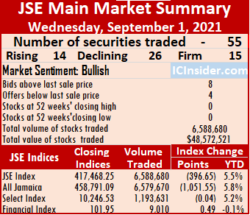

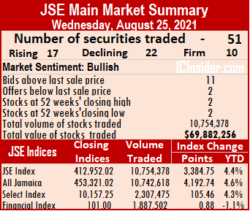

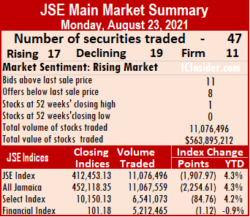

Market activity ended Wednesday with the volume and value of shares trading declining 62 percent and 68 percent, respectively, than on Tuesday, leading to a decline in the Jamaica Stock Exchange Main Market indices and ended with fewer rising stocks than those declining.

The All Jamaican Composite Index dropped 1,051.55 points to 458,791.09, the Main Index fell 396.65 points to 417,468.25 and the JSE Financial Index popped 0.49 points to end at 101.95.

The All Jamaican Composite Index dropped 1,051.55 points to 458,791.09, the Main Index fell 396.65 points to 417,468.25 and the JSE Financial Index popped 0.49 points to end at 101.95.

The number of stocks trading remained high, with 55 securities compared to 50 on Tuesday, with 14 stocks rising, 26 declining and 15 remaining unchanged. The PE Ratio, a measure used to compute appropriate stock values, averages 15.9 based on ICInsider.com’s 2021-22 earnings forecast.

The market closed with 6,588,680 shares trading for $48,572,521 versus 17,371,190 units at $150,660,788 on Tuesday. Wigton Windfarm led trading with 45.3 percent of total volume for an exchange of 2.99 million shares, followed by Transjamaican Highway with 8.1 percent for 532,579 units and Sagicor Select Financial Fund 7.5 percent, with 493,056 shares.

Trading averages 119,794 units at $883,137, compared to 347,424 shares at $3,013,216 on Tuesday. August closed with an average of 480,039 units at $8,561,549.

Investor’s Choice bid-offer indicator shows eight stocks ending with bids higher than their last selling prices and four with lower offers.

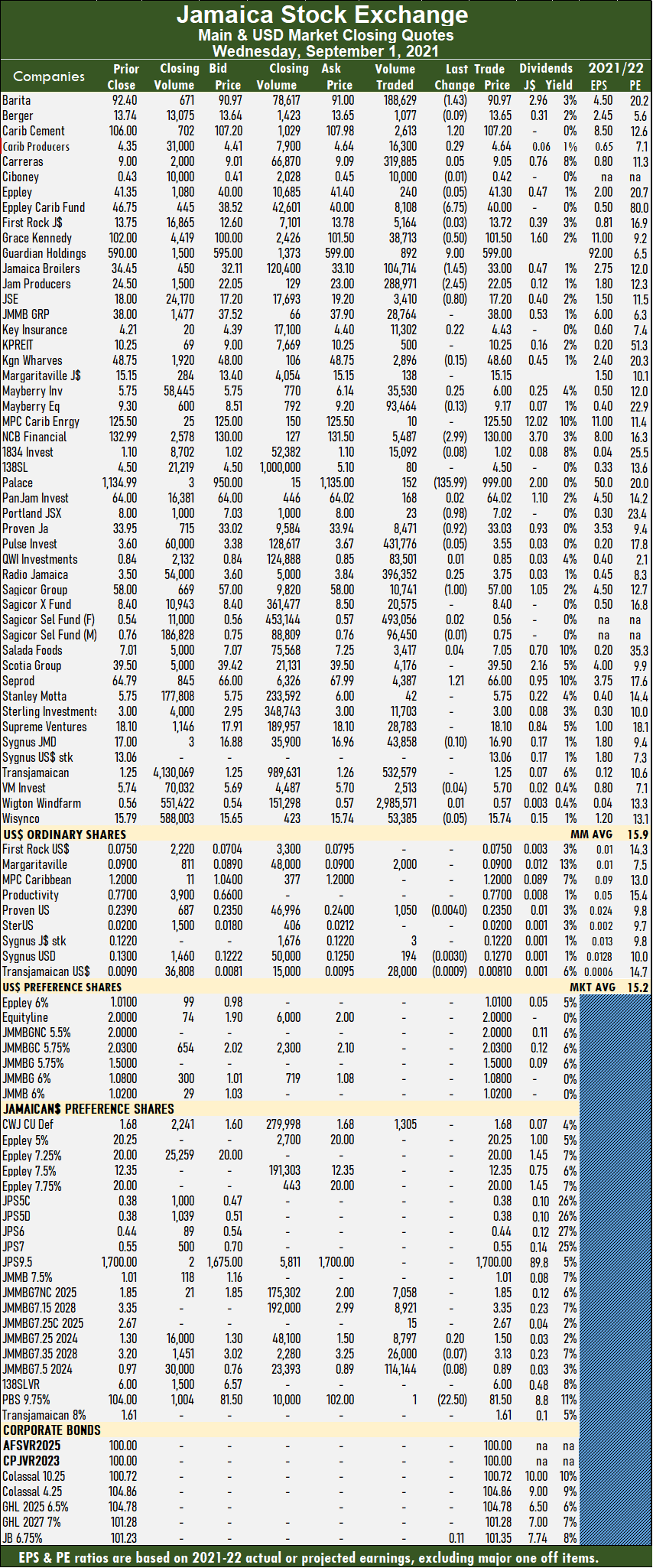

At the close, Barita Investments fell $1.43 to $90.97 in switching ownership of 188,629 shares, Caribbean Cement rose $1.20 to $107.20 in exchanging 2,613 stocks, Caribbean Producers gained 29 cents to end at $4.64 with 16,300 shares crossing the exchange, Eppley Caribbean Property Fund dropped $6.75 to $40 in trading 8,108 stock units, GraceKennedy slipped 50 cents to $101.50 with a transfer of 38,713 stocks, Guardian Holdings spiked $9 to $599 with 892 units changing hands, Jamaica Broilers fell $1.45 to $33 with the swapping of 104,714 shares. Jamaica Producers declined $2.45 to $22.05 after 288,971 stocks cleared the market, Jamaica Stock Exchange shed 80 cents to close at $17.20 in transferring 3,410 stock units, Key Insurance popped 22 cents to $4.43 after exchanging 11,302 stocks. Mayberry Investments rallied 25 cents to $6 in exchanging 35,530 units, NCB Financial declined $2.99 to $130 in switching ownership of 5,487 shares, Palace Amusement dropped $135.99 to end at $999 with 152 stock units changing hands, Portland JSX shed 98 cents to $7.02 with the swapping of 23 stocks.

