Main Event revenues are growing strongly.

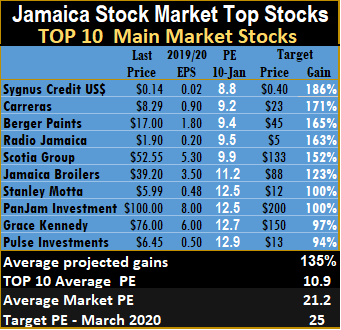

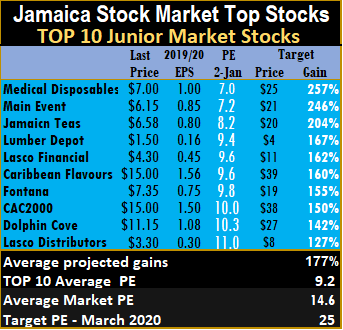

Entertainment event planners, Main Event and Sygnus Credit Investments US dollar-based stock surged to number one spot on the Junior and Main markets of the Jamaican Stock Exchange in a week with just one change to the TOP 10 lists.

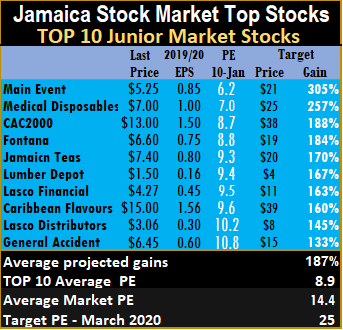

Dolphin Cove’s price moved to $11.90 and the stock moved out of the Junior Market TOP 10 and is replaced by General Accident with the stock price falling to $6.45.

The Jamaica Stock Exchange got some price changing news during the past week. Jamaican Teas announced that the directors would be meeting to consider increasing the share capital and a sub-division of the companies issued shares. That news created added interest in the stock, driving the price from $6.58 to close the week at $7.40.

Pulse Investments announced expansion into residential real estate development for sales and the retention of some units. The stock was added to the Main Market TOP 10 in 2019 and is on the verge of moving out, with increased buying interest. KLE Group announced the buy-out of the Tacks and Records restaurant in Montego Bay that will add significantly to revenues and boost profitability. KLE is one to watch. Proven Investments announced another stock offering, this time to the wider public. The move with help to boost broader interest in the stock as it pulls in new shareholders.

Pulse Investments announced expansion into residential real estate development for sales and the retention of some units. The stock was added to the Main Market TOP 10 in 2019 and is on the verge of moving out, with increased buying interest. KLE Group announced the buy-out of the Tacks and Records restaurant in Montego Bay that will add significantly to revenues and boost profitability. KLE is one to watch. Proven Investments announced another stock offering, this time to the wider public. The move with help to boost broader interest in the stock as it pulls in new shareholders.

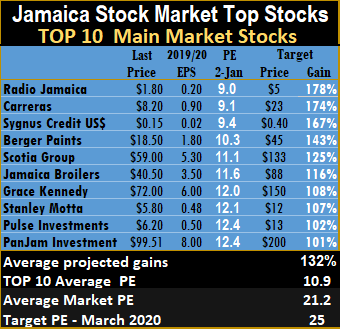

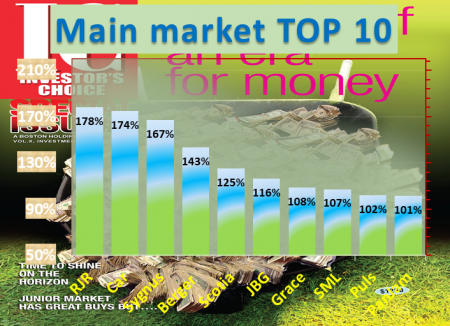

The JSE Main Market ended the week, with an overall PE of 21.2 and the Junior Market 14.4, based on current 2019 earnings. The PE ratio for Junior Market Top 10 stocks averages 8.9 with the Main Market at 10.9.

The targeted average PE ratio is 25, with several stocks trading at that level or just under, in 22 times region, currently. The TOP 10 companies now trade at a discount of 38 percent of the average for Junior Market and Main Market stocks trade at a discount of 49 percent to the overall market.

The average projected gain for the IC TOP 10 stocks is 187 percent for the Junior Market and 135 percent for JSE Main Market, based mostly on 2019 earnings.

The top three Junior Market stocks currently are by Main Event with projected gains of 305 percent, followed by Medical Disposables with 257 percent and CAC 2000, with 188 percent likely capital growth.

