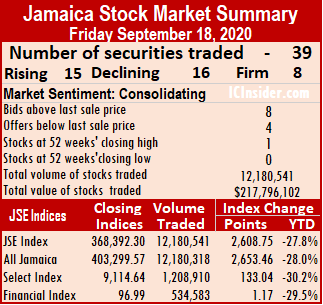

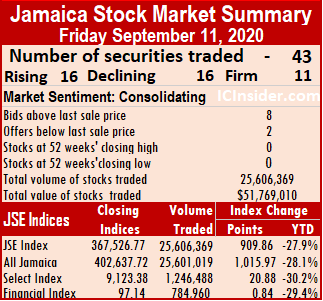

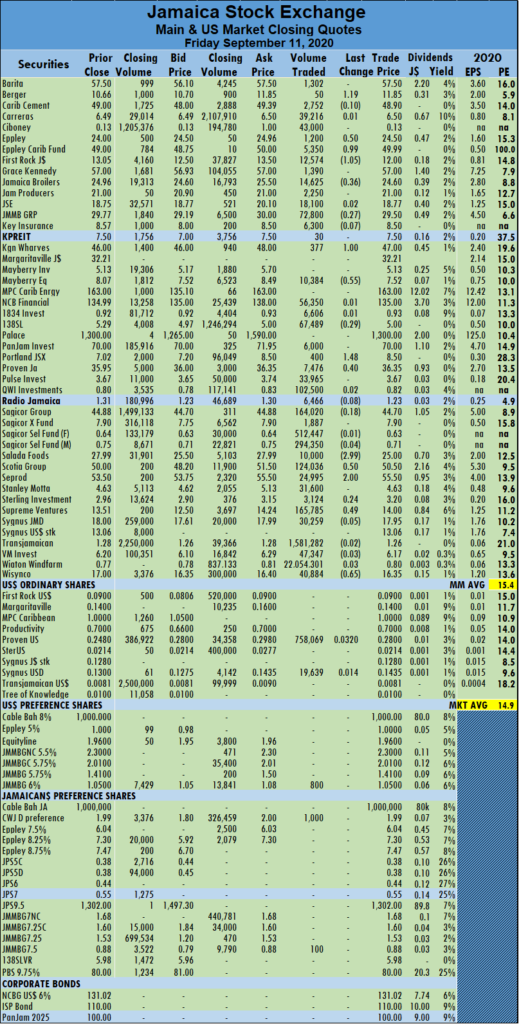

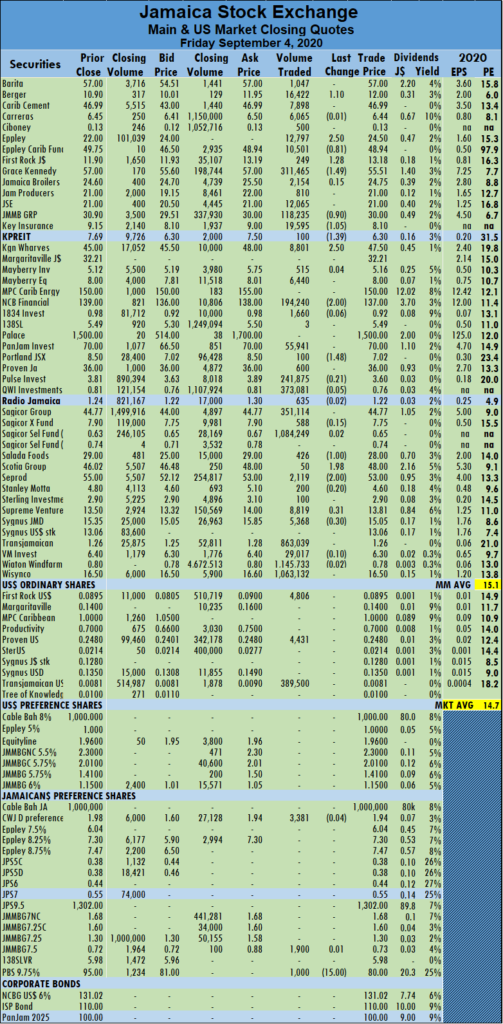

The Jamaica Stock Exchange Main Market ended trading on Friday, with the market rising after an almost equal number of stocks rising and falling after an exchange of 95 percent more shares and 437 percent more value than on Thursday.

At the close, the All Jamaican Composite Index carved out a gain of 2,653.46 points to 403,299.57, the Main Index increased 2,608.75 points to 368,392.30 and the JSE Financial Index gained 1.17 points to settle at 96.99.

At the close, the All Jamaican Composite Index carved out a gain of 2,653.46 points to 403,299.57, the Main Index increased 2,608.75 points to 368,392.30 and the JSE Financial Index gained 1.17 points to settle at 96.99.

Trading ended with 39 securities changing hands compared to 43 on Thursday and closed with the prices of 15 stocks rising, 16 declining and eight remaining unchanged. The average PE Ratio of the market ended at 15.6 based on IC Insider.com forecast of 2020-21 earnings.

The market closed with an exchange of 12,180,541 shares for $217,796,102 compared to 6,254,690 units at $40,537,477 on Thursday. Kingston Wharves led trading with 32.9 percent of total volume equaling 4 million shares, followed by Pulse Investments with 21.2 percent for 2.58 million units, Wigton Windfarm with 16.1 percent market share for 1.96 million units and Transjamaican Highway with 1.86 million units changing hands for 15.3 percent of the day’s volume.

