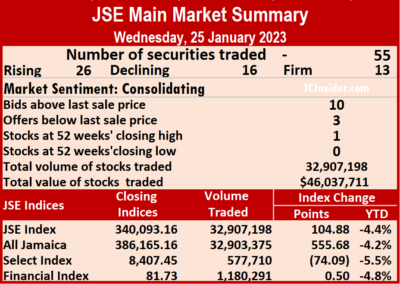

Investors exchanged 43 percent more stocks in the Jamaica Stock Exchange Main Market on Wednesday, valued slightly more than Tuesday, with trading in 55 securities, similar to Tuesday, and leading to prices of 26 stocks rising, 16 declining and 13 ending unchanged.

A total of 32,907,198 shares were traded for $46,037,711 compared to 23,052,827 units at $45,065,813 on Tuesday.

A total of 32,907,198 shares were traded for $46,037,711 compared to 23,052,827 units at $45,065,813 on Tuesday.

Trading averaged 598,313 units at $837,049 versus 419,142 shares at $819,378 on Tuesday and month to date, an average of 187,918 units at $1,331,594 compared to 162,977 units at $1,361,649 on the previous day. December closed with an average of 604,110 units at $4,072,598.

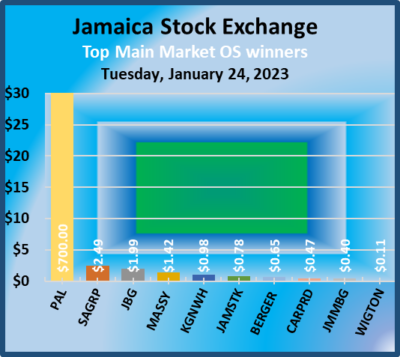

Wigton Windfarm led trading with 27.79 million shares for 84.5 percent of total volume, followed by Sagicor Select Financial Fund with 1.77 million units for 5.4 percent of the day’s trade and Transjamaican Highway with 1.09 million units for 3.3 percent market share.

The All Jamaican Composite Index advanced 555.68 points to 386,165.16, the JSE Main Index popped 104.88 points to settle at 340,093.16 and the JSE Financial Index rose 0.50 points to end at 81.73.

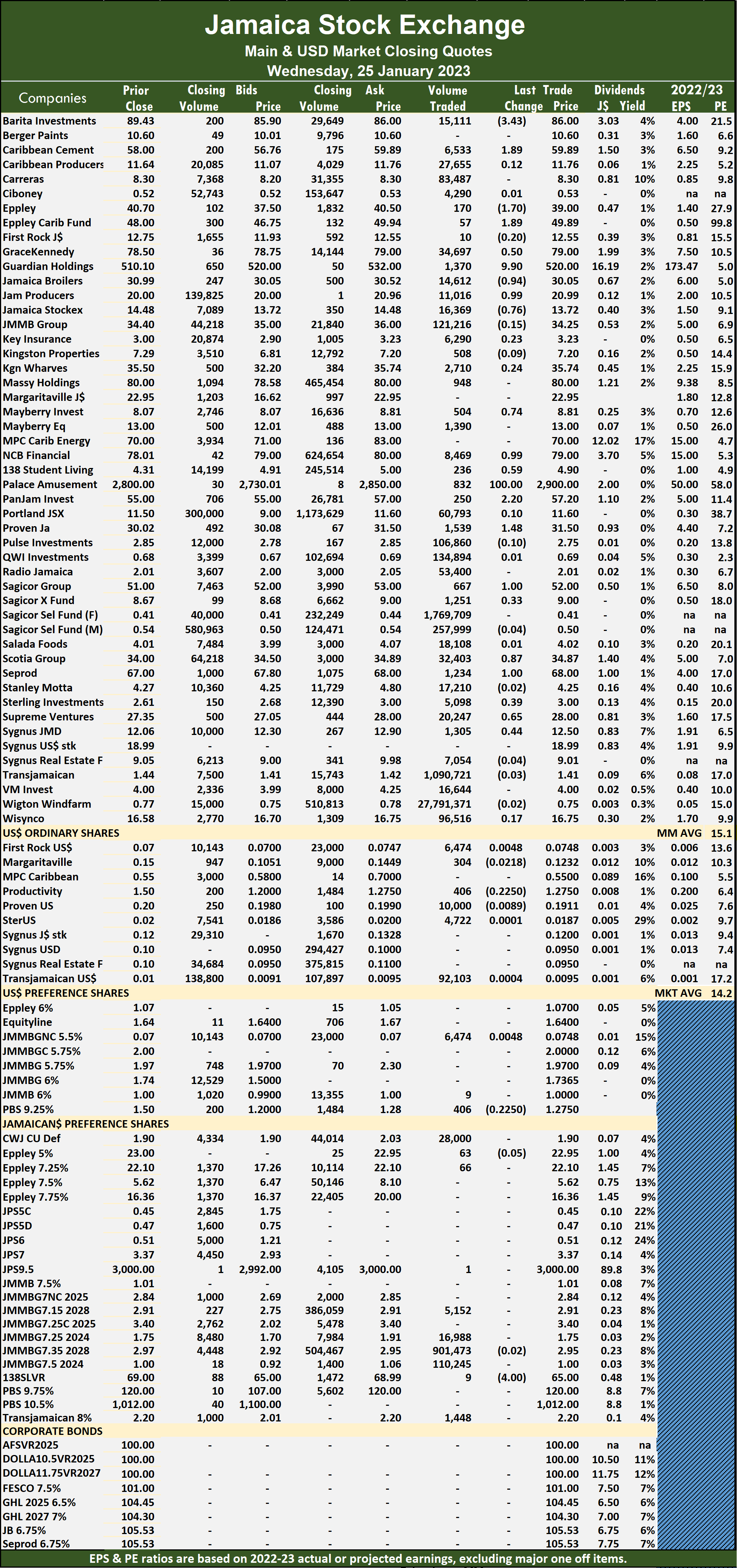

The PE Ratio, a formula to ascertain appropriate stock values, averages 15.1 on the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 15.1 on the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and three with lower offers.

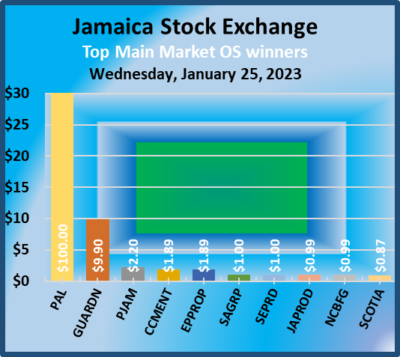

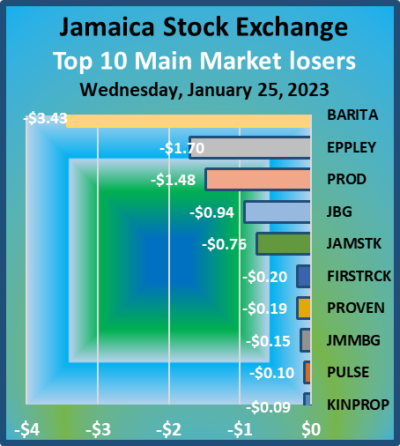

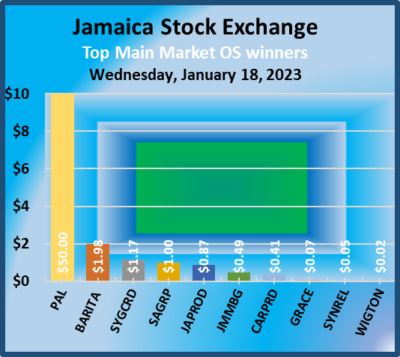

At the close, Barita Investments dropped $3.43 to end at $86 after a transfer of 15,111 shares, Caribbean Cement rose $1.89 to close at $59.89 in an exchange of 6,533 stock units, Eppley shed $1.70 to end at $39 with the swapping of 170 units. Eppley Caribbean Property Fund rallied $1.89 to $49.89 in trading 57 stocks, GraceKennedy popped 50 cents to end at $79 with investors transferring 34,697 shares, Guardian Holdings climbed $9.90 in closing at $520 after 1,370 stocks crossed the market. Jamaica Broilers fell 94 cents to $30.05 with 14,612 units changing hands, Jamaica Producers rose 99 cents to close at $20.99, trading 11,016 stock units, Jamaica Stock Exchange fell 76 cents to $13.72 after a transfer of 16,369 shares. Mayberry Investments advanced 74 cents to $8.81 in switching ownership of 504 units, NCB Financial rallied 99 cents to $79 in swapping 8,469 stock units, 138 Student Living gained 59 cents to finish at $4.90 trading 236 stocks. Palace Amusement climbed $100 to close at a 52 weeks’ high of $2,900 in transferring 832 stocks, PanJam Investment popped $2.20 to $57.20, with 250 units crossing the exchange, Proven Investments rose $1.48 in closing at $31.50 trading 1,539 stock units. Sagicor Group gained $1 to end at $52 with an exchange of 667 shares, Scotia Group popped 87 cents to $34.87 after an exchange of 32,403 units, Seprod rallied $1 to $68 with the swapping of 1,234 stock units.

