Carreras jumped $17.50 to $110 on Wednesdaay after the company indicated they are considering a stock split.

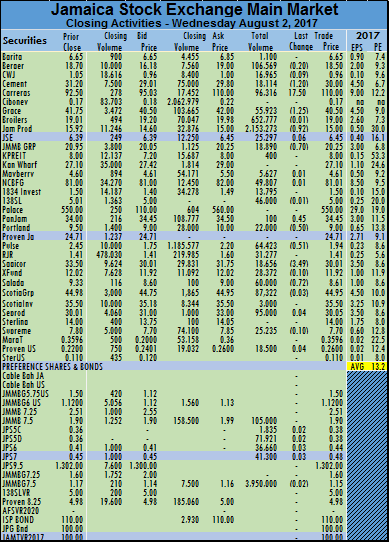

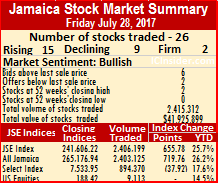

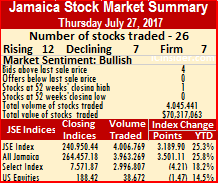

Trading on the main market of the Jamaica Stock Exchange saw increased number of securities changing hands including 6 preference stocks. The All Jamaica Composite Index surged 1,892.68 points to close at a new record of 268,601.52, the JSE Market Index jumped 1,724.45 points to a 4th consecutive record close, of 244,726.40.

The JSE US dollar market index rose 17.40 points to close at 201.17.

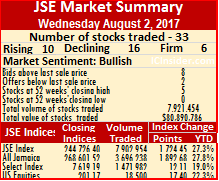

At the close of trading, 32 securities changed hands in the main market with 1 trading in the US dollar market, leading to 10 stocks advancing and 16 falling including 5 that ended at 52 weeks closing highs. At the close 7,902,954 units valued at 80,354,594 changed hands in the main market compared to 24,165,397 units valued at $225,427,641 at the close on Monday. Trading in the US dollar market accounted for 18,500 units valued at US$4,810 bringing the total of all trades to J$80,890,786.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 8 stocks with bids higher than their last selling prices and 2 with lower offers.

The main market ended trading with an average of 246,967 units valued at $2,511,081 for each security traded compared to an average of 1,006,892 units valued at $9,392,818. The average volume and value for July ended at 160,668 units with an average value of $2,691,438.

