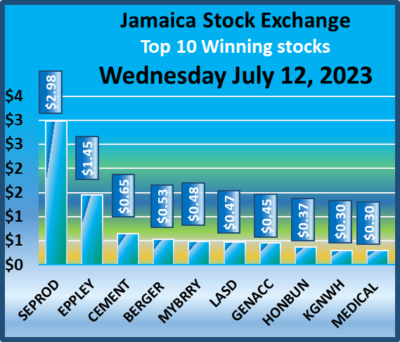

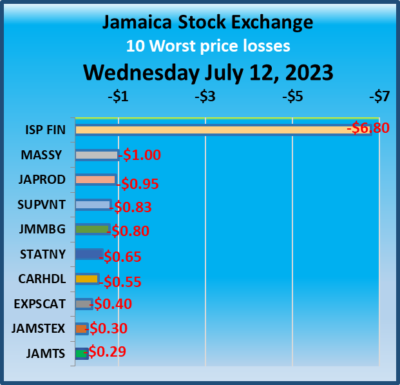

All markets fell at the close of trading on Wednesday with modest movements in all three market indices following a sharp rise in the volume and value of stocks traded compared to that of Tuesday.

At the close, the JSE Combined Market Index added 17.26 points to close at 339,692.73, the All Jamaican Composite Index slipped 41.48 points to conclude trading at 362,840.57, the JSE Main Index fell 77.50 points to finish at 325,206.38, while the Junior Market Index popped 9.79 points to end at 3,960.39 and the JSE USD Market Index added 0.41 points to settle at 247.44.

At the close, the JSE Combined Market Index added 17.26 points to close at 339,692.73, the All Jamaican Composite Index slipped 41.48 points to conclude trading at 362,840.57, the JSE Main Index fell 77.50 points to finish at 325,206.38, while the Junior Market Index popped 9.79 points to end at 3,960.39 and the JSE USD Market Index added 0.41 points to settle at 247.44.

Preference shares with notable price movements but are not in the TOP10 graphs are Eppley 5% preference share that popped $1 in closing at $21, Eppley 7.25% preference share rising $2.33 to $18.52, Jamaica Public Service 7% fell 96 cents to end at $41.54, Jamaica Public Service 9.5% rallied $342.47 to a record high of $3767.17 and 138 Student Living preference share dropped $15.75 to end at $89.24.

At the close, investors exchanged 71,109,240 shares in all three markets, up from 16,768,963 stocks on Tuesday.  The value of stocks trading in the Junior and Main markets was a mere $190.27 million, from $45.2 million on Tuesday. Trading on the JSE USD market ended with investors exchanging 929,491 shares for US$16,864 from 965,788 units at US$23,655 on Tuesday.

The value of stocks trading in the Junior and Main markets was a mere $190.27 million, from $45.2 million on Tuesday. Trading on the JSE USD market ended with investors exchanging 929,491 shares for US$16,864 from 965,788 units at US$23,655 on Tuesday.

