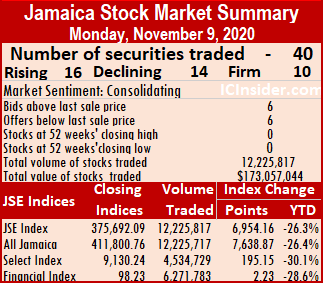

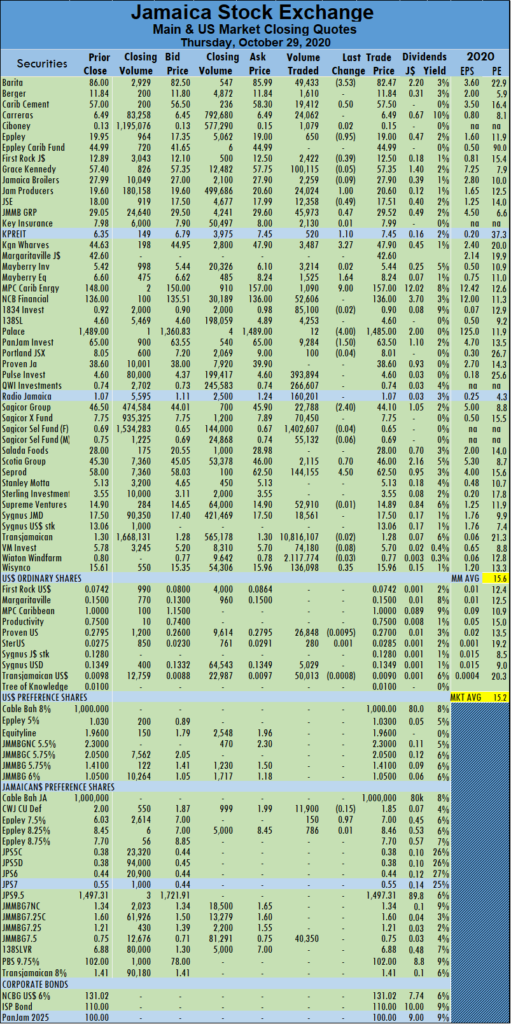

Stock prices surged sharply on the Jamaica Stock Exchange Main Market ended, with the All Jamaican Composite Index jumping 7,638.87 points to 411,800.76, the Main Index shot up by 6,954.16 points to 375,692.09, while the JSE Financial Index gained 2.23 points to settle at 98.23.

Trading ended with 40 securities changing hands compared to 44 on Friday and closed with the prices of 16 stocks rising, 14 declining and 10 ending unchanged. The average PE Ratio ends at 15.4 based on ICInsider.com’s forecast of 2020-21 earnings.

Trading ended with 40 securities changing hands compared to 44 on Friday and closed with the prices of 16 stocks rising, 14 declining and 10 ending unchanged. The average PE Ratio ends at 15.4 based on ICInsider.com’s forecast of 2020-21 earnings.

Trading closed with an exchange of 12,225,817 shares changing hands for $173,057,044 compared to 12,817,056 units at $399,677,339 on Friday.

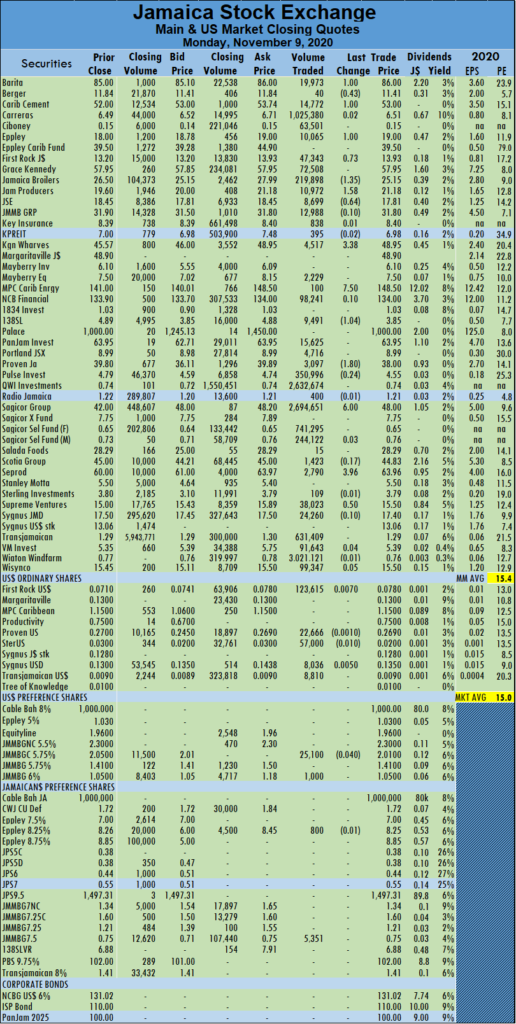

Wigton Windfarm led trading with 24.7 percent of the total volume of 3.02 million shares, followed by Sagicor Group at 22 percent with 2.69 million units and QWI Investments with 21.5 percent for 2.63 million shares and Carreras 8.4 percent with 1.03 million units.

Trading ended with an average of 305,645 units changing hands at $4,326,426 for each security, compared to an average of 291,297 shares at $9,083,576 on Friday. The average trade for the month to date ended at 206,115 units at $3,366,085 for each security, in contrast to 187,598 units at $3,187,417 to Friday. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532.

At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows eight stocks ending with bids higher than their last selling prices and two with lower offers.

