The Main Market indices on the Jamaica Stock Exchange ended the week on Friday, with another round of losses with the market closing down on Friday at the end of a volatile week.

The Main Market indices on the Jamaica Stock Exchange ended the week on Friday, with another round of losses with the market closing down on Friday at the end of a volatile week.

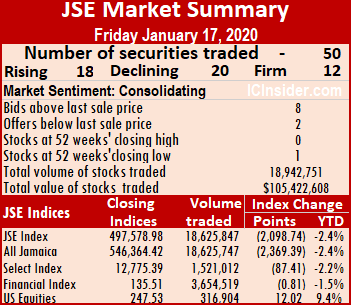

At the close, the JSE All Jamaican Composite Index dropped 2,369.39 points to close at 546,364.42, with a drop of 6,296 points for the week. The JSE Market Index declined 2,098.74 points to 497,578.98, leading to a decline of 5,758 points for the week and the JSE Financial Index lost 0.81 points to 135.51.

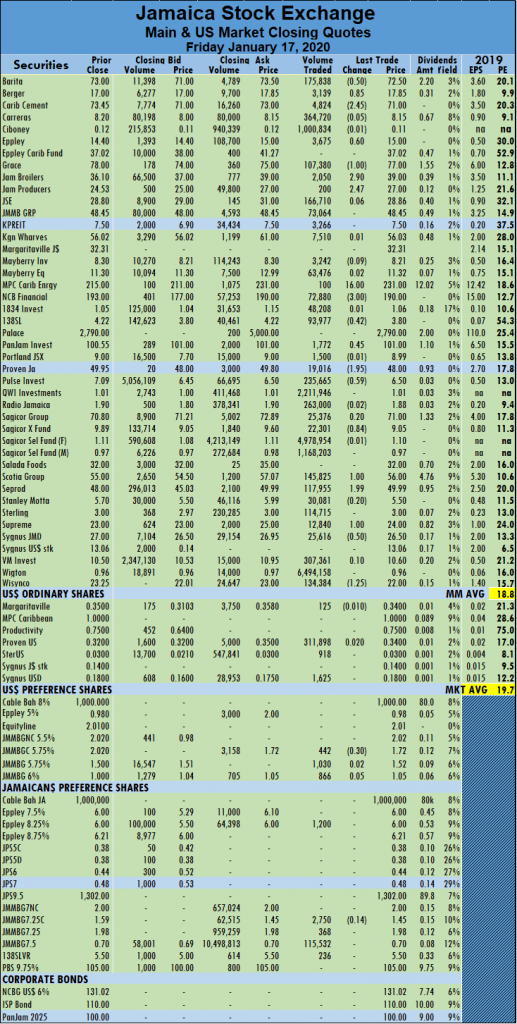

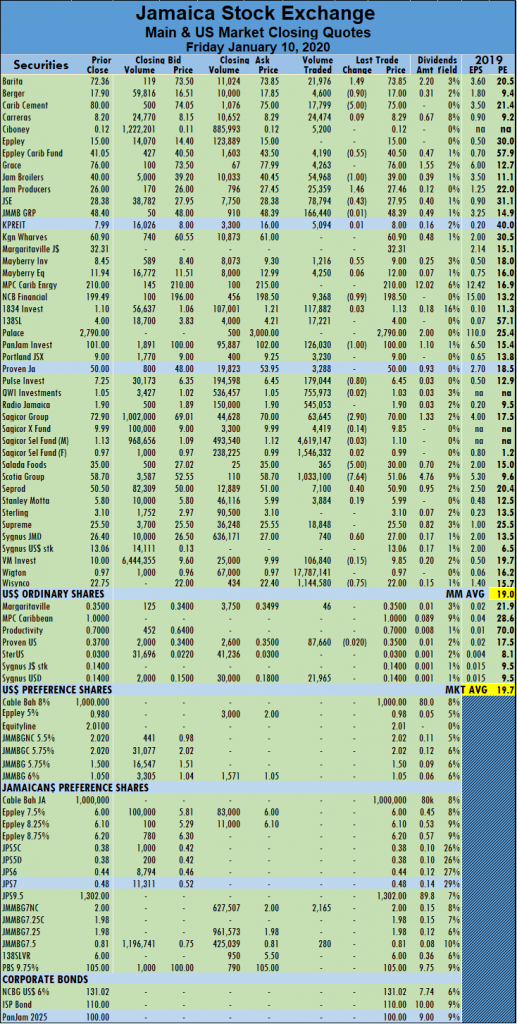

The market closed with 50 securities changing hands in the Main and US dollar markets with the prices of 18 advancing, 20 declining and 12 trading firm. The JSE Main Market activity ended with 43 securities accounting 18,625,847 units valued at $90,035,262 in contrast to 28,467,668 units valued at $102,258,217 from 42 securities on Thursday. JMMB Group 7.25% preference share closed at a 52 weeks’ low of $1.45.

Wigton Windfarm dominated trading with 6.5 million shares for 35 percent of total volume, followed by Sagicor Select Financial Fund with 5 million units for 27 percent of the day’s trade and QWI Investments with 2.2 million shares for 12 percent of the market’s volume. The only other stock trading more than one million shares was Sagicor Select Fund – Manufacturing and Distribution, with 1.2 million units.

The Market closed with an average of 433,159 units valued at an average of $2,093,843 for each security traded, in contrast to 662,039 units valued at an average of $2,378,098 on Thursday. The average volume and value for the month to date amounts to 537,214 units valued at $2,21,990 for each security changing hands, compared to 546,633 units valued at $2,234,657 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows eight stocks ending with bids higher than their last selling prices and two closing with lower offers. The PE ratio of the market ended at 19.7, while the Main Market ended at 18.8 times the 2019 earnings.

In the prime market, Barita Investments closed 50 cents lower to $72.50, with an exchange of 175,838 units, Berger Paints gained 85 cents to end at $17.85, with 3,139 shares changing hands, Caribbean Cement dropped $2.45, settling at $71 in trading 4,824 shares. Eppley closed 60 cents higher at $15, after transferring 3,675 units, Grace Kennedy slipped $1 to close at $77, in swapping 107,380 shares, Jamaica Broilers closed $2.90 higher to $39 after exchanging 2,050 shares. Jamaica Producers Group gained $2.47 to end at $27 trading 200 units.  MPC Caribbean Clean Energy advanced $16 to $231, with 100 units changing hands, NCB Financial Group lost $3 in transferring 72,880 shares to close at $190, after trading as low as $175.01, 138 Student Living lost 42 cents to settle at $3.80, in swapping 93,977 shares. PanJam Investment ended at $101, with a gain of 45 cents trading 1,772 shares, Proven Investments declined $1.95 to $48, after 19,016 units changed hands, Pulse Investments closed at $6.50, with a loss of 59 cents in transferring 235,665 shares. Sagicor Real Estate Fund lost 84 cents in swapping 22,301 shares, and ending at $9.05, Scotia Group added $1 to close at $56, with 145,825 shares changing hands, Seprod gained $1.99 and ended at $49.99, after trading 117,955 shares. Supreme Ventures gained $1 to end at 24.00 with 12,840 stock units trading, Sygnus Credit Investments slid to $26.50, after losing 50 cents and transferring 25,616 shares and Wisynco Group dropped $1.25 to end the day’s trade at $22, in swapping 134,384 shares.

