The Junior Market climbed 47 percent in just over a year since the market collapsed by just over 39 percent in March last year from the close of 2019 when the market hit a multi-year low of 2,031.79 on March 18 last year.

At the same time, the JSE Main Market, while trading above the March 2001 low, is nowhere near the 2020 high and closed out the first quarter marginally down on the 2020 closing.

At the same time, the JSE Main Market, while trading above the March 2001 low, is nowhere near the 2020 high and closed out the first quarter marginally down on the 2020 closing.

The Junior Market is up 13 percent for 2021 to the end of March, clawing back most of 21 percent of the fall in 2020 and is now just 11 percent from the close of 3,348.97 at the end of December 2019.

In 2020, the Junior and Main Markets declined, with the Junior Market just edging out the Main Market index with a lower decline of 21 percent versus 22.6 percent for the year.

One year ago, to the end of March, the Junior Market Index dropped 29 percent to 2304.14 but was down a much steeper 47 percent to March 18, at 2031.79 points on the market index. The March 2020 low was the lowest point for the Junior Market since it closed at 2,032.77 points on July 1, 2016.

The market made some recovery last year from the year’s low when it moved higher on April 14, to 2,686.90 points but drifted down after some attempts to break over 2,600 points on a sustained level and closed out 2020 at 2,643.38.

In the meantime, the JSE Main Market failed to move higher in 2021, ending the first quarter 0.20 percent lower than the December close. It is still a bit lower than the 442,905.76 reached on the All Jamaica Composite Index after the early rebound from the 2020 low of 375,091.09 reached on March 25 last year, or the 438,045.18 reached subsequently on November 30.

In the meantime, the JSE Main Market failed to move higher in 2021, ending the first quarter 0.20 percent lower than the December close. It is still a bit lower than the 442,905.76 reached on the All Jamaica Composite Index after the early rebound from the 2020 low of 375,091.09 reached on March 25 last year, or the 438,045.18 reached subsequently on November 30.

The gains of eighteen stocks in the first quarter, this year, exceed that of the average of the market and just three performed worse, including CAC 2000 with a fall of 24 percent 19 percent decline for Dolphin Cove and 16 percent in the case of Knutsford Express. Five stocks contributing to the 2021 rebound for the Junior Market are Jamaican Teas up 60 percent, Indies Pharma 48 percent, Lumber Depot 47 percent, Blue Power 35 percent, Caribbean Flavours 35 percent and Fosrich 28 percent.

The Main Market recorded gains in 16 stocks that beat the market’s average move in 2021, with 26 falling below. Main market stocks with healthy gains are Ciboney with a stunning 142 percent rise, followed by Salada Foods with 125 percent gain aided by a 10 to one stock split, Grace Kennedy 37 percent, First Rock 31 percent and proven Investments 27 percent. Palace Amusement Company that the Covid-19 dislocation has badly hurt is the worst-performing stock with a 51 percent decline, followed by Portland JSX with a loss of 25 percent and Radio Jamaica with 22 percent. Wisynco lost 14 percent and Wigton Windfarm 13 percent.

The Main Market recorded gains in 16 stocks that beat the market’s average move in 2021, with 26 falling below. Main market stocks with healthy gains are Ciboney with a stunning 142 percent rise, followed by Salada Foods with 125 percent gain aided by a 10 to one stock split, Grace Kennedy 37 percent, First Rock 31 percent and proven Investments 27 percent. Palace Amusement Company that the Covid-19 dislocation has badly hurt is the worst-performing stock with a 51 percent decline, followed by Portland JSX with a loss of 25 percent and Radio Jamaica with 22 percent. Wisynco lost 14 percent and Wigton Windfarm 13 percent.

Fosrich APO coming

FosRich, a distributor of lighting, electrical and solar energy products and a Junior Market listed company, seems set to go back to the capital market to raise funds for expansion and reduce loan funding.

