nitThe Main Market of the Jamaica Stock Exchange rose on Monday for the eight in ten days as the market closed higher with the prices of more stocks rising than falling.

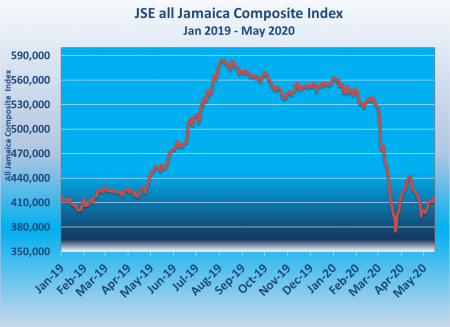

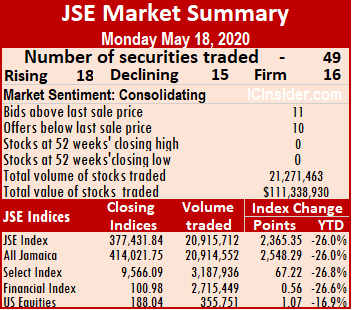

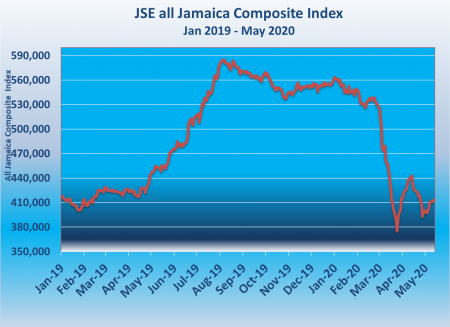

At the close, the JSE All Jamaican Composite Index advanced by 2,548.29 points to 414,021.75, the JSE Market Index climbed 2,365.35 points to 377,431.84 and the JSE Financial Index rose 0.56 points to 100.98.

At the close, the JSE All Jamaican Composite Index advanced by 2,548.29 points to 414,021.75, the JSE Market Index climbed 2,365.35 points to 377,431.84 and the JSE Financial Index rose 0.56 points to 100.98.