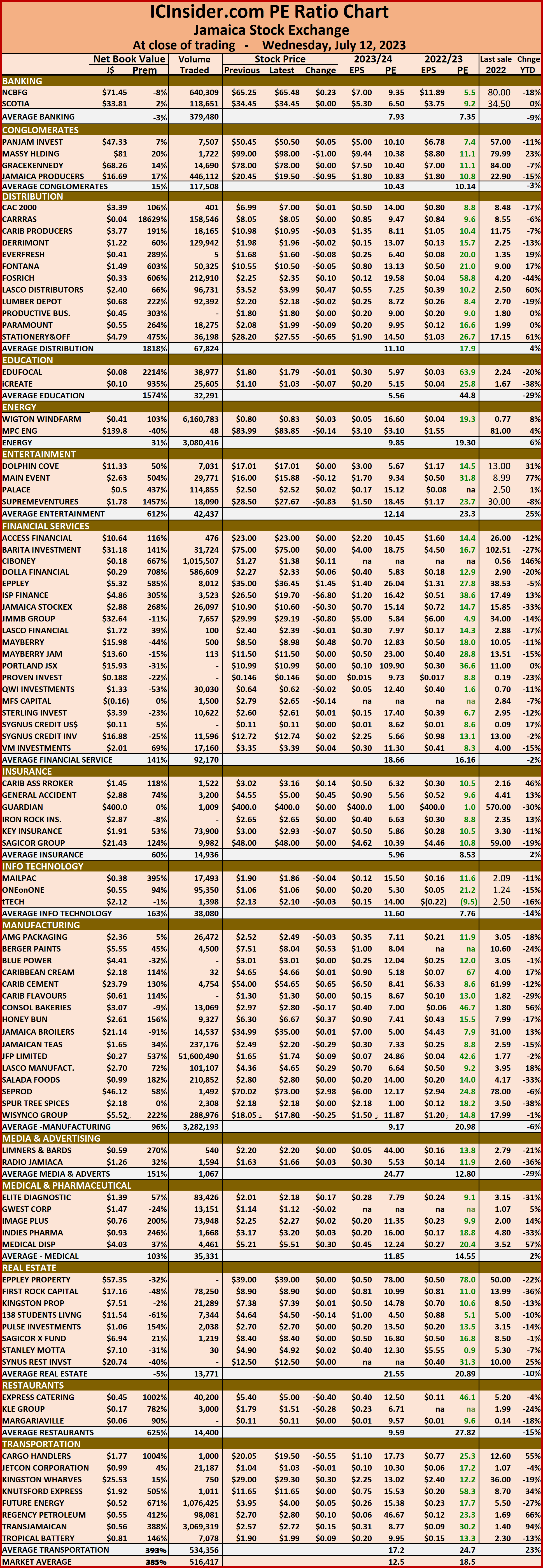

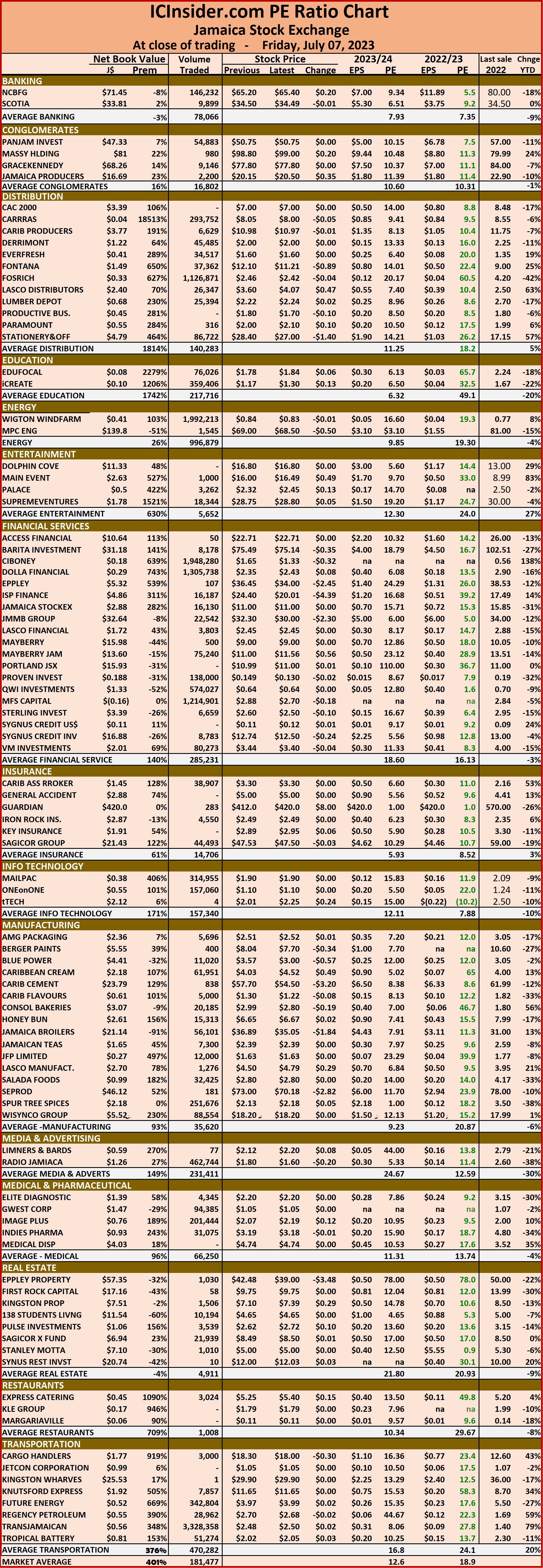

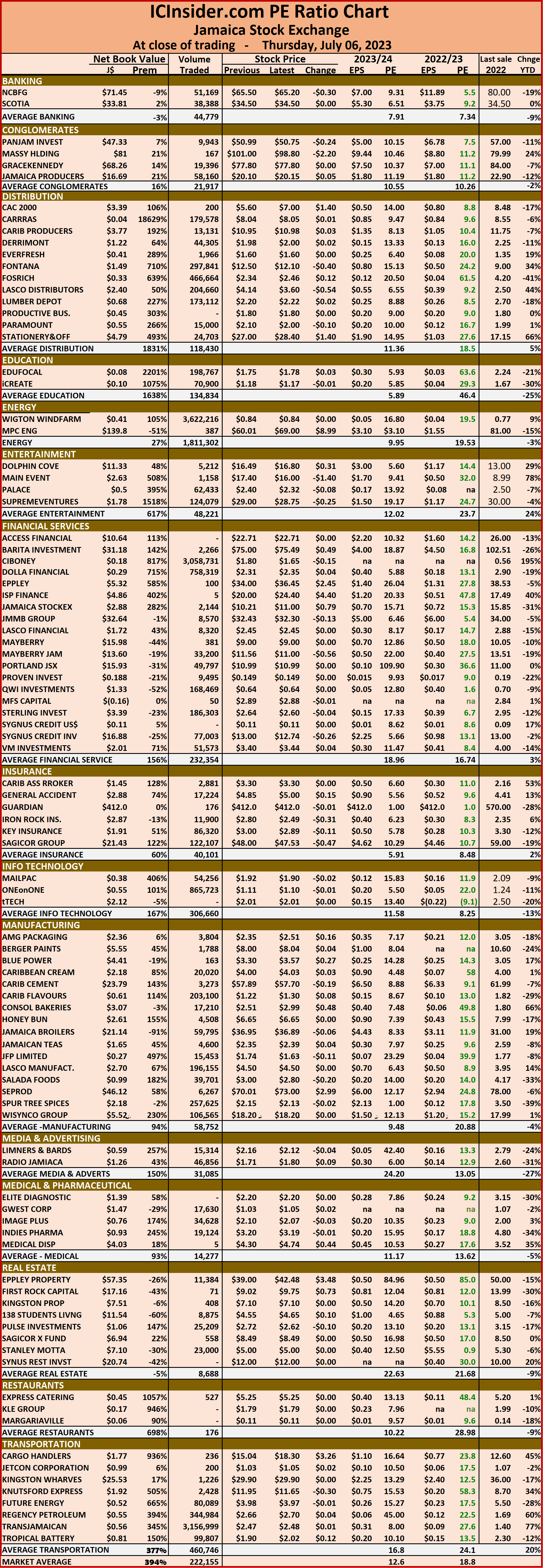

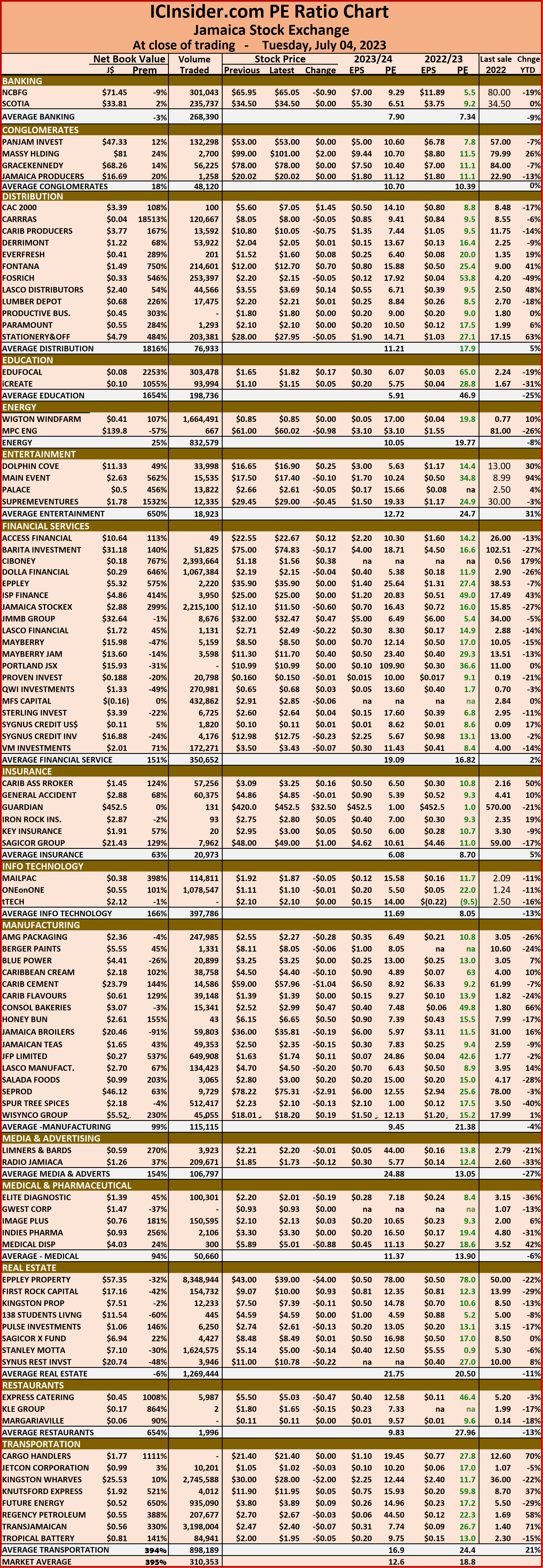

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.5 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

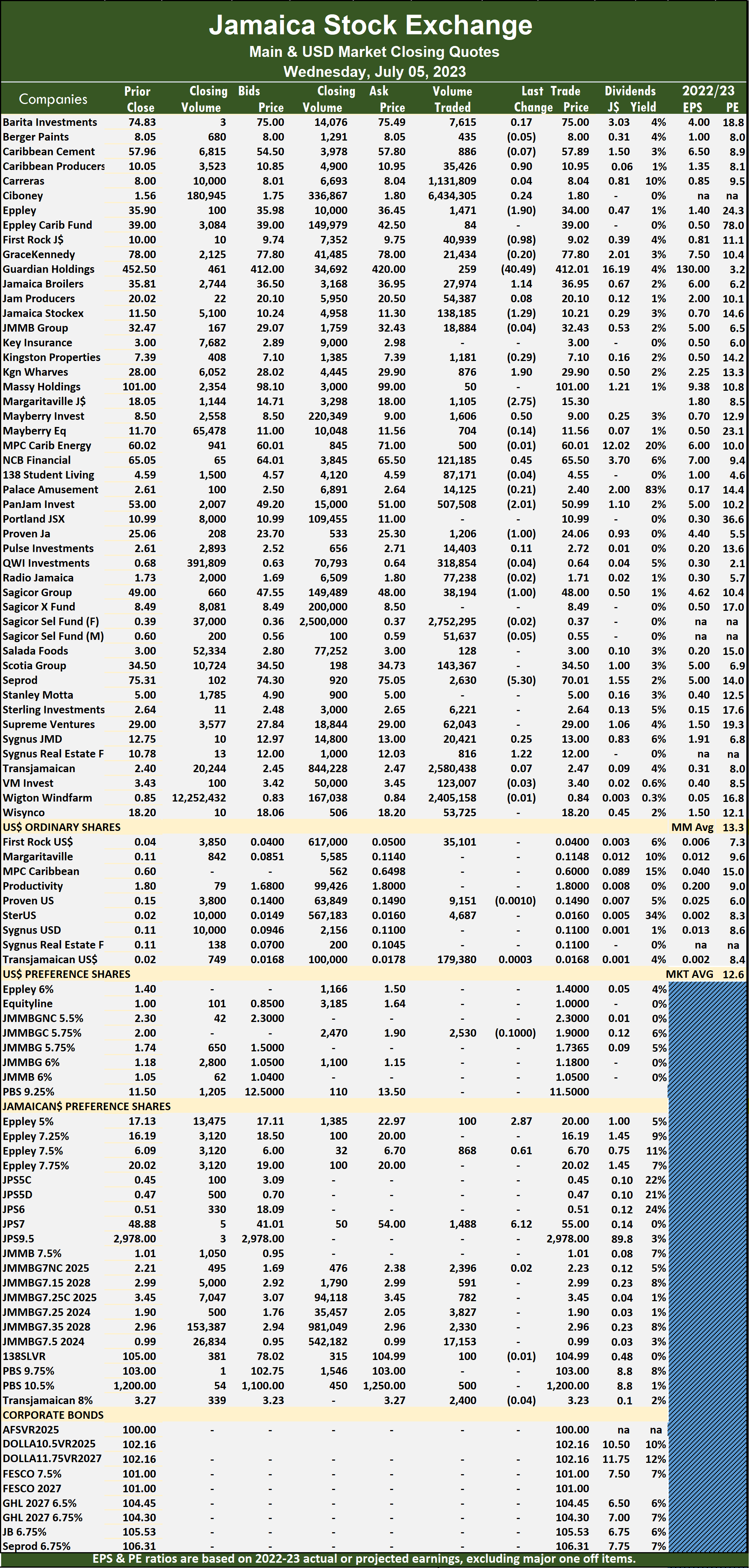

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Modest movement in all JSE market indices

