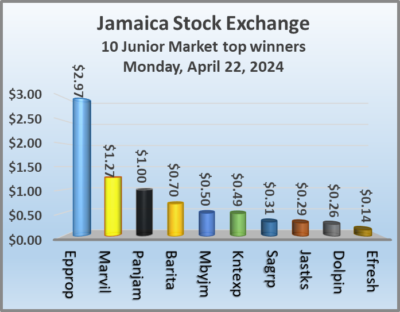

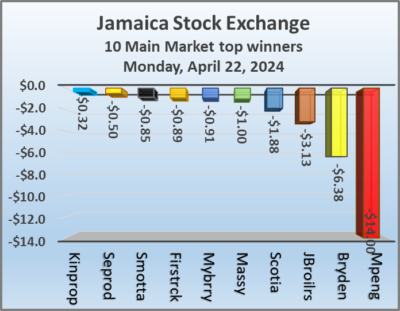

Trading jumped sharply on the Jamaica Stock Exchange on Monday with trading in 12.13 million shares in Jamaica Broilers followed by Sagicor Group with 12.07 million units, valued at $388 million and $500 million respectively and pushed the overall value of stock trading to $1.1 billion with volume well above that on Friday as the Main Market and the Junior Market declined at the close of the market but the JSE USD market closed moderately higher as trading ended with the prices of 22 shares rising and 44 declining.

At the close of the market, the JSE Combined Market Index dropped 3,753.71 points to 331,404.71, the All Jamaican Composite Index declined 2,565.76 points to end at 356,312.39, the JSE Main Index shed 3,787.12 points to finish at 318,254.75. The Junior Market Index dipped 17.69 points to finish at 3,776.45 and the JSE USD Market Index gained 4.33 points to finish at 242.03.

At the close of the market, the JSE Combined Market Index dropped 3,753.71 points to 331,404.71, the All Jamaican Composite Index declined 2,565.76 points to end at 356,312.39, the JSE Main Index shed 3,787.12 points to finish at 318,254.75. The Junior Market Index dipped 17.69 points to finish at 3,776.45 and the JSE USD Market Index gained 4.33 points to finish at 242.03.

At the end of trading, 43,112,419 shares were exchanged in all three markets, up from 7,124,664 units on Friday, with the value of stocks traded on the Junior and Main markets amounted to $1.1 billion, well over the $82.86 million on the previous trading day and the JSE USD market closed with an exchange of 119,368 shares for US$11,630 compared to 880,808 units at US$49,826 on Friday.

In Main Market activity, Jamaica Broilers led trading with 12.13 million shares followed by Sagicor Group with 12.07 million units, Scotia Group with 3.05 million units, Wisynco Group with 2.56 million shares, Wigton Windfarm with 1.84 million stock units and Transjamaican Highway with 1.15 million stocks.

In Junior Market trading, Spur Tree Spices led trading with 4.60 million shares followed by KLE Group with 567,507 stock units and Jamaican Teas with 363,876 units.

In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 and 138 Student Living preference share advanced $7 to close at $218.

In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 and 138 Student Living preference share advanced $7 to close at $218.