Trading closed with an average of 312,322 units changing hands at $5,584,515 for each security compared to an average of 145,458 shares at $942,732 on Thursday. The average trade for the month to date ended at 217,776 units at $1,474,275 for each security, in contrast to 211.084 units at $1,183,350. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

Trading closed with an average of 312,322 units changing hands at $5,584,515 for each security compared to an average of 145,458 shares at $942,732 on Thursday. The average trade for the month to date ended at 217,776 units at $1,474,275 for each security, in contrast to 211.084 units at $1,183,350. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows eight stocks ending with bids higher than their last selling prices and four with lower offers.

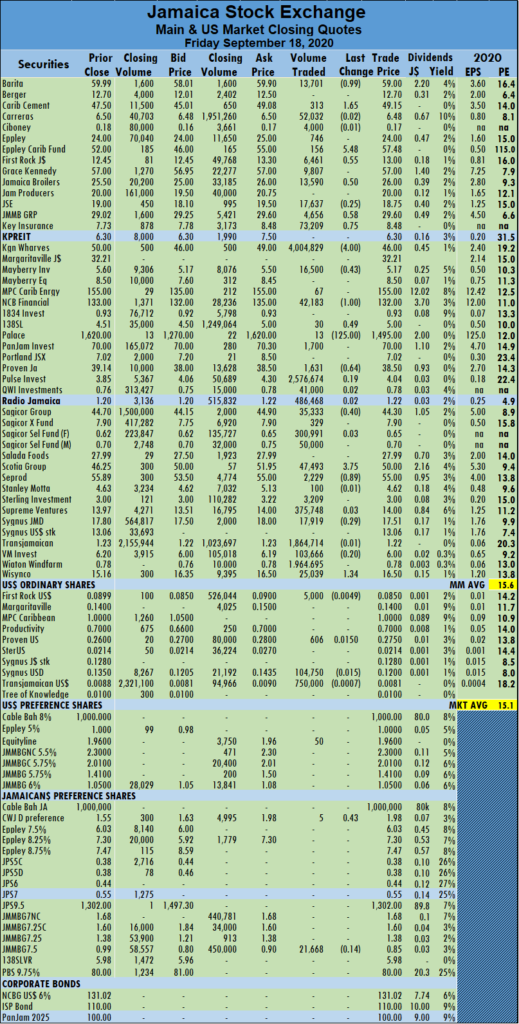

At the close of the market, Barita Investments shed 99 cents to end at $59, with investors swapping 13,701 shares, Caribbean Cement climbed $1.65 to $49.15, after exchanging 313 units, Eppley Caribbean Property Fund jumped $5.48 to settle at an all-time high of $57.48, in an exchange of 156 stock units. First Rock Capital closed at $13, after picking up 55 cents and trading 6,461 stocks, Jamaica Broilers Group gained 50 cents to settle at $26, with 13,590 stock units clearing the market, JMMB Group rose 58 cents to $29.60, in trading 4,656 stock units.  Key Insurance climbed 75 cents to $8.48 after exchanging 73,209 shares. Kingston Wharves declined $4 in closing at $46, after an exchange of 4,004,829 shares, Mayberry Investments lost 43 cents to finish at $5.17, with 16,500 stock units passing through the market, NCB Financial Group fell to $132, after losing $1 and trading 42,183 stock units. 138 Student Living gained 49 cents to close at $5, with an exchange of 30 shares, Palace Amusement dropped $125 to end at $1,495 in an exchange of 13 units, Proven Investments lost 64 cents to settle at $38.50, in transferring 1,631 units, Sagicor Group lost 40 cents to close at $44.30, with investors swapping 35,333 shares. Scotia Group advanced by $3.75, ending at $50 while exchanging 47,493 shares, Seprod lost 89 cents to close at $55, with investors switching ownership of 2,229 stock units and Wisynco Group rose $1.34, in ending at $16.50, with 25,039 stock units changing hands.

Key Insurance climbed 75 cents to $8.48 after exchanging 73,209 shares. Kingston Wharves declined $4 in closing at $46, after an exchange of 4,004,829 shares, Mayberry Investments lost 43 cents to finish at $5.17, with 16,500 stock units passing through the market, NCB Financial Group fell to $132, after losing $1 and trading 42,183 stock units. 138 Student Living gained 49 cents to close at $5, with an exchange of 30 shares, Palace Amusement dropped $125 to end at $1,495 in an exchange of 13 units, Proven Investments lost 64 cents to settle at $38.50, in transferring 1,631 units, Sagicor Group lost 40 cents to close at $44.30, with investors swapping 35,333 shares. Scotia Group advanced by $3.75, ending at $50 while exchanging 47,493 shares, Seprod lost 89 cents to close at $55, with investors switching ownership of 2,229 stock units and Wisynco Group rose $1.34, in ending at $16.50, with 25,039 stock units changing hands.