At the close of the market, Barita Investments rose $1 in closing at $86, with 19,973 stock units passing through the market, Berger Paints shed 43 cents to end at $11.41 as investors swapped 40 units. Caribbean Cement advanced $1 to $53 in trading 14,772 stock units, Eppley gained $1 to settle at $19, with investors trading 10,065 units,  First Rock Capital gained 73 cents trading 47,343 shares to close at $13.93. Jamaica Broilers fell $1.35 to $25.15, with an exchange of 219,898 shares, Jamaica Producers rose $1.58 to $21.18 trading 10,972 units, Jamaica Stock Exchange lost 64 cents to settle at $17.81, with 8,699 units crossing the market Kingston Wharves advanced $3.38 to $48.95, after clearing the market with 4,517 units, MPC Caribbean Clean Energy climbed $7.50 to settle at $148.50, in trading 100 units, 138 Student Living declined $1.04 to $3.85 after 9,491 units crossed the market, Proven Investments fell $1.80 to $38, in an exchange of 3,097 units. Sagicor Group climbed $6 to $48, with 2,694,651 shares changing hands, Seprod advanced $3.96 in closing at $63.96, with investors swapping 2,790 units and Supreme Ventures gained 50 cents exchanging 38,023 shares to close at $15.50.

First Rock Capital gained 73 cents trading 47,343 shares to close at $13.93. Jamaica Broilers fell $1.35 to $25.15, with an exchange of 219,898 shares, Jamaica Producers rose $1.58 to $21.18 trading 10,972 units, Jamaica Stock Exchange lost 64 cents to settle at $17.81, with 8,699 units crossing the market Kingston Wharves advanced $3.38 to $48.95, after clearing the market with 4,517 units, MPC Caribbean Clean Energy climbed $7.50 to settle at $148.50, in trading 100 units, 138 Student Living declined $1.04 to $3.85 after 9,491 units crossed the market, Proven Investments fell $1.80 to $38, in an exchange of 3,097 units. Sagicor Group climbed $6 to $48, with 2,694,651 shares changing hands, Seprod advanced $3.96 in closing at $63.96, with investors swapping 2,790 units and Supreme Ventures gained 50 cents exchanging 38,023 shares to close at $15.50.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

This week’s focus: Grace Kennedy continues to enjoy a phenomenal year, with profit attributed to the company’s shareholders, rising 33 percent to $1.68 billion in the September quarter, from $1.26 billion for the third quarter in the previous year and grew 35 percent for the nine months to September, to just $4.4 billion from $3.27 billion the corresponding period in 2019. Taxation more than doubled in both periods, but profit before tax grew 49 percent in the third quarter to $2.79 billion and for the nine-months, it rose 51.5 percent to $7.3 billion. Earnings per share are $1.69 for the quarter and $4.47 for the nine months and should exceed $6 for the full year.

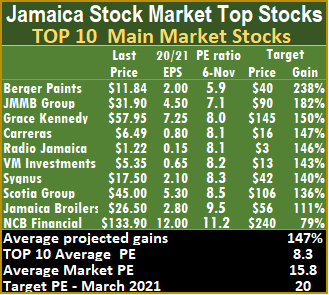

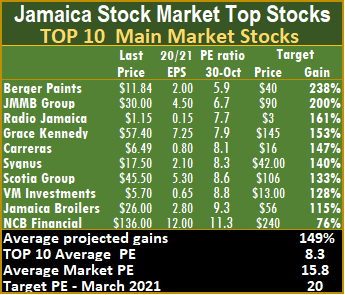

This week’s focus: Grace Kennedy continues to enjoy a phenomenal year, with profit attributed to the company’s shareholders, rising 33 percent to $1.68 billion in the September quarter, from $1.26 billion for the third quarter in the previous year and grew 35 percent for the nine months to September, to just $4.4 billion from $3.27 billion the corresponding period in 2019. Taxation more than doubled in both periods, but profit before tax grew 49 percent in the third quarter to $2.79 billion and for the nine-months, it rose 51.5 percent to $7.3 billion. Earnings per share are $1.69 for the quarter and $4.47 for the nine months and should exceed $6 for the full year. With expected gains of 150 to 238 percent, the top three Main Market stocks are now, Berger Paints followed by JMMB Group and Grace Kennedy in the third position.

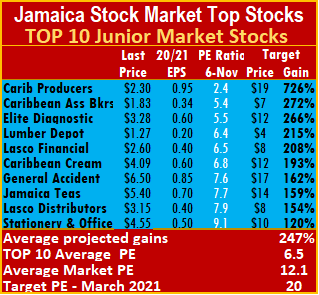

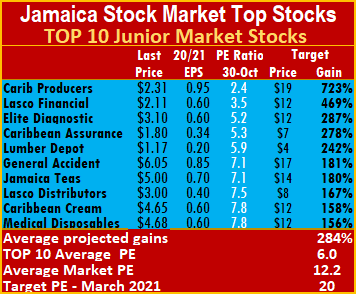

With expected gains of 150 to 238 percent, the top three Main Market stocks are now, Berger Paints followed by JMMB Group and Grace Kennedy in the third position. The average projected gain for the Junior Market IC TOP 10 stocks is 247 percent, and 147 percent for the JSE Main Market, based on 2020-21 earnings, indicating potentially greater gains in the Junior Market than the Main Market.

