Jamaica Stock Exchange Main Market activity ended with the market index declining for a second day, just ahead of the final trading day for May as investors exchanged more shares than on Wednesday.

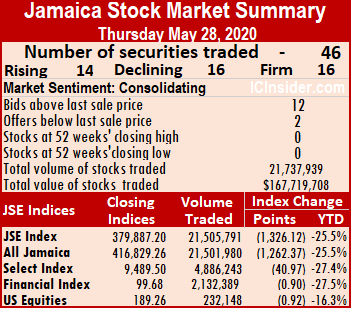

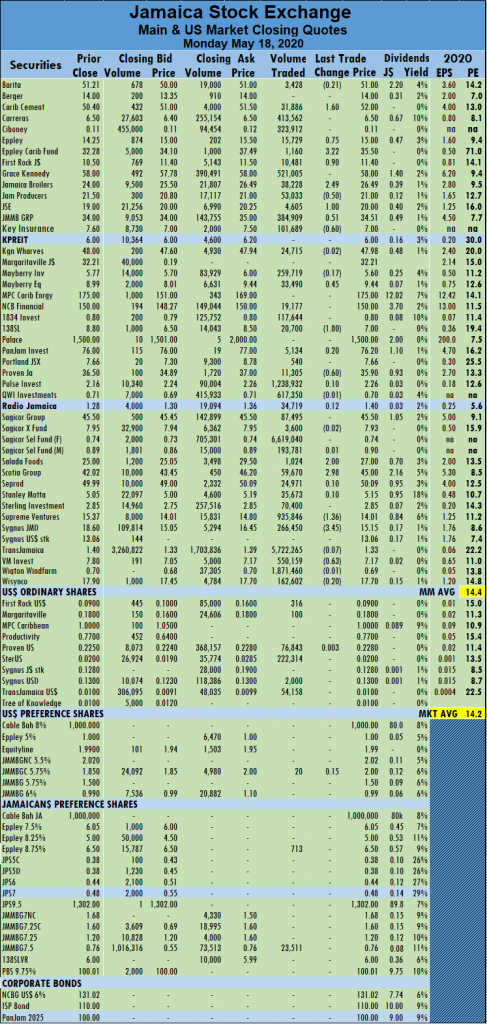

At the close, the JSE All Jamaican Composite Index declined by 1,262.37 points to 416,829.26, the JSE Market Index fell 1,326.12 points to 379,887.20 and the JSE Financial Index lost 0.90 points to 99.68. The PE ratio of the market ended at 14.4, while the Main Market ended at 14.6 times 2020-21 earnings.

At the close, the JSE All Jamaican Composite Index declined by 1,262.37 points to 416,829.26, the JSE Market Index fell 1,326.12 points to 379,887.20 and the JSE Financial Index lost 0.90 points to 99.68. The PE ratio of the market ended at 14.4, while the Main Market ended at 14.6 times 2020-21 earnings.

