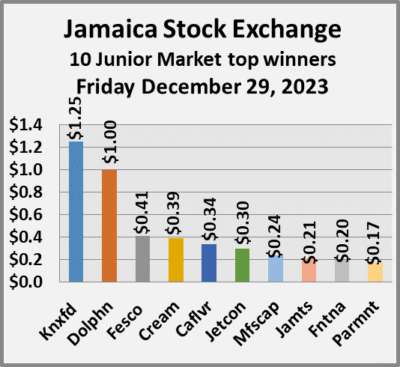

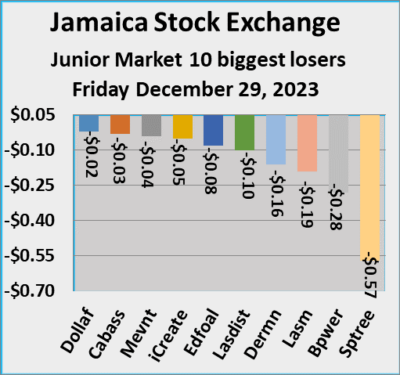

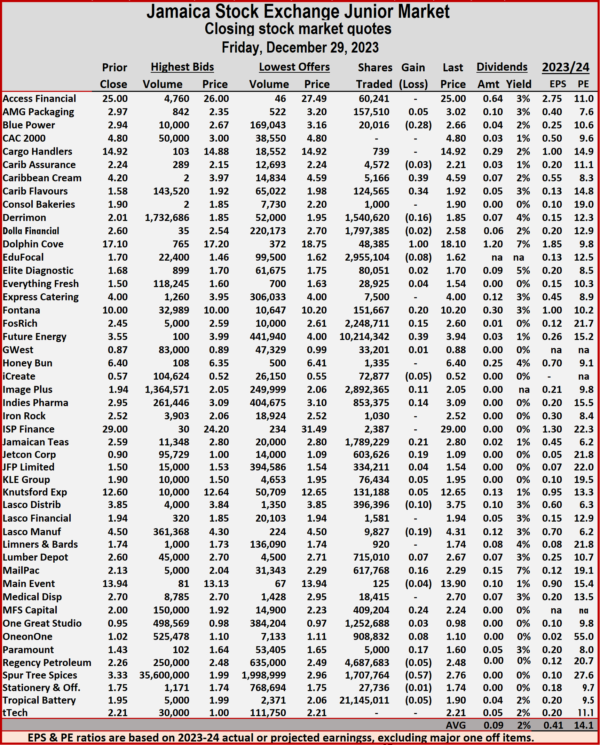

Trading surged on the Junior Market of the Jamaica Stock Exchange on Friday, as the market closed out 2023 with a small decline for the second time since 2020, with a huge jump in the volume of stocks traded rising by 460 percent and the value jumping 479 percent more than Thursday with trading concluding with 46 securities changing hands compared with 45 on Thursday and ended with prices of 24 rising, 12 declining and 10 closing unchanged.

The market closed with an exchange of 58,141,717 stock units for $143,291,459 versus 10,388,698 units at $24,745,282 on Thursday.

The market closed with an exchange of 58,141,717 stock units for $143,291,459 versus 10,388,698 units at $24,745,282 on Thursday.

Trading averaged 1,263,950 shares for $3,115,032 compared with 230,860 units at $549,895 on Thursday. Trading ended with the month to date averaging 466,866 units at $1,111,272 compared to 416,223 stocks at $983,962 on the previous day, well up on November that closed with an average of 262,280 units at $587,545.

Tropical Battery led trading with 21.15 million shares for 36.4 percent of the volume followed by Future Energy with 10.21 million stock units for 17.6 percent of the day’s trade, Regency Petroleum closed with 4.69 million units for 8.1 percent market share, EduFocal with 2.96 million units for 5.1 percent market share, Image Plus ended with 2.89 million units changing hands for 5 percent of stocks traded and Fosrich closed with 2.25 million units for 3.9 percent of the overall volume.

At the close, the Junior Market Index increased 65.03 points to lock up trading for 2023 at 3,848.33 with a loss of 3.5 percent for the year.

The Junior Market ended trading with an average PE Ratio of 14.1, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

The Junior Market ended trading with an average PE Ratio of 14.1, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Blue Power dipped 28 cents to end at $2.66, with 20,016 shares crossing the market, Caribbean Cream increased 39 cents to $4.59 as investors exchanged 5,166 units, Caribbean Flavours climbed 34 cents and ended at a 52 weeks’ high of $1.92 as 124,565 shares passed through the market. Derrimon Trading sank 16 cents to close at $1.85 in an exchange of 1,540,620 stock units, Dolphin Cove popped $1 in closing at $18.10 with traders dealing in 48,385 shares, EduFocal fell 8 cents to $1.62 while exchanging 2,955,104 stocks. Fontana advanced 20 cents in closing at $10.20 with a transfer of 151,667 units, Fosrich rose 15 cents and ended at $2.60 with investors swapping 2,248,711 stock units, Future Energy gained 39 cents to end at $3.94 in an exchange of 10,214,342 shares.  Image Plus rallied 11 cents to close at $2.05 with investors transferring 2,892,365 units, Indies Pharma popped 14 cents to close at $3.09 after an exchange of 853,375 stocks, Jamaican Teas advanced 21 cents to end at 52 weeks’ high of $2.80, with 1,789,229 stock units crossing the market. Jetcon Corporation rose 19 cents in closing at $1.09 with an exchange of 603,626 shares, Lasco Distributors declined 10 cents to close at $3.75 with 396,396 stock units clearing the market, Lasco Manufacturing shed 19 cents and ended at $4.31 with investors dealing in 9,827 units. Mailpac Group gained 16 cents to $2.29 after an exchange of 617,768 stocks, MFS Capital Partners rallied 24 cents to end at $2.24 with investors trading 409,204 units, ONE on ONE Educational increased 8 cents in closing at $1.10, with 908,832 shares changing hands.

Image Plus rallied 11 cents to close at $2.05 with investors transferring 2,892,365 units, Indies Pharma popped 14 cents to close at $3.09 after an exchange of 853,375 stocks, Jamaican Teas advanced 21 cents to end at 52 weeks’ high of $2.80, with 1,789,229 stock units crossing the market. Jetcon Corporation rose 19 cents in closing at $1.09 with an exchange of 603,626 shares, Lasco Distributors declined 10 cents to close at $3.75 with 396,396 stock units clearing the market, Lasco Manufacturing shed 19 cents and ended at $4.31 with investors dealing in 9,827 units. Mailpac Group gained 16 cents to $2.29 after an exchange of 617,768 stocks, MFS Capital Partners rallied 24 cents to end at $2.24 with investors trading 409,204 units, ONE on ONE Educational increased 8 cents in closing at $1.10, with 908,832 shares changing hands.  Paramount Trading climbed 17 cents and ended at $1.60 in trading 5,000 stock units, Regency Petroleum increased 22 cents to close at $2.48 after 4,687,683 stocks changed hands and Spur Tree Spices dropped 57 cents to close out the year at $2.76 after investors traded trading 1,707,764 shares.

