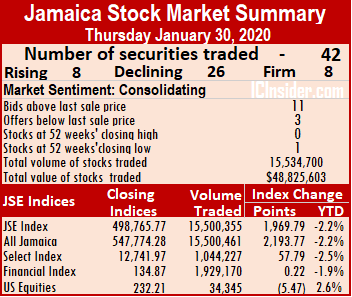

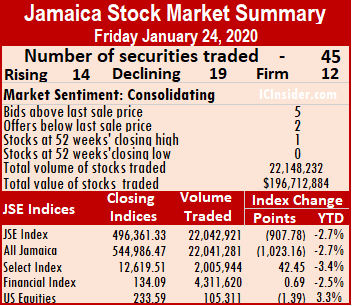

Volume trading on the Main Market of the Jamaica Stock Exchange fell sharply to half of Wednesday’s level while the value of all stocks trading fell to just 15 percent of that on Wednesday.

Volume trading on the Main Market of the Jamaica Stock Exchange fell sharply to half of Wednesday’s level while the value of all stocks trading fell to just 15 percent of that on Wednesday.

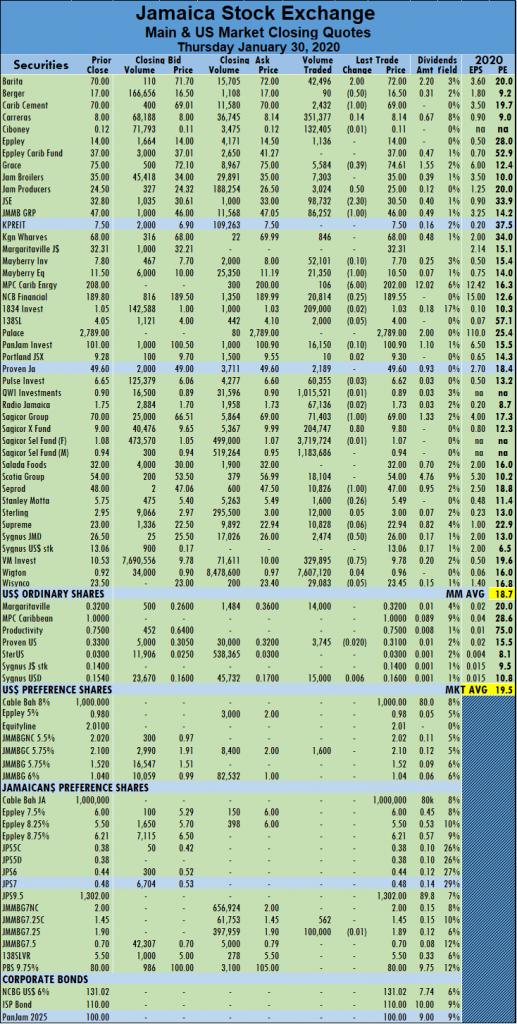

The JSE Main Market activity ended with 38 securities accounting for 15,500,355 units valued at just $47,239,549 in contrast to 31,689,008 units valued at $315,401,563 from 37 securities on Wednesday.

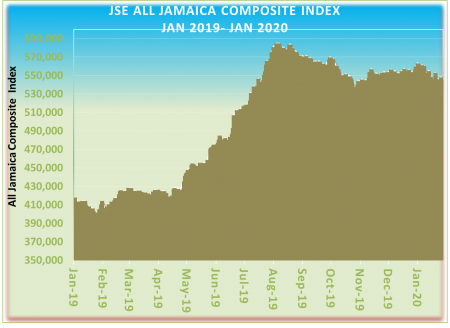

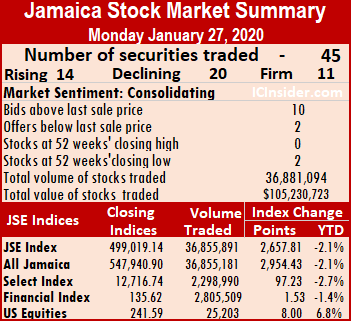

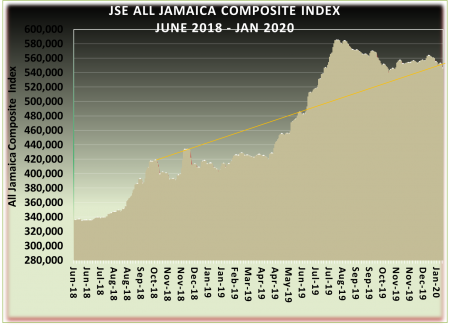

At the close, the JSE All Jamaican Composite Index advanced 2,193.77 points to 547,774.28, the JSE Market Index added 1,969.79 points to close at 498,765.77 and the JSE Financial Index gained 0.22 points to end at 134.87.

