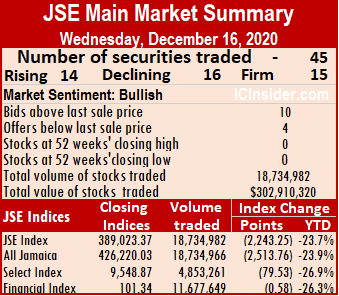

Market activity resulted in more stocks declining than rising at the end of trading on the Jamaica Stock Exchange Main Market on Wednesday after an exchange of 149 percent more shares than on Tuesday and the value surging by 196 percent.

At the close, the All Jamaican Composite Index dropped 2,513.76 points to 426,220.03, the Main Index lost 2,243.25 points to settle at 389,023.37 and the JSE Financial Index lost 0.58 points to close at 101.34.

At the close, the All Jamaican Composite Index dropped 2,513.76 points to 426,220.03, the Main Index lost 2,243.25 points to settle at 389,023.37 and the JSE Financial Index lost 0.58 points to close at 101.34.

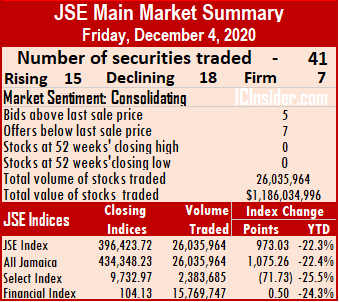

Trading ended with 45 securities changing hands compared to 43 on Tuesday and closed with the prices of 14 stocks rising, 16 declining and 15 remaining unchanged. The average PE Ratio ended at 16.8 based on ICInsider.com’s forecast of 2020-21 earnings.

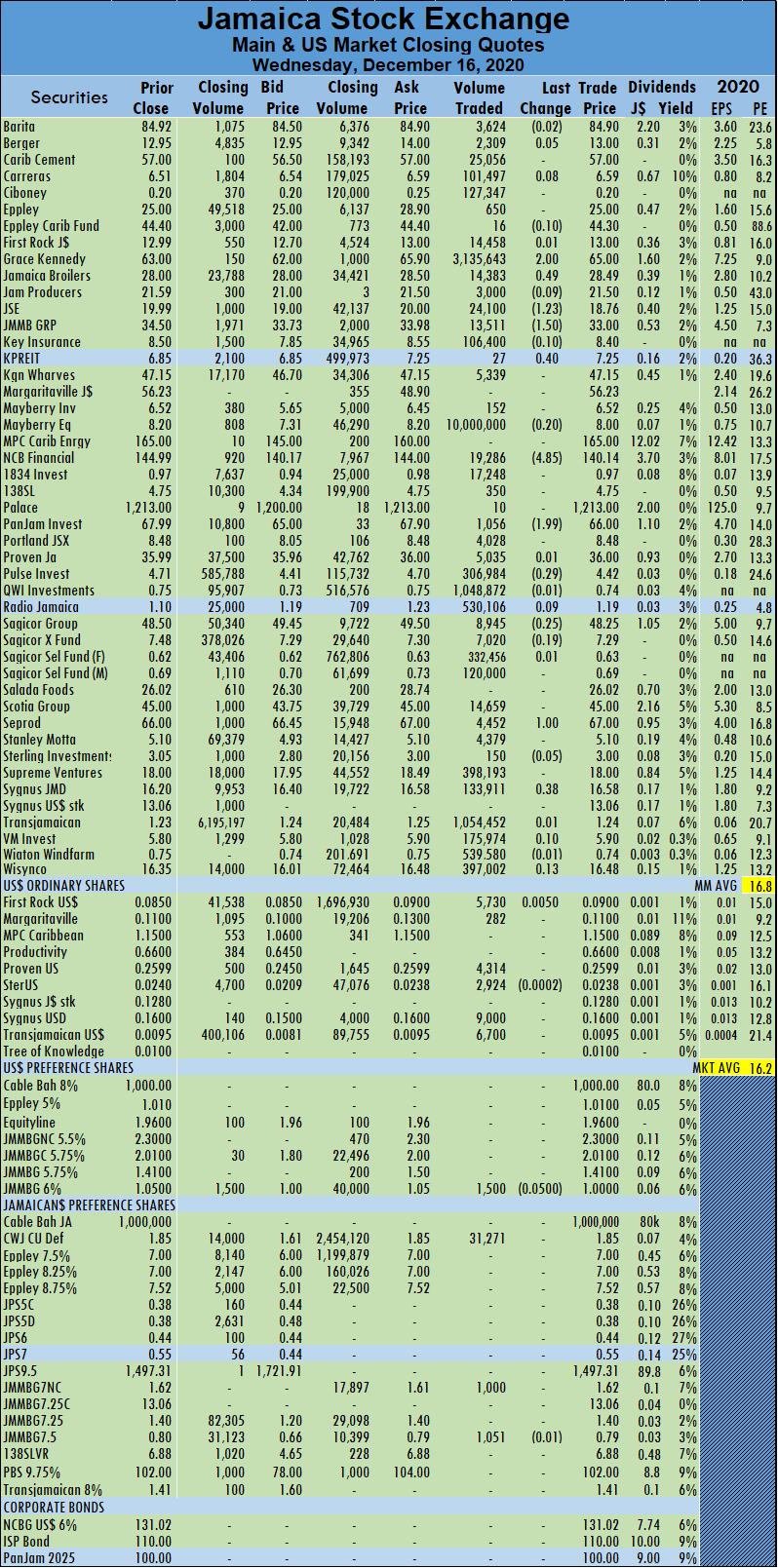

Investors exchanged 18,734,982 shares for $302,910,320 compared to 7,525,461 units at $102,351,143 on Tuesday. Mayberry Jamaican Equities led trading with 53.4 percent of total volume, after an exchange of 10 million shares followed by Grace Kennedy with 16.7 percent for 3.14 million units, Transjamaican Highway with 5.6 percent for 1.05 million units and QWI Investments with 5.6 percent for 1.05 million units changing hands.

Trading for the day averaged 416,333 units at $6,731,340 for each security, compared to an average of 175,011 shares at $2,380,259 on Tuesday. Month to date averaged 312,683 units at $4,031,460 for each security, in contrast to 302,986 units at $3,778,872 to Tuesday. November averaged 623,120 units at $6,686,047.

Trading for the day averaged 416,333 units at $6,731,340 for each security, compared to an average of 175,011 shares at $2,380,259 on Tuesday. Month to date averaged 312,683 units at $4,031,460 for each security, in contrast to 302,986 units at $3,778,872 to Tuesday. November averaged 623,120 units at $6,686,047.

Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and four with lower offers.

At the close of the market, Grace Kennedy advanced by $2 to $65, with 3,135,643 shares changing hands, Jamaica Broilers gained 49 cents to end at $28.49 after exchanging 14,383 stock units, Jamaica Stock Exchange fell by $1.23 to $18.76, in trading 24,100 units. JMMB Group closed at $33, with a loss of $1.50 in exchanging 13,511 shares, Kingston Properties rose 40 cents to $7.25, after crossing the exchange with a mere 27 units, NCB Financial dropped $4.85 to $140.14, with investors switching ownership of 19,286 stocks.  Pan Jam Investment settled at $66, after losing $1.99 after transferring 1,056 units, Seprod closed $1 higher at $67, with 4,452 stock units changing hands and Sygnus Credit Investments rose 38 cents to $16.58 trading 133,911 shares.

