First Citizens closed at a 52 weeks’ high on Tuesday

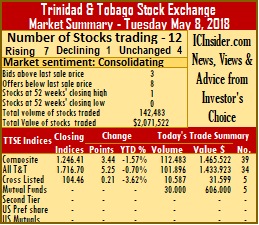

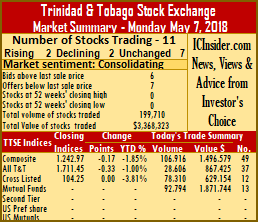

Trading on the Trinidad & Tobago Stock Exchange ended on Tuesday with trading in 12 securities against 11 on Monday, with 7 advancing, 1 declining and 4 remaining unchanged.

The market ended with the total volume traded being 142,483 shares with a value of $2,071,522, compared to 199,710 shares with a value of $3,368,323.

At close of the market the, Composite Index At close of the market the Composite Index increased 3.44 points on Tuesday to 1,246.41, the All T&T Index gained 5.25 points to 1,716.70, while the Cross Listed Index rose 0.21 points to close at 104.46.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows the market continuing to be weak as it closed with 3 stocks ending with higher bids than the last selling prices and 8 with lower offers, an indication of the continuation of a weak market currently.

Gains| Clico Investments closed with a gain of 3 cents and completed trading at $20.20, with 30,000 units, First Citizens gained 62 cents and concluded at a 52 weeks’ high of $35, after exchanging 3,546 shares, LJ Williams B Share finished trading with a gain of 1 cent and concluded at $0.72, after exchanging 10,000 shares, National Flour closed with an increase of 10 cents and settled at $1.85, with 46,392 shares changing hands, Trinidad Cement ended trading with a rise of 33 cents and settled at $2.99, exchanging 2,308 shares, Unilever Caribbean finished 50 cents higher and concluded trading at $34, with 2,050 shares and West Indian Tobacco gained 1 cent and ended at $88.51, with 404 stock units changing hands.

Gains| Clico Investments closed with a gain of 3 cents and completed trading at $20.20, with 30,000 units, First Citizens gained 62 cents and concluded at a 52 weeks’ high of $35, after exchanging 3,546 shares, LJ Williams B Share finished trading with a gain of 1 cent and concluded at $0.72, after exchanging 10,000 shares, National Flour closed with an increase of 10 cents and settled at $1.85, with 46,392 shares changing hands, Trinidad Cement ended trading with a rise of 33 cents and settled at $2.99, exchanging 2,308 shares, Unilever Caribbean finished 50 cents higher and concluded trading at $34, with 2,050 shares and West Indian Tobacco gained 1 cent and ended at $88.51, with 404 stock units changing hands.

Losses| Trinidad & Tobago NGL ended trading 1 cent lower to close at $29, in exchanging 36,108 shares.

Firm Traded| Grace Kennedy completed trading at $3.10, with 9,587 units, JMMB Group ended at $1.80, with 1,000 stock units changing hands, Massy Holdings ended at $47.25, with 588 stock units changing hands and Scotiabank settled at $63.23, after exchanging 500 shares.

Prices of securities trading for the day are those at which the last trade took place.

