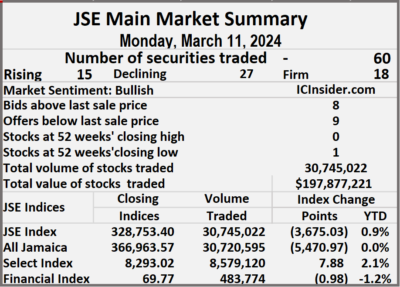

Trading on the Jamaica Stock Exchange Main Market ended on Monday, with the volume of stocks traded rising 27 percent and the value 99 percent more than on Friday, with trading in 60 securities compared with 58 on Friday, with prices of 15 stocks rising, 27 declining and 18 ending unchanged.

The market closed with 30,745,022 shares trading for $197,877,221 up from 24,192,561 units at $99,647,338 on Friday.

The market closed with 30,745,022 shares trading for $197,877,221 up from 24,192,561 units at $99,647,338 on Friday.

Trading averaged 512,417 shares at $3,297,954 compared to 417,113 units at $1,718,058 on Friday and month to date, an average of 1,790,475 units at $2,930,865 compared with 2,008,326 stocks at $2,868,293 on the previous day and February with an average of 385,143 units at $3,418,046.

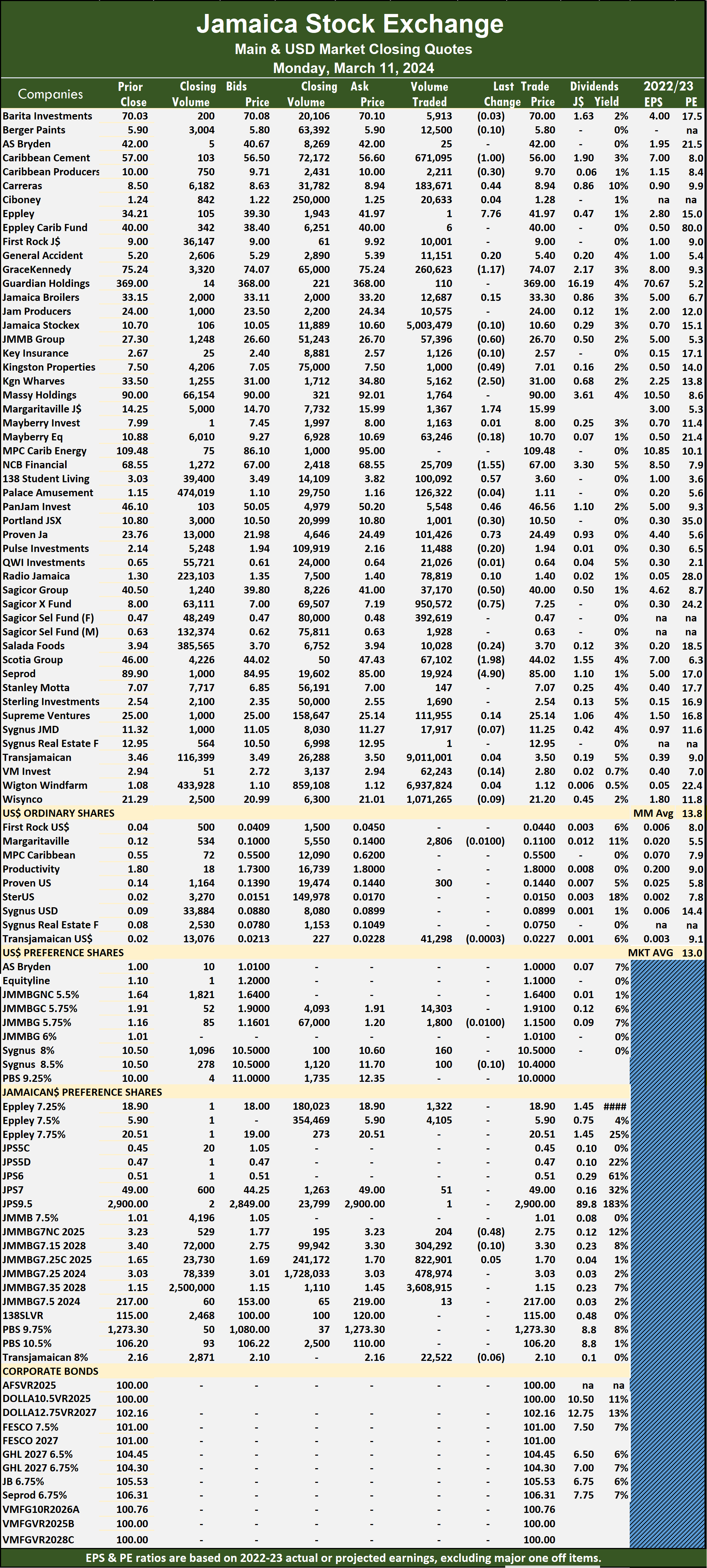

Transjamaican Highway led trading with 9.01 million shares for 29.3 percent of total volume followed by Wigton Windfarm with 6.94 million units for 22.6 percent of the day’s trade, Jamaica Stock Exchange ended with 5.0 million units for 16.3 percent market share, JMMB 9.5% preference share with 3.61 million units for 11.7 percent total Main market trading and Wisynco Group with 1.07 million units for 3.5 percent of total volume.

The All Jamaican Composite Index plunged 5,470.97 points to end at 366,963.57, the JSE Main Index sank 3,675.03 points to 328,753.40 and the JSE Financial Index lost 0.98 points to settle at 69.77.

The All Jamaican Composite Index plunged 5,470.97 points to end at 366,963.57, the JSE Main Index sank 3,675.03 points to 328,753.40 and the JSE Financial Index lost 0.98 points to settle at 69.77.

