Access Financial dropped out of the ICTOP10 this past week and is added to the stocks to watch, it could move higher if the closing bids and offers that were posted hold, Monday’s market activity will shed some light on it.

With Barita Investments climbing to a record high of $115.04 on the Jamaica Stock Exchange Main Market on Friday after 6.5 million of the company’s shares were traded leaving only two lots on offer at the end of trading with the lowest offer, 7,200 shares at $140 and the other just 50 units at $200 and three bids at $115 and $115.04 to buy over 400,000 shares, this ought to be watched to see what investors respond.

With Barita Investments climbing to a record high of $115.04 on the Jamaica Stock Exchange Main Market on Friday after 6.5 million of the company’s shares were traded leaving only two lots on offer at the end of trading with the lowest offer, 7,200 shares at $140 and the other just 50 units at $200 and three bids at $115 and $115.04 to buy over 400,000 shares, this ought to be watched to see what investors respond.

Consolidated Bakeries ended at fresh multiyear closing high during the past week of $2.95 but closed on Friday, at $2.66 and is up 122 for the year to September and 79 percent since added to Stocks to Watch.

ICInsider.com watch list comprises Access Financial, Barita Investments, Caribbean Assurance Brokers, Consolidated Bakers, Dolphin Cove, Caribbean Producers, Elite Diagnostic, Everything Fresh, General Accident, Guardian Holdings, Jamaica Broilers, Key Insurance, Knutsford Express, Lasco Distributors, Lasco Manufacturing, NCB Financial, Stationery and Office Supplies, Paramount Trading and Scotia Group.

Major factors to consider going forward. The rebound in tourist arrivals only came back to 2019 levels since June. Providing there are no reversals, then companies who are highly dependent on the sector will enjoy a big bounce for the next nine months compared to the lower business generated since last year to April this year. The same applies to the entertainment industry as the sector only opened up after March this year. Banks will make a fortune from increased interest rates.

Major factors to consider going forward. The rebound in tourist arrivals only came back to 2019 levels since June. Providing there are no reversals, then companies who are highly dependent on the sector will enjoy a big bounce for the next nine months compared to the lower business generated since last year to April this year. The same applies to the entertainment industry as the sector only opened up after March this year. Banks will make a fortune from increased interest rates.

Persons who compiled this report may have an interest in securities commented on.

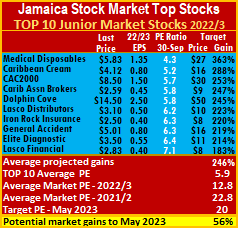

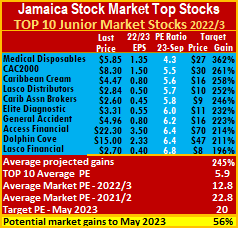

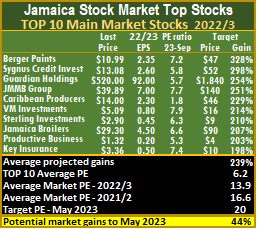

At the end of the week, the average PE for the JSE Main Market TOP 10 is 6.2, well below the market average of 14.2, while the Junior Market Top 10 PE sits at 5.9 versus the market at 12.8, important indicators of the level of undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 246 percent and the Main Market TOP10 s projected to gain an average of 243 percent, by May 2023.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 6.2, well below the market average of 14.2, while the Junior Market Top 10 PE sits at 5.9 versus the market at 12.8, important indicators of the level of undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 246 percent and the Main Market TOP10 s projected to gain an average of 243 percent, by May 2023. Currently, the Junior Market reflects a positive positioning and is poised to move higher in the weeks ahead. The recent negative clouds that hang over the main markets seem to be lifting with the market index slowly bouncing off a recent bottom.