Pan Jam Investment settled at $66, after losing $1.99 after transferring 1,056 units, Seprod closed $1 higher at $67, with 4,452 stock units changing hands and Sygnus Credit Investments rose 38 cents to $16.58 trading 133,911 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

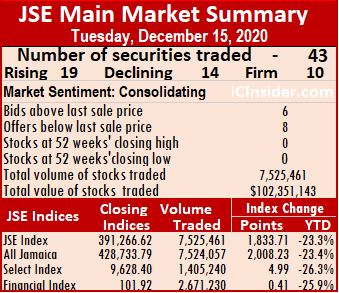

At the close, the All Jamaican Composite Index climbed 2,008.23 points to 428,733.79, the Main Index advanced 1,833.71 points to 391,266.62 and the JSE Financial Index rose 0.41 points to 101.92.

At the close, the All Jamaican Composite Index climbed 2,008.23 points to 428,733.79, the Main Index advanced 1,833.71 points to 391,266.62 and the JSE Financial Index rose 0.41 points to 101.92. Month to date trade averaged 302,986 units at $3,778,872, in contrast to 315,550 units at $3,916,179 on Monday. November averaged 623,120 units at $6,686,047.

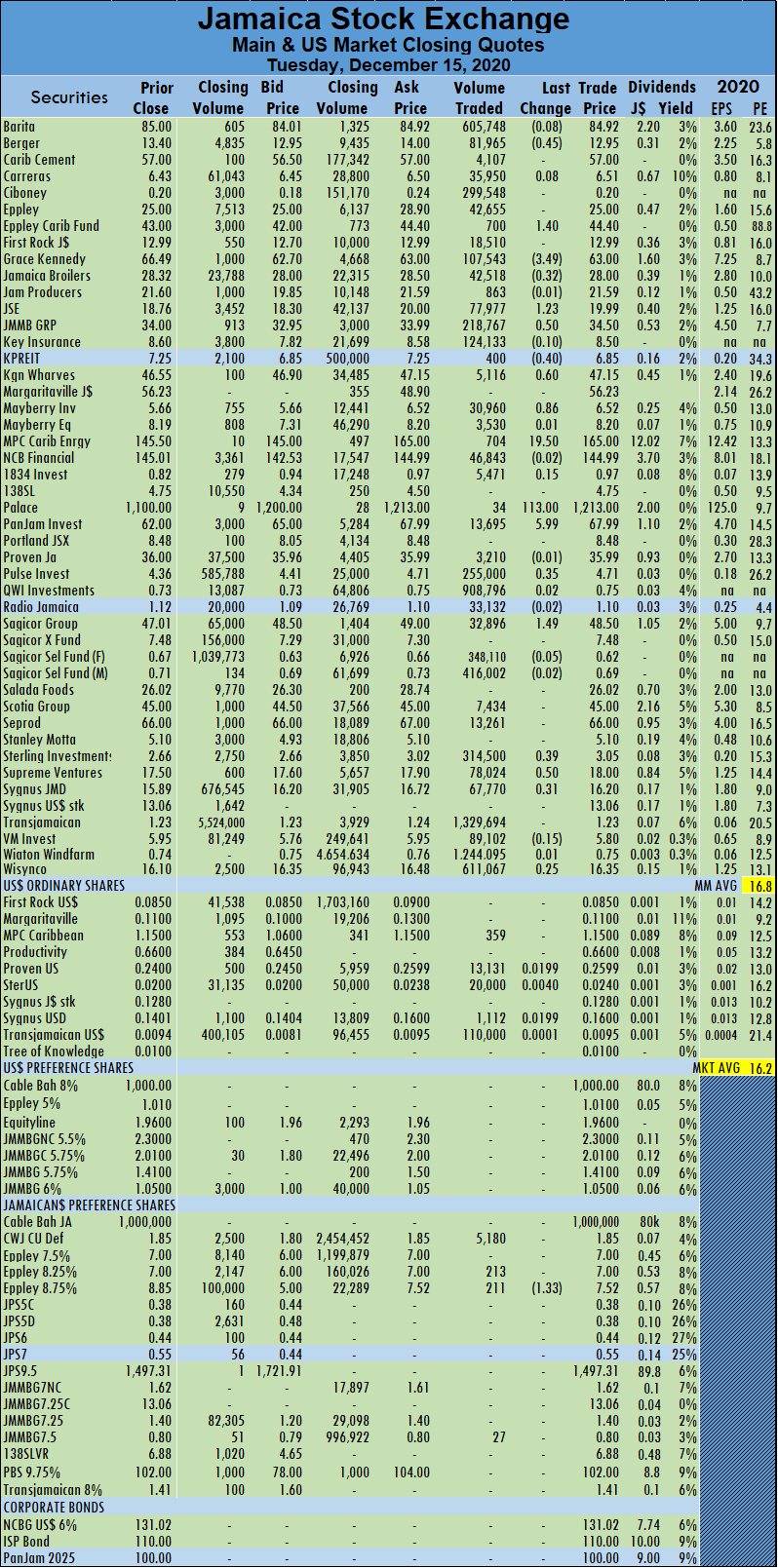

Month to date trade averaged 302,986 units at $3,778,872, in contrast to 315,550 units at $3,916,179 on Monday. November averaged 623,120 units at $6,686,047. Pulse Investments gained 35 cents to end at $4.71, with 255,000 shares changing hands, Sagicor Group rose $1.49 to $48.50, trading 32,896 stock units, Sterling Investments gained 39 cents to settle at $3.05, in an exchange of 314,500 shares. Supreme Ventures finished at $18, with gains of 50 cents and 78,024 shares crossing the exchange, Sygnus Credit Investments gained 31 cents to end at $16.20, after 67,770 shares cleared the market.

