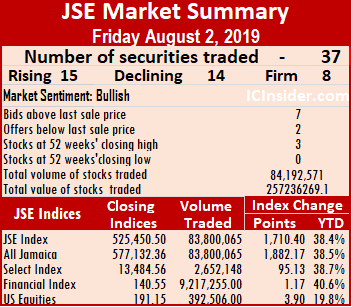

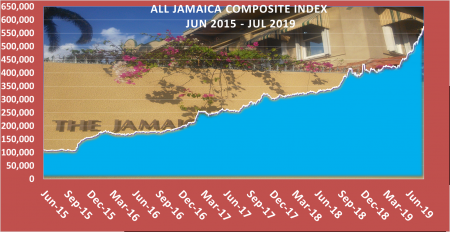

The Jamaica Stock Exchange started August on a positive note with rising stocks beating out declining ones and driving the market to the 39th record close for the year to date.

The Jamaica Stock Exchange started August on a positive note with rising stocks beating out declining ones and driving the market to the 39th record close for the year to date.

The market closed, with the JSE All Jamaican Composite Index rising 1,882.17 points to end at a record close of 577,132.36, the JSE Index gained 1,710.40 points to close at another high of 525,450.50 and the JSE Financial Index advanced by 1.17 points to close at 140.55.

Market activity resulted in 37 securities trading in the main and US dollar markets, leading to 21 securities advancing, 11 declining and 8 trading firm, compared to 40 securities trading on Wednesday.

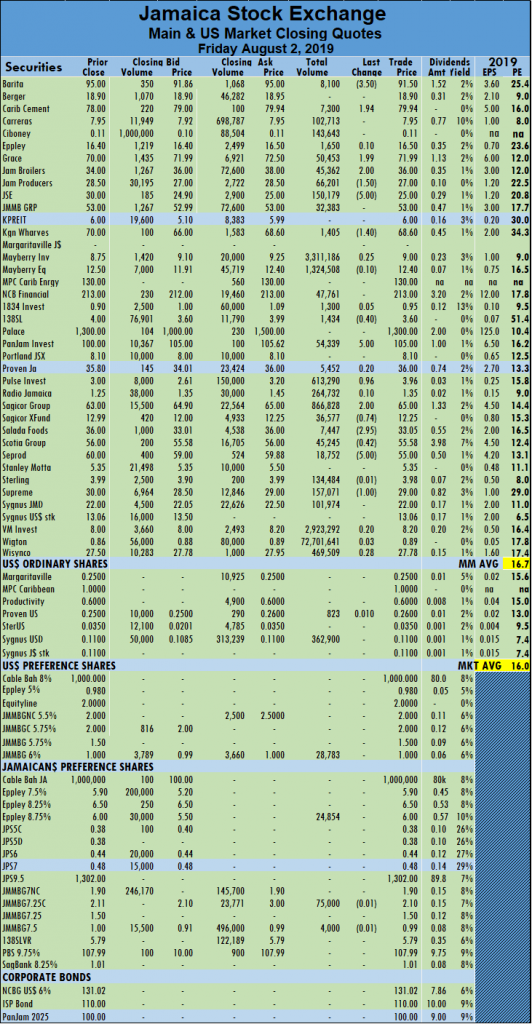

At the close of trading, Jamaica Broilers ended at a 52 weeks’ record close of $36 after trading at an all-time high of $38, Sagicor Group ended at a record close of $65 and Victoria Mutual Investments ended at a record closing of $8.20, after hitting $9 during the day. Seprod traded at an all-time high of $70 but pulled back to close at $55. Trading ended with 83,800,065 units valued at over $247,863,696, compared to 53,548,880 units valued at $758,601,832 changing hands on Wednesday.

Wigton Windfarm led trading with 72.7 million units for 87 percent of total volume, Mayberry Investments followed with 3.3 million shares for 4 percent of the day’s volume and Victoria Mutual Investments with 2.9 million shares for 3.5 percent of total main market volume.

The market closed with an average of 2,464,708 units valued at $7,290,109 for each security traded. In contrast to 1,447,267 units valued at an average of $20,502,752 on Wednesday. July closed with an average of 1,297,718 shares valued at $17,985,644 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 7 stocks ending with bids higher than the last selling price and just 2 with lower offers.