Sygnus US dollar-denominated stock, holds on to the lead of Main Market stocks with projected gains with 186 percent, followed by Carreras in the number two spot, with 171 percent and Berger Paints with 165 percent.

IC TOP 10 stocks are likely to deliver the best returns to March this year. Forecasted earnings and PE ratio for the current fiscal year are in determining potential gains. Possible gains for each stock are ranked, with highest-ranked being the most attractive. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Persons who compiled this report may have an interest in securities commented on.

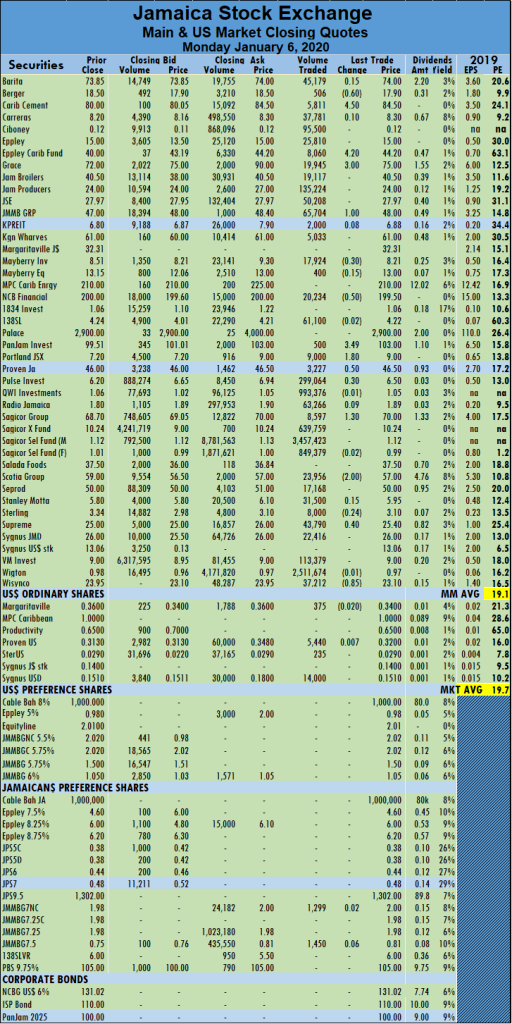

Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

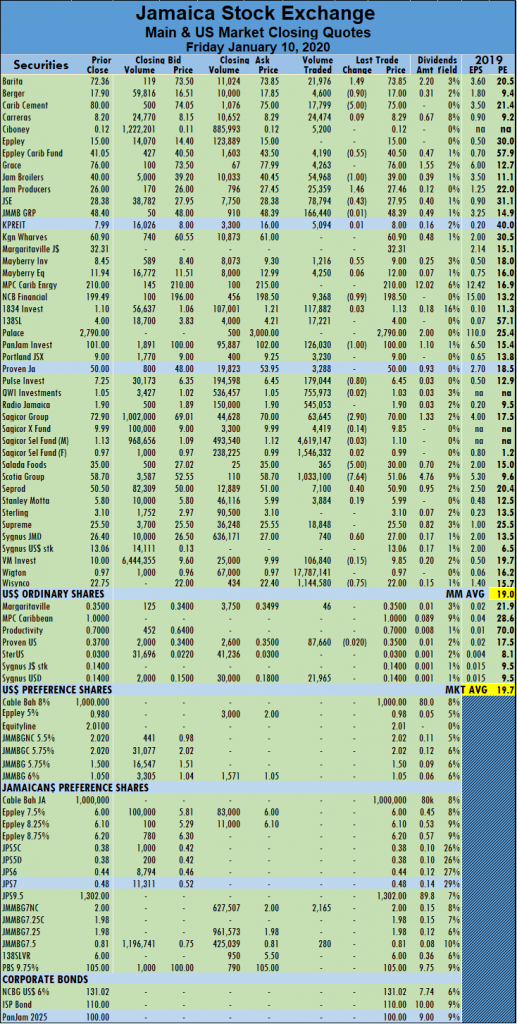

Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security. PanJam Investments fell by $1 in settling at $100 and trading 126,030 shares, Pulse Investments closed 80 cents lower at $6.45, with 179,044 units changing hands. Sagicor Group dropped $2.90 to end at $70 in swapping 63,645 shares, Salada Foods dropped to $30, with a loss of $5 in exchanging a mere 365 shares, Scotia Group dived $7.64 to $51.06 with 1,033,100 shares changing hands, Seprod gained 40 cents to close the day’s trade at $50.90, with 7,100 units changing hands. Sygnus Credit Investments ended 60 cents higher to settle at $27 after transferring 740 shares and Wisynco Group lost 75 cents to close at $22, with an exchange of 1,144,580 shares.