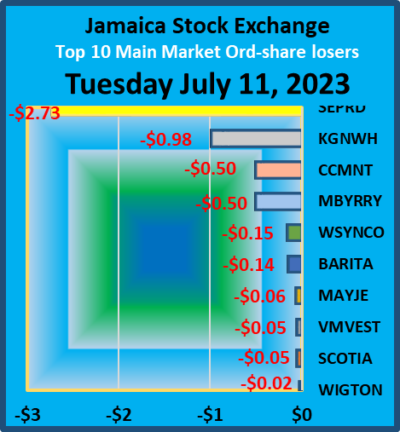

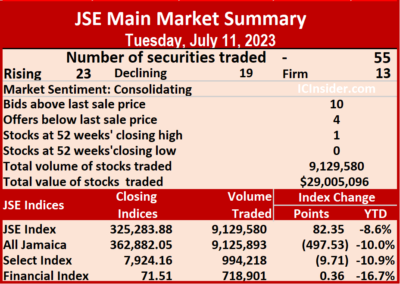

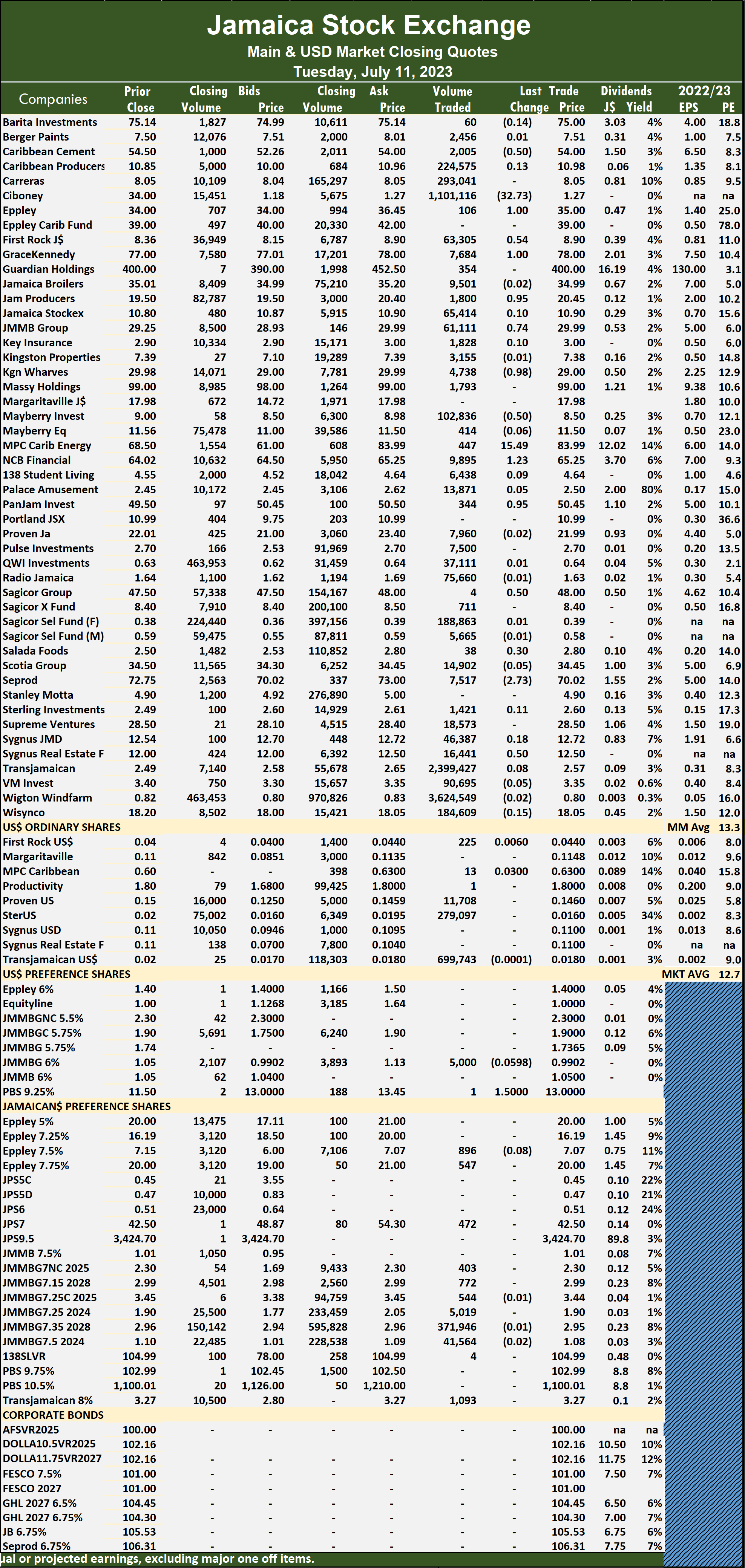

Trading plunged on the Main Market

Trading activity on the Jamaica Stock Exchange Main Market ended on Tuesday with a 63 percent fall in the volume of stocks traded declining with a 65 percent lower value than on Monday, following trading in 55 securities compared with 56 on Monday, resulting in 23 rising, 19 declining and 13 ending unchanged.

A total of 9,129,580 shares were traded for $29,005,096 down from 24,449,466 units at $83,643,070 on Monday.

A total of 9,129,580 shares were traded for $29,005,096 down from 24,449,466 units at $83,643,070 on Monday.

Trading averaged 165,992 shares at $527,365 compared to 436,598 units at $1,493,626 on Monday and month to date, an average of 425,596 units at $2,654,714, down from 467,590 units at $2,998,844 on the previous day. June closed an average of 366,795 units at $6,952,581 including trading in Bonds.

Wigton Windfarm led trading with 3.62 million shares for 39.7 percent of the volume, Transjamaican Highway followed with 2.40 million units for 26.3 percent of the day’s trade and closed at a record close of $2.57 after trading at an intraday high of $2.65 and Ciboney Group with 1.10 million units for 12.1 percent of the day’s trade.

The All Jamaican Composite Index declined 497.53 points to close at 362,882.05, the JSE Main Index advanced 82.35 points to end at 325,283.88 and the  JSE Financial Index added 0.36 points to conclude trading at 71.51.

JSE Financial Index added 0.36 points to conclude trading at 71.51.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

Investor’s Choice bid-offer indicator shows 10 stocks ending with bids higher than their last selling prices and four with lower offers.

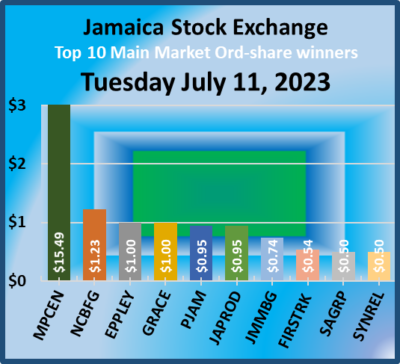

At the close, Caribbean Cement fell 50 cents in closing at $54 after an exchange of 2,005 shares, Eppley rose $1 and ended at $35, with 106 stocks crossing the market, First Rock Real Estate gained 54 cents to end at $8.90 in trading 63,305 units. GraceKennedy popped $1 to close at $78 with an exchange of 7,684 stock units, Jamaica Producers increased 95 cents to $20.45 with investors transferring 1,800 shares,  JMMB Group climbed 74 cents in closing at $29.99 after 61,111 units passed through the market. Kingston Wharves dropped 98 cents to end at $29 while exchanging 4,738 stocks, Mayberry Investments lost 50 cents to close at $8.50 as investors exchanged 102,836 stock units, MPC Caribbean Clean Energy climbed $15.49 to $83.99, with 447 shares clearing the market. NCB Financial rallied $1.23 to close at $65.25 after 9,895 stock units crossed the market, Pan Jamaica advanced 95 cents and ended at $50.45 after 344 stocks passed through the exchange, Sagicor Group popped 50 cents to close at $48 after an exchange of 4 units. Salada Foods gained 30 cents to end at $2.80 with shareholders swapping 38 stock units,

JMMB Group climbed 74 cents in closing at $29.99 after 61,111 units passed through the market. Kingston Wharves dropped 98 cents to end at $29 while exchanging 4,738 stocks, Mayberry Investments lost 50 cents to close at $8.50 as investors exchanged 102,836 stock units, MPC Caribbean Clean Energy climbed $15.49 to $83.99, with 447 shares clearing the market. NCB Financial rallied $1.23 to close at $65.25 after 9,895 stock units crossed the market, Pan Jamaica advanced 95 cents and ended at $50.45 after 344 stocks passed through the exchange, Sagicor Group popped 50 cents to close at $48 after an exchange of 4 units. Salada Foods gained 30 cents to end at $2.80 with shareholders swapping 38 stock units,  Seprod shed $2.73 in closing at $70.02, with 7,517 stocks changing hands and Sygnus Real Estate Finance rose 50 cents to end at $12.50 in an exchange of 16,441 units.

