The ICTOP10 stocks racked up some solid gains to close out the past week, even as the Jamaica Stock Exchange Junior and the Main Market that suffered losses last week declined further this past week.

The Main Market had just two stocks with notable price changes this past week, with Scotia Group jumping 13 percent to $34 and Key Insurance slipping 8 percent to close the week at $2.55. There were more changes of note in the Junior Market ICTOP10 that closed the week with a 15 percent rise in General Accident Insurance to $5.24, the price of Elite Diagnostic rose 11 percent to $1.79 and Iron Rock Insurance gained 5 percent to end at $2.20. Image Plus with a 4 percent loss to $2.02, was the only declining stock of note.

The Main Market had just two stocks with notable price changes this past week, with Scotia Group jumping 13 percent to $34 and Key Insurance slipping 8 percent to close the week at $2.55. There were more changes of note in the Junior Market ICTOP10 that closed the week with a 15 percent rise in General Accident Insurance to $5.24, the price of Elite Diagnostic rose 11 percent to $1.79 and Iron Rock Insurance gained 5 percent to end at $2.20. Image Plus with a 4 percent loss to $2.02, was the only declining stock of note.

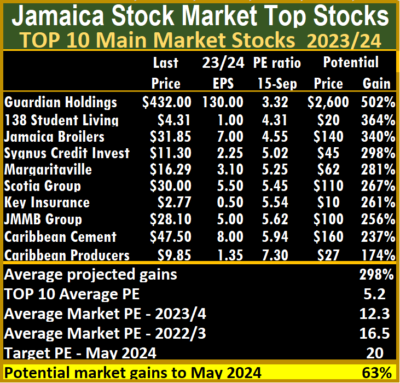

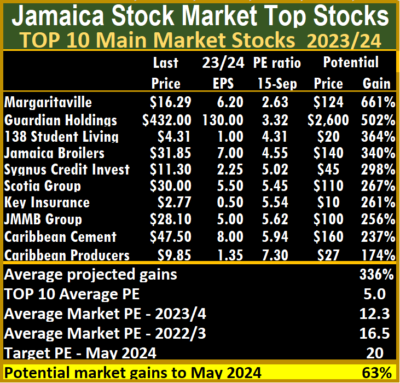

Earnings for Margaritaville was adjusted to $3.10 for the current fiscal year ending May 2024, placing the stock at number 5 on the list.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5, well below the market average of 12.2. The Main Market TOP10 is projected to gain an average of 298 percent, to May 2024, based on 2023 forecasted earnings.

A total of 11 of the most highly valued stocks representing 23 percent of the Main Market are priced with a PE of 16 to 84, with an average of 31 and 21 excluding the highest PE ratios, with a PE of 21 for the top half and 17 excluding the stocks with the over weighted valuations.

The PE of the Junior Market Top 10 sits at 5.2 just half of the market at 10.4. There are 10 stocks or 26 percent of the market, with PEs from 15 to 29, averaging 19 that are well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently, and projected to rise by 288 percent to May 2024.

The PE of the Junior Market Top 10 sits at 5.2 just half of the market at 10.4. There are 10 stocks or 26 percent of the market, with PEs from 15 to 29, averaging 19 that are well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently, and projected to rise by 288 percent to May 2024.

The divergence between the average PE of the Main and Junior Markets and the overall market valuation are important indicators of the level of likely gains for ICTOP10 stocks.

The markets are not in a bullish state but there continue to be cases of slow upward movements in some prices as investors respond to some recent results leading them to quietly nibble away at the supplies of a number of stocks on offer and paving the way for price appreciation ahead. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors, Lasco Manufacturing and Transjamaican Highway.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 stocks are likely to deliver the best returns up to the end of May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly changes in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

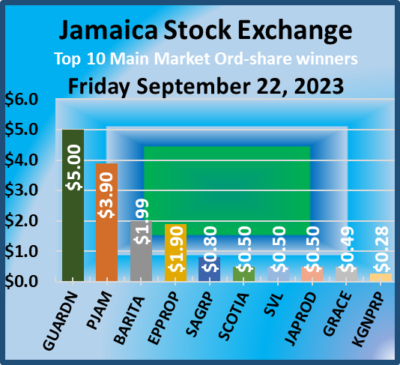

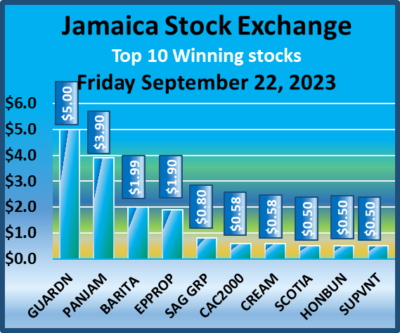

Overall, 3,872,550 shares were traded for $72,059,401 up from 6,606,269 units at $40,160,944 on Thursday.

Overall, 3,872,550 shares were traded for $72,059,401 up from 6,606,269 units at $40,160,944 on Thursday. Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and four with lower offers.

