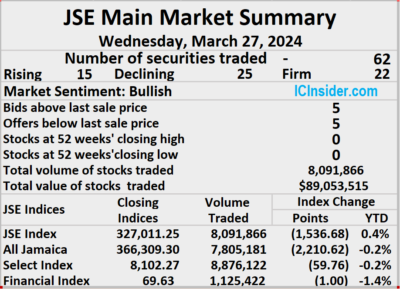

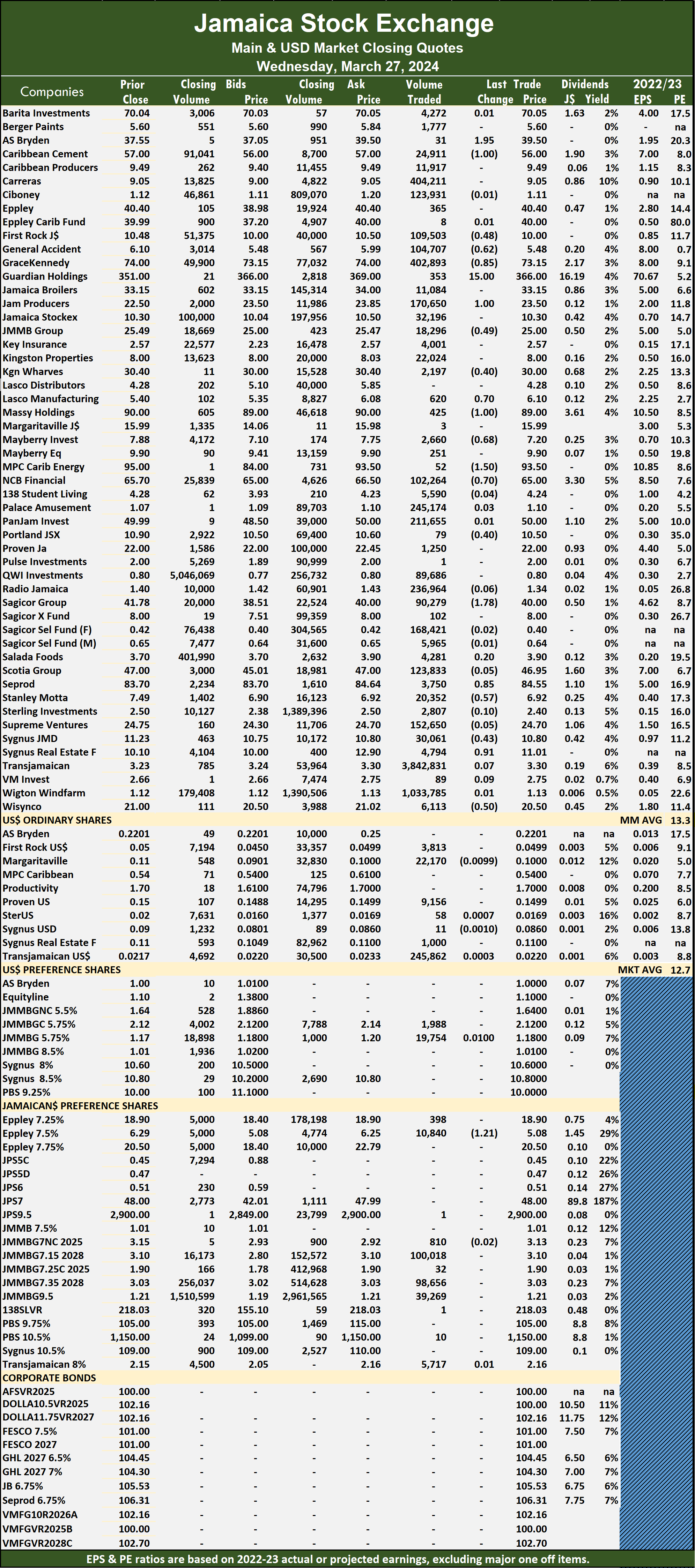

Trading on the Jamaica Stock Exchange Main Market ended on Wednesday, with a 43 percent fall in the volume of stocks traded at a 38 percent lower value than on Tuesday, with trading in 62 securities compared with 60 on Tuesday, with prices of 15 stocks rising, 25 declining and 22 ending unchanged.

The market closed with 8,091,866 shares being traded for $89,053,515 compared with 13,924,449 units at $141,822,725 on Tuesday.

The market closed with 8,091,866 shares being traded for $89,053,515 compared with 13,924,449 units at $141,822,725 on Tuesday.

Trading averaged 130,514 shares at $1,436,347 compared to 240,077 units at $2,408,705 on Tuesday and month to date, an average of 878,131 units at $2,354,246 compared to 922,487 units at $2,408,705 on the previous day and February with an average of 387,306 units at $3,375,928.

Transjamaican Highway led trading with 3.84 million shares for 47.5 percent of total volume followed by Wigton Windfarm with 1.03 million units for 12.8 percent of the day’s trade and Carreras with 404,211 units for 5 percent market share.

The All Jamaican Composite Index shed 2,210.62 points to close at 366,309.30, the JSE Main Index dipped 1,536.68 points to settle at 327,011.25 and the JSE Financial Index sank 1.00 points to settle at 69.63.

