Rates ended mixed on the latest issues of Government of Jamaica Treasury bills issued on Friday, June 9, following the auction of the two issues on Wednesday for $1.4 billion.

The 91 days issue for $700 million that matures in September this year resulted in an average yield of 7.86327 percent and the 182 days instrument has an average yield of 7.88671 percent.

The 91 days issue for $700 million that matures in September this year resulted in an average yield of 7.86327 percent and the 182 days instrument has an average yield of 7.88671 percent.

The yield on the 182 days instrument is the lowest since August 2022 when it averaged 7.86, while the 91 days T-bill inched up from 7.82 percent in May but matched the rate in November last year and came against a background when the previous Bank of Jamaica CD average rate jumped to 9.30 percent, with only $21.36 billion going after the $22 billion the central bank offered.

The amounts of Treasury Bills applied for was $2.3 billion for the shorter term instrument and $3.06 billion for the other.

Mixed interest rate movements

BOJ CD rate dips under 8%

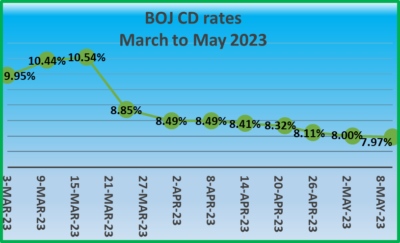

BOJ CD rates dipped under 8 percent for the first time since October 2022, data out of the Bank of Jamaica shows.

The Central Bank’s offer of $20 billion to the public attracted $27 billion from 216 bids in going after the amount offered with rates ranging from 7.15 percent to a high of 10.10 percent, with the highest successful rate coming in at 8.16 percent.

The Central Bank’s offer of $20 billion to the public attracted $27 billion from 216 bids in going after the amount offered with rates ranging from 7.15 percent to a high of 10.10 percent, with the highest successful rate coming in at 8.16 percent.

The average rate for accepted bids is 7.97 percent from 173 successful bids and represents the eighth consecutive fall after peaking at 10.54 percent in early March. The auction will result in the total amount of 30 days CDs standing at $104 billion, up from $101 billion previously.

Interest rates are down again

Interest rates declined in the latest auction of CDs placed on the market by the Bank of Jamaica, with the average rate falling to 8.41 percent from 8.49 percent at the auctions over the past two weeks.

The rate is slightly ahead of the 91 days Treasury bill rate of 8.136 percent, which was determined at the Treasury bill auction held on April 12 and 8.315 percent for the 182 days Treasury bill.

The rate is slightly ahead of the 91 days Treasury bill rate of 8.136 percent, which was determined at the Treasury bill auction held on April 12 and 8.315 percent for the 182 days Treasury bill.

The central bank offered $17 billion and received offers amounting to $40.7 billion from 275 bids, with 161 being successful, down from the previous week of 351 and 253 successful bids. The lowest bid was at 8 percent, the same as the prior week, and the highest bid was at 11.5 percent, down from 13.5 percent, but the highest successful bid was 8.59 percent, a fall from 8.749 percent.

At the close of the auction, the amount pulled from the financial market was $104 billion, up from $99 billion the previous week.

Whether Jamaican interest rates?

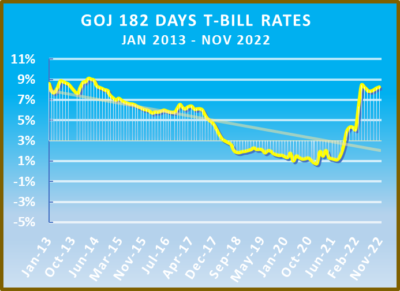

Interest rates on the last government of Jamaica Treasury bills averaged 8.27 percent on the 182 days instrument in November, the highest level since December 2012 at 9.12 percent.

The rate is well over the trend since 2013, which suggests it should be just over 3 percent on a longer term. In 2013, the rate did not remain at its peak for long and continued decreasing gradually. It rose again to 9.11 in March 2014 for a brief period and fell to 6.99 percent by January 2015 and moved gradually down to under two percent by 2018.

The rate is well over the trend since 2013, which suggests it should be just over 3 percent on a longer term. In 2013, the rate did not remain at its peak for long and continued decreasing gradually. It rose again to 9.11 in March 2014 for a brief period and fell to 6.99 percent by January 2015 and moved gradually down to under two percent by 2018.

While the Bank of Jamaica has only recently pushed the Overnight rate to 7 percent the 182 days, Treasury bill rates were around 8 percent from April this year when the average was 8.46 percent and moderated slightly downwards since an indication that the market has determined that these rates are at or close to the peak. The decline in rates should start in the first half of 2023 and could adjust downwards gradually, as was the case in 2014.

The attached chart shows the trend-line slopping from the left side of the chart and reaching around two percent, with the current rates being well over trend, an indication that the recent hike since last year is not sustainable and could start to decline not too long from now with inflation rate now closer to 7 percent and falling.