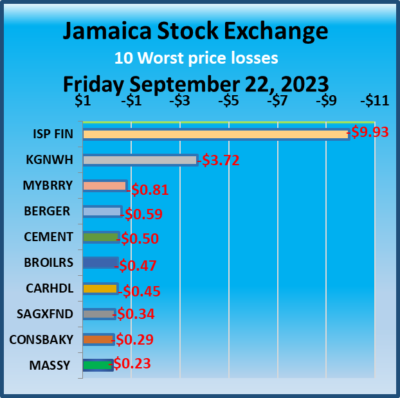

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and four with lower offers. Kingston Wharves skidded $3.72 to close at a multiyear low of $24 with stakeholders exchanging 45,945 stocks. Massy Holdings dipped 23 cents to end at $104.17 with traders dealing in 178 shares, Mayberry Investments shed 81 cents to $7.10 after a transfer of 18,129 stocks, Pan Jamaica increased $3.90 in closing at $45 with 230,694 stock units crossing the market, Sagicor Group climbed 80 cents in closing at $44.60 with investors transferring 15,345 units. Sagicor Real Estate Fund dipped 34 cents to close at $8, with 20,000 shares changing hands, Scotia Group popped 50 cents and ended at $34 in trading 92,228 stocks and Supreme Ventures gained 50 cents to end at $27.50 after exchanging 19,296 units.

Kingston Wharves skidded $3.72 to close at a multiyear low of $24 with stakeholders exchanging 45,945 stocks. Massy Holdings dipped 23 cents to end at $104.17 with traders dealing in 178 shares, Mayberry Investments shed 81 cents to $7.10 after a transfer of 18,129 stocks, Pan Jamaica increased $3.90 in closing at $45 with 230,694 stock units crossing the market, Sagicor Group climbed 80 cents in closing at $44.60 with investors transferring 15,345 units. Sagicor Real Estate Fund dipped 34 cents to close at $8, with 20,000 shares changing hands, Scotia Group popped 50 cents and ended at $34 in trading 92,228 stocks and Supreme Ventures gained 50 cents to end at $27.50 after exchanging 19,296 units. In the preference segment, JMMB Group 7.25% preference share advanced 23 cents to $1.90 after an exchange of 544 stock units and 138 Student Living preference share jumped $11.52 and ended at $105 as investors exchanged 114 units.

In the preference segment, JMMB Group 7.25% preference share advanced 23 cents to $1.90 after an exchange of 544 stock units and 138 Student Living preference share jumped $11.52 and ended at $105 as investors exchanged 114 units. At close, the JSE Combined Market Index rose 869.06 points to close at 326,253.01, with the All Jamaican Composite Index falling 1,768.93 points to 343,636.27, the JSE Main Index rallied 876.64 points to close at 312,277.29, the Junior Market Index rose 5.83 points to 3809.59, while the JSE USD Market Index shed 1.12 points to finish at 254.26.