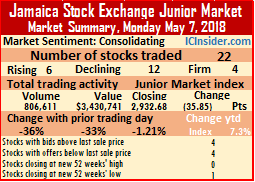

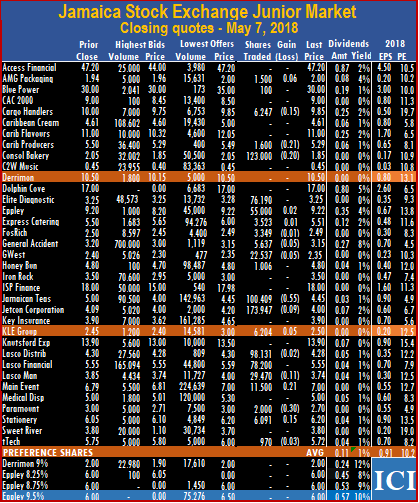

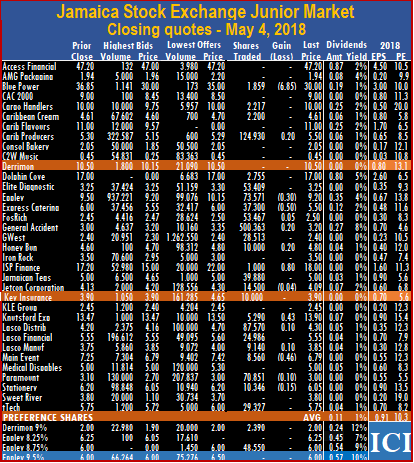

Blue Power concluded trading at $30, with 100 units, Cargo Handlers settled with a loss of 15 cents at $9.85, with 6,247 shares, Caribbean Producers finished trading with a loss of 21 cents at $5.29, with 1,600 units changing hands, Consolidated Bakeries closed with a loss of 20 cents at $1.85, with 123,000 shares. Elite Diagnostic settled at $3.25, with 76,190 units, Eppley ended trading 2 cents higher at $9.22, with 55,000 shares, Express Catering traded 1 cent higher at $5.51, with 3,523 shares, FosRich Group finished trading with a loss of 1 cent at $2.49, with 3,349 shares. General Accident closed with a loss of 5 cents at $3.15, trading 5,637 stock units, GWest Corporation ended with a loss of 5 cents at a 52 weeks’ low of $2.35, while exchanging 22,537 units, Honey Bun concluded trading at $4.80, with 1,006 shares,

Blue Power concluded trading at $30, with 100 units, Cargo Handlers settled with a loss of 15 cents at $9.85, with 6,247 shares, Caribbean Producers finished trading with a loss of 21 cents at $5.29, with 1,600 units changing hands, Consolidated Bakeries closed with a loss of 20 cents at $1.85, with 123,000 shares. Elite Diagnostic settled at $3.25, with 76,190 units, Eppley ended trading 2 cents higher at $9.22, with 55,000 shares, Express Catering traded 1 cent higher at $5.51, with 3,523 shares, FosRich Group finished trading with a loss of 1 cent at $2.49, with 3,349 shares. General Accident closed with a loss of 5 cents at $3.15, trading 5,637 stock units, GWest Corporation ended with a loss of 5 cents at a 52 weeks’ low of $2.35, while exchanging 22,537 units, Honey Bun concluded trading at $4.80, with 1,006 shares, Jamaican Teas ended trading with a loss of 55 cents at $4.45, with 100,409 stock units. Jetcon Corporation traded with a loss of 9 cents at $4, with 173,947 units, after trading at a 52 weeks’ low of $3.50, KLE Group closed 5 cents higher at $2.50, with 6,204 shares, Lasco Distributors concluded trading with a loss of 2 cents at $4.28, with 98,131 stock units, Lasco Financial finished at $5.55, with 78,200 units. Lasco Manufacturing settled with a loss of 11 cents at $3.74, with 29,470 shares, Main Event ended trading 21 cents higher at $7, with 11,500 shares, Paramount Trading finished trading with a loss of 30 cents at $2.70, with 2,000 stock units, Stationery and Office closed 15 cents higher at $6.20, with 6,091 units and tTech concluded trading with a loss of 3 cents at $5.72, with 970 shares changing hands.

Jamaican Teas ended trading with a loss of 55 cents at $4.45, with 100,409 stock units. Jetcon Corporation traded with a loss of 9 cents at $4, with 173,947 units, after trading at a 52 weeks’ low of $3.50, KLE Group closed 5 cents higher at $2.50, with 6,204 shares, Lasco Distributors concluded trading with a loss of 2 cents at $4.28, with 98,131 stock units, Lasco Financial finished at $5.55, with 78,200 units. Lasco Manufacturing settled with a loss of 11 cents at $3.74, with 29,470 shares, Main Event ended trading 21 cents higher at $7, with 11,500 shares, Paramount Trading finished trading with a loss of 30 cents at $2.70, with 2,000 stock units, Stationery and Office closed 15 cents higher at $6.20, with 6,091 units and tTech concluded trading with a loss of 3 cents at $5.72, with 970 shares changing hands.

Firm Traded| Clico Investments completed trading at $20.17, with 92,794 units, First Caribbean International Bank settled at $8.90, after exchanging 19,900 shares, NCB Financial Group concluded market activity at $5.75, in exchanging 317 shares, Sagicor Financial completed trading at $7.75, with 58,093 units, Scotiabank settled at $63.23, with an exchange of 3,033 shares, Trinidad & Tobago NGL closed trading at $29.01, with 15,305 units and West Indian Tobacco ended at $88.50, with 1,600 stock units changing hand.