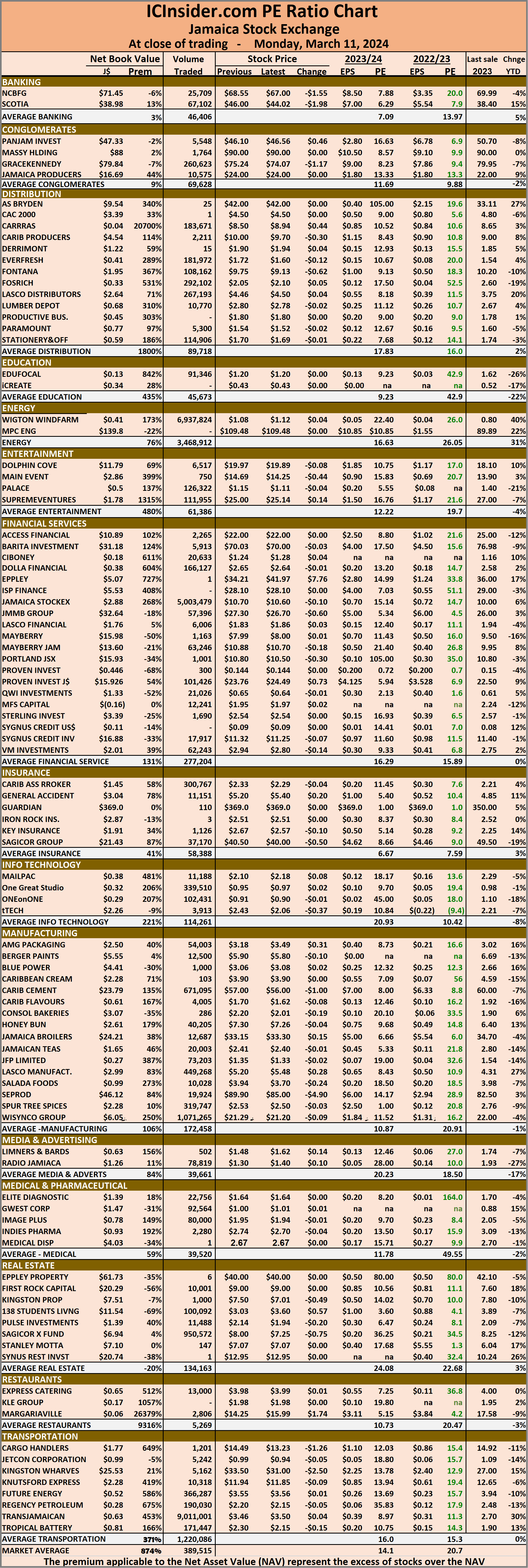

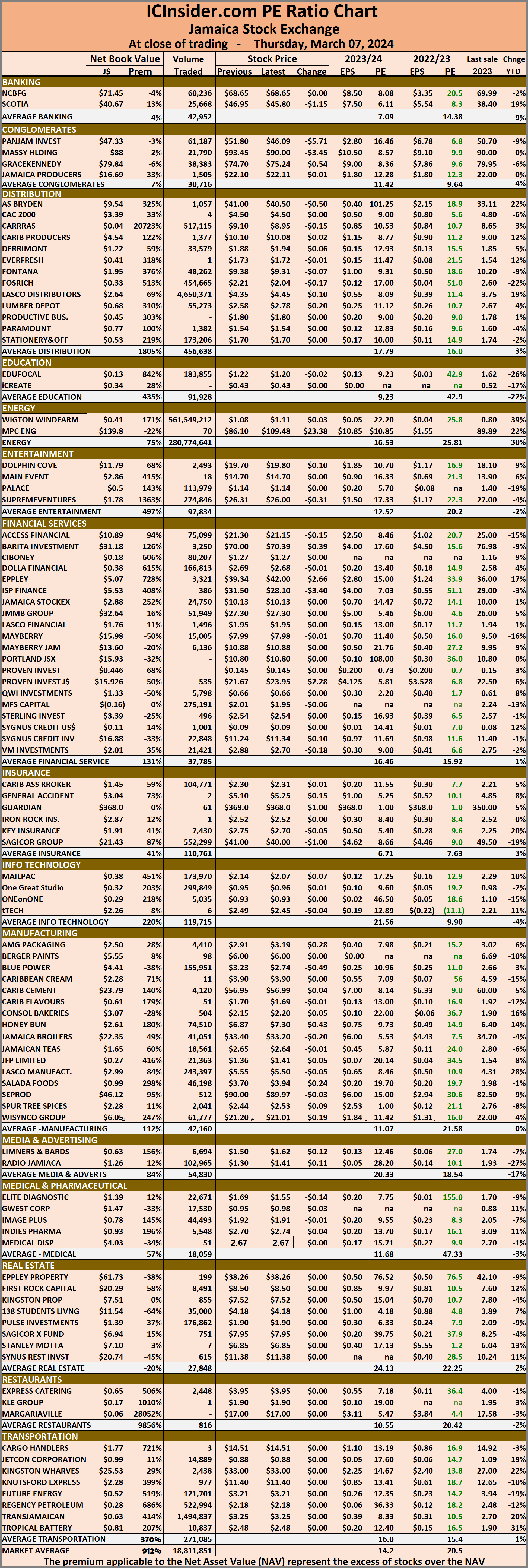

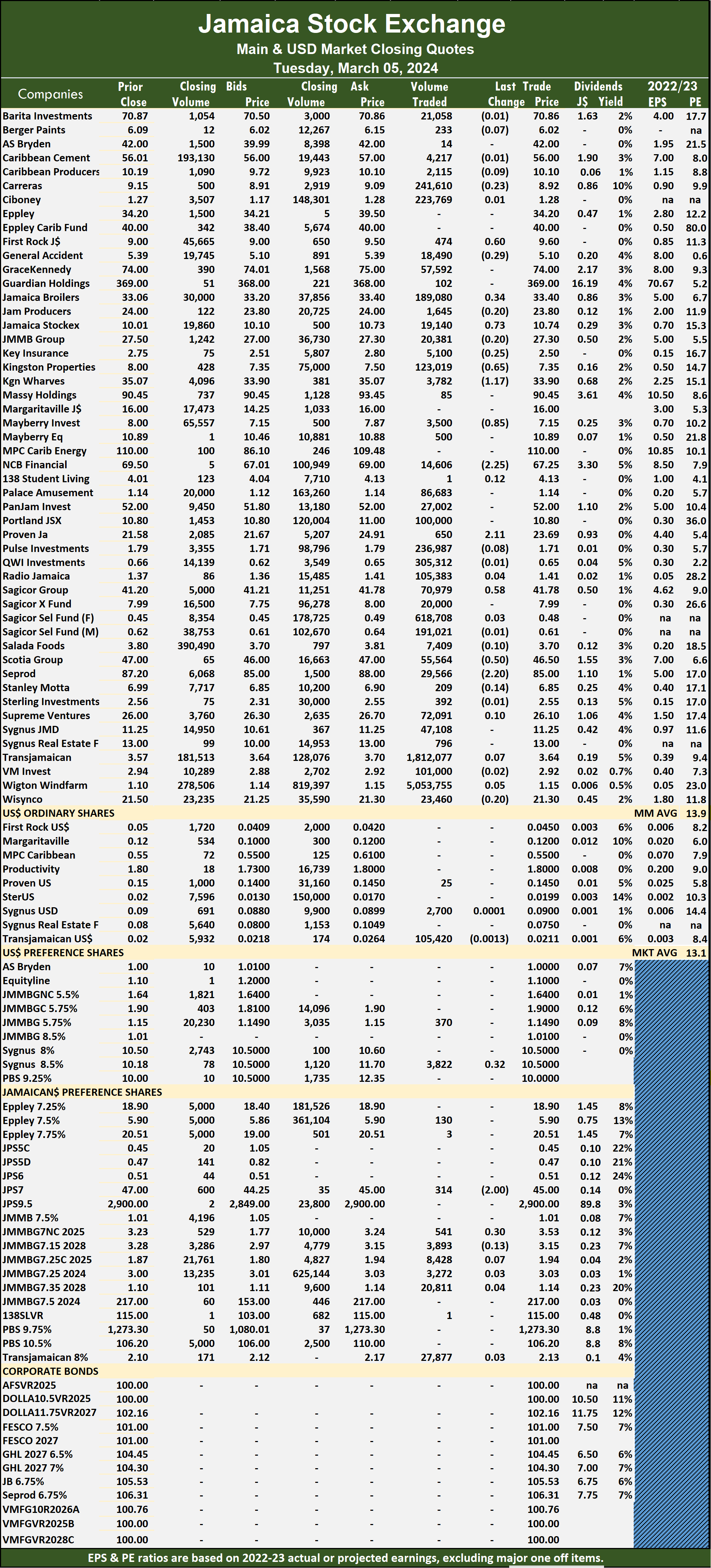

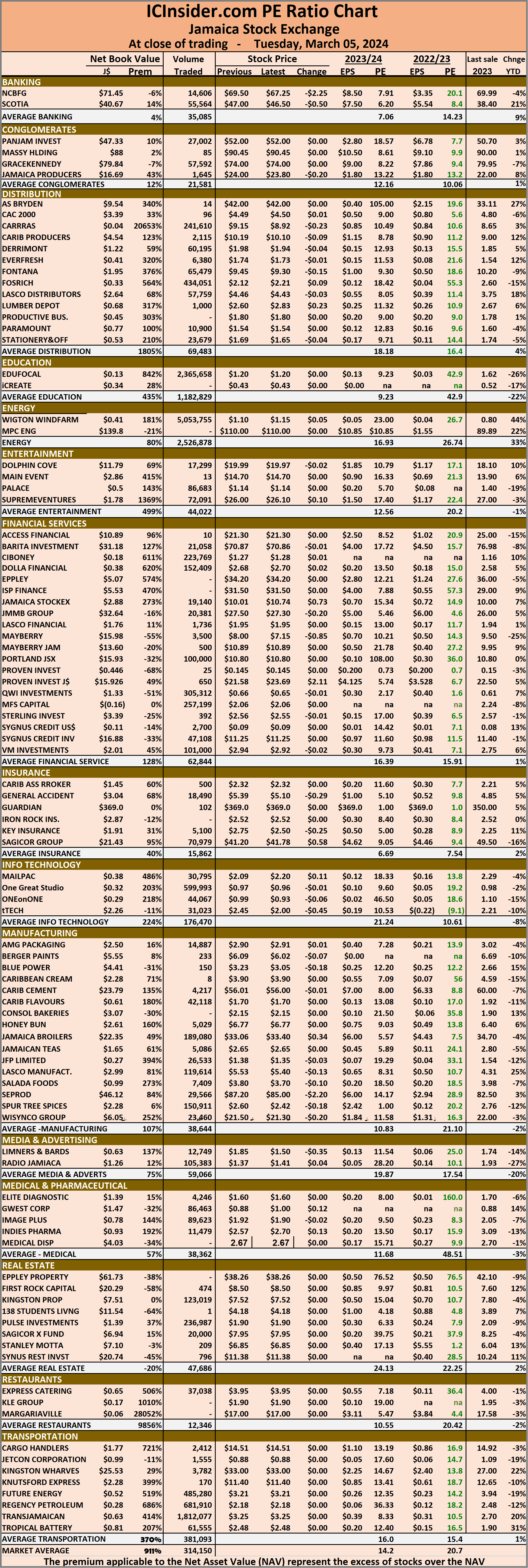

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and nine with lower offers.