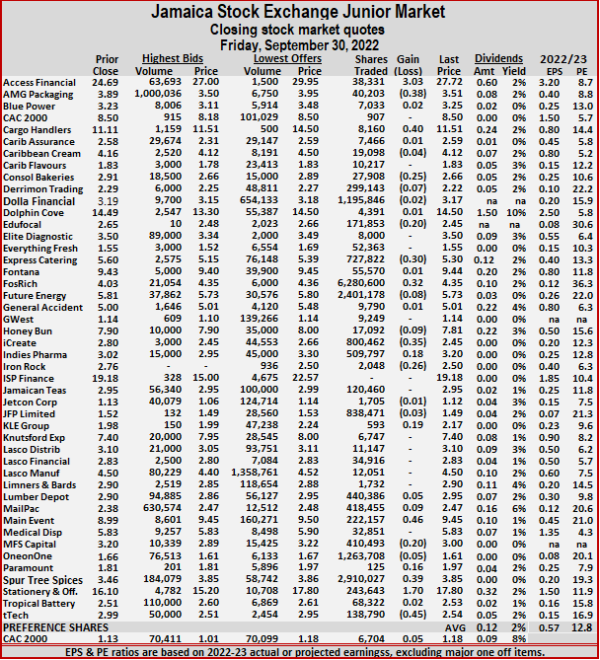

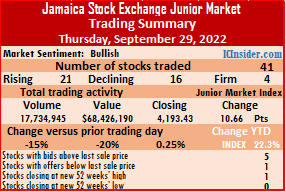

Currently, the Junior Market reflects a positive positioning and is poised to move higher in the weeks ahead. The recent negative clouds that hang over the main markets seem to be lifting with the market index slowly bouncing off a recent bottom. A total of 19,888,010 shares were traded for $79,051,861 up from 17,734,945 units at $68,426,190 on Thursday.

A total of 19,888,010 shares were traded for $79,051,861 up from 17,734,945 units at $68,426,190 on Thursday. At the close, Access Financial popped $3.03 in closing at $27.72 in an exchange of 38,331 shares, AMG Packaging declined 38 cents to end at $3.51 and closed with trading of 40,203 stocks, Cargo Handlers increased 40 cents to $11.51 with 8,160 stock units changing hands. Consolidated Bakeries dipped 25 cents to end at $2.66 with a transfer of 27,908 units, EduFocal dropped 20 cents to $2.45, with 171,853 units clearing the market, Express Catering shed 30 cents to close at $5.30 with the swapping of 727,822 shares. Fosrich advanced 32 cents in closing at $4.35 in trading 6,280,600 stock units, iCreate lost 35 cents to end at $2.45 with investors transferring 800,462 stocks, Indies Pharma gained 18 cents in ending at $3.20 after a transfer of 509,797 stocks. Iron Rock Insurance fell 26 cents to $2.50 in switching ownership of 2,048 units, KLE Group rose 19 cents to $2.17, with 593 shares crossing the market, Main Event rallied 46 cents to close at $9.45 while exchanging 222,157 stock units. MFS Capital Partners declined 20 cents to end at $3, 410,493 stock units crossing the exchange, Paramount Trading climbed 16 cents to $1.97 after exchanging 125 shares, Spur Tree Spices popped 39 cents in closing at $3.85, with 2,910,027 stocks changing hands.

At the close, Access Financial popped $3.03 in closing at $27.72 in an exchange of 38,331 shares, AMG Packaging declined 38 cents to end at $3.51 and closed with trading of 40,203 stocks, Cargo Handlers increased 40 cents to $11.51 with 8,160 stock units changing hands. Consolidated Bakeries dipped 25 cents to end at $2.66 with a transfer of 27,908 units, EduFocal dropped 20 cents to $2.45, with 171,853 units clearing the market, Express Catering shed 30 cents to close at $5.30 with the swapping of 727,822 shares. Fosrich advanced 32 cents in closing at $4.35 in trading 6,280,600 stock units, iCreate lost 35 cents to end at $2.45 with investors transferring 800,462 stocks, Indies Pharma gained 18 cents in ending at $3.20 after a transfer of 509,797 stocks. Iron Rock Insurance fell 26 cents to $2.50 in switching ownership of 2,048 units, KLE Group rose 19 cents to $2.17, with 593 shares crossing the market, Main Event rallied 46 cents to close at $9.45 while exchanging 222,157 stock units. MFS Capital Partners declined 20 cents to end at $3, 410,493 stock units crossing the exchange, Paramount Trading climbed 16 cents to $1.97 after exchanging 125 shares, Spur Tree Spices popped 39 cents in closing at $3.85, with 2,910,027 stocks changing hands.  Stationery and Office Supplies jumped $1.70 to close at $17.80 with an exchange of 243,643 units and tTech dropped 45 cents in closing at $2.54 as investors exchanged 138,790 stock units.

