The main market of the Jamaica Stock Exchange, has scaled several new highs this trading on Thursday morning on its record run that resulted in the JSE All Jamaican Composite Index hitting a record high of 426,298.79 points after rising 7,810.80 and the JSE index gaining 7,116.53 to 388,406.43 after just 51 minutes into the trading day.

The main market of the Jamaica Stock Exchange, has scaled several new highs this trading on Thursday morning on its record run that resulted in the JSE All Jamaican Composite Index hitting a record high of 426,298.79 points after rising 7,810.80 and the JSE index gaining 7,116.53 to 388,406.43 after just 51 minutes into the trading day.

The All Jamaica Composite Index has since broken the 427,000 points mark. The market opened up at the start of trading with gains of 1,433.80 points for the All Jamaica Composite Index and 1,306.36 for the JSE Index.

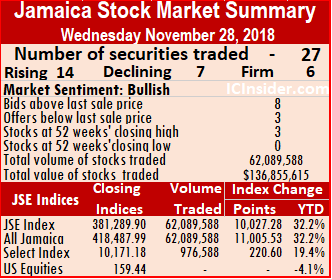

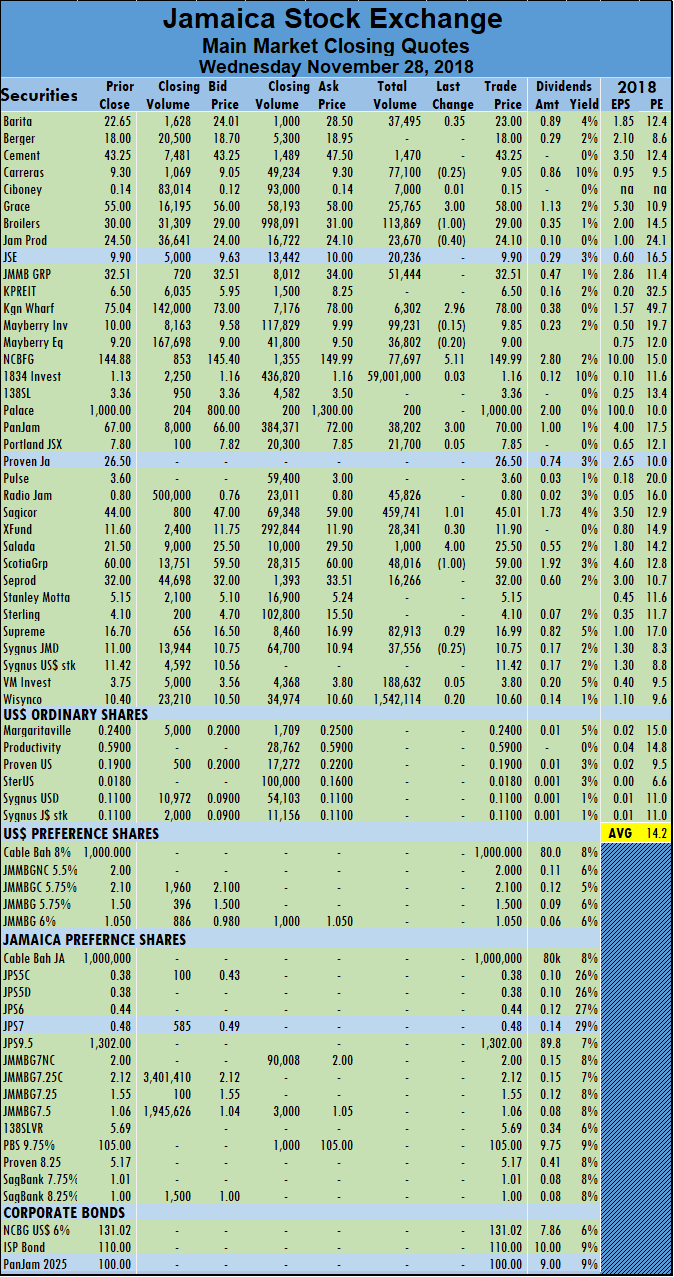

The opening high follows Wednesday’s trading when the JSE All Jamaican Composite Index closed at a new all-time high of 418,487.99 and JSE Index ended at 381,289.90.

Barita Investments traded at a new high of $24.01 to more than double for the year so far, NCB Financial now trades at $150 and Sagicor Group at $51.92 haven risen sharply to a record high, Scotia Group trades at $60..

The Junior Market continues under some selling pressure is not sharing in the strong gains of the more matured companies and declined by 8.22 a point to 3,170.22.

All Jamaica hits record 427,000 points

Many more stocks to watch now

NCB had a good 2018 fiscal year with strong profit gains that boosted interest in the stock.

Jamaica’s largest financial institution, advised the Jamaica Stock Exchange that a connected party sold 2,768,165 of the group’s shares and three directors and a senior manager purchased a total of 2,836,672 shares between November 23 and 26. This development is the clearest signs that the immediate future is extremely bright for the group.

The local stock market is showing major shift in sentiment with the news that Scotia Group is selling off of its insurance arm to Sagicor Group. The announcement drove up the prices of Scotia Group, Sagicor Group and Pan Jamaican that traded at a new high on Wednesday. But NCB continued to scale new highs on each day for the week. NCB has little supply coming onto the market as demand continues to climb.

