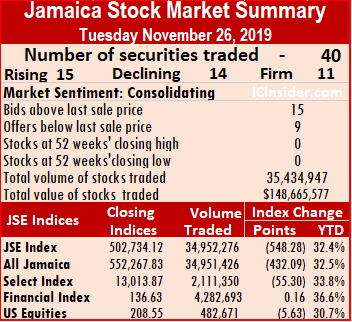

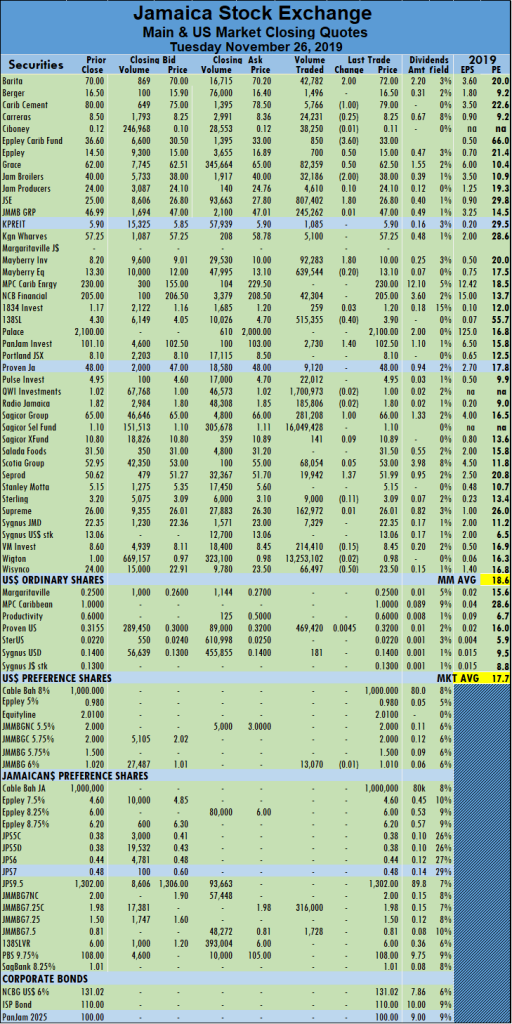

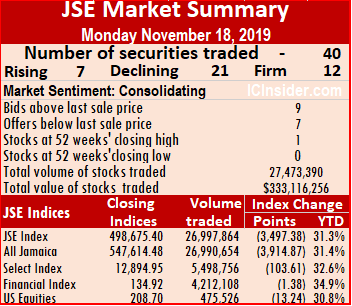

Activities picked up a bit on the Jamaica Stock Exchange primary market on Tuesday but left the market in a stalemate with an almost equal number of securities rising and falling as the market tries to claw its way higher ahead of the final month of 2019.

Activities picked up a bit on the Jamaica Stock Exchange primary market on Tuesday but left the market in a stalemate with an almost equal number of securities rising and falling as the market tries to claw its way higher ahead of the final month of 2019.

At the close, the All Jamaican Composite Index dipped 432.09 points to close at 552,267.83, the JSE Index lost 548.28 points to 502,734.12 while the JSE Financial Index gained 0.16 points to close at 136.63.

The market closed with 40 securities changing hands in the main and US dollar markets with 15 stocks advancing, 14 declining and 11 stocks trading firm. Main market activity ended with 37 securities accounting for 34,952,276 units valued at $127,514,628, in contrast to 17,983,605 units valued at $109,287,271 on Monday from 38 securities.

Sagicor Select Funds dominated trading with 16 million shares for 46 percent of the day’s trade, Wigton Windfarm with 13.2 million shares and 38 percent and QWI Investments with 1.7 million shares and 4.9 percent of total volume.

The market closed with an average of 944,656 units valued at an average of $3,446,341 for each security traded, in contrast to 473,523 units for an average of 2,875,981 on Monday. The average volume and value for the month to date amounts to 660,717 units valued at $8,989,829 and previously, an average of 644,199 units valued at $9,331,109 for each security changing hands. The market closed out October with an average of 957,488 units valued at $13,947,047 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 15 stocks ending with bids higher than their last selling prices and 9 with lower offers. The PE ratio of the market ended at 17.7, with the traditional market ending at 18.6 times 2019 current year’s earnings.

In the premier market, Barita Investments climbed $2 higher to $72 after trading 42,782 shares, Caribbean Cement lost $1 to settle at $79, after exchanging 5,766 shares, Eppley Caribbean Property Fund dropped $3.60, in ending at $33 with 850 units traded. Eppley gained 50 cents to close at $15, in swapping 700 shares, Grace Kennedy rose by 50 cents to $62.50, while transferring 82,359 units,  Jamaica Broilers lost $2 to close at $38, with an exchange of 32,186 shares, Jamaica Stock Exchange climbed $1.80 to finish at $26.80 after 807,402 shares changed hands. Mayberry Investments closed with a rise of $1.80 to $10, in transferring 92,283 stock units, 138 Student Living lost 40 cents, ending the day at $3.90 with 515,355 units changing hands. PanJam Investment climbed to $102.50, with gains of $1.40 in swapping 2,730 shares, Sagicor Group closed $1 higher to $66, with an exchange of 281,208 stock units, Seprod climbed $1.37 higher to $51.99, with 19,942 units traded and Wisynco Group lost 50 cents in ending at $23.50 with 66,497 shares crossing the market.

Jamaica Broilers lost $2 to close at $38, with an exchange of 32,186 shares, Jamaica Stock Exchange climbed $1.80 to finish at $26.80 after 807,402 shares changed hands. Mayberry Investments closed with a rise of $1.80 to $10, in transferring 92,283 stock units, 138 Student Living lost 40 cents, ending the day at $3.90 with 515,355 units changing hands. PanJam Investment climbed to $102.50, with gains of $1.40 in swapping 2,730 shares, Sagicor Group closed $1 higher to $66, with an exchange of 281,208 stock units, Seprod climbed $1.37 higher to $51.99, with 19,942 units traded and Wisynco Group lost 50 cents in ending at $23.50 with 66,497 shares crossing the market.

Trading in the US dollar market closed with 482,671 units valued at US$154,386, with the market index declining 5.63 points to close at 208.55. Proven Investments gained 0.45 cents and closed at 32 US cents while trading 469,420 shares, JMMB Group 6% preference share closed at US$1.01, losing 1 US cent, with 13,070 units changing hands and Sygnus Credit Investments ended at 14 US cents with an exchange of 181 units.