Paramount Trading climbed 17 cents and ended at $1.60 in trading 5,000 stock units, Regency Petroleum increased 22 cents to close at $2.48 after 4,687,683 stocks changed hands and Spur Tree Spices dropped 57 cents to close out the year at $2.76 after investors traded trading 1,707,764 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading surges on Junior Market to end 2023

Friday’s bulk trading returns to Junior Market

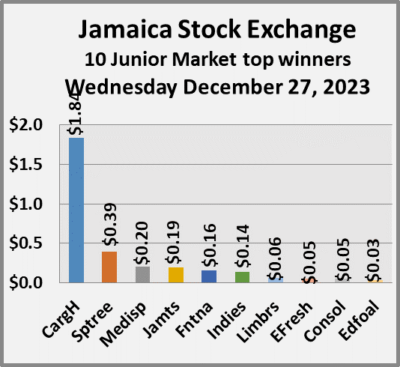

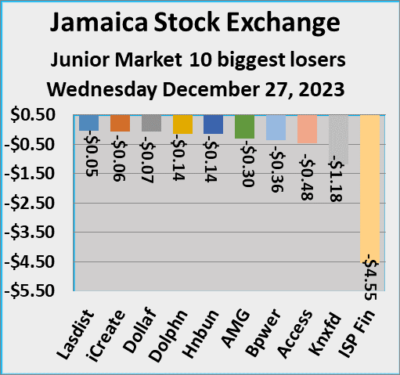

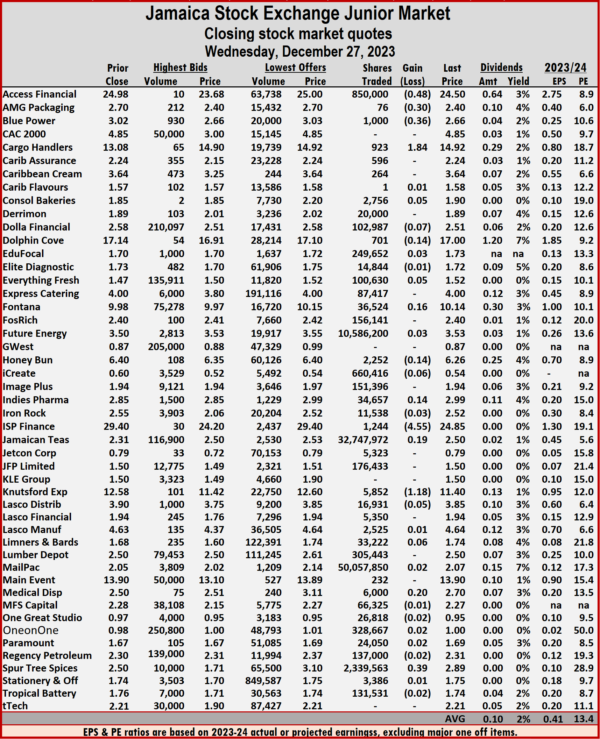

The large blocks of stocks in four companies that swelled trading on Friday dominated trading again on Wednesday on the Junior Market of the Jamaica Stock Exchange, with the overall volume and the value of stocks traded rising a mere one percent over trading on Friday with trading in 44 securities up from 40 on Friday and ended with prices of 18 rising, 15 declining and 11 closing unchanged.

Mailpac Group was the leading trade with 50.06 million shares for 50.3 percent of total volume followed by Jamaican Teas with 32.75 million units for 32.9 percent of the day’s trade, Future Energy chipped in with 10.59 million units for 10.6 percent market share and Spur Tree Spices with 2.34 million units for 2.4 percent of total volume.

Mailpac Group was the leading trade with 50.06 million shares for 50.3 percent of total volume followed by Jamaican Teas with 32.75 million units for 32.9 percent of the day’s trade, Future Energy chipped in with 10.59 million units for 10.6 percent market share and Spur Tree Spices with 2.34 million units for 2.4 percent of total volume.

The total amount of stocks traded was 99,492,688 for $248,103,688 up from 98,460,419 units at $245,339,629 on Friday.

Trading averaged 2,261,197 shares at $5,638,720, compared with 2,461,510 units at $6,133,491 on Friday with the month to date, averaging 428,507 units at $1,012,729 compared with 301,518 stock units at $692,188 on the previous day. November closed with an average of 262,280 units at $587,545.

At the close, the Junior Market Index rose 5.11 points to end at 3,733.25.

At the close, the Junior Market Index rose 5.11 points to end at 3,733.25.

The Junior Market ended trading with an average PE Ratio of 13.4, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Access Financial fell 48 cents to $24.50 with 850,000 stock units clearing the market, AMG Packaging declined 30 cents and ended at $2.40 with traders dealing in 76 shares, Blue Power lost 36 cents to end at $2.66, with 1,000 stocks crossing the exchange.  Cargo Handlers popped $1.84 in closing at $14.92 with investors trading 923 units, Dolphin Cove skidded 14 cents to close at $17 after an exchange of 701 stocks, Fontana advanced 16 cents to $10.14 with investors transferring 36,524 units. Honey Bun sank 14 cents to close at $6.26 in an exchange of 2,252 shares, Indies Pharma rose 14 cents and ended at $2.99, with 34,657 stock units crossing the market, ISP Finance shed $4.55 in closing at $24.85 with an exchange of 1,244 shares. Jamaican Teas climbed 19 cents to end at $2.50 after investors ended trading 32,747,972 stocks, Knutsford Express dropped $1.18 in closing at $11.40 while exchanging 5,852 units, Medical Disposables increased 20 cents to $2.70 in trading 6,000 stock units and Spur Tree Spices gained 39 cents to close at $2.89 with, 2,339,563 shares changing hands.

Cargo Handlers popped $1.84 in closing at $14.92 with investors trading 923 units, Dolphin Cove skidded 14 cents to close at $17 after an exchange of 701 stocks, Fontana advanced 16 cents to $10.14 with investors transferring 36,524 units. Honey Bun sank 14 cents to close at $6.26 in an exchange of 2,252 shares, Indies Pharma rose 14 cents and ended at $2.99, with 34,657 stock units crossing the market, ISP Finance shed $4.55 in closing at $24.85 with an exchange of 1,244 shares. Jamaican Teas climbed 19 cents to end at $2.50 after investors ended trading 32,747,972 stocks, Knutsford Express dropped $1.18 in closing at $11.40 while exchanging 5,852 units, Medical Disposables increased 20 cents to $2.70 in trading 6,000 stock units and Spur Tree Spices gained 39 cents to close at $2.89 with, 2,339,563 shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading surge for Jamaican stocks

Trading surged again on Wednesday following the sharp jump on Friday on the Jamaica Stock Exchange with the value of stocks traded exceeding $1 billion, with trading ending with the Junior and The Main Market rising above the close on Friday, with the USD Market also closing higher as the Junior Market slipped to close out trading, with market activity ending with the volume and falling below Wednesday’s levels on the penultimate day before the Christmas break for the market.

A total of 132,966,020 shares, were traded in all three markets, up from 123,026,015 units on Friday.

A total of 132,966,020 shares, were traded in all three markets, up from 123,026,015 units on Friday.

The value of stocks traded on the Junior and Main markets amounts to $1.06 billion compared with $527.23 million on Friday. The JSE USD market with 127,343 shares traded for US$6,740 compared to 159,494 units at US$2,742 on Friday.

Barita Investments was one of a number of stocks dominating trading, after an exchange of 1.84 million shares at $129 million, Caribbean Cement traded 2.15 million shares for $115.6 million, Mailpac Group trading 50.06 million shares for $103 million, Jamaican Teas ended with an exchange of 32.75 million units for $74.8 million, NCB Financial traded 3,108,015 shares at $202 million, Wisynco Group closed with 4.37 million shares for $93.8 million, Sygnus Credit Investments closed with 5.88 million at $62.9 million and Pan Jamaica had an exchange of 1.55 million shares for $76.7 million.

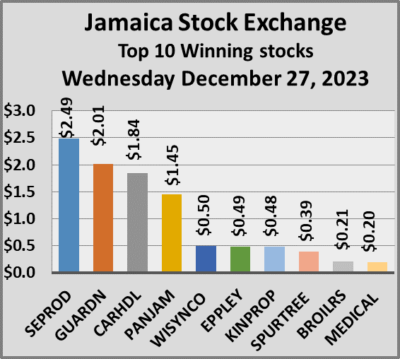

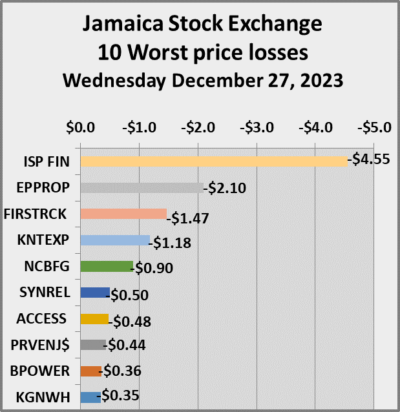

At the close of the market, Main Market stocks rallying were Seprod up $2.49, Guardian Holdings with a rise of $2.01, Pan Jamaica up $1.45 and Wisynco Group, up 50 cents. Declining Main Market stocks were Eppley Caribbean Property down $2.10 90 cents, First Rock Real Estate with a loss of $1.47 and NCB Financial with a fall of 90 cents.