In the preference segment of the market, Community & Workers Credit Union gained 43 cents to end at $1.98 in trading just five units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

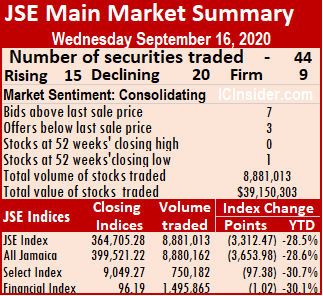

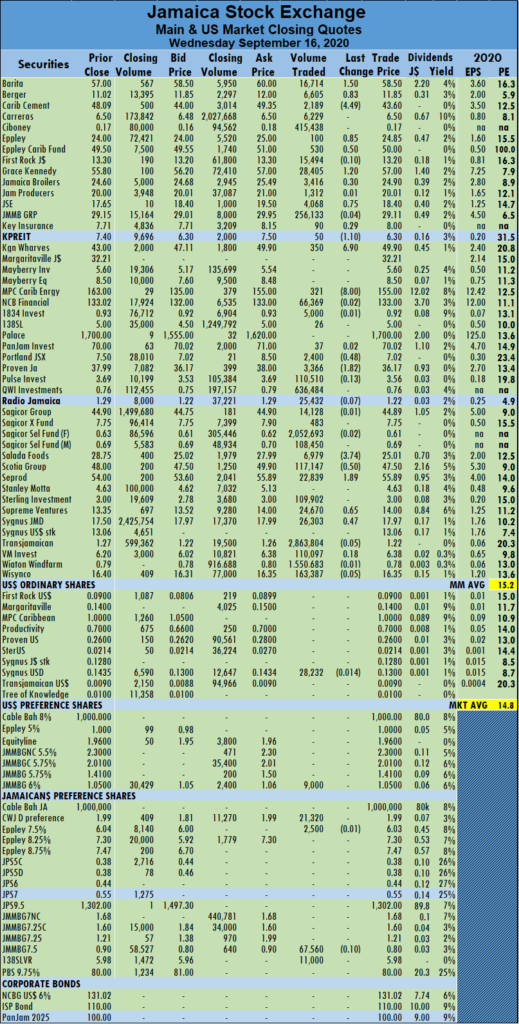

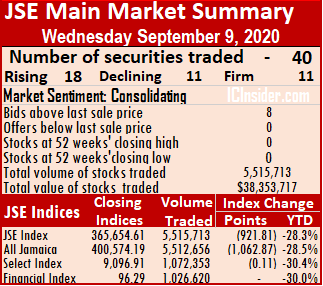

At the close, the All Jamaican Composite Index declined by 3,653.98 points to 399,521.22. The Main Index fell by 3,312.47 points to 364,705.28, the JSE Financial Index shed 1.02 points to settle at 96.19.

At the close, the All Jamaican Composite Index declined by 3,653.98 points to 399,521.22. The Main Index fell by 3,312.47 points to 364,705.28, the JSE Financial Index shed 1.02 points to settle at 96.19. IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows seven stocks ending with bids higher than their last selling prices and three with lower offers.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows seven stocks ending with bids higher than their last selling prices and three with lower offers. Kingston Properties shed $1.10 to settle at $6.30 with investors swapping 50 units. Kingston Wharves jumped $6.90 to settle at $49.90 after 350 units crossed the market, MPC Caribbean Clean Energy dropped $8 to $155, in an exchange of 321 units, Portland JSX lost 48 cents in closing at $7.02 and trading 2,400 stock units. Proven Investments fell $1.82 to $36.17, with investors swapping 3,366 stock units, Salada Foods declined by $3.74 to $25.01, with an exchange of 6,979 stock units, Scotia Group shed 50 cents to settle at $47.50, in transferring 117,147 shares. Seprod rose to $55.89, after climbing $1.89 and exchanging 22,839 shares, Supreme Ventures gained 65 cents to close at $14, trading 24,670 shares and Sygnus Credit Investments rose 47 cents to $17.97, with 26,303 shares changing hands.