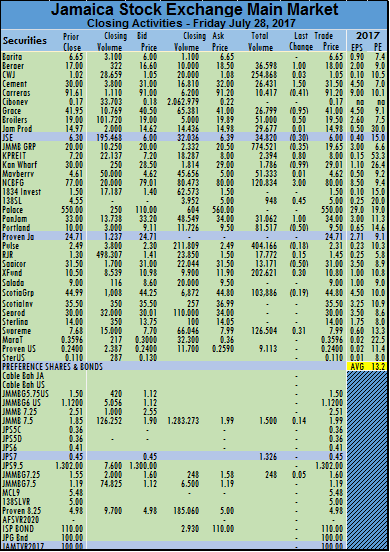

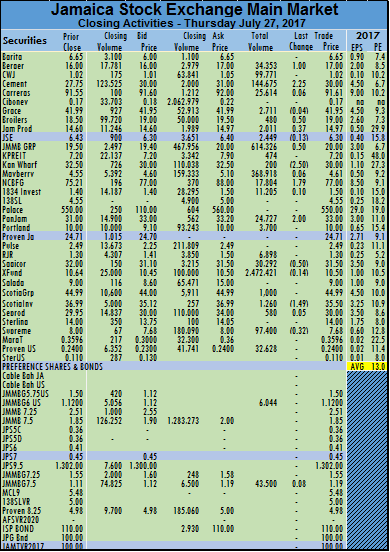

In market activity, Barita Investments closed at $6.65 with trades of 1,100 shares, Berger Paints lost 20 cents, closing at $18.50 exchanging 106,569 shares, Cable and Wireless closed at 96 cents, losing 9 cents trading 16,965 shares, Caribbean Cement closed at $30, with a loss of $1.20 exchanging 18,114 shares, Carreras closed at $110, advancing $17.50, with trades of 96,316 shares, Grace Kennedy closed at $40.50, with a loss of $1.25 exchanging 55,923 shares. Jamaica Broilers was down 1 cent to close at $19 trading 652,777 shares, Jamaica Producers traded 92 cents lower to close at $15 with 2,153,273 shares exchanged. Jamaica Stock Exchange closed with gains of 6 cents to $6.45 trading 25,297 shares, JMMB Group closed 70 cents lower to $20.25, with trades of 18,890 shares and Kingston Properties exchanged 400 units at $8. Mayberry Investments gained 1 cent to close at $4.61 trading 5,627 shares, NCB Financial Group added 1 cent to close at $81.01, after exchanging 49,807 shares, 1834 Investments closed at $1.50, with an exchange of 13,795 shares, 138 Student Living lost 1 cent to close at $5, with trades of 46,000 shares, PanJam Investment gained 45 cents, closing at $34.45 trading 100 units, Portland JSX traded 50 cents lower to $9 exchanging 22,000 shares, Pulse Investments lost 51 cents to close at $1.94, with trades of 64,423 shares and Radio Jamaica closed at $1.41 with 31,277 shares exchanged. Sagicor Group fell $3.49 to $30.01 trading 18,656 shares, Sagicor Real Estate fund lost 10 cents, closing at $11.92 trading 28,372 shares, Salada Foods closed at $8.61, with a loss of 72 cents and 60,000 shares changing owners,

In market activity, Barita Investments closed at $6.65 with trades of 1,100 shares, Berger Paints lost 20 cents, closing at $18.50 exchanging 106,569 shares, Cable and Wireless closed at 96 cents, losing 9 cents trading 16,965 shares, Caribbean Cement closed at $30, with a loss of $1.20 exchanging 18,114 shares, Carreras closed at $110, advancing $17.50, with trades of 96,316 shares, Grace Kennedy closed at $40.50, with a loss of $1.25 exchanging 55,923 shares. Jamaica Broilers was down 1 cent to close at $19 trading 652,777 shares, Jamaica Producers traded 92 cents lower to close at $15 with 2,153,273 shares exchanged. Jamaica Stock Exchange closed with gains of 6 cents to $6.45 trading 25,297 shares, JMMB Group closed 70 cents lower to $20.25, with trades of 18,890 shares and Kingston Properties exchanged 400 units at $8. Mayberry Investments gained 1 cent to close at $4.61 trading 5,627 shares, NCB Financial Group added 1 cent to close at $81.01, after exchanging 49,807 shares, 1834 Investments closed at $1.50, with an exchange of 13,795 shares, 138 Student Living lost 1 cent to close at $5, with trades of 46,000 shares, PanJam Investment gained 45 cents, closing at $34.45 trading 100 units, Portland JSX traded 50 cents lower to $9 exchanging 22,000 shares, Pulse Investments lost 51 cents to close at $1.94, with trades of 64,423 shares and Radio Jamaica closed at $1.41 with 31,277 shares exchanged. Sagicor Group fell $3.49 to $30.01 trading 18,656 shares, Sagicor Real Estate fund lost 10 cents, closing at $11.92 trading 28,372 shares, Salada Foods closed at $8.61, with a loss of 72 cents and 60,000 shares changing owners,  Scotia Group closed at $44.95, losing 3 cents with trades of 87,322 shares, Scotia Investments exchanged 3,000 shares at $35.50, Seprod closed at $30.05, with a gain of 4 cents and 95,000 shares changing hands and Supreme Ventures lost 10 cents to close at $7.70 with 25,235 shares exchanged. Proven Investments US ordinary shares closed at 26 US cents, gaining 0.04 US cents trading 18,500 units.

Scotia Group closed at $44.95, losing 3 cents with trades of 87,322 shares, Scotia Investments exchanged 3,000 shares at $35.50, Seprod closed at $30.05, with a gain of 4 cents and 95,000 shares changing hands and Supreme Ventures lost 10 cents to close at $7.70 with 25,235 shares exchanged. Proven Investments US ordinary shares closed at 26 US cents, gaining 0.04 US cents trading 18,500 units.

A large number of preference shares traded with 4 trading at 52 weeks’ highs.JMMB Group 7.50% preference share closed at $1.15, with a loss of 2 cents exchanging 3,950,000 units, JMMB 7.5% preference share closed at $1.90 trading 105,000 units, JPS 7% preference share gained 3 cents to close at a 52 weeks’ high of 48 cents with 41,300 units switching owners, JPS 5% C preference share closed with gains of 2 cents to a 52 weeks’ high of 38 cents trading 1,835 units, JPS 5% D preference share gained 2 cents, closing at a 52 weeks’ high of 38 cents with 71,921 units exchanged, JPS 6% preference share closed at 52 weeks’ high of 44 cents, gaining 3 cents trading 36,660 units.

