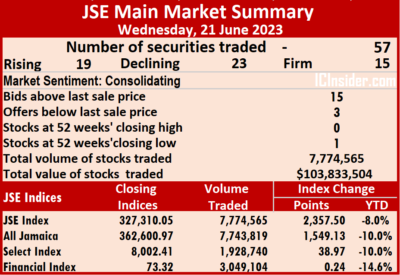

Trading activity on the Jamaica Stock Exchange Main Market ended on Wednesday, with the volume of stocks traded declining 75 percent accompanied by an 83 percent fall in the value compared with that on Tuesday, after 57 securities were traded compared with 55 on Tuesday, and resulting in the prices of 19 rising, 23 declining and 15 ending unchanged.

A total of 7,774,565 shares were traded for $103,833,504, down from 31,469,005 units at $596,839,341 on Tuesday.

A total of 7,774,565 shares were traded for $103,833,504, down from 31,469,005 units at $596,839,341 on Tuesday.

Trading averaged 136,396 shares at $1,821,640 compared with 572,164 stocks at $10,851,624 on Tuesday. The average trade month to date is 347,633 shares at $5,082,435 versus 362,797 units at $5,316,522 on the previous day. May closed with an average of 226,361 shares at $1,362,447.

Transjamaican Highway led trading with 1.61 million shares for 20.6 percent of total volume followed by QWI Investments with 1.17 million units for 15 percent of the day’s trade, Sagicor Select Financial Fund ended with 1.16 million units for 14.9 percent market share and NCB Financial with 1.09 million units for 14 percent of total volume.

The All Jamaican Composite Index rose 1,549.13 points to settle at 362,600.97, the JSE Main Index increased 2,357.50 points to end at 327,310.05 and the JSE Financial Index rallied 0.24 points to 73.32.

The All Jamaican Composite Index rose 1,549.13 points to settle at 362,600.97, the JSE Main Index increased 2,357.50 points to end at 327,310.05 and the JSE Financial Index rallied 0.24 points to 73.32.