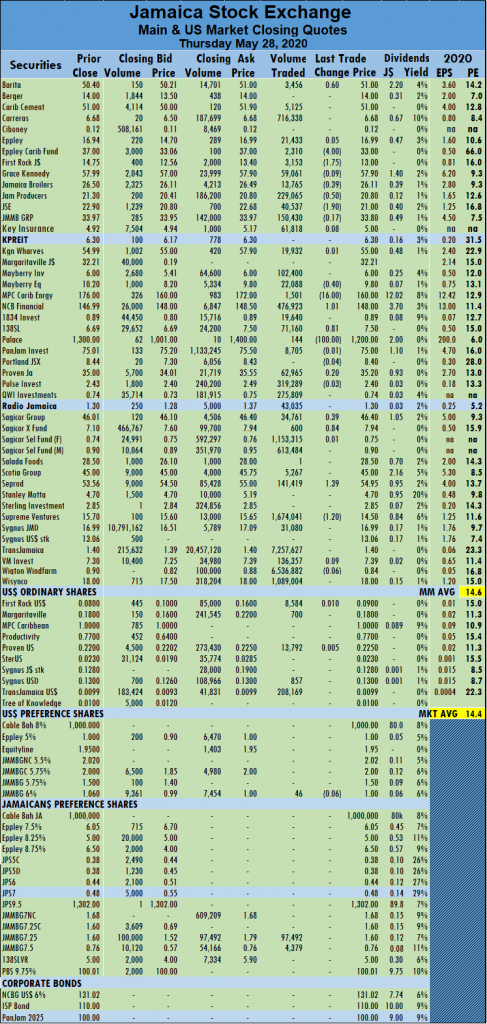

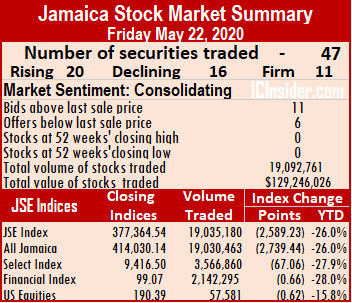

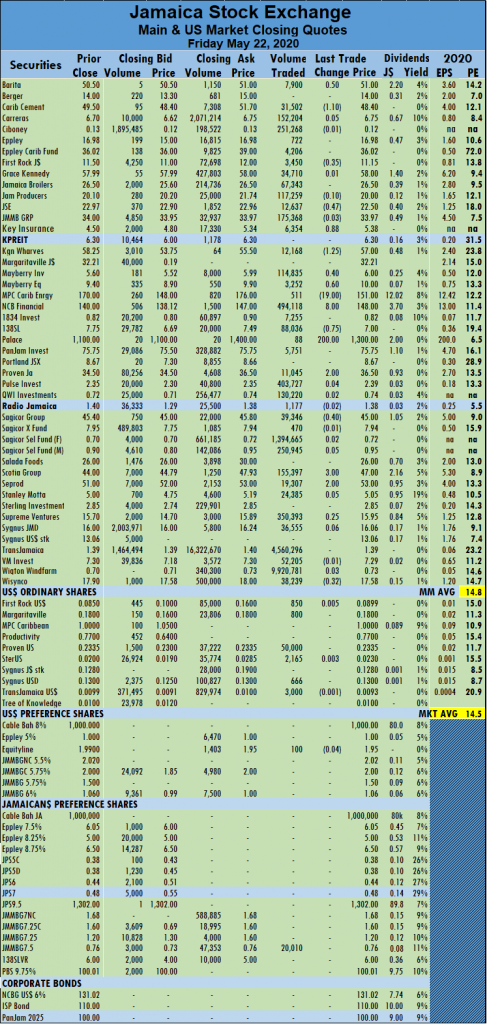

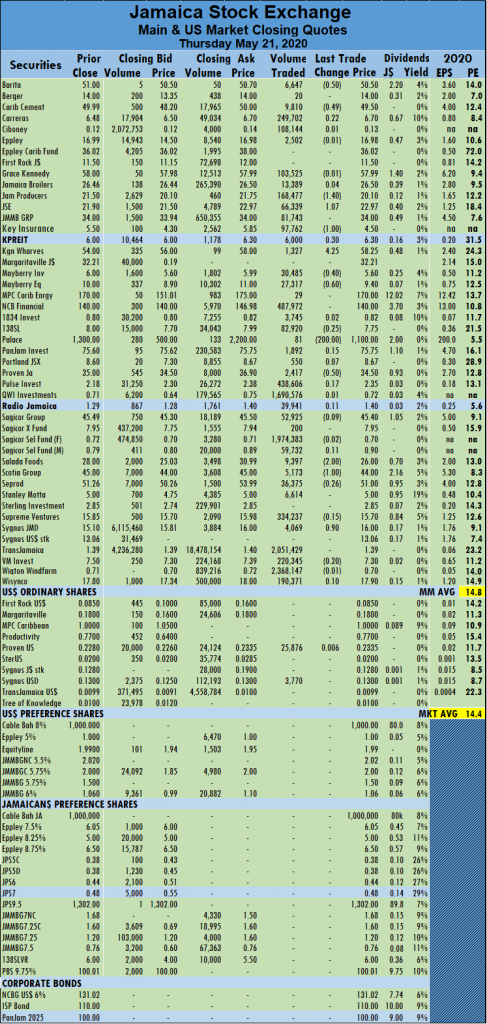

The market closed with 46 securities changing hands in the Main and US dollar markets with prices of 14 stocks advancing, 16 declining and 16 securities trading firm. The JSE Main Market activity ended with 40 securities accounting for 21,505,791 units valued at $167,719,708, in contrast to 18,437,961 units valued at $158,788,476 from 44 securities on Wednesday.

Trans Jamaican Highway led trading with 7.3 million shares for 34 percent of the total volume, followed by Wigton Windfarm with 6.5 million units for 30.4 percent of the day’s trade and Supreme Ventures with 1.7 million units for 7.8 percent market share. Other stocks trading over 1 million units were Sagicor Select Financial Fund and Wisynco Group, with 1.15 million units and 1.1 million units, respectively.

The average trade for the day was 537,645 units at $4,192,993 each, in contrast to 419,045 units for $3,608,829 on Wednesday. The average volume and value for the month to date amount to 369,670 units valued at $2,994,834 for each security changing hands, compared to 361,176 units with an average value of $2,930,932. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The average trade for the day was 537,645 units at $4,192,993 each, in contrast to 419,045 units for $3,608,829 on Wednesday. The average volume and value for the month to date amount to 369,670 units valued at $2,994,834 for each security changing hands, compared to 361,176 units with an average value of $2,930,932. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows twelve stocks ending with bids higher than their last selling prices and two stocks closing with lower offers.

