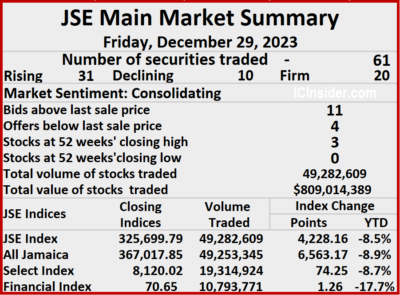

Trading activity remained buoyant on the Jamaica Stock Exchange Main Market to close out the year on Friday, with 49,282,609 shares traded for $809,014,389 compared with 54,718,064 units at $832,512,122 on Thursday after trading resulted in 61 securities changing hands compared with 58 on Thursday, and ended with prices of 31 stocks rising, 10 declining and 20 ending unchanged.

Trading averaged 807,912 shares at $13,262,531 compared with 943,415 units at $14,353,657 on Thursday and month to date, an average of 264,266 units at $3,755,94 compared with 230,599 units at $3,167,213 on the previous day. November closed with an average of 275,587 units at $2,488,949.

Trading averaged 807,912 shares at $13,262,531 compared with 943,415 units at $14,353,657 on Thursday and month to date, an average of 264,266 units at $3,755,94 compared with 230,599 units at $3,167,213 on the previous day. November closed with an average of 275,587 units at $2,488,949.

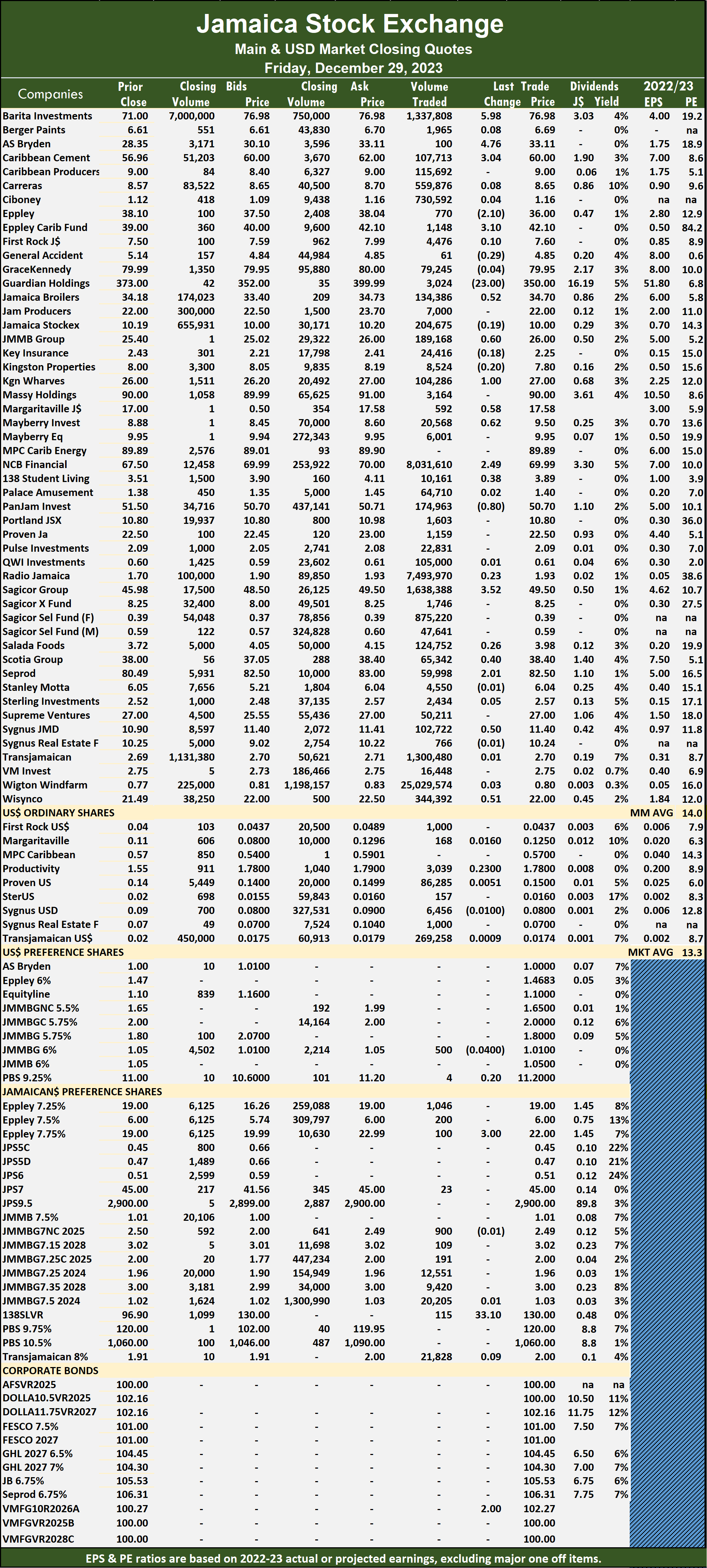

Wigton Windfarm led trading with 25.03 million shares for 50.8 percent of total volume followed by NCB Financial with 8.03 million units for 16.3 percent of the day’s trade, Radio Jamaica ended with 7.49 million shares for 15.2 percent of market share, Sagicor Group with 1.64 million units for 3.3 percent of trading. Barita Investments closed with 1.34 million shares for 2.7 percent of market activity and Transjamaican Highway, 1.30 million units for 2.6 percent of total volume.

The All Jamaican Composite Index surged 6,563.17 points to close at 367,017.85, the JSE Main Index popped 4,228.16 points to end the year at 325,699.79 as the market lost 9 percent for the year and the JSE Financial Index gained 1.26 points to end at 70.65.