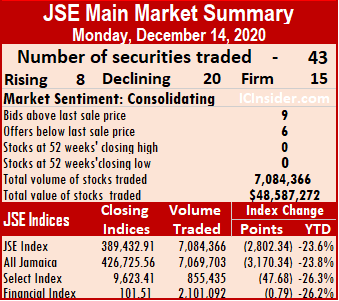

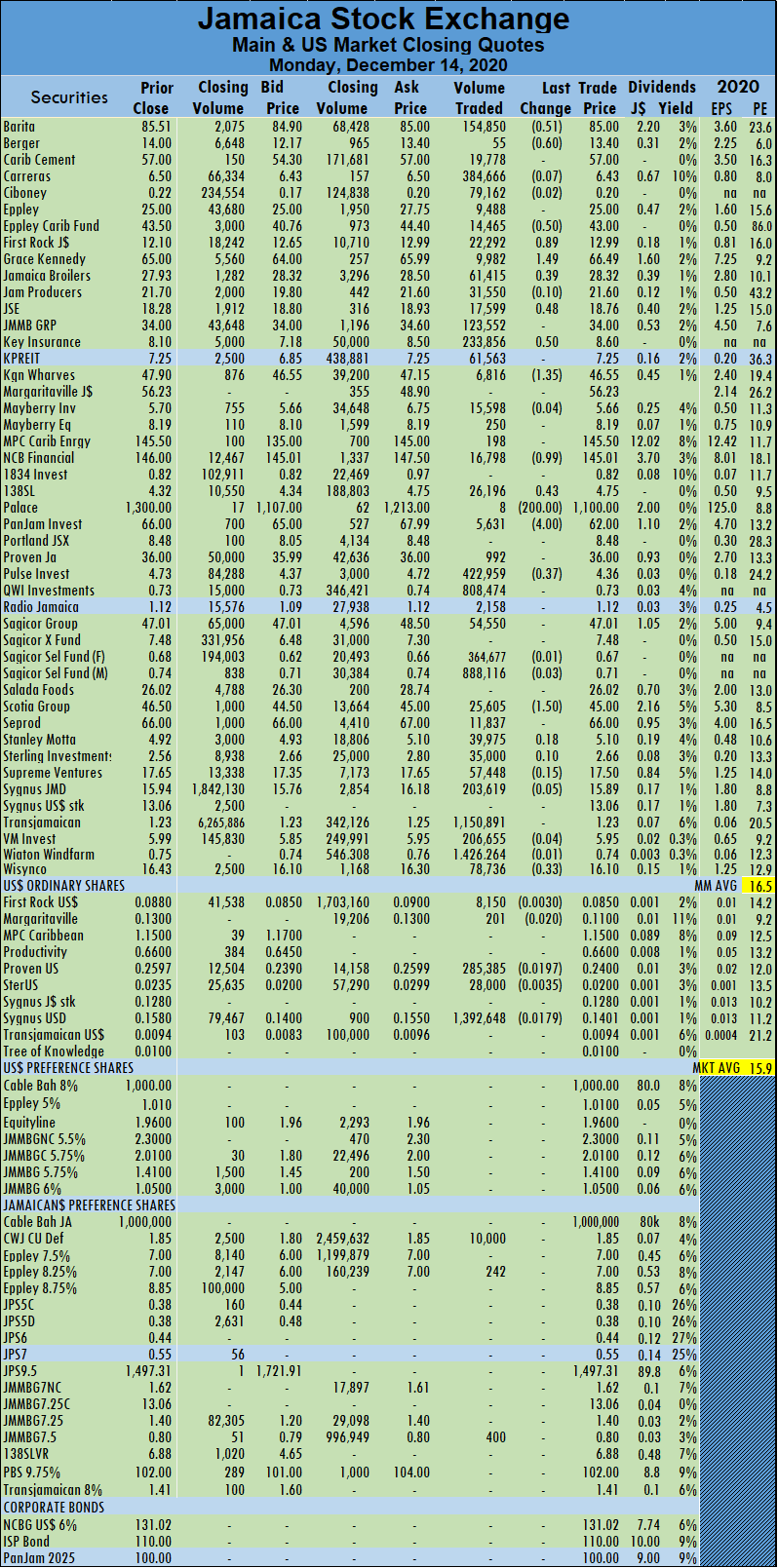

Pulse Investments gained 35 cents to end at $4.71, with 255,000 shares changing hands, Sagicor Group rose $1.49 to $48.50, trading 32,896 stock units, Sterling Investments gained 39 cents to settle at $3.05, in an exchange of 314,500 shares. Supreme Ventures finished at $18, with gains of 50 cents and 78,024 shares crossing the exchange, Sygnus Credit Investments gained 31 cents to end at $16.20, after 67,770 shares cleared the market. At the close, the All Jamaican Composite Index lost 3,170.34 points to 426,725.56, the Main Index shed 2,802.34 points to 389,432.91 and the JSE Financial Index lost 0.79 points to settle at 101.51.

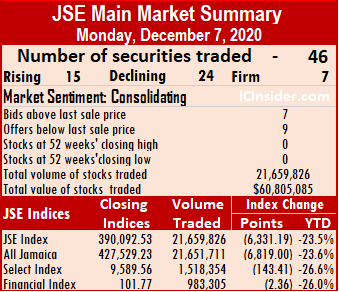

At the close, the All Jamaican Composite Index lost 3,170.34 points to 426,725.56, the Main Index shed 2,802.34 points to 389,432.91 and the JSE Financial Index lost 0.79 points to settle at 101.51. Trading for the day averaged 164,753 units at $1,129,937 for each security, compared to an average of 515,078 shares at $2,484,699 on Friday. Month to date trade averaged 315,550 units at $3,916,179, compared to 331,966 units at $4,219,492 on Friday. November averaged 623,120 units at $6,686,047.

Trading for the day averaged 164,753 units at $1,129,937 for each security, compared to an average of 515,078 shares at $2,484,699 on Friday. Month to date trade averaged 315,550 units at $3,916,179, compared to 331,966 units at $4,219,492 on Friday. November averaged 623,120 units at $6,686,047. Kingston Wharves fell $1.35 to $145.01, with 16,798 units crossing the exchange, 138 Student Living gained 43 cents to settle at $4.75, in exchanging 26,196 stock units, Palace Amusement dropped $200 to $1,100, in transferring 8 units. Pan Jam Investment dropped $4 to close at $62 after 5,631 units crossed the exchange, Pulse Investments shed 37 cents to $4.36 in trading 422,959 shares, Scotia Group fell $1.50 to $45 in an exchange of 25,605 stock units and Wisynco Group shed 33 cents to end at $16.10, with 78.736 shares crossing the exchange.

Kingston Wharves fell $1.35 to $145.01, with 16,798 units crossing the exchange, 138 Student Living gained 43 cents to settle at $4.75, in exchanging 26,196 stock units, Palace Amusement dropped $200 to $1,100, in transferring 8 units. Pan Jam Investment dropped $4 to close at $62 after 5,631 units crossed the exchange, Pulse Investments shed 37 cents to $4.36 in trading 422,959 shares, Scotia Group fell $1.50 to $45 in an exchange of 25,605 stock units and Wisynco Group shed 33 cents to end at $16.10, with 78.736 shares crossing the exchange. The Junior Market closed the week at the highest level since November 17 and before that, October 2 and seems poised to take out all recent highs on the way to the year-end rally and a bullish period to come, to take it over 3,000 points. The main Market pulled back from last week’s levels but closed at the highest point for the week on Friday.