BOJ’s several missed inflation forecasts

Bank of Jamaica has done an awful job of telling the truth about inflation in Jamaica since early 2021 and the bank’s management of the tools to combat it. The impression given is that inflation continues to run at nearly ten percent per annum for most of this year, but that is false. According to data released by Statin since January, inflation is running at just under 6.5 percent per annum, not the ten percent the bank is consistently mentioning in its reports and recently reduced to 9.3 percent.

BOJ interest cuts overnight rate.

It is not that interest rates should not have been increased, the question is the extent of it and how long it may go on. It also means that they have been applying the incorrect dosage of interest rates medicine to inflation that has subsided since the start of the year. The reality is that the terribly high inflation rate was up to September last year, not in 2022, although they were some high months this year but not as high as the comparative periods last year.

Come December or January, the country will be told that inflation has suddenly plummeted to the 6 percent level because the bad periods for 2021 are no longer in the data set. The decline will have had little to do with Bank of Jamaica’s interest rate hike, but as sure as night follows day, the central bank will be praised for its action in bringing the inflation rate sharply down. That of course will be far from the truth.

The reality is that just about every public forecast by the country’s central bank since the beginning of last year proved to be wrong. It started with a letter written to the Minister of Finance in March last year in defending the maintenance of the 4-6 percent target for three years. In May of that year BOJ stated that while inflation is forecasted to rise further over the next two months, the Bank forecasts inflation to fall in the second half of the year, consistent with the consensus forecast for a fall in commodity prices. Immediately after that statement, the inflation rate declined in the following two months.

The classic case of getting wrong is BOJ’s letter to the Minister of Finance in 2021.

“I am recommending that the target for the 12 months point to point in the spread as measured by the percentage change in consumer price index remains at 4 percent to 6 percent for the next three fiscal year,” this is an extract from a letter written to the Minister of Finance by Richard Byles head of the Monetary Policy Committee (MPC ) of Bank of Jamaica dated March 29th 2021, the letter went on to state “the targeted lower rate of inflation is not advisable as achieving this lower rate will require tighter monetary policy which will restrain the anticipated recovery in the Jamaican economy and impair the government’s debt reduction strategy. “

By May of 2021, the central bank changed its position, informing the nation that tighter monetary policy would be put into effect and that the overnight rate would be raised when they meet in September, an action which has taken from 0.5 percent to 1.5 percent.

By May of 2021, the central bank changed its position, informing the nation that tighter monetary policy would be put into effect and that the overnight rate would be raised when they meet in September, an action which has taken from 0.5 percent to 1.5 percent.

Inflation data indicates that the dark days of higher inflation started to overshadow the country from November and December of 2020 compounded by the March inflation and was well embedded from May onwards suggesting the higher rates should have commenced from then, but the focus on point to point inflation disguised the true extent of what was going on. It appears that they are set to make the same error again, this time by focusing overwhelmingly on the point to point inflation since last year rather than looking at the trends since late last year and in 2022.

Interestingly, although the central bankers raised interest rates over the period to 6.5 percent the economic growth of the country exceeded the bank’s forecast and raises questions about their original assessment that rising interest rates would have trimmed GDP growth significantly.

The issue for this publication is not whether the Bank of Jamaica should raise rates it was clear from the earliest 2019 that the bank erred in dropping rates as low as it did at the time thus removing the incentive of Jamaicans to save in local dollars and instead encouraging them to switch to U.S. dollar investments.  If the Bank of Jamaica in a matter of a few months got the inflation outlook so wrong what assurance can there be that the increase rates will not over impact the economy and create mayhem within the financial system?

If the Bank of Jamaica in a matter of a few months got the inflation outlook so wrong what assurance can there be that the increase rates will not over impact the economy and create mayhem within the financial system?

Jamaicans should therefore be very concerned whether the Bank of Jamaica is correctly interpreting the data that they are churning out or not and how much credibility can be afforded them in directing the country’s monetary affairs. Longer term the bank is still holding to the 4 to 6 percent target, which suggests that sooner than later rates will have to be reduced to prevent the rate from slipping under the 4 percent bottom.

They stated in their MPC release that “while headline inflation at June 2022 may be lower than expected, the Bank prefers to see evidence of a definitive fall in commodity prices, consistent with global consensus forecasts, and a reduction in core inflation before moderating the tight monetary policy stance. The Bank expects to see this in the September and December 2022 quarters and with it, a fall in inflation expectations. Of course, this depends on tensions between Russia and Ukraine not escalating.”