Rising Junior Market stocks include Cargo handlers up $1.84, Spur Tree Spices gaining 39 cents and Medical Disposables up 20 cents. ISP Financial lost $4.55 and Knutsford Express fell $1.18.

At the close of trading, the JSE Combined Market Index rose 1,922.04 points to close at 330,516.72, the All Jamaican Composite Index rallied 858.00 points to 354,396.78, the JSE Main Index rallied 761.89 points to wrap-up trading at 317,560.34. The Junior Market Index popped 5.11 points to end the day at 3,733.25 and the JSE USD Market Index rose 1.36 points to conclude trading at 222.46.

At the close of trading, the JSE Combined Market Index rose 1,922.04 points to close at 330,516.72, the All Jamaican Composite Index rallied 858.00 points to 354,396.78, the JSE Main Index rallied 761.89 points to wrap-up trading at 317,560.34. The Junior Market Index popped 5.11 points to end the day at 3,733.25 and the JSE USD Market Index rose 1.36 points to conclude trading at 222.46.

In the preference segment, no stock traded with a notable price change.

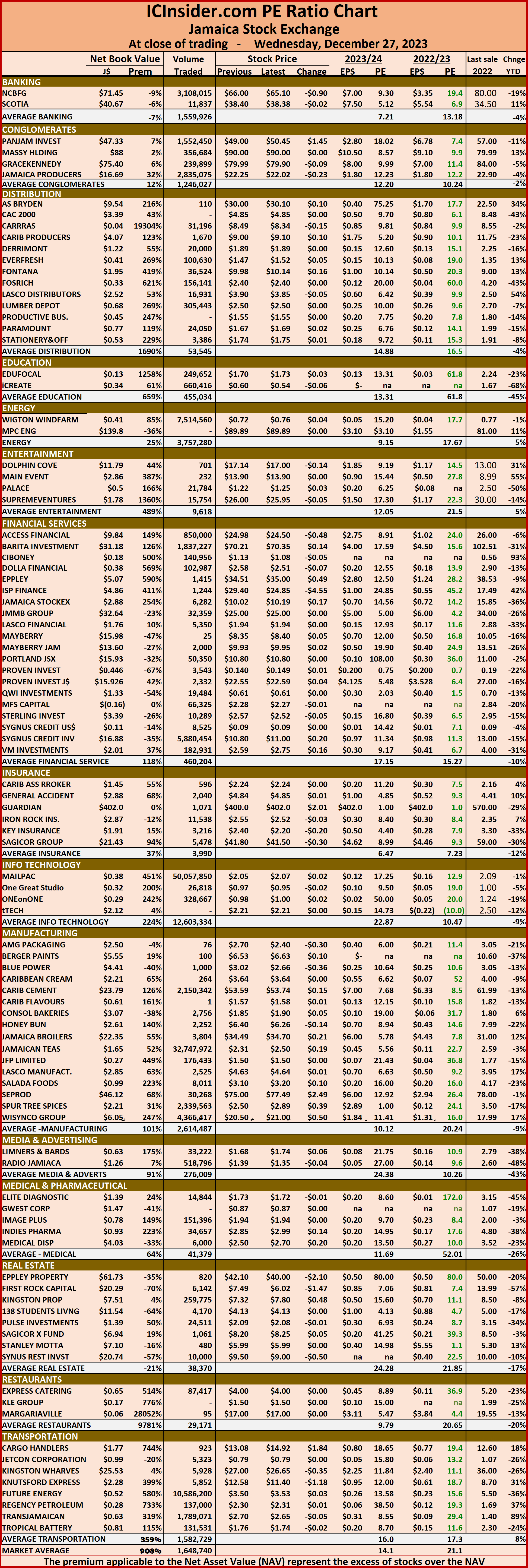

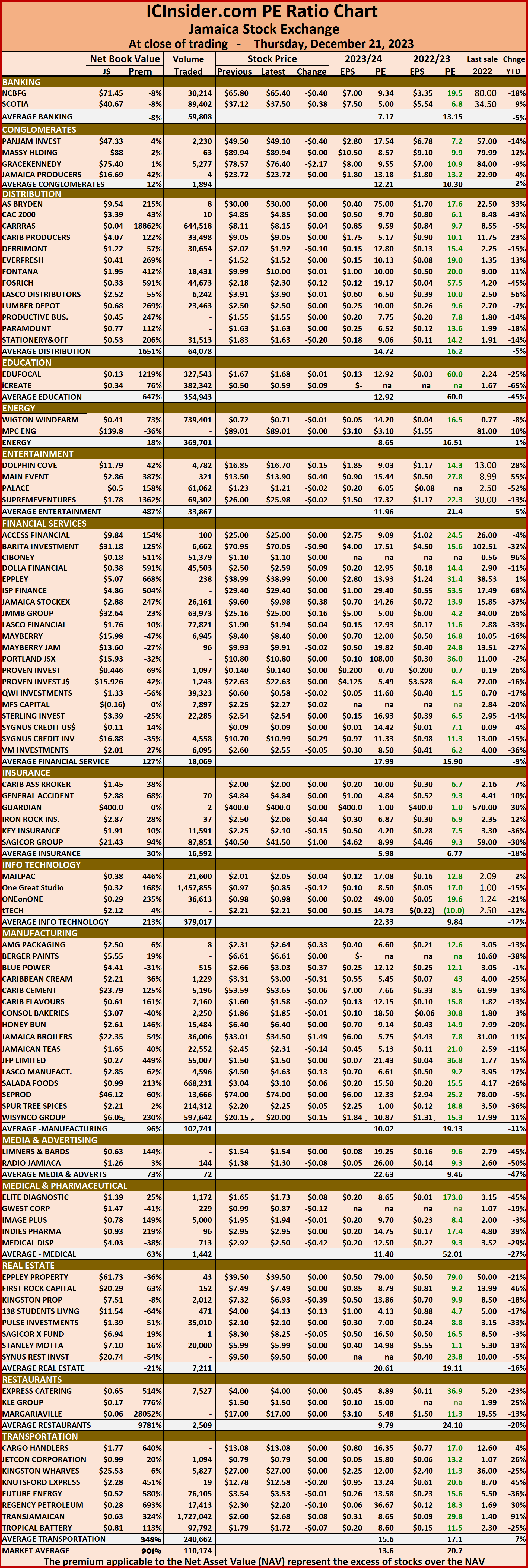

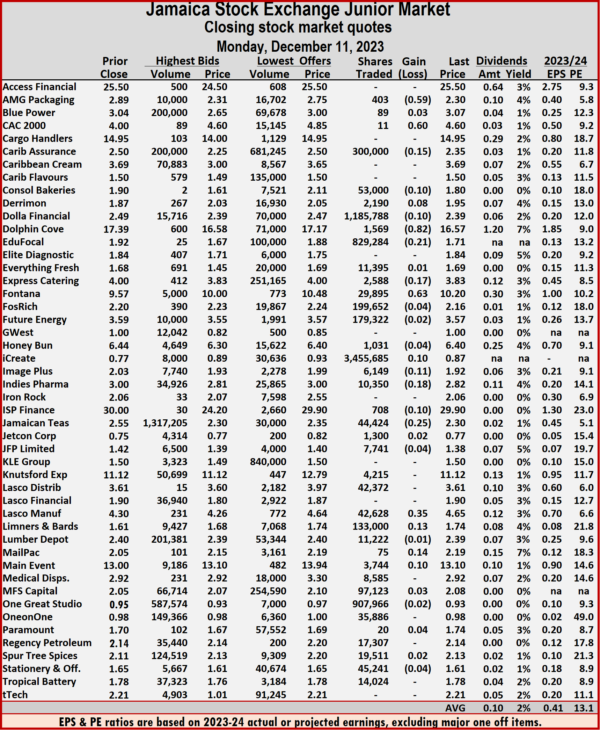

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21 on 2022-23 earnings and 14.1 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Trading surges on Jamaica Stock Exchange