Trading closed with 42 securities changing hands in the Main and US dollar markets with the prices of 8 advancing, 26 declining and eight trading firm.

Wigton Windfarm dominated trading with 7.6 million shares for 49 percent of total volume, followed by Sagicor Select Financial Fund with 3.7 million units for 24 percent of the day’s trade and Sagicor Select Manufacturing and Distribution Fund with 1.2 million shares for 7.6 percent of market volume. QWI Investments, with 1.015 million shares, was the only other stock trading more than one million units.

The market closed with an average of 407,904 units at $1,243,146 for each security traded, in contrast to 856,460 units valued at an average of $8,524,367 on Wednesday. The average volume and value for the month to date amounts to 626,696 units valued at $3,584,638for each security changing hands, compared to 636,606 units valued at $3,530,001 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

The market closed with an average of 407,904 units at $1,243,146 for each security traded, in contrast to 856,460 units valued at an average of $8,524,367 on Wednesday. The average volume and value for the month to date amounts to 626,696 units valued at $3,584,638for each security changing hands, compared to 636,606 units valued at $3,530,001 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows eleven stocks ending with bids higher than their last selling prices and three closing with lower offers. The PE ratio of the market ended at 19.5, while the Main Market ended at 18.7 times the 2019 earnings.

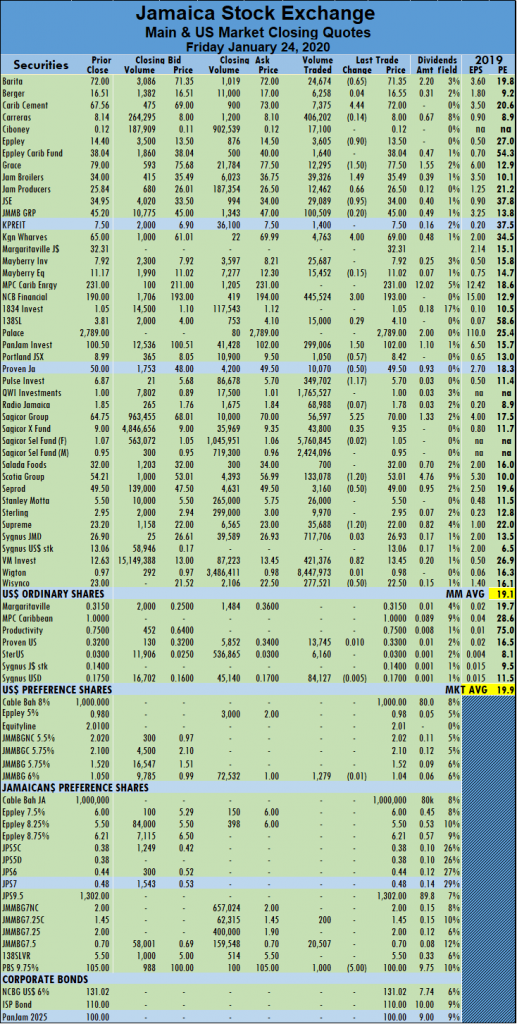

In the Main Market, Barita Investments climbed $2 to $72 in transferring 42,496 shares, Berger Paints lost 50 cents to close at $16.50, with an exchange of just 90 units, Caribbean Cement settled at $69, having lost $1 in trading 2,432 shares. Grace Kennedy lost 39 cents to close at $74.61, with 5,584 units changing hands, Jamaica Producers gained 50 cents to end at $25, after transferring 3,024 units, Jamaica Stock Exchange dropped $2.30 to settle at $30.50 trading 98,732 shares.  JMMB Group slipped $1 to $46, with an exchange of 86,252 shares, Mayberry Jamaican Equities closed $1 lower to $10.50 transferring 21,350 shares, MPC Caribbean Clean Energy fell $6 to end at $202, after swapping 106 units. NCB Financial Group declined by 25 cents to $189.55, after exchanging 20,814 shares, Sagicor Group ended at $69, after a loss of $1, in trading 71,403 stock units, Sagicor Real Estate Fund gained 80 cents to settle at $9.80, with 204,747 shares changing hands. Seprod lost $1 transferring 10,826 shares to close at $47, Sygnus Credit Investments closed 50 cents lower to $26, with an exchange of 2,474 shares and Victoria Mutual Investments ended the day’s trade at $9.78, after losing 75 cents in trading 329,895 units.

