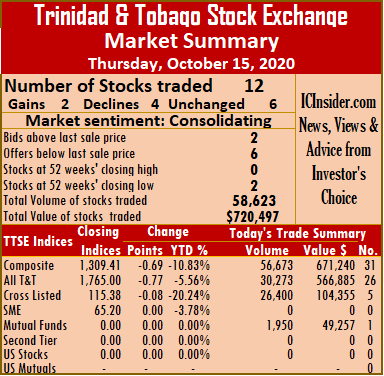

Trading resulted in 177 percent more shares changing hands with values rising 16 percent on the Trinidad and Tobago Stock Exchange on Wednesday than Thursday, in large part due to Guardian Holdings, the dominant trade.

The market closed with 14 securities trading, similar to Wednesday, and closed with five stocks advancing, three declining and six remaining unchanged. Trading resulted in 552,641 shares for $9,388,509 compared to 199,471 shares valued $8,074,531 on Wednesday.

The market closed with 14 securities trading, similar to Wednesday, and closed with five stocks advancing, three declining and six remaining unchanged. Trading resulted in 552,641 shares for $9,388,509 compared to 199,471 shares valued $8,074,531 on Wednesday.

The average trade for the day amounted to 39,474 units at $670,608 versus an average of 14,248 units at $576,752 for each security on Wednesday. For the month to date, the average trade amounts to 15,847 shares at $309,327 compared to 14,106 units at $282,706 on Wednesday. In contrast, September closed with an average of 12,021 shares for $174,137.

The T&T Composite Index rose 1.51 points to 1,309.74, the All T&T Index lost 0.67 points to end at 1,762.97, while the Cross Listed Index gained 0.51 points to close at 115.76.

The Investor’s Choice bid-offer indicator ended with the bids of three stocks higher than their last selling price and nine with lower offers.

Stocks rising│ JMMB Group gained 5 cents trading 53,753 shares to close at $1.80, Massy Holdings ended at $59, after gaining 50 cents in transferring 115 units, NCB Financial closed 5 cents higher at $8, with 58,000 shares crossing the market. Scotiabank rose 45 cents to $55.45 in an exchange of 290 units and Trinidad and Tobago NGL picked up 1 cent to settle at $15.01 trading 18,195 stock units.

Stocks declining│First Citizens Bank slipped 50 cents to $44.50, after exchanging 799 units, Guardian Holdings lost 9 cents to finish at $19.10, in transferring 296,363 shares, with a value of $5,663,064 and Grace Kennedy ended at $3.55, with a loss of 5 cents trading 30,000 shares.

Stocks declining│First Citizens Bank slipped 50 cents to $44.50, after exchanging 799 units, Guardian Holdings lost 9 cents to finish at $19.10, in transferring 296,363 shares, with a value of $5,663,064 and Grace Kennedy ended at $3.55, with a loss of 5 cents trading 30,000 shares.

Stocks trading firm │Clico Investments exchanged 23,409 stock units at $25.20, National Flour traded at $1.85, with 8,192 shares changing hands, One Caribbean Media held firm at $4.80, in transferring 150 units. Republic Financial Holdings closed at $141.75, with an exchange of 70 units, Unilever Caribbean traded 200 units at $16.95 and West Indian Tobacco closed at $33.45 after 63,105 shares changed hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