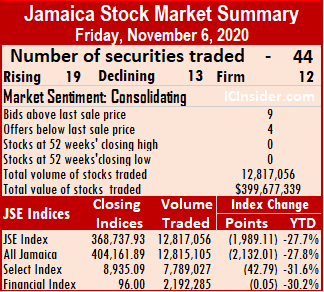

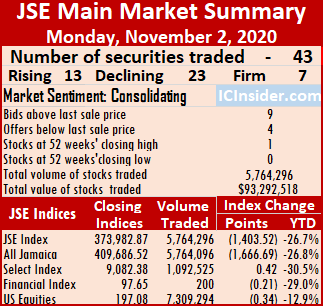

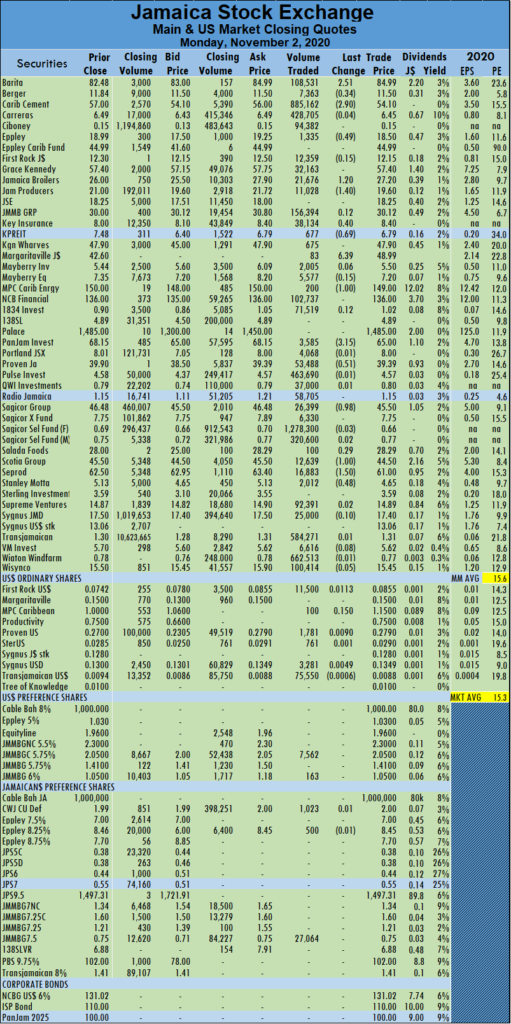

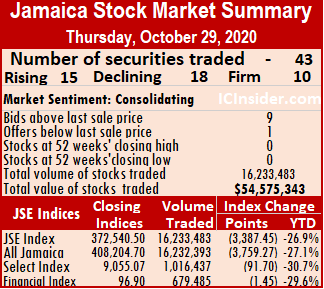

The average projected gain for the Junior Market IC TOP 10 stocks is 247 percent, and 147 percent for the JSE Main Market, based on 2020-21 earnings, indicating potentially greater gains in the Junior Market than the Main Market. At the close, the All Jamaican Composite Index dropped 2,132.01 points to 404,161.89, the Main Index fell by 1,989.11 points to 368,737.93 and the JSE Financial Index lost 0.05 points to settle at 96.00.

At the close, the All Jamaican Composite Index dropped 2,132.01 points to 404,161.89, the Main Index fell by 1,989.11 points to 368,737.93 and the JSE Financial Index lost 0.05 points to settle at 96.00. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532.

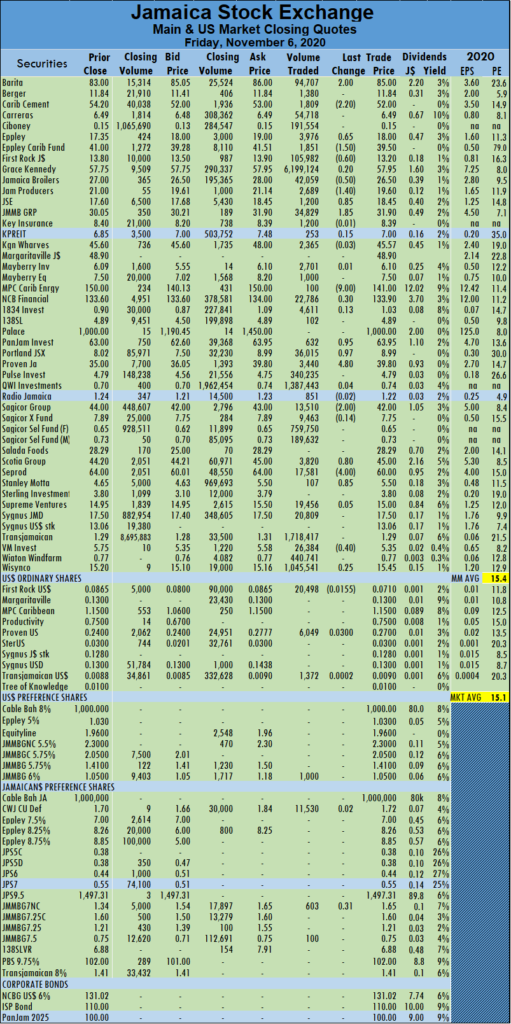

Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532. MPC Caribbean Clean Energy dropped $9 to close at $141, in exchanging100 units, NCB Financial finished at $133.90, with gains of 30 cents after an exchange of 22,786 stock units, PanJam Investment rose 95 cents to end at $63.95, with the trading of 632 units. Portland JSX lost 97 cents ending at $8.99, with a transfer of 36,015 stock units, Proven Investments advanced $4.80 to settle at $39.80, with 3,440 stock units crossing the exchange, Sagicor Group fell $2 to end at $42 and clearing the market with 13,510 units. Scotia Group rose 80 cents in closing at $45, with an exchange of 3,820 units, Seprod declined by $4 to end at $60, with 17,581 stock units passing through the market, Stanley Motta gained 85 cents to settle at $5.50, after exchanging 107 units and Victoria Mutual Investments lost 40 cents to close at $5.35 after trading 26,384 stock units.