In the main market activity, Barita Investments traded 8,100 shares and lost $3.50 to close at $91.50, Caribbean Cement rose $1.94 trading 7,300 units at $79.94, Grace Kennedy rose $1.99 in the trading of 50,453 units to close at $71.99, Jamaica Broilers exchanged 45,352 shares and rose $2 to close at $36. Jamaica Producers fell $1.50 trading 66,201 units to close at $27, Jamaica Stock Exchange dived $5 trading 150,179 shares to end at $25, Kingston Wharves declined $1.40 while trading 1,405 shares to end at $68.60, Mayberry Investments rose 25 cents to close at $9 in trading 3,311,186 shares. 138 Student Living lost 40 cents in exchanging 1,434 units to close $3.60, PanJam Investment jumped $5 in trading 54,339 shares in closing at $105, Pulse Investments exchange 613,290 shares after rising 96 cents to close at $3.96, Sagicor Group jumped $2 in trading 866,828 shares to close at record high of $65. Sagicor Real Estate Fund lost 74 cents to end at $12.25 while trading 36,577 shares, Salada Foods traded 7,447 shares and lost $2.95 to close at $33.05, Scotia Group dipped 42 cents to close at $55.58 trading 45,245 shares, Seprod dropped $5 trading 18,752 units to close at $55. Supreme Ventures lost $1 trading of 157,071 units to end at a record high of $29, Victoria Mutual Investments traded 2,923,292 and gained 20 cents to end at a record high of $8.20 and Wisynco Group traded 214,850 and gained 28 cents to close at $27.78.

Pulse Investments exchange 613,290 shares after rising 96 cents to close at $3.96, Sagicor Group jumped $2 in trading 866,828 shares to close at record high of $65. Sagicor Real Estate Fund lost 74 cents to end at $12.25 while trading 36,577 shares, Salada Foods traded 7,447 shares and lost $2.95 to close at $33.05, Scotia Group dipped 42 cents to close at $55.58 trading 45,245 shares, Seprod dropped $5 trading 18,752 units to close at $55. Supreme Ventures lost $1 trading of 157,071 units to end at a record high of $29, Victoria Mutual Investments traded 2,923,292 and gained 20 cents to end at a record high of $8.20 and Wisynco Group traded 214,850 and gained 28 cents to close at $27.78.

Trading in the US securities market resulted in 392,506 units valued $68,915 changing hands as, JMMB Group 6% preference share settled at $1 with 28,783 stock units trading, Proven Investments gained 10 cents and closed at 26 US cents with an exchange of 823 shares and Sygnus Credit Investments traded 362,900 shares at 11 US cents. The JSE USD Equities Index rose 3.90 points to close at 191.15.

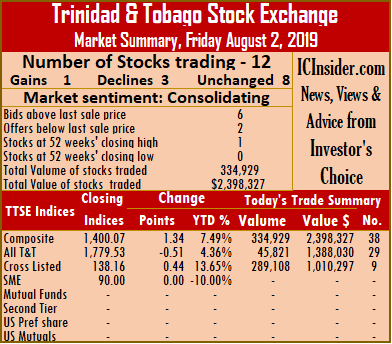

Reduced trading on TTSE – Friday

Trinidad & Tobago Stock Exchange Head Quarters

After being closed for the emancipation holiday trading resumed on the Trinidad & Tobago Stock Exchange on Friday, with less market activity than on Wednesday.

At the close of trading, the Composite Index rose 1.34 points to 1,400.07. The All T&T Index shed 0.51 points to 1,779.53, while the Cross Listed Index added 0.44 points to close at 138.16.

Market activity ended with 12 securities changing hands against 14 on Wednesday, of which, one advanced, 3 declined and 8 remained unchanged. Trading ended with 334,929 shares at a value of $2,398,327 compared to 173,952 shares at a value of $3,902,423, on Wednesday.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with 6 stocks closing with bids that were higher than their last selling prices and two with lower offers.

Gains| Grace Kennedy gained 15 cents and ended at a 52 weeks’ high of $3.50, with 273,335 units crossing the exchange.

Losses| Sagicor Financial lost 10 cents and completed trading 1,887 shares at $10, Trinidad & Tobago NGL fell 29 cents in trading 18,617 units in closing at $28.01 and West Indian Tobacco lost 20 cents trading of 94 shares to close at $110.

