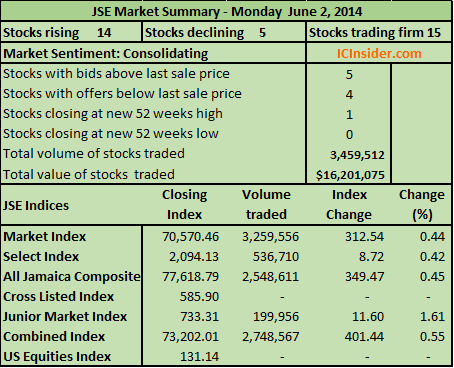

In Friday’s trading on the Jamaica Stock Exchange the prices of 5 stocks rose and 7 declined as 19 securities changed hands resulting in 8,662,257 shares trading, valued at $48,043,196 sparking a moderate gain in the main indices as well as the Junior market Index.

Main Market| The JSE Market Index inched up 78.18 points to 69,741.08 and the JSE All Jamaican Composite index moved up by 87.42 points to close at 76,691.40.

Main Market| The JSE Market Index inched up 78.18 points to 69,741.08 and the JSE All Jamaican Composite index moved up by 87.42 points to close at 76,691.40.

Gains| Stocks recording gains at the end of trading in the main market are Desnoes & Geddes with 304,463 units changing hands and the price gained 20 cents to close at $4.50, Jamaica Money Market Brokers with 4,600 shares to close with a gain of 4 cents to close at $6.65, Proven Investments with 7,700 ordinary shares to close with a gain of 0.0001 US cents to close at 18 US cents and Sagicor Group with 18,919 shares to close with a gain of 10 cents at $8.90.

Firm| The stocks in the main market to close without a change in price are Cable & Wireless which traded 609,766 shares to close at 30 cents, Gleaner with 3,759,161 shares to close at $1.10, Grace Kennedy traded 464,183 units valued at $25 million, just over half of the value of trade in the market, to close at $54, Jamaica Money Market Brokers 7.50% preference share, traded 14,400 units to close at $2 and Seprod with 234,532 units to close at $10.50.

Declines| The number of stocks that declined in the main market are Carreras with 141,077 shares, declined by 1 cent to end at $33.50, Pan Jamaican Investment 2,000 units to decline by 4 cents to end at $48.01, Sagicor Real Estate Fund 30,000 shares as the price fell by a cent to close at $6.0, Scotia Group with 11,365 units as the price drifted down by 19 cents to end at $19.01, Scotia Investments with only 2,750 units to close with a 50 cents loss at $21.50, a new 52 weeks low and Supreme Ventures with 3,051,100 shares as the price slipped 9 cents to end at $1.90.

Junior Market| The JSE Junior Market Index gained 1.25 points to close at 719.35 as 3 stocks traded with 1 advancing and 1 declining and a debenture.

Gains| The only stock recording gains at the end of trading in the junior market was Lasco Distributors with a mere 1,490 shares to close with a gain of 2 cents at $1.20.

Firm Trades| Jamaican debenture notes traded 34,000 units at par of $100 each, valued at $3,400,000 and Medical Disposables 2,000 units to close at $1.95 were the only securities in the junior market that traded to close at the same price as the prior trading day.

Declines| The only stock declining in the junior market at the end of trading is AMG Packaging with 2,751 shares to close with a loss of 20 cents at $3.10, for a new 52 weeks low.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 7 stocks with the bid higher than the last selling price and 5 stocks with offers that were lower. This suggest continued sideways movement for the market in the short term.

Declining stocks more than advancing

Declining stocks dominate trade

The Jamaica Stock Exchange continues to lose ground with more stocks falling than rising as the prices of only 5 stocks rose and 12 declined with 25 securities traded resulting in 2,034,342 shares trading valued at $8,897,265 but the junior market index rose although the two main market indices fell.

Main Market| Only 2 companies in the main market advanced at the end of trading and one from the US dollar market and 6 declined as the indices moved down with the JSE Market Index erasing 432.21 points to close at 72,697.29 and the JSE All Jamaican Composite index lost 483.28 points to close at 79,996.96.

Main Market| Only 2 companies in the main market advanced at the end of trading and one from the US dollar market and 6 declined as the indices moved down with the JSE Market Index erasing 432.21 points to close at 72,697.29 and the JSE All Jamaican Composite index lost 483.28 points to close at 79,996.96.