At the close, Barita Investments fell $1.43 to $90.97 in switching ownership of 188,629 shares, Caribbean Cement rose $1.20 to $107.20 in exchanging 2,613 stocks, Caribbean Producers gained 29 cents to end at $4.64 with 16,300 shares crossing the exchange, Eppley Caribbean Property Fund dropped $6.75 to $40 in trading 8,108 stock units, GraceKennedy slipped 50 cents to $101.50 with a transfer of 38,713 stocks, Guardian Holdings spiked $9 to $599 with 892 units changing hands, Jamaica Broilers fell $1.45 to $33 with the swapping of 104,714 shares. Jamaica Producers declined $2.45 to $22.05 after 288,971 stocks cleared the market, Jamaica Stock Exchange shed 80 cents to close at $17.20 in transferring 3,410 stock units, Key Insurance popped 22 cents to $4.43 after exchanging 11,302 stocks. Mayberry Investments rallied 25 cents to $6 in exchanging 35,530 units, NCB Financial declined $2.99 to $130 in switching ownership of 5,487 shares, Palace Amusement dropped $135.99 to end at $999 with 152 stock units changing hands, Portland JSX shed 98 cents to $7.02 with the swapping of 23 stocks.  Proven Investments fell 92 cents to $33.03 with 8,471 stock units crossing the market, Radio Jamaica rallied 25 cents to $3.75 in an exchange of 396,352 shares. Sagicor Group shed $1 in, ending at $57 after switching ownership of 10,741 stocks, Seprod popped $1.21 to $66 in trading 4,387 shares.

Proven Investments fell 92 cents to $33.03 with 8,471 stock units crossing the market, Radio Jamaica rallied 25 cents to $3.75 in an exchange of 396,352 shares. Sagicor Group shed $1 in, ending at $57 after switching ownership of 10,741 stocks, Seprod popped $1.21 to $66 in trading 4,387 shares.

In the preference segment, JMMB Group 7.25% spiked 20 cents to $1.50 after 8,797 stocks crossed the market and Productive Business Solutions 9.75% preference share dropped $22.50 to close at $81.50, switching ownership of 1 share.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

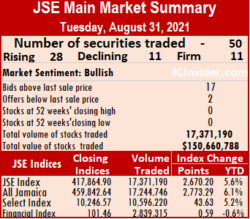

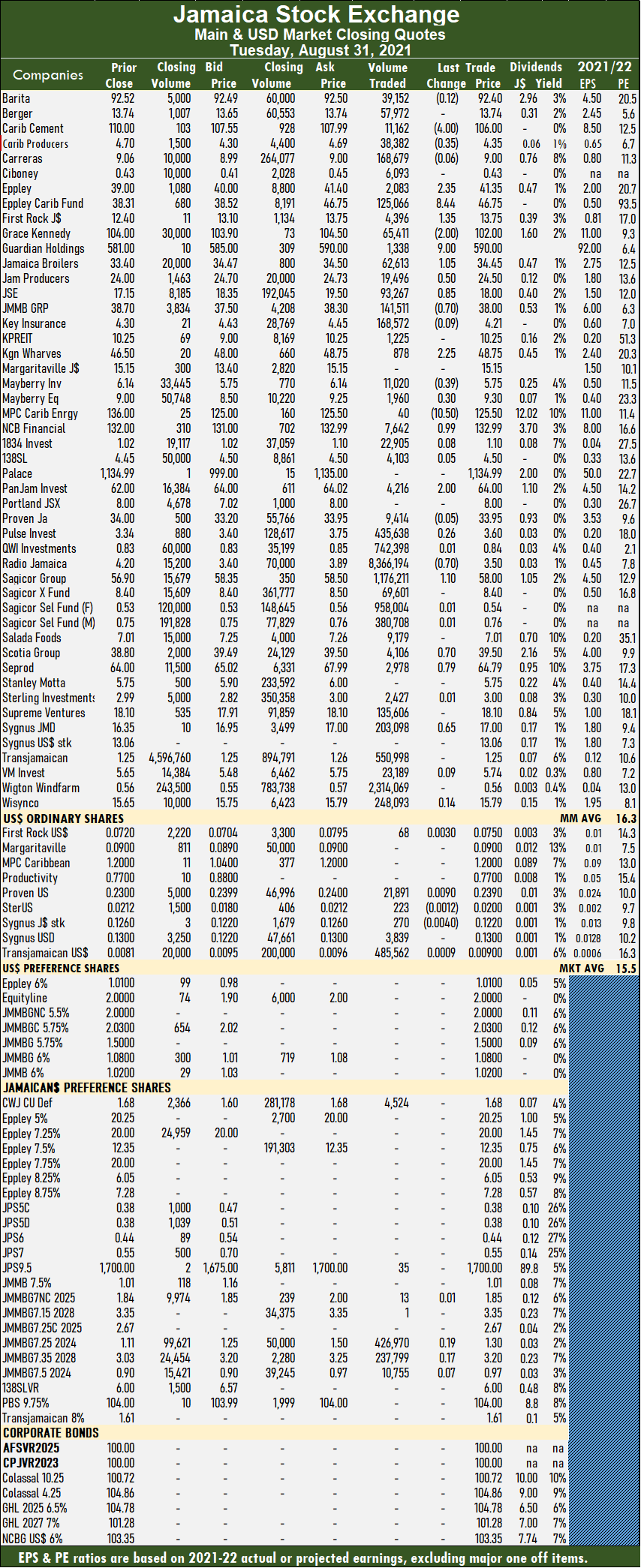

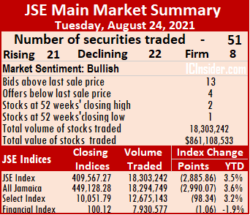

The All Jamaican Composite Index spiked 2,773.29 points to 459,842.64, the JSE Main Index climbed 2,670.20 points to 417,864.90 and the JSE Financial Index popped 0.59 points to close trading at 101.46.