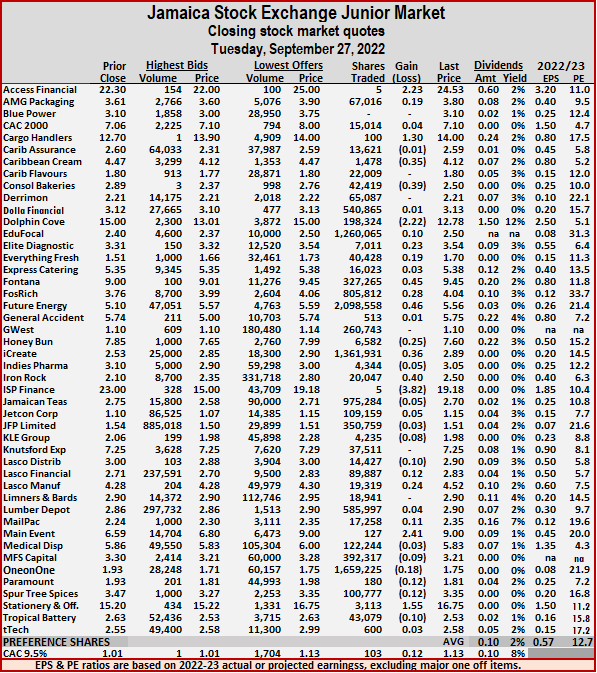

Stationery and Office Supplies jumped $1.70 to close at $17.80 with an exchange of 243,643 units and tTech dropped 45 cents in closing at $2.54 as investors exchanged 138,790 stock units. A total of 17,734,945 shares were traded for $68,426,190 compared to 20,778,103 units at $85,799,358 on Wednesday.

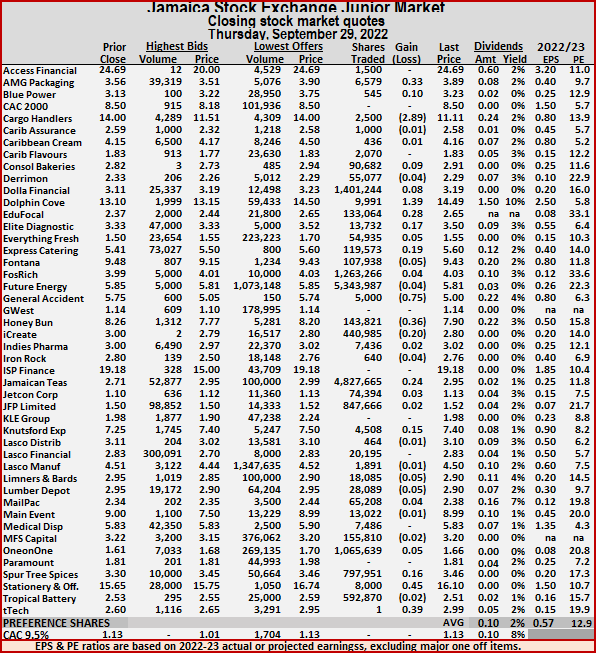

A total of 17,734,945 shares were traded for $68,426,190 compared to 20,778,103 units at $85,799,358 on Wednesday. At the close, AMG Packaging rose 33 cents to $3.89 with a transfer of 6,579 shares, Blue Power gained 10 cents to close at $3.23 in switching owners of 545 units, Cargo Handlers dipped $2.89 to $11.11 after finishing trading of 2,500 stock units. Dolphin Cove advanced $1.39 to end at $14.49 with investors transferring 9,991 stocks, EduFocal popped 28 cents in closing at $2.65 after an exchange of 133,064 units, Elite Diagnostic climbed 17 cents in closing at $3.50 after 13,732 stock units changed hands. Express Catering increased 19 cents to $5.60 in exchanging 119,573 stocks, General Accident lost 75 cents in ending at $5 and trading 5,000 shares, Honey Bun dropped 36 cents to close at $7.90, with 143,821 shares crossing the market. iCreate declined 20 cents to end at $2.80 with an exchange of 440,985 stock units, Jamaican Teas rallied 24 cents to close at $2.95 after a transfer of 4,827,665 stocks, Knutsford Express advanced 15 cents to end at $7.40 in trading 4,508 units.