JMMB Group slipped $1 to $46, with an exchange of 86,252 shares, Mayberry Jamaican Equities closed $1 lower to $10.50 transferring 21,350 shares, MPC Caribbean Clean Energy fell $6 to end at $202, after swapping 106 units. NCB Financial Group declined by 25 cents to $189.55, after exchanging 20,814 shares, Sagicor Group ended at $69, after a loss of $1, in trading 71,403 stock units, Sagicor Real Estate Fund gained 80 cents to settle at $9.80, with 204,747 shares changing hands. Seprod lost $1 transferring 10,826 shares to close at $47, Sygnus Credit Investments closed 50 cents lower to $26, with an exchange of 2,474 shares and Victoria Mutual Investments ended the day’s trade at $9.78, after losing 75 cents in trading 329,895 units.

Trading in the US dollar market ended with 34,345 units valued at over US$11,249. The market index declined 5.47 points to close at 232.21. JMMB Group 5.75% preference share closed at US$2.10, with 1,600 units changing hands. Margaritaville Turks traded 14,000 units at 32 US cents, Proven Investments lost 2 US cents to settle at 31 US cents after transferring 3,745 units and Sygnus Credit Investments gained just under 1 US cent in trading 15,000 units to end at 16 US cents.

TTSE record gains on Thursday

The Trinidad & Tobago Stock Exchange market recorded gains on Thursday, with Republic Holdings climbing $3 to $140 and seems poised to move much higher.

Republic Holdings hits a 52 weeks’ high of $140.

The T&T Composite Index gained 3.23 to close at 1,493.65. The All T&T Index rose 6.41 points to 1,892.44 while the Cross Listed Index remained at 148.34. Trading resulted in an exchange of 102,489 shares, amounting to $2,231,866 compared to 53,255 shares at $2,164,720 on Wednesday.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with the bids of five stocks higher than their last selling prices and one with a lower offer.

Gains| Guardian Holdings gained 5 cents and closed at $22, with 55,749 stock units changing hands, National Flour ended trading 250 stock units with a rise of 5 cents to $1.45. Prestige Holdings rose 10 cents to $9, with investors exchanging ten shares, Republic Financial climbed $3 to end at a 52 weeks’ high of $140, with 200 units crossing the exchange and L.J Williams added at 5 cents to close at $1.55, with 8,150 units changing hands.

Losses| One Caribbean Media fell 25 cents and ended at a 52 weeks’ low of $8, after exchanging 8,110 shares and Trinidad & Tobago NGL lost 5 cents in trading 4,372 shares to close at $20.90 after trading at a 52 weeks’ low of $20.88 earlier in the day.

Firm Trades| Ansa McAl settled at $55.30, after exchanging 4,000 shares, Clico Investment traded 2,138 shares at $28.48, First Caribbean International Bank ended at $7.85, with 100 stock units changing hands, Grace Kennedy closed at $3.95, with investors exchanging 828 shares. JMMB Group exchanged 7,000 shares to settle at $2.74, while Massy Holdings traded 2,343 shares at $62. National Enterprises ended at $5.50, with 20 stock units changing hands, NCB Financial ended at $11.29, with investors exchanging 300 shares and West Indian Tobacco concluded the trading 8,919 shares at $40.

Prices of securities trading are those at which the last trade took place.

TTSE slips moderately on Wednesday

First Citizens Bank closed at 52 weeks’ high on Wednesday.

The Trinidad & Tobago Stock Exchange market indices closed on Wednesday with minor declines with advancing stocks outnumbering declining ones.

The market closed with 13 securities changing hands, compared to 18 on Tuesday, with five gaining, two declining and the prices of six remained unchanged. One stock closed at 52 weeks’ high.

The T&T Composite Index slipped 0.67 to close at 1,490.42. The All T&T Index shed 1.22 points to 1,886.03 while the Cross Listed Index inched just 0.02 points lower to 148.34. Trading resulted in an exchange of 53,255 shares, for $2,164,720 compared to 248,341 shares, amounting to $4,079,099 on Tuesday.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with the bids of five stocks higher than their last selling prices and three with lower offers.