Firm Traded| Clico Investments completed trading at $20.17, with 92,794 units, First Caribbean International Bank settled at $8.90, after exchanging 19,900 shares, NCB Financial Group concluded market activity at $5.75, in exchanging 317 shares, Sagicor Financial completed trading at $7.75, with 58,093 units, Scotiabank settled at $63.23, with an exchange of 3,033 shares, Trinidad & Tobago NGL closed trading at $29.01, with 15,305 units and West Indian Tobacco ended at $88.50, with 1,600 stock units changing hand.

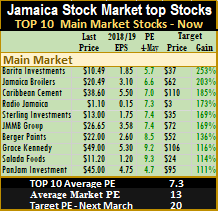

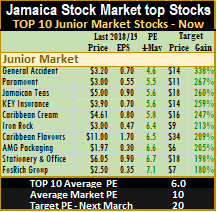

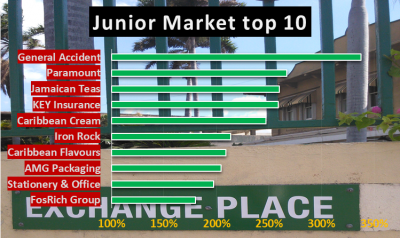

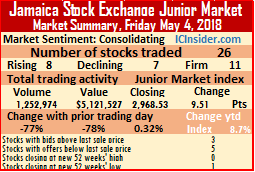

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6 compared to an average PE for the overall main market of 10 based on 2018 estimated earnings. The main market PE is 7.3 for the top stocks, compared to a market average of 13.

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6 compared to an average PE for the overall main market of 10 based on 2018 estimated earnings. The main market PE is 7.3 for the top stocks, compared to a market average of 13. The Stocks to Watch this week are Stationery and Office Supplies that should release first quarter results early this week with profits that could double over the 2017 first quarter. It should be interesting to see how investors treat with the lack of supplies for Barita and Berger while Palace could jump in price with continued success of movies now being shown.

The Stocks to Watch this week are Stationery and Office Supplies that should release first quarter results early this week with profits that could double over the 2017 first quarter. It should be interesting to see how investors treat with the lack of supplies for Barita and Berger while Palace could jump in price with continued success of movies now being shown.

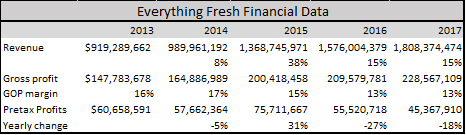

Operations started in 2008, data provided indicates that revenues hit $919 million in 2013 and generated pretax profit of $61 million. Revenues grew each year reaching $1.8 billion in 2017 with profit of $45 million before taxation of $8 million. The fall in profit for 2017 is due mainly to increase in payment for management team that was previously nominally paid, bringing it more in line with what more normal levels and foreign exchange losses of $4 million. Revenues and profit growth slowed but in 2015 revenues started to rise but lower profit margins resulted in a reduction in profits.

Operations started in 2008, data provided indicates that revenues hit $919 million in 2013 and generated pretax profit of $61 million. Revenues grew each year reaching $1.8 billion in 2017 with profit of $45 million before taxation of $8 million. The fall in profit for 2017 is due mainly to increase in payment for management team that was previously nominally paid, bringing it more in line with what more normal levels and foreign exchange losses of $4 million. Revenues and profit growth slowed but in 2015 revenues started to rise but lower profit margins resulted in a reduction in profits. Investors pushed the Jamaica Stock Exchange the market up strongly to reach the highest levels ever on Friday with the price of 11 stocks rising, 5 falling and 11 trading firm.

Investors pushed the Jamaica Stock Exchange the market up strongly to reach the highest levels ever on Friday with the price of 11 stocks rising, 5 falling and 11 trading firm.  Trading resulted in an average of 187,974 units valued at an average of $3,130,559 for each security traded. In contrast to 1,702,441 units for an average of $150,553,328 on Thursday. The average for the month to date is 613,556 shares with a value of $37,585,846 and previously 765,133 shares with a value of $49,857,592. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

Trading resulted in an average of 187,974 units valued at an average of $3,130,559 for each security traded. In contrast to 1,702,441 units for an average of $150,553,328 on Thursday. The average for the month to date is 613,556 shares with a value of $37,585,846 and previously 765,133 shares with a value of $49,857,592. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

IC bid-offer Indicator|At the end of trading, the Investor’s Choice bid-offer indicator reading shows 3 stocks ending with bids higher than their last selling prices and 5 with lower offers.