At the close, AMG Packaging rose 33 cents to $3.89 with a transfer of 6,579 shares, Blue Power gained 10 cents to close at $3.23 in switching owners of 545 units, Cargo Handlers dipped $2.89 to $11.11 after finishing trading of 2,500 stock units. Dolphin Cove advanced $1.39 to end at $14.49 with investors transferring 9,991 stocks, EduFocal popped 28 cents in closing at $2.65 after an exchange of 133,064 units, Elite Diagnostic climbed 17 cents in closing at $3.50 after 13,732 stock units changed hands. Express Catering increased 19 cents to $5.60 in exchanging 119,573 stocks, General Accident lost 75 cents in ending at $5 and trading 5,000 shares, Honey Bun dropped 36 cents to close at $7.90, with 143,821 shares crossing the market. iCreate declined 20 cents to end at $2.80 with an exchange of 440,985 stock units, Jamaican Teas rallied 24 cents to close at $2.95 after a transfer of 4,827,665 stocks, Knutsford Express advanced 15 cents to end at $7.40 in trading 4,508 units.  Spur Tree Spices rose 16 cents to $3.46, with 797,951 units clearing the market, Stationery and Office Supplies popped 45 cents in closing at $16.10 while exchanging 8,000 stock units and tTech gained 39 cents to $2.99 after an exchange of a mere one share.

Spur Tree Spices rose 16 cents to $3.46, with 797,951 units clearing the market, Stationery and Office Supplies popped 45 cents in closing at $16.10 while exchanging 8,000 stock units and tTech gained 39 cents to $2.99 after an exchange of a mere one share.

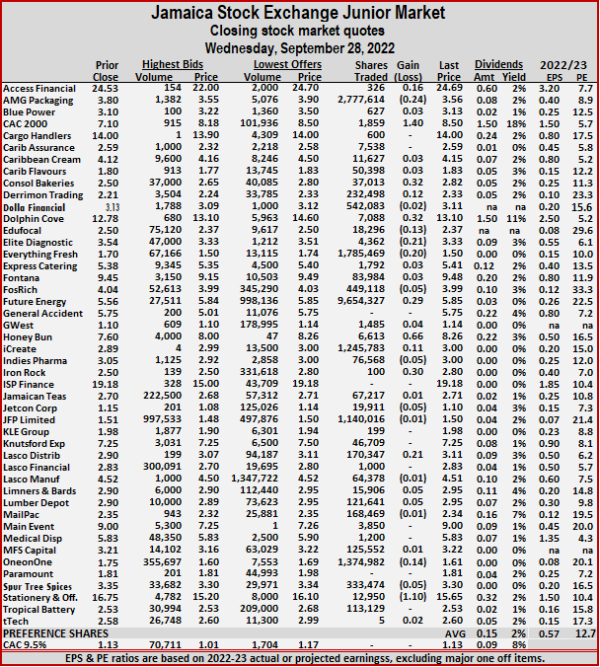

At the close, Access Financial rallied 16 cents to $24.69 with the swapping of 326 shares, AMG Packaging lost 24 cents to end at $3.56 with an exchange of 2,777,614 stock units, CAC 2000 advanced $1.40 to $8.50 in exchanging 1,859 units. Consolidated Bakeries climbed 32 cents in closing at $2.82 as investors exchanged 37,013 stocks, Derrimon Trading increased 12 cents to $2.33 in switching ownership of 232,498 units, Dolphin Cove rose 32 cents to $13.10 after a transfer of 7,088 stocks. EduFocal shed 13 cents to $2.37 with investors transferring 18,296 shares, Elite Diagnostic fell 21 cents in closing at $3.33 in an exchange of 4,362 stock units, Everything Fresh dipped 20 cents to end at $1.50 in trading 1,785,469 shares. Future Energy Source popped 29 cents to close at $5.85 after trading 9,654,327 stocks, Honey Bun gained 66 cents to end at $8.26, with 6,613 stock units clearing the market, iCreate popped 11 cents to $3 with a transfer of 1,245,783 units.