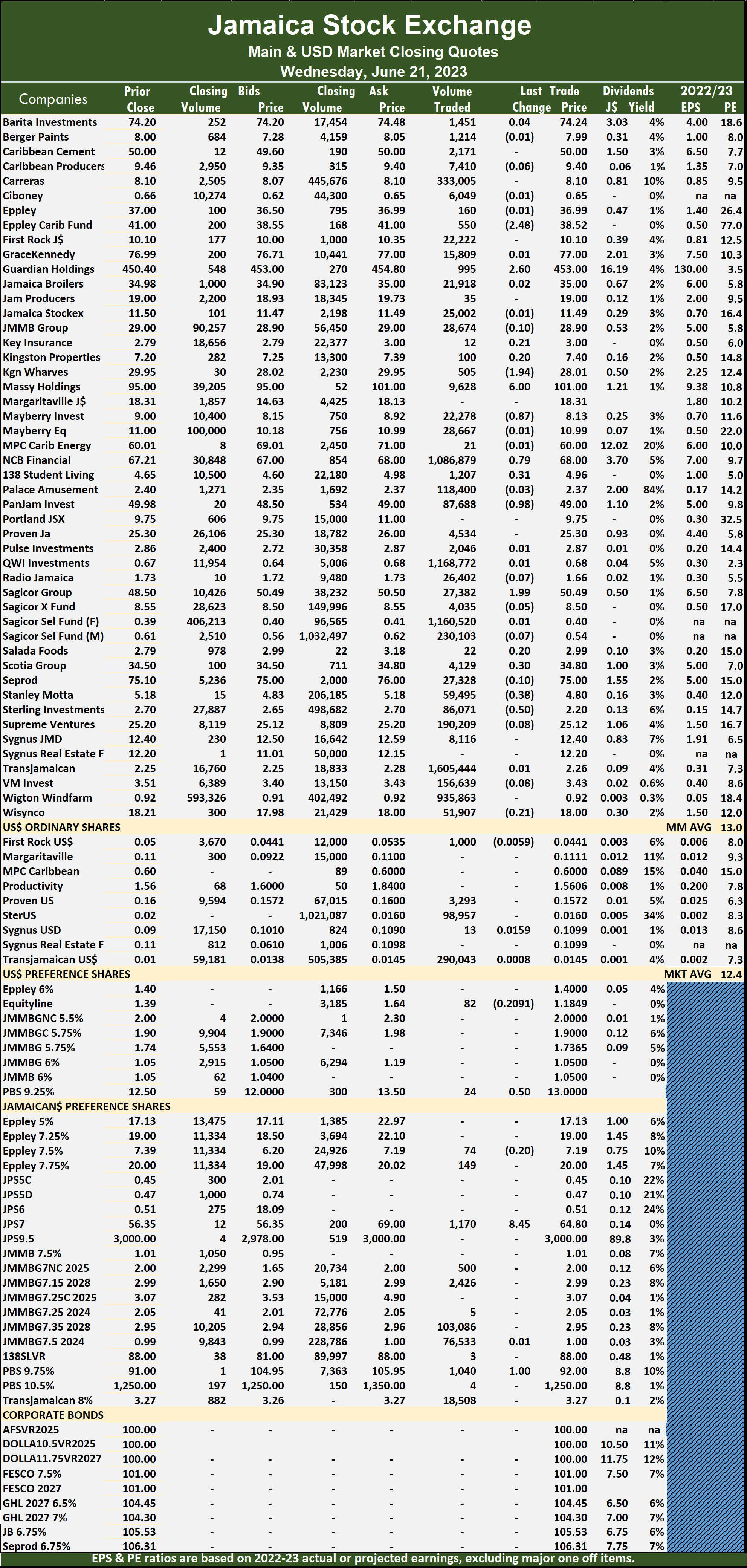

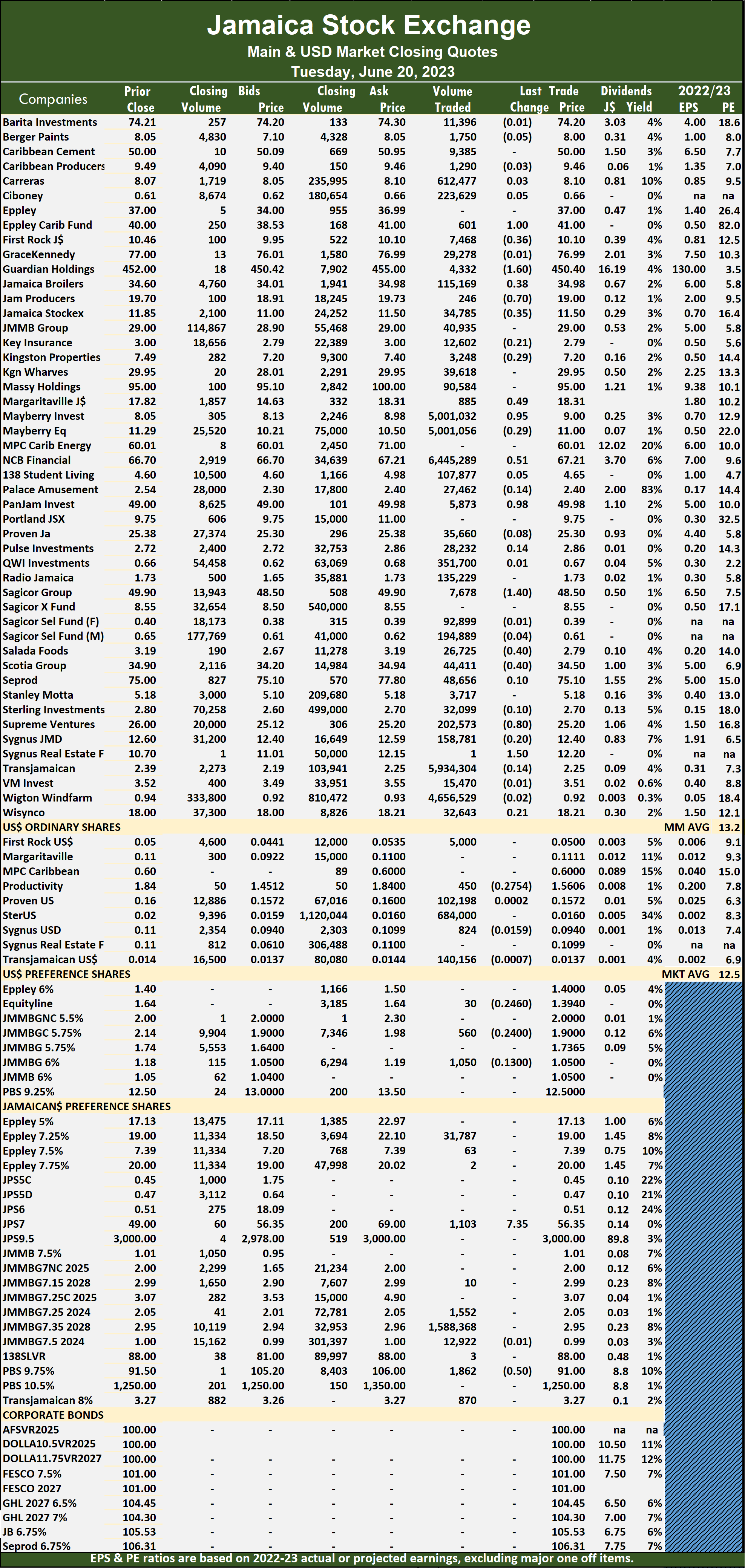

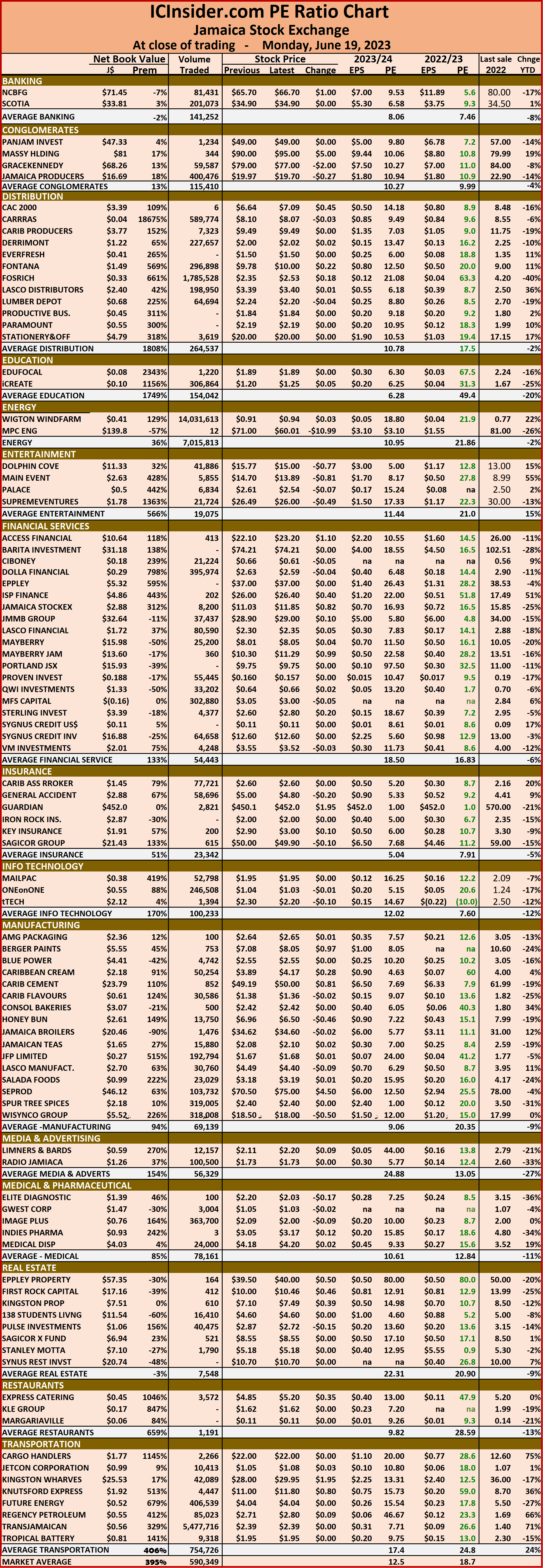

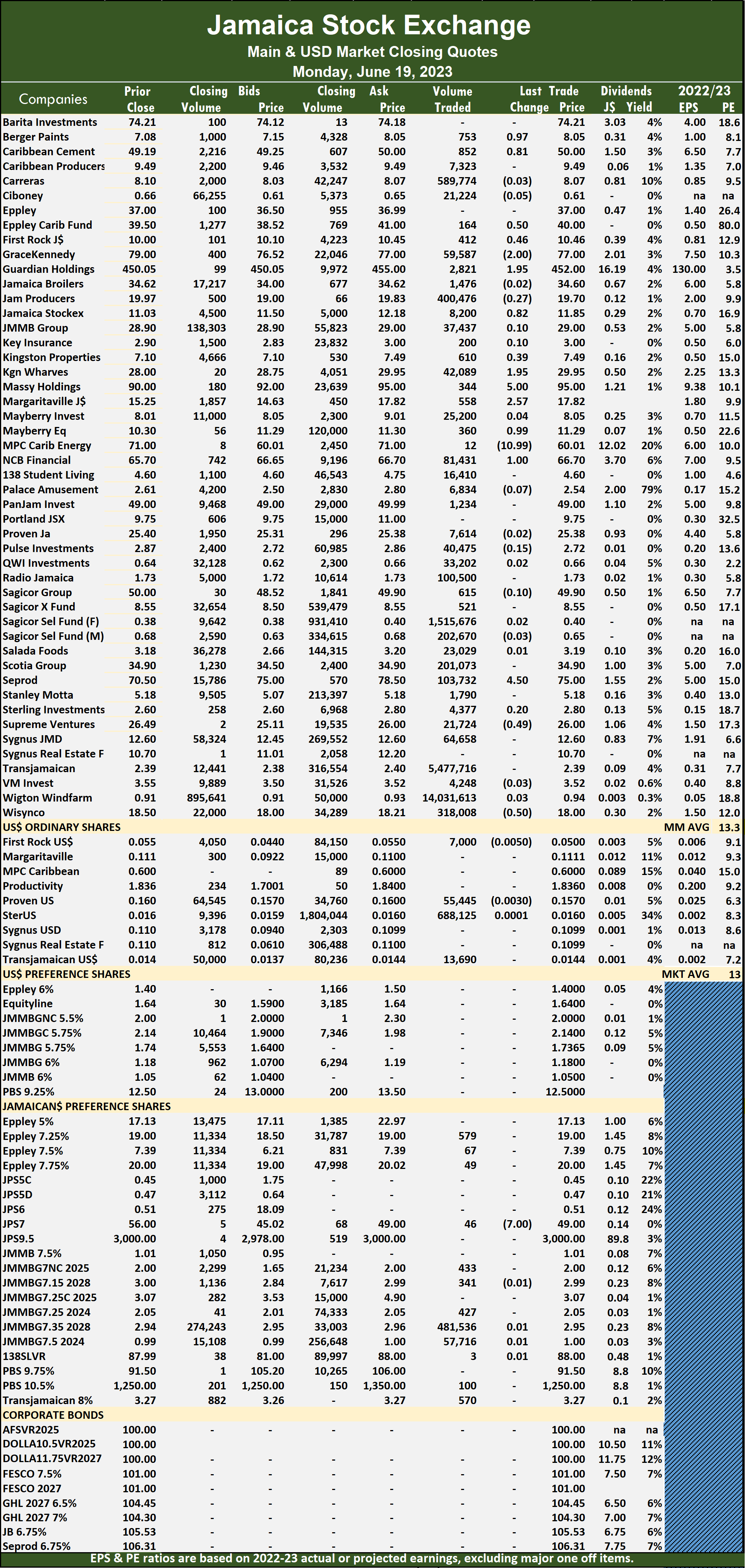

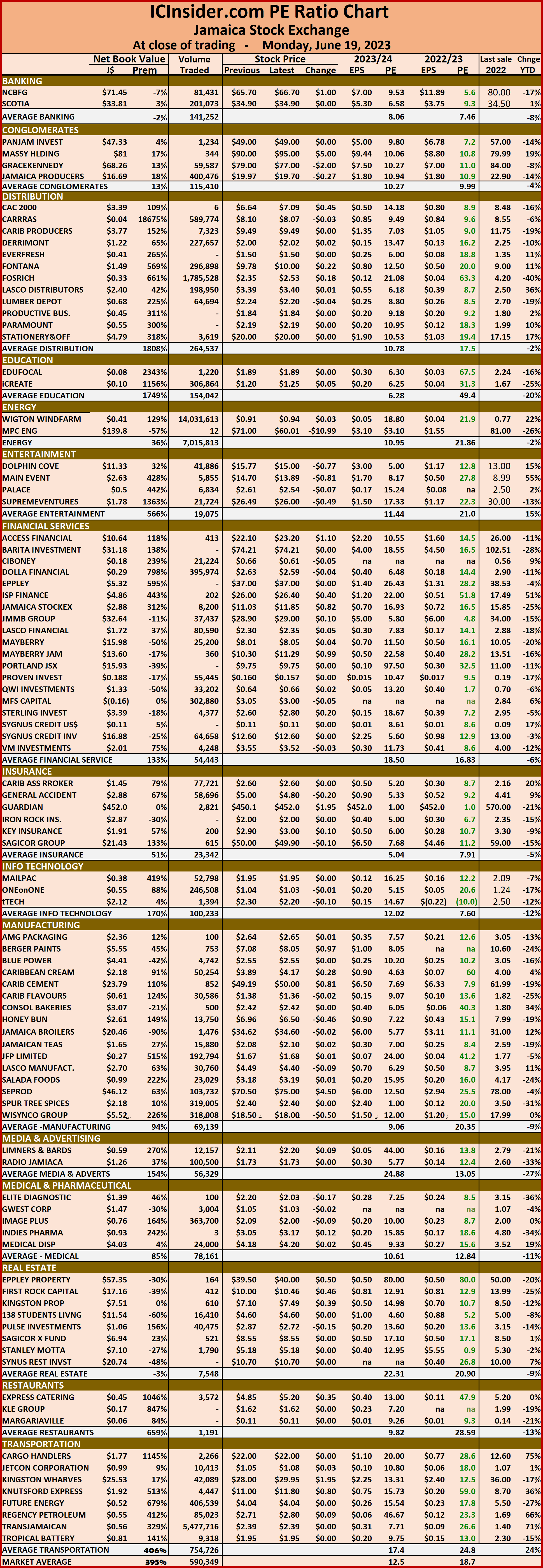

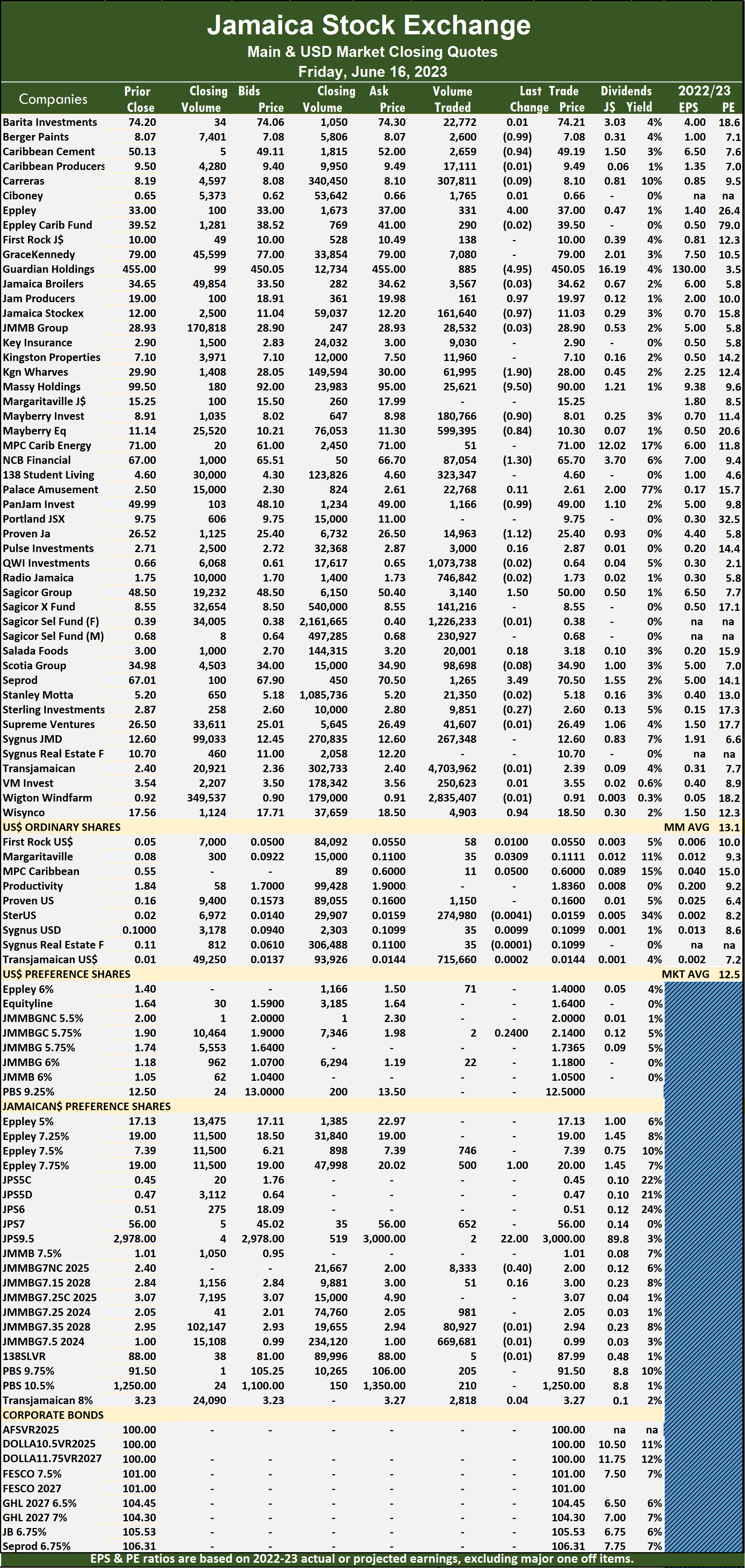

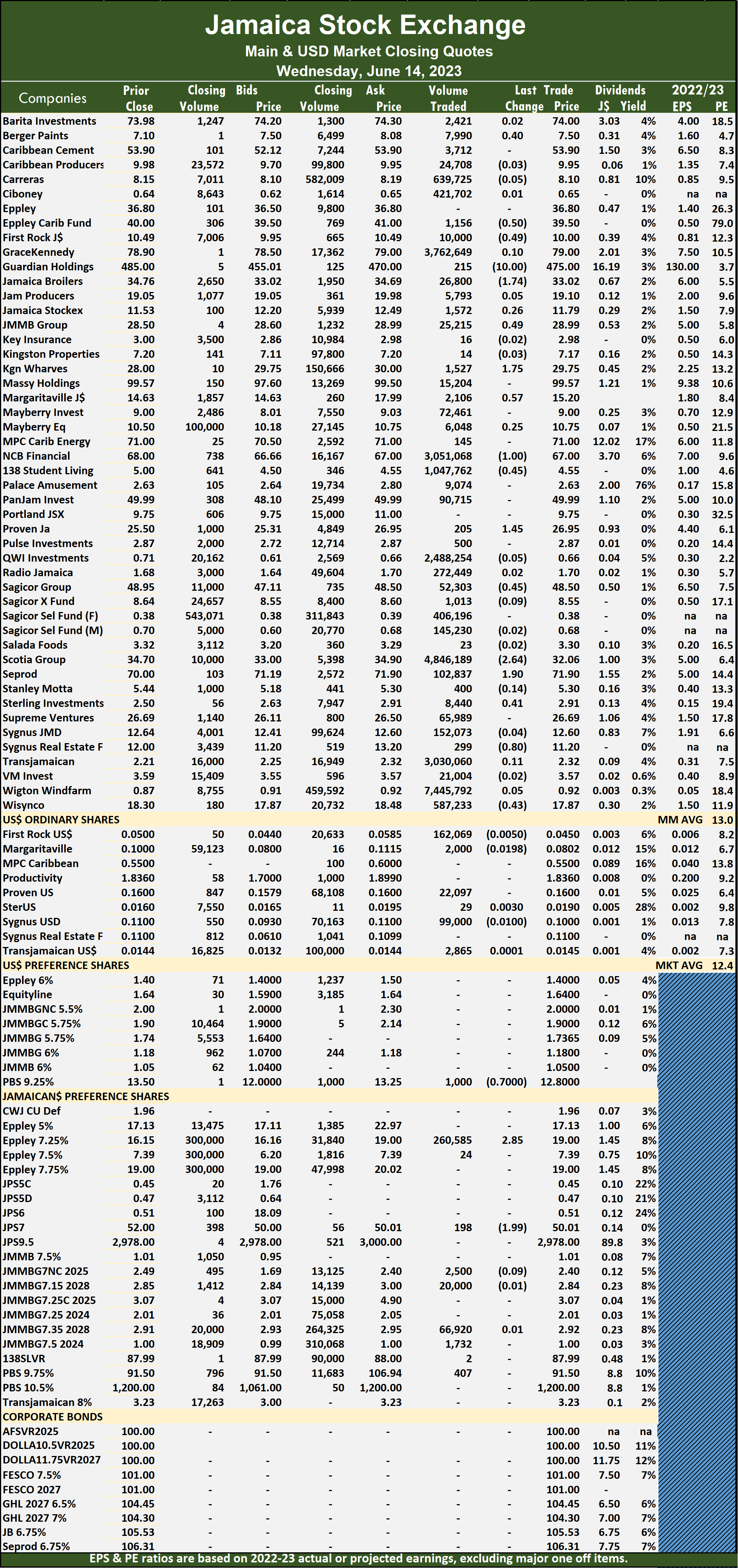

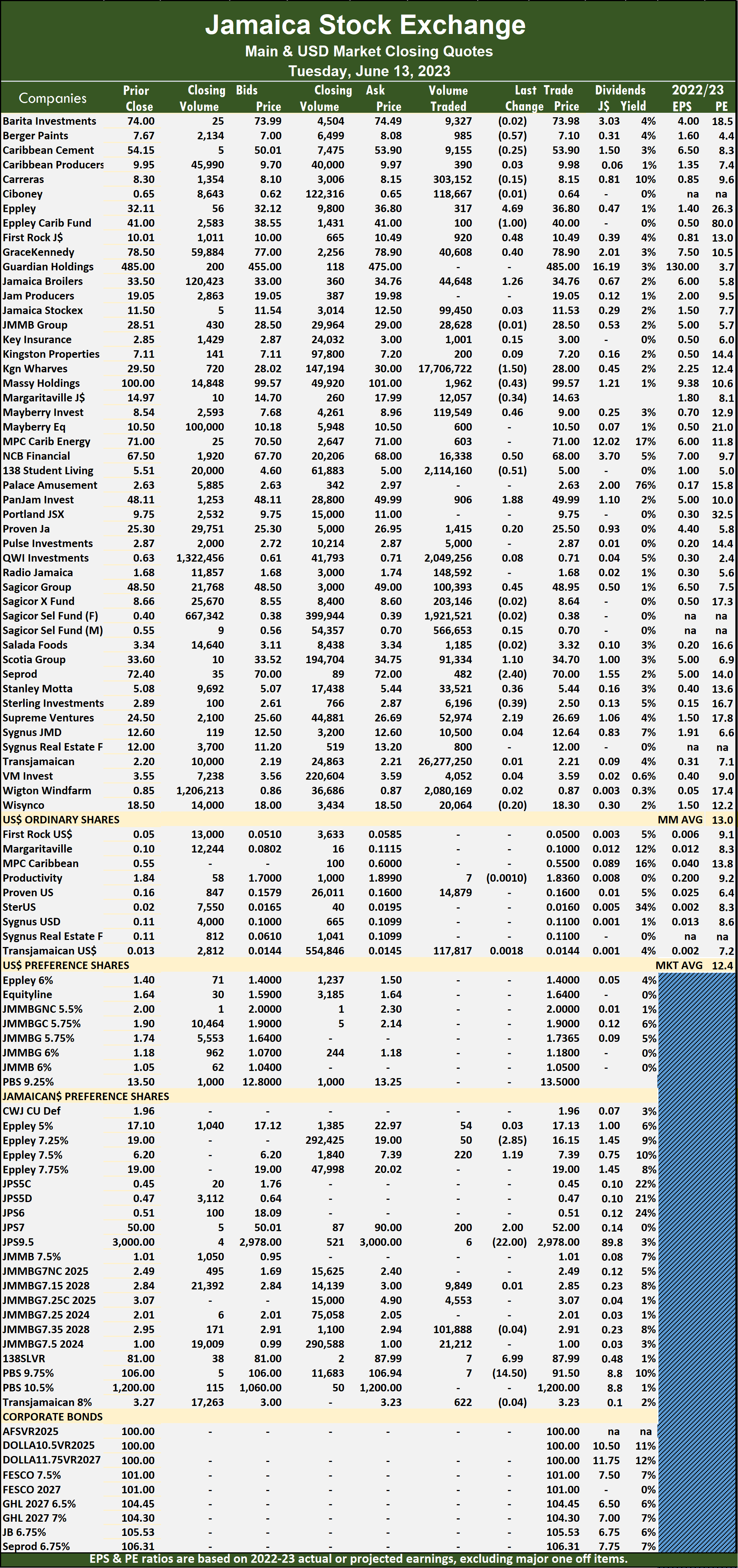

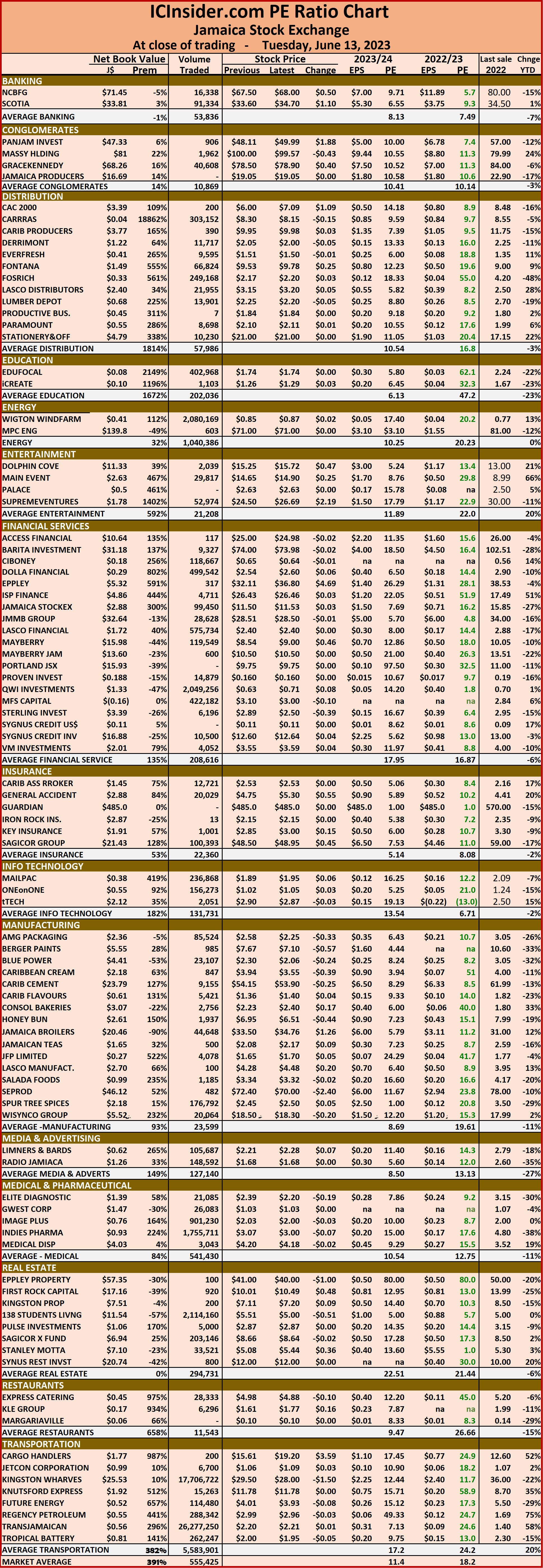

The PE Ratio, a formula used to compute appropriate stock values, averages 13 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