The All Jamaican Composite Index spiked 2,773.29 points to 459,842.64, the JSE Main Index climbed 2,670.20 points to 417,864.90 and the JSE Financial Index popped 0.59 points to close trading at 101.46. Investor’s Choice bid-offer indicator reading has 17 stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator reading has 17 stocks ending with bids higher than their last selling prices and two with lower offers. PanJam Investment popped $2 to end at $64, with 4,216 stock units clearing the market, Pulse Investments rallied 26 cents to close at $3.60 after exchanging 435,638 units. Radio Jamaica dived 70 cents to $3.50 after exchanging 8,366,194 stock units, Sagicor Group rose $1.10 to end at $58 in trading 1,176,211 units, Scotia Group rallied 70 cents in closing at $39.50, with 4,106 stock units crossing the market. Seprod rose 79 cents to $64.79 in exchanging 2,978 shares and Sygnus Credit Investments popped 65 cents to $17 with the swapping of 203,098 units.

PanJam Investment popped $2 to end at $64, with 4,216 stock units clearing the market, Pulse Investments rallied 26 cents to close at $3.60 after exchanging 435,638 units. Radio Jamaica dived 70 cents to $3.50 after exchanging 8,366,194 stock units, Sagicor Group rose $1.10 to end at $58 in trading 1,176,211 units, Scotia Group rallied 70 cents in closing at $39.50, with 4,106 stock units crossing the market. Seprod rose 79 cents to $64.79 in exchanging 2,978 shares and Sygnus Credit Investments popped 65 cents to $17 with the swapping of 203,098 units. Trading averaged 305,774 units at $16,700,628, compared to 319,594 shares at $3,515,324 on Friday and month to date an average of 487,063 units at $8,855,423, in contrast to 497,417 units at $8,407,376 on Friday. July closed with an average of 322,932 units at $15,201,099.

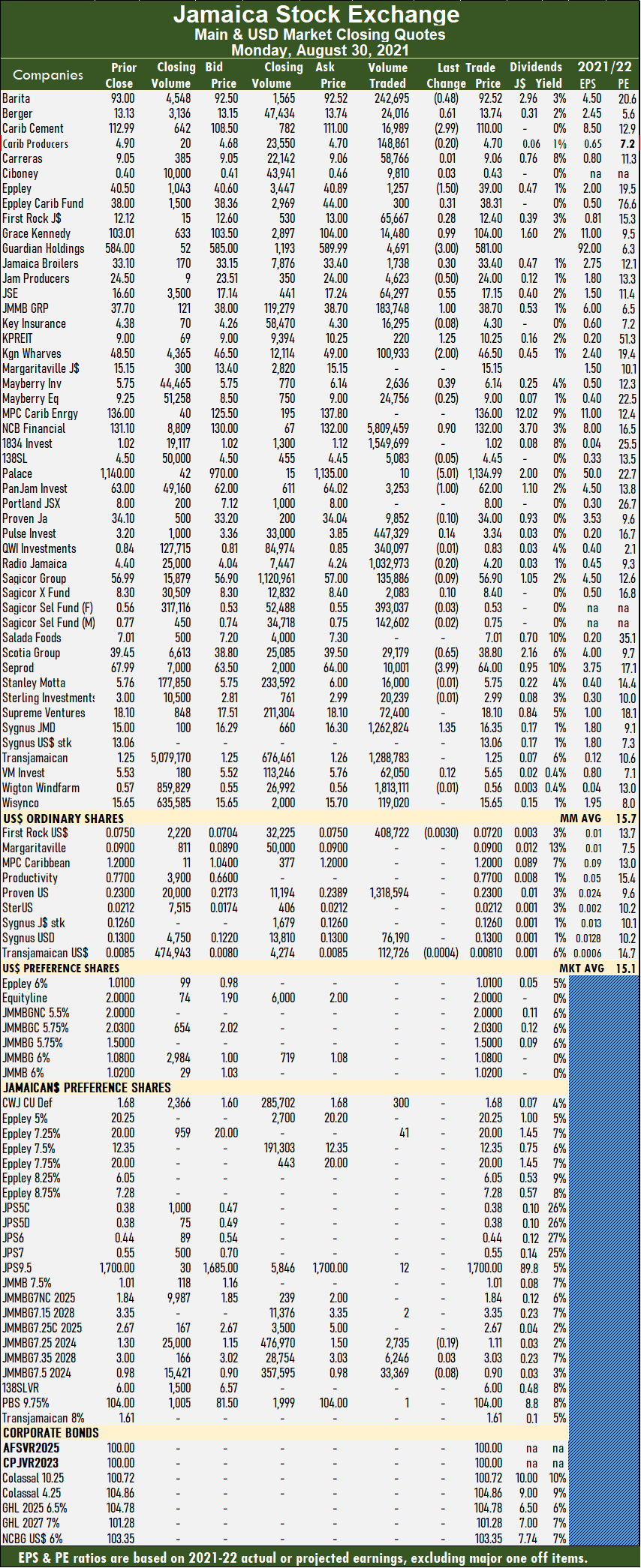

Trading averaged 305,774 units at $16,700,628, compared to 319,594 shares at $3,515,324 on Friday and month to date an average of 487,063 units at $8,855,423, in contrast to 497,417 units at $8,407,376 on Friday. July closed with an average of 322,932 units at $15,201,099. Kingston Properties climbed $1.25 to $10.25 with 220 stock units traded, Kingston Wharves dropped $2 to $46.50 with an exchange of100,933 shares, Mayberry Investments advanced 39 cents to $6.14 with investors switching ownership of 2,636 units. Mayberry Jamaican Equities lost 25 cents to end at $9 with 24,756 stocks changing hands, NCB Financial Group climbed 90 cents to $132 with an exchange of 5,809,459 shares, Palace Amusement shed $5.01 to close at $1134.99 with 10 stocks traded.PanJam Investment dropped $1 to $62 with a transfer of 3,253 units, Scotia Group fell 65 cents to $38.80 with 29,179 stock units passing through the market, Seprod declined $3.99 to $64 with 10,001 stocks changing hands and Sygnus Credit Investments advanced $1.35 to $16.35 with 1,262,824 shares crossing the exchange after the company posted strong gains in full year’s profit.