Seprod shed $2.73 in closing at $70.02, with 7,517 stocks changing hands and Sygnus Real Estate Finance rose 50 cents to end at $12.50 in an exchange of 16,441 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

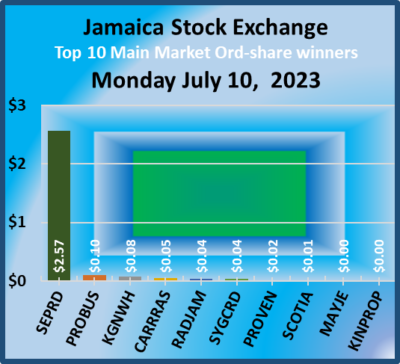

Trading climbs on JSE Main market

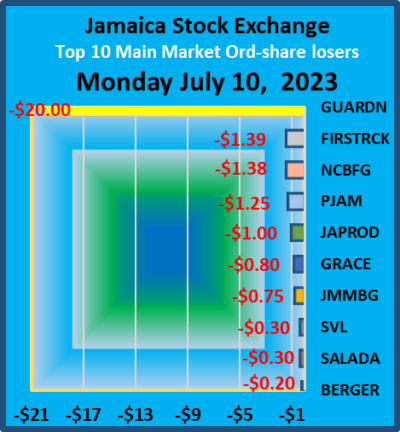

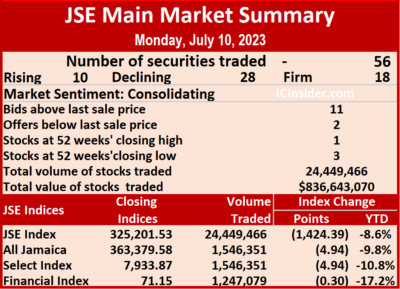

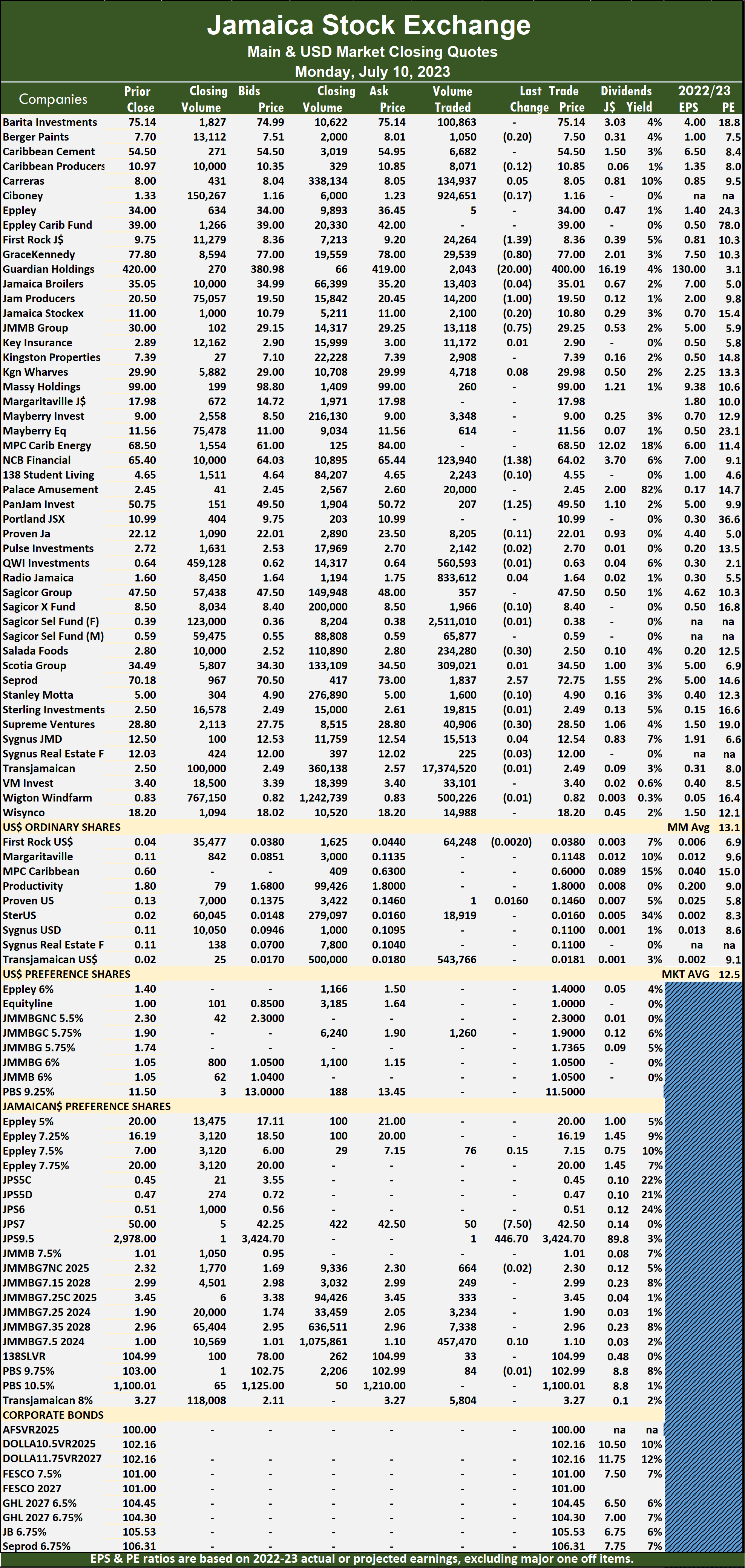

Trading activity on the Jamaica Stock Exchange Main Market ended on Monday, with the volume of stocks traded rising 105 percent and the value 99 percent more than on Friday, with trading taking place in 56 securities compared with 57 on Friday, with 10 rising, 28 declining and 18 unchanged after three stocks traded at a 52 weeks’ lows and one at a 52 weeks’ high and one at a record intraday high.

A total of 24,449,466 shares were exchanged for $83,643,070 up from 11,913,117 units at $42,086,420 on Friday.

A total of 24,449,466 shares were exchanged for $83,643,070 up from 11,913,117 units at $42,086,420 on Friday.

Trading averaged 436,598 shares at $1,493,626 compared with 209,002 units at $738,358 on Friday and month to date, an average of 467,590 units at $2,998,844 compared with 473,702 units at $3,295,648 on the previous day. June closed with an average of 366,795 units at $6,952,581 including trading in Bonds.

Transjamaican Highway led trading with 17.37 million shares for 71.1 percent of total volume while it traded at a record high of $2.60 and was followed by Sagicor Select Financial Fund with 2.51 million units for 10.3 percent of the day’s trade and Ciboney Group with 924,651 units for 3.8 percent of market share.

The All Jamaican Composite Index rose 91.60 points to close trading at 363,379.58, the JSE Main Index dipped 1,424.39 points to end at 325,201.53 and the JSE Financial Index slipped 0.30 points to conclude trading at 71.15.

The All Jamaican Composite Index rose 91.60 points to close trading at 363,379.58, the JSE Main Index dipped 1,424.39 points to end at 325,201.53 and the JSE Financial Index slipped 0.30 points to conclude trading at 71.15.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.1 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and none with a lower offer.

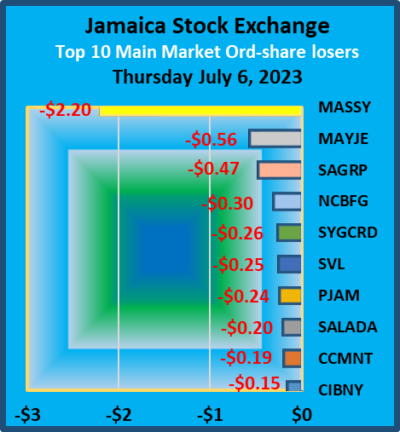

At the close, Berger Paints fell 20 cents in closing at $7.50 in an exchange of 1,050 shares, First Rock Real Estate lost $1.39 to close at a 52 weeks’ low of $8.36 in an exchange of 24,264 shares, following the dropping of the price to a 52 weeks’ intraday low of $7, GraceKennedy fell 80 cents in closing at $77 while exchanging 29,539 stocks.  Guardian Holdings dropped $20 to end at a 52 weeks’ low of $400 with investors transferring 2,043 units, after the price hit a 52 weeks intraday low of $375.05, Jamaica Producers dropped $1 to end at $19.50, with 14,200 stock units crossing the market, Jamaica Stock Exchange declined 20 cents to $10.80 after 2,100 stocks changed hands, JMMB Group shed 75 cents and ended at $29.25 after trading 13,118 shares. NCB Financial declined $1.38 and ended at $64.02 after an exchange of 123,940 stock units, Pan Jamaica declined $1.25 to close at $49.50 with 207 stocks changing hands. Salada Foods shed 30 cents to end at a 52 weeks’ low of $2.50 after 234,280 units passed through the market, Seprod climbed $2.57 to $72.75, with stakeholders exchanging 1,837 stocks and Supreme Ventures dropped 30 cents in closing at $28.50 in switching ownership of 40,906 shares.