Investor’s Choice bid-offer indicator shows 15 stocks ended with bids higher than their last selling prices and three with lower offers.

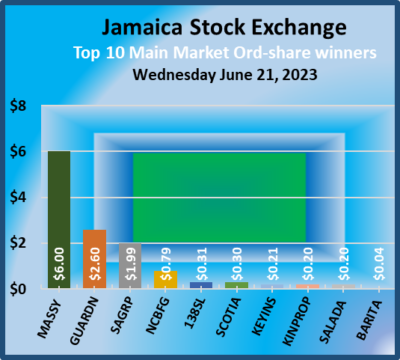

At the close, Eppley Caribbean Property Fund lost $2.48 to close at $38.52 after 550 shares passed through the market,  Guardian Holdings rallied $2.60 in closing at $453 after traders exchanged 995 stocks, Kingston Wharves dipped $1.94 to end at $28.01 with shareholders swapping 505 stock units. Massy Holdings jumped $6 to end at $101 in an exchange of 9,628 units, Mayberry Investments declined 87 cents and ended at $8.13 with investors transferring 22,278 stock units, NCB Financial rose 79 cents to $68 following the trading of 1,086,879 shares. 138 Student Living advanced 31 cents to end at $4.96 with a transfer of 1,207 shares, Pan Jamaica dipped 98 cents to $49 after trading 87,688 stocks, Sagicor Group climbed $1.99 in closing at $50.49 after an exchange of 27,382 units. Scotia Group gained 30 cents and ended at $34.80 in an exchange of 4,129 shares, Stanley Motta shed 38 cents to $4.80, with 59,495 stocks clearing the market and Sterling Investments fell 50 cents to close at $2.20 while exchanging 86,071 stock units.