Trading surged sharply on the Jamaica Stock Exchange on Friday, with the Junior market listed Mailpac Group trading 50.04 million shares, Jamaican Teas, 32.66 million units, Future Energy 10.9 million units and Spur Tree Spices with 1.84 million units, while in the Main Market, JMMB Group 7.5% preference share traded 10 million shares followed by Sygnus Credit Investments with 5.84 million units, Jamaica Producers 2.87 million units and Pan Jamaica with 1.50 million units as a total of 123,026,015 shares were traded in all three markets, up sharply from just 10,449,490 units on Tuesday.

The value of stocks traded on the Junior and Main markets surged to $527.23 million compared with a mere $48.29 million on Thursday. The JSE USD market closed after 159,494 shares were traded, for US$2,742 compared to 6,525 units at US$320 on Thursday.

The value of stocks traded on the Junior and Main markets surged to $527.23 million compared with a mere $48.29 million on Thursday. The JSE USD market closed after 159,494 shares were traded, for US$2,742 compared to 6,525 units at US$320 on Thursday.

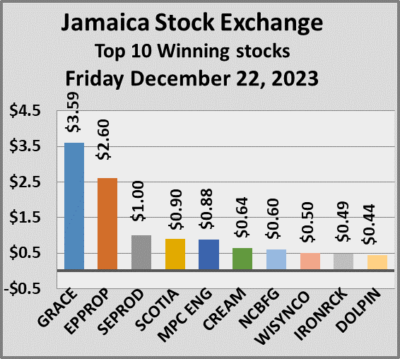

At the close of the market, Main Market stocks rallying were GraceKennedy up $3.59, Eppley Caribbean Property with a rise of $2.60, Seprod rose $1, Scotia Group closing at a new 52 weeks’ closing high of $38.40, after gaining 90 cents and MPC Caribbean Energy rose 88 cents. Falling Main Market stocks were mostly modest except for Eppley down $4.48 and Jamaica Producers with a fall of $1.47.

Rising Junior Market stocks include Caribbean Cream with a gain of 64 cents, Iron Rock Insurance up 49 cents, Dolphin Cove with a gain of 44 cents and Spur Tree gaining 25 cents. There were declining stocks of note.

At the close of trading, the JSE Combined Market Index rose 1,162.73 points to close at 328,594.68, the All Jamaican Composite Index climbed 1,555.49 points to lock up trading at 353,538.78,  the JSE Main Index rallied by 812.63 points to end trading at 316,798.45. The Junior Market Index rallied 45.75 points to end the day at 3,728.14 and the JSE USD Market Index skidded 2.03 points to wrap up trading at 221.10.

the JSE Main Index rallied by 812.63 points to end trading at 316,798.45. The Junior Market Index rallied 45.75 points to end the day at 3,728.14 and the JSE USD Market Index skidded 2.03 points to wrap up trading at 221.10.

In the preference segment, Jamaica Public Service 7% rallied $4 to end at $45 and Productive Business Solutions 9.75% preference share advanced $4.50 and ended at $120.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21.1 on 2022-23 earnings and 13.9 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

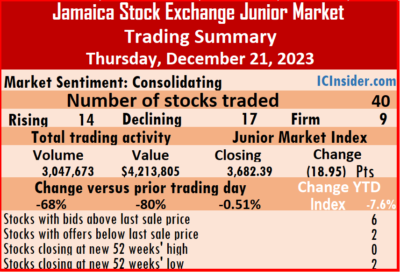

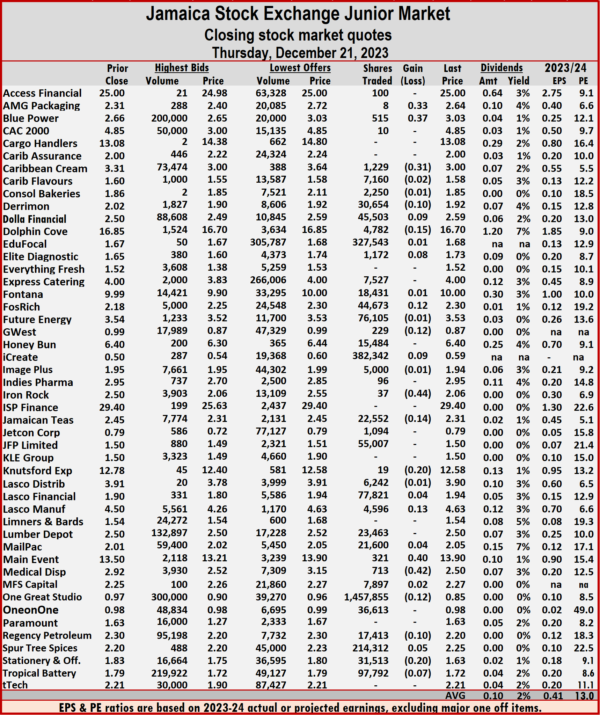

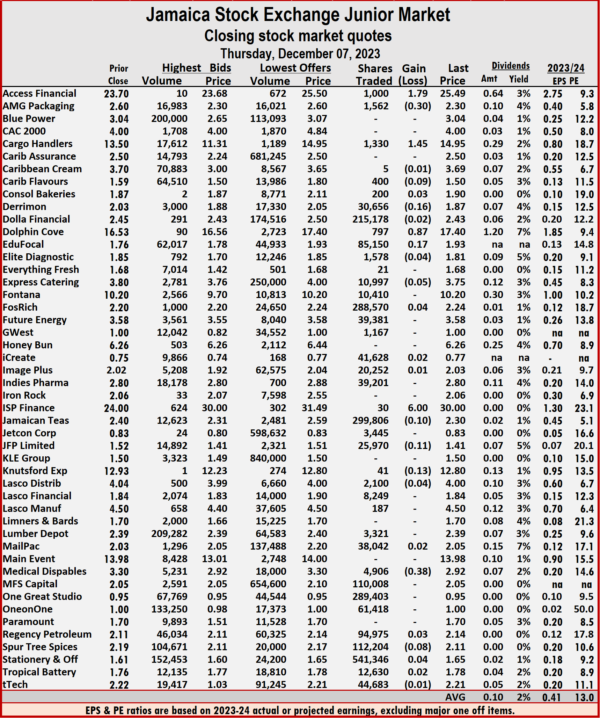

Junior Market drops with reduced trading

Trading declined sharply below Wednesday’s levels on the Junior Market of the Jamaica Stock Exchange on Thursday, with the volume of stocks traded declining 68 percent and the value 80 percent lower than Wednesday after trading in 40 securities compared with 37 on Wednesday and ended with 14 rising, 17 declining and nine closing unchanged as two stocks traded at 52 weeks’ low.

Investors traded 3,047,673 shares for $4,213,805 down from 9,632,022 units at $21,100,384 on Wednesday.

Investors traded 3,047,673 shares for $4,213,805 down from 9,632,022 units at $21,100,384 on Wednesday.

Trading averaged 76,192 shares at $105,345 compared with 260,325 units at $570,281 on Wednesday. Trading month to date, averages 156,308 units at $326,386 compared to 162,082 stock units at 342,317 on the previous day, down compared to November, with an average of 262,280 units at $587,545.

One Great Studio led trading with 1.46 million shares for 47.8 percent of total volume followed by the managerially troubled iCreate with 382,342 units for 12.5 percent of the day’s trade and EduFocal with 327,543 units for 10.7 percent market share.