JSE main market in consolidation mode

JSE main market rally

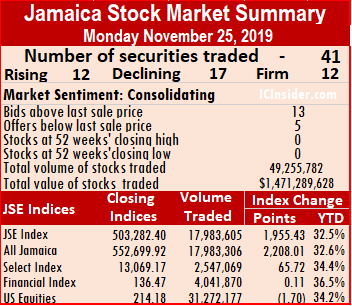

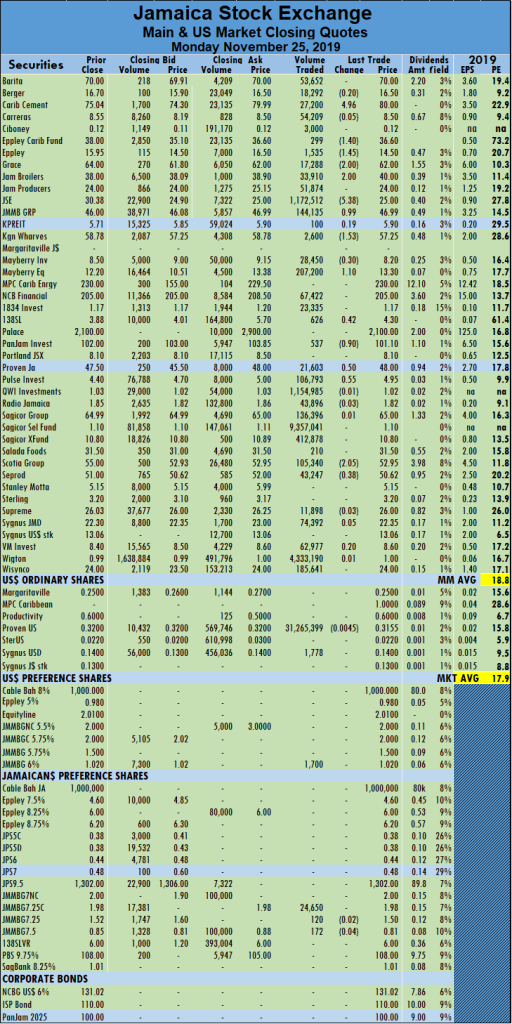

The Jamaica Stock Exchange main market surged forward on Monday with the All Jamaican Composite Index rising 2,208.01 points to close at 552,699.92, while the JSE Index gained 1,955.43 points to 503,282.40 and the JSE Financial Index inched 0.11 points higher to 136.477

The Jamaica Stock Exchange main market surged forward on Monday with the All Jamaican Composite Index rising 2,208.01 points to close at 552,699.92, while the JSE Index gained 1,955.43 points to 503,282.40 and the JSE Financial Index inched 0.11 points higher to 136.477

The market closed with 41 securities changing hands in the main and US dollar markets with 12 stocks advancing, 17 declining and 12 stocks trading firm. Main market activity ended with 38 securities accounting for 17,983,605 units valued at $109,287,271, in contrast to 16,239,630 units valued at $138,772,724 on Friday from 35 securities.

Sagicor Select Funds dominated trading with 9.4 million shares for 52 percent of the day’s trade after hitting an intraday low of $1. Wigton Windfarm followed with 4.3 million shares for 24 percent main market volume after moving to an intraday record high of $1.15 and Jamaica Stock Exchange with 1.17 million shares and 6.5 percent. QWI Investments traded at an all-time low of $1.

The market closed with an average of 473,523 units valued at an average of $2,875,981 for each security traded, in contrast to 463,989 units for an average of 3,964,935 on Friday. The average volume and value for the month to date amounts to 644,199 units valued at $9,331,109 and previously, an average of 655,062 units valued at $9,766,801 for each security changing hands. The market closed out October with an average of 957,488 units valued at $13,947,047 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 13 stocks ending with bids higher than their last selling prices and 5 with lower offers. The PE ratio of the market ended at 17.9 with the main market ending at 18.8 times 2019 current year’s earnings.

In main market activity, Caribbean Cement jumped $4.96 to close at $80, with 27,200 shares changing hands, Eppley Caribbean Property Fund closed $1.40 lower at $36.60, with the trading of 299 units, Eppley ended at $14.50 after falling $1.40 and swapping 1,535 stock units. Grace Kennedy slid $2 to end at $62, in trading 17,288 shares, Jamaica Broilers gained $2 to close at $40 with an exchange of 33,910 shares, Jamaica Stock Exchange dropped $5.38, settling at $25 after 1,172,512 shares crossed the exchange, JMMB Group rose 99 cents to end at $46.99, with exchanging 616,089 shares.  Kingston Wharves closed $1.53 lower to $57.25, with 2,600 units changing hands, Mayberry Investments lost 30 cents in transferring 28,450 shares to settle at $8.20, Mayberry Jamaica Equities closed $1.10 higher at $13.30 trading 207,200 units. 138 Student Living added 42 cents, ending the day at $4.30, transferring 626 shares, PanJam Investment lost 90 cents to close at $101.10 with 537 units trading. Proven Investments added 50 cents to $48, after exchanging 21,603 units, Pulse Investments rose to $4.55 with gains of 55 cents while trading 106,793 shares, Scotia Group tumbled to $52.95 with a fall of $2.05 in transferring 105,340 shares and Seprod closed 38 cents lower to $50.62, with 43,247 units changing hands.

Kingston Wharves closed $1.53 lower to $57.25, with 2,600 units changing hands, Mayberry Investments lost 30 cents in transferring 28,450 shares to settle at $8.20, Mayberry Jamaica Equities closed $1.10 higher at $13.30 trading 207,200 units. 138 Student Living added 42 cents, ending the day at $4.30, transferring 626 shares, PanJam Investment lost 90 cents to close at $101.10 with 537 units trading. Proven Investments added 50 cents to $48, after exchanging 21,603 units, Pulse Investments rose to $4.55 with gains of 55 cents while trading 106,793 shares, Scotia Group tumbled to $52.95 with a fall of $2.05 in transferring 105,340 shares and Seprod closed 38 cents lower to $50.62, with 43,247 units changing hands.

Trading in the US dollar market closed with 31,272,177 units valued at US$9,869,582, with the market index losing 1.70 points to close at 214.18. Proven Investments lost 0.45 US cents to close at 31.15 US cents in the trading 31,265,399 shares, JMMB Group 6% preference share closed at US$1.02 exchanging 1,700 units and Sygnus Credit Investments ended at 14 US cents with 1,778 units changing hands.

Greater stability for IC TOP 10

NCB Financial is back in IC TOP10

The past week saw the initial public offers for Mailpac Group and Lumber Depot coming to the market with both being fully subscribed.

There were just two changes to the IC TOP 10 list of stocks at the end of the week. NCB Financial makes it back into the TOP 10 at the expense of JMMB Group that rose in price to $46 while the Junior Market TOP 10 welcomed Dolphin Cove while saying goodbye to Fontana.

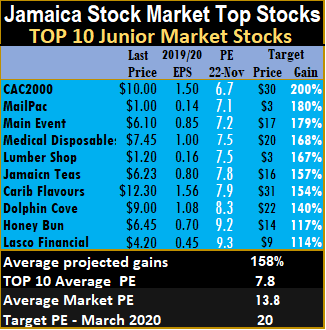

The top three Junior Market stocks, is now led by CAC 2000 with projected gains of 200 percent, followed by MailPac Group with 180 percent and Main Event, with potential gains of 179 percent.