MPC Caribbean Clean Energy advanced $16 to $231, with 100 units changing hands, NCB Financial Group lost $3 in transferring 72,880 shares to close at $190, after trading as low as $175.01, 138 Student Living lost 42 cents to settle at $3.80, in swapping 93,977 shares. PanJam Investment ended at $101, with a gain of 45 cents trading 1,772 shares, Proven Investments declined $1.95 to $48, after 19,016 units changed hands, Pulse Investments closed at $6.50, with a loss of 59 cents in transferring 235,665 shares. Sagicor Real Estate Fund lost 84 cents in swapping 22,301 shares, and ending at $9.05, Scotia Group added $1 to close at $56, with 145,825 shares changing hands, Seprod gained $1.99 and ended at $49.99, after trading 117,955 shares. Supreme Ventures gained $1 to end at 24.00 with 12,840 stock units trading, Sygnus Credit Investments slid to $26.50, after losing 50 cents and transferring 25,616 shares and Wisynco Group dropped $1.25 to end the day’s trade at $22, in swapping 134,384 shares.

Trading in the US dollar market ended with 316,904 units valued at over US$112,316. The market index advanced 12.02 points to close at 247.53. Margaritaville lost 1 US cent in an exchange of 125 units at 34 US cents, Proven Investments gained 2 US cents to close at 34 US cents, after exchanging 311,898 shares, Sygnus Credit Investments traded 1,625 units at 18 US cents, Sterling Investments closed at 3 US cents with 918 units changing hands,

In the preference section of the US dollar market, JMMB Group 5.75% swapped 1,030 units, gaining 2 US cents to end at US$1.52, JMMB Group 6% settled at US$1.05, after rising 5 US cents trading 866 shares and JMMB Group 5.75% lost 30 US cents to settle at US$1.72, after an exchange of 442 units.

JSE majors drop 6,300 points this week

JSE Main Market enjoys bounce

Grace Kennedy put on $7 to recover from a big drop on Wednesday, but Scotia Group dropped $2.95 and, along with sixteen other rising stocks, helped to push the JSE Main Market Index up 3,600 points.

Grace Kennedy put on $7 to recover from a big drop on Wednesday, but Scotia Group dropped $2.95 and, along with sixteen other rising stocks, helped to push the JSE Main Market Index up 3,600 points.

Market activity resulted in the primary indices regaining almost half of the ground lost on Wednesday. At the close, the JSE All Jamaican Composite Index jumped 4,003.98 points to close at 548,733.81. The JSE Market Index climbed 3,628.22 points to 499,677.72 and the JSE Financial Index rose 1.55 points to 136.32.

The market closed with 47 securities changing hands in the Main and US dollar markets with the prices of 18 stocks advancing, 16 declining and 13 trading firm. The JSE Main Market activity ended with 42 securities accounting for 28,467,668 units valued at $102,258,217 in contrast to 49,953,294 units valued at $104,735,667 from 42 securities on Wednesday.

Wigton Windfarm dominated trading with 17.6 million shares for 62 percent of total volume, followed by Sagicor Select Financial Fund with 6.3 million units for 22 percent of the day’s trade and QWI Investments with 1.1 million shares for 4 percent of the market’s volume.

The Market closed with an average of 662,039 units, valued at an average of $2,378,098 for each security traded, in contrast to 1,218,373 units valued at an average of $2,554,528 on Wednesday. The average volume and value for the month to date amounts to 546,633 units valued at $2,234,657 for each security changing hands, compared to 535,146 units valued at $2,218,923 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows six stocks ending with bids higher than their last selling prices and eight closing with lower offers. The PE ratio of the market ended at 19.5, while the Main Market ended at 18.7 times the 2019 earnings.

In the prime market, Barita Investments lost $1 to close at $73, with 3,100 shares changing hands, Berger Paints gained 50 cents to settle at $17 trading 884 units, Grace Kennedy jumped $7 to close at $78, after swapping 112,533 stock units. Jamaica Producers Group dropped 97 cents to end at $24.53, in exchanging 3,752 shares, JMMB Group closed $1.70 higher to $48.45 with an exchange of 196,144 units, Mayberry Jamaican Equities lost 55 cents to settle at $11.30 in trading 56,800 units.  NCB Financial Group declined by 50 cents to close at $193, in an exchange of 74,576 shares, Sagicor Group climbed $1.80 to $70.80, in swapping 9,434 shares, Scotia Group ended $2.95 down at $55, with 34,209 shares changing hands, Seprod slipped 94 cents and closed at $48, in trading 35,213 shares. Supreme Ventures slid to $23, after a loss of $2 in transferring 147,830 shares, Victoria Mutual Investments closed 50 cents lower at $10.50, with an exchange of 297,116 shares and Wisynco Group gained $1.25 to end at $23.25, in swapping 188,582 shares. In the preference sector, JMMB Group 7.25% preference share lost 39 cents in closing at $1.59 with just 535 units changing hands.

NCB Financial Group declined by 50 cents to close at $193, in an exchange of 74,576 shares, Sagicor Group climbed $1.80 to $70.80, in swapping 9,434 shares, Scotia Group ended $2.95 down at $55, with 34,209 shares changing hands, Seprod slipped 94 cents and closed at $48, in trading 35,213 shares. Supreme Ventures slid to $23, after a loss of $2 in transferring 147,830 shares, Victoria Mutual Investments closed 50 cents lower at $10.50, with an exchange of 297,116 shares and Wisynco Group gained $1.25 to end at $23.25, in swapping 188,582 shares. In the preference sector, JMMB Group 7.25% preference share lost 39 cents in closing at $1.59 with just 535 units changing hands.

Trading in the US dollar market ended with 223,639 units valued at over US$55,813. The market index advanced 3.06 points to close at 235.51. Margaritaville Turks exchanged 122,500 shares at 35 US cents after rising a fraction of a cent. Sygnus Credit Investments gained 3.7 US cents trading 56,225 shares to end at 18 US cents, Sterling Investments closed at 3 US cents with 36,382 units changing hands. Productive Business Solution rose 5 US cents to 75 US cents, with a transfer of 123 units and Proven Investments lost half of a cent to end at 32 US cents while exchanging 8,409 shares.

JSE Main Market plunged – Wednesday

NCB Financial Montego Bay branch

Prices of Grace Kennedy and NCB Financial Group suffered sharp declines followed by Jamaica Broilers and Kingston Wharves and helped to knock several thousand points off the major indices of the Jamaica Stock Exchange on Wednesday.

At the close, the JSE All Jamaican Composite Index plummeted 9,959.24 points to close at 544,729.83, the JSE Market Index plunged 9,002.01 points to 496,049.50 and the JSE Financial Index declined 2.42 points to 134.77.