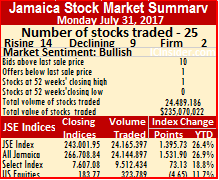

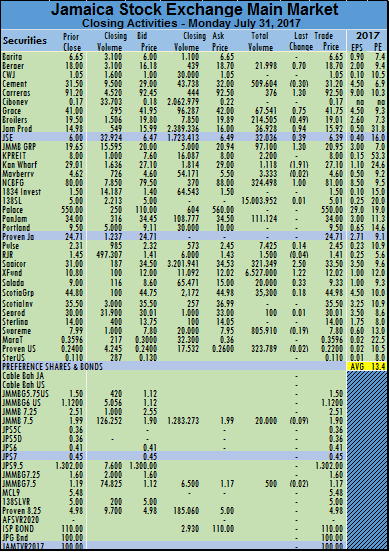

The main market ended with 24,165,397 units valued at $225,427,641 changing hands compared to 2,406,199 units valued at $41,645,948 at the close on Friday. Trading in the US dollar market accounted for 323,789 units valued at US$75,331 bringing the total of all trades to J$235,070,022.

The main market ended with 24,165,397 units valued at $225,427,641 changing hands compared to 2,406,199 units valued at $41,645,948 at the close on Friday. Trading in the US dollar market accounted for 323,789 units valued at US$75,331 bringing the total of all trades to J$235,070,022.

Mayberry Investments lost 2 cents to close at $4.60 trading 3,333 shares, NCB Financial Group traded $1 higher to a record close of $81, after exchanging 324,498 shares, 138 Student Living closed at $5.01, gaining 1 cent with 15,003,952 units having traded, PanJam Investment closed at $34 trading 111,124 shares, Pulse Investments gained 14 cents to close at $2.45, with an exchange of 7,425 shares, Radio Jamaica lost 4 cents, closing at $1.41 with 1,500 shares exchanged. Sagicor Group jumped $2.50 to $33.50, with 321,349 shares changing hands, Sagicor Real Estate Fund traded $1.22 higher to $12.02, closing trading with 6,527,000 shares, Salada Foods gained 33 cents to close at $9.33, with 20,000 shares changing owners, Scotia Group closed at $44.98, gaining 18 cents with trades of 35,300 shares, Seprod closed at $30.01, with a gain of 1 cent exchanging just 100 units, Supreme Ventures lost 19 cents to close at $7.80 with 805,910 shares exchanged. Proven Investments US ordinary shares closed at 22 US cents, losing 2 US cents in trading 323,789 units, JMMB Group 7.50% preference share closed at $1.17, with a loss of 2 cents exchanging 500 units and Jamaica Money Market Brokers 7.5% preference share lost 9 cents to close at $1.90 trading 20,000 units.

Mayberry Investments lost 2 cents to close at $4.60 trading 3,333 shares, NCB Financial Group traded $1 higher to a record close of $81, after exchanging 324,498 shares, 138 Student Living closed at $5.01, gaining 1 cent with 15,003,952 units having traded, PanJam Investment closed at $34 trading 111,124 shares, Pulse Investments gained 14 cents to close at $2.45, with an exchange of 7,425 shares, Radio Jamaica lost 4 cents, closing at $1.41 with 1,500 shares exchanged. Sagicor Group jumped $2.50 to $33.50, with 321,349 shares changing hands, Sagicor Real Estate Fund traded $1.22 higher to $12.02, closing trading with 6,527,000 shares, Salada Foods gained 33 cents to close at $9.33, with 20,000 shares changing owners, Scotia Group closed at $44.98, gaining 18 cents with trades of 35,300 shares, Seprod closed at $30.01, with a gain of 1 cent exchanging just 100 units, Supreme Ventures lost 19 cents to close at $7.80 with 805,910 shares exchanged. Proven Investments US ordinary shares closed at 22 US cents, losing 2 US cents in trading 323,789 units, JMMB Group 7.50% preference share closed at $1.17, with a loss of 2 cents exchanging 500 units and Jamaica Money Market Brokers 7.5% preference share lost 9 cents to close at $1.90 trading 20,000 units.