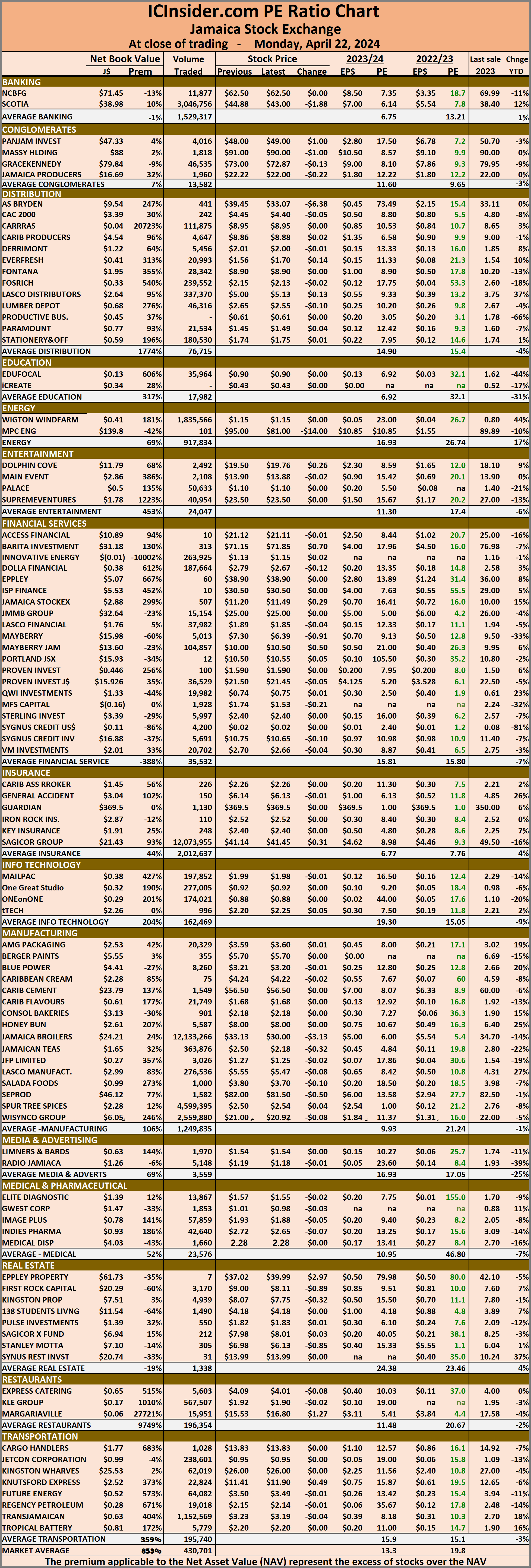

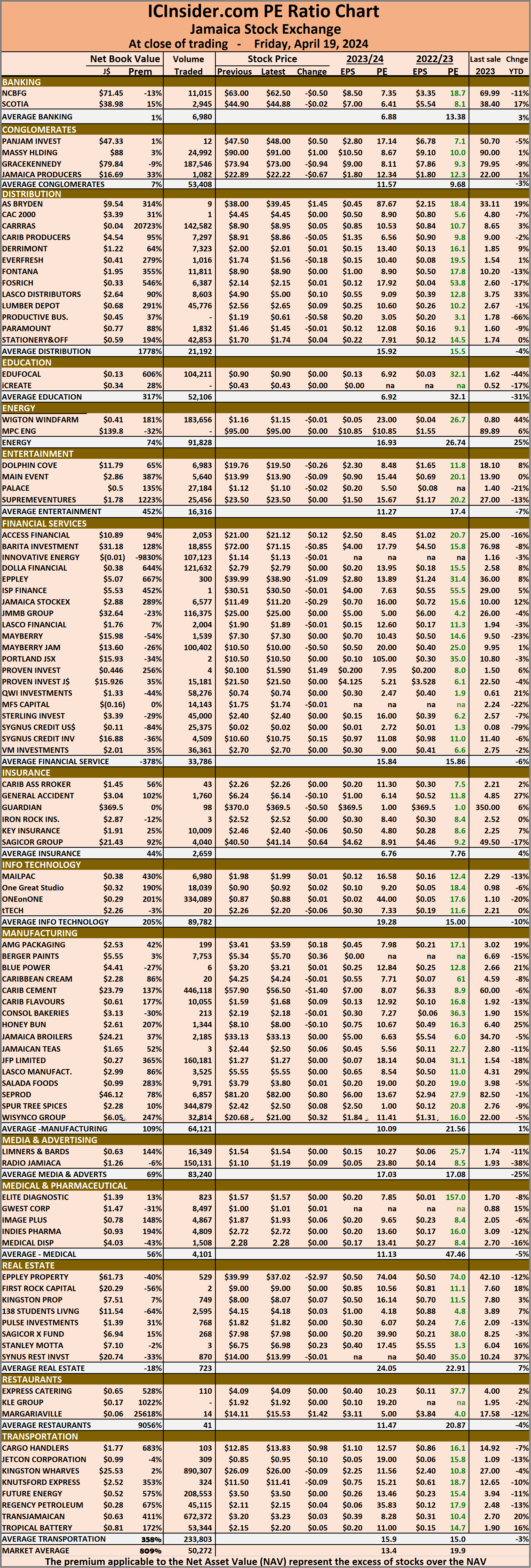

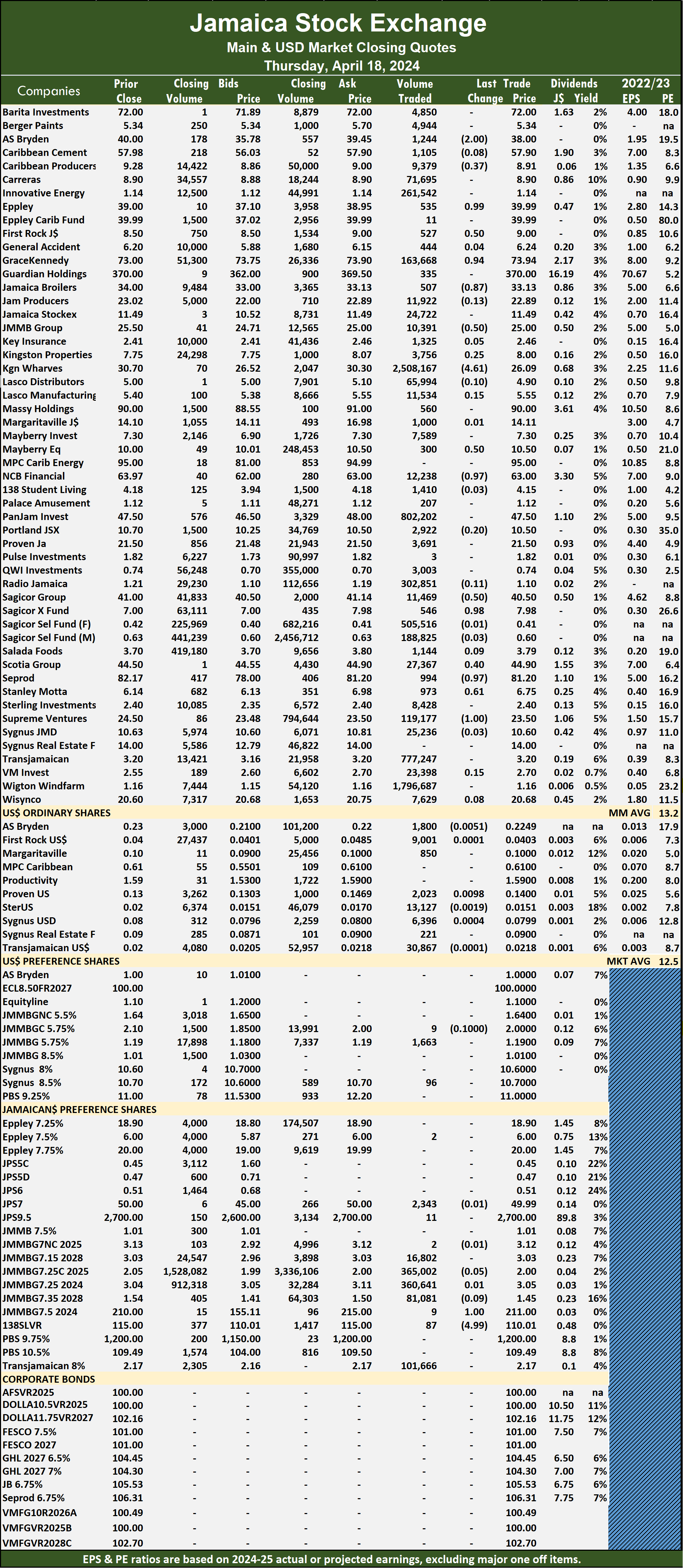

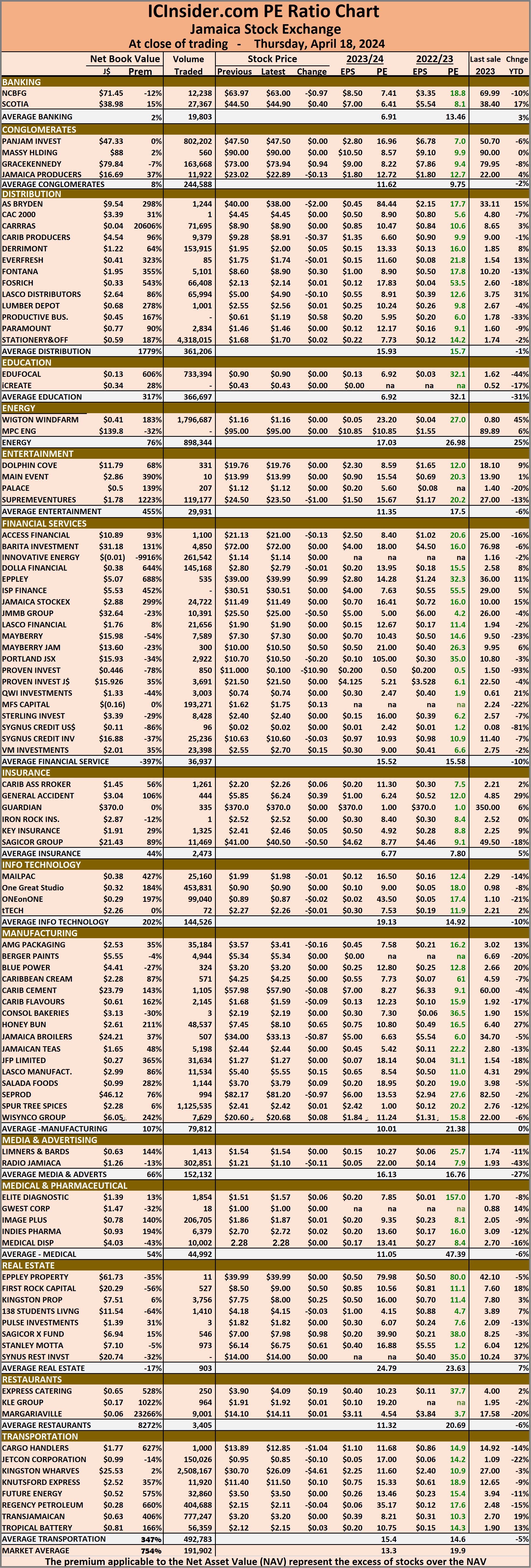

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.8 on 2023-24 earnings and 13.3. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

