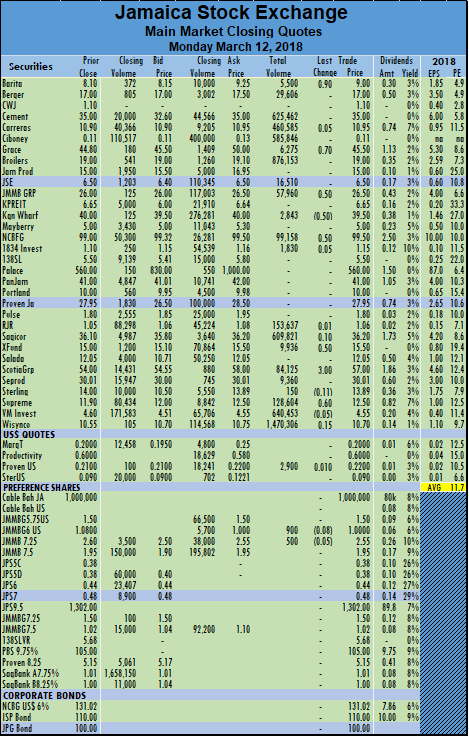

The main market of the Jamaica Stock Exchange closed down on Tuesday after ending at a record closing high on Monday after Scotia Group and NCB Financial prices fell and helped to pull back the index.

The main market of the Jamaica Stock Exchange closed down on Tuesday after ending at a record closing high on Monday after Scotia Group and NCB Financial prices fell and helped to pull back the index.

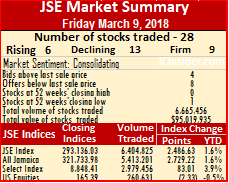

Main market activity ended with 24 securities changing hands, with just 7 securities rising, 10 falling, 7 trading firm and closed with 9,664,260 units valued at over $708,128,861.

At the close of trading, the JSE All Jamaican Composite Index dived 1,583.39 points to 322,981.60 and the JSE Index dropped 1,442.64 points to 294,272.76.

In main market activity, Barita Investments closed at $9, with 8,729 shares, Carreras finished with a loss of 5 cents at $10.90, with 109,260 shares, Caribbean Cement settled with a loss of $2.39 at $32.61, with 9,561 shares, Grace Kennedy traded 10 cents higher at $45.60, with 2,303 stock units,  Jamaica Broilers finished trading 50 cents higher at $19.50, with 6,339 units. Jamaica Stock Exchange ended with a loss of 20 cents at $6.30, with 3,200 shares, JMMB Group concluded trading at $26.50, with 258,232 shares, Kingston Wharves settled at $39.50, with 2,082 units, Mayberry Investments ended trading 15 cents higher at $5.15, with 11,043 shares. NCB Financial Group traded with a loss of $1.30 at $98.20, with 6,813,889 shares, 1834 Investments finished trading 3 cents higher at $1.18, with 31,000 shares, PanJam Investment ended 10 cents higher at $41.10, with 3,122 units, Pulse Investments finished 5 cents higher at $1.85, with 2,655 shares. Radio Jamaica settled at $1.06, with 14,401 shares, Sagicor Group ended trading with a loss of 10 cents at $36.10, with 126,997 stock units, Sagicor Real Estate Fund ended trading with a loss of 40 cents at $15.10, with 70,864 shares,