All the above stocks are now the watch list, but investors must keep watch on Barita Investments that has shot up to a record high of $23 with a bid at $24.01. There is some amount of public chatter about the performance of the company that has encouraged more interest in the stock. The company will benefit from several developments in the financial market, including the impact of the change in

accounting policy that will result in gains or losses in investments whether realized or not going straight to the profit and loss account. With growth in the stock market Barita should benefit in two ways, increased value of the portfolio, for example, 48 million JSE shares owned increasing around $100 million in the December quarter so far but Barita is said to also own shares in NCB that has risen sharply in price for the quarter. The equity linked unit trust will garner more fee income based purely on the fact that the portfolio would have grown based on gains in stock price. The other financial stock to be watched is Key Insurance that has traded over 21 million shares so far with the stock having a bid of $4 to buy over 911,000 shares. The movement in the Key shares seems like the start of an aggressive stance an investor, watch developments in this one keenly. Seprod also seems poised to rise with early selling from the public offer now appearing to be abating.

accounting policy that will result in gains or losses in investments whether realized or not going straight to the profit and loss account. With growth in the stock market Barita should benefit in two ways, increased value of the portfolio, for example, 48 million JSE shares owned increasing around $100 million in the December quarter so far but Barita is said to also own shares in NCB that has risen sharply in price for the quarter. The equity linked unit trust will garner more fee income based purely on the fact that the portfolio would have grown based on gains in stock price. The other financial stock to be watched is Key Insurance that has traded over 21 million shares so far with the stock having a bid of $4 to buy over 911,000 shares. The movement in the Key shares seems like the start of an aggressive stance an investor, watch developments in this one keenly. Seprod also seems poised to rise with early selling from the public offer now appearing to be abating.Mayberry Jamaican Equities is yet another to watch as the local stock market moves higher over the next several weeks and it could drag it mother company Mayberry Investments with it.

JSE pushes to new record close – Wednesday

The main market of the Jamaica Stock Exchange, surged 11,005.53 points on Wednesday, the most, ever, leading the All Jamaica Index to close at a record high of 418,487.99 and the JSE Index rose 10,027.28 points to close at a record high 381,289.90.

The main market of the Jamaica Stock Exchange, surged 11,005.53 points on Wednesday, the most, ever, leading the All Jamaica Index to close at a record high of 418,487.99 and the JSE Index rose 10,027.28 points to close at a record high 381,289.90.

Strong gains in Grace Kennedy, NCB Financial Group that ended at a record close of $149.99, Kingston Wharves, PanJam Investment that traded at a record high of $72 and Sagicor Group were the main contributor to the market’s record move.

Market activity ended with 3 securities closing at record highs as 27 securities in the main and US dollar markets changed hands, compared to a 29 on Tuesday. At the end, prices of 14 stocks rose, 7 declined and 6 remained unchanged.

The main market ended with 62,089,588 units valued at over $136,855,615 changing hands, compared  with 5,592,346 units valued at $176,485,571 exchanged, on Tuesday.

with 5,592,346 units valued at $176,485,571 exchanged, on Tuesday.

The main market ended with 1834 Investments leading with 59,001,000 units, accounting for 95 percent of the day’s trades, followed by Wisynco Group with 1,542,114 units or 20.5 percent of the day’s volume and Sagicor Group with 459,741 units.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator reading shows 8 stocks ending with bids higher than the last selling prices and 3 closing with lower offers.

Trading resulted in an average of 2,299,614 units valued at over $5,068,726, in contrast to 207,124 shares valued at $6,536,503 on Tuesday. The average volume and value for the month to date, amounts to 410,125 valued at $7,009,413, compared to 319,025 valued at $7,107,722. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

In main market activity, Barita Investments rose 35 to a record close of $23, with 37,495 shares trading, Grace Kennedy rose $3 in trading of 25,765 shares at $58, Jamaica Broilers lost $1, trading 113,869 stock units at $29, Jamaica Producers shed 40 cents to close at $24.10, trading of 23,670 shares, Kingston Wharves jumped $2.96 in trading 6,302 shares to end at $78. NCB Financial Group jumped $5.11 to end trading of 77,697 shares at record close of $149.99, PanJam Investment jumped $3 to record close of $70, with an exchange of 38,202 stock units, Sagicor Group rose $1.01 trading 459,741 shares at $45.01, Scotia Group traded 48,016 shares and shed $1 to close at $59 and Supreme Ventures rose 29 cents to end at $16.99, with an exchange of 82,913 shares. There were no trades in the US dollar market.

NCB record $145, Barita record $22.65 – Tuesday

NCB Financial Group ended at a new record close of $144.88 on the Jamaica Stock Exchange on Monday while Barita Investments jumped to a high of $22.65 on a day when the market indices gained the most points in a single day.

NCB Financial Group ended at a new record close of $144.88 on the Jamaica Stock Exchange on Monday while Barita Investments jumped to a high of $22.65 on a day when the market indices gained the most points in a single day.