Jamaica Stock Exchange fell 76 cents to $13.72 after a transfer of 16,369 shares. Mayberry Investments advanced 74 cents to $8.81 in switching ownership of 504 units, NCB Financial rallied 99 cents to $79 in swapping 8,469 stock units, 138 Student Living gained 59 cents to finish at $4.90 trading 236 stocks. Palace Amusement climbed $100 to close at a 52 weeks’ high of $2,900 in transferring 832 stocks, PanJam Investment popped $2.20 to $57.20, with 250 units crossing the exchange, Proven Investments rose $1.48 in closing at $31.50 trading 1,539 stock units. Sagicor Group gained $1 to end at $52 with an exchange of 667 shares, Scotia Group popped 87 cents to $34.87 after an exchange of 32,403 units, Seprod rallied $1 to $68 with the swapping of 1,234 stock units.  Supreme Ventures gained 65 cents to close at $28 in trading 20,247 stocks and Sygnus Credit Investments rallied 44 cents in closing at $12.50 with 1,305 shares crossing the market.

Supreme Ventures gained 65 cents to close at $28 in trading 20,247 stocks and Sygnus Credit Investments rallied 44 cents in closing at $12.50 with 1,305 shares crossing the market.

In the preference segment, 138 Student Living preference share declined $4, ending at $65, with nine stocks changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

ICTOP10 buy rated Knutsford gains 44%

Shares of Image Plus Consultants were listed on the Junior Market of the Jamaica Stock Exchange on Friday to become the 48 listed company on the exchange and the 52nd company to be listed since the market commenced operations in 2010.

Knutsford Express

The stock failed to sparkle on listing, rising just 10 percent at the close and could come under selling pressure as investors exit for what they see as greener pastures. Regardless, the stock climbed into the ICTOP10 list for this week and replaces Caribbean Cream got an earnings downgrade.

Knutsford Express dropped out of the ICTOP10 at the end of the prior week and closed this past week at $12.49 to be up a solid 44 percent since it entered the TOP10 on the end of December. It still has much more room to rise with a current PE of just 12.5 and less, based on next fiscal years’ earnings. The move shows, the power that increased earnings have on price movement, with the company posting a profit of $143 million for the six months to November up from $13 million in 2021.

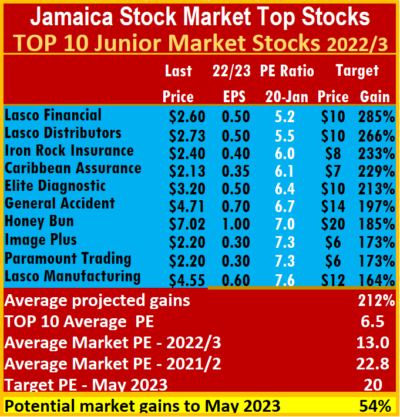

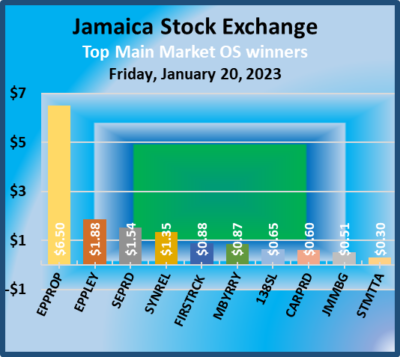

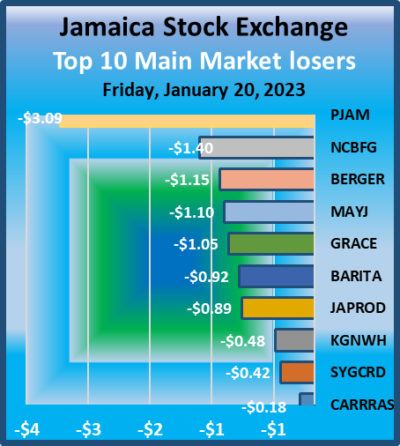

The Junior Market rose this past week t into poo record a rise for the first time this year, the move resulted in three solid gains and three sizable losses for the ICTOP10.  Iron Rock Insurance jumped 19 percent to $2.40, Lasco Manufacturing gained 13 percent to $4.55 and Paramount Trading climbed 11 percent to $2.20, after release of strong second quarter results that showed continued improvement in profit, jumping 212 percent for the half year to $149 million. Caribbean Cream reported improving results but the overall profit was light and the stock fell 20 percent to $3.20, Lasco Financial shed 8 percent to $2.60 and General Accident slipped 7 percent to $4.71. All other movements in the Junior Market TOP10 were 3 percent or less. The Main Market only major mover was Berger Paints with an 11 percent loss to $9.50.

Iron Rock Insurance jumped 19 percent to $2.40, Lasco Manufacturing gained 13 percent to $4.55 and Paramount Trading climbed 11 percent to $2.20, after release of strong second quarter results that showed continued improvement in profit, jumping 212 percent for the half year to $149 million. Caribbean Cream reported improving results but the overall profit was light and the stock fell 20 percent to $3.20, Lasco Financial shed 8 percent to $2.60 and General Accident slipped 7 percent to $4.71. All other movements in the Junior Market TOP10 were 3 percent or less. The Main Market only major mover was Berger Paints with an 11 percent loss to $9.50.

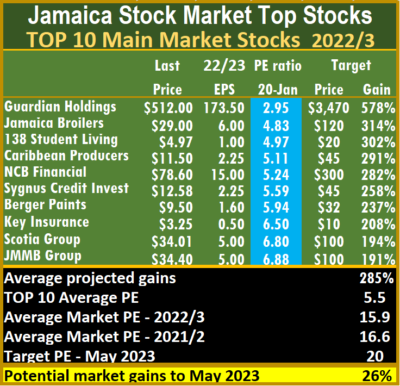

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.5, well below the market average of 15.9, while the Junior Market Top 10 PE sits at 6.5 versus the market at 13, important indicators of the level of the undervaluation of the ICTOP10 stocks currently. The Junior Market is projected to rise by 212 percent and the Main Market TOP10 an average now of 285 percent, to May this year.

The Junior Market has 17 stocks representing 35 percent of the market, with PEs from 15 to 30, averaging 20.7 compared with the above average of the market. The top half of the market has an average PE of 19 and shows the extent of potential gains for the TOP 10 stocks.  The situation in the Main Market is similar, with the 18 highest valued stocks priced at a PE of 15 to 104, with an average of 32 and 23 excluding the highest valued stocks and 27 for the top half excluding the highest valued stock.

The situation in the Main Market is similar, with the 18 highest valued stocks priced at a PE of 15 to 104, with an average of 32 and 23 excluding the highest valued stocks and 27 for the top half excluding the highest valued stock.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Knutsford Express leaves ICTOP10

Knutsford Express posted half year results that show revenues up 72 percent to $813 million and up 65 percent for the second quarter to $398 million and delivered profit of $59 million for the November quarter, up from just $2 million in 2021 and $143 million for the six months from $13 million in 2021, sending investors to pounce on the stock on Friday and pushing it to an intraday 52 weeks’ high of $11.60. The stock closed at $9.60 to exit the ICTOP 10 with an increase of 7 percent for the week.

With the latest results, Knutsford’s 2023 fiscal year earnings have been adjusted to $1 per share and putting the stock on target for at least $20 this year, at the close there were only a few stocks on offer for sale.

With the latest results, Knutsford’s 2023 fiscal year earnings have been adjusted to $1 per share and putting the stock on target for at least $20 this year, at the close there were only a few stocks on offer for sale.

Knutsford is replaced by baking company Honey Bun coming in with a $7.20 price, with the potential for the price to move to $20 this year.