“We are currently examining a possible additional Public Offer (APO) in 2021,” managing director Cecil Foster stated in response to ICInsider.com enquiry as to why would they not take advantage of favourable market conditions currently to reduce the high debt load.

“We are currently examining a possible additional Public Offer (APO) in 2021,” managing director Cecil Foster stated in response to ICInsider.com enquiry as to why would they not take advantage of favourable market conditions currently to reduce the high debt load.

Fosrich borrowed debt totalling $1.6 billion is more than twice the Shareholders’ equity of $869 million at the end of December last year. The company has lent nearly $400 million to a related party that should be repaid this year, with the proceeds expected to reduce the debt load. Even after that, the company will still be overleveraged and will need approximately $500 million in new equity to bring its financing to accepted levels. Any new issue seems unlikely until the last quarter of 2021, with the company annual general meeting that will likely be held in August, as was the case in 2020 that would most likely approve such an issue. Additionally, with the stock now price over $5, a stock split would likely be considered to be approved at the 2021 AGM.

The company had a successful 2020 financial year with increased profits from rising sales and the stock price rising 31 percent so far in 2021.

Rising Junior Market shifts up IC TOP10

During the past week, the Junior Market moved decisively up, with the market index closing well above the 2,900 mark that became a barrier for weeks, surpassing the 3,000 level, but closed trading since Tuesday just a few points below and is poised to move higher in the weeks ahead. Main Market stocks remain in the consolidation zone awaiting profit results to move prices higher.

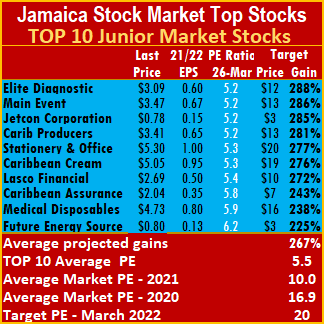

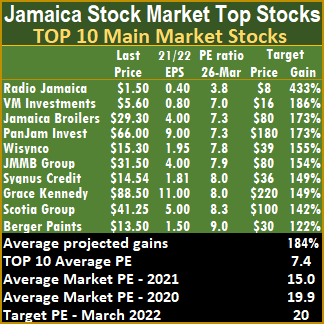

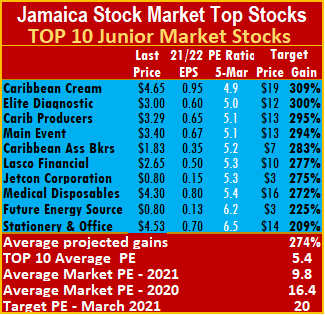

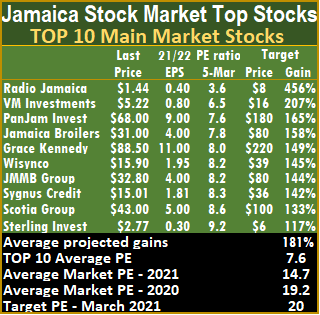

TOP 10 stocks had a few changes during the past week, with Berger Paints back in the Main Market TOP10, replacing Sterling Investments that entered the list last week, while in the Junior Market, Caribbean Assurance Brokers returns to the TOP 10 as General Accident moved out.

TOP 10 stocks had a few changes during the past week, with Berger Paints back in the Main Market TOP10, replacing Sterling Investments that entered the list last week, while in the Junior Market, Caribbean Assurance Brokers returns to the TOP 10 as General Accident moved out.

This publication has stated that Junior Market TOP10 contains several companies that suffered a sharp reversal of fortunes in 2020, with recovery projected in 2021. Green shoots are showing for some with sales picking up in recent quarters, with improving profit. Some of these companies may require another quarter or two of improvement before meaningful buying starts. Main Event is one such company, reporting a profit on reduced income for the January quarter. Revenues climbed solidly in the latest quarter over the October and July quarters, but still far below the prior year’s level.

Caribbean Producers is another that will definitely benefit from pick up in the tourist trade later in the year. Expect also companies such as Knutsford Express, Express Catering and Stationery and Office Supplies to be on that list.