At the close, the Junior Market Index shed 18.95 points to culminate at 3,682.39.

The Junior Market ended trading with an average PE Ratio of 13.1, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and two with lower offers.

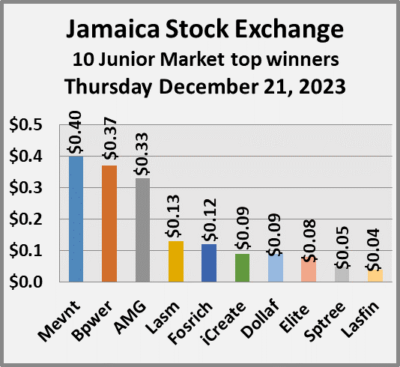

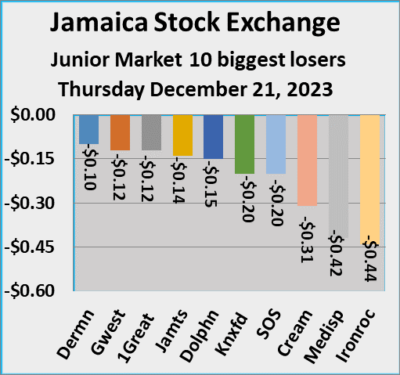

At the close, AMG Packaging popped 33 cents to finish trading at $2.64, with 8 stocks changing hands, Blue Power climbed 37 cents to close at $3.03 in trading 515 units, Caribbean Cream skidded 31 cents to $3 after a mere 1,229 shares changed hands. Derrimon Trading fell 10 cents and ended at $1.92 in an exchange of 30,654 stock units, Dolla Financial rose 9 cents to $2.59 with investors dealing in 45,503 shares, Dolphin Cove shed 15 cents in closing at $16.70 while exchanging 4,782 units. Elite Diagnostic advanced 8 cents to $1.73 after 1,172 stocks passed through the market, Fosrich gained 12 cents to close at $2.30 in switching ownership of 44,673 stock units, GWest Corporation sank 12 cents and ended at 87 cents with 229 shares clearing the market. iCreate gained 9 cents to end at 59 cents with investors swapping 382,342 units, Iron Rock Insurance declined 44 cents to $2.06 in an exchange of 37 stocks, Jamaican Teas lost 14 cents to end at $2.31, with 22,552 stock units crossing the market. Knutsford Express dipped 20 cents in closing at $12.58 after an exchange of 19 shares, Lasco Manufacturing rallied 13 cents to close at $4.63 after 4,596 stocks passed through the market, Main Event popped 40 cents and ended at $13.90 with a transfer of 321 units. Medical Disposables dropped 42 cents to a 52 weeks’ low of $2.50 after an exchange of 713 stock units, One Great Studio sank 12 cents in closing at an all-time low of 85 cents with investors trading 1,457,855 shares, Regency Petroleum dipped 10 cents to close at $2.20 with an exchange of 17,413 stocks and Stationery and Office Supplies fell 20 cents to end at $1.63 after trading 31,513 units.

iCreate gained 9 cents to end at 59 cents with investors swapping 382,342 units, Iron Rock Insurance declined 44 cents to $2.06 in an exchange of 37 stocks, Jamaican Teas lost 14 cents to end at $2.31, with 22,552 stock units crossing the market. Knutsford Express dipped 20 cents in closing at $12.58 after an exchange of 19 shares, Lasco Manufacturing rallied 13 cents to close at $4.63 after 4,596 stocks passed through the market, Main Event popped 40 cents and ended at $13.90 with a transfer of 321 units. Medical Disposables dropped 42 cents to a 52 weeks’ low of $2.50 after an exchange of 713 stock units, One Great Studio sank 12 cents in closing at an all-time low of 85 cents with investors trading 1,457,855 shares, Regency Petroleum dipped 10 cents to close at $2.20 with an exchange of 17,413 stocks and Stationery and Office Supplies fell 20 cents to end at $1.63 after trading 31,513 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

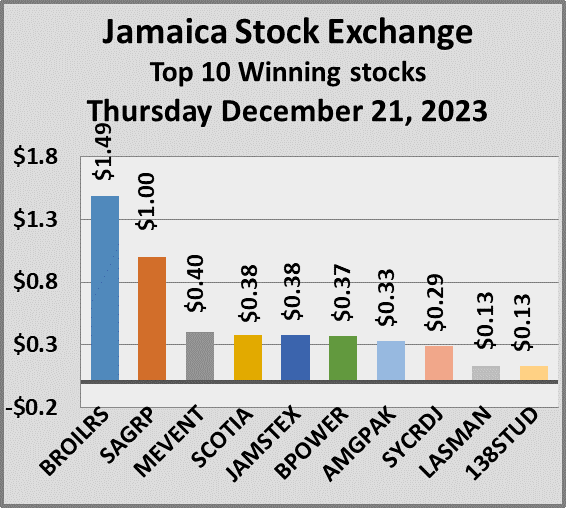

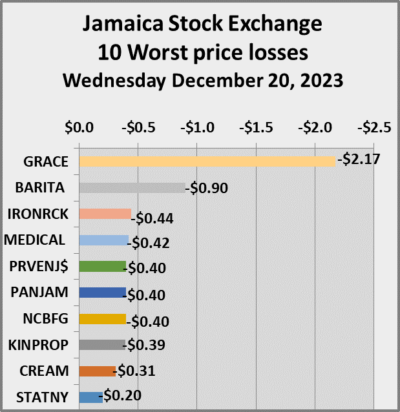

JSE Main & USD markets gains, Juniors slip

The Main Market of the Jamaica Stock Exchange gained at the close of trading on Thursday, with the USD Market also closing higher as the Junior Market slipped to close out trading, with market activity ending with the volume and value of stocks traded falling below Wednesday’s levels on the penultimate day before the Christmas break for the market.

At the close of the market, Main Market stocks rallying were Jamaica Broilers with a gain of $1.49, Sagicor Group up $1 and Scotia Group closing at a new 52 weeks’ closing high of $37.50, after gaining 38 cents. Declining Main Market stocks include GraceKennedy down $2.17 and Barita Investments with a fall of 90 cents.

At the close of the market, Main Market stocks rallying were Jamaica Broilers with a gain of $1.49, Sagicor Group up $1 and Scotia Group closing at a new 52 weeks’ closing high of $37.50, after gaining 38 cents. Declining Main Market stocks include GraceKennedy down $2.17 and Barita Investments with a fall of 90 cents.

Rising Junior Market stocks include Main Event with a gain of 40 cents, Blue Power up 37 cents, and AMG Packaging gaining 33 cents. Declining stocks include Medical Disposables falling 42 cents followed by Caribbean Cream with a loss of 31 cents and Iron Rock Insurance down 44 cents.

At the close of trading, the JSE Combined Market Index rose 512.77 points to 328,594.68, the All Jamaican Composite Index climbed 571.53 points to wrap up trading at 351,983.29, the JSE Main Index popped 723.66 points to 315,985.82. The Junior Market Index dipped 18.95 points to wrap-up trading at 3,682.39 and the JSE USD Market Index gained 4.25 points to finish at 223.13.

Investors traded 10,449,490 shares, in all three markets, down from 13,761,322 units on Tuesday. The value of stocks traded on the Junior and Main markets amounts to $48.29 million compared with $65.97 million on Tuesday. The JSE USD market closed after just 6,525 shares were traded, for US$320 compared to 130,502 units at US$2,973 on Wednesday.

Investors traded 10,449,490 shares, in all three markets, down from 13,761,322 units on Tuesday. The value of stocks traded on the Junior and Main markets amounts to $48.29 million compared with $65.97 million on Tuesday. The JSE USD market closed after just 6,525 shares were traded, for US$320 compared to 130,502 units at US$2,973 on Wednesday.