The market closed with 46 securities changing hands in the Main and US dollar markets with the prices of 13 advancing, 21 declining and 12 trading firm. The JSE Main Market activity ended with 41 securities accounting for 49,953,294 units at $104,735,667 in contrast to 25,370,029 units valued at $66,307,015 from 36 securities on Tuesday.

Sagicor Select Financial Fund dominated trading with 36.3 million shares for 73 percent of total volume, followed by JMMB Group 7.5% with 5 million units for 10 percent of the day’s trade, and Wigton Windfarm with 2.9 million shares for 6 percent of the market’s volume.  Other stocks trading more than one million units were Sagicor Select Manufacturing & Distribution Fund with 2.2 million shares and QWI Investments with 1.7 million units.

Other stocks trading more than one million units were Sagicor Select Manufacturing & Distribution Fund with 2.2 million shares and QWI Investments with 1.7 million units.

The Market closed with an average of 1,218,373 units valued at an average of $2,554,528 for each security traded, in contrast to 704,723 units for $1,841,862 on Tuesday for each security changing hands. The average volume and value for the month to date amounts to 535,146 units for $2,218,923 for each security crossing the exchange, compared to 463,503 units valued at $2,179,721 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows six stocks ending with bids higher than their last selling prices and two closing with lower offers. The PE ratio of the market ended at 18.7, while the Main Market ended at 19.4 times the 2019 earnings.

In the prime market, Barita Investments gained 50 cents to settle at $74 trading 4,241 units, Caribbean Cement climbed $4.45 to end at $73.45, with 29,398 shares changing hands, Eppley Caribbean Property Fund closed $1 higher to $37.02 after transferring 610 shares. Grace Kennedy dropped $5.01 to $71 in exchanging 20,194 shares, Jamaica Broilers closed $2.79 lower to $36.11, after swapping 10,149 shares. Jamaica Producers Group climbed $1.49 to settle at $25.50, in trading 2,247 shares,  JMMB Group lost $1.25 to close at $46.75, with 95,804 units changing hands. Kingston Wharves ended at $56.02, after losing $2.48 in trading 1,501 shares, Mayberry Jamaican Equities gained 54 cents to close at $11.85, in swapping 9,302 units, NCB Financial Group tumbled to $193.50, with a loss of $4.50 after transferring 97,143 shares. PanJam Investment closed $1.50 lower to $100.50 while exchanging 2,500 units, Pulse Investments gained 55 cents to close at $7, with 22,670 units changing hands. Sagicor Group lost $1 to end at $69, in swapping 52,139 shares, Seprod closed $1.06 lower to $48.94 trading 12,584 shares, Sygnus Credit Investments gained 50 cents in transferring 38,791, to end at $27. Victoria Mutual Investments climbed $1 to a record $11, with an exchange of 341,192 shares and Wisynco Group closed 50 cents lower to $22 in swapping 319,531 shares.

JMMB Group lost $1.25 to close at $46.75, with 95,804 units changing hands. Kingston Wharves ended at $56.02, after losing $2.48 in trading 1,501 shares, Mayberry Jamaican Equities gained 54 cents to close at $11.85, in swapping 9,302 units, NCB Financial Group tumbled to $193.50, with a loss of $4.50 after transferring 97,143 shares. PanJam Investment closed $1.50 lower to $100.50 while exchanging 2,500 units, Pulse Investments gained 55 cents to close at $7, with 22,670 units changing hands. Sagicor Group lost $1 to end at $69, in swapping 52,139 shares, Seprod closed $1.06 lower to $48.94 trading 12,584 shares, Sygnus Credit Investments gained 50 cents in transferring 38,791, to end at $27. Victoria Mutual Investments climbed $1 to a record $11, with an exchange of 341,192 shares and Wisynco Group closed 50 cents lower to $22 in swapping 319,531 shares.

Trading in the US dollar market ended with 220,522 units valued US$77,797. The market index lost 1.49 points to close at 232.45. Proven Investments traded 104,624 units, gaining half of 1 US cent to close at 0.325 US cents, Sterling Investments swapped 10,000 units at 3 US cents and Sygnus Credit Investments lost 3.7 US cents in exchanging 73,431 shares to end at 14.3 US cents. JMMB Group 6% preference closed at US$1, after falling just under half of one US cent in trading 32,467 shares.

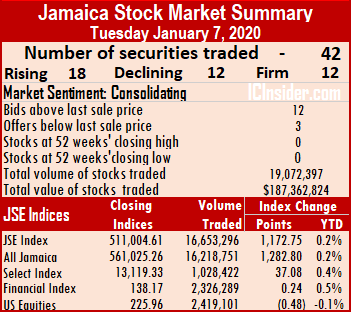

More Gains for JSE Main Market

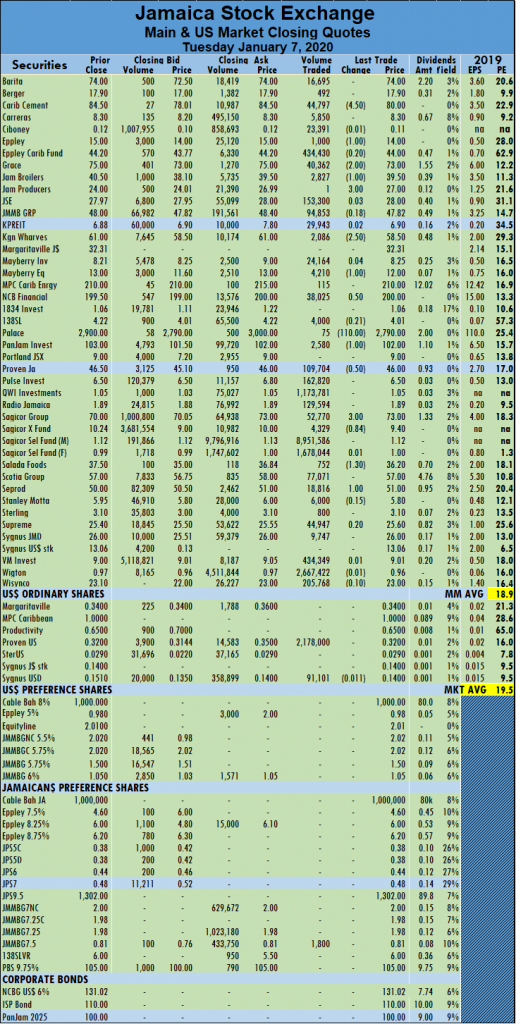

Main Market activity on the Jamaica Stock Exchange resulted in more gains for the major indices on Tuesday, but with declining stocks edging out advancing ones.

Main Market activity on the Jamaica Stock Exchange resulted in more gains for the major indices on Tuesday, but with declining stocks edging out advancing ones.

At the close, the JSE All Jamaican Composite Index advanced 1,603.82 points to close at 554,689.07, the JSE Market Index gained 1,368.73 points to 505,051.51 and the JSE Financial Index added 0.86 points to end at 137.19.