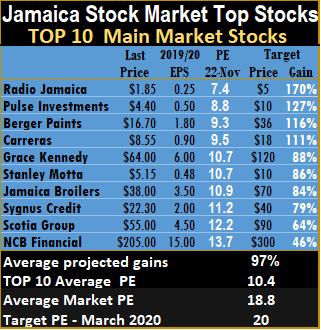

Radio Jamaica remains the lead stock with projected gains of 170 percent, followed by Pulse Investments in the number two spot with projected growth of 127 and Berger Paints with likely gains of 116 percent and percent is next.

The main market, closed the week with the overall PE of 18.8 and the Junior Market at 13.8, based on the current year’s earnings. The PE ratio for Junior Market Top 10 stocks averages 7.8 with the main market PE at 10.4.

The TOP 10 stocks now trade at a discount of 43 percent to the average for Junior Market stocks and main market stocks trade at a discount of 45 percent to the overall market.

IC TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have an interest in the securities commented on.

JSE majors searching for direction

The JSE market indices declined marginally for the third consecutive day on Friday even as more stock rose than fall as investors continue to search for a longer-term direction for stocks.

The JSE market indices declined marginally for the third consecutive day on Friday even as more stock rose than fall as investors continue to search for a longer-term direction for stocks.

The All Jamaican Composite Index declined 528.54 points to close at 550,491.91, while the JSE Index lost 478.93 points to 501,326.97 and the JSE Financial Index dipped 0.19 points to close at 136.36.

The market closed with 38 securities changing hands in the main and US dollar markets with the prices of 15 stocks advancing, 11 declining and prices of 12 stocks trading unchanged. Main market activity ended with 35 securities accounting for 16,239,630 units valued at $138,772,724, in contrast to 36,435,491 units valued at $481,608,400 on Thursday from 36 securities.

Sagicor Select Funds dominated trading with 8 million shares for 49.5 percent of the day’s trade, Wigton Windfarm with 4.3 million shares for 26.3 percent of total volume and QWI Investments with 919,163 shares with 5.7 percent of total volume.

The market closed with an average of 463,989 units valued at an average of $3,964,935 for each security traded, in contrast to 1,012,097 units for an average of $13,378,011 on Thursday. The average volume and value for the month to date amounts to 655,062 units valued at $9,766,801 and previously, an average of 666,940 units valued at $10,151,395 for each security changing hands. The market closed October with an average of 957,488 units valued at $13,947,047 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 11 stocks ending with bids higher than their last selling prices and 3 with lower offers. The PE ratio of the market ended at 17.3 with the primary market ending at 18.8 times 2019 current year’s earnings.

In main market activity, Berger Paints closed 70 cents higher to $16.70, with 17,737 shares traded, Carreras gained 50 cents to settle at $8.55, with 47,337 units changing hands, Grace Kennedy lost 30 cents to end at $64, in swapping 17,728 shares. Jamaica Producers closed $1 higher to $24 trading 101,198 shares, JMMB Group rose $1.05 to $46 exchanging 616,089 shares, Kingston Wharves climbed $1.53 to $58.78, with 315 units traded, Mayberry Jamaican Equities closed at $12.20, after losing 80 cents trading 198,974 units.  NCB Financial Group dropped $5 to close at $205, in exchanging 49,914 units, 138 Student Living gained 38 cents, ending the day at $3.88, in transferring 43,183 shares. Proven Investments climbed 50 cents to $47.50, after trading 17,142 units, Scotia Group lost 55 cents to settle at $55, in swapping 82,307 shares, Stanley Motta closed 30 cents lower to $5.15, with 27,800 units exchanged and Sygnus Credit Investments gained 30 cents trading 100 units, ending the day’s trade at $22.30.

NCB Financial Group dropped $5 to close at $205, in exchanging 49,914 units, 138 Student Living gained 38 cents, ending the day at $3.88, in transferring 43,183 shares. Proven Investments climbed 50 cents to $47.50, after trading 17,142 units, Scotia Group lost 55 cents to settle at $55, in swapping 82,307 shares, Stanley Motta closed 30 cents lower to $5.15, with 27,800 units exchanged and Sygnus Credit Investments gained 30 cents trading 100 units, ending the day’s trade at $22.30.

Trading in the US dollar market closed with 16,990 units valued at US$8,483 with the market index adding 0.34 points to close at 215.88. Proven Investments closed 1 US cents higher to 32 US cents trading 14,185 shares, JMMB Group 6% preference share settled at US$1.02 exchanging 1,700 units and JMMB Group 5.75% preference share ended the day’s trade at US$2 with 1,150 units changing hands.

