The Jamaica Stock Exchange took another sizable jump to end at a record close on Friday as advancing stocks out-numbered declining stocks in continuation of the market’s record bull run.

The Jamaica Stock Exchange took another sizable jump to end at a record close on Friday as advancing stocks out-numbered declining stocks in continuation of the market’s record bull run.

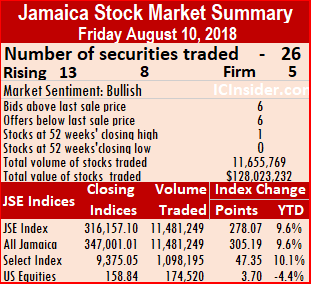

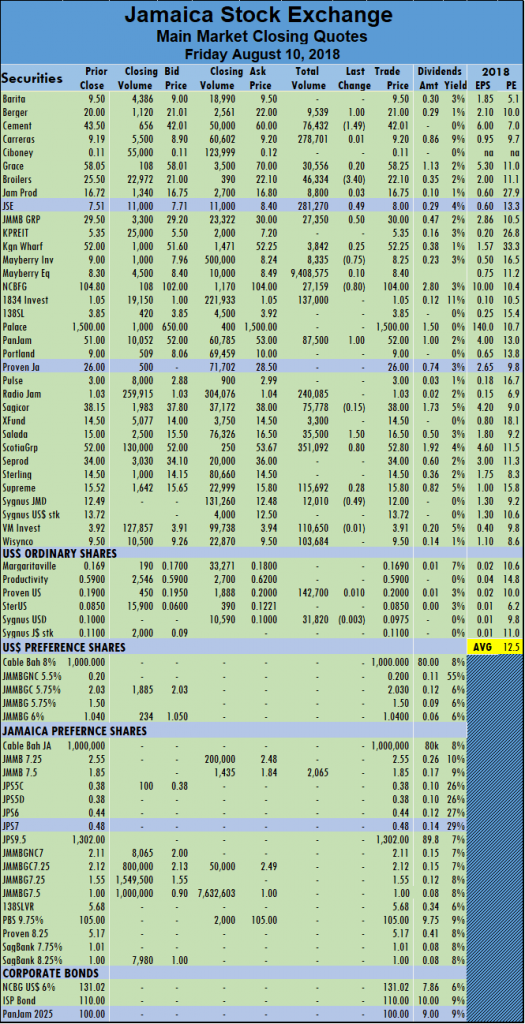

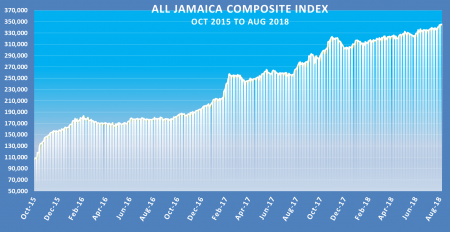

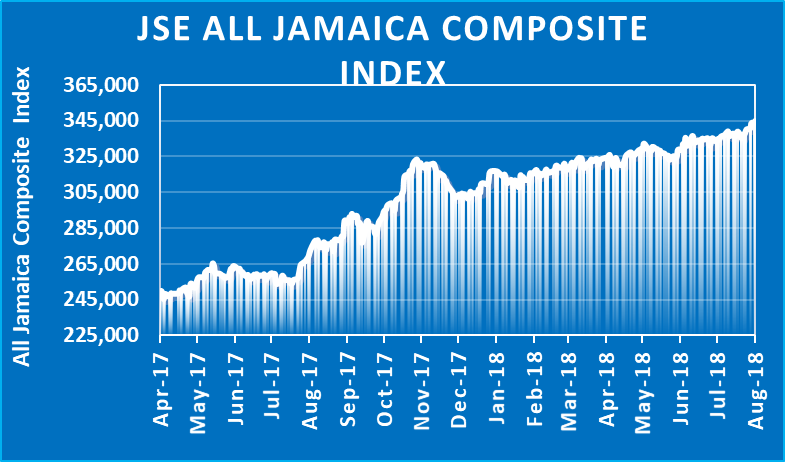

At the close trading, the All Jamaican Composite Index rose 305.19 points to 347,001.01, the first time it closed above 347,000 points and the JSE Index climbed 278.07 points to end at a record close of 316,157.10. The market has gained 9.6 percent for the year to date, the shortage of stocks and low interest rates suggest that the gain for the rest of the year should exceed that of the first 7 months.