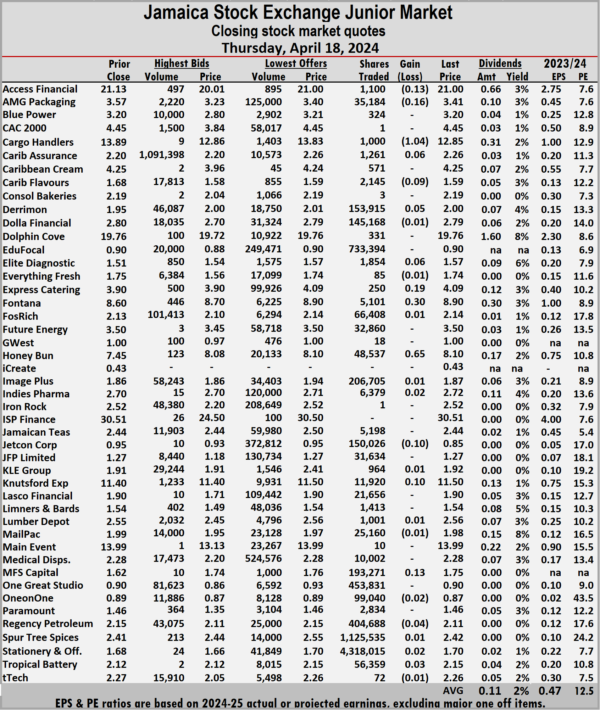

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Profits continue to send mixed signals

Early profit results for the first 2024 quarter show some positives, with the Montego Bay-based Knutsford Express reporting b revenue growth and profit for the quarter and the nine months to February, followed by positive results for AMG Packaging and Express Catering, but there were also some disappointing ones.

Knutsford Express

The directors of Knutsford Express stated that “strong and steady demand for our courier services complemented our passenger services have combined in delivering year to date profit of $268 million, up 27.1 percent from $211 million at the end of February 2023. We, therefore, recorded a 20.9 percent growth in our total revenue in this quarter moving to $565 million from $468 million in the comparative period in 2023. Similarly, our nine-month year-to-date revenue has increased by 19.5 percent from $1,281 million in 2023 to $1,530 million in 2024.”

Innovative Energy, formerly Ciboney reported no revenues in the February quarter and a loss of $4.4 million with the year to date, ending with $500,000 in income and a loss of $7.8 million.

AMG Packaging grew profit by 79 percent to $32 million from $18 million in 2023, better than the 72 percent rise in the first quarter. For the six months to February, profit was up by 79 percent to $84 million from $47 million in 2023.

Revenues climbed from US$6 million to US$7 million at Express Catering, up 17.6 percent in the quarter and increased by 23 percent from US$15 million to US$18.7 million, delivering a profit of US$2 million for the year to date and US$1 million for the latest quarter, compared with US$1.9 million for the nine months in 2023 and $1.15 million in the February 2023 quarter. Ian Dear, the company’s CEO confirmed that added cost in the third quarter would have been associated with new restaurants opened close to the quarter as such, some of the cost would not be fully covered by revenues.

The revenue at Margaritaville (Turks) rose just 5 percent to US$5.25 million for the current year, compared to US$4.98 million for the same period last year, with a net profit of US$521,909, earnings per share of 0.773 US cents compared with the similar period of 2023, with a net profit of US$1.18 million which includes non-recurring gains of US$658,000 for EPS of 1.749 US cents.

The revenue at Margaritaville (Turks) rose just 5 percent to US$5.25 million for the current year, compared to US$4.98 million for the same period last year, with a net profit of US$521,909, earnings per share of 0.773 US cents compared with the similar period of 2023, with a net profit of US$1.18 million which includes non-recurring gains of US$658,000 for EPS of 1.749 US cents.

For the third quarter, revenues fell to US$1.9 million from US$2.2 million in 2023, delivering a profit of US$222,174 versus US$725,000 in 2023 including one time income of US$340,000.

Sygnus Real Estate Finance fell by 43 percent in the February quarter from $67 million in 2023 to $44 million in 2024. For six months revenues reached $88 million down 38 percent from $142 million in the prior year. The company incurred a loss of $187 million in the 2024 second quarter 45 percent worse than the $129 million and for the six months, a loss of $320 million was incurred marginally more than $302 million in 2023.

Paramount Trading is expanding into Chlorine and bleach processing.

Paramount Trading reported reduced revenues and profit for the third quarter and the nine months. Revenues in the February quarter declined 8.5 percent from $438 million in 2023 to $401 million in 2024. For the nine months, revenues fell 23 percent from $1.63 billion down to $1.266 billion with profits coming in at 40 percent lower at $18 million for the quarter from $30 million in 2023 and 44 percent to $100 million for the nine months of February this year from $179 million in the previous year.