The main market took flight with the All Jamaica Index having the highest gain in a day, surging 10,574.31 points to close at 407,482.46, while the JSE Index jumped 9,634.39 points to 371,262.62. Market activity closed with 2 securities closing at record highs as 29 securities in the main and US dollar markets changed hands, compared to a 31 on Monday. At the end, prices of 14 stocks rose, 8 declined and 7 remained unchanged.

The main market ended with 5,592,346 units valued at $176,485,571 changing hands, compared with 6,956,000 units valued at $513,002,473 exchanged, on Monday.

The main market ended with Seprod leading with 1,850,546 units, accounting for 33 percent of the day’s trades, followed by Wisynco Group with 1,125,534 units or 20 percent of the day’s volume and Scotia Group with 865,661 units or just 15.5 percent of the overall volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator reading shows 6 stocks ending with bids higher than the last selling prices and 4 closing with lower offers.

Trading resulted in an average of 207,124 units valued at over $6,536,503, in contrast to 239,862 shares valued at $17,689,740 on Monday. The average volume and value for the month to date, amounts to  319,025 valued at $7,107,722, compared to 324,693 valued at $7,138,202. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

319,025 valued at $7,107,722, compared to 324,693 valued at $7,138,202. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

In main market activity, Barita Investments rose $1.65 to close at record $22.65, with 72,505 shares trading, Berger Paints ended trading of 23,778 units but lost $1.05 to $18, Caribbean Cement lost $4.75 to close at $43.25 in trading just 2,000 shares, Grace Kennedy shed $1 in trading of 903 shares at $55, Jamaica Broilers rose $1.50, trading 339,292 stock units at $30, Jamaica Stock Exchange gained 49 cents to close at $9.90, trading of 880 shares, JMMB Group fell 49 cents to $32.51, with an exchange of 87,335 shares, Mayberry Jamaica Equities lost 50 cents trading 78,806 shares in closing at $9.20, NCB Financial Group jumped $4.89 to end trading at record close of $144.88 with 84,352 shares, PanJam Investment jumped $3 to $67, with an exchange of 127,085  stock units, Sagicor Group rose $4 trading 260,532 shares at $44, Scotia Group traded 865,661 shares and gained $3.90 to close at $60, Seprod added 25 trading of 1,850,546 shares, to close at $32 and Supreme Ventures lost 29 cents to end at $16.70, with an exchange of 196,680 shares.

stock units, Sagicor Group rose $4 trading 260,532 shares at $44, Scotia Group traded 865,661 shares and gained $3.90 to close at $60, Seprod added 25 trading of 1,850,546 shares, to close at $32 and Supreme Ventures lost 29 cents to end at $16.70, with an exchange of 196,680 shares.

Trading in the US dollar market amounted to 31,000 units valued at $15,630 as JMMB Group 5.75% preference share close trading with 5,000 units to gain 10 cents to close at US$2.10 and Proven Investments ended trading of 27,000 shares at 19 U$ cents. The JSE USD Equities Index closed with a fall of 1.90 at 159.44.

Record $140 for NCB on JSE – Monday

NCB investors are having a great 2018 with the stock trading at record levels.

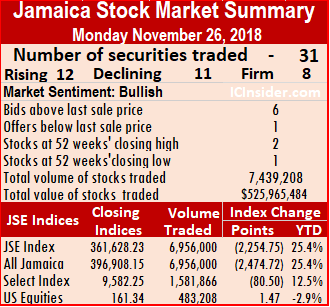

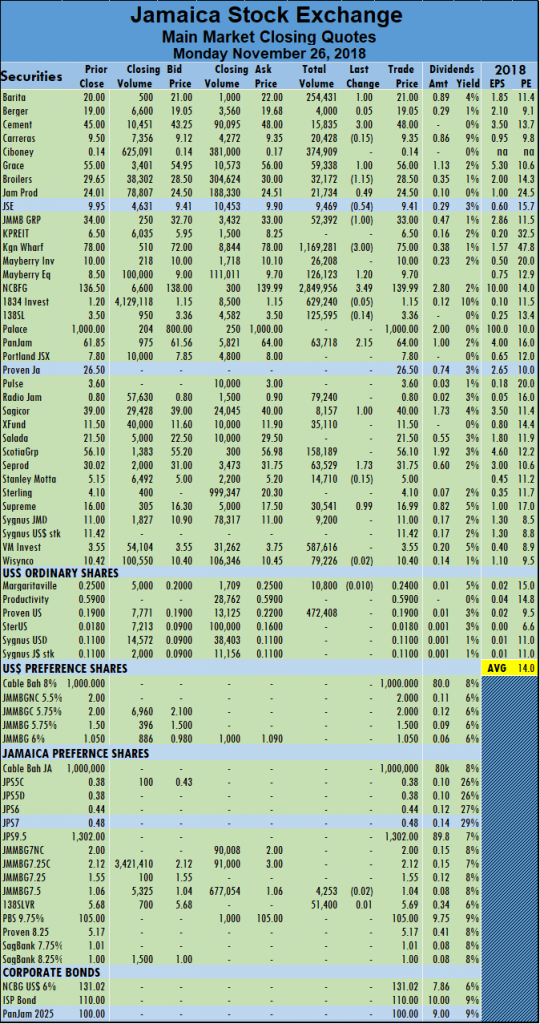

NCB Financial Group ended at a new record close of $139.99 after trading at $140 after trading 2.85 million shares that accounted for 41 percent of the day’s volume on the Jamaica Stock Exchange on Monday.