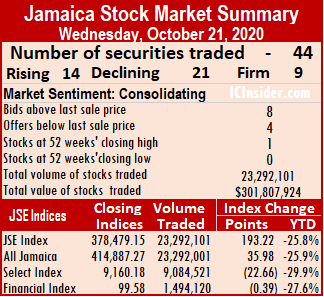

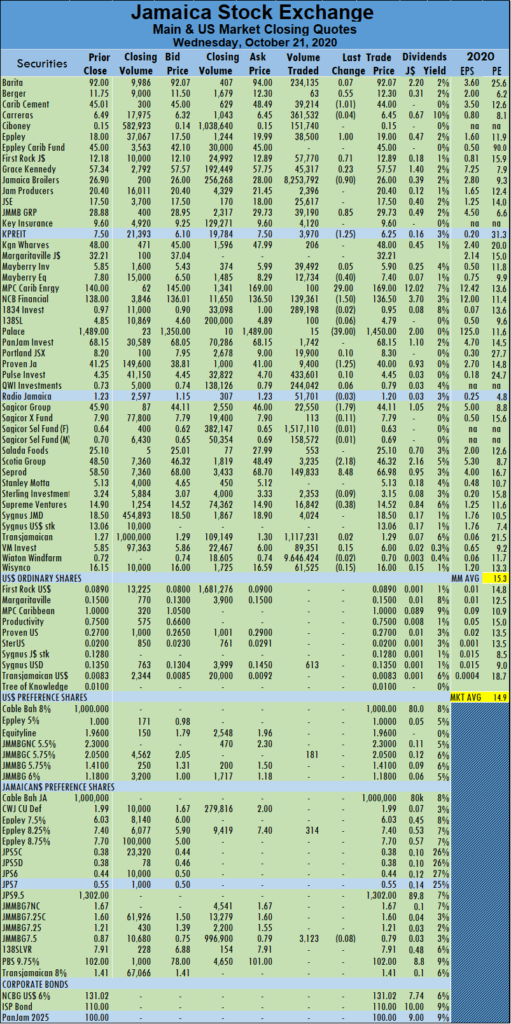

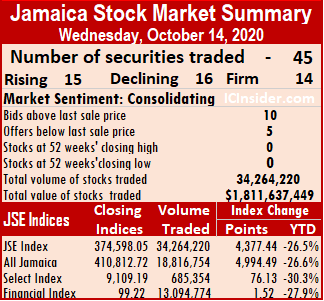

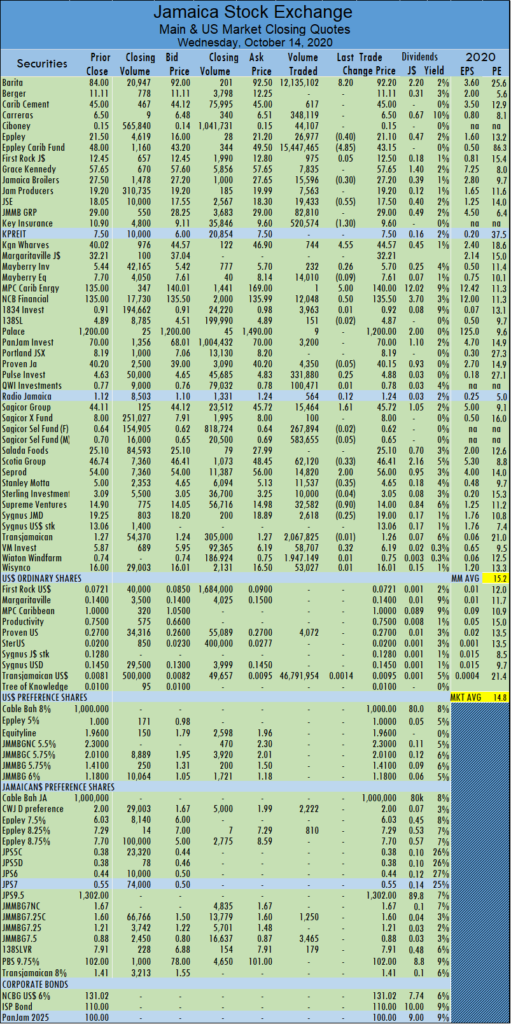

At the close, the All Jamaican Composite Index gained 35.98 points to 414,887.27, the Main Index rose 193.22 points to 378,479.15, while the JSE Financial Index shed 0.39 points to settle at 99.58.

At the close, the All Jamaican Composite Index gained 35.98 points to 414,887.27, the Main Index rose 193.22 points to 378,479.15, while the JSE Financial Index shed 0.39 points to settle at 99.58. Trading ended with an average of 529,366 units at $6,859,271 for each security compared to an average of 99,936 shares at $838,249 on Tuesday. The average trade for October to date ended at 347,371 units at $5,634,183 for each security, in contrast to 332,968 units at $5,537,233. Trading month to date is well up on September’s average of 265,170 units at $3,271,625.