At the close, Access Financial rallied 16 cents to $24.69 with the swapping of 326 shares, AMG Packaging lost 24 cents to end at $3.56 with an exchange of 2,777,614 stock units, CAC 2000 advanced $1.40 to $8.50 in exchanging 1,859 units. Consolidated Bakeries climbed 32 cents in closing at $2.82 as investors exchanged 37,013 stocks, Derrimon Trading increased 12 cents to $2.33 in switching ownership of 232,498 units, Dolphin Cove rose 32 cents to $13.10 after a transfer of 7,088 stocks. EduFocal shed 13 cents to $2.37 with investors transferring 18,296 shares, Elite Diagnostic fell 21 cents in closing at $3.33 in an exchange of 4,362 stock units, Everything Fresh dipped 20 cents to end at $1.50 in trading 1,785,469 shares. Future Energy Source popped 29 cents to close at $5.85 after trading 9,654,327 stocks, Honey Bun gained 66 cents to end at $8.26, with 6,613 stock units clearing the market, iCreate popped 11 cents to $3 with a transfer of 1,245,783 units.  Iron Rock Insurance gained 30 cents in closing at $2.80, with 100 shares changing hands, Lasco Distributors rallied 21 cents to close at $3.11 while exchanging 170,347 stock units, ONE on ONE Educational dropped 14 cents to $1.61, with 1,374,982 stocks crossing the market and Stationery and Office Supplies declined $1.10 in ending at $15.65 after an exchange of 12,950 units.

Iron Rock Insurance gained 30 cents in closing at $2.80, with 100 shares changing hands, Lasco Distributors rallied 21 cents to close at $3.11 while exchanging 170,347 stock units, ONE on ONE Educational dropped 14 cents to $1.61, with 1,374,982 stocks crossing the market and Stationery and Office Supplies declined $1.10 in ending at $15.65 after an exchange of 12,950 units. At the close, Access Financial popped $2.23 to end at $24.53, with 5 shares crossing the market, AMG Packaging gained 19 cents in closing at $3.80 with a transfer of 67,016 stocks, Cargo Handlers rallied $1.30 to $14 in switching ownership of 100 units. Caribbean Cream dipped 35 cents to $4.12 with the swapping of 1,478 stock units, Consolidated Bakeries fell 39 cents to close at $2.50 after a transfer of 42,419 stock units, Dolphin Cove dropped $2.22 in ending at $12.78 in an exchange of 198,324 units. EduFocal advanced 10 cents to close at $2.50, with 1,260,065 shares crossing the exchange, Elite Diagnostic climbed 23 cents to $3.54 after trading 7,011 stocks, Everything Fresh increased 19 to $1.70 as investors exchanged 40,428 stocks. Fontana rose 45 cents to end at $9.45, with 327,265 units changing hands, Fosrich rallied 28 cents to $4.04 and closed with an exchange of 805,812 stock units, Future Energy Source increased 46 cents to end at $5.56 while exchanging 2,098,558 shares. Honey Bun declined 25 cents in closing at $7.60 and finished with trading of 6,582 stock units, iCreate gained 36 cents to $2.89 trading 1,361,931 shares, Iron Rock Insurance climbed 40 cents to close at $2.50 in exchanging 20,047 units. ISP Finance lost $3.82 in closing at $19.18 after 5 stocks changed hands, Lasco Distributors shed 10 cents to end at $2.90 after exchanging 14,427 stock units, Lasco Financial rose 12 cents in ending at $2.83, with 89,887 units clearing the market. Lasco Manufacturing advanced 24 cents to close at $4.52 in trading 19,319 stocks,