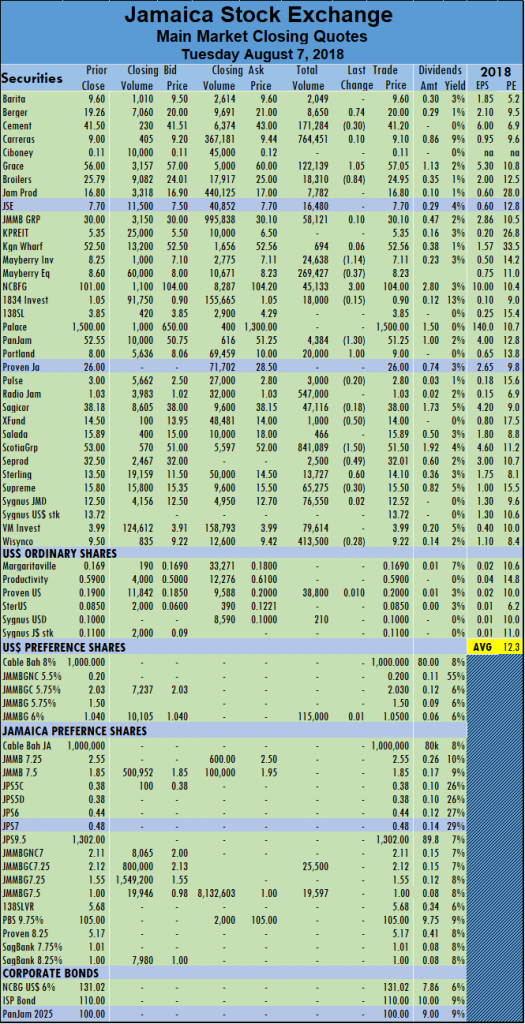

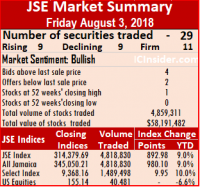

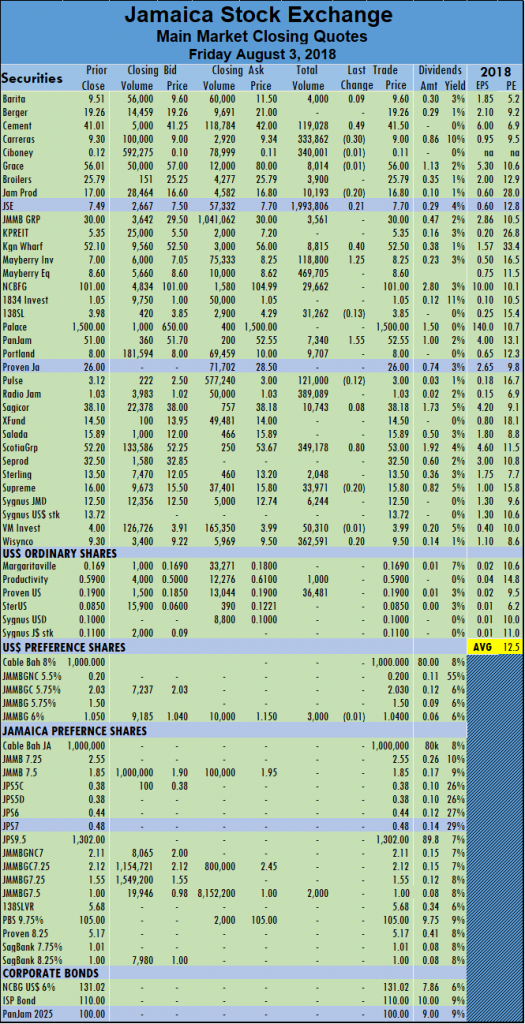

Trading in the main market ended with 11,481,249 units valued $123,719,859 compared to 7,873,698 units valued at $335,479,879 on Thursday.