The main market lost flight with the All Jamaica Composite Index declining 2,474.72 points to 396,908.15, while the JSE Index dropped 2,254.75 points to close at 361,628.23. Market activity closed with 2 securities ending at record highs and one at a 52 weeks’ low as 31 securities in the main and US dollar markets trading, compared to a same number on Friday. At the end prices of 12 stocks rose, 11 declined and 8 remained unchanged.

The main market ended with 6,956,000 units valued at $513,002,473 changing hands, compared with 37,219,908 units valued at $266,712,510 exchanged, on Friday.

The main market ended with NCB Financial leading with 2,849,956 units, followed by Kingston Wharves with 1,169,281 units or 16.8 percent of the day’s volume and 1834 Investments with 629,240 units or just 9 percent of the overall volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator reading shows 6 stocks ending with bids higher than the last selling prices and 1 closing with a lower offer.

Trading resulted in an average of 239,862 units valued at over $17,689,740, in contrast to 1,283,445 shares valued at $9,196,983 on Friday. The average volume and value for the month to date, amounts to 324,693 valued at $7,138,202, compared to 329,574 valued at $6,496,704. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

In main market activity, Barita Investments rose $1 to close at record $21, with 254,431 shares trading, Caribbean Cement gained $3 to close at $48 in trading 15,885 shares, Grace Kennedy gained $1 in trading of 59,338 shares at $56, Jamaica Broilers lost $1.15, trading 32,172 stock units at $28.50, Jamaica Stock Exchange declined 54 cents to close at $9.41, trading of 9,469 shares, JMMB Group fell $1 to $33, with an exchange of 52,392 shares,  Jamaica Producers gained 49 cents and finished trading of 21,734 units at $24.50, Kingston Wharves dropped $3 to finish at $75, with 1,169,281 stock units changing hands, Mayberry Jamaica Equities rose $1.20 trading 126,123 shares in closing at $9.70, NCB Financial Group jumped $3.49 to end trading at record close of $139.99 with 2,849,956 shares, 138 Student Living traded 125,595 shares and declined by 14 cents to end a 52 weeks’ low of $3.35, PanJam Investment jumped $3.15 to $64, with an exchange of 63,718 stock units, Sagicor Group rose $1 and finished trading at $40, with 8,157 shares, Seprod added $1.73 trading of 63,529 shares, to close at $31.75 and Supreme Ventures gained 99 cents to end at $16.99, with an exchange of 30,541 shares.

Jamaica Producers gained 49 cents and finished trading of 21,734 units at $24.50, Kingston Wharves dropped $3 to finish at $75, with 1,169,281 stock units changing hands, Mayberry Jamaica Equities rose $1.20 trading 126,123 shares in closing at $9.70, NCB Financial Group jumped $3.49 to end trading at record close of $139.99 with 2,849,956 shares, 138 Student Living traded 125,595 shares and declined by 14 cents to end a 52 weeks’ low of $3.35, PanJam Investment jumped $3.15 to $64, with an exchange of 63,718 stock units, Sagicor Group rose $1 and finished trading at $40, with 8,157 shares, Seprod added $1.73 trading of 63,529 shares, to close at $31.75 and Supreme Ventures gained 99 cents to end at $16.99, with an exchange of 30,541 shares.

Trading in the US dollar market amounted to 483,208 units valued at $94,621 as Margaritaville with 10,800 units to close at 25 US cents and Proven Investments ended trading of 472,408 shares at 19 U$ cents. The JSE USD Equities Index closed with a rise of 1.47 at 161.34.

4 new entrants in IC Top 10

Seprod shares now trades at $32 each.

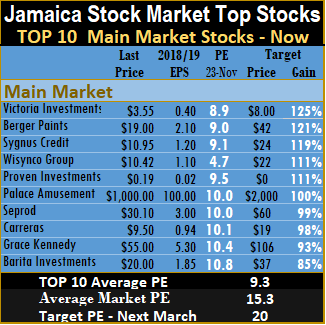

There are three changes to the TOP 10 main market list and one Junior Market stock. Increased prices during the week, pushed out Access Financial, Salada Foods, Stanley Motta and Scotia Group.

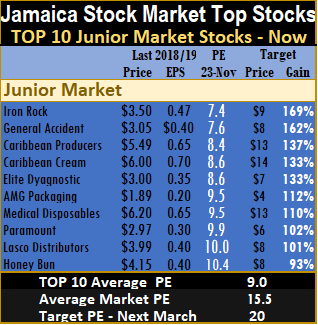

Medical Disposables returns to the TOP 10 Junior Market list with the price at $6.20, down from $7.50 the previous week, as it pushed out Access that rose to $52 during last week. Berger Paints and Seprod moved up modestly in price but that was not sufficient to prevent them from returning to the TOP, with other stocks rising in price during the week. Palace Amusement also returned to the TOP 10 main market list.