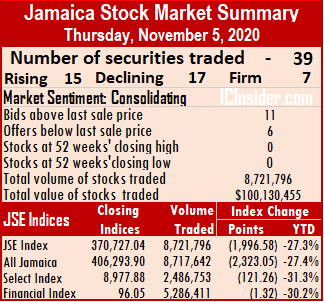

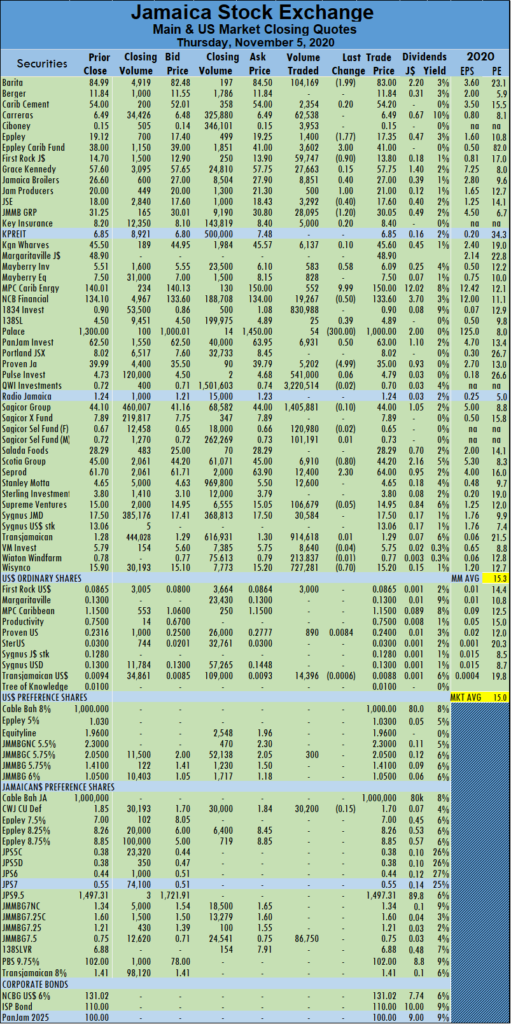

MPC Caribbean Clean Energy dropped $9 to close at $141, in exchanging100 units, NCB Financial finished at $133.90, with gains of 30 cents after an exchange of 22,786 stock units, PanJam Investment rose 95 cents to end at $63.95, with the trading of 632 units. Portland JSX lost 97 cents ending at $8.99, with a transfer of 36,015 stock units, Proven Investments advanced $4.80 to settle at $39.80, with 3,440 stock units crossing the exchange, Sagicor Group fell $2 to end at $42 and clearing the market with 13,510 units. Scotia Group rose 80 cents in closing at $45, with an exchange of 3,820 units, Seprod declined by $4 to end at $60, with 17,581 stock units passing through the market, Stanley Motta gained 85 cents to settle at $5.50, after exchanging 107 units and Victoria Mutual Investments lost 40 cents to close at $5.35 after trading 26,384 stock units. At the close, the All Jamaican Composite Index dropped 2,323.05 points to 406,293.9, the Main Index lost 1,996.58 points to 370,727.04 and the JSE Financial Index shed 1.32 points to settle at 96.05.

At the close, the All Jamaican Composite Index dropped 2,323.05 points to 406,293.9, the Main Index lost 1,996.58 points to 370,727.04 and the JSE Financial Index shed 1.32 points to settle at 96.05. Trading ended with an average of 223,636 units changing hands at $2,567,448 for each security, in comparison to an average of 192,871 shares at $1,502,526 on Wednesday. The average trade for the month to date ends at 160,915 units at $1,670,277, in contrast to 142,384 units at $1,405,203. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532.

Trading ended with an average of 223,636 units changing hands at $2,567,448 for each security, in comparison to an average of 192,871 shares at $1,502,526 on Wednesday. The average trade for the month to date ends at 160,915 units at $1,670,277, in contrast to 142,384 units at $1,405,203. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532. Jamaica Stock Exchange lost 40 cents to end at $17.60, with 3,292 units passing through the market, JMMB Group lost $1.20 to settle at $30.05, in an exchange of 28,095 stock units. Mayberry Investments rose 58 cents to $6.09, with investors switching ownership of 583 units, MPC Caribbean Clean Energy climbed $9.99 to settle at $150, with 552 units crossing the market, NCB Financial finished 50 cents lower at $133.60, with an exchange of 19,267 stock units. 138 Student Living gained 39 cents and settled at $4.89, with an exchange of 25 units, Palace Amusement dropped $300 to close a 52 weeks’ low of $1,000 after exchanging 54 units, Pan Jam Investment gained 50 cents to close at $63 trading 6,931 stock units, Proven Investments fell $4.99 in closing at $35, with investors switching ownership of 5,202 units. Scotia Group shed 80 cents to end at $44.20 after trading 6,910 units Seprod climbed $2.30 to close at $64, with a transfer of 12,400 stock units and Wisynco Group shed 70 cents after ending at $15.20, with 727,281 shares changing hands.