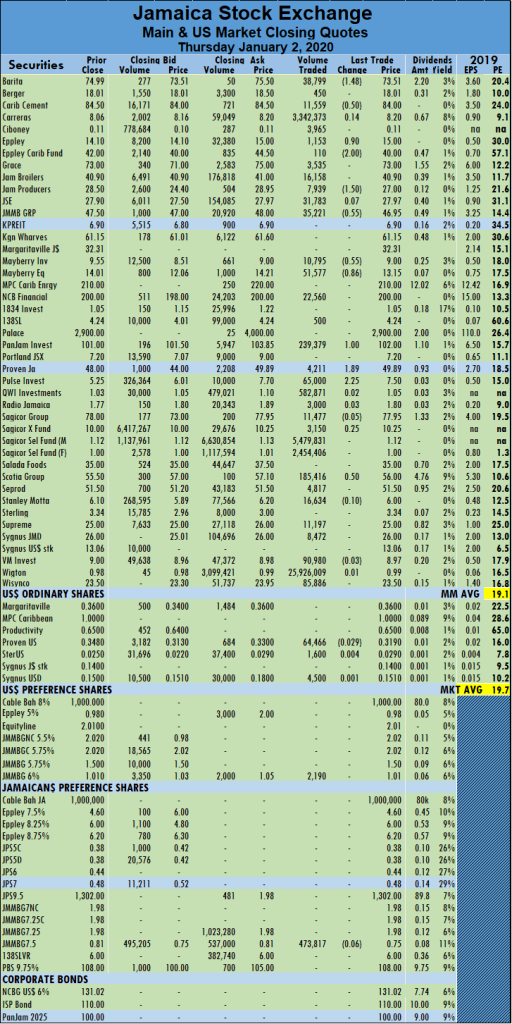

PanJam Investments fell by $1 in settling at $100 and trading 126,030 shares, Pulse Investments closed 80 cents lower at $6.45, with 179,044 units changing hands. Sagicor Group dropped $2.90 to end at $70 in swapping 63,645 shares, Salada Foods dropped to $30, with a loss of $5 in exchanging a mere 365 shares, Scotia Group dived $7.64 to $51.06 with 1,033,100 shares changing hands, Seprod gained 40 cents to close the day’s trade at $50.90, with 7,100 units changing hands. Sygnus Credit Investments ended 60 cents higher to settle at $27 after transferring 740 shares and Wisynco Group lost 75 cents to close at $22, with an exchange of 1,144,580 shares. The Main Market of the Jamaica Stock Exchange ended trading on Thursday with the major indices rebounding from the previous day’s losses with two stocks closing at 52 weeks’ highs.