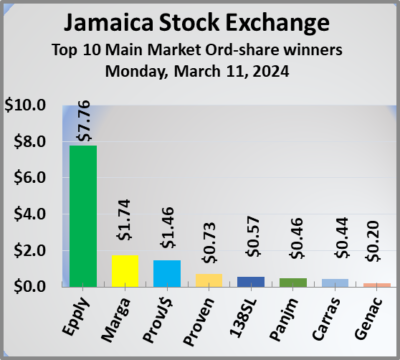

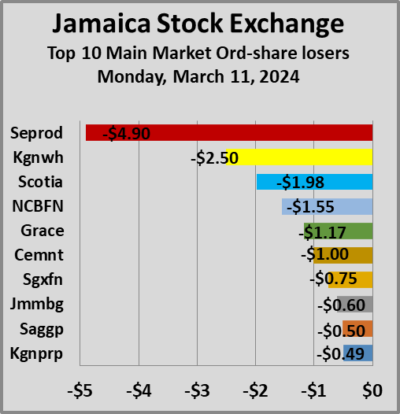

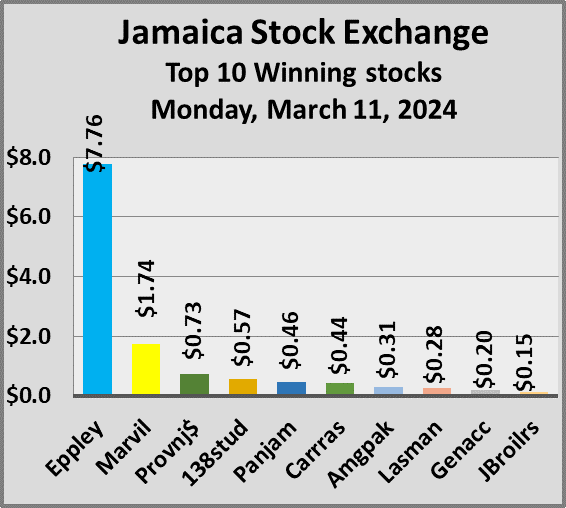

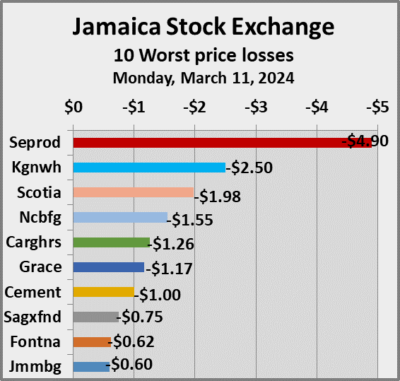

At the close, Caribbean Cement dipped $1 and ended at $56 in an exchange of 671,095 stocks, Caribbean Producers lost 30 cents to close at $9.70 after trading 2,211 units, Carreras climbed 44 cents in closing at $8.94, with 183,671 shares crossing the exchange. Eppley popped $7.76 to close at $41.97 with investors swapping just one stock unit, GraceKennedy skidded $1.17 to end at $74.07 after an exchange of 260,623 shares, JMMB Group fell 60 cents to $26.70 with investors transferring 57,396 stock units. Kingston Properties dropped 49 cents in closing at $7.01 with 1,000 stocks clearing the market, Kingston Wharves shed $2.50 and ended at $31 while exchanging 5,162 units, Margaritaville increased $1.74 to close at $15.99 after 1,367 stocks passed through the market.  NCB Financial declined $1.55 to end at $67 with investors dealing in 25,709 units, 138 Student Living advanced 57 cents in closing at $3.60, with 100,092 shares changing hands, Pan Jamaica rose 46 cents to $46.56 and closed after 5,548 stock units changed hands. Portland JSX sank 30 cents to close at $10.50 in an exchange of 1,001 shares, Proven Investments gained 73 cents to end at $24.49 with traders dealing in 101,426 stocks, Sagicor Group skidded 50 cents and ended at $40, with 37,170 units crossing the market. Sagicor Real Estate Fund fell 75 cents to $7.25 after an exchange of 950,572 stock units, Scotia Group sank $1.98 to close at $44.02 in trading 67,102 shares and Seprod dipped $4.90 in closing at $85 after 19,924 stocks crossed the market.

NCB Financial declined $1.55 to end at $67 with investors dealing in 25,709 units, 138 Student Living advanced 57 cents in closing at $3.60, with 100,092 shares changing hands, Pan Jamaica rose 46 cents to $46.56 and closed after 5,548 stock units changed hands. Portland JSX sank 30 cents to close at $10.50 in an exchange of 1,001 shares, Proven Investments gained 73 cents to end at $24.49 with traders dealing in 101,426 stocks, Sagicor Group skidded 50 cents and ended at $40, with 37,170 units crossing the market. Sagicor Real Estate Fund fell 75 cents to $7.25 after an exchange of 950,572 stock units, Scotia Group sank $1.98 to close at $44.02 in trading 67,102 shares and Seprod dipped $4.90 in closing at $85 after 19,924 stocks crossed the market.

In the preference segment, JMMB Group 7% preference share lost 48 cents to end at $2.75 with a transfer of 204 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market stocks fall

JSE USD market rises others drop

The JSE USD market jumped at the close of trading on Monday but the Main and Junior Markets of the Jamaica Stock Exchange declined as trading ended with the number of stocks changing hands falling, while the value traded jumped sharply over the previous trading day, as trading in the Main Market jumped, resulting in prices of just 27 shares rising and overwhelmed by 49 declining.

At the close of trading, the JSE Combined Market Index dropped 3,696.83 points to 341,657.18, the All Jamaican Composite Index dived 5,470.97 points to 366,963.57, the JSE Main Index collapsed 3,675.03 points to settle at 328,753.40. The Junior Market Index shed 28.57 points to end at 3,806.68 and the JSE USD Market Index popped 9.35 points to end the day at 265.19.

At the close of trading, the JSE Combined Market Index dropped 3,696.83 points to 341,657.18, the All Jamaican Composite Index dived 5,470.97 points to 366,963.57, the JSE Main Index collapsed 3,675.03 points to settle at 328,753.40. The Junior Market Index shed 28.57 points to end at 3,806.68 and the JSE USD Market Index popped 9.35 points to end the day at 265.19.

At the close of trading, 34,746,725 shares were exchanged in all three markets, down from 46,550,162 units on Friday, with the value of stocks traded on the Junior and Main markets amounted to $209.43 million, up from $147.48 million on the previous trading day and the JSE USD market closed with 60,767 shares trading for US$33,398 compared to 765,260 units at US$64,253 on Friday.

Trading in the Main Market was dominated by Transjamaican Highway trading with 9.01 million shares followed by Wigton Windfarm with 6.94 million units, Jamaica Stock Exchange chipped in with 5.0 million stock units, JMMB 9.5% preference share ended with 3.61 million shares and Wisynco Group with 1.07 million stocks.

In the Junior Market, Lasco Manufacturing led trading with 449,268 shares, followed by Future Energy with just 366,287 units and One Great Studio with 339,510 stock units.