One On One Educational Services reported revenues of $57 million in the February quarter down 12 percent from $73 million in 2023 and fell 27 percent to $111 million for the six months to February from $153 million in 2023.

A loss of $20 million million was incurred in the February quarter down from a profit of $6 million in 2023 and a loss of $41 million for the six months, down from a profit of $17 million in 2023 for the 6 months.

Big trading jump on the JSE USD Market

Trading jumped sharply on the Jamaica Stock Exchange US dollar market ended on Friday, with a huge 1,233 percent rise in the volume of stocks exchanged, with 794 percent greater value than on Thursday, resulting in trading in eight securities, down from 11 on Thursday with prices of four rising, two declining and two ending unchanged.

The market closed with an exchange of 880,808 shares for US$49,826 up sharply from 66,053 stock units at US$5,573 on Thursday.

The market closed with an exchange of 880,808 shares for US$49,826 up sharply from 66,053 stock units at US$5,573 on Thursday.

Trading averaged 110,101 units at US$6,228 versus 6,005 shares at US$507 on Thursday, with a month to date average of 38,941 shares at US$2,417 compared with 33,620 units at US$2,132 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index declined 3.05 points to wrap-up trading at 237.70.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share rose 0.52 of one cent in closing at 4.55 US cents as investors exchanged 14 stocks, Productive Business Solutions ended at US$1.59 and closed with an exchange of 4 units, Proven Investments ended at 14 US cents as investors traded 113,267 shares.  Sterling Investments climbed 0.19 of a cent and ended at 1.7 US cents after 25,375 stock units passed through the market, Sygnus Credit Investments declined 0.02 of a cent to end at 7.97 US cents after a transfer of 4,488 shares and Transjamaican Highway lost 0.18 of a cent to close at 2 US cents, with 726,047 stocks crossing the market.

Sterling Investments climbed 0.19 of a cent and ended at 1.7 US cents after 25,375 stock units passed through the market, Sygnus Credit Investments declined 0.02 of a cent to end at 7.97 US cents after a transfer of 4,488 shares and Transjamaican Highway lost 0.18 of a cent to close at 2 US cents, with 726,047 stocks crossing the market.

In the preference segment, JMMB Group US8.5% preference share popped 1 cent to US$1.20 with a transfer of 11,224 units and Productive Business Solutions 9.25% preference share gained 20 cents and ended at US$11.20, with 389 stock units crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading spreads on JSE USD Market

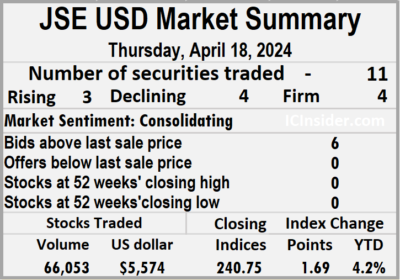

Investors participated in a wide selection of stocks in trading on the Jamaica Stock Exchange US dollar market on Thursday, resulting in trading in 11 securities, compared to 10 on Wednesday with prices of three rising, four declining and four ending unchanged, with the volume of stocks traded declining 93 percent with an 89 percent lower value than on Wednesday.

The market closed with an exchange of 66,053 shares for US$5,574 compared to 1,005,394 units at US$50,711 on Wednesday.

The market closed with an exchange of 66,053 shares for US$5,574 compared to 1,005,394 units at US$50,711 on Wednesday.

Trading averaged 6,005 units at US$507 versus 100,539 shares at US$5,071 on Wednesday, with a month to date average of 33,620 shares at US$2,132 compared with 36,785 units at US$2,318 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index popped 1.69 points to culminate at 240.75.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, AS Bryden lost 0.51 of one cent to 22.49 US cents after a transfer of 1,800 shares, First Rock Real Estate USD share gained 0.01 of a cent to close at 4.03 US cents in trading 9,001 units, Margaritaville remained at 10 US cents in switching ownership of 850 shares. Proven Investments rose 0.98 of one cent in closing at 14 US cents with investors trading 2,023 stock units, Sterling Investments dipped 0.19 of a cent to end at 1.51 US cents with 13,127 shares clearing the market, Sygnus Credit Investments rallied 0.04 cent to finish at 7.99 US cents after an exchange of 6,396 stock units. Sygnus Real Estate Finance USD share ended at 9 US cents after 221 stocks crossed the market and Transjamaican Highway fell 0.01 of a cent to end at 2.18 US cents as investors exchanged 30,867 units.

Sygnus Real Estate Finance USD share ended at 9 US cents after 221 stocks crossed the market and Transjamaican Highway fell 0.01 of a cent to end at 2.18 US cents as investors exchanged 30,867 units.