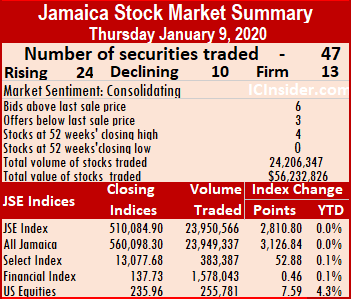

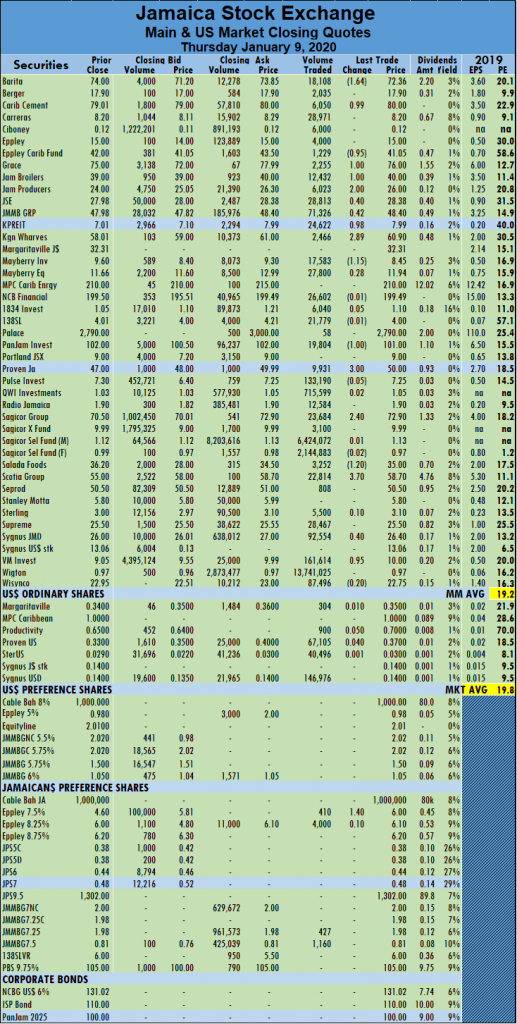

The Main Market of the Jamaica Stock Exchange ended trading on Thursday with the major indices rebounding from the previous day’s losses with two stocks closing at 52 weeks’ highs.

PanJam Investments lost $1, ending at $101 after trading 19,804 units, Proven Investments climbed $3 to $50, with 9,931 units changing hands, Sagicor Group gained $2.40 to settle at $72.90 in trading 23,684 shares. Salada Foods closed $1.20 lower at $35, after swapping 3,252 shares, Scotia Group gained $3.70 to end at $58.70 with 22,814 shares changing hands, Sygnus Credit Investments rose 40 cents to settle at $26.40 in trading 92,554 shares and Victoria Mutual Investments gained 95 cents to close at a 52 weeks’ high of $10, with an exchange of 161,614 shares. Trading in the US dollar market ended with 255,781 units valued at over US$45,167. The market index advanced 7.59 points to close at 235.96.

PanJam Investments lost $1, ending at $101 after trading 19,804 units, Proven Investments climbed $3 to $50, with 9,931 units changing hands, Sagicor Group gained $2.40 to settle at $72.90 in trading 23,684 shares. Salada Foods closed $1.20 lower at $35, after swapping 3,252 shares, Scotia Group gained $3.70 to end at $58.70 with 22,814 shares changing hands, Sygnus Credit Investments rose 40 cents to settle at $26.40 in trading 92,554 shares and Victoria Mutual Investments gained 95 cents to close at a 52 weeks’ high of $10, with an exchange of 161,614 shares. Trading in the US dollar market ended with 255,781 units valued at over US$45,167. The market index advanced 7.59 points to close at 235.96. The main market of the Jamaican Stock Exchange pulled back at the end of trading on Wednesday with large declines in the major indices as declining stocks bettered advancers.

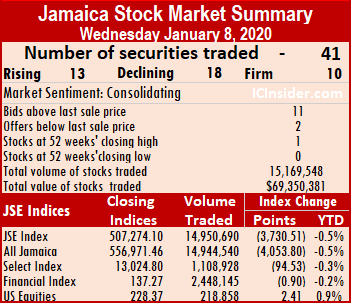

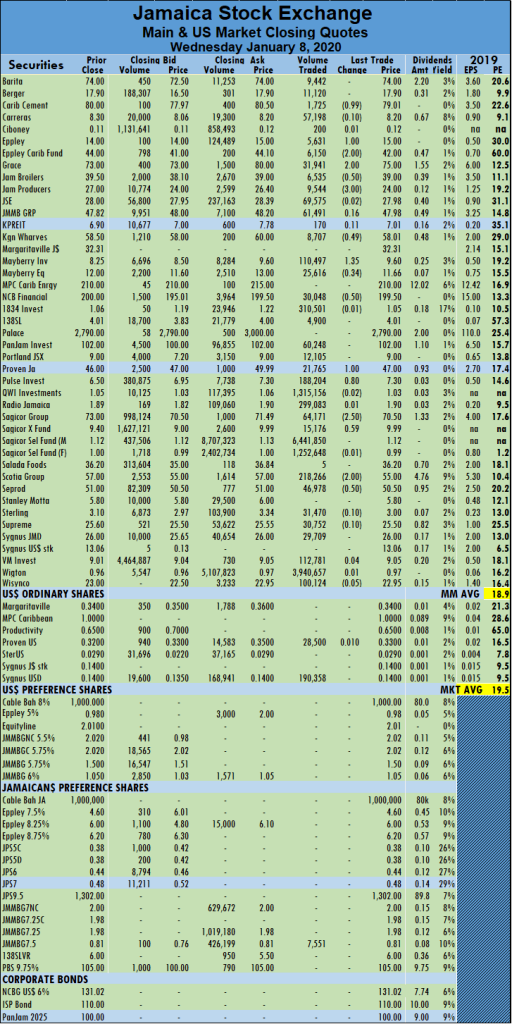

The main market of the Jamaican Stock Exchange pulled back at the end of trading on Wednesday with large declines in the major indices as declining stocks bettered advancers.  Trading in December resulted in an average of 595,143 units for $9,344,514 for each security.