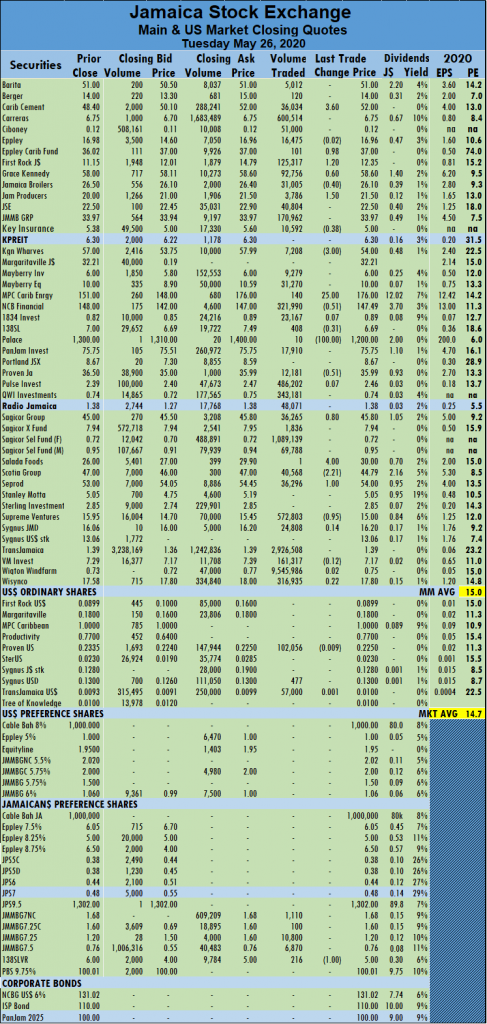

In the Main Market, Barita Investments gained 60 cents to close at $51 in trading 3,456 units, Eppley Caribbean Property Fund dropped $4 to $33, with an exchange of 2,310 units, First Rock Capital ended $1.75 lower at $13 after transferring 3,153 units. Jamaica Broilers shed 39 cents exchanging 13,765 stock units to settle at $26.11, Jamaica Producers slipped 50 cents to $20.80, in transferring 229,065 shares. Jamaica Stock Exchange dropped $1.90 to finish at $21, with 40,537 stock units changing hands. Mayberry Jamaican Equities closed 40 cents lower at $9.80, in switching ownership of 22,088 stock units,  MPC Caribbean Clean Energy tumbled $16 to $160 trading 1,501 units, NCB Financial Group climbed $1.01 to end at $148, with 476,923 shares changing hands. 138 Student Living gained 81 cents and transferred 71,160 stock units in closing at $7.50, Palace Amusement dived $100 to end at $1,200 trading 144 units, Sagicor Group rose 39 cents to $46.40 exchanging 34,761 stock units. Sagicor Real Estate Fund added 84 cents to finish at $7.94, with 600 units changing hands, Seprod climbed $1.39 to close at $54.95, in trading 141,419 shares and Supreme Ventures slid $1.20 transferring 1,674,041 shares and closed at $14.50.

MPC Caribbean Clean Energy tumbled $16 to $160 trading 1,501 units, NCB Financial Group climbed $1.01 to end at $148, with 476,923 shares changing hands. 138 Student Living gained 81 cents and transferred 71,160 stock units in closing at $7.50, Palace Amusement dived $100 to end at $1,200 trading 144 units, Sagicor Group rose 39 cents to $46.40 exchanging 34,761 stock units. Sagicor Real Estate Fund added 84 cents to finish at $7.94, with 600 units changing hands, Seprod climbed $1.39 to close at $54.95, in trading 141,419 shares and Supreme Ventures slid $1.20 transferring 1,674,041 shares and closed at $14.50.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