Guardian Holdings rallied $2.60 in closing at $453 after traders exchanged 995 stocks, Kingston Wharves dipped $1.94 to end at $28.01 with shareholders swapping 505 stock units. Massy Holdings jumped $6 to end at $101 in an exchange of 9,628 units, Mayberry Investments declined 87 cents and ended at $8.13 with investors transferring 22,278 stock units, NCB Financial rose 79 cents to $68 following the trading of 1,086,879 shares. 138 Student Living advanced 31 cents to end at $4.96 with a transfer of 1,207 shares, Pan Jamaica dipped 98 cents to $49 after trading 87,688 stocks, Sagicor Group climbed $1.99 in closing at $50.49 after an exchange of 27,382 units. Scotia Group gained 30 cents and ended at $34.80 in an exchange of 4,129 shares, Stanley Motta shed 38 cents to $4.80, with 59,495 stocks clearing the market and Sterling Investments fell 50 cents to close at $2.20 while exchanging 86,071 stock units.

In the preference segment, Jamaica Public Service 7% popped $8.45 in closing at $64.80, with 1,170 stocks crossing the market and Productive Business Solutions 9.75% preference share popped $1 to end at $92, with 1,040 shares changing hands.

In the preference segment, Jamaica Public Service 7% popped $8.45 in closing at $64.80, with 1,170 stocks crossing the market and Productive Business Solutions 9.75% preference share popped $1 to end at $92, with 1,040 shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

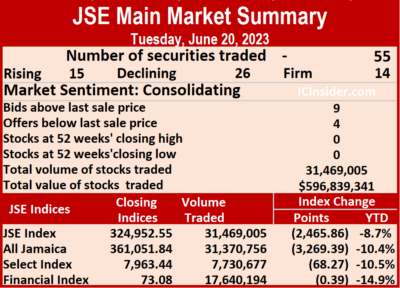

A total of 31,469,005 shares were traded for $596,839,341 compared with 24,000,889 units at $78,140,528 on Monday.

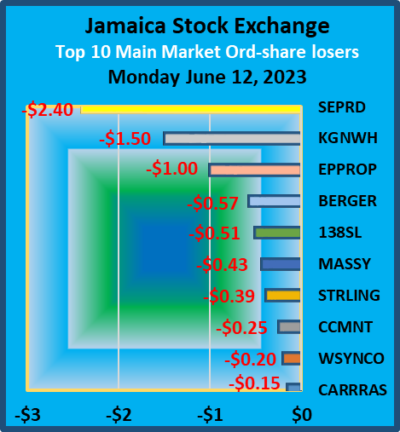

A total of 31,469,005 shares were traded for $596,839,341 compared with 24,000,889 units at $78,140,528 on Monday. The All Jamaican Composite Index fshed 3,269.39 points to end at 361,051.84, the JSE Main Index declined 2,465.86 points to 324,952.55 and the JSE Financial Index dipped 0.39 points to 73.08.

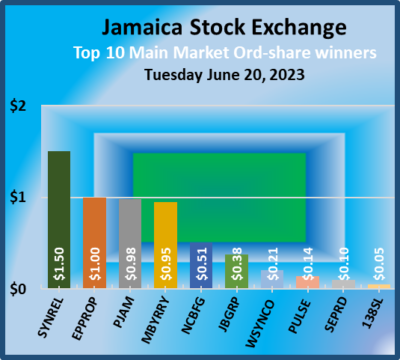

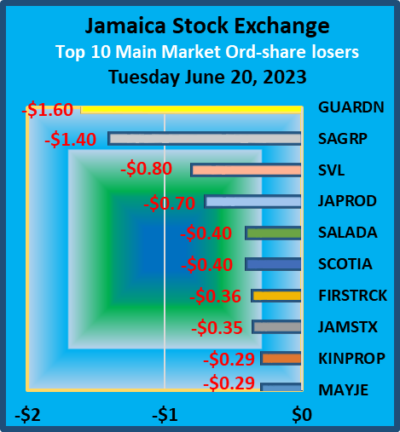

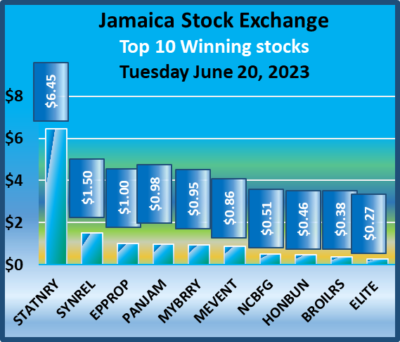

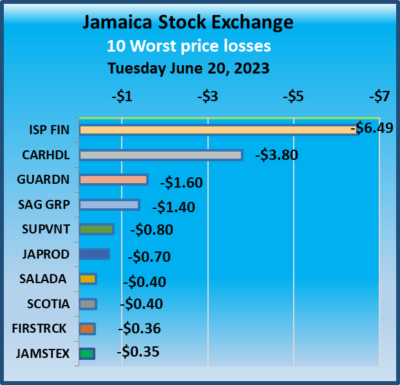

The All Jamaican Composite Index fshed 3,269.39 points to end at 361,051.84, the JSE Main Index declined 2,465.86 points to 324,952.55 and the JSE Financial Index dipped 0.39 points to 73.08. Jamaica Producers dropped 70 cents and ended at $19 with investors trading 246 stock units, Jamaica Stock Exchange dipped 35 cents and ended at $11.50 after a transfer of 34,785 stocks. Margaritaville rallied 49 cents to $18.31 as investors exchanged 885 shares, Mayberry Investments rose 95 cents in closing at $9 after 5,001,032 units were traded, NCB Financial climbed 51 cents to end at $67.21 with stakeholders exchanging 6,445,289 units. Pan Jamaica Group increased 98 cents to close at $49.98 after 5,873 stock units passed through the market, Sagicor Group lost $1.40 to end at $48.50 as 7,678 stocks passed through the market, Salada Foods declined 40 cents to $2.79, with 26,725 shares crossing the exchange. Scotia Group shed 40 cents to close at $34.50 with a transfer of 44,411 shares,

Jamaica Producers dropped 70 cents and ended at $19 with investors trading 246 stock units, Jamaica Stock Exchange dipped 35 cents and ended at $11.50 after a transfer of 34,785 stocks. Margaritaville rallied 49 cents to $18.31 as investors exchanged 885 shares, Mayberry Investments rose 95 cents in closing at $9 after 5,001,032 units were traded, NCB Financial climbed 51 cents to end at $67.21 with stakeholders exchanging 6,445,289 units. Pan Jamaica Group increased 98 cents to close at $49.98 after 5,873 stock units passed through the market, Sagicor Group lost $1.40 to end at $48.50 as 7,678 stocks passed through the market, Salada Foods declined 40 cents to $2.79, with 26,725 shares crossing the exchange. Scotia Group shed 40 cents to close at $34.50 with a transfer of 44,411 shares,  Supreme Ventures dropped 80 cents to end at $25.20 in an exchange of 202,573 units and Sygnus Real Estate Finance popped $1.50 in closing at $12.20 in switching ownership of just one stock unit.

Supreme Ventures dropped 80 cents to end at $25.20 in an exchange of 202,573 units and Sygnus Real Estate Finance popped $1.50 in closing at $12.20 in switching ownership of just one stock unit. Elsewhere, the Main Market declined, but the Junior Market closed above the 3,900 mark for the first time since the middle of February this year, the JSE USD Market closed lower at the end of increased trading.

Elsewhere, the Main Market declined, but the Junior Market closed above the 3,900 mark for the first time since the middle of February this year, the JSE USD Market closed lower at the end of increased trading. Trading on the JSE USD market resulted in investors exchanging 934,268 shares for US$32,448 compared to 764,260 units at US$20,272 on Monday.

Trading on the JSE USD market resulted in investors exchanging 934,268 shares for US$32,448 compared to 764,260 units at US$20,272 on Monday. Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume about the highest bid and the lowest offer for each company.

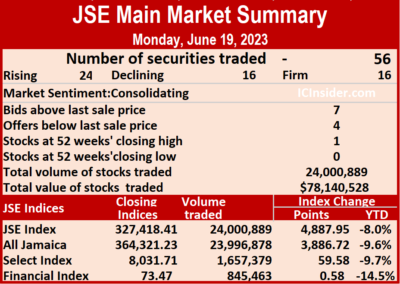

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume about the highest bid and the lowest offer for each company. A total of 24,000,889 shares were traded for $78,140,528 up on the 14,340,680 units at $56,260,192 that were exchanged on Friday.

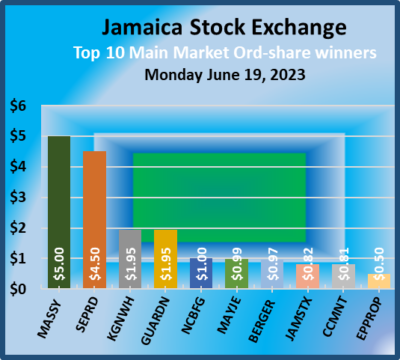

A total of 24,000,889 shares were traded for $78,140,528 up on the 14,340,680 units at $56,260,192 that were exchanged on Friday. The All Jamaican Composite Index jumped 3,886.72 points to 364,321.23, the JSE Main Index surged 4,887.95 points to close at 327,418.41 and the JSE Financial Index inched 0.58 points higher to end at 73.47.