Trading ended with an average of 529,366 units at $6,859,271 for each security compared to an average of 99,936 shares at $838,249 on Tuesday. The average trade for October to date ended at 347,371 units at $5,634,183 for each security, in contrast to 332,968 units at $5,537,233. Trading month to date is well up on September’s average of 265,170 units at $3,271,625. Kingston Properties fell $1.25 to $6.25 after finishing with 3,970 stock units changing hands, Mayberry Jamaican Equities shed 40 cents to close at $7.40, in trading 12,734 stock, MPC Caribbean Clean Energy rose $29 to $169 after trading 100 units. NCB Financial Group declined $1.50 in closing at $136.50, with an exchange of 139,361 shares, Palace Amusement lost $39 and closed at $1,450, trading 15 units, Proven Investments dropped $1.25 to end at $40, in an exchange of 9,400 stock units. Sagicor Group fell $1.79 to $44.11 trading 22,550 shares, Scotia Group dropped $2.18 to $46.32, in trading 3,235 units, Seprod climbed $8.48 to a 52 weeks’ closing high of $66.98 after hitting a new high of $70, with investors swapping 149,833 shares after the company reported a big increase in nine months profit and Supreme Ventures lost 38 cents to end at $14.52, in trading 16,842 stock units.

Kingston Properties fell $1.25 to $6.25 after finishing with 3,970 stock units changing hands, Mayberry Jamaican Equities shed 40 cents to close at $7.40, in trading 12,734 stock, MPC Caribbean Clean Energy rose $29 to $169 after trading 100 units. NCB Financial Group declined $1.50 in closing at $136.50, with an exchange of 139,361 shares, Palace Amusement lost $39 and closed at $1,450, trading 15 units, Proven Investments dropped $1.25 to end at $40, in an exchange of 9,400 stock units. Sagicor Group fell $1.79 to $44.11 trading 22,550 shares, Scotia Group dropped $2.18 to $46.32, in trading 3,235 units, Seprod climbed $8.48 to a 52 weeks’ closing high of $66.98 after hitting a new high of $70, with investors swapping 149,833 shares after the company reported a big increase in nine months profit and Supreme Ventures lost 38 cents to end at $14.52, in trading 16,842 stock units.

Trinidad and Tobago NGL closed 5 cents higher at $15 after exchanging 41,771 shares and Unilever Caribbean rose 15 cents to settle at $16.95, with a transfer of just 5 units.

Trinidad and Tobago NGL closed 5 cents higher at $15 after exchanging 41,771 shares and Unilever Caribbean rose 15 cents to settle at $16.95, with a transfer of just 5 units. Wigton Windfarm with 18.8 percent or 789,387 units and Carreras with 11 percent market share, for 459,648 units.