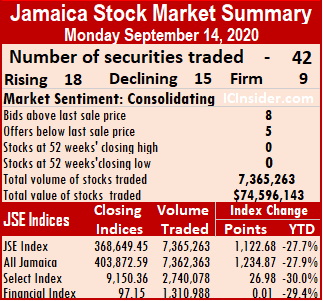

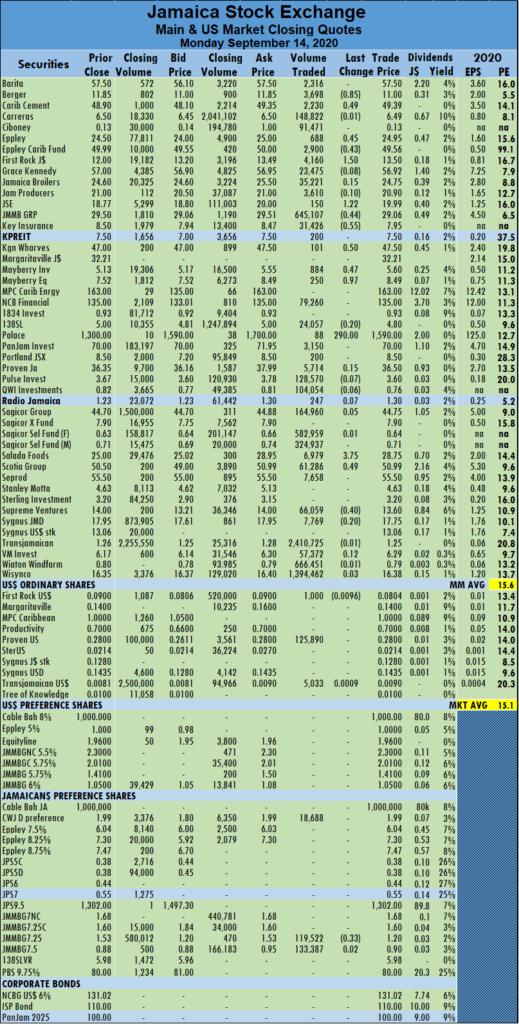

Kingston Properties shed $1.10 to settle at $6.30 with investors swapping 50 units. Kingston Wharves jumped $6.90 to settle at $49.90 after 350 units crossed the market, MPC Caribbean Clean Energy dropped $8 to $155, in an exchange of 321 units, Portland JSX lost 48 cents in closing at $7.02 and trading 2,400 stock units. Proven Investments fell $1.82 to $36.17, with investors swapping 3,366 stock units, Salada Foods declined by $3.74 to $25.01, with an exchange of 6,979 stock units, Scotia Group shed 50 cents to settle at $47.50, in transferring 117,147 shares. Seprod rose to $55.89, after climbing $1.89 and exchanging 22,839 shares, Supreme Ventures gained 65 cents to close at $14, trading 24,670 shares and Sygnus Credit Investments rose 47 cents to $17.97, with 26,303 shares changing hands. At the close, the All Jamaican Composite Index advanced by 1,234.87 points to 403,872.59, the Main Index rose 1,122.68 points to 368,649.45 and the JSE Financial Index gained 0.01 point to close at 97.15.

At the close, the All Jamaican Composite Index advanced by 1,234.87 points to 403,872.59, the Main Index rose 1,122.68 points to 368,649.45 and the JSE Financial Index gained 0.01 point to close at 97.15. Trading month to date compares adversely to August with an average of 497,441 units at $3,201,918.

Trading month to date compares adversely to August with an average of 497,441 units at $3,201,918. Key Insurance lost 55 cents to end at $7.95 exchanging 31,426 shares. Kingston Wharves closed at $47.50, with gains of 50 cents and 101 units crossing the exchange, Mayberry Investments gained 47 cents in ending at $5.60 and trading 884 units, Mayberry Jamaican Equities settled at $8.49, after picking up 97 cents, with 250 units clearing the market. Palace Amusement surged $290 to end at $1,590, with an exchange of 88 units, after the company announced the opening of a drive-in cinema in New Kingston. Salada Foods jumped $3.75 to $28.75, with investors switching ownership of 6,979 stock units,

Key Insurance lost 55 cents to end at $7.95 exchanging 31,426 shares. Kingston Wharves closed at $47.50, with gains of 50 cents and 101 units crossing the exchange, Mayberry Investments gained 47 cents in ending at $5.60 and trading 884 units, Mayberry Jamaican Equities settled at $8.49, after picking up 97 cents, with 250 units clearing the market. Palace Amusement surged $290 to end at $1,590, with an exchange of 88 units, after the company announced the opening of a drive-in cinema in New Kingston. Salada Foods jumped $3.75 to $28.75, with investors switching ownership of 6,979 stock units,  Trading ended with an average of 95,497 units at $1,203,930 for each security, in comparison to an average of 244,891 shares at $884,695 on Thursday. The average trade for the month to date ended at 233,735 units at $1,206,845 for each security, in contrast to 187,575 units at $1,207,217. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

Trading ended with an average of 95,497 units at $1,203,930 for each security, in comparison to an average of 244,891 shares at $884,695 on Thursday. The average trade for the month to date ended at 233,735 units at $1,206,845 for each security, in contrast to 187,575 units at $1,207,217. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918. First Rock Capital fell $1.05 to settle at $12, with 12,574 shares changing hands, Jamaica Broilers Group shed 36 cents to end at $24.60, after 14,625 stock units crossed the market, Kingston Wharves rose $1 to $47, in trading 377 units. Mayberry Jamaican Equities lost 55 cents with an exchange of 10,384 stock units to end at $7.52, Portland JSX advanced $1.48, in ending at $8.50 with investors switching ownership of 400 stock units, Proven Investments finished at $36.35, with gains of 4 cents in trading 7,476 stock units. Salada Foods declined by $2.99 to close at $25 in transferring 10,000 stock units, Scotia Group gained 50 cents in closing at $50.50, with 124,036 shares passing through the market, Seprod rose $2 to $55.50 after the transfer of 24,995 stock units. Supreme Ventures picked up 49 cents to settle at $14, with investors switching ownership of 165,785 shares and Wisynco Group shed 65 cents to end at $16.35, in exchanging 40,884 shares.