Kingston Properties climbed $1.25 to $10.25 with 220 stock units traded, Kingston Wharves dropped $2 to $46.50 with an exchange of100,933 shares, Mayberry Investments advanced 39 cents to $6.14 with investors switching ownership of 2,636 units. Mayberry Jamaican Equities lost 25 cents to end at $9 with 24,756 stocks changing hands, NCB Financial Group climbed 90 cents to $132 with an exchange of 5,809,459 shares, Palace Amusement shed $5.01 to close at $1134.99 with 10 stocks traded.PanJam Investment dropped $1 to $62 with a transfer of 3,253 units, Scotia Group fell 65 cents to $38.80 with 29,179 stock units passing through the market, Seprod declined $3.99 to $64 with 10,001 stocks changing hands and Sygnus Credit Investments advanced $1.35 to $16.35 with 1,262,824 shares crossing the exchange after the company posted strong gains in full year’s profit.

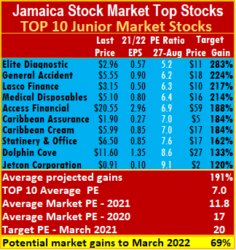

The charting of the Junior and Main Market indices shows early signs of the markets bouncing from the mild summer correction. We may be seeing early signs of a longer term rebound, with the Main and Junior Markets closing at the highest levels this week since July 23.

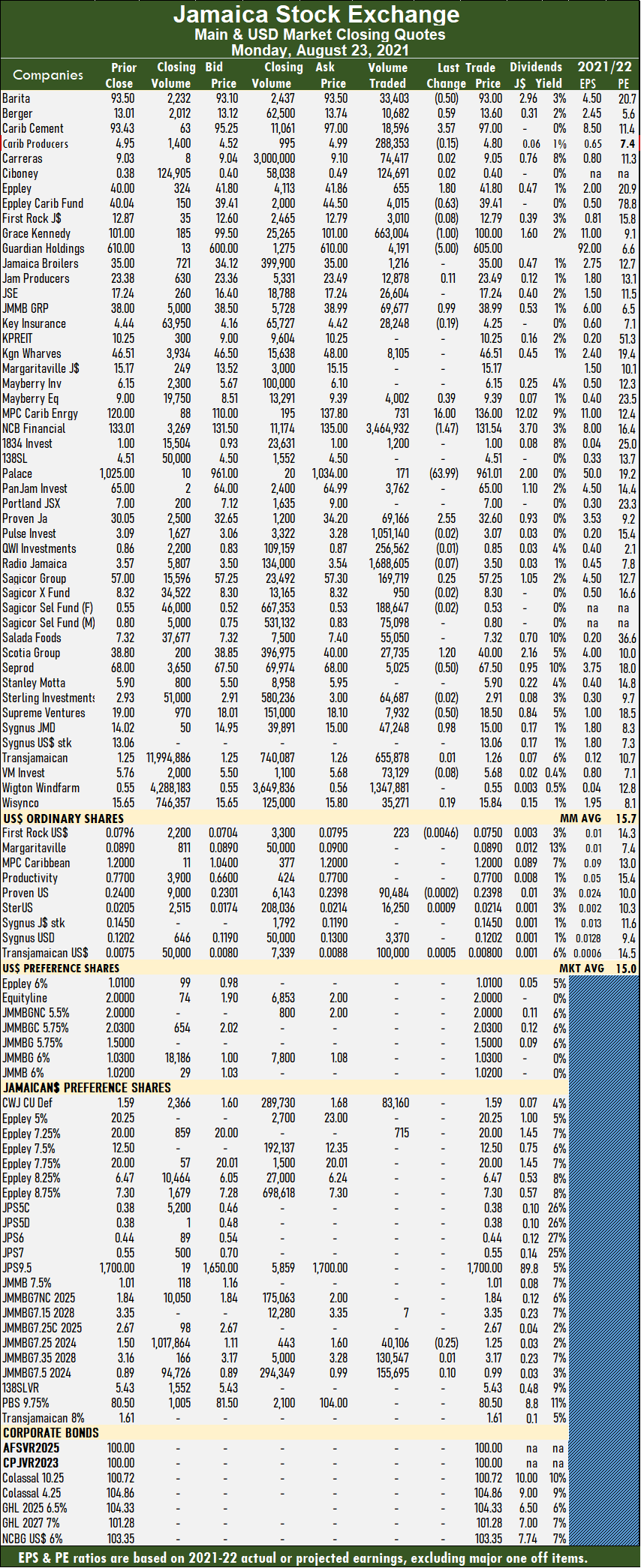

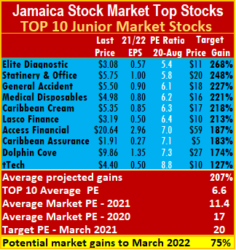

The charting of the Junior and Main Market indices shows early signs of the markets bouncing from the mild summer correction. We may be seeing early signs of a longer term rebound, with the Main and Junior Markets closing at the highest levels this week since July 23. The top three stocks in the Junior Market are Elite Diagnostic, followed by General Accident and Lasco Financial. All three have the potential to gain between 217percent and 283 percent, compared to 227 and 268 percent last week. Stationery and Office Supplies closed the previous week at $5.75 to sit at number 2 in the Junior Market list enjoyed a bounce in price to $6.50 and moved down to the 8th spot this week.

The top three stocks in the Junior Market are Elite Diagnostic, followed by General Accident and Lasco Financial. All three have the potential to gain between 217percent and 283 percent, compared to 227 and 268 percent last week. Stationery and Office Supplies closed the previous week at $5.75 to sit at number 2 in the Junior Market list enjoyed a bounce in price to $6.50 and moved down to the 8th spot this week. The JSE Main Market ended the week with an overall PE of 15.6, a little distance from the 19 the market ended at in March, suggesting a 12 percent rise at a PE of 19 and 28 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.7, with a 50 percent discount to that market’s average PE, well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 15.6, a little distance from the 19 the market ended at in March, suggesting a 12 percent rise at a PE of 19 and 28 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.7, with a 50 percent discount to that market’s average PE, well off the potential of 20. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

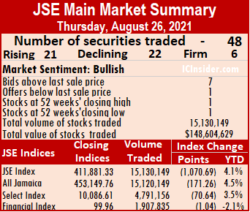

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information. The Main Market All Jamaican Composite Index surged 4,560.86 points to 457,710.62, the highest daily close since July 23, while the JSE Main Index jumped 3,833.76 points to 415,715.09 and the JSE Financial Index inched 1.17 points to 101.13 as rising stocks beating declining ones nearly 2 to 1 on Friday, with the volume and value of shares trading, rising moderately over Thursday levels, at the close of the Jamaica Stock Exchange.