Caribbean Producers is another that will definitely benefit from pick up in the tourist trade later in the year. Expect also companies such as Knutsford Express, Express Catering and Stationery and Office Supplies to be on that list.

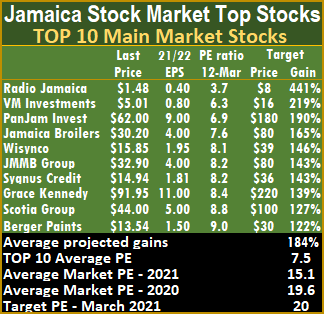

The Main Market has a number in the list that have put out record profits or show signs of strong earnings in 2021, with the stocks clearly undervalued; these include JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

Both the Junior Market and the Main Market continue to get support from technical indicators that point to robust gains ahead. To benefit from the growth in the market to come, many investors will need to be on board at an early stage.

This week’s focus: Future Energy Source Company Initial Public Offer of 500 million shares at 80 cents per share opens on Wednesday, with pretax earnings for the fiscal year to March this year around 7 cents per shares. The shares should be snapped up quickly by investors, with the company having long-term prospects for strong growth.

This week’s focus: Future Energy Source Company Initial Public Offer of 500 million shares at 80 cents per share opens on Wednesday, with pretax earnings for the fiscal year to March this year around 7 cents per shares. The shares should be snapped up quickly by investors, with the company having long-term prospects for strong growth.

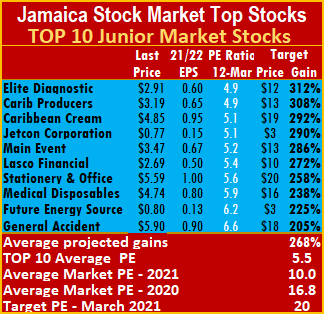

The top three stocks in the Junior Market mostly changed, with the potential to gain between 285 to 288 percent are Elite Diagnostic, followed by Main Event and Jetcon Corporation. The top three Main Market stocks with expected gains of 173 to 433 percent are Radio Jamaica, followed by VM Investments and Jamaica Broilers.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10, based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.4 or 50 percent of the PE of that market.

The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.4 or 50 percent of the PE of that market.

The average projected gain for the Junior Market IC TOP 10 stocks is 267 percent and 184 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Fesco IPO opens next week

Future Energy Source Company (Fesco) initial public offer of shares will open at 9 am on Wednesday, March 31 and close on April 9, at 4 PM, unless it closes earlier.

The issue comprises 300 million new shares with 200 million to be sold by existing shareholders at 80 cents each. If successful, the total issued shares will be 2.5 billion, with the shares slated to list on the Jamaica Stock Exchange Junior Market.

The issue comprises 300 million new shares with 200 million to be sold by existing shareholders at 80 cents each. If successful, the total issued shares will be 2.5 billion, with the shares slated to list on the Jamaica Stock Exchange Junior Market.

The projection shows a profit of $151 before taxes for the year ended March 2021 from revenues of $7 billion and earnings per share of 7 cents. The company forecast revenues of $106 billion and a profit of $264 million or 10.5 cents per share for 2022.

ICInsider.com had earlier done a detailed review of the offer and rated it a buy with long term growth prospects as there is much room for expansion as it currently has only 14 service stations under its banner. NCB Capital Markets is the lead broker.

Steady market steadies IC TOP10

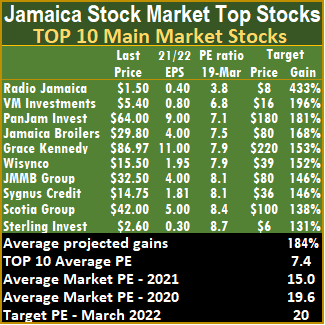

The JSE Main Market and Junior Market slipped to end the week marginally lower than the close of the previous week. Against the background, Berger Paints was the only stock moving out of the TOP10 as it made way for Sterling Investments.