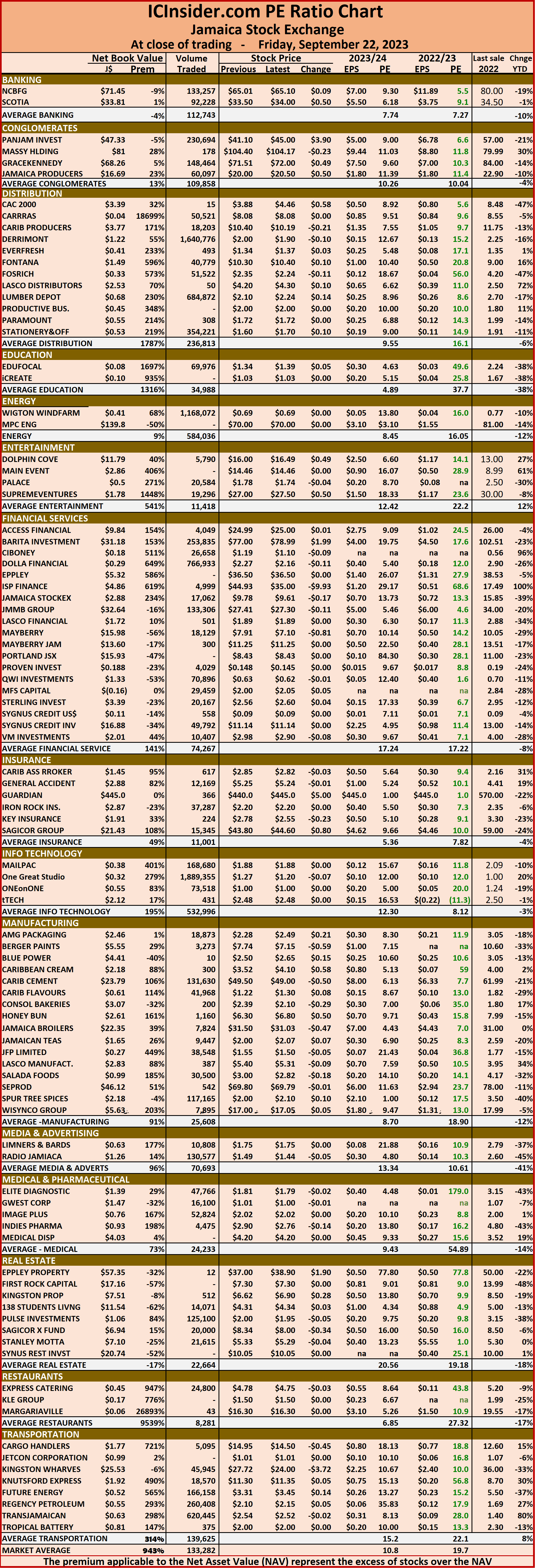

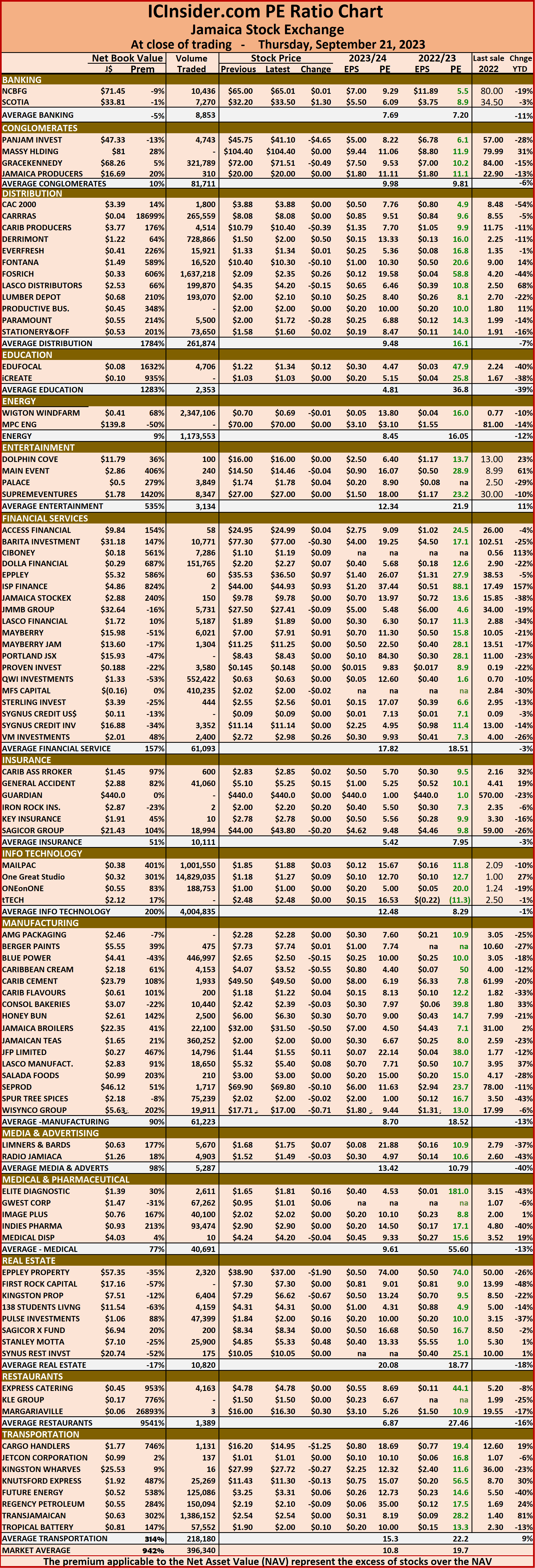

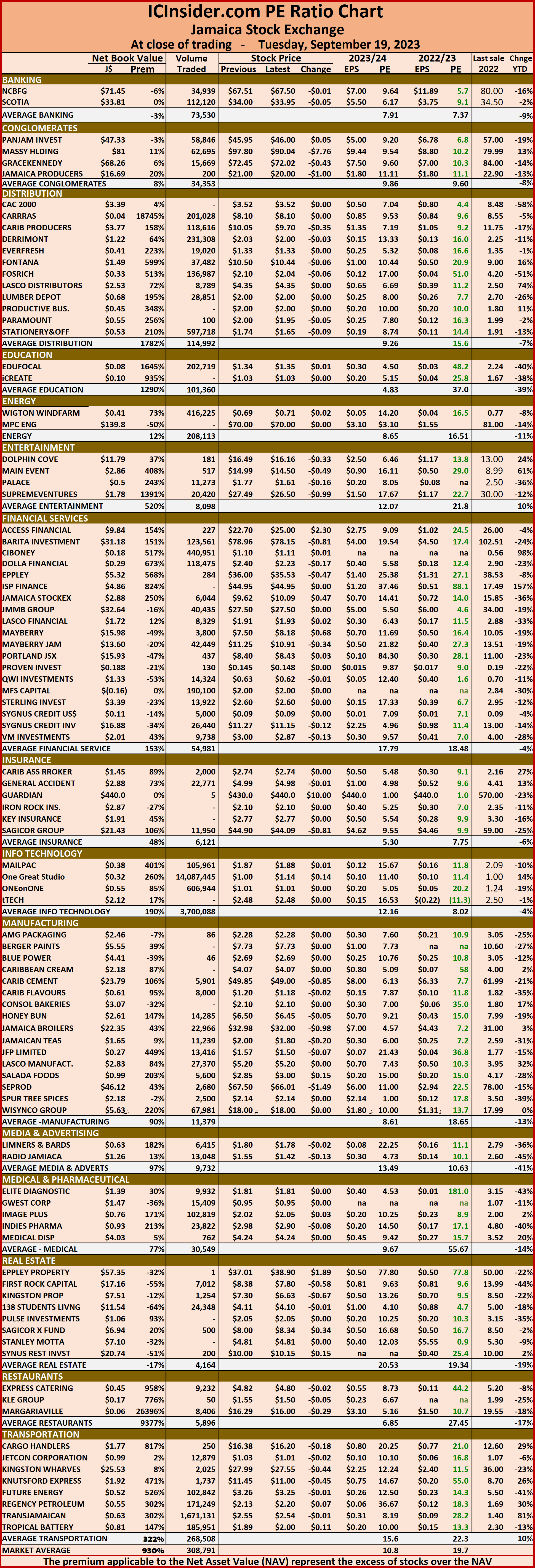

At close, the JSE Combined Market Index rose 869.06 points to close at 326,253.01, with the All Jamaican Composite Index falling 1,768.93 points to 343,636.27, the JSE Main Index rallied 876.64 points to close at 312,277.29, the Junior Market Index rose 5.83 points to 3809.59, while the JSE USD Market Index shed 1.12 points to finish at 254.26. The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 19.7 on 2022-23 earnings and 10.8 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 19.7 on 2022-23 earnings and 10.8 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making. The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. A total of 6,606,269 shares were traded at $40,160,944 compared to 4,914,260 units at $86,517,288 on Wednesday.