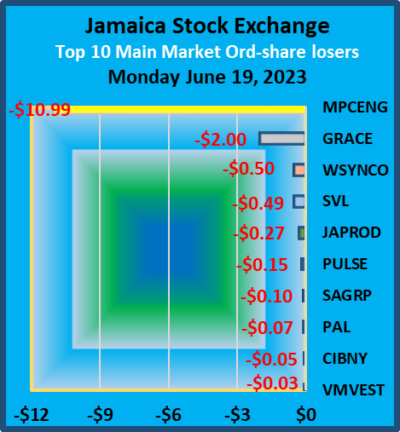

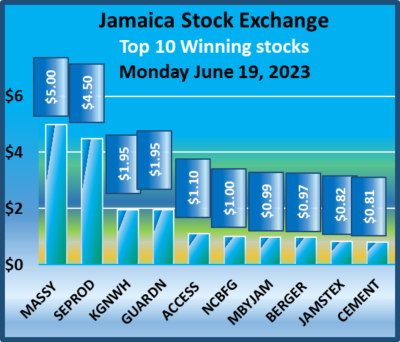

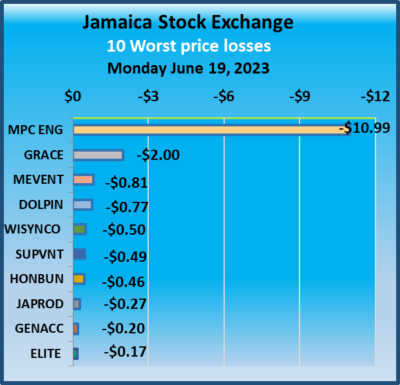

The All Jamaican Composite Index jumped 3,886.72 points to 364,321.23, the JSE Main Index surged 4,887.95 points to close at 327,418.41 and the JSE Financial Index inched 0.58 points higher to end at 73.47. GraceKennedy declined $2 and ended at $77 after 59,587 shares were transferred, Guardian Holdings popped $1.95 to close at $452 with investors trading 2,821 stocks. Jamaica Stock Exchange climbed 82 cents to end at $11.85 with investors transferring 8,200 stock units, Kingston Properties rose 39 cents to $7.49 while traders exchanged 610 units, Kingston Wharves popped $1.95 and ended at $29.95 after trading 42,089 stock units. Margaritaville rose $2.57 in closing at $17.82 with stakeholders trading 558 shares, Massy Holdings climbed $5 to $95, with 344 stocks crossing the market, Mayberry Jamaican Equities advanced 99 cents to end at $11.29 with shareholders swapping 360 units. MPC Caribbean Clean Energy dropped $10.99 to close at $60.01 and closed after 12 shares changed hands, NCB Financial rallied $1 in closing at $66.70 in an exchange of 81,431 stock units.

GraceKennedy declined $2 and ended at $77 after 59,587 shares were transferred, Guardian Holdings popped $1.95 to close at $452 with investors trading 2,821 stocks. Jamaica Stock Exchange climbed 82 cents to end at $11.85 with investors transferring 8,200 stock units, Kingston Properties rose 39 cents to $7.49 while traders exchanged 610 units, Kingston Wharves popped $1.95 and ended at $29.95 after trading 42,089 stock units. Margaritaville rose $2.57 in closing at $17.82 with stakeholders trading 558 shares, Massy Holdings climbed $5 to $95, with 344 stocks crossing the market, Mayberry Jamaican Equities advanced 99 cents to end at $11.29 with shareholders swapping 360 units. MPC Caribbean Clean Energy dropped $10.99 to close at $60.01 and closed after 12 shares changed hands, NCB Financial rallied $1 in closing at $66.70 in an exchange of 81,431 stock units. Seprod increased $4.50 and ended at $75, with 103,732 stocks clearing the market, Supreme Ventures fell 49 cents to close at $26 in an exchange of 21,724 units and Wisynco Group shed 50 cents to $18, with 318,008 stock units changing hands.

Seprod increased $4.50 and ended at $75, with 103,732 stocks clearing the market, Supreme Ventures fell 49 cents to close at $26 in an exchange of 21,724 units and Wisynco Group shed 50 cents to $18, with 318,008 stock units changing hands. At the close, the JSE Combined Market Index jumped 4,488.68 points to close at 341,020.08 the All Jamaican Composite Index rallied 3,886.72 points to 364,321.23, the JSE Main Index surged 4,887.95 points to 327,418.41, the Junior Market Index slipped 7.88 points to 3,879.91, as the JSE USD Market Index slipped 1.17 points to close a 241.01.

At the close, the JSE Combined Market Index jumped 4,488.68 points to close at 341,020.08 the All Jamaican Composite Index rallied 3,886.72 points to 364,321.23, the JSE Main Index surged 4,887.95 points to 327,418.41, the Junior Market Index slipped 7.88 points to 3,879.91, as the JSE USD Market Index slipped 1.17 points to close a 241.01.  The market’s PE ratio ended at 18.7 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading.

The market’s PE ratio ended at 18.7 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading. The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. The Junior Market has broken through the downward-sloping resistance line of the wedge. The Junior Market reclaimed the 3,800 handle last week and is close to retaking the 3,900 level shortly, with the market set for a big rally in the second half of the year a position supported by technical analysis of the market. The Main Market seems to be weighed down by concerns relating to inflation and interest rates, if so the reading is wrong as inflation is well under control and interest rates will start dropping before the year ends.

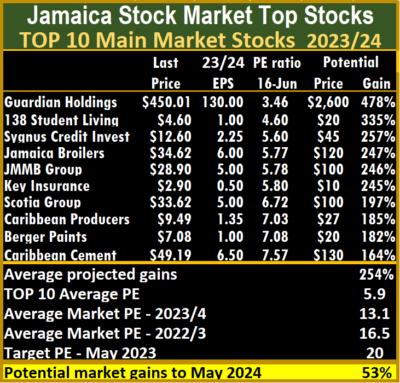

The Junior Market has broken through the downward-sloping resistance line of the wedge. The Junior Market reclaimed the 3,800 handle last week and is close to retaking the 3,900 level shortly, with the market set for a big rally in the second half of the year a position supported by technical analysis of the market. The Main Market seems to be weighed down by concerns relating to inflation and interest rates, if so the reading is wrong as inflation is well under control and interest rates will start dropping before the year ends. Transjamaican moved out of the Main Market TOP10, with a gain of 27 percent since entering the TOP10 and 35 percent since it was added to

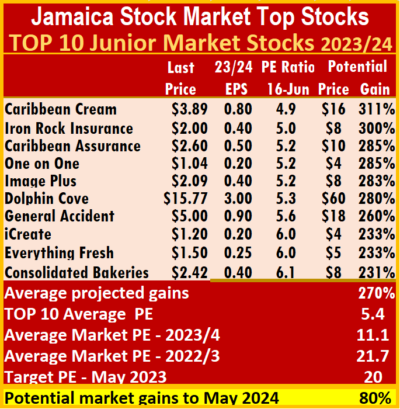

Transjamaican moved out of the Main Market TOP10, with a gain of 27 percent since entering the TOP10 and 35 percent since it was added to  The Junior Market Top 10 PE sits at 5.8 compared with the market at 11.1. There are 11 stocks representing 23 percent of the market, with PE from 15 to 42, averaging 21 that are well above the average of the market. The top half of the market has an average PE of 16, possibly the lowest fair value for Junior Market stocks currently. Junior Market is projected to rise by 270 percent to May 2024.

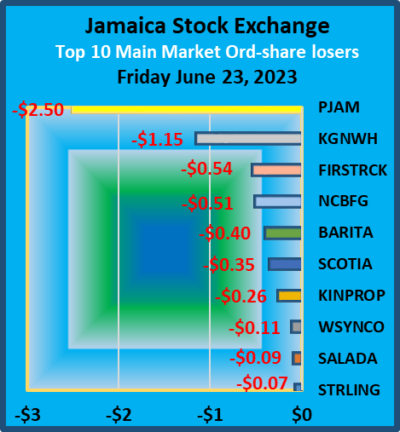

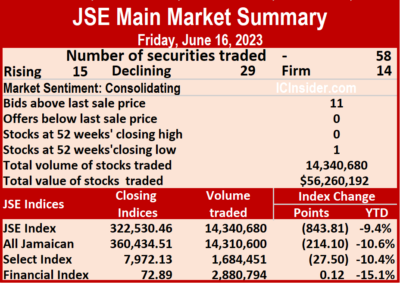

The Junior Market Top 10 PE sits at 5.8 compared with the market at 11.1. There are 11 stocks representing 23 percent of the market, with PE from 15 to 42, averaging 21 that are well above the average of the market. The top half of the market has an average PE of 16, possibly the lowest fair value for Junior Market stocks currently. Junior Market is projected to rise by 270 percent to May 2024. A total of 58 securities changed hands compared with 59 on Thursday and ended with 15 rising 29 declining and 14 unchanged as two stocks hit 52 weeks’ lows, with NCB Financial closing act is 52 weeks’ low of $65.70 while Salada Foods dipped to a 52 weeks’ intraday low of $2.51.