Junior Market stocks kept above the 2,900 mark of the market index only slipping below that level just one day during the week, as the market continues to consolidate in the move higher. Main Market stocks made attempts to break clear of the consolidation zone but the market is awaiting some strong profit results to move prices and that will not come until late April.

Junior Market stocks kept above the 2,900 mark of the market index only slipping below that level just one day during the week, as the market continues to consolidate in the move higher. Main Market stocks made attempts to break clear of the consolidation zone but the market is awaiting some strong profit results to move prices and that will not come until late April.

The publication has stated that Junior Market TOP10 contains several companies that suffered a sharp reversal of revenues and profit in 2020, with recovery projected for them in 2021. Green shoots are showing for some with sales picking up in recent quarters with improving bottom-line. Some of these companies may require another quarter or two of improving fortunes before there is meaningful buying into them. Main Event is one such company and it reported a profit on reduced income for the January quarter with revenues climbing solidly in the latest quarter over the October and July quarters.

The Main Market has a number in the list that have put out record profits or show signs of strong earnings in 2021, with the stocks clearly undervalued, these include, JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

The Main Market has a number in the list that have put out record profits or show signs of strong earnings in 2021, with the stocks clearly undervalued, these include, JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

Both the Junior Market and the Main Market continue to get support from technical indicators that point to robust gains ahead. To benefit from the growth in the market to come many investors will need to be on board at an early stage.

This week’s focus: Limners and Bards reported strong first quarter results with rising revenues and profit. Revenues grew a strong 36 percent over the 2020 period to $356 million with profit rising 36 percent to $67 million as cost of operations rising 38 percent over the 2020 period. The company nevertheless seems set to nearly doubling profit for the full year, with profit of $192 million and earnings per share of 20 cents.

This week’s focus: Limners and Bards reported strong first quarter results with rising revenues and profit. Revenues grew a strong 36 percent over the 2020 period to $356 million with profit rising 36 percent to $67 million as cost of operations rising 38 percent over the 2020 period. The company nevertheless seems set to nearly doubling profit for the full year, with profit of $192 million and earnings per share of 20 cents.

The top three stocks in the Junior Market with the potential to gain between 292 to 312 percent are Main Event followed by Stationery and Office Supplies and Caribbean Producers. With expected gains of 181 to 433 percent, the top three Main Market stocks are, Radio Jamaica, followed by VM Investments and PanJam Investment.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10, based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.4 or 49 percent of the PE of that market.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10, based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.4 or 49 percent of the PE of that market.

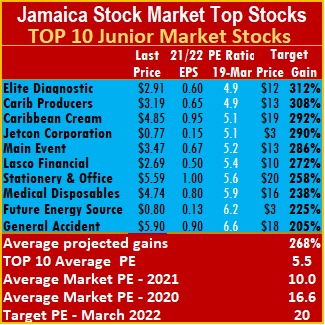

The average projected gain for the Junior Market IC TOP 10 stocks is 268 percent and 184 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

More changes to IC TOP10 stocks

Berger Paints returns to the TOP 10 Main Market stocks while Sterling Investments drifted out, while the price of Caribbean Assurance Brokers rose 26 percent to $2.30 during the week and tumbled out of the Junior Market TOP10 and is replaced by General Accident.

Elsewhere, the 2021 TOP 15 listed Carreras that migrated from the 2021 ICTOP10 in February hit a new 52 weeks’ high during the week to sit at $10 for a rise of 45 percent for the year to date. The price could climb further, helped by improving profit and a high dividend yield. Future Energy Source (Fesco) hangs onto the Junior Market TOP10 list at the tenth position, with the prospectus still to be released to the public.

Elsewhere, the 2021 TOP 15 listed Carreras that migrated from the 2021 ICTOP10 in February hit a new 52 weeks’ high during the week to sit at $10 for a rise of 45 percent for the year to date. The price could climb further, helped by improving profit and a high dividend yield. Future Energy Source (Fesco) hangs onto the Junior Market TOP10 list at the tenth position, with the prospectus still to be released to the public.