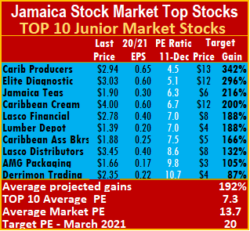

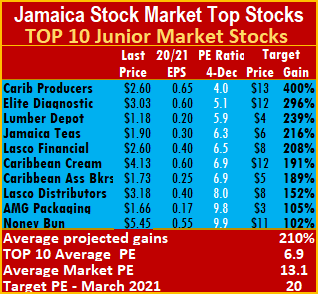

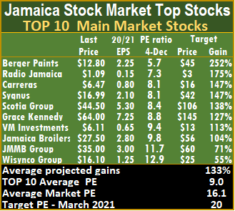

The Junior Market closed the week at the highest level since November 17 and before that, October 2 and seems poised to take out all recent highs on the way to the year-end rally and a bullish period to come, to take it over 3,000 points. The main Market pulled back from last week’s levels but closed at the highest point for the week on Friday. Honey Bun dropped out of the TOP 10, with Derrimon Trading replacing it at the bottom of the list. Honey Bun’s stock price jumped 19 percent for the week to $6.49 on Friday, with the stock now showing very limited supply and a bit of demand on the buying side, although a bit below the last sale price. The increased demand this week follows a strong September quarter profit that rose 76 percent over 2019. Wisynco Group spent just a week in the Main Market TOP 10, moved up in price to close out the week with the stock rising to $16.43 from $16.10 and replaced by NCB, in at the tenth position. The projections are for earnings to recover from the increased provision for expected credit loss charges in 2020 and from continued growth in the business and deliver earnings of $12 per share for the current year to September.

Honey Bun dropped out of the TOP 10, with Derrimon Trading replacing it at the bottom of the list. Honey Bun’s stock price jumped 19 percent for the week to $6.49 on Friday, with the stock now showing very limited supply and a bit of demand on the buying side, although a bit below the last sale price. The increased demand this week follows a strong September quarter profit that rose 76 percent over 2019. Wisynco Group spent just a week in the Main Market TOP 10, moved up in price to close out the week with the stock rising to $16.43 from $16.10 and replaced by NCB, in at the tenth position. The projections are for earnings to recover from the increased provision for expected credit loss charges in 2020 and from continued growth in the business and deliver earnings of $12 per share for the current year to September. Former TOP10 holder MailPac, hit a record high on Friday, in closing at $2.60, up 19 percent from $2.19 last week. Lumber Depot reported earnings for the October quarter, keeping earnings on track for 20 cents per share and put added life into the stock, moving the price up 6 percent to close the week at $1.39 at a PE of 7 times earnings, well below the market average of 13.7. Caribbean Producers moved up 13 percent from $2.60 to $2.94 at the close and up a nice 21.5 percent for the month to date. The stock seems on target to move back into the $4 range sooner than later, with stock supplies thinning out and prospects for improved business looking increasingly better in 2021.

Former TOP10 holder MailPac, hit a record high on Friday, in closing at $2.60, up 19 percent from $2.19 last week. Lumber Depot reported earnings for the October quarter, keeping earnings on track for 20 cents per share and put added life into the stock, moving the price up 6 percent to close the week at $1.39 at a PE of 7 times earnings, well below the market average of 13.7. Caribbean Producers moved up 13 percent from $2.60 to $2.94 at the close and up a nice 21.5 percent for the month to date. The stock seems on target to move back into the $4 range sooner than later, with stock supplies thinning out and prospects for improved business looking increasingly better in 2021. Diagnostic and Jamaican Teas. Lumber Depot, in at third position last week, is now down to sixth after investors responded positively to quarterly results. With expected gains of 146 to 236 percent, the top three Main Market stocks are Berger Paints, followed by Radio Jamaica and Carreras.

Diagnostic and Jamaican Teas. Lumber Depot, in at third position last week, is now down to sixth after investors responded positively to quarterly results. With expected gains of 146 to 236 percent, the top three Main Market stocks are Berger Paints, followed by Radio Jamaica and Carreras. The average projected gain for the Junior Market IC TOP 10 stocks is 192 percent down from 210 percent and 129 percent from 133 percent last week for the JSE Main Market, based on 2020-21 earnings. IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

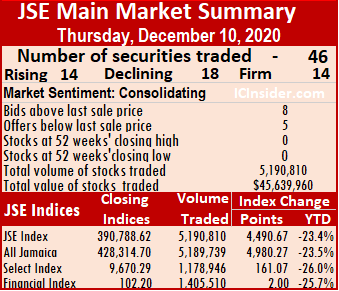

The average projected gain for the Junior Market IC TOP 10 stocks is 192 percent down from 210 percent and 129 percent from 133 percent last week for the JSE Main Market, based on 2020-21 earnings. IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information. At the close, the All Jamaican Composite Index advanced by 4,980.27 points to 428,314.70, the Main Index climbed 4,490.67 points to 390,788.62 and the JSE Financial Index rose 2.00 points to settle at 102.20.

At the close, the All Jamaican Composite Index advanced by 4,980.27 points to 428,314.70, the Main Index climbed 4,490.67 points to 390,788.62 and the JSE Financial Index rose 2.00 points to settle at 102.20. Trading for the day averaged 112,844 units at $992,173 for each security, compared to an average of 95,691 shares at $922,175 on Wednesday. The average month to date trade is 309,597 units at $4,431,412 for each security, in contrast to 339,174 units at $4,948,422 on Wednesday. November averaged 623,120 units at $6,686,047.