Firm Trades| First Citizens Bank finished at $39.95 with 2,200 units crossing the exchange, JMMB Group ended at $2.50, with 13,886 units crossing the exchange, National Enterprises ended at $6.20, with investors exchanging 2,000 shares, One Caribbean Media closed at $10.10, with 4,940 units crossing the exchange, Point Lisas settled at $3.75, with 5,000 units crossing the exchange. Republic Financial traded 3,145 units and ended at $121.33, Scotiabank closed at $59.75 after exchanging 4,825 shares and Trinidad Cement completed trading at $2.45, after exchanging 5,000 shares.

Prices of securities trading are those at which the last trade took place.

$45 for Barita Investments rights

Barita Investments headquarters

Barita Investments will offer 116,845,955 ordinary shares to its ordinary stockholders by way of a renounceable rights issue of 11 shares for each 100 own as of August 20.

The exercise price will be $45 per share with the last date for renunciation will be September 10. Shareholders will have up to September 15, to accept the amount of their offer but can apply for additional shares from amounts not taken up by allottees, up to September 20.

The current offer is the second rights issue to purchase additional shares in the company, in less than a year. The stock traded on the Jamaica Stock Exchange on Friday to close at $91.50, for a rise of 72 percent for the year to date. but it has gained 862 percent in the last twelve months, not including gains from the issue of rights in March.

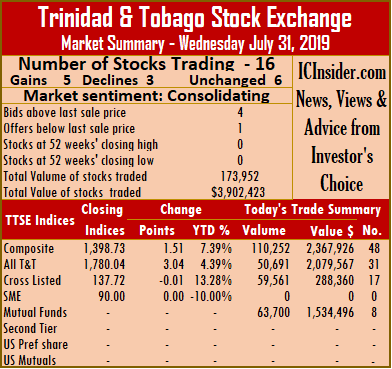

Sedate trading on TTSE – Wednesday

Trinidad & Tobago Stock Exchange inched higher on Wednesday, with the Composite Index rising 1.51 points to 1,398.73. The All T&T Index added 3.04 points to end at 1,780.04, while the Cross Listed Index lost 0.01 points to close at 137.72.

Trinidad & Tobago Stock Exchange inched higher on Wednesday, with the Composite Index rising 1.51 points to 1,398.73. The All T&T Index added 3.04 points to end at 1,780.04, while the Cross Listed Index lost 0.01 points to close at 137.72.

Market activity ended with 14 securities changing hands against 17 on Tuesday, of which, 5 advanced, 3 declined and 6 remained unchanged. Trading ended with 173,952 shares at a value of $3,902,423 compared to 298,128 shares changing hands with a value of $4,548,413, on Tuesday.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with 4 stocks closing with bids that were higher than their last selling prices and one with a lower offer.

Gains| Republic Financial rose 13 cents to settle at $121.33, in exchanging 50 units, Sagicor Financial closed with an increase of 10 cents at $10.10, with 17,077 units trading, Scotiabank climbed 75 cents and settled at $59.75, with investors exchanging 12,215 shares. Unilever Caribbean added 99 cents and settled at $25, with 1,584 stock units changing hands and West Indian Tobacco ended trading of 522 shares and rose 26 cents to close at $110.25.

Losses| Clico Investments Fund shed 5 cents and settled at $24.05, after exchanging 63,700 shares, First Citizens Bank dropped 5 cents and completed trading of 6,823 shares at $39.95  and Massy Holdings declined 51 cents and settled at $54.49, with investors exchanging 6,675 shares.

and Massy Holdings declined 51 cents and settled at $54.49, with investors exchanging 6,675 shares.

Firm Trades| First Caribbean International Bank ended at $8.34, with investors exchanging 2,000 shares, Guardian Media settled at $10.75, with 1,752 stock units changing hands, JMMB Group completed trading of 40,484 units at $2.50, National Flour closed at $1.69, with 200 units crossing the exchange. Trinidad Cement completed trading at $2.45, with investors exchanging 100 shares and Trinidad & Tobago NGL traded 20,770 units in closing at $28.30.

Prices of securities trading are those at which the last trade took place.