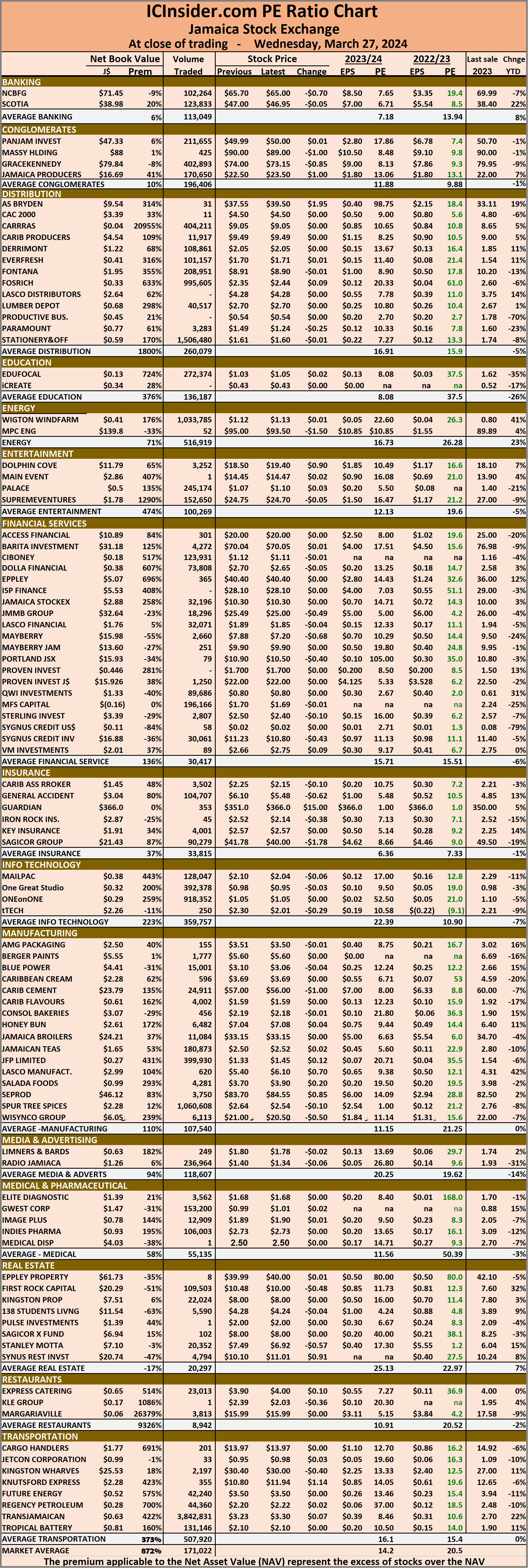

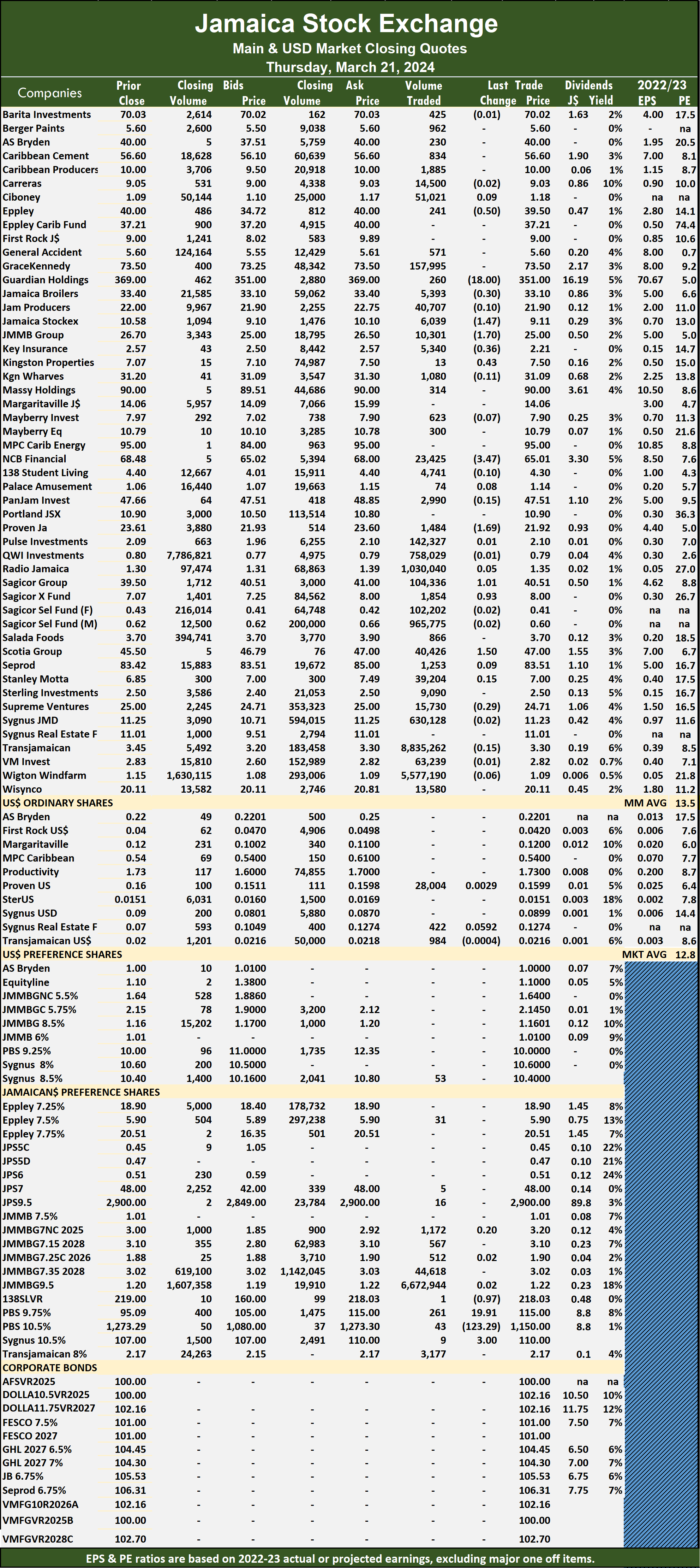

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and five with lower offers.

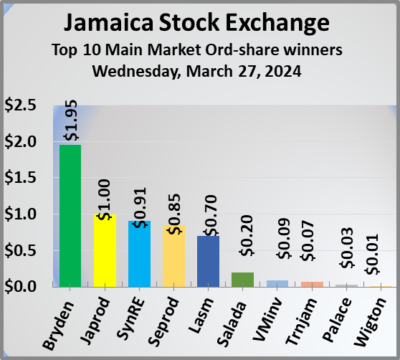

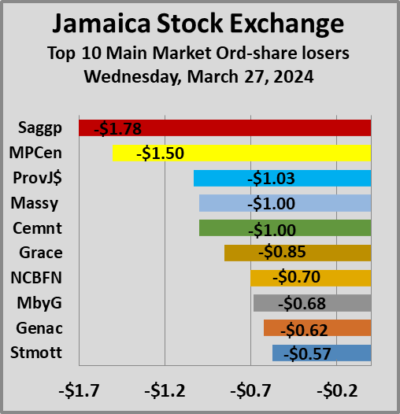

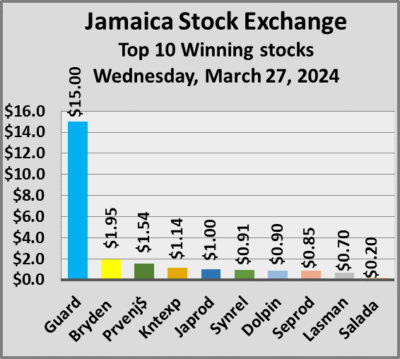

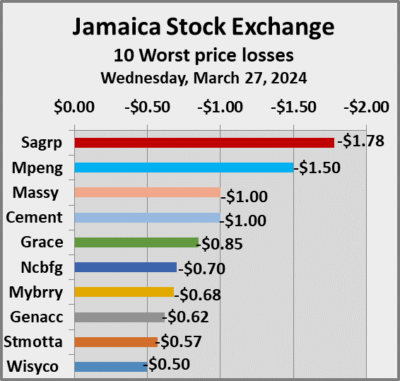

At the close, AS Bryden advanced $1.95 in closing at $39.50 with an exchange of 31 shares, Caribbean Cement dipped $1 to $56 with an exchange of 24,911 units, First Rock Real Estate fell 48 cents and ended at $10 with investors dealing in 109,503 shares. General Accident skidded 62 cents to end at $5.48 in an exchange of 104,707 stock units, GraceKennedy lost 85 cents to close at $73.15 with traders dealing in 402,893 shares, Guardian Holdings popped $15 to $366 as investors exchanged 353 stock units. Jamaica Producers climbed $1 and ended at $23.50 with a transfer of 170,650 stocks, JMMB Group shed 49 cents to close at $25 while exchanging 18,296 units, Kingston Wharves declined 40 cents in closing at $30 with investors trading 2,197 stocks.  Lasco Manufacturing migrated to the Main market on Wednesday and rose 70 cents to end at $6.10 in an exchange of a mere 620 units, following an absence of meaningful offers to sell. Massy Holdings sank $1 in closing at $89, with 425 shares changing hands, Mayberry Group dropped 68 cents to $7.20 with an exchange of 2,660 stock units. MPC Caribbean Clean Energy sank $1.50 and ended at $93.50, with investors trading 52 shares, NCB Financial declined 70 cents to close at $65 with a transfer of 102,264 stocks, Portland JSX fell 40 cents to end at $10.50 after exchanging 79 units. Sagicor Group skidded $1.78 in closing at $40 with investors swapping 90,279 stock units, Seprod rallied 85 cents to $84.55 with 3,750 shares clearing the market, Stanley Motta lost 57 cents to close at $6.92 in switching ownership of 20,352 stock units. Sygnus Credit Investments shed 43 cents to end at $10.80, with 30,061 stocks crossing the market,

Lasco Manufacturing migrated to the Main market on Wednesday and rose 70 cents to end at $6.10 in an exchange of a mere 620 units, following an absence of meaningful offers to sell. Massy Holdings sank $1 in closing at $89, with 425 shares changing hands, Mayberry Group dropped 68 cents to $7.20 with an exchange of 2,660 stock units. MPC Caribbean Clean Energy sank $1.50 and ended at $93.50, with investors trading 52 shares, NCB Financial declined 70 cents to close at $65 with a transfer of 102,264 stocks, Portland JSX fell 40 cents to end at $10.50 after exchanging 79 units. Sagicor Group skidded $1.78 in closing at $40 with investors swapping 90,279 stock units, Seprod rallied 85 cents to $84.55 with 3,750 shares clearing the market, Stanley Motta lost 57 cents to close at $6.92 in switching ownership of 20,352 stock units. Sygnus Credit Investments shed 43 cents to end at $10.80, with 30,061 stocks crossing the market,  Sygnus Real Estate Finance increased 91 cents and ended at $11.01 in trading 4,794 units and Wisynco Group dropped 50 cents to $20.50 after a transfer of 6,113 stocks.