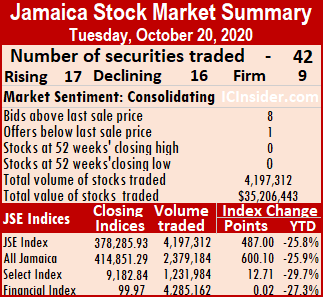

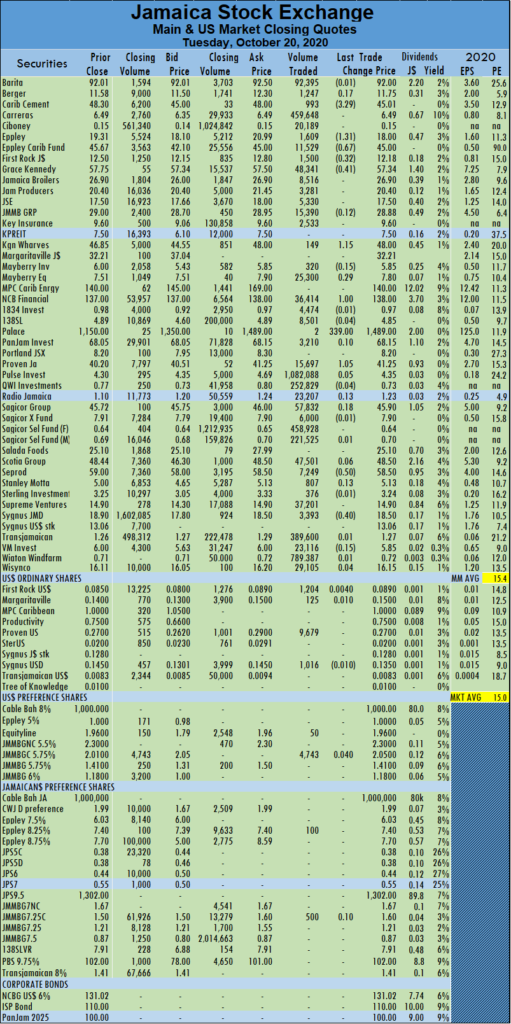

Wigton Windfarm with 18.8 percent or 789,387 units and Carreras with 11 percent market share, for 459,648 units. Eppley Caribbean Property Fund dipped 67 cents to close at $45 while trading 11,529 stock units. First Rock Capital lost 32 cents to finish at $12.18, with investors exchanging 1,500 units, Grace Kennedy settled at $57.34, with a loss of 41 cents after 48,341 shares crossed the exchange, Kingston Wharves climbed $1.15 to $48, in an exchange of 149 units. NCB Financial rose $1 to $138 and cleared the market with 36,414 shares, Palace Amusement gained $339 to $1,489, with only 2 units passing through the market, Proven Investments ended $1.05 higher at $41.25, in exchanging 15,697 stock units. Seprod lost 50 cents after a transfer of 7,249 stock units to end at $58.50 and Sygnus Credit Investments closed at $18.50 after losing 40 cents with 3,393 units crossing the exchange.

Eppley Caribbean Property Fund dipped 67 cents to close at $45 while trading 11,529 stock units. First Rock Capital lost 32 cents to finish at $12.18, with investors exchanging 1,500 units, Grace Kennedy settled at $57.34, with a loss of 41 cents after 48,341 shares crossed the exchange, Kingston Wharves climbed $1.15 to $48, in an exchange of 149 units. NCB Financial rose $1 to $138 and cleared the market with 36,414 shares, Palace Amusement gained $339 to $1,489, with only 2 units passing through the market, Proven Investments ended $1.05 higher at $41.25, in exchanging 15,697 stock units. Seprod lost 50 cents after a transfer of 7,249 stock units to end at $58.50 and Sygnus Credit Investments closed at $18.50 after losing 40 cents with 3,393 units crossing the exchange. The market closed with 13 securities trading, up from twelve on Monday and closed with one stock advancing, three declining and nine remaining unchanged. Trading resulted in 34,476 shares changing hands for $642,275 compared to 57,704 shares valued $1,530,562 on Monday.

The market closed with 13 securities trading, up from twelve on Monday and closed with one stock advancing, three declining and nine remaining unchanged. Trading resulted in 34,476 shares changing hands for $642,275 compared to 57,704 shares valued $1,530,562 on Monday. JMMB Group ended 4 cents lower at $1.75 after exchanging 1,190 units and Scotiabank lost 10 cents to finish at $55, in transferring 1,732 shares.

JMMB Group ended 4 cents lower at $1.75 after exchanging 1,190 units and Scotiabank lost 10 cents to finish at $55, in transferring 1,732 shares.

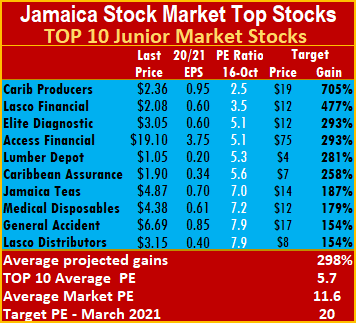

The top three stocks in each market saw no change in ranking, leaving the top three Junior Market stocks with the potential to gain between 293 to 705 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 245 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and

The top three stocks in each market saw no change in ranking, leaving the top three Junior Market stocks with the potential to gain between 293 to 705 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 245 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and The Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.8 and the Junior Market 11.6, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 49 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.5 or 54 percent of the PE of that market.

The Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.8 and the Junior Market 11.6, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 49 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.5 or 54 percent of the PE of that market. IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in the selection process in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

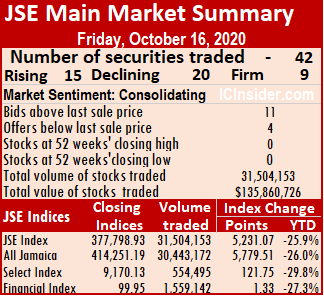

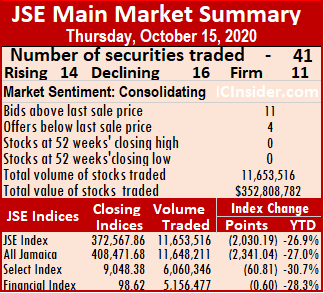

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in the selection process in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information. The All Jamaican Composite Index jumped 5,779.51 points to 414,251.19 and the Main Index climbed 5,231.07 points to 377,798.93, while the JSE Financial Index rose 1.33 points to settle at 99.95.

The All Jamaican Composite Index jumped 5,779.51 points to 414,251.19 and the Main Index climbed 5,231.07 points to 377,798.93, while the JSE Financial Index rose 1.33 points to settle at 99.95. The Investor’s Choice bid-offer indicator reading shows 12 stocks ending with bids higher than their last selling prices and four with lower offers.

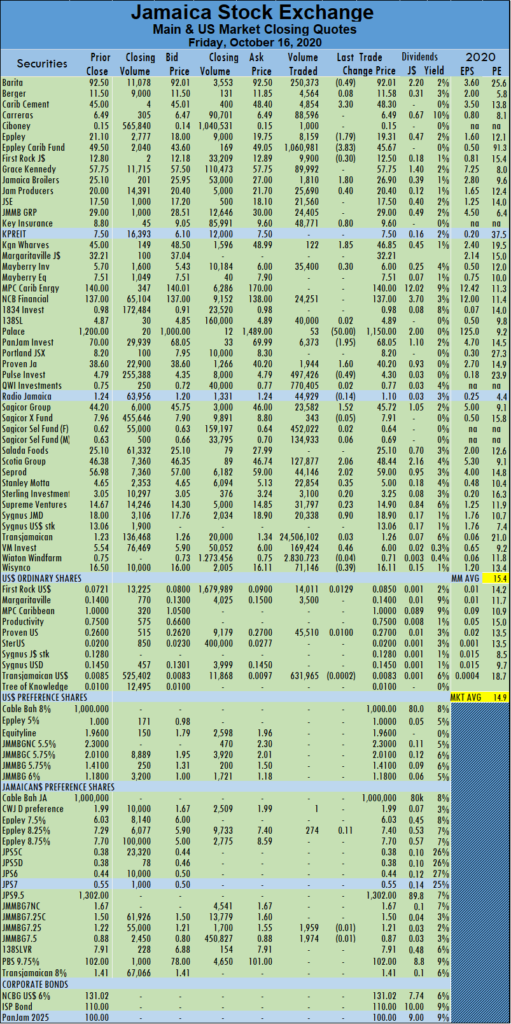

The Investor’s Choice bid-offer indicator reading shows 12 stocks ending with bids higher than their last selling prices and four with lower offers. Palace Amusement dropped $50 in closing at $1,150, with a transfer of 53 units, Pan Jam Investment fell $1.95 to $68.05 after trading 6,373 stock units. Proven Investments gained $1.60 to end at $40.20 with an exchange of 1,944 stock units, Pulse Investments lost 49 cents in closing at $4.30, after the transfer of 497,426 shares, Sagicor Group rose $1.52 to end at $45.72, with 23,582 stock units changing hands. Scotia Group climbed $2.06 to $48.44, trading 127,877 shares, Seprod settled at $59, with gains of $2.02 with the transfer of 44,146 shares, Stanley Motta gained 35 cents to close at $5, in exchanging 22,854 stock units. Sygnus Credit Investments finished 90 cents higher at $18.90, with 20,338 stock units crossing the market, Victoria Mutual Investments gained 46 cents to settle at $6 after exchanging 169,424 shares and Wisynco Group lost 39 cents to close at $16.11, trading 71,146 stock units.