In the preference segment, Jamaica Public Service 7% rallied $1 to $41 and Productive Business Solutions 10.5 % preference share lost $30 to end at $1,060.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.7 on 2022-23 earnings and 13.7 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

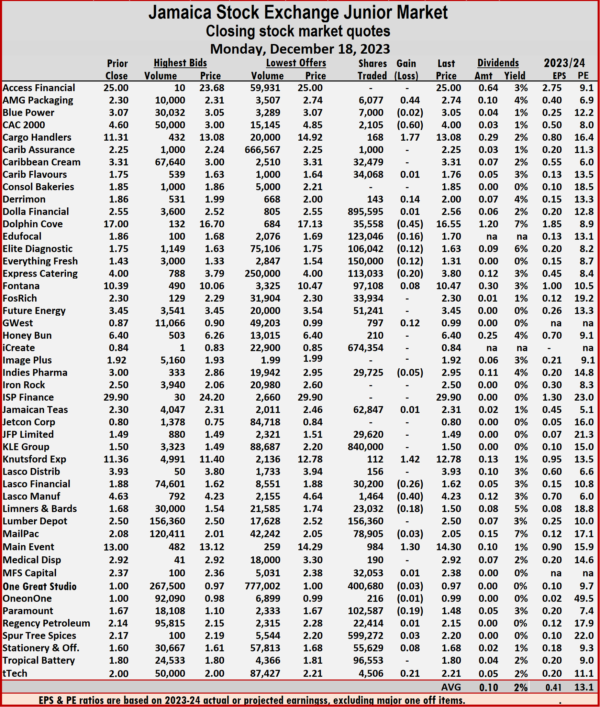

Steady Junior Market

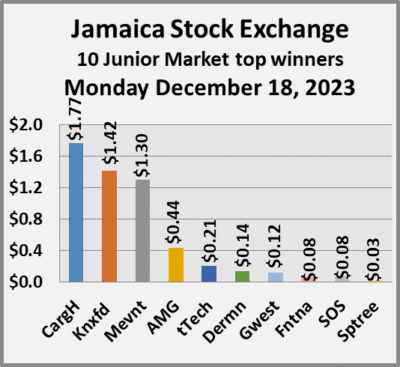

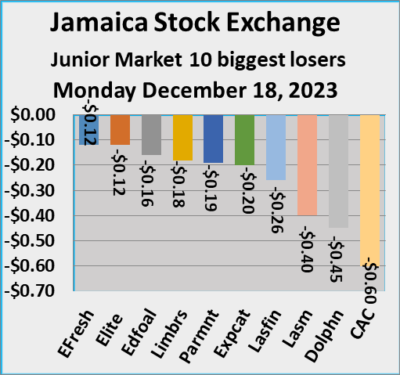

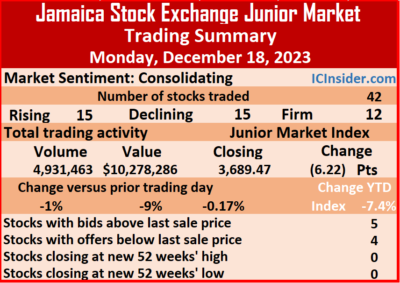

Market activity ended with 15 stocks rising and 15 declining in trading on the Junior Market of the Jamaica Stock Exchange Monday and 12 closed unchanged after trading in 42 securities compared with 40 on Friday with the volume and value of stocks traded marginally lower than on Friday.

Investors traded 4,931,463 shares for $10,278,286 compared with 4,960,272 units at $11,287,117 on Friday.

Investors traded 4,931,463 shares for $10,278,286 compared with 4,960,272 units at $11,287,117 on Friday.

Trading averaged 117,416 shares at $244,721 compared to 124,007 units at $282,178 on Friday with the month to date, averaging 161,052 stock units at $335,710 compared with 165,266 shares at $344,495 on the previous day. November closed with an average of 262,280 units at $587,545.

Dolla Financial led trading with 895,595 shares for 18.2 percent of total volume followed by KLE Group with 840,000 units for 17 percent of the day’s trade and iCreate with 674,354 units for 13.7 percent market share.

At the close, the Junior Market Index skidded 6.22 points to end the day at 3,689.47.

The Junior Market ended trading with an average PE Ratio of 13.1, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, AMG Packaging advanced 44 cents in closing at $2.74, with 6,077 stock units crossing the market, CAC 2000 sank 60 cents to $4 with a transfer of 2,105 shares, Cargo Handlers rose $1.77 to end at $13.08 after an exchange of 168 units. Derrimon Trading climbed 14 cents to close at $2 in switching ownership of 143 stocks, Dolphin Cove shed 45 cents and ended at $16.55 after a transfer of 35,558 shares, EduFocal lost 16 cents to close at $1.70, with 123,046 stock units changing hands. Elite Diagnostic fell 12 cents in closing at $1.63 in an exchange of 106,042 units, Everything Fresh skidded 12 cents to end at $1.31 with investors dealing in 150,000 stocks, Express Catering dipped 20 cents to $3.80, with 113,033 shares crossing the market.  Fontana increased 8 cents to close at $10.47 in trading 97,108 stock units, GWest Corporation popped 12 cents to 99 cents and closed with an exchange of 797 units, Knutsford Express gained $1.42 to close at $12.78 with an exchange of 112 stocks. Lasco Financial declined 26 cents to end at $1.62 after trading 30,200 units, Lasco Manufacturing dropped 40 cents in closing at $4.23 with investors transferring 1,464 stocks, Limners and Bards fell 18 cents and ended at $1.50 in an exchange of 23,032 shares. Main Event rallied $1.30 to $14.30 with traders dealing in 984 stock units, Paramount Trading sank 19 cents and ended at $1.48 passed through the market 102,587 shares, Stationery and Office Supplies popped 8 cents to close at $1.68 with investors swapping 55,629 units and tTech increased 21 cents in closing at $2.21 after an exchange of 4,506 stocks.

Fontana increased 8 cents to close at $10.47 in trading 97,108 stock units, GWest Corporation popped 12 cents to 99 cents and closed with an exchange of 797 units, Knutsford Express gained $1.42 to close at $12.78 with an exchange of 112 stocks. Lasco Financial declined 26 cents to end at $1.62 after trading 30,200 units, Lasco Manufacturing dropped 40 cents in closing at $4.23 with investors transferring 1,464 stocks, Limners and Bards fell 18 cents and ended at $1.50 in an exchange of 23,032 shares. Main Event rallied $1.30 to $14.30 with traders dealing in 984 stock units, Paramount Trading sank 19 cents and ended at $1.48 passed through the market 102,587 shares, Stationery and Office Supplies popped 8 cents to close at $1.68 with investors swapping 55,629 units and tTech increased 21 cents in closing at $2.21 after an exchange of 4,506 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading jumps on the Junior Market

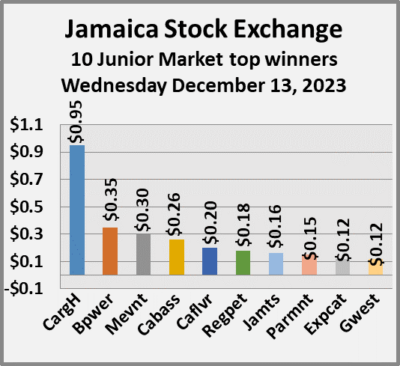

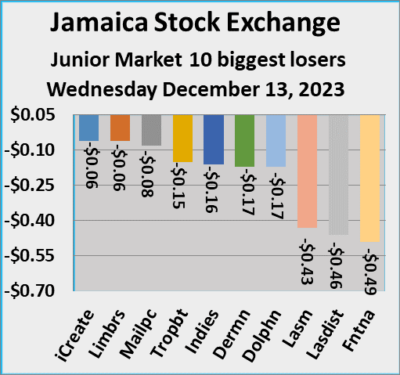

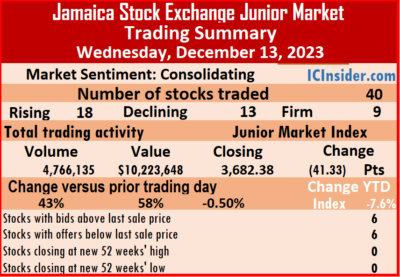

Trading climbed on the Junior Market of the Jamaica Stock Exchange Wednesday, with the volume of stocks traded rising 43 percent and the value 58 percent more than Tuesday following trading in 40 securities similar to the outcome on Tuesday and ended with 18 rising, 13 declining and nine unchanged but that failed to save the market index from dropping at the close following a jump in the index in the morning session.