Jamaica Broilers finished trading 50 cents higher at $19.50, with 6,339 units. Jamaica Stock Exchange ended with a loss of 20 cents at $6.30, with 3,200 shares, JMMB Group concluded trading at $26.50, with 258,232 shares, Kingston Wharves settled at $39.50, with 2,082 units, Mayberry Investments ended trading 15 cents higher at $5.15, with 11,043 shares. NCB Financial Group traded with a loss of $1.30 at $98.20, with 6,813,889 shares, 1834 Investments finished trading 3 cents higher at $1.18, with 31,000 shares, PanJam Investment ended 10 cents higher at $41.10, with 3,122 units, Pulse Investments finished 5 cents higher at $1.85, with 2,655 shares. Radio Jamaica settled at $1.06, with 14,401 shares, Sagicor Group ended trading with a loss of 10 cents at $36.10, with 126,997 stock units, Sagicor Real Estate Fund ended trading with a loss of 40 cents at $15.10, with 70,864 shares,  Salada Foods traded at $12.05, with 25,000 units, Scotia Group finished trading with a loss of $1.50 at $55.50, with 33,156 shares. Seprod closed at $30.01, with 745 shares, Supreme Ventures concluded trading with a loss of 51 cents at $11.99, with 482,227 stock units, Victoria Mutual Investments finished with a loss of 5 cents at $4.50, with 1,464,709 units and Wisynco Group settled 5 cents higher at $10.75, with 77,913 shares. In the main market preference segment, Jamaica Money Market 7.25% ended trading at $2.55, with 11,031 shares, Jamaica Money Market 7.5% traded with a loss of 5 cents at $1.90, with 95,802 stock units changing hands.

Salada Foods traded at $12.05, with 25,000 units, Scotia Group finished trading with a loss of $1.50 at $55.50, with 33,156 shares. Seprod closed at $30.01, with 745 shares, Supreme Ventures concluded trading with a loss of 51 cents at $11.99, with 482,227 stock units, Victoria Mutual Investments finished with a loss of 5 cents at $4.50, with 1,464,709 units and Wisynco Group settled 5 cents higher at $10.75, with 77,913 shares. In the main market preference segment, Jamaica Money Market 7.25% ended trading at $2.55, with 11,031 shares, Jamaica Money Market 7.5% traded with a loss of 5 cents at $1.90, with 95,802 stock units changing hands.

Prices of securities trading for the day are those at which the last trade took place. For more details of market activities, see “JSE pulls back from record – Tuesday.”

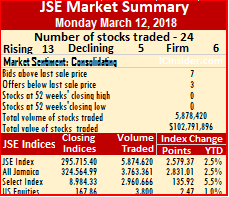

Only 10 securities trade on TTSE – Monday

Market activity on the Trinidad & Tobago Stock Exchange on Monday ended with 10 securities trading as oppose to 16 on Friday.

Market activity on the Trinidad & Tobago Stock Exchange on Monday ended with 10 securities trading as oppose to 16 on Friday.

The market closed with 403,022 shares valued at $11,039,167 trading, compared to 200,883 shares valued at $1,445,272 on Friday. The prices of 4 stocks rose, 3 declined and 3 remained unchanged. The Composite Index rose 1.44 points on Monday to 1,268.83, the All T&T Index closed with a gain of 2.55 points to 1,697.26, while the Cross Listed Index added 0.04 points to close at 113.42.

IC bid-offer Indicator|At the end of trading, on Monday, the Investor’s Choice bid-offer indicator reading shows 8 stocks with bids lower than their last selling prices and 4 with lower offers.

Gains| First Caribbean International Bank closed with an increase of 2 cents and completed trading at $9.30, after exchanging 127,455 shares, Guardian Holdings ended trading with a rise of 50 cents to $16, after exchanging 13,000 shares,  Trinidad & Tobago NGL finished trading 10 cents higher and settled at $27.75, after exchanging 5,563 shares and Unilever Caribbean rose 30 cents and ended at $30.30, with 480 units changing hands.

Trinidad & Tobago NGL finished trading 10 cents higher and settled at $27.75, after exchanging 5,563 shares and Unilever Caribbean rose 30 cents and ended at $30.30, with 480 units changing hands.

Losses| Ansa Mcal shed 95 cents and ended at $60.05, with 50,334 units, First Citizens lost 3 cents and settled at $32.17, after exchanging 1,615 shares and JMMB Group ended trading 2 cents lower at $1.98, with 134,136 stock units changing hands.

Firm Traded| Republic Financial Holdings concluded market activity at $101.52, with 610 stock units changing hands, Scotiabank completed trading at $62.01, after exchanging 3,949 shares and West Indian Tobacco closed at $88.50, after exchanging 65,880 shares.

Prices of securities trading for the day are those at which the last trade took place.