A total of 58 securities changed hands compared with 59 on Thursday and ended with 15 rising 29 declining and 14 unchanged as two stocks hit 52 weeks’ lows, with NCB Financial closing act is 52 weeks’ low of $65.70 while Salada Foods dipped to a 52 weeks’ intraday low of $2.51.

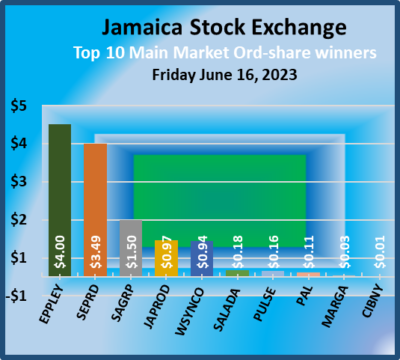

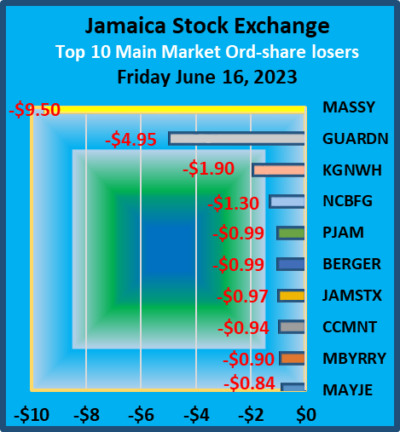

Kingston Wharves declined $1.90 to $28 in switching ownership of 61,995 units, Massy Holdings lost $9.50 in ending at $90 with 25,621 shares clearing the market, Mayberry Investments fell 90 cents to $8.01 in an exchange of 180,766 stock units, Mayberry Jamaican Equities lost 84 cents to end at $10.30, with 599,395 units being traded, NCB Financial declined $1.30 to end at a 52 weeks’ low of $65.70 with an exchange of 87,054 stocks, Pan Jamaica Group dipped 99 cents to $49 in trading 1,166 shares Proven Investments dropped $1.12 to close at $25.40 after an exchange 14,963 stock units, Sagicor Group gained $1.50 in closing at $50 as investors exchanged 3,140 stocks, Seprod advanced $3.49 and ended at $70.50 after 1,265 shares changed hands and Wisynco Group rallied 94 cents to end at $18.50 after 4,903 units crossed the market.

Kingston Wharves declined $1.90 to $28 in switching ownership of 61,995 units, Massy Holdings lost $9.50 in ending at $90 with 25,621 shares clearing the market, Mayberry Investments fell 90 cents to $8.01 in an exchange of 180,766 stock units, Mayberry Jamaican Equities lost 84 cents to end at $10.30, with 599,395 units being traded, NCB Financial declined $1.30 to end at a 52 weeks’ low of $65.70 with an exchange of 87,054 stocks, Pan Jamaica Group dipped 99 cents to $49 in trading 1,166 shares Proven Investments dropped $1.12 to close at $25.40 after an exchange 14,963 stock units, Sagicor Group gained $1.50 in closing at $50 as investors exchanged 3,140 stocks, Seprod advanced $3.49 and ended at $70.50 after 1,265 shares changed hands and Wisynco Group rallied 94 cents to end at $18.50 after 4,903 units crossed the market. In the preference segment, Eppley 7.75% preference share rose $1 to close at $20 as 500 stock units passed through the market, Jamaica Public Service 9.5% climbed $22 to $3000 with stakeholders exchanging 2 shares and JMMB Group 7% preference share dipped 40 cents to $2 with investors transferring 8,333 stocks.

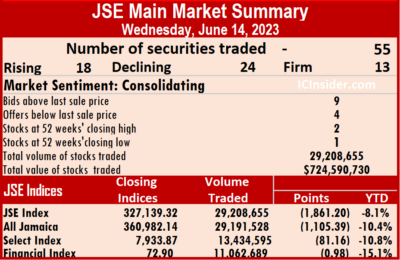

In the preference segment, Eppley 7.75% preference share rose $1 to close at $20 as 500 stock units passed through the market, Jamaica Public Service 9.5% climbed $22 to $3000 with stakeholders exchanging 2 shares and JMMB Group 7% preference share dipped 40 cents to $2 with investors transferring 8,333 stocks. Trading ended with 55 securities changing hands compared with 56 on Tuesday, resulting in prices of 18 rising, 24 declining and 13 ending unchanged, resulting in the trading of an average of 531,066 shares at $13,174,377 compared to 970,422 shares at $10,592,120 on Tuesday and month to date, an average of 349,102 units at $6,003,345, up from 329,517 units at $5,231,512 on the previous day. Trading in May ended with an average of 226,361 units at $1,362,447.

Trading ended with 55 securities changing hands compared with 56 on Tuesday, resulting in prices of 18 rising, 24 declining and 13 ending unchanged, resulting in the trading of an average of 531,066 shares at $13,174,377 compared to 970,422 shares at $10,592,120 on Tuesday and month to date, an average of 349,102 units at $6,003,345, up from 329,517 units at $5,231,512 on the previous day. Trading in May ended with an average of 226,361 units at $1,362,447. At the close of the market, the All Jamaican Composite Index shed 1,105.39 points to end at 360,982.14, the JSE Main Index dropped 1,861.20 points to 327,139.32 and the JSE Financial Index dipped 0.98 points to end at 72.90.

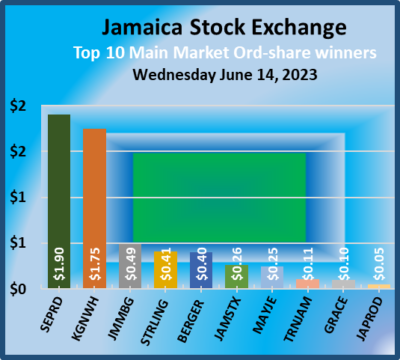

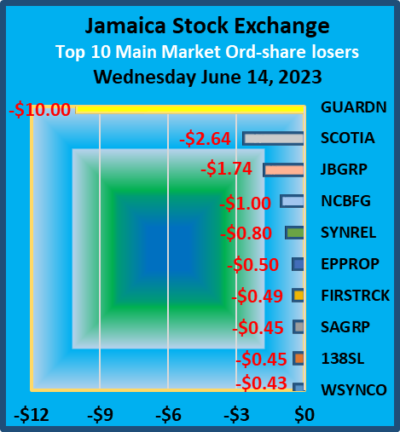

At the close of the market, the All Jamaican Composite Index shed 1,105.39 points to end at 360,982.14, the JSE Main Index dropped 1,861.20 points to 327,139.32 and the JSE Financial Index dipped 0.98 points to end at 72.90. Jamaica Broilers fell $1.74 in closing at $33.02 after an exchange of 26,800 units, JMMB Group rallied 49 cents to end at $28.99 with investors trading 25,215 stock units, Kingston Wharves advanced $1.75 to $29.75 after a transfer of 1,527 stocks, Margaritaville rose 57 cents ended at $15.20 with shareholders swapping 2,106 shares. NCB Financial declined $1 to $67 in trading 3,051,068 units, 138 Student Living dipped 45 cents in closing at $4.55, with 1,047,762 stocks crossing the market, Proven Investments popped $1.45 and ended at $26.95 after stakeholders exchanged 205 shares, Sagicor Group dropped 45 cents to $48.50 with an exchange of 52,303 stock units. Scotia Group dipped $2.64 in closing at $32.06 with a transfer of 4,846,189 stock units, Seprod climbed $1.90 to close at $71.90 with 102,837 stocks crossing the exchange,

Jamaica Broilers fell $1.74 in closing at $33.02 after an exchange of 26,800 units, JMMB Group rallied 49 cents to end at $28.99 with investors trading 25,215 stock units, Kingston Wharves advanced $1.75 to $29.75 after a transfer of 1,527 stocks, Margaritaville rose 57 cents ended at $15.20 with shareholders swapping 2,106 shares. NCB Financial declined $1 to $67 in trading 3,051,068 units, 138 Student Living dipped 45 cents in closing at $4.55, with 1,047,762 stocks crossing the market, Proven Investments popped $1.45 and ended at $26.95 after stakeholders exchanged 205 shares, Sagicor Group dropped 45 cents to $48.50 with an exchange of 52,303 stock units. Scotia Group dipped $2.64 in closing at $32.06 with a transfer of 4,846,189 stock units, Seprod climbed $1.90 to close at $71.90 with 102,837 stocks crossing the exchange,  Sterling Investments increased 41 cents to end at $2.91 after an exchange of 8,440 units, Sygnus Real Estate Finance declined 80 cents to $11.20 as investors exchanged 299 shares, Wisynco Group shed 43 cents in closing at $17.87, with 587,233 stock units crossing the market.

