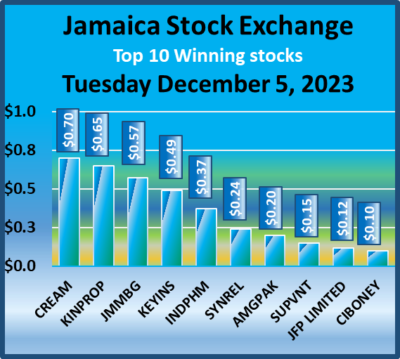

Trading picked up on the Jamaica Stock Exchange on Monday with a greater volume of stocks trading at a much higher value than on Monday, with both the Main and the junior Market indices dropping from Monday’s close while the JSE USD Market rose after sharp declines in a series of stocks led by Guardian Holdings, down $104.99, ISP finance with a fall of $7.50, Pan Jamaica down $5.41, Seprod falling $4.70, Eppley Property $4.30, Carib Cement off $2.77 and Access down $2,45.

led by Guardian Holdings, down $104.99, ISP finance with a fall of $7.50, Pan Jamaica down $5.41, Seprod falling $4.70, Eppley Property $4.30, Carib Cement off $2.77 and Access down $2,45.

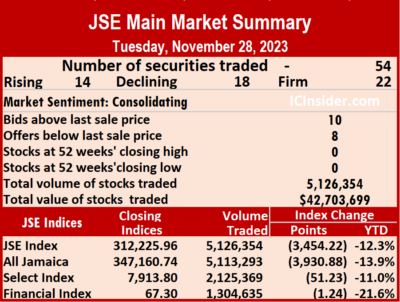

Trading closed with a plunge in JSE Combined Market Index by 4,203.69 points to end trading at 323,867.88, the All Jamaican Composite Index dropped 3,347.62 points to finish at 347,377.50, the JSE Main Index dived 4,153.74 points to 310,988.80. The Junior Market Index dropped 35.17 points to wrap-up trading at 3,677.75 on Tuesday and the JSE USD Market Index rose 3.47 points to end trading at 227.60.

Investors traded 20,284,498 shares, in all three markets, up from 12,196,470 units on Monday. The value of stocks traded on the Junior and Main markets amounts to $174.37 million up from just $40.13 million on Monday, as Wisynco Group dominated trading with 5.18 million shares for $104 million. The JSE USD market closed after 198,410 shares were traded, for US$3,547 compared to 89,619 units at US$7,899 on Monday.

In the preference segment, Jamaica Public Service 7% popped $1 to end at $46.

In the preference segment, Jamaica Public Service 7% popped $1 to end at $46.