At the close, Access Financial popped $2.23 to end at $24.53, with 5 shares crossing the market, AMG Packaging gained 19 cents in closing at $3.80 with a transfer of 67,016 stocks, Cargo Handlers rallied $1.30 to $14 in switching ownership of 100 units. Caribbean Cream dipped 35 cents to $4.12 with the swapping of 1,478 stock units, Consolidated Bakeries fell 39 cents to close at $2.50 after a transfer of 42,419 stock units, Dolphin Cove dropped $2.22 in ending at $12.78 in an exchange of 198,324 units. EduFocal advanced 10 cents to close at $2.50, with 1,260,065 shares crossing the exchange, Elite Diagnostic climbed 23 cents to $3.54 after trading 7,011 stocks, Everything Fresh increased 19 to $1.70 as investors exchanged 40,428 stocks. Fontana rose 45 cents to end at $9.45, with 327,265 units changing hands, Fosrich rallied 28 cents to $4.04 and closed with an exchange of 805,812 stock units, Future Energy Source increased 46 cents to end at $5.56 while exchanging 2,098,558 shares. Honey Bun declined 25 cents in closing at $7.60 and finished with trading of 6,582 stock units, iCreate gained 36 cents to $2.89 trading 1,361,931 shares, Iron Rock Insurance climbed 40 cents to close at $2.50 in exchanging 20,047 units. ISP Finance lost $3.82 in closing at $19.18 after 5 stocks changed hands, Lasco Distributors shed 10 cents to end at $2.90 after exchanging 14,427 stock units, Lasco Financial rose 12 cents in ending at $2.83, with 89,887 units clearing the market. Lasco Manufacturing advanced 24 cents to close at $4.52 in trading 19,319 stocks,  Mailpac Group popped 11 cents to $2.35 with an exchange of 17,258 shares, Main Event advanced $2.41 to close at $9 with investors transferring 127 stock units. Paramount Trading dropped 12 cents in closing at $1.81 after trading 180 stocks, Spur Tree Spices fell 12 cents to $3.35 in switching owners of 100,777 shares, Stationery and Office Supplies gained $1.55 to end at $16.75 with an exchange of 3,113 units and Tropical Battery lost 10 cents ending at $2.53 as investors exchanged 43,079 shares.

Mailpac Group popped 11 cents to $2.35 with an exchange of 17,258 shares, Main Event advanced $2.41 to close at $9 with investors transferring 127 stock units. Paramount Trading dropped 12 cents in closing at $1.81 after trading 180 stocks, Spur Tree Spices fell 12 cents to $3.35 in switching owners of 100,777 shares, Stationery and Office Supplies gained $1.55 to end at $16.75 with an exchange of 3,113 units and Tropical Battery lost 10 cents ending at $2.53 as investors exchanged 43,079 shares. A total of 11,121,148 shares were exchanged for $31,427,127 versus 10,149,669 units at $26,870,316 on Friday.