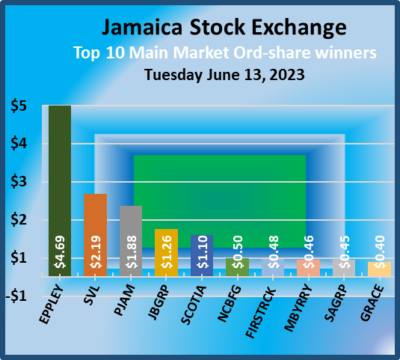

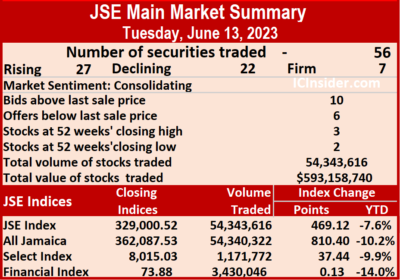

Sterling Investments increased 41 cents to end at $2.91 after an exchange of 8,440 units, Sygnus Real Estate Finance declined 80 cents to $11.20 as investors exchanged 299 shares, Wisynco Group shed 43 cents in closing at $17.87, with 587,233 stock units crossing the market. Trading occurred in 56 securities compared with 62 on Monday and ended with prices of 27 rising, 22 declining and seven unchanged as three stocks hit 52 weeks’ high and two 52 weeks’ low, stocks trading at 52 weeks’ high are Transjamaican closing at a record of $2.21, Sagicor Select MD at 70 cents and Wigton Windfarms at 87 cents while Barita closed at a 52 weeks’ low of $73.95 and Eppley 7.25 Preference Share at $16.15.

Trading occurred in 56 securities compared with 62 on Monday and ended with prices of 27 rising, 22 declining and seven unchanged as three stocks hit 52 weeks’ high and two 52 weeks’ low, stocks trading at 52 weeks’ high are Transjamaican closing at a record of $2.21, Sagicor Select MD at 70 cents and Wigton Windfarms at 87 cents while Barita closed at a 52 weeks’ low of $73.95 and Eppley 7.25 Preference Share at $16.15. The All Jamaican Composite Index rallied 810.40 points to 362,087.53, the JSE Main Index rose 469.12 points to 329,000.52 and the JSE Financial Index popped 0.13 points to close trading at 73.88.

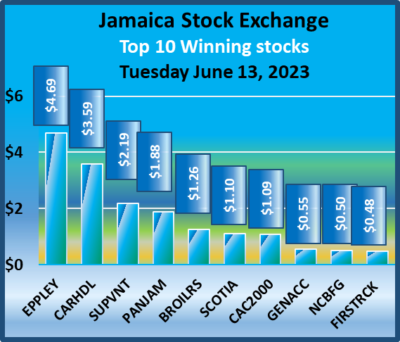

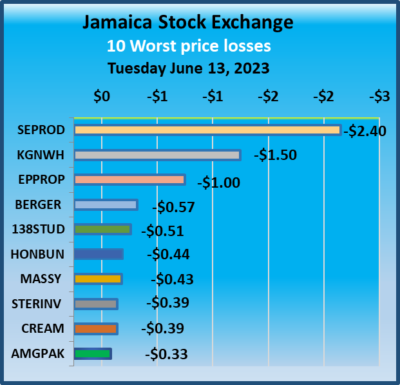

The All Jamaican Composite Index rallied 810.40 points to 362,087.53, the JSE Main Index rose 469.12 points to 329,000.52 and the JSE Financial Index popped 0.13 points to close trading at 73.88. Massy Holdings fell 43 cents to close at $99.57 in an exchange of 1,962 shares, Mayberry Investments gained 46 cents and ended at $9 after a transfer of 119,549 units, NCB Financial climbed 50 cents to end at $68 in trading 16,338 stock units, 138 Student Living lost 51 cents to close at $5, with 2,114,160 stocks changing hands, Pan Jamaica Group rose $1.88 to $49.99, with 906 shares crossing the market,Sagicor Group popped 45 cents to $48.95 as investors exchanged 100,393 stocks, Scotia Group rallied $1.10 in closing at $34.70 after an exchange of 91,334 stock units, Seprod shed $2.40 to end at $70 with a transfer of 482 units, Stanley Motta advanced 36 cents and ended at $5.44 after exchanging 33,521 shares, Sterling Investments slipped 39 cents to $2.50 after 6,196 stocks passed through the market, Supreme Ventures increased $2.19 to close at $26.69 trading 52,974 units.

Massy Holdings fell 43 cents to close at $99.57 in an exchange of 1,962 shares, Mayberry Investments gained 46 cents and ended at $9 after a transfer of 119,549 units, NCB Financial climbed 50 cents to end at $68 in trading 16,338 stock units, 138 Student Living lost 51 cents to close at $5, with 2,114,160 stocks changing hands, Pan Jamaica Group rose $1.88 to $49.99, with 906 shares crossing the market,Sagicor Group popped 45 cents to $48.95 as investors exchanged 100,393 stocks, Scotia Group rallied $1.10 in closing at $34.70 after an exchange of 91,334 stock units, Seprod shed $2.40 to end at $70 with a transfer of 482 units, Stanley Motta advanced 36 cents and ended at $5.44 after exchanging 33,521 shares, Sterling Investments slipped 39 cents to $2.50 after 6,196 stocks passed through the market, Supreme Ventures increased $2.19 to close at $26.69 trading 52,974 units. Eppley 7.50% preference share climbed $1.19 to end at $7.39, with 220 units crossing the exchange, Jamaica Public Service 7% gained $2 in closing at $52 after a transfer of 200 stock units, Jamaica Public Service 9.5% fell $22 to close at $2978, with six shares crossing the market, 138 Student Living preference share rose $6.99 and ended at $87.99 in switching ownership of 7 stocks and Productive Business Solutions 9.75% preference share dipped $14.50 to $91.50 in trading seven units.

Eppley 7.50% preference share climbed $1.19 to end at $7.39, with 220 units crossing the exchange, Jamaica Public Service 7% gained $2 in closing at $52 after a transfer of 200 stock units, Jamaica Public Service 9.5% fell $22 to close at $2978, with six shares crossing the market, 138 Student Living preference share rose $6.99 and ended at $87.99 in switching ownership of 7 stocks and Productive Business Solutions 9.75% preference share dipped $14.50 to $91.50 in trading seven units. Trading ended with the JSE Combined Market Index popping 826.66 points to 342,175.85, while the All Jamaican Composite Index rallied 810.40 points to 362,087.53, the JSE Main Index climbed 469.12 points to 329,000.52. The Junior Market Index jumped 42.50 points to close at 3,844.90 and seems to be breaking out from wedge-shaped chart formation, while the JSE USD Market Index popped 4.19 points to 238.13.

Trading ended with the JSE Combined Market Index popping 826.66 points to 342,175.85, while the All Jamaican Composite Index rallied 810.40 points to 362,087.53, the JSE Main Index climbed 469.12 points to 329,000.52. The Junior Market Index jumped 42.50 points to close at 3,844.90 and seems to be breaking out from wedge-shaped chart formation, while the JSE USD Market Index popped 4.19 points to 238.13.  At the close, investors exchanged 60,867,391 shares in all three markets on Tuesday compared to 22,548,034 shares on Tuesday. The value of stocks trading in the Junior and main markets was $609.18 million, up sharply from $90.9 million on Tuesday. Trading on the JSE USD market resulted in investors exchanging 132,703 shares for US$3,992 compared to 2,048,216 units at US$53,374 on Tuesday.

At the close, investors exchanged 60,867,391 shares in all three markets on Tuesday compared to 22,548,034 shares on Tuesday. The value of stocks trading in the Junior and main markets was $609.18 million, up sharply from $90.9 million on Tuesday. Trading on the JSE USD market resulted in investors exchanging 132,703 shares for US$3,992 compared to 2,048,216 units at US$53,374 on Tuesday. The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.