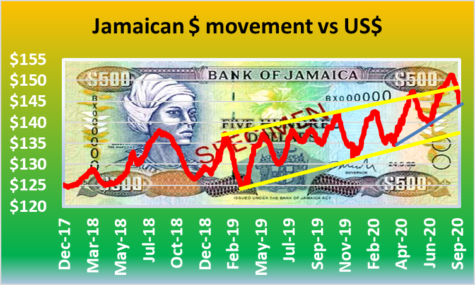

First Rock Capital fell $1.05 to settle at $12, with 12,574 shares changing hands, Jamaica Broilers Group shed 36 cents to end at $24.60, after 14,625 stock units crossed the market, Kingston Wharves rose $1 to $47, in trading 377 units. Mayberry Jamaican Equities lost 55 cents with an exchange of 10,384 stock units to end at $7.52, Portland JSX advanced $1.48, in ending at $8.50 with investors switching ownership of 400 stock units, Proven Investments finished at $36.35, with gains of 4 cents in trading 7,476 stock units. Salada Foods declined by $2.99 to close at $25 in transferring 10,000 stock units, Scotia Group gained 50 cents in closing at $50.50, with 124,036 shares passing through the market, Seprod rose $2 to $55.50 after the transfer of 24,995 stock units. Supreme Ventures picked up 49 cents to settle at $14, with investors switching ownership of 165,785 shares and Wisynco Group shed 65 cents to end at $16.35, in exchanging 40,884 shares. Since August when the rate hit a low of $151.27 against the US dollar, the local dollar has rebounded 4.5 percent. A number of developments have occurred to help the local currency. Unbeknown to many is an issue of $5 billion government bond with a duration of more than 30 years that pulled liquidity out of the market to purchase them at an average rate of just over 7 percent, there was also another issue at the beginning of September for J$3 billion bonds resulting in an average rate of 2.91 percent for the instrument that has a two and a half years life. In addition, the reopening of the tourism sector would be adding some badly needed US dollars to the system.

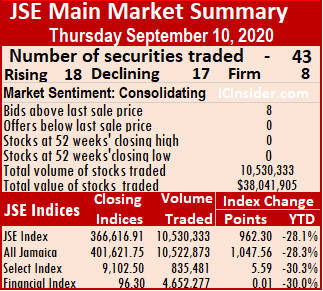

Since August when the rate hit a low of $151.27 against the US dollar, the local dollar has rebounded 4.5 percent. A number of developments have occurred to help the local currency. Unbeknown to many is an issue of $5 billion government bond with a duration of more than 30 years that pulled liquidity out of the market to purchase them at an average rate of just over 7 percent, there was also another issue at the beginning of September for J$3 billion bonds resulting in an average rate of 2.91 percent for the instrument that has a two and a half years life. In addition, the reopening of the tourism sector would be adding some badly needed US dollars to the system. At the close, the All Jamaican Composite Index climbed 1,047.56 points to 401,621.75, the Main Index rose 962.30 points to 366,616.91 and the JSE Financial Index gained 0.01 points to close at 96.30.

At the close, the All Jamaican Composite Index climbed 1,047.56 points to 401,621.75, the Main Index rose 962.30 points to 366,616.91 and the JSE Financial Index gained 0.01 points to close at 96.30. Trading ended with an average of 244,891 units changing hands at $884,695 for each security, in comparison to an average of 137,893 shares at $958,843 on Wednesday. The average trade for the month to date ended at 187,575 units at $1,207,217 for each security, in contrast to 179,192 units at $1,254,388. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

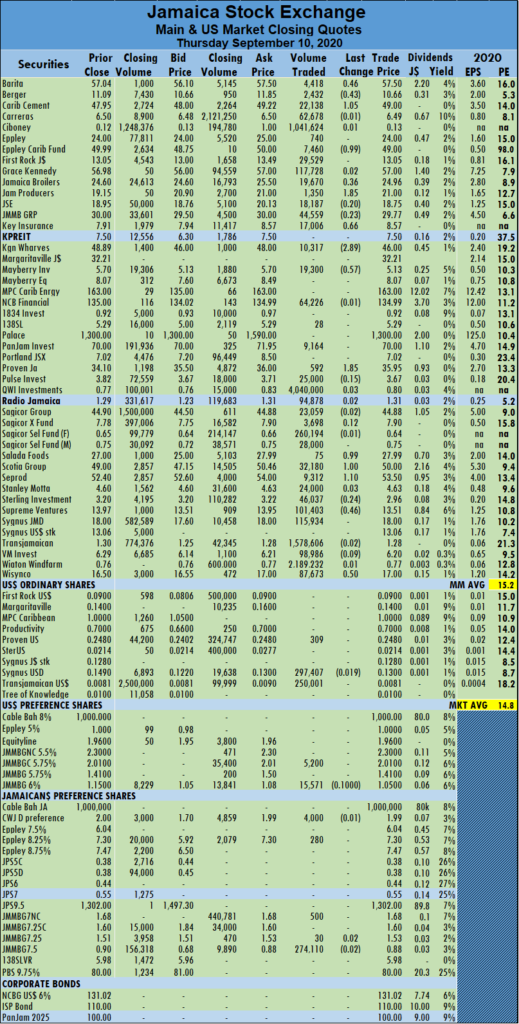

Trading ended with an average of 244,891 units changing hands at $884,695 for each security, in comparison to an average of 137,893 shares at $958,843 on Wednesday. The average trade for the month to date ended at 187,575 units at $1,207,217 for each security, in contrast to 179,192 units at $1,254,388. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918. Jamaica Broilers rose 36 cents to close at $24.96 in trading 19,670 shares, Jamaica Producers advanced $1.85 to $21 and cleared the market with 1,350 units. Key Insurance rose 66 cents to $8.57 trading 17,006 stock units, Kingston Wharves dropped $2.89 in closing at $46, with 10,317 units crossing the market, Mayberry Investments slipped 57 cents to $5.13, after 19,300 stock units passed through the market. Proven Investments advanced $1.85 to $35.95, after an exchange of 592 units, Salada Foods gained 99 cents to close at $27.99, with 75 units crossing the market, Scotia Group rose $1 to end at $50, after trading 32,180 shares. Seprod climbed $1.10 to $53.50, in exchanging 9,312 units, Supreme Ventures lost 46 cents to settle at $13.51 trading 101,403 shares and Wisynco Group gained 50 cents to close at $17, with 87,673 shares changing hands.