Market activities resulted in 26 securities trading including 2 in the US dollar market compared to 28 securities trading on Thursday. At the end of trading, the prices of 13 stocks rose, 8 declined and 5 traded unchanged, including Caribbean Cement trading at an intraday high of $50 and Salada Foods trading at an all-time high of $17 before pulling back at the close, to a 52 weeks’ high of $16.50.

The day’s volume was led by, Mayberry Jamaican Equities with 9,408,575 units 81.95 percent of the main market volume, followed by Scotia Group with juts 351,092 units and Jamaica Stock Exchange with 281,270 units.

Stocks with major price changes| Berger Paints rose $1 and ended at $21, trading 9,539 stock units, Caribbean Cement fell $1.49 to $42.01 exchanging 76,432 shares, Jamaica Broilers traded 46,334 stock units and dropped $3.40 to end at $22.10, Jamaica Stock Exchange rose 49 cents to close at $8, with 281,270 shares changing hands, JMMB Group rose 50 cents and ended at $30, trading 27,350 shares. Mayberry Investments lost 75 cents to end at $8.25 trading just 8,335 shares, Kingston Wharves finished at $52.25, after rising 25 cents with 3,842 stock units, NCB Financial Group lost 80 cents and ended trading at $104, exchanging 27,159 shares, PanJam Investment jumped $1 to $52 trading 87,500 stock units. Salada Foods jumped $1.50 and ended trading at 52 weeks’ closing high of $16.50, with 35,500 stock units, Scotia Group traded 351,092 units and gained 80 cents to end at $52.80 and Sygnus Credit Investments fell 49 cents in trading 12,010 at $12.

Trading in the US dollar market closed with 174,520 units valued at US$31,642 as  Proven Investments fell 1 cent and closed at 19 US cents trading 3,200 shares and Sygnus Credit Investments fell 0.25 cents in trading 12,010 at 0.0975 US cents. The JSE USD Equities Index rose 3.70 and closed at 154.43

Proven Investments fell 1 cent and closed at 19 US cents trading 3,200 shares and Sygnus Credit Investments fell 0.25 cents in trading 12,010 at 0.0975 US cents. The JSE USD Equities Index rose 3.70 and closed at 154.43

Trading resulted in an average of 478,385 units valued at an average of $5,154,994 for each security traded. In contrast to 302,835 units for an average of $12,903,072 on Thursday. For the month to date an average of 198,469 shares valued at an average of $4,438,731 versus 185,362 shares valued at an average of $5,398,127 on Thursday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

IC bid-offer Indicator| At the end of trading, the Choice bid-offer indicator reading shows 6 stocks ended with bids higher than their last selling prices and 6 closing with lower offers.