Carib Cement 2019 profit mixed

Carib Cement silos

Caribbean Cement revenues climbed 5.6 percent in the June quarter to $4.68 billion and 4 percent year to June, with $9.13 billion booked.

The company reported lower profit the June quarter than in 2018, due mainly to $485 million incurred as foreign currency losses and ended up with profit after tax at $368 million versus $674 million in 2018. Or the half-year profit after tax grew 48.6 percent to $15 billion. The company reported earnings per share of 43 cents versus 79 cents in the similar quarter in 2018 and $1.76 compared to $1.18 in the 2018 six months period.

Expenses excluding depreciation and finance grew 2.7 percent for the quarter to $2.94 billion and fell 21 percent for the half-year to $5.47 billion. The sharp reduction in cost results from the termination of an equipment lease agreement with the parent company and the purchase of those assets. The acquisition of the assets drove depreciation charge for the quarter to $405 million from $340 million in 2018 and $796 million from $467 million for the six months periods. Finance cost including foreign exchange losses rose to $688 million from $412 million for the quarter and $856 million versus $386 million for the half-year.

The results boosted shareholders’ equity to $7.9 billion from $6.4 billion at the end of December last year as the company wiped out accumulated losses of $994 million at the end of 2018 leaving a surplus of $493 million. Borrowing amounts to $9.8 billion while cash funds amount to $394 million and net current assets stood at negative $759 million.

The stock trades at $80 on the Jamaica Stock Exchange main market. IC Insider.com projects earnings for the full year to December at $5 per share that would place the PE ratio at 16, just around the markets PE of 17. With the economy doing well and increased construction activities, investors should have their eyes focused on increased future earnings.

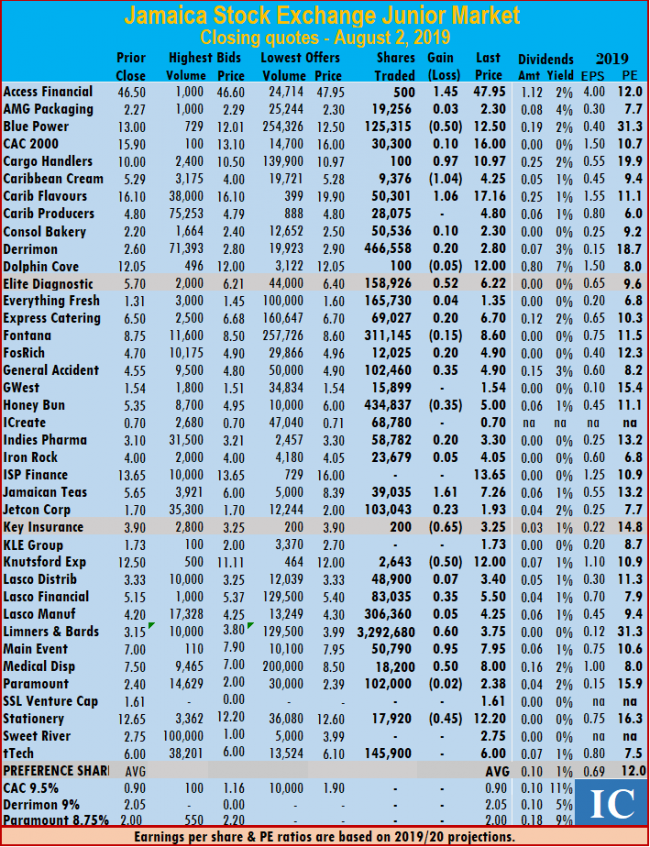

Jetcon Corporation climbed 23 cents to settle at $1.93 with 103,043 shares trading, Knutsford Express shed 50 cents to end at $12 with an exchange of 2,643 stock units, Key Insurance dropped 65 cents to settle at $3.25 with 200 shares changing hands, Limners and Bards gained 60 cents to end at record close of $3.75 with 3,292,680 stock units trading. Lasco Distributors added 7 cents to end at $3.40, trading 48,900 stock units. Lasco Financial rose 35 cents to $5.50, in trading 83,035 shares, Lasco Manufacturing inched 5 cents higher to settle at $4.25 with 306,360 shares changing hands, Main Event climbed 95 cents to end at $7.95, trading 50,790 shares, Medical Disposables gained 50 cents to end at $8 with 18,200 stock units trading. Paramount Trading fell 2 cents to $2.38, trading 102,000 shares, Iron Rock Insurance rose 5 cents to settle at $4.05 with 23,679 shares changing hands, Stationery and Office Supplies fell 45 cents to end at $12.20, in trading 17,920 shares and tTech closed at $6, trading 145,900 shares.