Palace Amusement dropped $50 in closing at $1,150, with a transfer of 53 units, Pan Jam Investment fell $1.95 to $68.05 after trading 6,373 stock units. Proven Investments gained $1.60 to end at $40.20 with an exchange of 1,944 stock units, Pulse Investments lost 49 cents in closing at $4.30, after the transfer of 497,426 shares, Sagicor Group rose $1.52 to end at $45.72, with 23,582 stock units changing hands. Scotia Group climbed $2.06 to $48.44, trading 127,877 shares, Seprod settled at $59, with gains of $2.02 with the transfer of 44,146 shares, Stanley Motta gained 35 cents to close at $5, in exchanging 22,854 stock units. Sygnus Credit Investments finished 90 cents higher at $18.90, with 20,338 stock units crossing the market, Victoria Mutual Investments gained 46 cents to settle at $6 after exchanging 169,424 shares and Wisynco Group lost 39 cents to close at $16.11, trading 71,146 stock units. Trading ended with an average of 284,232 units changing hands at $8,605,092 for each traded security compared to an average of 761,427 shares at $40,258,610 on Wednesday. The average trade for the month to date ended at 316,587 units at $6,160,243 for each security, in contrast to 319,665 units at $5,927,670. Trading month to date compares well to September’s average of 265,170 units at $3,271,625.

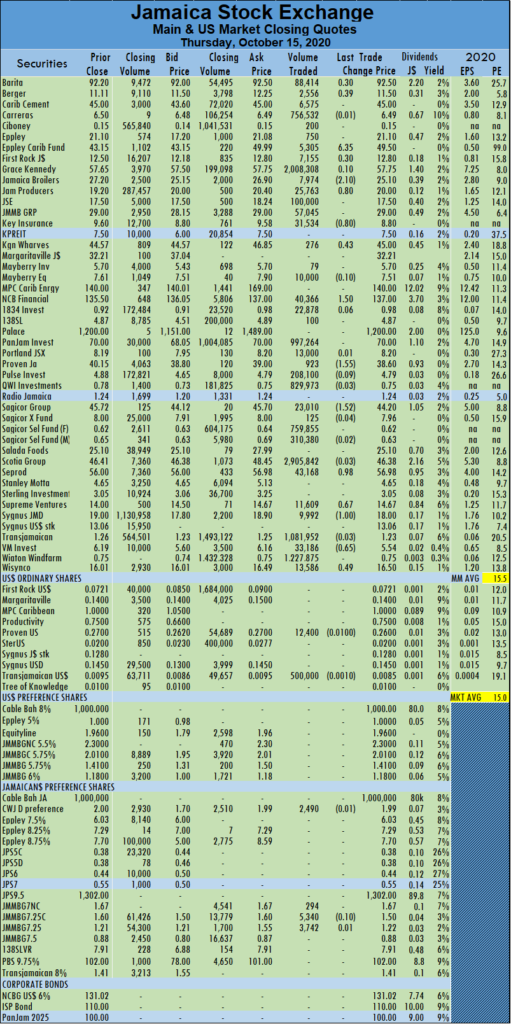

Trading ended with an average of 284,232 units changing hands at $8,605,092 for each traded security compared to an average of 761,427 shares at $40,258,610 on Wednesday. The average trade for the month to date ended at 316,587 units at $6,160,243 for each security, in contrast to 319,665 units at $5,927,670. Trading month to date compares well to September’s average of 265,170 units at $3,271,625. First Rock Capital ended 30 cents higher at $12.80, in transferring 7,155 units, Jamaica Broilers Group declined by $2.10 to settle at $25.10, with investors swapping 7,974 units, Jamaica Producers rose 80 cents to end at $20, with 25,763 stock units crossing the exchange. Key Insurance shed 80 cents in closing at $8.80, trading 31,534 shares, Kingston Wharves gained 43 cents to finish at $45, in transferring 276 units, NCB Financial climbed $1.50 to settle at $137, with 40,366 shares changing hands. Proven Investments fell $1.55 to end at $38.60 trading 923 units, Sagicor Group declined $1.52 to settle at $44.20, with 23,010 stock units crossing the exchange, Seprod closed 98 cents higher to $56.98 after 43,168 shares passed through the market. Supreme Ventures ended with gains of 67 cents as investors switched ownership of 11,609 stock units, Sygnus Credit Investments shed $1 to end at $18, in exchanging 9,992 units, Victoria Mutual Investments lost 65 cents to settle at $5.54, with 33,186 stock units changing hands and Wisynco Group gained 49 cents to end at $16.50 trading 13,586 stock units.