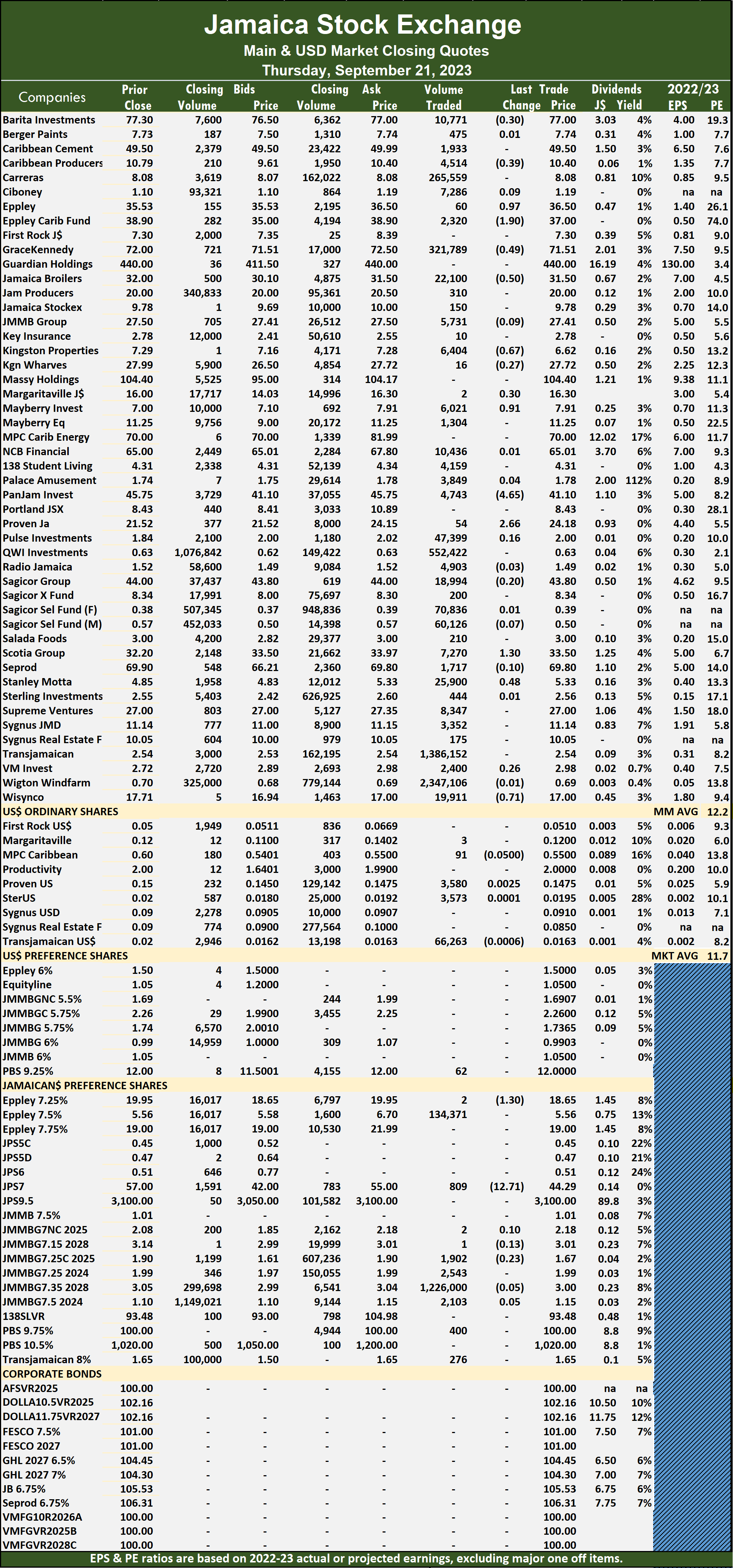

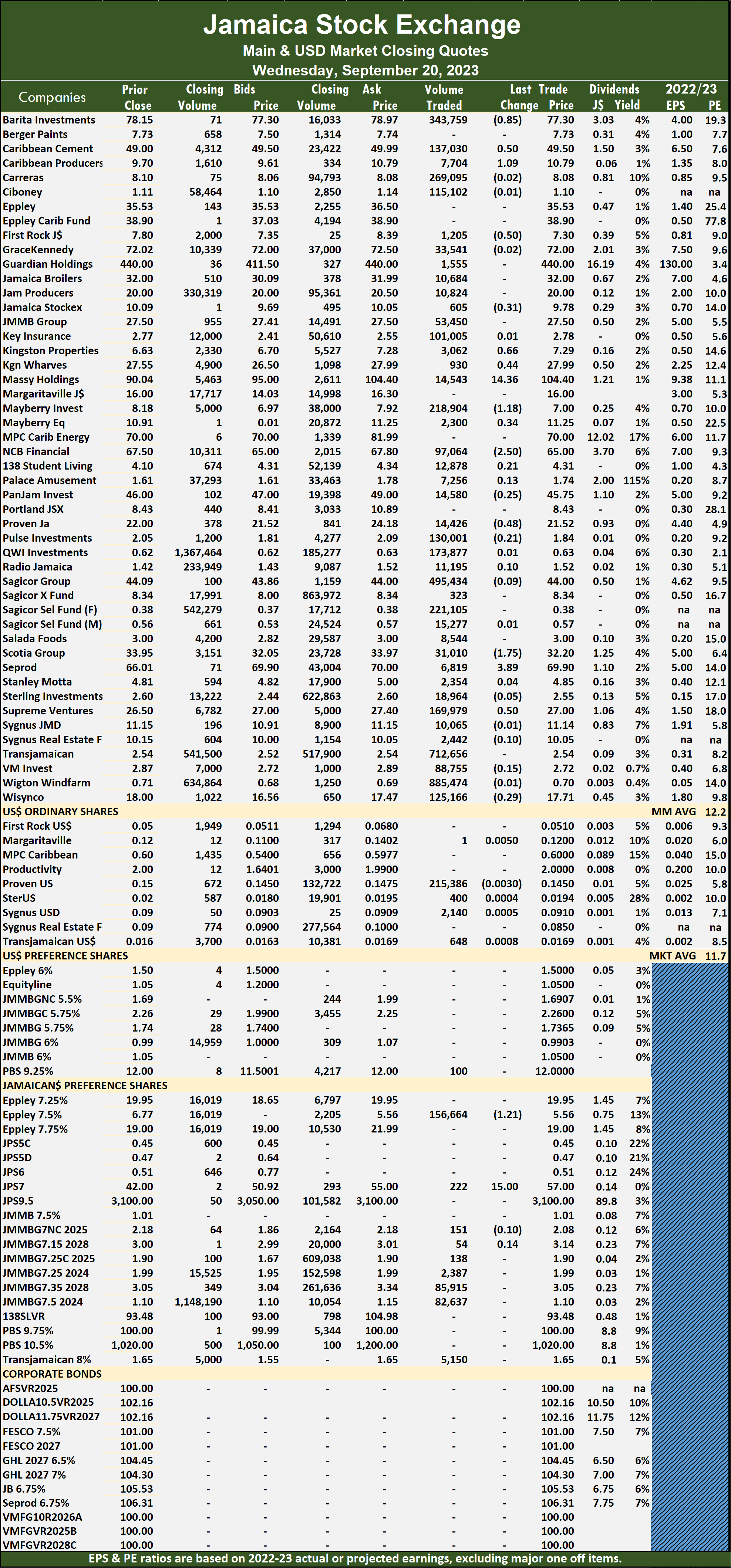

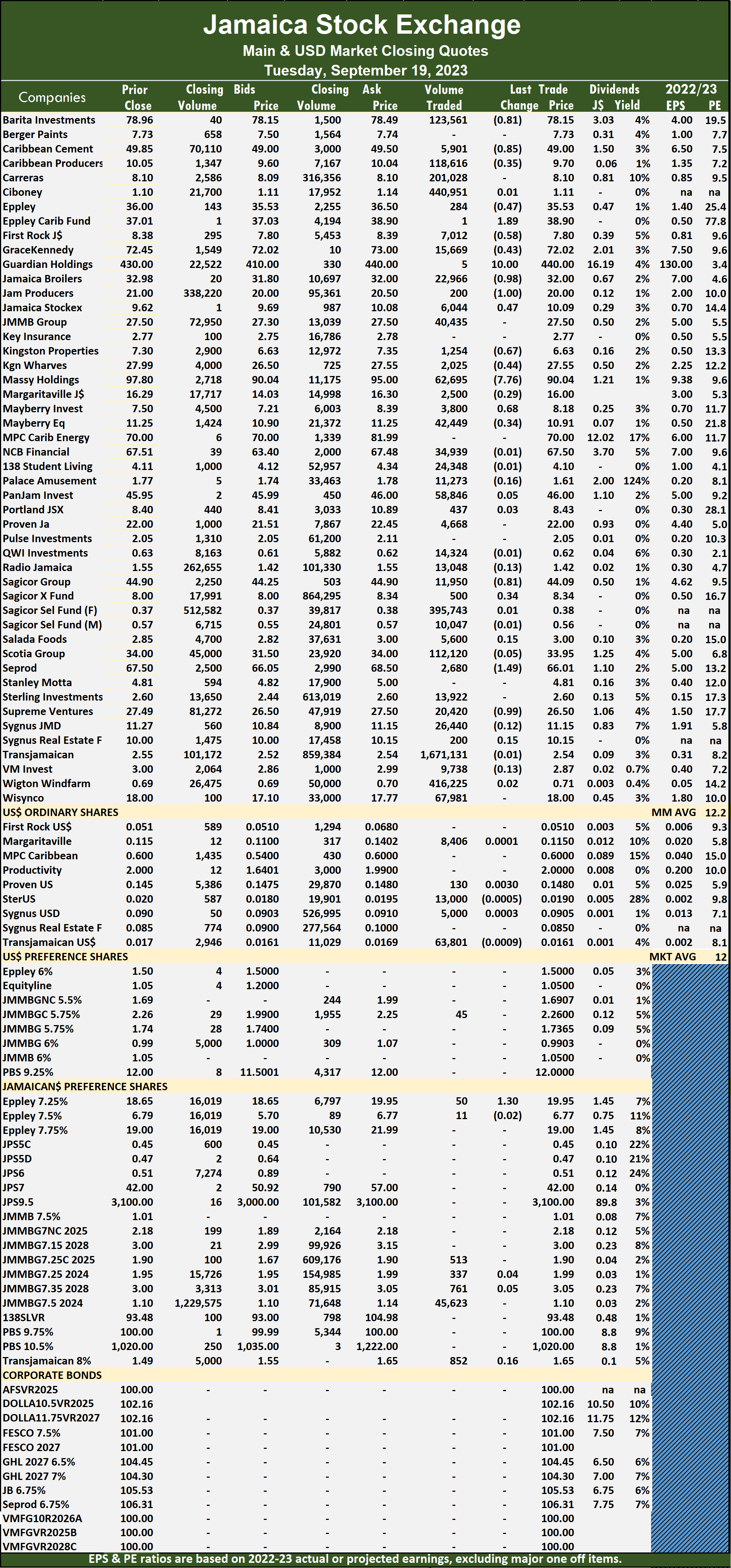

A total of 6,606,269 shares were traded at $40,160,944 compared to 4,914,260 units at $86,517,288 on Wednesday. The Main Market ended trading with an average PE of 12.2. The JSE Main and USD Market PEs are based on last traded prices and earnings projected by ICInsider.com for companies with the financial year ending up to August 2024.

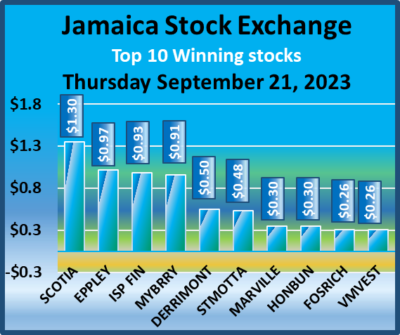

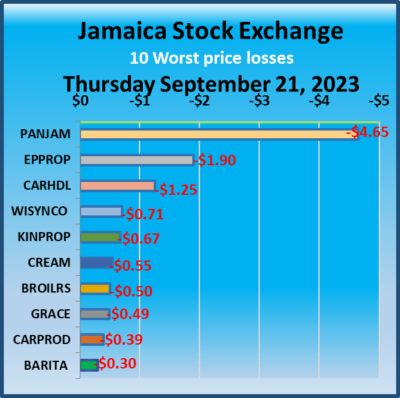

The Main Market ended trading with an average PE of 12.2. The JSE Main and USD Market PEs are based on last traded prices and earnings projected by ICInsider.com for companies with the financial year ending up to August 2024. Margaritaville rose 30 cents to close at $16.30 after trading in just 2 units, Mayberry Investments climbed 91 cents in closing at $7.91 after an exchange of 6,021 stock units, Pan Jamaica dropped $4.65 to $41.10 after investor traded 4,743 stocks, Proven Investments popped $2.66 to $24.18 with shareholders swapping 54 shares. Sagicor Group declined 20 cents to