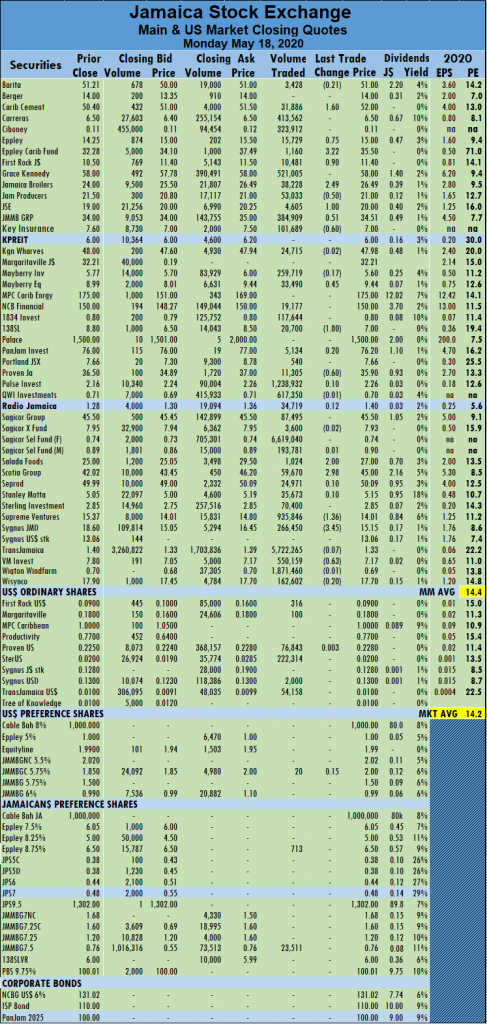

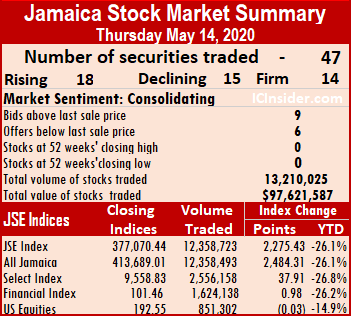

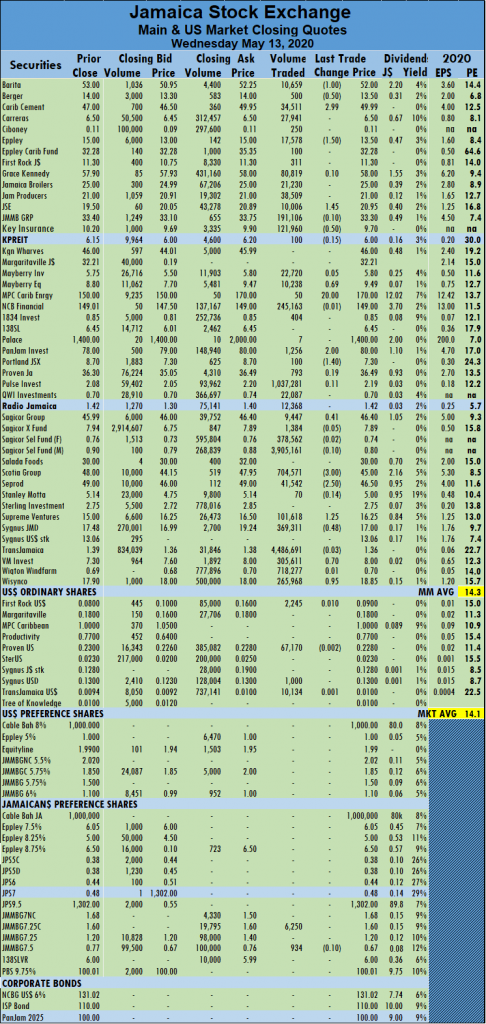

The market closed with 49 securities changing hands in the Main and US dollar markets with prices of 18 stocks advancing, 15 declining and 16 securities trading firm. The JSE Main Market activity ended with 42 securities accounting for 20,915,712 units valued at $107,984,225, in contrast to 24,395,591 units valued at $156,997,429 from 41 securities on Friday.

Sagicor Select Financial Fund led trading with 6.6 million shares for 31.7 percent of total volume followed by Trans Jamaican Highway with 5.7 million units for 27.4 percent of the day’s trade and Wigton Windfarm with 1.9 million units for 9 percent market share.

The Market closed with an average of 497,993 units at $2,571,053 for each security traded, in contrast to 595,014 units valued at an average of $3,829,206 on Friday. The average volume and value for the month to date amount to 356,991 units valued at $2,821,161 for each security changing hands, compared to 344,979 units with an average cost of $2,844,401. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The average volume and value for the month to date amount to 356,991 units valued at $2,821,161 for each security changing hands, compared to 344,979 units with an average cost of $2,844,401. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows eleven stocks ending with bids higher than their last selling prices and ten stocks closing with lower offers. The PE ratio of the market ended at 14.2, while the Main Market ended at 14.4 times 2020-21 earnings.