The market closed with 42 securities changing hands in the Main and US dollar markets with the prices of 16 stocks advancing, 18 declining and 8 trading firm. The JSE Main Market activity ended with 36 securities accounting for 25,370,029 units valued at $66,307,015 in contrast to 12,661,713 units valued at $111,971,239 from 47 securities on Monday.

Sagicor Select Financial Fund dominated trading with 16.9 million shares for 67 percent of total volume, followed by Wigton Windfarm with 4.1 million units for 16 percent of the day’s trade, and Sagicor Select Manufacturing & Distribution with 1.9 million shares for 7 percent of the market’s volume.

The Market closed with an average of 704,723 units valued $1,841,862 units for each security traded, in contrast to 301,469 units valued at an average of $2,665,982 on Monday. The average volume and value for the month to date amounts to 463,503 units valued at $2,179,721 for each security changing hands, compared to 439,042 units valued at $2,218,333 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows ten stocks ending with bids higher than their last selling prices and two securities closing with lower offers. The PE ratio of the market ended at 19.4, while the Main Market ended at 18.7 times the 2019 earnings.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows ten stocks ending with bids higher than their last selling prices and two securities closing with lower offers. The PE ratio of the market ended at 19.4, while the Main Market ended at 18.7 times the 2019 earnings.

In the prime market, Caribbean Cement dropped $4.50 to end at $69, with an exchange of 21,839 shares, Eppley gained 60 cents to close at $14.40 trading 5,607 shares, Grace Kennedy lost 99 cents exchanging 28,130 shares to end at $76.01, Jamaica Broilers closed 50 cents lower to $38.90, after swapping 8,915 shares. Jamaica Producers dropped $2.39 to settle at $24.01, with an exchange of 14,000 shares, Jamaica Stock Exchange climbed 90 cents transferring 150,186 units to end at $28.85, JMMB Group closed $2 higher to $48 in trading 106,771 units. Mayberry Investments ended at $8.50, after losing 50 cents with 21,947 shares changing hands, Mayberry Jamaican Equities closed 89 cents lower at $11.31, in swapping 4,158 units, NCB Financial Group gained $3 to settle at $198, after transferring 23,644 shares. PanJam Investment closed $2 higher at $102 after trading just 364 units, Pulse Investments lost 44 cents to close at $6.45, with 122,736 units changing hands.  Sagicor Group gained 40 cents to end at $70 in swapping 50,866 shares, Scotia Group advanced $3 to $58 in exchanging 58,212 shares and Supreme Ventures closed with a loss of 50 cents to end at $25, in swapping 10,227 shares.

Sagicor Group gained 40 cents to end at $70 in swapping 50,866 shares, Scotia Group advanced $3 to $58 in exchanging 58,212 shares and Supreme Ventures closed with a loss of 50 cents to end at $25, in swapping 10,227 shares.

Trading in the US dollar market ended with 84,352 units valued at over US$42,656. The market index advanced 8.56 points to close at 238.40. Margaritaville closed at 34.99 US cents, with 425 units changing hands, Proven Investments traded 58,581 units, in losing 1 US cent to close at 32 US cents. Sygnus Credit Investments ended with 8,800 shares changing hands at 18 US cents, Sterling Investments closed at 3 US cents after exchanging 3,458 units. JMMB Group 5.75% preference share traded 8,731 units at US$2.02 and JMMB Group 6% preference share traded 4,357 units at US$1.04.

Modest gains for JSE majors

Jamaica Stock Exchange.

The Main Market of the Jamaica Stock Exchange suffered a sharp increase in the number of stocks declining, with the leading indices enjoying marginal gains on Monday, following the tumultuous dive on Friday.

At the close, the JSE All Jamaican Composite Index advanced 424.97 points to close at 553,085.25, the JSE Market Index gained 346.27 points to 503,682.78, and the JSE Financial Index rose 0.30 points to 136.33.

The market closed with 47 securities changing hands in the Main and US dollar markets with the prices of 10 advancing, 24 declining and 12 trading firm. The JSE Main Market activity ended with 38 securities accounting for 12,661,713 units valued at $111,971,239 in contrast to 28,514,298 units valued at $143,131,830 from 38 securities on Friday.

Wigton Windfarm dominated trading with 4.1 million shares for 33 percent of total volume. Sagicor Select Financial Fund followed with 2.6 million units for 21 percent of the day’s trade and Sagicor Select Manufacturing & Distribution with 1.4 million shares for 11 percent of the market’s volume.

The Market closed with an average of 301,469 units valued at an average of $2,665,982 for each security traded, in contrast to 750,376 units valued at an average of $3,766,627 on Friday. The average volume and value for the month to date amounts to 439,042 units valued at 2,218,333 for each security changing hands, compared to 457,502 units valued at $2,149,464 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

The Market closed with an average of 301,469 units valued at an average of $2,665,982 for each security traded, in contrast to 750,376 units valued at an average of $3,766,627 on Friday. The average volume and value for the month to date amounts to 439,042 units valued at 2,218,333 for each security changing hands, compared to 457,502 units valued at $2,149,464 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows ten stocks ending with bids higher than their last selling prices and two with lower offers. The PE ratio of the market ended at 19.5, while the Main Market ended at 18.7 times the 2019 earnings.

