First Citizens Bank trades at 52 weeks’ high.

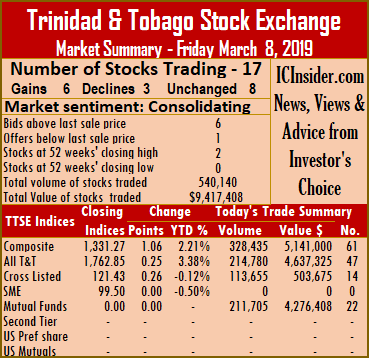

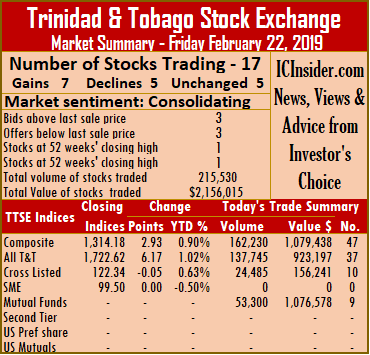

Market activity on the Trinidad & Tobago Stock Exchange ended on Friday with trading in 17 securities against 11 on Thursday, with 6 advancing, 3 declining and 8 remaining unchanged.

At close of the market, the Composite Index advanced 1.06 points to 1,331.27. The All T&T Index gained 0.25 points to 1,762.85, while the Cross Listed Index rose 0.26 points to close at 121.43.

Trading ended with 540,140 shares at a value of $9,417,408 compared to 366,633 shares valued $17,550,757 trading on Thursday. First Citizens Bank and West Indian Tobacco traded at a 52 weeks’ high.

IC bid-offer Indicator|The Investor’s Choice bid-offer ended at 6 stocks with bids lower than their last selling prices and 1 with a lower offer.

At the close of the market, stocks trading with gains are| First Citizens with a rise of 10 cents and settling at $35.10, after exchanging 500 shares, Grace Kennedy adding 15 cents to end at $3.25, with 70,400 stock units changing hands, National Flour that increased 1 cent and completed trading of 63,000 units at $1.65. Prestige Holdings rose 5 cents to close at $7.55, with an exchange of 511 units, Trinidad & Tobago NGL closed with a gain of 1 cent and completed trading of 112,608 units at $30.01 and West Indian Tobacco gained 2 cents and ended at $96.02, with 2,550 stock units changing hands.

Stocks closing with losses|Massy Holdings shares fell 2 cents to $50, after exchanging 3,548 shares,  One Caribbean Media closed with a loss of 33 cents and ended at $10.07, in trading 10,000 shares and Scotiabank shed 1 cent and ended at $63.59, with 6,000 stock units changing hands.

One Caribbean Media closed with a loss of 33 cents and ended at $10.07, in trading 10,000 shares and Scotiabank shed 1 cent and ended at $63.59, with 6,000 stock units changing hands.

Stocks closing firm| Angostura Holdings ended at $15.80, with 1,380 stock units changing hands, Clico Investments ended at $20.20, trading 211,705 stock units, Guardian Holdings completed trading of 5,313 units at $19, JMMB Group closed at $1.75, after exchanging 14,016 shares. NCB Financial Group settled at $8.39, trading 10,036 shares, Sagicor Financial exchanged 19,203 shares at $8.75, Trinidad Cement settled at $2.55, after swapping 6,171 shares and Unilever Caribbean concluded trading of 3,199 shares at $26.50.

Prices of securities trading for the day are those at which the last trade took place.

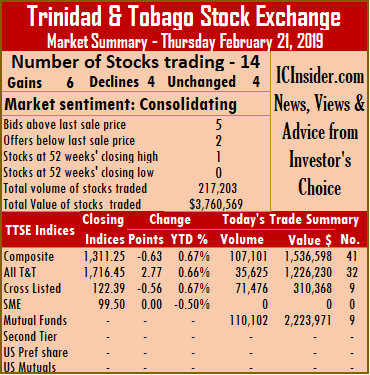

The Trinidad & Tobago Stock Exchange softened on Thursday with trading in 11 securities against 12 on Wednesday, in the fall of all three main indices and a weak reading in IC bid-offer Indicator.

The Trinidad & Tobago Stock Exchange softened on Thursday with trading in 11 securities against 12 on Wednesday, in the fall of all three main indices and a weak reading in IC bid-offer Indicator. Sagicor Financial concluded trading with a loss of 32 cents at $8.75, after exchanging 2,369 shares. Trinidad & Tobago NGL traded with a loss of 13 cents and completed trading at $30, with exchange of 1,500 units and West Indian Tobacco shares fell 2 cents and ended at $96, with 117,327 stock units changing hands.