Guardian Holdings dropped $20 to end at a 52 weeks’ low of $400 with investors transferring 2,043 units, after the price hit a 52 weeks intraday low of $375.05, Jamaica Producers dropped $1 to end at $19.50, with 14,200 stock units crossing the market, Jamaica Stock Exchange declined 20 cents to $10.80 after 2,100 stocks changed hands, JMMB Group shed 75 cents and ended at $29.25 after trading 13,118 shares. NCB Financial declined $1.38 and ended at $64.02 after an exchange of 123,940 stock units, Pan Jamaica declined $1.25 to close at $49.50 with 207 stocks changing hands. Salada Foods shed 30 cents to end at a 52 weeks’ low of $2.50 after 234,280 units passed through the market, Seprod climbed $2.57 to $72.75, with stakeholders exchanging 1,837 stocks and Supreme Ventures dropped 30 cents in closing at $28.50 in switching ownership of 40,906 shares.

In the preference segment, Jamaica Public Service 7% lost $7.50 to close at $42.50 with shareholders swapping 50 stock units and Jamaica Public Service 9.5% rose $446.70 to a record high of $3,424.70 with a transfer of one unit.

In the preference segment, Jamaica Public Service 7% lost $7.50 to close at $42.50 with shareholders swapping 50 stock units and Jamaica Public Service 9.5% rose $446.70 to a record high of $3,424.70 with a transfer of one unit.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

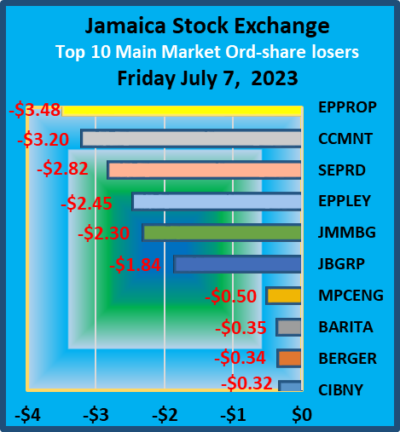

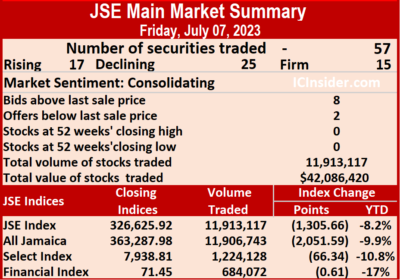

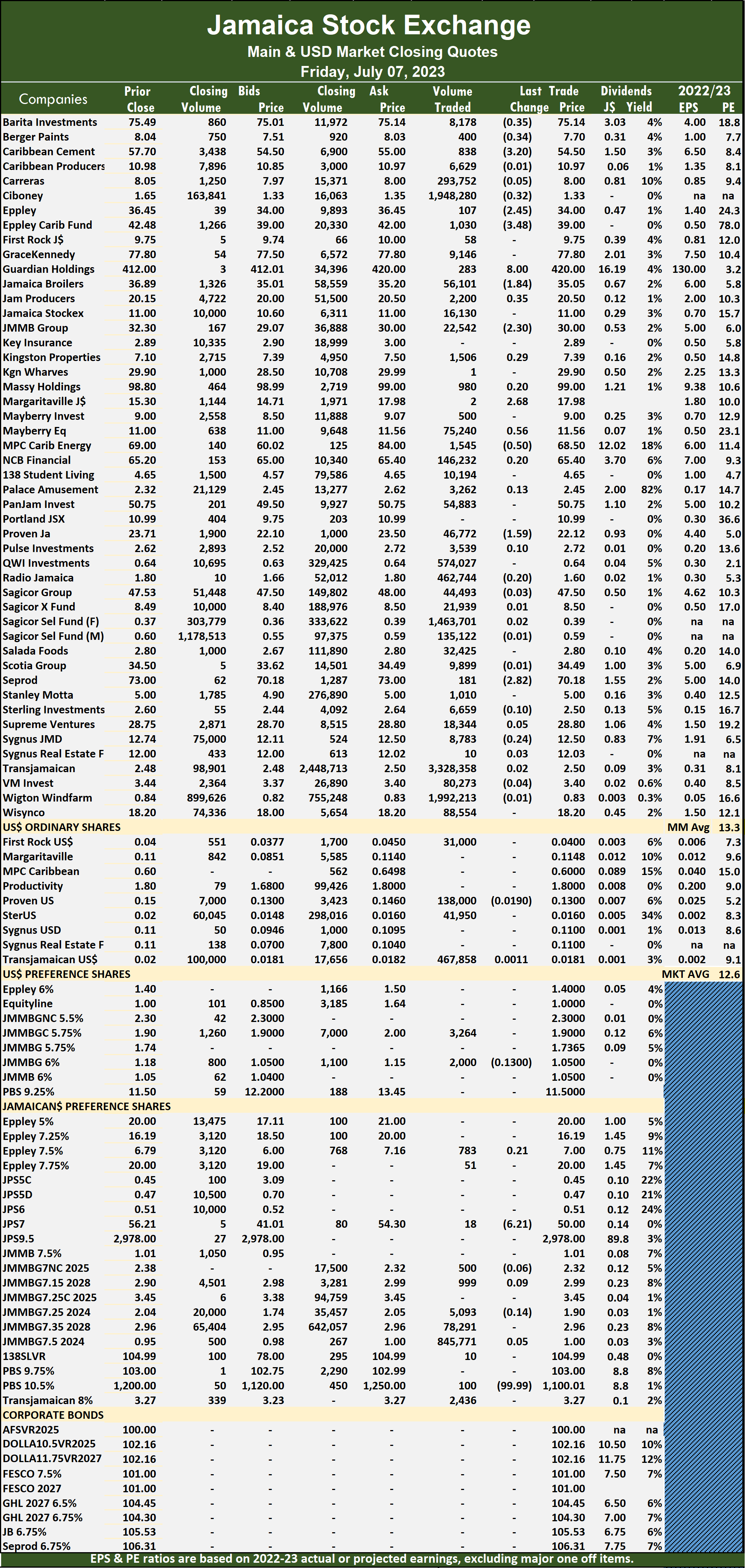

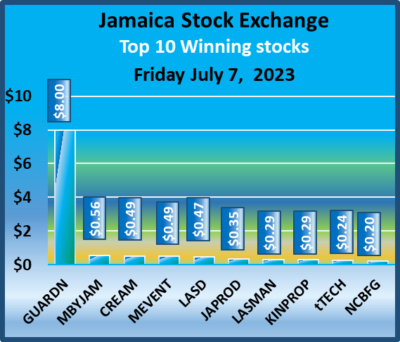

JSE Main Market falls

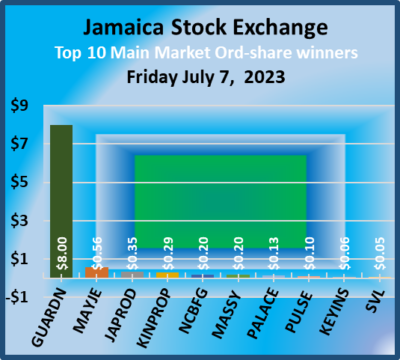

Trading declined on the Jamaica Stock Exchange Main Market on Friday, with the volume of stocks traded falling 39 percent with a 12 percent lower value than on Thursday, with trading in 57 securities similar to trading on Thursday and ended with 17 rising, 25 declining and 15 ending unchanged.

A total of 11,913,117 shares were traded for $42,086,420 compared to 19,516,550 units at $47,807,103 on Thursday.

A total of 11,913,117 shares were traded for $42,086,420 compared to 19,516,550 units at $47,807,103 on Thursday.

Trading averaged 209,002 shares at $738,358 compared with 342,396 units at $838,721 on Thursday and month to date, an average of 473,702 shares at $3,295,648, compared with 540,168 units at $3,937,787 on the previous day. Trading in June closed with an average of 366,795 units at $6,952,581 including trading in Bonds.

Transjamaican Highway led trading with 3.33 million shares for 27.9 percent of total volume followed by Wigton Windfarm with 1.99 million units for 16.7 percent of the day’s trade, Ciboney Group with 1.95 million units for 16.4 percent of market share and Sagicor Select Financial Fund with 1.46 million units for 12.3 percent of total volume.

The All Jamaican Composite Index lost 2,051.59 points to end at 363,287.98, the JSE Main Index fell 1,305.66 points to finish at 326,625.92 and the JSE Financial Index shed 0.61 points to end at 71.45.

The All Jamaican Composite Index lost 2,051.59 points to end at 363,287.98, the JSE Main Index fell 1,305.66 points to finish at 326,625.92 and the JSE Financial Index shed 0.61 points to end at 71.45.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and two with lower offers.