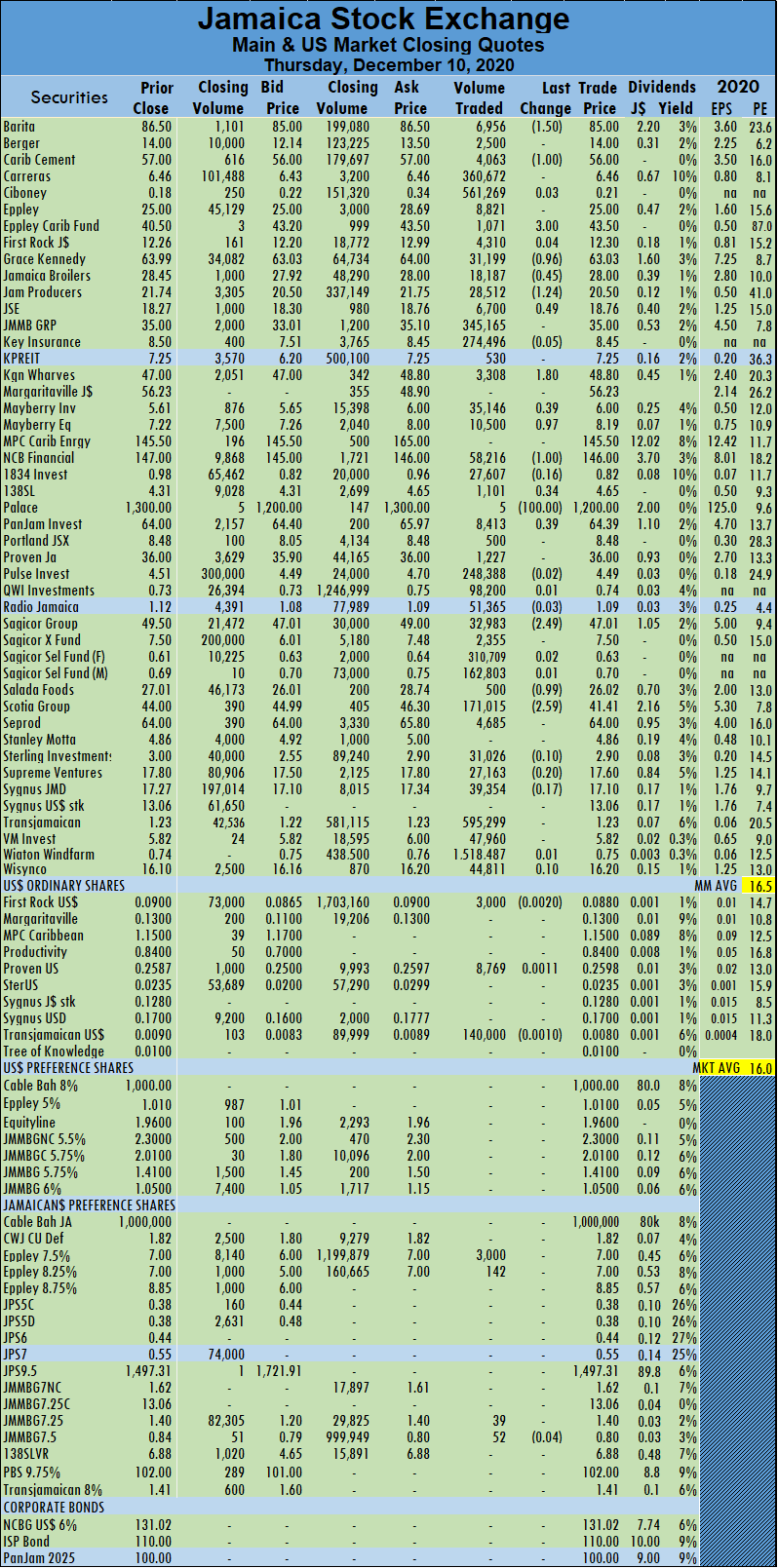

Trading for the day averaged 112,844 units at $992,173 for each security, compared to an average of 95,691 shares at $922,175 on Wednesday. The average month to date trade is 309,597 units at $4,431,412 for each security, in contrast to 339,174 units at $4,948,422 on Wednesday. November averaged 623,120 units at $6,686,047. 138 Student Living gained 34 cents to end at $4.65, with 1,101 units trading, Palace Amusement dropped $100 in closing at $1,200, with 5 units passing through the market, Pan Jam Investment gained 39 cents to end at $64.39, with an exchange of 8,413 units. Sagicor Group fell by $2.49 to $47.01, with 32,983 shares crossing the exchange, Salada Foods shed 99 cents to close at $26.02 trading 500 units and Scotia Group declined by $2.59 to close at $41.41, in transferring 171,015 shares after the Group reported lower full-year profit than in 2019.

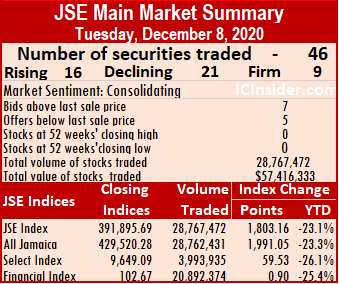

138 Student Living gained 34 cents to end at $4.65, with 1,101 units trading, Palace Amusement dropped $100 in closing at $1,200, with 5 units passing through the market, Pan Jam Investment gained 39 cents to end at $64.39, with an exchange of 8,413 units. Sagicor Group fell by $2.49 to $47.01, with 32,983 shares crossing the exchange, Salada Foods shed 99 cents to close at $26.02 trading 500 units and Scotia Group declined by $2.59 to close at $41.41, in transferring 171,015 shares after the Group reported lower full-year profit than in 2019. At the close, the All Jamaican Composite Index climbed 1,991.05 points to 429,520.28, the Main Index advanced by 1,803.16 points to 391,895.69 and the JSE Financial Index gained 0.90 points to settle at 102.67.

At the close, the All Jamaican Composite Index climbed 1,991.05 points to 429,520.28, the Main Index advanced by 1,803.16 points to 391,895.69 and the JSE Financial Index gained 0.90 points to settle at 102.67. The average month to date trade is 380,065 units at $5,624,586 , in contrast to 327,822 units at $6,556,598. November averaged 623,120 units at $6,686,047.