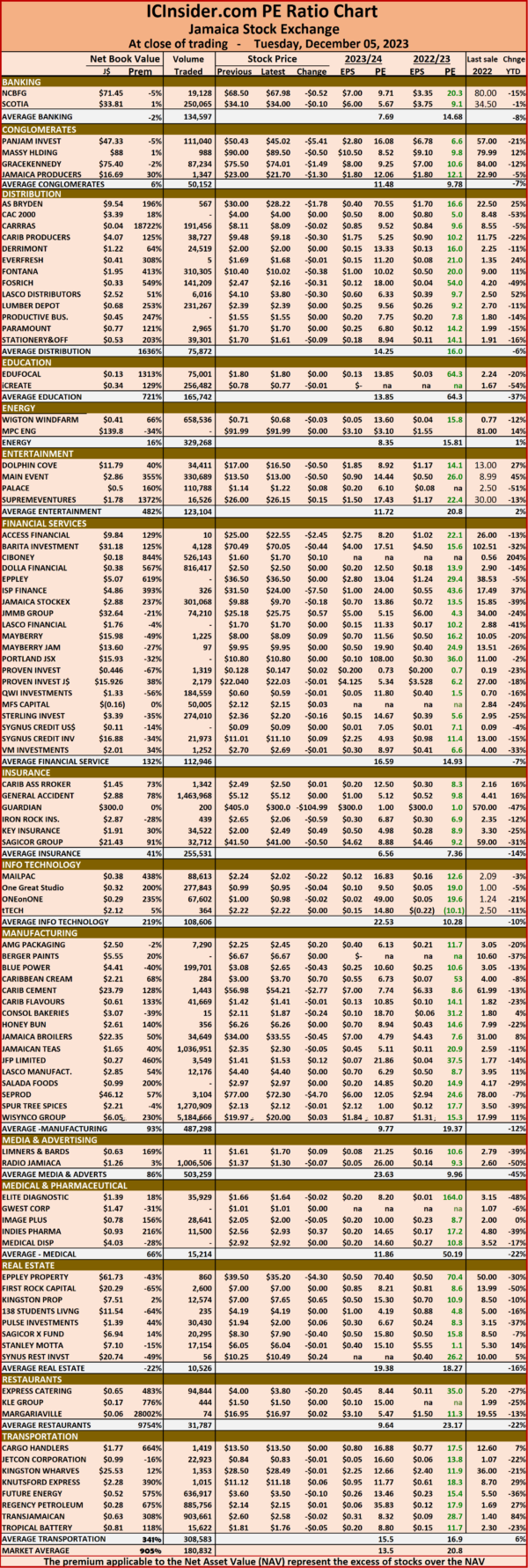

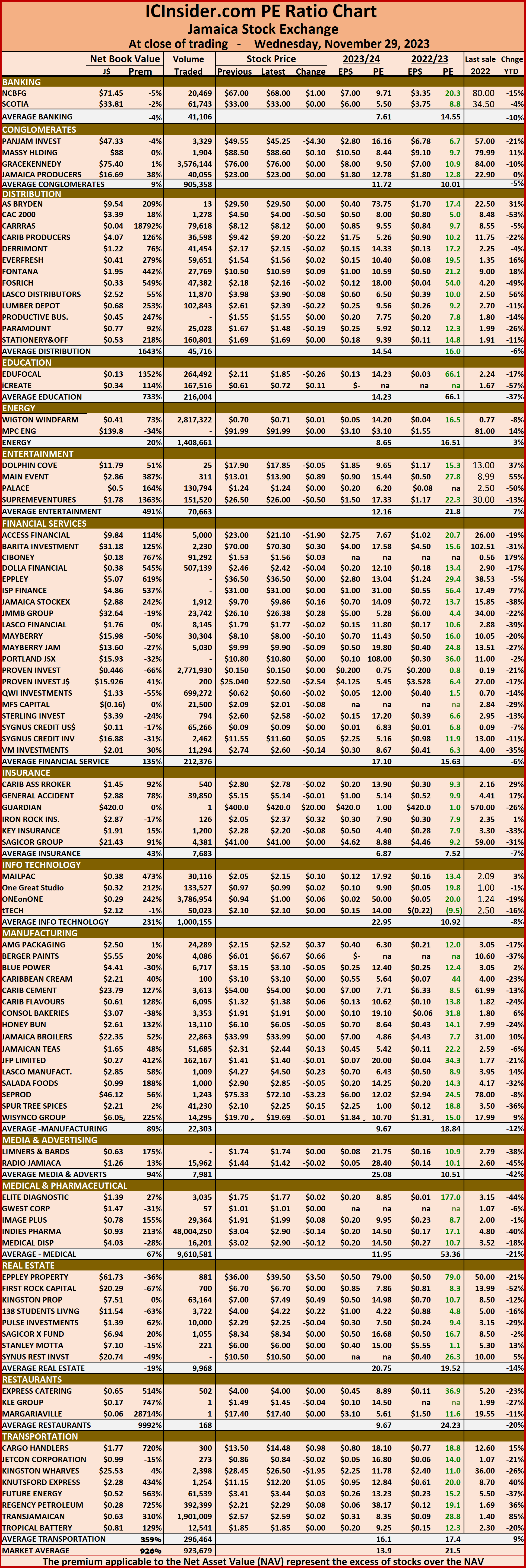

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.8 on 2022-23 earnings and 13.5 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Trading picks up on the JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with the volume of stocks changing hands rising 137 percent valued 215 percent more than on Friday, resulting in six securities trading on both Monday and Friday, with two rising, four declining on Monday.

Overall, 89,619 shares were traded, for US$7,899 up from 37,877 units at US$2,504 on Friday.

Overall, 89,619 shares were traded, for US$7,899 up from 37,877 units at US$2,504 on Friday.

Trading averaged 14,937 units at US$1,316, versus 6,313 shares at US$417 on Friday, with a month to date average of 10,625 shares at US$867 compared to November with an average of 249,102 units for US$14,204.