New closing high for JSE – Friday

Record close for JSE – Thursday

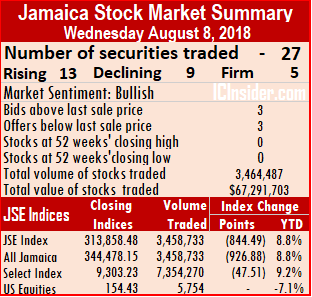

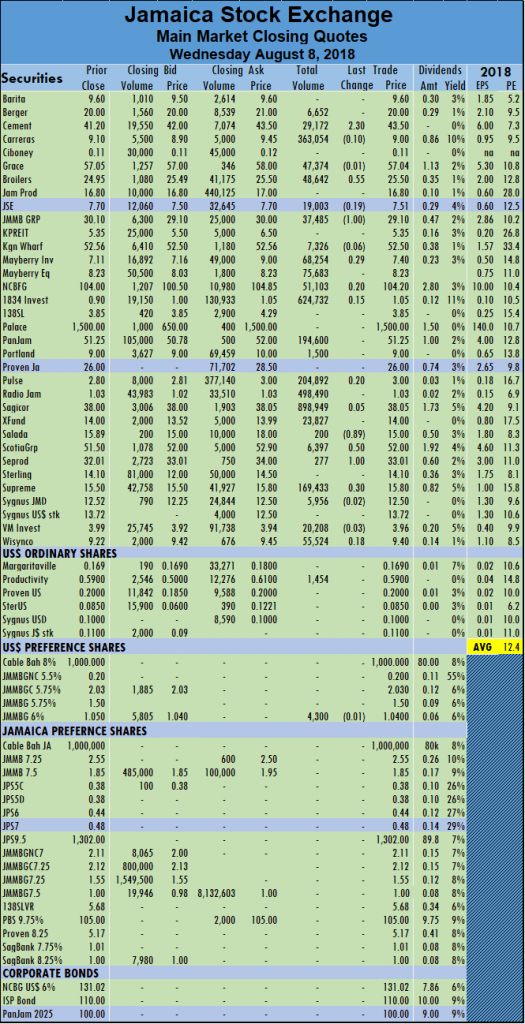

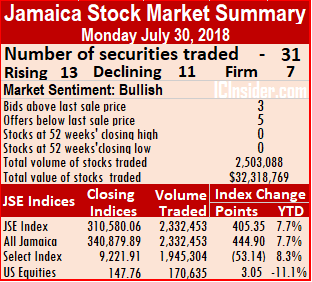

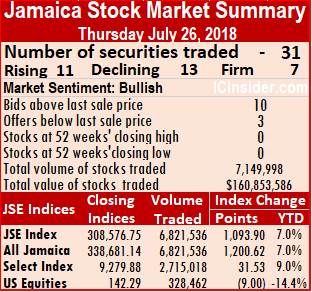

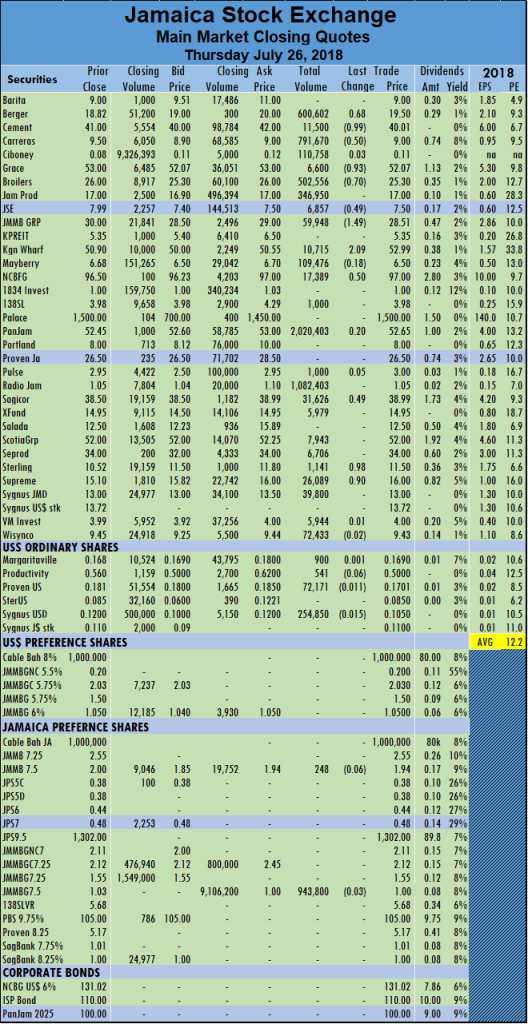

The All Jamaican Composite Index of the Jamaica Stock Exchange surged to more than 345,000 points in the early morning session on Thursday but failed to hold on at that level but still managed to end at a new record close.