JSE main market slips

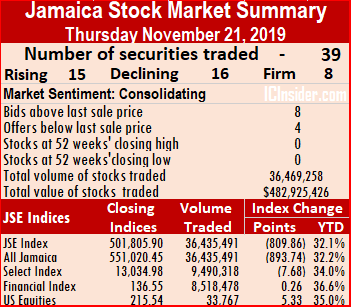

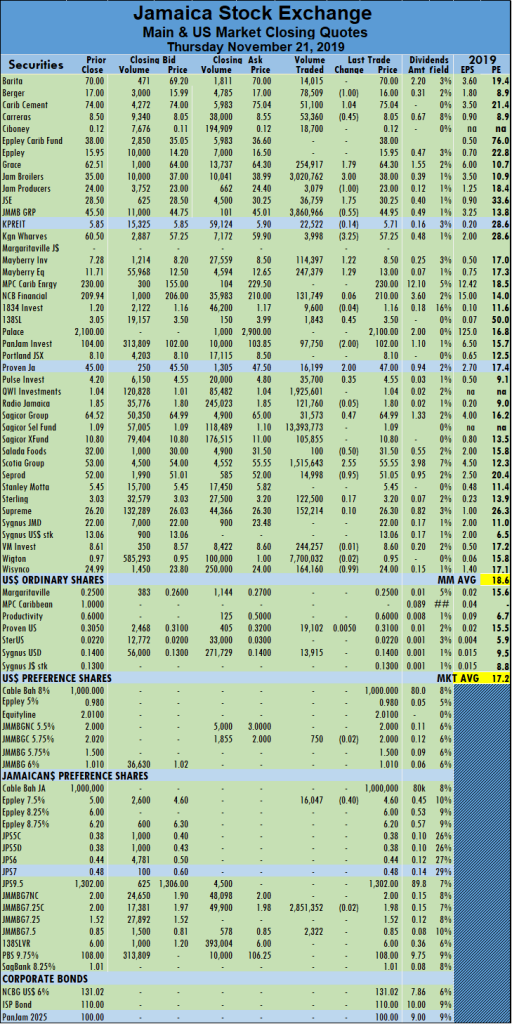

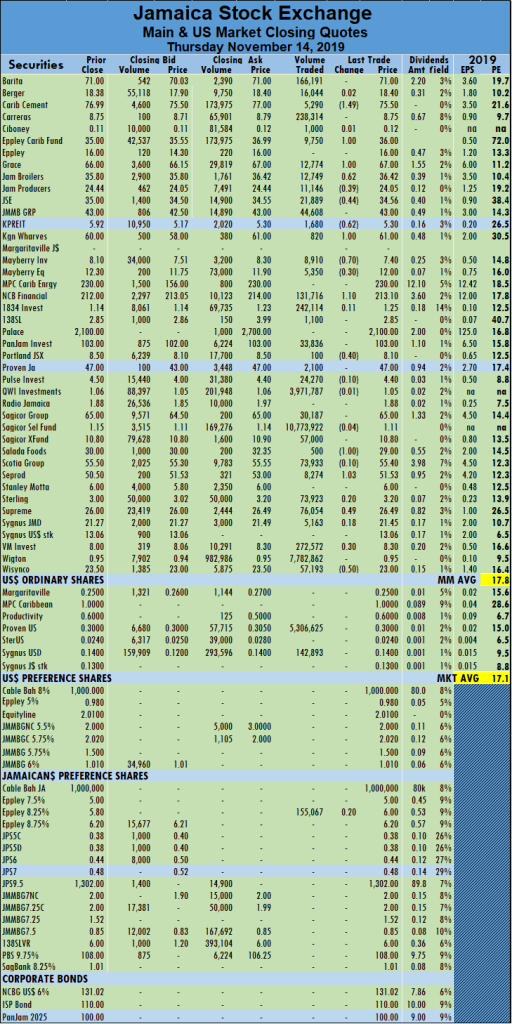

Main market indices declined again on Thursday, with the All Jamaican Composite Index dropped 893.74 points to close at 551,020.45, while the JSE Index lost 809.86 points to 501,805.90 and the JSE Financial Index gained 0.26 points to close at 136.55.

Main market indices declined again on Thursday, with the All Jamaican Composite Index dropped 893.74 points to close at 551,020.45, while the JSE Index lost 809.86 points to 501,805.90 and the JSE Financial Index gained 0.26 points to close at 136.55.

The market closed with 39 securities changing hands in the main and US dollar markets with 15 advancing, 17 declining and 7 trading firm. Main market activity ended with 36 securities accounting for 36,435,491 units valued at $481,608,400, in contrast to 70,895,481 units valued at $2,991,514,213 on Wednesday from 39 securities.

Sagicor Select Funds dominated trading with 13.4 million shares for 37 percent of total volume, followed by Wigton Windfarm with 7.7 million units accounting for 21 percent of the day’s trade and JMMB Group with 3.9 million shares and 10.6 percent. Other stocks trading more than 1 million shares were Jamaica Broilers, QWI Investments and Scotia Group.

The market closed with an average of 1,012,097 units valued at an average of $13,378,011 for each security traded, in contrast to 1,916,094 units for an average of $80,851,735 on Wednesday. The average volume and value for the month to date amounts to 665,757 units valued at $10,132,205 and previously, an average of 642,143 units valued at $9,895,189 for each security changing hands.  The market closed out October with an average of 957,488 units valued at $13,947,047 for each security traded.

The market closed out October with an average of 957,488 units valued at $13,947,047 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8 stocks ending with bids higher than their last selling prices and 4 with lower offers. The PE ratio of the market ended at 17.1, with the main market ending at 18.6 times 2019 current year’s earnings.

In main market activity, Berger Paints slipped $1 to $16 with 78,509 shares crossing the exchange, Caribbean Cement gained $1.04 to end at $75.04 after trading 51,100 stock units, Carreras lost 45 cents to settle at $8.05 in transferring 53,360 units. Grace Kennedy closed at $64.30 after rising $1.79 in swapping 254,917 shares, Jamaica Broilers climbed $3 to $38, with 3,020,762 units traded. Jamaica Producers closed $1 lower to $23 trading 3,079 shares, Jamaica Stock Exchange rose $1.75 to close at $30.25, with 36,759 shares changing hands, JMMB Group lost 55 cents to close at $44.95 in exchanging 3,860,966 stock units, Kingston Wharves slid $3.25 to $57.25, while trading 3,998 units. Mayberry Investments gained $1.22 to settle at $8.50, in swapping 114,397 shares,  Mayberry Jamaican Equities closed at $13, after climbing $1.29 and trading 247,379 units. 138 Student Living rose to $3.50, gaining 45 cents while exchanging 1,843 units, PanJam Investment slid $2 to $102, with 97,750 shares crossing the exchange, Proven Investments gained $2 to end at $47, trading 16,199 units. Sagicor Group gained 47 cents to close at $64.99, after transferring 31,573 shares, Salada Foods lost 50 cents to settle at $31.50, with 100 units changing hands. Scotia Group rose $2.55 to end at $55.55, in swapping 1,515,643 shares, Seprod lost 95 cents, ending the day at $51.05 with an exchange of 14,998 units and Wisynco Group closed 99 cents lower to settle at $24 after trading 164,160 shares.

Mayberry Jamaican Equities closed at $13, after climbing $1.29 and trading 247,379 units. 138 Student Living rose to $3.50, gaining 45 cents while exchanging 1,843 units, PanJam Investment slid $2 to $102, with 97,750 shares crossing the exchange, Proven Investments gained $2 to end at $47, trading 16,199 units. Sagicor Group gained 47 cents to close at $64.99, after transferring 31,573 shares, Salada Foods lost 50 cents to settle at $31.50, with 100 units changing hands. Scotia Group rose $2.55 to end at $55.55, in swapping 1,515,643 shares, Seprod lost 95 cents, ending the day at $51.05 with an exchange of 14,998 units and Wisynco Group closed 99 cents lower to settle at $24 after trading 164,160 shares.

Trading in the US dollar market closed with 33,767 units valued at US$9,544, with the market index rising 5.33 points to close at 215.54. Proven Investments closed 0.5 US cents higher to 31 US cents trading 19,102 shares, Sygnus Investments exchanged 13,915 units at 14 US cents and JMMB Group 5.75% preference shares lost 2 US cents to end the day’s trade at US$2 with 750 units changing hands.

JSE main market climbs – Tuesday

Market activity on the Jamaica Stock Exchange rebounded on Tuesday with all primary indices enjoying robust gains with trading resulted in just less than half the value that traded on Monday.

Market activity on the Jamaica Stock Exchange rebounded on Tuesday with all primary indices enjoying robust gains with trading resulted in just less than half the value that traded on Monday.