Junior Market action resulted in Paramount Trading climbing 30 percent to $1.99, ahead of second quarter results that showed continued improvement in profit as revenues climbed 50 percent in the November quarter, to $601 million and 55 percent for the half year to $1.2 billion ahead the 2021 period. Profit surged 126 percent to November quarter to $65 million and 212 percent for the half year to $149 million. Knutsford rose 7 percent to $9.60, but Iron Rock Insurance dropped 14 percent to $2.01. All other movements in the  Junior Market TOP10 were 3 percent or less and similarly for the JSE Main Market TOP10.

Junior Market TOP10 were 3 percent or less and similarly for the JSE Main Market TOP10.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.6, well below the market average of 14.4. At the same time, the Junior Market Top 10 PE sits at 6.2 versus the market at 12.8, important indicators of the level of the undervaluation of the ICTOP10 stocks currently. The Junior Market is projected to rise by 226 percent and the Main Market TOP10, an average now of 280 percent, to May this year.

The Junior Market has 16 stocks for 34 percent of the market, with PEs from 15 to 31, averaging 19.6 compared with the above average of the market. The top half of the market has an average PE of 18 and shows the extent of potential gains for the TOP 10 stocks. The situation in the Main Market is similar, with the 19 highest valued stocks priced at a PE of 15 to 100, with an average of 31 and 23 excluding the highest valued ones and 26 for the top half excluding the highest valued stock.

ICTOP10 focuses on likely yearly winners. Accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners. Accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

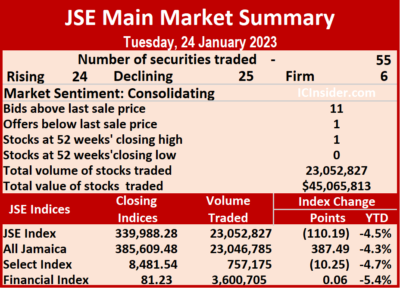

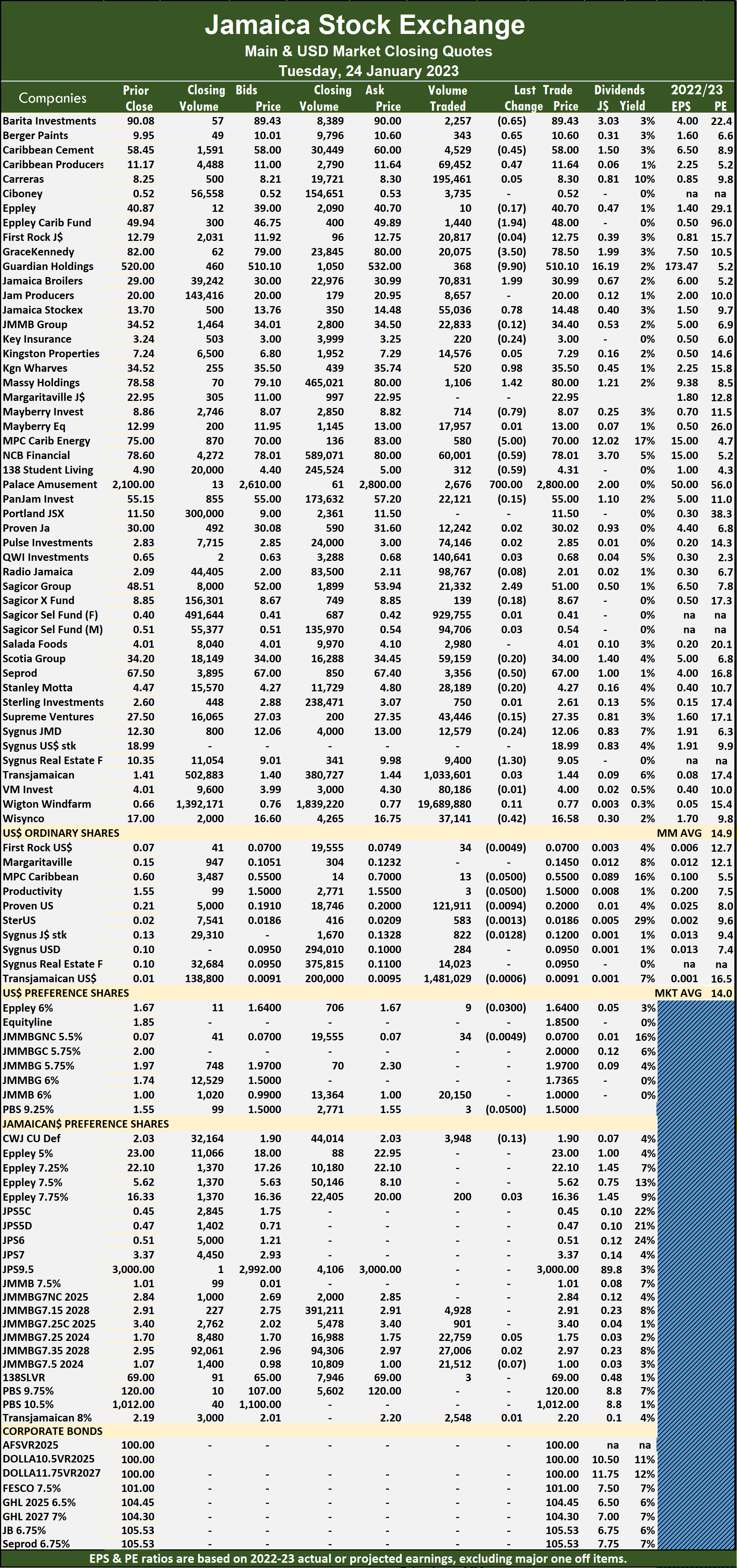

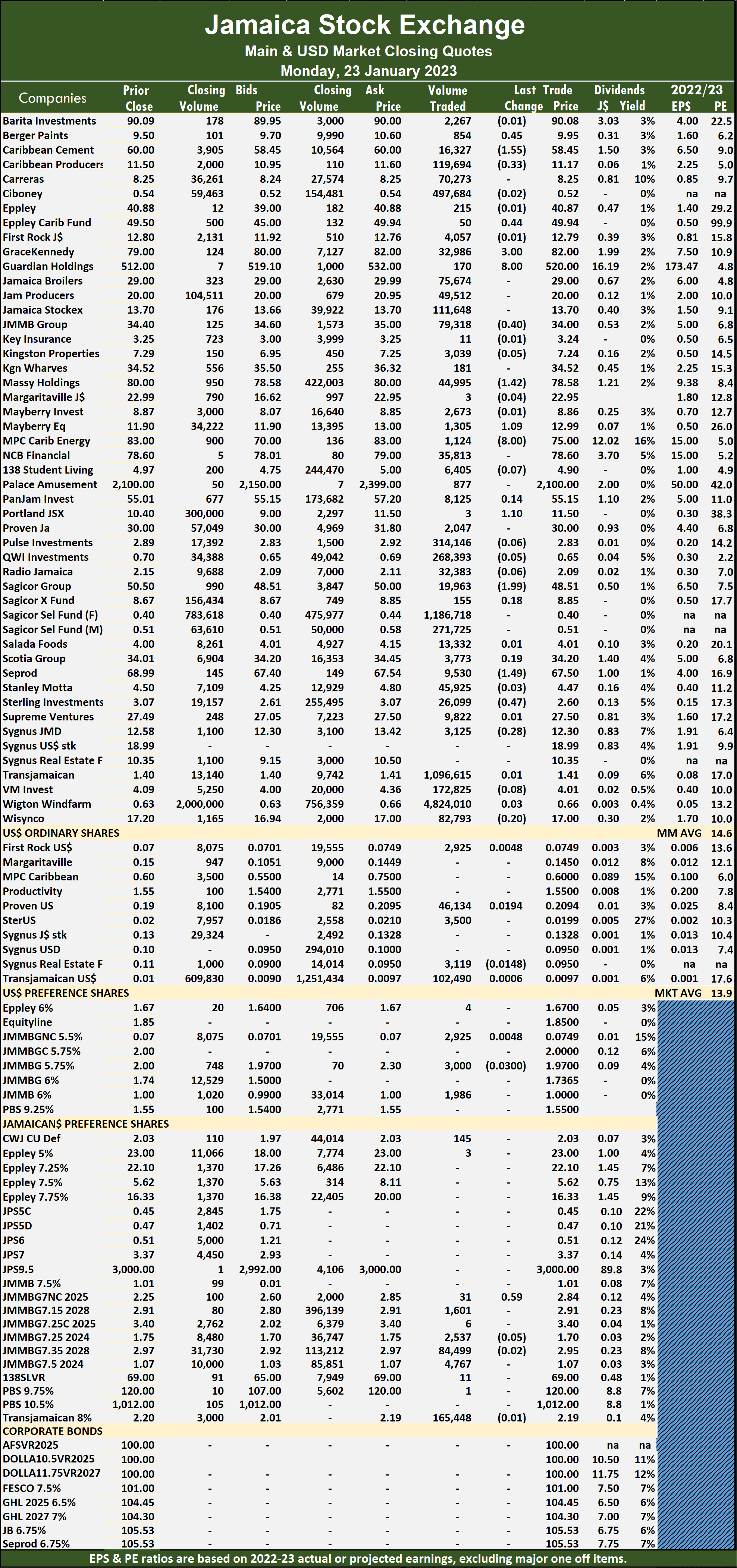

A total of 23,052,827 shares were traded for $45,065,813 up from 9,807,711 units at $34,195,444 on Monday.