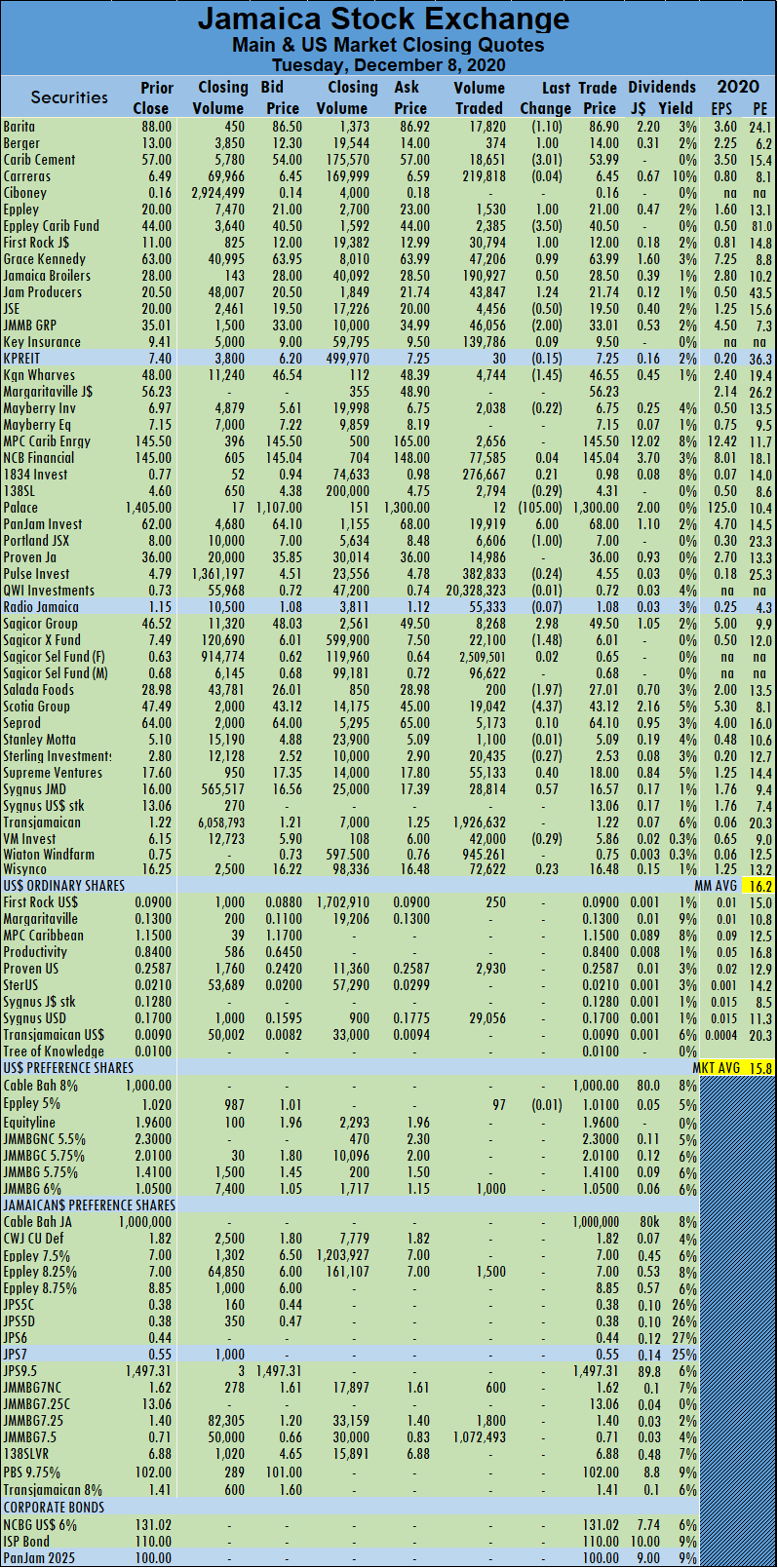

The average month to date trade is 380,065 units at $5,624,586 , in contrast to 327,822 units at $6,556,598. November averaged 623,120 units at $6,686,047. Palace Amusement declined by $105 to $1,300 after trading 12 units, Pan Jam Investment advanced $6 to $68, with 19,919 stock units crossing the exchange, Portland JSX fell by $2 to $7, in exchanging 6,606 shares. Sagicor Group rose $2.98 to $49.50 after owners switched 8,268 units, Sagicor Real Estate Fund shed $1.48 to settle at $6.01 trading 22,100 stock units, Salada Foods ended at $27.01, with a loss of $1.97 exchanging 200 shares. Scotia Group declined $4.37 to $43.12, in clearing the market with 19,042 stock units, Supreme Ventures gained 40 cents to settle at $18, with 55,133 shares crossing the market and Sygnus Credit Investments closed 57 cents higher at $16.57, in exchanging 28,814 stock units.

Palace Amusement declined by $105 to $1,300 after trading 12 units, Pan Jam Investment advanced $6 to $68, with 19,919 stock units crossing the exchange, Portland JSX fell by $2 to $7, in exchanging 6,606 shares. Sagicor Group rose $2.98 to $49.50 after owners switched 8,268 units, Sagicor Real Estate Fund shed $1.48 to settle at $6.01 trading 22,100 stock units, Salada Foods ended at $27.01, with a loss of $1.97 exchanging 200 shares. Scotia Group declined $4.37 to $43.12, in clearing the market with 19,042 stock units, Supreme Ventures gained 40 cents to settle at $18, with 55,133 shares crossing the market and Sygnus Credit Investments closed 57 cents higher at $16.57, in exchanging 28,814 stock units. Investor’s Choice bid-offer indicator reading has seven stocks ending with bids higher than their last selling prices and nine with lower offers.

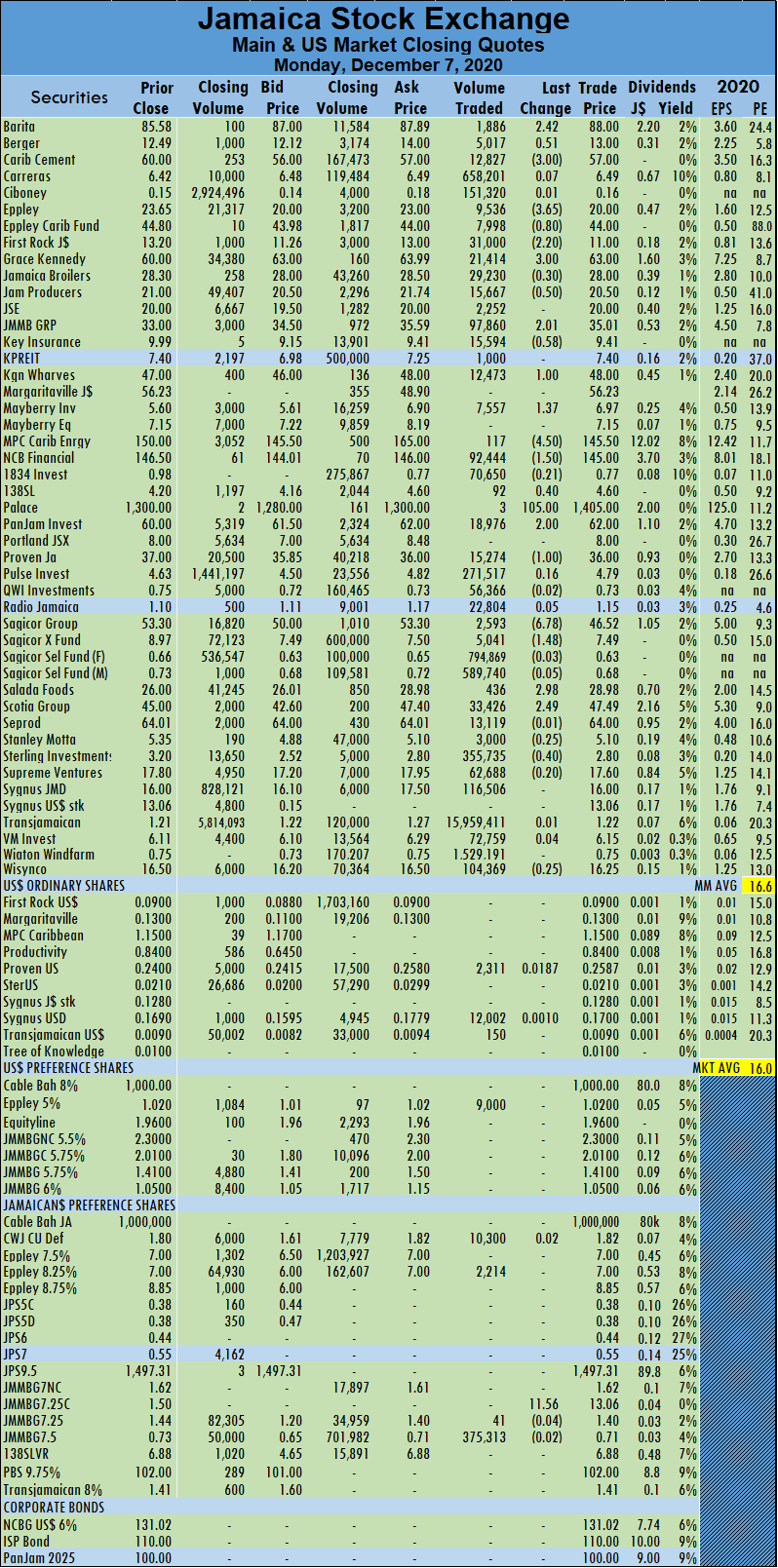

Investor’s Choice bid-offer indicator reading has seven stocks ending with bids higher than their last selling prices and nine with lower offers. Proven Investments dropped $1 to close at $36, in trading 15,274 units, Sagicor Group declined by $5.48 to $46.52, in clearing the market with 2,593 units, Scotia Group climbed $2.99 in closing at $47.49, with an exchange of 33,426 shares. Seprod fell $1.99 to settle at $64, in transferring 13,119 stock units, Supreme Ventures gained 49 cents in closing at $17.60, with investors switching ownership of 62,688 shares and Sygnus Credit Investments lost 99 cents to settle at $16, with an exchange of 116,506 shares.