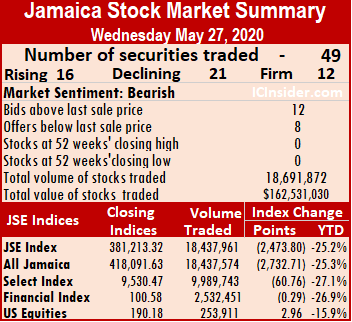

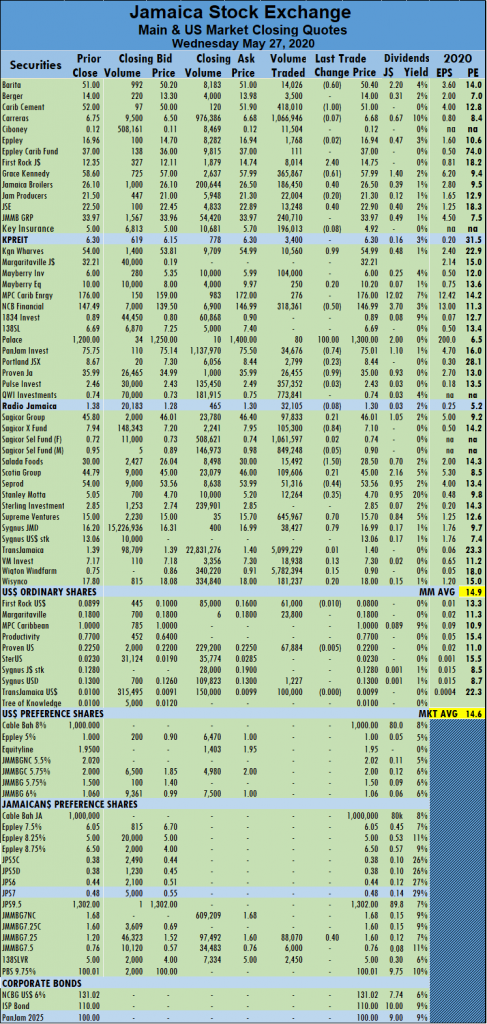

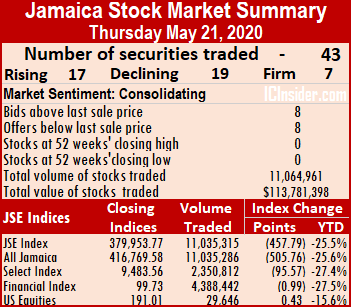

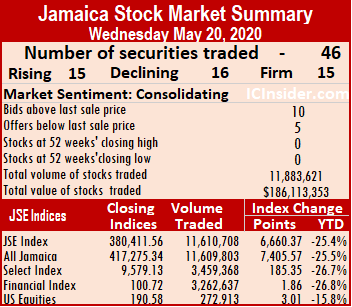

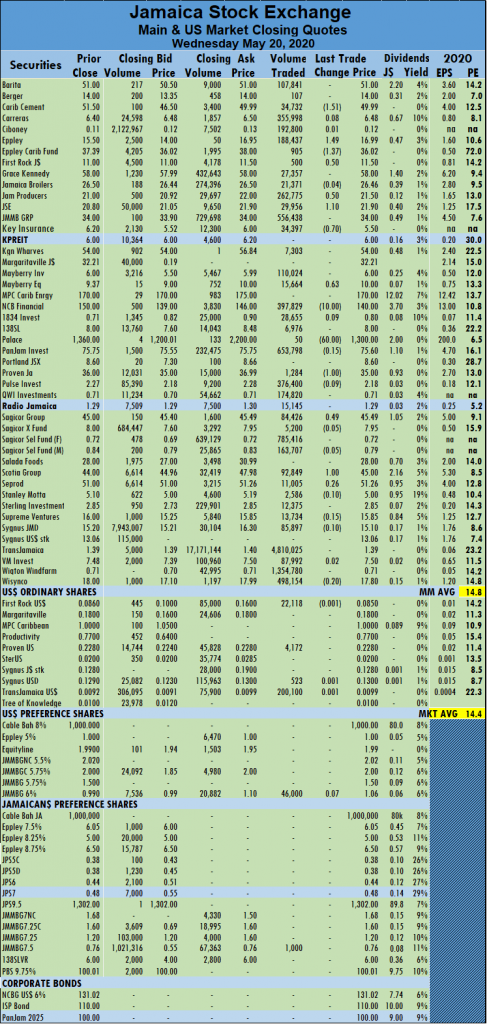

At the close, the JSE All Jamaican Composite Index declined by 2,732.71 points to 418,091.63, the JSE Market Index dropped 2,473.80 points to 381,213.32 and the JSE Financial Index lost 0.29 points to 100.58.

At the close, the JSE All Jamaican Composite Index declined by 2,732.71 points to 418,091.63, the JSE Market Index dropped 2,473.80 points to 381,213.32 and the JSE Financial Index lost 0.29 points to 100.58. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. NCB Financial Group slipped 50 cents to end at $146.99, after swapping 318,361 shares, Palace Amusement advanced $100 to end at $1,300 while trading 80 units. PanJam Investment closed at $75.01, with a loss of 74 cents after exchanging 34,676 stock units, Proven Investments fell 99 cents to finish at $35, in swapping 26,455 stock units, Sagicor Real Estate Fund ended 84 cents lower at $7.10, with 105,300 shares changing hands. Salada Foods declined $1.50 to $28.50 after 15,492 stock units changed hands, Seprod lost 44 cents to close at $53.56, in trading 51,316 stock units, Stanley Motta finished at $4.70, having lost 35 cents in swapping 12,264 units. Supreme Ventures ended at $15.70, with a rise of 70 cents in exchanging 645,967 shares and Sygnus Credit Investments gained 79 cents with 38,427 stock units crossing the exchange and closed at $16.99.

NCB Financial Group slipped 50 cents to end at $146.99, after swapping 318,361 shares, Palace Amusement advanced $100 to end at $1,300 while trading 80 units. PanJam Investment closed at $75.01, with a loss of 74 cents after exchanging 34,676 stock units, Proven Investments fell 99 cents to finish at $35, in swapping 26,455 stock units, Sagicor Real Estate Fund ended 84 cents lower at $7.10, with 105,300 shares changing hands. Salada Foods declined $1.50 to $28.50 after 15,492 stock units changed hands, Seprod lost 44 cents to close at $53.56, in trading 51,316 stock units, Stanley Motta finished at $4.70, having lost 35 cents in swapping 12,264 units. Supreme Ventures ended at $15.70, with a rise of 70 cents in exchanging 645,967 shares and Sygnus Credit Investments gained 79 cents with 38,427 stock units crossing the exchange and closed at $16.99. At the close, the JSE All Jamaican Composite Index advanced by 6,794.20 points to 420,824.34, the JSE Market Index climbed 6,322.58 points to 383,687.12 and the JSE Financial Index gained 1.80 points to 100.87.