The Main Market All Jamaican Composite Index surged 4,560.86 points to 457,710.62, the highest daily close since July 23, while the JSE Main Index jumped 3,833.76 points to 415,715.09 and the JSE Financial Index inched 1.17 points to 101.13 as rising stocks beating declining ones nearly 2 to 1 on Friday, with the volume and value of shares trading, rising moderately over Thursday levels, at the close of the Jamaica Stock Exchange.  Transjamaican Highway controlled 12.5 percent, with 1.96 million units and GraceKennedy with 7.4 percent after 1.16 million units changing hands.

Transjamaican Highway controlled 12.5 percent, with 1.96 million units and GraceKennedy with 7.4 percent after 1.16 million units changing hands. Mayberry Investments shed 25 cents to $5.75 with a transfer of 5,620 units, NCB Financial Group fell 90 cents to $131.10, with the swapping of 31,524 stock units, Palace Amusement rallied $15 to $1,140 in switching ownership of 71 shares. PanJam Investment rose $1 to $63 in trading 1,550 units, Sagicor Group popped 49 cents to $56.99 with 62,270 shares clearing the market, Seprod spiked $5.98 to $67.99 after exchanging 6,959 stocks and Victoria Mutual Investments climbed 23 cents to $5.53 with 45,965 stock units crossing the market.

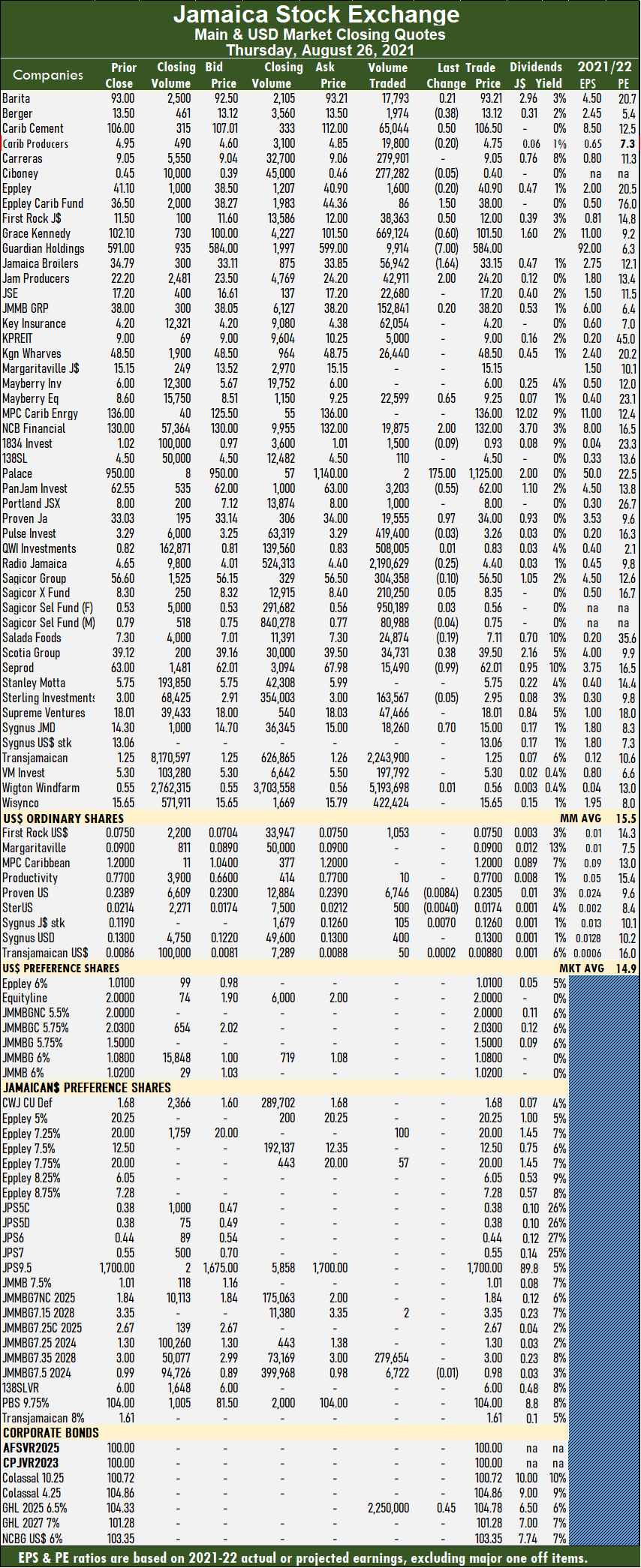

Mayberry Investments shed 25 cents to $5.75 with a transfer of 5,620 units, NCB Financial Group fell 90 cents to $131.10, with the swapping of 31,524 stock units, Palace Amusement rallied $15 to $1,140 in switching ownership of 71 shares. PanJam Investment rose $1 to $63 in trading 1,550 units, Sagicor Group popped 49 cents to $56.99 with 62,270 shares clearing the market, Seprod spiked $5.98 to $67.99 after exchanging 6,959 stocks and Victoria Mutual Investments climbed 23 cents to $5.53 with 45,965 stock units crossing the market. At the close, Barita Investments gained 21 cents at $93.21 with 17,793 shares crossing the market, Berger Paints dipped 38 cents to $13.12 in trading 1,974 stock units, Caribbean Cement spiked 50 cents to end at a 52 weeks’ closing high of $106.50 with the swapping of 65,044 shares, but traded at an intraday high of $115, as demand is picking for the stock at the same time that supply is dwindling. Caribbean Producers lost 20 cents to close at $4.75 in exchanging 19,800 units, Eppley lost 20 cents to end at $40.90 in switching ownership of 1,600 shares, Eppley Caribbean Property Fund advanced $1.50 to $38 with 86 stock units changing hands, First Rock Capital rallied 50 cents to close at $12 in exchanging 38,363 units. GraceKennedy shed 60 cents to end at $101.50 after 669,124 stock units cleared the market, Guardian Holdings declined $7 to $584 in trading 9,914 shares, Jamaica Broilers shed $1.64 to $33.15 with the transfer of 56,942 stocks. Jamaica Producers advanced $2 to $24.20 with 42,911 units crossing the exchange, JMMB Group rose 20 cents to $38.20 in an exchange of 152,841 shares, Mayberry Jamaican Equities popped 65 cents to $9.25 with the swapping of 22,599 stock units. NCB Financial Group rose $2 in closing at $132 after hitting an intraday 52 weeks’ low of $121.03 and switching ownership of just 19,875 shares, Palace Amusement surged $175 to $1,125 after exchanging just 2 units, PanJam Investment shed 55 cents to close at $62 in transferring 3,203 shares.