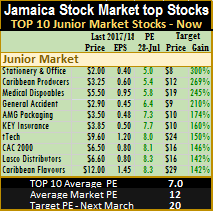

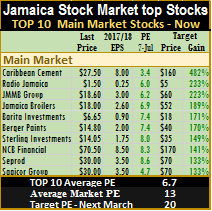

Caribbean Flavours and CAC 2000 that fell out of the top listing at the end of the prior week return this week with the exit of Express Catering , Lasco Financial that rose to $3.80 and Caribbean Cream that returned to $7.

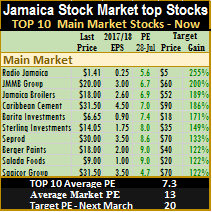

Caribbean Flavours and CAC 2000 that fell out of the top listing at the end of the prior week return this week with the exit of Express Catering , Lasco Financial that rose to $3.80 and Caribbean Cream that returned to $7. At the close of the week, IC Insider.com’s TOP 10 Junior Market stocks now trade at an average discount of 42 percent to the Junior Market average, while those in the main market are trading at a 44 percent discount, to the average of the market, leaving stocks with room for growth in the months ahead.

At the close of the week, IC Insider.com’s TOP 10 Junior Market stocks now trade at an average discount of 42 percent to the Junior Market average, while those in the main market are trading at a 44 percent discount, to the average of the market, leaving stocks with room for growth in the months ahead.

The main market ended trading with an average of 96,248 units valued at 1,665,838 for each security traded compared to an average of 166,949 units valued at $2,146,344. The average volume and value for the month to date ended at 118,357 units with an average value of $2,356,369 compared with an average of 119,521 units with an average value of $2,389,059 on the previous trading day. The average volume and value for June ended at 218,951 units with an average value of $3,871,959.

The main market ended trading with an average of 96,248 units valued at 1,665,838 for each security traded compared to an average of 166,949 units valued at $2,146,344. The average volume and value for the month to date ended at 118,357 units with an average value of $2,356,369 compared with an average of 119,521 units with an average value of $2,389,059 on the previous trading day. The average volume and value for June ended at 218,951 units with an average value of $3,871,959. Kingston Wharves closed 99 cents lower to $29.01, with 1,786 units switching owners. Mayberry Investments added 1 cent to close at $4.62 trading 51,333 shares, NCB Financial Group traded $3 higher to a record close of $80, after exchanging 120,834 shares, 138 Student Living closed at $5, gaining 45 cents, trading 948 units, PanJam Investment climbed $1, closing at $34 in trading 31,062 shares, Portland JSX lost 50 cents, closing at $9.50 while exchanging 81,517 shares, Pulse Investments traded 18 cents lower to $2.31, with an exchange of 404,166 shares, Radio Jamaica gained 15 cents to close at $1.45 with 17,772 shares exchanged. Sagicor Group lost 50 cents, with 13,171 shares traded, to close at $31, Sagicor Real Estate Fund gained 30 cents, closing at $10.80 and trading 202,621 shares, Scotia Group closed at $44.80, after losing 19 cents with 103,886 shares traded, Supreme Ventures gained 31 cents to close at $7.99 with 126,504 shares exchanged. Proven Investments US ordinary shares closed at 24 US cents trading 9,113 units, JMMB Group 7.25% preference share closed at a record $1.60, with gains of 5 cents exchanging 248 units, JPS 7% preference share traded 1,326 units at 45 cents and JMMB 7.5% preference share gained 14 cents to close at $1.99 trading 1,500 units.

Kingston Wharves closed 99 cents lower to $29.01, with 1,786 units switching owners. Mayberry Investments added 1 cent to close at $4.62 trading 51,333 shares, NCB Financial Group traded $3 higher to a record close of $80, after exchanging 120,834 shares, 138 Student Living closed at $5, gaining 45 cents, trading 948 units, PanJam Investment climbed $1, closing at $34 in trading 31,062 shares, Portland JSX lost 50 cents, closing at $9.50 while exchanging 81,517 shares, Pulse Investments traded 18 cents lower to $2.31, with an exchange of 404,166 shares, Radio Jamaica gained 15 cents to close at $1.45 with 17,772 shares exchanged. Sagicor Group lost 50 cents, with 13,171 shares traded, to close at $31, Sagicor Real Estate Fund gained 30 cents, closing at $10.80 and trading 202,621 shares, Scotia Group closed at $44.80, after losing 19 cents with 103,886 shares traded, Supreme Ventures gained 31 cents to close at $7.99 with 126,504 shares exchanged. Proven Investments US ordinary shares closed at 24 US cents trading 9,113 units, JMMB Group 7.25% preference share closed at a record $1.60, with gains of 5 cents exchanging 248 units, JPS 7% preference share traded 1,326 units at 45 cents and JMMB 7.5% preference share gained 14 cents to close at $1.99 trading 1,500 units.