Investors traded 4,766,135 shares for $10,223,648 compared with 3,334,500 units at $6,456,830 on Tuesday.

Investors traded 4,766,135 shares for $10,223,648 compared with 3,334,500 units at $6,456,830 on Tuesday.

Trading averaged 119,153 shares at $255,591 compared to 83,363 units at $161,421 on Tuesday with the month to date, averaging 132,501 stock units at $288,790 compared to 134,174 shares at $292,953 on the previous day and markedly lower than November with an average of 262,280 units at $587,545, after the market opened in the 3,750 range.

Spur Tree Spices led trading with 1.02 million shares for 21.3 percent of total volume followed by Fosrich with 626,665 units for 13.1 percent of the day’s trade and Dolla Financial with 626,493 units for 13.1 percent market share.

At the close, the Junior Market Index lost 41.33 points to close at 3,682.38 after the market traded in the 3,750 range in early market activity.

The Junior Market ended trading with an average PE Ratio of 13.2, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and six with lower offers.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and six with lower offers.

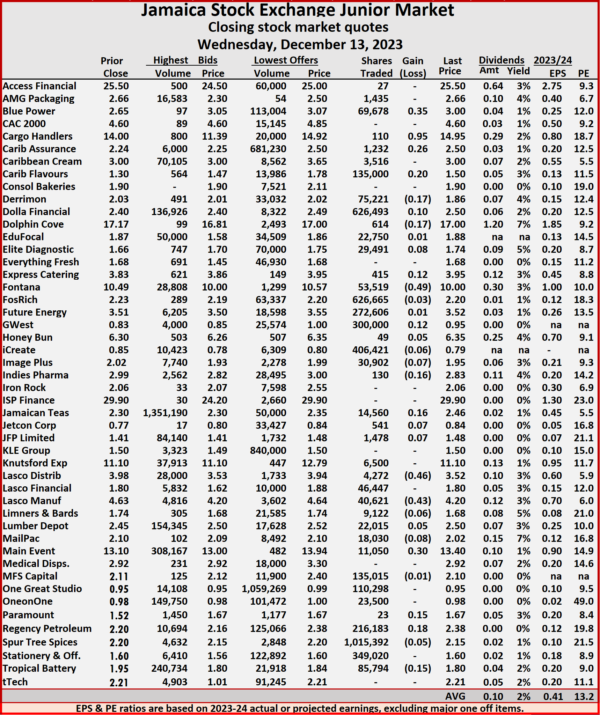

At the close, Blue Power rallied 35 cents and ended at $3 as 69,678 stocks passed through the market, following the release of half year results with profit up 330 percent to $70.5 million, Cargo Handlers rose 95 cents to close at $14.95 with an exchange of 110 units, Caribbean Assurance Brokers rose 26 cents to $2.50, with 1,232 shares clearing the market. Caribbean Flavours popped 20 cents in closing at $1.50 with a transfer of 135,000 stock units, Derrimon Trading dipped 17 cents to end at $1.86, with 75,221 shares crossing the market, Dolla Financial increased 10 cents in closing at $2.50 with investors trading 626,493 stock units. Dolphin Cove fell 17 cents to $17 and closed with an exchange of 614 stocks, Elite Diagnostic advanced 8 cents and ended at $1.74 with investors trading 29,491 units, Express Catering gained 12 cents to end at $3.95, with an exchange of 415 shares. Fontana skidded 49 cents to close at $10 after a transfer of 53,519 stocks, GWest Corporation popped 12 cents to 95 cents with shareholders swapping 300,000 units, Indies Pharma lost 16 cents to end at $2.83 after an exchange of 130 stock units.  Jamaican Teas climbed 16 cents in closing at $2.46, with the trading of 14,560 shares, Lasco Distributors declined 46 cents to $3.52 with stakeholders exchanging 4,272 units, Lasco Manufacturing shed 43 cents to end at $4.20 in switching ownership of 40,621 stocks. Mailpac Group dropped 8 cents to $2.02 as investors exchanged 18,030 stock units, Main Event popped 30 cents to $13.40 after 11,050 shares were traded, Paramount Trading advanced 15 cents in closing at $1.67 with traders dealing in 23 units. Regency Petroleum rose 18 cents and ended at $2.38 in an exchange of 216,183 stocks and Tropical Battery shed 15 cents to close at $1.80 with investors dealing in 85,794 stock units.

Jamaican Teas climbed 16 cents in closing at $2.46, with the trading of 14,560 shares, Lasco Distributors declined 46 cents to $3.52 with stakeholders exchanging 4,272 units, Lasco Manufacturing shed 43 cents to end at $4.20 in switching ownership of 40,621 stocks. Mailpac Group dropped 8 cents to $2.02 as investors exchanged 18,030 stock units, Main Event popped 30 cents to $13.40 after 11,050 shares were traded, Paramount Trading advanced 15 cents in closing at $1.67 with traders dealing in 23 units. Regency Petroleum rose 18 cents and ended at $2.38 in an exchange of 216,183 stocks and Tropical Battery shed 15 cents to close at $1.80 with investors dealing in 85,794 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Falling stocks pelted Junior Market

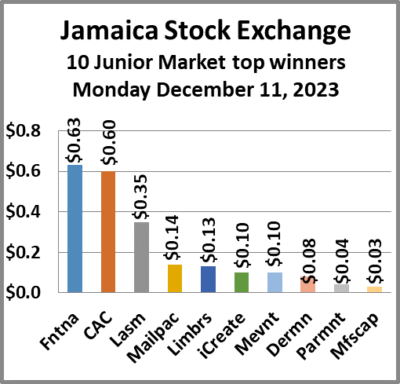

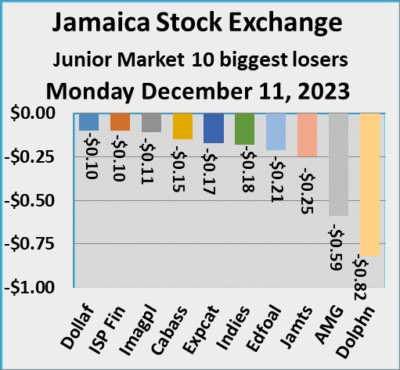

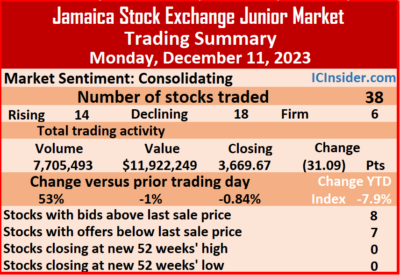

The Junior Market of the Jamaica Stock Exchange dropped for a third consecutive day, on Monday, after the volume of stocks traded climbed 53 percent and the value slipped a tad lower than Friday following trading in 38 securities compared with 36 on Friday and ended with prices of 14 rising, 18 declining and six closing unchanged.

Investors traded 7,705,493 shares for $11,922,249 compared with 5,022,943 units at $11,992,912 on Friday.

Investors traded 7,705,493 shares for $11,922,249 compared with 5,022,943 units at $11,992,912 on Friday.

Trading averaged 202,776 shares at $313,743, compared with 139,526 units at $333,136 on Friday with the month to date, averaging 141,459 units at $311,810 compared with 131,791 stock units at $311,505 on the previous trading day down from November with an average of 262,280 units at $587,545.

iCreate led trading with 3.46 million shares for 44.8 percent of total volume followed by Dolla Financial with 1.19 million units for 15.4 percent of the day’s trade and One Great Studio with 907,966 units for 11.8 percent market share.