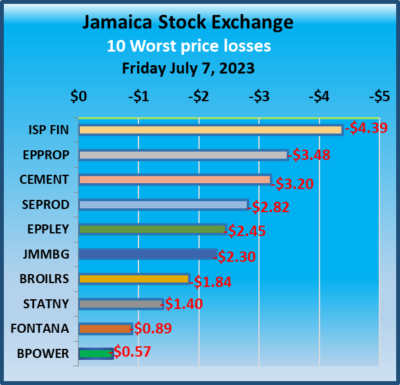

At the close, Barita Investments dipped 35 cents to close at $75.14 with investors transferring 8,178 shares, Berger Paints fell 34 cents to end at $7.70 as 400 units passed through the market, Caribbean Cement declined $3.20 to $54.50 after an exchange of 838 stocks,  Ciboney Group shed 32 cents in closing at $1.33, with 1,948,280 stock units changing hands. Eppley lost $2.45 and ended at $34, with 107 stocks crossing the market, Eppley Caribbean Property Fund dropped $3.48 in closing at $39 with an exchange of 1,030 stock units, Guardian Holdings rose $8 to end at $420, with 283 shares crossing the market, Jamaica Broilers dipped $1.84 to close at $35.05 with 56,101 units clearing the market, Jamaica Producers gained 35 cents and ended at $20.50 as investors exchanged 2,200 shares. JMMB Group dropped $2.30 to $30 after a transfer of 22,542 stocks, Margaritaville increased $2.68 in ending at $17.98 in an exchange of 2 units, Mayberry Jamaican Equities popped 56 cents to close at $11.56 with a transfer of 75,240 stock units, MPC Caribbean Clean Energy lost 50 cents to end at $68.50 in an exchange of 1,545 stock units.

Ciboney Group shed 32 cents in closing at $1.33, with 1,948,280 stock units changing hands. Eppley lost $2.45 and ended at $34, with 107 stocks crossing the market, Eppley Caribbean Property Fund dropped $3.48 in closing at $39 with an exchange of 1,030 stock units, Guardian Holdings rose $8 to end at $420, with 283 shares crossing the market, Jamaica Broilers dipped $1.84 to close at $35.05 with 56,101 units clearing the market, Jamaica Producers gained 35 cents and ended at $20.50 as investors exchanged 2,200 shares. JMMB Group dropped $2.30 to $30 after a transfer of 22,542 stocks, Margaritaville increased $2.68 in ending at $17.98 in an exchange of 2 units, Mayberry Jamaican Equities popped 56 cents to close at $11.56 with a transfer of 75,240 stock units, MPC Caribbean Clean Energy lost 50 cents to end at $68.50 in an exchange of 1,545 stock units.  Proven Investments shed $1.59 to $22.12 in trading 46,772 shares and Seprod fell $2.82 in closing at $70.18 with shareholders swapping 181 units.

Proven Investments shed $1.59 to $22.12 in trading 46,772 shares and Seprod fell $2.82 in closing at $70.18 with shareholders swapping 181 units.

In the preference segment, Productive Business 10.50% preference share declined $99.99 in closing at $1100.01 in switching ownership of 100 stocks and Jamaica Public Service 7% declined $6.21 to close at $50 after 18 stock units crossed the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market in black after 6 months

On a day when the Main Market slipped moderately and the JSE USD market recorded modest gains, the Junior Market climbed to its highest level since the end of January this year and closed in positive territory for the first time in just over five months, having crossed over 4,000 points mark at the close as it continues to consolidate in pursuit of much higher levels as indicated by technical readings, as the overall market ended trading activities below that on Thursday.

At the close, the JSE Combined Market Index lost 969.18 points to close at 341,482.60, the All Jamaican Composite Index dropped 2,051.59 points to end at 363,287.98, the JSE Main Index fell 1,305.66 points to 326,625.92, while the Junior Market Index popped 27.22 points to close at 4,011.23 and the JSE USD Market Index popped 0.95 points to close at 243.83.

At the close, the JSE Combined Market Index lost 969.18 points to close at 341,482.60, the All Jamaican Composite Index dropped 2,051.59 points to end at 363,287.98, the JSE Main Index fell 1,305.66 points to 326,625.92, while the Junior Market Index popped 27.22 points to close at 4,011.23 and the JSE USD Market Index popped 0.95 points to close at 243.83.

Preference shares with notable price movements but not included in the Main Market TOP10 graphs include Productive Business 10.50% pref share that declined by $99.99 to $1100.01 and Jamaica Public Service 7% fell $6.21 to close at $50.

At the close, investors exchanged 18,632,454 shares in all three markets, down from 24,344,007 stocks on Thursday. The value of stocks trading in the Junior and Main markets was $59.33 million, compared with $61.37 million on Thursday. Trading on the JSE USD market ended with investors exchanging 684,072 shares for US$37,141, up from 266,681 units at US$6,174 on Thursday.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.9 on 2022-23 earnings and 12.6 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.9 on 2022-23 earnings and 12.6 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

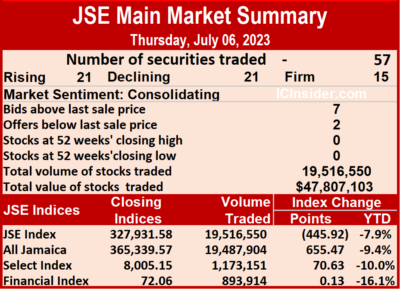

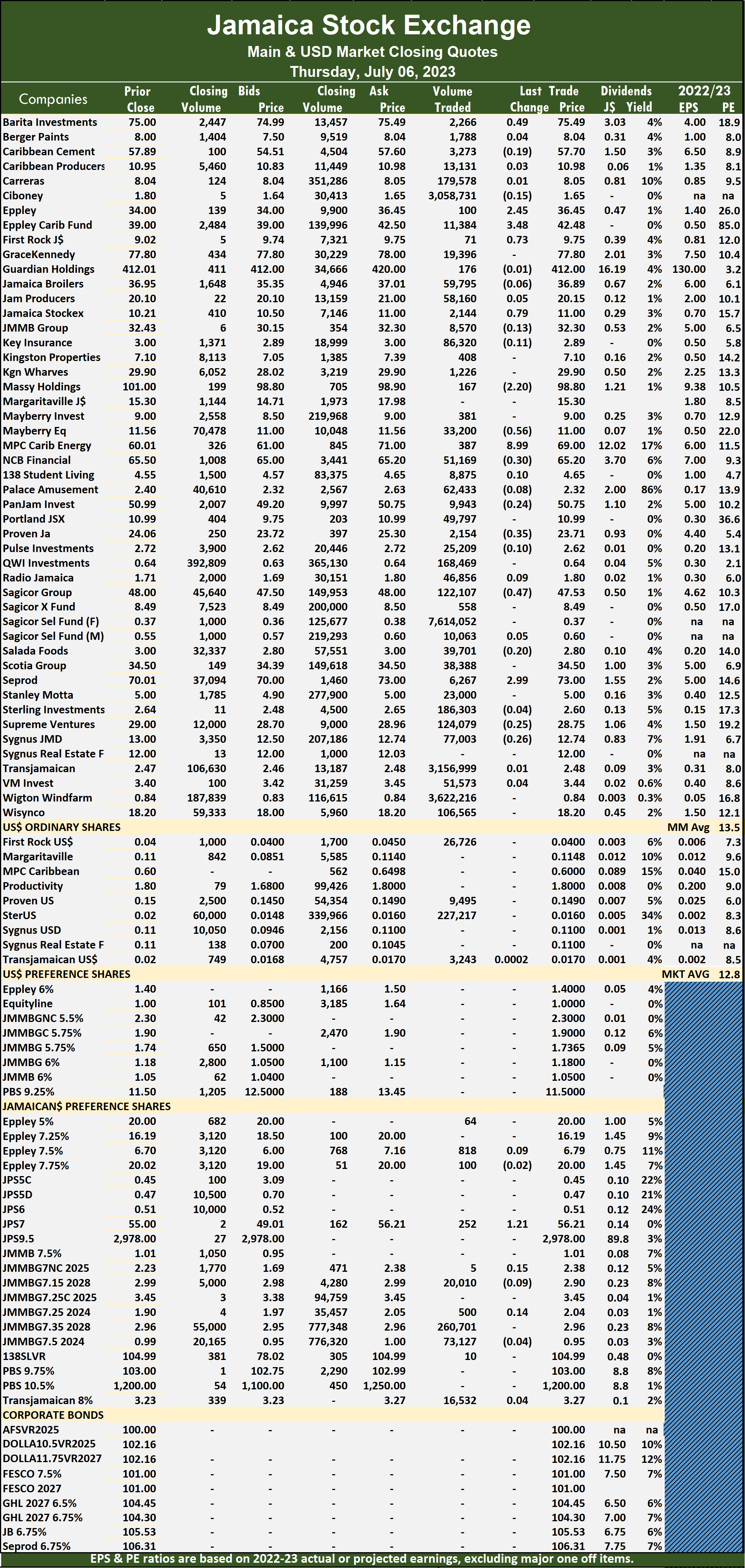

Winners & losers shared JSE Main Market

Trading activity on the Jamaica Stock Exchange Main Market ended on Thursday, with the volume of stocks traded rising 13 percent and the value 43 percent lower than on  Wednesday, after trading took place in 57 securities compared with 56 on Wednesday, with prices of 21 rising, 21 declining and 15 ending unchanged.

