Cable & Wireless Head quarters.

Cable & Wireless is possibly the main stock to watch for the coming week with the company returning to profitability in the June quarter.

The company lost several billion dollars for many years but posted a profit of $222 million in the latest quarter on an 11 percent surge in revenues. Subsequent to the close of the quarter, Cable and Wireless increased rates on a series of services that should add to revenues and profits in the coming quarters. Profit for the full year to December should end positively, thus wiping out the $311 million loss for the first half of the year after tax and a lower pretax loss of just $199 million. The recent turn around in the fortune of the company is likely to be a big surprise to many investors and will help move the stock price much higher than the $1.07 it closed at, on Friday.

Other stocks that investors should keep an eye on this week include, Barita Investments with an announced take over offer on the table, JMMB Group, Stationery & Office Supplies that just listed and selling below potential, NCB Financial with limited supply, Jetcon Corporation with profit doubling for the half year leading to strong buying in the past week and recently listed Express Catering with demand to buy 765,925 shares at $5.50.

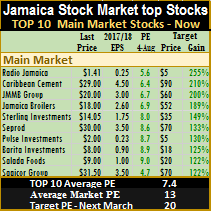

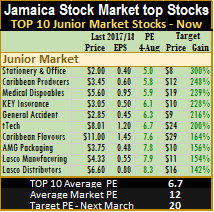

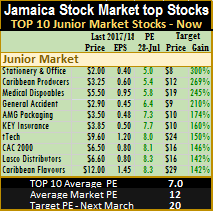

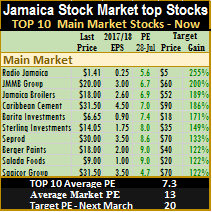

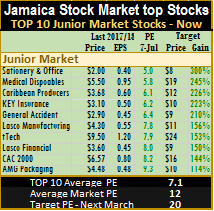

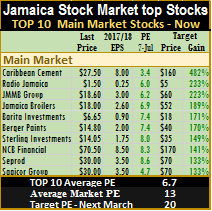

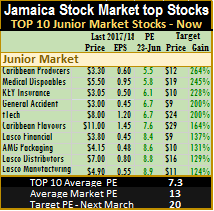

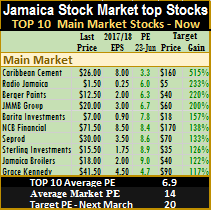

Recent TOP 10 billing,

Recent TOP 10 billing,  The average PE for the overall main market trades at 13.3 and 12 for Junior Market, based on 2017 estimated earnings.

The average PE for the overall main market trades at 13.3 and 12 for Junior Market, based on 2017 estimated earnings.

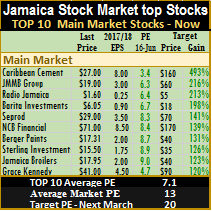

Caribbean Flavours and CAC 2000 that fell out of the top listing at the end of the prior week return this week with the exit of Express Catering , Lasco Financial that rose to $3.80 and Caribbean Cream that returned to $7.

Caribbean Flavours and CAC 2000 that fell out of the top listing at the end of the prior week return this week with the exit of Express Catering , Lasco Financial that rose to $3.80 and Caribbean Cream that returned to $7. At the close of the week, IC Insider.com’s TOP 10 Junior Market stocks now trade at an average discount of 42 percent to the Junior Market average, while those in the main market are trading at a 44 percent discount, to the average of the market, leaving stocks with room for growth in the months ahead.

At the close of the week, IC Insider.com’s TOP 10 Junior Market stocks now trade at an average discount of 42 percent to the Junior Market average, while those in the main market are trading at a 44 percent discount, to the average of the market, leaving stocks with room for growth in the months ahead.

IPO being nearly 4 times oversubscribed with more than 1,000 applications received for the 52 million shares.

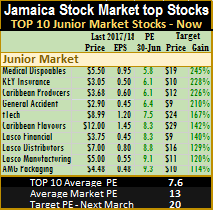

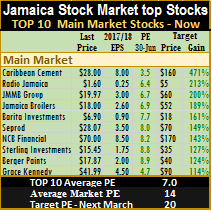

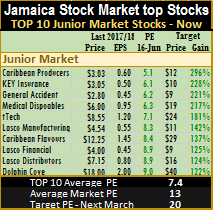

IPO being nearly 4 times oversubscribed with more than 1,000 applications received for the 52 million shares. At the close of the week, IC Insider.com’s TOP 10 Junior Market stocks now trade at an average discount of 45 percent to the Junior Market average, while those in the main market are trading at a 49 percent discount, to the average of the market, leaving stocks with room for growth in the months ahead.

