid-offer indicator shows no stock ending with a bid higher than the last selling price and two with lower offers. Honey Bun rose 5 cents and ended at a 52 weeks’ closing high of $7.92 after 21,824 shares were traded, Iron Rock Insurance lost 32 cents to finish at $2.20, with 1,770 units crossing the market, ISP Finance rose $4.65 to end at $31 after a transfer of a mere 3 stock units, Jetcon Corporation advanced 7 cents to close at 95 cents, with 6,731 stock units changing hands. Knutsford Express gained 30 cents to $11.50 in an exchange of 38 shares, Lumber Depot shed 12 cents to end at $2.55, after 14,656 stocks passed through the market and MFS Capital Partners popped 11 cents in closing at $1.87 after an exchange of 497,347 units.

Honey Bun rose 5 cents and ended at a 52 weeks’ closing high of $7.92 after 21,824 shares were traded, Iron Rock Insurance lost 32 cents to finish at $2.20, with 1,770 units crossing the market, ISP Finance rose $4.65 to end at $31 after a transfer of a mere 3 stock units, Jetcon Corporation advanced 7 cents to close at 95 cents, with 6,731 stock units changing hands. Knutsford Express gained 30 cents to $11.50 in an exchange of 38 shares, Lumber Depot shed 12 cents to end at $2.55, after 14,656 stocks passed through the market and MFS Capital Partners popped 11 cents in closing at $1.87 after an exchange of 497,347 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