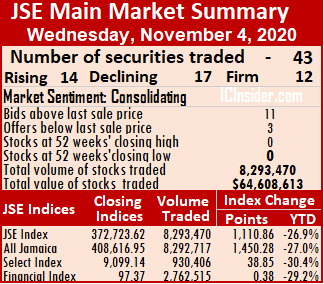

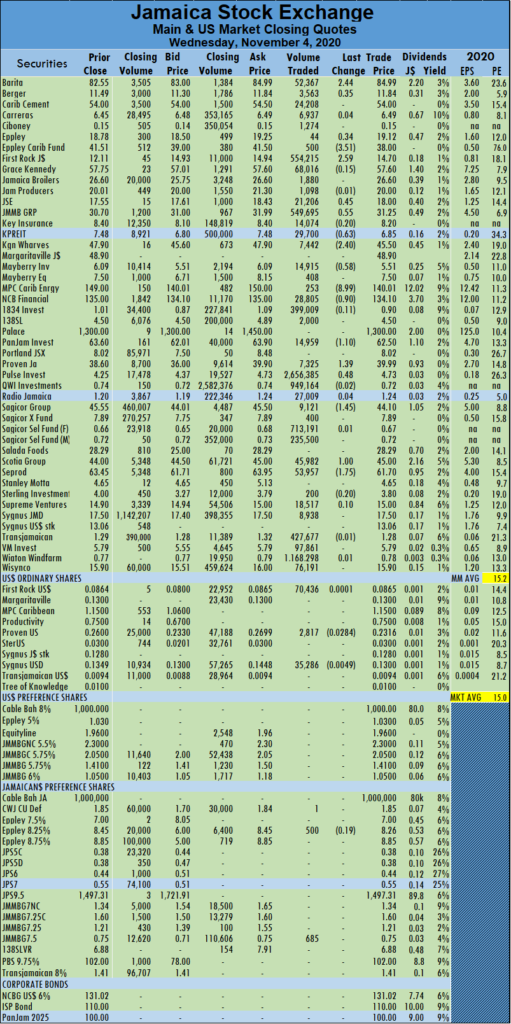

Jamaica Stock Exchange lost 40 cents to end at $17.60, with 3,292 units passing through the market, JMMB Group lost $1.20 to settle at $30.05, in an exchange of 28,095 stock units. Mayberry Investments rose 58 cents to $6.09, with investors switching ownership of 583 units, MPC Caribbean Clean Energy climbed $9.99 to settle at $150, with 552 units crossing the market, NCB Financial finished 50 cents lower at $133.60, with an exchange of 19,267 stock units. 138 Student Living gained 39 cents and settled at $4.89, with an exchange of 25 units, Palace Amusement dropped $300 to close a 52 weeks’ low of $1,000 after exchanging 54 units, Pan Jam Investment gained 50 cents to close at $63 trading 6,931 stock units, Proven Investments fell $4.99 in closing at $35, with investors switching ownership of 5,202 units. Scotia Group shed 80 cents to end at $44.20 after trading 6,910 units Seprod climbed $2.30 to close at $64, with a transfer of 12,400 stock units and Wisynco Group shed 70 cents after ending at $15.20, with 727,281 shares changing hands. At the close, the All Jamaican Composite Index advanced by 1,450.28 points to 408,616.95, the Main Index climbed 1,110.86 points to 372,723.62 and the JSE Financial Index rose 0.38 points to settle at 97.37.

At the close, the All Jamaican Composite Index advanced by 1,450.28 points to 408,616.95, the Main Index climbed 1,110.86 points to 372,723.62 and the JSE Financial Index rose 0.38 points to settle at 97.37. The average trade for November to date is 142,384 units at $1,405,203 for each security versus 117,991 units at $1,358,182. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532.

The average trade for November to date is 142,384 units at $1,405,203 for each security versus 117,991 units at $1,358,182. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532. JMMB Group ended 55 cents higher at $31.25, in the transfer of 549,695 shares, Kingston Properties shed 63 cents in closing at $6.85 and trading 29,700 stock units, Kingston Wharves lost $2.40 to end at $45.50, with investors swapping 7,442 stock units. Mayberry Investments shed 58 cents in closing at $5.51, trading 14,915 stock units, MPC Caribbean Clean Energy shed $8.99 to $140.01, with an exchange of 253 units, NCB Financial lost 90 cents in closing at $134.10, after a transfer of 28,805 stock units. Pan Jam Investment fell $1.10 to $62.50, after an exchange of 14,959 stock shares, Proven Investments climbed $1.39 to $39.99 trading 7,325 units, Pulse Investments gained 48 cents to end at $4.73, with investors switching ownership of 2,656,385 shares. Sagicor Group fell $1.45 to settle at $44.10, with 9,121 units passing through the market, Scotia Group rose $1 to close at $45, in exchanging 45,982 shares and Seprod fell $1.75 to $61.70 after trading 53,957 shares.

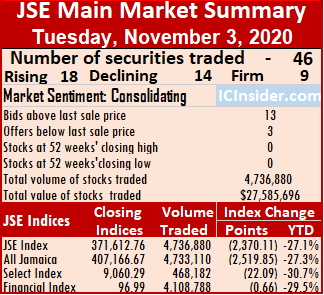

JMMB Group ended 55 cents higher at $31.25, in the transfer of 549,695 shares, Kingston Properties shed 63 cents in closing at $6.85 and trading 29,700 stock units, Kingston Wharves lost $2.40 to end at $45.50, with investors swapping 7,442 stock units. Mayberry Investments shed 58 cents in closing at $5.51, trading 14,915 stock units, MPC Caribbean Clean Energy shed $8.99 to $140.01, with an exchange of 253 units, NCB Financial lost 90 cents in closing at $134.10, after a transfer of 28,805 stock units. Pan Jam Investment fell $1.10 to $62.50, after an exchange of 14,959 stock shares, Proven Investments climbed $1.39 to $39.99 trading 7,325 units, Pulse Investments gained 48 cents to end at $4.73, with investors switching ownership of 2,656,385 shares. Sagicor Group fell $1.45 to settle at $44.10, with 9,121 units passing through the market, Scotia Group rose $1 to close at $45, in exchanging 45,982 shares and Seprod fell $1.75 to $61.70 after trading 53,957 shares. At the close, the All Jamaican Composite Index dropped 2,519.85 points to end at 407,166.67, the Main Index declined 2,370.11 points to 371,612.76 and the JSE Financial Index shed 0.66 points to settle at 96.99.