At the close, the Junior Market Index skidded 31.09 points to end the day at 3,669.67.

The Junior Market ended trading with an average PE Ratio of 13.1, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

The Junior Market ended trading with an average PE Ratio of 13.1, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and seven with lower offers

At the close, AMG Packaging shed 59 cents to close at $2.30 with investors transferring just 403 stock units, CAC 2000 climbed 60 cents and ended at $4.60, with 11 shares crossing the market, Caribbean Assurance Brokers declined 15 cents in closing at $2.35 while exchanging 300,000 units. Consolidated Bakeries fell 10 cents to end at $1.80 in trading 53,000 stocks, Derrimon Trading increased 8 cents to close at $1.95 after an exchange of 2,190 units, Dolla Financial dipped 10 cents to $2.39, after 1,185,788 stocks passed through the market. Dolphin Cove lost 82 cents to close at $16.57 in trading 1,569 shares, EduFocal skidded 21 cents to end at $1.71 in an exchange of 829,284 stock units, Express Catering dropped 17 cents in closing at $3.83, with 2,588 shares changing hands. Fontana popped 63 cents and ended at $10.20 in an exchange of 29,895 stocks, iCreate advanced 10 cents to 87 cents with 3,455,685 units clearing the market, Image Plus fell 11 cents and ended at $1.92 in switching ownership of 6,149 stock units. Indies Pharma dipped 18 cents in closing at $2.82 with stakeholders exchanging 10,350 shares, ISP Finance lost 10 cents to end at $29.90 after a transfer of 708 stock units, Jamaican Teas skidded 25 cents to close at $2.30 with shareholders swapping 44,424 units. Lasco Manufacturing rose 35 cents to $4.65 with an exchange of 42,628 stocks, Limners and Bards gained 13 cents in closing at $1.74 with investors dealing in 133,000 shares,

Dolphin Cove lost 82 cents to close at $16.57 in trading 1,569 shares, EduFocal skidded 21 cents to end at $1.71 in an exchange of 829,284 stock units, Express Catering dropped 17 cents in closing at $3.83, with 2,588 shares changing hands. Fontana popped 63 cents and ended at $10.20 in an exchange of 29,895 stocks, iCreate advanced 10 cents to 87 cents with 3,455,685 units clearing the market, Image Plus fell 11 cents and ended at $1.92 in switching ownership of 6,149 stock units. Indies Pharma dipped 18 cents in closing at $2.82 with stakeholders exchanging 10,350 shares, ISP Finance lost 10 cents to end at $29.90 after a transfer of 708 stock units, Jamaican Teas skidded 25 cents to close at $2.30 with shareholders swapping 44,424 units. Lasco Manufacturing rose 35 cents to $4.65 with an exchange of 42,628 stocks, Limners and Bards gained 13 cents in closing at $1.74 with investors dealing in 133,000 shares,  Mailpac Group rallied 14 cents to close at $2.19 with a transfer of 75 stock units and Main Event increased 10 cents to end at $13.10 after closing with 3,744 stocks changing hands.

Mailpac Group rallied 14 cents to close at $2.19 with a transfer of 75 stock units and Main Event increased 10 cents to end at $13.10 after closing with 3,744 stocks changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market trading falls off

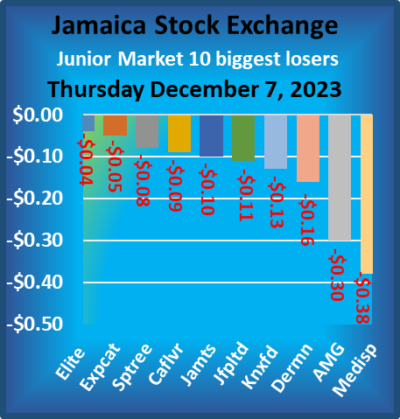

Trading pulled back all-around at the close of the Junior Market of the Jamaica Stock Exchange on Thursday, with a 59 percent drop in the volume of stocks traded with a 60 percent decline in the value  compared to Wednesday and resulting in the trading of 39 securities down from 41 on Wednesday, ending with prices of 12 rising, 15 declining and 12 closing unchanged.

compared to Wednesday and resulting in the trading of 39 securities down from 41 on Wednesday, ending with prices of 12 rising, 15 declining and 12 closing unchanged.

Investors exchanged 2,442,247 shares at $4,763,066 compared to 5,954,626 units at $12,034,127 on Wednesday.

Trading ended with an average of 62,622 shares at $122,130 compared to 145,235 units at $293,515 on Wednesday with the month to date averaging 130,432 units at $307,707 compared with 146,364 stock units at $351,306 on the previous day and November that closed with an average of 262,280 units at $587,545.

Stationery and Office Supplies led trading with 541,346 shares for 22.2 percent of total volume followed by  Jamaican Teas with 299,806 units for 12.3 percent of the day’s trade and One Great Studio with 289,403 units for 11.8 percent market share.

Jamaican Teas with 299,806 units for 12.3 percent of the day’s trade and One Great Studio with 289,403 units for 11.8 percent market share.

At the close, the Junior Market Index shed 12.14 points to cease trading at 3,713.03.

The Junior Market ended trading with an average PE Ratio of 13, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer.

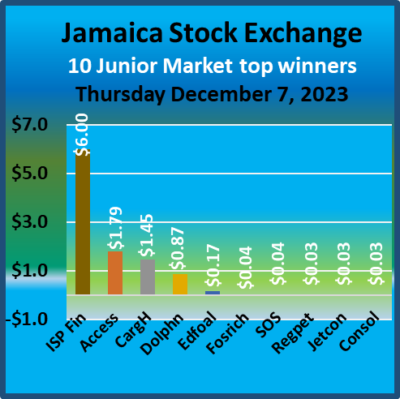

At the close, Access Financial rose $1.79 and ended at $25.49 with shareholders swapping a mere 1,000 shares, AMG Packaging skidded 30 cents to $2.30 after an exchange of 1,562 units, Cargo Handlers rallied $1.45 in closing at $14.95 with investors transferring 1,330 shares. Caribbean Flavours fell 9 cents to end at $1.50 after an exchange of 400 stock units,  Derrimon Trading shed 16 cents to close at $1.87 with a transfer of 30,656 shares, Dolphin Cove increased 87 cents to $17.40 after 797 stock units passed through the market. EduFocal popped 17 cents to end at $1.93 in an exchange of 85,150 stocks, ISP Finance picked up $6 in closing at $30 with traders dealing in just 30 units, Jamaican Teas declined 10 cents to close at $2.30, with 299,806 shares crossing the market. JFP Ltd lost 11 cents and ended at $1.41 with an exchange of 25,970 units, Knutsford Express dipped 13 cents to $12.80 while trading 41 stocks, Medical Disposables dipped 38 cents to end at $2.92 in switching ownership of 4,906 stock units and Spur Tree Spices lost 8 cents in closing at $2.11 while exchanging 112,204 shares.

Derrimon Trading shed 16 cents to close at $1.87 with a transfer of 30,656 shares, Dolphin Cove increased 87 cents to $17.40 after 797 stock units passed through the market. EduFocal popped 17 cents to end at $1.93 in an exchange of 85,150 stocks, ISP Finance picked up $6 in closing at $30 with traders dealing in just 30 units, Jamaican Teas declined 10 cents to close at $2.30, with 299,806 shares crossing the market. JFP Ltd lost 11 cents and ended at $1.41 with an exchange of 25,970 units, Knutsford Express dipped 13 cents to $12.80 while trading 41 stocks, Medical Disposables dipped 38 cents to end at $2.92 in switching ownership of 4,906 stock units and Spur Tree Spices lost 8 cents in closing at $2.11 while exchanging 112,204 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 192

- Next Page »