The US Denominated Equities Index dropped 2.72 points to close at 224.13.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Proven Investments lost 0.8 of a cent to close at 12.8 US cents after 3,327 stocks passed through the market, Sygnus Credit Investments climbed 0.29 of one cent to 9 US cents with investors transferring 30,840 units and Transjamaican Highway skidded 0.01 of a cent to end at 1.7 US cents, with 55,050 shares crossing the market.

In the preference segment, Eppley 6% preference share fell 22.5 cents in closing at US$1.275 with an exchange of 71 stock units, JMMB Group 5.75% popped 6 cents and ended at US$1.80 after closing with an exchange of 14 shares and Productive Business Solutions 9.25% preference share shed 1 cent to US$11.50, with 317 stock units clearing the market.

In the preference segment, Eppley 6% preference share fell 22.5 cents in closing at US$1.275 with an exchange of 71 stock units, JMMB Group 5.75% popped 6 cents and ended at US$1.80 after closing with an exchange of 14 shares and Productive Business Solutions 9.25% preference share shed 1 cent to US$11.50, with 317 stock units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

First Rock trades 19m shares in JSE USD Market

Trading jumped sharply on the Jamaica Stock Exchange US dollar market on Wednesday, with the volume of stocks changing hands surging 16,744 percent valued 15,601 percent more than on Tuesday and resulting with trading of seven securities , compared to three on Tuesday with four rising, no declining and three ending unchanged.

Overall, 22,289,394 shares were traded, for US$1,286,713 compared to 132,328 units at US$8,195 on Tuesday.

Overall, 22,289,394 shares were traded, for US$1,286,713 compared to 132,328 units at US$8,195 on Tuesday.

Trading averaged 3,184,199 shares at US$183,816 compared with 44,109 shares at US$2,732 on Tuesday, with a month to date average of 252,426 shares at US$14,653 compared with 79,969 units at US$4,702 on the previous day. October ended with an average of 47,977 units for US$4,392.

The US Denominated Equities Index advanced 4.45 points to cease trading at 228.23.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share inched 0.2 of a cent higher to 4.44 US cents after an exchange of 19,350,000 units, Margaritaville rose 1.79 cent to close at 13.79 US cents after a mere one stock passed through the market, MPC Caribbean Clean Energy ended at 57 US cents with 1,187 shares changing hands, Proven Investments ended at 15 US cents after an exchange of 2,771,930 stock units, Sterling Investments advanced 0.1 of a cent to end at 1.6 US cents after 1,206 shares were traded, Sygnus Credit Investments remained at 8.71 US cents in an exchange of 65,266 units and Transjamaican Highway popped 0.01 of a cent to 1.56 US cents, with 99,804 stocks changing hands.

At the close, First Rock Real Estate USD share inched 0.2 of a cent higher to 4.44 US cents after an exchange of 19,350,000 units, Margaritaville rose 1.79 cent to close at 13.79 US cents after a mere one stock passed through the market, MPC Caribbean Clean Energy ended at 57 US cents with 1,187 shares changing hands, Proven Investments ended at 15 US cents after an exchange of 2,771,930 stock units, Sterling Investments advanced 0.1 of a cent to end at 1.6 US cents after 1,206 shares were traded, Sygnus Credit Investments remained at 8.71 US cents in an exchange of 65,266 units and Transjamaican Highway popped 0.01 of a cent to 1.56 US cents, with 99,804 stocks changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

All traded stocks fell on JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with the volume of stocks changing hands declining 84 percent valued 80 percent lower than on Monday and resulted in three securities traded, compared to five on Monday with all three declining.

Overall, 132,328 shares were traded, for US$8,195 compared to 837,700 units at US$41,015 on Monday.

Overall, 132,328 shares were traded, for US$8,195 compared to 837,700 units at US$41,015 on Monday.

Trading averaged 44,109 units at US$2,732, versus 167,540 shares at US$8,203 on Monday, with a month to date average of 79,969 shares at US$4,702 compared with 80,896 units at US$4,753 on the previous day. October ended with an average of 47,977 units for US$4,392.

The US Denominated Equities Index fell 3.22 points to lock up trading at 223.77.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and none with a lower offer.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Proven Investments fell 0.98 of one cent to end at 15 US cents with traders dealing in 43,281 stock units, Sygnus Credit Investments skidded 0.02 of a cent to 8.71 US cent in switching ownership of 4,000 units and Transjamaican Highway lost 0.15 of a cent in closing at 1.55 US cents with stakeholders exchanging 85,047 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

A total of just 5,640,042 shares were traded for $27,974,248 down from 6,383,376 units at $32,170,003 on Friday.