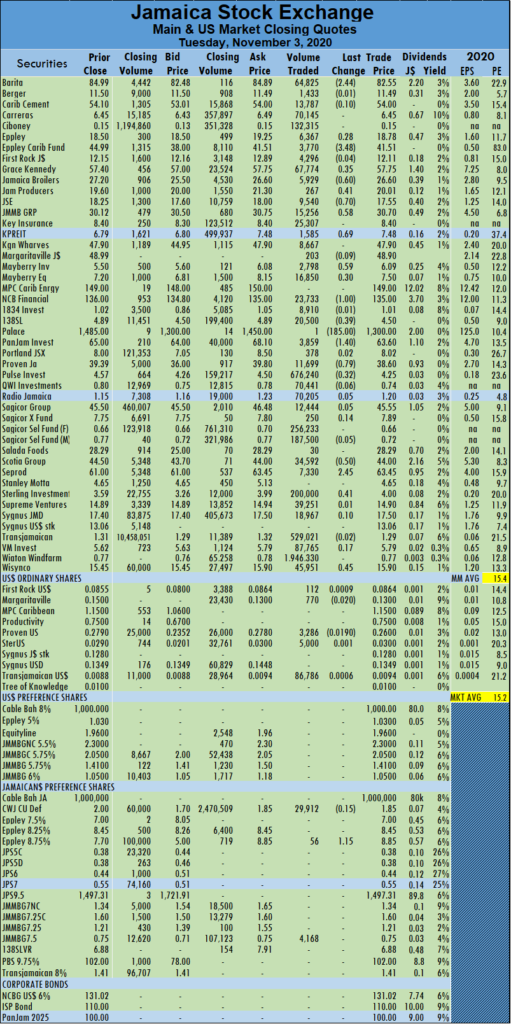

At the close, the All Jamaican Composite Index dropped 2,519.85 points to end at 407,166.67, the Main Index declined 2,370.11 points to 371,612.76 and the JSE Financial Index shed 0.66 points to settle at 96.99. At the close of the market, Barita Investments fell $2.44 to $82.55 trading 64,825 shares, Eppley Caribbean Property Fund declined $3.48 to $41.51, with the transfer of 3,770 units. Grace Kennedy rose 35 cents to end at $57.75, in an exchange of 67,774 shares, Jamaica Broilers shed 60 cents in closing at $26.60, with 5,929 units passing through the market, Jamaica Producers gained 41 cents to close at $20.01 after exchanging 267 units. Jamaica Stock Exchange lost 70 cents to end at $17.55, after crossing the market with 9,540 units, JMMB Group closed 58 cents higher to settle at $30.70 trading 15,256 stock units, Kingston Properties ended at $7.48, with gains of 69 cents in trading 1,585 units. Mayberry Investments rose 59 cents in closing at $6.09, after trading 2,798 units, Mayberry Jamaican Equities gained 30 cents to close at $7.50 trading 16,850 stock units,

At the close of the market, Barita Investments fell $2.44 to $82.55 trading 64,825 shares, Eppley Caribbean Property Fund declined $3.48 to $41.51, with the transfer of 3,770 units. Grace Kennedy rose 35 cents to end at $57.75, in an exchange of 67,774 shares, Jamaica Broilers shed 60 cents in closing at $26.60, with 5,929 units passing through the market, Jamaica Producers gained 41 cents to close at $20.01 after exchanging 267 units. Jamaica Stock Exchange lost 70 cents to end at $17.55, after crossing the market with 9,540 units, JMMB Group closed 58 cents higher to settle at $30.70 trading 15,256 stock units, Kingston Properties ended at $7.48, with gains of 69 cents in trading 1,585 units. Mayberry Investments rose 59 cents in closing at $6.09, after trading 2,798 units, Mayberry Jamaican Equities gained 30 cents to close at $7.50 trading 16,850 stock units, NCB Financial fell $1 to $135, with 23,733 stock units changing hands. 138 Student Living lost 39 cents in closing at $4.50, in exchanging 20,500 stock units, Palace Amusement dropped $185 to $1,300, trading just one unit, Pan Jam Investment fell to 41.40 to $63.60, trading 3,859 units, Proven Investments shed 79 cents to close at $38.60, after exchanging 11,699 stock units. Pulse Investments lost 32 cents to settle at $4.25, with an exchange of 676,240 shares, Scotia Group shed 50 cents to end at $44, in exchanging 34,592 stock units, Seprod gained $2.45 to end at $63.45 while crossing the market with 7,330 units. Sterling Investments closed at $4 after gaining 41 cents ttrading 200,000 shares and Wisynco Group finished 45 cents higher at $15.90, in trading 45,951 shares.

NCB Financial fell $1 to $135, with 23,733 stock units changing hands. 138 Student Living lost 39 cents in closing at $4.50, in exchanging 20,500 stock units, Palace Amusement dropped $185 to $1,300, trading just one unit, Pan Jam Investment fell to 41.40 to $63.60, trading 3,859 units, Proven Investments shed 79 cents to close at $38.60, after exchanging 11,699 stock units. Pulse Investments lost 32 cents to settle at $4.25, with an exchange of 676,240 shares, Scotia Group shed 50 cents to end at $44, in exchanging 34,592 stock units, Seprod gained $2.45 to end at $63.45 while crossing the market with 7,330 units. Sterling Investments closed at $4 after gaining 41 cents ttrading 200,000 shares and Wisynco Group finished 45 cents higher at $15.90, in trading 45,951 shares. At the close, the All Jamaican Composite Index declined by 1,666.69 points to 409,686.52, the Main Index fell 1,403.52 points to 373,982.87 and the JSE Financial Index lost 0.21 points to settle at 97.65.