A total of 23,052,827 shares were traded for $45,065,813 up from 9,807,711 units at $34,195,444 on Monday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

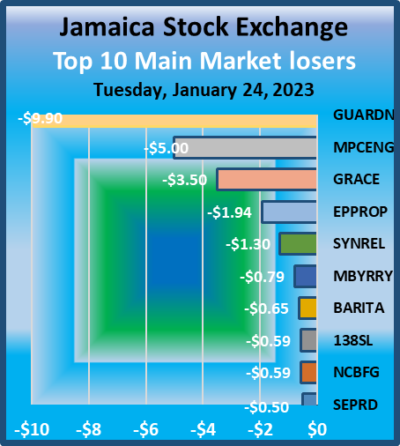

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Jamaica Broilers advanced $1.99 to $30.99 in an exchange of 70,831 shares, Jamaica Stock Exchange gained 78 cents to settle at $14.48 after a transfer of 55,036 units. JMMB Group popped 40 cents to end at $34.40 with the swapping of 22,833 stocks, Kingston Wharves rallied 98 cents to end at $35.50 in switching ownership of 520 stock units, Massy Holdings advanced $1.42 to $80 in trading 1,106 shares. Mayberry Investments shed 79 cents to end at $8.07 after 714 stocks cleared the market, MPC Caribbean Clean Energy declined $5 in closing at $70 in transferring 580 shares, NCB Financial lost 59 cents to close at $78.01 in an exchange of 60,001 units. 138 Student Living dipped 59 cents to $4.31 as investors traded 312 stock units, Palace Amusement climbed $700 to a 52 weeks’ high of $2,800 with a transfer of 2,676 stocks, with shareholders voting at the annual general meeting held after trading closed to spill the stock 600 to one in late February, Sagicor Group advanced $2.49 to end at $51 in switching ownership of 21,332 shares.

Jamaica Broilers advanced $1.99 to $30.99 in an exchange of 70,831 shares, Jamaica Stock Exchange gained 78 cents to settle at $14.48 after a transfer of 55,036 units. JMMB Group popped 40 cents to end at $34.40 with the swapping of 22,833 stocks, Kingston Wharves rallied 98 cents to end at $35.50 in switching ownership of 520 stock units, Massy Holdings advanced $1.42 to $80 in trading 1,106 shares. Mayberry Investments shed 79 cents to end at $8.07 after 714 stocks cleared the market, MPC Caribbean Clean Energy declined $5 in closing at $70 in transferring 580 shares, NCB Financial lost 59 cents to close at $78.01 in an exchange of 60,001 units. 138 Student Living dipped 59 cents to $4.31 as investors traded 312 stock units, Palace Amusement climbed $700 to a 52 weeks’ high of $2,800 with a transfer of 2,676 stocks, with shareholders voting at the annual general meeting held after trading closed to spill the stock 600 to one in late February, Sagicor Group advanced $2.49 to end at $51 in switching ownership of 21,332 shares.  Seprod lost 50 cents in closing at $67 after 3,356 units passed through the market, Sygnus Real Estate Finance fell $1.30 to close at $9.05 with the swapping of 9,400 stock units and Wisynco Group dipped 42 cents to close at $16.58 after exchanging 37,141 shares.

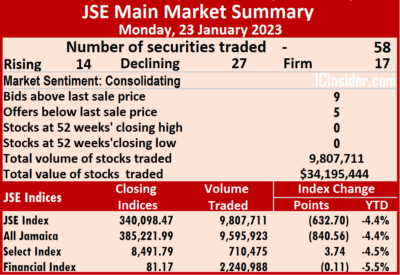

Seprod lost 50 cents in closing at $67 after 3,356 units passed through the market, Sygnus Real Estate Finance fell $1.30 to close at $9.05 with the swapping of 9,400 stock units and Wisynco Group dipped 42 cents to close at $16.58 after exchanging 37,141 shares. A total of 9,807,711 shares were traded for $34,195,444 compared to 9,464,712 units at $128,636,676 on Friday.

A total of 9,807,711 shares were traded for $34,195,444 compared to 9,464,712 units at $128,636,676 on Friday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

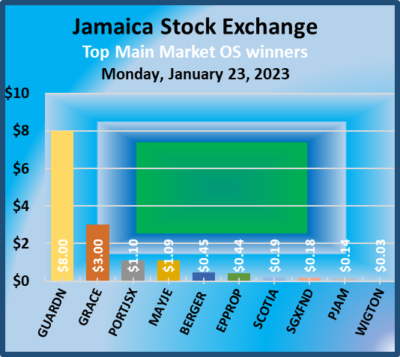

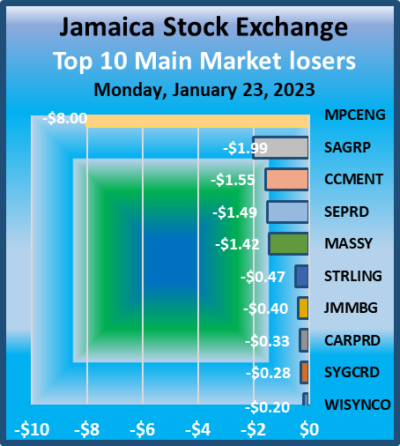

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Guardian Holdings climbed $8 to close at $520 with a transfer of 170 units, JMMB Group lost 40 cents to end at $34 in exchanging 79,318 stock units. Massy Holdings fell $1.42 to close at $78.58 in trading 44,995 shares, Mayberry Jamaican Equities advanced $1.09 to $12.99 after swapping of 1,305 stocks, MPC Caribbean Clean Energy dropped $8 to $75 with investors transferring 1,124 stocks. Portland JSX rose $1.10 in ending at $11.50 after three shares passed through the market, Sagicor Group declined $1.99 to close at $48.51 trading 19,963 stock units, Seprod dipped $1.49 to $67.50 as investors exchanged 9,530 units and Sterling Investments shed 47 cents to $2.60 trading 26,099 stocks.

Guardian Holdings climbed $8 to close at $520 with a transfer of 170 units, JMMB Group lost 40 cents to end at $34 in exchanging 79,318 stock units. Massy Holdings fell $1.42 to close at $78.58 in trading 44,995 shares, Mayberry Jamaican Equities advanced $1.09 to $12.99 after swapping of 1,305 stocks, MPC Caribbean Clean Energy dropped $8 to $75 with investors transferring 1,124 stocks. Portland JSX rose $1.10 in ending at $11.50 after three shares passed through the market, Sagicor Group declined $1.99 to close at $48.51 trading 19,963 stock units, Seprod dipped $1.49 to $67.50 as investors exchanged 9,530 units and Sterling Investments shed 47 cents to $2.60 trading 26,099 stocks. In the preference segment, JMMB Group 7% preference share gained 59 cents in closing at $2.84 transferring 31 shares.

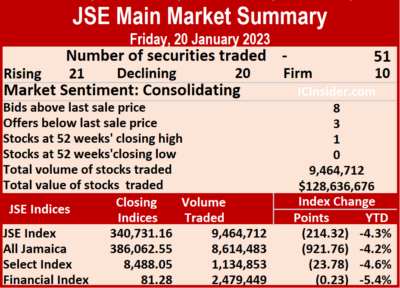

In the preference segment, JMMB Group 7% preference share gained 59 cents in closing at $2.84 transferring 31 shares. A total of 9,464,712 shares were exchanged for $128,636,676 versus 12,878,672 units at just $32,824,074 on Thursday.