Wednesday, after trading took place in 57 securities compared with 56 on Wednesday, with prices of 21 rising, 21 declining and 15 ending unchanged.

A total of 19,516,550 shares were traded for $47,807,103 compared with 17,334,420 units at $83,845,979 on Wednesday.

Trading averaged 342,396 shares at $838,721 in comparison with 309,543 stocks at $1,497,250 on Wednesday and month to date, an average of 540,168 units at $3,937,787compared to 606,480 shares at $4,976,885 on the previous day. Trading in June closed with an average of 366,795 units at $6,952,581 including trading in Bonds.

Sagicor Select Financial Fund led trading with 7.61 million shares for 39 percent of total volume followed by Wigton Windfarm with 3.62 million units for 18.6 percent of the day’s trade, Transjamaican Highway closed with 3.16 million units for 16.2 percent of market share and Ciboney Group ended with 3.06 million units for 15.7 percent of total volume.

Transjamaican Highway closed with 3.16 million units for 16.2 percent of market share and Ciboney Group ended with 3.06 million units for 15.7 percent of total volume.

The All Jamaican Composite Index rose 655.47 points to close at 365,339.57, the JSE Main Index dipped 445.92 points and closed at 327,931.58 and the JSE Financial Index rallied 0.13 points to end at 72.06.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ending with bids higher than their last selling prices and two with lower offers.

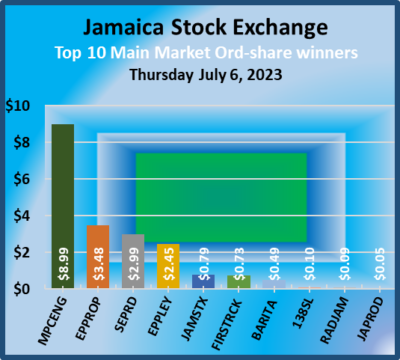

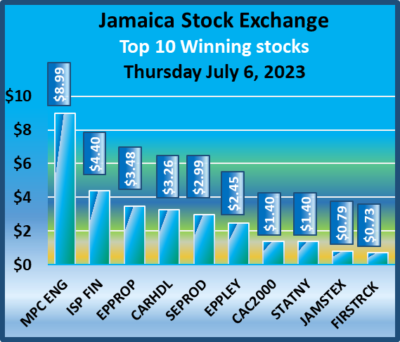

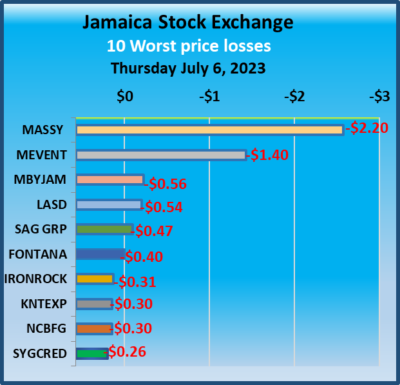

At the close, Barita Investments rose 49 cents to close at $75.49 after trading 2,266 shares, Eppley gained $2.45 to end at $36.45 in switching ownership of 100 stocks,  Eppley Caribbean Property Fund advanced $3.48 to $42.48, with 11,384 units changing hands, First Rock Real Estate increased 73 cents in closing at $9.75 after a transfer of 71 stock units. Jamaica Stock Exchange rallied 79 cents and ended at $11 after closing with 2,144 stock units changing hands, Massy Holdings dipped $2.20 to $98.80 with a transfer of 167 shares, Mayberry Jamaican Equities shed 56 cents and ended at $11, with 33,200 units crossing the exchange, MPC Caribbean Clean Energy climbed $8.99 to close at $69 in an exchange of 387 stocks. NCB Financial declined 30 cents in closing at $65.20 in an exchange of 51,169 stock units, Proven Investments dropped 35 cents to $23.71 with an exchange of 2,154 stocks,

Eppley Caribbean Property Fund advanced $3.48 to $42.48, with 11,384 units changing hands, First Rock Real Estate increased 73 cents in closing at $9.75 after a transfer of 71 stock units. Jamaica Stock Exchange rallied 79 cents and ended at $11 after closing with 2,144 stock units changing hands, Massy Holdings dipped $2.20 to $98.80 with a transfer of 167 shares, Mayberry Jamaican Equities shed 56 cents and ended at $11, with 33,200 units crossing the exchange, MPC Caribbean Clean Energy climbed $8.99 to close at $69 in an exchange of 387 stocks. NCB Financial declined 30 cents in closing at $65.20 in an exchange of 51,169 stock units, Proven Investments dropped 35 cents to $23.71 with an exchange of 2,154 stocks,  Sagicor Group lost 47 cents in closing at $47.53 in trading 122,107 units and Seprod popped $2.99 to $73 with 6,267 shares clearing the market.

Sagicor Group lost 47 cents in closing at $47.53 in trading 122,107 units and Seprod popped $2.99 to $73 with 6,267 shares clearing the market.

In the preference segment, Jamaica Public Service 7% popped $1.21 in ending at $56.21 while exchanging 252 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

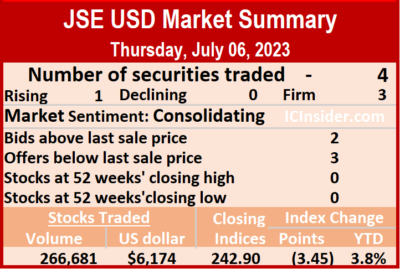

Decline in JSE USD Market

A mere four securities were traded on the Jamaica Stock Exchange US dollar market on Thursday, but the volume of stocks changing hands climbed 16 percent but with a 43 percent lower value than on Wednesday, compared to five stocks trading on Wednesday, at the close the price of one stock rose, no declined and three ended unchanged.

Overall, 266,681 shares were exchanged for US$6,174 compared with 230,849 units at US$10,905 on Wednesday.

Overall, 266,681 shares were exchanged for US$6,174 compared with 230,849 units at US$10,905 on Wednesday.

Trading averaged 66,670 units at US$1,544 compared with 46,170 shares at US$2,181 on Wednesday, with a month to date average of 97,424 shares at US$2,578 compared to 103,899 units at US$2,796 on the previous day. June ended with an average of 60,969 units for US$3,967.

The US Denominated Equities Index dropped 3.45 points to 242.90.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.9. The PE ratio is computed using the last traded price divided by ICInsider.com’s projected earnings for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, First Rock Real Estate USD share ended at 4 US cents while exchanging 26,726 shares, Proven Investments ended at 14.9 US cents in an exchange of 9,495 stock units, Sterling Investments ended at 1.6 US cents with investors trading 227,217 stocks and Transjamaican Highway popped 0.02 cents to end at 1.7 US cents after an exchange of 3,243 units, with the closing price being 10 percent higher than the price in the Jamaican dollar market.

At the close, First Rock Real Estate USD share ended at 4 US cents while exchanging 26,726 shares, Proven Investments ended at 14.9 US cents in an exchange of 9,495 stock units, Sterling Investments ended at 1.6 US cents with investors trading 227,217 stocks and Transjamaican Highway popped 0.02 cents to end at 1.7 US cents after an exchange of 3,243 units, with the closing price being 10 percent higher than the price in the Jamaican dollar market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading dives on the Jamaica Exchange

Trading ended with mixed fortunes on Thursday, with trading levels falling below that on Wednesday and resulted in the JSE Main index and JSE USD market indices declining but the Junior Markets and the All Jamaican index rose.

At the close, the JSE Combined Market Index fell 385.17 points to end at 342,451.78, the All Jamaican Composite Index rallied 655.47 points to 365,339.57, but the JSE Main Index dipped 445.92 points to 327,931.58 while the Junior Market Index popped 3.37 points to close at 3,984.01, after closing in on 4,040 points up to last 30 minutes left in the day’s session. The JSE USD Market Index slipped 3.45 points to 242.88.

At the close, the JSE Combined Market Index fell 385.17 points to end at 342,451.78, the All Jamaican Composite Index rallied 655.47 points to 365,339.57, but the JSE Main Index dipped 445.92 points to 327,931.58 while the Junior Market Index popped 3.37 points to close at 3,984.01, after closing in on 4,040 points up to last 30 minutes left in the day’s session. The JSE USD Market Index slipped 3.45 points to 242.88.