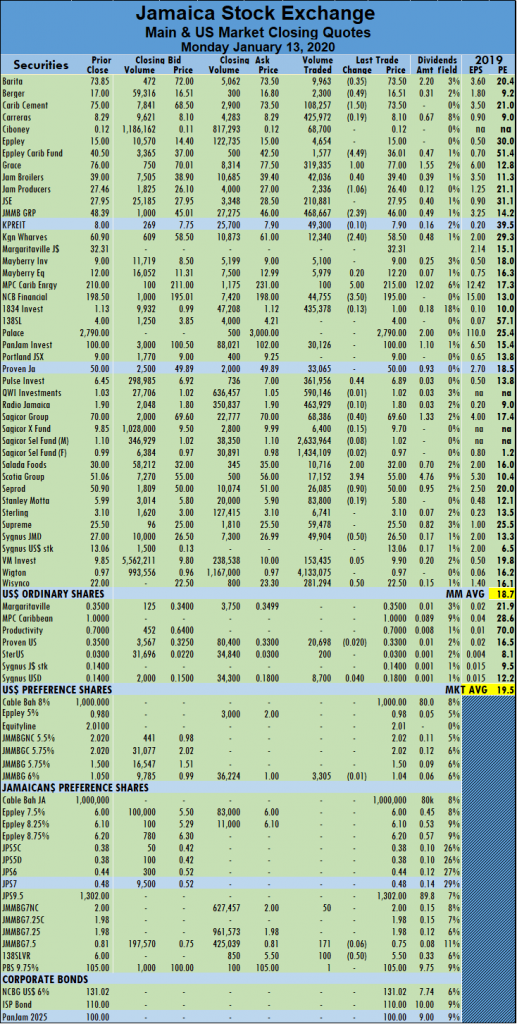

In the prime market, Barita Investments lost 35 cents, in ending at $73.50 and trading 9,963 units, Berger Paints settled at $16.51, after losing 49 cents exchanging 2,300 shares, Caribbean Cement dropped $1.50 to end at $73.50, with 108,257 stock units changing hands. Eppley Caribbean Property Fund closed $4.49 lower to $36.01 after transferring just 1,577 shares, Grace Kennedy gained $1 trading 319,335 units to end at $77, Jamaica Broilers closed at $39.40, with gains of 40 cents in swapping 42,036 stock units. Jamaica Producers Group dropped $1.06, falling to $26.40 with an exchange of 2,336 shares, JMMB Group closed $2.39 lower at $46 in trading 468,667 units. Kingston Wharves ended at $58.50, after losing $2.40 exchanging 12,340 shares, MPC Caribbean Clean Energy settled at $215, having gained $5 with 100 units trading.  NCB Financial Group declined $3.50 to $195, after falling $3.50 transferring 44,755 shares, Pulse Investments added 44 cents to close at $6.89, with 361,956 units changing hands, Sagicor Group lost 40 cents to end at $69.60 in swapping 68,386 shares. Salada Foods gained $2 to close at $32, with an exchange of 10,716 units, Scotia Group rose $3.94 to $55, after trading 17,152 shares, Seprod lost 90 cents to close at $50, with 26,085 units changing hands. Sygnus Credit Investments lost 50 cents to settle at $26.50 in swapping 49,904 shares, Wisynco Group ended 50 cents higher at $22.50, with an exchange of 281,294 shares and in the preference sector, 138 Student Living lost 50 cents in trading 100 stock units to close at $5.50.

NCB Financial Group declined $3.50 to $195, after falling $3.50 transferring 44,755 shares, Pulse Investments added 44 cents to close at $6.89, with 361,956 units changing hands, Sagicor Group lost 40 cents to end at $69.60 in swapping 68,386 shares. Salada Foods gained $2 to close at $32, with an exchange of 10,716 units, Scotia Group rose $3.94 to $55, after trading 17,152 shares, Seprod lost 90 cents to close at $50, with 26,085 units changing hands. Sygnus Credit Investments lost 50 cents to settle at $26.50 in swapping 49,904 shares, Wisynco Group ended 50 cents higher at $22.50, with an exchange of 281,294 shares and in the preference sector, 138 Student Living lost 50 cents in trading 100 stock units to close at $5.50.

Trading in the US dollar market ended with 32,903 units valued at US$11,906. The market index advanced 8.56 points to close at 238.40. Proven Investments traded 20,698 units, after losing 2 US cents to close at 33 US cents. Sygnus Credit Investments gained 4 US cents with 8,700 shares changing hands and ended at a record high of 18 US cents and Sterling Investments ended at 3 US cents, with 200 units changing hands. JMMB Group 6% preference share lost 1 US cent to close at US$1.04 while exchanging 3,305 units.

Main Event & Sygnus lead IC TOP 10

Main Event revenues are growing strongly.

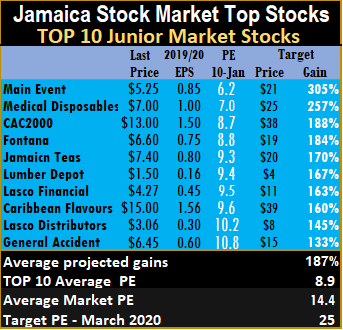

Entertainment event planners, Main Event and Sygnus Credit Investments US dollar-based stock surged to number one spot on the Junior and Main markets of the Jamaican Stock Exchange in a week with just one change to the TOP 10 lists.

Dolphin Cove’s price moved to $11.90 and the stock moved out of the Junior Market TOP 10 and is replaced by General Accident with the stock price falling to $6.45.

The Jamaica Stock Exchange got some price changing news during the past week. Jamaican Teas announced that the directors would be meeting to consider increasing the share capital and a sub-division of the companies issued shares. That news created added interest in the stock, driving the price from $6.58 to close the week at $7.40.

Pulse Investments announced expansion into residential real estate development for sales and the retention of some units. The stock was added to the Main Market TOP 10 in 2019 and is on the verge of moving out, with increased buying interest. KLE Group announced the buy-out of the Tacks and Records restaurant in Montego Bay that will add significantly to revenues and boost profitability. KLE is one to watch. Proven Investments announced another stock offering, this time to the wider public. The move with help to boost broader interest in the stock as it pulls in new shareholders.

Pulse Investments announced expansion into residential real estate development for sales and the retention of some units. The stock was added to the Main Market TOP 10 in 2019 and is on the verge of moving out, with increased buying interest. KLE Group announced the buy-out of the Tacks and Records restaurant in Montego Bay that will add significantly to revenues and boost profitability. KLE is one to watch. Proven Investments announced another stock offering, this time to the wider public. The move with help to boost broader interest in the stock as it pulls in new shareholders.

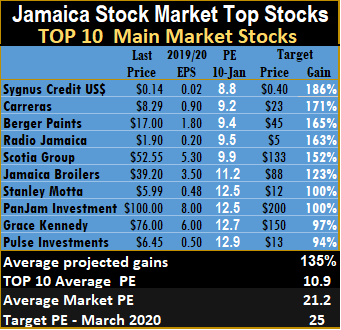

The JSE Main Market ended the week, with an overall PE of 21.2 and the Junior Market 14.4, based on current 2019 earnings. The PE ratio for Junior Market Top 10 stocks averages 8.9 with the Main Market at 10.9.

The targeted average PE ratio is 25, with several stocks trading at that level or just under, in 22 times region, currently. The TOP 10 companies now trade at a discount of 38 percent of the average for Junior Market and Main Market stocks trade at a discount of 49 percent to the overall market.

The average projected gain for the IC TOP 10 stocks is 187 percent for the Junior Market and 135 percent for JSE Main Market, based mostly on 2019 earnings.

The top three Junior Market stocks currently are by Main Event with projected gains of 305 percent, followed by Medical Disposables with 257 percent and CAC 2000, with 188 percent likely capital growth.

Sygnus US dollar-denominated stock, holds on to the lead of Main Market stocks with projected gains with 186 percent, followed by Carreras in the number two spot, with 171 percent and Berger Paints with 165 percent.

IC TOP 10 stocks are likely to deliver the best returns to March this year. Forecasted earnings and PE ratio for the current fiscal year are in determining potential gains. Possible gains for each stock are ranked, with highest-ranked being the most attractive. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Persons who compiled this report may have an interest in securities commented on.

Scotia & Sagicor big drop hits JSE hard

Scotia Group dived $7.64, Caribbean Cement shed $5 and Sagicor Group dropped $2.90 to inflict significant damage to the Main Market of the Jamaica Stock Exchange as the leading indices nosedived on Friday.

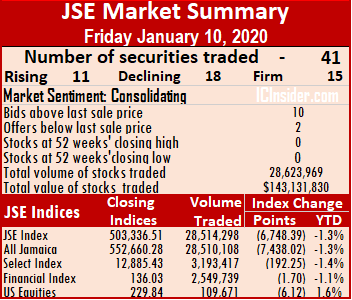

At the close of trading, the JSE All Jamaican Composite Index tumbled 7,438.02 points to close at 552,660.28, the JSE Market Index declined 6,748.39 points to 503,336.51 and the JSE Financial Index dropped 1.70 points to 136.03.