end at a 52 weeks’ low of $43.80, with 18,994 stocks clearing the market, Scotia Group rallied $1.30 and ended at $33.50 with a transfer of 7,270 units, Stanley Motta increased 48 cents to close at $5.33 with investors transferring 25,900 stock units, Victoria Mutual Investments advanced 26 cents to end at $2.98 after 2,400 shares passed through the market and Wisynco Group dipped 71 cents and ended at $17, with 19,911 stocks crossing the exchange.

Margaritaville rose 30 cents to close at $16.30 after trading in just 2 units, Mayberry Investments climbed 91 cents in closing at $7.91 after an exchange of 6,021 stock units, Pan Jamaica dropped $4.65 to $41.10 after investor traded 4,743 stocks, Proven Investments popped $2.66 to $24.18 with shareholders swapping 54 shares. Sagicor Group declined 20 cents to end at a 52 weeks’ low of $43.80, with 18,994 stocks clearing the market, Scotia Group rallied $1.30 and ended at $33.50 with a transfer of 7,270 units, Stanley Motta increased 48 cents to close at $5.33 with investors transferring 25,900 stock units, Victoria Mutual Investments advanced 26 cents to end at $2.98 after 2,400 shares passed through the market and Wisynco Group dipped 71 cents and ended at $17, with 19,911 stocks crossing the exchange. In the preference segment, Eppley 7.25% preference share lost $1.30 in closing at $18.65 after a transfer of 2 units, Jamaica Public Service 7% shed $12.71 to land at $44.29 in an exchange of 809 stock units and JMMB Group 7.25% preference share skidded 23 cents to close at $1.67 in switching ownership of 1,902 shares.

In the preference segment, Eppley 7.25% preference share lost $1.30 in closing at $18.65 after a transfer of 2 units, Jamaica Public Service 7% shed $12.71 to land at $44.29 in an exchange of 809 stock units and JMMB Group 7.25% preference share skidded 23 cents to close at $1.67 in switching ownership of 1,902 shares. At close, the JSE Combined Market Index dipped 223.89 points to close at 325,383.95, at the same time the All Jamaican Composite Index fell 541.98 points to close at 345,405.20, the JSE Main Index shed 445.30 points to 311,400.65, the Junior Market Index rose 20.71 points to settle at 3803.96, while the JSE USD Market Index rallied 0.95 points to settle at 255.38.