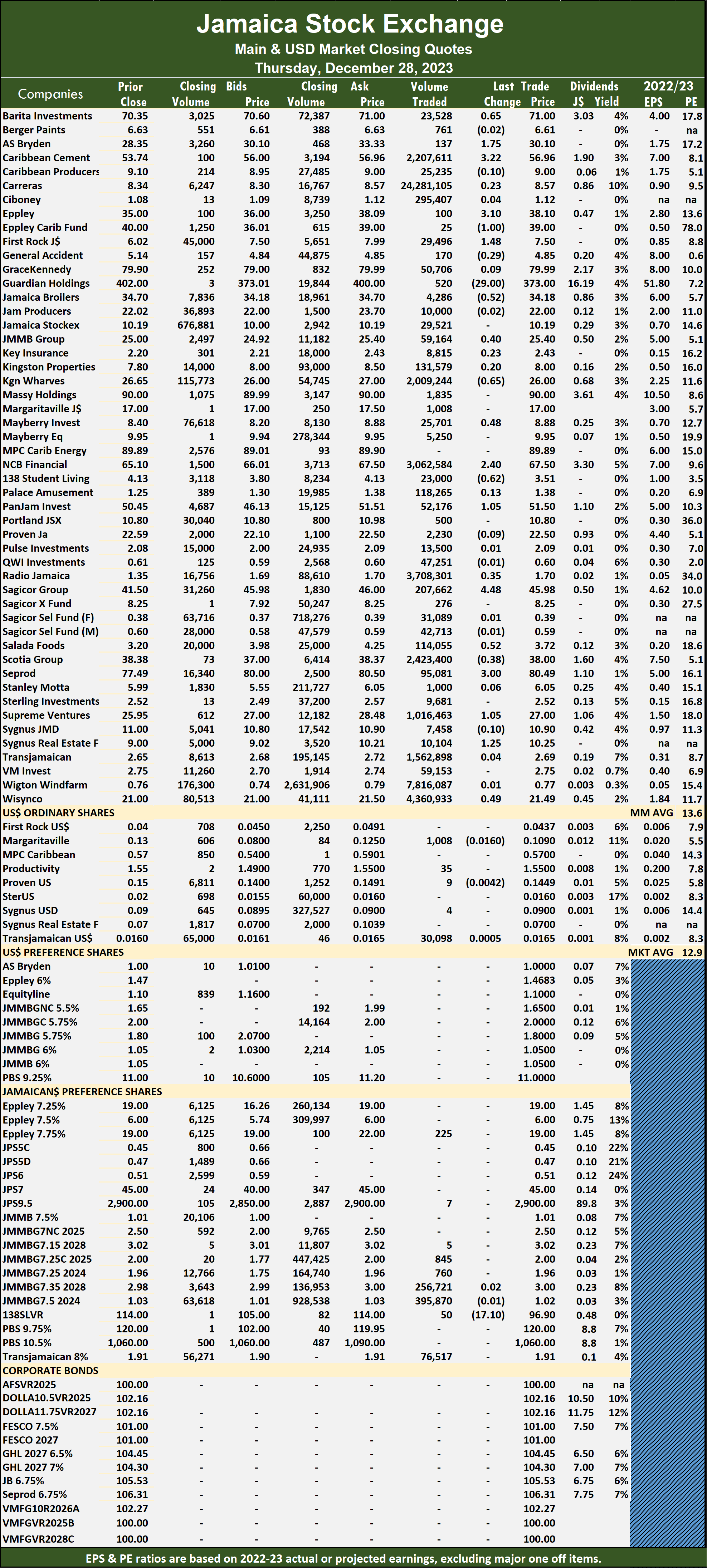

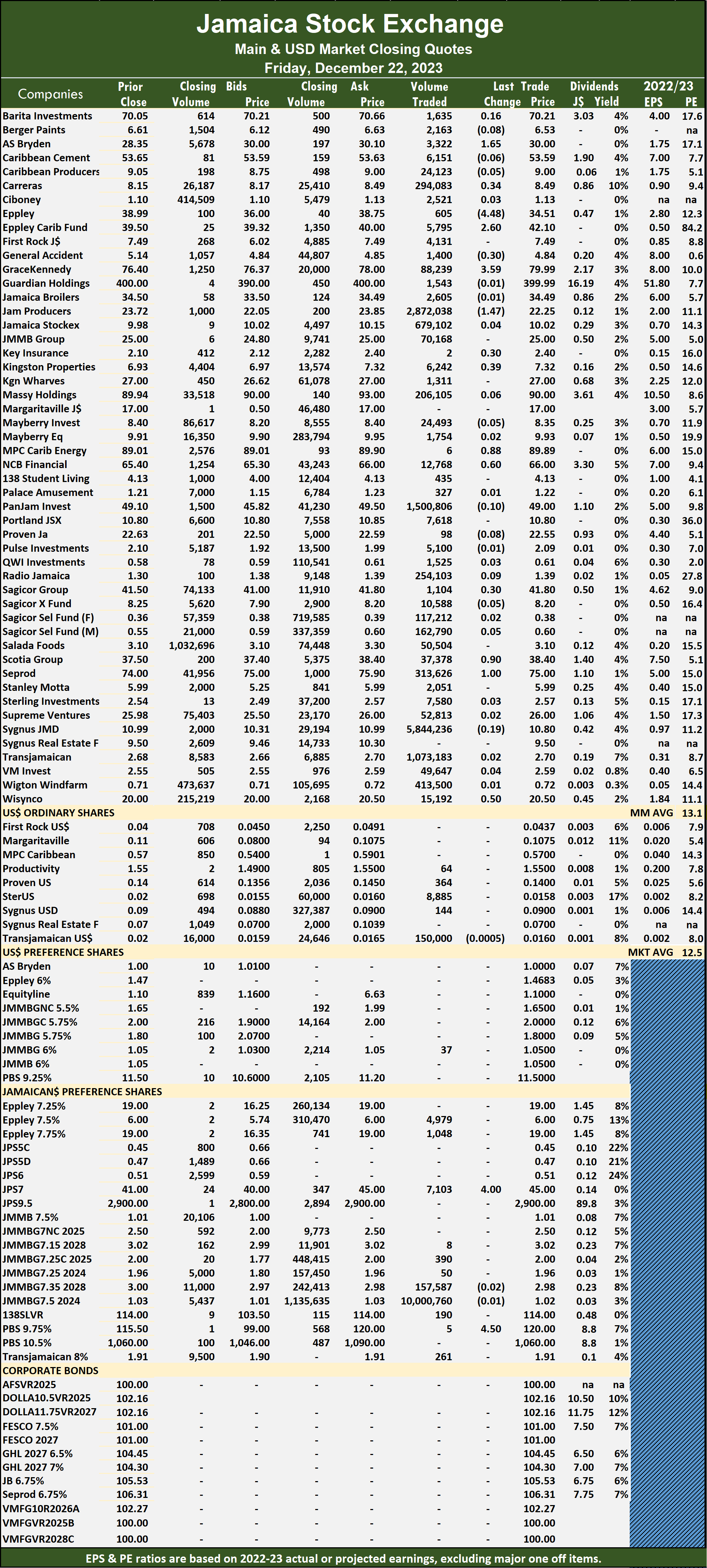

The Main Market ended trading with an average PE Ratio of 14. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 14. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and four with lower offers.

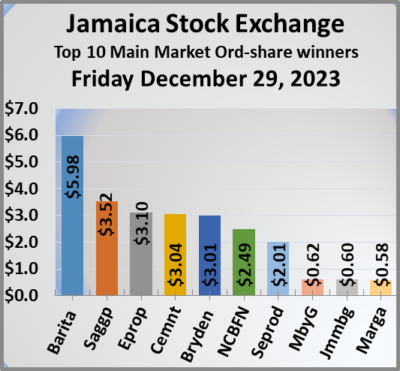

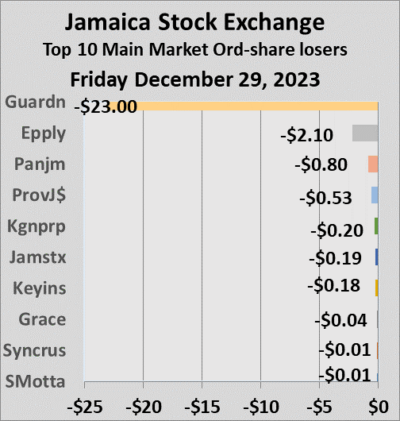

At the close, AS Bryden increased $3.01 to end at a recording closing high of $33.11 as investors exchanged 100 stock units, Barita Investments popped $5.98 to end at $76.98 in trading 1,337,808 shares, Caribbean Cement rallied $3.04 to $60 and closed with an exchange of 107,713 units. Eppley lost $2.10 in closing at $36 while exchanging 770 stocks, Eppley Caribbean Property Fund rose $3.10 and ended at $42.10 with traders dealing in 1,148 shares, Guardian Holdings declined $23 to $350 in an exchange of 3,024 stocks. Jamaica Broilers advanced 52 cents and ended at $34.70, with 134,386 units changing hands, JMMB Group climbed 60 cents in closing at $26 with a transfer of 189,168 stock units, Kingston Wharves gained $1 to close at $27 after an exchange of 104,286 shares.  Margaritaville rose 58 cents to end at $17.58 with 592 stocks clearing the market, Mayberry Group climbed 62 cents in closing at $9.50 with an exchange of 20,568 units, NCB Financial increased $2.49 to $69.99, with 8,031,610 stock units crossing the market. 138 Student Living popped 38 cents to close at $3.89 in an exchange of 10,161 shares, Pan Jamaica sank 80 cents to end at $50.70 after trading 174,963 stock units, Sagicor Group gained $3.52 and ended at $49.50 after an exchange of 1,638,388 stocks. Salada Foods advanced 26 cents to $3.98 with investors transferring 124,752 units, Scotia Group rallied 40 cents to end at $38.40 in switching ownership of 65,342 stocks, Seprod popped $2.01 in closing at $82.50 after 59,998 units passed through the market. Sygnus Credit Investments climbed 50 cents and ended at $11.40 after a transfer of 102,722 shares and Wisynco Group increased 51 cents to close at $22, with 344,392 stock units crossing the market.

Margaritaville rose 58 cents to end at $17.58 with 592 stocks clearing the market, Mayberry Group climbed 62 cents in closing at $9.50 with an exchange of 20,568 units, NCB Financial increased $2.49 to $69.99, with 8,031,610 stock units crossing the market. 138 Student Living popped 38 cents to close at $3.89 in an exchange of 10,161 shares, Pan Jamaica sank 80 cents to end at $50.70 after trading 174,963 stock units, Sagicor Group gained $3.52 and ended at $49.50 after an exchange of 1,638,388 stocks. Salada Foods advanced 26 cents to $3.98 with investors transferring 124,752 units, Scotia Group rallied 40 cents to end at $38.40 in switching ownership of 65,342 stocks, Seprod popped $2.01 in closing at $82.50 after 59,998 units passed through the market. Sygnus Credit Investments climbed 50 cents and ended at $11.40 after a transfer of 102,722 shares and Wisynco Group increased 51 cents to close at $22, with 344,392 stock units crossing the market.

