NCB Financial stock could hit $190

There are not many stocks to watch this week, as earnings season is almost over, with just a few more reports to be released.

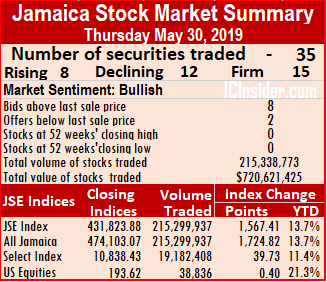

Investors responded well to companies reporting good profit gains and in the case of NCB Financial, to the increased holdings in Guardian Group. The stock seems to have broken through resistance at the $150 level. The $165 region where the stock trades at now is also a resistance area but the strong buying last week at this price point, suggests it is poised to move higher with $190 being the next point of resistance.

Lasco Manufacturing posted strong full year results during the past week with an outstanding fourth quarter that led investors to pick up almost 1.4 million shares resulting in rise of 60 cents on Friday. Barita Investments is enjoying buying interest as the value of stock prices rise and the Jamaican dollar value remains lower than at the end of March, both will likely give a big boost to profit in the June quarter.

Eppley seems to have demand that should push the price higher during the week as the company is getting set to launch an IPO for the Eppley Property Fund. Medical Disposables’ full year’s

SOS expect to maximize profits from all business lines in 2019.

Stationery and Office reported good first quarter results, weeks ago driving renewed interest in the stock. The demand left supply very short, suggesting it is only a matter of time before the price moves higher. Wigton Windfarm hit a low of 72 cents during the past week but closed at 79 cents on Friday and could move back into the 80 cents range in the coming week.

Investors should keep eyes on Jamaica Producers, Sagicor Group and Honey Bun.