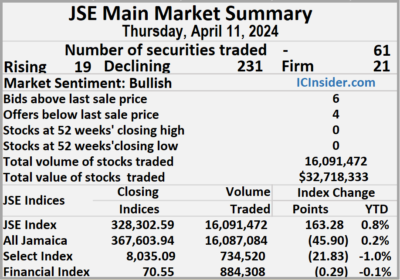

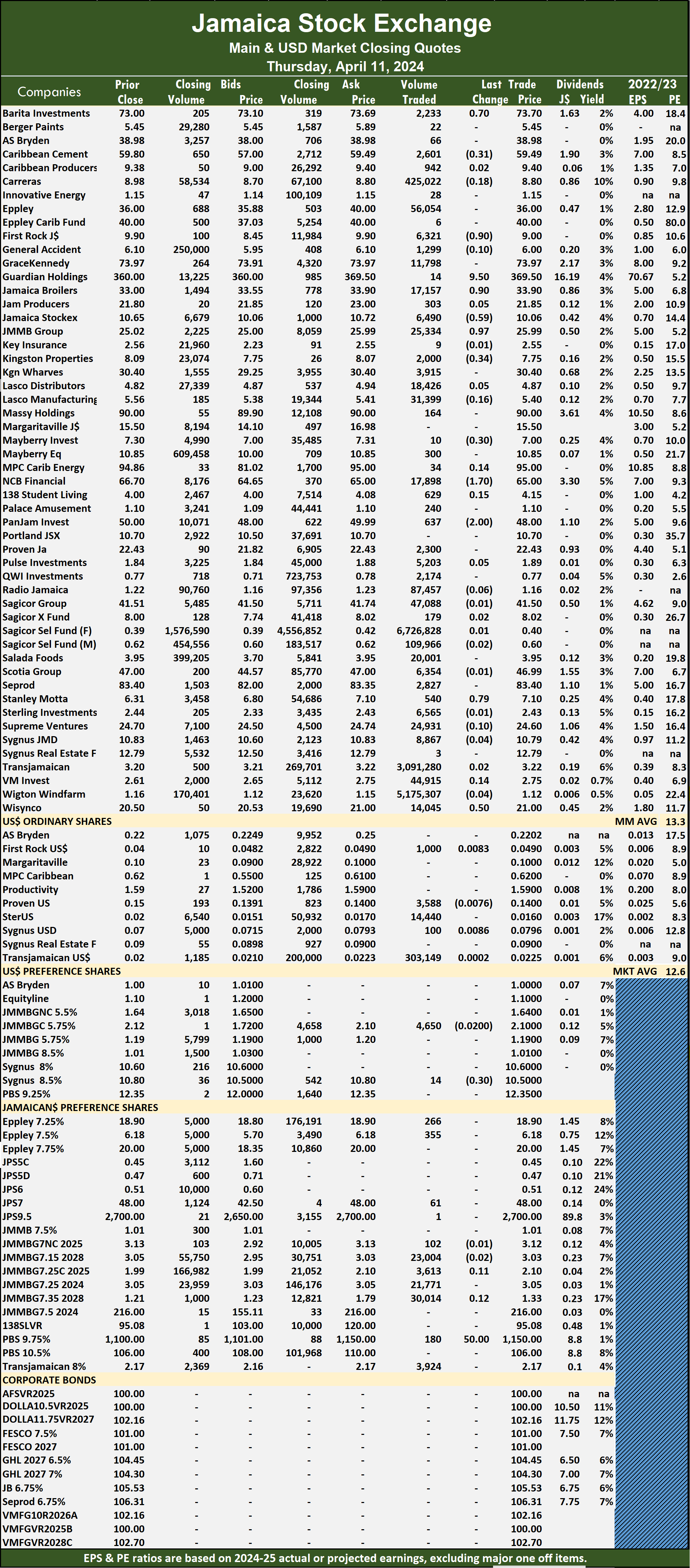

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed with trading of 16,091,472 shares for $32,718,333 up from 8,771,865 units at $27,969,713 on Wednesday.

The market closed with trading of 16,091,472 shares for $32,718,333 up from 8,771,865 units at $27,969,713 on Wednesday. The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

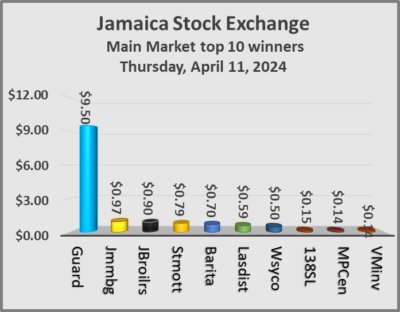

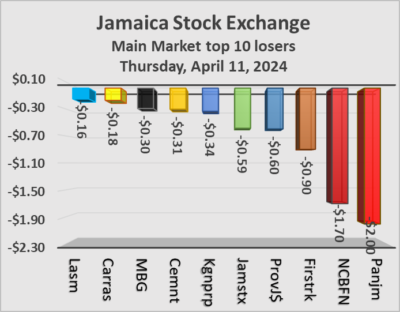

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. JMMB Group rose 97 cents to $25.99 after a transfer of 25,334 stocks, Kingston Properties skidded 34 cents in closing at $7.75 after 2,000 stock units passed through the market, Mayberry Group fell 30 cents to end at $7, with 10 shares changing hands. NCB Financial declined by $1.70 and ended at $65 in an exchange of 17,898 stocks, Pan Jamaica lost $2 to finish at $48 with investors transferring 637 units, Stanley Motta advanced 79 cents to close at $7.10 after closing with an exchange of 540 stock units and Wisynco Group increased 50 cents to $21 with a transfer of 14,045 shares.

JMMB Group rose 97 cents to $25.99 after a transfer of 25,334 stocks, Kingston Properties skidded 34 cents in closing at $7.75 after 2,000 stock units passed through the market, Mayberry Group fell 30 cents to end at $7, with 10 shares changing hands. NCB Financial declined by $1.70 and ended at $65 in an exchange of 17,898 stocks, Pan Jamaica lost $2 to finish at $48 with investors transferring 637 units, Stanley Motta advanced 79 cents to close at $7.10 after closing with an exchange of 540 stock units and Wisynco Group increased 50 cents to $21 with a transfer of 14,045 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

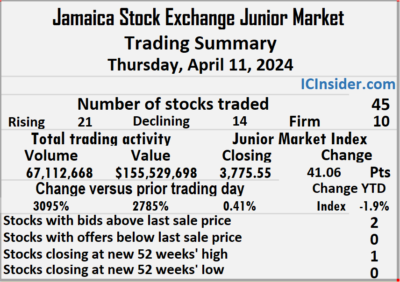

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. following a 2,785 percent jump in value over Wednesday after trading in 45 securities similar to Wednesday and ending with prices of 21 rising, 14 declining and 10 closing unchanged.

following a 2,785 percent jump in value over Wednesday after trading in 45 securities similar to Wednesday and ending with prices of 21 rising, 14 declining and 10 closing unchanged. Energy with 4.04 million units for 6 percent of the day’s trade and One Great Studio with 832,703 units for 1.2 percent market share.