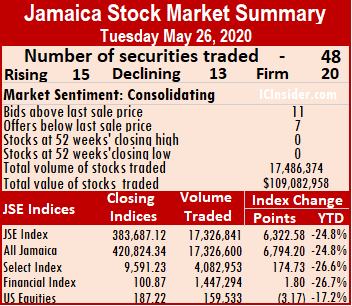

At the close, the JSE All Jamaican Composite Index advanced by 6,794.20 points to 420,824.34, the JSE Market Index climbed 6,322.58 points to 383,687.12 and the JSE Financial Index gained 1.80 points to 100.87. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. NCB Financial Group slipped to $147.49, with a loss of 51 cents with 321,990 shares changing hands, 138 Student Living closed 31 cents lower at $6.69, after exchanging 408 units, Palace Amusement declined by $100 to end at $1,200, with a transfer of just 10 units. Proven Investments closed 51 cents lower at $35.99, transferring 12,181 stock units, Sagicor Group rose 80 cents to $45.80, with 36,265 stock units changing hands, Salada Foods advanced by $4 to $30 trading only one unit. Scotia Group fell by $2.21 to $44.79, in transferring 40,568 stock units, Seprod gained $1 to end at $54, in exchanging 36,296 stock units and Supreme Ventures ended 95 cents lower at $15, with 572,803 shares crossing the exchange.

NCB Financial Group slipped to $147.49, with a loss of 51 cents with 321,990 shares changing hands, 138 Student Living closed 31 cents lower at $6.69, after exchanging 408 units, Palace Amusement declined by $100 to end at $1,200, with a transfer of just 10 units. Proven Investments closed 51 cents lower at $35.99, transferring 12,181 stock units, Sagicor Group rose 80 cents to $45.80, with 36,265 stock units changing hands, Salada Foods advanced by $4 to $30 trading only one unit. Scotia Group fell by $2.21 to $44.79, in transferring 40,568 stock units, Seprod gained $1 to end at $54, in exchanging 36,296 stock units and Supreme Ventures ended 95 cents lower at $15, with 572,803 shares crossing the exchange.

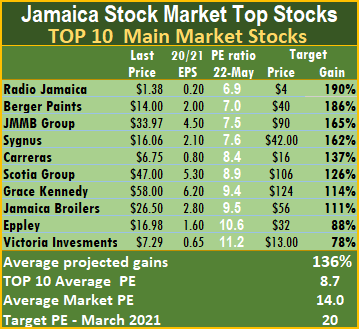

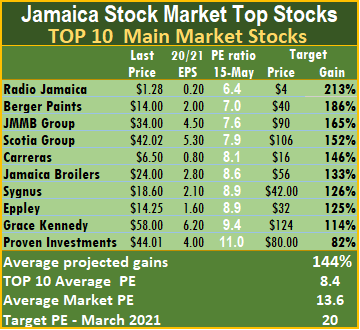

In the Main Market, Proven Investments dropped out of the TOP 10 and replaced by Victoria Mutual Investments.

In the Main Market, Proven Investments dropped out of the TOP 10 and replaced by Victoria Mutual Investments. The new subsidiary, Trinidad based MotorOne Insurance made a small loss of $2 million in the quarter, an indication that not much contribution to profit is expected from it for the current year, it could add to 2021 profit for the group. Total assets of the company grew substantially since March last year from $7.5 billion to $12 billion in the current year, with liabilities rising by $3.5 billion.

The new subsidiary, Trinidad based MotorOne Insurance made a small loss of $2 million in the quarter, an indication that not much contribution to profit is expected from it for the current year, it could add to 2021 profit for the group. Total assets of the company grew substantially since March last year from $7.5 billion to $12 billion in the current year, with liabilities rising by $3.5 billion. One company that has seen an uptick in business, Jamaican Teas, had to lay on new work shifts and extra production days to keep up with export demand.

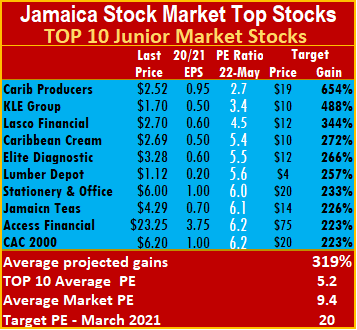

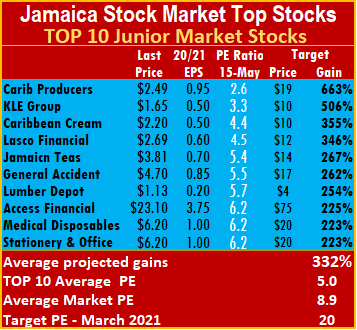

One company that has seen an uptick in business, Jamaican Teas, had to lay on new work shifts and extra production days to keep up with export demand. The PE ratio for Junior Market Top 10 stocks averages a mere 5.2 with or 55 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at 8.7 or 62 percent of the PE of the overall market.