Gains| Stocks recording gains at the end of trading in the main market are Cable & Wireless in trading 51,164 shares to close with a gain of 2 cents at 34 cents, Margaritaville gained 2 US cents to close at 12 US cents with 340 units changing hands for the first time since listing to close at a new high and Sagicor Group swapped 177,506 units 5 cents higher to end at $9.30.

Firm| There were 6 stocks in the main market to close without a change in price with Grace Kennedy trading 1,000 units and closed at $55, Jamaica Broilers 156,467 shares closing at $4.70, National Commercial Bank 25,550 shares to close at $18, Radio Jamaica 30,895 shares closing at $1.29, Sagicor Real Estate Fund 4,940 units in closing at $6.60, Scotia Group 109,624 shares to close at $19.70.

Declines| The number of stocks that declined in the main market are Caribbean Cement with 30,316 shares while losing 20 cents to end at $3.30, Carreras 11,000 shares to close at $34.75 with a $1.20 decline, Gleaner 74,821 stock units to close with a cent down at $1.10, Pan Jamaican Investment as it traded 15,486 shares to close at $48.10 with the price falling by 40 cents, Salada Foods down by 10 cents while trading 2,830 units at $7.90, Scotia Investments 10,635 shares to close at $23.50, a decline of $2 and Supreme Ventures 316,847 stock units to close with a loss of 10 cents to $2 for a new 52 weeks low.

Junior Market| The JSE Junior Market Index rose 3.56 points to close at 729.12 as only 9 stocks traded with 2 advancing and 2 declining.

Gains| Stocks recording gains at the end of trading in the junior market are Jamaican Teas with 49,530 units to close at $3.45 as the price rose by 24 cents and Lasco Financial Services traded 31,500 shares to close 5 cents higher at $1.15.

Firm Trades| The 2 stocks in the junior market stocks that traded to close at the same price as the day before are Caribbean Producers with 50,000 shares closing at $2.73 and Lasco Distributors with 222,054 units to close at $1.40.

Declines| Five stocks declined in the junior market at the end of trading are AMG Packaging in trading 5,000 units to close at $3.30, down 19 cents, for a 52 weeks low, Caribbean Flavours with 53,065 units to close with a 20 fall to $2.50, followed by Consolidated Bakeries 157,299 as the price declined by 18 cents in light of the reduced profits reported for the March quarter to end at 92 cents. The company saw profits fall 48 percent to $7.4 million in the March quarter from reduced gross profit margin in spite of a 14 percent rise in sales revenues to $197 million. General Accident 200,198 shares to close at $1.48 with a one cent fall and Lasco Manufacturing that is expected to report final results for the year to March by the end of May traded 246,275 units to close with a one cent loss at $1.14.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 5 stocks with the bid higher than the last selling price and 5 stocks with offers that were lower.

Main indices up but junior eases

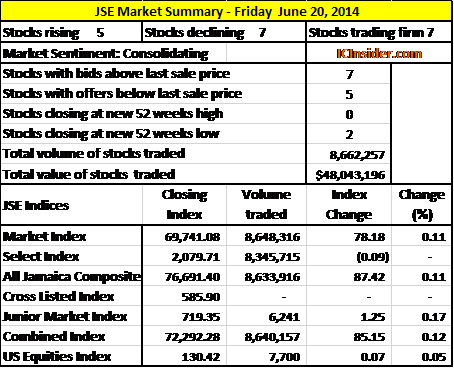

In Tuesday’s trading on the Jamaica Stock Exchange the prices of 8 stocks rose, 11 declined as 31 securities traded resulting in 7,099,320 shares changing hands valued at $45,025,458.

Main Market| Seven (7) companies in the main market rose, 5 declined as the indices moved up with the JSE Market Index gaining 526.88 points to 73,019.48 and the JSE All Jamaican Composite index moving up 589.14 points to close at 80,357.22.

Gains| Stocks recording gains at the end of trading in the main market are Carreras trading 60,623 shares to close with a gain of 75 cents at $34.75, Jamaica Money Market Brokers 5,000 units to close at $7.40 with a 10 cents gain, Radio Jamaica with 4,462 shares to close with a gain of a cent at $1.29, Sagicor Group with 534,732 units to close with a gain of 20 cents at $9.35, Sagicor Real Estate Fund 119,402 shares to close 20 cents higher at $6.50, Scotia Group 357,781 units to close at $19.70 as the price rose by 19 cents and Scotia Investments 9,780 shares to close with a gain of $1.40 at $24.50.