Jetcon Corporation climbed 23 cents to settle at $1.93 with 103,043 shares trading, Knutsford Express shed 50 cents to end at $12 with an exchange of 2,643 stock units, Key Insurance dropped 65 cents to settle at $3.25 with 200 shares changing hands, Limners and Bards gained 60 cents to end at record close of $3.75 with 3,292,680 stock units trading. Lasco Distributors added 7 cents to end at $3.40, trading 48,900 stock units. Lasco Financial rose 35 cents to $5.50, in trading 83,035 shares, Lasco Manufacturing inched 5 cents higher to settle at $4.25 with 306,360 shares changing hands, Main Event climbed 95 cents to end at $7.95, trading 50,790 shares, Medical Disposables gained 50 cents to end at $8 with 18,200 stock units trading. Paramount Trading fell 2 cents to $2.38, trading 102,000 shares, Iron Rock Insurance rose 5 cents to settle at $4.05 with 23,679 shares changing hands, Stationery and Office Supplies fell 45 cents to end at $12.20, in trading 17,920 shares and tTech closed at $6, trading 145,900 shares. The Junior Market of the Jamaica Stock Exchange is up 52.35 points to cross over the 3,500 points level for the first time in the market’s history.

The Junior Market of the Jamaica Stock Exchange is up 52.35 points to cross over the 3,500 points level for the first time in the market’s history.

Mayberry Jamaica Equities traded 3,752,372 to gain 50 cents and ended at $12.50, NCB Financial lost $2 exchanging 162,275 units to close $213, Proven Investments lost 70 cents trading 5,326 shares in closing at $35.80,

Mayberry Jamaica Equities traded 3,752,372 to gain 50 cents and ended at $12.50, NCB Financial lost $2 exchanging 162,275 units to close $213, Proven Investments lost 70 cents trading 5,326 shares in closing at $35.80,  and Stationery and Office Supplies closed at a record high of $12.65.