In the preference segment, Eppley 7.75% preference share rose $3 to $22 with investors trading 100 shares and 138 Student Living preference share advanced $33.10 in closing at $130, with 115 stock units crossing the exchange.

In the preference segment, Eppley 7.75% preference share rose $3 to $22 with investors trading 100 shares and 138 Student Living preference share advanced $33.10 in closing at $130, with 115 stock units crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

The JSE Main Market bounces to close out 2023

Aggressive trading pushes Main Market to 5 months high

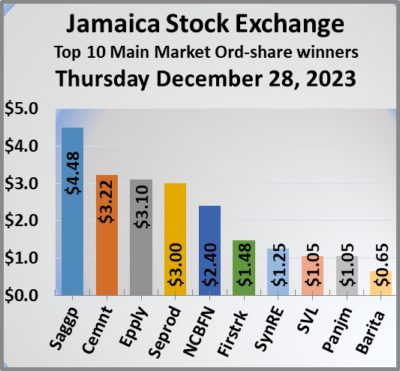

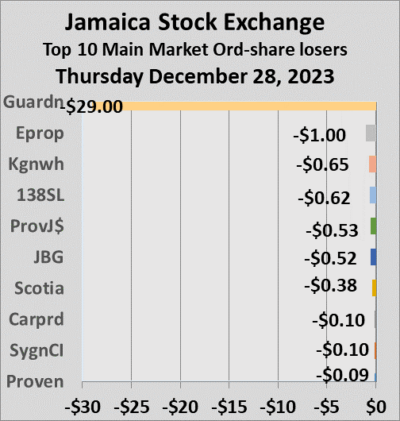

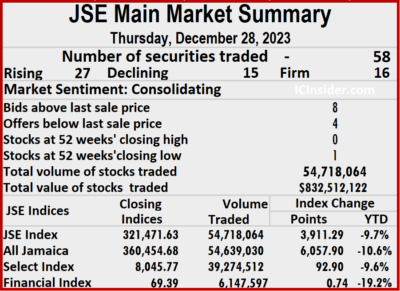

Aggressive trading on Thursday with prices of 27 stocks jumping, 15 declining and 16 ending unchanged following trading in 58 securities compared with 59 on Wednesday and closed after the Main Market of the Jamaica Stock Exchange recorded a 64 percent surge in the volume of stocks traded at a marginally higher value than on Wednesday as investors pushed the market to the highest level since the first week in August.

At the close of the market, 54,718,064 shares were traded for $832,512,122 up from 33,345,989 units at $814,176,218 on Wednesday.

At the close of the market, 54,718,064 shares were traded for $832,512,122 up from 33,345,989 units at $814,176,218 on Wednesday.

Trading averaged 943,415 shares at $14,353,657 up from 565,186 stocks at $13,799,597 on Wednesday, Trading for the month to date, averages of 230,599 units at $3,167,213 up from 186,000 units at $2,467,306 on the previous day. November closed with an average of 275,587 units at $2,488,949.

Carreras led trading with 24.28 million shares for 44.4 percent of total volume followed by Wigton Windfarm with 7.82 million units for 14.3 percent of the day’s trade, Wisynco Group ended with 4.36 million shares for 8 percent market share, Radio Jamaica closed with 3.71 million units for 6.8 percent of Main Market trading, NCB Financial contributed 3.06 million units for 5.6 percent of market activity and Scotia Group with 2.42 million units for 4.4 percent of total volume.

The All Jamaican Composite Index surged 6,057.90 points to end at 360,454.68, the JSE Main Index railed 3,911.29 points to end the day at 321,471.63 and the JSE Financial Index popped 0.74 points to 69.39.

The All Jamaican Composite Index surged 6,057.90 points to end at 360,454.68, the JSE Main Index railed 3,911.29 points to end the day at 321,471.63 and the JSE Financial Index popped 0.74 points to 69.39.

The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Barita Investments rose 65 cents to close at $71 in switching ownership of 23,528 shares, Caribbean Cement advanced $3.22 to end at $56.96, with 2,207,611 units clearing the market, Eppley popped $3.10 to close at $38.10 after a transfer of 100 shares. Eppley Caribbean Property Fund shed $1 and ended at $39 with investors swapping 25 stock units, First Rock Real Estate gained $1.48 to end at $7.50, with 29,496 shares changing hands, Guardian Holdings declined $29 in closing at $373 after 520 stocks passed through the market.  Jamaica Broilers fell 52 cents to $34.18 after an exchange of only 4,286 units, JMMB Group gained 40 cents to close at $25.40 after a transfer of 59,164 stocks, Kingston Wharves skidded 65 cents and ended at $26 as investors exchanged 2,009,244 shares. Mayberry Group climbed 48 cents to $8.88 after investors ended trading 25,701 stock units, NCB Financial rallied $2.40 to $67.50 after an exchange of 3,062,584 stocks, 138 Student Living lost 62 cents to at a 52 weeks’ low of $3.51, with 23,000 units crossing the market. Pan Jamaica popped $1.05 to end at $51.50 with traders dealing in 52,176 shares, Radio Jamaica rallied 35 cents to close at $1.70 while exchanging 3,708,301 stock units, Sagicor Group rose $4.48 and ended at $45.98 with investors dealing in 207,662 units. Salada Foods gained 52 cents to close $3.72 in an exchange of 114,055 stocks, Scotia Group dipped 38 cents to close at $38 with investors trading 2,423,400 shares, Seprod increased $3 to end at $80.49 in an exchange of 95,081 stocks.

Jamaica Broilers fell 52 cents to $34.18 after an exchange of only 4,286 units, JMMB Group gained 40 cents to close at $25.40 after a transfer of 59,164 stocks, Kingston Wharves skidded 65 cents and ended at $26 as investors exchanged 2,009,244 shares. Mayberry Group climbed 48 cents to $8.88 after investors ended trading 25,701 stock units, NCB Financial rallied $2.40 to $67.50 after an exchange of 3,062,584 stocks, 138 Student Living lost 62 cents to at a 52 weeks’ low of $3.51, with 23,000 units crossing the market. Pan Jamaica popped $1.05 to end at $51.50 with traders dealing in 52,176 shares, Radio Jamaica rallied 35 cents to close at $1.70 while exchanging 3,708,301 stock units, Sagicor Group rose $4.48 and ended at $45.98 with investors dealing in 207,662 units. Salada Foods gained 52 cents to close $3.72 in an exchange of 114,055 stocks, Scotia Group dipped 38 cents to close at $38 with investors trading 2,423,400 shares, Seprod increased $3 to end at $80.49 in an exchange of 95,081 stocks.  Supreme Ventures climbed $1.05 in closing at $27, with 1,016,463 units crossing the market, Sygnus Real Estate Finance advanced $1.25 and ended at $10.25 in trading 10,104 stock units and Wisynco Group popped 49 cents to $21.49 after exchanging 4,360,933 shares.

Supreme Ventures climbed $1.05 in closing at $27, with 1,016,463 units crossing the market, Sygnus Real Estate Finance advanced $1.25 and ended at $10.25 in trading 10,104 stock units and Wisynco Group popped 49 cents to $21.49 after exchanging 4,360,933 shares.