The All Jamaican Composite Index of the Jamaica Stock Exchange surged to more than 345,000 points in the early morning session on Thursday but failed to hold on at that level but still managed to end at a new record close.

At the close, the All Jamaican Composite Index held on to just 119.17 points of the early gains to end at a record closing high of 344,070.11 and the JSE Index clung to 108.58 points to end at record closing high of 313,486.71.

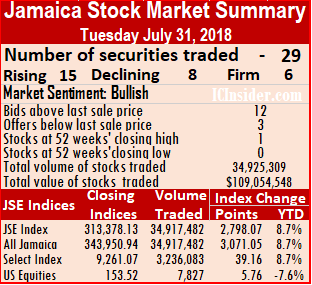

Trading in the main market ended with 4,999,824 units valued at over $34,788,166 compared to 34,917,482 units valued at $108,176,982 on Tuesday.

Market activities resulted in 31 securities trading including 4 in the US dollar market compared to 29 securities trading on Tuesday. At the end of trading, the prices of 14 stocks rose, 8 declined and 9 traded unchanged.

Market activities resulted in 31 securities trading including 4 in the US dollar market compared to 29 securities trading on Tuesday. At the end of trading, the prices of 14 stocks rose, 8 declined and 9 traded unchanged.

The day’s volume was led by, Mayberry Investments trading 1,003,340 shares to close at $7, after it traded at an intraday 52 weeks’ high of $7.60 JMMB Group 7.5% preference share closing at $1, in trading 952,000 shares and Mayberry Equities closed trading at $8.50 with 522,731 shares trading.

Major price changes| Grace Kennedy traded at an intraday 52 weeks’ high of $56.70 but ended trading at a 52 weeks’ closing high of $56.01. Jamaica Producers rose 30 cents to $17, trading 5,988 stock units, Mayberry Equities lost 55 cents trading 522,731 shares to end at $8.60, PanJam Investment concluded trading 51,973 shares at $51, after falling $1.54, Sagicor Group shed 40 cents and settled at $38.10, with 21,574 shares trading, Scotia Group traded 13,284 units and rose $1.10 to end at $52.20 and Sterling jumped $1.50 and finished trading at $13.50, with 2,952 shares changing hands.

Trading in the US dollar market closed with 98,429 units valued at US$87,029 as JMMB Group 6 percent preference share completed trading 80,000 stock units at $1.05, Margaritaville ended trading 10,524 shares to close at 16.9 US cents and Proven Investments rose 1 cent to 19 US cents trading 5,105 shares. The JSE USD Equities Index rose 1.62 points to 155.14.

Trading resulted in an average of 185,179 units valued at an average of $1,288,451 for each security traded. In contrast to 1,342,980 units for an average of $4,160,653 on Tuesday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 7 stocks ended with bids higher than their last selling prices and 2 closing with lower offers.

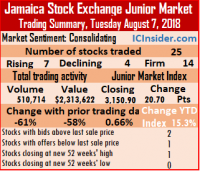

The All Jamaican Composite Index of the Jamaica Stock Exchange traded at an intraday record high of

The All Jamaican Composite Index of the Jamaica Stock Exchange traded at an intraday record high of

Proven Investments added 1 cent and closed at 20 US cents trading 38,800 shares and Sygnus Credit closed 10 US cents in trading 210 shares. The JSE USD Equities Index lost 0.71 points and closed at 154.43

Proven Investments added 1 cent and closed at 20 US cents trading 38,800 shares and Sygnus Credit closed 10 US cents in trading 210 shares. The JSE USD Equities Index lost 0.71 points and closed at 154.43