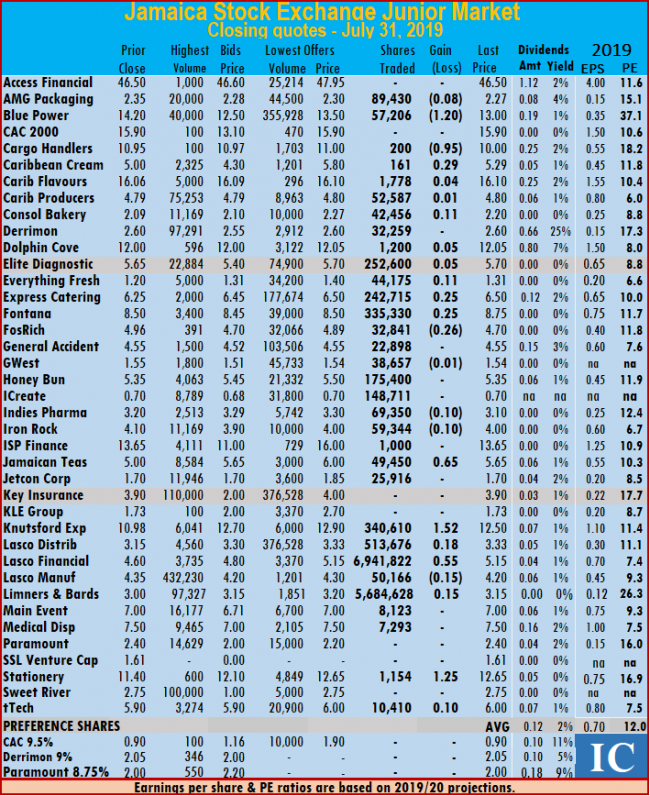

and Stationery and Office Supplies closed at a record high of $12.65. Stocks ending with price changes| AMG Packaging lost 8 cents in trading 89,430 shares to close at $2.27, Blue Power declined $1.20 in trading of 57,206 units to close at $13, Caribbean Cream exchanged 161 stock units and rose 29 cents higher to $5.29, Caribbean Flavours climbed 4 cents exchanging 1,778 shares at $16.10. Cargo Handlers lost 95 cents in trading of 200 units at $10, Caribbean Producers closed 1 cent higher at $4.80, with 52,587 stock units trading, Caribbean Producers ended trading with 52,587 shares, after rising 1 cent to end at $4.80, Consolidated Bakeries ended trading with 42,456 shares, after rising 11 cents to end at $2.20. Dolphin Cove ended trading with 1,200 shares, after rising 5 cents to close at $12.05, Express Catering climbed 25 cents and exchanged 242,715 shares to close at $6.50. Everything Fresh ended trading of 44,175 shares, after rising 11 cents to end at $1.31, Elite Diagnostic closed 5 cents higher at $5.70, with 252,600 stock units trading. Fosrich Group dipped 26 cents in trading of 32,841 units to end at $4.70, Fontana closed trading of 335,330 units and gained 25 cents to end at $8.75, GWest Corporation ended with a loss of 1 cent at $1.54 with 38,657 stock units changing hands, Indies Pharma lost 10 cents in trading of 69,350 units at $3.10. Jamaican Teas closed trading of 49,450 units and gained 65 cents to end at record closing high of $5.65,

Stocks ending with price changes| AMG Packaging lost 8 cents in trading 89,430 shares to close at $2.27, Blue Power declined $1.20 in trading of 57,206 units to close at $13, Caribbean Cream exchanged 161 stock units and rose 29 cents higher to $5.29, Caribbean Flavours climbed 4 cents exchanging 1,778 shares at $16.10. Cargo Handlers lost 95 cents in trading of 200 units at $10, Caribbean Producers closed 1 cent higher at $4.80, with 52,587 stock units trading, Caribbean Producers ended trading with 52,587 shares, after rising 1 cent to end at $4.80, Consolidated Bakeries ended trading with 42,456 shares, after rising 11 cents to end at $2.20. Dolphin Cove ended trading with 1,200 shares, after rising 5 cents to close at $12.05, Express Catering climbed 25 cents and exchanged 242,715 shares to close at $6.50. Everything Fresh ended trading of 44,175 shares, after rising 11 cents to end at $1.31, Elite Diagnostic closed 5 cents higher at $5.70, with 252,600 stock units trading. Fosrich Group dipped 26 cents in trading of 32,841 units to end at $4.70, Fontana closed trading of 335,330 units and gained 25 cents to end at $8.75, GWest Corporation ended with a loss of 1 cent at $1.54 with 38,657 stock units changing hands, Indies Pharma lost 10 cents in trading of 69,350 units at $3.10. Jamaican Teas closed trading of 49,450 units and gained 65 cents to end at record closing high of $5.65,  Knutsford Express climbed $1.52 to settle at $12.50 with 340,610 shares changing hands, Limners and Bards climbed 15 cents and exchanged 5,684,628 shares to end at a record closing high of $3.15. Lasco Distributors climbed 18 cents trading 513,676 shares to end at $3.33, Lasco Financial closed trading of 6,941,822 units and climbed 55 cents to end at $5.15, Lasco Manufacturing lost 15 cents in trading 50,166 units to close at $4.20. Iron Rock Insurance closed with a loss of 10 cents at $4, in swapping 59,344 shares, Stationery and Office Supplies gained $1.25 to end at a record high of $12.65, in trading 1,154 stock units and tTech ended trading of 10,410 shares, after rising 10 cents to close at $6.

Knutsford Express climbed $1.52 to settle at $12.50 with 340,610 shares changing hands, Limners and Bards climbed 15 cents and exchanged 5,684,628 shares to end at a record closing high of $3.15. Lasco Distributors climbed 18 cents trading 513,676 shares to end at $3.33, Lasco Financial closed trading of 6,941,822 units and climbed 55 cents to end at $5.15, Lasco Manufacturing lost 15 cents in trading 50,166 units to close at $4.20. Iron Rock Insurance closed with a loss of 10 cents at $4, in swapping 59,344 shares, Stationery and Office Supplies gained $1.25 to end at a record high of $12.65, in trading 1,154 stock units and tTech ended trading of 10,410 shares, after rising 10 cents to close at $6.