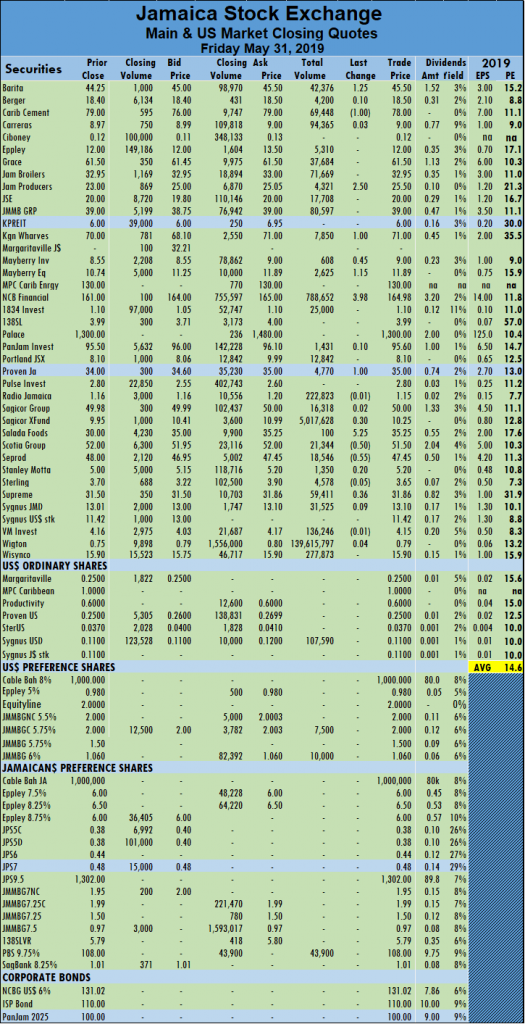

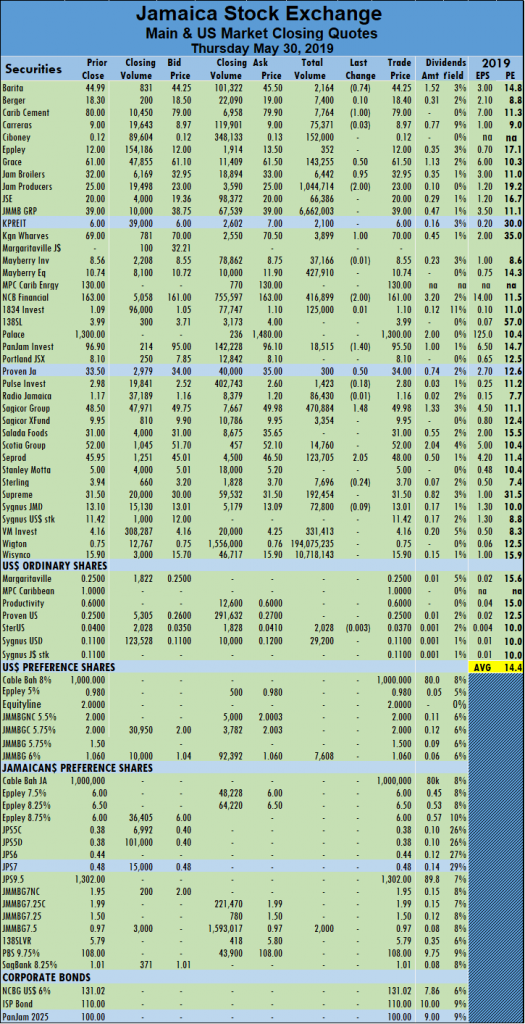

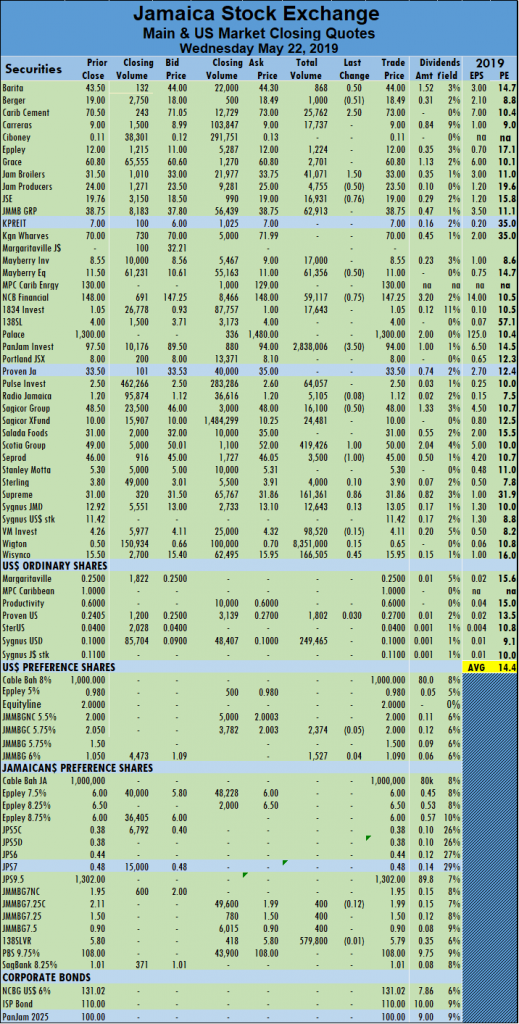

Proven Investments rose $1 to close at $35 with an exchange of 4,770 shares, Salada Foods added $5.25 and ended trading at $35.25, with an exchange of a mere 100 stock units. Scotia Group declined by 50 cents to close at $51.50, with 21,344 shares changing hands, Seprod fell 55 cents, trading 18,546 shares to close at $47.45 and Supreme Ventures finished with a rise of 36 cents to close at $31.86, with an exchange of 59,411 units.