The MPC report goes on to say, “inflation is projected to fall within the target range by the December 2023 quarter. This is two quarters later than previously projected. Consistent with the consensus forecast for a fall in commodity prices and the Bank’s overall monetary policy stance, and absent any new shocks, annual inflation is projected to range between 9 per cent and 11 per cent for the remaining months of 2022. Inflation is projected to fall to single digits in early 2023 as long as the conflict between Russia and Ukraine does not escalate and inflation among Jamaica’s trading partners continues to fall. In addition, the Bank’s baseline forecast assumes that the public’s expectation for future inflation will fall during the second half of 2022.”

The above is not what is taking place currently.

BOJ hikes interest rate higher to 5.50%

The Bank of Jamaica hikes its overnight rate once more by 0.50 percent to 5.50 percent following the latest meeting of the Monetary Policy Committee (MPC).

The decision the bank stated was “unanimously agreed to” by MPC who “also decided to continue pursuing other measures to contain Jamaican dollar liquidity expansion and maintain relative stability in the foreign exchange market.”

The Committee noted that “while inflation at May 2022 of 10.9 percent was lower than inflation at April 2022, core inflation remained elevated and headline inflation is likely to continue to breach the Bank’s target range over the next year.”

“while inflation at May 2022 of 10.9 percent was lower than inflation at April 2022, core inflation remained elevated and headline inflation is likely to continue to breach the Bank’s target range over the next year.”

The MPC noted that its current decision reflects a cumulative increase in the policy rate of 500 bps since October 2021, which has taken the policy rate closer to the level that the Committee considers appropriate. The bank stated that “the measures are also aimed at reducing economic demand and, consequently, the ability of businesses to pass on price increases to consumers. These decisions are also expected to continue to support a relatively more stable foreign exchange market.”

Bank of Jamaica inflation response worsened

Inflation in Jamaica is getting better, not worse, contrary to the recent statement by the Bank of Jamaica, to the contrary in justifying a steep hike in overnight deposit interest rates by 1.5 percent to 4 percent starting on Monday.

BOJ hikes overnight rate.

Yes, the point to point inflation rate moved up to 9.7 percent, giving the impression that inflation is getting out of hand, but that number does not tell the true story. The 4 percent interest rate will help savers get a more realistic rate on their savings.

The bank really had no significant new information that they did have when rates were raised between September and December, last year. If anything, the new information indicates clearly that inflation is moderating not worsening.

What are the facts? In January and February, last year inflation was negative 1.6 and 0.1 percent respectively and jumped to 1.1 percent in March while slipping to 0.5 percent in April, for a negative year to date inflation then, of 1.1 percent. Between May and September when BOJ moved rates up by 100 basis points inflation was the worse for the year at 1.32 percent per month or annualized 16 percent that is well up from 0.48 percent per month or 5.76 percent. The high rate of inflation suggests the bank should have moved earlier to raise rates than in September.

Inflation since the first interest rate move in September, is running at 0.6 percent per month or 7.2 percent per annum just slightly above the BOJ range of 4-6 percent. The average for the last three months is running at an average of 0.47 percent or 5.64 percent annualized, well below the 16 percent per annum for the period indicated above.

Inflation since the first interest rate move in September, is running at 0.6 percent per month or 7.2 percent per annum just slightly above the BOJ range of 4-6 percent. The average for the last three months is running at an average of 0.47 percent or 5.64 percent annualized, well below the 16 percent per annum for the period indicated above.

Negative inflation in January 2021 was due to a steep decline in the prices of vegetables and tubers a development that was not sustainable, as such the underlying inflation was more likely positive than negative as such the 0.6 percent increase in January this year is not out of line and is better than the December rate of 0.8 percent. The question to be answered is what can justify a sharp interest rate increase to tame much more moderate inflation over the past three months compared to when the rates were initially raised in September and on two other occasions last year by much smaller amounts that that starting on Monday?

Jamaica’s interest rates holding for now

Zero inflation in December and prospects that low to negative inflation for the first four months of 2022 might have checked the move by the Bank of Jamaica to further engineer further increase in interest rates at this time.

At its latest Bank of Jamaica certificate of deposit (CD) auction, in the amount of $11 billion that was auctioned last Wednesday, January 4, the yield held, for the 30 day instrument, remaining the same as the out turn at the December 29 auction, at 4.13 percent, marginally lower than the rate in mid October.

At its latest Bank of Jamaica certificate of deposit (CD) auction, in the amount of $11 billion that was auctioned last Wednesday, January 4, the yield held, for the 30 day instrument, remaining the same as the out turn at the December 29 auction, at 4.13 percent, marginally lower than the rate in mid October.

Bids amounting to $21.53 billion were received covering 85 applications. There were 49 successful Bids with rates ranging between 4 and 4.2 percent. The highest bid was 5.5 percent for $1 million that was not successful.

Bank of Jamaica reduced the amount of CDS to $36.5 billion that is down from $46.5 billion at the peak late last year in mid-October, with the average rate at 4.17 percent.

At the latest auction of the Bank of Jamaica Fixed Rate

At the latest auction of the Bank of Jamaica Fixed Rate