Firm| 7 main market stocks closed without a change in price as Berger Paints with 7,899 shares closed at $1.67, Cable & Wireless with 1,076,240 units closed at 30 cents, Jamaica Broilers 482,878 shares to close at $4.71, Jamaica Money Market Brokers 7.50% preference share 75,000 units and closed at $2, Jamaica Producers 5,201 shares to close at $18.26, Kingston Wharves 8,106 units as the price closed at $5.75 and Mayberry Investments 2,040 shares to close at $1.75.

Declines| The stocks that declined in the main market are Caribbean Cement with 3,036 shares trading while losing 10 cents to end at $3.50, Desnoes & Geddes with 3,002,000 shares in closing at $4.40 for a 9 cents loss, Grace Kennedy 14,320 units to close at $55 with a loss of $1.50, National Commercial Bank 512,600 shares to close at $17.75, down by 35 cents, and Seprod with 40,667 units in closing at $10.75 for a 50 cents decline.

Junior Market| The JSE Junior Market Index declined by 2.45 points to close at 733.19 as 12 stocks traded with 1 advancing and 6 declining.

Gains| Blue Power traded 200,000 shares to close 9 cents higher at $9.10 as was the only junior market stock to rise.

Firm Trades| Stocks in the junior market stocks that traded to close at the same price as the day before are Access Financial with 24,575 units changing hands to close at $11.50, AMG Packaging with 5,558 units at $3.49, Derrimon Trading with 286,000 shares to close at $2.28, Knutsford Express traded 3,020 units to close at $5.17 and Lasco Distributors 41,000 units in closing at $1.35.

Declines| Stocks declining in the junior market at the end of trading are Cargo Handlers with 220 units at $14.31 with a fall of 4 cents, Caribbean Cream with 12,530 units to close with a fall of 7 cents at 72 cents, Caribbean Producers with 32,900 shares to close at $2.99 with an fall of 11 cents, Dolphin Cove 19,700 units at $8.10 for a 10 cents decline, Lasco Manufacturing 128,850 shares to end with a fall of 14 cents at $1 and Medical Disposables with 23,200 units in closing at $2 for a 4 cents fall.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 8 stocks with the bid higher than the last selling price and 8 stocks with offers that were lower.

Market on rebounds

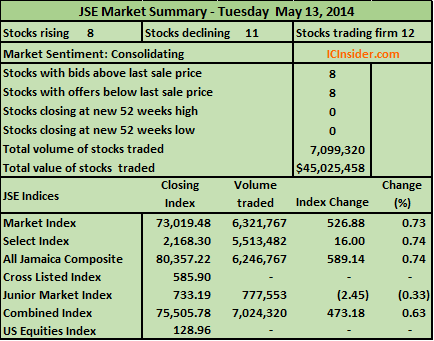

In Monday’s trading on the Jamaica Stock Exchange the market rebounded when measured by the main market indices but the junior market index slipped. At the close, the IC bid-offer Indicator was flashing a strong signal of further rebound in prices. The main market indices recorded gains as the prices of 8 stocks rose and 11 declined with 28 securities traded in both markets resulting in 53,344,226 units changing hands valued at $30,050,258. C2W Music had one trade of 50,895,843 units valued at $21.37 million.

Main Market| AT the end of trading the JSE Market Index rose by 466.57 points to 72,492.60 and the JSE All Jamaican Composite index gained 521.70 points to close at 79,768.08 as all 8 stocks to rise came from this market while 5 declined.

Main Market| AT the end of trading the JSE Market Index rose by 466.57 points to 72,492.60 and the JSE All Jamaican Composite index gained 521.70 points to close at 79,768.08 as all 8 stocks to rise came from this market while 5 declined.

Gains| Stocks recording gains at the end of trading in the main market are Caribbean Cement, trading 54,218 shares to close with a gain of 10 cents at $3.60, Carreras gained 35 cents to close at $34 with 1,000 units changing hands, Grace Kennedy traded 2,306 units to close at $56.50 with 50 cents gain, National Commercial Bank closed with 26,424 shares changing hands as the price close at $18.10 with a 10 cents gain but it traded as low as $17.16 before recovering towards the end of trading. Sagicor Group exchanged 62,900 units in closing 15 cents higher at $9.15, Sagicor Real Estate Fund traded 42,500 units at 30 cents higher in closing at $6.30, Scotia Group put in only 14,288 shares to end a cent higher at $19.51 and Seprod gained 70 cents with 5,000 units to close at $11.25 after the company reported increased profit in the quarter to March with a 50 percent increase to $473 million or 77 cents per share from operating revenue increase, of only 4 percent.