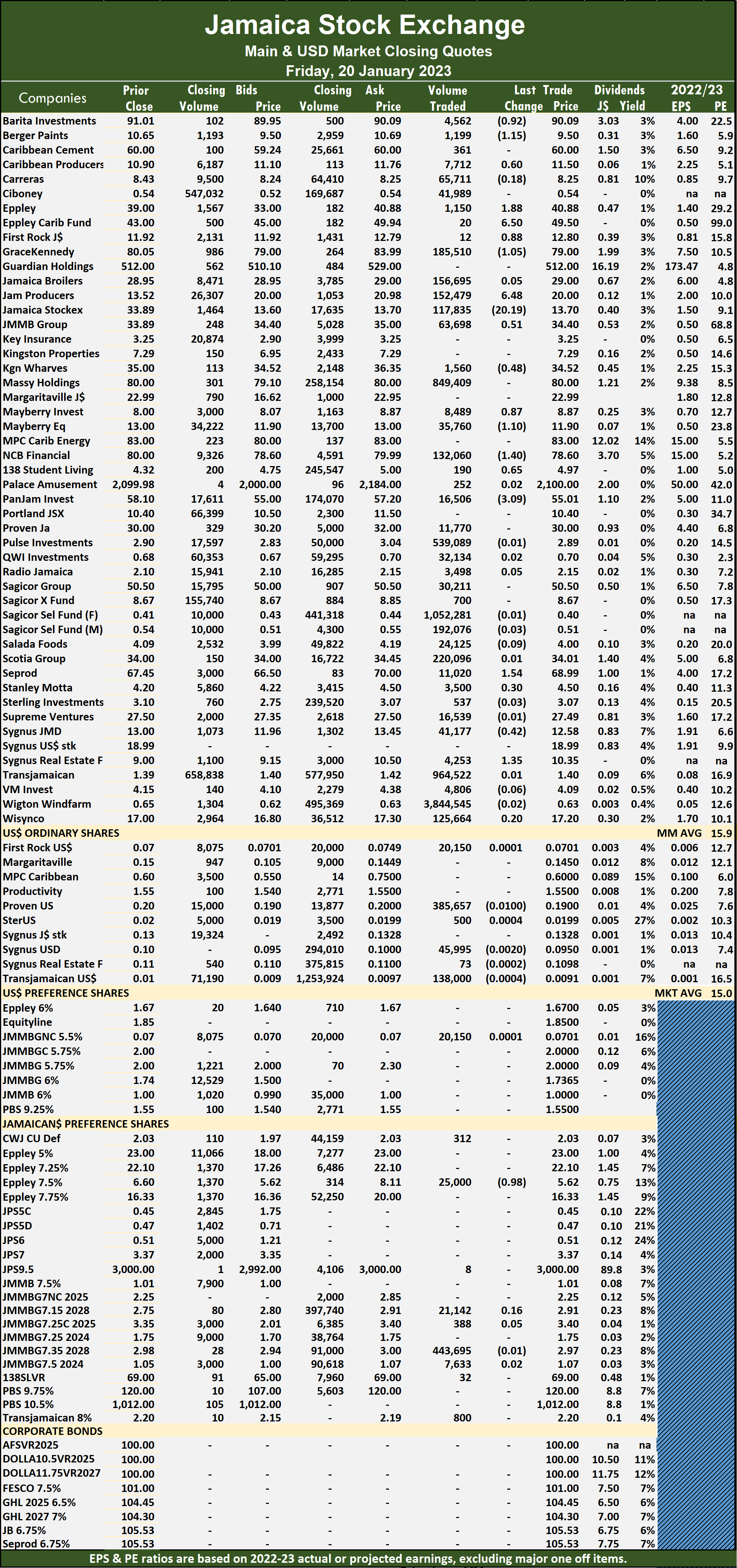

A total of 9,464,712 shares were exchanged for $128,636,676 versus 12,878,672 units at just $32,824,074 on Thursday. The PE Ratio, a formula to ascertain appropriate stock values, averages 15.9 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 15.9 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. GraceKennedy shed $1.05 to finish at $79 with the swapping of 185,510 units, Jamaica Producers lost 89 cents to end at $20 after an exchange of 152,479 stock units, JMMB Group popped 51 cents to close at $34.40 as investors traded 63,698 shares. Kingston Wharves dipped 48 cents to $34.52 with 1,560 stocks changing hands, Mayberry Investments rose 87 cents to $8.87 with a transfer of 8,489 units, Mayberry Jamaican Equities dropped $1.10 to close at $11.90 in trading 35,760 stock units. NCB Financial shed $1.40 after ending at $78.60 in switching ownership of 132,060 shares, 138 Student Living rallied 65 cents to close at $4.97 after 190 stocks cleared the market, Palace Amusement traded 252 shares with a gain of 2 cents to close at a 52 weeks’ high of $2,100, PanJam Investment declined $3.09 in closing at $55.01 with the swapping of 16,506 units. Seprod advanced $1.54 to $68.99 after an exchange of 11,020 stock units,

GraceKennedy shed $1.05 to finish at $79 with the swapping of 185,510 units, Jamaica Producers lost 89 cents to end at $20 after an exchange of 152,479 stock units, JMMB Group popped 51 cents to close at $34.40 as investors traded 63,698 shares. Kingston Wharves dipped 48 cents to $34.52 with 1,560 stocks changing hands, Mayberry Investments rose 87 cents to $8.87 with a transfer of 8,489 units, Mayberry Jamaican Equities dropped $1.10 to close at $11.90 in trading 35,760 stock units. NCB Financial shed $1.40 after ending at $78.60 in switching ownership of 132,060 shares, 138 Student Living rallied 65 cents to close at $4.97 after 190 stocks cleared the market, Palace Amusement traded 252 shares with a gain of 2 cents to close at a 52 weeks’ high of $2,100, PanJam Investment declined $3.09 in closing at $55.01 with the swapping of 16,506 units. Seprod advanced $1.54 to $68.99 after an exchange of 11,020 stock units,  Sygnus Credit Investments dipped 42 cents to end at $12.58 with 41,177 shares changing hands and Sygnus Real Estate Finance rose $1.35 to close at $10.35 in switching ownership of 4,253 stock units.

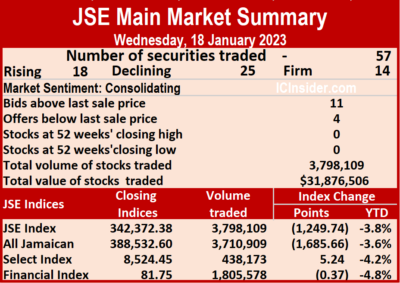

Sygnus Credit Investments dipped 42 cents to end at $12.58 with 41,177 shares changing hands and Sygnus Real Estate Finance rose $1.35 to close at $10.35 in switching ownership of 4,253 stock units. A total of 12,878,672 shares were traded for $32,824,074 compared with 3,798,109 units at $31,876,506 on Wednesday.

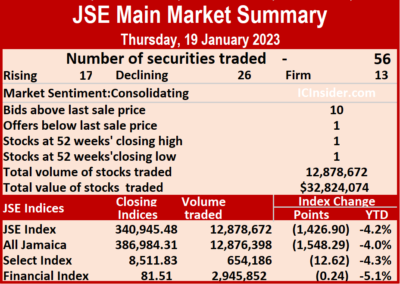

A total of 12,878,672 shares were traded for $32,824,074 compared with 3,798,109 units at $31,876,506 on Wednesday. The PE Ratio, a formula to ascertain appropriate stock values, averages 15.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