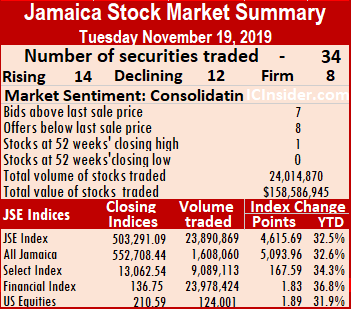

At the close, the All Jamaican Composite Index advanced 5,093.96 points to close at 552,708.44, while the JSE Index gained 4,615.69 points to 503,291.09 and the JSE Financial Index added 1.83 points to close at 136.75.

The market closed with 34 securities changing hands in the main and US dollar markets with 14 advancing, 12 declining and 8 trading firm. Main market activity ended with 33 securities accounting for 23,890,869 units valued at $153,275,236 in contrast to 26,997,864 units valued at $314,531,311 on Monday from 37 securities.

Wigton Windfarm dominated trading with 14.1 million shares for 59 percent of total volume, followed by Sagicor Select Funds with 5.2 million units accounting for 22 percent of the day’s trade and QWI Investments with 2.5 million shares and 10 percent.

The market closed with an average of 723,966 units at $4,644,704 for each security traded, in contrast to 729,672 units for an average of $8,500,846 on Monday. The average volume and value for the month to date amounts to 546,143 units valued at $4,137,949 and previously, an average of 533,330 units valued at $4,098,200 for each security changing hands. The market closed out October with an average of 957,488 units valued at $13,947,047 for each security traded.

The average volume and value for the month to date amounts to 546,143 units valued at $4,137,949 and previously, an average of 533,330 units valued at $4,098,200 for each security changing hands. The market closed out October with an average of 957,488 units valued at $13,947,047 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 7 stocks ending with bids higher than their last selling prices and 8 with lower offers. The PE ratio of the market ended at 17.4, with the main market ending at 18.3 times 2019 current year’s earnings.

In main market activity, Barita Investments dropped $1.30 to end at $69 after trading 39,757 shares, Caribbean Cement advanced $3 to close at $78, in exchanging 15,689 shares, Eppley gained $1.79 to settle at $ 15.95, with 9,998 units crossing the exchange. Grace Kennedy ended at $64, after rising $1 and trading of 19,561 shares, Jamaica Broilers closed $4 higher to $37 with a transfer of 24,991 shares, Jamaica Producers lost $1.74 to end at $22.06, after swapping 6,028 shares. Jamaica Stock Exchange rose by $3.25 to $31.45, in exchanging 22,916 shares, Kingston Wharves closed $2 lower to $58 with 2,237 units changing hands, Mayberry Investments gained 40 cents to close at $8.40, with 1,100 units trading, Mayberry Jamaican Equities closed at $12, after climbing 75 cents with 145,216 units changing hands. NCB Financial tumbled to $205, after losing $5 trading 472,382 units, PanJam Investment closed $1 higher to $104, in swapping only 854 units, Portland JSX lost 40 cents to settle at $8.10 with 2,036 shares changing hands. Proven Investments jumped $5 to close at a 52 weeks’ closing high of $50, after trading a mere 600 stock units, Sagicor Real Estate Fund lost 50 cents to end at $10.80, in exchanging 655,288 shares. Seprod gained 50 cents to close at $51, with 7,451 units changing hands, Sygnus Investments ended at $22 with a loss of $1 and trading 55,300 shares and Wisynco closed $1 higher at $24 with 115,573 shares crossing the exchange.

NCB Financial tumbled to $205, after losing $5 trading 472,382 units, PanJam Investment closed $1 higher to $104, in swapping only 854 units, Portland JSX lost 40 cents to settle at $8.10 with 2,036 shares changing hands. Proven Investments jumped $5 to close at a 52 weeks’ closing high of $50, after trading a mere 600 stock units, Sagicor Real Estate Fund lost 50 cents to end at $10.80, in exchanging 655,288 shares. Seprod gained 50 cents to close at $51, with 7,451 units changing hands, Sygnus Investments ended at $22 with a loss of $1 and trading 55,300 shares and Wisynco closed $1 higher at $24 with 115,573 shares crossing the exchange.

Trading in the US dollar market closed with 124,001 units valued at US$37,941, with the market index rising 1.89 points to close at 210.59. Proven Investments, the only stock traded, lost 3 US cents to end the day’s trade at 30 US cents.

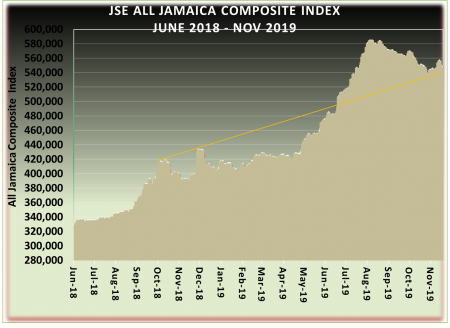

JSE main market drop

The major indices on the Jamaica Stock Exchange lost more ground on Monday following Friday’s 5,000 points fall as trading resulted in lower volumes and higher value passing through the market, with investors having some new stock offers in which to invest.

The major indices on the Jamaica Stock Exchange lost more ground on Monday following Friday’s 5,000 points fall as trading resulted in lower volumes and higher value passing through the market, with investors having some new stock offers in which to invest.

At the close of trading, the All Jamaican Composite Index shedding 3,914.87 points to close at 547,614.48, while the JSE Index dropped 3,497.38 points to 498,675.40 and the JSE Financial Index lost 1.38 points to close at 134.92.

The market closed with 40 securities changing hands in the main and US dollar markets with 7 rising, 21 declining and 12 closing unchanged. Main market activity ended with 37 securities accounting for 26,997,864 units valued at $314,531,311 in contrast to 43,823,390 units for $226,040,673 on Friday, from 33 securities.

Sagicor Select Funds dominated trading with 12.4 million shares for 46 percent of total volume, followed by Wigton Windfarm with 7 million units accounting for 25.8 percent of the day’s trade and Jamaica Broilers with 2.3 million shares and 8.4 percent. QWI Investments traded 1.2 million shares and Sagicor Group 1 million units to be the other entities trading more than a million shares.

The market closed with an average of 729,672 units valued at an average of $8,500,846 for each security traded. In contrast to 1,327,982 units for an average of 6,849,717 on Friday. The average volume and value for the month to date amounts to 533,330 units valued at $4,098,200 and previously, an average of 516,075 units valued at $3,676,184 for each security changing hands. The market closed out October with an average of 957,488 units valued at $13,947,047 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 9 stocks ending with bids higher than their last selling prices and 7 with lower offers. The PE ratio of the market ended at 17.3, with the main market stocks ending at 18 times 2019 current year’s earnings.