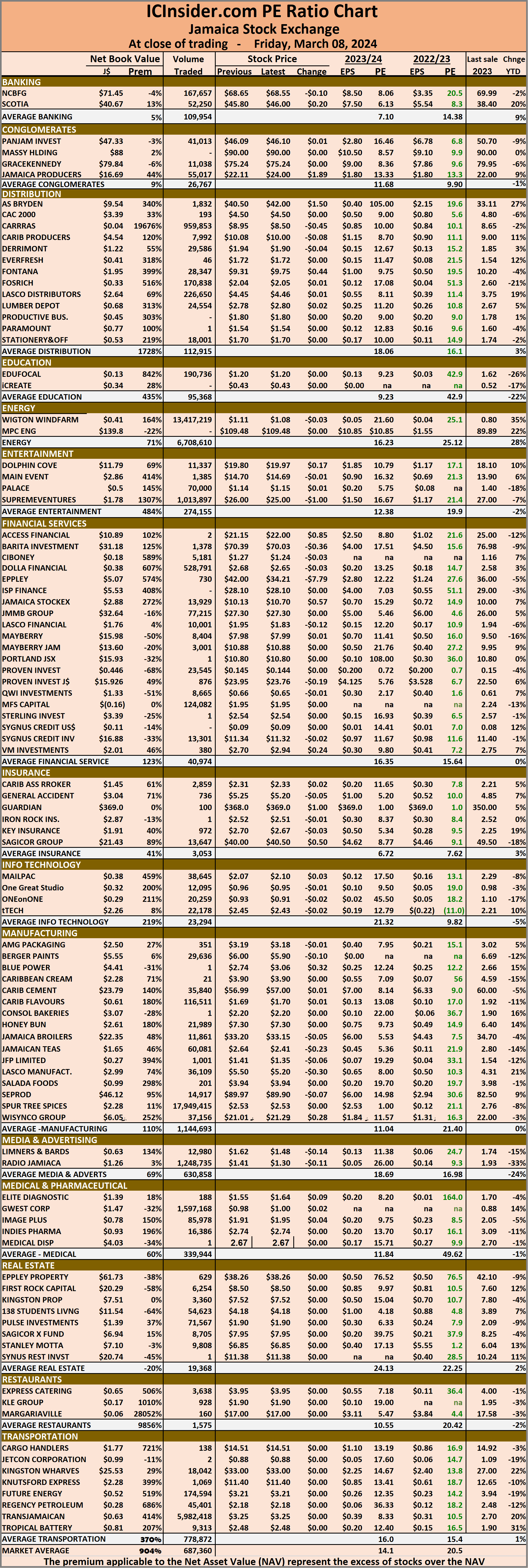

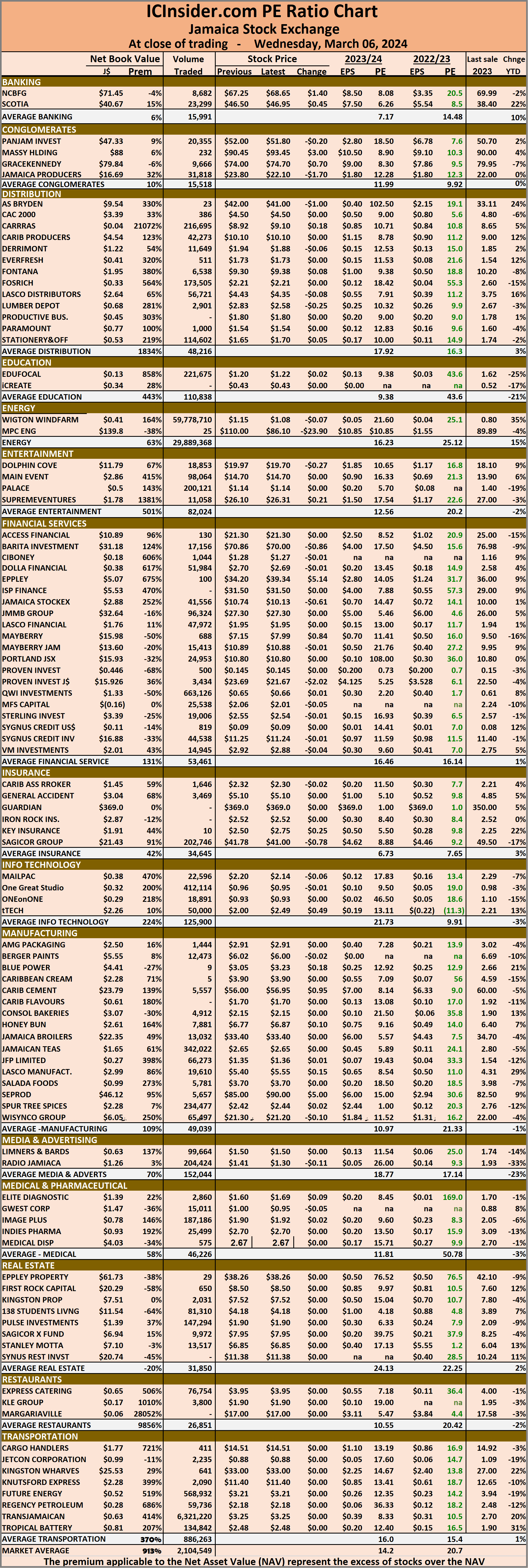

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.6 on 2022-23 earnings and 14.1 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.6 on 2022-23 earnings and 14.1 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

JSE Main Market trading back to the norm

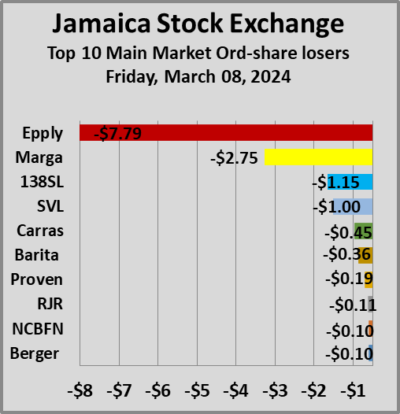

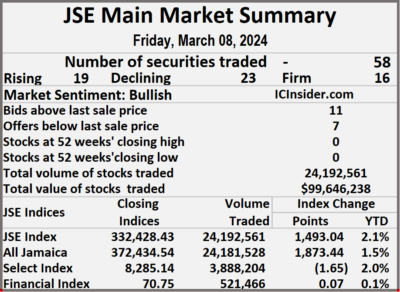

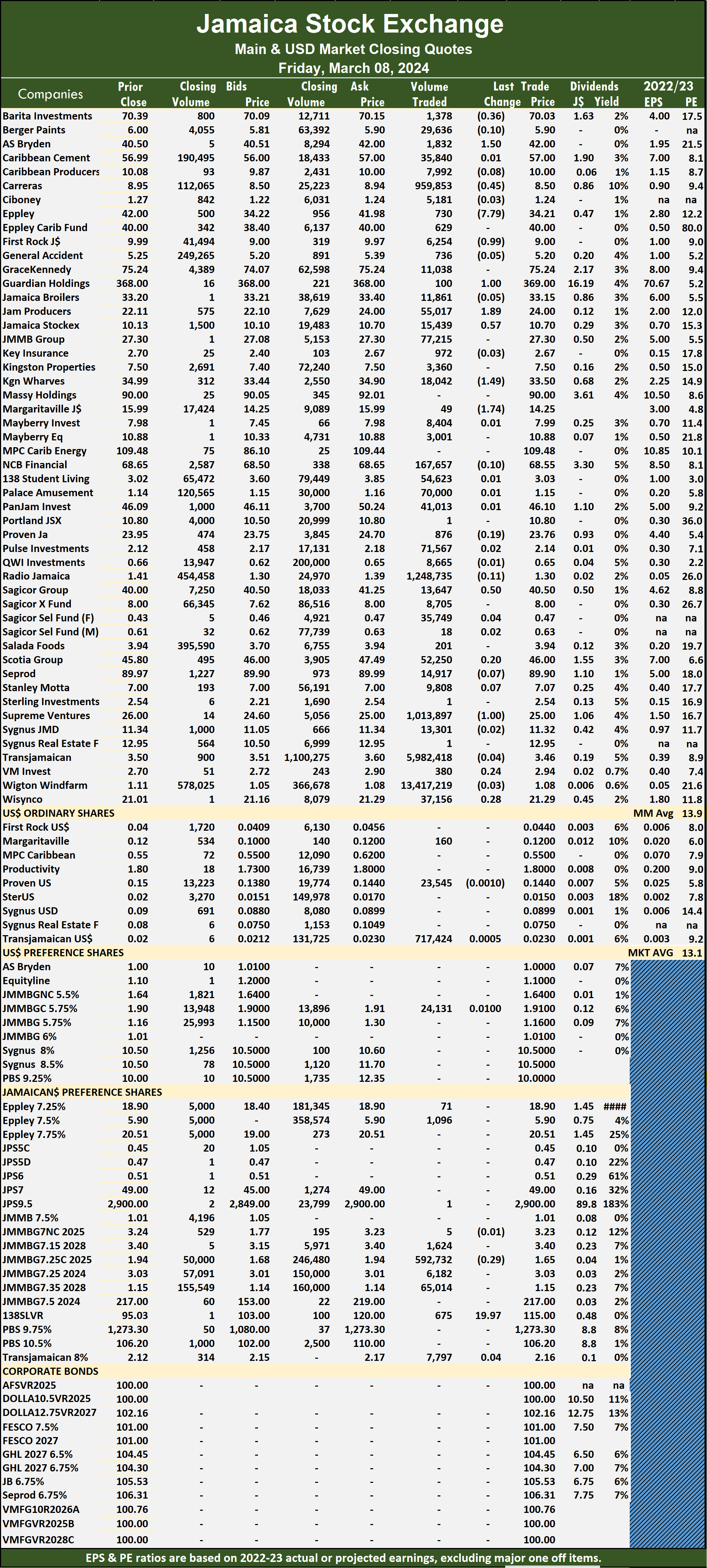

Investors traded 96 percent fewer stocks at an 83 percent lower value than on Thursday, after trading in 58 securities compared with 59 on Thursday, with prices of 19 stocks rising, 23 declining and 16 ending unchanged, at the close of the Jamaica Stock Exchange Main Market on Friday with Wigton Windfarm traded just 13.4 million shares compared to more than 561 million on Thursday.

The market closed with 24,192,561 shares being traded for $99,646,238 compared with 566,948,248 units at $597,471,743 on Thursday.

The market closed with 24,192,561 shares being traded for $99,646,238 compared with 566,948,248 units at $597,471,743 on Thursday.

Trading averaged 417,113 shares at $1,718,058 compared to 9,774,970 units at $10,301,237 on Thursday and month to date, an average of 2,018,048 stock units at $2,876,457, in comparison with 2,322,239 units at $3,095,210 on the previous day and February with an average of 385,143 units at $3,418,046.

For a second consecutive day, Wigton Windfarm led trading with 13.42 million shares for 55.5 percent of total volume followed by Transjamaican Highway with 5.98 million units for 24.7 percent of the day’s trade, Radio Jamaica ended with 1.25 million stocks for 5.2 percent market share and Supreme Ventures closed with 1.01 million units for 4.2 percent of total volume.

The All Jamaican Composite Index rallied 1,873.44 points to 372,434.54, the JSE Main Index rose 1,493.04 points to 332,428.43 and the JSE Financial Index inched 0.07 points higher to 70.75.

The All Jamaican Composite Index rallied 1,873.44 points to 372,434.54, the JSE Main Index rose 1,493.04 points to 332,428.43 and the JSE Financial Index inched 0.07 points higher to 70.75.