A total of just 5,640,042 shares were traded for $27,974,248 down from 6,383,376 units at $32,170,003 on Friday. the JSE Main Index dropped 526.46 points to finish trading at 315,142.54 and the JSE Financial Index dipped 0.40 points to end trading at 68.17.

the JSE Main Index dropped 526.46 points to finish trading at 315,142.54 and the JSE Financial Index dipped 0.40 points to end trading at 68.17. GraceKennedy popped 75 cents to close at $75.50, with 65,161 stock units crossing the exchange, JMMB Group lost 42 cents and ended at $25.18 with shareholders swapping 129,520 shares, Mayberry Investments climbed 50 cents to $8 in trading 56,820 stocks. NCB Financial rose 50 cents and ended at $68.50, with 21,422 units clearing the market, Pan Jamaica gained 73 cents to close at $50.43 with a transfer of 5,880 stock units, Sagicor Group shed 45 cents in closing at $41.50 after trading 24,167 shares. Seprod advanced $3 to end at $77 with an exchange of 3,906 stocks and Supreme Ventures dropped 99 cents to $26, with 27,440 units crossing the market.

GraceKennedy popped 75 cents to close at $75.50, with 65,161 stock units crossing the exchange, JMMB Group lost 42 cents and ended at $25.18 with shareholders swapping 129,520 shares, Mayberry Investments climbed 50 cents to $8 in trading 56,820 stocks. NCB Financial rose 50 cents and ended at $68.50, with 21,422 units clearing the market, Pan Jamaica gained 73 cents to close at $50.43 with a transfer of 5,880 stock units, Sagicor Group shed 45 cents in closing at $41.50 after trading 24,167 shares. Seprod advanced $3 to end at $77 with an exchange of 3,906 stocks and Supreme Ventures dropped 99 cents to $26, with 27,440 units crossing the market.

Trading slipped to a mere 6,383,376 shares being exchanged for just $32,170,003 down from 16,736,165 units at $57,402,800 on Thursday.

Trading slipped to a mere 6,383,376 shares being exchanged for just $32,170,003 down from 16,736,165 units at $57,402,800 on Thursday. Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and six with lower offers.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and six with lower offers. Proven Investments shed $1.48 to end at $22.01 in an exchange of 15,848 shares, Sagicor Group popped 95 cents in closing at $41.95 with traders dealing in 175,260 units, Scotia Group gained $1.14 and ended at $33.99 after an exchange of 5,240 stocks. Seprod dipped $3.89 to $74, with 27,420 stock units crossing the market, Supreme Ventures rose 49 cents in closing at $26.99 in switching ownership of 11,913 shares and Sygnus Credit Investments fell 64 cents to end at $11.11 after exchanging 20,349 units.

Proven Investments shed $1.48 to end at $22.01 in an exchange of 15,848 shares, Sagicor Group popped 95 cents in closing at $41.95 with traders dealing in 175,260 units, Scotia Group gained $1.14 and ended at $33.99 after an exchange of 5,240 stocks. Seprod dipped $3.89 to $74, with 27,420 stock units crossing the market, Supreme Ventures rose 49 cents in closing at $26.99 in switching ownership of 11,913 shares and Sygnus Credit Investments fell 64 cents to end at $11.11 after exchanging 20,349 units. Jamaica Public Service 7% shed $1 to close at $45, with 198 stocks clearing the market and JMMB Group 7% preference share lost 36 cents and ended at $2.04 with a transfer of 3,435 stock units.

Jamaica Public Service 7% shed $1 to close at $45, with 198 stocks clearing the market and JMMB Group 7% preference share lost 36 cents and ended at $2.04 with a transfer of 3,435 stock units. Trading ended after 16,736,165 shares were traded for $57,402,800 compared to 9,982,907 units at $279,360,313 on Wednesday.

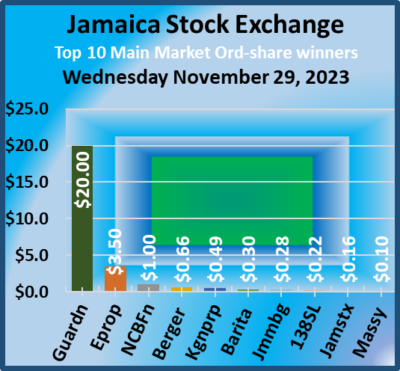

Trading ended after 16,736,165 shares were traded for $57,402,800 compared to 9,982,907 units at $279,360,313 on Wednesday. The All Jamaican Composite Index jumped 2,968.81 points to 349,935.85, the JSE Main Index climbed 1,982.67 points to conclude trading at 315,147.63 and the JSE Financial Index rose 0.40 points to end trading at 68.40.