In the preference segment, 138 Student Living preference share sank $17.10 in closing at $96.90 with investors transferring 50 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading jumps on JSE Main Market as prices rise

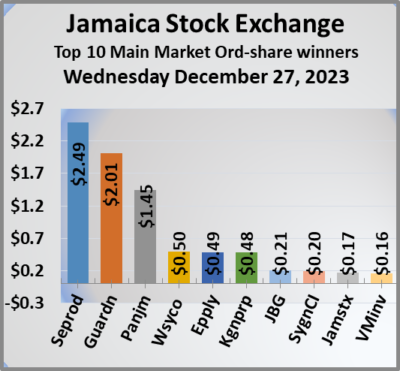

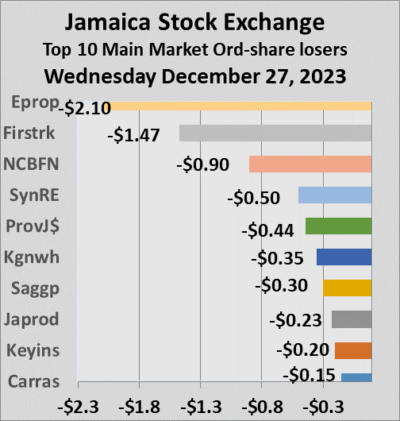

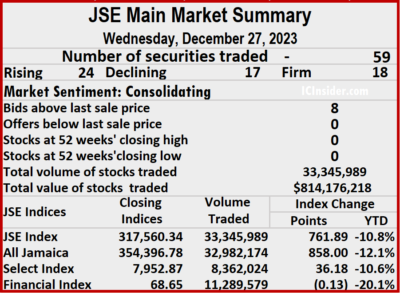

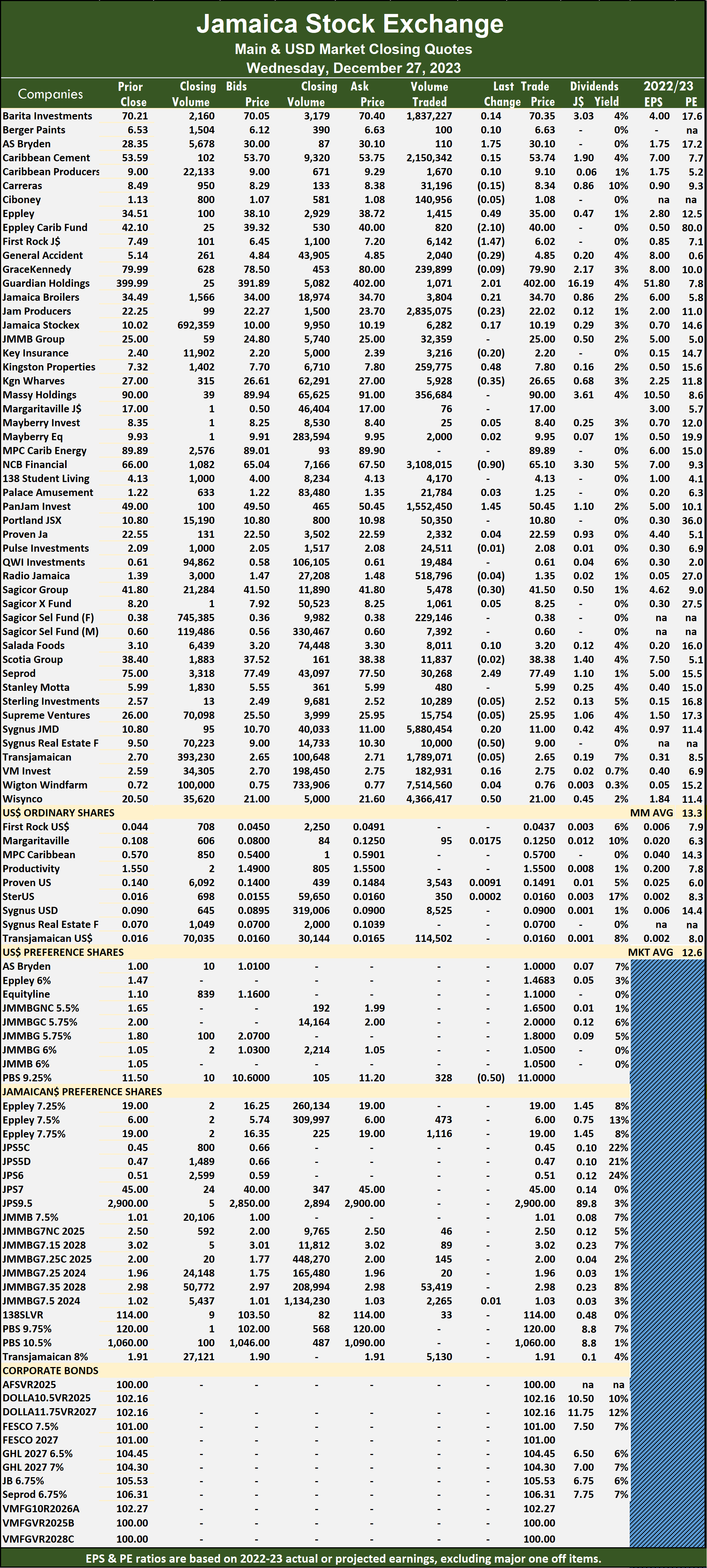

Trading activity on the Jamaica Stock Exchange Main Market ended on Wednesday, with the volume of stocks traded rising 37 percent and the value surging 189 percent over trading on Friday, with 59 securities trading similar to trading on Friday and ended with prices of 24 stocks rising, 17 declining and 18 ending unchanged as JMMB Group traded at an intraday 52 weeks’ low of $24.80.

Trading ended with an exchange of 33,345,989 shares for $814,176,218 compared with 24,406,102 units at $281,890,487 on Friday.

Trading ended with an exchange of 33,345,989 shares for $814,176,218 compared with 24,406,102 units at $281,890,487 on Friday.

Trading averaged 565,186 shares at $13,799,597 up sharply from 413,663 units at $4,777,805 on Friday and month to date, an average of 186,000 stock units at $2,467,306 compared to 160,226 units at $1,697,024 that were previously traded. November ended with an average of 275,587 units at $2,488,949.

Wigton Windfarm led trading with 7.51 million shares for 22.5 percent of total volume followed by Sygnus Credit Investments with 5.88 million units for 17.6 percent of the day’s trade, Wisynco Group closed trading with 4.37 million units for 13.1 percent of the day’s volume, NCB Financial ended with 3.11 million units for 9.3 percent market share, Jamaica Producers closed with 2.84 million stock units for 8.5 percent trading and Caribbean Cement with 2.15 million units for 6.4 percent of total volume.

The All Jamaican Composite Index climbed 858.00 points to 354,396.78, the JSE Main Index increased 761.89 points to conclude trading at 317,560.34 and the JSE Financial Index slipped 0.13 points to settle at 68.65.

The All Jamaican Composite Index climbed 858.00 points to 354,396.78, the JSE Main Index increased 761.89 points to conclude trading at 317,560.34 and the JSE Financial Index slipped 0.13 points to settle at 68.65.

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasted by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Eppley increased 49 cents to $35 with investors trading 1,415 stocks, Eppley Caribbean Property Fund dipped $2.10 in closing at $40, with 820 units clearing the market,  First Rock Real Estate fell $1.47 and ended at $6.02 with investors transferring 6,142 shares. Guardian Holdings popped $2.01 to close at $402, with 1,071 stock units crossing the market, Kingston Properties advanced 48 cents to $7.80 after investors traded 259,775 shares, Kingston Wharves skidded 35 cents to $26.65 after an exchange of 5,928 units. NCB Financial sank 90 cents to close at $65.10 with investors trading 3,108,015 stocks, Pan Jamaica rose $1.45 to end at $50.45 after 1,552,450 stock units passed through the market, Sagicor Group shed 30 cents in closing at $41.50 while exchanging 5,478 shares. Seprod climbed $2.49 and ended at $77.49, with investors trading 30,268 stock units, Sygnus Real Estate Finance declined 50 cents to $9 in an exchange of 10,000 units and Wisynco Group rallied 50 cents in closing at $21 with traders dealing in 4,366,417 stocks.

First Rock Real Estate fell $1.47 and ended at $6.02 with investors transferring 6,142 shares. Guardian Holdings popped $2.01 to close at $402, with 1,071 stock units crossing the market, Kingston Properties advanced 48 cents to $7.80 after investors traded 259,775 shares, Kingston Wharves skidded 35 cents to $26.65 after an exchange of 5,928 units. NCB Financial sank 90 cents to close at $65.10 with investors trading 3,108,015 stocks, Pan Jamaica rose $1.45 to end at $50.45 after 1,552,450 stock units passed through the market, Sagicor Group shed 30 cents in closing at $41.50 while exchanging 5,478 shares. Seprod climbed $2.49 and ended at $77.49, with investors trading 30,268 stock units, Sygnus Real Estate Finance declined 50 cents to $9 in an exchange of 10,000 units and Wisynco Group rallied 50 cents in closing at $21 with traders dealing in 4,366,417 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Mostly price gains for ICTOP10

The Main Market of the JSE rose around two percent and Junior Market just under one percent for the week and led the top 10 mostly higher, with 7 Main Market and 4 Junior Market stocks rising with declining stocks recording losses of 4 percent or less, at the same time one stock moved out of the TOP10.