Junior Market stocks continue to fight clear of the 2,900 level of the market index for another week, but they closed above it on the last two days of the week, as the market continues to consolidate around that level. Main Market stocks made gains during the week, adding 1,524 points as they try to break clear of the consolidation zone.

The Junior Market TOP10 contains companies that suffered a sharp reversal of revenues and profit in 2020, with recovery projected for them in 2021. Green shoots are showing for some, with sales picking up in recent quarters with improving bottom-line. Some of these companies may require another quarter or two of improving fortunes before there is meaningful buying into them. The Main Market has a number in the list that has put out record profits or shows strong earnings in 2021, with the stocks clearly undervalued. These include JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

The Junior Market TOP10 contains companies that suffered a sharp reversal of revenues and profit in 2020, with recovery projected for them in 2021. Green shoots are showing for some, with sales picking up in recent quarters with improving bottom-line. Some of these companies may require another quarter or two of improving fortunes before there is meaningful buying into them. The Main Market has a number in the list that has put out record profits or shows strong earnings in 2021, with the stocks clearly undervalued. These include JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

Both the Junior Market and the Main Market continue to be supported by technical indicators that point to robust gains ahead that are backed up by a number of companies reporting positive profit results with their stock undervalued currently.

The top three stocks in the Junior Market with the potential to gain between 292 to 312 percent are Elite Diagnostic, followed by Caribbean Producers and Caribbean Cream. With expected gains of 190 to 441 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment.

The top three stocks in the Junior Market with the potential to gain between 292 to 312 percent are Elite Diagnostic, followed by Caribbean Producers and Caribbean Cream. With expected gains of 190 to 441 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 15.1 and the Junior Market 10, based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average.  The Main Market TOP 10 stocks trade at a PE of 7.5 or 50 percent of that market’s PE.

The Main Market TOP 10 stocks trade at a PE of 7.5 or 50 percent of that market’s PE.

The average projected gain for the Junior Market IC TOP 10 stocks is 268 percent and 184 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

More growth for Grace

Fresh from a record-breaking profit performance in 2020, Grace Kennedy announced the signing of an agreement to acquire all the shares of Scotia Insurance Eastern Caribbean Limited subject to regulatory approval.

Grace Kennedy HQ in Kingston

Scotia Insurance operates in seven countries in the Eastern Caribbean: Anguilla, Antigua and Barbuda, Dominica, Grenada, St. Kitts and Nevis, St. Lucia and St. Vincent and the Grenadines. Scotia Insurance offers credit protection regionally to customers of Scotiabank on personal loans, residential mortgages, personal lines of credit, personal and small business credit cards.

According to Don Wehby, CEO of Grace Kennedy, “the operation is profitable but not highly profitable”. Grace’s ownership is likely to result in lower operating cost and a vehicle to do business in other countries and for other financial institutions.

In an investors briefing on Monday, Wehby stated that the proposed acquisition is one of ten that the group is looking at currently, at various stages of assessment or negotiation, including some being stress tested and others at the legal stages.

Wehby in answer to a question on the growth rate of 2020 continuing into 2021 confirmed, that it will as the 2020 growth was achieved after years of work to lay the foundation for it to happen.

tTech limited is a Junior Market that seems set to benefit when the acquisition is concluded, the extent of its involvement will depend on the technology in use and whether the acquisition will continue to utilize the current infrastructure or not. tTech is a major Information Technology supplier to Grace.

Grace is listed on the Jamaica Stock Exchange and currently trades at $90.99, the shares are trading on the Trinidad and Tobago Stock Exchange at TT$4.50, in line with the JSE price.