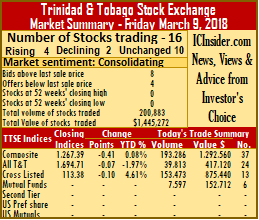

4 up 2 down on TTSE on Friday

Market activity on the Trinidad & Tobago Stock Exchange on Thursday ended with 16 securities trading the number as on Thursday. The market closed with 200,883 shares valued at $1,445,272 trading, compared to 501,264 shares valued at $7,417,872 on Thursday.

Market activity on the Trinidad & Tobago Stock Exchange on Thursday ended with 16 securities trading the number as on Thursday. The market closed with 200,883 shares valued at $1,445,272 trading, compared to 501,264 shares valued at $7,417,872 on Thursday.

The market closed with the prices of 4 stocks rising, 2 declining and 10 remaining unchanged. At close, the Composite Index fell 41 points on Friday to 1,267.39, the All T&T Index closed with a fall 0.07 points to 1,694.71, while the Cross Listed Index lost 0.10 points to close at 113.38.

IC bid-offer Indicator|At the end of trading, on Friday, the Investor’s Choice bid-offer indicator reading shows 8 stocks with bids lower than their last selling prices and 4 with lower offers.

Gains| First Citizens added 4 cents and closed at $32.20, trading 627 shares, Grace Kennedy price increased 1 cent and completed trading at $3.35, with 61,893 units, Scotiabank rose 5 cents and settled at $62.01, trading 546 shares and Trinidad & Tobago NGL closed with a gain of 14 cents at $27.65, trading 2,961 shares.

Losses| Guardian Holdings fell 15 cents and settled at $15.50, trading 1,599 shares and National Flour lost 1 cent and closed at $1.82, trading 8,176 shares. Firm Traded| Ansa Merchant closed at $40, trading 503 shares, Clico Investments completed trading at $20.10, with 7,597 units, First Caribbean International Bank settled at $9.28, trading 5,823 shares, JMMB Group ended at $2, with 10,100 stock units changing hands LJ Williams B share concluded market activity at 75 cents, trading 20,000 shares. Massy Holdings ended at $47.50, with 3,301 stock units changing hands Prestige Holdings settled at $10.01, trading 1,300 shares, Sagicor Financial ended at $7.85, with 75,657 units, Trinidad Cement closed at $3.01, with 400 stock units changing hands and West Indian Tobacco settled at $88.50, trading 400 shares.

Losses| Guardian Holdings fell 15 cents and settled at $15.50, trading 1,599 shares and National Flour lost 1 cent and closed at $1.82, trading 8,176 shares. Firm Traded| Ansa Merchant closed at $40, trading 503 shares, Clico Investments completed trading at $20.10, with 7,597 units, First Caribbean International Bank settled at $9.28, trading 5,823 shares, JMMB Group ended at $2, with 10,100 stock units changing hands LJ Williams B share concluded market activity at 75 cents, trading 20,000 shares. Massy Holdings ended at $47.50, with 3,301 stock units changing hands Prestige Holdings settled at $10.01, trading 1,300 shares, Sagicor Financial ended at $7.85, with 75,657 units, Trinidad Cement closed at $3.01, with 400 stock units changing hands and West Indian Tobacco settled at $88.50, trading 400 shares.

Prices of securities trading for the day are those at which the last trade took place.

JSE trading in record territory

Scotia Group is trading at $53.50 following the release of first quarter results yesterday and helped to push the main market into record territory.

Scotia Group is trading at $53.50 following the release of first quarter results yesterday and helped to push the main market into record territory.

The market is trading at an intraday high on the all Jamaica Index of 325,588.39 having risen 6,583.63 points at 10.27 in the morning session. The JSE index jumped 5,998.43 points to 296,647.83. if the market closed around these levels it would end at a n all-time closing high beating the previous record close by a few thousand points. The market indices slipped back a bit and are now at 325,177.34 for the all Jamaica Index and 296,273.32 for the JSE Index.

Scotia Group was showed increased profits from lower loan loss provisioning and gains from sale of its former subsidiary CrediScotia.