In the Main Market, Caribbean Cement climbed $1.60 to $52 while transferring 31,886 stock units, Eppley added 75 cents higher to end at $15 trading 15,729 units, Eppley Caribbean Property Fund advanced to $35.50, with gains of $3.22 in swapping 1,160 units. First Rock Capital closed at $11.40, after picking up 90 cents and transferring 10,481 units, Jamaica Broilers closed $2.49 higher to $26.49, in trading 38,228 stock units, Jamaica Producers shed 50 cents to settle at $21, with 53,033 shares changing hands. Jamaica Stock Exchange gained $1 after swapping 4,605 units and closed at $20, JMMB Group transferred 384,909 shares at $34.51, after rising 51 cents, Key Insurance lost 60 cents exchanging 101,689 shares to end at $7.  Mayberry Jamaican Equities closed 45 cents higher at $9.44, in swapping 33,490 stock units, 138 Student Living fell by $1.80 to $7, after trading 20,700 units, Proven Investments shed 60 cents to settle at $35.90, with 11,305 units changing hands. Salada Foods climbed $2 to $27, transferring 1,024 units, Scotia Group advanced by $$2.98 to $45, with an exchange of 59,670 shares, Supreme Ventures closed $1.36 lower to $14.01, after swapping 935,846 shares. Sygnus Credit Investments declined by $3.45 to end at $15.15, in trading 266,450 stock us and Victoria Mutual Investments shed 63 cents transferring 550,159 shares to finish at $7.17.

Mayberry Jamaican Equities closed 45 cents higher at $9.44, in swapping 33,490 stock units, 138 Student Living fell by $1.80 to $7, after trading 20,700 units, Proven Investments shed 60 cents to settle at $35.90, with 11,305 units changing hands. Salada Foods climbed $2 to $27, transferring 1,024 units, Scotia Group advanced by $$2.98 to $45, with an exchange of 59,670 shares, Supreme Ventures closed $1.36 lower to $14.01, after swapping 935,846 shares. Sygnus Credit Investments declined by $3.45 to end at $15.15, in trading 266,450 stock us and Victoria Mutual Investments shed 63 cents transferring 550,159 shares to finish at $7.17.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

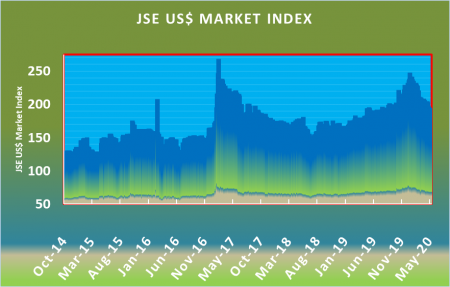

Market activity ended in seven securities changing hands, with two advancing while five remained unchanged. Investors exchanged 355,751 units at US$22,821, in contrast to 1,343277 units for US$36,373 on Friday.

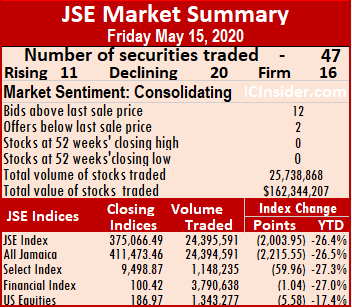

Market activity ended in seven securities changing hands, with two advancing while five remained unchanged. Investors exchanged 355,751 units at US$22,821, in contrast to 1,343277 units for US$36,373 on Friday. The JSE Market Index lost 2,003.95 points to end at 375,066.49, the JSE Financial Index inched 1.04 points lower to 100.42 and the PE ratio of the market ended at 14.1, while the Main Market ended at 14.4 times 2020-21 earnings.

The JSE Market Index lost 2,003.95 points to end at 375,066.49, the JSE Financial Index inched 1.04 points lower to 100.42 and the PE ratio of the market ended at 14.1, while the Main Market ended at 14.4 times 2020-21 earnings. The average volume and value for the month to date amount to 344,979 units valued at $2,844,401 for each security changing hands, compared to 322,299 units with an average of $2,746,160. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