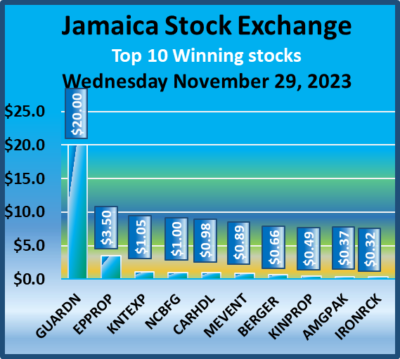

The All Jamaican Composite Index jumped 2,968.81 points to 349,935.85, the JSE Main Index climbed 1,982.67 points to conclude trading at 315,147.63 and the JSE Financial Index rose 0.40 points to end trading at 68.40. Kingston Wharves climbed $1.95 to end at $28.45 after an exchange of 505 shares, Margaritaville dipped 40 cents to $17 after 25 stocks were traded. Massy Holdings rose $1.40 to end at $90 with an exchange of 1,574 units, NCB Financial advanced $1.20 in closing at $69.20 with, 38,317 stock units changing hands, 138 Student Living shed 31 cents to close at $3.91 in trading 12,055 shares. Pan Jamaica popped $3.75 and ended at $49, with 64,091 stock units crossing the exchange, Proven Investments gained 99 cents to close at $23.49 after a transfer of 873 stocks, Seprod rallied $5.79 and ended at $77.89 while exchanging 60,013 units. Supreme Ventures popped 50 cents in closing at $26.50, as 120,308 stocks passed through the market and Wisynco Group rallied 31 cents to close at $20 as investors exchanged 327,965 shares.

Kingston Wharves climbed $1.95 to end at $28.45 after an exchange of 505 shares, Margaritaville dipped 40 cents to $17 after 25 stocks were traded. Massy Holdings rose $1.40 to end at $90 with an exchange of 1,574 units, NCB Financial advanced $1.20 in closing at $69.20 with, 38,317 stock units changing hands, 138 Student Living shed 31 cents to close at $3.91 in trading 12,055 shares. Pan Jamaica popped $3.75 and ended at $49, with 64,091 stock units crossing the exchange, Proven Investments gained 99 cents to close at $23.49 after a transfer of 873 stocks, Seprod rallied $5.79 and ended at $77.89 while exchanging 60,013 units. Supreme Ventures popped 50 cents in closing at $26.50, as 120,308 stocks passed through the market and Wisynco Group rallied 31 cents to close at $20 as investors exchanged 327,965 shares. In the preference segment, 138 Student Living preference share rose 51 cents to end at $107, with 10,581 stock units clearing the market.

In the preference segment, 138 Student Living preference share rose 51 cents to end at $107, with 10,581 stock units clearing the market. Overall, 9,982,907 shares were traded at $279,360,313 compared with 5,126,354 units at $42,703,699 on Tuesday.

Overall, 9,982,907 shares were traded at $279,360,313 compared with 5,126,354 units at $42,703,699 on Tuesday. the JSE Main Index gained 939.00 points to close at 313,164.96 and the JSE Financial Index advanced 0.70 points to 68.00.