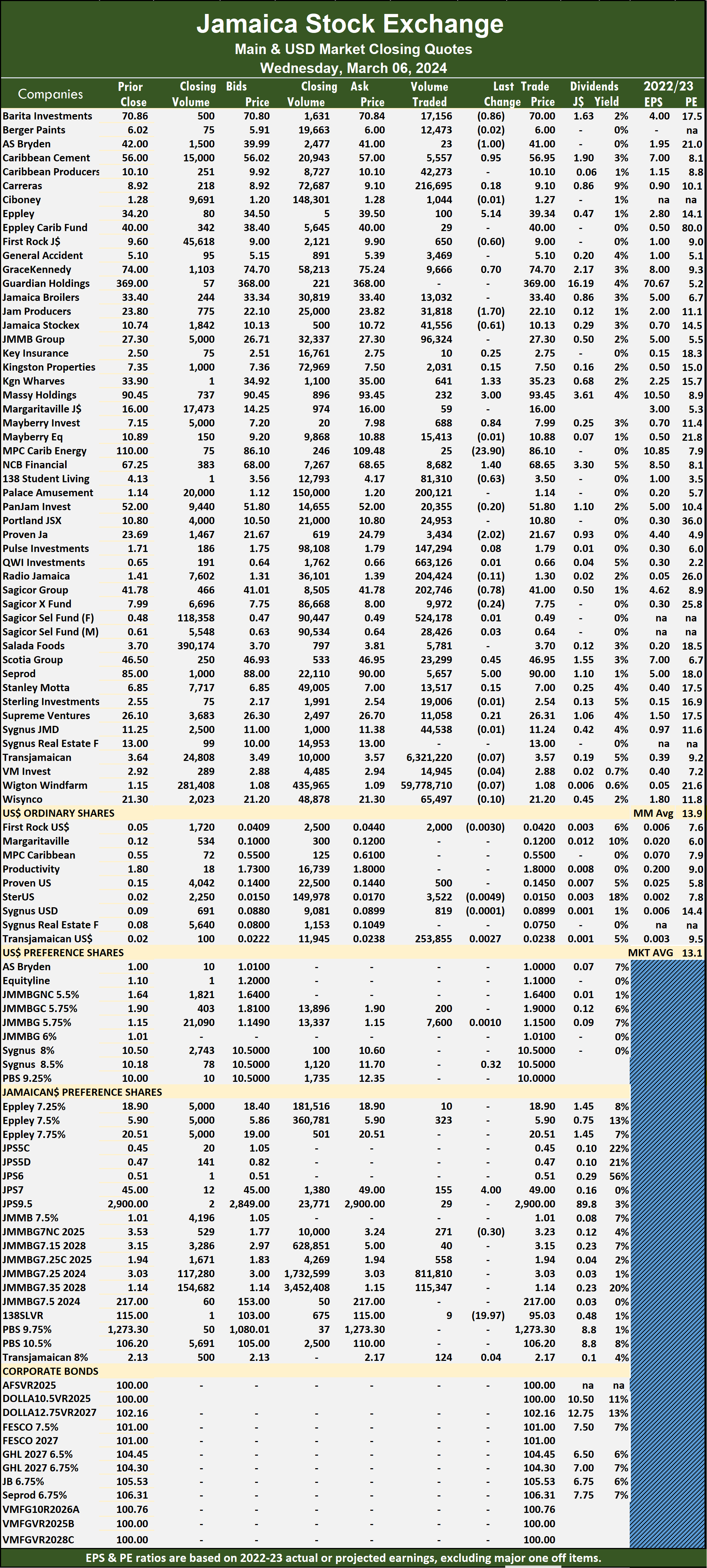

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and seven with lower offers.

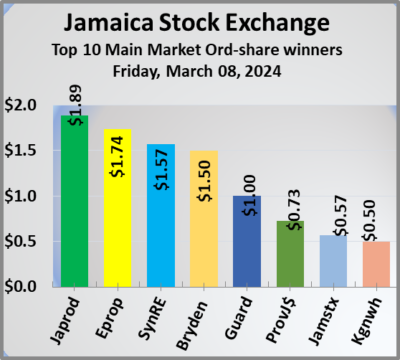

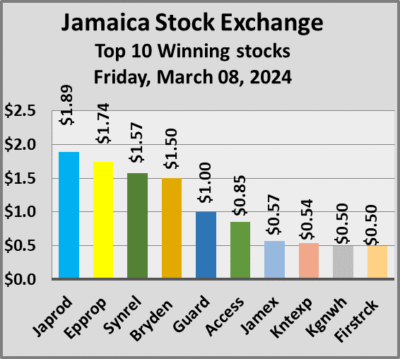

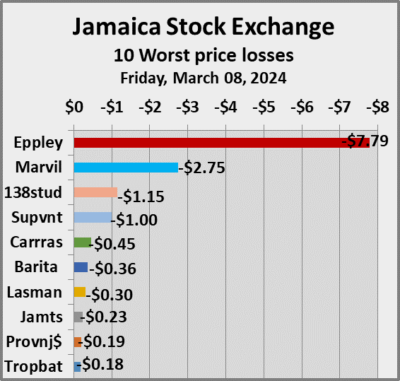

At the close, AS Bryden climbed $1.50 in closing at $42, with 1,832 shares crossing the market, Barita Investments declined 36 cents to $70.03 after a transfer of 1,378 stocks, Carreras lost 45 cents to close at $8.50 with investors trading 959,853 shares. Eppley dropped $7.79 and ended at $34.21 after closing with an exchange of 730 stock units, First Rock Real Estate sank 99 cents to end at $9 after investors traded 6,254 shares,  Guardian Holdings popped $1 to $369, with 100 units crossing the exchange. Jamaica Producers advanced $1.89 and ended at $24 in trading 55,017 stocks, Jamaica Stock Exchange rose 57 cents $10.70 after 13,929 stocks passed through the market, Kingston Wharves dipped $1.49 to $33.50 after an exchange of 18,042 shares. Margaritaville fell $1.74 to end at $14.25 with 49 units clearing the market, Sagicor Group rallied 50 cents to $40.50 while 13,647 stocks were traded and Supreme Ventures skidded $1 and ended at $25 with traders dealing in 1,013,897 stock units.

Guardian Holdings popped $1 to $369, with 100 units crossing the exchange. Jamaica Producers advanced $1.89 and ended at $24 in trading 55,017 stocks, Jamaica Stock Exchange rose 57 cents $10.70 after 13,929 stocks passed through the market, Kingston Wharves dipped $1.49 to $33.50 after an exchange of 18,042 shares. Margaritaville fell $1.74 to end at $14.25 with 49 units clearing the market, Sagicor Group rallied 50 cents to $40.50 while 13,647 stocks were traded and Supreme Ventures skidded $1 and ended at $25 with traders dealing in 1,013,897 stock units.

In the preference segment, Productive Business Solutions 9.75% preference share jumped $19.97 to end at $115 in an exchange of 675 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market jumps USD market drops

The Main Market of the Jamaica Stock Exchange bounced in trading on Friday as the Junior Market JSE USD market closed moderately higher but the JSE USD Market after the number of stocks changing hands declined from the heavy trading on Thursday, with the value of stocks traded dropping sharply from the previous day’s heavy trading with Wigton Windfarm having complete command of trading activity, resulting in prices of rising stocks outpacing those declining with 39 securities rising and 36 declining.

At the close of trading on Friday, the JSE Combined Market Index climbed 1,460.87 points to close at 345,354.01, the All Jamaican Composite Index popped 1,873.44 points to close at 372,434.54, the JSE Main Index increased 1,493.04 points to lock up trading at 332,428.43. The Junior Market Index rose 6.92 points to end at 3,835.25 and the JSE USD Market Index declined 13.20 points to conclude trading at 255.84.

At the close of trading on Friday, the JSE Combined Market Index climbed 1,460.87 points to close at 345,354.01, the All Jamaican Composite Index popped 1,873.44 points to close at 372,434.54, the JSE Main Index increased 1,493.04 points to lock up trading at 332,428.43. The Junior Market Index rose 6.92 points to end at 3,835.25 and the JSE USD Market Index declined 13.20 points to conclude trading at 255.84.

At the close of trading, 46,550,162 shares were exchanged in all three markets, down from units on 575,019,706 on Thursday, with the value of stocks traded on the Junior and Main markets amounted to $147.47.million, down from $627.86 million on the previous trading day and the JSE USD market closed with an exchange of 765,260 shares for US$64,253 compared to 74,096 units at US$22,194 on Thursday.

Trading in the Main Market was dominated by Wigton Windfarm led trading with 13.42 million shares followed by Transjamaican Highway with 5.98 million units, Radio Jamaica with 1.25 million stock units and Supreme Ventures with 1.01 million shares.

In the Junior Market, Spur Tree Spices led trading with 17.95 million shares followed by GWest Corporation with 1.60 million units and Dolla Financial with 528,791 stock units.

In the Junior Market, Spur Tree Spices led trading with 17.95 million shares followed by GWest Corporation with 1.60 million units and Dolla Financial with 528,791 stock units.