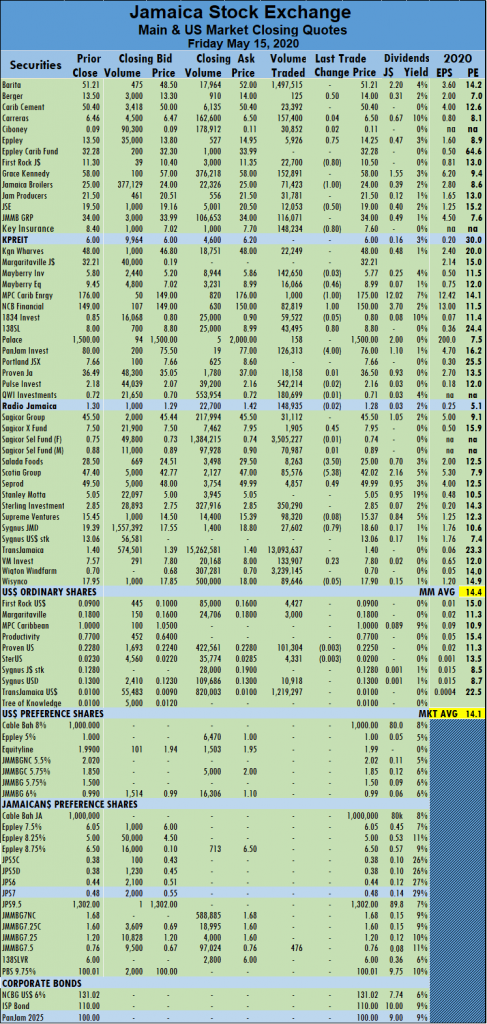

The average volume and value for the month to date amount to 344,979 units valued at $2,844,401 for each security changing hands, compared to 322,299 units with an average of $2,746,160. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. MPC Caribbean Clean Energy declined by $1 to $175 after trading 1,000 units, NCB Financial closed at $150, with gains of $1 in swapping 82,819 shares. 138 Student Living added 80 cents to reach $8.80, after exchanging 43,495 stock units, PanJam Investment declined by $4 to settle at $76, in transferring 126,313 shares, Sagicor Real Estate Fund gained 45 cents trading 1,905 units at $7.95. Salada Foods dropped $3.50 to $25, in exchanging 8,263 units, Scotia Group shed $5.38 to close at $42.02, with 85,576 shares crossing the exchange, Seprod closed 49 cents higher at $49.99 after transferring 4,857 units and Sygnus Credit Investments shed 79 cents to end at $18.60, with 27,602 stock units changing hands.

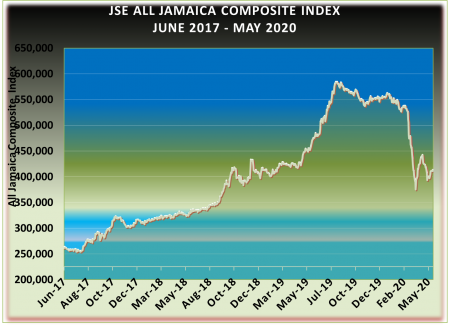

MPC Caribbean Clean Energy declined by $1 to $175 after trading 1,000 units, NCB Financial closed at $150, with gains of $1 in swapping 82,819 shares. 138 Student Living added 80 cents to reach $8.80, after exchanging 43,495 stock units, PanJam Investment declined by $4 to settle at $76, in transferring 126,313 shares, Sagicor Real Estate Fund gained 45 cents trading 1,905 units at $7.95. Salada Foods dropped $3.50 to $25, in exchanging 8,263 units, Scotia Group shed $5.38 to close at $42.02, with 85,576 shares crossing the exchange, Seprod closed 49 cents higher at $49.99 after transferring 4,857 units and Sygnus Credit Investments shed 79 cents to end at $18.60, with 27,602 stock units changing hands. Friday’s decline brings the year to date loss to 17.4 percent as a number of the stocks pulled back from the highs they were trading at earlier in the year. At the close of trading, the PE ratio of the market ended with an average of 13.0 times 2020 earnings.