In the preference segment, JMMB Group US8.5% preference share ended at US$1.19 with 1,663 stocks crossing the market. JMMB Group 5.75% skidded 10 cents to US$2 with investors swapping 9 shares and Sygnus Credit Investments E8.5% ended at US$10.70 as 96 units passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

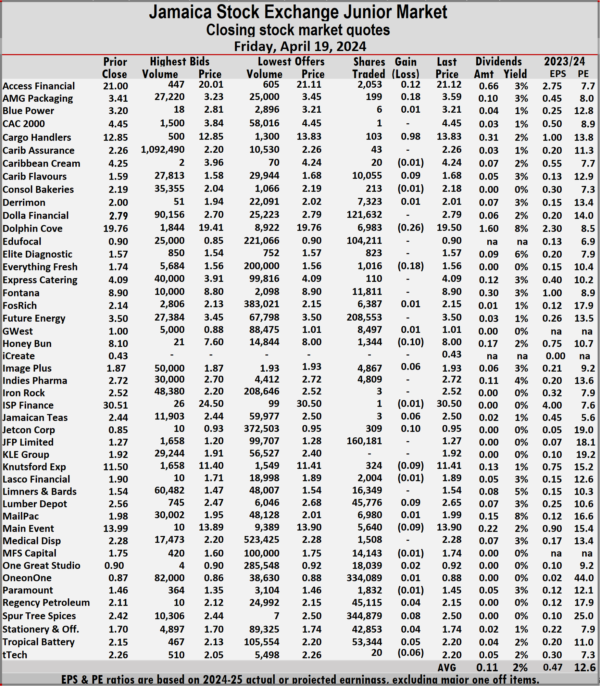

The market closed with 4,649,405 shares trading for $79,455,741 down from 8,718,855 units at $132,519,420 on Thursday.

The market closed with 4,649,405 shares trading for $79,455,741 down from 8,718,855 units at $132,519,420 on Thursday. The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Margaritaville increased $1.42 in closing at $15.53 in an exchange of 4 stocks, Massy Holdings climbed $1 to finish at $91 with investors swapping 24,992 stock units, Mayberry Jamaican Equities declined 50 cents to close at $10 in an exchange of 100,402 stock units. NCB Financial skidded 50 cents to $62.50 after investors traded 11,015 shares, Pan Jamaica rose 50 cents to close at $48 with an exchange of 12 stocks, Sagicor Group gained 64 cents in closing at $41.14 with 4,040 units clearing the market. Seprod advanced 80 cents to end at $82 and closed with 6,857 stock units changing hands and Wisynco Group rose 32 cents and ended at $21 with an exchange of 32,814 shares.

Margaritaville increased $1.42 in closing at $15.53 in an exchange of 4 stocks, Massy Holdings climbed $1 to finish at $91 with investors swapping 24,992 stock units, Mayberry Jamaican Equities declined 50 cents to close at $10 in an exchange of 100,402 stock units. NCB Financial skidded 50 cents to $62.50 after investors traded 11,015 shares, Pan Jamaica rose 50 cents to close at $48 with an exchange of 12 stocks, Sagicor Group gained 64 cents in closing at $41.14 with 4,040 units clearing the market. Seprod advanced 80 cents to end at $82 and closed with 6,857 stock units changing hands and Wisynco Group rose 32 cents and ended at $21 with an exchange of 32,814 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

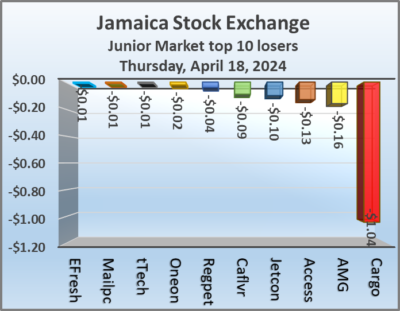

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading closed with an exchange of 1,594,451 shares for $3,409,014 down sharply from 8,355,224 stock units at $15,074,942 on Thursday.

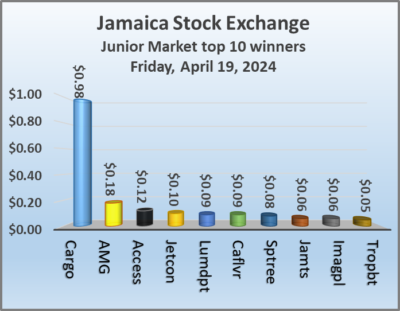

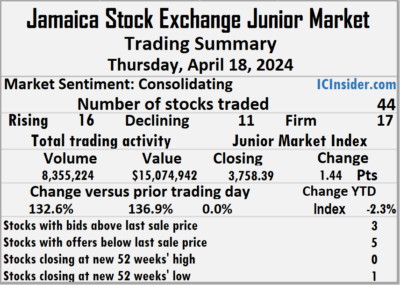

Trading closed with an exchange of 1,594,451 shares for $3,409,014 down sharply from 8,355,224 stock units at $15,074,942 on Thursday. Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling price and two with lower offers.

Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling price and two with lower offers. Jetcon Corporation increased 10 cents to end at 95 cents and closed after an exchange of 309 stocks, Knutsford Express sank 9 cents in closing at $11.41 after an exchange of 324 units. Lumber Depot popped 9 cents higher and ended at $2.65 with investors trading 45,776 stocks, Main Event dipped 9 cents to finish at $13.90 after an exchange of 5,640 shares. Spur Tree Spices advanced 8 cents to close at $2.50 in trading 344,879 stock units, Tropical Battery increased 5 cents to end at $2.20 with investors transferring 53,344 stocks and tTech shed 6 cents to close at $2.20 after trading 20 units.

Jetcon Corporation increased 10 cents to end at 95 cents and closed after an exchange of 309 stocks, Knutsford Express sank 9 cents in closing at $11.41 after an exchange of 324 units. Lumber Depot popped 9 cents higher and ended at $2.65 with investors trading 45,776 stocks, Main Event dipped 9 cents to finish at $13.90 after an exchange of 5,640 shares. Spur Tree Spices advanced 8 cents to close at $2.50 in trading 344,879 stock units, Tropical Battery increased 5 cents to end at $2.20 with investors transferring 53,344 stocks and tTech shed 6 cents to close at $2.20 after trading 20 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading on the overall market ended as the number and value of stocks changing hands dropped, from the previous trading day, resulting in prices of 37 shares rising and 31 declining.

Trading on the overall market ended as the number and value of stocks changing hands dropped, from the previous trading day, resulting in prices of 37 shares rising and 31 declining. In the preference segment, Productive Business Solutions 9.75% preference share gained $4.99 to finish at $115.

In the preference segment, Productive Business Solutions 9.75% preference share gained $4.99 to finish at $115. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

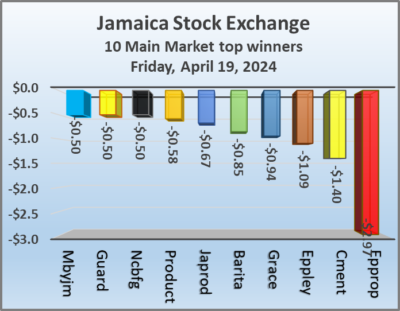

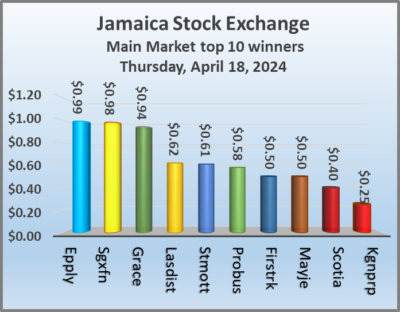

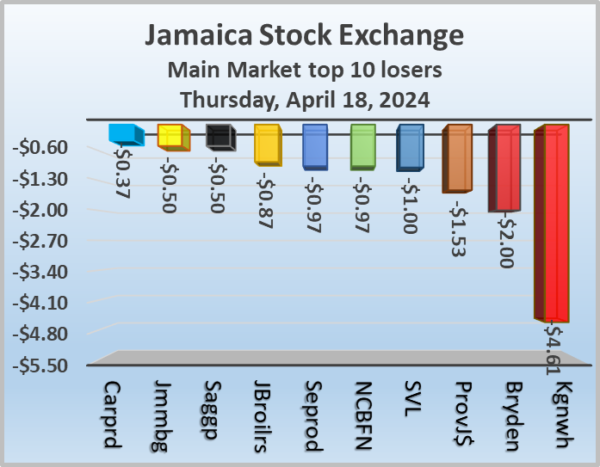

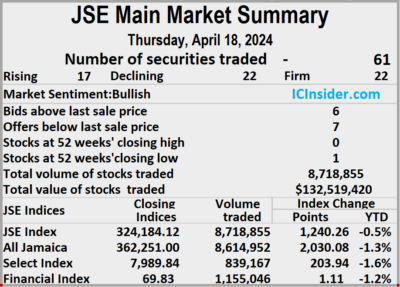

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed with 8,718,855 shares being traded at $132,519,420 up from 7,107,320 units at $37,509,746 on Wednesday.