For the nine months to September, Seprod generated $15.50 billion in revenues, an increase of $3.36 billion or 28 percent over the similar period in 2017. Net profit for the period was $970 million, an increase of $387 million or 66 percent over 2017. Earnings per share came out at $2.03 with the third quarter rising to 85  cents from 38 cents in 2017.

cents from 38 cents in 2017.  For the full year earnings could hit $3 per share. That should put the stock back in the $40 range before too long.

For the full year earnings could hit $3 per share. That should put the stock back in the $40 range before too long.

Berger Paints profit for the nine months to September was below expectations, with $9 million profit in the third quarter versus $54 million in 2017 and $43 million for the nine months to September, down sharply from $143 million in 2017. The company now enters the busiest period of the year when the bulk of income and profits are made. Last year company was closed for sales for several days for stock taking in December, resulting in lost sales and profit. The company should not suffer the same fate this year as the new owners would be aware of the problem and work at  preventing same. That should result in better sales and profit than in the 2017 final quarter. In the final quarter of 2016 pretax profit was $233 million compared to just $67 million for the similar period in 2017, when the disruptions occurred.

preventing same. That should result in better sales and profit than in the 2017 final quarter. In the final quarter of 2016 pretax profit was $233 million compared to just $67 million for the similar period in 2017, when the disruptions occurred.

The main market closed the week with the overall PE remains at 15.3, the PE of the Junior market is at 15.5.

The PE ratio for Junior Market Top 10 stocks average 9 and the main market PE is now 9.3.

The TOP 10 stocks now trade at an average discount of 42 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings. The main market stocks trade at a discount of 39 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns within a 12 months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

JSE stocks making strong recovery

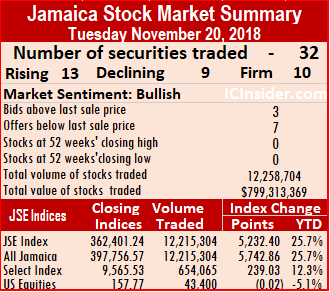

The Jamaica Stock Exchange main market indices were pushed sharply higher on Tuesday, sending the All Jamaica Index surging 5,742.86 points to 397,756.57 and JSE Index jumped 5,232.40 points to close at 362,401.24, thanks partially to jump in the price of NCB Financial.

The Jamaica Stock Exchange main market indices were pushed sharply higher on Tuesday, sending the All Jamaica Index surging 5,742.86 points to 397,756.57 and JSE Index jumped 5,232.40 points to close at 362,401.24, thanks partially to jump in the price of NCB Financial.

Market activity closed with 32 active securities in the main and US dollar markets, compared to 30 on Thursday with the prices of 13 stocks rose, 9 declined and 10 remained unchanged.

Main market trading closed with JMMB Group leading with 5,977,409 units, or 49 percent of the day’s volume and NCB Financial with just under 4.29 million units and 35 percent of volume traded.

IC bid-offer Indicator|At the end of trading, the Choice bid-offer indicator reading shows 3 stocks ending with the bid higher than the last selling prices and 7 closing with lower offers.

The market closed with much more trading volume and value than on Monday as 12,215,304 units valued at over $798,389,015 changed hands, compared with 8,566,949 units valued at $433,399,089 being exchanged, on Monday.

Trading resulted in an average of 436,261 units valued at over $28,513,893, in contrast to 295,412 shares valued at $14,944,796 on Monday. The average volume and value for the month to date, amounts to 268,764 valued at $6,039,932, compared to 256,707 valued at $4,301,615. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

In the main market activity, Barita Investments gained 74 cents and closed at $19.75, trading 2,000 shares, Carreras concluded trading of 10,257 units and lost 32 cents at $9.50, Caribbean Cement jumped $7.75 to close at $50 in trading of 7,325 shares, PanJam Investment rose $2.30 in closing at $64, with an exchange of 62,978 stock units, Sagicor Group advanced by $2 to $39 with an exchange of 3,563 shares, Sagicor Real Estate Fund gained 30 cents and settled at $11.75, trading 3,880  shares, Scotia Group gained $2.99 trading 31,977 to close at $55.99, Seprod shed 50 cents to end trading of 156,060 shares at $29.50 and Sterling Investments fell 50 cents and closed at $20, with 3,094 shares.

shares, Scotia Group gained $2.99 trading 31,977 to close at $55.99, Seprod shed 50 cents to end trading of 156,060 shares at $29.50 and Sterling Investments fell 50 cents and closed at $20, with 3,094 shares.

Trading in the US dollar market amounted to 43,400 units valued at over $18,506 as JMMB Group 6.00% traded 12,100 units losing 1 cent to close at $1.04, Productive Business Solution traded 1,000 shares at 59 US cents, Proven Investments closed the trading of 25,000 shares at 19 U$ cents and Sygnus Credit Investments USD share ended with 5,300 units changing hands and rose 1 cent to 9 US cents..

The JSE USD Equities Index inched 0.02 points down to close at 157.77.

Falling stocks dominate JSE main market – Thursday

The Jamaica Stock Exchange main market lost more ground on Thursday, with volume exceeding Wednesday’s levels by a wide margin.