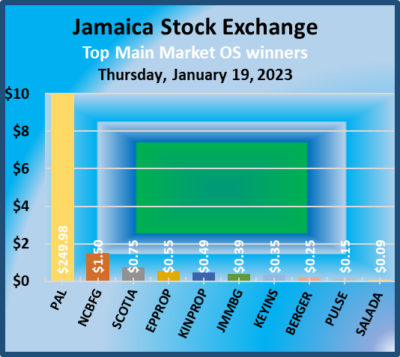

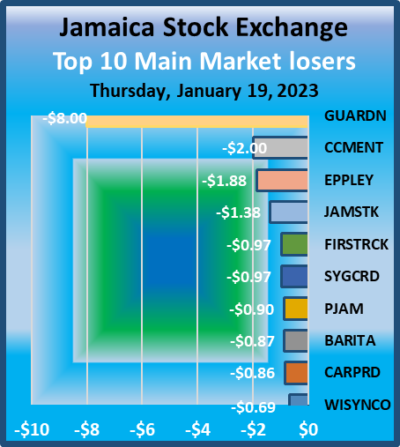

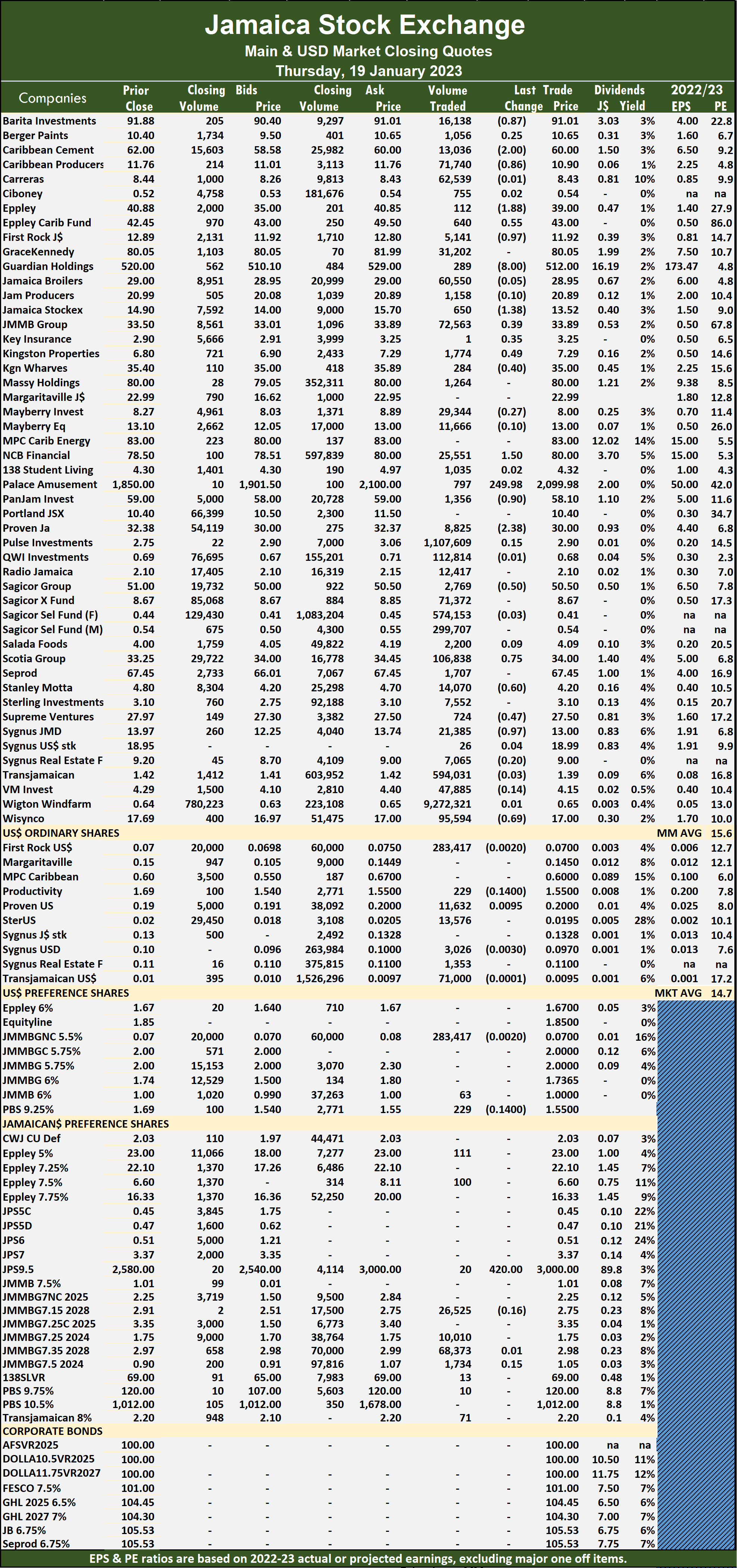

The PE Ratio, a formula to ascertain appropriate stock values, averages 15.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Guardian Holdings dropped $8 to close at $512 after a transfer of 289 units, Jamaica Stock Exchange declined $1.38 after ending at $13.52 after 650 stocks changed hands, Kingston Properties gained 49 cents to close at $7.29 after a transfer of 1,774 stock units. Kingston Wharves lost 40 cents in closing at $35 in trading 284 stocks, NCB Financial popped $1.50 to $80 in swapping 25,551 shares, Palace Amusement jumped $249.98 to a 52 weeks’ high of $2,099.98 in exchanging 797 units. PanJam Investment dipped 90 cents in closing at $58.10 with 1,356 units changing hands, Proven Investments declined $2.38 to $30 with investors transferring 8,825 stocks, Sagicor Group lost 50 cents to end at $50.50 after trading 2,769 stock units. Scotia Group gained 75 cents to close at $34 after an exchange of 106,838 shares, Stanley Motta shed 60 cents to finish at $4.20 as investors transferred 14,070 units, Supreme Ventures lost 47 cents in ending at $27.50 with an exchange of 724 shares.

Guardian Holdings dropped $8 to close at $512 after a transfer of 289 units, Jamaica Stock Exchange declined $1.38 after ending at $13.52 after 650 stocks changed hands, Kingston Properties gained 49 cents to close at $7.29 after a transfer of 1,774 stock units. Kingston Wharves lost 40 cents in closing at $35 in trading 284 stocks, NCB Financial popped $1.50 to $80 in swapping 25,551 shares, Palace Amusement jumped $249.98 to a 52 weeks’ high of $2,099.98 in exchanging 797 units. PanJam Investment dipped 90 cents in closing at $58.10 with 1,356 units changing hands, Proven Investments declined $2.38 to $30 with investors transferring 8,825 stocks, Sagicor Group lost 50 cents to end at $50.50 after trading 2,769 stock units. Scotia Group gained 75 cents to close at $34 after an exchange of 106,838 shares, Stanley Motta shed 60 cents to finish at $4.20 as investors transferred 14,070 units, Supreme Ventures lost 47 cents in ending at $27.50 with an exchange of 724 shares.  Sygnus Credit Investments declined 97 cents in closing at $13 trading 21,385 stock units and Wisynco Group shed 69 cents to end at $17 in clearing the market with 95,594 stocks.

Sygnus Credit Investments declined 97 cents in closing at $13 trading 21,385 stock units and Wisynco Group shed 69 cents to end at $17 in clearing the market with 95,594 stocks. A total of 3,798,109 shares were traded for $31,876,506,down from 7,367,753 units at $142,989,772 on Tuesday.

A total of 3,798,109 shares were traded for $31,876,506,down from 7,367,753 units at $142,989,772 on Tuesday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

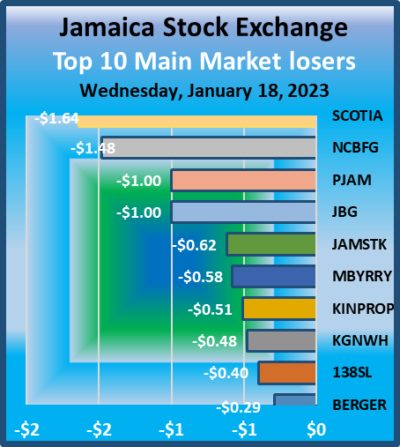

The PE Ratio, a formula to ascertain appropriate stock values, averages 14 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Kingston Properties dipped 51 cents to $6.80 with 21,200 shares changing hands, Kingston Wharves shed 48 cents to end at $35.40 in swapping 159 stock units, Mayberry Investments lost 58 cents after finishing at $8.27 in an exchange of 9,044 units. NCB Financial declined $1.48 to $78.50, trading 30,418 stock units, 138 Student Living dropped 67 cents to $4.30 with a transfer of 15,687 shares, Palace Amusement popped $50 to close at $1,850 after 232 stocks cleared the market. PanJam Investment dipped $1, ending at $59 as investors switched ownership of 15,557 stock units, Proven Investments advanced $2.38 to close at $32.38 with 3,616 units changing hands, Sagicor Group rose $1 in closing at $51, trading 61,922 shares. Scotia Group declined $1.64 to $33.25 after exchanging 815 stocks and Sygnus Credit Investments rallied $1.17 after ending at $13.97 in transferring 47,726 stock units.