At the close, Barita Investments gained 21 cents at $93.21 with 17,793 shares crossing the market, Berger Paints dipped 38 cents to $13.12 in trading 1,974 stock units, Caribbean Cement spiked 50 cents to end at a 52 weeks’ closing high of $106.50 with the swapping of 65,044 shares, but traded at an intraday high of $115, as demand is picking for the stock at the same time that supply is dwindling. Caribbean Producers lost 20 cents to close at $4.75 in exchanging 19,800 units, Eppley lost 20 cents to end at $40.90 in switching ownership of 1,600 shares, Eppley Caribbean Property Fund advanced $1.50 to $38 with 86 stock units changing hands, First Rock Capital rallied 50 cents to close at $12 in exchanging 38,363 units. GraceKennedy shed 60 cents to end at $101.50 after 669,124 stock units cleared the market, Guardian Holdings declined $7 to $584 in trading 9,914 shares, Jamaica Broilers shed $1.64 to $33.15 with the transfer of 56,942 stocks. Jamaica Producers advanced $2 to $24.20 with 42,911 units crossing the exchange, JMMB Group rose 20 cents to $38.20 in an exchange of 152,841 shares, Mayberry Jamaican Equities popped 65 cents to $9.25 with the swapping of 22,599 stock units. NCB Financial Group rose $2 in closing at $132 after hitting an intraday 52 weeks’ low of $121.03 and switching ownership of just 19,875 shares, Palace Amusement surged $175 to $1,125 after exchanging just 2 units, PanJam Investment shed 55 cents to close at $62 in transferring 3,203 shares. Proven Investments rallied 97 cents to $34 in trading 19,555 stock units, Radio Jamaica traded as high as $4.7t, but selling came into the market and it lost 25 cents at the close to end at $4.40 after 2,190,629 shares cleared the market. Scotia Group spiked 38 cents to $39.50, with 34,731 stocks crossing the market. Seprod fell 99 cents to $62.01 with an exchange of 15,490 stock units and Sygnus Credit Investments popped 70 cents in closing at $15 in trading 18,260 units.

Proven Investments rallied 97 cents to $34 in trading 19,555 stock units, Radio Jamaica traded as high as $4.7t, but selling came into the market and it lost 25 cents at the close to end at $4.40 after 2,190,629 shares cleared the market. Scotia Group spiked 38 cents to $39.50, with 34,731 stocks crossing the market. Seprod fell 99 cents to $62.01 with an exchange of 15,490 stock units and Sygnus Credit Investments popped 70 cents in closing at $15 in trading 18,260 units. Investor’s Choice bid-offer indicator reading has 11 stocks ending with bids higher than their last selling prices and two with lower offers.