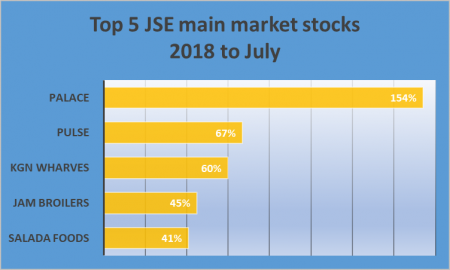

The big winners for the year to July are,

The big winners for the year to July are,  The big losers in the main market are,

The big losers in the main market are,

Market activities resulted in 29 securities trading including 3 in the US dollar market compared to 31 securities trading on Thursday. At the end of trading, the prices of 9 stocks rose, 9 declined and 11 traded unchanged.

Market activities resulted in 29 securities trading including 3 in the US dollar market compared to 31 securities trading on Thursday. At the end of trading, the prices of 9 stocks rose, 9 declined and 11 traded unchanged. Trading in the US dollar market closed with 40,481 units valued at US$10,641 as JMMB Group 6 percent preference share completed trading of 3,000 stock units and fell 1 cents to end at $1.04, Productive Business Solution ended trading 1,000 shares to close at 59 US cents and Proven Investments closed at 19 US cents trading 36,481 shares. The JSE USD Equities Index close unchanged at 155.14.

Trading in the US dollar market closed with 40,481 units valued at US$10,641 as JMMB Group 6 percent preference share completed trading of 3,000 stock units and fell 1 cents to end at $1.04, Productive Business Solution ended trading 1,000 shares to close at 59 US cents and Proven Investments closed at 19 US cents trading 36,481 shares. The JSE USD Equities Index close unchanged at 155.14. The main market of the Jamaica Stock Exchange hit several

The main market of the Jamaica Stock Exchange hit several

of 9 cents at 59 US cents with 541 shares changing hands and Proven Investments lost 1 cent to 18 US cents with 1,700 shares trading The JSE USD Equities Index rose 5.76 points to 153.52.

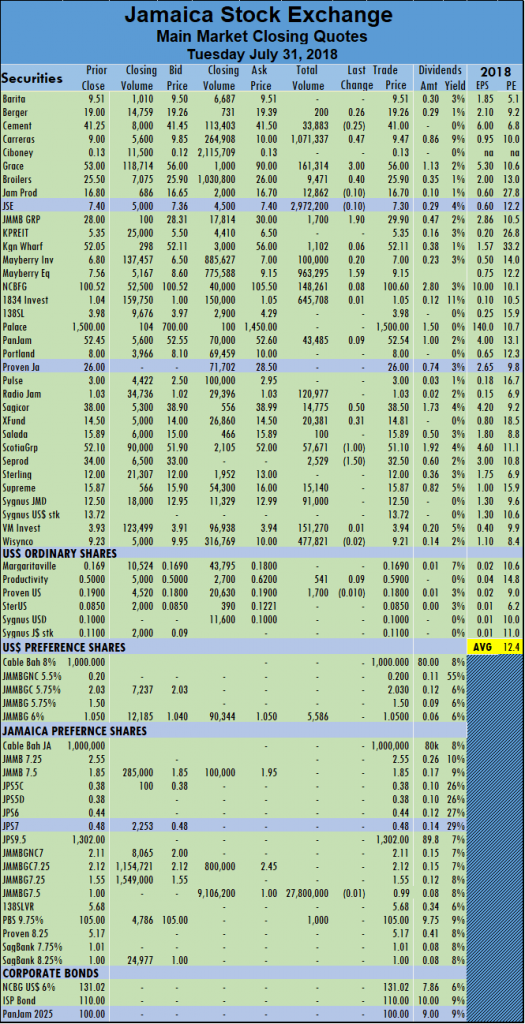

of 9 cents at 59 US cents with 541 shares changing hands and Proven Investments lost 1 cent to 18 US cents with 1,700 shares trading The JSE USD Equities Index rose 5.76 points to 153.52. The day’s volume was led by, Radio Jamaica with 649,627 shares, Carreras with 596,249 units and 1834 Investments Limited with 250,000 units.