The Main Market ICTOP10 ended with, General Accident declined 11 percent to $4.50. Buying interest picked up during the week for Scotia Group pushing the stock to several 52 weeks’ highs and a rose of 7 percent for the week to a 52 weeks’ closing high of $38.40. This stock has much more juice left that should take it into the $40 range by early 2024. Caribbean Producers rallied 6 percent to $9, while Margaritaville also rose 6 percent and closed at $17 and Pulse Investments rose 5 percent to $2.09 and Key Insurance slipped 4 percent to $2.40.

The Main Market ICTOP10 ended with, General Accident declined 11 percent to $4.50. Buying interest picked up during the week for Scotia Group pushing the stock to several 52 weeks’ highs and a rose of 7 percent for the week to a 52 weeks’ closing high of $38.40. This stock has much more juice left that should take it into the $40 range by early 2024. Caribbean Producers rallied 6 percent to $9, while Margaritaville also rose 6 percent and closed at $17 and Pulse Investments rose 5 percent to $2.09 and Key Insurance slipped 4 percent to $2.40.

The Junior Market ended the week, with AMG Packaging climbing 17 percent to $2.70, buying is not aggressive currently while supplies up to $3.15 is limited, with none on offer until $10. Investors should expect a big bounce in the first quarter profits due by mid-January. The company states that they are exploring the possibility of new equipment and expanded facilities that could shape a future expansion of momentous proportions. Caribbean Cream rose 10 percent to $3.64 and Stationery and Office Supplies gained 9 percent and dropped out of the TOP10 and is replaced by Tropical Battery. There were no notable declines at the end of the week.

There was no new addition to the IC Main Market TOP10.

Indications of where stock prices could be by May 2024 can be seen from stocks with the highest values in the Main and Junior Markets.

The average PE for the JSE Main Market ICTOP 10 stands at 5.3, well below the market average of 13.1. The Main Market ICTOP10 is projected to gain an average of 288 percent by May 2024, based on 2023 forecasted earnings and now provides better values than the Junior Market with the potential to gain 195 percent over the same time frame.

The average PE for the JSE Main Market ICTOP 10 stands at 5.3, well below the market average of 13.1. The Main Market ICTOP10 is projected to gain an average of 288 percent by May 2024, based on 2023 forecasted earnings and now provides better values than the Junior Market with the potential to gain 195 percent over the same time frame.

In the Main Market ICTOP10, 15 of the most highly valued stocks, 31 percent of the Main Market are priced at a PE of 15 to 108, with an average of 29 and 18 excluding the highest PE ratios, and a PE of 24 for the top half and 16 excluding the stocks with overweight values.

The PE of the Junior Market TOP10 sits at 7, just over half of the market, with an average of 13.2. There are 14 stocks, or 29 percent of the market, with PEsfrom 15 to 49, averaging 21, well above the market’s average. The top half of the market has an average PE of 18, possibly the lowest fair value for stocks.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Big trading day for JSE Main Market

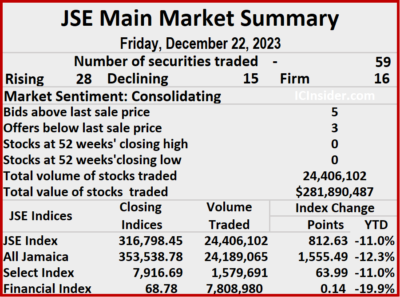

Trading jumped sharply on the Jamaica Stock Exchange Main Market ended on Friday, with the volume of stocks traded jumping 230 percent and the value 540 percent more than on Thursday, with 59 securities trading compared with 54 on Thursday, with 28 rising, 15 declining and 16 ending unchanged.

Overall, 24,406,102 shares were traded for $281,890,487 up from 7,395,292 units at $44,075,720 on Thursday.

Overall, 24,406,102 shares were traded for $281,890,487 up from 7,395,292 units at $44,075,720 on Thursday.

Trading averaged 413,663 shares at $4,777,805 compared to 136,950 units at $816,217 on Thursday and month to date, an average of 160,226 units at $1,697,024 compared to 141,743 units at $1,472,344 on the previous day, down from November with an average of 275,587 units at $2,488,949.

JMMB Group 7.5% led trading with 10.0 million shares for 41 percent of the total volume followed by Sygnus Credit Investments with 5.84 million units for 23.9 percent of the day’s trade, Jamaica Producers chipped in with 2.87 million units for 11.8 percent market share, Pan Jamaica ended with 1.50 million units for 6.1 percent of the day’s trade and Transjamaican Highway with 1.07 million units for 4.4 percent of total volume.

The All Jamaican Composite Index advanced 1,555.49 points to 353,538.78, the JSE Main Index climbed 812.63 points to end at 316,798.45 and the JSE Financial Index gained 0.14 points to conclude trading at 68.78.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

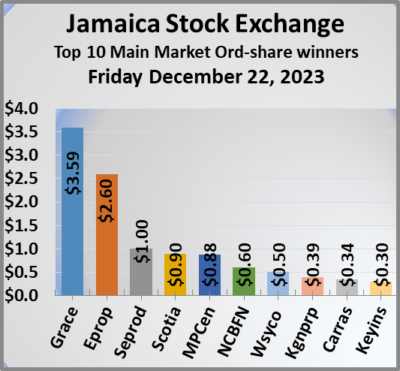

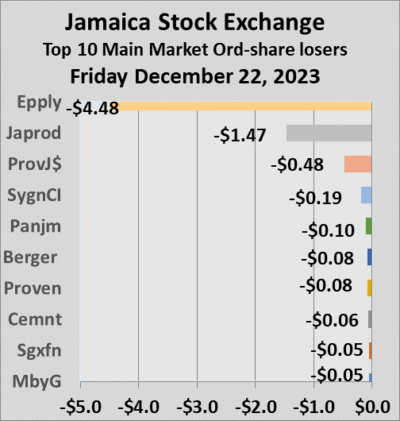

At the close, Carreras advanced 34 cents to $8.49 with traders dealing in 294,083 shares, Eppley skidded $4.48 and ended at $34.51 while exchanging 605 stocks, Eppley Caribbean Property Fund rose $2.60 in closing at $42.10 with a transfer of 5,795 units. GraceKennedy rallied $3.59 to close at $79.99 after exchanging 88,239 stock units, Jamaica Producers lost $1.47 to end at $22.25 after 2,872,038 shares passed through the market, Key Insurance increased 30 cents in closing at $2.40 with an exchange of 2 units. Kingston Properties climbed 39 cents to $7.32 after investors traded 6,242 stocks,  MPC Caribbean Clean Energy popped 88 cents and ended at $89.89 after an exchange of 6 stock units, NCB Financial gained 60 cents to close at $66 with investors trading 12,768 shares. Sagicor Group rose 30 cents to end at $41.80, with 1,104 units crossing the market, Scotia Group gained 90 cents to end at $38.40 with investors trading 37,378 stocks, Seprod popped $1 to close at $75, with 313,626 units crossing the market and Wisynco Group climbed 50 cents in closing at $20.50 after a transfer of 15,192 shares.

MPC Caribbean Clean Energy popped 88 cents and ended at $89.89 after an exchange of 6 stock units, NCB Financial gained 60 cents to close at $66 with investors trading 12,768 shares. Sagicor Group rose 30 cents to end at $41.80, with 1,104 units crossing the market, Scotia Group gained 90 cents to end at $38.40 with investors trading 37,378 stocks, Seprod popped $1 to close at $75, with 313,626 units crossing the market and Wisynco Group climbed 50 cents in closing at $20.50 after a transfer of 15,192 shares.

In the preference segment, Jamaica Public Service 7% increased $4 to end at $45 with 7,103 stock units clearing the market and Productive Business Solutions 9.75% preference share advanced $4.50 and ended at $120 in switching ownership of 5 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for JSE Main Market

Trading activity on the Jamaica Stock Exchange Main Market ended on Thursday with an 85 percent jump in the volume of stocks traded, with the value slipping moderately lower than on Wednesday, with trading in 54 securities compared with 56 on Wednesday, with prices of 11 stocks rising, 18 declining and 25 ending unchanged and leading the market indices higher at the close.