The PE ratio for Junior Market Top 10 stocks averages a mere 5.2 with or 55 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at 8.7 or 62 percent of the PE of the overall market. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. Mayberry Jamaican Equities picked up 60 cents to end at $10, with a transfer of 3,252 units, MPC Caribbean Clean Energy declined by $19 trading 511 units and closed at $151. NCB Financial Group advanced $8 to $148, with 494,118 shares changing hands, 138 Student Living closed 75 cents lower at $7, after swapping 88,036 stock units, Palace Amusement clawed back $200 to advance to $1,300, after trading 88 units. Proven Investments climbed $2 to finish at $36.50, with 11,045 units crossing the exchange, Sagicor Group traded 39,346 stock units at $45, after gaining 40 cents, Scotia Group advanced by $3 to $47, in transferring 155,397 shares. Seprod climbed $2 to $53 exchanging 19,307 units and Wisynco Group ended the day’s trade 32 cents lower at $17.58, in swapping 38,239 stock units.

Mayberry Jamaican Equities picked up 60 cents to end at $10, with a transfer of 3,252 units, MPC Caribbean Clean Energy declined by $19 trading 511 units and closed at $151. NCB Financial Group advanced $8 to $148, with 494,118 shares changing hands, 138 Student Living closed 75 cents lower at $7, after swapping 88,036 stock units, Palace Amusement clawed back $200 to advance to $1,300, after trading 88 units. Proven Investments climbed $2 to finish at $36.50, with 11,045 units crossing the exchange, Sagicor Group traded 39,346 stock units at $45, after gaining 40 cents, Scotia Group advanced by $3 to $47, in transferring 155,397 shares. Seprod climbed $2 to $53 exchanging 19,307 units and Wisynco Group ended the day’s trade 32 cents lower at $17.58, in swapping 38,239 stock units. The average volume and value for the month to date amount to 348,777 units valued at $2,908,729 for each security changing hands, compared to 354,034 units with an average value of $2,919,802. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The average volume and value for the month to date amount to 348,777 units valued at $2,908,729 for each security changing hands, compared to 354,034 units with an average value of $2,919,802. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. Mayberry Investments lost 40 cents to close at $5.60 with 30,485 stock units changing hands, Mayberry Jamaican Equities exchanged 27,317 stock units after shedding 60 cents to end at $9.40, and is trading at an 11.5 percent premium to the Net Asset Value as of May 18, of J$8.15. Palace Amusement closed $200 lower to $1,100, in trading 81 units, Proven Investments lost 50 cents to settle at $34.50 in swapping 2,417 units, Salada Foods declined to $26, with a loss of $2 after transferring 9,397 units. Scotia Group closed at $44, after losing $1 and exchanging 5,173 units and Sygnus Credit Investments ended the day 90 cents higher at $16, with 4,069 units changing hands.

Mayberry Investments lost 40 cents to close at $5.60 with 30,485 stock units changing hands, Mayberry Jamaican Equities exchanged 27,317 stock units after shedding 60 cents to end at $9.40, and is trading at an 11.5 percent premium to the Net Asset Value as of May 18, of J$8.15. Palace Amusement closed $200 lower to $1,100, in trading 81 units, Proven Investments lost 50 cents to settle at $34.50 in swapping 2,417 units, Salada Foods declined to $26, with a loss of $2 after transferring 9,397 units. Scotia Group closed at $44, after losing $1 and exchanging 5,173 units and Sygnus Credit Investments ended the day 90 cents higher at $16, with 4,069 units changing hands. The market closed with 46 securities changing hands in the Main and US dollar markets with prices of 15 stocks advancing, 16 declining and 15 securities trading firm. The JSE Main Market activity ended with 41 securities changing hands accounting for 11,610,708 units valued at $178,231,093, in contrast to 17,254,018 units valued at $121,600,273 from 45 securities on Tuesday.

The market closed with 46 securities changing hands in the Main and US dollar markets with prices of 15 stocks advancing, 16 declining and 15 securities trading firm. The JSE Main Market activity ended with 41 securities changing hands accounting for 11,610,708 units valued at $178,231,093, in contrast to 17,254,018 units valued at $121,600,273 from 45 securities on Tuesday. The average volume and value for the month to date amount to 354,034 units valued at $2,919,802 for each security changing hands, compared to 359,042 units with an average of $2,811,232. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The average volume and value for the month to date amount to 354,034 units valued at $2,919,802 for each security changing hands, compared to 359,042 units with an average of $2,811,232. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. Jamaica Producers gained 50 cents transferring 262,775 shares and closed at $21.50, Jamaica Stock Exchange advanced $1.10 to $21.90, in trading 29,956 stock units. Key Insurance fell 70 cents to $5.50, with an exchange of 34,397 stock units, Mayberry Jamaican Equities gained 63 cents to end at $10, after swapping 15,664 units, NCB Financial Group declined by $10 to end at $140, after exchanging 397,829 shares. Palace Amusement ended the day’s trade $60 lower at $1,300, in transferring 50 units, Proven Investments fell $1 to $35, with 1,284 units changing hands, Sagicor Group picked up 49 cents to finish at $45.49, in trading 84,426 shares and Scotia Group closed at $45, with gains of $1 exchanging 92,849 shares.