The day’s volume was led by, Radio Jamaica with 649,627 shares, Carreras with 596,249 units and 1834 Investments Limited with 250,000 units. Trading in the US dollar market closed with 170,635 units valued at US$27,064 as Proven Investments rose 1 cent to 19 US cents with 112,235 shares trading and Sygnus Credit Investments closed with 58,400 units trading at 10 US cents. The JSE USD Equities Index rose 3.05 points to 147.76.

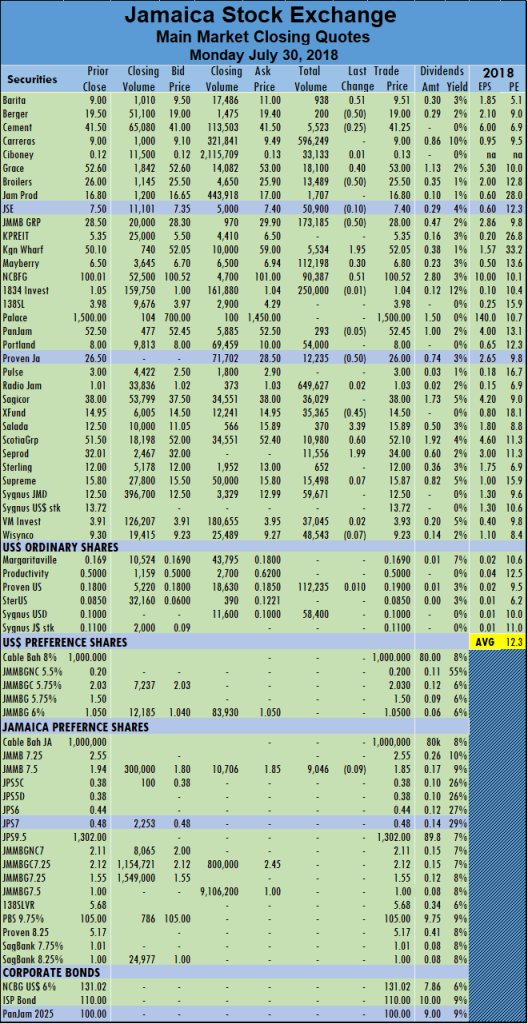

Trading in the US dollar market closed with 170,635 units valued at US$27,064 as Proven Investments rose 1 cent to 19 US cents with 112,235 shares trading and Sygnus Credit Investments closed with 58,400 units trading at 10 US cents. The JSE USD Equities Index rose 3.05 points to 147.76. The main market of the Jamaica Stock Exchange jumped to new record highs at the end of trading on Friday, after trading at an intraday