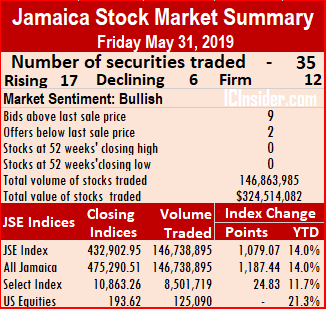

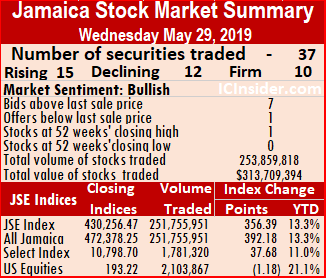

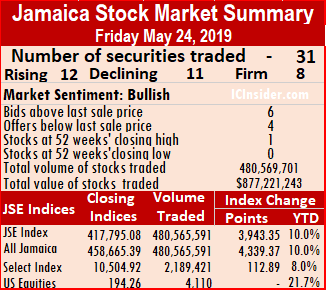

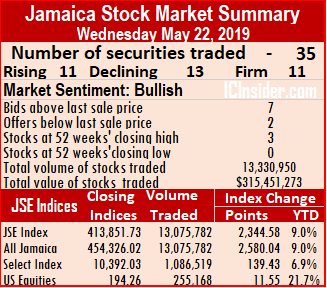

Proven Investments rose $1 to close at $35 with an exchange of 4,770 shares, Salada Foods added $5.25 and ended trading at $35.25, with an exchange of a mere 100 stock units. Scotia Group declined by 50 cents to close at $51.50, with 21,344 shares changing hands, Seprod fell 55 cents, trading 18,546 shares to close at $47.45 and Supreme Ventures finished with a rise of 36 cents to close at $31.86, with an exchange of 59,411 units. The main market of the Jamaica Stock Exchange ended trading for the 5th straight record close on Thursday and the 14th record close for the year.

The main market of the Jamaica Stock Exchange ended trading for the 5th straight record close on Thursday and the 14th record close for the year.

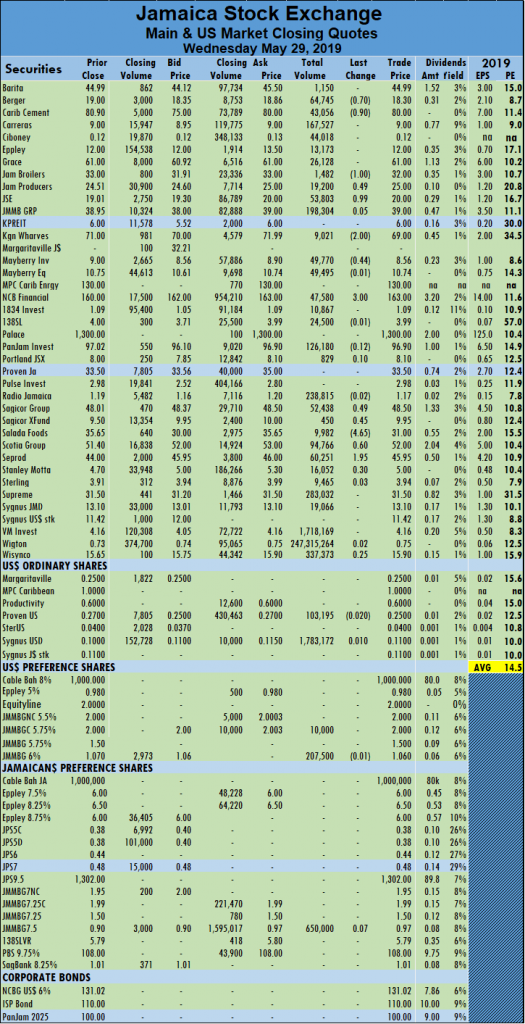

Kingston Wharves settled at $70, with 3,899 units trading after gaining by $1, NCB Financial Group lost $2 trading 416,899 shares to end at $161. PanJam Investment dropped $1.40 and ended at $95.50, with 18,515 units trading, Pulse Investments finished at $2.55, with 45,001 shares, Proven Investments rose 50 cents to close at $34 with an exchange of 300 shares, Sagicor Group added $1.48 and ended trading at $49.98, with an exchange of 470,884 stock units and Seprod added $2.05 in trading 123,705 shares to close at $48.

Kingston Wharves settled at $70, with 3,899 units trading after gaining by $1, NCB Financial Group lost $2 trading 416,899 shares to end at $161. PanJam Investment dropped $1.40 and ended at $95.50, with 18,515 units trading, Pulse Investments finished at $2.55, with 45,001 shares, Proven Investments rose 50 cents to close at $34 with an exchange of 300 shares, Sagicor Group added $1.48 and ended trading at $49.98, with an exchange of 470,884 stock units and Seprod added $2.05 in trading 123,705 shares to close at $48.

Salada Foods dropped $4.65 to $31 in trading 9,982 stock units. Scotia Group gained 60 cents to close at $52, with 94,766 shares trading, Seprod added $1.95 in trading 60,251 shares to close at $45.95 and Stanley Motta gained 30 cents and ended at $5 trading 16,52 shares.