The Main Market of the Jamaica Stock Exchange ended trading at record close on Monday with Scotia Group climbing to $57 being the main factor behind the rally along with several others that rose.

The Main Market of the Jamaica Stock Exchange ended trading at record close on Monday with Scotia Group climbing to $57 being the main factor behind the rally along with several others that rose.

For the month to date an average of 747,070 units with an average value at $10,075,319 traded, compared to 796,886 units with an average value at $10,718,888 traded on the previous trading day.In contrast, February closed with average of 213,336 units valued at $3,392,475 for each security traded.

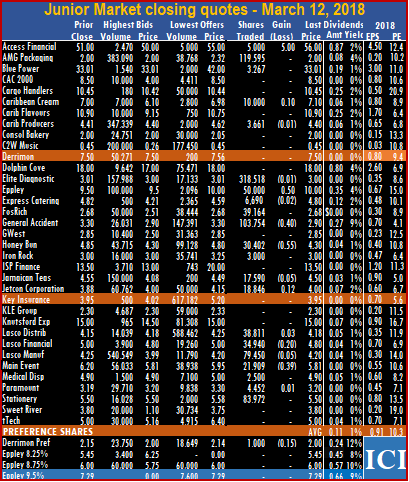

For the month to date an average of 747,070 units with an average value at $10,075,319 traded, compared to 796,886 units with an average value at $10,718,888 traded on the previous trading day.In contrast, February closed with average of 213,336 units valued at $3,392,475 for each security traded. The Junior Market of the Jamaica Stock Exchange index closed trading on Monday with a 40.83 points rise to close at 2,956.96 with the prices of 6 securities advancing, 10 declining and 7 remaining unchanged.

The Junior Market of the Jamaica Stock Exchange index closed trading on Monday with a 40.83 points rise to close at 2,956.96 with the prices of 6 securities advancing, 10 declining and 7 remaining unchanged.  IC bid-offer Indicator|At the end of trading, the Investor’s Choice bid-offer indicator reading shows 3 stocks ending with the bid higher than the last selling price and 7 with lower offers.

IC bid-offer Indicator|At the end of trading, the Investor’s Choice bid-offer indicator reading shows 3 stocks ending with the bid higher than the last selling price and 7 with lower offers. Lasco Distributors concluded trading 3 cents higher at $4.18, with 38,811 stock units, Lasco Financial finished with a loss of 20 cents at $4.80, with 34,940 units, Lasco Manufacturing settled with a loss of 5 cents at $4.20, with 79,450 shares. Main Event ended trading with a loss of 39 cents at $5.81, with 21,909 shares, Medical Disposables traded at $4.90, with 2,500 shares, Paramount Trading finished trading 1 cent higher at $3.20, with 4,452 stock units and Stationery and Office closed at $5.50, with 83,972 units. In the junior market preference segment, Derrimon Trading closed with a loss of 15 cents at $2, with 1,000 shares changed hands.

Lasco Distributors concluded trading 3 cents higher at $4.18, with 38,811 stock units, Lasco Financial finished with a loss of 20 cents at $4.80, with 34,940 units, Lasco Manufacturing settled with a loss of 5 cents at $4.20, with 79,450 shares. Main Event ended trading with a loss of 39 cents at $5.81, with 21,909 shares, Medical Disposables traded at $4.90, with 2,500 shares, Paramount Trading finished trading 1 cent higher at $3.20, with 4,452 stock units and Stationery and Office closed at $5.50, with 83,972 units. In the junior market preference segment, Derrimon Trading closed with a loss of 15 cents at $2, with 1,000 shares changed hands. The main market of the Jamaica Stock Exchange rose sharply on Monday and erased the previous record close at the end of October and closed at a new record closing high on Monday as Scotia group jumped $3 to $57 with 11 other ordinary shares rising.