Sygnus Real Estate Finance increased 91 cents and ended at $11.01 in trading 4,794 units and Wisynco Group dropped 50 cents to $20.50 after a transfer of 6,113 stocks.

In the preference segment, Eppley 7.50% preference share dipped $1.21 to end at $5.08, with 10,840 shares crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Stocks lost ground on the JSE Main Market

Main Market drops Junior & USD markets rise

The Main Market of the Jamaica Stock Exchange declined in trading on Wednesday as the Junior and JSE USD markets closed moderately higher as trading ended with the number and value of stocks changing hands falling, compared with the previous trading day, resulting in prices of 29 shares rising and 38 declining, on a day when Lasco Distributors and Lasco Manufacturing switched over to the Main Market from the Junior Market., with the latter jumping 70 cents at the close of the day.

At the close of trading, the JSE Combined Market Index dropped 1,382.30 points to close at 340,171.27, the All Jamaican Composite Index dropped 2,210.62 points to close at 366,309.30, the JSE Main Index sank 1,536.68 points to close at 327,011.25. The Junior Market Index rallied 13.03 points to culminate at 3,829.89 and the JSE USD Market Index gained 0.31 points to finish at 249.15.

At the close of trading, the JSE Combined Market Index dropped 1,382.30 points to close at 340,171.27, the All Jamaican Composite Index dropped 2,210.62 points to close at 366,309.30, the JSE Main Index sank 1,536.68 points to close at 327,011.25. The Junior Market Index rallied 13.03 points to culminate at 3,829.89 and the JSE USD Market Index gained 0.31 points to finish at 249.15.

At the close of trading, 15,566,466 shares were exchanged in all three markets, down from 25,574,514 units on Tuesday, with the value of stocks traded on the Junior and Main markets amounting to $103.70 million, compared with $167.57, million on the previous trading day and the JSE USD market closed with an exchange of 303,812 shares for US$36,667 compared to 154,383 units at US$11,426 on Tuesday.

Trading in the Main Market was dominated by Transjamaican Highway with 3.84 million shares followed by Wigton Windfarm with 1.03 million units and Carreras with 404,211 stocks.

In the Junior Market, Stationery and Office Supplies led trading with 1.51 million shares followed by Spur Tree Spices with 1.06 million stock units and Fosrich with 995,605 units.

In the preference segment, Eppley 7.50% preference share dipped $1.21 to $5.08.

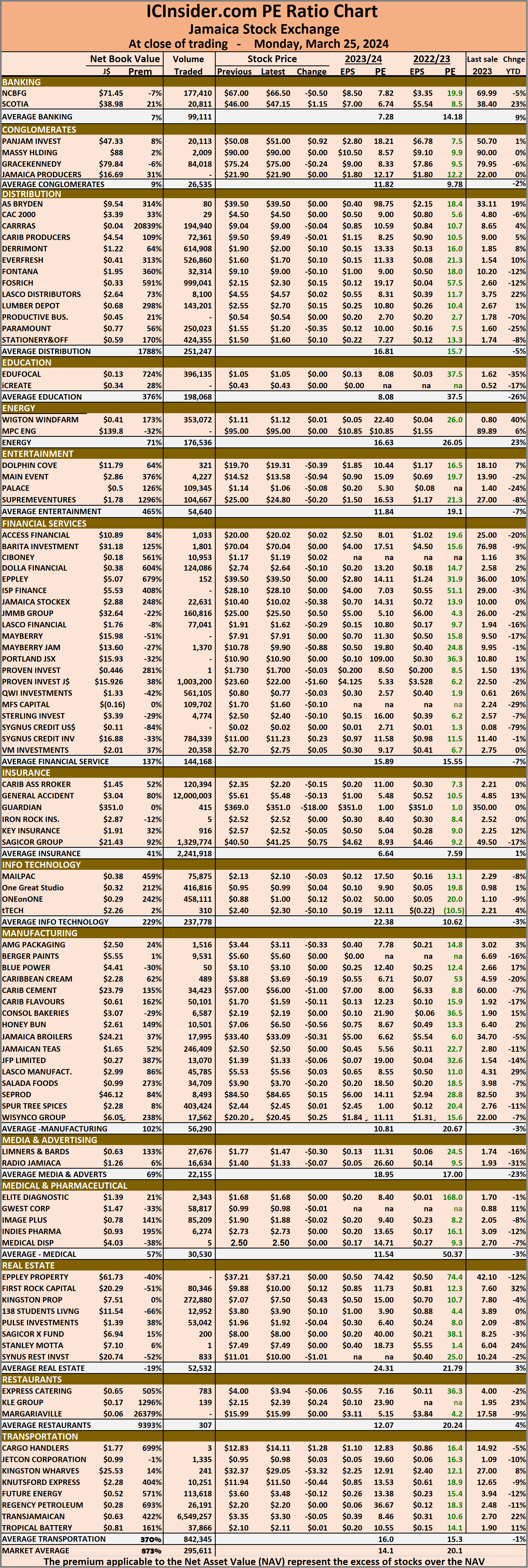

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.5 on 2022-23 earnings and 14.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.5 on 2022-23 earnings and 14.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