The market closed with 41 securities changing hands in the Main and US dollar markets with the prices of 11 stocks advancing, 18 declining and 15 trading firm. The JSE Main Market activity ended with 38 securities accounting for 28,514,298 units valued at $143,131,830 in contrast to 23,950,566 units valued at $50,135,329 from 42 securities on Thursday.

Wigton Windfarm dominated trading with 17.8 million shares for 62 percent of total volume, followed by Sagicor Select Financial Fund with 4.6 million units for 16 percent of the day’s trade and Sagicor Select Manufacturing & Distribution with 1.5 million shares for 5 percent of the market’s volume. Other stocks trading more than one million units were Wisynco Group with 1.14 million and Scotia Group with 1.03 million.

The market closed with an average of 750,376 units valued at an average of $3,766,627 for each security traded, in contrast to 570,252 units valued at an average of $1,193,698 on Thursday. The average volume and value for the month to date amounts to 457,502 units valued at $2,149,464 for each security changing hands, compared to 417,032 units valued at $1,887,966 for each security traded.  Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows ten stocks ending with bids higher than their last selling prices and two ending with lower offers. The PE ratio of the market ended at 19.7, while the Main Market ended at 19 times the 2019 earnings.

In the prime market, Barita Investments gained $1.49 to close at $73.85, exchanging 21,976 units, Berger Paints lost 90 cents to settle at $17 after trading 4,600 shares, Caribbean Cement closed $5 lower to $75, after swapping 17,799 shares. Eppley Caribbean Property Fund dropped 55 cents, ending at $40.50 with 4,190 shares changing hands, Jamaica Broilers settled at $39, after losing $1 and trading 54,968 shares. Jamaica Producers Group added $1.46, rising to $27.46 with an exchange of 25,359 shares, Jamaica Stock Exchange lost 43 cents transferring 78,794 units to end at $27.95, Mayberry Investments gained 55 cents after swapping 1,216 units to end at $9. NCB Financial Group closed at $198.50, after declining 99 cents exchanging 9,368 shares.  PanJam Investments fell by $1 in settling at $100 and trading 126,030 shares, Pulse Investments closed 80 cents lower at $6.45, with 179,044 units changing hands. Sagicor Group dropped $2.90 to end at $70 in swapping 63,645 shares, Salada Foods dropped to $30, with a loss of $5 in exchanging a mere 365 shares, Scotia Group dived $7.64 to $51.06 with 1,033,100 shares changing hands, Seprod gained 40 cents to close the day’s trade at $50.90, with 7,100 units changing hands. Sygnus Credit Investments ended 60 cents higher to settle at $27 after transferring 740 shares and Wisynco Group lost 75 cents to close at $22, with an exchange of 1,144,580 shares.

PanJam Investments fell by $1 in settling at $100 and trading 126,030 shares, Pulse Investments closed 80 cents lower at $6.45, with 179,044 units changing hands. Sagicor Group dropped $2.90 to end at $70 in swapping 63,645 shares, Salada Foods dropped to $30, with a loss of $5 in exchanging a mere 365 shares, Scotia Group dived $7.64 to $51.06 with 1,033,100 shares changing hands, Seprod gained 40 cents to close the day’s trade at $50.90, with 7,100 units changing hands. Sygnus Credit Investments ended 60 cents higher to settle at $27 after transferring 740 shares and Wisynco Group lost 75 cents to close at $22, with an exchange of 1,144,580 shares.

Trading in the US dollar market ended with 109,671 units valued at over US$31,294. The market index declined 6.12 points to close at 229.84. Margaritaville remained unchanged at 35 US cents, with 46 units changing hands, Proven Investments traded 87,660 units and lost 2 US cents to close at 35 US cents and Sygnus Credit Investments exchanged 21,965 shares at 14 US cents.

Rebound for JSE Main Market

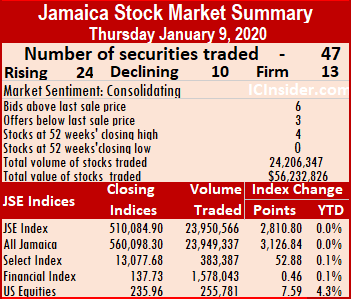

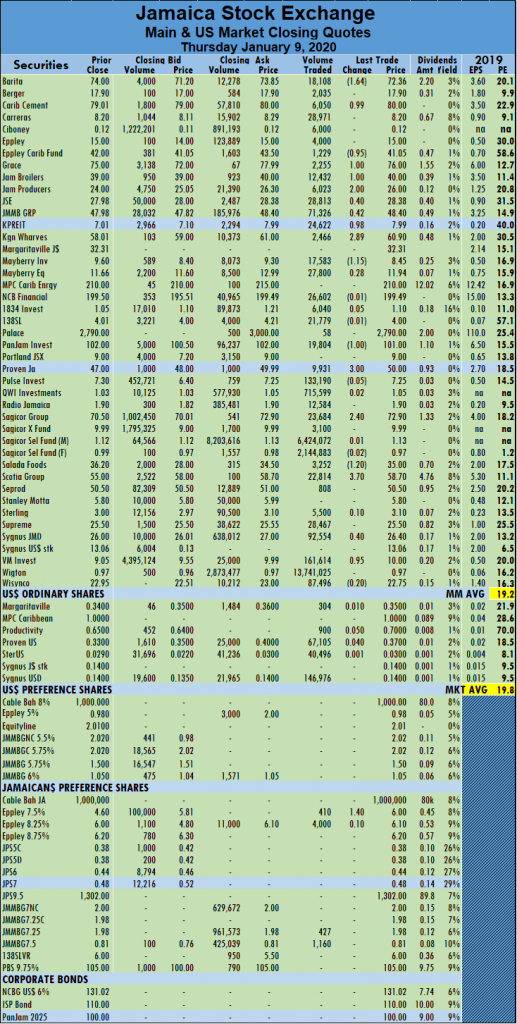

The Main Market of the Jamaica Stock Exchange ended trading on Thursday with the major indices rebounding from the previous day’s losses with two stocks closing at 52 weeks’ highs.

The Main Market of the Jamaica Stock Exchange ended trading on Thursday with the major indices rebounding from the previous day’s losses with two stocks closing at 52 weeks’ highs.

Productive Business Solution and Proven Investments also closed at new highs, trading in the US dollar market.

At the close, the JSE All Jamaican Composite Index advanced 3,126.84 points to close at 560,098.30, the JSE Market Index gained 2,810.80 points to 510,084.90 and the JSE Financial Index climbed 0.46 points to 137.73.

The market closed with 47 securities changing hands in the Main and US dollar markets with the prices of 24 securities advancing, 10 declining and 13 securities trading firm. The JSE Main Market activity ended with 42 securities accounting for 23,950,566 units valued at $50,135,329 in contrast to 14,950,690 units valued at $64,523,919 from 39 securities on Wednesday.