At the close, the All Jamaican Composite Index declined by 1,666.69 points to 409,686.52, the Main Index fell 1,403.52 points to 373,982.87 and the JSE Financial Index lost 0.21 points to settle at 97.65. Trading ended with an average of 134,053 units changing hands at $2,169,593 for each security compared to an average of 203,478 shares at $1,700,784 on Friday. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532.

Trading ended with an average of 134,053 units changing hands at $2,169,593 for each security compared to an average of 203,478 shares at $1,700,784 on Friday. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532. Key Insurance gained 40 cents to end at $8.40, with 38,134 stock units changing hands, Kingston Properties shed 69 cents to end at $6.79, in transferring 677 units, Margaritaville advanced $6.39 to settle at a 52 weeks’ high of $48.99, with investors switching ownership of 83 units. MPC Caribbean Clean Energy ended $1 lower at $149, in crossing the market with 200 units, Pan Jam Investment dropped $3.15 to $65 trading 3,585 units, Proven Investments shed 51 cents to end at $39.39 after exchanging 53,488 shares. Sagicor Group lost 98 cents to settle at $45.50, in trading 26,399 stock units, Scotia Group fell $1 to close at $44.50, after 12,639 units crossed the exchange, Seprod shed $1.50 to settle at $61, trading 16,883 stock units and Stanley Motta lost 48 cents to end at $4.65, in exchanging 2,012 units.

Key Insurance gained 40 cents to end at $8.40, with 38,134 stock units changing hands, Kingston Properties shed 69 cents to end at $6.79, in transferring 677 units, Margaritaville advanced $6.39 to settle at a 52 weeks’ high of $48.99, with investors switching ownership of 83 units. MPC Caribbean Clean Energy ended $1 lower at $149, in crossing the market with 200 units, Pan Jam Investment dropped $3.15 to $65 trading 3,585 units, Proven Investments shed 51 cents to end at $39.39 after exchanging 53,488 shares. Sagicor Group lost 98 cents to settle at $45.50, in trading 26,399 stock units, Scotia Group fell $1 to close at $44.50, after 12,639 units crossed the exchange, Seprod shed $1.50 to settle at $61, trading 16,883 stock units and Stanley Motta lost 48 cents to end at $4.65, in exchanging 2,012 units.

Remittances grew 11 percent and added $50 million to revenues while Cambio operations contributed 10.8 percent or $34 million to increased revenues, the company’s Managing Director Jacinth Hall-Tracey, informed shareholders in a commentary accompanying the quarterly report.

Remittances grew 11 percent and added $50 million to revenues while Cambio operations contributed 10.8 percent or $34 million to increased revenues, the company’s Managing Director Jacinth Hall-Tracey, informed shareholders in a commentary accompanying the quarterly report. With expected gains of 161 to 238 percent, the top three Main Market stocks are now Berger Paints followed by JMMB Group, Radio Jamaica replacing Grace Kennedy in the third position last week.

With expected gains of 161 to 238 percent, the top three Main Market stocks are now Berger Paints followed by JMMB Group, Radio Jamaica replacing Grace Kennedy in the third position last week. The average projected gain for the Junior Market IC TOP 10 stocks is 287 percent, and 149 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially greater gains in the Junior Market than the Main Market.

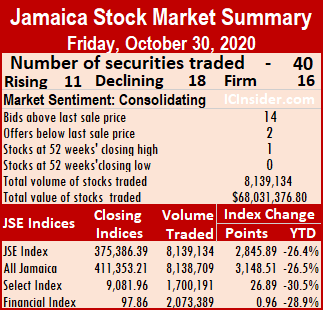

The average projected gain for the Junior Market IC TOP 10 stocks is 287 percent, and 149 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially greater gains in the Junior Market than the Main Market. The Jamaica Stock Exchange Main Market ended trading on Friday with the market rising and is wont to be the case at the end of month trading as investors stocks rising beat those declining almost two to one after an exchange of 50 percent fewer shares than on Thursday.

The Jamaica Stock Exchange Main Market ended trading on Friday with the market rising and is wont to be the case at the end of month trading as investors stocks rising beat those declining almost two to one after an exchange of 50 percent fewer shares than on Thursday. The market closed with an exchange of 8,139,134 shares for $68,031,377 compared to 16,233,483 units at $54,575,343 on Thursday.