Sagicor Financial concluded trading with a loss of 32 cents at $8.75, after exchanging 2,369 shares. Trinidad & Tobago NGL traded with a loss of 13 cents and completed trading at $30, with exchange of 1,500 units and West Indian Tobacco shares fell 2 cents and ended at $96, with 117,327 stock units changing hands.

close at $1.60 and Sagicor Financial lost 73 cents to $9.07, after exchanging 1,000 shares.

close at $1.60 and Sagicor Financial lost 73 cents to $9.07, after exchanging 1,000 shares.

Market activity on the Trinidad & Tobago Stock Exchange ended on Thursday with trading in 17 securities against 15 on Wednesday, with 2 advancing, 5 declining and 10 remaining unchanged.

Market activity on the Trinidad & Tobago Stock Exchange ended on Thursday with trading in 17 securities against 15 on Wednesday, with 2 advancing, 5 declining and 10 remaining unchanged. trading 600 shares.

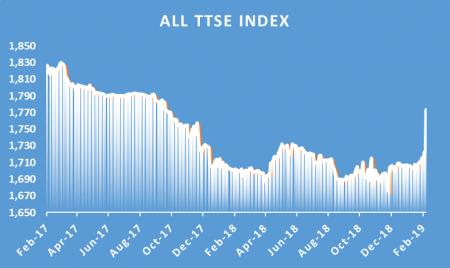

trading 600 shares. Republic Financial Holdings jumped $14 points to close at a 52 weeks’ high of $125 and helped in pushing the All T&T Index up 50.51 to close at 1,772.90, Composite Index gained 25.43 points to 1,339.33 while the Cross Listed Index rose 0.04 points to close at 122.25.

Republic Financial Holdings jumped $14 points to close at a 52 weeks’ high of $125 and helped in pushing the All T&T Index up 50.51 to close at 1,772.90, Composite Index gained 25.43 points to 1,339.33 while the Cross Listed Index rose 0.04 points to close at 122.25. 253,624 stock units at $8, One Caribbean Media rose 1 cent to $10.01, after exchanging 1,605 shares and Republic Financial Holdings advanced $14 concluded at $125, after exchanging 561 shares but the stock was offered at $120 at the close to sell 15,407 shares.

253,624 stock units at $8, One Caribbean Media rose 1 cent to $10.01, after exchanging 1,605 shares and Republic Financial Holdings advanced $14 concluded at $125, after exchanging 561 shares but the stock was offered at $120 at the close to sell 15,407 shares. Market activity on the Trinidad & Tobago Stock Exchange ended on Tuesday with trading in 16 securities against 14 on Monday, with 4 advancing, 4 declining and 8 remaining unchanged.

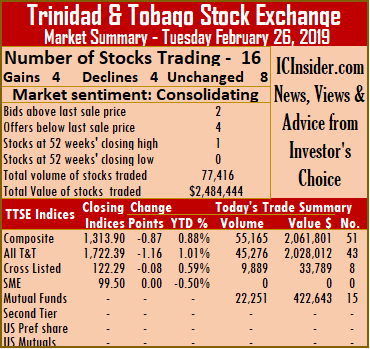

Market activity on the Trinidad & Tobago Stock Exchange ended on Tuesday with trading in 16 securities against 14 on Monday, with 4 advancing, 4 declining and 8 remaining unchanged.

changing hands, National Flour ended trading with 11,000 units, 1 cent lower at $1.64, One Caribbean Media concluded trading of 5,800 shares with a loss of 34 cents to close at a 52 weeks’ low of $10.01. Sagicor Financial traded with a loss of 40 cents at $9.58, after exchanging 8,760 shares and Scotiabank shares fell 13 cents and settled at $63.50, with 1,000 stock units changing hands.

changing hands, National Flour ended trading with 11,000 units, 1 cent lower at $1.64, One Caribbean Media concluded trading of 5,800 shares with a loss of 34 cents to close at a 52 weeks’ low of $10.01. Sagicor Financial traded with a loss of 40 cents at $9.58, after exchanging 8,760 shares and Scotiabank shares fell 13 cents and settled at $63.50, with 1,000 stock units changing hands. stock units changing hands.

stock units changing hands.