Salada Foods dropped $4.65 to $31 in trading 9,982 stock units. Scotia Group gained 60 cents to close at $52, with 94,766 shares trading, Seprod added $1.95 in trading 60,251 shares to close at $45.95 and Stanley Motta gained 30 cents and ended at $5 trading 16,52 shares. Trading for April resulted in an average of 157,923 shares at $3,718,919, for each security traded.

Trading for April resulted in an average of 157,923 shares at $3,718,919, for each security traded. trading at $48.01, with an exchange of 271,975 stock units, Salada Foods surged $5.65 to $35.65 in trading 565 stock units. Scotia Group shed $1.60 to $51.40, with 162,037 shares trading, Seprod added $1 trading 15,149 shares to close at $44, Stanley Motta fell 30 cents and ended at $4.70 trading 17,800 shares and Supreme Ventures rose 50 cents to finish at $31.50, with 103,297 units changing hands.

trading at $48.01, with an exchange of 271,975 stock units, Salada Foods surged $5.65 to $35.65 in trading 565 stock units. Scotia Group shed $1.60 to $51.40, with 162,037 shares trading, Seprod added $1 trading 15,149 shares to close at $44, Stanley Motta fell 30 cents and ended at $4.70 trading 17,800 shares and Supreme Ventures rose 50 cents to finish at $31.50, with 103,297 units changing hands.

Sagicor Group rose 50 cents and ended trading at $48.50, with an exchange of 2,950,094 stock units, Sagicor Real Estate Fund lost 50 cents trading 3,500 shares at $9.50. Salada Foods declined $2 to $30 in trading 1,000 stock units. Scotia Group climbed $2.50 to $53, with 271,656 shares trading, Seprod shed $1.30 trading 315,880 shares to close at $43, Stanley Motta lost 30 cents and ended at $5 trading 30,000 shares and Supreme Ventures lost 75 cents to finish at $31, with 44,425 units changing hands.

Sagicor Group rose 50 cents and ended trading at $48.50, with an exchange of 2,950,094 stock units, Sagicor Real Estate Fund lost 50 cents trading 3,500 shares at $9.50. Salada Foods declined $2 to $30 in trading 1,000 stock units. Scotia Group climbed $2.50 to $53, with 271,656 shares trading, Seprod shed $1.30 trading 315,880 shares to close at $43, Stanley Motta lost 30 cents and ended at $5 trading 30,000 shares and Supreme Ventures lost 75 cents to finish at $31, with 44,425 units changing hands.

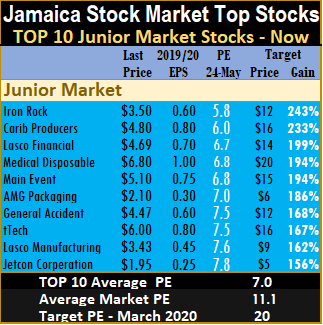

with possible gains of 210 percent. Of the three, Lasco Financial seems likely to break out after they release full year results later this week, but keep a keen eye on Lasco Manufacturing as well.