The Jamaica Stock Exchange main market lost more ground on Thursday, with volume exceeding Wednesday’s levels by a wide margin.

Market activity closed with 32 active securities in the main and US dollar markets, compared to 33 on Wednesday with the prices of 8 stocks rose, 18 declined and 6 remained unchanged.

The All Jamaica Composite Index lost 299.44 points to end at 390,498.41 and the JSE Index declined by 272.83 points to close at 355,788.24.

Main market trading closed with Jamaica Producers leading with 650,876 units, or 19.7 percent of the day’s volume, Seprod with 616,205 units and 18.7 percent of volume traded and 1834 Investments with 443,270 units accounting for 13.4 percent of main market volume.

IC bid-offer Indicator|At the end of trading, the Choice bid-offer indicator reading shows just 2 stocks ending with the bid higher than the last selling prices and 3 closing with lower offers.

The market closed with much trading volume than on Wednesday as 3,304,274 units valued at $77,547,412 changed hands, compared with 7,229,792 units valued at $190,325,727 being exchanged, on Wednesday.

Trading resulted in an average of 110,142 units valued at over $2,584,914, in contrast to 225,931 shares valued at $5,947,679 on Wednesday. The average volume and value for the month to date, amounts to 251,748 valued at $3,117,393, compared to 265,815 valued at $3,175,481. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

In the main market activity, Barita Investments lost $1 to close at $19, trading 140,000 shares, Berger Paints lost $1.40 and ended at $18.60, with 6,680 stock units, Caribbean Cement dived $4 to close at $46 in trading of 500 shares, Grace Kennedy rose 60 cents to end trading of 10,836 shares at $55, Jamaica Producers dipped 99 cents to end at $23.01, trading 650,876 shares, Jamaica Stock Exchange lost 84 cents, in closing at $10.16, trading 96,393 shares, JMMB Group rose $1.60 to $34, with an exchange of 63,957 shares, Kingston Wharves dropped $2 to $76 trading 14,080 shares, Mayberry Investments shed 43 cents to settle at $9.57, in exchanging 13,638 units, NCB Financial Group rose 40 cents and ended trading of 164,248 shares at $130.41. PanJam Investment gained 60 cents in closing at $65.10, with an exchange of just 1,775 stock  units, Sagicor Group declined 90 cents to $38.65, trading 37,603 shares, Sagicor Real Estate Fund fell 98 cents and settled at $11.50, trading 64,571 shares, Scotia Group rose $4.70 trading 90,583 to close at $55.99, Seprod rose $2.50 to end trading 616,205 shares at $29.50, Sterling Investments lost 75 cents and closed at $19.75, trading 800 shares, Supreme Ventures lost 50 cents and ended at $16.50, with an exchange of 156,532 shares and Sygnus Credit Investments Jamaican dollar based ordinary share dropped 95 cents in trading 33,550 units at $11.05.

units, Sagicor Group declined 90 cents to $38.65, trading 37,603 shares, Sagicor Real Estate Fund fell 98 cents and settled at $11.50, trading 64,571 shares, Scotia Group rose $4.70 trading 90,583 to close at $55.99, Seprod rose $2.50 to end trading 616,205 shares at $29.50, Sterling Investments lost 75 cents and closed at $19.75, trading 800 shares, Supreme Ventures lost 50 cents and ended at $16.50, with an exchange of 156,532 shares and Sygnus Credit Investments Jamaican dollar based ordinary share dropped 95 cents in trading 33,550 units at $11.05.

Trading in the US dollar market amounted to 40,126 units valued at $5,783. Proven investments completed trading 21,126 shares to end at 20 U$ cents and rose 0.5 cents and Sygnus Credit Investments US dollar based ordinary share dropped 2 cents in trading 19,000 units at an all-time low of 8 US cents. The JSE USD Equities Index fell 3.13 points to close at 159.65.

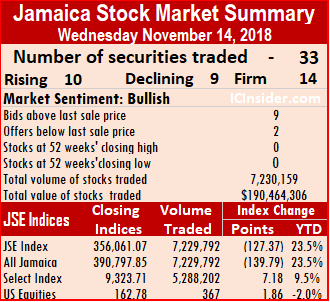

Palace plunged $500 on Wednesday

Palace Dropped $500 back to $1,000.

After months with no trades, with investors offering the stock well below that last traded price of $1,500, Palace Amusement finally traded but with just 100 units, the trade took place on The Jamaica Stock Exchange on Wednesday for $500 less than the previous traded price.