At close, the JSE Combined Market Index dipped 223.89 points to close at 325,383.95, at the same time the All Jamaican Composite Index fell 541.98 points to close at 345,405.20, the JSE Main Index shed 445.30 points to 311,400.65, the Junior Market Index rose 20.71 points to settle at 3803.96, while the JSE USD Market Index rallied 0.95 points to settle at 255.38. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making. The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. A total of 4,914,260 shares were traded for $86,517,288 up from 4,072,123 units at $39,480,185 on Tuesday.

A total of 4,914,260 shares were traded for $86,517,288 up from 4,072,123 units at $39,480,185 on Tuesday. The Main Market closed with an average PE Ratio of 12.2. The JSE Main and USD Market PEs are based on the last traded prices and earnings forecasted by ICInsider.com for companies with the financial year ending up to August 2024.

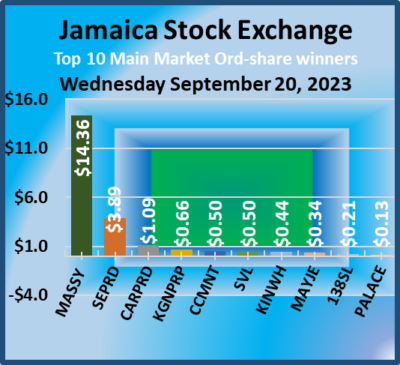

The Main Market closed with an average PE Ratio of 12.2. The JSE Main and USD Market PEs are based on the last traded prices and earnings forecasted by ICInsider.com for companies with the financial year ending up to August 2024. Mayberry Jamaican Equities rose 34 cents to close at $11.25 clearing the market with 2,300 shares, NCB Financial dropped $2.50 in closing at $65 with a transfer of 97,064 stock units, 138 Student Living increased 21 cents to end at $4.31 closed at 12,878 stocks, Pan Jamaica lost 25 cents and ended at $45.75 after exchanging 14,580 stock units, Proven Investments dipped 48 cents to close at $21.52 crossing the exchange 14,426 stocks, Pulse Investments declined 21 cents to $1.84 after an exchange of 130,001 shares, Scotia Group lost $1.75 and ended at $32.20 crossing the market 31,010 units, Seprod gained $3.89 in closing at $69.90 trading 6,819 units, Supreme Ventures rose 50 cents to end at $27 with traders dealing in 169,979 shares, Wisynco Group dropped 29 cents to close at $17.71 while exchanging 125,1stock units.

Mayberry Jamaican Equities rose 34 cents to close at $11.25 clearing the market with 2,300 shares, NCB Financial dropped $2.50 in closing at $65 with a transfer of 97,064 stock units, 138 Student Living increased 21 cents to end at $4.31 closed at 12,878 stocks, Pan Jamaica lost 25 cents and ended at $45.75 after exchanging 14,580 stock units, Proven Investments dipped 48 cents to close at $21.52 crossing the exchange 14,426 stocks, Pulse Investments declined 21 cents to $1.84 after an exchange of 130,001 shares, Scotia Group lost $1.75 and ended at $32.20 crossing the market 31,010 units, Seprod gained $3.89 in closing at $69.90 trading 6,819 units, Supreme Ventures rose 50 cents to end at $27 with traders dealing in 169,979 shares, Wisynco Group dropped 29 cents to close at $17.71 while exchanging 125,1stock units. In the preference segment, Eppley 7.50% preference share dipped $1.21 to $5.56 changing hands 156,664 stocks and Jamaica Public Service 7% rallied $15 to $57 passed through the market 222 stocks.

In the preference segment, Eppley 7.50% preference share dipped $1.21 to $5.56 changing hands 156,664 stocks and Jamaica Public Service 7% rallied $15 to $57 passed through the market 222 stocks. A total of 4,072,123 shares were traded for $39,480,185 versus 8,294,756 units at $80,258,458 on Monday.

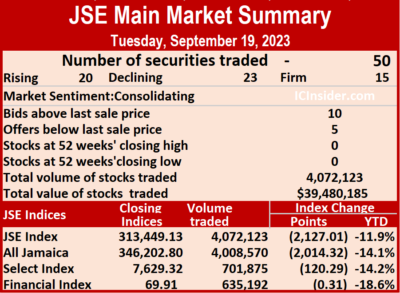

A total of 4,072,123 shares were traded for $39,480,185 versus 8,294,756 units at $80,258,458 on Monday. The Main Market ended trading with an average PE Ratio of 12.2. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

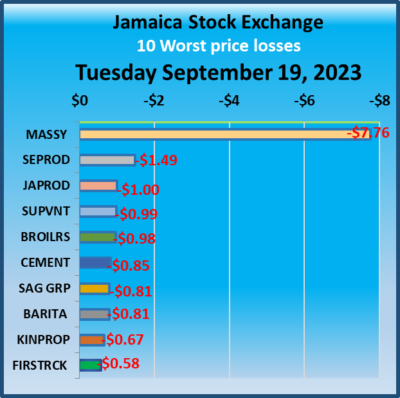

The Main Market ended trading with an average PE Ratio of 12.2. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. Jamaica Broilers fell 98 cents and ended at $32 in an exchange of 22,966 shares, Jamaica Producers lost $1 to end at $20 after a transfer of 200 stocks, Jamaica Stock Exchange rallied 47 cents to $10.09 with a transfer of 6,044 units, Kingston Properties skidded 67 cents in closing at $6.63 after exchanging 1,254 units. Kingston Wharves shed 44 cents and ended at $27.55 as investors traded 2,025 units, Margaritaville dipped 29 cents to end at $16 in switching ownership of 2,500 shares, Massy Holdings declined $7.76 to close at $90.04, with 62,695 stock units crossing the market, Mayberry Investments increased 68 cents to $8.18 with investors transferring 3,800 stocks. Mayberry Jamaican Equities fell 34 cents to end at $10.91 with stakeholders exchanging 42,449 shares, Sagicor Group dropped 81 cents to close at $44.09 and closed after 11,950 stocks changed hands.