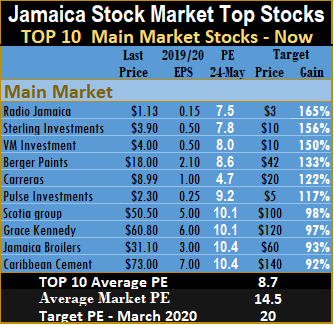

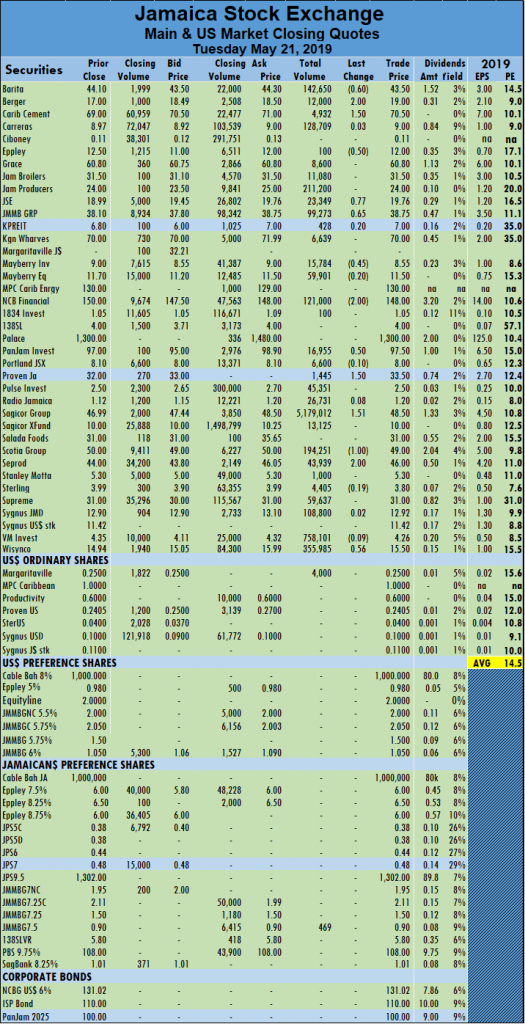

with possible gains of 210 percent. Of the three, Lasco Financial seems likely to break out after they release full year results later this week, but keep a keen eye on Lasco Manufacturing as well. The main market, closed the week with the overall PE at 14.5 and the Junior Market at just 11.1. The PE ratio for Junior Market Top 10 stocks averages 7 and the main market PE 8.7. These levels, point to a big upside for TOP 10 stocks over the next 12 months and Junior Market stocks in particular.

The main market, closed the week with the overall PE at 14.5 and the Junior Market at just 11.1. The PE ratio for Junior Market Top 10 stocks averages 7 and the main market PE 8.7. These levels, point to a big upside for TOP 10 stocks over the next 12 months and Junior Market stocks in particular. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

The average volume and value for the month to date amounts 1,135,538 to units valued $12,389,326 and previously, 275,231 units valued $11,357,912. Trading for April resulted in an average of 157,923 shares at $3,718,919, for each security traded.

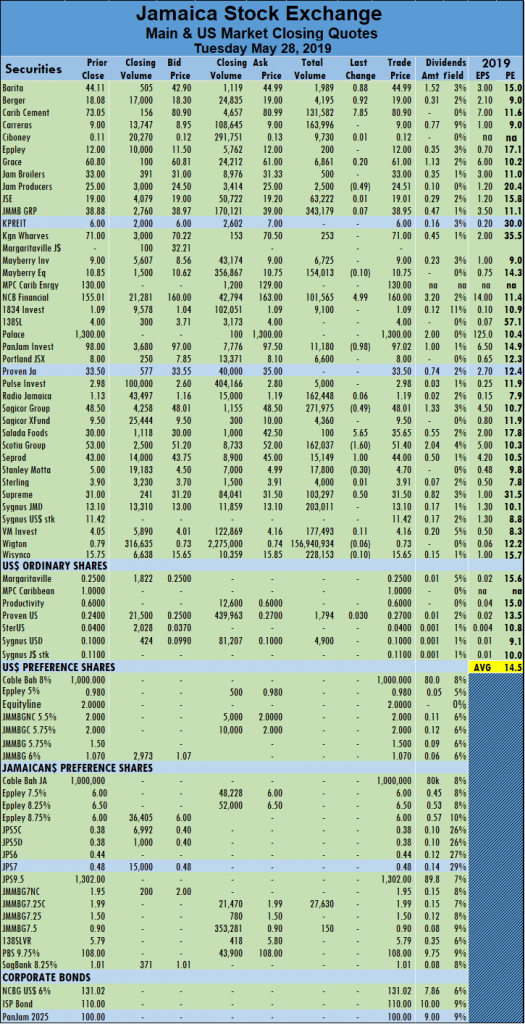

The average volume and value for the month to date amounts 1,135,538 to units valued $12,389,326 and previously, 275,231 units valued $11,357,912. Trading for April resulted in an average of 157,923 shares at $3,718,919, for each security traded. 72,635, Kingston Wharves traded 2,328 shares but lost $2 to close at $68, shares changing hands. Mayberry Investments gained 45 cents and ended trading of 5,467 shares at $9, Mayberry Jamaican Equities rose 50 cents and ended trading of 94,800 shares at $11.50, NCB Financial Group jumped $5.75 trading 214,535 shares at $153. PanJam Investment dropped $4 with 4,199,150 shares changing hands, to close at $90, Salada Foods rose $2 to end at $32 in trading 2,000 stock units, Scotia Group climbed 50 cents to $50.50, with 39,401 shares trading and Seprod shed 70 cents trading 315,880 shares to close at $44.30.