The main market ended trading with an average of 166,949 units valued at $2,146,344 for each security traded compared to an average of 123,924 units valued at $1,919,690. The average volume and value for the month to date ended at 119,521 units with an average value of $2,389,059 compared with an average of 116,886 units with an average value of $2,402,544 on the previous trading day. The average volume and value for June ended at 218,951 units with an average value of $3,871,959.

The main market ended trading with an average of 166,949 units valued at $2,146,344 for each security traded compared to an average of 123,924 units valued at $1,919,690. The average volume and value for the month to date ended at 119,521 units with an average value of $2,389,059 compared with an average of 116,886 units with an average value of $2,402,544 on the previous trading day. The average volume and value for June ended at 218,951 units with an average value of $3,871,959. Mayberry Investments closed at $4.61, with a gain of 6 cents trading 368,918 shares, NCB Financial Group traded $1.79 higher to a record close of $77, after exchanging 17,804 shares, 1834 Investments closed at $1.50, rising 10 cents with 11,205 shares traded, PanJam Investment gained $2 to $33 trading 24,727 shares, Portland JSX closed at $10 exchanging 3,700 shares, Radio Jamaica traded 6,898 shares at $1.30. Sagicor Group lost 50 cents, with an exchange of 30,292 shares, to close at $31.50, Sagicor Real Estate Fund declined 14 cents, closing at $10.50 while trading 2,472,421 shares, Scotia Group closed at $44.99, with trades of 1,000 shares, Scotia Investments traded $1.49 lower to close at $35.50, with an exchange of 1,260 shares, Seprod added 5 cents, closing at $30 with 580 units traded,Supreme Ventures lost 32 cents to close at $7.68 with 97,400 shares exchanged. Proven Investments US ordinary shares closed at 24 US cents trading 32,628 units, JMMB Group US 6% preference share closed at US$1.12 exchanging 6,044 units and JMMB Group 7.5% preference share gained 8 cents to close at $1.19 trading 43,500 units.

Mayberry Investments closed at $4.61, with a gain of 6 cents trading 368,918 shares, NCB Financial Group traded $1.79 higher to a record close of $77, after exchanging 17,804 shares, 1834 Investments closed at $1.50, rising 10 cents with 11,205 shares traded, PanJam Investment gained $2 to $33 trading 24,727 shares, Portland JSX closed at $10 exchanging 3,700 shares, Radio Jamaica traded 6,898 shares at $1.30. Sagicor Group lost 50 cents, with an exchange of 30,292 shares, to close at $31.50, Sagicor Real Estate Fund declined 14 cents, closing at $10.50 while trading 2,472,421 shares, Scotia Group closed at $44.99, with trades of 1,000 shares, Scotia Investments traded $1.49 lower to close at $35.50, with an exchange of 1,260 shares, Seprod added 5 cents, closing at $30 with 580 units traded,Supreme Ventures lost 32 cents to close at $7.68 with 97,400 shares exchanged. Proven Investments US ordinary shares closed at 24 US cents trading 32,628 units, JMMB Group US 6% preference share closed at US$1.12 exchanging 6,044 units and JMMB Group 7.5% preference share gained 8 cents to close at $1.19 trading 43,500 units. The main market of the Jamaica Stock Exchange indices rose sharply at the close on Wednesday with the All Jamaica Composite Index advanced 3,380.75 points to close at 260,956.07, the JSE Market Index rose 3,080.24 points to 237,760.54 and the JSE US dollar market index gained 0.89 points to close at 189.89.

The main market of the Jamaica Stock Exchange indices rose sharply at the close on Wednesday with the All Jamaica Composite Index advanced 3,380.75 points to close at 260,956.07, the JSE Market Index rose 3,080.24 points to 237,760.54 and the JSE US dollar market index gained 0.89 points to close at 189.89.  The average volume and value for the month to date ended at 116,886 units with an average value of $2,509,606 compared with an average of 116,472 units with an average value of $2,430,947 on the previous trading day. The average volume and value for June ended at 218,951 units with an average value of $3,871,959.