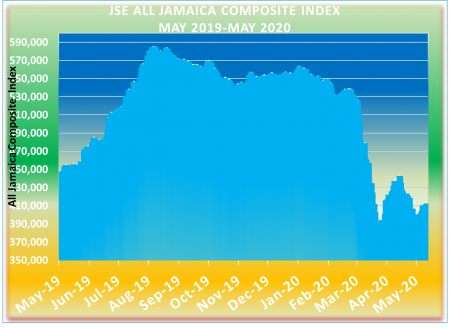

Friday’s decline brings the year to date loss to 17.4 percent as a number of the stocks pulled back from the highs they were trading at earlier in the year. At the close of trading, the PE ratio of the market ended with an average of 13.0 times 2020 earnings. At the close, the JSE All Jamaican Composite Index rebounded 2,484.31 points to 413,689.01, the JSE Market Index climbed 2,275.43 points to 377,070.44 and the JSE Financial Index gained 0.98 points to 101.46.

At the close, the JSE All Jamaican Composite Index rebounded 2,484.31 points to 413,689.01, the JSE Market Index climbed 2,275.43 points to 377,070.44 and the JSE Financial Index gained 0.98 points to 101.46. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

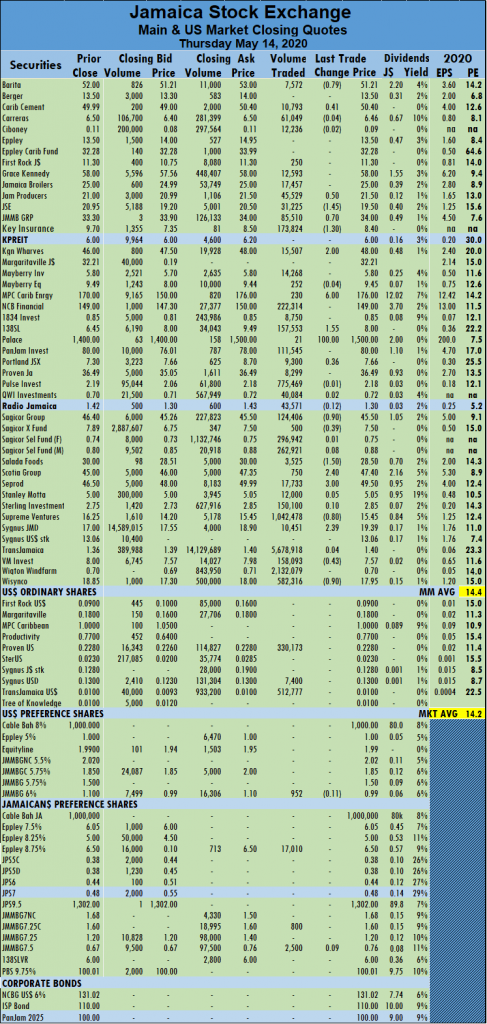

Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. Palace Amusement advanced $100 to $1,500 with just 21 units changing hands, Portland JSX gained 36 cents to settle at $7.66, in an exchange of 9,300 units, Sagicor Group shed 90 cents to end at $45.50, in switching ownership of 124,406 shares. Sagicor Real Estate Fund lost 39 cents transferring 500 units and closed at $7.50, Salada Foods fell by $1.50 to $28.50, with an exchange of 3,525 units, Scotia Group gained $2.40 and ended at $47.40, in trading 750 units. Seprod had 17,733 stock units changing hands at $49.50, after rising $3. Supreme Ventures shed 80 cents to end at $15.45, with 1,042,478 shares crossing the exchange, Sygnus Credit Investments climbed $2.39 to $19.39, in transferring 10,451 units, Victoria Mutual Investments lost 43 cents in exchanging 158,093 shares to close at $7.57 and Wisynco Group shed 90 cents to end at $17.95 in trading 582,316 shares.