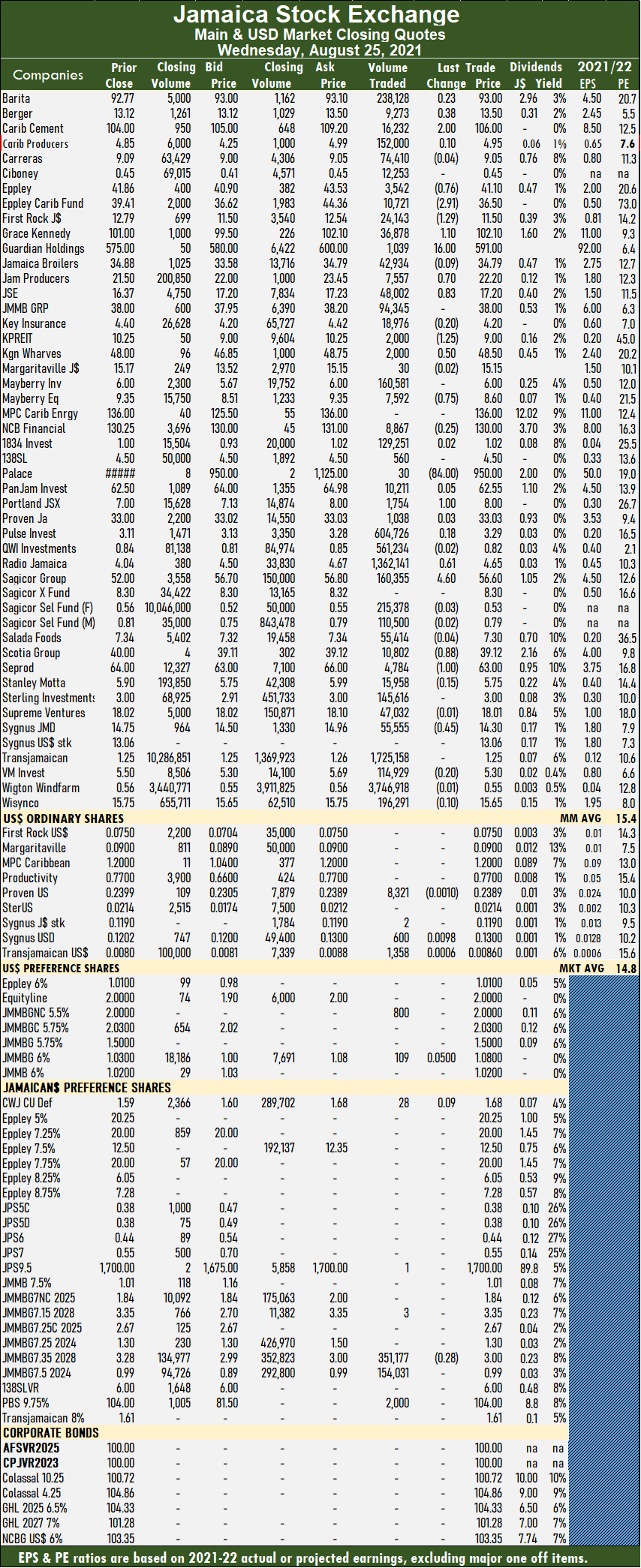

Investor’s Choice bid-offer indicator reading has 11 stocks ending with bids higher than their last selling prices and two with lower offers. Kingston Wharves gained 50 cents to $48.50 with 2,000 stocks clearing the market, Mayberry Jamaican Equities lost 75 cents in closing at $8.60 with the swapping of 7,592 stock units, NCB Financial Group slipped 25 cents to $130 with 8,867 stocks changing hands. Palace Amusement dropped $84 to $950 in trading 30 shares, Portland JSX rose $1 to $8 in switching ownership of 1,754 stocks. Radio Jamaica popped 35 cents ending at a 52 weeks’ closing high of $4.65 after exchanging 1,362,141 shares. Sagicor Group rallied $4.60 to $56.60 in trading 160,355 stock units, Scotia Group shed 88 cents to $39.12 with 10,802 units crossing the exchange, Seprod shed $1 to $63 with the swapping of 4,784 stocks, Sygnus Credit Investments slipped 45 cents to $14.30, with 55,555 stock units crossing the market.

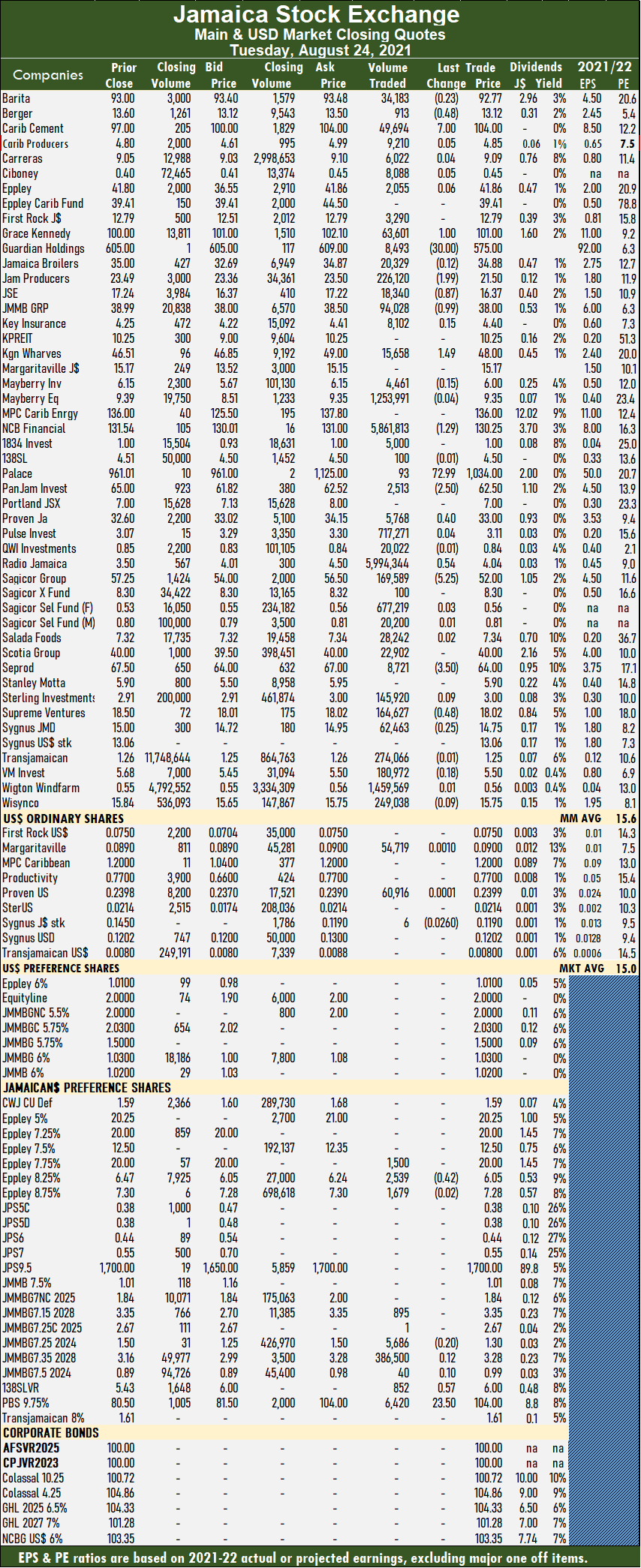

Kingston Wharves gained 50 cents to $48.50 with 2,000 stocks clearing the market, Mayberry Jamaican Equities lost 75 cents in closing at $8.60 with the swapping of 7,592 stock units, NCB Financial Group slipped 25 cents to $130 with 8,867 stocks changing hands. Palace Amusement dropped $84 to $950 in trading 30 shares, Portland JSX rose $1 to $8 in switching ownership of 1,754 stocks. Radio Jamaica popped 35 cents ending at a 52 weeks’ closing high of $4.65 after exchanging 1,362,141 shares. Sagicor Group rallied $4.60 to $56.60 in trading 160,355 stock units, Scotia Group shed 88 cents to $39.12 with 10,802 units crossing the exchange, Seprod shed $1 to $63 with the swapping of 4,784 stocks, Sygnus Credit Investments slipped 45 cents to $14.30, with 55,555 stock units crossing the market. At the close, Barita Investments lost 23 cents in ending at $92.77 in trading 34,183 shares, Berger Paints fell 48 cents to $13.12 after 913 stock units changed hands, Caribbean Cement surged $7 to a record high of $104 while exchanging 49,694 stocks. GraceKennedy popped $1 to $101 in trading 63,601 shares, Guardian Holdings dropped $30 to an all-time low of $575 with an exchange of 8,493 units. Jamaica Producers shed $1.99 to close at $21.50, exchanging 226,120 shares, Jamaica Stock Exchange fell 87 cents to $16.37 after exchanging 18,340 stocks. JMMB Group dropped 99 cents to $38 in an exchange of 94,028 stock units, Kingston Wharves gained $1.49 to end at $48, after 15,658 shares crossed the market, NCB Financial Group shed $1.29 to $130.25, with 5,861,813 stock units crossing the market, Palace Amusement spiked $72.99 to $1034, with 93 units clearing the market, PanJam Investment shed $2.50 to $62.50, with an exchange of 2,513 shares. Proven Investments rose 40 cents to $33 after 5,768 stocks changed hands, Radio Jamaica bolted 80 cents to a 52 weeks’ high of $4.04 after trading 5,994,344 stock units.