The main market of the Jamaica Stock Exchange rose sharply on Monday and erased the previous record close at the end of October and closed at a new record closing high on Monday as Scotia group jumped $3 to $57 with 11 other ordinary shares rising.  Sagicor Real Estate Fund ended trading 50 cents higher at $15.50, with 9,936 share, Scotia Group finished trading $3 higher at $57, with 84,125 shares, Seprod closed at $30.01, with 9,360 shares, Sterling Investments ended with a loss of 11 cents at $13.89, with 150 shares. Supreme Ventures concluded trading $12.50 higher at $12.50, with 128,604 stock units, Victoria Mutual Investments lost 5 cents and closed at $4.55, with 640,453 units, Wisynco Group settled 15 cents higher at $10.70, exchanging 1,470,306 shares and in the main market preference segment, Jamaica Money Market 7.25% ended trading with a loss of 5 cents at $2.55, with 500 shares, changing hands.

Sagicor Real Estate Fund ended trading 50 cents higher at $15.50, with 9,936 share, Scotia Group finished trading $3 higher at $57, with 84,125 shares, Seprod closed at $30.01, with 9,360 shares, Sterling Investments ended with a loss of 11 cents at $13.89, with 150 shares. Supreme Ventures concluded trading $12.50 higher at $12.50, with 128,604 stock units, Victoria Mutual Investments lost 5 cents and closed at $4.55, with 640,453 units, Wisynco Group settled 15 cents higher at $10.70, exchanging 1,470,306 shares and in the main market preference segment, Jamaica Money Market 7.25% ended trading with a loss of 5 cents at $2.55, with 500 shares, changing hands.

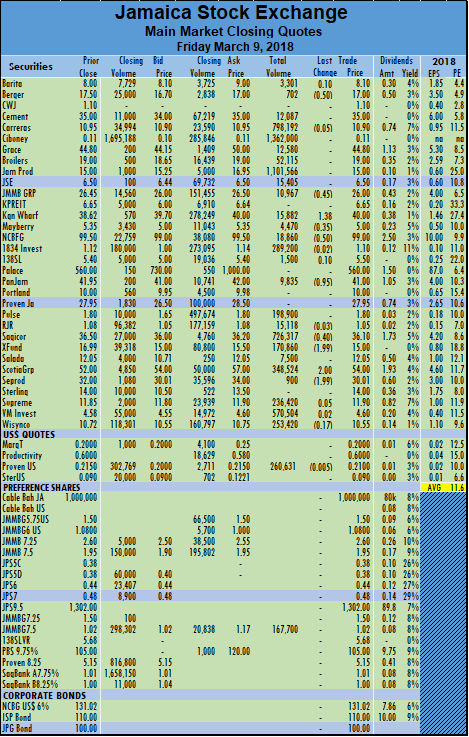

Caribbean Cement settled at $35, with 12,087 shares, Ciboney Group ended trading at $0.11, with 1,362,000 shares. Grace Kennedy traded at $44.80, with 12,580 stock units, Jamaica Broilers finished trading at $19, with 52,115 units, Jamaica Producers closed at $15, with 1,101,566 shares, Jamaica Stock Exchange ended at $6.50, with 15,405 shares. JMMB Group concluded trading with a loss of 45 cents at $26, with 10,967 shares, Kingston Wharves settled $1.38 higher at $40, with 15,882 units, Mayberry Investments ended trading with a loss of 35 cents at $5, with 4,470 shares, NCB Financial Group traded with a loss of 50 cents at $99, with 18,860 shares. 1834 Investments lost 2 cents to close at a 52 weeks’ low of $1.10, with 289,200 shares, 138 Student Living concluded trading 10 cents higher at $5.50, with 1,500 shares, PanJam Investment ended with a loss of 95 cents at $41, with 9,835 units, Pulse Investments finished at $1.80, with 198,900 shares, Radio Jamaica settled with a loss of 3 cents at $1.05, with 15,118 shares.