Palace Amusement advanced $100 to $1,500 with just 21 units changing hands, Portland JSX gained 36 cents to settle at $7.66, in an exchange of 9,300 units, Sagicor Group shed 90 cents to end at $45.50, in switching ownership of 124,406 shares. Sagicor Real Estate Fund lost 39 cents transferring 500 units and closed at $7.50, Salada Foods fell by $1.50 to $28.50, with an exchange of 3,525 units, Scotia Group gained $2.40 and ended at $47.40, in trading 750 units. Seprod had 17,733 stock units changing hands at $49.50, after rising $3. Supreme Ventures shed 80 cents to end at $15.45, with 1,042,478 shares crossing the exchange, Sygnus Credit Investments climbed $2.39 to $19.39, in transferring 10,451 units, Victoria Mutual Investments lost 43 cents in exchanging 158,093 shares to close at $7.57 and Wisynco Group shed 90 cents to end at $17.95 in trading 582,316 shares. Market activity resulted in four securities changing hands, with one declining, leaving three unchanged. Investors traded 851,302 units with a value of US$82,312, in contrast to 80,549 units for US$15,756 on Wednesday.

Market activity resulted in four securities changing hands, with one declining, leaving three unchanged. Investors traded 851,302 units with a value of US$82,312, in contrast to 80,549 units for US$15,756 on Wednesday. Trans Jamaica

Trans Jamaica

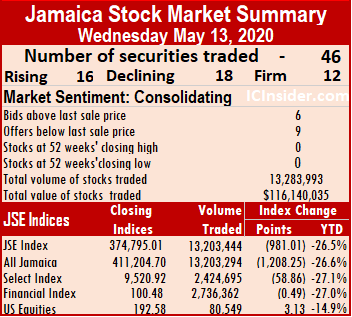

At the close of the market, the JSE All Jamaican Composite Index lost 1,208.25 points to end at 411,204.70, the JSE Market Index fell 981.01 points to 374,795.01 and the JSE Financial Index lost 0.49 points to 100.48.

At the close of the market, the JSE All Jamaican Composite Index lost 1,208.25 points to end at 411,204.70, the JSE Market Index fell 981.01 points to 374,795.01 and the JSE Financial Index lost 0.49 points to 100.48. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. Pan Jam Investment climbed $2 exchanging 1,256 units to settle at $80. Portland JSX closed $1.40 lower at $7.30 with 100 units changing hands, Sagicor Group added 41 cents to reach $46.40, with 9,447 units passing through the market, Scotia Group ended at $45, with a loss of $3 trading 704,571 shares. Seprod exchanged 41,542 shares at $46.50, after shedding $2.50. Supreme Ventures advanced by $1.25 to $16.25, with 101,618 shares crossing the exchange, Sygnus Credit Investments shed 48 cents to end at $17, in trading 369,311 shares, VM Wealth Investments gained 70 cents exchanging 305,611 shares and closed at $$8 and Wisynco Group added 95 cents to end at $18.85, with 265,968 shares changing hands.

Pan Jam Investment climbed $2 exchanging 1,256 units to settle at $80. Portland JSX closed $1.40 lower at $7.30 with 100 units changing hands, Sagicor Group added 41 cents to reach $46.40, with 9,447 units passing through the market, Scotia Group ended at $45, with a loss of $3 trading 704,571 shares. Seprod exchanged 41,542 shares at $46.50, after shedding $2.50. Supreme Ventures advanced by $1.25 to $16.25, with 101,618 shares crossing the exchange, Sygnus Credit Investments shed 48 cents to end at $17, in trading 369,311 shares, VM Wealth Investments gained 70 cents exchanging 305,611 shares and closed at $$8 and Wisynco Group added 95 cents to end at $18.85, with 265,968 shares changing hands. The JSE US dollar Market closed trading on Wednesday with a lower volume and value of stocks crossing the market than on Tuesday.

The JSE US dollar Market closed trading on Wednesday with a lower volume and value of stocks crossing the market than on Tuesday.  The JSE US Market resulted in a lower number of companies trading on Tuesday that delivered a higher turnout of volume and value of stocks crossing through the market.

The JSE US Market resulted in a lower number of companies trading on Tuesday that delivered a higher turnout of volume and value of stocks crossing through the market.