A total of 7,395,292 shares were traded for $44,075,720 compared to 3,998,798 units at $44,873,267 on Wednesday.

A total of 7,395,292 shares were traded for $44,075,720 compared to 3,998,798 units at $44,873,267 on Wednesday.

Trading averaged 136,950 shares at $816,217 compared to 71,407 units at $801,308 on Wednesday and month to date, an average of 141,743 units at $1,472,344, compared with 142,086 units at $1,519,272 on the previous day and well below November with an average of 275,587 units at $2,488,949.

JMMB Group 7.5% led trading with 2.06 million shares for 27.9 percent of the total volume followed by Transjamaican Highway with 1.73 million units for 23.4 percent of the day’s trade and Wigton Windfarm with 739,401 units for 10 percent market share.

The All Jamaican Composite Index rose 571.53 points to close at 351,983.29, the JSE Main Index advanced 723.66 points to 315,985.82 and the JSE Financial Index rose 0.11 points to finish at 68.64.

The All Jamaican Composite Index rose 571.53 points to close at 351,983.29, the JSE Main Index advanced 723.66 points to 315,985.82 and the JSE Financial Index rose 0.11 points to finish at 68.64.

The Main Market ended trading with an average PE Ratio of 12.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Barita Investments dropped 90 cents to $70.05 crossing the market 6,662 units, GraceKennedy fell $2.17 to close at $76.40, with investors exchanging 5,277 stocks, Jamaica Broilers climbed $1.49 to end at $34.50 in trading 36,006 shares. Jamaica Stock Exchange rose 38 cents in closing at $9.98 after 26,161 stock units passed through the market,  Kingston Properties skidded 39 cents and ended at $6.93 with traders dealing in 2,012 shares, NCB Financial sank 40 cents to $65.40 with 30,214 units crossing the market. Pan Jamaica dipped 40 cents to close at $49.10 as investors exchanged 2,230 stocks, Sagicor Group advanced $1 in closing at $41.50 after an exchange of 87,851 stock units, Scotia Group popped 38 cents to end at $37.50 with investors dealing in 89,402 shares and Sygnus Credit Investments gained 29 cents and ended at $10.99 with a transfer of 4,558 stocks.

Kingston Properties skidded 39 cents and ended at $6.93 with traders dealing in 2,012 shares, NCB Financial sank 40 cents to $65.40 with 30,214 units crossing the market. Pan Jamaica dipped 40 cents to close at $49.10 as investors exchanged 2,230 stocks, Sagicor Group advanced $1 in closing at $41.50 after an exchange of 87,851 stock units, Scotia Group popped 38 cents to end at $37.50 with investors dealing in 89,402 shares and Sygnus Credit Investments gained 29 cents and ended at $10.99 with a transfer of 4,558 stocks.

In the preference segment, Jamaica Public Service 7% rallied $1 to $41, with 51 units changing hands and Productive Business Solutions 10.5 % preference share lost $30 to end at $1,060 with investors trading 110 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big JSE Main Market jump

Trading activity dived on the Jamaica Stock Exchange Main Market on Wednesday, but rising prices beat out those declining, following a 77 percent drop in the volume of stocks traded and an 87 percent fall in value from Tuesday, resulting from trading in 56 securities compared with 62 on Tuesday, with prices of 19 rising, 13 declining and 24 ending unchanged.

Overall, 3,998,798 shares were traded for $44,873,267 in comparison with 17,429,449 units at $353,349,332 on Tuesday.

Overall, 3,998,798 shares were traded for $44,873,267 in comparison with 17,429,449 units at $353,349,332 on Tuesday.

Trading averaged 71,407 shares at $801,308 down from 281,120 units at $5,699,183 on Tuesday. Trading for the month to date, averages 142,086 units at $1,519,272 compared to 147,748 units at $1,576,792 on the previous day. Trading in November averaged 275,587 units at $2,488,949.

Transjamaican Highway led trading with 972,604 shares for 24.3 percent of total volume followed by Wigton Windfarm with 810,804 units for 20.3 percent of the day’s trade and Supreme Ventures with 500,542 units for 12.5 percent market share.

The All Jamaican Composite Index blasted 3,444.03 points higher to 351,411.76, the JSE Main Index jumped 2,092.44 points to end trading at 315,262.16 and the JSE Financial Index rallied 0.19 points to 68.53.

The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Barita Investments increased 90 cents in closing at $70.95 with an exchange of 9,553 stock units, Caribbean Cement rose 29 cents to $53.59 after 1,390 shares were traded, GraceKennedy popped 57 cents and ended at $78.57 with investors dealing in 116,168 stock units. Guardian Holdings rallied $8 to close at $400 and closed with an exchange of 548 stocks, Jamaica Broilers sank $1.10 to end at $33.01 with a transfer of 56,112 units, Jamaica Producers rose 97 cents in closing at $23.72 as investors exchanged 16,902 stocks. Jamaica Stock Exchange advanced 40 cents to $9.60, after 48 shares passed through the market, Massy Holdings gained 44 cents to end at $89.94 with investors swapping 40 stock units, Mayberry Group dropped 45 cents to close at $8.40, with 203,772 shares crossing the market.  NCB Financial rose 30 cents and ended at $65.80 in switching ownership of 106,244 stock units, Pan Jamaica rallied 50 cents to $49.50 with investors trading 738 stocks, Scotia Group increased 72 cents to close at a 52 weeks’ high of $37.12 in an exchange of 96,527 units after the price hit a new intraday 52 weeks’ high of $41.50 that induced new selling to come into the market. At the close, there were only 5 offers to sell less than 30,000 units at $40 or below, but bids to buy are mostly below $37. Seprod shed 40 cents and ended at $74 after trading 1,848 shares, Stanley Motta popped 78 cents to end at $5.99 while exchanging 900 stock units and Sygnus Credit Investments declined 29 cents in closing at $10.70 with traders dealing in 6,058 stocks.

NCB Financial rose 30 cents and ended at $65.80 in switching ownership of 106,244 stock units, Pan Jamaica rallied 50 cents to $49.50 with investors trading 738 stocks, Scotia Group increased 72 cents to close at a 52 weeks’ high of $37.12 in an exchange of 96,527 units after the price hit a new intraday 52 weeks’ high of $41.50 that induced new selling to come into the market. At the close, there were only 5 offers to sell less than 30,000 units at $40 or below, but bids to buy are mostly below $37. Seprod shed 40 cents and ended at $74 after trading 1,848 shares, Stanley Motta popped 78 cents to end at $5.99 while exchanging 900 stock units and Sygnus Credit Investments declined 29 cents in closing at $10.70 with traders dealing in 6,058 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

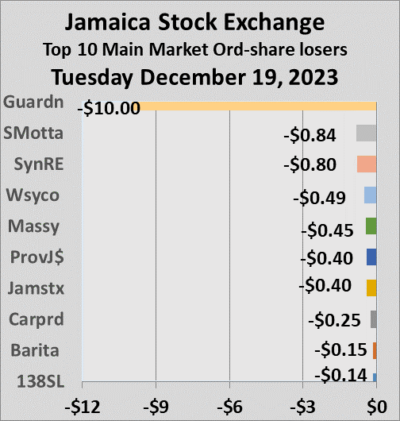

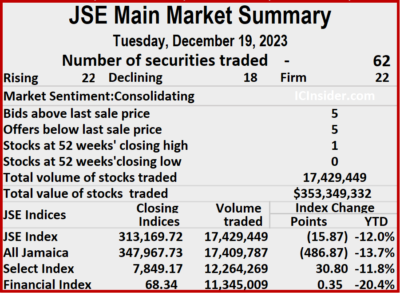

JSE Main Market slips on increased trading

JMMB Group dominated trading on the Jamaica Stock Exchange Main Market on Tuesday, with an exchange of more than 11 million shares with a value of $278 million which led to a 143 percent jump in the volume of stocks traded with the value climbing 221 percent more than on Monday, following trading in 62 securities compared with 52 on Monday and ended with prices of 22 stocks rising, 18 declining and 22 ending unchanged.