In the preference segment, Productive Business Solutions 9.75% preference share increased $19.97 to $115.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.5 on 2022-23 earnings and 14.1 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Big drop for JSE Main Market as Wigton dominates

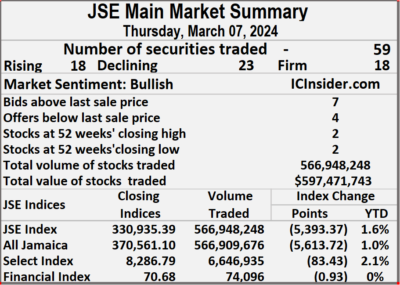

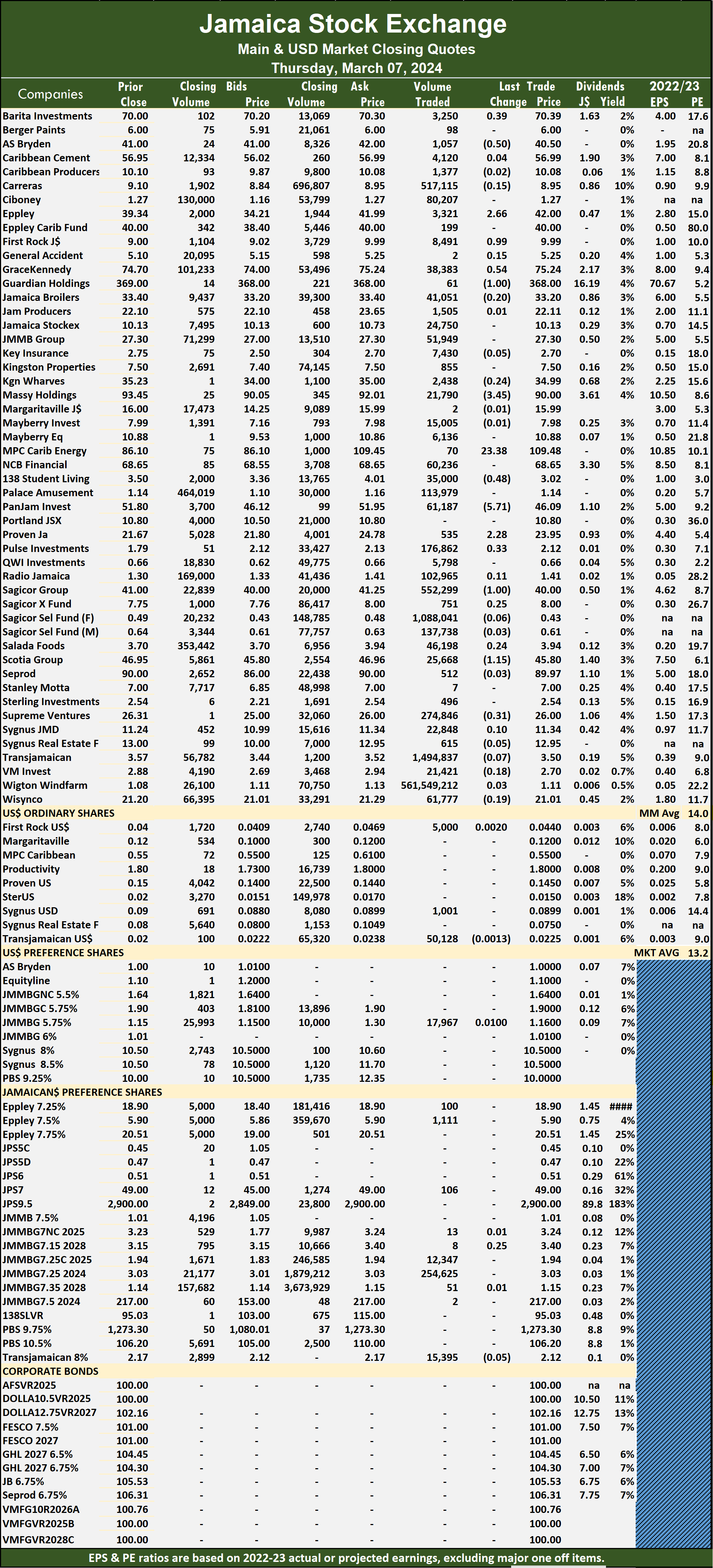

Wigton Windfarm with an exchange with more than 561 million shares and falling stocks dominated trading on the Jamaica Stock Exchange, Main Market on Thursday, with the All Jamaican Composite Index diving 5,613.72 points to 370,561.10 as the JSE Main Index dropped 5,393.37 points to end at 330,935.39 and the JSE Financial Index shed 0.93 points to lock up trading at 70.68, following a big 712 percent surge in the volume of stocks traded rising following a 406 percent jumped in the value over Wednesday.

Trading ended with 59 securities on Wednesday and Thursday, resulting in prices of 18 stocks rising, 23 declining and 18 ending unchanged as the prices of two stocks closed at yearly highs and two at yearly lows, with 138 Student Living falling to $3.02 and Sagicor Group declining to $40, with Eppley ending at $42 and JMMMB Group 7.15% closing at $3.40.

Trading ended with 59 securities on Wednesday and Thursday, resulting in prices of 18 stocks rising, 23 declining and 18 ending unchanged as the prices of two stocks closed at yearly highs and two at yearly lows, with 138 Student Living falling to $3.02 and Sagicor Group declining to $40, with Eppley ending at $42 and JMMMB Group 7.15% closing at $3.40.

The market closed with exchange of 566,948,248 shares at $597,471,743 compared with 69,861,889 units at $117,997,722 on Wednesday.

Trading averaged 9,609,292 shares at $10,126,640 compared to 1,184,100 units at $1,999,961 on Wednesday and month to date, an average of 2,322,239 units at $3,095,210, in comparison with 492,724 units at $1,329,872 on the previous day and February that closed with an average of 385,143 units at $3,418,046.

Wigton Windfarm led trading with 561.55 million shares for 99 percent of total volume followed by Transjamaican Highway with 1.49 million units for 0.3 percent of the day’s trade and Sagicor Select Financial Fund with 1.09 million units for 0.2 percent of the day’s trade.

The Main Market ended trading with an average PE Ratio of 14. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 14. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and four with lower offers.

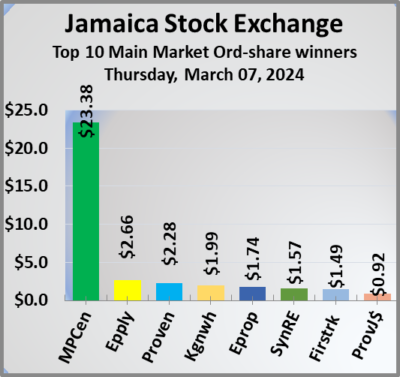

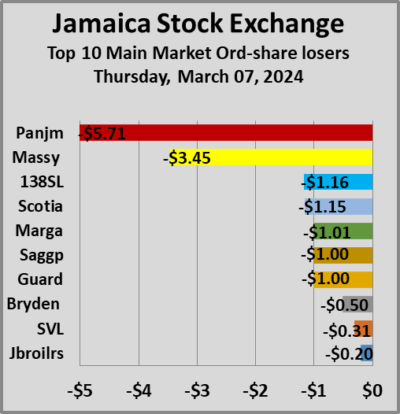

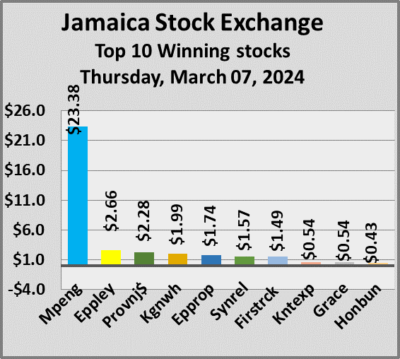

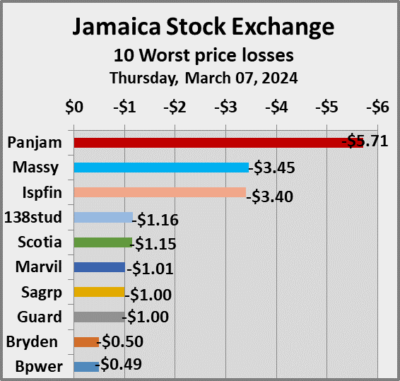

At the close, AS Bryden sank 50 cents to $40.50 with an exchange of 1,057 shares, Barita Investments popped 39 cents in closing at $70.39 after 3,250 units crossed the market, Eppley rallied $2.66 to end at a 52 weeks’ high of $42 in an exchange of 3,321 shares. First Rock Real Estate increased 99 cents to close at $9.99 with investors dealing in 8,491 stock units, GraceKennedy climbed 54 cents and ended at $75.24, with 38,383 shares crossing the exchange, Guardian Holdings shed $1 to $368 in switching ownership of 61 stock units.  Massy Holdings dropped $3.45 and ended at $90 after investors traded 21,790 stocks, MPC Caribbean Clean Energy rose $23.38 to end at $109.48 in trading 70 units, 138 Student Living lost 48 cents in closing at a 52 weeks’ low of $3.02, with 35,000 stocks changing hands. Pan Jamaica skidded $5.71 to close at $46.09 with investors trading 61,187 units, Proven Investments gained $2.28 to end at $23.95, with 535 shares crossing the market, Pulse Investments advanced 33 cents to close at $2.12 as investors exchanged 176,862 stock units. Sagicor Group fell $1 to close at $40 after an exchange of 552,299 shares, Scotia Group dipped $1.15 and ended at $45.80 with investors transferring 25,668 units and Supreme Ventures declined 31 cents to end at $26 after an exchange of 274,846 stock units.

