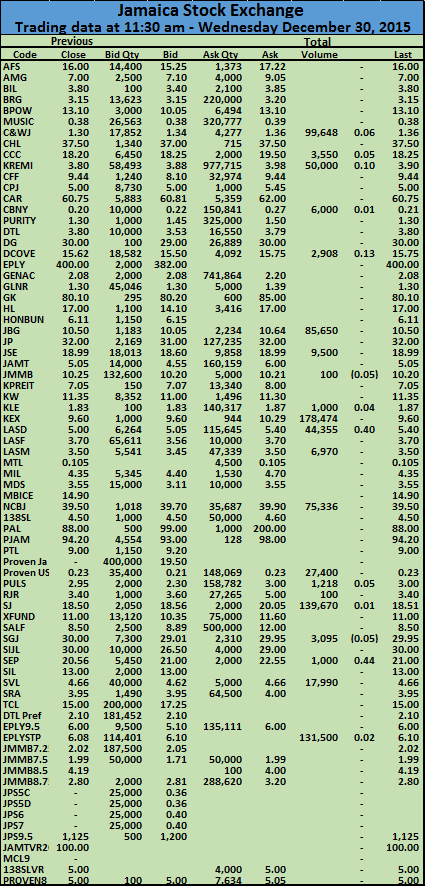

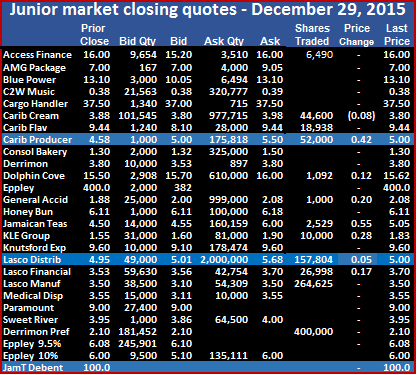

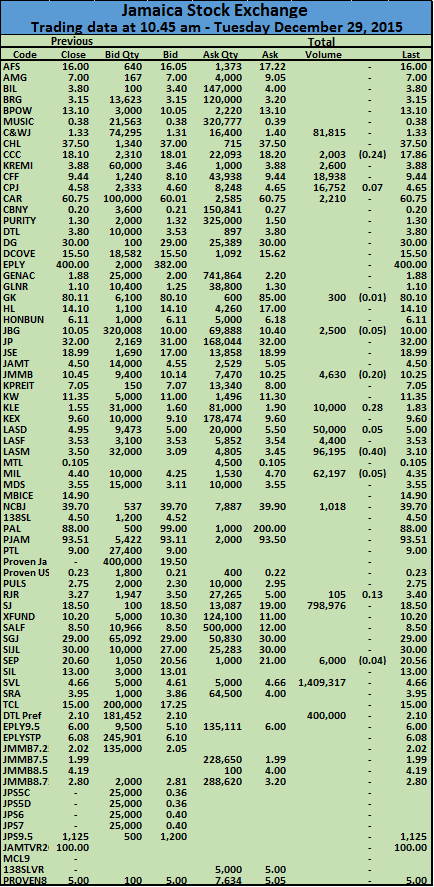

The market closed with 11 securities trading 7 of which advanced, 1 declined with 2 closing at a new 52 weeks high. Volume changing hands amounted to 886,844 units, valued at $4,712,436.

At the close there was 1 security ending with no bid to buy and 6 securities had no stocks being offered for sale. A total of 4 stocks closed with bids higher than their last traded prices while 2 closed with lower offers.

In trading, C2W Music closed with 4,000 units changing hands at 38 cents, Caribbean Cream rose 18 cents with 64,025 shares changing hands at $3.98, Caribbean Producers traded 8,730 units to close at $5. Dolphin Cove ended with 2,908 shares changing hands at $15.75 by gaining 13 cents, General Accident ended with 1,000 shares trading close at $2.08.

KLE Group ended at $1.86 with 86,054 shares changing hands to record a gain of 3 cents to close at a new 52 weeks’ high, Knutsford Express ended at $9.60 with 178,474 shares changing hands, Lasco Distributors rose by 40 cents and closed with 124,055 shares changing hands at $5.40 for a 52 weeks’ closing high, Lasco Financial closed at $3.70, with 6,101 shares changing hands, Lasco Manufacturing closed at $3.50 with 278,997 shares trading and Eppley 2019 preference share gained 2 cents in trading 131,500 units at $6.10.

KLE Group ended at $1.86 with 86,054 shares changing hands to record a gain of 3 cents to close at a new 52 weeks’ high, Knutsford Express ended at $9.60 with 178,474 shares changing hands, Lasco Distributors rose by 40 cents and closed with 124,055 shares changing hands at $5.40 for a 52 weeks’ closing high, Lasco Financial closed at $3.70, with 6,101 shares changing hands, Lasco Manufacturing closed at $3.50 with 278,997 shares trading and Eppley 2019 preference share gained 2 cents in trading 131,500 units at $6.10.