Gains| First Citizens Bank added 30 cents and ended at a 52 weeks’ high of $46.80, with 5,974 stock units trading, JMMB Group gained 4 cents and ended at $2.70, with investors exchanging 2,503 shares.  Massy Holdings ended trading 11 cents higher at $62, after a transfer of 18,201 shares, Scotiabank increased 27 cents to $61.49, with 3,923 units changing hands and Trinidad & Tobago NGL rose 5 cents in trading 6,977 shares to close at $20.95.

Massy Holdings ended trading 11 cents higher at $62, after a transfer of 18,201 shares, Scotiabank increased 27 cents to $61.49, with 3,923 units changing hands and Trinidad & Tobago NGL rose 5 cents in trading 6,977 shares to close at $20.95.

Losses| NCB Financial slipped 1 cent to end at $11.29, with 101 stock units changing hands and West Indian Tobacco lost 65 cents to close at $40, with an exchange of 7,661 units.

Firm Trades| Clico Investment traded 103 shares at $28.48, First Caribbean International Bank ended at $7.85, with investors exchanging 1,000 shares, Grace Kennedy completed trading at $3.95, with 2,000 units crossing the exchange. Guardian Holdings settled at $21.95, with 175 stock units changing hands. National Enterprises traded 1,200 shares at $5.50, and Prestige Holdings ended at $8.90, with 3,437 stock units changing hands.

Prices of securities trading are those at which the last trade took place.

TTSE closed slightly up on Tuesday

First Citizens Bank closed at a 52 weeks’ high on TTSE on Tuesday.

The Trinidad & Tobago Stock Exchange closed on Tuesday with the two major market indices finishing higher than at the close on Monday, with an equal number of declining and advancing stocks.

The market closed with 18 securities changing hands, compared to 19 on Monday, with five gaining, five declining and the prices of nine remained unchanged. Two stocks closed at 52 weeks’ high and two at 52 weeks’ lows.

The T&T Composite Index advanced 1.99 points to close at 1,491.09. The All T&T Index gained 4.36 points to 1,887.25, while the Cross Listed Index lost just 0.06 points to close at 148.36. Trading resulted in an exchange of 248,341 shares, for a sum of $4,079,099 compared to 239,819 shares, amounting to $4,423,787 on Monday.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with the bids of four stocks higher than their last selling prices and none with a lower offer.

Gains| Angostura Holdings rose 13 cents and settled at a 52 weeks’ high of $16.30, with 20 units crossing the exchange, First Citizens added 40 cents and ended at a 52 weeks’ high of $46.50, with 6,250 stock units trading, Scotiabank increased 21 cents to $61.22, with 6,883 units changing hands. Trinidad & Tobago NGL rose 10 cents in trading 67,550 shares to close at $20.90 and West Indian Tobacco increased by 60 cents to close at $40.65, with an exchange of 12,184 units.

Losses| First Caribbean International Bank dropped 5 cents and ended at $7.85, with investors exchanging 9,656 shares, Guardian Holdings declined 4 cents and settled at $21.95, with 10,300 stock units changing hands. Guardian Media dropped 25 cents and settled at 52 weeks’ low of $6.75, with investors exchanging 4,414 shares, Massy Holdings ended trading 10 cents lower at $61.89, after a transfer of 1,055 shares and LJ Williams declined 19 cents and settled at $1.50, with 26,013 units changing hands.

Firm Trades| Ansa McAl closed at $55.30, with an exchange of 40 units, Grace Kennedy completed trading at $3.95, with 85,517 units crossing the exchange, JMMB Group ended at $2.70, with investors exchanging 400 shares. NCB Financial ended at $11.30, with 38 stock units changing hands, One Caribbean Media settled at $8.25, with 1,340 units crossing the exchange, Prestige Holdings ended at $8.90, with 5,000 stock units changing hands and Republic Financial completed trading 2,750 units at $137.

Prices of securities trading are those at which the last trade took place.

TTSE closed down on Monday

Trinidad & Tobago Stock Exchange Head Quarters

The Trinidad & Tobago Stock Exchange closed on Monday with the two major market indices falling, as declining stocks were twice as many as those rising.

Trading resulted in an exchange of 239,819 shares, for a sum of $4,423,787 compared to 403,858 shares, amounting to $5,540,178 on Friday.

The market closed on Monday with 19 securities trading, compared to 18 on Friday, with three gaining, six declining and the prices of ten closed unchanged. One stock closed at 52 weeks’ high and two at 52 weeks’ lows.