Massy Holdings dropped $3.45 and ended at $90 after investors traded 21,790 stocks, MPC Caribbean Clean Energy rose $23.38 to end at $109.48 in trading 70 units, 138 Student Living lost 48 cents in closing at a 52 weeks’ low of $3.02, with 35,000 stocks changing hands. Pan Jamaica skidded $5.71 to close at $46.09 with investors trading 61,187 units, Proven Investments gained $2.28 to end at $23.95, with 535 shares crossing the market, Pulse Investments advanced 33 cents to close at $2.12 as investors exchanged 176,862 stock units. Sagicor Group fell $1 to close at $40 after an exchange of 552,299 shares, Scotia Group dipped $1.15 and ended at $45.80 with investors transferring 25,668 units and Supreme Ventures declined 31 cents to end at $26 after an exchange of 274,846 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big Wigton trade as Main Market dives

Wigton Windfarm dominated trading in the Main Market of the Jamaica Stock Exchange with more than 560 million of its shares being traded as investors continue to gobble up the stock, with the pending lifting of the ten percent ownership limitation to be lifted this year, but the trade did nothing to lift the Main Market that plunged several thousand  points on the day the JSE USD market closed at a new record high and the Junior Market inched up a few points following the surge in the number of stocks changing hands, with a hugely higher value than the previous day, resulting in prices of 40 shares rising and 37 declining.

points on the day the JSE USD market closed at a new record high and the Junior Market inched up a few points following the surge in the number of stocks changing hands, with a hugely higher value than the previous day, resulting in prices of 40 shares rising and 37 declining.

At the close of trading, the JSE Combined Market Index nose dived 5,043.75 points to close at 343,893.14, the All Jamaican Composite Index plunged 5,613.72 points to 370,561.10, the JSE Main Index sank 5,393.37 points to end at 330,935.39. The Junior Market Index popped 1.64 points to 3,828.33 and the JSE USD Market Index gained 2.30 points to end at a record high of 269.04

At the close of trading, 575,019,706 shares were exchanged in all three markets, up sharply from 73,323,889 units on Wednesday, with the value of stocks traded on the Junior and Main markets amounted to $627.86 million, up from $126.9 million on the previous trading day and the JSE USD market closed with an exchange of 74,096 shares for US$22,194 compared to 268,496 units at US$15,237 on Wednesday.

Trading in the Main Market was dominated by Wigton Windfarm led trading with 561.55 million shares followed by Transjamaican Highway with 1.49 million stock units and Sagicor Select Financial Fund with 1.09 million units.

Trading in the Main Market was dominated by Wigton Windfarm led trading with 561.55 million shares followed by Transjamaican Highway with 1.49 million stock units and Sagicor Select Financial Fund with 1.09 million units.

In the Junior Market, Lasco Distributors led trading with 4.65 million shares followed by Regency Petroleum with 522,994 units and Fosrich with 454,665 stock units.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.5 on 2022-23 earnings and 14.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Wigton dominated Main Market trading

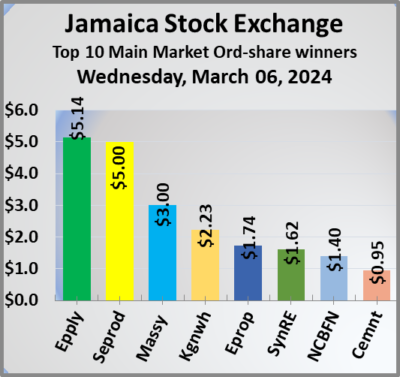

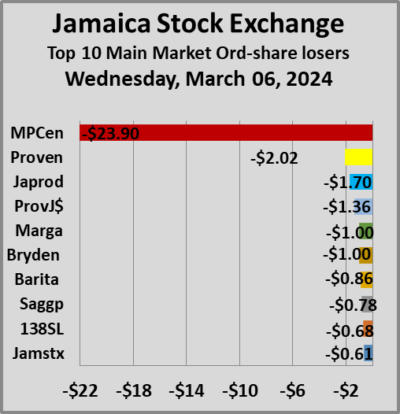

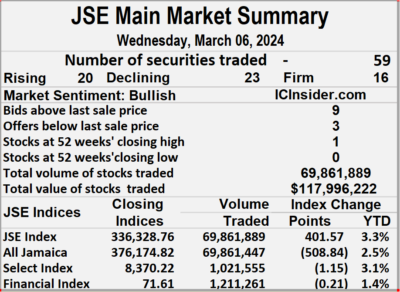

Wigton Windfarm led trading with 59.78 million shares and swelling trading to 69,861,889 shares for $117,997,722 up from 9,981,935 units at $45,441,226 on Tuesday on the Jamaica Stock Exchange Main Market on Wednesday, as the volume of stocks traded surged 600 percent and the value 160 percent more than on Tuesday, with trading in 59securities compared with 56 on Tuesday, with prices of 20 stocks rising, 23 declining and 16 ending unchanged.

The Main Market closed with an average of 1,184,100 shares trading at $1,999,961 compared to 178,249 units at $811,450 on Tuesday and month to date, an average of 492,724 units at $1,329,872,in comparison with 260,955 units at $1,105,240 on the previous day and February with an average of 385,143 units at $3,418,046.

The Main Market closed with an average of 1,184,100 shares trading at $1,999,961 compared to 178,249 units at $811,450 on Tuesday and month to date, an average of 492,724 units at $1,329,872,in comparison with 260,955 units at $1,105,240 on the previous day and February with an average of 385,143 units at $3,418,046.

Wigton Windfarm led trading with 59.78 million shares for 85.6 percent of the volume Transjamaican Highway followed with 6.32 million units for 9 percent of the day’s trade and JMMB Group 7.35% – 2028 with 811,810 units for 1.2 percent market share.

The All Jamaican Composite Index fell 508.84 points to settle at 376,174.82, the JSE Main Index climbed 401.57 points to 336,328.76 and the JSE Financial Index dipped 0.21 points to end at 71.61.

The Main Market ended trading with an average PE Ratio of 13.9.The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and three with lower offers.

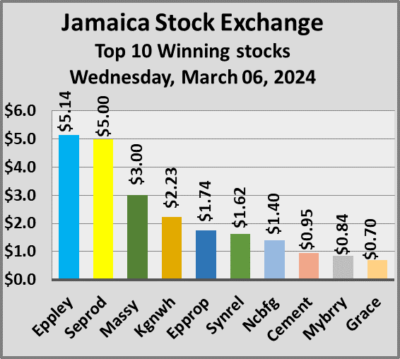

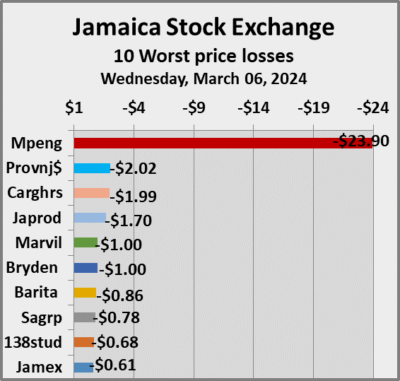

At the close, AS Bryden declined $1 to close at $41, with 23 stocks crossing the market, Barita Investments shed 86 cents to end at $70 with investors transferring 17,156 units, Caribbean Cement increased 95 cents in closing at $56.95 after 5,557 shares passed through the market. Eppley popped $5.14 and ended at $39.34 in an exchange of 100 stock units, First Rock Real Estate dropped 60 cents to end at $9 with traders dealing in 650 shares, GraceKennedy advanced 70 cents in closing at $74.70 after an exchange of 9,666 units. Jamaica Producers sank $1.70 to $22.10 with a transfer of 31,818 stocks, Jamaica Stock Exchange skidded 61 cents to end at $10.13 after exchanging 41,556 stock units, Kingston Wharves rose $1.33 to close at $35.23 in trading 641 shares. Massy Holdings climbed $3 and ended at $93.45 with 232 stock units clearing the market, Mayberry Group rallied 84 cents to $7.99 in an exchange of 688 stocks, MPC Caribbean Clean Energy fell $23.90 to close at $86.10 with investors swapping 25 units.  NCB Financial gained $1.40 to end at $68.65 with an exchange of 8,682 stocks, 138 Student Living dipped 63 cents in closing at $3.50 with 81,310 shares crossing the market, Proven Investments lost $2.02 and ended at $21.67 with investors dealing in 3,434 units. Sagicor Group skidded 78 cents to close at $41 after trading of 202,746 stock units, Scotia Group popped 45 cents to close at $46.95 as investors exchanged 23,299 shares and Seprod climbed $5 to end at $90 with 5,657 stocks changing hands.

NCB Financial gained $1.40 to end at $68.65 with an exchange of 8,682 stocks, 138 Student Living dipped 63 cents in closing at $3.50 with 81,310 shares crossing the market, Proven Investments lost $2.02 and ended at $21.67 with investors dealing in 3,434 units. Sagicor Group skidded 78 cents to close at $41 after trading of 202,746 stock units, Scotia Group popped 45 cents to close at $46.95 as investors exchanged 23,299 shares and Seprod climbed $5 to end at $90 with 5,657 stocks changing hands.

In the preference segment, Jamaica Public Service 7% increased $4 in closing at $49 after a transfer of 155 units, JMMB Group 7% preference share sank 30 cents and ended at $3.23 after investors ended trading of 271 stock units and Productive Business Solutions 9.75% preference share declined $19.97 to $95.03 in switching ownership of 9 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Jamaican USD stocks at record high

New record high for JSEUSD Market.

The Jamaica Stock Exchange delivered another record high in trading on Wednesday as the JSE USD market closed at a record high as the Main Market higher indices ended mixed and Junior Market slipped modestly after heading close to the 3,900 points mark in early trading as market activity ended with the number and value of stocks changing hands rising, resulting in prices of 34 shares rising and 35 declining.