72,635, Kingston Wharves traded 2,328 shares but lost $2 to close at $68, shares changing hands. Mayberry Investments gained 45 cents and ended trading of 5,467 shares at $9, Mayberry Jamaican Equities rose 50 cents and ended trading of 94,800 shares at $11.50, NCB Financial Group jumped $5.75 trading 214,535 shares at $153. PanJam Investment dropped $4 with 4,199,150 shares changing hands, to close at $90, Salada Foods rose $2 to end at $32 in trading 2,000 stock units, Scotia Group climbed 50 cents to $50.50, with 39,401 shares trading and Seprod shed 70 cents trading 315,880 shares to close at $44.30.

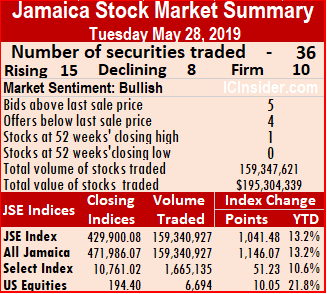

The average volume and value for the month to date amounts to 275,231 units valued $11,357,912 and previously, 265,920 units valued $11,582,843. Trading for April resulted in an average of 157,923 shares at $3,718,919, for each security traded.

The average volume and value for the month to date amounts to 275,231 units valued $11,357,912 and previously, 265,920 units valued $11,582,843. Trading for April resulted in an average of 157,923 shares at $3,718,919, for each security traded. PanJam Investment dropped $3.50 with 2,838,006 shares changing hands, to close at $94,

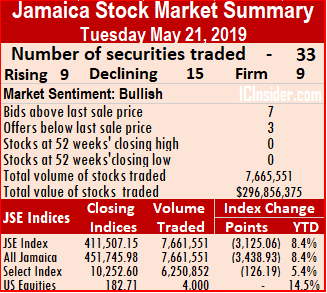

PanJam Investment dropped $3.50 with 2,838,006 shares changing hands, to close at $94,  Trading on the Jamaica Stock Exchange main market returned to more normal levels on Tuesday, than the heavy trading that took place on Monday.

Trading on the Jamaica Stock Exchange main market returned to more normal levels on Tuesday, than the heavy trading that took place on Monday. The average volume and value for the month to date amounts to 265,920 units valued $11,582,843 and previously, 267,779 units valued $11,609,967. Trading for April resulted in an average of 157,923 shares at $3,718,919, for each security traded.

The average volume and value for the month to date amounts to 265,920 units valued $11,582,843 and previously, 267,779 units valued $11,609,967. Trading for April resulted in an average of 157,923 shares at $3,718,919, for each security traded. NCB Financial Group lost $2 trading 121,000 shares at $148. PanJam Investment added 50 cents with 16,955 shares changing hands, to close at $97.50, Proven Investments rose $1.50 to close trading of 1,445 units at $33.50, Sagicor Group jumped $1.51 to end at $48.50 in trading 5,179,012 stock units, Scotia Group declined $1 to $49, with 194,251 shares trading. Seprod gained $2 trading 43,939 shares to close at $46 and Wisynco Group rose 56 cents to close at a record high of $15.50, with 355,985 shares trading.

NCB Financial Group lost $2 trading 121,000 shares at $148. PanJam Investment added 50 cents with 16,955 shares changing hands, to close at $97.50, Proven Investments rose $1.50 to close trading of 1,445 units at $33.50, Sagicor Group jumped $1.51 to end at $48.50 in trading 5,179,012 stock units, Scotia Group declined $1 to $49, with 194,251 shares trading. Seprod gained $2 trading 43,939 shares to close at $46 and Wisynco Group rose 56 cents to close at a record high of $15.50, with 355,985 shares trading.