Wigton Windfarm dominated trading with 13.7 million shares for 57 percent of total Main Market volume. Sagicor Select Financial Fund followed with 6.4 million units for 27 percent of the day’s trade, and Sagicor Select Manufacturing & Distribution Fund with 2.1 million stock units for 9 percent of the market’s volume.

The Market closed with an average of 570,252 units valued at an average of $1,193,698 for each security traded, in contrast to 383,351 units valued at an average of $2,142,837 on Wednesday. The average volume and value for the month to date amounts to 417,032 units valued at $1,887,966 for each security changing hands, compared to 470,120 units valued at $2,039,050 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows six stocks ending with bids higher than their last selling prices and three stocks closing with lower offers. The PE ratio of the market ended at 19.8, while the Main Market ended at 19.2 times 2019 earnings.

In the prime market, Barita Investments closed $1.64 lower to settle at $72.36 with 18,108 shares traded, Caribbean Cement gained 99 cents to end at $80 with 6,050 units changing hands, Eppley Caribbean Property Fund dropped 95 cents and ended at $41.05 in trading 1,229 stock units. Grace Kennedy advanced $1 to a 52 weeks’ high of $76 after 2,255 units crossed the exchange, Jamaica Broilers closed $1 higher to settle at $40 trading 12,432 shares, Jamaica Producers Group climbed by $2, settling at $26 with 6,023 shares changing hands. Jamaica Stock Exchange gained 40 cents swapping 28,813 units to end at $28.38, JMMB Group closed 42 cents higher at $48.40 after transferring 71,326 units, Kingston Properties gained 98 cents to end at $7.99, with 24,622 shares changing hands. Kingston Wharves gained $2.89 to end at $60.90 with 2,466 crossing the exchange, Mayberry Investments dropped $1.15 after trading 17,583 units to end at $8.45, Mayberry Jamaican Equities closed at $11.94, after gaining 28 cents in exchanging 27,800 shares.  PanJam Investments lost $1, ending at $101 after trading 19,804 units, Proven Investments climbed $3 to $50, with 9,931 units changing hands, Sagicor Group gained $2.40 to settle at $72.90 in trading 23,684 shares. Salada Foods closed $1.20 lower at $35, after swapping 3,252 shares, Scotia Group gained $3.70 to end at $58.70 with 22,814 shares changing hands, Sygnus Credit Investments rose 40 cents to settle at $26.40 in trading 92,554 shares and Victoria Mutual Investments gained 95 cents to close at a 52 weeks’ high of $10, with an exchange of 161,614 shares. Trading in the US dollar market ended with 255,781 units valued at over US$45,167. The market index advanced 7.59 points to close at 235.96.

PanJam Investments lost $1, ending at $101 after trading 19,804 units, Proven Investments climbed $3 to $50, with 9,931 units changing hands, Sagicor Group gained $2.40 to settle at $72.90 in trading 23,684 shares. Salada Foods closed $1.20 lower at $35, after swapping 3,252 shares, Scotia Group gained $3.70 to end at $58.70 with 22,814 shares changing hands, Sygnus Credit Investments rose 40 cents to settle at $26.40 in trading 92,554 shares and Victoria Mutual Investments gained 95 cents to close at a 52 weeks’ high of $10, with an exchange of 161,614 shares. Trading in the US dollar market ended with 255,781 units valued at over US$45,167. The market index advanced 7.59 points to close at 235.96.

Margaritaville Turks picked up 1 US cent trading 304 units, to end at 35 US cents, Productive Business Solution climbed to a 52 weeks’ high of 70 US cents, after gaining 5 US cents trading 900 shares. Proven Investments exchanged 67,105 units with gains of 4 US cents to close at a 52 weeks’ high of 37 US cents, Sterling Investments rose the fraction of a cent to close at 3 US cents from 2.9 US cents previously in transferring 40,496 shares and Sygnus Credit Investments traded 146,976 shares at 14 US cents.

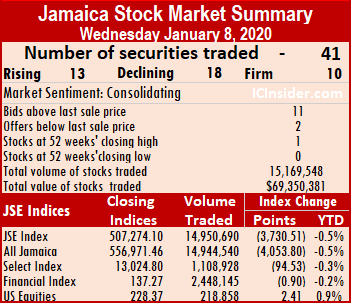

JSE Main Market dives

The main market of the Jamaican Stock Exchange pulled back at the end of trading on Wednesday with large declines in the major indices as declining stocks bettered advancers.

The main market of the Jamaican Stock Exchange pulled back at the end of trading on Wednesday with large declines in the major indices as declining stocks bettered advancers.

At the close, JSE All Jamaican Composite Index dived 4,053.80 points to 556,971.46. The JSE Market Index dropped 3,730.51 to close at 507,274.10 while the JSE Financial Index declined by 0.90 points to close at 137.27.

The market closed with 41 securities changing hands in the Main and US dollar markets, with the prices of 13 advancing, 18 declining and 10 stocks remaining unchanged. The JSE Main Market activity ended, with 39 securities accounting for 14,950,690 units, valued $64,523,919 in contrast to 16,653,296 units valued $85,713,471 from 40 securities on Tuesday.

Sagicor Select – Financial Fund dominated trading, with 6.4 million shares and 43 percent of shares traded followed by Wigton Windfarm with 3.9 million units for 26 percent of the day’s trade and QWI Investments with 1.3 million shares for 9 percent of the market share.

The Market closed with an average of 383,351 units valued at an average of $1,654,459 for each security traded. In contrast to 416,332 units for an average of $2,142,837 on Tuesday. The average volume and value for the month to date amounts to 470,120 units valued at $2,039,050 for each security changing hands, compared to 492,094 units valued at $2,136,446 for each security crossing the exchange. Trading in December resulted in an average of 595,143 units for $9,344,514 for each security.

Trading in December resulted in an average of 595,143 units for $9,344,514 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows eleven stocks ending, with bids higher than their last selling prices and two closing, with lower offers. The PE ratio of the market ended at 19.5, with the Main Market ending at 18.9 times the current year’s earnings.

In the prime market, Caribbean Cement dropped 99 cents to end at $79.01 with the trading of 1,725 units, Eppley gained $1 to close at $15 after exchanging 5,631 shares, while Eppley Caribbean slipped $2 to settle at $42 with 6,150 stock units changing hands. Grace Kennedy climbed by $2 to end at $75 with 31,941 units crossing the exchange, Jamaica Broilers fell 50 cents to $39 with 6,535 units changing hands, Jamaica Producers lost $3 to end at $24, with 9,544 stock units traded. Kingston Wharves shed 49 cents to end at $58.01 with 8,707 units crossing the exchange. Mayberry Investments climbed $1.35 in trading 110,497 shares to end at $9.60, while Mayberry Equities declined by 34 cents to finish at $11.66 with 25616 units changing hands,  NCB Financial lost 50 cents trading 30,048 shares to close at $199.50. Proven Investments advanced by $1 to settle at $47 with a swap of 21,765 shares, Pulse Investments rose by 80 cents to end at weeks’ high of $7.30 with 188,204 units changing hands, Sagicor Group lost $2.50, trading 64,171 shares to end at $70.50. Sagicor Property Fund picked up 59 cents to close at $9.99 with an exchange of 15,176 stock units, Scotia Group lost $2 to close at $55 with 218,266 units crossing the exchange and Seprod declined by 50 cents to end at $50.50 with 46,978 shares transferred.