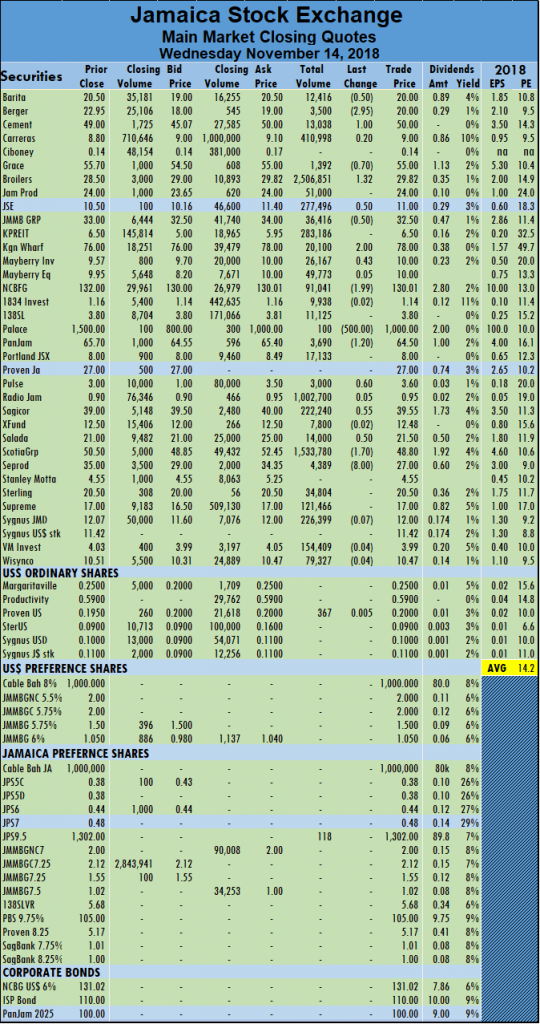

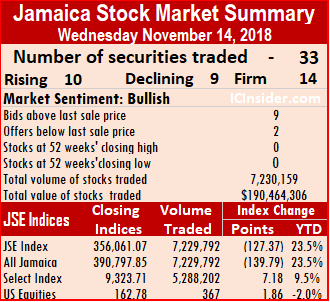

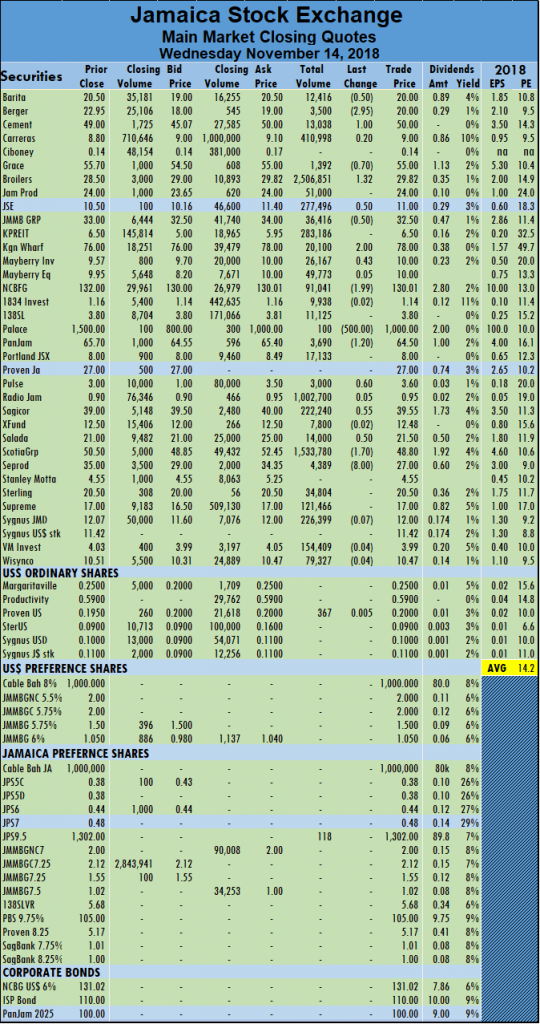

Market activity closed with 33 active securities in the main and US dollar markets, compared to 30 on Tuesday with the prices of 10 stocks rose, 9 declined and 14 remained unchanged.

The All Jamaica Composite Index lost 139.79 points to close at 390,797.85 and the JSE Index declined by 127.37 points to close at 356,061.07.

Main market trading closed with Jamaica Broilers leading with 2,506,851 units, or 34.7 percent of the day’s volume, Scotia Group with 1,533,780 units and 21 percent of volume traded and Radio Jamaica with 1,002,700 units accounting for 13.9 percent of main market volume.

IC bid-offer Indicator|At the end of trading, the Choice bid-offer indicator reading shows just 3 stocks ending with the bid higher than the last selling prices and 5 closing with lower offers.

Trading closed with 7,229,792 units valued at $190,325,727 changing hands compared with 2,275,042 units valued at $61,431,938 being exchanged, on Tuesday.

Trading resulted in an average of 225,931 units valued at over $5,947,679, in contrast to 81,252 shares valued at $2,193,998 on Tuesday. The average volume and value for the month to date, amounts to 265,815 valued at $3,175,481, compared to 270,542 valued at $2,810,418. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