Proven Investments dropped $1 to close at $36, in trading 15,274 units, Sagicor Group declined by $5.48 to $46.52, in clearing the market with 2,593 units, Scotia Group climbed $2.99 in closing at $47.49, with an exchange of 33,426 shares. Seprod fell $1.99 to settle at $64, in transferring 13,119 stock units, Supreme Ventures gained 49 cents in closing at $17.60, with investors switching ownership of 62,688 shares and Sygnus Credit Investments lost 99 cents to settle at $16, with an exchange of 116,506 shares.

Wisynco Group’s performance was on a roll, with revenues up 27.5 percent in the nine months to March this year, and 24 percent in the March quarter, but gross profit margin slipped in the March quarter while rising Administration and other expenses squeezed profits even more. Sales dipped slightly in the June and September quarters, but the September 2019 quarter, includes sales of $503 million from a discontinued operation, leaving flat sales from ongoing operations. Net Profits Attributable to Stockholders from continuing operations was $851 million or 23 cents per stock unit compared to $932 million or 25 cents per stock unit for the corresponding period of the prior year. Revenues for the quarter from continuing operations of $8.1 billion fell 6.1 percent from $8.6 billion in the 2019 quarter.

Wisynco Group’s performance was on a roll, with revenues up 27.5 percent in the nine months to March this year, and 24 percent in the March quarter, but gross profit margin slipped in the March quarter while rising Administration and other expenses squeezed profits even more. Sales dipped slightly in the June and September quarters, but the September 2019 quarter, includes sales of $503 million from a discontinued operation, leaving flat sales from ongoing operations. Net Profits Attributable to Stockholders from continuing operations was $851 million or 23 cents per stock unit compared to $932 million or 25 cents per stock unit for the corresponding period of the prior year. Revenues for the quarter from continuing operations of $8.1 billion fell 6.1 percent from $8.6 billion in the 2019 quarter.  The company expects to have lower energy costs with the successfully commissioning of the Cogeneration plant in July 2020, with the company seeing a positive contribution from the implementation through reduced energy costs.

The company expects to have lower energy costs with the successfully commissioning of the Cogeneration plant in July 2020, with the company seeing a positive contribution from the implementation through reduced energy costs. The PE ratio for the Junior Market Top 10 stocks average a mere 6.9 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9 or 56 percent of the PE of that market.

The PE ratio for the Junior Market Top 10 stocks average a mere 6.9 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9 or 56 percent of the PE of that market. Trading averaged 635,024 units at $28,925,756 for each security, compared to an average of 190,187 shares at $1,780,784 on Thursday. The average trade for the month to date is 289,116 units at $7,973,059 for each security, in contrast to 179,176 units at $1,313,675. November averaged 623,120 units at $6,686,047.

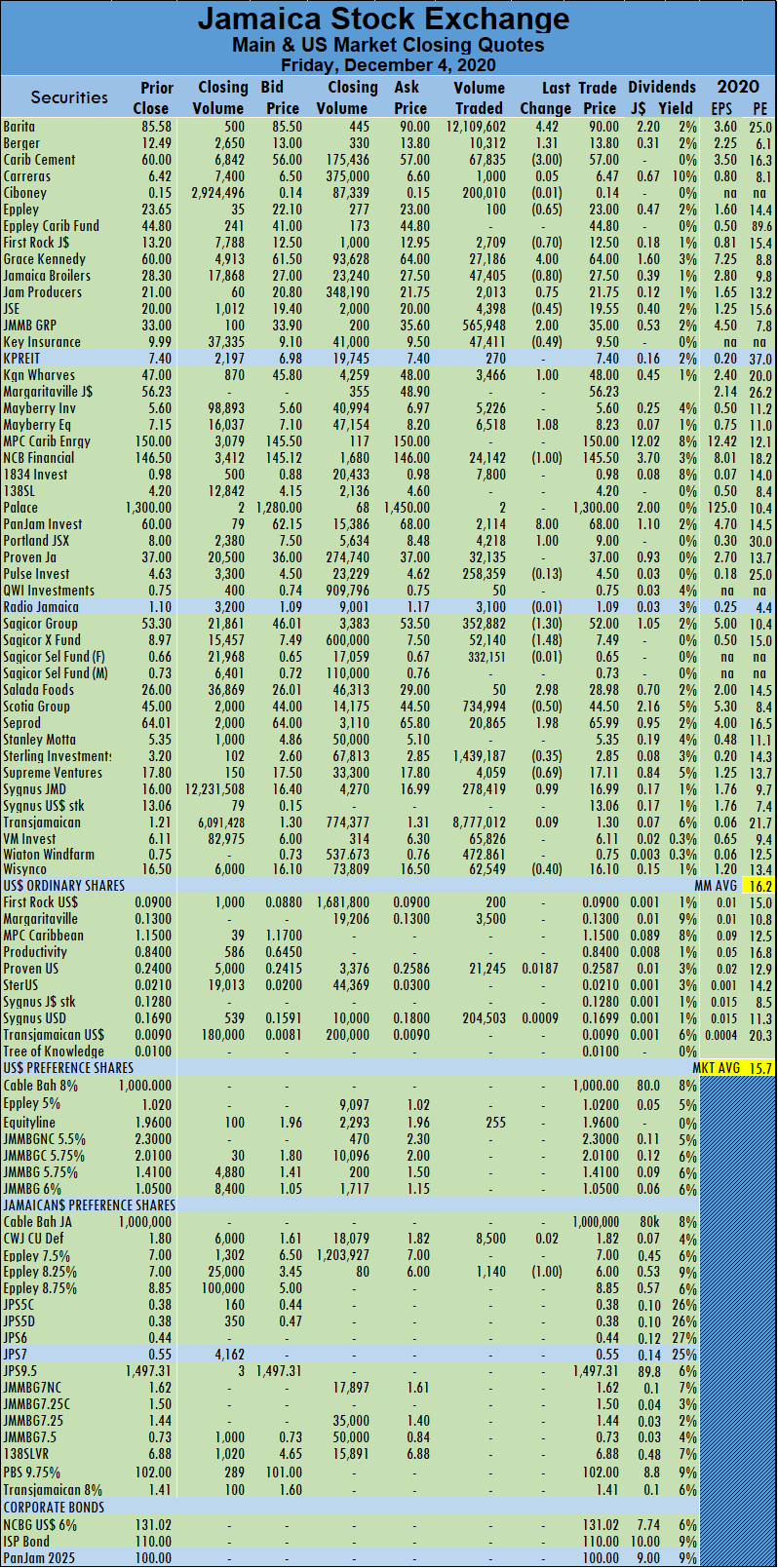

Trading averaged 635,024 units at $28,925,756 for each security, compared to an average of 190,187 shares at $1,780,784 on Thursday. The average trade for the month to date is 289,116 units at $7,973,059 for each security, in contrast to 179,176 units at $1,313,675. November averaged 623,120 units at $6,686,047. Salada Foods climbed $2.98 to $28.98, with 50 stocks crossing the exchange, Scotia Group lost 50 cents to finish at $44.50 trading 734,994 shares, Seprod rose $1.98 to end at $65.99, clearing the market with 20,865 stock units. Sterling Investments shed 35 cents to end at $2.85 trading 1,439,187 shares, Supreme Ventures lost 69 cents to close at $17.11, with investors swapping 4,059 units, Sygnus Credit Investments gained 99 cents to settle at $16.99 after investors switched ownership of 278,419 shares and Wisynco Group lost 40 cents to end at $16.10, in exchanging 62,549 shares.