Jamaica Broilers rose 36 cents to close at $24.96 in trading 19,670 shares, Jamaica Producers advanced $1.85 to $21 and cleared the market with 1,350 units. Key Insurance rose 66 cents to $8.57 trading 17,006 stock units, Kingston Wharves dropped $2.89 in closing at $46, with 10,317 units crossing the market, Mayberry Investments slipped 57 cents to $5.13, after 19,300 stock units passed through the market. Proven Investments advanced $1.85 to $35.95, after an exchange of 592 units, Salada Foods gained 99 cents to close at $27.99, with 75 units crossing the market, Scotia Group rose $1 to end at $50, after trading 32,180 shares. Seprod climbed $1.10 to $53.50, in exchanging 9,312 units, Supreme Ventures lost 46 cents to settle at $13.51 trading 101,403 shares and Wisynco Group gained 50 cents to close at $17, with 87,673 shares changing hands. The average trade for the month to date ended at 179,192 units at $1,254,388 for each security, in contrast to 185,696 units at $1,300,931. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

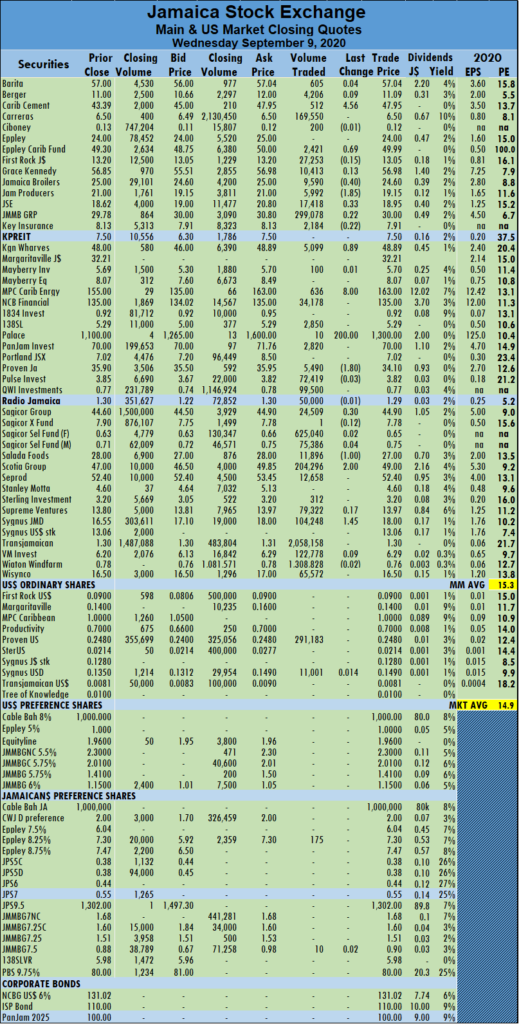

The average trade for the month to date ended at 179,192 units at $1,254,388 for each security, in contrast to 185,696 units at $1,300,931. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918. Jamaica Producers declined by $1.85 to $19.15, with 5,992 units changing hands, Jamaica Stock Exchange gained 33 cents, in finishing at $18.95 with 17,418 stock units crossing the market, Kingston Wharves closed at $48.89, having gained 89 cents and trading 5,099 stock units. MPC Caribbean Clean Energy climbed $8 to close at $163, after exchanging 636 units, Palace Amusement climbed $200 in closing at $1,300 trading 10 units, Proven Investments declined by $1.80 to $34.10 with an exchange of 5,490 stock units. Sagicor Group gained 30 cents to close at $44.90, in transferring 24,509 stock units, Salada Foods dropped $1 to $27, with an exchange of 11,896 units, Scotia Group climbed $2 to $49 while trading 204,296 shares and Sygnus Credit Investments ended at $18, with gains of $1.45 in transferring 104,248 stock units.

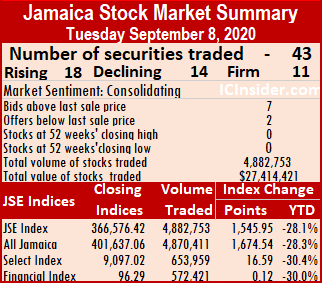

Jamaica Producers declined by $1.85 to $19.15, with 5,992 units changing hands, Jamaica Stock Exchange gained 33 cents, in finishing at $18.95 with 17,418 stock units crossing the market, Kingston Wharves closed at $48.89, having gained 89 cents and trading 5,099 stock units. MPC Caribbean Clean Energy climbed $8 to close at $163, after exchanging 636 units, Palace Amusement climbed $200 in closing at $1,300 trading 10 units, Proven Investments declined by $1.80 to $34.10 with an exchange of 5,490 stock units. Sagicor Group gained 30 cents to close at $44.90, in transferring 24,509 stock units, Salada Foods dropped $1 to $27, with an exchange of 11,896 units, Scotia Group climbed $2 to $49 while trading 204,296 shares and Sygnus Credit Investments ended at $18, with gains of $1.45 in transferring 104,248 stock units. At the close, the All Jamaican Composite Index advanced by 1,674.54 points to 401,637.06, the Main Index carved out a gain of 1,545.95 points to 366,576.42 and the JSE Financial Index rose 0.12 points to close at 96.29.