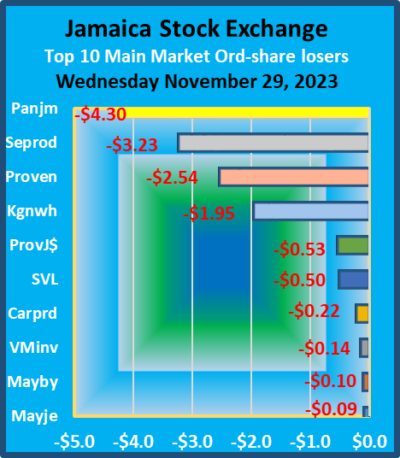

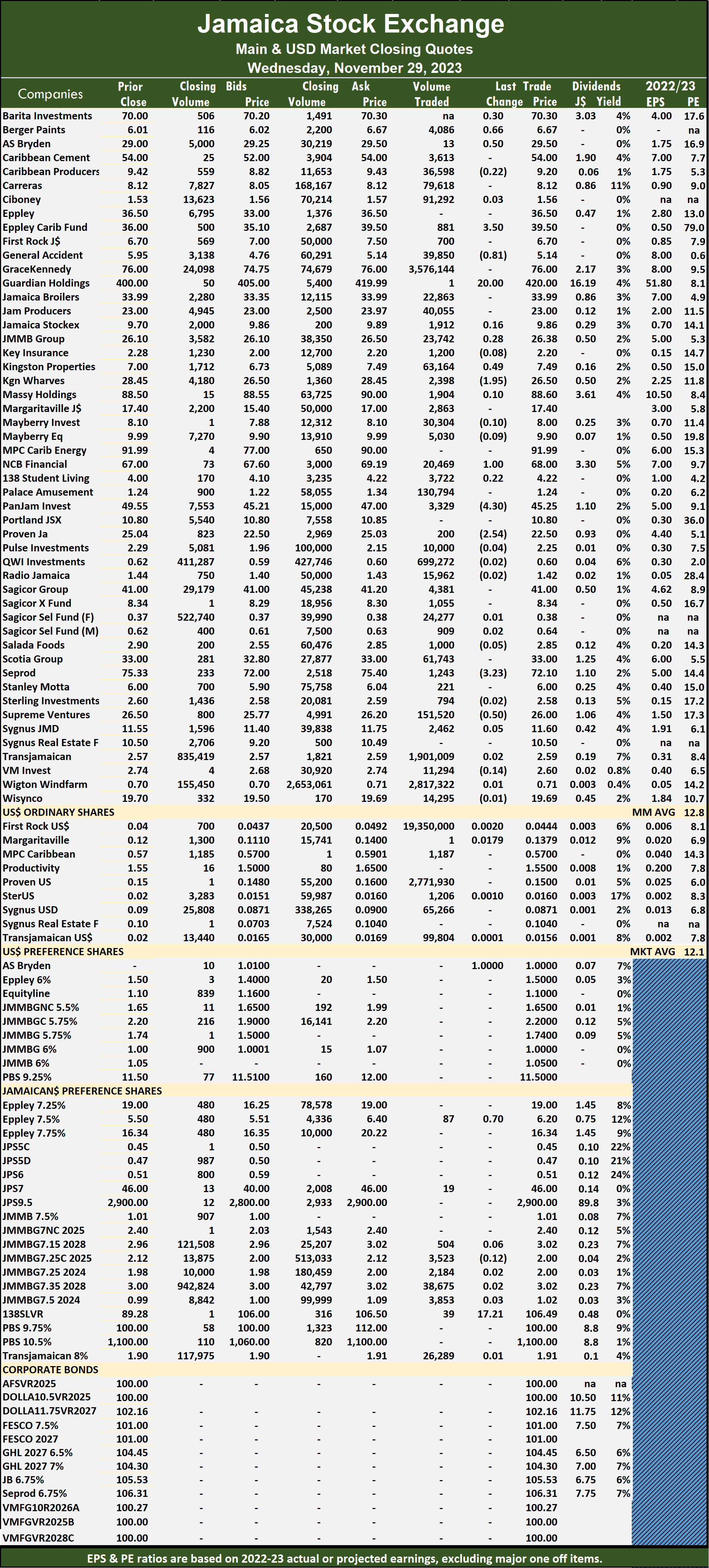

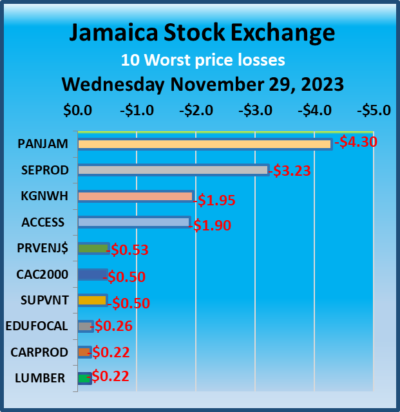

the JSE Main Index gained 939.00 points to close at 313,164.96 and the JSE Financial Index advanced 0.70 points to 68.00. Kingston Properties rose 49 cents to $7.49 after investors exchanged 63,164 units. Kingston Wharves declined $1.95 to close at $26.50 with stakeholders exchanging 2,398 stocks, NCB Financial gained $1 to end at $68 in trading 20,469 stock units, Pan Jamaica lost $4.30 in closing at $45.25, with 3,329 shares crossing the market. Proven Investments skidded $2.54 and ended at $22.50 after an exchange of 200 stocks, Seprod fell $3.23 to $72.10 in switching ownership of 1,243 units and Supreme Ventures dropped 50 cents to close at $26 as investors exchanged 151,520 stock units.