The average volume and value for the month to date ended at 116,886 units with an average value of $2,509,606 compared with an average of 116,472 units with an average value of $2,430,947 on the previous trading day. The average volume and value for June ended at 218,951 units with an average value of $3,871,959. NCB Financial Group traded $1.16 higher to $75.21, after exchanging 37,026 shares, 1834 Investments closed at $1.40 with trades of 11,205 shares, PanJam Investment closed with a loss of $2 to $31 trading 2,673 units, Proven Investments closed at $24.71 with 250,000 shares traded, Pulse Investments gained 17 cents to close at $2.49 with 34,547 shares changing owners, Radio Jamaica closed at $1.30, with gains of 5 cents trading 15,036 shares. Sagicor Group gained 50 cents, with an exchange of 26,433 shares, to close at $32, Sagicor Real Estate Fund declined 56 cents, closing at $10.64 exchanging 393,442 shares, Scotia Group gained $1.48 to close at $44.99, with trades of 2,270 shares, Seprod closed at $29.95, with gains of 20 cents exchanging 1,940 shares, Supreme Ventures traded 6,900 shares at $8, having gained 20 cents. Proven Investments US ordinary shares closed at 24 US cents trading 123,899 units, JMMB 7.5% preference share closed at $1.85, losing 15 cents exchanging 304,177 units and JMMB Group 7.5% preference share traded 37,000 units at $1.11.

NCB Financial Group traded $1.16 higher to $75.21, after exchanging 37,026 shares, 1834 Investments closed at $1.40 with trades of 11,205 shares, PanJam Investment closed with a loss of $2 to $31 trading 2,673 units, Proven Investments closed at $24.71 with 250,000 shares traded, Pulse Investments gained 17 cents to close at $2.49 with 34,547 shares changing owners, Radio Jamaica closed at $1.30, with gains of 5 cents trading 15,036 shares. Sagicor Group gained 50 cents, with an exchange of 26,433 shares, to close at $32, Sagicor Real Estate Fund declined 56 cents, closing at $10.64 exchanging 393,442 shares, Scotia Group gained $1.48 to close at $44.99, with trades of 2,270 shares, Seprod closed at $29.95, with gains of 20 cents exchanging 1,940 shares, Supreme Ventures traded 6,900 shares at $8, having gained 20 cents. Proven Investments US ordinary shares closed at 24 US cents trading 123,899 units, JMMB 7.5% preference share closed at $1.85, losing 15 cents exchanging 304,177 units and JMMB Group 7.5% preference share traded 37,000 units at $1.11. The main market ended trading with an average of 105,582 units valued at $1,172,402 for each security traded compared to an average of 96,184 units valued at $988,206. The average volume and value for the month to date ended at 116,472 units with an average value of $2,430,947 compared with an average of 117,153 units with an average value of $2,509,606 on the previous trading day. The average volume and value for June ended at 218,951 units with an average value of $3,871,959.

The main market ended trading with an average of 105,582 units valued at $1,172,402 for each security traded compared to an average of 96,184 units valued at $988,206. The average volume and value for the month to date ended at 116,472 units with an average value of $2,430,947 compared with an average of 117,153 units with an average value of $2,509,606 on the previous trading day. The average volume and value for June ended at 218,951 units with an average value of $3,871,959. JMMB Group lost 20 cents to close at $19, with trades of 38,014 shares, Kingston Properties gained 5 cents to close at $7.20 exchanging 3,282 shares, Kingston Wharves traded $1 higher to $30, with 250 units switching owners. Mayberry Investments closed at $4.55, with an exchange of 31,000 shares, NCB Financial Group traded 87 cents lower to $74.05, after exchanging 29,557 shares, PanJam Investment closed with gains of $1 to $33, trading 8,427 units, Portland JSX exchanged 300 units at $10, Proven Investments gained 4 cents, closing at $24.71 with 261,700 shares traded, Pulse Investments fell by 17 cents to $2.32 with 54,907 shares changing owners, Radio Jamaica lost 5 cents to close at $1.25, trading 179,023 shares. Sagicor Group dropped 49 cents, with an exchange of 89,872 shares, to close at $31.50. Scotia Group lost 49 cents, closing at $43.51 with 86,085 shares trading, Scotia Investments closed with gains of 89 cents to $36.99 trading 18,000 units, Seprod lost 20 cents, closing at $29.75 trading 1,490 shares, Sterling Investments closed at $14, with a loss of 5 cents trading 570 units, Supreme Ventures traded 592,150 shares at $7.80. Proven Investments US ordinary shares lost 0.02 US cents to close at 24 US cents trading 260,398 units, Jamaica Money Market Brokers 7.5% preference share closed at $2, losing 10 cents exchanging 100,000 units and JMMB Group US 6% preference share traded 22,483 units at US$1.12.