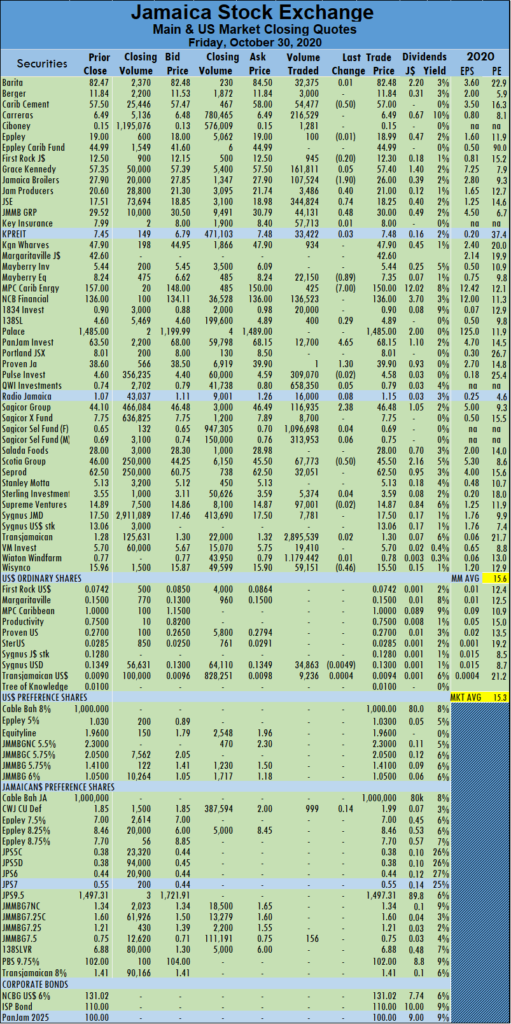

The market closed with an exchange of 8,139,134 shares for $68,031,377 compared to 16,233,483 units at $54,575,343 on Thursday. Caribbean Cement shed 50 cents, in ending at $57 after exchanging 54,477 shares, Jamaica Broilers declined $1.90 in closing at $26, with 107,524 shares changing hands, Jamaica Producers gained 40 cents to settle at $21 trading 3,486 units. Jamaica Stock Exchange gained 74 cents and closed at $18.25 after the transfer of 344,824 shares, JMMB Group gained 48 cents to settle at $30, with 44,131 stock units passing through the market, Mayberry Jamaican Equities fell 89 cents to $7.35, in exchanging 22,150 stock units. MPC Caribbean Clean Energy declined by $7 to $150 after the swapping of 425 units. Pan Jam Investment advanced to $68.15, with gains of $4.65 trading 12,700 units, Proven Investments climbed $1.30 to $39.90 after exchanging just one unit. Sagicor Group ended $2.38 higher at $46.48, with 116,935 shares passing through the market, Scotia Group shed 50 cents, in ending at $45.50 with an exchange of 67,773 shares and Wisynco Group lost 46 cents in closing at $15.50, with 59,151 stock units crossing the market.

Caribbean Cement shed 50 cents, in ending at $57 after exchanging 54,477 shares, Jamaica Broilers declined $1.90 in closing at $26, with 107,524 shares changing hands, Jamaica Producers gained 40 cents to settle at $21 trading 3,486 units. Jamaica Stock Exchange gained 74 cents and closed at $18.25 after the transfer of 344,824 shares, JMMB Group gained 48 cents to settle at $30, with 44,131 stock units passing through the market, Mayberry Jamaican Equities fell 89 cents to $7.35, in exchanging 22,150 stock units. MPC Caribbean Clean Energy declined by $7 to $150 after the swapping of 425 units. Pan Jam Investment advanced to $68.15, with gains of $4.65 trading 12,700 units, Proven Investments climbed $1.30 to $39.90 after exchanging just one unit. Sagicor Group ended $2.38 higher at $46.48, with 116,935 shares passing through the market, Scotia Group shed 50 cents, in ending at $45.50 with an exchange of 67,773 shares and Wisynco Group lost 46 cents in closing at $15.50, with 59,151 stock units crossing the market. Trading ended with an average of 377,523 units changing hands at $1,269,194 compared to an average of 353,293 shares at $1,932,013 on Wednesday. The average trade for October to date ended at 407,163 units at $4,757,020, in contrast to 408,707 units at $4,938,583 on Wednesday and exceeds by a good margin September’s average of 265,170 units at $3,271,625.

Trading ended with an average of 377,523 units changing hands at $1,269,194 compared to an average of 353,293 shares at $1,932,013 on Wednesday. The average trade for October to date ended at 407,163 units at $4,757,020, in contrast to 408,707 units at $4,938,583 on Wednesday and exceeds by a good margin September’s average of 265,170 units at $3,271,625. JMMB Group gained 47 cents in closing at $29.52, with 45,973 shares changing hands, Kingston Properties advanced by $1.10 to $7.45, in transferring 520 units, Kingston Wharves climbed $3.27 to $47.90, with 3,487 units passing through the market. Mayberry Jamaican Equities carved out a gain of $1.64 after crossing the market with 1,525 units to settle at $8.24, MPC Caribbean Clean Energy gained $9 and closed at $157, with 1,090 units clearing the market, Palace Amusement declined by $4 in closing at $1,485 while trading 12 units. Pan Jam Investment dipped $1.50 to $63.50, with investors switching ownership of 9,284 stock units, Sagicor Group declined by $2.40 to $44.10, in an exchange of 22,788 stock units, Scotia Group gained 70 cents to settle at $46, with 2,115 units changing hands. Seprod climbed $4.50 to $62.50, with an exchange of 144,155 shares and Wisynco Group ended at $15.96, with gains of 35 cents after crossing the market with 136,098 shares.

JMMB Group gained 47 cents in closing at $29.52, with 45,973 shares changing hands, Kingston Properties advanced by $1.10 to $7.45, in transferring 520 units, Kingston Wharves climbed $3.27 to $47.90, with 3,487 units passing through the market. Mayberry Jamaican Equities carved out a gain of $1.64 after crossing the market with 1,525 units to settle at $8.24, MPC Caribbean Clean Energy gained $9 and closed at $157, with 1,090 units clearing the market, Palace Amusement declined by $4 in closing at $1,485 while trading 12 units. Pan Jam Investment dipped $1.50 to $63.50, with investors switching ownership of 9,284 stock units, Sagicor Group declined by $2.40 to $44.10, in an exchange of 22,788 stock units, Scotia Group gained 70 cents to settle at $46, with 2,115 units changing hands. Seprod climbed $4.50 to $62.50, with an exchange of 144,155 shares and Wisynco Group ended at $15.96, with gains of 35 cents after crossing the market with 136,098 shares.