Trading in December resulted in an average of 595,143 units for $9,344,514 for each security. NCB Financial lost 50 cents trading 30,048 shares to close at $199.50. Proven Investments advanced by $1 to settle at $47 with a swap of 21,765 shares, Pulse Investments rose by 80 cents to end at weeks’ high of $7.30 with 188,204 units changing hands, Sagicor Group lost $2.50, trading 64,171 shares to end at $70.50. Sagicor Property Fund picked up 59 cents to close at $9.99 with an exchange of 15,176 stock units, Scotia Group lost $2 to close at $55 with 218,266 units crossing the exchange and Seprod declined by 50 cents to end at $50.50 with 46,978 shares transferred.

NCB Financial lost 50 cents trading 30,048 shares to close at $199.50. Proven Investments advanced by $1 to settle at $47 with a swap of 21,765 shares, Pulse Investments rose by 80 cents to end at weeks’ high of $7.30 with 188,204 units changing hands, Sagicor Group lost $2.50, trading 64,171 shares to end at $70.50. Sagicor Property Fund picked up 59 cents to close at $9.99 with an exchange of 15,176 stock units, Scotia Group lost $2 to close at $55 with 218,266 units crossing the exchange and Seprod declined by 50 cents to end at $50.50 with 46,978 shares transferred. Trading remains buoyant on the Main Market of the Jamaica Stock Exchange on Tuesday, with market activities accounting for 40 securities changing hands, compared to 39 listings trading on Monday.

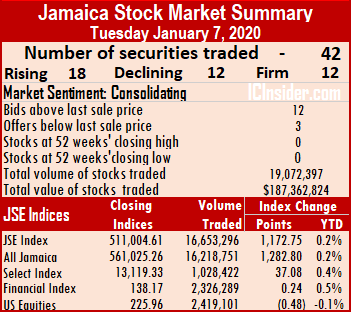

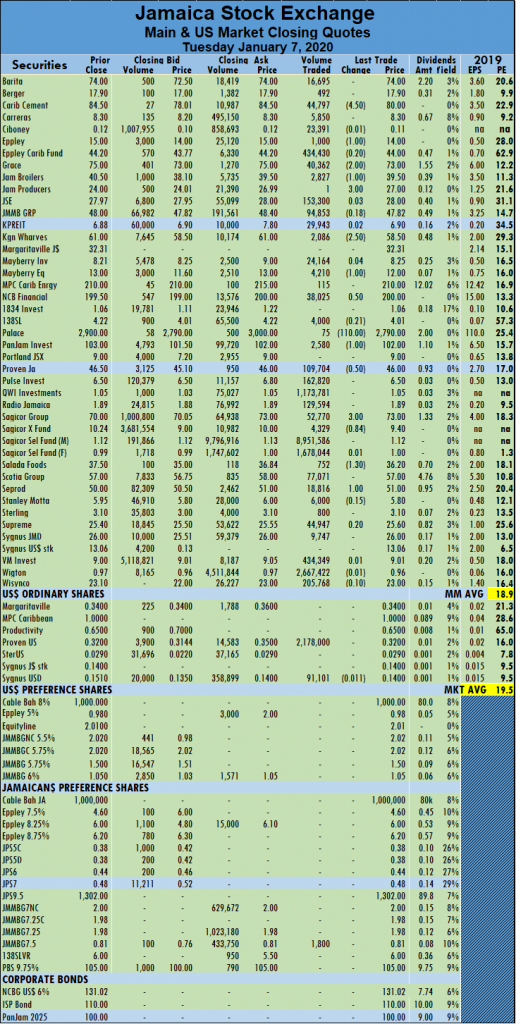

Trading remains buoyant on the Main Market of the Jamaica Stock Exchange on Tuesday, with market activities accounting for 40 securities changing hands, compared to 39 listings trading on Monday.