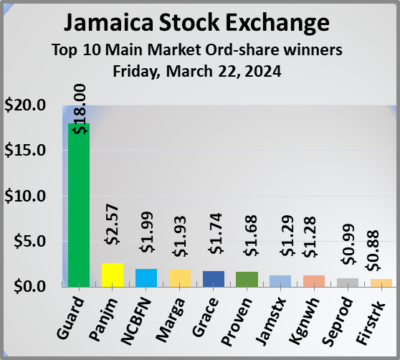

Stocks record big gains on JSE Main Market

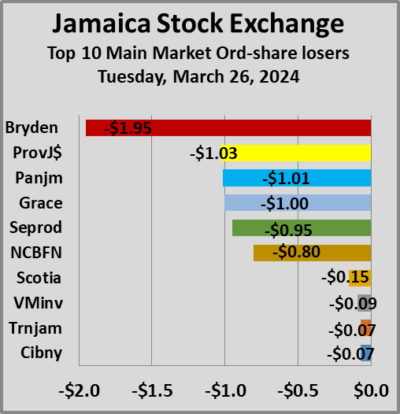

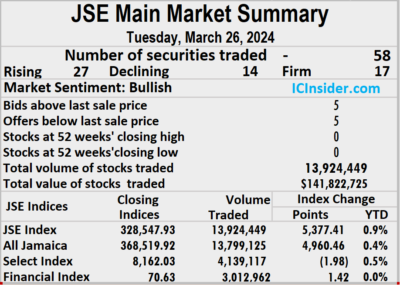

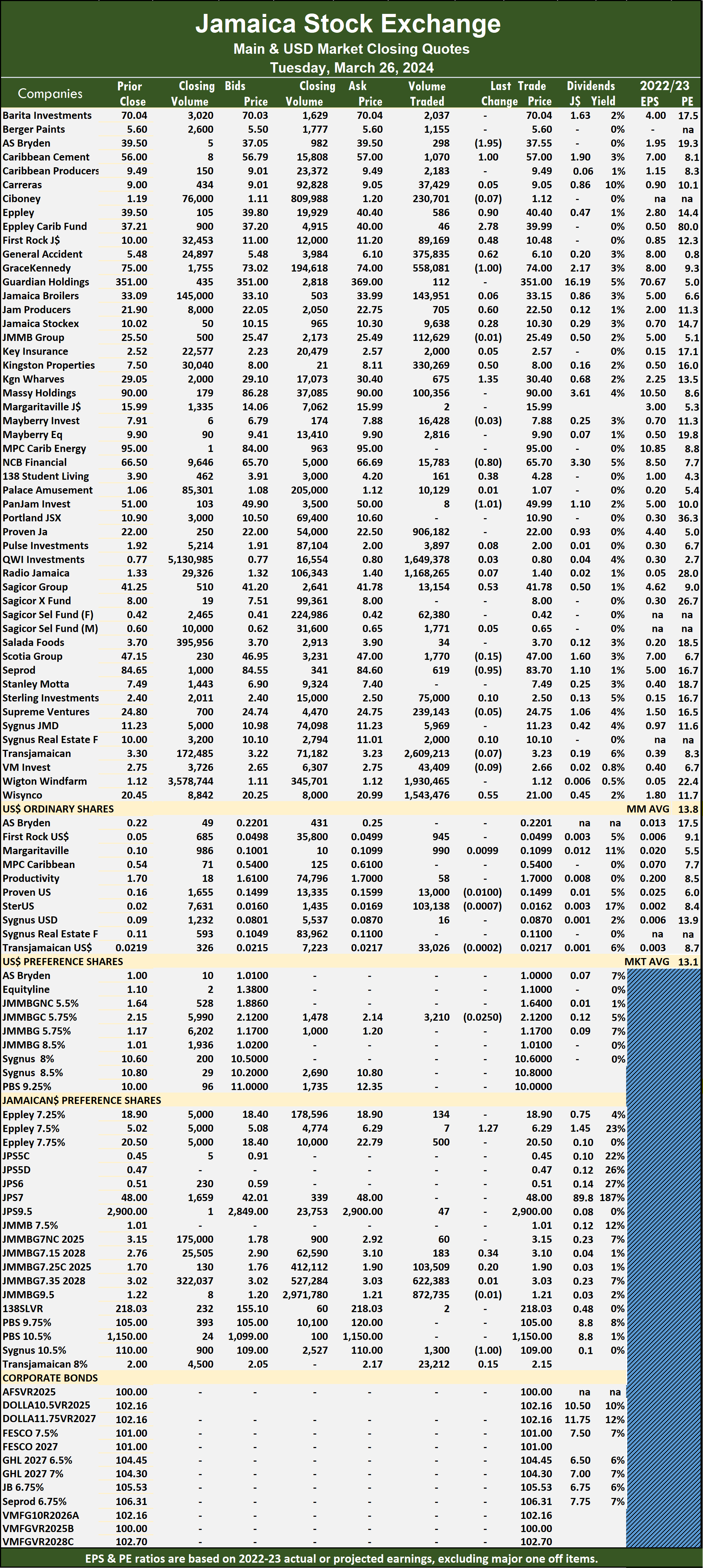

Trading on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks traded declining 46 percent and the value 31 percent lower than on Monday, following trading in 58 securities compared with 55 on Monday, with prices of 27 stocks rising, 14 declining and 17 ending unchanged.

The market closed on Tuesday with the trading of 13,924,449 shares with a value of $141,822,725 compared with 25,850,445 units at $206,255,781 on Monday.

The market closed on Tuesday with the trading of 13,924,449 shares with a value of $141,822,725 compared with 25,850,445 units at $206,255,781 on Monday.

Trading averaged 240,077 shares at $2,445,219 compared to 470,008 units at $3,750,105 on Monday and month to date, an average of 922,487 units at $2,408,707, in comparison to 962,588 units at $2,406,562 on the previous day and February with an average of 385,143 units at $3,418,046.

Transjamaican Highway led trading with 2.61 million shares for 18.7 percent of total volume followed by Wigton Windfarm with 1.93 million units for 13.9 percent of the day’s trade, QWI Investments ended with 1.65 million units for 11.8 percent of market share, Wisynco Group closed with 1.54 million units for 11.1 percent of shares trading and Radio Jamaica with 1.17 million units for 8.4 percent of total volume.

The All Jamaican Composite Index climbed 4,960.46 points to culminate at 368,519.92, the JSE Main Index jumped 5,377.41 points to 328,547.93 and the JSE Financial Index popped 1.42 points to lock up trading at 70.63.

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and five with lower offers.

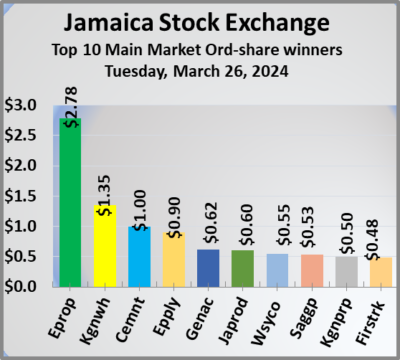

At the close, AS Bryden fell $1.95 in closing at $37.55 after 298 stock units cleared the market, Caribbean Cement gained $1 to $57 after exchanging 1,070 shares, Eppley rose 90 cents and ended at $40.40 with a transfer of 586 units. Eppley Caribbean Property Fund climbed $2.78 to end at $39.99 with investors dealing in 46 stocks, First Rock Real Estate popped 48 cents to close at $10.48 with 89,169 units crossing the market, General Accident rallied 62 cents to $6.10 with investors transferring 375,835 stocks. GraceKennedy lost $1 and ended at $74 trading 558,081 shares, Jamaica Producers increased 60 cents to close at $22.50 in switching ownership of 705 stock units, Kingston Properties advanced 50 cents to end at $8 with investors swapping 330,269 shares. Kingston Wharves rose $1.35 in closing at $30.40, with 675 units crossing the exchange, NCB Financial shed 80 cents to end at $65.70 after a transfer of 15,783 stocks, 138 Student Living gained 38 cents to end at $4.28 after 161 stock units passed through the market. Pan Jamaica declined $1.01 in closing at $49.99 while exchanging 8 shares, Sagicor Group popped 53 cents to close at $41.78 with investors trading 13,154 units, Seprod sank 95 cents and ended at $83.70 with an exchange of 619 stocks and Wisynco Group increased 55 cents to $21, with 1,543,476 stock units changing hands.

NCB Financial shed 80 cents to end at $65.70 after a transfer of 15,783 stocks, 138 Student Living gained 38 cents to end at $4.28 after 161 stock units passed through the market. Pan Jamaica declined $1.01 in closing at $49.99 while exchanging 8 shares, Sagicor Group popped 53 cents to close at $41.78 with investors trading 13,154 units, Seprod sank 95 cents and ended at $83.70 with an exchange of 619 stocks and Wisynco Group increased 55 cents to $21, with 1,543,476 stock units changing hands.

In the preference segment, Eppley 7.50% preference share climbed $1.27 to end at $6.29 in an exchange of 7 shares, JMMB Group 7.15% – 2028 rallied 34 cents in closing at $3.10 after 183 stock units passed through the exchange and Sygnus Credit Investments C10.5% skidded $1 to close at $109 as investors exchanged 1,300 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main & Junior Market rally as USD Market slips

The Main Market of the Jamaica Stock Exchange and the Junior Market made spirited moves in trading on Tuesday while JSE USD market closed moderately lower as trading ended with the number of stocks and the value of changing hands falling, from the levels of the previous day, resulting in prices of 39 shares rising and 24 declining.

At the close of trading, the JSE Combined Market Index jumped by 5,250.77 points to 341,553.57, the All Jamaican Composite Index pushed 4,960.46 points higher to 368,519.92, the JSE Main Index surged 5,377.41 points to 328,547.93. The Junior Market Index gained 23.71 points to lock up trading at 3,816.86 and the JSE USD Market Index fell 1.73 points to end the day at 248.84.