At the close, Barita Investments lost 23 cents in ending at $92.77 in trading 34,183 shares, Berger Paints fell 48 cents to $13.12 after 913 stock units changed hands, Caribbean Cement surged $7 to a record high of $104 while exchanging 49,694 stocks. GraceKennedy popped $1 to $101 in trading 63,601 shares, Guardian Holdings dropped $30 to an all-time low of $575 with an exchange of 8,493 units. Jamaica Producers shed $1.99 to close at $21.50, exchanging 226,120 shares, Jamaica Stock Exchange fell 87 cents to $16.37 after exchanging 18,340 stocks. JMMB Group dropped 99 cents to $38 in an exchange of 94,028 stock units, Kingston Wharves gained $1.49 to end at $48, after 15,658 shares crossed the market, NCB Financial Group shed $1.29 to $130.25, with 5,861,813 stock units crossing the market, Palace Amusement spiked $72.99 to $1034, with 93 units clearing the market, PanJam Investment shed $2.50 to $62.50, with an exchange of 2,513 shares. Proven Investments rose 40 cents to $33 after 5,768 stocks changed hands, Radio Jamaica bolted 80 cents to a 52 weeks’ high of $4.04 after trading 5,994,344 stock units. Sagicor Group lost $5.25 in ending at $52 after exchanging 169,589 stock units, Seprod fell $3.50 to $64 with 8,721 stocks changing hands. Supreme Ventures dropped 48 cents to close at $18.02 trading 164,627 stocks and Sygnus Credit Investments declined 25 cents to end at $14.75 in trading 62,463 shares.

Sagicor Group lost $5.25 in ending at $52 after exchanging 169,589 stock units, Seprod fell $3.50 to $64 with 8,721 stocks changing hands. Supreme Ventures dropped 48 cents to close at $18.02 trading 164,627 stocks and Sygnus Credit Investments declined 25 cents to end at $14.75 in trading 62,463 shares. Investor’s Choice bid-offer indicator reading has 11 stocks ending with bids higher than their last selling prices and eight stocks with lower offers.

Investor’s Choice bid-offer indicator reading has 11 stocks ending with bids higher than their last selling prices and eight stocks with lower offers. Palace Amusement shed $63.99 to $961.01 while exchanging 171 stock units, Proven Investments rose $2.55 to $32.60 in trading 69,166 units, Sagicor Group rose 25 cents to $57.25 in an exchange of 169,719 shares, Scotia Group climbed $1.20 to $40 while exchanging 27,735 stocks, Seprod declined 50 cents to close at $67.50 after exchanging 5,025 units. Supreme Ventures shed 50 cents to $18.50, 7,932 stocks changing hands, Sygnus Credit Investments spiked 98 cents to $15 in switching ownership of 47,248 stock units and Wisynco Group rallied 19 cents to $15.84, with 35,271 shares clearing the market.

Palace Amusement shed $63.99 to $961.01 while exchanging 171 stock units, Proven Investments rose $2.55 to $32.60 in trading 69,166 units, Sagicor Group rose 25 cents to $57.25 in an exchange of 169,719 shares, Scotia Group climbed $1.20 to $40 while exchanging 27,735 stocks, Seprod declined 50 cents to close at $67.50 after exchanging 5,025 units. Supreme Ventures shed 50 cents to $18.50, 7,932 stocks changing hands, Sygnus Credit Investments spiked 98 cents to $15 in switching ownership of 47,248 stock units and Wisynco Group rallied 19 cents to $15.84, with 35,271 shares clearing the market. Dolphin Cove reported a profit of US$1.24 million in the June quarter or 49 cents in Jamaican currency, thus wiping out the first quarter loss of US$155,000 and seems on target to generate around $3.3 million in profit for the year.

Dolphin Cove reported a profit of US$1.24 million in the June quarter or 49 cents in Jamaican currency, thus wiping out the first quarter loss of US$155,000 and seems on target to generate around $3.3 million in profit for the year. The smart money bought 52 million shares on April 6 last year, at an average of $1.33. On April 13, 95.4 million units were picked up and 67.7 million on April 27 at $1.26. The next big buy was August 17th, with 10 million units at $1.30 and 0n October 19 with 20 million units.

The smart money bought 52 million shares on April 6 last year, at an average of $1.33. On April 13, 95.4 million units were picked up and 67.7 million on April 27 at $1.26. The next big buy was August 17th, with 10 million units at $1.30 and 0n October 19 with 20 million units. The top three stocks in the Junior Market are Elite Diagnostic, followed by Stationery and Office Supplies that fell on Friday to $5.75, from $7.43 last week and General Accident, with all three having the potential to gain between 221 percent and 295 percent, compared to 256 and 336 percent, last week.

The top three stocks in the Junior Market are Elite Diagnostic, followed by Stationery and Office Supplies that fell on Friday to $5.75, from $7.43 last week and General Accident, with all three having the potential to gain between 221 percent and 295 percent, compared to 256 and 336 percent, last week. This past week the average gains projected for the Junior Market moved from 193 percent to 207 percent and Main Market stocks from 180 percent to 172 percent.

This past week the average gains projected for the Junior Market moved from 193 percent to 207 percent and Main Market stocks from 180 percent to 172 percent. The Main Market TOP 10 trades at a PE of 7.6, with a 41 percent discount to the PE of that market, well off the potential of 20.

The Main Market TOP 10 trades at a PE of 7.6, with a 41 percent discount to the PE of that market, well off the potential of 20.