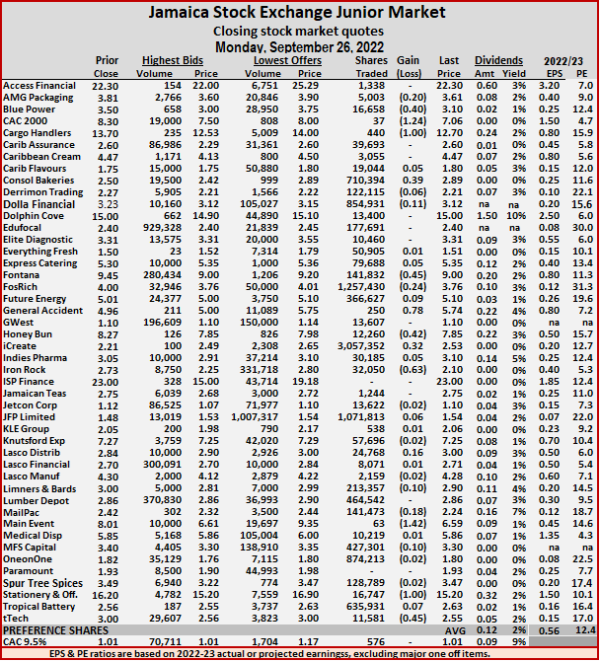

A total of 11,121,148 shares were exchanged for $31,427,127 versus 10,149,669 units at $26,870,316 on Friday. At the close, AMG Packaging lost 20 cents to end at $3.61 in an exchange of 5,003 shares, Blue Power fell 40 cents to close at $3.10 in trading 16,658 units, CAC 2000 shed $1.24 to $7.06 with the swapping of 37 stock units. Cargo Handlers dropped $1 to $12.70, with 440 stocks crossing the exchange, Consolidated Bakeries rallied 39 cents in ending at a multi-year closing high of $2.89 as investors exchanged 710,394 shares, Dolla Financial dipped 11 cents to close at $3.12 after a transfer of 854,931 stocks. Fontana declined 45 cents in closing at $9 with a transfer of 141,832 units, Fosrich declined 24 cents to $3.76 with an exchange of 1,257,430 stock units, General Accident increased 78 cents to end, with 250 stock units crossing the market. Honey Bun dropped 42 cents to $7.85 with 12,260 units clearing the market, iCreate climbed 32 cents in closing at $2.53 after exchanging 3,057,352 shares, Iron Rock Insurance shed 63 cents to end at a 52 weeks’ low of $2.10, in switching ownership of 32,050 stocks. Lasco Distributors advanced 16 cents to $3 after exchanging 24,768 shares, Limners and Bards lost 10 cents to close at $2.90, with 213,357 units changing hands, Mailpac Group dipped 18 cents in ending at $2.24, with 141,473 stock units crossing the market.

At the close, AMG Packaging lost 20 cents to end at $3.61 in an exchange of 5,003 shares, Blue Power fell 40 cents to close at $3.10 in trading 16,658 units, CAC 2000 shed $1.24 to $7.06 with the swapping of 37 stock units. Cargo Handlers dropped $1 to $12.70, with 440 stocks crossing the exchange, Consolidated Bakeries rallied 39 cents in ending at a multi-year closing high of $2.89 as investors exchanged 710,394 shares, Dolla Financial dipped 11 cents to close at $3.12 after a transfer of 854,931 stocks. Fontana declined 45 cents in closing at $9 with a transfer of 141,832 units, Fosrich declined 24 cents to $3.76 with an exchange of 1,257,430 stock units, General Accident increased 78 cents to end, with 250 stock units crossing the market. Honey Bun dropped 42 cents to $7.85 with 12,260 units clearing the market, iCreate climbed 32 cents in closing at $2.53 after exchanging 3,057,352 shares, Iron Rock Insurance shed 63 cents to end at a 52 weeks’ low of $2.10, in switching ownership of 32,050 stocks. Lasco Distributors advanced 16 cents to $3 after exchanging 24,768 shares, Limners and Bards lost 10 cents to close at $2.90, with 213,357 units changing hands, Mailpac Group dipped 18 cents in ending at $2.24, with 141,473 stock units crossing the market.  Main Event fell $1.42 to $6.59 while exchanging 63 stocks, MFS Capital Partners shed 10 cents in closing at $3.30 with investors transferring 427,301 stock units, Stationery and Office Supplies dipped $1 to end at $15.20 in trading 16,747 units and tTech lost 45 cents to close at $2.55 after trading 11,581 stocks.

Main Event fell $1.42 to $6.59 while exchanging 63 stocks, MFS Capital Partners shed 10 cents in closing at $3.30 with investors transferring 427,301 stock units, Stationery and Office Supplies dipped $1 to end at $15.20 in trading 16,747 units and tTech lost 45 cents to close at $2.55 after trading 11,581 stocks.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 6.2, well below the market average of 13.9, while the Junior Market Top 10 PE sits at 5.9 versus the market at 12.8, important indicators of the level of undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 245 percent and the Main Market TOP10 s projected to gain an average of 239 percent, to May 2023.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 6.2, well below the market average of 13.9, while the Junior Market Top 10 PE sits at 5.9 versus the market at 12.8, important indicators of the level of undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 245 percent and the Main Market TOP10 s projected to gain an average of 239 percent, to May 2023. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