At the close of trading, the JSE Combined Market Index jumped by 5,250.77 points to 341,553.57, the All Jamaican Composite Index pushed 4,960.46 points higher to 368,519.92, the JSE Main Index surged 5,377.41 points to 328,547.93. The Junior Market Index gained 23.71 points to lock up trading at 3,816.86 and the JSE USD Market Index fell 1.73 points to end the day at 248.84.

At the close of trading, 25,574,514 shares were exchanged in all three markets, down from 31,872,543 units on Monday, with the value of stocks traded on the Junior and Main markets being $167.57 million, down from $217.58 million on the previous trading day and the JSE USD market closed with an exchange of 154,383 shares for US$11,426 compared to 90,769 units at US$18,681 on Monday.

Trading in the Main Market was dominated by Transjamaican Highway with 2.61 million shares followed by Wigton Windfarm with 1.93 million units, QWI Investments was next with 1.65 million stocks, Wisynco Group ended with 1.54 million units and Radio Jamaica with 1.17 million shares.

In the Junior Market, Spur Tree Spices led trading with 6.79 million shares followed by ONE on ONE Educational with 818,975 units and EduFocal with 665,885 stocks.

In the Junior Market, Spur Tree Spices led trading with 6.79 million shares followed by ONE on ONE Educational with 818,975 units and EduFocal with 665,885 stocks.

In the preference segment, Eppley 7.50% preference share climbed $1.27 to end at $6.29 and Sygnus Credit Investments C10.5% skidded $1 to close at $109.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.4 on 2022-23 earnings and 14.3 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

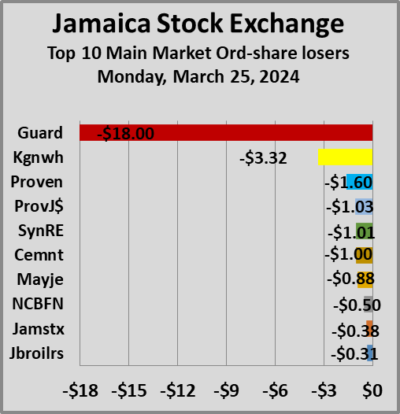

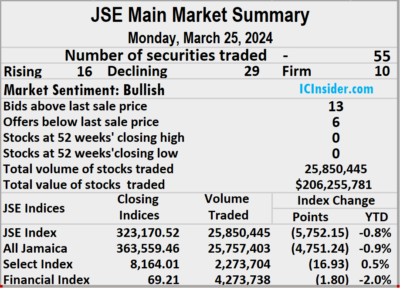

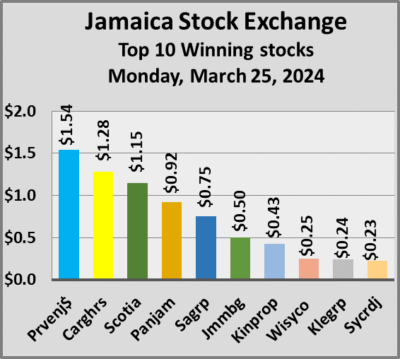

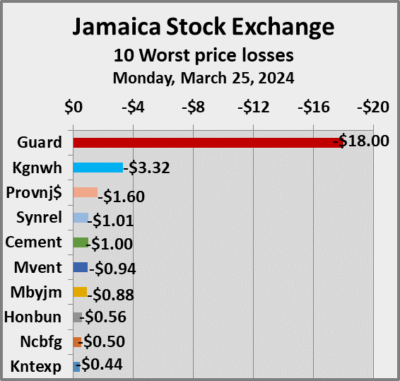

JSE Main Market plunged

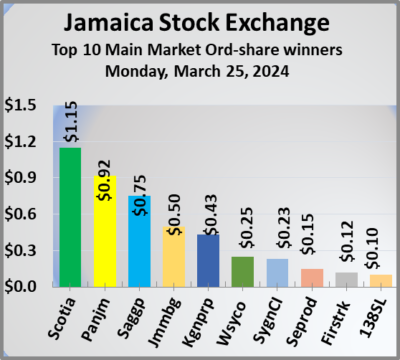

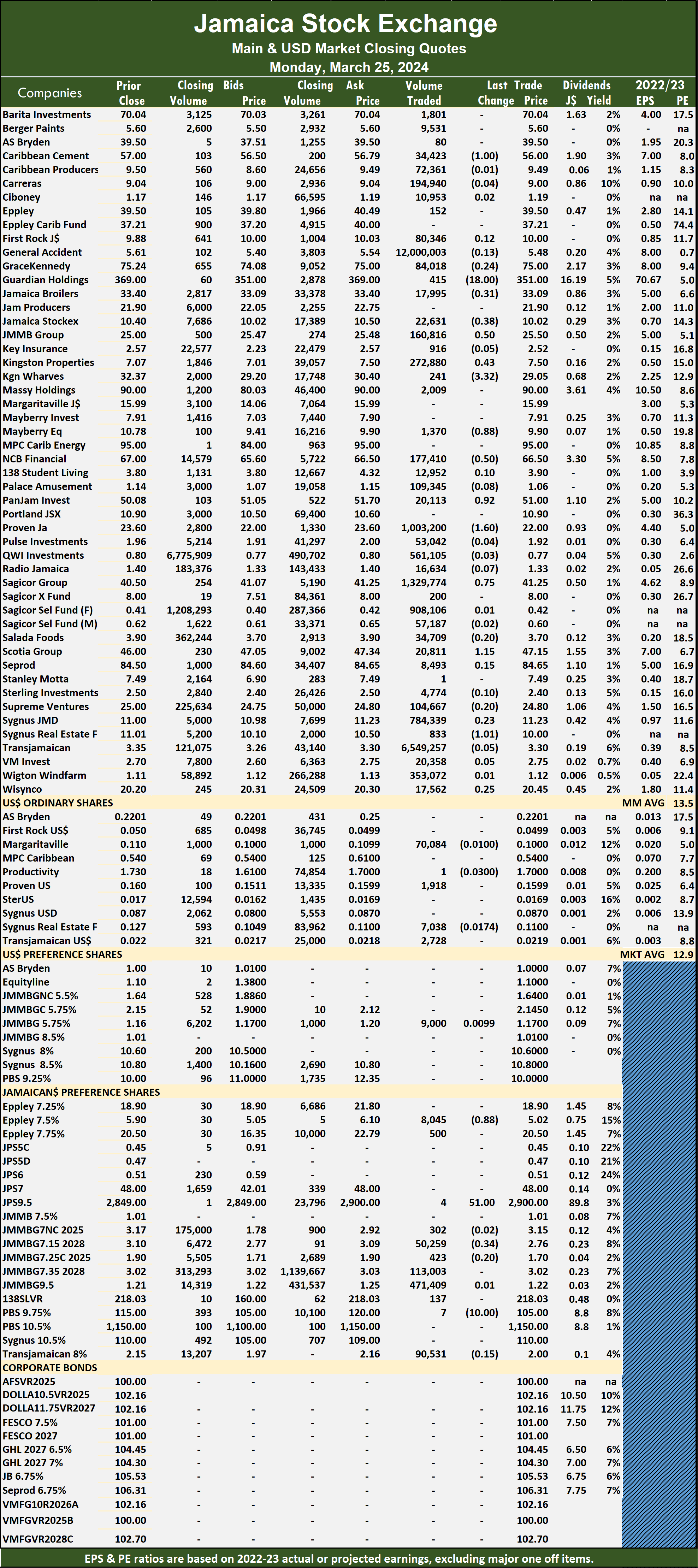

Stocks plunged on Jamaica Stock Exchange Main Market on Monday, sending the market indices sharply lower by the close after the volume of stocks traded rose 174 percent and the value surged 587 percent over Friday’s levels, with trading in 55 securities compared with 57 on Friday, ending with prices of 16 stocks rising, 29 declining and 10 ending unchanged.