Firm| The stocks in the main market to close without change in price are Jamaica Money Market Brokers 8.75% preference share with 160,000 units to close at $3.03, Mayberry Investments with 18,858 shares while closing at $1.71, Pan Jamaican Investment with 10,800 shares while closing at $48.06, Proven Investments 67,200 units to close at 18US cents and Proven Investments 8% preference share 1,850 units to close at $5.09.

Declines| The stocks that declined in the main market are Desnoes & Geddes with 35,559 units while losing a cent to end at $4.49, Jamaica Broilers 62,900 units in closing at $4.71, down 9 cents, Jamaica Money Market Brokers 13,113 shares to close at $7.30 with a cent off, Jamaica Stock Exchange 925 units in closing at $1.95 as the price eased 5 cents and Kingston Wharves 8,300 shares to close 24 cents lower at $5.75.

Junior Market| The JSE Junior Market Index declined by 10.60 points to close at 735.64 as 10 stocks traded with none recording a price gain and 6 declining.

Firm Trades| The stocks trading in the junior market to close at the same price as the day before are Access Financial with 121,400 units to close at $11.50, Caribbean Cream with 1,250 units to close at 79 cents, Consolidated Bakeries with 3,000 shares in closing at $1.10 and Lasco Distributors with 1,357,149 shares to close at $1.35.

Declines| Stocks declining in the junior market at the end of trading are AMG Packaging trading 1,000 units at $3.49 as the price slipped a cent, C2W Music with 50,895,843 shares as the price lost 3 cents to end at 42 cents, KLE Group with 138,703 as the price eased by a cent for a new 52 weeks low of 93 cents, Lasco Financial 69,751 shares at 12 cents lower to end at $1.08, Lasco Manufacturing 102,884 shares as it closed at $1.14 for a 6 cents decline and Medical Disposables with 65,105 units to close with a cent off at $2.04.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 12 stocks with the bid higher than the last selling price and 7 stocks with offers that were lower.

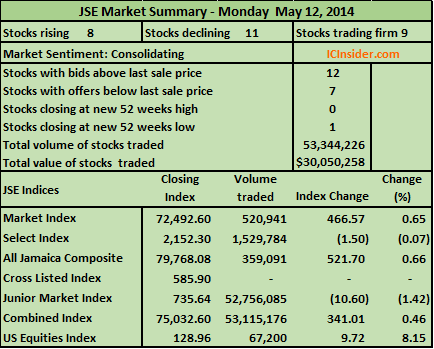

Advancing stocks top declines

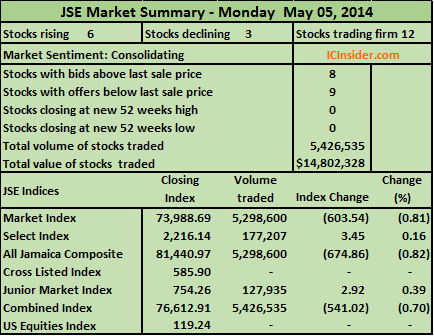

In Monday’s trading on the Jamaica Stock Exchange the prices of 6 stocks rose and 3 declined as 21 securities traded resulting in 5,426,535 shares changing hands valued at $14,802,328. The IC market sentiment indicator is pointing to continued fluidity in prices with almost an even number of stocks with bids and offers above or below their last traded prices.

Main Market| 5 companies in the main market advanced, only 3 declined as the indices moved down with the JSE Market Index falling by 603.54 points to 73,988.69 and the JSE All Jamaican Composite index declining by 674.86 points to close at 81,440.97.

Main Market| 5 companies in the main market advanced, only 3 declined as the indices moved down with the JSE Market Index falling by 603.54 points to 73,988.69 and the JSE All Jamaican Composite index declining by 674.86 points to close at 81,440.97.