In the main market activity, Barita Investments shed 50 cents to close at $20, trading 12,416 shares, Berger Paints shed $2.95 and ended at $20, trading 3,500 stock units, Caribbean Cement climbed $1 to close at $50 in trading of 13,030 shares, Grace Kennedy lost 70 cents and ended trading 63,596 shares at $55. Jamaica Broilers traded 40,054 stock units and rose $1.32 to close at $30, Jamaica Stock Exchange gained 50 cents, in closing at $11, trading 277,496 shares, JMMB Group fell 50 cents and ended at $32.50, with an exchange of 36,416 shares, Kingston Wharves climbed $2 to $78 trading 20,100  shares, Mayberry Investments added 43 cents to settle at $10, in exchanging 26,167 units, NCB Financial Group dropped $1.99 in trading of 91,041 shares at $130.01. Palace Amusement traded just 100 units but fell $500 in closing at $1,000, PanJam Investment lost $1.20 in closing at $64.50, with an exchange of just 3,690 stock units, Pulse Investments rose 60 cents in trading 3,000 units at $3.60, Sagicor Group rose 55 cents to $39.55, trading 222,240 shares, Salada Foods gained 50 cents and settled at $21.50, trading 14,000 shares, Scotia Group traded 1,533,780 shares and declined $1.70 at $48.80 and Seprod dived $8 to end trading 4,389 shares at $27.

shares, Mayberry Investments added 43 cents to settle at $10, in exchanging 26,167 units, NCB Financial Group dropped $1.99 in trading of 91,041 shares at $130.01. Palace Amusement traded just 100 units but fell $500 in closing at $1,000, PanJam Investment lost $1.20 in closing at $64.50, with an exchange of just 3,690 stock units, Pulse Investments rose 60 cents in trading 3,000 units at $3.60, Sagicor Group rose 55 cents to $39.55, trading 222,240 shares, Salada Foods gained 50 cents and settled at $21.50, trading 14,000 shares, Scotia Group traded 1,533,780 shares and declined $1.70 at $48.80 and Seprod dived $8 to end trading 4,389 shares at $27.

Trading in the US dollar market saw Proven investments as the sole stock to trade and completed trading of a mere 367 shares and rose 0.5 cents to end at 20 U$ cents.The JSE USD Equities Index rose 1.86 points to close at 162.78.

JSE main market down again on Tuesday

The Jamaica Stock Exchange main market lost ground on Tuesday but with the advancing stocks just edged out declining stocks by one.

The Jamaica Stock Exchange main market lost ground on Tuesday but with the advancing stocks just edged out declining stocks by one.

Market activity closed with 30 active securities in the main and US dollar markets, compared to 29 on Monday with the prices of 10 stocks rose, 9 declined and 11 remained unchanged.

The All Jamaica Composite Index lost 1,977.46 points to close at 390,937.64 and the JSE Index declined by 1,801.69 points to close at 356,188.44.

Main market trading closed with Scotia Group leading with 498,076 units, or 22 percent of the day’s volume, Wisynco Group with 438,385 units and 19 percent of volume traded and Mayberry Jamaican Equities with 420,374 units accounting for 18.5 percent of main market volume.

IC bid-offer Indicator|At the end of trading, the Choice bid-offer indicator reading shows just 3 stocks ending with the bid higher than the last selling prices and 5 closing with lower offers.

Trading closed with 2,275,042 units valued at $61,431,938 changing hands compared with 2,530,491 units valued at $58,080,585 being exchanged, on Friday.

Trading resulted in an average of 81,252 units valued at over $2,193,998, in contrast to 93,722 shares valued at $2,151,133 on Monday. The average volume and value for the month to date, amounts to 270,542 valued at $2,810,418, compared to 292,443 valued at $2,890,696. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

In the main market activity, Barita Investments gained 50 cent to close at $20.50, trading 550 shares, Caribbean Cement jumped $5 to close at $49 in trading of 18,535 shares, Jamaica Producers gained $1 to end at $24, trading 15,800 shares, JMMB Group fell 90 cents and ended at $33, with an exchange of 110,598 shares, Kingston Wharves dropped $2 to $76 trading 4,800 shares, Mayberry Investments shed 43 cents to settle at $9.57, in exchanging 32,704 units, NCB Financial Group lost $1 and ended trading 127,194 shares at $132, after trading at a 52 weeks’ high of $135.01. PanJam Investment gained $1.70 in closing at $65.70, with an exchange of just 500 stock units, Sagicor Group rose 50 cents to $39, trading 13,945 shares, Sagicor Real Estate Fund gained 50 cents and settled at $12.50, trading 297 shares and Seprod fell $1 and finished trading 4,833 shares at $35.

JMMB Group fell 90 cents and ended at $33, with an exchange of 110,598 shares, Kingston Wharves dropped $2 to $76 trading 4,800 shares, Mayberry Investments shed 43 cents to settle at $9.57, in exchanging 32,704 units, NCB Financial Group lost $1 and ended trading 127,194 shares at $132, after trading at a 52 weeks’ high of $135.01. PanJam Investment gained $1.70 in closing at $65.70, with an exchange of just 500 stock units, Sagicor Group rose 50 cents to $39, trading 13,945 shares, Sagicor Real Estate Fund gained 50 cents and settled at $12.50, trading 297 shares and Seprod fell $1 and finished trading 4,833 shares at $35.

Trading in the US dollar market ended with 12,200 units valued at over US$20,506 traded, Proven investments completed trading of 429,681 shares and fell 3.5 cents to end at 19.5 U$ cents and Sygnus Credit Investments traded 2,500 units after falling 1 cent to 10 US cents. The JSE USD Equities Index declined by 14.71 points to close at 160.92.

- « Previous Page

- 1

- …

- 133

- 134

- 135

- 136

- 137

- …

- 170

- Next Page »