Mayberry Jamaican Equities lost $1 to end at $12 in trading 4,210 units, NCB Financial fell 50 cents in exchanging 38,025 to close at $200. Palace Amusement dropped by $110 to close at $2,790 after trading 75 units. Pan Jam Investment lost $1 with a transfer of 2,580 shares to end at $102. Proven Investments dropped 50 cents in exchanging 109,704 units to close at $46. Sagicor Group gained $3, trading 52,770 shares to end at $73, while Sagicor Property Fund lost 84 cents to end the day at $9.40 with 4,329 stock units changing hands. Salada Foods declined by $1.30 to close at $36.20 with 752 units crossing the exchange, and Seprod lost $1 to end at $51 with the transfer of 18,616 shares.

Mayberry Jamaican Equities lost $1 to end at $12 in trading 4,210 units, NCB Financial fell 50 cents in exchanging 38,025 to close at $200. Palace Amusement dropped by $110 to close at $2,790 after trading 75 units. Pan Jam Investment lost $1 with a transfer of 2,580 shares to end at $102. Proven Investments dropped 50 cents in exchanging 109,704 units to close at $46. Sagicor Group gained $3, trading 52,770 shares to end at $73, while Sagicor Property Fund lost 84 cents to end the day at $9.40 with 4,329 stock units changing hands. Salada Foods declined by $1.30 to close at $36.20 with 752 units crossing the exchange, and Seprod lost $1 to end at $51 with the transfer of 18,616 shares. Declines in primary indices of the JSE Main Market continues at the close on Monday, with a greater fall than that suffered on Friday as trading volume and value fell sharply.

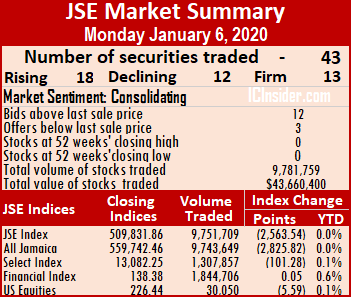

Declines in primary indices of the JSE Main Market continues at the close on Monday, with a greater fall than that suffered on Friday as trading volume and value fell sharply.  Trading in December, resulted in an average of 595,143 units for $9,344,514 for each security changing hands.

Trading in December, resulted in an average of 595,143 units for $9,344,514 for each security changing hands. Proven Investments rose by 50 cents in trading 3,227 units to close at $46.50, Sagicor Group added $1.30 to close at $70 with 8,597 units crossing the exchange, Scotia Group fell $2 to close at $57 with an exchange of 23,956 stock units, Supreme exchanged 43,790 shares and gained 40 cents to close at $25.40 and Wisynco Group fell 85 cents to $23.10, with 37,212 shares changing hands.

Proven Investments rose by 50 cents in trading 3,227 units to close at $46.50, Sagicor Group added $1.30 to close at $70 with 8,597 units crossing the exchange, Scotia Group fell $2 to close at $57 with an exchange of 23,956 stock units, Supreme exchanged 43,790 shares and gained 40 cents to close at $25.40 and Wisynco Group fell 85 cents to $23.10, with 37,212 shares changing hands.

The JSE Main Market ended the week, with an overall PE of 21.2 and the Junior Market 14.6, based on current 2019 earnings. The PE ratio for Junior Market Top 10 stocks averages 9.4 with the Main Market 10.2.

The JSE Main Market ended the week, with an overall PE of 21.2 and the Junior Market 14.6, based on current 2019 earnings. The PE ratio for Junior Market Top 10 stocks averages 9.4 with the Main Market 10.2. The average projected gain for the IC TOP 10 stocks is 177 percent for the Junior Market and 132 percent for JSE Main Market based mostly on 2019 earnings.

The average projected gain for the IC TOP 10 stocks is 177 percent for the Junior Market and 132 percent for JSE Main Market based mostly on 2019 earnings. IC TOP 10 stocks are likely to deliver the best returns to March next year. Forecasted earnings and PE ratio for the current fiscal year are in determining potential gains. The projected increase for each stock is ranked, with highest-ranked being the most attractive. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

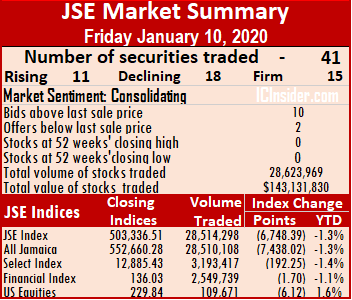

IC TOP 10 stocks are likely to deliver the best returns to March next year. Forecasted earnings and PE ratio for the current fiscal year are in determining potential gains. The projected increase for each stock is ranked, with highest-ranked being the most attractive. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list. More stocks declined than rose at the end of trading on the JSE Main Market on Friday, leading to a modest fall in the primary indices of the market.