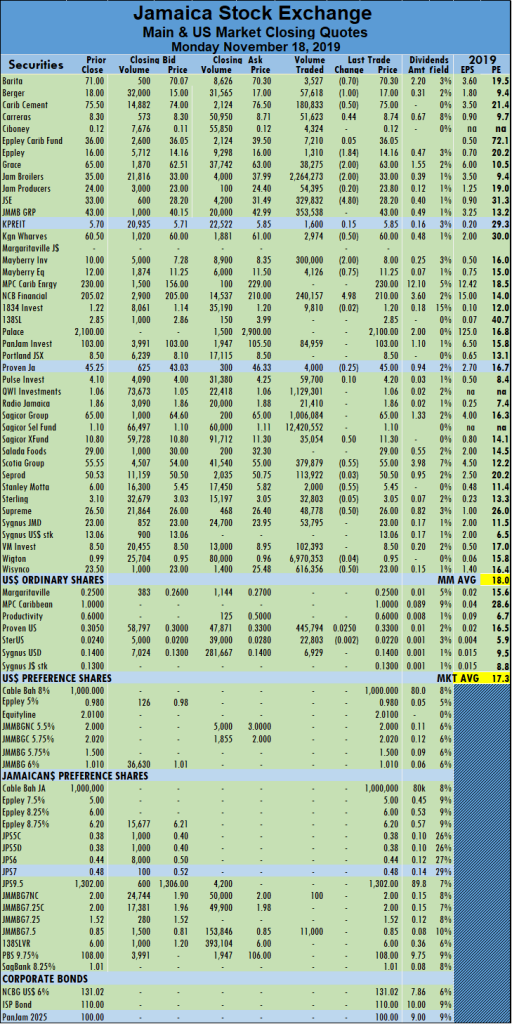

In main market activity, Barita Investments closed 70 cents lower to $70.30 in trading 3,527 shares, Berger Paints dropped $1 to settle at $17, after exchanging 57,618 units, Caribbean Cement lost 50 cents swapping 180,833 shares, to end at $75. Carreras gained 44 cents to close at $8.74, with 51,623 shares changing hands, Eppley closed $1.84 lower to $14.16 with 1,310 units crossing the exchange, Grace Kennedy dropped $2 in ending at $63 and trading 38,275 shares, Jamaica Broilers slid $2 and closing at $33 with of 2,264,273 shares changing hands. Jamaica Stock Exchange dropped $4.80 to settle at $28.20, after swapping 329,832 shares, following the release of nine results last week, showing the stock price to be overly extended, at a PE ratio of well over 30. Kingston Wharves fell 50 cents to $60 with 2,974 units changing hands, Mayberry Investments lost $2 to close at $8, with 300,000 units traded, Mayberry Jamaican Equities ended the day’s trade at $11.25, after losing 75 cents with an exchange of 4,126 units.  NCB Financial gained to close at $210 after trading 240,157 units, Sagicor Real Estate Fund added 50 cents to end at $11.30 with 35,054 shares crossed the exchange, Scotia Group declined 55 cents to end at $55, in trading 379,879 shares. Stanley Motta lost 55 cents to close at $5.45, with 2,000 shares crossing the exchange, Supreme Ventures ended at $26, falling 50 cents and trading 48.778 units, ending the day’s trade at $23 and Wisynco Group settled at $23 after falling 50 cents and previously trading as high as $26, early in the trading session with 616,356 shares changing hands. The increased interest comes as reports are that the company is enjoying strong sales in the final quarter of the year.

NCB Financial gained to close at $210 after trading 240,157 units, Sagicor Real Estate Fund added 50 cents to end at $11.30 with 35,054 shares crossed the exchange, Scotia Group declined 55 cents to end at $55, in trading 379,879 shares. Stanley Motta lost 55 cents to close at $5.45, with 2,000 shares crossing the exchange, Supreme Ventures ended at $26, falling 50 cents and trading 48.778 units, ending the day’s trade at $23 and Wisynco Group settled at $23 after falling 50 cents and previously trading as high as $26, early in the trading session with 616,356 shares changing hands. The increased interest comes as reports are that the company is enjoying strong sales in the final quarter of the year.

Trading in the US dollar market closed with 475,526 units valued at US$135,657, with the market declining 13.24 points to close at 208.70. Proven Investments gained 2.5 US cents to close at a 52 weeks’ closing high of 33 US cents after exchanging 445,794 units, Sterling Investments closed at 2.2 US cents after falling 0.2 US cents in trading 22,803 units and Sygnus Credit Investments closed at 14 US cents with 6,929 units changing hands.

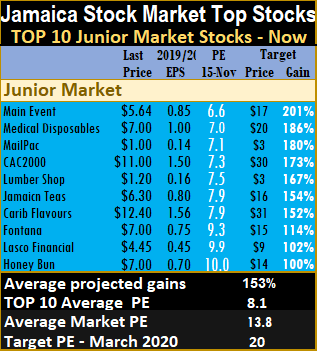

Major shakeup in IC TOP 10

The past week saw the release of quarterly results by several companies and that helped in reshaping IC TOP 10 list of stocks for the coming week. The Junior Market TOP 10 has 5 changes and the main market just one.

The past week saw the release of quarterly results by several companies and that helped in reshaping IC TOP 10 list of stocks for the coming week. The Junior Market TOP 10 has 5 changes and the main market just one.

Earnings downgrades and the announcement of new initial public offers were the main factors that resulted in the changes.

Mailpac Group and the Lumber Depot released prospectuses this past week, with both making it into the Junior Market TOP 10 list. Other notable changes to the Junior Market list are Caribbean Flavours, Fontana and Honey Bun that reentered the top list after weeks of absence. Dropping from the list are Iron Rock Insurance, Caribbean Producers and tTech, all of which suffered earnings downgrade.

Mailpac Group released its prospectus to sell 500 million shares at $1 each with earnings of 14 cents per share for a PE of 7 and potential gains of 180 percent. The Lumber Depot released its prospectus on Friday with a projected profit of $82 million or 16 cents per share.

JMMB Group released substantial gains in the half-year results that helped to propel it into the main market TOP 10 at the expense of Seprod. The latter suffered an earnings downgrade following the release of the nine months results.

The top three Junior Market stocks, is now led by Main Event with projected gains of 201 percent, followed by Medical Disposables with 186 percent and by new entrant MailPac Group, with a potential increase of 180 percent.

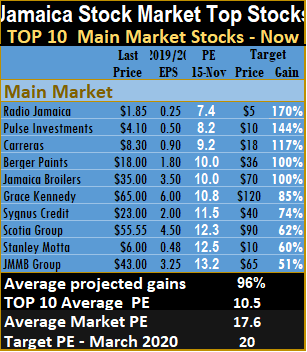

Radio Jamaica remains the lead stock with projected gains of 170 percent, followed by Pulse Investments in the number two spot with projected growth of 144 and Carreras with a likely increase in the stock price of 117 percent and percent is next.

The main market, closed the week with the overall PE of 17.6 and the Junior Market at 13.8 from 12.1, based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks averages 8.1 with the main market PE at 10.5.