Jamaica Broilers fell 98 cents and ended at $32 in an exchange of 22,966 shares, Jamaica Producers lost $1 to end at $20 after a transfer of 200 stocks, Jamaica Stock Exchange rallied 47 cents to $10.09 with a transfer of 6,044 units, Kingston Properties skidded 67 cents in closing at $6.63 after exchanging 1,254 units. Kingston Wharves shed 44 cents and ended at $27.55 as investors traded 2,025 units, Margaritaville dipped 29 cents to end at $16 in switching ownership of 2,500 shares, Massy Holdings declined $7.76 to close at $90.04, with 62,695 stock units crossing the market, Mayberry Investments increased 68 cents to $8.18 with investors transferring 3,800 stocks. Mayberry Jamaican Equities fell 34 cents to end at $10.91 with stakeholders exchanging 42,449 shares, Sagicor Group dropped 81 cents to close at $44.09 and closed after 11,950 stocks changed hands.  Sagicor Real Estate Fund popped 34 cents and ended at $8.34, with 500 stock units crossing the exchange, Seprod skidded $1.49 in closing at $66.01 in an exchange of 2,680 units and Supreme Ventures fell 99 cents to end at $26.50 after 20,420 stocks changed hands.

Sagicor Real Estate Fund popped 34 cents and ended at $8.34, with 500 stock units crossing the exchange, Seprod skidded $1.49 in closing at $66.01 in an exchange of 2,680 units and Supreme Ventures fell 99 cents to end at $26.50 after 20,420 stocks changed hands. At close, the JSE Combined Market Index fell 803.13 points to 329,164.88, the All Jamaican Composite Index skidded 2,014.32 points to finish at 346,202.80, the JSE Main Index fell 2,127.01 points to end at 313,449.13, the Junior Market Index dipped 21.90 points to 3,770.02 while the JSE USD Market Index slipped 0.47 points to end at 254.89.

At close, the JSE Combined Market Index fell 803.13 points to 329,164.88, the All Jamaican Composite Index skidded 2,014.32 points to finish at 346,202.80, the JSE Main Index fell 2,127.01 points to end at 313,449.13, the Junior Market Index dipped 21.90 points to 3,770.02 while the JSE USD Market Index slipped 0.47 points to end at 254.89. The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 19.7 on 2022-23 earnings and 10.8 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks ended at 19.7 on 2022-23 earnings and 10.8 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making. The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. A total of 8,294,756 shares were traded for $80,258,458 versus 5,471,926 units at $103,330,084 on Friday.

A total of 8,294,756 shares were traded for $80,258,458 versus 5,471,926 units at $103,330,084 on Friday. The Main Market closed with an average PE Ratio of 12.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

The Main Market closed with an average PE Ratio of 12.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. Kingston Wharves popped $1.47 to close at $27.99 in switching ownership of 3,552 stocks, MPC Caribbean Clean Energy skidded $11.50 and ended at $70 after an exchange of 494 stock units, NCB Financial popped 51 cents to close at $67.51 with investors dealing in 27,212 shares, 138 Student Living dipped 20 cents to end at $4.11 with traders dealing in 837 units, Pan Jamaica advanced $3.94 to close at $45.95 with a transfer of 2,043 stocks, Sagicor Group rose 78 cents to $44.90 in an exchange of 13,599 shares,

Kingston Wharves popped $1.47 to close at $27.99 in switching ownership of 3,552 stocks, MPC Caribbean Clean Energy skidded $11.50 and ended at $70 after an exchange of 494 stock units, NCB Financial popped 51 cents to close at $67.51 with investors dealing in 27,212 shares, 138 Student Living dipped 20 cents to end at $4.11 with traders dealing in 837 units, Pan Jamaica advanced $3.94 to close at $45.95 with a transfer of 2,043 stocks, Sagicor Group rose 78 cents to $44.90 in an exchange of 13,599 shares,  In the preference segment, Eppley 7.25% preference share fell $1.40 and ended at $18.65 with investors transferring 2 stock units.

In the preference segment, Eppley 7.25% preference share fell $1.40 and ended at $18.65 with investors transferring 2 stock units. Developments in the past week, the Main Market, Key Insurance rose 11 percent to close the week at $2.77, followed by a 10 percent fall in

Developments in the past week, the Main Market, Key Insurance rose 11 percent to close the week at $2.77, followed by a 10 percent fall in  A total of 12 of the most highly valued stocks representing 26 percent of the Main Market are priced with a PE of 15 to 84, with an average of 30 and 21 excluding the highest PE ratios, with a PE of 21 for the top half and 17 excluding the stocks with the highest PEs.

A total of 12 of the most highly valued stocks representing 26 percent of the Main Market are priced with a PE of 15 to 84, with an average of 30 and 21 excluding the highest PE ratios, with a PE of 21 for the top half and 17 excluding the stocks with the highest PEs. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.