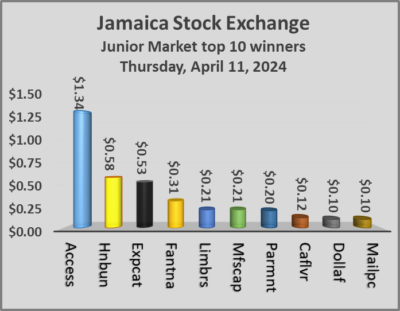

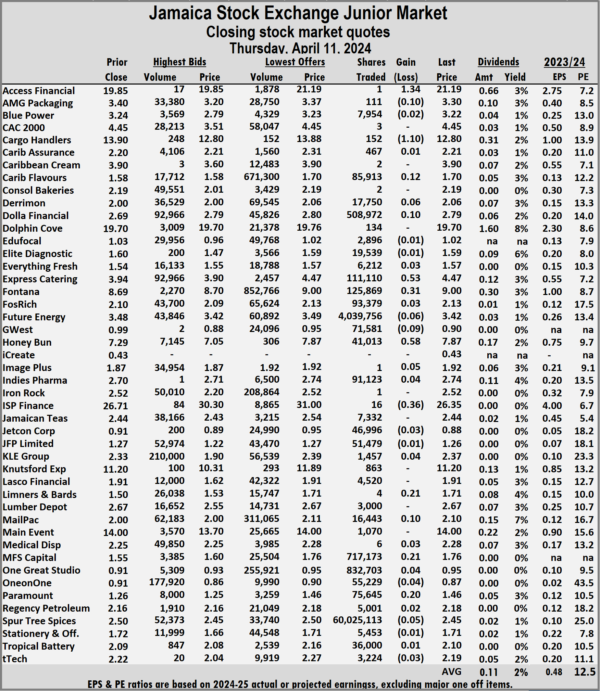

Energy with 4.04 million units for 6 percent of the day’s trade and One Great Studio with 832,703 units for 1.2 percent market share. Caribbean Flavours rallied 12 cents to end at $1.70 with 85,913 stock units crossing the market, Dolla Financial popped 10 cents in closing at $2.79 with an exchange of 508,972 shares, Express Catering gained 53 cents to finish at $4.47 after investors ended trading 111,110 stock units. Fontana increased 31 cents and ended at $9 with the transferring of 125,869 stocks, GWest Corporation sank 9 cents to 90 cents in an exchange of 71,581 units, Honey Bun climbed 58 cents to close at a 52 weeks’ high of $7.87 with investors dealing in 41,013 stocks. ISP Finance slipped 36 cents to finish at $26.35, with 16 units crossing the exchange, Limners and Bards advanced 21 cents in closing at $1.71 in trading a mere 4 shares, Mailpac Group rose 10 cents to end at $2.10, with 16,443 stock units changing hands. MFS Capital Partners gained 21 cents to close at $1.76 with investors trading 717,173 shares and Paramount Trading popped 20 cents to finish at $1.46 in an exchange of 75,645 stocks.

Caribbean Flavours rallied 12 cents to end at $1.70 with 85,913 stock units crossing the market, Dolla Financial popped 10 cents in closing at $2.79 with an exchange of 508,972 shares, Express Catering gained 53 cents to finish at $4.47 after investors ended trading 111,110 stock units. Fontana increased 31 cents and ended at $9 with the transferring of 125,869 stocks, GWest Corporation sank 9 cents to 90 cents in an exchange of 71,581 units, Honey Bun climbed 58 cents to close at a 52 weeks’ high of $7.87 with investors dealing in 41,013 stocks. ISP Finance slipped 36 cents to finish at $26.35, with 16 units crossing the exchange, Limners and Bards advanced 21 cents in closing at $1.71 in trading a mere 4 shares, Mailpac Group rose 10 cents to end at $2.10, with 16,443 stock units changing hands. MFS Capital Partners gained 21 cents to close at $1.76 with investors trading 717,173 shares and Paramount Trading popped 20 cents to finish at $1.46 in an exchange of 75,645 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.