The market closed on Monday with an exchange of 25,850,445 shares at $206,255,781 compared to 9,443,669 units at $30,041,719 on Friday.

The market closed on Monday with an exchange of 25,850,445 shares at $206,255,781 compared to 9,443,669 units at $30,041,719 on Friday.

Trading averaged 470,008 shares at $3,750,105 compared to 165,678 units at $527,048 on Friday and month to date, an average of 962,588 units at $2,406,562 compared with 991,657 units at $2,327,275 on the previous trading day and February that closed with an average of 385,143 units at $3,418,046.

General Accident led trading with 12.0 million shares for 46.4 percent of total volume followed by Transjamaican Highway with 6.55 million units for 25.3 percent of the day’s trade, Sagicor Group chipped in with 1.33 million stocks for 5.1 percent of market share and Proven Investments with 1.0 million units for 3.9 percent of total volume.

The All Jamaican Composite Index dropped 4,751.24 points to 363,559.46, the JSE Main Index sank 5,752.15 points to end at 323,170.52 and the JSE Financial Index lost 1.80 points to 69.21.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and six with lower offers.

At the close, Caribbean Cement fell $1 to close at $56 after34,423 stocks passed through the market, Guardian Holdings skidded $18 to $351 with an exchange of 415 units, Jamaica Broilers lost 31 cents to end at $33.09, with 17,995 shares crossing the market. Jamaica Stock Exchange shed 38 cents in closing at $10.02 with traders dealing in 22,631 stock units, JMMB Group popped 50 cents and ended at $25.50 in switching ownership of 160,816 shares, Kingston Properties climbed 43 cents to $7.50, with 272,880 units crossing the exchange. Kingston Wharves dropped $3.32 and ended at $29.05 with investors swapping 241 stocks, Mayberry Jamaican Equities sank 88 cents in closing at $9.90, with 1,370 stock units crossing the market, NCB Financial declined 50 cents to close at $66.50 with trading of 177,410 shares.  Pan Jamaica rose 92 cents to end at $51 after an exchange of 20,113 stock units, Proven Investments dipped $1.60 to $22 with investors trading 1,003,200 stocks, Sagicor Group advanced 75 cents to end at $41.25 after an exchange of 1,329,774 units. Scotia Group gained $1.15 in closing at $47.15 with investors dealing in 20,811 shares and Sygnus Real Estate Finance fell $1.01 to close at $10 after a transfer of 833 units.

Pan Jamaica rose 92 cents to end at $51 after an exchange of 20,113 stock units, Proven Investments dipped $1.60 to $22 with investors trading 1,003,200 stocks, Sagicor Group advanced 75 cents to end at $41.25 after an exchange of 1,329,774 units. Scotia Group gained $1.15 in closing at $47.15 with investors dealing in 20,811 shares and Sygnus Real Estate Finance fell $1.01 to close at $10 after a transfer of 833 units.

In the preference segment, Eppley 7.50% preference share skidded 88 cents and ended at $5.02 while exchanging 8,045 stocks. Jamaica Public Service 9.5% increased $51 to $2,900 with investors transferring 4 stock units, JMMB Group 7.15% – 2028 sank 34 cents to close at $2.76 in an exchange of 50,259 shares and Productive Business Solutions 9.75% preference share dropped $10 in closing at $105 after 7 stocks changed hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main market suffers big loss as trading climbs

Stocks fell in Monday’s trading session and pushed down the market indices, with the Main Market index losing more than 6,000 points, with the Junior Market after losing around 33 points, deep into the trading session bounced back before the close to end the day with a minor of a few points while the JSE USD market closed moderately lower as trading ended with the number of stocks changing hands falling and the value jumping sharply over the previous trading day, resulting in prices of 29 shares rising and 43 declining.

At the close of trading on Monday, the JSE Combined Market Index dived 5.384.99 points to close at 336,302.80, the All Jamaican Composite Index dropped 4,751.24 points to finish at 363,559.46, while the JSE Main Index plunged 5,752.15 points to end trading at 323,170.52. The Junior Market Index rose 1.10 points to 3,793.15 and the JSE USD Market Index fell 0.14 points to wrap up trading at 250.57.

At the close of trading on Monday, the JSE Combined Market Index dived 5.384.99 points to close at 336,302.80, the All Jamaican Composite Index dropped 4,751.24 points to finish at 363,559.46, while the JSE Main Index plunged 5,752.15 points to end trading at 323,170.52. The Junior Market Index rose 1.10 points to 3,793.15 and the JSE USD Market Index fell 0.14 points to wrap up trading at 250.57.

At the close of trading, 31,872,543 shares were exchanged in all three markets, down from 36,320,454 units on Friday, with the value of stocks traded on the Junior and Main markets amounted to $217.58 million, up from just $61.09, million on the previous trading day and the JSE USD market closed with an exchange of 90,769 shares for US$18,681 compared to 83,304 units at US$2,577 on Friday.

Trading in the Main Market was dominated by General Accident with 12.0 million shares followed by Transjamaican Highway with 6.55 million units, Sagicor Group with 1.33 million stock units and Proven Investments with 1.0 million stocks.

In the Junior Market, Fosrich led trading with 999,041 shares followed by Derrimon Trading with 614,908 units and Everything Fresh with 526,860 stocks.

In the preference segment, Jamaica Public Service 9.5% increased $51 to $2,900 and Productive Business Solutions 9.75% preference share dropped $10 in closing at $105.

In the preference segment, Jamaica Public Service 9.5% increased $51 to $2,900 and Productive Business Solutions 9.75% preference share dropped $10 in closing at $105.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.1 on 2022-23 earnings and 14.1 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Trading dropped prices rise on JSE Main Market