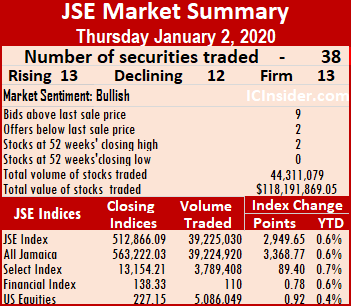

More stocks declined than rose at the end of trading on the JSE Main Market on Friday, leading to a modest fall in the primary indices of the market. The market closed, with an average of 247,622 units valued at $2,097,532 for each security traded, in contrast to 1,153,677 units valued at an average of $3,371,058 on Thursday. The average volume and value for the month to date amounts to 658,367 units for $2,674,864 for each security changing hands. Trading in December resulted in an average of 595,143 units for $9,344,514 for each security traded.

The market closed, with an average of 247,622 units valued at $2,097,532 for each security traded, in contrast to 1,153,677 units valued at an average of $3,371,058 on Thursday. The average volume and value for the month to date amounts to 658,367 units for $2,674,864 for each security changing hands. Trading in December resulted in an average of 595,143 units for $9,344,514 for each security traded. Proven Investments dropped $3.89 in exchanging 28,052 units to close at $46, Pulse Investments declined $1.30 with 323,031 shares changing hands, to end at $6.20. Sagicor Group dived $9.25 trading 37,462 stock units at $68.70, Salada Foods jumped $2.50 to close at $37.50 with 3,260 changing hands, Scotia Group rose $3 to close at $59 with an exchange of 601,925 stock units. Seprod lost $1.50 to end at $50 with a transfer of 6,883 shares and Wisynco Group gained 45 cents to $23.95, with 133,187 shares changing hands.

Proven Investments dropped $3.89 in exchanging 28,052 units to close at $46, Pulse Investments declined $1.30 with 323,031 shares changing hands, to end at $6.20. Sagicor Group dived $9.25 trading 37,462 stock units at $68.70, Salada Foods jumped $2.50 to close at $37.50 with 3,260 changing hands, Scotia Group rose $3 to close at $59 with an exchange of 601,925 stock units. Seprod lost $1.50 to end at $50 with a transfer of 6,883 shares and Wisynco Group gained 45 cents to $23.95, with 133,187 shares changing hands. Rising and falling JSE Main Market stocks were almost equal in number on the first trading day on the new-year when market activity closed on Thursday.

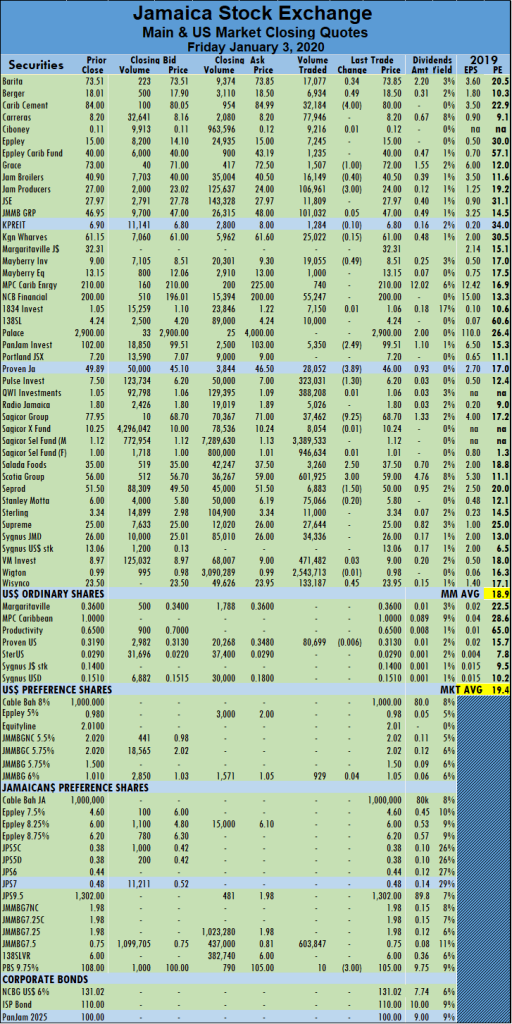

Rising and falling JSE Main Market stocks were almost equal in number on the first trading day on the new-year when market activity closed on Thursday.