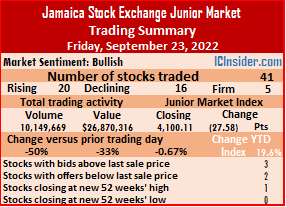

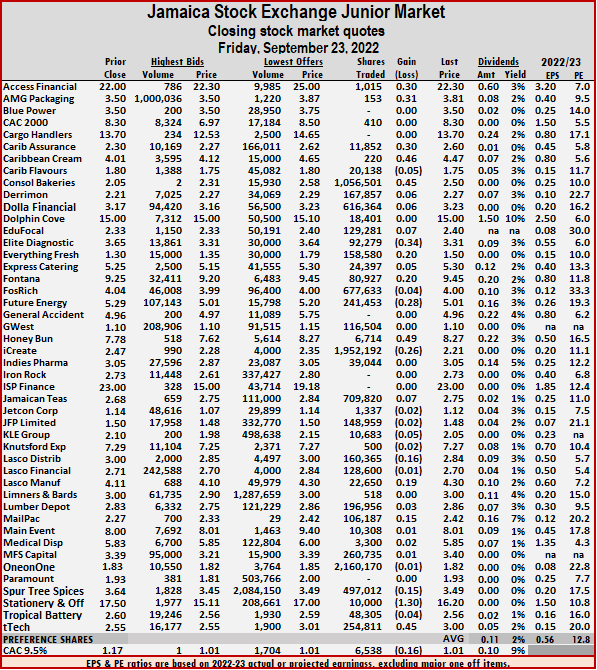

A total of 10,149,669 shares were traded for $26,870,316 down from 20,300,179 units at $40,240,995 on Thursday.

A total of 10,149,669 shares were traded for $26,870,316 down from 20,300,179 units at $40,240,995 on Thursday. At the close, Access Financial increased 30 cents to $22.30 in trading 1,015 shares, AMG Packaging gained 31 cents to end at $3.81, with 153 units crossing the exchange, Caribbean Assurance Brokers rallied 30 cents to $2.60 with an exchange of 11,852 stocks. Caribbean Cream advanced 46 cents to $4.47, with 220 stock units crossing the market, Consolidated Bakeries climbed 45 cents in ending at a multiple-year closing high of $2.50 while exchanging 1,056,501 stock units, Elite Diagnostic declined 34 cents to close at $3.31 in a swapping of 92,279 stocks. Everything Fresh rose 20 cents in closing at $1.50 with investors transferring 158,580 units, Fontana popped 20 cents in ending at $9.45 after 80,927 shares crossed the market, Future Energy Source shed 28 cents to end at $5.01 with 241,453 stock units clearing the market. Honey Bun rose 49 cents to $8.27 after trading 6,714 units, iCreate fell 26 cents in closing at $2.21 with the swapping of 1,952,192 shares, Lasco Distributors lost 16 cents to end at $2.84 after exchanging 160,365 stocks. Lasco Manufacturing increased 19 cents to end at $4.30 in trading 22,650 units, Mailpac Group popped 15 cents in ending at $2.42 after exchanging 106,187 shares, Spur Tree Spices dipped 15 cents to close at $3.49 in an exchange of 497,012 stocks.

At the close, Access Financial increased 30 cents to $22.30 in trading 1,015 shares, AMG Packaging gained 31 cents to end at $3.81, with 153 units crossing the exchange, Caribbean Assurance Brokers rallied 30 cents to $2.60 with an exchange of 11,852 stocks. Caribbean Cream advanced 46 cents to $4.47, with 220 stock units crossing the market, Consolidated Bakeries climbed 45 cents in ending at a multiple-year closing high of $2.50 while exchanging 1,056,501 stock units, Elite Diagnostic declined 34 cents to close at $3.31 in a swapping of 92,279 stocks. Everything Fresh rose 20 cents in closing at $1.50 with investors transferring 158,580 units, Fontana popped 20 cents in ending at $9.45 after 80,927 shares crossed the market, Future Energy Source shed 28 cents to end at $5.01 with 241,453 stock units clearing the market. Honey Bun rose 49 cents to $8.27 after trading 6,714 units, iCreate fell 26 cents in closing at $2.21 with the swapping of 1,952,192 shares, Lasco Distributors lost 16 cents to end at $2.84 after exchanging 160,365 stocks. Lasco Manufacturing increased 19 cents to end at $4.30 in trading 22,650 units, Mailpac Group popped 15 cents in ending at $2.42 after exchanging 106,187 shares, Spur Tree Spices dipped 15 cents to close at $3.49 in an exchange of 497,012 stocks.  Stationery and Office Supplies dropped $1.30 to end at $16.20 in switching ownership of 10,000 stock units and tTech rallied 45 cents to $3 as investors exchanged 254,811 stocks.

Stationery and Office Supplies dropped $1.30 to end at $16.20 in switching ownership of 10,000 stock units and tTech rallied 45 cents to $3 as investors exchanged 254,811 stocks.