JMMB Group lost 20 cents to close at $19, with trades of 38,014 shares, Kingston Properties gained 5 cents to close at $7.20 exchanging 3,282 shares, Kingston Wharves traded $1 higher to $30, with 250 units switching owners. Mayberry Investments closed at $4.55, with an exchange of 31,000 shares, NCB Financial Group traded 87 cents lower to $74.05, after exchanging 29,557 shares, PanJam Investment closed with gains of $1 to $33, trading 8,427 units, Portland JSX exchanged 300 units at $10, Proven Investments gained 4 cents, closing at $24.71 with 261,700 shares traded, Pulse Investments fell by 17 cents to $2.32 with 54,907 shares changing owners, Radio Jamaica lost 5 cents to close at $1.25, trading 179,023 shares. Sagicor Group dropped 49 cents, with an exchange of 89,872 shares, to close at $31.50. Scotia Group lost 49 cents, closing at $43.51 with 86,085 shares trading, Scotia Investments closed with gains of 89 cents to $36.99 trading 18,000 units, Seprod lost 20 cents, closing at $29.75 trading 1,490 shares, Sterling Investments closed at $14, with a loss of 5 cents trading 570 units, Supreme Ventures traded 592,150 shares at $7.80. Proven Investments US ordinary shares lost 0.02 US cents to close at 24 US cents trading 260,398 units, Jamaica Money Market Brokers 7.5% preference share closed at $2, losing 10 cents exchanging 100,000 units and JMMB Group US 6% preference share traded 22,483 units at US$1.12.

IPO being nearly 4 times oversubscribed with more than 1,000 applications received for the 52 million shares.

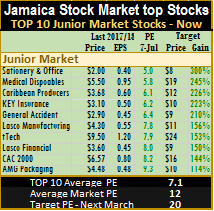

IPO being nearly 4 times oversubscribed with more than 1,000 applications received for the 52 million shares. At the close of the week, IC Insider.com’s TOP 10 Junior Market stocks now trade at an average discount of 45 percent to the Junior Market average, while those in the main market are trading at a 49 percent discount, to the average of the market, leaving stocks with room for growth in the months ahead.

At the close of the week, IC Insider.com’s TOP 10 Junior Market stocks now trade at an average discount of 45 percent to the Junior Market average, while those in the main market are trading at a 49 percent discount, to the average of the market, leaving stocks with room for growth in the months ahead. Pull back in the prices of several Junior Market stocks, resulted in changes in the TOP 10 junior stocks at the close of the week. The changes took place against the back ground of an unprecedented 5 issues of new shares around the same time in the market.

Pull back in the prices of several Junior Market stocks, resulted in changes in the TOP 10 junior stocks at the close of the week. The changes took place against the back ground of an unprecedented 5 issues of new shares around the same time in the market. IC Insider.com BUY RATED Stationery and Office Supplies (SOS) jumped into the TOP 10 Junior Market stocks in the number one position at the close of the past week.

IC Insider.com BUY RATED Stationery and Office Supplies (SOS) jumped into the TOP 10 Junior Market stocks in the number one position at the close of the past week.  CAC 2000 moved into the TOP 10 with the price having fallen to $6.57 by the end of the week.

CAC 2000 moved into the TOP 10 with the price having fallen to $6.57 by the end of the week. The average PE ratio for the Junior Market Top stocks remain at 7 even with SOS being added at a PE of 5 times 2017 earnings. The PE for the main market slipped to 6.7 with the sharp fall in prices during the week. The average PE for the overall main market, is down to 13 while it remains at 12 for Junior Market, based on 2017 estimated earnings.

The average PE ratio for the Junior Market Top stocks remain at 7 even with SOS being added at a PE of 5 times 2017 earnings. The PE for the main market slipped to 6.7 with the sharp fall in prices during the week. The average PE for the overall main market, is down to 13 while it remains at 12 for Junior Market, based on 2017 estimated earnings.