At the close of the week, IC Insider.com’s TOP 10 Junior Market stocks now trade at an average discount of 45 percent to the Junior Market average, while those in the main market are trading at a 49 percent discount, to the average of the market, leaving stocks with room for growth in the months ahead. Pull back in the prices of several Junior Market stocks, resulted in changes in the TOP 10 junior stocks at the close of the week. The changes took place against the back ground of an unprecedented 5 issues of new shares around the same time in the market.

Pull back in the prices of several Junior Market stocks, resulted in changes in the TOP 10 junior stocks at the close of the week. The changes took place against the back ground of an unprecedented 5 issues of new shares around the same time in the market. IC Insider.com BUY RATED Stationery and Office Supplies (SOS) jumped into the TOP 10 Junior Market stocks in the number one position at the close of the past week.

IC Insider.com BUY RATED Stationery and Office Supplies (SOS) jumped into the TOP 10 Junior Market stocks in the number one position at the close of the past week.  CAC 2000 moved into the TOP 10 with the price having fallen to $6.57 by the end of the week.

CAC 2000 moved into the TOP 10 with the price having fallen to $6.57 by the end of the week. The average PE ratio for the Junior Market Top stocks remain at 7 even with SOS being added at a PE of 5 times 2017 earnings. The PE for the main market slipped to 6.7 with the sharp fall in prices during the week. The average PE for the overall main market, is down to 13 while it remains at 12 for Junior Market, based on 2017 estimated earnings.

The average PE ratio for the Junior Market Top stocks remain at 7 even with SOS being added at a PE of 5 times 2017 earnings. The PE for the main market slipped to 6.7 with the sharp fall in prices during the week. The average PE for the overall main market, is down to 13 while it remains at 12 for Junior Market, based on 2017 estimated earnings. Berger Paints

Berger Paints  they have implemented a number of measures that is improving efficiency that will allow them to take on more business without the need to increase staff compliment for a while. They also pointed out that the sale team have been working to bring in new business and they expect increase business activity in the second half of the current year. Additionally, management took the recommendation about a possible stock split and informed the meeting that the board will discuss same.

they have implemented a number of measures that is improving efficiency that will allow them to take on more business without the need to increase staff compliment for a while. They also pointed out that the sale team have been working to bring in new business and they expect increase business activity in the second half of the current year. Additionally, management took the recommendation about a possible stock split and informed the meeting that the board will discuss same. for the overall main market and 12.7 for Junior Market, based on 2017 estimated earnings. Several stocks are trading below these averages, and have potential for more gains in the months ahead, barring major negative developments.

for the overall main market and 12.7 for Junior Market, based on 2017 estimated earnings. Several stocks are trading below these averages, and have potential for more gains in the months ahead, barring major negative developments.

Thursday, with attempts to trade at $7.40 on Friday thwarted by the circuit breaker rules. The trade was cancelled after the market closed.

Thursday, with attempts to trade at $7.40 on Friday thwarted by the circuit breaker rules. The trade was cancelled after the market closed. Several stocks are trading below these averages, and have potential for more gains in the months ahead, barring major negative developments.

Several stocks are trading below these averages, and have potential for more gains in the months ahead, barring major negative developments.

The markets offer some good opportunities for bottom fishing, with

The markets offer some good opportunities for bottom fishing, with  favourably with 13.4 for the overall main market and 13 for Junior Market, based on 2017 estimated earnings. Several stocks are trading below the average, and have the potential for more gains for the rest of 2017, barring major negative developments.

favourably with 13.4 for the overall main market and 13 for Junior Market, based on 2017 estimated earnings. Several stocks are trading below the average, and have the potential for more gains for the rest of 2017, barring major negative developments. TOP 10 list as a result, while

TOP 10 list as a result, while  In a number of cases, the TOP stocks will need to deliver results in the upcoming quarter in order to send a message that the potential they have will be manifested.

In a number of cases, the TOP stocks will need to deliver results in the upcoming quarter in order to send a message that the potential they have will be manifested.