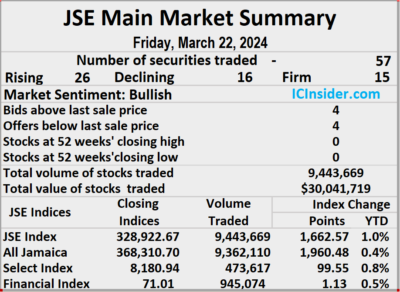

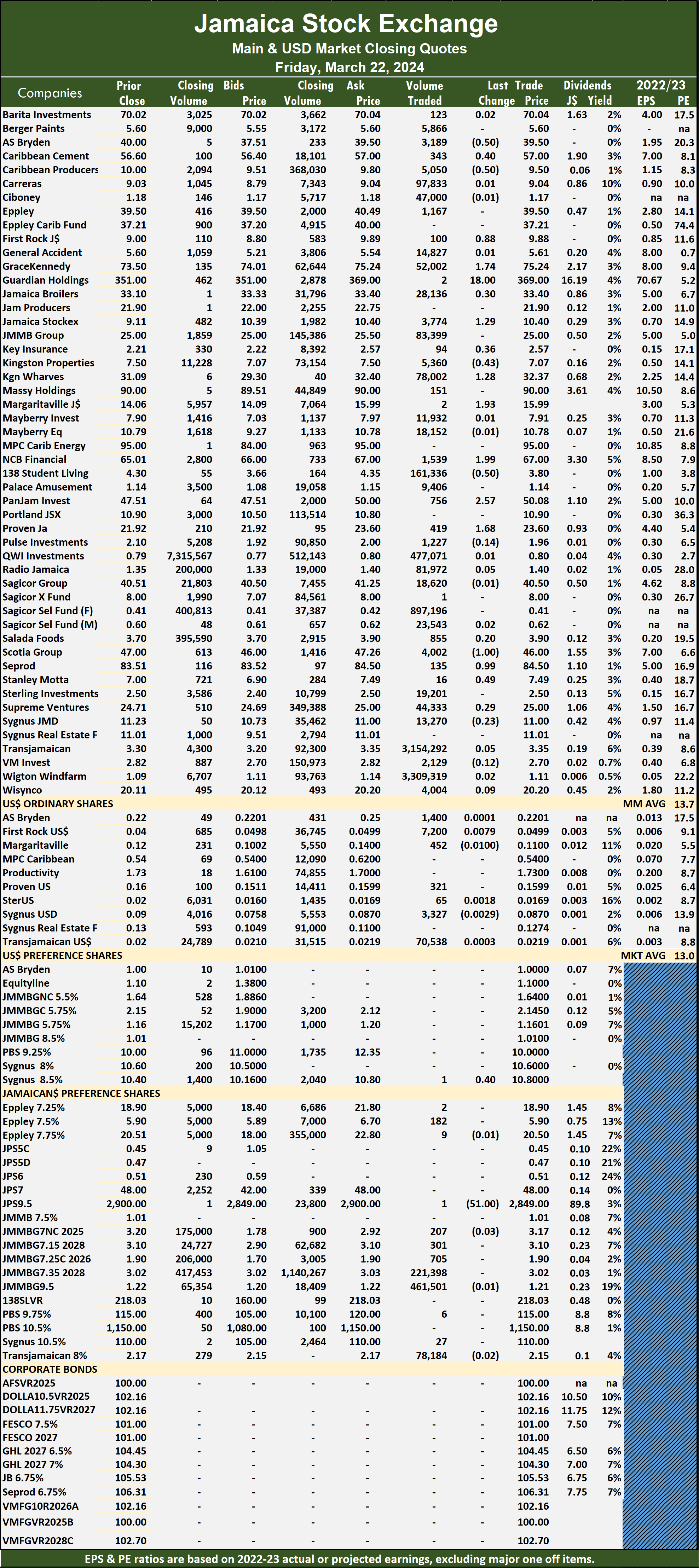

Trading dropped on the Jamaica Stock Exchange Main Market on Friday, with the volume of stocks traded plunging 63 percent and the value 61 percent lower, compared with market activity on Thursday, ending with trading in 57 securities as was the case on Thursday, with prices of 26 stocks rising, 16 declining and 15 ending unchanged.

The market closed with 9,443,669 shares trading for a mere $30,041,719 down sharply from 25,385,635 units at $76,122,713 on Thursday.

The market closed with 9,443,669 shares trading for a mere $30,041,719 down sharply from 25,385,635 units at $76,122,713 on Thursday.

Trading averaged 165,678 shares at $527,048 compared to 445,362 units at $1,335,486 on Thursday and month to date, an average of 991,657 stocks at $2,327,275 compared to 1,045,463 units at $2,444,547 on the previous day and February that closed with an average of 385,143 stock units at $3,418,046.

Wigton Windfarm led trading with 3.31 million shares for 35 percent of total volume followed by Transjamaican Highway with 3.15 million units for 33.4 percent of the day’s trade and Sagicor Select Financial Fund with 897,196 units for 9.5 percent market share.

The All Jamaican Composite Index increased 1,960.48 points to conclude trading at 368,310.70, the JSE  Main Index increased 1,662.57 points to finish at 328,922.67 and the JSE Financial Index advanced 1.13 points to settle at 71.01.

Main Index increased 1,662.57 points to finish at 328,922.67 and the JSE Financial Index advanced 1.13 points to settle at 71.01.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

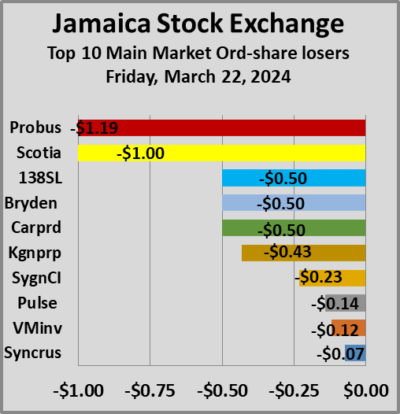

At the close, AS Bryden dropped 50 cents to $39.50 while exchanging 3,189 stock units, Caribbean Cement gained 40 cents to close at $57 in trading 343 shares, Caribbean Producers fell 50 cents in closing at $9.50 with 5,050 stocks clearing the market. First Rock Real Estate rose 88 cents and ended at $9.88 after exchanging 100 units, GraceKennedy advanced $1.74 to end at $75.24 with investors swapping 52,002 shares, Guardian Holdings popped $18 to $369 with an exchange of just two units. Jamaica Broilers increased 30 cents and ended at $33.40, with 28,136 stocks crossing the market,  Jamaica Stock Exchange climbed $1.29 in closing at $10.40 with a transfer of 3,774 stock units, Key Insurance rallied 36 cents to end at $2.57, with 94 shares crossing the market. Kingston Properties dipped 43 cents to close at $7.07 in trading 5,360 stock units, Kingston Wharves rose $1.28 to $32.37 and closed with an exchange of 78,002 units, Margaritaville advanced $1.93 in closing at $15.99 with investors transferring a mere two stocks. NCB Financial popped $1.99 to end at $67 after 1,539 shares passed through the market, 138 Student Living lost 50 cents to close at $3.80, with 161,336 stock units changing hands, Pan Jamaica increased $2.57 and ended at $50.08 as investors exchanged 756 units. Proven Investments climbed $1.68 to $23.60 after a transfer of 419 stocks, Scotia Group shed $1 to close at $46, with 4,002 shares crossing the exchange, Seprod rallied 99 cents and ended at $84.50 with investors dealing in 135 stock units and Stanley Motta gained 49 cents to end at $7.49 in an exchange of 16 units.

Jamaica Stock Exchange climbed $1.29 in closing at $10.40 with a transfer of 3,774 stock units, Key Insurance rallied 36 cents to end at $2.57, with 94 shares crossing the market. Kingston Properties dipped 43 cents to close at $7.07 in trading 5,360 stock units, Kingston Wharves rose $1.28 to $32.37 and closed with an exchange of 78,002 units, Margaritaville advanced $1.93 in closing at $15.99 with investors transferring a mere two stocks. NCB Financial popped $1.99 to end at $67 after 1,539 shares passed through the market, 138 Student Living lost 50 cents to close at $3.80, with 161,336 stock units changing hands, Pan Jamaica increased $2.57 and ended at $50.08 as investors exchanged 756 units. Proven Investments climbed $1.68 to $23.60 after a transfer of 419 stocks, Scotia Group shed $1 to close at $46, with 4,002 shares crossing the exchange, Seprod rallied 99 cents and ended at $84.50 with investors dealing in 135 stock units and Stanley Motta gained 49 cents to end at $7.49 in an exchange of 16 units.

In the preference segment, Jamaica Public Service 9.5% declined $51 in closing at $2849 with investors trading just one stock.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

All JSE markets rose on Friday

Stocks closed higher on all three markets of the Jamaica Stock Exchange on Friday as the Junior Market recovered a major part of the value lost on Thursday to close at just under 3,800 points. The market closed with a rise in the number of stocks changing hands, but with a lower value compared with the previous trading day, as trading rose in the Junior Market and declined in the Main Market, resulting in prices of 50 shares rising and 21 declining.

At the close of trading on Friday, the JSE Combined Market Index climbed 1,858.20 points to end at 341,687.79, the All Jamaican Composite Index rose by 1,960.48 points to finish at 368,310.70, the JSE Main Index rallied 1,662.57 points to 328,922.67. The Junior Market Index climbed 34.14 points to finish at 3,792.05 and the JSE USD Market Index increased 1.68 points to finish at 250.71.

At the close of trading on Friday, the JSE Combined Market Index climbed 1,858.20 points to end at 341,687.79, the All Jamaican Composite Index rose by 1,960.48 points to finish at 368,310.70, the JSE Main Index rallied 1,662.57 points to 328,922.67. The Junior Market Index climbed 34.14 points to finish at 3,792.05 and the JSE USD Market Index increased 1.68 points to finish at 250.71.