Caribbean Cement settled at $35, with 12,087 shares, Ciboney Group ended trading at $0.11, with 1,362,000 shares. Grace Kennedy traded at $44.80, with 12,580 stock units, Jamaica Broilers finished trading at $19, with 52,115 units, Jamaica Producers closed at $15, with 1,101,566 shares, Jamaica Stock Exchange ended at $6.50, with 15,405 shares. JMMB Group concluded trading with a loss of 45 cents at $26, with 10,967 shares, Kingston Wharves settled $1.38 higher at $40, with 15,882 units, Mayberry Investments ended trading with a loss of 35 cents at $5, with 4,470 shares, NCB Financial Group traded with a loss of 50 cents at $99, with 18,860 shares. 1834 Investments lost 2 cents to close at a 52 weeks’ low of $1.10, with 289,200 shares, 138 Student Living concluded trading 10 cents higher at $5.50, with 1,500 shares, PanJam Investment ended with a loss of 95 cents at $41, with 9,835 units, Pulse Investments finished at $1.80, with 198,900 shares, Radio Jamaica settled with a loss of 3 cents at $1.05, with 15,118 shares.  Sagicor Group ended trading with a loss of 40 cents at $36.10, with 726,317 stock units, Sagicor Real Estate Fund ended trading with a loss of 1.99 cents at $15, with 170,860 shares, Salada Foods traded at $12.05, with 7,500 units, Scotia Group finished trading $2 higher at $54, with 348,524 shares, Seprod concluded trading with a loss of $1.99 at $30.01, with 900 stock units. Supreme Ventures closed 5 cents higher at $11.90, with 236,420 stock units, Victoria Mutual Investments gained 2 cents to end at $4.60, with 570,504 units, Wisynco Group settled with a loss of 17 cents at $10.55, with 253,420 shares and in the main market preference segment, JMMB Group 7.5% closed at $1.02, with 167,700 shares, changing hands.

Sagicor Group ended trading with a loss of 40 cents at $36.10, with 726,317 stock units, Sagicor Real Estate Fund ended trading with a loss of 1.99 cents at $15, with 170,860 shares, Salada Foods traded at $12.05, with 7,500 units, Scotia Group finished trading $2 higher at $54, with 348,524 shares, Seprod concluded trading with a loss of $1.99 at $30.01, with 900 stock units. Supreme Ventures closed 5 cents higher at $11.90, with 236,420 stock units, Victoria Mutual Investments gained 2 cents to end at $4.60, with 570,504 units, Wisynco Group settled with a loss of 17 cents at $10.55, with 253,420 shares and in the main market preference segment, JMMB Group 7.5% closed at $1.02, with 167,700 shares, changing hands. The Junior Market of the Jamaica Stock Exchange index closed virtually flat at the close of trading on Friday with a miniscule rise of just 0.03 points to close at 2,916.93 with the prices of 9 securities advancing, 10 declining and 7 remaining unchanged.

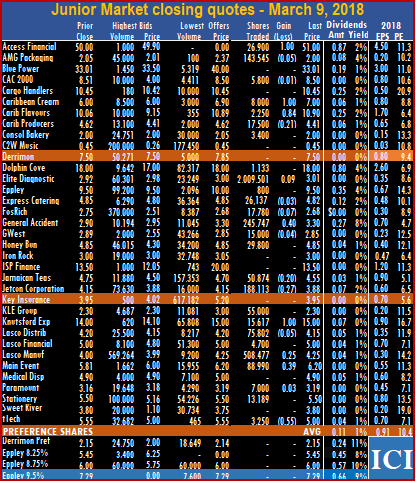

The Junior Market of the Jamaica Stock Exchange index closed virtually flat at the close of trading on Friday with a miniscule rise of just 0.03 points to close at 2,916.93 with the prices of 9 securities advancing, 10 declining and 7 remaining unchanged.  IC bid-offer Indicator|At the end of trading, the Investor’s Choice bid-offer indicator reading shows 4 stocks ending with the bid higher than the last selling price and 3 with lower offers.

IC bid-offer Indicator|At the end of trading, the Investor’s Choice bid-offer indicator reading shows 4 stocks ending with the bid higher than the last selling price and 3 with lower offers. GWest Corporation lost 4 cents at $2.85, with 15,000 units, Honey Bun concluded trading at $4.85, with 29,800 shares,

GWest Corporation lost 4 cents at $2.85, with 15,000 units, Honey Bun concluded trading at $4.85, with 29,800 shares,