The TOP 10 stocks now trade at a discount of 42 percent to the average for Junior Market stocks and main market stocks trade at a discount of 40 percent to the overall market.

IC TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have an interest in the securities commented on.

JSE main market drops

The major indices on the Jamaica Stock Exchange tumbled on Friday, erasing some of the gains made in the week to Thursday but still leaving the market ahead of the close of the previous week.

The major indices on the Jamaica Stock Exchange tumbled on Friday, erasing some of the gains made in the week to Thursday but still leaving the market ahead of the close of the previous week.

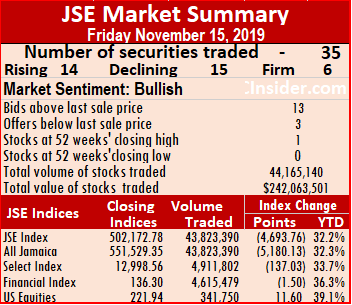

The All Jamaican Composite Index plunged 5,180.13 points to close at 551,529.35, the JSE Index dropped 4,693.76 points to 502,172.78 and the JSE Financial Index lost 1.50 points to close at 136.30.

The market closed with 35 securities changing hands in the main and US dollar markets with 14 advancing, 15 declining and 6 trading firm. Main market activity ended with 33 securities accounting for 43,823,390 units valued at $226,040,673 in contrast to 24,330,188 units valued at $89,041,566 on Thursday from 36 securities.

Wigton Windfarm dominated trading with 31.4 million shares for 72 percent of total volume, followed by Sagicor Select Funds with 5.5 million units accounting for 13 percent of the day’s trade and QWI Investments with 2.2 million shares and 5 percent. Wisynco Group was the only other stock trading over 1 million shares in the main market.

The market closed with an average of 1,327,982 units valued at an average of $6,849,717 for each security traded, in contrast to 675,839 units for an average of 2,473,377 on Thursday. The average volume and value for the month to date amounts to 516,075 units at $3,676,184 and previously, an average of 447,021 units valued at $3,379,509 for each security changing hands. The market closed out October with an average of 957,488 units valued at $13,947,047 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 13 stocks ending with bids higher than their last selling prices and 3 with lower offers. The PE ratio of the market ended at 17.3 with the main market ending at 18 times 2019 current year’s earnings.

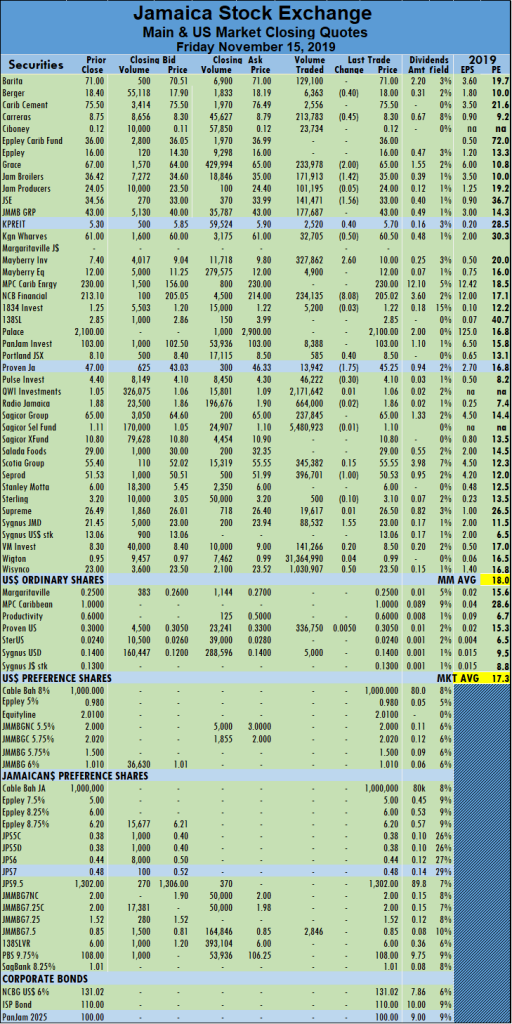

In main market activity, Berger Paints lost 40 cents, in swapping 6,363 units to close at $18, Carreras declined 45 cents to settle at $8.30, with 213,783 shares traded, Grace Kennedy closed $2 lower at $$65 exchanging 233,978 shares, Jamaica Broilers dropped $1.42, ending the day’s trade at $35 with 171,913 shares changing hands. Jamaica Stock Exchange settled at $33, after losing $1.56 in trading 141,471 shares, Kingston Properties gained 40 cents trading 2,520 shares, to end at $5.70, Kingston Wharves closed 50 cents lower to $60.50 with 32,705 units changing hands. Mayberry Investments climbed $2.60 to $10, with 327,682 units traded,  NCB Financial dived $8.08 to close at $205.02, after exchanging 234,135 units, Portland JSX gained 40 cents to end at $8.50 with the transfer of 585 units, Proven Investments dropped $1.75 to $45.25, with 13,942 shares changing hands. Pulse Investments closed 30 cents lower to $4.10 trading 46,222 shares. Seprod closed $1 lower to $50.53, with 396,704 shares crossing the exchange, Sygnus Credit Investments gained $1.55 swapping 88,532 units and ending at $23 and Wisynco Group added 50 cents settled at $23.50, with 1,030,907 shares changing hands.

NCB Financial dived $8.08 to close at $205.02, after exchanging 234,135 units, Portland JSX gained 40 cents to end at $8.50 with the transfer of 585 units, Proven Investments dropped $1.75 to $45.25, with 13,942 shares changing hands. Pulse Investments closed 30 cents lower to $4.10 trading 46,222 shares. Seprod closed $1 lower to $50.53, with 396,704 shares crossing the exchange, Sygnus Credit Investments gained $1.55 swapping 88,532 units and ending at $23 and Wisynco Group added 50 cents settled at $23.50, with 1,030,907 shares changing hands.

Trading in the US dollar market closed with 341,750 units valued at US$113,637 with the market advancing 11.60 points to close at 221.94. Proven Investments gained 0.5 US cents traded 336,750 units at a 52 weeks’ high of 30.5 US cents, after hitting a high of 35 cents before closing and Sygnus Credit Investments closed at 14 US cents with 5,000 units changing hands.