At the close of trading, 36,320,454 shares were exchanged in all three markets, up from 31,075,461 units on Thursday, with the value of stocks traded on the Junior and Main markets amounted to $61.09 million, down from $91.08, million on the previous trading day and the JSE USD market closed with an exchange of 83,304 shares for US$2,577 compared to 29,463 units at US$5,112 on Thursday.

Trading in the Main Market was dominated by Wigton Windfarm with 3.31 million shares followed by Transjamaican Highway with 3.15 million stock units and Sagicor Select Financial Fund with 897,196 units.

In the Junior Market, One Great Studio led trading with 23.11 million shares followed by EduFocal with 1.06 million stock units and Fontana with 619,770 units.

In the Junior Market, One Great Studio led trading with 23.11 million shares followed by EduFocal with 1.06 million stock units and Fontana with 619,770 units.

In the preference segment, Jamaica Public Service 9.5% declined $51 in closing at $2,849.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21 on 2022-23 earnings and 14. times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so.  This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

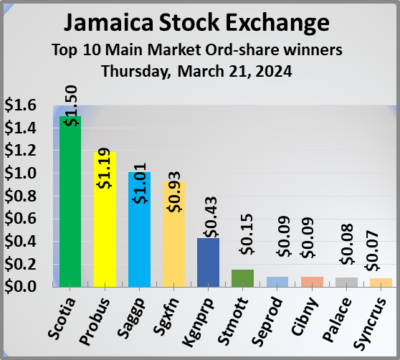

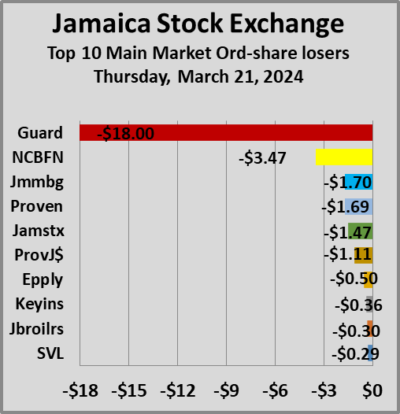

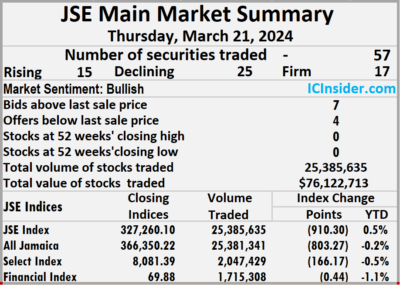

JSE Main market lost altitude

Trading on the Jamaica Stock Exchange Main Market ended on Thursday, with the volume of stocks traded rising 112 percent with a marginally greater value than on Wednesday, with trading in 57 securities compared with 58 on Wednesday, with prices of 15 stocks rising, 25 declining and 17 ending unchanged.

The market closed with 25,385,635 shares being traded for $76,122,713 compared with 11,956,313 units at $74,815,722 on Wednesday.

The market closed with 25,385,635 shares being traded for $76,122,713 compared with 11,956,313 units at $74,815,722 on Wednesday.

Trading averaged 445,362 shares at $1,335,486 compared with 206,143 units at $1,289,926 on Wednesday and for the month to date, an average of 1,045,463 units at $2,444,547 compared with 1,087,279 units at $2,521,829 on the previous day and February that closed with an average of 385,143 units at $3,418,046.

Transjamaican Highway led trading with 8.84 million shares for 34.8 percent of total volume followed by JMMB 9.5% preference share with 6.67 million units for 26.3 percent of the day’s trade, Wigton Windfarm chipped in with 5.58 million units for 22 percent market share and Radio Jamaica ended with 1.03 million units for 4.1 percent of total volume.

The All Jamaican Composite Index shed 803.27 points to end at 366,350.22, the JSE Main Index sank 910.30 points to end at 327,260.10 and the JSE Financial Index declined 0.44 points to close at 69.88.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Eppley declined 50 cents to end at $39.50 with 241 stocks clearing the market, Guardian Holdings fell $18 to $351 in an exchange of 260 units, Jamaica Broilers shed 30 cents and ended at $33.10 after 5,393 shares passed through the market. Jamaica Stock Exchange sank $1.47 to close at $9.11, with 6,039 stock units changing hands, JMMB Group skidded $1.70 in closing at $25 after an exchange of 10,301 shares, Key Insurance lost 36 cents to $2.21 with traders dealing in 5,340 units. Kingston Properties rose 43 cents to end at $7.50 with 13 stocks crossing the market, NCB Financial dipped $3.47 in closing at $65.01 after exchanging 23,425 stock units, Proven Investments dropped $1.69 and ended at $21.92 with a transfer of 1,484 shares.  Sagicor Group gained $1.01 to close at $40.51 as investors exchanged 104,336 stock units, Sagicor Real Estate Fund popped 93 cents to $8 after a transfer of 1,854 units and Scotia Group climbed $1.50 to end at $47 in trading 40,426 stocks.

Sagicor Group gained $1.01 to close at $40.51 as investors exchanged 104,336 stock units, Sagicor Real Estate Fund popped 93 cents to $8 after a transfer of 1,854 units and Scotia Group climbed $1.50 to end at $47 in trading 40,426 stocks.

In the preference segment, 138 Student Living preference share shed 97 cents in closing at $218.03 with just one share passing through the exchange, Productive Business Solutions 10.5 % preference share lost $123.29 to close at $1150 with investors trading 43 stock units, Productive Business Solutions 9.75% preference share increased $19.91 and ended at $115 in an exchange of 261 units and Sygnus Credit Investments C10.5% rallied $3 to $110, with a mere 9 stocks crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading rises as markets mostly fall

The Main Market and Junior Market of the Jamaica Stock Exchange declined in trading on Thursday as the JSE USD market closed moderately higher as trading ended with the number and value of stocks changing hands rising, over the previous trading day, resulting in prices of 26 shares rising and 38 declining.

At the close of trading, the JSE Combined Market Index declined 1,213.73 points to 339,829.59, the All Jamaican Composite Index declined 803.27 points to 366,350.22, the JSE Main Index dropped 910.30 points to 327,260.10. The Junior Market Index plunged 41.11 points to close at 3,757.91 and the JSE USD Market Index rose 1.38 points to 249.03.

At the close of trading, the JSE Combined Market Index declined 1,213.73 points to 339,829.59, the All Jamaican Composite Index declined 803.27 points to 366,350.22, the JSE Main Index dropped 910.30 points to 327,260.10. The Junior Market Index plunged 41.11 points to close at 3,757.91 and the JSE USD Market Index rose 1.38 points to 249.03.

At the close of trading, 31,075,461 shares were exchanged in all three markets, up from 15,867,211 units on Thursday, with the value of stocks traded on the Junior and Main markets amounted to $91.08 million, up from $82.89, million on the previous trading day and the JSE USD market closed with an exchange of 9,463 shares for US$5,112 compared to 288,604 units at US$12,293 on Wednesday.

Main Market trading was dominated by Transjamaican Highway with 8.84 million shares followed by JMMB 9.5% preference share with 6.67 million units, Wigton Windfarm with 5.58 million stock units and Radio Jamaica with 1.03 million shares.

In the Junior Market, EduFocal led trading with 1.58 million shares followed by Lumber Depot with 1.15 million units and Future Energy with 807,980 stock units.

In the preference segment, Productive Business Solutions 10.5% preference share dropped $123.29 to $1,150, Productive Business Solutions 9.75% preference share increased $19.91 and ended at $115 and Sygnus Credit Investments C10.5% rallied $3 to $110.

In the preference segment, Productive Business Solutions 10.5% preference share dropped $123.29 to $1,150, Productive Business Solutions 9.75% preference share increased $19.91 and ended at $115 and Sygnus Credit Investments C10.5% rallied $3 to $110.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.1 on 2022-23 earnings and 13.9. times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 209

- Next Page »