Kingston Properties dipped 51 cents to $6.80 with 21,200 shares changing hands, Kingston Wharves shed 48 cents to end at $35.40 in swapping 159 stock units, Mayberry Investments lost 58 cents after finishing at $8.27 in an exchange of 9,044 units. NCB Financial declined $1.48 to $78.50, trading 30,418 stock units, 138 Student Living dropped 67 cents to $4.30 with a transfer of 15,687 shares, Palace Amusement popped $50 to close at $1,850 after 232 stocks cleared the market. PanJam Investment dipped $1, ending at $59 as investors switched ownership of 15,557 stock units, Proven Investments advanced $2.38 to close at $32.38 with 3,616 units changing hands, Sagicor Group rose $1 in closing at $51, trading 61,922 shares. Scotia Group declined $1.64 to $33.25 after exchanging 815 stocks and Sygnus Credit Investments rallied $1.17 after ending at $13.97 in transferring 47,726 stock units.

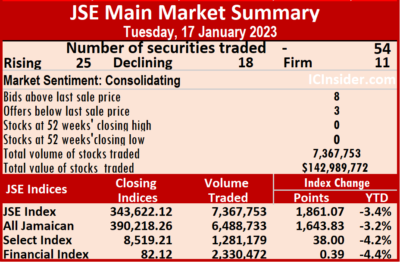

A total of 7,367,753 shares were traded for $142,989,772 up from 5,922,099 units at $55,983,304 on Monday.

A total of 7,367,753 shares were traded for $142,989,772 up from 5,922,099 units at $55,983,304 on Monday. Main Index advanced 1,861.07 points to 343,622.12 and the JSE Financial Index rose 0.39 points to close at 82.12.

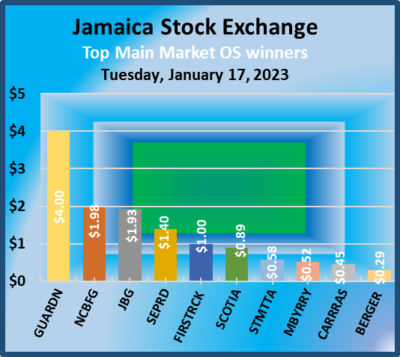

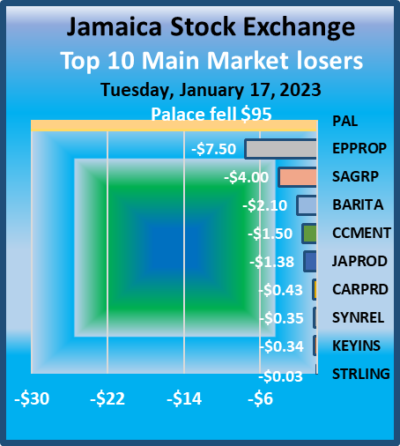

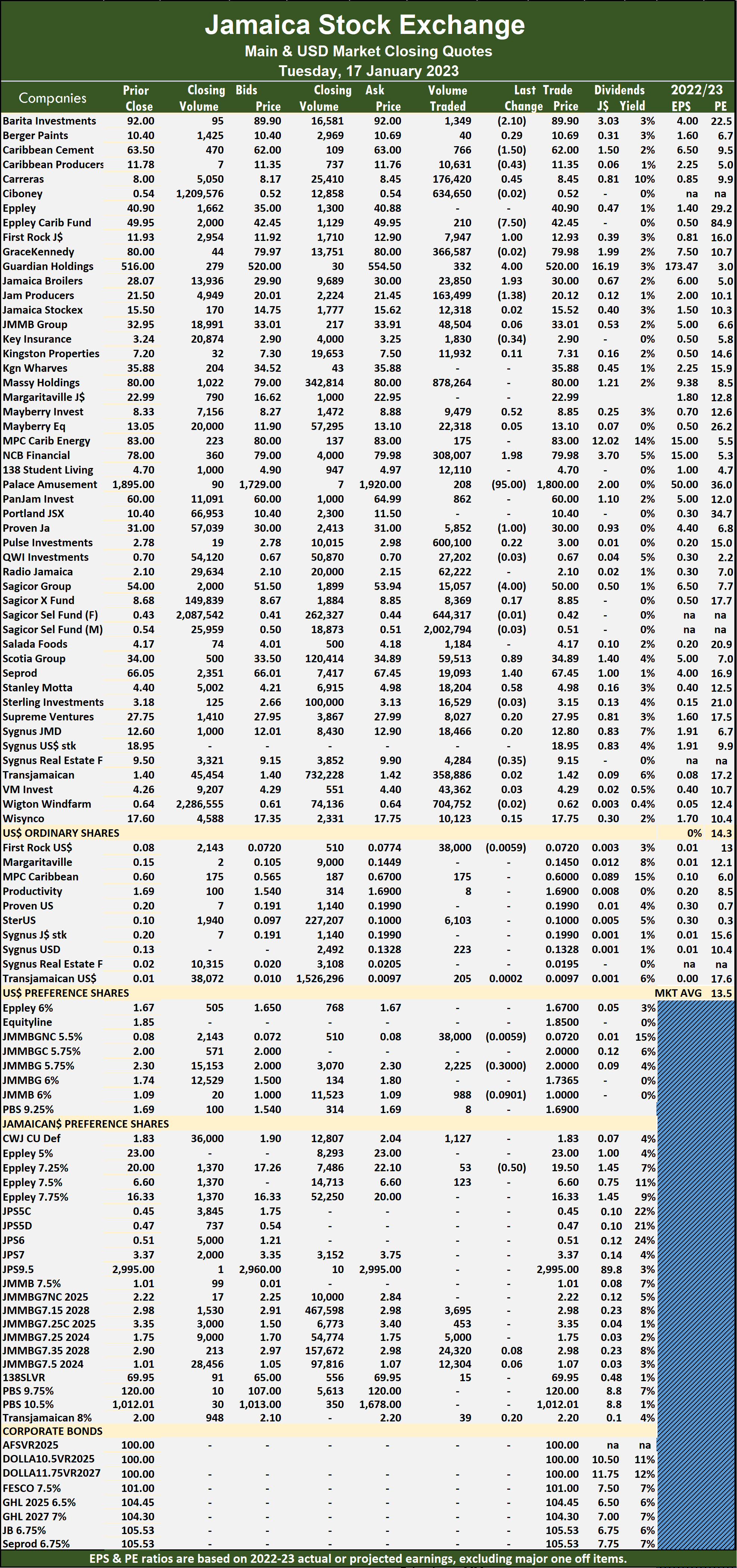

Main Index advanced 1,861.07 points to 343,622.12 and the JSE Financial Index rose 0.39 points to close at 82.12. First Rock Real Estate gained $1 to end at $12.93 after investors swapped 7,947 stocks. Guardian Holdings rose $4 to $520 with 332 units changing hands, Jamaica Broilers advanced $1.93 to $30 in trading 23,850 stock units, Jamaica Producers fell $1.38 to $20.12 after 163,499 stock units cleared the market. Mayberry Investments rallied 52 cents to end at $8.85 with a transfer of 9,479 stocks, NCB Financial climbed $1.98 to $79.98 trading 308,007 shares, Palace Amusement dropped $95 to close at $1,800 after 208 units were exchanged. Proven Investments shed $1 ending at $30 with investors swapping 5,852 stock units, Sagicor Group declined $4 to close at $50 in exchanging 15,057 stocks, Scotia Group popped 89 cents to $34.89 in switching ownership of 59,513 units. Seprod gained $1.40 in ending at $67.45 with 19,093 shares changing hands and Stanley Motta popped 58 cents in closing at $4.98 trading 18,204 units.

First Rock Real Estate gained $1 to end at $12.93 after investors swapped 7,947 stocks. Guardian Holdings rose $4 to $520 with 332 units changing hands, Jamaica Broilers advanced $1.93 to $30 in trading 23,850 stock units, Jamaica Producers fell $1.38 to $20.12 after 163,499 stock units cleared the market. Mayberry Investments rallied 52 cents to end at $8.85 with a transfer of 9,479 stocks, NCB Financial climbed $1.98 to $79.98 trading 308,007 shares, Palace Amusement dropped $95 to close at $1,800 after 208 units were exchanged. Proven Investments shed $1 ending at $30 with investors swapping 5,852 stock units, Sagicor Group declined $4 to close at $50 in exchanging 15,057 stocks, Scotia Group popped 89 cents to $34.89 in switching ownership of 59,513 units. Seprod gained $1.40 in ending at $67.45 with 19,093 shares changing hands and Stanley Motta popped 58 cents in closing at $4.98 trading 18,204 units.