PanJam Investment gained $1 to end at $102, with 239,379 units crossing the exchange. Proven Investments gained $1.89 in exchanging 4,211 units to close at $49.89, Pulse Investments climbed $2.25 with 65,000 shares changing hands, to end at a 52 weeks’ high of $7.50, after trading at an all-time high of $6.20. Sagicor Real Estate Fund lost 25 cents in trading 3,150 shares at $10.25 and Scotia Group rose 50 cents to close at $56 with an exchange of 185,416 stock units.

PanJam Investment gained $1 to end at $102, with 239,379 units crossing the exchange. Proven Investments gained $1.89 in exchanging 4,211 units to close at $49.89, Pulse Investments climbed $2.25 with 65,000 shares changing hands, to end at a 52 weeks’ high of $7.50, after trading at an all-time high of $6.20. Sagicor Real Estate Fund lost 25 cents in trading 3,150 shares at $10.25 and Scotia Group rose 50 cents to close at $56 with an exchange of 185,416 stock units. Prices of several stocks bounced sharply on the JSE Main Market as the year came to an end with 43 securities changing hands in the Main and US dollar market

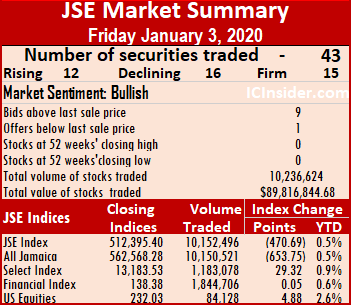

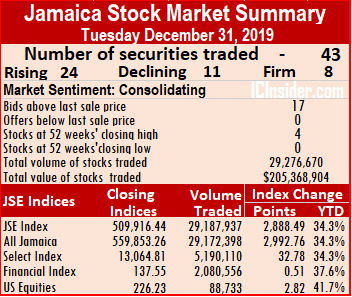

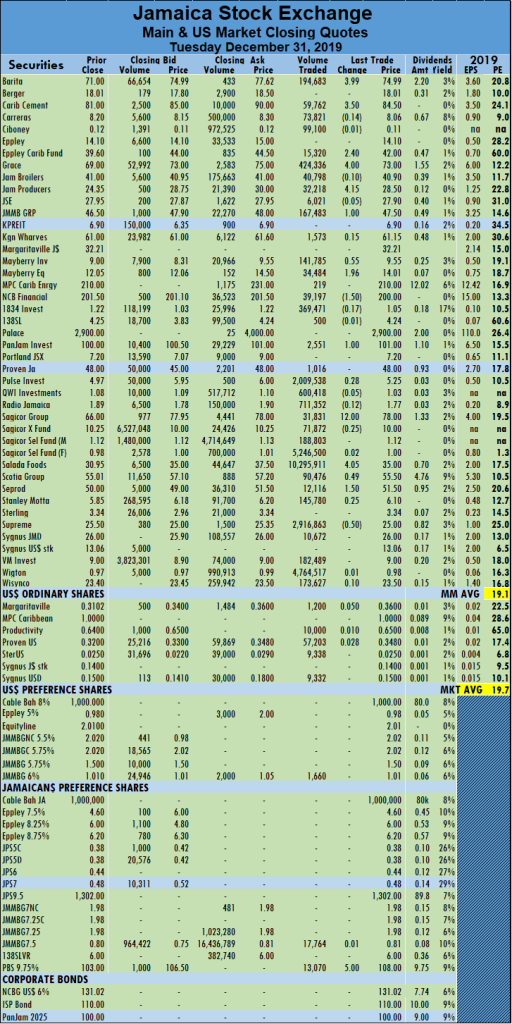

Prices of several stocks bounced sharply on the JSE Main Market as the year came to an end with 43 securities changing hands in the Main and US dollar market

Scotia Group rose 49 cents to close at $55.50 with an exchange of 90,476 stock units, Seprod recovered $1.50 previously lost to end at $51.50 with a transfer of 12,116 shares and Supreme Ventures lost 50 cents to end at $25, after exchanging 2,916,863 shares.

Scotia Group rose 49 cents to close at $55.50 with an exchange of 90,476 stock units, Seprod recovered $1.50 previously lost to end at $51.50 with a transfer of 12,116 shares and Supreme Ventures lost 50 cents to end at $25, after exchanging 2,916,863 shares.