At the close, the All Jamaican Composite Index advanced by 1,674.54 points to 401,637.06, the Main Index carved out a gain of 1,545.95 points to 366,576.42 and the JSE Financial Index rose 0.12 points to close at 96.29. Trading ended with an average of 113,552 units changing hands at $637,545, in comparison to an average of 241,851 shares at $1,208,807 on Monday. The average trade for the month to date ended at 185,696 units at $1,300,931 for each security, in contrast to 200,398 units at $1,436,123 on Monday. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

Trading ended with an average of 113,552 units changing hands at $637,545, in comparison to an average of 241,851 shares at $1,208,807 on Monday. The average trade for the month to date ended at 185,696 units at $1,300,931 for each security, in contrast to 200,398 units at $1,436,123 on Monday. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918. Jamaica Broilers Group declined by 45 cents in closing at $25 and 33,295 shares crossing the exchange, Jamaica Stock Exchange carved out a gain of 62 cents to end at $18.62 trading 12,262 units, Mayberry Investments settled at $5.69, with a rise of 57 cents, with 2,000 units passing through the market. Mayberry Jamaican Equities shed 43 cents to end at $8.07 with investors swapping 122 stock units, NCB Financial fell 60 cents to settle at $135, after exchanging 48,381 shares, Palace Amusement dived $400 in closing at $1,100, in trading 20 shares. Proven Investments climbed $1.75 to settle at $35.90, with 1,191 units changing hands, Scotia Group lost $1 to end at $47 with 7,120 units crossing the exchange and Seprod climbed $1.40 to close at $52.40 with investors switching ownership of 63,478 shares.

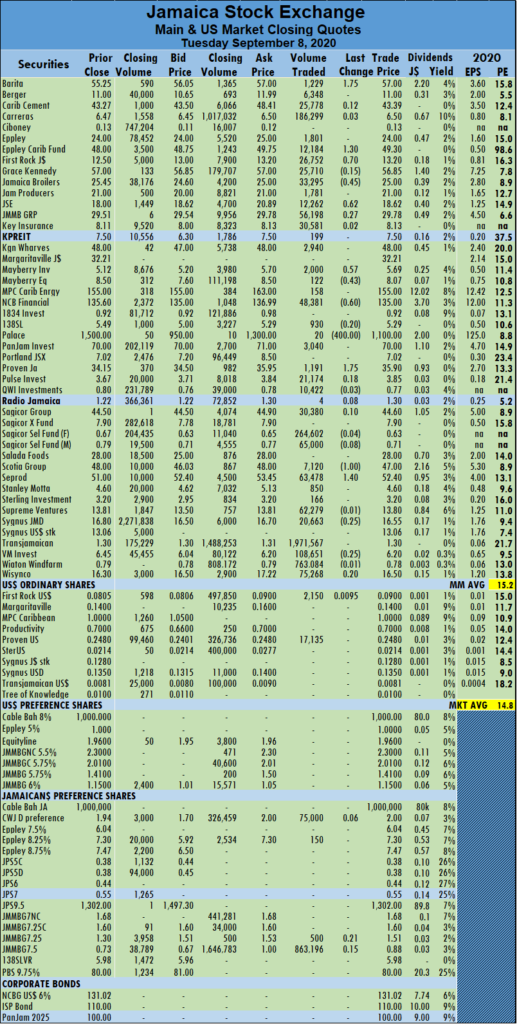

Jamaica Broilers Group declined by 45 cents in closing at $25 and 33,295 shares crossing the exchange, Jamaica Stock Exchange carved out a gain of 62 cents to end at $18.62 trading 12,262 units, Mayberry Investments settled at $5.69, with a rise of 57 cents, with 2,000 units passing through the market. Mayberry Jamaican Equities shed 43 cents to end at $8.07 with investors swapping 122 stock units, NCB Financial fell 60 cents to settle at $135, after exchanging 48,381 shares, Palace Amusement dived $400 in closing at $1,100, in trading 20 shares. Proven Investments climbed $1.75 to settle at $35.90, with 1,191 units changing hands, Scotia Group lost $1 to end at $47 with 7,120 units crossing the exchange and Seprod climbed $1.40 to close at $52.40 with investors switching ownership of 63,478 shares. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