Kingston Properties rose 49 cents to $7.49 after investors exchanged 63,164 units. Kingston Wharves declined $1.95 to close at $26.50 with stakeholders exchanging 2,398 stocks, NCB Financial gained $1 to end at $68 in trading 20,469 stock units, Pan Jamaica lost $4.30 in closing at $45.25, with 3,329 shares crossing the market. Proven Investments skidded $2.54 and ended at $22.50 after an exchange of 200 stocks, Seprod fell $3.23 to $72.10 in switching ownership of 1,243 units and Supreme Ventures dropped 50 cents to close at $26 as investors exchanged 151,520 stock units. In the preference segment, Eppley 7.50% preference share rose 70 cents and ended at $6.20 after 87 shares crossed the market and 138 Student Living preference share rallied $17.21 to close at $106.49 after an exchange of 39 stocks.

In the preference segment, Eppley 7.50% preference share rose 70 cents and ended at $6.20 after 87 shares crossed the market and 138 Student Living preference share rallied $17.21 to close at $106.49 after an exchange of 39 stocks. At the close of trading, the JSE Combined Market Index rose 793.44 points to close at 326,055.23, the All Jamaican Composite Index declined by 193.70 points to 346,967.04, the JSE Main Index gained 939.00 points to finish at 313,164.96. The Junior Market Index shed 9.97 points to end trading at 3,694.47 and the JSE USD Market Index climbed 4.49 points to end at 228.26.

At the close of trading, the JSE Combined Market Index rose 793.44 points to close at 326,055.23, the All Jamaican Composite Index declined by 193.70 points to 346,967.04, the JSE Main Index gained 939.00 points to finish at 313,164.96. The Junior Market Index shed 9.97 points to end trading at 3,694.47 and the JSE USD Market Index climbed 4.49 points to end at 228.26. In the preference segment, 138 Student Living preference share rallied $17.21 to close at $106.49.

In the preference segment, 138 Student Living preference share rallied $17.21 to close at $106.49. The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. A total of 5,126,354 shares were traded for $42,703,699 compared with 6,629,759 units at $37,460,689 on Monday.