The T&T Composite Index dipped 0.94 to 1,489.10. The All T&T Index declined by a sizable 9.58 points to 1,882.89, while the Cross Listed Index gained 1.07 points to close at 148.42.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with the bids of five stocks higher than their last selling prices and one with a lower offer.

Gains| NCB Financial gained 15 cents and settled at $11.30, after exchanging 1,100 shares, Republic Financial rose 50 cents and completed trading at a 52 weeks’ high of $137, with 1,237 units changing hands and Unilever Caribbean added 23 cents and settled at $22.23, after exchanging 1,403 shares.

Losses| National Enterprises closed with a loss of 20 cents at $5.50, with investors exchanging 10,000 shares, One Caribbean Media declined by 13 cents and settled at a 52 weeks’ low of $8.25, with 300 units changing hands, Scotiabank shed 98 cents and completed trading 921 shares at $61.01.  Trinidad & Tobago NGL lost 20 cents in trading 93,576 shares and closed at a 52 weeks’ low of $20.80, Trinidad Cement declined 3 cents to end at $1.95, with 32,656 stock units changing hands and West Indian Tobacco dropped 60 cents and settled at $40.05, with 800 stock units crossing the exchange.

Trinidad & Tobago NGL lost 20 cents in trading 93,576 shares and closed at a 52 weeks’ low of $20.80, Trinidad Cement declined 3 cents to end at $1.95, with 32,656 stock units changing hands and West Indian Tobacco dropped 60 cents and settled at $40.05, with 800 stock units crossing the exchange.

Firm Trades|Clico Investments completed trading at $28.50, with 16,414 stock units changing hands, CinemaOne closed at $5.75, with 500 units crossing the exchange, First Caribbean International Bank ended at $7.90, with an exchange of 650 units. First Citizens Bank closed at $46.10, with 1,580 units changing hands, Grace Kennedy completed trading of 12,416 stock units at $3.95, Guardian Holdings settled at $21.99, with 1,354 stock units changing hands. JMMB Group settled at $2.70, with 38,261 stock units, Massy Holdings completed trading at $61.99, with 20,625 units, National Flour ended at $1.40, after exchanging 3,400 shares and Prestige Holdings ended at $8.90 after 2,626 shares changed hands.

Prices of securities trading are those at which the last trade took place.

TTSE closed week with gains on Friday

First Citizens Bank closed at 52 weeks’ high on Friday.

The Trinidad & Tobago Stock Exchange closed on Friday with gains in the market indices as more stocks rose than declined.

Trading resulted in an exchange of 403,858 shares, for a sum of $5,540,178 compared to 225,598 shares, amounting to $3,601,556 on Thursday.

The market closed on Friday with 18 securities trading, compared to 11 on Thursday, with eight gaining, four declining as the prices of six closed unchanged. Two stocks closed at 52 weeks’ high and one at 52 weeks’ low.

The T&T Composite Index rose 3.76 points to 1,490.04. The All T&T Index gained 3.87 points to 1,892.47, while the Cross Listed Index added 0.50 points to close at 147.35.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with the bids of three stocks higher than their last selling prices and two with lower offers.

Gains| Clico Investments closed with a gain of 25 cents at $28.50, with 106,891 units trading, First Caribbean International Bank gained 5 cents and settled at $7.90, with 506 units changing hands, First Citizens Bank finished trading of 700 shares after rising 10 cents to end at a 52 weeks’ high of $46.10. Grace Kennedy closed with an increase of 5 cents and closed at $3.95, with 26,017 units changing hands, Guardian Holdings rose 48 cents and settled at $21.99, after exchanging 8,960 shares, JMMB Group ended trading of 157,602 shares with a gain of 4 cents at $2.70.  Massy Holdings rose 48 cents and ended at $61.99, with 9,025 units changing hands and Republic Financial added 49 cents and ended at a 52 weeks’ high of $136.50, after exchanging just 50 shares.

Massy Holdings rose 48 cents and ended at $61.99, with 9,025 units changing hands and Republic Financial added 49 cents and ended at a 52 weeks’ high of $136.50, after exchanging just 50 shares.

Losses| Scotiabank lost 1 cent and completed trading of 2,347 units at $61.99, Trinidad & Tobago NGL lost 60 cents in trading 16,246 shares and closed at $21. West Indian Tobacco ended trading with 1,120 units and lost 35 cents to settle at $40.65 and Unilever Caribbean shares fell 15 cents to $22 in swapping 2,853 shares.