Sizable gains for JSE main market

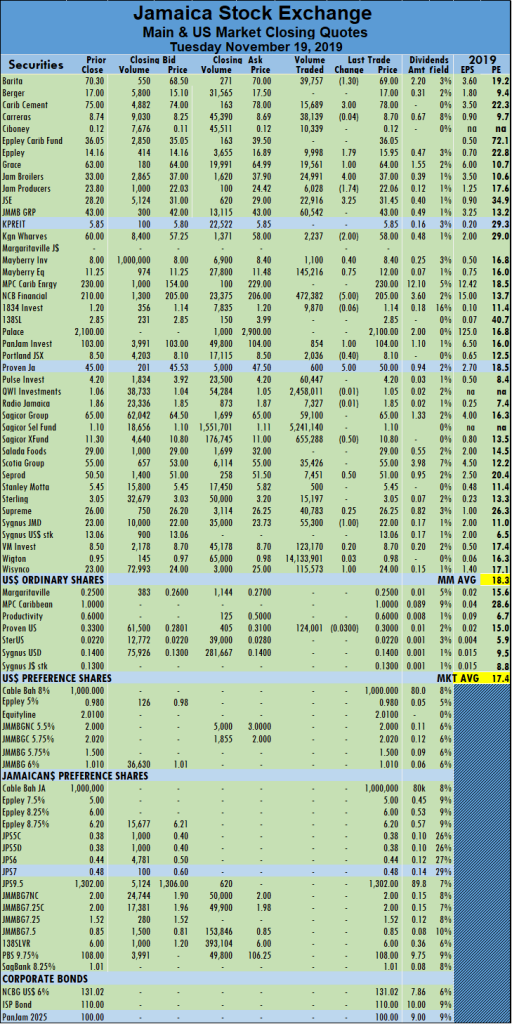

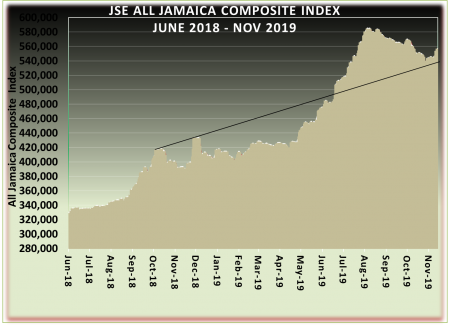

Market activity on the Junior Market resulted in the major indices recording more gains on Thursday and bringing the increase for the week to 11,719.17 points as the market continues to recover from its 42,772.34 fall from the peak in early August.

Market activity on the Junior Market resulted in the major indices recording more gains on Thursday and bringing the increase for the week to 11,719.17 points as the market continues to recover from its 42,772.34 fall from the peak in early August.

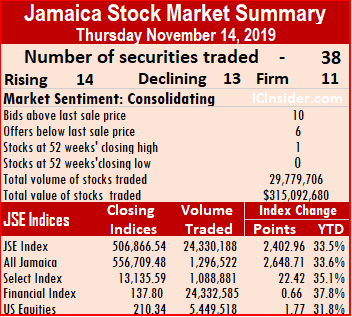

The market closed with the All Jamaican Composite Index climbing 2,648.71 points to 556,709.48, the JSE Index advancing 2,402.96 points to 506,866.54 and the JSE Financial Index posting 0.66 points to end at 137.80.

The market activity led to 38 securities changing hands in the main and US dollar markets with 14 advancing, 13 declining and 11 trading firm. Main market activity ended with 36 securities accounting for 24,330,188 units valued at $89,041,566 in contrast to 20,477,665 units valued at $53,408,633 on Wednesday from 33 securities.

Sagicor Select Funds dominated trading with 10.8 million shares for 44 percent of total volume, followed by Wigton Windfarm with 7.8 million units accounting for 32 percent of the day’s trade and QWI Investments with 4 million shares and 16 percent. 1834 Investments closed at a 52 weeks’ high of $1.25 after trading at $1.26 earlier, while Proven Investments US dollar listed stock traded at a 52 weeks’ high of 30.5 US cents.

The market closed with an average of 675,839 units valued at an average of $2,473,377 for each security traded, in contrast to 619,626 units for an average of 1,618,443 on Wednesday. The average volume and value for the month to date amounts to 447,021 units valued at $3,379,509 and previously, an average of 423,619 units valued at $3,482,413 for each security changing hands. The market closed out October with an average of 957,488 units valued at $13,947,047 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 10 stocks ending with bids higher than their last selling prices and 6 with lower offers. The PE ratio of the market ended at 17.1, with the main market ending at 17.8 times 2019 current year’s earnings.

In main market activity, Caribbean Cement traded 5,290 stock units and closed at $75.50, after losing $1.49, Eppley Caribbean Property Fund gained $1 to settle at $36, with 9,750 shares changing hands, Grace Kennedy closed $1 higher to $$67, in swapping 12,774 units. Jamaica Broilers added 62 cents to close at $36.42, trading 12,749 shares, Jamaica Producers lost 39 cents to end at $24.05, with an exchange of 11,146 shares, Jamaica Stock Exchange lost 44 cents to settle at $34.56 after 21,889 stock units passed through the market. Kingston Properties lost 62 cents while trading 1,680 units, to end at $5.30, Kingston Wharves gained $1 to close at $61 with 820 shares changing hands, Mayberry Investments closed 70 cents lower to $7.40, with 8,910 units traded, Mayberry Jamaican Equities lost 30 cents to end at $12 exchanging 5,350 shares. NCB Financial ended at $213.10, after rising $1.10 with a transfer of 131,716 units, Portland JSX closed at $8.10, after losing 40 cents with 100 units trading, Salada Foods dropped $1, in ending at $29 with 500 units crossing the exchange. Seprod rose by $1.03 to $51.53, with 8,274 shares changing hands, Supreme Ventures gained 49 cents, ending the day’s trade at $26.49 with 76,054 shares traded, Victoria Mutual Investments closed 30 cents higher to settle at $8.30, with 272,572 shares changing hands and Wisynco Group lost 50 cents to close at $23, with 57,193 shares crossing the exchange.

Kingston Properties lost 62 cents while trading 1,680 units, to end at $5.30, Kingston Wharves gained $1 to close at $61 with 820 shares changing hands, Mayberry Investments closed 70 cents lower to $7.40, with 8,910 units traded, Mayberry Jamaican Equities lost 30 cents to end at $12 exchanging 5,350 shares. NCB Financial ended at $213.10, after rising $1.10 with a transfer of 131,716 units, Portland JSX closed at $8.10, after losing 40 cents with 100 units trading, Salada Foods dropped $1, in ending at $29 with 500 units crossing the exchange. Seprod rose by $1.03 to $51.53, with 8,274 shares changing hands, Supreme Ventures gained 49 cents, ending the day’s trade at $26.49 with 76,054 shares traded, Victoria Mutual Investments closed 30 cents higher to settle at $8.30, with 272,572 shares changing hands and Wisynco Group lost 50 cents to close at $23, with 57,193 shares crossing the exchange.

Trading in the US dollar market closed with 5,449,518 units valued at US$1,638,052 with the market adding 1.77 points to close at 210.34. Proven Investments traded 5,306,625 units at 30 US cents and Sygnus Credit Investments closed at 14 US cents with 142,893 units changing hands.

- « Previous Page

- 1

- …

- 97

- 98

- 99

- 100

- 101

- …

- 129

- Next Page »