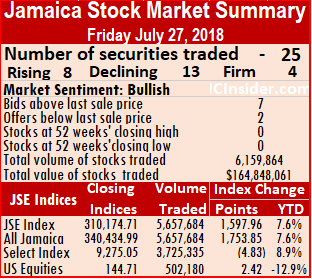

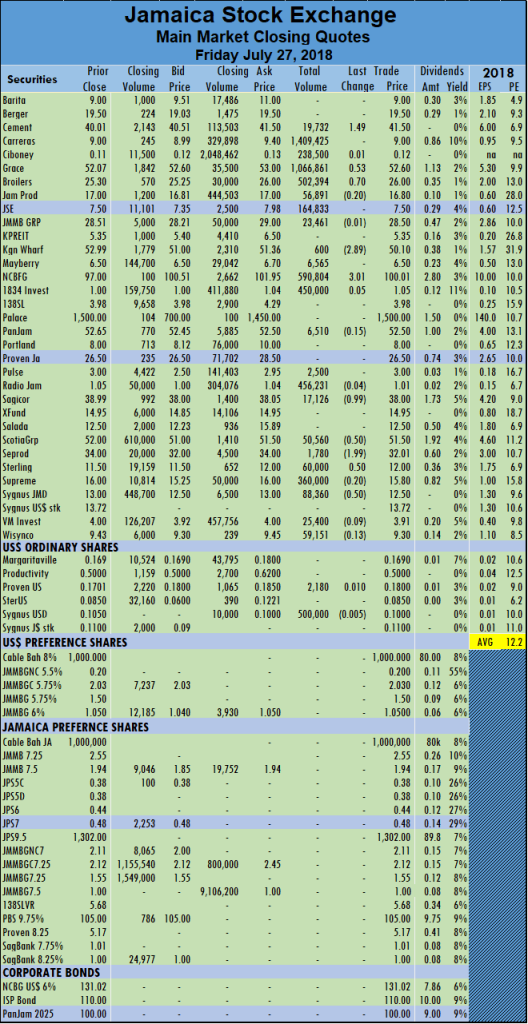

The main market of the Jamaica Stock Exchange jumped to new record highs at the end of trading on Friday, after trading at an intraday  The day’s volume was led by Carreras with 1,409,425 units and 24.91 percent of the day’s volume, followed by Grace Kennedy with 1,066,861 units accounting for 18.86 percent of the day’s volume and

The day’s volume was led by Carreras with 1,409,425 units and 24.91 percent of the day’s volume, followed by Grace Kennedy with 1,066,861 units accounting for 18.86 percent of the day’s volume and  Trading in the US dollar market closed with 502,180 units valued at US$50,395 as Proven Investments rose 0.99 cent to 18 US cents with 2,180 shares trading and Sygnus Credit Investments closed with 500,000 units trading with a decline of 0.5 cents to 10 US cents. The JSE USD Equities Index rose 2.42 points to 144.71.

Trading in the US dollar market closed with 502,180 units valued at US$50,395 as Proven Investments rose 0.99 cent to 18 US cents with 2,180 shares trading and Sygnus Credit Investments closed with 500,000 units trading with a decline of 0.5 cents to 10 US cents. The JSE USD Equities Index rose 2.42 points to 144.71. The main market of the Jamaica Stock Exchange suffered moderate losses in the main indices with just over 30 points drop at the close on Thursday as advancing stocks out-paced decliners.

The main market of the Jamaica Stock Exchange suffered moderate losses in the main indices with just over 30 points drop at the close on Thursday as advancing stocks out-paced decliners.  The day’s volume was led by, PanJam Investment that closed at $52.65, with 2,20,403 stock units, Radio Jamaica with 1,082,403 shares, JMMB Group 7.5% preference share trading 943,000 units, Carreras with 791,670 units and Berger Paints with 600,602 shares.

The day’s volume was led by, PanJam Investment that closed at $52.65, with 2,20,403 stock units, Radio Jamaica with 1,082,403 shares, JMMB Group 7.5% preference share trading 943,000 units, Carreras with 791,670 units and Berger Paints with 600,602 shares. Trading in the US dollar market closed with 328,462 units valued at US$40,221 as Margaritaville rose 0.10 cent and ended at 16.90 US cents with 900 shares and Productivity Business ended trading 6 cents lower to 50 cents with 541 shares, Proven Investments lost 1.09 cents to 17.01 US cents with 72,171 shares trading and Sygnus Credit Investments closed with 254,850 units trading with a decline of 1.5 cents to 10.50 US cents. The JSE USD Equities Index fell 9 points to 142.29.

Trading in the US dollar market closed with 328,462 units valued at US$40,221 as Margaritaville rose 0.10 cent and ended at 16.90 US cents with 900 shares and Productivity Business ended trading 6 cents lower to 50 cents with 541 shares, Proven Investments lost 1.09 cents to 17.01 US cents with 72,171 shares trading and Sygnus Credit Investments closed with 254,850 units trading with a decline of 1.5 cents to 10.50 US cents. The JSE USD Equities Index fell 9 points to 142.29.