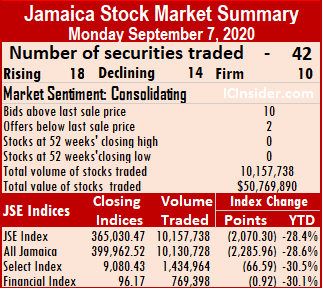

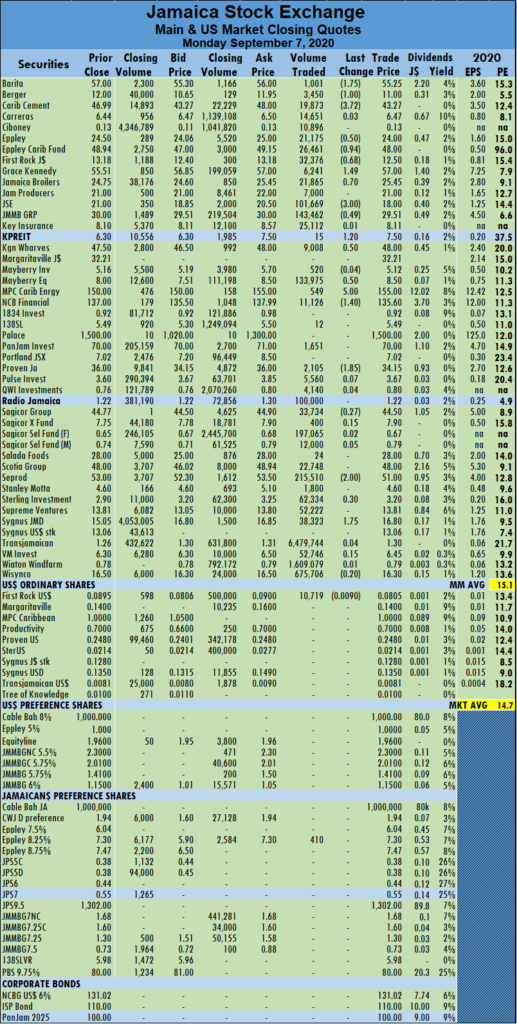

Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918. Jamaica Stock Exchange declined by $3 to settle at $18 after 101,669 shares changed hands. JMMB Group shed 49 cents to end at $29.51, in exchanging 143,462 stock units, Kingston Properties advanced $1.20 to $7.50 with an exchange of 15 stock units, Kingston Wharves gained 50 cents, trading 9,008 units to end at $48. Mayberry Jamaican Equities rose 50 cents to $8.50, with 133,975 shares changing hands, MPC Caribbean Clean Energy climbed $5 to $155 and cleared the market with 549 units, NCB Financial fell $1.40 to $135.60, in exchanging 11,126 stock units. Proven Investments lost $1.85 to end at $34.15, after trading 2,105 units, Seprod dropped $2 to settle at $51 with investors switching ownership of 215,510 shares, Sterling Investments gained 30 cents ending at $3.20, with 62,334 stock units crossing the exchange and Sygnus Credit Investments climbed $1.75 to close at $16.80 trading 38,323 shares.

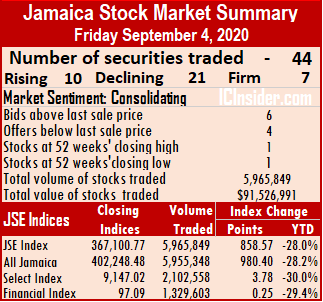

Jamaica Stock Exchange declined by $3 to settle at $18 after 101,669 shares changed hands. JMMB Group shed 49 cents to end at $29.51, in exchanging 143,462 stock units, Kingston Properties advanced $1.20 to $7.50 with an exchange of 15 stock units, Kingston Wharves gained 50 cents, trading 9,008 units to end at $48. Mayberry Jamaican Equities rose 50 cents to $8.50, with 133,975 shares changing hands, MPC Caribbean Clean Energy climbed $5 to $155 and cleared the market with 549 units, NCB Financial fell $1.40 to $135.60, in exchanging 11,126 stock units. Proven Investments lost $1.85 to end at $34.15, after trading 2,105 units, Seprod dropped $2 to settle at $51 with investors switching ownership of 215,510 shares, Sterling Investments gained 30 cents ending at $3.20, with 62,334 stock units crossing the exchange and Sygnus Credit Investments climbed $1.75 to close at $16.80 trading 38,323 shares. At the close, the All Jamaican Composite Index advanced 980.40 points to 402,248.48, the Main Index rose 858.57 points to 367,100.77 and the JSE Financial Index added 0.25 points to close at 97.09.

At the close, the All Jamaican Composite Index advanced 980.40 points to 402,248.48, the Main Index rose 858.57 points to 367,100.77 and the JSE Financial Index added 0.25 points to close at 97.09. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918. Key Insurance declined by $1.05 to settle at $8.10, in transferring 19,595 stock units, Kingston Properties fell by $1.39 to $6.30, while exchanging 100 units, Kingston Wharves closed $2.50 higher at $47.50, with an exchange of 8,801 units. NCB Financial declined $2 to $137, trading 194,240 shares, Portland JSX fell $1.48, in ending at $7.02 with 100 units changing hands. Salada Foods closed at $28, with a loss of $1 after trading 426 shares. Scotia Group climbed $1.98 to $48, with investors switching the ownership of 50 stocks, Seprod declined $2 to settle at $53, in exchanging 2,119 units, Supreme Ventures gained 31 cents to close $13.81, in transferring 8,819 stock units and Sygnus Credit Investments lost 30 cents to close at $15.05, with 5,368 stock units crossing the market.

Key Insurance declined by $1.05 to settle at $8.10, in transferring 19,595 stock units, Kingston Properties fell by $1.39 to $6.30, while exchanging 100 units, Kingston Wharves closed $2.50 higher at $47.50, with an exchange of 8,801 units. NCB Financial declined $2 to $137, trading 194,240 shares, Portland JSX fell $1.48, in ending at $7.02 with 100 units changing hands. Salada Foods closed at $28, with a loss of $1 after trading 426 shares. Scotia Group climbed $1.98 to $48, with investors switching the ownership of 50 stocks, Seprod declined $2 to settle at $53, in exchanging 2,119 units, Supreme Ventures gained 31 cents to close $13.81, in transferring 8,819 stock units and Sygnus Credit Investments lost 30 cents to close at $15.05, with 5,368 stock units crossing the market.