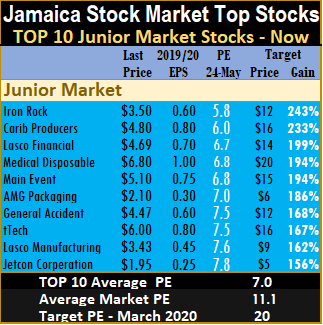

Lasco Manufacturing that IC Insider last week suggested readers keep a keen eye on, reported outstanding full year results and climbed 18.5 percent to $3.85 on Friday, exit the Junior Market IC Insider.com’s TOP 10.

Lasco Manufacturing that IC Insider last week suggested readers keep a keen eye on, reported outstanding full year results and climbed 18.5 percent to $3.85 on Friday, exit the Junior Market IC Insider.com’s TOP 10.

Lasco Financial came in with full year results that were above the 2018 figures and the price moved up to $5. IC Insider downgraded 2020 earnings to 60 cents per share, the combination of the two changes, pushed the stock outside the TOP 10, Jetcon is the third stock to move out of the top tier. Coming in to replace the above are CAC 2000, Everything Fresh and Consolidated Bakeries, all three newcomers have been having challenges with growing profits.

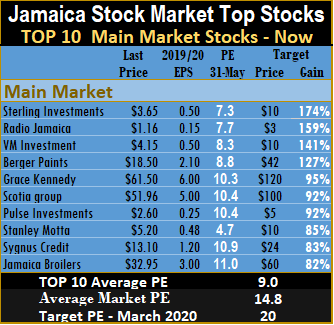

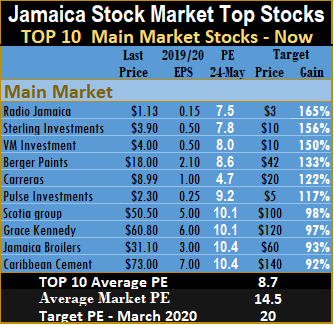

Carreras reported flat profits for the year to March resulting in downgrading of 2020 profits, with the stock no longer in the TOP 10, also leaving is Caribbean Cement with the price recovering during the week to close at $78, the two are replaced by Stanley Motta and Sygnus Credit Investments.

Carreras reported flat profits for the year to March resulting in downgrading of 2020 profits, with the stock no longer in the TOP 10, also leaving is Caribbean Cement with the price recovering during the week to close at $78, the two are replaced by Stanley Motta and Sygnus Credit Investments.

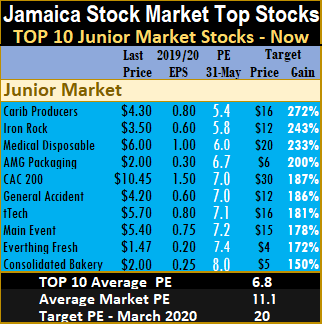

The three leading Junior Market stocks for the coming week are, Caribbean Producers with projected gains of 272 percent, followed by Iron Rock with likely gains of 243 percent and Medical Disposables with possible gains of 233 percent.

Sterling Investments with potential gains of 174 percent leads main market stocks, followed by Radio Jamaica with 159 percent and VM Investments in third spot with the potential to gain 141 percent within twelve months.

Sterling Investments with potential gains of 174 percent leads main market stocks, followed by Radio Jamaica with 159 percent and VM Investments in third spot with the potential to gain 141 percent within twelve months.

The main market, closed the week with the overall PE at 14.8 and the Junior Market at 11.1. The PE ratio for Junior Market Top 10 stocks averages 6.8 and the main market PE 9. These levels, point to a big upside for TOP 10 stocks over the next 12 months and Junior Market stocks in particular.

The TOP 10 stocks now trade at an average discount of 39 percent to the average for the Junior Market Top stocks and main market stocks trade at a discount of 39 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns within a 12 months period. Projected earnings, for each company’s current fiscal year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have interest in the securities commented on.

with possible gains of 210 percent. Of the three, Lasco Financial seems likely to break out after they release full year results later this week, but keep a keen eye on Lasco Manufacturing as well.

with possible gains of 210 percent. Of the three, Lasco Financial seems likely to break out after they release full year results later this week, but keep a keen eye on Lasco Manufacturing as well. The main market, closed the week with the overall PE at 14.5 and the Junior Market at just 11.1. The PE ratio for Junior Market Top 10 stocks averages 7 and the main market PE 8.7. These levels, point to a big upside for TOP 10 stocks over the next 12 months and Junior Market stocks in particular.

The main market, closed the week with the overall PE at 14.5 and the Junior Market at just 11.1. The PE ratio for Junior Market Top 10 stocks averages 7 and the main market PE 8.7. These levels, point to a big upside for TOP 10 stocks over the next 12 months and Junior Market stocks in particular. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

The bulk of investors who would be buying the vast quantity are more professional than not and are versed on the valuation levels of stocks. Accordingly, they are unlikely to be buying a stock that has doubtful expansion credentials at an inflated value. The most popular valuation tool, the PE ratio does not support a price much higher than $1.20, with EPS of 6 cents per share. A price of $1.20 equates to a relatively high PE ratio of 20. Only a few stocks are valued close to this multiple and many of them have prospects for profits to grow. Wigton has no immediate prospects for growth in earnings, pricing it at 20 times EPS would, therefore, be unwise. The market will speak but the heavy selling on Friday is more in line with the thinking that the top is not far off. Investors who buy shares above the accepted market norm will likely get crushed unless they have a long term investment horizon on their minds. PE ratios are there to give a sense of appropriate values. When investors try to break away from where the bulk of investments funds place the value of a stock at, they usually end up regretting the move.

The bulk of investors who would be buying the vast quantity are more professional than not and are versed on the valuation levels of stocks. Accordingly, they are unlikely to be buying a stock that has doubtful expansion credentials at an inflated value. The most popular valuation tool, the PE ratio does not support a price much higher than $1.20, with EPS of 6 cents per share. A price of $1.20 equates to a relatively high PE ratio of 20. Only a few stocks are valued close to this multiple and many of them have prospects for profits to grow. Wigton has no immediate prospects for growth in earnings, pricing it at 20 times EPS would, therefore, be unwise. The market will speak but the heavy selling on Friday is more in line with the thinking that the top is not far off. Investors who buy shares above the accepted market norm will likely get crushed unless they have a long term investment horizon on their minds. PE ratios are there to give a sense of appropriate values. When investors try to break away from where the bulk of investments funds place the value of a stock at, they usually end up regretting the move.

Popular new stock issues have a way of electrifying stock markets and empower new stock market investors to increase their wealth.

Popular new stock issues have a way of electrifying stock markets and empower new stock market investors to increase their wealth.

If the bid closes at 84 cents at the close of trading then it can trade as high as $1.09 on Friday when the market reopens after the Labour day holiday.

If the bid closes at 84 cents at the close of trading then it can trade as high as $1.09 on Friday when the market reopens after the Labour day holiday.