Firm Trades| Angostura Holdings completed trading of 1,000 stock units at $16.17, CinemaOne ended at $5.75, after exchanging 1,000 shares, Guardian Media settled at $7, after swapping of 2,759 shares. National Flour concluded trading of 2,051 units at $1.40, One Caribbean Media closed at $8.38, with an exchange of 64,231 stock units and Trinidad Cement ended at $1.98, with 500 units crossing the exchange.

Prices of securities trading are those at which the last trade took place.

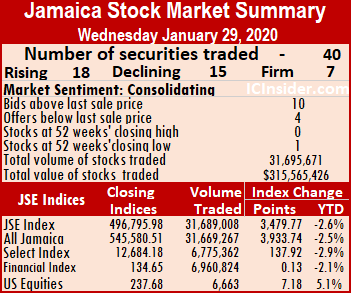

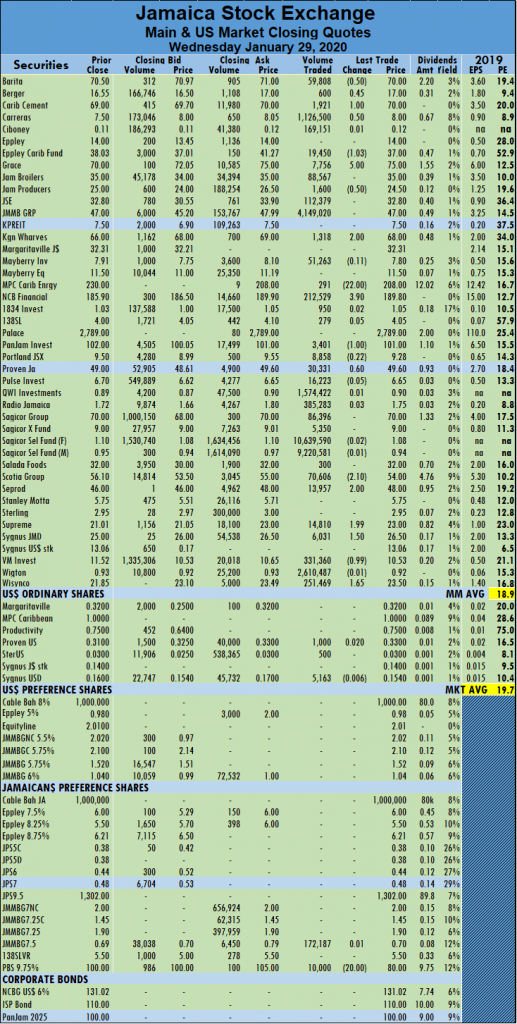

JSE All Jamaican Composite Index advanced 3,933.74 points to close at 545,580.51, the JSE Market Index rose 3,479.77 points to 496,795.98 and the JSE Financial Index gained 0.13 points to 134.65.

JSE All Jamaican Composite Index advanced 3,933.74 points to close at 545,580.51, the JSE Market Index rose 3,479.77 points to 496,795.98 and the JSE Financial Index gained 0.13 points to 134.65. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security. Proven Investments added 60 cents to close at $49.60, in an exchange of 30,331 shares, Scotia Group ended the day’s trade at $54, after losing $2.10 and trading 70,606 units, Seprod gained $2 in transferring 13,957 stock units to end at $48. Supreme Ventures closed $1.99 higher at $23, with an exchange of 14,810 shares. Sygnus Credit Investments climbed $1.50 to $26.50, in swapping 6,031 shares, Victoria Mutual Investments closed 99 cents lower to $10.53, after exchanging 331,360 units and Wisynco Group added $1.65 to settle at $23.50 trading 251,469 shares. Productivity Business Solution preference share, fell $20 to a 52 weeks’ low of $80 with 10,000 shares trading.