At the close of trading, the JSE Combined Market Index climbed 323.60 points to close at 348,936.89, the All Jamaican Composite Index dropped 508.84 points to cease trading at 376,174.82, the JSE Main Index gained 401.57 points to wrap up trading at 336,328.76. The Junior Market Index fell 6.05 points to conclude trading at 3,826.69 and the JSE USD Market Index rose 5.58 points to finish at 266.74.

The Junior Market Index fell 6.05 points to conclude trading at 3,826.69 and the JSE USD Market Index rose 5.58 points to finish at 266.74.

At the close of trading, 73,323,889 shares were exchanged in all three markets, up from 16,093,329 units on Thursday, with the value of stocks traded on the Junior and Main markets amounting to $126.9 million, up from $57.13, million on the previous trading day and the JSE USD market closed with an exchange of 268,496 shares for US$15,237 compared to 112,337 units at US$43,069 on Tuesday.

Trading in the Main Market was dominated by Wigton Windfarm with 59.78 million shares being traded followed by Transjamaican Highway with 6.32 million units and JMMB Group 7.35% – 2028 with 811,810 stocks.

In the Junior Market, Future Energy led trading with 568,932 shares followed by One Great Studio with 412,114 units and Jamaican Teas with 342,022 units.

In the preference segment, Jamaica Public Service 7% jumped $4 in closing at $49 and Productive Business Solutions 9.75% preference share declined $19.97 to $95.03.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.7 on 2022-23 earnings and 14.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.7 on 2022-23 earnings and 14.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Trading dips on JSE Main Market

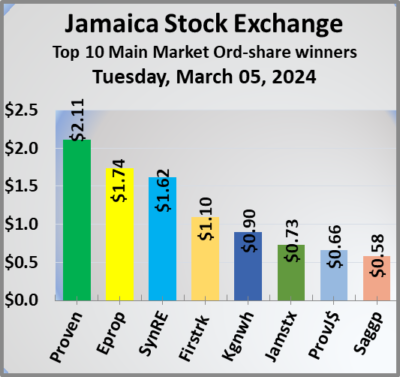

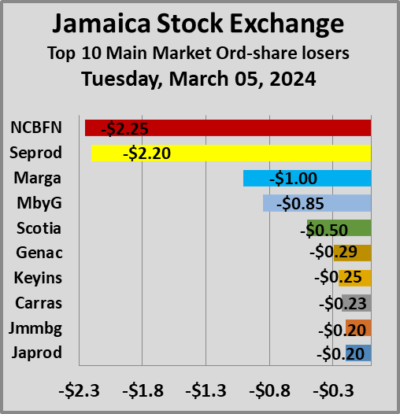

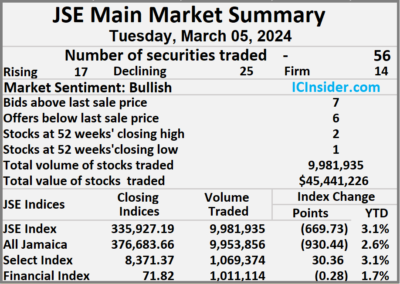

Trading on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks traded declining 34 percent and the value 17 percent lower than on Monday, with trading in 56 securities compared with 61 on Monday, with prices of 17 stocks rising, 25 declining and 14 ending unchanged.

The market closed with 9,981,935 shares trading for only $45,441,226 compared with 15,142,311 units at $54,478,058 on Monday.

The market closed with 9,981,935 shares trading for only $45,441,226 compared with 15,142,311 units at $54,478,058 on Monday.

Trading averaged 178,249 shares at $811,450 compared to 248,235 units at $893,083 on Monday and month to date, an average of 260,955 units at $1,105,240 compared with 299,552 units at $1,242,342 on the previous day and February with an average of 385,143 units at $3,418,046.

Wigton Windfarm led trading with 5.05 million shares for 50.6 percent of total volume followed by Transjamaican Highway with 1.81 million units for 18.2 percent of the day’s trade after trading at 52 weeks’ high and Sagicor Select Financial Fund with 618,708 units for 6.2 percent market share.

The All Jamaican Composite Index declined by 930.44 points to close at 376,683.66, the JSE Main Index shed 669.73 points to close at 335,927.19 and the JSE Financial Index dipped 0.28 points to wrap up trading at 71.82.

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and six with lower offers.

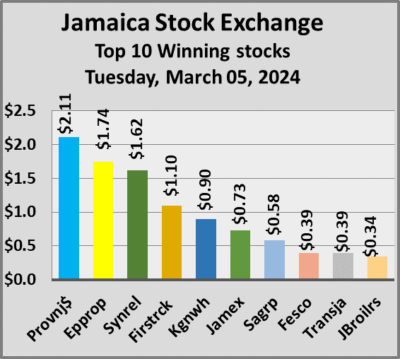

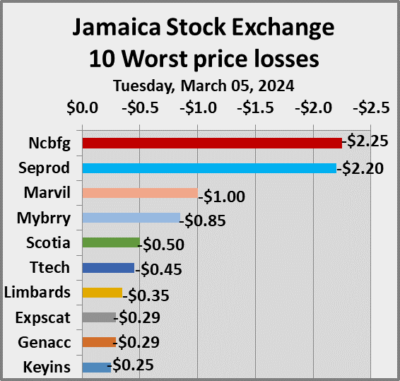

At the close, First Rock Real Estate climbed 60 cents to close at $9.60 in trading 474 stocks, Jamaica Broilers increased 34 cents to $33.40, with 189,080 units crossing the market, Jamaica Stock Exchange popped 73 cents in closing at $10.74 as investors exchanged 19,140 shares. Kingston Properties shed 65 cents to end at $7.35 in switching ownership of 123,019 stock units, Kingston Wharves sank $1.17 and ended at $33.90 with dealers exchanging 3,782 shares, Mayberry Group declined 85 cents to $7.15 and closed after an exchange of 3,500 stocks.  NCB Financial lost $2.25 to end at $67.25 with an exchange of 14,606 stock units, Proven Investments gained $2.11 in closing at $23.69, with 650 units passing through the market, Pulse Investments lost 8 cents in closing at a 52 weeks’ low of $1.71 after an exchange of 236,987 shares. Sagicor Group rose 58 cents to close at $41.78 with a transfer of 70,979 stocks, Scotia Group dropped 50 cents and ended at $46.50 after investors exchanged 55,564 units and Seprod fell $2.20 to $85 with investors swapping 29,566 shares.

NCB Financial lost $2.25 to end at $67.25 with an exchange of 14,606 stock units, Proven Investments gained $2.11 in closing at $23.69, with 650 units passing through the market, Pulse Investments lost 8 cents in closing at a 52 weeks’ low of $1.71 after an exchange of 236,987 shares. Sagicor Group rose 58 cents to close at $41.78 with a transfer of 70,979 stocks, Scotia Group dropped 50 cents and ended at $46.50 after investors exchanged 55,564 units and Seprod fell $2.20 to $85 with investors swapping 29,566 shares.

In the preference segment, Jamaica Public Service 7% dipped $2 to end at $45 in an exchange of 314 stock units and JMMB Group 7% preference share rallied 30 cents in closing at a 52 weeks’ high of $3.53 with investors transferring 541 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Jamaica stocks fall on Tuesday

All three markets of the Jamaica Stock Exchange closed moderately lower on Tuesday as the Junior Market and JSE USD market lost a few points and the Main Market four digit decline when trading ended with the number and value of stocks changing hands falling, from the previous Monday levels and resulting in prices of 24 shares rising and 43 declining.

At the close of trading, the JSE Combined Market Index declined by 630.92 points to close at 348,613.29, the All Jamaican Composite Index shed 930.44 points to culminate at 376,683.66, the JSE Main Index fell 669.73 points to end at 335,927.19. The Junior Market Index slipped 0.32 points to end the day at 3,832.74.and the JSE USD Market Index dropped 1.80 points to settle at 261.16.

At the close of trading, the JSE Combined Market Index declined by 630.92 points to close at 348,613.29, the All Jamaican Composite Index shed 930.44 points to culminate at 376,683.66, the JSE Main Index fell 669.73 points to end at 335,927.19. The Junior Market Index slipped 0.32 points to end the day at 3,832.74.and the JSE USD Market Index dropped 1.80 points to settle at 261.16.

At the close of trading, 16,093,329 shares were exchanged in all three markets from 32,837,215 units on Friday, with the value of stocks traded on the Junior and Main markets amounted to $57.13 million, down from $87.6, million on the previous trading day and the JSE USD market closed with an exchange of 112,337 shares for US$43,069 compared to 301,898 units at US$10,518 on Monday.

Trading in the Main Market was dominated by Wigton Windfarm with 5.05 million shares followed by Transjamaican Highway with 1.81 million units and Sagicor Select Financial Fund with 618,708 stock units.

In the Junior Market, EduFocal led with 2.37 million shares followed by Regency Petroleum with 681,910 units and One Great Studio with 599,993 stock units.

In the Junior Market, EduFocal led with 2.37 million shares followed by Regency Petroleum with 681,910 units and One Great Studio with 599,993 stock units.

In the preference segment, Jamaica Public Service 7% dipped $2 to end at $45.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.7 on 2022-23 earnings and 14.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume on the highest bid and the lowest offer for each company.

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- …

- 209

- Next Page »