Fesco, JMMB & Sygnus in IC TOP10 stocks

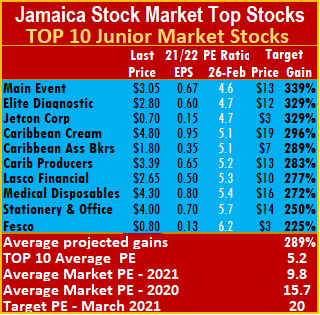

IC TOP10 stocks are now based on earnings for 2021/22 fiscal years. Of the January listing, Access Financial Services moved out of the TOP 10 Junior Market list while Main Market QWI Investment and Carreras fell from the Main market list with increased prices.

Coming into the TOP10 are Fesco, the latest IPO that is expected to come to market shortly, with the prospectus having been released but temporarily withdrawn to correct some errors. JMMB Group and Sygnus Credit Investments are now in the TOP10 Main market listing.

Coming into the TOP10 are Fesco, the latest IPO that is expected to come to market shortly, with the prospectus having been released but temporarily withdrawn to correct some errors. JMMB Group and Sygnus Credit Investments are now in the TOP10 Main market listing.

Since the start of the year, the Junior Market is up 10.5 percent, with 11 companies’ stock rising between 20 and 63 percent, including four with gains from 49 percent up. The Main Market, on the other hand, is marginally down for the year by less than one percent, with five stocks recording gains between 21 percent and 47 percent and Ciboney rising 500 percent for the year to date.

The Junior Market and the Main Market moves are supported by technical indicators, pointing to robust gains ahead and back up by some companies reporting positive profit results.

This week’s focus: Grace Kennedy had outstanding results for 2020 with much more to come in 2021; expect the price to move sharply over the next few weeks. Caribbean Cement reported a 70 percent rise in profit for 2020 and is projected to earn $6.70 for 2021, the stock is an ideal candidate to move higher in the weeks ahead.

This week’s focus: Grace Kennedy had outstanding results for 2020 with much more to come in 2021; expect the price to move sharply over the next few weeks. Caribbean Cement reported a 70 percent rise in profit for 2020 and is projected to earn $6.70 for 2021, the stock is an ideal candidate to move higher in the weeks ahead.

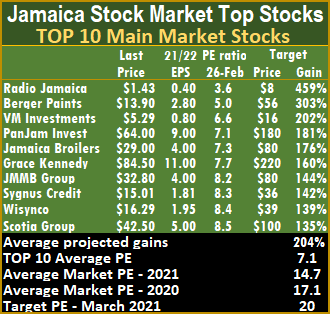

The top three stocks in the Junior Market can gain between 329 to 339 percent are Main Event followed by Elite Diagnostic and Jetcon. With expected gains of 202 to 459 percent, the top three Main Market stocks are Radio Jamaica, followed by Berger Paints and VM Investments.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, a clear indication of strong gains ahead. The JSE Main Market ended the week, with an overall PE of 14.7 and the Junior Market 9.8 based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.2 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.1 or 48 percent of the PE of that market.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, a clear indication of strong gains ahead. The JSE Main Market ended the week, with an overall PE of 14.7 and the Junior Market 9.8 based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.2 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.1 or 48 percent of the PE of that market.

The average projected gain for the Junior Market IC TOP 10 stocks is 289 percent and 204 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The average projected gain for the Junior Market IC TOP 10 stocks is 289 percent and 204 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

The Main Market has a number in the list that have put out record profits or show signs of strong earnings with the stocks clearly undervalued; these include, JMMB Group, Jamaica Broilers, Sygnus Credit Investments, Grace Kennedy are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

The Main Market has a number in the list that have put out record profits or show signs of strong earnings with the stocks clearly undervalued; these include, JMMB Group, Jamaica Broilers, Sygnus Credit Investments, Grace Kennedy are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside. With expected gains of 165 to 456 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment.

With expected gains of 165 to 456 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment.  The average projected gain for the Junior Market IC TOP 10 stocks is 274 percent and 181 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The average projected gain for the Junior Market IC TOP 10 stocks is 274 percent and 181 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.