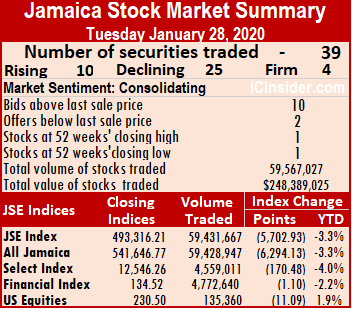

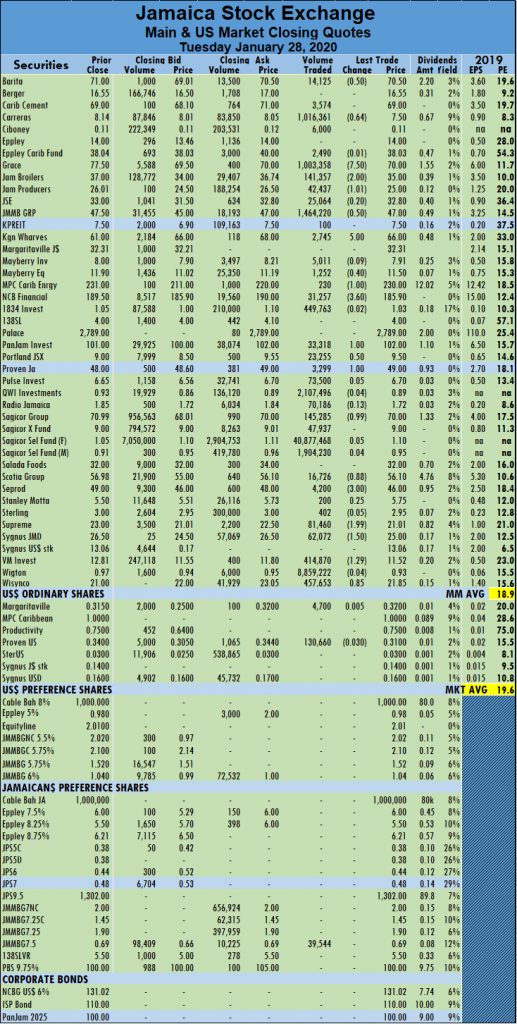

Proven Investments added 60 cents to close at $49.60, in an exchange of 30,331 shares, Scotia Group ended the day’s trade at $54, after losing $2.10 and trading 70,606 units, Seprod gained $2 in transferring 13,957 stock units to end at $48. Supreme Ventures closed $1.99 higher at $23, with an exchange of 14,810 shares. Sygnus Credit Investments climbed $1.50 to $26.50, in swapping 6,031 shares, Victoria Mutual Investments closed 99 cents lower to $10.53, after exchanging 331,360 units and Wisynco Group added $1.65 to settle at $23.50 trading 251,469 shares. Productivity Business Solution preference share, fell $20 to a 52 weeks’ low of $80 with 10,000 shares trading. The Main Market of the Jamaica Stock Exchange declined sharply at the close of trading on Tuesday, knocking over 6,000 points from the market, as one stock each closed at a 52 weeks’ high and low.

The Main Market of the Jamaica Stock Exchange declined sharply at the close of trading on Tuesday, knocking over 6,000 points from the market, as one stock each closed at a 52 weeks’ high and low.  The average volume and value for the month to date amounts to 626,463 units valued at $3,287,493 for each security changing hands, compared to 579,074 units valued at $3,112,683 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

The average volume and value for the month to date amounts to 626,463 units valued at $3,287,493 for each security changing hands, compared to 579,074 units valued at $3,112,683 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security. Scotia Group settled at $56.10, after losing 88 cents in exchanging 16,726 shares, Seprod dropped $3 trading 4,200 shares and ended at $46, Supreme Ventures closed $1.99 lower to $21.01, with 81,460 units changing hands. Sygnus Credit Investments lost $1.50 to close at $25, in transferring 62,072 shares, Victoria Mutual Investments ended $1.29 lower to $11.52, trading 414,870 units and Wisynco Group gained 85 cents, after swapping 457,653 shares and closed at $21.85.

Scotia Group settled at $56.10, after losing 88 cents in exchanging 16,726 shares, Seprod dropped $3 trading 4,200 shares and ended at $46, Supreme Ventures closed $1.99 lower to $21.01, with 81,460 units changing hands. Sygnus Credit Investments lost $1.50 to close at $25, in transferring 62,072 shares, Victoria Mutual Investments ended $1.29 lower to $11.52, trading 414,870 units and Wisynco Group gained 85 cents, after swapping 457,653 shares and closed at $21.85. The Main Market of the Jamaica Stock Exchange closed on Monday with gains in the two major indices as the market continues its daily seesaw movement.