First Rock Capital ended 30 cents higher at $12.80, in transferring 7,155 units, Jamaica Broilers Group declined by $2.10 to settle at $25.10, with investors swapping 7,974 units, Jamaica Producers rose 80 cents to end at $20, with 25,763 stock units crossing the exchange. Key Insurance shed 80 cents in closing at $8.80, trading 31,534 shares, Kingston Wharves gained 43 cents to finish at $45, in transferring 276 units, NCB Financial climbed $1.50 to settle at $137, with 40,366 shares changing hands. Proven Investments fell $1.55 to end at $38.60 trading 923 units, Sagicor Group declined $1.52 to settle at $44.20, with 23,010 stock units crossing the exchange, Seprod closed 98 cents higher to $56.98 after 43,168 shares passed through the market. Supreme Ventures ended with gains of 67 cents as investors switched ownership of 11,609 stock units, Sygnus Credit Investments shed $1 to end at $18, in exchanging 9,992 units, Victoria Mutual Investments lost 65 cents to settle at $5.54, with 33,186 stock units changing hands and Wisynco Group gained 49 cents to end at $16.50 trading 13,586 stock units.

One Caribbean Media shed 10 cents to finish at 52 weeks’ low of $$4.80, with 4,763 stock units changing hands.

One Caribbean Media shed 10 cents to finish at 52 weeks’ low of $$4.80, with 4,763 stock units changing hands.

Eppley Caribbean Property Fund led trading with 45.1 percent of total volume with 15.45 million shares, followed by Barita Investments with 35.4 percent as 12.14 million units passed through the market, Transjamaican Highway ended with 6 percent market share after 2.07 million units traded and Wigton Windfarm closed with 5.7 percent market share after 1.95 million units changed hands.

Eppley Caribbean Property Fund led trading with 45.1 percent of total volume with 15.45 million shares, followed by Barita Investments with 35.4 percent as 12.14 million units passed through the market, Transjamaican Highway ended with 6 percent market share after 2.07 million units traded and Wigton Windfarm closed with 5.7 percent market share after 1.95 million units changed hands. Jamaica Broilers Group shed 30 cents, exchanging 15,596 stock units to end at $27.20, Jamaica Stock Exchange closed at $17.50, after losing 55 cents with 19,433 stock units changing hands, Key Insurance declined by $1.30 to end at $9.60, after crossing the market with 520,574 shares. Kingston Wharves climbed $4.55 to $44.57 in trading 744 units, MPC Caribbean Clean Energy advanced by $5 to $140, with a transfer of only one unit, NCB Financial gained 50 cents in closing at $135.50 in exchanging 12,048 units. Sagicor Group rose $1.61 to $45.72, with 15,464 units passing through the market, Scotia Group shed 33 cents trading 62,120 shares and closed at $46.41, Seprod climbed $2 to $56, in exchanging 14,820 units. Stanley Motta lost 35 cents to end at $4.65 after trading 11,537 units, Supreme Ventures slid 90 cents in closing at $14, with 32,582 units crossing the exchange and Victoria Mutual Investments gained 32 cents to finish at $6.19 after investors trading 58,707 shares.

Jamaica Broilers Group shed 30 cents, exchanging 15,596 stock units to end at $27.20, Jamaica Stock Exchange closed at $17.50, after losing 55 cents with 19,433 stock units changing hands, Key Insurance declined by $1.30 to end at $9.60, after crossing the market with 520,574 shares. Kingston Wharves climbed $4.55 to $44.57 in trading 744 units, MPC Caribbean Clean Energy advanced by $5 to $140, with a transfer of only one unit, NCB Financial gained 50 cents in closing at $135.50 in exchanging 12,048 units. Sagicor Group rose $1.61 to $45.72, with 15,464 units passing through the market, Scotia Group shed 33 cents trading 62,120 shares and closed at $46.41, Seprod climbed $2 to $56, in exchanging 14,820 units. Stanley Motta lost 35 cents to end at $4.65 after trading 11,537 units, Supreme Ventures slid 90 cents in closing at $14, with 32,582 units crossing the exchange and Victoria Mutual Investments gained 32 cents to finish at $6.19 after investors trading 58,707 shares.