NCB Financial lost 50 cents trading 30,048 shares to close at $199.50. Proven Investments advanced by $1 to settle at $47 with a swap of 21,765 shares, Pulse Investments rose by 80 cents to end at weeks’ high of $7.30 with 188,204 units changing hands, Sagicor Group lost $2.50, trading 64,171 shares to end at $70.50. Sagicor Property Fund picked up 59 cents to close at $9.99 with an exchange of 15,176 stock units, Scotia Group lost $2 to close at $55 with 218,266 units crossing the exchange and Seprod declined by 50 cents to end at $50.50 with 46,978 shares transferred.

Trading in the US dollar market closed with 218,858 valued at over US$36,018. The market index gained 2.41 points to close at 228.37. Proven Investments picked up 1 cent to close at 33 US cents with 28,500 stock units changing hands while Sygnus Credit Investments closed at 14 cents in trading 190,358 shares.

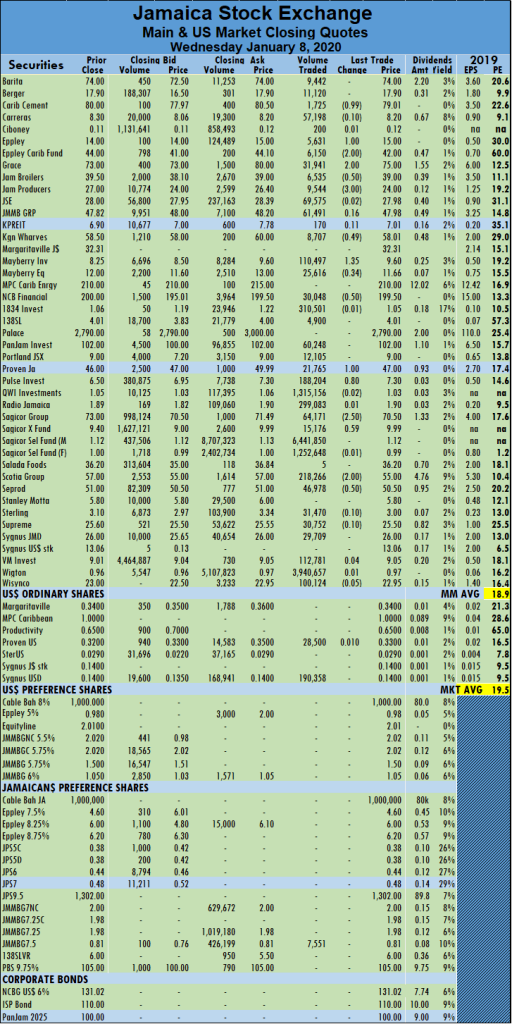

Gains for JSE Main Market

Trading remains buoyant on the Main Market of the Jamaica Stock Exchange on Tuesday, with market activities accounting for 40 securities changing hands, compared to 39 listings trading on Monday.

Trading remains buoyant on the Main Market of the Jamaica Stock Exchange on Tuesday, with market activities accounting for 40 securities changing hands, compared to 39 listings trading on Monday.

A total of 42 securities traded in the Main and US dollar market, with prices of 18 advancing, 12 declining and 13 stocks holding firm.

The JSE Main Market activity ended, with 16,653,296 shares, valued $85,713,471 in contrast to 9,751,709 units for $42,684,443 on Monday.

At the close, JSE All Jamaican Composite Index gained 1,282.80 points to 561,025.26. The JSE Market Index gained 1,172.75 points to close at 511,004.61 and the JSE Financial Index advanced by 0.24 points to close at 138.17.

Sagicor Select – Financial Fund dominated trading, with 8.95 million shares for 54 percent of stock traded. Wigton Windfarm ended with 2.67 million units for 16 percent of the day’s trade and Sagicor Select – Manufacturing & Distribution Fund ended with 1.67 million shares for 10 percent of market share.

The Market closed with an average of 416,332 units valued at an average of $2,142,837 for each security traded. In contrast to 250,044 units for an average of $1,094,473 on Monday. The average volume and value for the month to date amounts to 492,094 units valued at $2,136,446 for each security changing hands, compared to 518,678 shares at $2,134,204 for each security crossing the exchange. Trading in December resulted in an average of 595,143 units for $9,344,514 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows twelve stocks ending, with bids higher than their last selling prices with three closing, with lower offers. The PE ratio of the market ended at 19.5, with the Main Market ending at 18.9 times the current year’s earnings.

In the prime market, Caribbean Cement dropped $4.50 to end at $80 in exchanging 44,797 stock units, Eppley lost $1 to close at $14, after trading 1,000 shares, Grace Kennedy fell $2 to end at $73 with 40,362 units crossing the exchange. Jamaica Broilers lost $1 to settle at $39.50, with 2,827 units changing hands, Jamaica Producers surged $3 to end at $27, with just one stock unit traded, Kingston Wharves shed $2.50 to end at $58.50 with 2,086 units changing hands.  Mayberry Jamaican Equities lost $1 to end at $12 in trading 4,210 units, NCB Financial fell 50 cents in exchanging 38,025 to close at $200. Palace Amusement dropped by $110 to close at $2,790 after trading 75 units. Pan Jam Investment lost $1 with a transfer of 2,580 shares to end at $102. Proven Investments dropped 50 cents in exchanging 109,704 units to close at $46. Sagicor Group gained $3, trading 52,770 shares to end at $73, while Sagicor Property Fund lost 84 cents to end the day at $9.40 with 4,329 stock units changing hands. Salada Foods declined by $1.30 to close at $36.20 with 752 units crossing the exchange, and Seprod lost $1 to end at $51 with the transfer of 18,616 shares.

Mayberry Jamaican Equities lost $1 to end at $12 in trading 4,210 units, NCB Financial fell 50 cents in exchanging 38,025 to close at $200. Palace Amusement dropped by $110 to close at $2,790 after trading 75 units. Pan Jam Investment lost $1 with a transfer of 2,580 shares to end at $102. Proven Investments dropped 50 cents in exchanging 109,704 units to close at $46. Sagicor Group gained $3, trading 52,770 shares to end at $73, while Sagicor Property Fund lost 84 cents to end the day at $9.40 with 4,329 stock units changing hands. Salada Foods declined by $1.30 to close at $36.20 with 752 units crossing the exchange, and Seprod lost $1 to end at $51 with the transfer of 18,616 shares.

Trading in the US dollar market closed with 2,419,101 valued at US$758,577. The market index declined by 0.48 points to close at 225.96. Proven Investments held firm at 32 US cents with 2,178,000 stock units trading while Sygnus Credit Investments fell by 1.1 cents to trade 91,101 units at 14 US cents.

- « Previous Page

- 1

- …

- 132

- 133

- 134

- 135

- 136

- …

- 264

- Next Page »