Trading ended with an exchange of 17,429,449 shares at $353,349,332 compared with 7,174,227 units at $110,200,209 on Monday.

Trading ended with an exchange of 17,429,449 shares at $353,349,332 compared with 7,174,227 units at $110,200,209 on Monday.

Trading averaged 281,120 shares at $5,699,183 compared with 137,966 units at $2,119,235 on Monday and month to date, an average of 147,748 units at $1,576,792, compared to 134,767 units at $1,175,554 on the previous day and below November with an average of 275,587 units at $2,488,949.

JMMB Group led trading with 11.12 million shares for 63.8 percent of total volume followed by Transjamaican Highway with 2.07 million units for 11.9 percent of the day’s trade and Kingston Wharves with 1.60 million units for 9.2 percent of the day’s trade.

The All Jamaican Composite Index declined 486.87 points to conclude trading at 347,967.73, the JSE Main Index fell 15.87 points to cease trading at 313,169.72 and the JSE Financial Index climbed 0.35 points to wrap up trading at 68.34.

The Main Market ended trading with an average PE Ratio of 13.4. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and five with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, Caribbean Producers skidded 25 cents to close at $9.07 after 41,669 stock units passed through the market, Eppley Caribbean Property Fund advanced 50 cents to close at $39.50 in an exchange of a mere 4 units, General Accident rose 44 cents and ended at $4.85 after 9,604 shares were traded. GraceKennedy rallied $1.50 in closing at $78 after an exchange of 11,942 stock units, Guardian Holdings fell $10 to $392 with a transfer of 651 shares, Jamaica Producers popped 74 cents to $22.75 after exchanging 8,105 units. Jamaica Stock Exchange declined 40 cents and ended at $9.20, with 5,047 stocks, clearing the market Massy Holdings sank 45 cents in closing at $89.50 while exchanging 430 stock units, NCB Financial gained 50 cents to close at $65.50 in switching ownership of 19,537 shares. Proven Investments increased 48 cents to end at $22.63 with investors transferring 2,400 stocks, Scotia Group climbed 90 cents to a 52 weeks’ closing high of $36.40, with 31,462 units crossing the market, Seprod increased $2.90 to close at $74.40 with investors dealing in 73,172 stock units. Stanley Motta dipped 84 cents to end at $5.21 with 720 shares being traded, Supreme Ventures climbed 30 cents in closing at $26 as investors exchanged 47,117 stock units, Sygnus Credit Investments rose 49 cents and ended at $10.99 after a transfer of 7,180 units. Sygnus Real Estate Finance lost 80 cents to $9.50 with investors swapping 114 stocks and Wisynco Group shed 49 cents in closing at $20.01, with 76,908 units changing hands,

Stanley Motta dipped 84 cents to end at $5.21 with 720 shares being traded, Supreme Ventures climbed 30 cents in closing at $26 as investors exchanged 47,117 stock units, Sygnus Credit Investments rose 49 cents and ended at $10.99 after a transfer of 7,180 units. Sygnus Real Estate Finance lost 80 cents to $9.50 with investors swapping 114 stocks and Wisynco Group shed 49 cents in closing at $20.01, with 76,908 units changing hands,

In the preference segment, Eppley 7.50% preference share dropped 80 cents to close at $6 with investors trading 10,511 stocks. Eppley 7.75% preference share gained $2.66 to end at $19 in an exchange of 2,000 shares, JMMB Group 7.25% preference share popped 35 cents and ended at $2 after trading 216 stock units, 138 Student Living preference share rallied $24 to $114, with 133 shares crossing the exchange. Productive Business Solutions 10.5% preference share fell $10 and ended at $1,090 in trading 55 stock units and Productive Business Solutions 9.75% preference share advanced $10.50 in closing at $115.50 with traders dealing in 51 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for JSE Main Market

Trading ended on Monday with a 35 percent jump in the volume of stocks traded after the value surged 312 percent more than on Friday on the Jamaica Stock Exchange Main Market and resulted from trading in 52 securities compared with 53 on Friday, with prices of 20 stocks rising, 17 declining and 15 ending unchanged, with the market rising to close off the day after the market indices gained much more than it lost on Friday

A total of 7,174,227 shares were traded for $110,200,209 up from 5,322,135 units at $26,717,369 on Friday.

A total of 7,174,227 shares were traded for $110,200,209 up from 5,322,135 units at $26,717,369 on Friday.

Trading averaged 137,966 shares at $2,119,235 which is above the 100,418 units at $504,101 on Friday and month to date, an average of 134,767 units at $1,175,554, compared to 134,482 units at $1,091,671 on the previous trading day and well below November with an average of 275,587 units at $2,488,949.

Wisynco Group led trading with 3.08 million shares for 42.9 percent of total volume, Transjamaican Highway was next with 2.27 million units for 31.7 percent of the day’s trade and Kingston Wharves 420,053 units for 5.9 percent market share.

The All Jamaican Composite Index gained 2,418.86 points to 348,454.60, the JSE Main Index rallied 1,868.21 points to 313,185.59 and the JSE Financial Index rose 0.46 points to end the day at 67.99.

The Main Market ended trading with an average PE Ratio of 12.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 12.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