The market closed with 8,718,855 shares being traded at $132,519,420 up from 7,107,320 units at $37,509,746 on Wednesday. The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

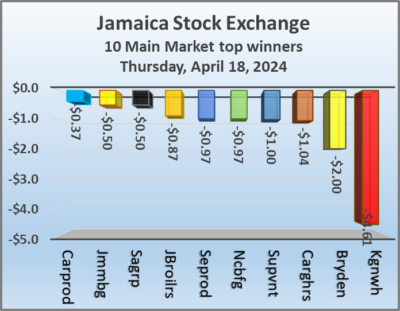

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Kingston Wharves fell $4.61 to $26.09 with an exchange of 2,508,167 shares. Mayberry Jamaican Equities rallied 50 cents to end at $10.50 with 300 stocks crossing the market, NCB Financial dipped 97 cents in closing at $63 as investors exchanged 12,238 units, Sagicor Group lost 50 cents to close at $40.50 in trading 11,469 stock units. Sagicor Real Estate Fund rallied 98 cents to $7.98 after exchanging 546 shares, Scotia Group advanced 40 cents to finish at $44.90 with investors swapping 27,367 stocks, Seprod dropped 97 cents and ended at $81.20 after an exchange of 994 units. Stanley Motta rose 61 cents to close at $6.75 with investors transferring 973 stock units and Supreme Ventures slipped $1 in closing at $23.50 with 119,177 shares changing hands.

Kingston Wharves fell $4.61 to $26.09 with an exchange of 2,508,167 shares. Mayberry Jamaican Equities rallied 50 cents to end at $10.50 with 300 stocks crossing the market, NCB Financial dipped 97 cents in closing at $63 as investors exchanged 12,238 units, Sagicor Group lost 50 cents to close at $40.50 in trading 11,469 stock units. Sagicor Real Estate Fund rallied 98 cents to $7.98 after exchanging 546 shares, Scotia Group advanced 40 cents to finish at $44.90 with investors swapping 27,367 stocks, Seprod dropped 97 cents and ended at $81.20 after an exchange of 994 units. Stanley Motta rose 61 cents to close at $6.75 with investors transferring 973 stock units and Supreme Ventures slipped $1 in closing at $23.50 with 119,177 shares changing hands. In the preference segment, 138 Student Living preference share rallied $1 to end at $211 with investors dealing in 9 units and Productive Business Solutions 9.75% preference share sank $4.99 to $110.01 after trading 87 stocks.

In the preference segment, 138 Student Living preference share rallied $1 to end at $211 with investors dealing in 9 units and Productive Business Solutions 9.75% preference share sank $4.99 to $110.01 after trading 87 stocks. The market closed with trading of 8,355,224 shares for $15,074,942 up from just 3,592,810 units at $6,363,318 on Wednesday.

The market closed with trading of 8,355,224 shares for $15,074,942 up from just 3,592,810 units at $6,363,318 on Wednesday. At the close of trading, the Junior Market Index popped 1.44 points to 3,758.39.

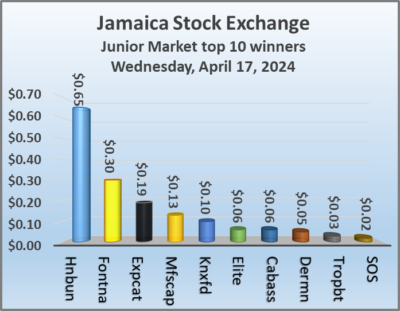

At the close of trading, the Junior Market Index popped 1.44 points to 3,758.39. Express Catering rose 19 cents to end at $4.09 with investors transferring 250 units, Fontana climbed 30 cents in closing at $8.90 in an exchange of 5,101 shares. Honey Bun popped 65 cents to $8.10 with investors trading 48,537 stocks, Jetcon Corporation declined 10 cents to end at 85 cents in switching ownership of 150,026 stock units, Knutsford Express advanced 10 cents in closing at $11.50 after 11,920 shares passed through the exchange and MFS Capital Partners rallied 13 cents to close at $1.75 in trading 193,271 stocks.

Express Catering rose 19 cents to end at $4.09 with investors transferring 250 units, Fontana climbed 30 cents in closing at $8.90 in an exchange of 5,101 shares. Honey Bun popped 65 cents to $8.10 with investors trading 48,537 stocks, Jetcon Corporation declined 10 cents to end at 85 cents in switching ownership of 150,026 stock units, Knutsford Express advanced 10 cents in closing at $11.50 after 11,920 shares passed through the exchange and MFS Capital Partners rallied 13 cents to close at $1.75 in trading 193,271 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index climbed 1,198.94 points to 336,962.83, the All Jamaican Composite Index jumped 2,030.08 points to 362,251.00, the JSE Main Index rose 1,240.26 points to conclude trading at 324,184.12. The Junior Market Index squeezed out a gain of 1.44 points to close trading at 3,758.39 and the JSE USD Market Index rose 1.69 points to settle at 240.75.

At the close of trading, the JSE Combined Market Index climbed 1,198.94 points to 336,962.83, the All Jamaican Composite Index jumped 2,030.08 points to 362,251.00, the JSE Main Index rose 1,240.26 points to conclude trading at 324,184.12. The Junior Market Index squeezed out a gain of 1.44 points to close trading at 3,758.39 and the JSE USD Market Index rose 1.69 points to settle at 240.75. The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.9 on 2023-24 earnings and 13.3 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.9 on 2023-24 earnings and 13.3 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.