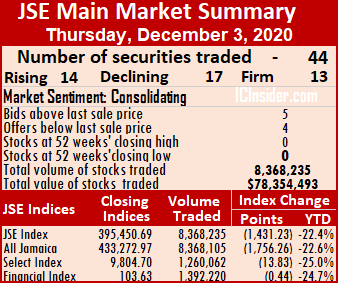

Salada Foods climbed $2.98 to $28.98, with 50 stocks crossing the exchange, Scotia Group lost 50 cents to finish at $44.50 trading 734,994 shares, Seprod rose $1.98 to end at $65.99, clearing the market with 20,865 stock units. Sterling Investments shed 35 cents to end at $2.85 trading 1,439,187 shares, Supreme Ventures lost 69 cents to close at $17.11, with investors swapping 4,059 units, Sygnus Credit Investments gained 99 cents to settle at $16.99 after investors switched ownership of 278,419 shares and Wisynco Group lost 40 cents to end at $16.10, in exchanging 62,549 shares. Trading averaged 190,187 units at $1,780,784 for each security, compared to an average of 169,420 shares at $1,098,311 on Wednesday. The average trade for the month to date is 179,176 units at $1,313,675 for each security, in contrast to 173,476 units at $1,071,877. November averaged 623,120 units at $6,686,047.

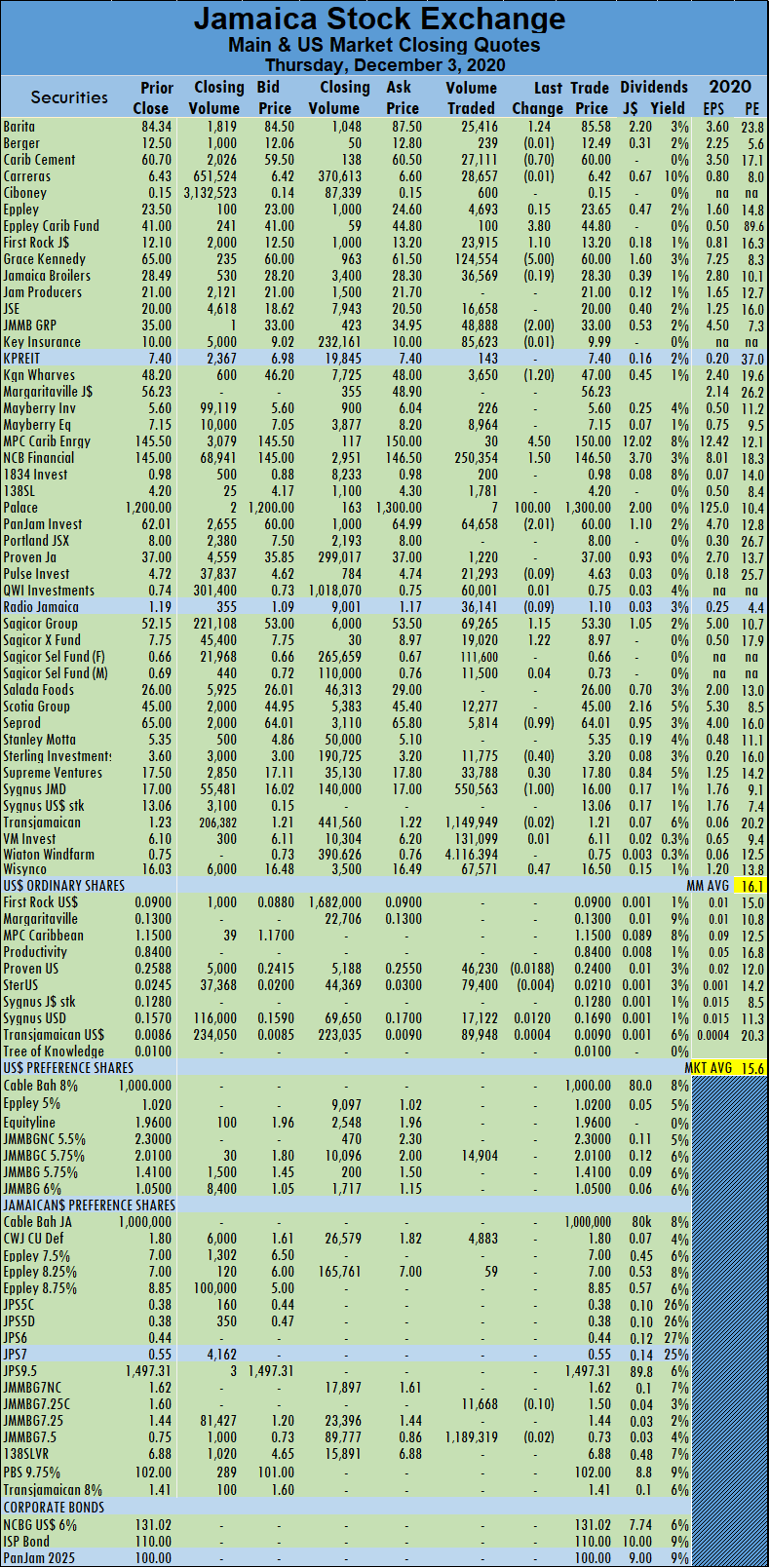

Trading averaged 190,187 units at $1,780,784 for each security, compared to an average of 169,420 shares at $1,098,311 on Wednesday. The average trade for the month to date is 179,176 units at $1,313,675 for each security, in contrast to 173,476 units at $1,071,877. November averaged 623,120 units at $6,686,047. Sagicor Real Estate Fund climbed $1.22 to $8.97 after exchanging 19,020 units, Seprod shed 99 cents to finish at $64.01, with 5,814 units changing hands, Sterling Investments lost 40 cents in closing at $3.20 after trading 11,775 units. Supreme Ventures gained 30 cents to end at $17.80, trading 33,788 stock units, Sygnus Credit Investments shed $1 to end at $16, after 550,563 shares crossed the exchange and Wisynco Group settled at $16.50, with gains of 47 cents as investors swapped 67,571 shares.

Sagicor Real Estate Fund climbed $1.22 to $8.97 after exchanging 19,020 units, Seprod shed 99 cents to finish at $64.01, with 5,814 units changing hands, Sterling Investments lost 40 cents in closing at $3.20 after trading 11,775 units. Supreme Ventures gained 30 cents to end at $17.80, trading 33,788 stock units, Sygnus Credit Investments shed $1 to end at $16, after 550,563 shares crossed the exchange and Wisynco Group settled at $16.50, with gains of 47 cents as investors swapped 67,571 shares.