Gains| Stocks recording gains at the end of trading in the main market are Cable & Wireless trading 16,832 shares to close with a gain of one cent at 41 cents, Desnoes & Geddes gained 20 cents to close at $4.50 with 450 units changing hands, National Commercial Bank 1,690 shares to close at $18.30 with a gain of 20 cents, Pan Jamaican Investment with 101,574 shares to close at $49.28, up 23 cents. Radio Jamaica had 4,900,000 units changing hands to close with a 4 cents gain at $1.32.

Firm| There were only 6 stocks in the main market to close without a change in price as Gleaner with 22,980 shares closed at $1.10, Grace Kennedy 810 units helped the price to close at $56.51, Jamaica Broilers traded 113,552 shares to close at $4.85, Mayberry Investments with 1,020 shares closed at $1.70, Sagicor Real Estate Fund traded 11,930 units to close at $6.50 and Scotia Group with 18,575 units closed at $20.50.

Declines| The number of stocks that declined in the main market are Jamaica Money Market Brokers with 1,298 shares in losing 2 cents to end at $7.22, Sagicor Group 106,867 shares to close down by 30 cents at $9.50 and Seprod with 1,022 at $10.80 for a 4 cents fall.

Junior Market| The JSE Junior Market Index advanced by 2.92 points to close at 754.26 as only 6 stocks traded in that market.

Gains| Lasco Manufacturing was the only stock recording a gain at the end of trading in the junior market as 44,697 shares changed hands to close up by 9 cents at $1.19.

Firm Trades| Stocks in the junior market that traded to close at the same price as the day before are AMG Packaging with 500 units at $3.50, Blue Power with 19,438 units at $9.01, Derrimon Trading 12,000 units at $2.28, Lasco Distributors 37,300 shares at $1.40 and Lasco Financial Services 14,000 units at $1.20. Access Financial 9% Unsecured Short Term Notes traded 9,000 units at $99.50.

Declines| No stock declined in the junior market at the end of trading on Monday.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 8 stocks with the bid higher than the last selling price and 9 stocks with offers that were lower.

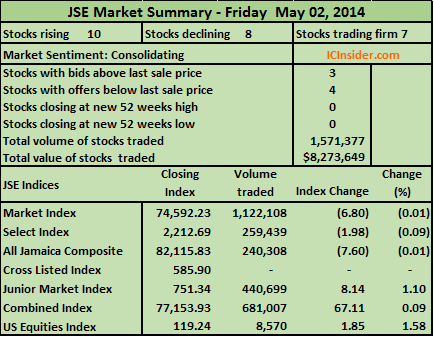

Very moderate market movement

There was very moderate activity on the Jamaica Stock Exchange at the close of the trading week as the prices of 10 stocks rose and 8 declined as only 25 securities traded in a very slow market session resulting in 1,571,377 shares trading valued at a mere $8,273,649.

Main Market| Six companies in the main and US dollar markets advanced and 6 declined as the indices moved down moderately with the JSE Market Index inching down by 6.80 points to 74,592.23 and the JSE All Jamaican Composite index shedding just 7.60 points to close at 82,115.83.

Main Market| Six companies in the main and US dollar markets advanced and 6 declined as the indices moved down moderately with the JSE Market Index inching down by 6.80 points to 74,592.23 and the JSE All Jamaican Composite index shedding just 7.60 points to close at 82,115.83.

Gains| Stocks recording gains at the end of trading in the main market are Kingston Wharves with 9,534 shares to close with a gain of 48 cents at $5.99, National Commercial Bank gained 10 cents to close at $18.10 with 9,100 units changing hands, Proven Investments ordinary share, with 8,570 units to close up 0.02 us cents at 18 US cents, Sagicor Group 18,000 units closing at $9.80 for a 30 cents gain, Salada Foods 5,000 shares to close at $8 as the price gained 50 cents and Scotia Investments with only 700 shares to end at $23.10 for a gain of 10 cents.

Firm| There were only 4 stocks in the main market to close without a change in price as Cable & Wireless with 43,699 shares closed at 40 cents, Carreras with 5,000 units closed at $33.56, Jamaica Money Market Brokers 7.50% preference share traded 500,000 and closed at $2 and Proven Investments 8% preference share with 381,800 units closed at $5.07.