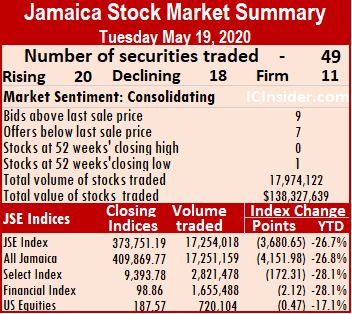

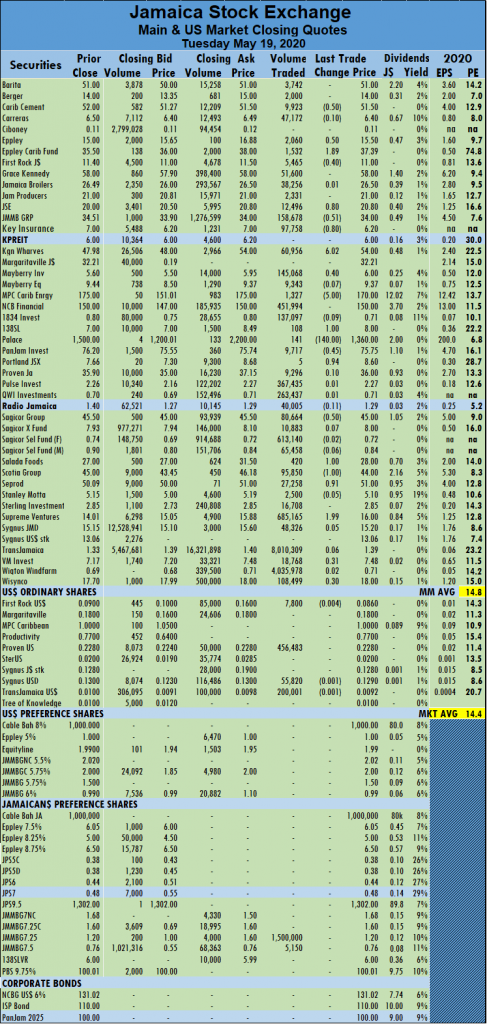

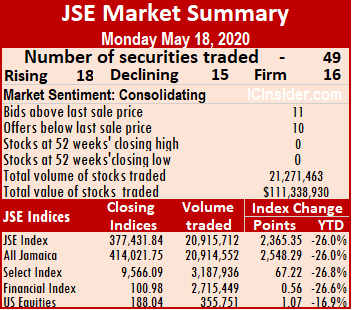

Jamaica Producers gained 50 cents transferring 262,775 shares and closed at $21.50, Jamaica Stock Exchange advanced $1.10 to $21.90, in trading 29,956 stock units. Key Insurance fell 70 cents to $5.50, with an exchange of 34,397 stock units, Mayberry Jamaican Equities gained 63 cents to end at $10, after swapping 15,664 units, NCB Financial Group declined by $10 to end at $140, after exchanging 397,829 shares. Palace Amusement ended the day’s trade $60 lower at $1,300, in transferring 50 units, Proven Investments fell $1 to $35, with 1,284 units changing hands, Sagicor Group picked up 49 cents to finish at $45.49, in trading 84,426 shares and Scotia Group closed at $45, with gains of $1 exchanging 92,849 shares. At the close, the JSE All Jamaican Composite Index dropped 4,151.98 points to 409,869.77, the JSE Market Index declined by 3,680.65 points to 373,751.19 and the JSE Financial Index shed 2.12 points to close at 98.86.

At the close, the JSE All Jamaican Composite Index dropped 4,151.98 points to 409,869.77, the JSE Market Index declined by 3,680.65 points to 373,751.19 and the JSE Financial Index shed 2.12 points to close at 98.86. IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and seven stocks closing with lower offers. The PE ratio of the market ended at 14.4, while the Main Market ended at 14.8 times 2020-21 earnings.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and seven stocks closing with lower offers. The PE ratio of the market ended at 14.4, while the Main Market ended at 14.8 times 2020-21 earnings. PanJam Investment shed 45 cents to settle at $75.75, in trading 9,717 units, Portland JSX picked up 94 cents swapping a mere five units to end at $8.60. Sagicor Group finished 50 cents lower at $45, with an exchange of 80,664 shares, Salada Foods added $1 to end at $28, in transferring 420 units, Scotia Group closed at $44, with a loss of $1 in trading 95,850 shares.