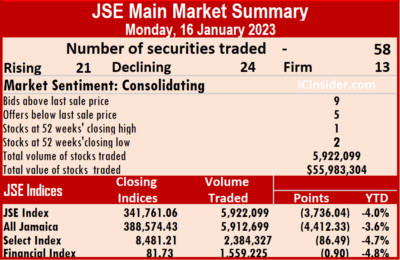

A mere 5,922,099 shares were traded for $55,983,304 versus 5,510,092 units at $150,228,385 on Friday.

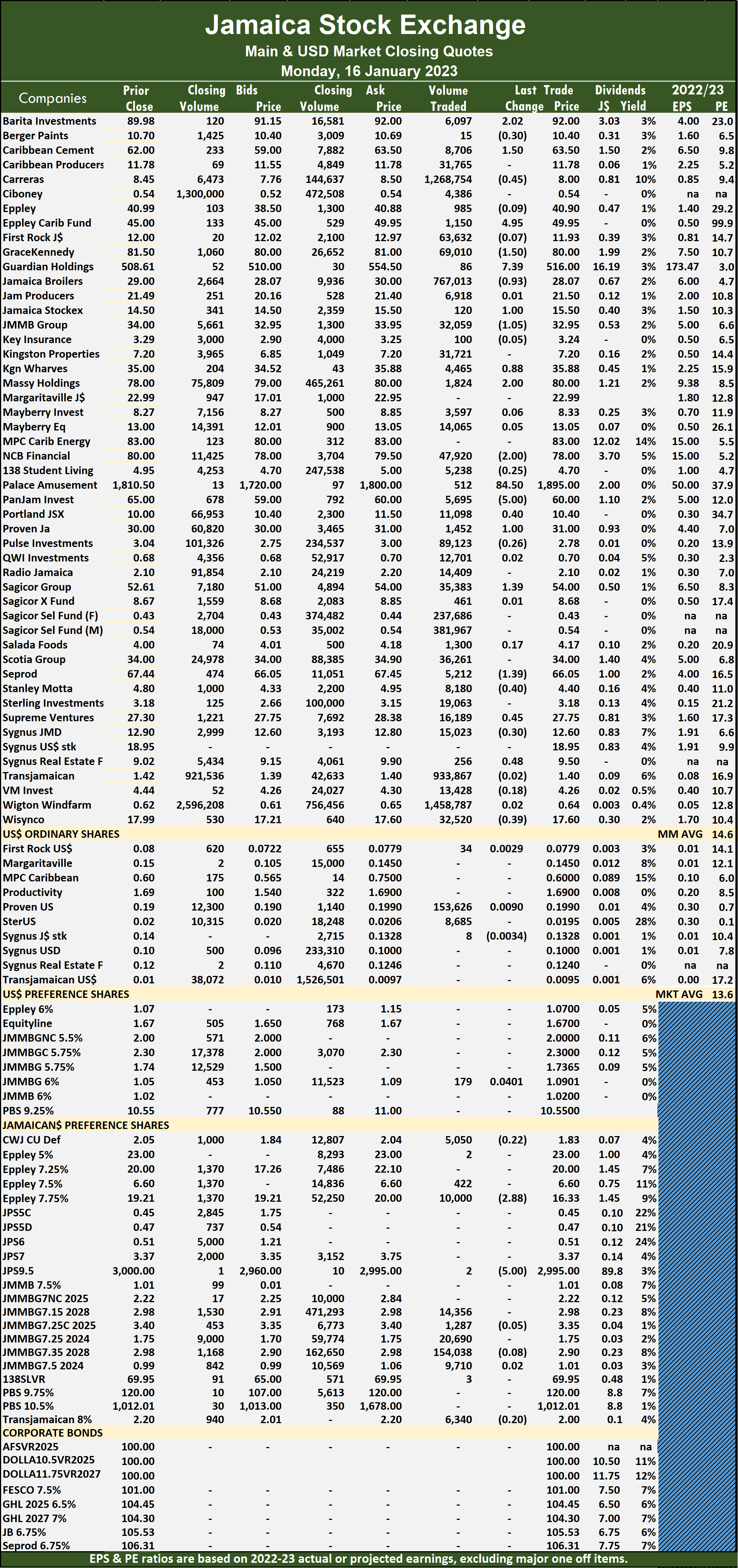

A mere 5,922,099 shares were traded for $55,983,304 versus 5,510,092 units at $150,228,385 on Friday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

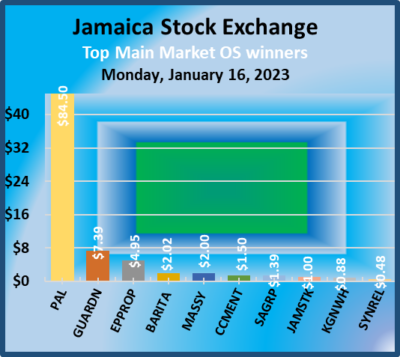

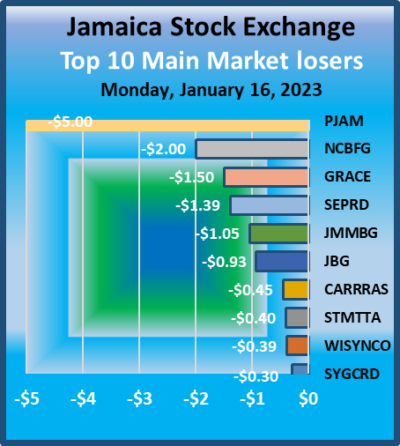

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Jamaica Stock Exchange popped $1 to $15.50 in trading 120 units, JMMB Group fell $1.05 to end at $32.95 after exchanging 32,059 units. Kingston Wharves rose 88 cents to close at $35.88 with the swapping of 4,465 stock units, Massy Holdings advanced $2 to $80 with a transfer of 1,824 shares, NCB Financial declined $2 in closing at a 52 weeks’ low of $78 after trading 47,920 stocks after the price hit a 52 weeks’ high of $2,004. Palace Amusement climbed $84.50 to $1,895 as investors switched ownership of 512 shares, PanJam Investment declined $5 in ending at $60 after 5,695 stock units passed through the market, Portland JSX gained 40 cents to close at $10.40 with investors transferring 11,098 units. Proven Investments popped $1 in closing at $31 in exchanging 1,452 stocks, Sagicor Group rallied $1.39 to finish at $54 with 35,383 stocks changing hands, Seprod dipped $1.39 to $66.05 trading 5,212 stock units. Stanley Motta lost 40 cents to end at $4.40 after a transfer of 8,180 units, Supreme Ventures popped 45 cents to close at $27.75 after an exchange of 16,189 shares and Sygnus Real Estate Finance gained 48 cents to end at $9.50 in switching ownership of 256 stocks.

Jamaica Stock Exchange popped $1 to $15.50 in trading 120 units, JMMB Group fell $1.05 to end at $32.95 after exchanging 32,059 units. Kingston Wharves rose 88 cents to close at $35.88 with the swapping of 4,465 stock units, Massy Holdings advanced $2 to $80 with a transfer of 1,824 shares, NCB Financial declined $2 in closing at a 52 weeks’ low of $78 after trading 47,920 stocks after the price hit a 52 weeks’ high of $2,004. Palace Amusement climbed $84.50 to $1,895 as investors switched ownership of 512 shares, PanJam Investment declined $5 in ending at $60 after 5,695 stock units passed through the market, Portland JSX gained 40 cents to close at $10.40 with investors transferring 11,098 units. Proven Investments popped $1 in closing at $31 in exchanging 1,452 stocks, Sagicor Group rallied $1.39 to finish at $54 with 35,383 stocks changing hands, Seprod dipped $1.39 to $66.05 trading 5,212 stock units. Stanley Motta lost 40 cents to end at $4.40 after a transfer of 8,180 units, Supreme Ventures popped 45 cents to close at $27.75 after an exchange of 16,189 shares and Sygnus Real Estate Finance gained 48 cents to end at $9.50 in switching ownership of 256 stocks. In the preference segment, Eppley 7.75% preference share fell $2.88 to a 52 weeks’ low of $16.33 with an exchange of 10,000 shares and Jamaica Public Service 9.5% declined $5 in closing at $2,995 as investors transferred two stock units.

In the preference segment, Eppley 7.75% preference share fell $2.88 to a 52 weeks’ low of $16.33 with an exchange of 10,000 shares and Jamaica Public Service 9.5% declined $5 in closing at $2,995 as investors transferred two stock units.