IC bid-offer Indicator|At the end of trading, the Investor’s Choice bid-offer indicator reading shows 3 stocks ending with bids higher than their last selling prices and 5 with lower offers. Key Insurance finished trading at $3.90, with 10,000 shares, Knutsford Express ended 43 cents higher at $13.90, with 5,290 shares. Lasco Distributors concluded trading 10 cents higher at $4.30, with 87,570 stock units, Lasco Financial finished at $5.55, with 24,986 units, Lasco Manufacturing settled 10 cents higher at $3.85, with 9,140 shares, Main Event ended trading with a loss of 46 cents at $6.79, with 8,560 shares. Paramount Trading finished trading with a loss of 10 cents at $3, with 70,851 stock units, Stationery and Office closed with a loss of 15 cents at $6.05, with 10,346 units and tTech concluded trading at $5.75, with 29,327 shares. In the junior market preference segment, Derrimon Trading 9% ended at $2, with 2,390 stock units, Eppley 8.75% concluded trading at $6, with 48,550 units changing hands.

Key Insurance finished trading at $3.90, with 10,000 shares, Knutsford Express ended 43 cents higher at $13.90, with 5,290 shares. Lasco Distributors concluded trading 10 cents higher at $4.30, with 87,570 stock units, Lasco Financial finished at $5.55, with 24,986 units, Lasco Manufacturing settled 10 cents higher at $3.85, with 9,140 shares, Main Event ended trading with a loss of 46 cents at $6.79, with 8,560 shares. Paramount Trading finished trading with a loss of 10 cents at $3, with 70,851 stock units, Stationery and Office closed with a loss of 15 cents at $6.05, with 10,346 units and tTech concluded trading at $5.75, with 29,327 shares. In the junior market preference segment, Derrimon Trading 9% ended at $2, with 2,390 stock units, Eppley 8.75% concluded trading at $6, with 48,550 units changing hands. The main market of the Jamaica Stock Exchange is closing the week the way it started with a new recording high.

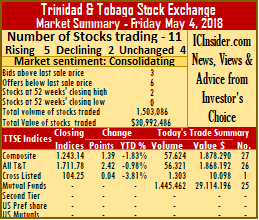

The main market of the Jamaica Stock Exchange is closing the week the way it started with a new recording high. Trading on the Trinidad & Tobago Stock Exchange on Friday, surged in monetary terms with Clico Investments trading 96 percent of the day’s volume traded and 84 percent of the value.

Trading on the Trinidad & Tobago Stock Exchange on Friday, surged in monetary terms with Clico Investments trading 96 percent of the day’s volume traded and 84 percent of the value. Gains| Clico Investments concluded trading with a rise of 17 cents to settle at $20.17, with 1,445,462 units with a value of $29,114,196, First Citizens added 15 cents and ended at a 52 weeks’ high of $34.25, after exchanging 170 shares, Prestige Holdings increased 29 cents and concluded trading at $10.30, after exchanging 92 shares, Republic Financial Holdings rose 5 cents to $101.65, with 2,397 stock units changing hands and Trinidad & Tobago NGL closed with a gain of 1 cent and settled at a 52 weeks’ closing high of $29.01, with 49,961 units changing hands.

Gains| Clico Investments concluded trading with a rise of 17 cents to settle at $20.17, with 1,445,462 units with a value of $29,114,196, First Citizens added 15 cents and ended at a 52 weeks’ high of $34.25, after exchanging 170 shares, Prestige Holdings increased 29 cents and concluded trading at $10.30, after exchanging 92 shares, Republic Financial Holdings rose 5 cents to $101.65, with 2,397 stock units changing hands and Trinidad & Tobago NGL closed with a gain of 1 cent and settled at a 52 weeks’ closing high of $29.01, with 49,961 units changing hands. The popularity of the Palace Amusement’s the Avengers Infinity War, now showing on the company’s cinema circuit has elicited some fictitious email now in circulation offering members of the public the chance to win free tickets to the blockbuster, Avengers showing.

The popularity of the Palace Amusement’s the Avengers Infinity War, now showing on the company’s cinema circuit has elicited some fictitious email now in circulation offering members of the public the chance to win free tickets to the blockbuster, Avengers showing.