Preference share with notable price movements but not in the Main Market TOP10 graphs was Jamaica Public Service 7% gaining $1.21 to $56.21.

At the close, investors exchanged 24,344,007 shares in all three markets, up from 23,127,467 stocks on Thursday. The value of stocks trading in the Junior and Main markets was $61.37 million, down from $108.2 million on Thursday. Trading on the JSE USD market ended with investors exchanging 266,681 shares for US$6,174 from 230,849 units at US$10,905 on Thursday.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.8 on 2022-23 earnings and 12.6 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.8 on 2022-23 earnings and 12.6 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

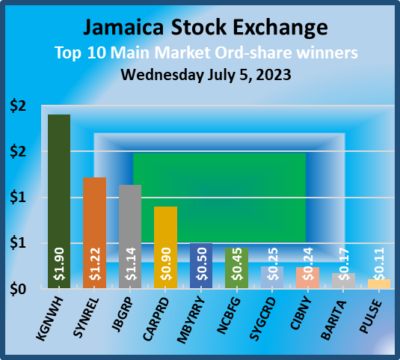

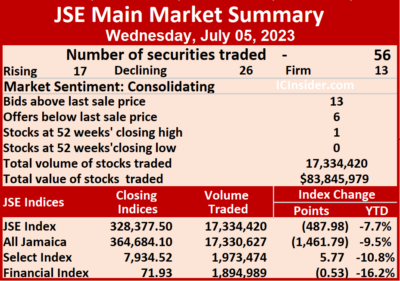

Sharp drop in JSE Main Market in trading

Trading dropped sharply on the Jamaica Stock Exchange Main Market on Wednesday, compared to Tuesday, with a 77 percent fall volume of stocks traded and an 87 percent drop in value following trading in 56 securities compared with 58, with prices of 17 rising, 26 declining and 13 ending unchanged.

A total of 17,334,420 shares were traded for $83,845,979 compared to 76,180,578 units at $630,021,406 on Tuesday.

A total of 17,334,420 shares were traded for $83,845,979 compared to 76,180,578 units at $630,021,406 on Tuesday.

Trading averaged 309,543 shares at $1,497,250 compared with 1,313,458 shares at $10,862,438 on Tuesday and month to date, an average of 606,480 units at $4,976,885, versus 752,344 units at $6,686,180 on the previous day. Trading in June closed with an average of 366,795 units at $6,952,581, including Bonds trading.

Ciboney Group led trading with 6.43 million shares for 37.1 percent of total volume, followed by Sagicor Select Financial Fund with 2.75 million units for 15.9 percent of the day’s trade, Transjamaican Highway ended with 2.58 million units for 14.9 percent of market share, Wigton Windfarm chipped in with 2.41 million units for 13.9 percent share and Carreras with 1.13 million units for 6.5 percent of total volume.

The All Jamaican Composite Index lost 1,461.79 points to finish at 364,684.10, the JSE Main Index fell 487.98 points to close at 328,377.50 and the JSE Financial Indexslipped 0.53 points to close at 71.93.

The All Jamaican Composite Index lost 1,461.79 points to finish at 364,684.10, the JSE Main Index fell 487.98 points to close at 328,377.50 and the JSE Financial Indexslipped 0.53 points to close at 71.93.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and six with lower offers.

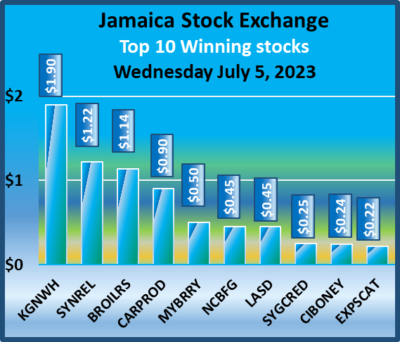

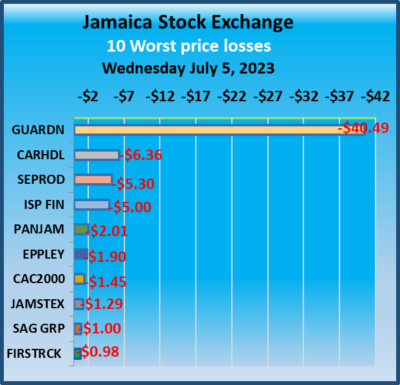

At the close, Caribbean Producers popped 90 cents in closing at $10.95 after an exchange of 35,426 shares, Eppley dropped $1.90 to $34 with shareholders swapping 1,471 units, First Rock Real Estate dipped 98 cents to end at $9.02 with stakeholders exchanging 40,939 stock units, Guardian Holdings fell $40.49 to close at $412.01 after an exchange of 259 stocks. Jamaica Broilers rallied $1.14 to $36.95 with a transfer of 27,974 stocks, Jamaica Stock Exchange shed $1.29 to $10.21 in trading 138,185 stock units, Kingston Wharves increased $1.90 in closing at $29.90 after 876 units crossed the market, Margaritaville lost $2.75 and ended at $15.30 after 1,105 shares passed through the exchange. Mayberry Investments rose 50 cents to end at $9 while exchanging 1,606 shares, NCB Financial advanced 45 cents to close at $65.50 in switching ownership of 121,185 stock units after the price hit an intraday 52 weeks’ low of $60, Pan Jamaica declined $2.01 and ended at $50.99, with 507,508 stocks crossing the exchange, Proven Investments declined $1 to end at $24.06 with 1,206 units crossing the market. Sagicor Group dipped $1 to close at $48 after a transfer of 38,194 stocks, Seprod shed $5.30 to $70.01 in an exchange of 2,630 stock units, Sygnus Real Estate Finance rose $1.22 in closing at $12 with 816 shares clearing the market.

Kingston Wharves increased $1.90 in closing at $29.90 after 876 units crossed the market, Margaritaville lost $2.75 and ended at $15.30 after 1,105 shares passed through the exchange. Mayberry Investments rose 50 cents to end at $9 while exchanging 1,606 shares, NCB Financial advanced 45 cents to close at $65.50 in switching ownership of 121,185 stock units after the price hit an intraday 52 weeks’ low of $60, Pan Jamaica declined $2.01 and ended at $50.99, with 507,508 stocks crossing the exchange, Proven Investments declined $1 to end at $24.06 with 1,206 units crossing the market. Sagicor Group dipped $1 to close at $48 after a transfer of 38,194 stocks, Seprod shed $5.30 to $70.01 in an exchange of 2,630 stock units, Sygnus Real Estate Finance rose $1.22 in closing at $12 with 816 shares clearing the market.

In the preference segment, Eppley 5% preference share gained $2.87 and ended at $20 in an exchange of 100 units, Eppley 7.50% preference share rallied 61 cents to end at $6.70, after trading 868 units and Jamaica Public Service 7% advanced $6.12 to $55 and closed with an exchange of 1,488 shares.

In the preference segment, Eppley 5% preference share gained $2.87 and ended at $20 in an exchange of 100 units, Eppley 7.50% preference share rallied 61 cents to end at $6.70, after trading 868 units and Jamaica Public Service 7% advanced $6.12 to $55 and closed with an exchange of 1,488 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading pull back on the Jamaica Exchange

Trading pulled back from a bounce on Tuesday and return to more recent levels as the Main and Junior Markets index slipped at the close of the Jamaica Stock Exchange on Wednesday and the USD markets rose after the volume and value of stocks traded dropped compared to Tuesday.

At the close, the JSE Combined Market Index dropped 489.22 points to 342,836.95, the All Jamaican Composite Index dropped 1,461.79 points to finish at 364,684.10, the JSE Main Index fell 487.98 points to settle at 328,377.50. The Junior Market Index slipped 3.70 points to close at 3,980.64. The JSE USD Market Index popped 3.85 points to close at 246.33.

At the close, the JSE Combined Market Index dropped 489.22 points to 342,836.95, the All Jamaican Composite Index dropped 1,461.79 points to finish at 364,684.10, the JSE Main Index fell 487.98 points to settle at 328,377.50. The Junior Market Index slipped 3.70 points to close at 3,980.64. The JSE USD Market Index popped 3.85 points to close at 246.33.

Preference shares with notable price movements but not in the Main Market TOP10 graphs are Eppley 5% preference share gained $2.87 and ended at $20, Eppley 7.50% preference share rallied 61 cents to end at $6.70 and Jamaica Public Service7% advanced $6.12 to $55.

At the close, investors exchanged 23,127,467 shares, in all three markets, down sharply from 83,893,459 stocks on Tuesday. The value of stocks trading in the Junior and Main markets was $108.2 million, a big climb from $654.8 million on Tuesday. Trading on the JSE USD market ended with investors exchanging 230,849 shares for US$10,905 from 447,072 units at US$12,058 on Tuesday.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.6 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 18.6 on 2022-23 earnings and 12.5 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

- « Previous Page

- 1

- …

- 31

- 32

- 33

- 34

- 35

- …

- 162

- Next Page »