The Main Market of the Jamaica Stock Exchange closed on Monday with gains in the two major indices as the market continues its daily seesaw movement.  The Market closed with an average of 877,521 units valued at an average of $2,469,378 for each security traded, in contrast to 537,632 units valued at an average of $4,732,316 on Friday. The average volume and value for the month to date amounts to 579,074 units valued at $3,112,683 for each security changing hands, compared to 561,737 units valued at $3,152,220 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

The Market closed with an average of 877,521 units valued at an average of $2,469,378 for each security traded, in contrast to 537,632 units valued at an average of $4,732,316 on Friday. The average volume and value for the month to date amounts to 579,074 units valued at $3,112,683 for each security changing hands, compared to 561,737 units valued at $3,152,220 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security. NCB Financial closed at $189.50, after losing $3.50 in trading 70,527 shares, PanJam Investment closed $1 lower at $101, with 17,178 units changing hands, Portland JSX gained 58 cents to settle at $9, in swapping 5,000 units, Proven Investments closed $1.50 lower at $48, in an exchange of 6,879 shares. Pulse Investments gained 95 cents to settle at $6.65, in transferring 171,832 shares. Sagicor Group added 99 cents to end at $70.99, with a transfer of 195,354 shares, Sagicor Real Estate Fund lost 35 cents to settle at $9 trading 52,137 shares, Scotia Group advanced to $56.98, having gained $3.97 in exchanging 12,100 shares. Supreme Ventures closed $1 higher to end at $23, with 45,273 units changing hands, Sygnus Credit Investments lost 43 cents to close at $26.50, in swapping 46,961 shares, Victoria Mutual Investments closed 64 cents lower to $12.81 trading 391,531 units and Wisynco Group slipped $1.50 to $21, with 204,925 units changing hands.

NCB Financial closed at $189.50, after losing $3.50 in trading 70,527 shares, PanJam Investment closed $1 lower at $101, with 17,178 units changing hands, Portland JSX gained 58 cents to settle at $9, in swapping 5,000 units, Proven Investments closed $1.50 lower at $48, in an exchange of 6,879 shares. Pulse Investments gained 95 cents to settle at $6.65, in transferring 171,832 shares. Sagicor Group added 99 cents to end at $70.99, with a transfer of 195,354 shares, Sagicor Real Estate Fund lost 35 cents to settle at $9 trading 52,137 shares, Scotia Group advanced to $56.98, having gained $3.97 in exchanging 12,100 shares. Supreme Ventures closed $1 higher to end at $23, with 45,273 units changing hands, Sygnus Credit Investments lost 43 cents to close at $26.50, in swapping 46,961 shares, Victoria Mutual Investments closed 64 cents lower to $12.81 trading 391,531 units and Wisynco Group slipped $1.50 to $21, with 204,925 units changing hands. The Main Market of the Jamaica Stock Exchange closed with a moderate fall on Friday as declining stocks outnumbered advancing stocks by 36 percent.

The Main Market of the Jamaica Stock Exchange closed with a moderate fall on Friday as declining stocks outnumbered advancing stocks by 36 percent. The average volume and value for the month to date amounts to 561,737 units valued at $3,152,220 for each security changing hands, compared to 563,186 units valued at $3,051,311 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security.

The average volume and value for the month to date amounts to 561,737 units valued at $3,152,220 for each security changing hands, compared to 563,186 units valued at $3,051,311 for each security traded. Trading in December resulted in an average of 595,143 units valued at $9,344,514 for each security. Sagicor Group advanced $5.25 to end at $70 after transferring 56,597 shares, Sagicor Real Estate Fund gained 35 cents to settle at $9.35 after trading 43,800 shares. Scotia Group declined $1.20 to $53.01, in swapping 133,078 stock units, Seprod lost 50 cents to end at $49 exchanging 3,160 units, Supreme Ventures dropped $1.20, to settle at $22, with an exchange of 35,688 shares. Victoria Mutual Investments gained 82 cents in trading 421,376 units and ended a 52 weeks’ high at $13.45 and Wisynco Group closed 50 cents lower to $22.50, after swapping 277,521 units.

Sagicor Group advanced $5.25 to end at $70 after transferring 56,597 shares, Sagicor Real Estate Fund gained 35 cents to settle at $9.35 after trading 43,800 shares. Scotia Group declined $1.20 to $53.01, in swapping 133,078 stock units, Seprod lost 50 cents to end at $49 exchanging 3,160 units, Supreme Ventures dropped $1.20, to settle at $22, with an exchange of 35,688 shares. Victoria Mutual Investments gained 82 cents in trading 421,376 units and ended a 52 weeks’ high at $13.45 and Wisynco Group closed 50 cents lower to $22.50, after swapping 277,521 units.