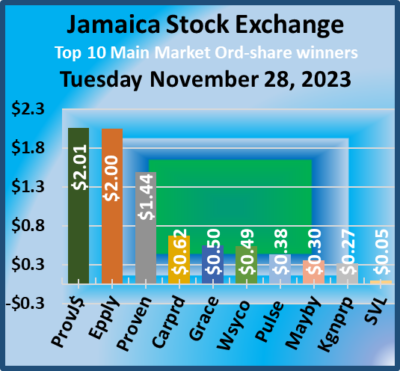

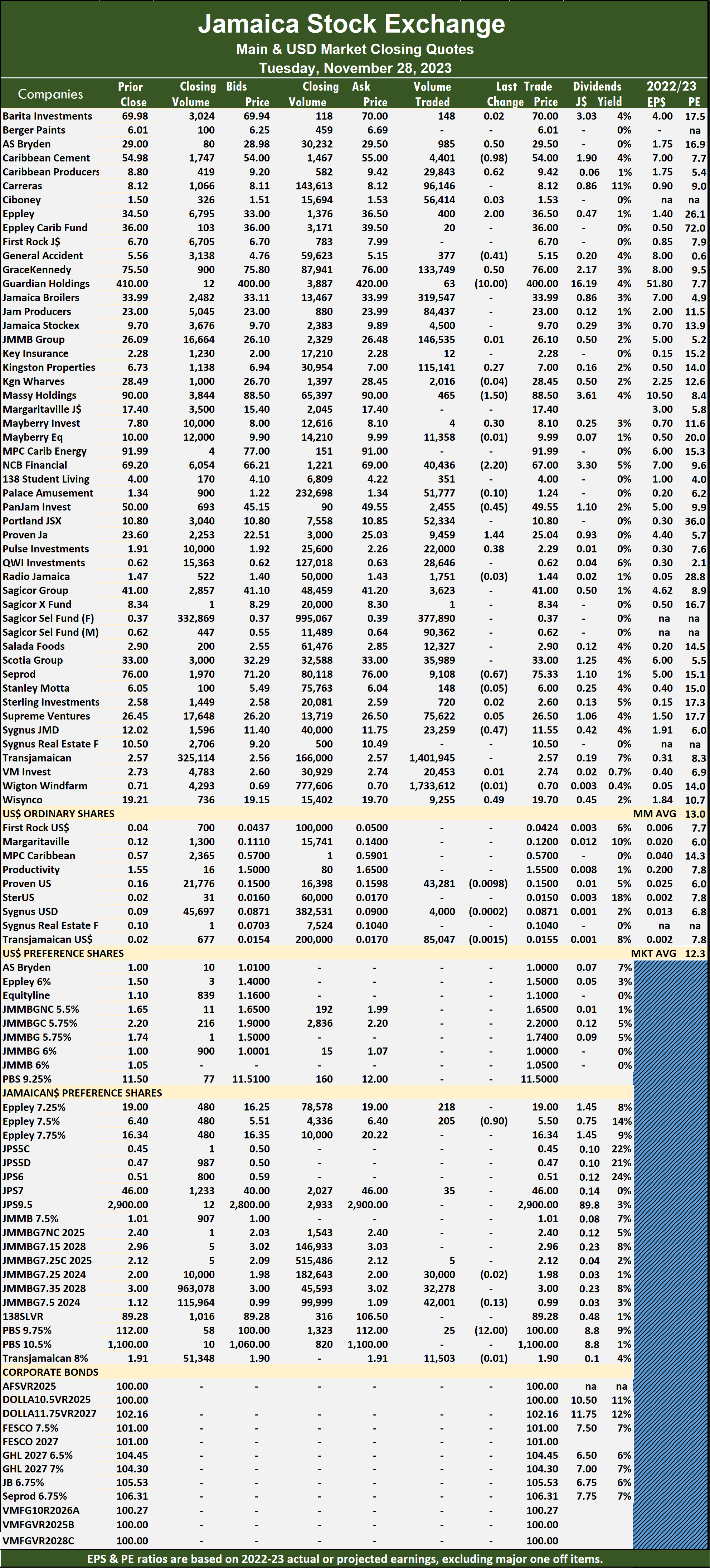

A total of 5,126,354 shares were traded for $42,703,699 compared with 6,629,759 units at $37,460,689 on Monday. The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. Mayberry Investments increased 30 cents to close at $8.10 with, 4 stocks changing hands, NCB Financial dipped $2.20 and ended at $67 after trading ended with 40,436 units changing hands. Pan Jamaica fell 45 cents to end at $49.55 and closed with 2,455 shares passing through the market, Proven Investments advanced $1.44 in closing at $25.04 with shareholders swapping 9,459 stock units, Pulse Investments rallied 38 cents to $2.29, with 22,000 stocks crossing the exchange. Seprod dropped 67 cents and ended at $75.33 with traders dealing in 9,108 units, Sygnus Credit Investments skidded 47 cents to close at $11.55 in an exchange of 23,259 stocks and Wisynco Group rose 49 cents to end at $19.70 as 9,255 shares passed through the market.

Mayberry Investments increased 30 cents to close at $8.10 with, 4 stocks changing hands, NCB Financial dipped $2.20 and ended at $67 after trading ended with 40,436 units changing hands. Pan Jamaica fell 45 cents to end at $49.55 and closed with 2,455 shares passing through the market, Proven Investments advanced $1.44 in closing at $25.04 with shareholders swapping 9,459 stock units, Pulse Investments rallied 38 cents to $2.29, with 22,000 stocks crossing the exchange. Seprod dropped 67 cents and ended at $75.33 with traders dealing in 9,108 units, Sygnus Credit Investments skidded 47 cents to close at $11.55 in an exchange of 23,259 stocks and Wisynco Group rose 49 cents to end at $19.70 as 9,255 shares passed through the market. In the preference segment, Eppley 7.50% preference share fell 90 cents to $5.50 with investors transferring 205 stock units and Productive Business Solutions 9.75% preference share dropped $12 to end at $100 in an exchange of 25 shares.

In the preference segment, Eppley 7.50% preference share fell 90 cents to $5.50 with investors transferring 205 stock units and Productive Business Solutions 9.75% preference share dropped $12 to end at $100 in an exchange of 25 shares.