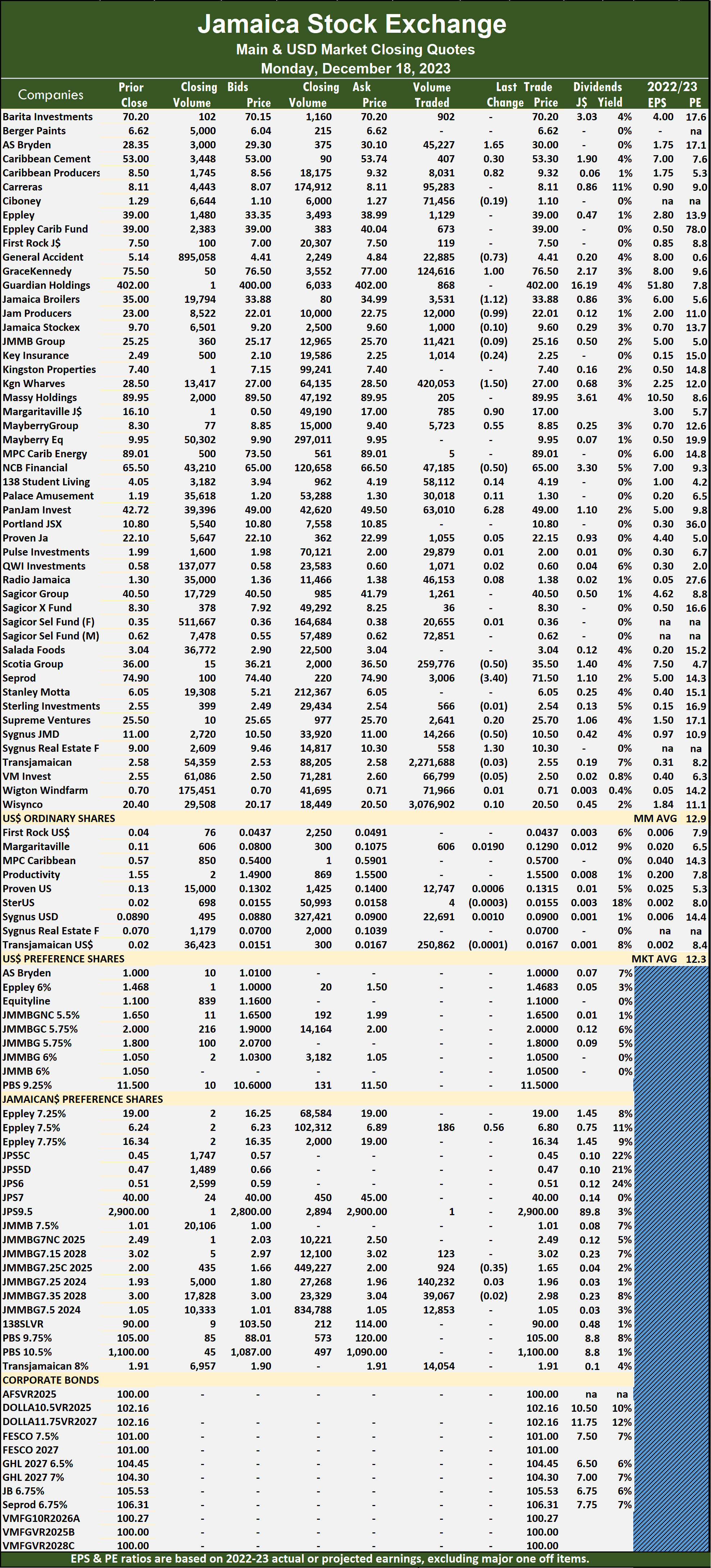

At the close, AS Bryden climbed $1.65 to end at $30 after an exchange of 45,227 stock units, Caribbean Cement increased 30 cents to close at $53.30, with 407 shares changing hands, Caribbean Producers popped 82 cents and ended at $9.32 with an exchange of 8,031 stocks. GraceKennedy rallied $1 to $76.50 with 124,616 units clearing the market, Jamaica Broilers fell $1.12 to close at $33.88 as investors exchanged 3,531 shares, Jamaica Producers dropped 99 cents to $22.01 in trading 12,000 stock units. Kingston Wharves shed $1.50 in closing at $27 after a transfer of 420,053 units, Margaritaville rose 90 cents and ended at $17 with investors dealing in 785 stocks,  Mayberry Group gained 55 cents to end at $8.85 in an exchange of 5,723 units. NCB Financial lost 50 cents to close at $65 with investors exchanging 47,185 stocks, Pan Jamaica jumped $6.28 to $49, with 63,010 shares crossing the exchange, Scotia Group skidded 50 cents to close at $35.50 with traders dealing in 259,776 stock units, following the stocks trading at a one year high of $37. Seprod sank $3.40 to $71.50 in switching ownership of 3,006 shares, Sygnus Credit Investments declined 50 cents and ended at $10.50 with investors swapping 14,266 stock units and Sygnus Real Estate Finance popped $1.30 to close at $10.30 after 558 stocks were traded.

Mayberry Group gained 55 cents to end at $8.85 in an exchange of 5,723 units. NCB Financial lost 50 cents to close at $65 with investors exchanging 47,185 stocks, Pan Jamaica jumped $6.28 to $49, with 63,010 shares crossing the exchange, Scotia Group skidded 50 cents to close at $35.50 with traders dealing in 259,776 stock units, following the stocks trading at a one year high of $37. Seprod sank $3.40 to $71.50 in switching ownership of 3,006 shares, Sygnus Credit Investments declined 50 cents and ended at $10.50 with investors swapping 14,266 stock units and Sygnus Real Estate Finance popped $1.30 to close at $10.30 after 558 stocks were traded.

In the preference segment, Eppley 7.50% preference share climbed 56 cents to $6.80 after an exchange of 186 stock units and JMMB Group 7.25% preference share dipped 35 cents in closing at $1.65 with investors trading 924 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big price movements for ICTOP10

The Main and Junior Markets closed the week slightly lower, resulting in big gains and losses in the Junior Market while movements in the Main Market were more moderate than the Junior Market stocks and surprisingly there is only one new entrant into the top 10 listings, this week.

Scotia Group released full year results with EPS of $5.54 and announced the payments of a dividend of 40 cents per share, with the price hitting a new one year high on Friday. The dividend suggests a minimum payment of $1.60 per share over the next twelve months. Based on historical norms of 40-50 percent payout of profits it should be a higher payout. With the release of 2023 full year results, ICInsider.com switched over to 2024 earnings, with EPS at $7.50. Buying interest picked up during the week. The stock trades at an extremely low PE of 4.8 times projected 2024 earnings and still only 6.5 times based on earnings for 2023. AMG Packaging trades at 6.5 times 2024 earnings with only 58,816 shares on offer at the close on Friday and so is Jamaica Teas, with offers now generally above $2.53, with buyers mostly at $2.30, some selling came in for Access Financial this week, Caribbean Cement also has limited stocks on offer and so does Seprod.

Scotia Group released full year results with EPS of $5.54 and announced the payments of a dividend of 40 cents per share, with the price hitting a new one year high on Friday. The dividend suggests a minimum payment of $1.60 per share over the next twelve months. Based on historical norms of 40-50 percent payout of profits it should be a higher payout. With the release of 2023 full year results, ICInsider.com switched over to 2024 earnings, with EPS at $7.50. Buying interest picked up during the week. The stock trades at an extremely low PE of 4.8 times projected 2024 earnings and still only 6.5 times based on earnings for 2023. AMG Packaging trades at 6.5 times 2024 earnings with only 58,816 shares on offer at the close on Friday and so is Jamaica Teas, with offers now generally above $2.53, with buyers mostly at $2.30, some selling came in for Access Financial this week, Caribbean Cement also has limited stocks on offer and so does Seprod.

Three Junior Market stocks gained 9 to 21 percent and three ended with 10 to 20 percent losses, while the Main Market had two stocks with worthwhile gains of 9 and 13 percent and three with sizable losses of 6 to 11 percent.

The Main Market ICTOP10 ended with, Key Insurance popping 13 percent to $2.49 and Scotia Group up 9 percent, while General Accident declined 11 percent to $4.50, Palace Amusement down 8 percent to $1.19 and  Caribbean Producers lost 6 percent to close at $8.50.

Caribbean Producers lost 6 percent to close at $8.50.

The Junior Market ended, with Iron Rock Insurance jumping 21 percent to $2.50, followed by Lasco Distributors and Lasco Manufacturing rising 9 percent each to $3.93 and $4.63 respectively. AMG Packaging dropped 20 percent to $2.30, Caribbean Cream and Jamaica Teas fell 10 percent to $3.31 and $2.30 respectively.

Tropical Battery dropped out of the Junior Market ICTOP10 and is replaced by Elite Diagnostic. There were no changes in the IC Main Market TOP10

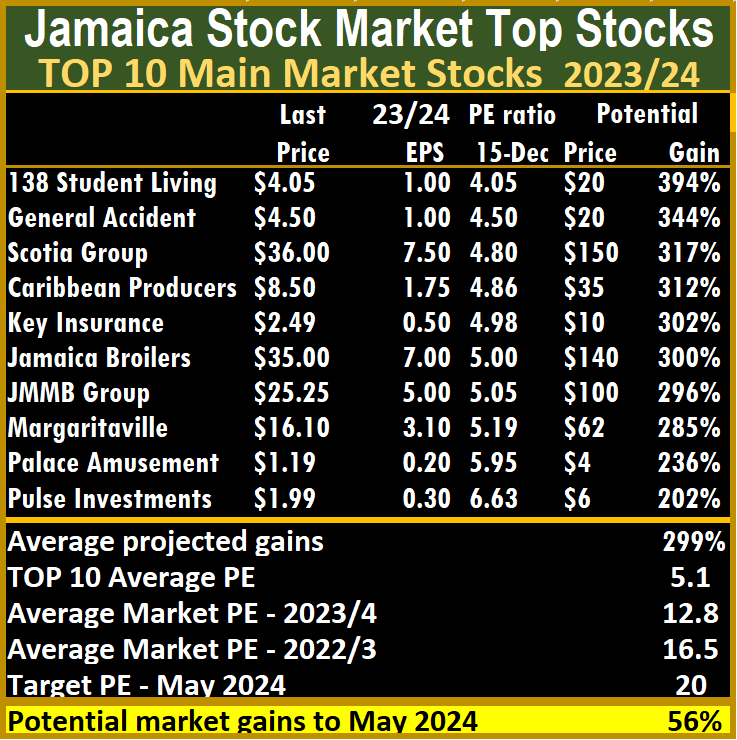

Indications of where stock prices could be by May 2024 can be seen from stocks with the highest values in the Main and Junior Markets.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 12.8. The Main Market ICTOP10 is projected to gain an average of 299 percent by May 2024, based on 2023 forecasted earnings and now provides better values than the Junior Market with the potential to gain 204 percent over the same time frame.

In the Main Market ICTOP 10, a total of 15 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 108, with an average of 28 and 18 excluding the highest PE ratios and a PE of 23 for the top half and 16 excluding the stocks with overweight values.

The PE of the Junior Market TOP10 sits at 6.8, over half of the market, with an average of 13.2. There are 13 stocks, or 27 percent of the market, with PEs from b>15 to 50, averaging 21, well above the market’s average. The top half of the market has an average PE of 18, possibly the lowest fair value for stocks.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 136

- Next Page »