Declines| The stocks declining in the main market are Gleaner with 2,500 shares while falling a cent to close at $1.10, Grace Kennedy lost $1.49 to end at $56.51 with 1,600 shares, Jamaica Broilers exchanged 20,538 units to close down a cent at $4.85. Pan Jamaican Investment 10,529 shares to end 55 cents lower at $49.05, Scotia Group had 110,308 units at $20.50 at the close as the price shed 12 cents and Supreme Ventures 3,800 shares to close with a 5 cents decline at $2.05.

Junior Market| The JSE Junior Market Index declined by 8.14 points to close at 751.34 as 9 stocks traded with 4 advancing and only 2 declining.

Gains| Stocks recording gains at the end of trading in the junior market are AMG Packaging that traded 5,560 units to close at $3.50, up by a cent, Access Financial with 72,600 units to close at $11.50 with a gain of $1.50, Caribbean Cream 3,000 units to close at 79 cents with a 4 cents increase and Caribbean Producers with 90,000 units in closing at $3, up 2 cents.

Firm Trades| The 3 stocks in the junior market traded to close at the same price as the day before are Blue Power with 3,400 shares in closing at $9.01, Lasco Financial 3,000 shares while closing at $1.20 and Medical Disposables 94,700 units, closing at $2.04.

Declines| Stocks declining in the junior market at the end of trading are General Accident with 2,000 units a $1.60, down 10 cents and Lasco Manufacturing with 166,439 shares to end down by 10 cents at $1.10.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 3 stocks with the bid higher than the last selling price and 4 stocks with offers that were lower.

AMG gearing for further growth

AMG Packaging is out with flat results for the year to August with profits of $49 million up about 4 percent from 2012, even as revenues from goods sold climbed 24 percent to $444 million as a result of a 16 percent increase in the volume of items sold.

The company reported improvement in gross profit which increased by 32 percent compared to the 2012 figure of 31 percent as it grew faster than sales. Increased administrative cost ate up just about all of the improvement in increased efficiency in the factory operations. This was due mainly to what management attributed to a revision to wage package, as there was no increase since 2009. Gross profit margin increased to 33 percent in the year from 31 percent in 2012 and 26 percent in 2011. In 2010 the margin was at 32 percent.

August quarter | Data indicates a 37 percent jump in revenues to $128 million but that was not enough to prevent a fall in profits in the quarter to $14 million versus $16 million in the 2012 quarter as just about all major areas of cost rose sharply. Raw material cost is up 49 percent, direct manufacturing cost grew by 42 percent, administration grew 36 percent, finance cost rose 197 percent and depreciation by 71 percent.

Negatively, return on equity fell in the year to 18.6 percent versus 22 percent in 2012 and 24.5 percent in 2011, clearly an area where work is needed. The company is working to improve efficiency and expansion of production by investing in new machines. During the year the company expended money on roof relays and some other items that have an one-off effect and not likely to be repeated in the coming year and should free the profit going forward. They are also moving to use LPG instead of placing total reliance on the electric grid, which they say will reduce energy cost in the coming year.

Negatively, return on equity fell in the year to 18.6 percent versus 22 percent in 2012 and 24.5 percent in 2011, clearly an area where work is needed. The company is working to improve efficiency and expansion of production by investing in new machines. During the year the company expended money on roof relays and some other items that have an one-off effect and not likely to be repeated in the coming year and should free the profit going forward. They are also moving to use LPG instead of placing total reliance on the electric grid, which they say will reduce energy cost in the coming year.

Management, in their report to investors, indicated that a multi-functional machine on order will replace older manual ones and a rotary die cut machine is being manufactured. Both are expected to be functional in the November quarter of 2013. These machines are expected to increase production and enhance the quality of products.

Finances | Current assets of $209 million including cash of $34 million is more than adequate to cover current liabilities of $71 million. Inventories climbed sharply to $93 million from $75 million in 2012 but it represents just under one and a half months of raw material cost.

Money borrowed rose to $85 million, an increase on the $29 million at the end of the prior year, with most of the increase used to fund expansion of the factory and added machinery. The debt compares favourably with equity of $291 million.

The stock recently declined to $3.50 and became weak sometime after the third quarter numbers were released suggesting minimal growth in the bottom line. Notwithstanding, the junior market has been exhibiting softness across most stocks. As such there could well be further decline in this stock price as there does not seem to be any major buying interest currently.

Insider call | With the expansion and modernisation that is underway and the tendency for sales to be boosted by increased volume the stock should be an attractive buy as a medium to long term investment around $3 per share.

Related posts | AMG is investing for tomorrow