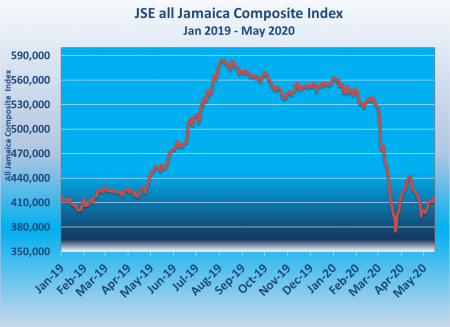

PanJam Investment shed 45 cents to settle at $75.75, in trading 9,717 units, Portland JSX picked up 94 cents swapping a mere five units to end at $8.60. Sagicor Group finished 50 cents lower at $45, with an exchange of 80,664 shares, Salada Foods added $1 to end at $28, in transferring 420 units, Scotia Group closed at $44, with a loss of $1 in trading 95,850 shares.  At the close, the JSE All Jamaican Composite Index advanced by 2,548.29 points to 414,021.75, the JSE Market Index climbed 2,365.35 points to 377,431.84 and the JSE Financial Index rose 0.56 points to 100.98.

At the close, the JSE All Jamaican Composite Index advanced by 2,548.29 points to 414,021.75, the JSE Market Index climbed 2,365.35 points to 377,431.84 and the JSE Financial Index rose 0.56 points to 100.98. The average volume and value for the month to date amount to 356,991 units valued at $2,821,161 for each security changing hands, compared to 344,979 units with an average cost of $2,844,401. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The average volume and value for the month to date amount to 356,991 units valued at $2,821,161 for each security changing hands, compared to 344,979 units with an average cost of $2,844,401. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. Mayberry Jamaican Equities closed 45 cents higher at $9.44, in swapping 33,490 stock units, 138 Student Living fell by $1.80 to $7, after trading 20,700 units, Proven Investments shed 60 cents to settle at $35.90, with 11,305 units changing hands. Salada Foods climbed $2 to $27, transferring 1,024 units, Scotia Group advanced by $$2.98 to $45, with an exchange of 59,670 shares, Supreme Ventures closed $1.36 lower to $14.01, after swapping 935,846 shares. Sygnus Credit Investments declined by $3.45 to end at $15.15, in trading 266,450 stock us and Victoria Mutual Investments shed 63 cents transferring 550,159 shares to finish at $7.17.

Mayberry Jamaican Equities closed 45 cents higher at $9.44, in swapping 33,490 stock units, 138 Student Living fell by $1.80 to $7, after trading 20,700 units, Proven Investments shed 60 cents to settle at $35.90, with 11,305 units changing hands. Salada Foods climbed $2 to $27, transferring 1,024 units, Scotia Group advanced by $$2.98 to $45, with an exchange of 59,670 shares, Supreme Ventures closed $1.36 lower to $14.01, after swapping 935,846 shares. Sygnus Credit Investments declined by $3.45 to end at $15.15, in trading 266,450 stock us and Victoria Mutual Investments shed 63 cents transferring 550,159 shares to finish at $7.17. In the Main Market, Seprod rose to $49.99 from $44.10 on limited volume, following robust first-quarter results, to be replaced by Proven Investments.

In the Main Market, Seprod rose to $49.99 from $44.10 on limited volume, following robust first-quarter results, to be replaced by Proven Investments.

The three top Junior Market stocks with the potential to gain between 355 to 663 percent by 2021 are

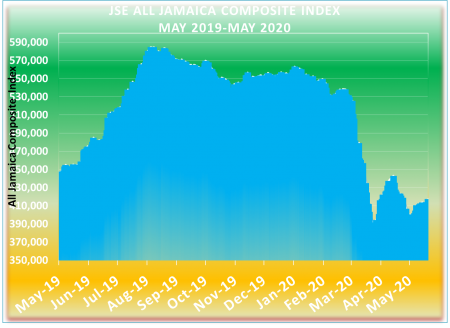

The three top Junior Market stocks with the potential to gain between 355 to 663 percent by 2021 are he targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results for the financial year ending after this year’s second quarter and up to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level. The JSE Main Market ended the week, with an overall PE of 13.6 and the Junior Market a mere 8.9, based on current 2020-21 earnings. The PE ratio for Junior Market Top 10 stocks averages a mere 5 with the Main Market at a much higher level of 8.4.

he targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results for the financial year ending after this year’s second quarter and up to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level. The JSE Main Market ended the week, with an overall PE of 13.6 and the Junior Market a mere 8.9, based on current 2020-21 earnings. The PE ratio for Junior Market Top 10 stocks averages a mere 5 with the Main Market at a much higher level of 8.4. IC TOP 10 stocks are likely to deliver the best returns to March 2021. Forecasted earnings and PE ratio for the current fiscal year are in determining potential gains. The ranking of stocks is in order of likely increases, with the highest-ranked, being the most attractive. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP 10 stocks are likely to deliver the best returns to March 2021. Forecasted earnings and PE ratio for the current fiscal year are in determining potential gains. The ranking of stocks is in order of likely increases, with the highest-ranked, being the most attractive. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.